Understanding lead origin is the single most important factor in predicting conversion rates, compliance risk, and true cost-per-acquisition. This guide breaks down the critical differences between first-party and third-party leads, backed by industry data and operational reality.

What Is the Difference Between First-Party and Third-Party Leads?

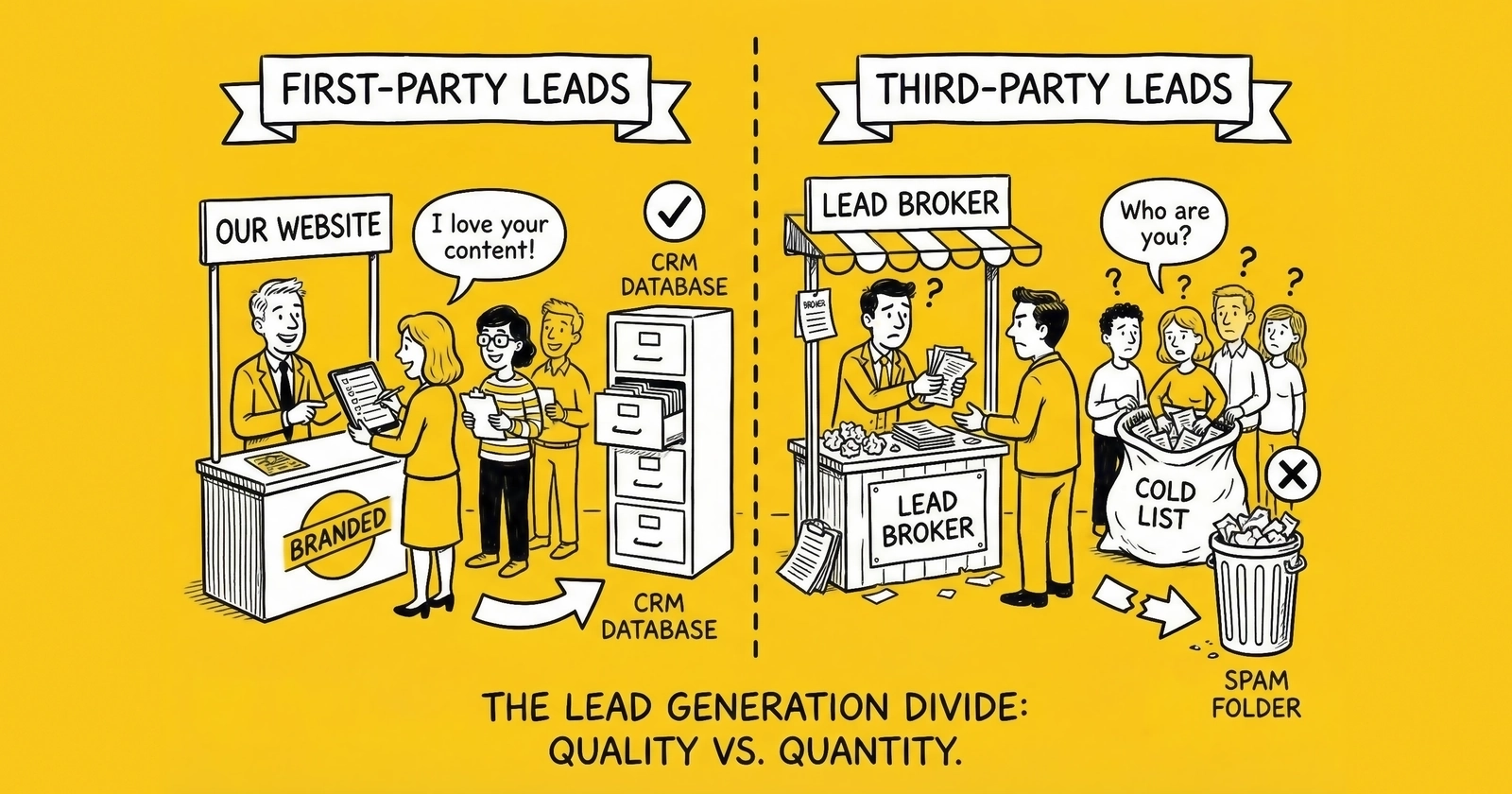

The distinction between first-party and third-party leads comes down to one question: Who generated the lead?

First-party leads come from your own traffic and properties. You ran the ads, you built the landing page, you captured the information. You control the entire funnel from impression to form submission.

Third-party leads come from external sources: affiliate publishers, lead aggregators, comparison shopping sites, or lead vendors. Someone else generated the traffic and captured the consumer’s information, then sold it to you.

This origin distinction cascades through every aspect of lead quality, compliance risk, and ultimate cost-per-acquisition. Understanding these differences determines whether your lead buying strategy generates profitable customers or hemorrhages money on worthless data.

What Are First-Party Leads?

First-party leads are generated directly on properties you own or control. When a consumer clicks your Google ad, lands on your website, and submits a form requesting information about your product or service, that’s a first-party lead.

Characteristics of First-Party Leads

Complete visibility into source. You know exactly which campaign, ad group, keyword, and creative generated each lead. This granular attribution enables optimization at every level of the funnel.

Direct consent capture. The consumer explicitly provided their information to you, for a specific purpose they understood. The consent documentation is straightforward because you control the form, disclosure language, and data capture process.

Higher match rates. First-party data achieves approximately 90% match rates when used for targeting, retargeting, or enrichment. The data is fresh, accurate, and directly verified at the point of collection. See our complete first-party data strategies guide for implementation details.

Lower fraud rates. Because you control the entire funnel, you can implement validation at every step. Bot detection, phone verification, email validation, and behavioral analysis all happen before a lead enters your system.

Examples of First-Party Lead Generation

- A mortgage lender running Facebook ads that drive to their own rate comparison tool

- An insurance carrier capturing quotes on their branded website

- A solar installer generating leads through SEO-optimized landing pages they operate

- A law firm collecting case inquiries through their practice website

The Economics of First-Party Leads

First-party leads typically cost more to generate per lead because you’re absorbing the full traffic acquisition cost. A first-party auto insurance lead might cost $35-$60 to generate, accounting for ad spend, landing page infrastructure, and validation services.

However, the true cost-per-acquisition tells a different story. First-party leads convert at higher rates, have lower return rates, and carry clearer consent documentation. When you factor in these downstream efficiencies, first-party leads often deliver lower cost-per-acquisition despite higher upfront cost-per-lead.

What Are Third-Party Leads?

Third-party leads originate from sources outside your organization. A lead aggregator, affiliate network, or comparison shopping site captures the consumer’s information and then sells it to you.

How Third-Party Lead Generation Works

A typical third-party lead flow looks like this:

- A consumer searches for “best car insurance rates”

- They land on a comparison shopping site they’ve never heard of

- They complete a form requesting quotes from “top insurance providers”

- The site sells that lead to multiple insurance carriers or agents

- You receive the lead via API delivery or CRM injection

The consumer may or may not understand who will receive their information. The consent disclosure might list dozens of potential recipients. The form might be optimized for volume rather than quality.

Types of Third-Party Lead Sources

Comparison shopping sites aggregate leads across multiple advertisers, selling each lead to several buyers. The consumer typically understands they’ll receive multiple quotes.

Affiliate publishers generate leads on their own properties and sell to lead aggregators or directly to buyers. Quality varies dramatically based on the publisher’s traffic sources and validation practices.

Lead aggregators purchase leads from multiple sources, apply varying levels of validation, and resell to end buyers. They add a layer of abstraction between you and the original lead generation.

Data resellers sell aged leads – consumer information collected days, weeks, or months ago – at discount prices. These leads have typically been contacted multiple times by other buyers.

Why Third-Party Leads Are Often Cheaper

Third-party lead pricing reflects the economics of aggregation. A lead generator can sell the same lead to multiple buyers, spreading acquisition cost across several sales. This enables lower per-buyer pricing.

Third-party leads also carry less accountability. The generator bears lower risk when quality issues arise because the relationship between them and the end buyer is often arm’s length. Return provisions, if they exist, may be limited in scope and duration.

The price differential is real: third-party leads in insurance verticals might run $15-$35, compared to $40-$80 for comparable first-party leads. But this price advantage often reverses when you calculate true cost-per-acquisition.

Quality Differences: Fraud Rates and Validity

The quality gap between first-party and third-party leads is not subtle. Industry data paints a stark picture.

The 30% Fraud Problem

Industry estimates suggest that 30% of third-party leads contain fraudulent or materially false information. This figure encompasses bot-generated leads, human fraud farms, stolen identity submissions, recycled aged leads sold as fresh, and incentivized form fills with no genuine purchase intent.

The sources of this fraud are varied:

Bot traffic generates fake submissions with fabricated or stolen data. Modern bots simulate human behavior patterns – realistic typing speeds, random mouse movements, natural scroll patterns – making detection increasingly difficult.

Human fraud farms employ real people to fill out lead forms manually, bypassing automated detection. These leads look authentic – real typing patterns, valid formatting, working phone numbers – but the consumers have no genuine interest in your product.

Stolen identity leads use legitimate personal information obtained through data breaches or dark web purchases. The phone numbers work. The addresses verify. But the consumers never consented to contact, creating compliance exposure every time you reach out.

Duplicate and recycled leads erode value through repetition. The same consumer information gets submitted multiple times, sometimes with minor variations to bypass deduplication filters.

First-Party Fraud Rates

First-party lead operations experience fraud rates typically in the 5-10% range when proper validation is implemented. The difference comes from control: You can implement bot detection at the landing page level, validate data in real-time before accepting the lead, analyze behavioral patterns during form completion, and require verification steps that weed out bad actors. The attack surface is smaller, and your ability to defend is greater.

Validity and Contact Rate Differences

Beyond outright fraud, third-party leads suffer from lower validity rates:

| Metric | First-Party Average | Third-Party Average |

|---|---|---|

| Phone validity | 92-96% | 75-85% |

| Email deliverability | 95-98% | 80-88% |

| Contact rate (answered calls) | 45-55% | 25-40% |

| Match rate (for targeting) | ~90% | 50-60% |

These differences compound through your sales funnel. If 40% of third-party leads have invalid or disconnected phone numbers, your sales team wastes significant effort dialing numbers that will never convert.

Consent and Compliance Differences

The consent landscape in lead generation has never been more complex – or more consequential. TCPA litigation increased 112% year-over-year in Q1 2025, with 507 class action lawsuits filed in a single quarter. Average settlements exceed $6.6 million. Consent documentation isn’t optional; it’s existential.

First-Party Consent Advantages

When you generate leads on your own properties, you control the consent capture process entirely:

Clear disclosure. You write the disclosure language, ensuring it accurately describes who will contact the consumer and for what purpose.

Unambiguous consent. The consumer knows they’re requesting information from your company specifically. There’s no question about who they intended to receive their data.

Complete documentation. You implement consent verification tools (TrustedForm, Jornaya) on your own forms, capturing the exact moment of consent with session replay capability.

No chain-of-custody questions. When consent is challenged in litigation, you can demonstrate the complete evidence chain from consumer action to contact.

Third-Party Consent Risks

Third-party leads introduce consent uncertainty at every step:

Disclosure ambiguity. Many third-party forms disclose that consumer data will be shared with “partners,” “providers,” or lists of companies that may include dozens of names. Whether this disclosure meets TCPA’s “clear and conspicuous” standard is frequently litigated.

Scope questions. Even when consent exists, its scope may not cover your specific use case. Consent to receive “information about insurance” may not clearly authorize calls about Medicare Advantage specifically.

Documentation gaps. Third-party lead sellers provide consent certificates, but you’re relying on their implementation. A certificate URL exists, but was the underlying form actually compliant? Was the consent checkbox pre-checked (which is non-compliant)? Was disclosure language visible and readable?

Chain of custody. When a lead passes through multiple intermediaries – publisher to aggregator to buyer – proving consent at each handoff becomes challenging. Courts have held that consent cannot be transferred indefinitely through successive “comparison shopping” forms.

The FCC One-to-One Consent Rule

The FCC adopted a one-to-one consent rule in December 2023 that would have required consumers to consent to each seller individually. Though this rule was vacated by the 11th Circuit Court in January 2025, the regulatory direction is clear:

- CMS already requires one-to-one consent for Medicare marketing (effective October 2024)

- Several states have enacted mini-TCPA laws with stricter consent requirements

- Major carriers like T-Mobile still require one-to-one consent in their network policies

- Many sophisticated buyers have adopted one-to-one practices regardless of federal mandate

For third-party lead buyers, this means evaluating not just whether consent exists, but whether consent is specific enough to survive regulatory scrutiny that continues tightening.

Pricing Comparison: Why Cheaper Often Costs More

Third-party leads carry lower price tags. First-party leads command premium pricing. But comparing price-per-lead is misleading. True cost-per-acquisition reveals the complete picture.

The Price Tag Illusion

Consider auto insurance leads:

| Lead Type | Price Per Lead | Contact Rate | Conversion Rate | Return Rate |

|---|---|---|---|---|

| Third-Party Shared | $18 | 32% | 3.5% | 18% |

| First-Party Exclusive | $55 | 52% | 8.5% | 6% |

At first glance, third-party leads cost $18 versus $55 – a 67% savings. But work through the math:

Third-party lead economics:

- 1,000 leads at $18 = $18,000 cost

- 18% return rate = $3,240 in returns refunded

- Net cost = $14,760 for 820 usable leads

- Effective CPL = $18 per usable lead

- Contact rate 32% = 262 conversations

- Conversion rate 3.5% = 9 customers

- Cost per acquisition = $1,640

First-party lead economics:

- 1,000 leads at $55 = $55,000 cost

- 6% return rate = $3,300 in returns refunded

- Net cost = $51,700 for 940 usable leads

- Effective CPL = $55 per usable lead

- Contact rate 52% = 489 conversations

- Conversion rate 8.5% = 42 customers

- Cost per acquisition = $1,231

The “expensive” first-party leads deliver customers at 25% lower cost-per-acquisition than the “cheap” third-party alternative.

Hidden Costs in Third-Party Leads

The price tag excludes significant operational costs:

Sales team inefficiency. Lower contact rates mean more dials per conversation. If your sales team makes 8 dials per contact on third-party leads versus 4 dials on first-party, you’re burning twice the labor per conversation.

Return processing. High return rates consume operational bandwidth. Someone must document return reasons, process refunds, and manage vendor disputes.

Compliance overhead. Third-party leads require more extensive consent verification, certificate validation, and documentation review. The compliance analyst reviewing 1,000 third-party leads spends more time than reviewing 1,000 first-party leads.

Fraud remediation. When fraudulent leads slip through, the costs extend beyond the lead price. Wasted sales effort, potential compliance exposure, and buyer relationship damage all carry costs.

When Third-Party Pricing Makes Sense

Third-party leads aren’t universally worse economic propositions. They make sense when:

- Testing new markets or verticals before investing in first-party infrastructure

- Supplementing first-party volume during capacity constraints

- Purchasing aged leads for low-cost nurture campaigns

- Accessing geographic or demographic segments outside your first-party reach

The key is understanding the true economics and building that understanding into your pricing and volume decisions. Our analysis of exclusive vs shared leads covers these dynamics in greater depth.

When First-Party Leads Make Sense

First-party lead generation requires significant investment: ad spend, landing page development, tracking infrastructure, consent capture tools, and ongoing optimization. This investment pays off in specific circumstances.

You Need Scale With Control

When you require predictable lead volume with consistent quality, first-party generation provides control that third-party sourcing cannot match. You can adjust volume by adjusting ad spend. You can improve quality by optimizing landing pages. You can shift geographic focus by reallocating budget.

Third-party lead availability fluctuates based on aggregator inventory, competitor bidding, and publisher whims. First-party volume fluctuates based on your decisions.

Compliance Is Non-Negotiable

For verticals with heightened compliance scrutiny – Medicare, financial services, legal – first-party generation offers defensible consent documentation. When regulators or litigators come calling, you can produce complete evidence chains from consumer action to contact.

The $6.6 million average TCPA settlement makes this calculation straightforward. If your third-party consent documentation has any weakness, the expected value of litigation exposure may exceed the savings from lower CPL. The TCPA compliance guide covers these requirements in detail.

Your Brand Matters

First-party leads interact with your brand from first impression. The consumer who clicks your ad, lands on your page, and submits your form has a brand relationship from the start.

Third-party leads may not know your company exists until the sales call. Building rapport starts from zero, and brand perception depends entirely on that first contact.

You’re Building Long-Term Assets

First-party lead generation builds proprietary assets: audience data, conversion learnings, optimization history. Over time, you develop insights about your specific market that no vendor can replicate.

Third-party purchasing builds nothing. Each transaction is independent. You’re buying fish, not learning to fish.

When Third-Party Leads Make Sense

Third-party leads serve legitimate purposes in a well-designed lead acquisition strategy. The key is understanding when they add value versus when they destroy it.

Market Testing and Expansion

Before investing $50,000 in first-party infrastructure for a new vertical or geography, third-party leads can validate demand. If you can’t profitably convert $10,000 in purchased leads, building your own generation probably won’t help.

Use third-party leads as a testing mechanism: Does this market convert? What objections arise? What buyer personas respond? Then build first-party infrastructure based on validated learnings.

Supplementing Volume Capacity

Your first-party generation may produce 500 leads per day, but your sales team can handle 700. Third-party leads can fill the gap – as long as you understand the quality differential and price accordingly.

The risk is quality contamination. If your sales team treats all leads identically, the lower conversion rates on third-party leads will depress overall metrics and potentially burn out agents who get frustrated with poor contact rates.

Aged Lead Strategies

First-party leads are fresh. Third-party sources include aged inventory – leads generated days, weeks, or months ago – at significant discounts. Aged leads price at 5-20% of fresh lead values.

Aged leads require different sales approaches: longer nurture sequences, recognition that competitors have already contacted these consumers, and acceptance of lower conversion rates. But for organizations with systematic nurture capabilities, aged leads can deliver positive ROI.

Geographic Coverage Gaps

Your first-party infrastructure may excel in certain markets but lack reach in others. Third-party leads can provide coverage in geographies where building your own presence isn’t justified by volume. A mortgage lender dominating the Northeast might purchase third-party leads for Southwest expansion testing before investing in regional first-party infrastructure.

Hybrid Strategies: Combining First-Party and Third-Party Leads

Most sophisticated lead operations run hybrid strategies, combining first-party generation with strategic third-party purchasing. The key is treating each source according to its characteristics.

Portfolio Approach

Build your lead acquisition like an investment portfolio. First-party leads are your core holdings – reliable, well-understood, and consistently performing. Third-party leads are tactical positions – higher risk, potentially higher reward, requiring active management.

Organizations targeting long-term sustainable growth might run 70% first-party, 30% third-party. Organizations in rapid expansion mode might invert that ratio temporarily, accepting higher cost-per-acquisition to capture market share.

Quality-Tiered Routing

Route first-party and third-party leads to different sales processes. First-party leads go to senior closers with proven conversion track records. Third-party leads go to newer representatives who need volume for training, or to speed-to-lead teams optimized for quick contact on lower-quality inventory.

This prevents quality contamination. Your best closers aren’t frustrated by third-party contact rates, and your training resources get abundant leads to practice on.

Separate Tracking and Attribution

Maintain distinct tracking for first-party versus third-party performance. Track cost per lead, contact rate, conversion rate, return rate, and cost per acquisition by source. When third-party CPL looks attractive but third-party CPA looks terrible, you have the data to make informed decisions.

Quarterly portfolio reviews should examine relative CPA across source types, quality trend lines, market pricing changes, and compliance incident rates by source.

Due Diligence for Third-Party Vendors: 15 Questions to Ask

Before purchasing third-party leads, conduct thorough due diligence. These questions separate legitimate vendors from those selling fraud-contaminated or compliance-risky inventory. For the complete vendor evaluation framework, see evaluating lead vendors: questions before buying.

Consent and Compliance Questions

1. What consent language appears on your lead forms? Request actual screenshots of disclosure language, not just descriptions. Review for TCPA compliance: Is the disclosure clear and conspicuous? Does it specifically authorize automated calls and texts? Is it un-bundled from other agreements?

2. Do you use pre-checked consent boxes? Pre-checked boxes do not constitute valid TCPA consent. Any vendor using them should be immediately disqualified.

3. What consent verification technology do you use? TrustedForm and Jornaya are industry standards. Request sample certificates and verify they’re genuine. Confirm the vendor retains certificates for at least 5 years.

4. Can you provide consent certificates with every lead? Not just “yes, we have them” – confirm they’ll be delivered with lead data and that you can retrieve them on demand.

5. How do you handle revocation requests? The FCC requires honoring revocation within 10 business days through any reasonable method. Vendors should have documented processes.

Quality and Fraud Questions

6. What validation do you perform before selling leads? Phone validation, email verification, address standardization, fraud detection, and duplicate checking should all be standard. Ask for specifics about each.

7. What is your typical fraud detection rate? Honest vendors will acknowledge that some fraud gets through. Vendors claiming zero fraud are either lying or not measuring.

8. What are your return rates with comparable buyers? Request documented return rate data by vertical and buyer type. Be suspicious of vendors who don’t track this or won’t share it.

9. Where does your traffic originate? Direct search traffic converts differently than social media traffic converts differently than display advertising. Understanding traffic composition helps predict quality.

10. Do you sell leads exclusively or shared? Shared leads will convert lower. Exclusive leads cost more. Know what you’re buying.

Business Practice Questions

11. What is your return policy? Understand time windows, acceptable return reasons, and maximum return rates allowed per period. Policies that prevent returns for “not interested” consumers may leave you holding bad inventory.

12. How quickly are leads delivered? Speed matters. Leads delivered within minutes of submission convert at dramatically higher rates than leads delivered hours later.

13. What happens to leads I return? Returned leads shouldn’t be resold as fresh inventory. Understand the vendor’s policy.

14. Who are your other buyers? If competitors are buying from the same pool, consumers may be over-contacted before you reach them.

15. What indemnification do you provide? If consent is challenged in litigation, will the vendor defend you? What insurance do they carry? Can they actually pay on indemnification obligations?

Frequently Asked Questions

What percentage of third-party leads are fraudulent?

Industry estimates suggest approximately 30% of third-party leads contain fraudulent or materially false information. This includes bot-generated submissions, human fraud farms, stolen identity leads, and recycled aged leads sold as fresh. First-party leads with proper validation typically see fraud rates of 5-10%.

Why do first-party leads have higher match rates?

First-party data achieves approximately 90% match rates compared to 50-60% for third-party data. The difference comes from data freshness, direct verification at collection, and elimination of the data degradation that occurs as information passes through multiple intermediaries.

Are third-party leads ever worth buying?

Third-party leads make sense for market testing before first-party investment, supplementing volume when first-party capacity is constrained, aged lead nurture campaigns at discounted pricing, and geographic expansion beyond first-party reach. The key is understanding true cost-per-acquisition, not just cost-per-lead.

How do I verify a third-party vendor’s consent compliance?

Request actual screenshots of consent language, not descriptions. Verify they use TrustedForm or Jornaya for certification. Request sample certificates and confirm they’re genuine. Ask specifically about pre-checked boxes, E-SIGN compliance, and consent scope. If anything seems unclear, consult TCPA counsel before purchasing.

What return rate should I expect from third-party leads?

Third-party lead return rates typically range from 15-25%, compared to 5-10% for first-party leads. Return rates above 20% indicate systematic quality problems. Track return rates by vendor and source; significant variance within a single vendor’s inventory suggests mixed quality.

Can I use third-party leads for Medicare or insurance marketing?

Medicare marketing requires one-to-one consent under CMS rules effective October 2024. Standard third-party leads with broad consent lists do not meet this requirement. Insurance leads face similar scrutiny under state mini-TCPA laws. Verify consent scope specifically covers your intended use before purchasing.

How do I calculate true cost-per-acquisition for lead sources?

Start with cost-per-lead. Subtract expected return rate to get net cost per usable lead. Apply contact rate to determine cost per conversation. Apply conversion rate to determine cost per acquisition. Factor in sales labor, compliance overhead, and fraud remediation costs for complete accuracy.

What is the difference between exclusive and shared third-party leads?

Exclusive leads are sold to one buyer only. Shared leads are sold to multiple buyers, typically 2-5. Exclusive leads command premium pricing (often 2-3x shared pricing) but convert 50-100% higher because consumers aren’t over-contacted by competitors.

How quickly should third-party leads be delivered?

Leads lose 10% of their value per hour after submission. Third-party leads should be delivered within minutes of generation, not hours. Real-time API delivery is the standard for quality vendors. Batch delivery or delayed transmission indicates aged inventory.

Should I require TrustedForm certificates from third-party vendors?

Yes. TrustedForm certificates provide independent documentation of the consent capture event, including session replay showing what the consumer saw and clicked. Certificates cost the vendor $0.15-$0.50 per lead. Vendors unwilling to provide them likely have compliance documentation they don’t want you to see.

Key Takeaways

-

First-party leads come from your own properties with complete visibility, direct consent, and lower fraud rates (5-10% vs 30% for third-party).

-

Third-party leads cost less per lead but often deliver higher cost-per-acquisition when return rates, contact rates, and conversion rates are factored in.

-

The 30% fraud problem in third-party leads includes bot traffic, human fraud farms, stolen identities, and recycled leads – requiring robust validation and vendor due diligence.

-

Consent compliance is dramatically simpler with first-party leads. Third-party leads introduce consent scope questions, chain-of-custody issues, and documentation risks that create TCPA exposure.

-

Calculate true CPA, not CPL. A $55 first-party lead that converts 8.5% may deliver lower cost-per-acquisition than an $18 third-party lead that converts 3.5%.

-

Hybrid strategies work best for most organizations – first-party as the core, third-party for testing, volume supplementation, and geographic expansion.

-

Due diligence matters. Before purchasing third-party leads, verify consent language, certification technology, validation processes, return rates, and indemnification provisions.

-

Track sources separately. Blending first-party and third-party performance obscures which strategies actually work and prevents accurate ROI optimization.

Sources

- Cisco Data Privacy Benchmark Study - Research on consumer data privacy expectations and first-party data preferences

- Meta Custom Audiences Documentation - Platform documentation on match rates (60-80%) for first-party data uploads

- FTC Business Guidance - Telemarketing Sales Rule - Federal consent requirements for lead generation

- Forrester Research - Industry analysis on TCPA litigation trends (112% YoY increase) and lead quality benchmarks

- WebRecon LLC - TCPA litigation tracking data and class action settlement statistics ($6.6M average)

- FTC Legal Library - Cases and Proceedings - Database of enforcement actions related to lead generation fraud

This article is part of The Lead Economy series on lead generation best practices. For comprehensive coverage of lead quality, compliance, and business strategy, see the complete guide.