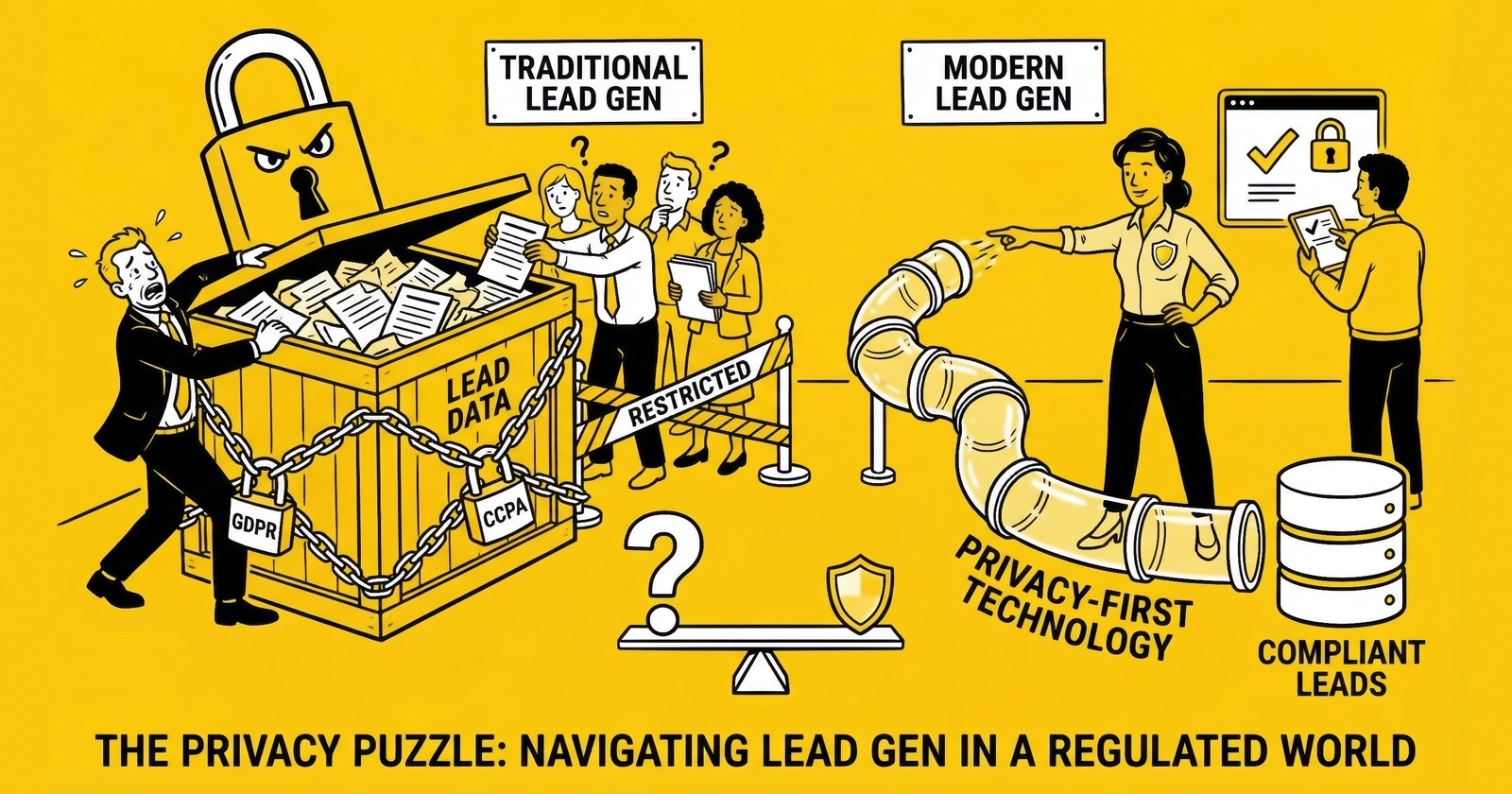

A comprehensive guide to navigating European and California privacy regulations in lead generation operations, where consent architecture separates compliant businesses from regulatory targets.

The email arrived on a Monday morning from a European data protection authority. A lead generation company based in Texas had been processing data from EU consumers through a comparison shopping site without proper consent mechanisms. The assessment: 2.3 million euros in fines, plus mandatory cessation of all EU-facing operations until compliance could be demonstrated.

This company had never considered itself a target for European regulators. They were selling leads to American insurance companies. But their website was accessible from Europe, they accepted submissions from European IP addresses, and they had no consent management infrastructure in place. Under GDPR, that was enough.

The lead generation industry operates at the intersection of two of the world’s most rigorous privacy frameworks: Europe’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act (CCPA), now strengthened by the California Privacy Rights Act (CPRA). Add the 19 additional state privacy laws enacted across the United States through 2024, and the compliance landscape has become genuinely complex.

This is not about checking boxes. This is about understanding that privacy regulation has fundamentally changed the economics of lead generation. Those who build privacy-compliant infrastructure will capture market share as less prepared competitors face regulatory action. Those who treat privacy as an afterthought will find themselves explaining their practices to regulators with enforcement powers that include percentage-of-revenue penalties.

Here is what you need to know to build lead generation operations that satisfy both GDPR and CCPA requirements – and why the technology choices you make today determine your regulatory exposure tomorrow.

Understanding the Regulatory Framework

GDPR: The Global Privacy Standard

The General Data Protection Regulation took effect on May 25, 2018, and immediately became the world’s most influential privacy law. Its reach extends far beyond Europe’s borders. Any organization that processes personal data of EU residents – regardless of where that organization is located – falls under GDPR jurisdiction.

For lead generation, this means that if your landing pages can be accessed from Europe, if you collect data from European consumers, or if you sell leads to companies that serve European markets, GDPR applies to your operations.

The regulation rests on several foundational principles that directly affect lead generation practices.

Lawful Basis Requirement. Under GDPR Article 6, every processing of personal data requires one of six lawful bases: consent, contract performance, legal obligation, vital interests, public task, or legitimate interests. For marketing purposes – which includes lead generation – only two of these bases are practically available: consent and legitimate interests.

Consent Standards. GDPR Article 7 establishes consent requirements far more stringent than most U.S. operators have encountered. Consent must be freely given, specific, informed, and unambiguous. It must result from a clear affirmative action – not silence, pre-ticked boxes, or inactivity. And consent must be as easy to withdraw as it was to give.

The Right to Object. Even when processing under legitimate interests, data subjects retain an absolute right to object to processing for direct marketing purposes. Once they object, processing must stop. There are no exceptions.

Data Subject Rights. GDPR grants eight fundamental rights: the right to be informed, right of access, right to rectification, right to erasure (the “right to be forgotten”), right to restrict processing, right to data portability, right to object, and rights related to automated decision-making. Lead buyers receiving data from your operations must be prepared to honor all of these rights.

Penalties. Maximum fines reach 20 million euros or 4% of global annual revenue – whichever is higher. The regulation also grants individuals the right to compensation for damages resulting from GDPR violations. These are not theoretical concerns: by late 2024, European data protection authorities had collectively issued over 4 billion euros in fines since GDPR enforcement began.

CCPA and CPRA: California’s Privacy Framework

The California Consumer Privacy Act, effective January 1, 2020, and significantly amended by the California Privacy Rights Act (CPRA) effective January 1, 2023, created the most comprehensive privacy framework in U.S. law.

CCPA applies to for-profit entities doing business in California that meet any of three thresholds: annual gross revenue exceeding $25 million, data processing involving 100,000 or more California residents, or deriving 50% or more of annual revenue from selling or sharing personal information. Most lead generation operations of any meaningful scale meet at least one of these thresholds.

The law grants California residents five fundamental rights that directly affect lead generation operations.

Right to Know. Consumers can request disclosure of what personal information a business has collected, where it came from, what purposes it serves, what categories of third parties receive it, and the specific pieces of information held. Businesses must respond to these requests within 45 days, extendable to 90.

Right to Delete. Upon request, businesses must delete personal information, with limited exceptions. For lead generators, this means being able to locate and delete all instances of a consumer’s data across your systems – including any copies that may exist in backups, archives, or downstream buyer databases.

Right to Opt-Out. California residents can direct businesses to stop selling or sharing their personal information. This right is central to lead generation operations because transferring leads to buyers typically constitutes “selling” or “sharing” under CCPA’s broad definitions. Businesses must provide a “Do Not Sell or Share My Personal Information” link on their websites.

Right to Correct. Added by CPRA, consumers can request correction of inaccurate personal information held by businesses.

Right to Limit Use of Sensitive Personal Information. Consumers can restrict use of sensitive data – including Social Security numbers, financial account information, precise geolocation, genetic data, and similar categories – to purposes necessary for providing requested services.

Enforcement. The California Attorney General and the California Privacy Protection Agency enforce CCPA violations. Private right of action exists only for data breaches involving unencrypted personal information, with statutory damages up to $750 per incident per consumer.

The State Privacy Law Proliferation

California was first, but it is no longer alone. By the end of 2024, 19 states had enacted comprehensive consumer privacy laws, with effective dates staggered through 2026. Virginia, Colorado, Connecticut, and Utah were among the first wave following California. Texas, Florida, Oregon, Montana, Delaware, Iowa, Nebraska, New Hampshire, New Jersey, Tennessee, Minnesota, Maryland, Rhode Island, Kentucky, and Indiana followed.

Each state law has its own nuances – different thresholds for applicability, different definitions of sensitive data, different consent requirements. But the trajectory is clear: comprehensive privacy regulation is becoming the national norm rather than the exception. Lead generation operations with national scope must prepare for a patchwork of state-level requirements, not just California’s framework.

The Consent Architecture Challenge

Consent vs. Legitimate Interest: A Critical Distinction

For lead generation, the choice between consent and legitimate interest as a lawful basis for processing carries profound operational implications.

Consent provides cleaner compliance but creates friction. Every data subject must affirmatively agree to processing before any data collection occurs. Consent must be specific – a blanket consent to all possible uses is invalid. Consent must be documented with evidence sufficient to demonstrate that it was actually given.

Legitimate Interest offers more operational flexibility but requires more sophisticated compliance infrastructure. Under GDPR, organizations may process personal data when processing is necessary for legitimate interests pursued by the controller or a third party, except where such interests are overridden by the fundamental rights and freedoms of the data subject.

For lead generation, legitimate interest is theoretically available. An organization has a legitimate interest in generating revenue through marketing activities. But three tests must be satisfied:

Purpose Test: Is there a genuine and legitimate interest behind the processing? Marketing activity qualifies, but this is the easy test.

Necessity Test: Is processing the data actually necessary to achieve the legitimate interest? This is where lead generation often struggles – the specific data fields collected must each be necessary, not merely convenient.

Balancing Test: Do the data subject’s rights and freedoms override the legitimate interest? This requires documenting a Legitimate Interests Assessment (LIA) that weighs organizational interests against individual impact. For direct marketing, this assessment often tips against legitimate interest, particularly when the data subject has no prior relationship with the organization.

The Practical Reality. European data protection authorities have consistently held that legitimate interest is rarely appropriate for third-party marketing – the exact use case central to lead generation. When lead data is collected for sale to buyers with whom the consumer has no relationship, legitimate interest is extremely difficult to defend. Most sophisticated practitioners targeting European consumers default to consent as their lawful basis, despite the operational complexity this creates.

Building GDPR-Compliant Consent

Valid consent under GDPR requires four elements, each with operational implications for lead generation.

Freely Given. Consent cannot be bundled with acceptance of terms and conditions for a service. A consumer cannot be forced to consent to marketing in order to obtain a quote. This prohibition on “bundled consent” means that lead forms must allow consumers to submit their information without consenting to third-party marketing – even if that reduces the value of the lead.

Specific. Consent must identify specific purposes and, critically for lead generation, specific recipients. Under GDPR, consent to receive marketing from “our partners” or “third parties” is invalid. The specific organizations that will receive the data must be identified at the time consent is obtained. This is functionally equivalent to the one-to-one consent rule the FCC briefly adopted (and the courts subsequently vacated) for TCPA purposes – but it remains a binding requirement under European law.

Informed. The data subject must understand what they are consenting to before giving consent. This requires clear disclosure of what data will be collected, why it will be processed, who will receive it, how long it will be retained, and what rights the data subject has regarding the data.

Unambiguous Indication by Clear Affirmative Action. GDPR Recital 32 explicitly states that “silence, pre-ticked boxes or inactivity should not therefore constitute consent.” The consumer must actively do something – check a box, click a button, take some affirmative step – to grant consent. Pre-selected consent checkboxes are invalid, as is inferring consent from continued use of a website.

Documentation Requirements. The controller must be able to demonstrate that consent was validly obtained. This requires capturing evidence of what was displayed to the consumer, what action they took, and when they took it. For lead generation, this means implementing consent verification services – TrustedForm, Jornaya, or equivalent – that document the consent transaction in a manner defensible to European regulators.

CCPA Opt-Out Architecture

CCPA operates from a different philosophical foundation than GDPR. Rather than requiring affirmative consent before data collection (opt-in), CCPA grants consumers the right to opt out of sale or sharing after the fact. This distinction has significant operational implications.

The “Do Not Sell or Share” Requirement. Every business subject to CCPA must provide a clear and conspicuous link on their website titled “Do Not Sell or Share My Personal Information” or an equivalent phrase. For lead generators, clicking this link must stop the consumer’s data from being sold to lead buyers going forward.

Global Privacy Control (GPC). CCPA regulations now require businesses to treat browser-based opt-out signals – specifically the Global Privacy Control standard – as valid opt-out requests. If a consumer’s browser transmits a GPC signal, your website must recognize and honor it, suppressing that consumer from any lead selling activity.

Operational Complexity. Unlike consent, which prevents data collection, CCPA opt-out rights create ongoing suppression obligations. A consumer who opts out today may have submitted leads previously that are still in your database or have been transferred to buyers. You must maintain opt-out status across your systems and be prepared to verify that opted-out consumers are not appearing in subsequent lead transfers.

The 12-Month Re-Opt-In Restriction. Once a consumer opts out, businesses must wait at least 12 months before requesting consent to sell their data again. You cannot immediately re-present an opt-in offer.

Privacy Technology Implementation

Consent Management Platforms

A consent management platform (CMP) provides the technical infrastructure to capture, document, and enforce consent preferences across your operations. For lead generation, a CMP must handle several critical functions.

Consent Capture. When a consumer visits your landing page, the CMP must present a consent interface that meets GDPR requirements – identifying specific recipients, explaining data uses, and capturing affirmative consent through an unambiguous action.

Geographic Detection. Because GDPR applies only to EU residents and CCPA applies to California residents, sophisticated operations implement geographic consent logic. EU visitors receive GDPR-compliant consent interfaces with opt-in requirements. California visitors receive CCPA disclosures with opt-out mechanisms. Visitors from other jurisdictions may receive lighter-touch consent flows, though the proliferation of state laws is making geographic segmentation increasingly complex.

Cookie Consent. Separate from data processing consent, GDPR’s ePrivacy Directive (as interpreted through regulations like the UK’s PECR) requires consent before placing marketing or tracking cookies. Many CMPs integrate cookie consent with data processing consent, though technically these are distinct consent requirements.

Preference Storage. The CMP must store consent preferences in a manner that can be queried by downstream systems. When a lead reaches your distribution system, the system must be able to verify that valid consent exists for the intended recipient before routing the lead.

Consent Receipts. For GDPR compliance, the CMP should generate consent receipts – documented records of when consent was given, what was consented to, and what was displayed to the consumer at the time of consent. These receipts become critical evidence if regulators question your consent practices.

Withdrawal Mechanisms. GDPR requires that withdrawal of consent be as easy as giving it. If consent was granted through a web form, withdrawal must be possible through an equally accessible web mechanism – not by requiring consumers to call a phone number or mail a letter.

Consent Verification for Lead Generation

Standard consent management platforms are designed primarily for website operators managing their own data relationships. Lead generation requires additional consent verification that documents consent in a manner transferable to lead buyers.

TrustedForm and Jornaya for GDPR. The same third-party verification services used for TCPA consent documentation – TrustedForm and Jornaya – are equally valuable for privacy regulation compliance. A TrustedForm certificate documenting that a consumer saw specific buyer names in a GDPR-compliant disclosure, actively checked a consent box, and submitted the form provides evidence transferable to lead buyers who must demonstrate lawful basis for their processing.

Certificate Requirements. For GDPR compliance, consent certificates should document:

- Exact disclosure language displayed, including identified recipients

- Consumer’s affirmative action (checkbox selection, button click)

- Timestamp of consent

- IP address and geolocation data supporting determination of applicable jurisdiction

- Evidence that no pre-selection was used

- Session replay or visual record of the consent interface

Buyer-Side Verification. Lead buyers subject to GDPR cannot process lead data unless they can demonstrate lawful basis. This means lead buyers are increasingly requiring sellers to provide consent documentation as a condition of purchase. The consent certificate effectively becomes part of the lead deliverable – without it, the lead has limited value to buyers operating under GDPR constraints.

Data Subject Rights Infrastructure

Both GDPR and CCPA grant consumers rights that require operational infrastructure to fulfill.

Request Intake. You must provide accessible methods for consumers to submit data subject requests. CCPA requires at least two methods (typically a web form and an email address or toll-free number). GDPR requires accessible request channels without specifying particular methods.

Identity Verification. Before responding to data subject requests, you must verify that the requestor is actually the data subject. This prevents third parties from using data rights requests to extract personal information about others. Verification methods must be proportionate to the sensitivity of the data – more sensitive data requires more robust verification.

Data Mapping. You cannot respond to a request to delete personal data if you do not know where that data resides. GDPR and CCPA compliance requires comprehensive data mapping documenting what personal data you collect, where it is stored, who has access to it, who you share it with, and how long you retain it.

Response Workflows. CCPA requires response to most requests within 45 calendar days, extendable to 90. GDPR requires response “without undue delay” and within one month, extendable to three months for complex requests. You need automated or semi-automated workflows to track request receipt, route requests to appropriate personnel, document response actions, and meet deadlines.

Downstream Notification. If you have shared personal data with buyers and then receive a deletion request, you must notify those buyers of the deletion request. GDPR Article 17 requires that controllers “take reasonable steps” to inform processors and other recipients about erasure requests. This creates chain-of-custody obligations that must be reflected in your buyer contracts.

Privacy-Compliant Lead Distribution

Lead distribution systems must incorporate privacy controls at the routing level.

Consent-Based Routing. Before routing a lead to a buyer, the distribution system must verify that valid consent exists for that specific buyer. For GDPR, this means confirming that the buyer was named in the consent disclosure. For CCPA, this means confirming that the consumer has not opted out of sale to that category of buyer.

Suppression Integration. Opt-out lists and deletion requests must propagate to distribution systems in real time. If a consumer opts out at 2:00 PM, any lead from that consumer that reaches the distribution system at 2:01 PM must be suppressed from sale.

Buyer Consent Requirements. Different buyers may have different consent requirements based on their regulatory exposure. A buyer with European operations may require GDPR-compliant consent documentation. A buyer focused solely on Texas may have fewer requirements today – though Texas now has its own privacy law effective July 2024. Your distribution system should be able to match leads to buyer requirements and route accordingly.

Data Minimization. GDPR’s data minimization principle requires that only data “adequate, relevant and limited to what is necessary” be processed. This applies to lead distribution: if a buyer does not need a particular data field, that field should not be transmitted to them. Distribution systems should support buyer-specific field mapping that limits data transfer to necessary elements.

Compliance Architecture by Role

For Lead Generators and Publishers

As a lead generator, you are typically the “data controller” under GDPR – the entity that determines the purposes and means of processing. This role carries primary responsibility for lawful data collection and consent capture.

Form Design. Every lead capture form must implement privacy-compliant consent mechanisms. For EU-facing forms:

- Consent checkbox must be unchecked by default

- Specific buyer names must appear in consent disclosure

- Consent language must be clear and accessible (not hidden in fine print or behind hyperlinks)

- Submission must be possible without marketing consent (unbundled)

- Cookie consent must be obtained before placing tracking cookies

Documentation. Implement third-party consent verification on all forms. Store consent certificates with lead records. Maintain evidence sufficient to demonstrate valid consent years after the fact – GDPR enforcement actions can arise years after data collection.

Buyer Qualification. Know who your buyers are and where they operate. Buyers with European exposure need GDPR-compliant consent. Buyers with California exposure need CCPA-compliant data flows. Qualifying buyers based on their compliance posture protects both parties.

Data Retention. Do not retain personal data longer than necessary for your purposes. GDPR requires retention limitation – data should be kept only as long as needed. Define retention periods based on legitimate operational needs and delete data that exceeds those periods.

For Lead Buyers

As a lead buyer, you receive data collected by others. Under GDPR, you may be a “data controller” if you determine how you will use the data, or a “joint controller” if purposes were determined jointly with the lead generator. Either way, you bear independent responsibility for processing lawfully.

Consent Verification. Before contacting leads, verify that valid consent exists for your organization. Request consent documentation from lead sellers. Review certificates to confirm that your organization (or a sufficiently specific category including your organization) was identified in the consent disclosure.

Contractual Requirements. Your lead purchase agreements should include representations from sellers regarding consent quality, GDPR compliance, and indemnification for claims arising from inadequate consent. If a regulator finds that consent was invalid, you need recourse against the seller who provided deficient documentation.

Data Subject Right Fulfillment. When data subjects exercise rights – access, deletion, correction – you must respond. This requires maintaining searchable records of lead data and having processes to locate all instances of a consumer’s data across your systems.

Vendor Due Diligence. GDPR and CCPA both impose obligations regarding the companies you work with. Buying leads from a generator with poor consent practices exposes you to regulatory risk. Conduct due diligence on lead sources, audit consent capture mechanisms, and terminate relationships with non-compliant sources.

For Lead Brokers and Aggregators

Brokers who purchase leads from generators and resell to buyers face compound compliance requirements.

Dual Documentation. You need consent documentation from upstream generators and must provide consent documentation to downstream buyers. The consent chain must be unbroken – if the generator failed to capture proper consent, no downstream party can cure that deficiency.

Data Processing Agreements. Under GDPR, when you transfer data between parties, data processing agreements (DPAs) defining responsibilities are required. DPAs should specify the purposes of processing, categories of data involved, security requirements, and obligations regarding data subject rights.

Cross-Border Transfer Mechanisms. If you transfer data from the EU to buyers outside the EU, additional transfer mechanisms may be required. The EU-U.S. Data Privacy Framework (effective as of 2023) provides one mechanism. Standard Contractual Clauses (SCCs) provide another. Without a valid transfer mechanism, cross-border transfers may themselves violate GDPR, regardless of consent quality.

Technology Stack for Privacy Compliance

Building privacy-compliant lead generation requires specific technology investments. The following components represent the minimum viable privacy technology stack for operations with exposure to GDPR and CCPA.

Essential Components

| Component | Purpose | Investment Priority |

|---|---|---|

| Consent Management Platform | Capture and document consent with regulatory precision | Immediate |

| Third-Party Consent Verification | TrustedForm, Jornaya, or equivalent for transferable documentation | Immediate |

| Geographic Detection | Route visitors to appropriate consent flows based on jurisdiction | Immediate |

| Cookie Consent Module | Manage tracking cookie consent separate from data consent | Immediate |

| Data Subject Request Portal | Intake and workflow for consumer rights requests | Within 90 days |

| Data Mapping Tool | Document data inventory, flows, and retention | Within 90 days |

| Privacy-Aware Distribution | Consent verification at lead routing decision points | Within 90 days |

| Suppression Management | Real-time opt-out and deletion propagation | Within 90 days |

Implementation Considerations

Integration Architecture. Privacy technology must integrate with existing lead capture, distribution, and CRM systems. Consent verification at the form level means nothing if distribution systems cannot query consent status before routing. Plan for integration across the full lead lifecycle.

Vendor Selection. Consent management platforms vary widely in sophistication and lead-generation-specific functionality. Some CMPs are designed for general website compliance; others have features specifically suited to lead generation (granular consent by buyer, API-based consent verification, integration with lead distribution platforms). Evaluate vendors based on your specific use case.

Multi-Jurisdictional Logic. With 20+ U.S. states implementing privacy laws and the EU requiring GDPR compliance, your technology must handle jurisdictional variation. This means either implementing sophisticated geo-detection with conditional consent flows or standardizing on the most restrictive requirements globally.

Audit Trail. Regulators may request evidence of compliance years after data processing occurred. Your technology must maintain comprehensive audit trails documenting consent capture, consent verification, and data subject request handling with sufficient detail to demonstrate compliance after the fact.

Real-World Implementation Scenarios

Scenario 1: U.S.-Based Generator with EU Traffic

A lead generation company based in Florida operates comparison shopping sites for insurance products. Most traffic is domestic, but 4% of visitors have EU IP addresses.

Challenge: EU traffic subjects the operation to GDPR. Ignoring EU visitors is not viable – they still access the site and may submit data.

Solution: Implement geographic detection that routes EU visitors to a GDPR-compliant consent experience. The EU flow requires opt-in consent with specific buyer identification before any data collection. The consent form includes an unchecked checkbox, displays the names of buyers who may receive the data, and allows form submission without marketing consent (in which case no lead is generated). EU leads receive consent certificates and are sold only to buyers named in the consent disclosure.

Implementation Cost: Approximately $15,000 to $30,000 for consent management platform implementation, plus ongoing CMP subscription costs (typically $500 to $2,000 monthly depending on volume). Third-party consent verification adds $0.15 to $0.50 per EU lead.

Risk Mitigation Value: A single GDPR enforcement action could exceed the entire annual revenue of many lead generation operations. The investment is trivial compared to the potential exposure.

Scenario 2: National Lead Buyer with California Exposure

A mortgage lender purchases leads nationally and contacts consumers via phone and email. Approximately 12% of purchased leads are from California.

Challenge: CCPA applies because the company does business in California and processes data from more than 100,000 California residents annually. Lead sellers may or may not have provided CCPA-compliant disclosures.

Solution: Require all lead sellers to provide documentation of CCPA compliance, including confirmation that privacy disclosures were provided and that consumers had access to opt-out mechanisms. Implement suppression checking against California opt-out requests before contacting California leads. Maintain data subject request intake mechanisms and response workflows.

Implementation Focus: The buyer cannot control upstream collection practices but can require contractual representations, conduct periodic audits of seller practices, and implement robust suppression management for opt-out requests received directly.

Scenario 3: Lead Broker Serving International Buyers

A lead aggregator purchases leads from U.S. generators and sells to buyers in the U.S., UK, and EU.

Challenge: Cross-border transfers to EU/UK buyers require valid transfer mechanisms. EU buyers need GDPR-compliant consent documentation. U.S. generators may not be capturing EU-grade consent.

Solution: Segment lead flows based on buyer location. For EU buyers, accept only leads with documented GDPR-compliant consent – specific buyer identification, affirmative opt-in action, no pre-checked boxes. Implement Standard Contractual Clauses in buyer agreements to satisfy transfer mechanism requirements. For U.S.-only buyers, TCPA-grade consent may suffice.

Operational Reality: The broker may need to reject or price differently leads that lack GDPR-compliant consent, limiting inventory available for EU buyers. Alternatively, the broker may work with generators to implement upgraded consent mechanisms on specific landing pages dedicated to EU-eligible lead capture.

Frequently Asked Questions

1. Does GDPR apply to my U.S.-based lead generation business?

GDPR applies if you process personal data of individuals located in the EU, regardless of where your company is based. If your landing pages are accessible from Europe and you collect data from EU visitors, GDPR likely applies. Practical triggers include: accepting submissions from EU IP addresses, advertising to EU audiences, or selling leads to buyers who serve EU markets. The safest approach is to implement GDPR-compliant consent mechanisms for visitors identified as being in the EU rather than hoping regulators will not notice.

2. What is the difference between GDPR consent and CCPA opt-out rights?

GDPR requires affirmative consent before data processing for marketing purposes – the consumer must actively agree before you collect or use their data. CCPA requires opt-out mechanisms after collection – consumers can stop future selling or sharing of their data but cannot prevent initial collection if privacy disclosures were provided. GDPR is opt-in; CCPA is opt-out. For lead generation, GDPR requires consent before the lead is generated, while CCPA allows lead generation but requires honoring opt-out requests regarding sale to buyers.

3. Can I use “legitimate interest” instead of consent for EU lead generation?

Theoretically yes, but practically difficult. Legitimate interest requires satisfying a three-part test: purpose, necessity, and balancing. For third-party marketing – where lead data is sold to companies with no prior relationship to the consumer – European regulators have consistently held that consumer interests typically override organizational interests. The UK Information Commissioner’s Office and other data protection authorities have issued guidance skeptical of legitimate interest for cold marketing. Most compliance advisors recommend consent as the lawful basis for lead generation targeting EU residents.

4. What constitutes valid GDPR consent for lead generation?

Valid consent requires four elements: freely given (not bundled with other agreements), specific (identifying particular recipients and purposes), informed (clear explanation of what will happen with the data), and given through clear affirmative action (no pre-ticked boxes or inferred consent). For lead generation, this means consent disclosures must name the specific companies that will receive the data, use clear and plain language, present consent separately from terms and conditions, use unchecked checkboxes that consumers actively select, and provide evidence that all of these requirements were met.

5. How do I handle data subject access requests for lead data?

Both GDPR and CCPA grant consumers the right to request access to their data. When you receive an access request, you must verify the requestor’s identity, locate all personal data you hold about them, compile it in a commonly used format, and provide it within the required timeframe (one month for GDPR, 45 days for CCPA). For lead data, this includes not just the information the consumer submitted but also any derived data, consent records, and information about who received the data. If you have sold or shared the data with buyers, you should be able to identify those recipients.

6. What are the penalties for GDPR violations in lead generation?

GDPR authorizes fines up to 20 million euros or 4% of global annual revenue, whichever is higher. The actual penalty depends on factors including the nature and gravity of the violation, the number of data subjects affected, whether the violation was intentional, and actions taken to mitigate damage. A lead generator processing EU data without valid consent could face fines based on the number of affected consumers multiplied by the severity of the violation. Beyond fines, enforcement actions can require cessation of non-compliant processing, meaning you might be ordered to stop EU-facing operations until compliance is demonstrated.

7. Do state privacy laws other than CCPA affect lead generation?

Yes. As of late 2024, 19 states have enacted comprehensive privacy laws, with effective dates ranging from 2023 through 2026. Virginia, Colorado, Connecticut, Utah, Texas, Oregon, Montana, and others now have operative privacy frameworks. Each has its own requirements regarding consumer rights, opt-out mechanisms, and business obligations. For lead generation with national scope, you must comply with the most restrictive applicable state law for each consumer based on their location. This creates operational complexity that is driving many practitioners toward standardizing on CCPA-level compliance nationally. Understanding the broader TCPA compliance landscape helps contextualize these state-level requirements.

8. How should I handle consent for leads that may be sold to multiple buyers?

Under GDPR, consent must identify specific recipients. If a lead may be sold to multiple buyers, those buyers must be identified at the time consent is captured. This can be done by listing all potential buyers in the consent disclosure, by dynamically displaying matched buyers based on ping/post results before consent is obtained, or by obtaining separate consent for each buyer (the most rigorous approach). Under CCPA, specific buyer identification is not required, but consumers must have the ability to opt out of sale to any buyer. The most compliant approach is to identify buyers specifically at consent capture, enabling clean documentation that particular buyers were covered by consent.

9. What is the EU-U.S. Data Privacy Framework and how does it affect lead transfers?

The EU-U.S. Data Privacy Framework, effective July 2023, provides a mechanism for transferring personal data from the EU to U.S. organizations that certify compliance with the framework’s principles. Organizations that participate in the framework can receive EU personal data without implementing additional transfer mechanisms like Standard Contractual Clauses. For lead generation, if your organization (or your buyers) are Data Privacy Framework participants, cross-border lead transfers have a cleaner legal basis. If not, you may need SCCs or other mechanisms to transfer EU-origin leads to U.S. recipients legally.

10. How do I implement Global Privacy Control (GPC) for CCPA compliance?

Global Privacy Control is a browser-based signal that communicates a consumer’s preference to opt out of data selling and sharing. CCPA regulations require businesses to recognize and honor GPC signals as valid opt-out requests. Implementation requires detecting the GPC signal in the browser request header (the Sec-GPC header set to “1”), treating that signal as an opt-out equivalent to clicking your “Do Not Sell or Share” link, and suppressing that visitor from lead selling activities. Most major consent management platforms now include GPC detection as a standard feature. If you are using custom forms without a CMP, you will need to implement GPC detection directly.

Key Takeaways

-

GDPR applies to U.S. lead generators who process EU data. If your websites are accessible from Europe and you collect data from EU visitors, you likely fall under GDPR jurisdiction with exposure to fines up to 20 million euros or 4% of global revenue.

-

Consent and legitimate interest are the only viable lawful bases for lead generation under GDPR. European regulators are skeptical of legitimate interest for third-party marketing. Most compliance advisors recommend obtaining affirmative consent.

-

GDPR consent requires specific buyer identification. Unlike TCPA multi-seller consent (which remains legal after the one-to-one rule vacatur), GDPR requires that consent disclosures identify specific companies that will receive the data.

-

CCPA grants opt-out rights rather than requiring opt-in consent. California consumers can stop future selling of their data but cannot prevent initial collection if proper disclosures were made.

-

Nineteen states now have comprehensive privacy laws. The compliance landscape extends far beyond California. National lead generation operations must prepare for multi-state requirements.

-

Privacy technology is not optional. Consent management platforms, third-party consent verification, data mapping, and rights request infrastructure are necessary investments for compliant operations.

-

Consent documentation must be transferable to buyers. Lead buyers need evidence that valid consent exists before processing lead data. TrustedForm certificates and similar documentation become part of the lead deliverable.

-

Cross-border transfers require additional mechanisms. Transferring EU-origin leads to U.S. buyers requires either EU-U.S. Data Privacy Framework participation or Standard Contractual Clauses.

-

The privacy compliance investment is trivial compared to enforcement exposure. A single GDPR fine or CCPA enforcement action can exceed the entire value of a lead generation operation. Building compliant infrastructure protects that value.

Building Privacy as Competitive Advantage

Those who view privacy compliance as a burden will struggle. Those who view it as competitive infrastructure will thrive.

When a lead buyer evaluates your operation, they are evaluating risk transfer. Every lead you sell transfers liability along with opportunity. Buyers who understand the regulatory landscape – and sophisticated buyers increasingly do – will pay premiums for leads with clean consent documentation and clear compliance lineage. They will avoid or discount leads from sources with questionable consent practices.

Privacy-compliant infrastructure becomes a differentiator. When competitors cannot serve EU-facing buyers because they lack GDPR-compliant consent, you can. When buyers audit source quality and find gaps in competitor consent documentation, your documented compliance wins the business.

The regulatory trajectory is clear. Privacy regulation is expanding, not contracting. The GDPR model has influenced laws on every continent. U.S. states are enacting comprehensive privacy frameworks at an accelerating pace. Federal privacy legislation remains under discussion in Congress. Building compliant infrastructure now positions you for the regulatory environment of 2026 and beyond – not just today’s requirements.

The technology investment is manageable. Consent management platforms, consent verification services, and data mapping tools represent infrastructure costs, not prohibitive barriers. These costs scale with operations – high-volume operators pay more but generate more revenue to absorb the investment.

The alternative is existential risk. A GDPR fine equal to 4% of global revenue is not a compliance cost – it is a business-ending event for most lead generation operations. A CCPA enforcement action resulting in an injunction against California-facing activities removes 12% of the U.S. market from your addressable opportunity.

Build privacy compliance into your operations now. The market is differentiating. Those who invest will capture share from those who do not.

Sources

- GDPR Article 6: Lawful Basis for Processing - Official text establishing the six lawful bases for data processing under GDPR

- GDPR Article 7: Conditions for Consent - Official requirements for valid consent under European law

- California Attorney General CCPA Information - Official CCPA regulatory guidance and enforcement resources

- EU-U.S. Data Privacy Framework - Official framework for transatlantic personal data transfers

- European Commission: Data Transfers Outside EU - EU adequacy decision announcement for EU-U.S. Data Privacy Framework

- GDPR Enforcement Tracker - Database of GDPR fines and enforcement actions across European authorities

- UK ICO GDPR Guidance - UK Information Commissioner’s Office guidance on GDPR implementation

- NOYB European Center for Digital Rights - Privacy advocacy organization tracking GDPR enforcement trends

- TrustedForm - Consent verification platform for privacy-compliant lead generation

- Jornaya - Independent consent documentation service for multi-jurisdiction compliance

This article reflects regulatory requirements as of late 2024. Privacy regulations evolve continuously through legislative action, regulatory guidance, and court decisions. Consult qualified legal counsel for current compliance requirements specific to your operations and jurisdictions.