The CDP market is growing at 30.7% annually, reaching $37.1 billion by 2030. For lead generation businesses, a CDP transforms fragmented customer data into unified profiles that power personalization, improve attribution accuracy, and drive 5-15% revenue increases. Here is what you need to know about selecting, implementing, and extracting value from customer data platforms.

Your lead generation operation likely runs on fragments. Traffic data lives in Google Analytics. Conversion data sits in your distribution platform. Email engagement metrics reside in your marketing automation tool. CRM records track buyer interactions separately. Financial data exists in yet another system.

This fragmentation creates blind spots. You cannot track a consumer’s complete journey from first impression through final conversion. You cannot attribute downstream sales to specific traffic sources with confidence. You cannot personalize experiences based on comprehensive behavioral profiles. And increasingly, you cannot comply with privacy regulations that require unified consent management across all touchpoints.

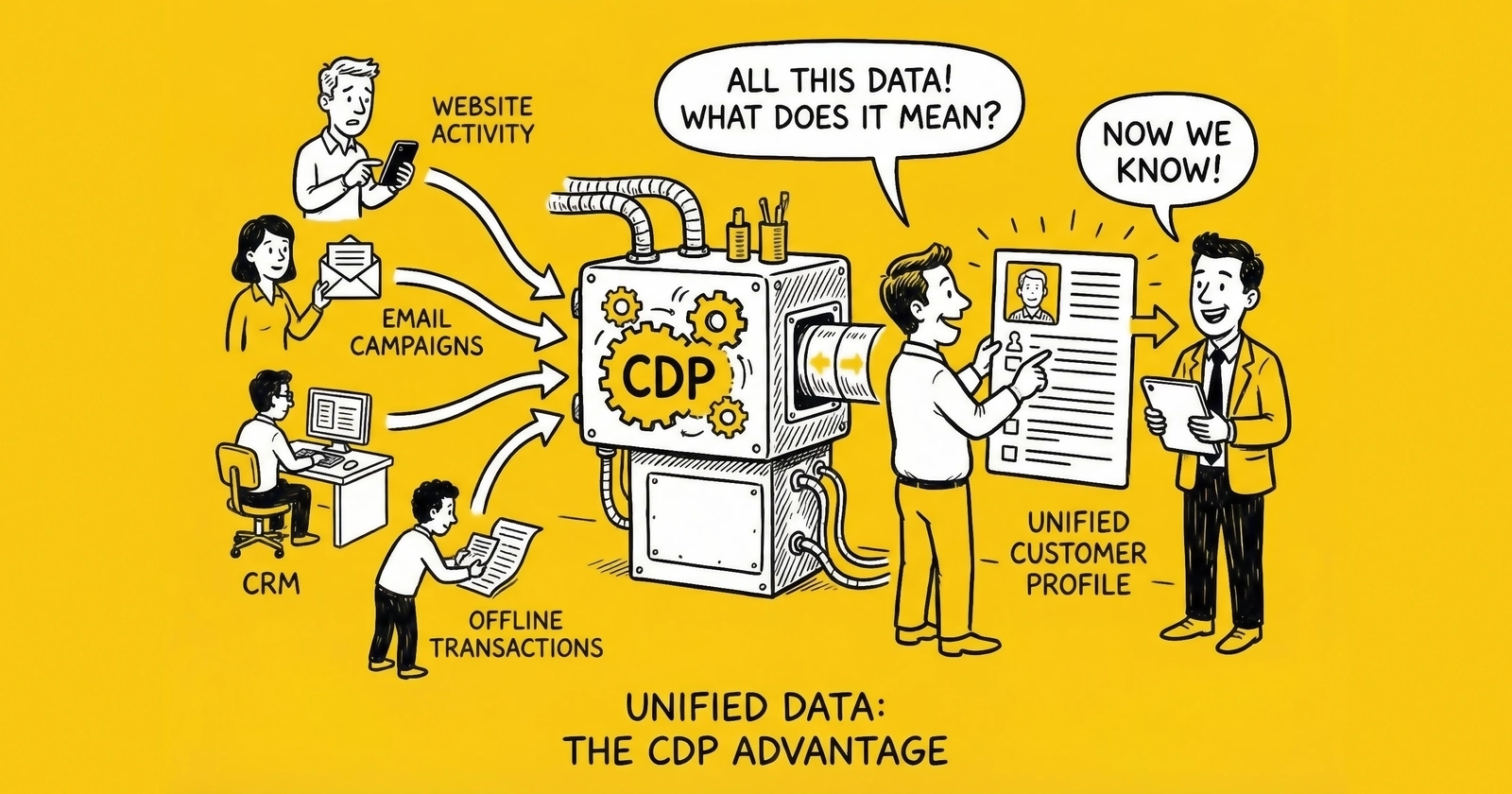

Customer Data Platforms solve this problem by unifying first-party customer data from every source into a single, persistent customer profile accessible to all your systems. The CDP Institute defines a CDP as “packaged software that creates a persistent, unified customer database that is accessible to other systems.” For lead generation businesses, this means connecting the dots between traffic acquisition, lead capture, distribution, and downstream conversion.

The stakes are substantial. According to Oracle, organizations that master personalization through unified customer data drive 5-15% revenue increases and 10-30% improvements in marketing spend efficiency. As third-party cookies deprecate and browser tracking restrictions intensify, first-party data infrastructure becomes not just advantageous but essential for survival.

This guide covers everything lead generation operators need to know about CDPs: what they do, why they matter specifically for lead businesses, how to evaluate options, implementation approaches, and common mistakes to avoid.

What Is a Customer Data Platform?

A Customer Data Platform is packaged software designed to collect, unify, and activate first-party customer data across all touchpoints. Unlike data warehouses managed by IT or CRM systems focused on sales interactions, CDPs are typically controlled by marketing and operations teams while remaining accessible to other systems through APIs, database queries, and file exports.

The Three Core Functions

Every CDP performs three fundamental functions, regardless of vendor or implementation.

Data Collection: CDPs ingest data from multiple sources in real-time. This includes website behavior tracked through JavaScript tags, mobile app events, email engagement, call recordings and transcripts, form submissions, CRM records, transaction data, and offline interactions. For lead generation specifically, this means capturing data from landing pages, distribution platforms, call centers, buyer feedback systems, and marketing automation tools.

Identity Resolution: Raw data arrives with inconsistent identifiers. The same consumer might appear as “john.smith@gmail.com” in one system, phone number “555-123-4567” in another, and cookie ID “abc123” in a third. CDPs resolve these fragments into unified customer profiles using deterministic matching (same email equals same person) and probabilistic matching (behavioral patterns suggest the same person across devices).

Data Activation: Unified profiles become accessible to downstream systems. This includes exporting audiences to advertising platforms, triggering personalized content in marketing automation, feeding enriched records to sales teams, and powering real-time personalization engines. The CDP serves as the central hub that synchronizes customer understanding across your entire technology stack.

CDP Categories

The CDP Institute classifies platforms into four categories based on functional sophistication.

Data CDPs provide core data assembly and profile storage. They unify data and make it accessible but offer limited analytical or activation capabilities. These suit organizations with strong existing analytics and marketing technology that need only the data unification layer.

Analytics CDPs add segmentation and predictive modeling on top of data unification. They can identify high-value customer segments, predict churn risk, and score leads based on behavioral patterns. For lead generation, analytics CDPs enable sophisticated lead scoring beyond simple demographic criteria.

Campaign CDPs include personalized treatment selection for individuals. They determine not just which segment a customer belongs to but which specific message, offer, or experience that individual should receive. These suit operations focused on cross-sell, upsell, and retention marketing.

Delivery CDPs provide message delivery across channels. They can execute campaigns directly rather than just feeding audience data to separate execution platforms. While powerful, these overlap significantly with marketing automation platforms and may introduce complexity for organizations with existing marketing technology stacks.

For most lead generation operations, Analytics CDPs provide the optimal balance of capability and complexity. You need unified profiles and predictive intelligence but likely already have distribution platforms and marketing automation tools handling execution.

Why CDPs Matter for Lead Generation

Lead generation presents unique data challenges that CDPs are particularly well-suited to address. Understanding these specific use cases helps justify investment and guides implementation priorities.

The Attribution Problem

Lead generation operates on traffic arbitrage. You buy clicks at one price and sell leads at another. Profitability depends entirely on knowing true cost per lead by source. But accurate attribution requires connecting data across multiple systems.

Consider the typical consumer journey. A prospect sees a Meta display ad on Monday. They search on Google Wednesday, clicking an organic result. They return directly Thursday and submit a form. That lead sells to a buyer, who converts them to a customer two weeks later.

Without unified data, you might credit the conversion entirely to direct traffic (last touch), entirely to Meta (first touch), or split it arbitrarily across touchpoints. None of these approaches reflect reality. The CDP tracks the complete journey, enabling accurate multi-touch attribution that reveals true source value.

For lead generation specifically, attribution extends beyond lead capture to downstream outcomes. When buyers report conversion data, a CDP can link those conversions back through the lead record to original traffic sources. This closed-loop attribution answers the question that actually matters: which traffic sources generate profitable customers, not just form fills.

The Personalization Opportunity

Personalization in lead generation means showing the right message to the right prospect at the right time. This extends beyond landing page copy to dynamic form questions, conditional offers, remarketing creative, and follow-up sequences.

CDPs enable personalization by providing complete behavioral context. A prospect who previously submitted a mortgage lead but did not convert might see different messaging than a first-time visitor. A returning visitor from a specific geographic region can receive localized offers. A consumer who engaged heavily with educational content might receive different calls-to-action than one who navigated directly to the quote form.

The personalization impact compounds over time. Organizations using CDP-powered personalization report 5-15% revenue increases from better matching of offers to consumer intent and 10-30% improvements in marketing efficiency from reduced waste on irrelevant messages.

The Privacy Compliance Imperative

Privacy regulations require unified consent management across all touchpoints. GDPR, CCPA/CPRA, and state-level privacy laws demand that organizations know what data they hold about each individual, honor opt-out requests across all systems, prove consent for data usage, and delete records on request.

When customer data is fragmented across a dozen systems, compliance becomes nearly impossible. Each system must be audited. Deletion requests must propagate to every database. Consent status must remain synchronized.

CDPs centralize this complexity. Consent preferences attach to unified customer profiles. When a consumer opts out, the CDP propagates that preference to all connected systems. Privacy portals enable consumers to view and manage their data from a single interface. Audit trails document data flows for regulatory review.

For lead generation specifically, consent documentation integrates with compliance infrastructure. TrustedForm certificates and Jornaya LeadiDs link to customer profiles, creating a complete record of consent capture, lead distribution, and buyer delivery.

The Cookie Deprecation Response

Browser restrictions have devastated third-party cookie-based tracking. Safari limits even first-party cookies to seven days for traffic from domains classified as trackers. iOS strips click identifiers in various contexts. Over 31% of internet users employ ad blockers globally, rising to 42% among ages 18-34.

CDPs enable first-party data strategies that survive these restrictions. By collecting data directly on your own domains and resolving identities through deterministic matching (email, phone) rather than cookie-based probabilistic matching, CDPs maintain visibility into customer journeys that cookie-dependent systems lose.

Server-side tracking integration extends this advantage. Modern CDPs can receive server-side events, meaning data captured through your servers (bypassing browser restrictions) flows into the same unified profiles. This architecture recovers 20-40% of conversion signals lost to browser-based tracking.

CDP Market Landscape

The CDP market has matured rapidly, with the global market expected to grow from $9.72 billion in 2025 to $37.11 billion by 2030 at a 30.7% compound annual growth rate. This growth reflects enterprise adoption of first-party data strategies as third-party tracking degrades.

Major Vendors

Enterprise CDPs: Salesforce Data Cloud, Adobe Real-Time CDP, Oracle Unity, SAP Customer Data Platform. These integrate deeply with their respective enterprise ecosystems but carry enterprise pricing and implementation complexity.

Independent CDPs: Segment (now part of Twilio), Treasure Data, Tealium, BlueConic, ActionIQ. These offer flexibility and focus specifically on data unification without the broader platform dependencies.

Marketing-Focused CDPs: Klaviyo, Braze, Bloomreach. These emphasize activation capabilities for e-commerce and consumer marketing, with strong integration to email, SMS, and personalization engines.

Analytics-Heavy CDPs: mParticle, Amperity, Lytics. These emphasize identity resolution and predictive analytics, suitable for organizations with complex identity matching requirements.

For lead generation operations, the optimal vendor depends on your existing technology stack and primary use cases. Operations already using Salesforce for buyer management might benefit from Salesforce Data Cloud integration. Operations prioritizing analytics and attribution might favor independent platforms with strong identity resolution.

Pricing Models

CDP pricing typically follows one of three models.

Event-based pricing charges per data point collected. Segment pioneered this approach. It scales predictably but can become expensive at high data volumes.

Profile-based pricing charges per unified customer profile. This works well for operations with clear customer counts but can complicate pricing for lead generation where “customer” definitions vary.

Feature-based pricing charges based on capability tiers. Base data unification is affordable; advanced analytics, predictive modeling, and activation capabilities add cost.

Entry-level implementations start around $12,000-25,000 annually for smaller operations. Mid-market implementations run $50,000-150,000 annually. Enterprise implementations exceed $250,000 annually and often include significant professional services.

For lead generation operations processing 10,000-50,000 leads monthly, expect annual CDP costs of $30,000-80,000 for capable implementations, varying by vendor and feature requirements.

CDP Architecture for Lead Generation

Implementing a CDP in lead generation requires thoughtful architecture that connects traffic sources, capture points, distribution systems, and buyer feedback into unified customer profiles.

Data Sources to Connect

Traffic and Attribution Data: Google Analytics, Meta Ads Manager, Google Ads, native advertising platforms, affiliate networks. This data reveals where customers originate and how they engage before conversion.

Lead Capture Data: Landing pages, form submissions, call tracking systems. This captures the conversion event and initial customer information.

Compliance Data: TrustedForm certificates, Jornaya LeadiDs, consent records. This documents the legal basis for contacting each consumer.

Distribution Data: Lead distribution platform records showing routing decisions, buyer matches, pricing, and delivery outcomes.

Buyer Feedback Data: Conversion rates, contact rates, return requests, customer lifetime value. This closes the loop from lead capture to actual business outcomes.

Engagement Data: Email opens and clicks, SMS responses, website revisits, remarketing engagement. This tracks ongoing relationships with consumers across your properties.

Identity Resolution Strategy

Lead generation presents specific identity resolution challenges. The same consumer might submit forms on multiple sites, use different email addresses, or provide varying phone numbers across interactions.

Effective identity resolution for lead generation requires clear primary identifiers, typically email and phone since these are validated during lead capture and used for downstream contact. Secondary identifiers include device fingerprints, IP addresses, and behavioral signatures that help match anonymous sessions to known individuals. Deterministic matching uses exact matches on primary identifiers and should be prioritized for accuracy. Probabilistic matching uses behavioral patterns and should be employed cautiously, with confidence thresholds that prevent false matches.

For operations purchasing leads from external sources, identity resolution must handle incoming records that may already exist in your database. Dedupe logic should match against the CDP’s unified profiles to prevent paying twice for the same consumer.

Integration Architecture

Three integration patterns serve lead generation CDP implementations.

Real-time streaming sends events to the CDP as they occur. Form submissions, page views, and distribution events flow continuously. This enables real-time personalization and immediate profile updates but requires robust event infrastructure.

Batch synchronization sends data in periodic updates, typically hourly or daily. This works well for data that does not require real-time availability, such as financial reconciliation and historical analytics.

Reverse ETL sends CDP data back to operational systems. Unified profiles enrich distribution platform records. Audience segments export to advertising platforms. Predictive scores feed sales prioritization.

Most lead generation implementations combine all three patterns. Critical events stream in real-time. Historical and financial data synchronizes in batches. Enriched data flows back to execution systems through reverse ETL.

CDP Selection for Lead Businesses

Selecting the right CDP requires evaluating capabilities against your specific requirements. Lead generation operations should prioritize several capabilities over generic marketing features.

Essential Capabilities

Identity Resolution Quality: The CDP must accurately match records across systems without over-matching distinct individuals or under-matching true duplicates. Test identity resolution with your actual data during evaluation, not just vendor demos.

Real-Time Data Ingestion: Lead generation operates in real-time. If the CDP cannot ingest and process events within seconds, personalization and routing intelligence suffer.

Distribution Platform Integration: The CDP must connect to your lead distribution platform, whether Boberdoo, LeadsPedia, Lead Prosper, or custom systems. Verify that integration exists or can be built through standard APIs.

Attribution Modeling: The CDP should support multi-touch attribution with configurable models. First-touch, last-touch, linear, time-decay, and position-based models each serve different analytical purposes.

Privacy Compliance: The CDP must support consent management, data subject requests, and deletion propagation. GDPR and CCPA compliance should be native, not bolted on.

Server-Side Integration: As browser tracking degrades, server-side event ingestion becomes essential. The CDP should accept server-side events from your tracking infrastructure.

Evaluation Process

Week 1-2: Requirements Definition. Document your data sources, integration requirements, use cases, and success metrics. Define what CDP success looks like for your operation specifically.

Week 3-4: Vendor Shortlisting. Research vendors against requirements. Request demos from three to five candidates. Narrow to two to three finalists based on capability fit and budget alignment.

Week 5-8: Technical Evaluation. Conduct proof-of-concept implementations with finalist vendors using your actual data. Test identity resolution accuracy, integration functionality, and performance under load.

Week 9-10: Reference Checks. Speak with current customers in similar industries. Ask about implementation experience, ongoing support quality, and realized value versus expectations.

Week 11-12: Contract Negotiation. Negotiate pricing, implementation support, and service level agreements. Ensure contracts include clear performance guarantees and exit provisions.

Red Flags to Avoid

Vague identity resolution. Vendors that cannot explain their matching methodology in detail are hiding limitations. Demand technical specifics.

Missing lead generation references. CDPs designed for e-commerce or B2B SaaS may not understand lead generation workflows. Seek vendors with relevant industry experience.

Integration promises without proof. “We can integrate with anything” often means “we have no pre-built integration and you will build it yourself.” Verify specific integrations exist and function.

Hidden implementation costs. Base licensing is often just the beginning. Clarify professional services, integration development, training, and ongoing support costs upfront.

Implementation Roadmap

CDP implementation follows a phased approach that builds foundation before attempting advanced use cases. Rushing to activation without solid data infrastructure creates brittle implementations that fail under operational pressure.

Phase 1: Foundation (Months 1-3)

Data Audit: Catalog all systems containing customer data. Document what data each system holds, how it identifies customers, and how it connects to other systems. This audit reveals integration requirements and data quality issues.

Source Prioritization: Not all data sources provide equal value. Prioritize connecting high-value sources first. For lead generation, this typically means distribution platform data, lead capture forms, and traffic attribution, followed by engagement data and buyer feedback.

Identity Schema: Define your identity resolution strategy. Which identifiers serve as primary keys? How will you handle conflicts when sources disagree? What confidence thresholds trigger matches?

Initial Integration: Connect the first three to five data sources. Focus on core lead flow data rather than edge cases. Validate that data flows correctly and identity resolution performs as expected.

Phase 2: Expansion (Months 3-6)

Complete Source Integration: Connect remaining data sources. Add compliance certification data, call tracking, marketing automation, and buyer feedback systems.

Profile Enrichment: Begin enhancing profiles with derived attributes. Calculate metrics like lead score, engagement level, and lifetime value at the profile level.

Quality Validation: Audit identity resolution accuracy. Sample matched profiles and verify accuracy manually. Tune matching logic based on findings.

Basic Activation: Enable initial use cases. Export audiences to advertising platforms for remarketing. Feed enriched data back to distribution platforms for improved routing.

Phase 3: Optimization (Months 6-12)

Attribution Implementation: Deploy multi-touch attribution models. Analyze source value across the complete funnel, not just to lead capture but through buyer conversion.

Predictive Modeling: Build predictive scores for lead quality, conversion probability, and lifetime value. Use these scores to optimize traffic acquisition and buyer routing.

Personalization: Enable real-time personalization on landing pages and in email sequences based on unified profile data.

Advanced Activation: Trigger automated workflows based on profile events. Route high-value leads to premium buyers. Suppress recently converted consumers from acquisition campaigns.

Phase 4: Scale (Months 12+)

Cross-Channel Orchestration: Coordinate messaging across email, SMS, remarketing, and site personalization based on unified customer journeys.

Lookalike Modeling: Use CDP profiles to build lookalike audiences that match your best-converting customers rather than just lead form fills.

Continuous Optimization: Iterate on models, integrations, and activation use cases based on measured outcomes. The CDP becomes an ongoing competitive advantage rather than a one-time implementation.

Common Implementation Mistakes

CDP implementations fail for predictable reasons. Understanding these pitfalls helps you avoid them.

Starting Too Complex

Organizations often attempt to connect every data source and enable every use case simultaneously. This creates implementation projects that drag on for months or years without delivering value.

Start simple. Connect three to five core data sources. Enable one to two high-value use cases. Deliver measurable results within 90 days. Then expand systematically.

Underestimating Data Quality

CDPs unify data, but they cannot fix fundamental data quality issues. If your source systems contain duplicate records, inconsistent formatting, and missing values, the CDP inherits these problems.

Invest in source system data quality before or alongside CDP implementation. Establish data governance practices that maintain quality over time.

Ignoring Identity Resolution Complexity

Identity resolution seems straightforward until you encounter real-world edge cases. The same phone number used by multiple household members. Email addresses that change over time. Consumers who deliberately use different information across interactions.

Plan for identity complexity. Define explicit rules for handling edge cases. Build monitoring to detect resolution errors before they corrupt analysis.

Neglecting Change Management

A CDP changes how teams work. Marketers access customer data differently. Analysts use new attribution models. Operations teams route leads based on CDP insights.

Without change management, the CDP becomes shelfware that nobody uses. Invest in training, documentation, and process redesign alongside technical implementation.

Underbudgeting for Ongoing Operations

CDP licensing is just the beginning. Ongoing costs include integration maintenance as source systems evolve, data quality monitoring and remediation, model retraining as patterns shift, platform upgrades and new feature adoption, and staff time for analysis and activation.

Budget for ongoing operations at 30-50% of initial implementation cost annually. Organizations that cut operational budgets see CDP value degrade over time.

Measuring CDP Value

CDPs represent significant investment. Measuring return ensures continued organizational support and guides optimization priorities.

Primary Metrics

Attribution Accuracy: Compare CDP-attributed conversions against previous models. Are you discovering value in sources previously underweighted? Finding waste in sources previously overweighted?

Marketing Efficiency: Track cost per lead and cost per customer before and after CDP activation. The 10-30% efficiency improvement documented in research provides a benchmark.

Personalization Lift: A/B test personalized experiences against control groups. Measure conversion rate improvements attributable to CDP-powered personalization.

Compliance Confidence: Assess ability to respond to data subject requests. Measure time to fulfill deletion requests before and after CDP implementation.

Secondary Metrics

Data Coverage: What percentage of customer interactions flow through the CDP? Higher coverage enables better analysis and activation.

Identity Match Rate: What percentage of records successfully match to unified profiles? Lower match rates indicate identity resolution issues.

Profile Completeness: How many attributes populate the average profile? More complete profiles enable better personalization and scoring.

Activation Velocity: How quickly can you move from insight to action? Faster activation compounds CDP value.

Calculating ROI

CDP ROI calculation follows this framework.

Costs include annual licensing, implementation services, internal staff time, integration maintenance, and ongoing operations.

Benefits include marketing efficiency gains (calculated as percentage improvement times marketing spend), revenue lift from personalization (calculated as percentage improvement times revenue), compliance cost avoidance (value of prevented fines and litigation), and operational efficiency (staff time saved on manual data integration).

Most lead generation CDP implementations target 150-300% ROI within the first full year of operation. Break-even typically occurs within six to nine months for well-executed implementations.

CDP and Your Technology Stack

CDPs do not operate in isolation. They integrate with your existing technology stack and may overlap with or replace certain capabilities.

CDP vs. Data Warehouse

Data warehouses store historical data for analysis. CDPs unify real-time customer profiles for activation. The technologies complement rather than compete.

Many organizations use both: the CDP handles real-time profile unification and activation while the data warehouse stores long-term historical data for strategic analysis. CDPs can feed data warehouses, and data warehouses can enrich CDP profiles.

For smaller lead generation operations, a CDP might replace the need for a separate data warehouse by providing sufficient analytical capability alongside activation.

CDP vs. CRM

CRM systems manage customer relationships, typically focused on sales interactions. CDPs unify customer data across all touchpoints, including pre-sales behavior.

CDPs complement CRMs by providing richer context about each customer. Lead generation operations might use their distribution platform as a quasi-CRM for lead management while the CDP provides the unified data layer across all customer touchpoints.

CDP vs. Marketing Automation

Marketing automation executes campaigns. CDPs provide the unified customer data that informs those campaigns.

The integration is typically bidirectional: engagement data from marketing automation flows to the CDP, while segments and personalization signals flow from the CDP to marketing automation.

CDP vs. Lead Distribution Platform

Lead distribution platforms route leads to buyers. CDPs unify customer data across the complete journey.

For lead generation, the distribution platform remains the operational core handling real-time matching and delivery. The CDP provides the analytical and personalization layer that informs acquisition strategy, scoring models, and buyer routing optimization.

Optimal architecture connects these systems: lead events flow from the distribution platform to the CDP, and insights from the CDP feed back into distribution platform configuration.

Frequently Asked Questions

What is a Customer Data Platform (CDP)?

A Customer Data Platform is packaged software that collects, unifies, and activates first-party customer data from multiple sources into a single, persistent customer database accessible to other systems. Unlike data warehouses managed by IT departments, CDPs are designed for business users – typically marketing and operations teams – to control. The CDP Institute defines three core requirements: packaged software (not custom-built), persistent unified customer database (with personal identifiers and behavioral history), and accessibility to other systems (via APIs and exports). For lead generation businesses, CDPs connect traffic attribution, lead capture, distribution, and buyer feedback into unified customer profiles that power better attribution, personalization, and compliance management.

How much does a CDP cost for lead generation businesses?

CDP pricing varies significantly by vendor, data volume, and feature requirements. Entry-level implementations for smaller operations start at $12,000-25,000 annually. Mid-market implementations typically run $50,000-150,000 annually. Enterprise implementations exceed $250,000 annually. For lead generation operations processing 10,000-50,000 leads monthly, expect annual costs of $30,000-80,000 for capable implementations. Beyond licensing, budget for implementation services (typically $15,000-50,000), integration development, training, and ongoing operations at 30-50% of initial cost annually. The CDP market is growing at 30.7% annually from $9.72 billion in 2025 to $37.11 billion by 2030, reflecting enterprise adoption of first-party data strategies.

What is the difference between a CDP and a CRM?

CRMs (Customer Relationship Management systems) focus on managing sales interactions, tracking deals, and storing contact records. CDPs focus on unifying customer data from all touchpoints – including behavior before any sales interaction occurs. CRMs are typically used by sales teams to manage known prospects and customers. CDPs serve marketing and operations teams by providing complete behavioral context that informs acquisition, personalization, and attribution. For lead generation, your distribution platform may function as your lead management system (quasi-CRM) while the CDP provides the unified data layer connecting traffic sources, lead capture, and buyer outcomes across the complete customer journey.

How does a CDP help with TCPA compliance?

CDPs support TCPA compliance by unifying consent records across all customer touchpoints. When a consumer provides consent through your landing page – documented by TrustedForm certificates or Jornaya LeadiDs – that consent record links to their unified profile. The CDP tracks which leads were sold to which buyers under which consent terms. When consumers revoke consent or request data deletion, the CDP propagates that preference to all connected systems. This centralized consent management simplifies compliance audits and enables faster response to data subject requests. However, CDPs complement rather than replace consent certification services – you still need TrustedForm, Jornaya, or equivalent tools capturing consent at the point of lead generation.

Can a CDP improve my lead quality scoring?

CDPs significantly enhance lead scoring by incorporating behavioral data beyond basic form field validation. Traditional lead scoring assigns points based on demographics and stated intent. CDP-powered scoring analyzes complete behavioral patterns: engagement depth across your properties, content consumption patterns, time between touchpoints, cross-device behavior, and historical outcomes for similar profiles. Predictive models trained on unified profile data identify patterns that simple demographic scoring misses. Organizations implementing CDP-powered predictive scoring report focusing sales effort on the 20% of leads that generate 80% of revenue. For lead generation, this means optimizing both buyer routing (which leads go to which buyers) and traffic acquisition (which sources produce leads that actually convert).

How long does CDP implementation take?

Typical CDP implementation follows a phased approach. Phase 1 (Foundation) takes two to three months: data audit, source prioritization, identity schema definition, and initial integration of three to five core data sources. Phase 2 (Expansion) takes three to six months: complete source integration, profile enrichment, quality validation, and basic activation. Phase 3 (Optimization) takes six to twelve months: attribution implementation, predictive modeling, personalization, and advanced activation use cases. Full implementation typically requires nine to twelve months before all intended use cases are operational. However, initial value should emerge within the first three months. Organizations that delay value delivery until “complete” implementation often face stakeholder fatigue and budget pressure. Start simple, deliver early wins, and expand systematically.

What data sources should I connect to a CDP first?

Prioritize high-value data sources that form the core of your lead generation operation. Start with your lead distribution platform – this contains lead records, routing decisions, buyer matches, and financial outcomes. Add lead capture forms and landing page tracking for conversion data and behavioral context. Include traffic attribution data from advertising platforms. Connect compliance certification services like TrustedForm and Jornaya. Then add engagement data from marketing automation and buyer feedback on conversion outcomes. The goal is establishing the complete lead lifecycle before expanding to edge cases. This prioritization enables attribution analysis and basic activation within the first implementation phase.

How does a CDP help with cookie deprecation?

CDPs enable first-party data strategies that survive browser restrictions degrading third-party cookie tracking. CDPs collect data on your own domains using first-party cookies and server-side events that bypass many browser restrictions. More importantly, CDPs resolve identity through deterministic matching – email addresses, phone numbers, and logged-in user IDs – rather than cookie-based probabilistic matching. When a consumer provides their email through a lead form, that identifier persists regardless of cookie status. Server-side tracking integration extends this advantage: data captured through your servers (avoiding browser restrictions entirely) flows into CDP profiles. Organizations combining CDPs with server-side tracking report recovering 20-40% of conversion signals lost to browser-based tracking alone.

Do I need a CDP if I already have a data warehouse?

CDPs and data warehouses serve complementary purposes. Data warehouses store historical data optimized for analytical queries. CDPs unify real-time customer profiles optimized for activation – feeding data to advertising platforms, personalization engines, and operational systems. Many organizations use both: the CDP handles real-time unification and activation while the data warehouse stores long-term historical data for strategic analysis. CDPs can feed processed data to warehouses, and warehouses can enrich CDP profiles with historical context. For smaller lead generation operations, a CDP might provide sufficient analytical capability to delay data warehouse investment. For larger operations, both technologies deliver distinct value.

What ROI should I expect from a CDP investment?

Well-executed CDP implementations typically target 150-300% ROI within the first full year, with break-even occurring within six to nine months. ROI comes from several sources. Marketing efficiency gains of 10-30% from better attribution and reduced waste on ineffective sources. Revenue lift of 5-15% from personalization powered by unified customer data. Compliance cost avoidance from centralized consent management and faster data subject request response. Operational efficiency from automated data integration replacing manual processes. Calculate ROI by comparing these benefits against total costs including licensing, implementation, and ongoing operations. Organizations that achieve highest ROI focus on high-value use cases first rather than attempting comprehensive implementation before demonstrating value.

Key Takeaways

-

Customer Data Platforms unify first-party customer data from all sources into persistent, accessible customer profiles – essential infrastructure as third-party tracking degrades.

-

The CDP market is growing at 30.7% annually, from $9.72 billion in 2025 to $37.11 billion by 2030, reflecting enterprise adoption of first-party data strategies.

-

Organizations using CDP-powered personalization report 5-15% revenue increases and 10-30% improvements in marketing spend efficiency.

-

For lead generation, CDPs solve the attribution problem by connecting traffic sources through lead capture and distribution to buyer conversion outcomes.

-

CDPs enable compliance with privacy regulations by centralizing consent management and data subject request fulfillment across all customer touchpoints.

-

The CDP Institute classifies platforms into four categories: Data CDPs, Analytics CDPs, Campaign CDPs, and Delivery CDPs – with Analytics CDPs typically optimal for lead generation operations.

-

Implementation follows a phased approach: foundation (months one through three), expansion (months three through six), optimization (months six through twelve), and scale (month twelve and beyond).

-

Expect annual CDP costs of $30,000-80,000 for mid-sized lead generation operations, plus implementation services and ongoing operational costs of 30-50% annually.

-

Common implementation mistakes include starting too complex, underestimating data quality requirements, ignoring identity resolution complexity, neglecting change management, and underbudgeting for ongoing operations.

-

CDP ROI typically reaches 150-300% within the first year for well-executed implementations, with break-even at six to nine months.

-

CDPs complement rather than replace existing technology: data warehouses for historical analysis, CRMs for sales management, marketing automation for campaign execution, and distribution platforms for lead routing.

-

Start with high-value data sources – distribution platform, lead capture, traffic attribution, compliance certification – then expand to engagement data and buyer feedback.

Sources

- Grand View Research - Customer Data Platform Market - Verifies CDP market growth at 30.7% CAGR, reaching $37.1 billion by 2030

- CDP Institute - Industry authority defining CDP categories (Data, Analytics, Campaign, Delivery) and core requirements

- Segment CDP - Major CDP vendor documentation for real-time data collection and identity resolution capabilities

- Backlinko - Ad Blocker Usage Statistics - Verifies 31% global ad blocker usage and 42% adoption among ages 18-34

- TrustedForm - Lead consent certification platform referenced for TCPA compliance documentation

- HubSpot Marketing Statistics - Industry benchmark data on personalization ROI and marketing efficiency improvements

Market data and vendor information current as of December 2025. The CDP landscape evolves rapidly; verify current capabilities and pricing during vendor evaluation.