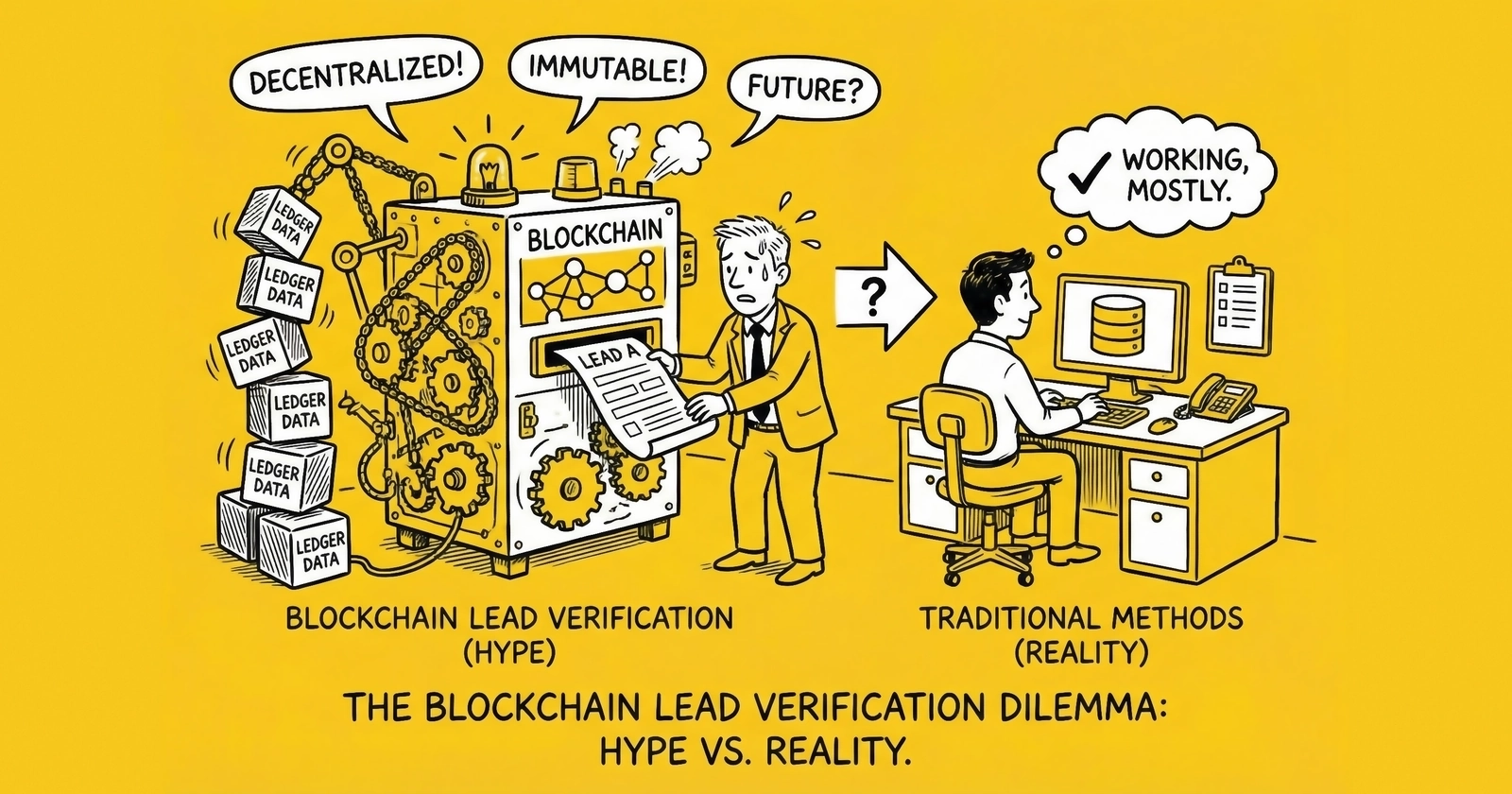

A clear-eyed assessment of blockchain technology for consent verification and lead authentication. Understanding what distributed ledger technology can and cannot solve, the practical implementation timeline, and when blockchain investments make strategic sense for lead generation operations.

The blockchain pitch for lead generation sounds compelling. Immutable consent records that cannot be tampered with. Transparent supply chain tracking from traffic source to conversion. Smart contracts automatically enforcing lead quality standards. Decentralized verification that no single party controls.

The reality is more complicated. After a decade of blockchain experimentation across industries, we have enough data to separate genuine use cases from technologist enthusiasm. For lead generation specifically, blockchain addresses some real problems while creating others. Understanding which is which determines whether your blockchain investment generates returns or becomes an expensive lesson in technology adoption.

This guide examines blockchain for lead verification with operator pragmatism rather than vendor optimism. We cover what blockchain actually does, the specific lead generation problems it can address, the practical limitations that constrain adoption, the realistic implementation timeline, and the decision framework for when blockchain investments make sense.

The lead generation industry processes over 200 million leads annually across major verticals. Consent verification platforms like TrustedForm and Jornaya already certify billions of lead transactions. Any blockchain implementation must demonstrate clear advantages over these established systems to justify adoption friction. That bar is higher than blockchain advocates typically acknowledge. For an overview of existing verification tools, see our guide on TrustedForm and Jornaya consent verification.

What Blockchain Actually Does

Before evaluating blockchain for lead verification, understanding the technology’s core capabilities separates realistic applications from marketing claims.

The Fundamental Innovation

Blockchain is a distributed ledger technology that enables multiple parties to maintain synchronized records without requiring a central authority. Each participant holds a complete copy of the ledger. New records are added through consensus mechanisms that make fraudulent modifications computationally impractical.

The key properties relevant to lead verification:

Immutability. Once data is written to a blockchain, altering it requires controlling a majority of network participants. For practical purposes, blockchain records are permanent. This creates tamper-resistant documentation that survives challenges about post-hoc modification.

Transparency. All participants can view all transactions (though the content can be encrypted while maintaining transaction visibility). This enables audit trails that any party can independently verify.

Decentralization. No single entity controls the ledger. This eliminates single points of failure and reduces the trust required in any individual participant. The system operates even if some participants act maliciously or go offline.

Programmability. Smart contracts enable automated execution of predefined logic when conditions are met. If Lead Quality Score exceeds threshold, execute payment. If consent revoked, propagate update to all parties.

What Blockchain Does Not Do

Equally important is understanding what blockchain cannot accomplish:

Blockchain does not verify truth. A blockchain records whatever data is submitted. If someone submits false consent documentation, the blockchain faithfully records that false documentation immutably. The technology ensures records cannot be changed after submission. It does not ensure records were accurate when submitted.

This distinction is fundamental. Blockchain solves the “was this record modified after creation” problem. It does not solve the “was this record accurate when created” problem. For lead verification, the latter is often the more pressing concern.

Blockchain does not eliminate intermediaries. Despite decentralization rhetoric, most blockchain implementations require trusted parties at data entry points. Someone must verify that the person submitting consent is who they claim to be. Someone must confirm the lead data is valid before recording. These verification steps require trust in specific parties, even if subsequent record-keeping is trustless.

Blockchain does not improve on-chain data quality. If your consent capture process is deficient, recording that deficient consent on a blockchain creates immutable evidence of your non-compliance. Garbage in, immutable garbage out. For proper consent requirements, see our TCPA compliance guide.

Blockchain does not solve governance. Who decides what data is recorded? What format is required? Who pays transaction costs? Who resolves disputes? These governance questions must be answered before blockchain adds value, and the answers typically require the same trust relationships blockchain was supposed to eliminate.

Public vs Private Blockchains

The blockchain used for Bitcoin and Ethereum differs fundamentally from the blockchain implementations realistic for enterprise lead generation.

Public blockchains allow anyone to participate, read all data, and contribute to consensus. They provide maximum decentralization and censorship resistance. They also impose significant transaction costs, slow confirmation times, and complete transparency that may not suit business applications.

Private or permissioned blockchains restrict participation to known entities. They sacrifice some decentralization for performance, privacy, and governance control. Most enterprise blockchain applications, including realistic lead verification implementations, use private blockchains.

The difference matters for lead generation. A public blockchain consent record would be visible to anyone, including competitors, litigators, and data scrapers. Private blockchain implementations restrict visibility to authorized participants while maintaining immutability and audit trail benefits.

The Consent Verification Problem Blockchain Could Address

The current consent verification landscape has genuine limitations that blockchain could theoretically address. Understanding these limitations clarifies where blockchain might add value.

Current State: Third-Party Certificate Platforms

TrustedForm and Jornaya dominate consent verification for lead generation. These platforms work well but operate on a centralized trust model:

Trust in the certificate provider. When you claim a TrustedForm certificate as evidence, you are trusting that ActiveProspect accurately recorded what happened during the form session. When a buyer reviews a Jornaya LeadiD, they trust that Verisk’s systems captured consent correctly.

Single point of control. Both platforms control their certificate databases. If a certificate is corrupted, lost, or the company experiences technical issues, that documentation may become unavailable. The 90-day TrustedForm expiration for unclaimed certificates demonstrates this dependency.

Opacity of matching. When you purchase leads with consent certificates, you trust that the certificate actually corresponds to the specific lead. Certificate-lead matching happens within opaque systems that you cannot independently verify.

Cost concentration. Verification costs flow to concentrated providers. While current pricing is reasonable relative to litigation exposure, the lack of competitive alternatives creates pricing power that could shift over time.

Data portability limitations. Your consent documentation exists within provider systems. If you want to move to a different verification provider, your historical certificates do not transfer.

These are not fatal flaws. TrustedForm and Jornaya have established credibility, courts accept their evidence, and the systems work. But they represent trust dependencies that blockchain could theoretically reduce.

What Blockchain Could Offer

A well-designed blockchain consent verification system could provide:

Multi-party verification. Rather than trusting a single certificate provider, consent events could be recorded across multiple independent nodes. No single party could alter records. Evidence would survive even if any individual participant went offline.

Independent auditability. Any participant could independently verify the chain of custody from consent capture to current state. Rather than accepting certificate provider assertions, buyers could examine the underlying data themselves.

Interoperability. A shared ledger could enable consent verification across platforms. Leads moving through multiple brokers would maintain verifiable consent documentation throughout the chain without repeated certificate purchases.

Immutable revocation tracking. When consumers revoke consent, that revocation could propagate immutably through the chain. All downstream parties would receive verifiable notification that cannot be disputed.

Smart contract automation. Lead quality rules, return windows, and payment terms could execute automatically based on verified on-chain data. Rather than disputes about whether return deadlines were met, smart contracts would enforce terms programmatically.

These capabilities sound attractive. The question is whether they justify the implementation complexity and adoption friction required to achieve them.

Practical Limitations and Implementation Challenges

Blockchain proponents often understate the practical challenges of deployment. For lead generation specifically, several limitations constrain realistic implementation.

The Oracle Problem

Blockchains are excellent at maintaining records once data is on-chain. They are terrible at verifying data accuracy before recording. This creates the “oracle problem”: how does accurate real-world information enter the chain?

For consent verification, the oracle problem manifests at multiple points:

Consent capture verification. How does the blockchain know that the person completing the form is who they claim to be? That the consent disclosure was actually displayed? That the checkbox was actually clicked? These questions require trusted verification at the point of capture, the same verification that TrustedForm and Jornaya provide today.

Lead data validation. How does the blockchain know the phone number is valid? That the email exists? That the address is real? Validation still requires trusted data sources, whether on-chain or off.

Identity resolution. Matching consent to the correct person requires identity verification that blockchain does not inherently provide. The same identity challenges that exist today persist in blockchain implementations.

The oracle problem means blockchain consent verification still requires trusted parties at data entry points. You are not eliminating trust requirements. You are shifting where trust is placed, from certificate storage to data entry verification.

Transaction Costs and Speed

Every blockchain transaction has costs, whether explicit (gas fees on public chains) or implicit (infrastructure for private chains).

For lead generation scale, these costs matter. Consider the economics:

- 100,000 monthly leads at $0.10 per blockchain transaction = $10,000 monthly

- TrustedForm certification at current volume pricing = approximately $15,000-50,000 monthly

The raw transaction costs might be comparable. But blockchain implementations also require infrastructure investment (nodes, development, integration), governance overhead (consortium management, dispute resolution), and operational complexity (key management, consensus participation).

Transaction speed also constrains use cases. Public blockchain confirmation times range from seconds to minutes. Private chains can be faster but still slower than centralized database writes. For real-time ping-post auctions where milliseconds matter, blockchain latency may be prohibitive.

Lead routing decisions happen in under 100 milliseconds. Waiting 2-10 seconds for blockchain confirmation would fundamentally change distribution economics. Blockchain consent verification would likely need to operate asynchronously, with leads distributed based on expected verification rather than confirmed on-chain state.

Adoption Network Effects

Blockchain value increases with participation. A consent verification blockchain with one participant provides no advantage over a centralized database. Value emerges when multiple publishers, brokers, and buyers share the same chain.

This creates a classic chicken-and-egg problem. Publishers will not implement blockchain consent capture until buyers require it. Buyers will not require blockchain verification until sufficient publishers provide it. Neither side moves without the other.

TrustedForm and Jornaya solved this through first-mover advantage and sales effort. Building similar network effects for blockchain verification requires either a dominant player forcing adoption (undermining the decentralization benefits) or organic coordination that has proven difficult in practice.

Industry consortiums have attempted blockchain adoption in advertising and supply chain contexts. Most have struggled with governance disputes, insufficient participation, and unclear value propositions that fail to justify switching costs. The lead generation industry would likely face similar challenges.

Data Privacy Tensions

Blockchain transparency conflicts with data privacy requirements. Even encrypted data on-chain reveals transaction patterns, participant relationships, and activity volumes that may be sensitive.

For consent verification specifically:

GDPR considerations. The right to erasure conflicts with blockchain immutability. While some implementations use off-chain data storage with on-chain hashes, this adds complexity and reintroduces centralization at the data layer.

Competitive intelligence. Transaction volumes on shared blockchains reveal operational scale to competitors. Even encrypted lead data exposes how much business flows through specific participants.

Consumer visibility. If consumers can access the chain, they might see how their leads were distributed, to how many buyers, at what prices. This transparency might be desirable or problematic depending on your business model.

Private blockchain implementations can address some privacy concerns but sacrifice decentralization benefits. The more restricted the participation, the more the system resembles a traditional database with extra complexity.

Technical Maturity and Standards

Blockchain technology continues evolving. Enterprise implementations often build on platforms that change significantly between versions. Investments in specific blockchain implementations risk obsolescence as the technology matures.

No industry standards exist for blockchain consent verification. Each implementation uses different data models, consensus mechanisms, and integration approaches. Interoperability between different blockchain systems is limited, fragmenting any network effects.

The platforms that might host lead generation blockchains, Hyperledger Fabric, enterprise Ethereum variants, Polygon, and others, each have different characteristics, vendor ecosystems, and long-term viability questions. Choosing the wrong foundation creates migration costs when standards eventually consolidate.

Current State: Where Blockchain Is Actually Used

Despite limitations, blockchain has found some traction in advertising and marketing adjacent to lead generation. Understanding these implementations provides realistic context.

Advertising Supply Chain Transparency

Several advertising industry initiatives use blockchain for supply chain tracking:

IBM and Mediaocean partnership. Tracked advertising transactions across the supply chain, recording impressions, placements, and payments on a shared ledger. The initiative provided transparency into programmatic advertising’s complex intermediary chain. Adoption remained limited due to participation challenges and unclear ROI for participants who benefited from opacity.

Amino Payments. Used blockchain to reconcile advertising payments across publishers and advertisers. The implementation reduced payment disputes and accelerated reconciliation. However, it addressed payment transparency rather than consent verification.

AdLedger consortium. Industry group developing blockchain standards for advertising. Published research on supply chain transparency and fraud prevention. Standards development continues but widespread adoption has not materialized.

These initiatives address different problems than consent verification but demonstrate both blockchain’s potential and its adoption challenges in marketing contexts.

Identity and Consent Experiments

More directly relevant to lead generation:

Brave Browser’s Basic Attention Token. Records user attention and consent on blockchain, enabling privacy-preserving advertising. Demonstrates that consent can be captured on-chain but operates in a fundamentally different model than traditional lead generation.

Several startups have attempted blockchain consent management: Civic, uPort, and others focused on decentralized identity. Most have pivoted away from pure blockchain approaches after encountering adoption challenges.

Consent management platforms like OneTrust and TrustArc have explored blockchain for consent audit trails. Implementations typically use blockchain for backup verification rather than primary consent storage.

No major consent verification platform has achieved significant market penetration using blockchain as the core technology. This absence is telling. If blockchain provided clear advantages, competitive pressure would have driven adoption by now.

Why Adoption Has Lagged

The gap between blockchain potential and actual adoption reflects several factors:

Existing solutions work. TrustedForm and Jornaya solve the consent verification problem adequately for most practitioners. The switching costs to blockchain alternatives exceed the incremental benefits.

Complexity without proportional benefit. Blockchain implementations require significant technical investment. For most lead generation operations, that investment would generate more value directed toward traffic acquisition, conversion optimization, or compliance infrastructure.

Governance coordination failure. No entity has successfully coordinated the industry participants necessary for blockchain network effects. Without coordination, individual implementations remain isolated experiments.

Regulatory uncertainty. How courts would treat blockchain evidence versus traditional certificates remains unclear. Until case law establishes blockchain record admissibility and evidentiary weight, conservative practitioners prefer established verification methods.

Realistic Use Cases for Lead Generation

Given the limitations, where might blockchain genuinely add value for lead generation? Several use cases show more promise than general consent verification.

Consent Revocation Propagation

When consumers revoke consent, that revocation must propagate to all parties who received the lead. Currently, this happens through DNC lists, suppression files, and direct notification. The process is fragmented, slow, and error-prone.

Blockchain could improve revocation propagation:

Single source of truth. A shared ledger recording revocations would ensure all participants see the same revocation data simultaneously. No party could claim they did not receive notification.

Automated enforcement. Smart contracts could automatically remove revoked consent from downstream systems, enforce the FCC’s 10-business-day processing requirement, and provide audit trails demonstrating compliance.

Reduced liability exposure. If revocation is verifiably propagated on-chain, parties can demonstrate they had no way to know about revocation if they acted before the on-chain record.

This use case is narrower than general consent verification but addresses a genuine pain point. The revocation propagation problem affects fewer transactions than initial consent (most consumers do not revoke), making blockchain overhead more justifiable.

Cross-Network Lead Tracking

Leads moving through multiple brokers accumulate quality signals at each stage. Currently, this information is fragmented. Buyer A’s conversion data does not inform Buyer B’s routing. Publisher quality scores exist in isolated silos.

Blockchain could enable privacy-preserving signal aggregation:

Quality signal accumulation. Each handler records quality observations (validation results, contact outcomes, conversion signals) on-chain without revealing raw data. Downstream participants see aggregated quality indicators.

Provenance verification. Buyers could trace lead origins through the distribution chain, verifying that sources meet quality standards and consent was captured appropriately at the origin.

Automated quality enforcement. Smart contracts could enforce quality standards across networks. Leads failing verification at any stage would be flagged for all participants.

This use case requires significant coordination but addresses the information asymmetry that creates lead quality problems. The complexity might be justified for high-value verticals (legal, mortgage) where lead quality variance significantly impacts buyer economics.

Settlement and Payment Automation

Lead generation payments involve complex relationships: net terms, return windows, quality adjustments, and volume incentives. Disputes consume operational bandwidth and strain partnerships.

Blockchain smart contracts could automate settlement:

Programmable payment terms. Net-30 payment, 5-day return window, 15% quality adjustment, all encoded in smart contracts that execute automatically based on verified events.

Dispute reduction. When terms are programmatic, there is less to dispute. The contract executes as written. Ambiguity that creates payment disputes is eliminated at contract design.

Cash flow predictability. Automatic settlement on verified conditions improves working capital planning for both parties.

This use case requires less consensus on data standards (financial terms are well-defined) and provides clear ROI (reduced payment operations overhead). Several blockchain payment platforms serve adjacent industries and could potentially extend to lead generation.

Fraud Ring Detection

Sophisticated fraud operates across multiple publishers and uses techniques that individual operators cannot detect in isolation. Network-level visibility could improve fraud detection.

Blockchain could enable collaborative fraud detection without raw data sharing:

Anonymized signal aggregation. Participants record fraud indicators (duplicate submissions, suspicious timing patterns, validation failures) on-chain. Pattern matching across the network identifies fraud rings invisible to individual operators.

Blacklist coordination. Known fraudulent actors could be flagged on-chain, with all participants receiving real-time updates. New market entrants would benefit from accumulated fraud intelligence.

Proof of detection. When fraud is identified, the detection methodology and evidence exist on-chain. This supports recovery efforts and legal action against fraud operators.

This use case aligns with blockchain’s strengths (coordination across distrustful parties) and addresses a problem with significant economic impact. Implementation complexity is substantial but proportional to the fraud losses it could prevent.

Implementation Timeline and Investment Framework

For practitioners evaluating blockchain investment, timing matters. Moving too early wastes resources on immature technology. Moving too late misses competitive positioning as standards emerge.

The Realistic Timeline

2024-2025: Experimentation phase. Blockchain consent verification exists primarily in pilot programs and startup experiments. No significant market adoption. Operators should monitor developments but avoid production commitments.

2026-2027: Standards emergence. If blockchain gains traction, industry standards for consent data models and interoperability will emerge during this period. Early participants in standards bodies will influence direction. Operators planning blockchain strategy should engage in standards discussions.

2028-2030: Potential adoption. If standards stabilize and clear use cases demonstrate ROI, adoption could accelerate during this period. Network effects would favor early participants who established positions during standards emergence.

This timeline assumes blockchain eventually achieves meaningful adoption. An alternative scenario: blockchain remains a niche technology for lead verification, with TrustedForm and Jornaya continuing to dominate. Current evidence suggests this alternative is equally likely.

Investment Framework

Given uncertainty, how should operators approach blockchain investment?

Monitor, do not build. Track blockchain developments in lead generation and adjacent industries. Attend industry conferences where blockchain is discussed. Read case studies from advertising supply chain implementations. Build understanding without production investment.

Participate in standards discussions. If industry groups form to develop blockchain consent standards, participate. Shaping standards creates competitive advantage if adoption occurs. Participation costs are modest relative to implementation investment.

Evaluate vendor offerings. When blockchain consent verification vendors emerge with production-ready solutions, evaluate them using the same criteria applied to traditional verification platforms: court acceptance, reliability, cost, integration complexity, and industry adoption.

Invest when network effects materialize. Blockchain value requires network participation. Wait until sufficient industry participation exists before significant investment. Early adoption without network effects creates cost without benefit.

Maintain existing verification. Do not abandon TrustedForm and Jornaya for unproven blockchain alternatives. Continue current verification practices while evaluating emerging options. Transition only when blockchain alternatives demonstrate clear advantages.

Decision Criteria for Blockchain Investment

When evaluating specific blockchain implementations, apply these criteria:

Court acceptance. Has blockchain evidence been accepted in TCPA or similar litigation? Until courts establish precedent, blockchain verification adds risk rather than removing it.

Network participation. Who else is using this blockchain? A verification chain with three participants provides no advantage over bilateral trust relationships. Look for meaningful network effects.

Integration complexity. How difficult is integration with existing lead distribution infrastructure? Blockchain implementations requiring complete technology stack replacement face adoption barriers that incremental improvements do not.

Cost comparison. What is the all-in cost versus TrustedForm or Jornaya? Include infrastructure, integration, operations, and governance overhead. Blockchain should provide clear cost advantages or superior capabilities to justify switching costs.

Vendor viability. Is the blockchain provider likely to exist in 10 years? Consent documentation must survive the TCPA statute of limitations. Provider longevity matters for technology that stores litigation-critical evidence.

When Blockchain Makes Sense for Lead Generation

Given the analysis, when should lead generation operators consider blockchain investment?

Justified Use Cases

You operate a multi-party network with trust deficits. If your business involves multiple publishers, brokers, and buyers who do not trust each other’s records, blockchain can provide neutral ground. The coordination overhead is justified when trust relationships are already strained.

You have significant revocation propagation problems. If TCPA litigation has exposed revocation notification failures, blockchain propagation could reduce that specific risk. The use case is narrow but high-impact.

You handle high-value leads where verification premiums are acceptable. Legal leads at $200+ CPL can absorb blockchain verification costs that would be prohibitive for insurance leads at $15 CPL. High-value verticals face proportionally higher verification ROI.

You are building new infrastructure from scratch. Greenfield technology builds can incorporate blockchain without legacy integration complexity. The calculus changes when you are not retrofitting existing systems.

Not Yet Justified

You need basic consent verification. TrustedForm and Jornaya solve this problem adequately. Blockchain adds complexity without clear improvement.

You operate at moderate scale without trust deficits. If your publisher and buyer relationships work based on existing trust and verification, blockchain adds overhead without corresponding benefit.

You lack technical resources for blockchain implementation. Successful blockchain deployment requires significant technical investment. Operations without data engineering capacity should prioritize other technology investments.

Your legal team is not prepared for blockchain evidence. Until your attorneys understand how to present blockchain evidence in litigation, the technology may not provide the protection you expect.

The Honest Assessment

Blockchain technology for lead verification represents genuine capability that has not yet demonstrated genuine necessity.

The technology can provide immutable records, multi-party verification, and programmable consent logic. These capabilities are real. The question is whether the lead generation industry needs them given existing solutions that work adequately.

TrustedForm and Jornaya have achieved market acceptance, court credibility, and operational reliability. They operate on centralized trust models that blockchain could theoretically improve. But “theoretically improve” is not the same as “demonstrably improve in production at acceptable cost.”

The blockchain implementations that might change this equation have not yet emerged. The network effects that would drive adoption have not materialized. The standards that would enable interoperability do not exist. The court precedents that would establish evidentiary weight are absent.

This could change. Regulatory pressure could force verification improvements that blockchain provides. A breakthrough implementation could demonstrate clear advantages. Industry coordination could achieve the network effects that enable value creation.

Or blockchain consent verification could remain a technology solution searching for a problem, while incremental improvements to existing platforms address the verification challenges that actually matter.

For most lead generation operators, the prudent approach is informed monitoring rather than active investment. Understand what blockchain could do. Track developments in adjacent industries. Evaluate emerging vendors critically. But keep your TrustedForm integration running and your Jornaya contracts current.

The hype cycle for blockchain peaked around 2017-2018. The disillusionment trough followed. We are now in the slope of enlightenment where realistic applications separate from overpromised ones. For lead verification, that separation process is still underway. The verdict is not yet in.

Frequently Asked Questions

1. What is blockchain and how does it differ from traditional databases for lead verification?

Blockchain is a distributed ledger technology where multiple parties maintain synchronized, immutable records without central authority. Traditional databases like those powering TrustedForm and Jornaya are centralized, meaning a single organization controls the data. Blockchain differs in three key ways: immutability (records cannot be altered after recording), decentralization (no single point of control or failure), and transparency (all participants can verify records independently). For lead verification, this means consent documentation could theoretically be maintained across multiple parties without any single organization being able to alter records or control access. However, blockchain does not verify the accuracy of data when it is recorded, only that it has not been modified afterward.

2. Can blockchain prevent lead fraud and consent falsification?

Blockchain can prevent post-hoc modification of records but cannot prevent false data from being recorded initially. This is the “oracle problem.” If someone submits fraudulent consent documentation, the blockchain faithfully records that fraud immutably. Blockchain ensures records have not been changed since creation. It does not ensure records were accurate when created. Fraud prevention still requires trusted verification at data entry points, the same verification TrustedForm and Jornaya provide today. Blockchain adds value for detecting whether records were later altered, not for preventing false records from being created.

3. How much does blockchain consent verification cost compared to TrustedForm or Jornaya?

Direct cost comparison is difficult because production-scale blockchain consent verification platforms do not exist at the scale of TrustedForm or Jornaya. Theoretical costs include blockchain transaction fees ($0.01-$0.50 per transaction depending on chain and complexity), infrastructure investment (nodes, development, integration), and ongoing operational overhead (governance, key management, consensus participation). TrustedForm costs approximately $0.15-$0.50 per certificate for retention. Blockchain implementations might achieve similar per-transaction costs but require significant upfront investment that TrustedForm does not. The total cost of ownership for blockchain likely exceeds centralized alternatives for at least the next 3-5 years until infrastructure matures and standards reduce implementation complexity.

4. Would courts accept blockchain evidence in TCPA litigation?

No significant case law establishes how courts treat blockchain consent evidence in TCPA litigation. Courts have accepted TrustedForm certificates and Jornaya reports as evidence, creating established precedent. Blockchain evidence would likely be treated as business records subject to standard evidentiary rules, but authentication, foundation requirements, and expert testimony needs remain undefined. Until courts rule on blockchain evidence admissibility in TCPA or similar cases, the evidentiary weight is uncertain. Conservative litigation defense strategies should rely on established verification methods with court precedent rather than unproven blockchain alternatives.

5. What problems does blockchain solve that existing consent verification platforms do not?

Blockchain addresses trust in the verification provider. With TrustedForm, you trust ActiveProspect maintained accurate records and did not modify them. Blockchain could eliminate this trust requirement by distributing record-keeping across multiple independent parties. Blockchain also enables better revocation propagation (all parties simultaneously see consent revocation on a shared ledger) and cross-network lead tracking (quality signals accumulate as leads move through distribution chains). These are genuine improvements over current centralized approaches. However, the improvements must be weighed against implementation complexity, adoption friction, and the adequacy of existing solutions that have achieved market acceptance and court credibility.

6. Are any major companies using blockchain for lead verification today?

No major consent verification platform uses blockchain as core technology. TrustedForm and Jornaya dominate the market with centralized architectures. Several advertising industry initiatives have explored blockchain for supply chain transparency (IBM/Mediaocean, AdLedger consortium), but these address different problems than consent verification. Startups have attempted blockchain consent management (Civic, uPort) but most have pivoted away from pure blockchain approaches. The absence of major blockchain consent verification platforms after a decade of industry experimentation suggests either the technology is not ready or the use case is not compelling enough to justify switching costs from established solutions.

7. What is the realistic timeline for blockchain adoption in lead generation?

Based on current development trajectories, the realistic timeline spans multiple phases. Through 2025, blockchain consent verification remains experimental with no significant market adoption. During 2026-2027, if blockchain gains traction, industry standards for consent data models and interoperability will emerge. Operators should engage in standards discussions during this period. Between 2028 and 2030, if standards stabilize and clear use cases demonstrate ROI, adoption could accelerate. This timeline assumes blockchain eventually achieves meaningful adoption. An alternative scenario where TrustedForm and Jornaya continue dominating is equally likely based on current evidence.

8. Should I invest in blockchain consent verification for my lead generation business?

For most practitioners, the answer today is no. TrustedForm and Jornaya solve consent verification adequately with established court acceptance and operational reliability. Blockchain investment should wait until network effects materialize (sufficient industry participation exists), standards stabilize (interoperability is possible), court acceptance is established (evidentiary weight is clear), and vendor solutions mature (production-ready platforms exist). Current appropriate actions include monitoring developments, participating in standards discussions if industry groups form, and maintaining existing verification while evaluating emerging alternatives. Invest when blockchain demonstrates clear advantages over current solutions, not based on theoretical potential.

9. How does blockchain consent verification handle GDPR’s right to erasure?

This creates genuine tension. Blockchain immutability conflicts with GDPR Article 17’s right to erasure. Several approaches attempt to resolve this: off-chain data storage with on-chain hashes only (personal data can be deleted while maintaining record integrity), encrypted data with key destruction (data becomes unreadable when keys are deleted), and private blockchain architectures with deletion capabilities (sacrificing some immutability for compliance). None of these solutions is fully satisfactory. Off-chain storage reintroduces centralization. Key destruction does not truly delete data. Deletion-capable blockchains weaken the immutability that provides blockchain value. This privacy tension remains an unresolved challenge for blockchain consent verification.

10. What should I do now to prepare for potential blockchain adoption in lead verification?

Practical preparation without production investment: Monitor developments by tracking blockchain initiatives in lead generation and advertising. Participate in standards by engaging with industry groups developing consent verification standards. Evaluate emerging vendors by applying rigorous criteria (court acceptance, network participation, cost comparison, vendor viability) to blockchain verification offerings as they emerge. Maintain current verification by continuing TrustedForm and Jornaya implementation while evaluating alternatives. Build understanding by ensuring your technical and legal teams understand blockchain capabilities and limitations. Transition only when blockchain alternatives demonstrate clear advantages over established solutions with court precedent and market acceptance.

Key Takeaways

-

Blockchain provides immutability, not accuracy. The technology ensures records cannot be modified after creation but does not verify data accuracy at submission. Fraudulent consent recorded on blockchain becomes immutable fraud. The oracle problem means trusted verification is still required at data entry points.

-

Current consent verification platforms work. TrustedForm and Jornaya have achieved market acceptance, court credibility, and operational reliability. Blockchain must demonstrate clear advantages over these established solutions to justify adoption friction and switching costs.

-

The network effect problem constrains adoption. Blockchain value requires multi-party participation. No entity has successfully coordinated the industry participants necessary for meaningful network effects. Without coordination, blockchain implementations remain isolated experiments without ecosystem benefits.

-

Realistic use cases are narrower than general consent verification. Consent revocation propagation, cross-network lead tracking, payment automation, and fraud ring detection show more promise than replacing TrustedForm for basic consent certification. These use cases address specific pain points where blockchain’s coordination benefits justify implementation complexity.

-

The timeline is years, not months. Standards emergence, network effect development, and court acceptance require 3-5 years of maturation before blockchain consent verification could achieve meaningful market penetration. Operators should monitor rather than invest during this development period.

-

Transaction costs and speed create constraints. Blockchain confirmation times ranging from seconds to minutes conflict with real-time lead routing where milliseconds matter. Transaction costs may be comparable to current verification but include significant infrastructure and governance overhead.

-

Privacy tensions remain unresolved. Blockchain transparency conflicts with GDPR right to erasure and competitive confidentiality. Private blockchain implementations address some concerns but sacrifice decentralization benefits.

-

Court acceptance is unproven. No significant case law establishes blockchain evidence treatment in TCPA litigation. Until courts rule on admissibility and evidentiary weight, blockchain verification adds uncertainty rather than removing it.

-

Prudent approach: informed monitoring. Understand blockchain capabilities. Track industry developments. Participate in standards discussions. Evaluate emerging vendors critically. But maintain TrustedForm and Jornaya integration until blockchain alternatives demonstrate clear, proven advantages.

-

The hype-reality gap is substantial. After a decade of blockchain experimentation, no major consent verification platform has adopted the technology. This absence suggests either technological immaturity or insufficient use case value. The verdict on blockchain for lead verification remains undecided.

Sources

- NIST Blockchain Technology Overview - National Institute of Standards and Technology technical report defining blockchain properties, consensus mechanisms, and limitations

- IBM Blockchain Explained - Enterprise blockchain fundamentals including private vs public chain distinctions and business applications

- Ethereum Smart Contracts Documentation - Technical documentation on programmable contracts and automated execution on blockchain

- Hyperledger Fabric - Enterprise permissioned blockchain framework used in most business blockchain implementations

- Polygon Technology - Layer 2 scaling solution addressing blockchain transaction costs and speed limitations

- GDPR Article 17 - Right to Erasure - Official GDPR text on the right to be forgotten that creates tension with blockchain immutability

- Basic Attention Token - Brave Browser’s blockchain-based consent and attention tracking implementation for advertising

- ActiveProspect TrustedForm - Leading consent verification platform using centralized architecture that blockchain would need to improve upon

This article reflects blockchain technology state and lead generation industry practices as of late 2025. Blockchain capabilities, platform offerings, and adoption patterns evolve. Consult qualified technology and legal counsel before making blockchain investment decisions. This article does not constitute technology or legal advice.

Related Resources: