How Geoffrey Moore’s technology adoption framework applies to lead generation innovation, helping vendors cross into mainstream markets and buyers evaluate emerging capabilities.

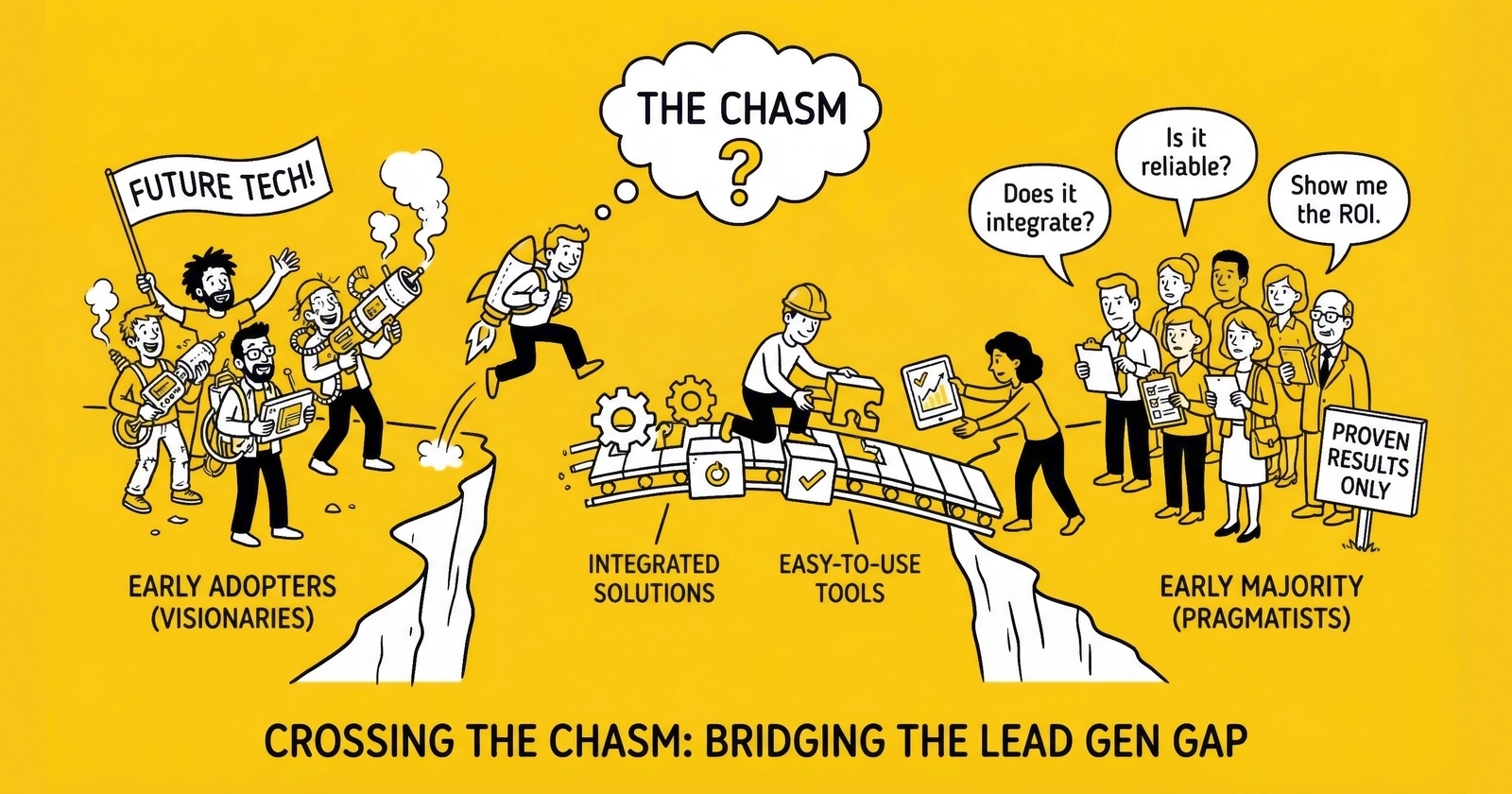

Geoffrey Moore’s “Crossing the Chasm” framework has guided technology strategy since 1991, explaining why promising innovations fail to reach mainstream markets and what separates successful technology companies from promising failures. The framework’s core insight – that different market segments require fundamentally different approaches – applies directly to lead generation, where technology vendors, platform providers, and innovative operators face the challenge of moving from early adopter success to mainstream market adoption.

For lead generation operators, the framework offers dual utility: evaluating technology vendors and their market position, and understanding how their own innovative offerings must evolve to reach broader buyer segments. The chasm between early adopters and mainstream buyers claims most technology innovations; understanding this dynamic separates operators who build sustainable businesses from those who plateau at early adopter scale.

This analysis applies Moore’s framework to lead generation technology, examining the adoption lifecycle, the characteristics of each adopter segment, strategies for crossing the chasm, and implications for both technology vendors and lead generation operators evaluating new capabilities.

The Technology Adoption Lifecycle in Lead Generation

Moore’s framework describes technology adoption as a bell curve divided into distinct segments, each with different motivations, evaluation criteria, and buying behavior:

-

Innovators (2.5%): Technology enthusiasts who pursue new technology for its own sake. In lead generation, these are operators running beta platforms, testing AI capabilities before documentation exists, and accepting significant risk for early access.

-

Early Adopters (13.5%): Visionaries who see technology’s strategic potential. They tolerate incomplete solutions if the vision is compelling. In lead generation, early adopters implement ping-post systems before industry standards stabilize, deploy AI scoring when accuracy is unproven, or adopt platforms before ecosystem support develops.

-

Early Majority (34%): Pragmatists who want proven solutions. They wait for technology to demonstrate reliability before committing. In lead generation, the early majority adopts established platforms with reference customers, documented ROI, and support infrastructure.

-

Late Majority (34%): Conservatives who adopt because they must, not because they want to. They follow industry standards rather than leading. In lead generation, late majority buyers move to new platforms only when old ones become unsupportable.

-

Laggards (16%): Skeptics who resist technology change until absolutely necessary. In lead generation, laggards still operate manual processes that automated systems replaced years ago.

The Chasm

The critical insight is that between early adopters and early majority lies a “chasm” – a gap that most technology innovations never cross. Early adopter success doesn’t predict mainstream success because these segments want fundamentally different things:

Early Adopters Want:

- Competitive advantage from being first

- Direct vendor relationship and influence on product direction

- Willingness to customize and integrate themselves

- Tolerance for incomplete solutions

- Vision alignment over proven performance

Early Majority Wants:

- Proven solutions with reference customers

- Complete products that work out of the box

- Established support and service infrastructure

- Industry acceptance and standards compliance

- Documented ROI from similar organizations

The strategies that win early adopters – bold vision, leading-edge features, direct executive relationships – fail with early majority buyers who want proof, stability, and risk reduction. Most technology ventures celebrate early adopter success, then discover their entire approach must change to reach mainstream markets.

Lead Generation Technology Through the Chasm Lens

Examining lead generation technology categories through this framework reveals where different capabilities sit on the adoption curve and what crossing the chasm requires.

AI-Powered Lead Scoring: Crossing Complete

AI-powered lead scoring has crossed the chasm into early majority adoption. The evidence:

- Major platforms (HubSpot, Salesforce, Marketo) include AI scoring as standard features. For implementation guidance on scoring systems, see our guide on AI lead scoring with machine learning prioritization

- Reference customers across industries demonstrate documented results

- Implementation patterns and best practices are established

- Integration ecosystems enable deployment without custom development

- ROI documentation exists for various use cases

Early majority buyers now evaluate AI scoring as a standard capability rather than innovative differentiation. The competitive frontier has moved to more sophisticated AI applications – agentic systems, multi-model architectures – that remain in early adopter territory.

Conversational AI: Crossing in Progress

Conversational AI for lead qualification sits in active chasm crossing:

- Early majority interest is high but adoption is cautious

- Reference customers exist but quality variation creates uncertainty

- Integration complexity prevents plug-and-play deployment

- ROI documentation is emerging but inconsistent

- Buyer concerns about customer experience risk slow adoption

Vendors targeting mainstream conversational AI adoption must address early majority concerns: complete solutions that don’t require AI expertise, proven performance in similar contexts, and risk mitigation for customer experience.

Agentic Systems: Pre-Chasm

Agentic AI systems – autonomous agents that make and execute decisions without human approval – remain firmly in early adopter territory. For analysis of agentic implementation patterns, see our guide on agentic AI workflows for lead generation:

- Primarily deployed by technology-forward organizations willing to experiment

- Implementation requires significant customization and integration

- Best practices and governance frameworks are still developing

- Reference customers are limited and often exceptional

- Risk factors (governance, compliance, control) concern pragmatic buyers

Vendors offering agentic capabilities must focus on early adopter value propositions: competitive advantage through autonomy, direct influence on product development, tolerance for ongoing evolution.

Consent Verification Infrastructure: Mainstream

Consent verification (TrustedForm, Jornaya) has fully crossed into late majority adoption. For comprehensive compliance guidance, see our TCPA compliance guide for lead generators:

- Industry standard practice rather than competitive advantage

- Required by major buyers as baseline expectation

- Integration is standardized and well-documented

- Pricing is competitive and predictable

- Non-adoption creates significant business risk

This represents technology that has completed the adoption lifecycle – now a cost of doing business rather than a strategic choice.

Strategies for Crossing the Chasm

Moore’s framework prescribes specific strategies for crossing the chasm, which apply directly to lead generation technology vendors and innovative operators.

The Beachhead Strategy

Rather than pursuing the entire early majority simultaneously, successful chasm crossers focus intensely on a single beachhead segment – a specific niche within the early majority that has compelling reason to adopt.

Beachhead Characteristics:

- Specific, identifiable segment with common characteristics

- Urgent problem that existing solutions don’t address

- Budget authority and decision-making capability

- Ability to serve as reference for adjacent segments

- Word-of-mouth connection to broader early majority

Lead Generation Application: A vendor with innovative AI scoring capability might target high-volume insurance agencies in specific states facing compliance pressure – a segment with urgent need (regulatory), budget (volume implies resources), and reference potential (other insurance agencies will listen).

The Whole Product Concept

Early adopters tolerate incomplete products; early majority demands complete solutions. The “whole product” includes everything needed for the buyer to achieve their objectives – not just the core technology but implementation, integration, training, support, and ecosystem.

Whole Product Components:

- Core product functionality

- Implementation and onboarding

- Integration with existing systems

- Training and documentation

- Ongoing support and success management

- Ecosystem of complementary solutions

- Reference customers and community

Lead Generation Application: An AI scoring vendor crossing the chasm must provide not just scoring algorithms but:

- Pre-built integration with major CRMs and distribution platforms

- Implementation methodology that doesn’t require AI expertise

- Training programs for operations teams

- Support infrastructure for production issues

- Customer success programs for optimization

- Partner ecosystem for adjacent needs

Positioning for the Early Majority

Early majority buyers evaluate differently than early adopters. Positioning must shift from vision and potential to proof and risk reduction.

Early Adopter Positioning: “The most advanced AI scoring technology, enabling 2x conversion improvement for operators who implement correctly.”

Early Majority Positioning: “AI scoring trusted by 500+ lead generation operations, with proven 25% conversion improvement and 90-day implementation timeline.”

The shift emphasizes: proven results over potential, breadth of adoption over leading-edge capability, predictable implementation over customization flexibility, and risk mitigation over competitive advantage.

Reference Customer Development

Early majority buyers require reference customers – organizations similar to themselves who have succeeded. Reference development becomes a strategic priority during chasm crossing.

Effective Reference Characteristics:

- Similarity to target beachhead segment

- Documented, quantifiable results

- Willingness to share experience publicly

- Accessible for prospect conversations

- Credible within their segment

Lead Generation Application: A ping-post platform crossing the chasm needs reference customers from specific verticals (insurance, mortgage, home services) who can demonstrate: implementation timeline, integration success, performance improvement, and support experience. Abstract case studies don’t convince; specific, verifiable references do.

Implications for Lead Generation Operators

The chasm framework offers strategic guidance for lead generation operators evaluating technology and positioning innovative offerings.

Technology Evaluation Through Adoption Lens

When evaluating technology vendors, consider their position on the adoption curve:

-

Pre-Chasm Vendors (Innovator/Early Adopter Stage): Offer potentially superior capability, require tolerance for incomplete solutions, may not survive to mainstream, provide competitive advantage if successful, and demand more buyer expertise and involvement.

-

Chasm-Crossing Vendors: Building complete solutions and reference base, actively developing implementation and support infrastructure, may offer favorable terms to gain references, risk of strategic shifts during crossing, and balance of innovation and stability.

-

Post-Chasm Vendors (Early Majority and Beyond): Proven solutions with established track records, predictable implementation and support, competitive pricing and terms, reduced risk but reduced differentiation, and industry standard rather than competitive advantage.

Match vendor position to your organization’s risk tolerance and strategic objectives. Early adopter organizations can accept pre-chasm vendors for competitive advantage; pragmatic organizations should prefer post-chasm solutions for reliability.

Positioning Innovative Offerings

Lead generation operators with innovative capabilities – unique scoring methodologies, specialized vertical expertise, novel distribution approaches – face their own chasm challenges.

-

If Targeting Early Adopters: Lead with vision and competitive potential, emphasize differentiation and innovation, offer customization and direct relationship, accept longer sales cycles and intensive support, and price for value rather than market comparison.

-

If Crossing to Early Majority: Develop complete offering including support and success, build reference customers in specific beachhead segments, create documentation and training for self-service, establish pricing that reflects market comparison, and invest in sales and marketing infrastructure.

-

If Serving Mainstream Market: Compete on reliability, price, and service, maintain feature parity with market expectations, invest in operational efficiency, build customer retention programs, and consider adjacency expansion.

The Bowling Alley Strategy

Moore describes the path from beachhead to broader market as a “bowling alley” – each segment knocked down makes the next easier to capture. For lead generation operators, this means:

- Identify beachhead: Specific segment with compelling need for your innovation

- Dominate beachhead: Become the obvious choice within that segment

- Identify adjacent pins: Segments connected to beachhead through relationships or similarity

- Use references: Use beachhead success to credibly enter adjacent segments

- Repeat expansion: Each captured segment enables the next

Example: An operator with specialized compliance capability might:

- Target Medicare supplement agencies facing CMS scrutiny (beachhead)

- Become the compliance-focused vendor for Medicare leads

- Expand to health insurance agencies (adjacent, similar compliance needs)

- Move to life insurance agencies (connected market, compliance relevance)

- Eventually serve general insurance vertical

Market Dynamics and Chasm Timing

The lead generation industry’s current technology transition creates specific chasm dynamics worth understanding.

AI Capabilities at Different Stages

Different AI capabilities occupy different adoption positions:

| Capability | Adoption Stage | Chasm Status |

|---|---|---|

| Basic AI scoring | Late majority | Crossed, mainstream |

| Predictive analytics | Early majority | Crossed, stabilizing |

| Conversational AI | Early majority | Crossing in progress |

| AI content generation | Early majority | Crossing in progress |

| Real-time optimization | Early adopter/early majority | Approaching chasm |

| Agentic systems | Early adopter | Pre-chasm |

| Multi-agent architectures | Innovator | Pre-chasm |

Operators should position investments according to their risk tolerance and adoption stage preferences.

Vendor Consolidation and Chasm Dynamics

Market consolidation affects chasm dynamics. As platforms acquire innovative vendors, some technologies cross the chasm through distribution rather than organic adoption. A pre-chasm AI capability acquired by an established platform may immediately access early majority customers through the parent’s relationships.

This creates both opportunity (faster mainstream access for innovative capabilities) and risk (independent vendors may be acquired or outcompeted before reaching scale).

Regulatory Acceleration

Regulatory requirements can accelerate adoption through the chasm. Consent verification crossed quickly because compliance requirements made non-adoption risky. One-to-one consent requirements may similarly accelerate adoption of consent management technology.

When regulation creates urgency, even pragmatic early majority buyers adopt quickly. Vendors can position innovative solutions as compliance necessities rather than optional enhancements.

Building Chasm-Crossing Capability

For lead generation operators seeking to cross the chasm with innovative offerings, several organizational capabilities matter:

Reference Customer Programs

Systematically develop reference customers:

- Identify ideal reference profile matching beachhead target

- Offer favorable terms in exchange for reference participation

- Document results rigorously with quantifiable metrics

- Enable various reference formats (case studies, calls, site visits)

- Maintain reference relationships over time

Customer Success Investment

Early majority buyers expect support beyond sales:

- Onboarding programs that ensure successful implementation

- Success management that drives value realization

- Training and documentation for self-sufficiency

- Community and peer learning opportunities

- Renewal and expansion programs

Marketing Shift

Marketing must evolve for early majority:

- From thought leadership to proof points

- From vision to implementation

- From differentiation to reliability

- From exclusivity to accessibility

- From innovation stories to success stories

Sales Methodology Evolution

Sales approaches change across the chasm:

- From executive relationship selling to process-driven sales

- From custom proposals to standardized offerings

- From proof-of-concept projects to reference-based selling

- From direct sales to channel and partnership models

- From long consultative cycles to efficient qualification

Vendor Risk Assessment Through Adoption Lens

Understanding where vendors sit on the adoption curve enables more informed risk assessment and vendor selection.

Pre-Chasm Vendor Risks

Vendors in innovator or early adopter stages present specific risks:

-

Survival Risk: Many pre-chasm vendors don’t survive to mainstream. Technology may be acquired, pivoted, or discontinued. Evaluate vendor financial stability, funding runway, and acquisition likelihood. Consider what happens to your operations if the vendor disappears.

-

Support Risk: Pre-chasm vendors often lack support infrastructure that mainstream vendors provide. Support may depend on founding team availability. Documentation may be incomplete. Integration assistance may be limited. Assess your internal capability to operate with limited vendor support.

-

Feature Risk: Pre-chasm products often lack features you need. The product roadmap may shift based on early customer feedback. What exists today may not represent what you eventually require. Evaluate feature gaps and your tolerance for workarounds.

-

Integration Risk: Pre-chasm vendors may lack established integration patterns with your existing technology stack. Custom integration work may be required. Integration may break as vendor product evolves. Assess integration complexity and maintenance requirements.

Chasm-Crossing Vendor Risks

Vendors actively crossing the chasm present different risk profiles:

-

Execution Risk: Chasm crossing requires different capabilities than early-stage success. Vendors may struggle with scaling support, maintaining quality while growing, or adapting positioning for mainstream buyers. Evaluate vendor’s progress indicators rather than assuming crossing success.

-

Strategic Shift Risk: Vendors crossing the chasm often pivot strategy – changing pricing, packaging, or target markets. Your use case may become de-prioritized if it doesn’t align with emerging mainstream focus. Assess alignment between your needs and vendor’s evolving strategy.

-

Pricing Risk: Vendors often change pricing models during chasm crossing – from value-based early adopter pricing to competitive mainstream pricing. Your current terms may not persist through contract renewals. Understand pricing trajectory and protect favorable terms contractually.

-

Attention Risk: During rapid growth, vendor attention to existing customers may decrease as focus shifts to new customer acquisition. Account management and support quality may degrade. Evaluate vendor’s customer retention track record during growth phases.

Post-Chasm Vendor Evaluation

Established vendors present lower risk but different considerations:

-

Innovation Risk: Post-chasm vendors may prioritize stability over innovation. If you need cutting-edge capability, mainstream vendors may not deliver. Evaluate vendor’s innovation investment and roadmap ambition.

-

Flexibility Risk: Mainstream vendors often have rigid processes and standard offerings. Custom requirements may be difficult or expensive to accommodate. Assess fit between your needs and vendor’s standard capabilities.

-

Lock-In Risk: Established vendors create switching costs through integration depth and data dependencies. Evaluate exit complexity and data portability before deep commitment.

Case Patterns: Technology Adoption in Lead Generation

Examining how specific technologies have navigated the adoption lifecycle provides practical insight.

Consent Verification: Rapid Chasm Crossing

TrustedForm and Jornaya represent technologies that crossed the chasm quickly, driven by regulatory urgency.

Pre-Chasm Phase: Initial adoption by compliance-focused early adopters who recognized TCPA litigation risk before most operators. Small customer base, limited integration options, and early pricing models.

Chasm Trigger: Increased TCPA enforcement and large settlements created urgency among pragmatic buyers. What early adopters adopted for competitive advantage became risk mitigation necessity for the mainstream.

Crossing Characteristics: Rapid customer growth as litigation risk made non-adoption untenable. Integration standardization as major platforms built connections. Pricing stabilization as market matured. Support infrastructure development to handle volume.

Post-Chasm Position: Now industry standard required by most buyers. Not a competitive differentiator but a cost of doing business. Multiple providers compete on price and features within established category.

Lesson: Regulatory urgency can dramatically accelerate chasm crossing by converting optional adoption into necessity.

Ping-Post Systems: Gradual Mainstream Adoption

Ping-post lead distribution technology crossed the chasm gradually over years rather than months.

Pre-Chasm Phase: Innovative operators built custom ping-post systems for competitive advantage. Technology was complex, required significant development, and had no standard platforms.

Chasm Crossing: Platform providers (boberdoo, LeadProsper, others) emerged offering packaged ping-post capability. Whole product development – documentation, implementation support, buyer integrations – enabled mainstream adoption. Reference customers accumulated across verticals.

Crossing Duration: The crossing took several years as platforms matured, integrations developed, and mainstream buyers built comfort with the model.

Post-Chasm Position: Ping-post is now standard architecture for lead distribution. Platforms compete on features, pricing, and service. The technology itself is no longer differentiating.

Lesson: Complex technologies may require extended crossing periods as whole product capability develops.

AI-Powered Scoring: Platform-Accelerated Crossing

AI lead scoring crossed the chasm partly through platform integration rather than standalone adoption.

Pre-Chasm Phase: Early AI scoring required data science expertise, custom model development, and significant technical capability. Only sophisticated operators could implement effectively.

Chasm Accelerator: Major CRM and marketing platforms (Salesforce Einstein, HubSpot predictive scoring, Marketo) integrated AI scoring as standard features. Platform distribution provided immediate mainstream access without standalone adoption decisions.

Crossing Characteristics: Platform integration eliminated implementation complexity for mainstream buyers. AI scoring became feature checkbox rather than strategic technology decision. Adoption measured in platform upgrades rather than vendor selections.

Post-Chasm Position: Basic AI scoring is expected capability. Differentiation moved to more sophisticated applications – real-time scoring, multi-model ensembles, agentic systems.

Lesson: Platform integration can accelerate crossing by reducing adoption friction to feature enablement rather than vendor selection.

Agentic Systems: Pre-Chasm Status

Autonomous AI agents represent technology still in early adopter territory, illustrating pre-chasm characteristics.

Current Position: Deployed primarily by technology-forward organizations willing to accept incomplete solutions and evolving capability. Reference customers are limited and often exceptional.

Chasm Barriers: Governance frameworks for autonomous AI remain immature. Compliance implications are unclear. Integration patterns aren’t standardized. Mainstream buyers express interest but hesitate to adopt without proven patterns.

Crossing Requirements: Successful crossing will require: established governance frameworks, compliance clarity, reference customers demonstrating safe deployment, whole product capability including implementation and support, and potentially regulatory guidance that reduces perceived risk.

Timeline Uncertainty: Whether agentic systems cross quickly (like consent verification under regulatory pressure) or slowly (like ping-post requiring extended capability development) remains unclear.

Lesson: New technologies with governance and compliance implications may face extended crossing timelines as institutional frameworks develop. For analysis of how human-AI collaboration models address governance concerns, see our guide on human-AI marketing collaboration.

Building Internal Adoption Capability

Lead generation operators benefit from systematic capability for evaluating and adopting new technologies.

Technology Evaluation Framework

Develop structured approach to technology assessment:

-

Adoption Stage Assessment: Where does this technology sit on the adoption curve? What are the stage-appropriate risks and opportunities?

-

Whole Product Evaluation: Does the offering include everything needed for success – not just core capability but implementation, integration, support, and ecosystem?

-

Reference Validation: Are there reference customers similar to your organization who have succeeded? Can you validate their experience directly?

-

Risk Assessment: What happens if this technology fails, vendor disappears, or product pivots away from your needs? Is the risk acceptable given potential reward?

-

Fit Evaluation: Does this technology address genuine problems you have? Does it fit your technical architecture, operational processes, and organizational capability?

Adoption Decision Framework

Structure adoption decisions based on risk tolerance and strategic position:

-

Conservative Approach (Risk-Averse Organizations): Wait for post-chasm technologies with proven track records, require multiple reference customers in similar situations, accept reduced competitive advantage for reduced risk, and prioritize stability and support over innovation.

-

Moderate Approach (Balanced Organizations): Consider chasm-crossing technologies with strong reference development, evaluate both risk and opportunity, require reasonable whole product capability, and balance innovation with operational stability.

-

Aggressive Approach (Innovation-Focused Organizations): Consider pre-chasm technologies for competitive advantage, accept incomplete solutions if vision aligns, build internal capability to supplement vendor gaps, and trade stability for differentiation potential.

Implementation Success Patterns

Regardless of adoption stage, successful implementation follows patterns:

-

Pilot Before Commitment: Test technologies in limited scope before organization-wide deployment. Pilots reveal integration challenges, performance reality, and organizational fit.

-

Define Success Criteria: Establish measurable criteria for implementation success before beginning. Clear criteria enable objective evaluation of results.

-

Plan for Iteration: Expect initial implementation to require refinement. Build iteration time and resources into implementation plans.

-

Build Internal Expertise: Develop internal capability rather than depending entirely on vendor expertise. Internal knowledge enables optimization and troubleshooting.

-

Document and Share: Document implementation experience and share across organization. Institutional learning improves future adoption decisions.

Key Takeaways

-

The technology adoption lifecycle divides markets into distinct segments – innovators, early adopters, early majority, late majority, and laggards – each requiring fundamentally different vendor approaches.

-

The chasm between early adopters and early majority claims most technology innovations because early adopter success strategies (vision, customization, direct relationships) fail with pragmatist buyers who want proof, stability, and risk reduction.

-

AI-powered lead scoring has crossed the chasm and is now an early majority standard; conversational AI is actively crossing; agentic systems remain in early adopter territory with pre-chasm risk and opportunity profiles.

-

The beachhead strategy focuses on a specific niche within the early majority that has urgent problems, budget authority, and word-of-mouth connection to broader markets – rather than pursuing all segments simultaneously.

-

The whole product concept requires complete solutions for early majority adoption: core technology plus implementation, integration, training, support, ecosystem, and references – early adopters tolerate incomplete offerings, pragmatists don’t.

-

Positioning must shift from vision to proof when crossing the chasm: “most advanced technology” appeals to early adopters; “trusted by 500+ operations with proven 25% improvement” appeals to early majority.

-

Reference customer development becomes strategic priority during chasm crossing: early majority buyers require similar organizations who succeeded – abstract case studies don’t convince, specific verifiable references do.

-

Lead generation operators should evaluate vendors through the adoption lens: pre-chasm vendors offer potentially superior but risky capability; post-chasm vendors offer reliability without differentiation – match vendor stage to risk tolerance.

-

The bowling alley strategy expands from beachhead to adjacent segments: dominate initial niche, use references to enter connected segments, repeat expansion until reaching mainstream market.

-

Regulatory requirements can accelerate chasm crossing by creating urgency that motivates even pragmatic buyers to adopt quickly – positioning innovative solutions as compliance necessities rather than optional enhancements.

Frequently Asked Questions

How do I determine where a vendor sits on the adoption curve?

Evaluate several indicators: customer count and diversity (pre-chasm vendors have few customers, often concentrated in tech-forward segments), reference availability (mainstream vendors readily provide industry-specific references), ecosystem development (post-chasm vendors have partner networks, integrations, and complementary solutions), support infrastructure (established vendors have support teams, documentation, training programs), and market position (industry analysts cover and rate mainstream vendors). Also consider vendor messaging: vision-focused positioning suggests early adopter targeting; proof-focused positioning suggests chasm crossing or mainstream status.

Should early-stage lead generation operations adopt pre-chasm technology?

It depends on your strategic position and risk tolerance. Pre-chasm technology offers competitive advantage potential: if you succeed with innovative capability before competitors adopt it, you gain differentiation. But pre-chasm technology also carries risk: incomplete solutions require more expertise, vendors may not survive to mainstream, and support infrastructure may be limited. Early-stage operations with technology expertise and risk tolerance may benefit from pre-chasm adoption. Operations focused on operational efficiency should prefer proven solutions. Evaluate: do you have expertise to implement incomplete solutions? Can you tolerate vendor failure? Is competitive advantage worth the risk?

How long does chasm crossing typically take for lead generation technology?

Timelines vary significantly based on technology complexity, market urgency, and vendor execution. Simple capabilities with clear value propositions may cross in 2-3 years. Complex capabilities requiring organizational change may take 5-7 years or longer. Consent verification crossed relatively quickly due to compliance urgency. AI scoring took longer as organizations built comfort with algorithmic decisions. Agentic systems may cross slowly because governance and control concerns create adoption friction. Monitor adoption indicators (vendor customer growth, analyst coverage, competitor adoption) rather than assuming fixed timelines.

What signals indicate a vendor is successfully crossing the chasm?

Successful chasm crossing shows in: accelerating customer growth beyond early adopter segment, expanding reference customer base across industries and organization types, development of partner ecosystem and integrations, analyst recognition and category leadership, shift in marketing from vision to proof, establishment of standardized pricing and packaging, investment in customer success and support infrastructure, and competitive response from established players. Vendors that plateau at early adopter scale without these indicators may be stuck in the chasm.

How does the framework apply to lead generation operators positioning innovative services?

Operators with innovative capabilities (unique methodologies, specialized expertise, novel approaches) face similar chasm dynamics as technology vendors. If your innovation appeals primarily to visionary buyers seeking competitive advantage, you’re in early adopter territory. Crossing to mainstream requires: developing complete service offerings including support and success management, building reference customers in specific beachhead segments, creating documentation and training for operational teams, establishing pricing that reflects market comparison rather than value-based premium, and investing in sales and marketing infrastructure that scales. The bowling alley strategy applies: dominate a specific segment, use references to expand to adjacent segments, and build toward mainstream position.

What role do acquisitions play in chasm crossing?

Acquisitions can accelerate chasm crossing by providing distribution through established customer relationships. A pre-chasm AI capability acquired by a major platform immediately accesses early majority customers through the parent’s sales infrastructure and trust relationships. For innovative vendors, acquisition by established players offers faster mainstream access than organic crossing. For operators evaluating vendors, acquisitions signal either technology validation (acquirer sees value) or risk (acquired products may be deprioritized or integrated away). Monitor post-acquisition execution: does the capability maintain development momentum? Does it receive sales and marketing investment? Is it integrated into the parent platform?

How should compliance requirements affect chasm strategy?

Regulatory requirements can dramatically accelerate chasm crossing by creating urgency that motivates pragmatic buyers. Consent verification crossed quickly because non-compliance created legal and business risk. Position innovative capabilities as compliance solutions when regulations align with your offering’s value proposition. If one-to-one consent requirements threaten traditional business models, technologies that address consent management become urgent rather than optional. Early majority buyers who would normally wait for proof will adopt quickly when non-adoption creates regulatory exposure. Time market entry to regulatory deadlines when your capability addresses compliance needs.

How do I evaluate whether a technology is actually crossing the chasm vs. stuck?

Assess multiple indicators simultaneously. Positive crossing signals include: increasing number of reference customers from mainstream buyer profile (not just innovators), growing competitive activity as mainstream vendors respond, decreasing implementation complexity and increasing whole product completeness, and community or ecosystem development indicating broader adoption. Stuck indicators include: customer base still dominated by technology-focused early adopters after extended period, whole product gaps that aren’t closing, vendor pivoting strategy frequently, and lack of competitive response from established players. The timeline matters too – pre-chasm technology that hasn’t shown crossing progress after 2-3 years may be permanently stuck.

What’s the role of industry standards in chasm crossing?

Industry standards can dramatically accelerate or impede chasm crossing. When technology requires integration with existing systems, standards enable interoperability that mainstream buyers require. Proprietary approaches may work for early adopters who can build custom integrations, but mainstream buyers often wait for standard protocols. In lead generation, standard data formats, API specifications, and integration patterns reduce adoption friction. Vendors who participate in standardization efforts may accelerate crossing by reducing buyer integration concerns. Conversely, competing standards or lack of standardization may slow crossing by creating buyer uncertainty about which approach will prevail.

How do network effects influence chasm crossing in lead generation technology?

Network effects can dramatically accelerate or impede chasm crossing. Technologies that become more valuable as adoption increases – lead exchanges, data consortiums, integration ecosystems – benefit from network effects that pull mainstream buyers toward adoption once critical mass is reached. For lead generation, buyer networks matter: if major lead buyers adopt a technology and begin requiring it from sellers, sellers must adopt regardless of their own technology preferences. Platform technologies that connect multiple parties experience stronger network effects than standalone tools. Evaluate whether your technology benefits from network effects and, if so, whether adoption has reached the tipping point where effects accelerate mainstream adoption. Pre-network-effect technologies require different go-to-market strategies than post-network-effect technologies.

Sources

- Geoffrey Moore. “Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers.” HarperBusiness.

- Geoffrey Moore. “Inside the Tornado: Strategies for Developing, Leveraging, and Surviving Hypergrowth Markets.” HarperBusiness.

- Gartner. “Technology Adoption Lifecycle.” https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

- McKinsey & Company. “The State of AI in 2025.” https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

- Forrester Research. “Predictions 2026: B2B Marketing, Sales, And Product.” https://www.forrester.com/press-newsroom/forrester-b2b-marketing-sales-product-2026-predictions/

- Christensen Institute. “Disruptive Innovation Theory.” https://www.christenseninstitute.org/theory/disruptive-innovation/