The invisible infrastructure that routes billions in lead value every year. Learn how to build distribution systems that maximize revenue, maintain compliance, and scale without breaking.

A consumer clicks “submit” on an insurance quote form. In the next 200 milliseconds, that lead travels to a distribution platform, gets broadcast to a dozen potential buyers, receives competitive bids, and routes to the highest bidder. The consumer sees a confirmation page. Behind the scenes, a real-time auction just determined which agent’s phone will ring.

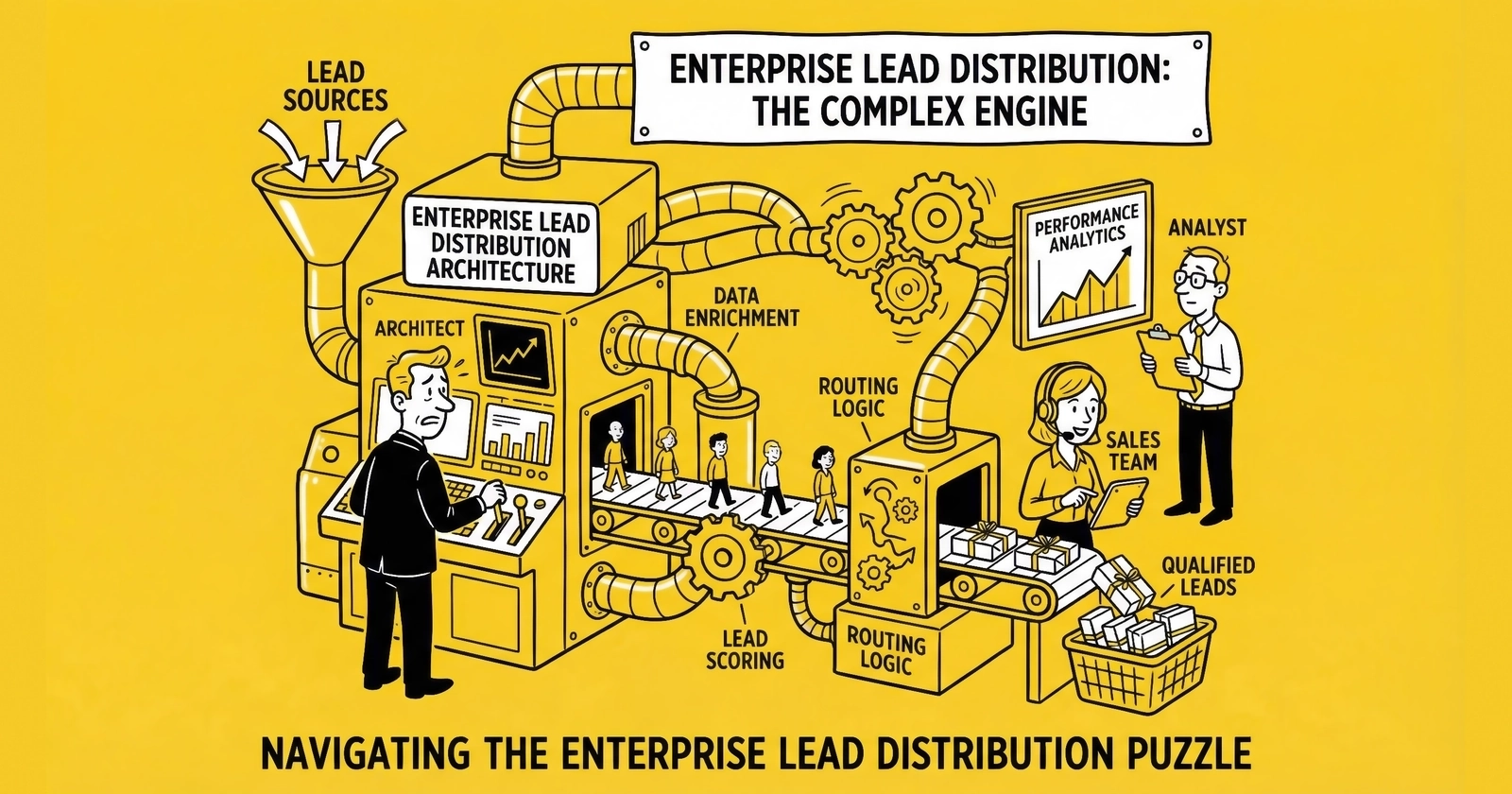

This is enterprise lead distribution: the decision engine that determines which buyer receives which lead, at what price, and in what sequence. Those who master distribution architecture build sustainable competitive advantages. They extract more value from each lead, maintain buyer loyalty through quality matching, and scale their operations efficiently while competitors struggle with manual processes and broken integrations.

For lead generators operating on 10-20% net margins, distribution architecture is not a back-office concern. It is the central nervous system that determines whether your business thrives or fails.

This guide provides the comprehensive technical framework for building, evaluating, and optimizing enterprise lead distribution systems. We will examine the six-layer reference architecture, core routing algorithms, ping/post mechanics, compliance infrastructure, scalability considerations, and platform selection criteria that separate professional operations from amateur ones.

What Enterprise Lead Distribution Architecture Actually Means

Lead distribution architecture refers to the complete technology ecosystem that captures, validates, routes, delivers, and reports on leads flowing through your operation. The architecture encompasses not just your core distribution platform, but every integrated component: landing pages and form systems, compliance and fraud detection services, buyer delivery endpoints, call routing infrastructure, and analytics layers.

Your lead distribution platform is the engine, but no engine runs alone. It needs fuel systems, exhaust systems, monitoring gauges, and transmission to deliver power to the wheels. In lead generation, that means compliance infrastructure, fraud detection, buyer delivery endpoints, call routing systems, and analytics – all connected through APIs and webhooks into a cohesive technology stack.

The difference between operators who struggle and those who scale often comes down to how thoughtfully they have designed their technology stack. A well-architected stack handles complexity invisibly. A poorly designed one creates friction at every step, requiring manual intervention that kills margins and limits growth.

The Problem Distribution Architecture Solves

A single lead might qualify for twelve different buyers, each with unique filter criteria, geographic requirements, volume caps, and bid levels. Some buyers want exclusive leads. Others accept shared leads at lower prices. Some pay premium for instant delivery. Others accept delayed batches for discounts.

Manual lead distribution is impossible at scale. A human cannot evaluate a dozen buyer qualifications, check capacity limits, compare prices, and route the lead within milliseconds. Distribution systems automate these decisions, executing complex routing logic faster than a confirmation page loads.

Beyond routing, enterprise distribution architecture must handle financial complexity: buying from sources, selling to buyers, managing returns, tracking margins, processing payments, reconciling accounts. TCPA litigation increased 67% year-over-year in 2024, with 507 class actions filed in Q1 2025 alone and average settlements exceeding $6.6 million. Your architecture must integrate consent documentation, store certificates for years, and provide retrieval capabilities when compliance inquiries arise.

The Six-Layer Reference Architecture

Lead distribution technology stacks follow recognizable patterns regardless of whether you are running boberdoo, LeadsPedia, Phonexa, or custom infrastructure. Understanding this reference architecture helps you evaluate completeness and identify gaps.

Layer 1: Lead Acquisition

This layer captures leads before they enter your distribution platform. It includes landing page builders and form systems, JavaScript tracking pixels for compliance certification, traffic source attribution tracking, and initial data capture validation. For most practitioners, landing pages post directly into the distribution platform via API. Sophisticated operations may route through middleware like LeadConduit first for pre-processing before leads hit the core system.

Increasingly critical within Layer 1 is server-side tracking infrastructure. As browser restrictions intensify – Safari ITP limiting cookies to seven days, iOS stripping click identifiers, ad blockers preventing pixel fires – server-side tracking routes attribution data through your servers before it reaches ad platforms. This architecture recovers 20-40% of conversion signals lost to browser-based tracking. Over 31% of internet users worldwide employ ad blockers, and that figure rises to 42% among users ages 18-34 who represent your highest-intent prospects.

Layer 2: Compliance and Fraud Detection

Before a lead can be sold, it must be validated for both compliance and authenticity. This layer includes consent certification services like TrustedForm and Jornaya TCPA Guardian, fraud detection systems like Anura, DNC and litigator scrubbing services, and data validation and verification tools.

TrustedForm certificates provide visual playback evidence of the form page and consumer actions during the lead event. Certificates include metadata about page elements, consent language, opt-in method, and timestamps. TrustedForm Retain stores these certificates for long-term access – critical given TCPA statute of limitations considerations. Every major platform integrates with TrustedForm and Jornaya. If yours does not, you are taking unnecessary legal risk.

These services typically integrate via API calls during the lead ingestion process. When a lead posts into your system, it triggers validation checks that either pass the lead through or reject it before any matching occurs.

Layer 3: Distribution Core

This is your primary lead distribution platform – boberdoo, LeadsPedia, LeadExec, Lead Prosper, Phonexa, or similar. It handles lead matching against buyer filter sets, ping/post auction mechanics, pricing and margin calculations, buyer account management, and financial operations including invoicing and rebilling.

The distribution core is the hub through which all other components connect. It receives leads from the acquisition layer, passes them through compliance checks, routes them to delivery endpoints, and reports back to analytics systems.

boberdoo has processed over 36.5 billion pings since inception, demonstrating the scale these systems can achieve. The platform emphasizes 99.99% uptime and has built fraud detection and regulatory compliance automation into its core infrastructure.

Layer 4: Delivery Endpoints

Once a lead is sold, it must reach the buyer’s system in their required format. Delivery endpoints include buyer CRM systems like Velocify, Salesforce, and industry-specific platforms, custom HTTP POST/GET integrations, XML/SOAP web services, email and CSV delivery systems, and FTP batch transfers.

Distribution platforms like boberdoo and LeadExec support dozens of delivery formats because every buyer has different technical requirements. LeadExec offers nine delivery methods: Webhook, Ping-Post, Email, SMS, FTP, CSV Attachment, Batch Delivery, Live Call Transfer, and Lead Portal.

Layer 5: Call Routing Infrastructure

For operations that include pay-per-call or live transfers, a parallel infrastructure handles voice traffic. This includes call tracking platforms like Ringba, Retreaver, or Phonexa Call Logic, IVR systems for caller qualification, real-time call routing and bidding, and telephony infrastructure.

Ringba’s Ring Tree technology enables real-time bidding for calls, similar to how ping/post works for data leads. The platform provides carrier-grade infrastructure to route calls in real-time, featuring bidding where buyers compete for live callers.

Layer 6: Analytics and Reporting

The final layer aggregates data from all other components into actionable insights. It encompasses built-in platform reporting, business intelligence tools like Tableau, Looker, or Power BI, custom dashboards and automated reports, and financial reconciliation systems.

boberdoo provides approximately 85 standard reports covering lead flow, profit analysis by source-buyer pair, transaction details, and payment reconciliation. Modern distribution platforms offer extensive built-in reporting, but sophisticated practitioners typically export data to dedicated BI tools for deeper analysis and cross-platform visibility.

Core Routing Algorithms Explained

Every distribution platform implements one or more routing frameworks. Each makes different tradeoffs between revenue optimization, buyer fairness, and operational complexity. Understanding what each algorithm optimizes for – and when to use it – determines how effectively you can monetize your lead inventory.

Price-Based Distribution

Price-based distribution functions like a real-time auction house. When a lead enters the system, it triggers instant bidding among qualified buyers. The system pings all matching buyers about the lead opportunity, receives bids within milliseconds, and routes to the highest bidder.

This approach maximizes immediate revenue per lead but requires sophisticated ping/post infrastructure and buyer relationships built around dynamic pricing. Platforms like boberdoo and Phonexa excel here with parallel pinging that evaluates all buyer bids simultaneously rather than working through them sequentially.

Price-based distribution works best when you have multiple buyers competing for similar inventory, when lead quality is consistent enough that buyers can bid confidently, and when speed-to-contact is not so critical that sequential routing delays create conversion loss.

Priority-Based (Waterfall) Distribution

Waterfall distribution creates sequential routing hierarchy where leads flow from top-tier buyers to subsequent tiers based on specific criteria. In financial services, leads route first to premium buyers with strict criteria and higher bids. If these buyers do not accept within a specified timeframe, the lead “waterfalls” to the next tier with broader criteria or lower bids. This continues until the lead finds a match or expires.

Priority-based routing does not optimize for revenue – it optimizes for relationship management. You might route a lead to a priority-1 buyer at $25 when a priority-3 buyer would pay $40. Use priority-based routing when buyer relationships require guaranteed volume or when certain buyers have operational requirements like exclusive territories that trump price optimization.

Waterfall recovery benchmarks:

- Under 10%: Poor – leads dying in waterfall

- 10-20%: Acceptable

- 20-30%: Strong

- Over 30%: Elite fallback strategy

Round-Robin Distribution

Round-robin routing distributes leads in strict rotation among qualified buyers. Lead 1 goes to Buyer A, Lead 2 to Buyer B, Lead 3 to Buyer C, then back to Buyer A for Lead 4.

This approach ensures absolute fairness that eliminates disputes about preferential treatment. It is simple to explain to buyers and requires minimal configuration. The limitation is that it does not optimize for revenue – a $30 buyer receives the same leads as a $60 buyer.

Round-robin works best for franchise networks, dealer distribution, insurance agent networks, and any context where perceived fairness matters more than revenue optimization.

Weighted Distribution

Weighted distribution allocates leads proportionally across buyers based on assigned weights. If Buyer A has weight 50, Buyer B has weight 30, and Buyer C has weight 20, they receive roughly 50%, 30%, and 20% of qualifying leads.

Weights typically reflect contracted volumes or performance targets. A buyer committed to 500 leads monthly receives higher weight than one committed to 100. The system continuously rebalances to maintain proportions throughout the period.

Earnings-Per-Lead (EPL) Distribution

EPL distribution incorporates real-time performance metrics into distribution decisions. Instead of relying solely on bid amounts, the system calculates a quality score based on recent activity and revenue generation, ensuring leads go to buyers who consistently deliver value.

Consider two insurance agents in the same territory. Agent A offers $50 per lead but only answers 60% of incoming calls. Agent B pays $35 per lead but maintains a 90% answer rate. Agent B’s effective EPL ($31.50) exceeds Agent A’s ($30.00) because of superior performance. The system recognizes this efficiency and prioritizes leads to Agent B, maximizing successful connections rather than raw bid amounts.

EPL distribution requires feedback integration from downstream buyer systems – you need conversion data, contact rates, and performance metrics flowing back to inform routing decisions. Platforms like boberdoo’s AI models calculate bid adjustments every 10 minutes based on this performance data.

Ping/Post Mechanics at Enterprise Scale

Ping/post represents the most sophisticated lead distribution technology. The industry-standard protocol for real-time lead trading involves two phases that execute in milliseconds.

Phase 1: The Ping (Blind Bid)

The ping carries non-identifying information for bid solicitation. Typical ping data includes geographic data (zip code, state, area code), lead attributes (credit tier, loan amount, vehicle type), metadata (source ID, timestamp, device type), and exclusivity flag (exclusive or shared offering).

The ping does NOT include consumer name, phone number, email address, full street address, or any personally identifiable information. This separation is fundamental. Buyers who do not win the auction never see consumer contact information. They cannot build databases from pings they never paid for.

Phase 2: The Post (Full Delivery)

When the auction closes and a winner emerges, the post delivers complete lead data: name, phone, email, address, and all qualifying information. Only the winning bidder receives this data. The transmission is encrypted and logged for compliance purposes.

Parallel vs. Sequential Processing

The difference between selecting the right processing approach can mean 15-25% variance in revenue per lead. Sequential processing offers leads to one buyer at a time, waiting for response before moving to the next. Parallel processing – boberdoo’s “Shotgun Ping Post” – sends pings to all matching buyers simultaneously, collecting bids before selecting the winner.

At scale, sequential routing introduces latency. By the time you have pinged your tenth buyer, the first buyer may have lost interest or the consumer may have moved on. Parallel processing compresses that latency into milliseconds.

Latency Requirements

Speed matters critically in ping/post systems. Target timing:

- Ping transmission: under 50 milliseconds

- Bid response: under 100-200 milliseconds

- Post delivery: under 500 milliseconds

- Total transaction: under 1-2 seconds

Platforms processing millions of pings invest heavily in geographic distribution, response optimization, and horizontal scaling. Buyers who consistently exceed response thresholds miss auctions entirely.

Scenario Optimization

Advanced platforms calculate optimal scenarios automatically. If Buyer A bids $60 exclusive but Buyers B, C, and D collectively offer $80 for shared access, the platform compares exclusive revenue ($60) against shared revenue ($80) and executes the optimal scenario.

The calculation becomes more complex when you factor in buyer reliability (acceptance and return rates), exclusivity contractual obligations, and long-term relationship value. boberdoo claims 20-40% additional revenue recovery from leads that initial buyers declined through this secondary optimization.

Post-reject recalculation adds another layer. When a buyer rejects a posted lead, basic systems move to the next buyer in sequence. Advanced systems recalculate optimal scenarios based on remaining buyers. A lead initially routed exclusively might become more valuable as a shared lead if the exclusive buyer rejects.

TCPA Compliance Infrastructure

The regulatory environment has made consent documentation a structural requirement rather than an optional add-on. TCPA litigation reached historic highs in 2025: 2,788 cases filed in 2024 representing a 67% year-over-year increase, with 507 class actions in Q1 2025 alone – a 112% increase over the same period in 2024. Nearly 80% of all TCPA lawsuits are now class actions seeking average settlements exceeding $6.6 million.

Platforms that treat compliance logging as an afterthought create operational risk that scales with your volume.

Consent Verification Integration

TrustedForm and Jornaya TCPA Guardian represent the two dominant consent documentation systems. Your lead distribution platform needs native integration with one or both.

TrustedForm certificates provide visual playback of the form page and consumer interactions during the lead event. Certificates include metadata about page elements, consent language, opt-in method, and timestamps. TrustedForm Retain stores certificates for long-term access – critical given the four-year TCPA statute of limitations.

Jornaya TCPA Guardian operates differently, analyzing lead transactions and consent disclosure language in real-time while maintaining an audit trail for compliance defense. The system can confirm whether TCPA-compliant consent was presented before phone or text outreach.

Many sophisticated operations use both services simultaneously, capturing both TrustedForm certificates and Jornaya LeadiDs for maximum documentation flexibility.

DNC Scrubbing and Litigator Suppression

Compliance infrastructure must include suppression against the National Do Not Call Registry (over 240 million numbers), state DNC registries, internal DNC lists from consumer opt-outs, and litigator databases identifying serial TCPA plaintiffs.

Analysis of 2024 filings found that 31-41% of TCPA cases were filed by individuals who had previously filed suits. These professional plaintiffs employ sophisticated techniques to generate litigation opportunities. Services like Contact Center Compliance and PossibleNOW maintain litigator suppression lists that help identify and avoid contacting known litigators.

Revocation Handling

The FCC’s April 2025 revocation rules require companies to honor consent withdrawal within ten business days through any reasonable method. Consumers may revoke consent via specific keywords (stop, quit, revoke, opt out, cancel, unsubscribe, end) or any communication that reasonably conveys intent to stop receiving calls or messages.

Your architecture must synchronize revocation status across all channels and platforms within ten days. If consent status is not synchronized, non-compliant contacts can occur after revocation.

Scalability Considerations

Technology stacks that work at low volume often break at scale. Planning for growth prevents painful migrations later.

Volume Projections and Bottleneck Identification

Estimate growth trajectories for lead volume, buyer count, traffic source count, and API call volume. Plan for 3x current volume as a baseline, with infrastructure capable of handling 10x spikes during successful campaigns.

Every system has capacity limits. Common bottlenecks include database query performance, API rate limits on external services, delivery endpoint capacity, and webhook processing throughput. Address these proactively before they cause production failures.

Latency Targets

Establish latency targets for critical paths:

- Lead validation: milliseconds

- Ping responses: under 500 milliseconds

- Delivery posts: within buyer-specified timeouts

- Total transaction: under 2 seconds

For high-intent leads where speed-to-contact drives conversion, a lead contacted in 1 minute converts at 391% higher rates. The five-minute rule for lead response is foundational to understanding these dynamics. Measure actual latency and optimize toward targets.

Horizontal Scalability

Design for horizontal scaling where possible. Adding more servers should increase capacity proportionally. Avoid architectures that require bigger servers since vertical scaling has hard limits.

Cloud Infrastructure Considerations

Modern lead distribution runs on cloud infrastructure. Managed services from AWS, Google Cloud, or Azure reduce operational burden. Auto-scaling configurations handle traffic spikes without manual intervention. Multi-region architecture improves reliability and reduces latency.

Google Cloud’s Cloud Run costs approximately $120-300 monthly for production server-side tracking environments. Specialized providers like Stape.io offer hosting starting at $20 per month for up to 500,000 requests, scaling to $100 monthly for 5 million requests.

Platform Selection Framework

Platform selection demands a rigorous process that accounts for both current requirements and future growth.

Requirements Gathering

Before evaluating any platform, document your operational requirements in detail:

Volume projections. How many leads are you processing today? What is your anticipated volume in one year? Three years? Your platform needs headroom beyond current volume – migrating platforms under growth pressure is operationally disruptive.

Business model requirements. Are you primarily a publisher generating and selling leads? A broker aggregating from multiple sources? A buyer with complex routing needs? Different platforms optimize for different positions in the ecosystem.

Vertical mix. Some platforms have deeper capabilities in specific verticals – insurance, mortgage, solar, legal. If your operation concentrates in particular verticals, platform expertise in those areas can accelerate implementation.

Integration requirements. What systems must your platform connect to? Which integrations are non-negotiable versus nice-to-have?

Compliance posture. What consent documentation do your buyers require? What validation services do you need?

Internal technical capacity. Do you have developers who can build custom integrations and configure complex routing logic? Or do you need a platform accessible to non-technical operators?

Proof-of-Concept Testing

Before committing to a platform, conduct a proof-of-concept implementation that tests your critical requirements under realistic conditions.

Define specific success criteria before beginning the POC. Test integration with your critical systems. Process representative lead volume through the platform. Evaluate the user experience with your actual operators. Document issues encountered and vendor responsiveness.

Total Cost of Ownership

Total cost of ownership includes monthly platform fee ($450-$5,000+), transaction fees ($0.01-$0.10 per lead), integration costs, and validation service fees. A mid-market operation processing 50,000 leads monthly should expect $2,500-$3,000/month total platform costs. Evaluate on total cost, not headline pricing.

Build vs. Buy Analysis

At some point, growing lead operations confront the build versus buy question directly.

When to Build Custom

Custom development makes strategic sense when your operational requirements genuinely cannot be met by commercial platforms and the competitive advantage of custom capability justifies the investment.

Legitimate cases for custom development exist. If your distribution logic involves proprietary algorithms that create competitive advantage, implementing them on a commercial platform might require exposing intellectual property. If your scale economics justify infrastructure investment – processing tens of millions of leads monthly – purpose-built systems can achieve efficiencies that general-purpose platforms cannot match.

The timeline consideration matters. Building a custom lead distribution platform capable of handling production traffic at scale requires years of development, not months. That is years of development resources diverted from core business activities, years of iteration to reach feature parity with commercial alternatives.

When to Buy Platform

For most practitioners, commercial platforms represent the better choice:

Speed to market. Commercial platforms provide production-ready capabilities that would take years to replicate through custom development.

Proven reliability. Mature platforms have handled the edge cases, failure modes, and scaling challenges that custom implementations must learn through experience.

Ongoing development. Vendor investment keeps platforms current as the industry evolves. Regulatory changes, new integration requirements, competitive feature expectations – commercial platforms spread that development cost across their customer base.

Support availability. When something breaks at 2 AM on a Saturday, commercial platform support teams can help diagnose and resolve issues.

Hybrid Approaches

The build versus buy choice is not always binary. Commercial platform plus custom components represents a common pattern. License a commercial platform for core distribution infrastructure, then build custom tools for specific capabilities where you have unique requirements.

API-first platform selection enables hybrid strategies. Platforms with robust APIs allow you to layer custom functionality on top of commercial infrastructure.

Frequently Asked Questions

Q1: What is the difference between exclusive and shared lead distribution?

Exclusive leads sell to one buyer only. The buyer receives the lead knowing no competitors are contacting the same consumer. Exclusive leads typically command 2-3x the price of shared leads. For a detailed analysis of this dynamic, see our exclusive vs. shared leads comparison.

Shared leads sell to multiple buyers (typically 3-5) who compete for the consumer’s business. Combined revenue from shared sales often exceeds single exclusive sales: three buyers at $15 each ($45) beats one exclusive buyer at $35.

Advanced platforms calculate optimal scenarios automatically, determining whether exclusive or shared distribution generates more total revenue for each specific lead.

Q2: How fast should enterprise lead distribution systems operate?

For real-time distribution via API, target sub-second delivery from platform receipt to buyer system. Total time from consumer form submission to buyer receipt should be under 2 seconds.

Ping responses should return in under 100-200 milliseconds. Buyers who consistently exceed this threshold miss auctions entirely. For high-intent verticals like insurance and mortgage, speed-to-contact directly impacts conversion: 1-minute response outperforms 5-minute response by 21x in qualification rate.

Q3: What compliance infrastructure is essential for enterprise distribution?

Essential compliance capabilities include:

- TrustedForm integration: Consent certificate capture and verification with visual replay

- Jornaya TCPA Guardian: Consent journey documentation and audit trail

- DNC suppression: Check against federal registry (240+ million numbers) and state registries

- Litigator suppression: Flag known serial TCPA plaintiffs (31-41% of 2024 filings)

- Revocation handling: Process opt-outs within 10 business days per April 2025 FCC rules

- Certificate retention: Store consent documentation for 5+ years (4-year statute of limitations plus buffer)

Q4: How do I choose between ping/post and direct post distribution?

Use ping/post when multiple buyers compete for similar leads, price discovery matters, lead volume exceeds 5,000 monthly, and your buyer ecosystem is competitive. Ping/post enables real-time competitive bidding that maximizes revenue.

Use direct post when single buyer relationships dominate, prices are contracted and fixed, volume is low, or buyer infrastructure cannot support real-time bidding.

Many operations use hybrid approaches: ping/post for competitive segments, direct post for exclusive partners.

Q5: What return rate is acceptable for enterprise distribution?

Target benchmarks:

- Under 5%: Elite performance

- 5-10%: Strong operation

- 10-15%: Acceptable range

- Over 15%: Indicates filter misalignment or source quality issues

Returns above 15% require immediate investigation. Analyze patterns by source, lead attribute, and time period. Tighten validation on problem sources and adjust filters to match actual buyer acceptance patterns.

Q6: How many buyers should I have for each lead type?

Minimum coverage recommendations:

- Round-robin distribution: 3-5 buyers

- Ping/post auctions: 5-15 active bidders

- Waterfall distribution: 3-4 tiers with 2-3 buyers per tier

More buyers improve fill rates but increase relationship management costs. Geographic coverage matters – ensure you have buyers in all regions where you generate leads.

Q7: What does enterprise distribution platform implementation typically cost?

Total cost of ownership includes:

- Monthly platform fees: $450-$5,000+ depending on tier and volume

- Setup fees: $250-$2,000 depending on platform

- Transaction fees: $0.001-$0.10 per lead

- Validation services: $0.02-$0.20 per lead for services like LeadQC

- Call routing: $0.035-$0.055 per minute

- Integration development costs

A mid-market operation processing 50,000 leads monthly should budget $2,500-$4,000/month total including platform, transaction fees, and validation services.

Q8: How long does enterprise distribution platform implementation take?

Realistic timelines vary by operational complexity:

- Single vertical, few buyers: 4-6 weeks

- Multi-vertical, moderate buyer count: 8-12 weeks

- Complex operation, many integrations: 3-6 months

Add 30+ days for parallel operation testing before full cutover. These timelines include requirements gathering, platform configuration, integration development, testing, and training. Rushed implementations create technical debt that haunts future operations.

Q9: Should I implement server-side tracking alongside my distribution platform?

Yes. Browser restrictions cause 30-40% signal loss for client-side tracking. Safari ITP limits cookies to 7 days (24 hours for ad traffic), 75% of iOS users opt out via ATT, and 31% of users globally employ ad blockers (42% among ages 18-34).

Server-side tracking routes conversion data through your servers via direct API calls, bypassing browser restrictions and recovering 20-40% of lost conversion signals. Infrastructure costs ($20-300/month) typically pay for themselves within 30 days through improved campaign efficiency.

Q10: What happens when all buyers hit their capacity limits?

Implement tiered fallback strategies:

- Secondary waterfall: Route to backup buyers at reduced prices

- Aged lead queue: Hold for batch processing to buyers accepting older leads at discounts

- Cross-vertical routing: Attempt to place in adjacent verticals

- Source credits: Log unsold leads for analysis, potentially return to source for refund

Effective fallback strategies recover 20-40% of leads that primary routing does not place. This incremental revenue often determines profitability.

Key Takeaways

-

Enterprise lead distribution architecture comprises six functional layers: Lead Acquisition, Compliance and Fraud Detection, Distribution Core, Delivery Endpoints, Call Routing Infrastructure, and Analytics and Reporting. Missing any layer creates operational gaps.

-

Routing algorithm selection directly impacts revenue: Price-based auctions maximize immediate revenue, priority-based routing optimizes relationships, round-robin ensures fairness, weighted distribution honors volume commitments, and EPL distribution incorporates performance metrics.

-

Ping/post processing at enterprise scale requires sub-second latency: Target 100-200 milliseconds for bid responses and under 2 seconds total transaction time. Parallel processing outperforms sequential by 15-25% in revenue per lead.

-

TCPA compliance infrastructure is now existential: 2,788 cases filed in 2024 (67% increase), 507 class actions in Q1 2025 (112% increase), with 80% filed as class actions seeking average settlements exceeding $6.6 million. Native integration with TrustedForm and Jornaya is table stakes.

-

Platform selection is an operational decision, not a software decision: Match platform capabilities to your business model, volume trajectory, and technical capacity. Calculate total cost of ownership including transaction fees, validation services, and integration costs rather than comparing headline pricing.

-

Server-side tracking infrastructure recovers 20-40% of conversion signals lost to browser restrictions. Safari ITP, iOS ATT, and ad blockers cause 30-40% attribution gaps that distort campaign optimization.

-

Fallback strategies recover 20-40% of leads that primary routing does not place. Secondary waterfalls, aged lead queues, and cross-vertical routing convert otherwise-lost inventory into incremental revenue.

-

Build vs. buy analysis favors commercial platforms for most practitioners: Speed to market, proven reliability, ongoing vendor development, and support availability outweigh customization benefits except at extreme scale or with genuinely proprietary requirements.

-

Well-architected stacks handle complexity invisibly while poorly designed ones create friction at every step. Those who build sustainable businesses treat platform selection as a strategic investment rather than a procurement exercise.

Sources

- boberdoo - Lead distribution platform processing 36.5+ billion pings with 99.99% uptime and ping/post auction capabilities

- LeadExec - Scalable, automated lead capture, validation, routing, and distribution platform

- LeadsPedia - Lead management platform supporting multi-channel distribution and nine delivery methods

- ActiveProspect TrustedForm - TCPA consent certification service providing visual playback evidence and certificate retention

- Ringba - Call tracking platform with real-time bidding Ring Tree technology for pay-per-call operations

Statistics and regulatory information current as of late 2025. TCPA requirements evolve continuously. Platform pricing and capabilities change. Verify current specifications before making selection decisions. Consult qualified legal counsel for compliance requirements specific to your operation.