A lead in Miami sells for 3x what the same coverage intent commands in Des Moines. The difference is not just hurricane risk. It is housing values, carrier competition, bundling potential, and buyer sophistication. Master geographic targeting and you capture margin that uniform-pricing competitors leave on the table.

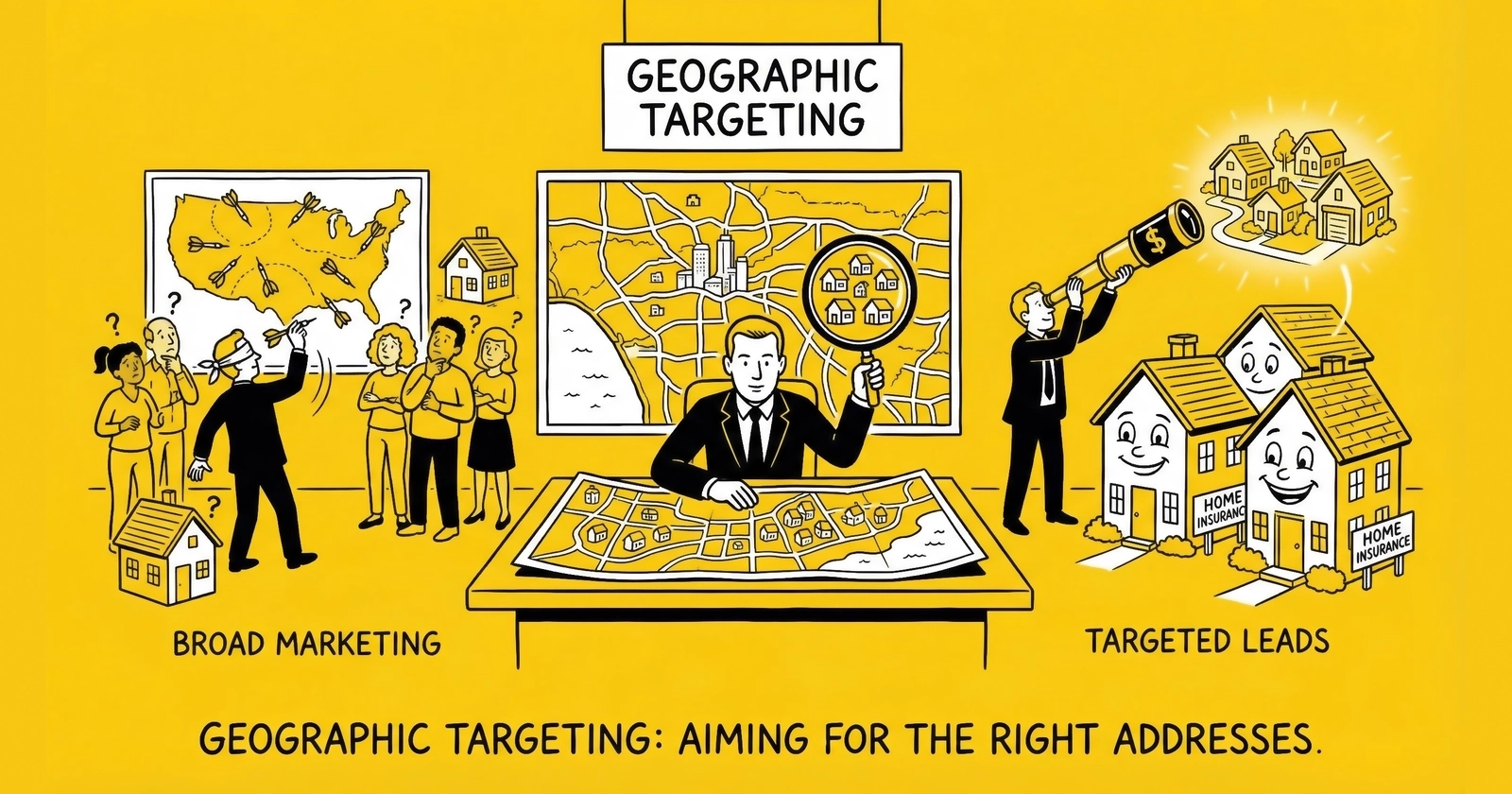

The home insurance lead market operates on a fundamental truth that most lead generators ignore: geography determines value more than any other single variable. A homeowner requesting coverage quotes in coastal Florida represents fundamentally different economics than one in rural Nebraska. The property values differ. The risk profiles differ. The carrier appetite differs. And the lead prices should differ accordingly.

Yet the majority of home insurance lead operations treat the United States as a monolithic market. They generate traffic nationally, price leads uniformly, and wonder why margins fluctuate unpredictably. They are leaving money on the table in premium markets and overpaying for traffic in markets where buyers will not support the costs.

This guide provides the geographic targeting intelligence you need to optimize home insurance lead generation. You will understand how to identify high-value territories, how to price leads based on local market conditions, how to align traffic acquisition with buyer demand, and how to build sustainable competitive advantage through geographic specialization.

Those who master these dynamics consistently outperform those running national commodity operations. The margin opportunity is real. The complexity is manageable. The path is clear.

The Home Insurance Lead Market: A Geographic Perspective

Home insurance leads represent a distinct segment within the broader property and casualty insurance vertical. Unlike auto insurance, where consumers shop annually and switching costs are low, homeowners insurance purchasing behavior concentrates around specific trigger events. These events are inherently geographic: home purchases cluster in active real estate markets, policy renewals follow housing stock patterns, and catastrophe-driven shopping spikes occur in disaster-affected regions.

Understanding this geographic foundation is essential for effective lead generation strategy.

Market Size and Structure

The homeowners insurance market in the United States generated approximately $145 billion in direct premiums written in 2024, with the lead generation segment representing an estimated $400-600 million in annual transaction value across all intermediaries and direct generation. This figure is smaller than auto insurance lead generation because shopping frequency is lower and the market is more tightly integrated with real estate transactions.

Home insurance lead distribution follows the same three-tier structure as other insurance verticals: publishers and affiliates generate traffic, intermediaries aggregate and distribute leads, and carriers and agents purchase leads for their sales pipelines. The major platforms operating in auto insurance also serve home insurance, with MediaAlpha and EverQuote both offering home insurance lead products to their carrier and agent buyer bases.

The market exhibits less public transparency than auto insurance because home leads represent a smaller percentage of public company revenues. EverQuote, for example, generated over $446 million from auto insurance in 2024 but does not break out home insurance separately. Industry estimates suggest home insurance represents 10-15% of total P&C lead transaction value, indicating a market of $500-700 million annually when including all generation methods.

Why Geography Matters More in Home Insurance

Several structural factors make geographic targeting more important in home insurance than in other verticals.

Property values drive policy sizes. A home insurance lead in San Francisco, where median home values exceed $1.2 million, represents potential for policies with $800,000+ in dwelling coverage. A lead in Cleveland, where median values hover around $120,000, represents policies with $100,000-150,000 in coverage. Carrier commission structures, typically 10-15% of first-year premium, mean the San Francisco lead generates 6-8x the commission opportunity. This value differential should be reflected in lead pricing.

Risk geography determines carrier appetite. Carriers actively seek leads in low-risk territories where loss ratios are favorable. They avoid or price aggressively in high-risk zones where catastrophe exposure threatens profitability. Coastal Florida, wildfire-prone California, and tornado alley present very different buyer demand profiles than the stable Midwest or Northeast. A lead generator who understands carrier risk appetite can route traffic to match demand.

Real estate activity concentrates geographically. Home insurance purchases correlate strongly with real estate transactions, and real estate activity clusters in specific markets. Austin, Phoenix, Tampa, and Nashville experienced 30-50% population growth over the past decade, creating concentrated lead demand. Meanwhile, Rust Belt cities with flat or declining populations generate fewer home purchase-triggered leads. Traffic acquisition should follow transaction volume.

Bundling opportunity varies by market. Carriers value home insurance leads partly for bundling potential with auto policies. Markets with high auto insurance premiums increase the bundling economics. Florida, Michigan, and California have the highest average auto premiums in the nation, making home insurance leads in those states more valuable for cross-sell potential.

Carrier concentration differs by region. Some markets have robust carrier competition with 15-20 active writers competing for business. Others are served by a handful of carriers, with some having restricted new writings entirely. The number of active buyers in a territory directly affects lead pricing and fill rates.

The Geographic Pricing Spread

Home insurance leads exhibit 2-4x pricing variation between highest and lowest value markets, a narrower spread than solar’s 8.5x range but still substantial enough to drive meaningful margin differences.

Premium markets command $80-150+ per exclusive lead:

- Coastal Florida (high premiums, bundling value, active real estate)

- California (high property values, bundling potential)

- Texas (large market, strong carrier competition)

- New York (high property values, regulatory complexity)

- New Jersey (high property values, density)

Strong markets command $50-80 per exclusive lead:

- Colorado, Arizona, Nevada (growing markets, moderate risk)

- Massachusetts, Connecticut (high property values)

- North Carolina, Georgia, Virginia (growth markets)

- Washington, Oregon (high property values, limited catastrophe exposure)

Moderate markets command $30-50 per exclusive lead:

- Most Midwest states

- Mountain West interior states

- Parts of the Southeast

Lower-value markets command $15-30 per exclusive lead:

- Rural markets with low property values

- Markets with limited carrier competition

- Territories with carrier moratoriums or restrictions

The arbitrage opportunity exists in the gap between traffic acquisition cost and lead sale price. If you can acquire traffic in Texas for the same cost as traffic in Iowa but sell Texas leads for 2x the price, the margin differential compounds across your entire operation.

Identifying High-Value Geographic Markets

Effective geographic targeting requires systematic analysis of the factors that drive lead value. Not every high-premium market justifies premium lead pricing, and some apparently moderate markets offer exceptional margin opportunity.

Primary Value Drivers

Property values and policy sizes. Median home values directly correlate with dwelling coverage limits, which determine premium size and commission potential. High-value markets include the coastal metros, California broadly, the Northeast corridor, and growth markets like Austin, Denver, and Seattle. The correlation is not perfect, as some high-value markets have carrier restrictions that reduce buyer appetite, but property value remains the foundational value driver.

Premium levels by state. State-level average premiums reflect both property values and risk factors. Florida leads the nation with average premiums exceeding $4,000 annually, driven by hurricane exposure and carrier profitability challenges. California, Texas, and Louisiana also show elevated premiums. States with low catastrophe exposure and moderate property values have lower premiums and correspondingly lower lead values.

Carrier competition and appetite. The number of carriers actively seeking new business determines buyer demand. Markets with 15-20+ active writers support higher lead prices because buyers compete for limited supply. Markets where carriers have restricted new writings, like parts of California and Louisiana, may have high theoretical value but limited practical buyer demand.

Real estate transaction volume. Active real estate markets generate purchase-triggered shopping. Markets with high inventory turnover produce consistent lead demand tied to purchase timelines. Track housing starts, home sales volume, and days-on-market metrics to identify transaction-dense territories.

Bundling economics. Carriers value home leads for cross-sell potential. Markets with high auto insurance premiums increase bundling value. Michigan, Florida, and Louisiana have the highest auto premiums nationally, making home leads in those markets more attractive to carriers pursuing bundle economics.

Risk Geography Analysis

Understanding risk geography helps predict both carrier appetite and pricing sustainability.

Hurricane exposure zones. Coastal areas from Texas through Florida and up the Atlantic seaboard face hurricane exposure. Carriers have different risk tolerances, and many have restricted coastal writings in recent years. Florida’s property insurance crisis of 2022-2024 led multiple carriers to exit the state, creating complicated buyer dynamics where remaining writers are selective about new business. Leads in hurricane zones may command premiums when buyers are actively seeking volume, but also face fill rate challenges when carrier appetite is restricted.

Wildfire exposure zones. California, Colorado, Oregon, and parts of the Southwest face wildfire risk. California’s FAIR Plan growth from 130,000 policies in 2017 to over 450,000 in 2024 reflects carriers retreating from fire-exposed territories. Lead generators must understand which zones are in moratorium and which still have active buyer demand.

Tornado and hail zones. The central United States from Texas through the Great Plains faces severe convective storm exposure. Carriers in these territories price for expected losses, and buyer appetite generally remains stable because the risk is modeled and priced. These markets often offer steady demand without the volatility of coastal exposure.

Flood zones. FEMA-designated flood zones require separate flood insurance, which affects homeowners policy economics. Properties in high-risk flood zones may have coverage limitations that reduce lead value. Understanding flood zone mapping helps qualify leads appropriately.

Market Opportunity Scoring Framework

Develop a systematic scoring framework for evaluating geographic markets:

Score each market on five factors (1-5 scale):

- Property value potential: Median home values and coverage amounts

- Premium levels: State average premiums and pricing trends

- Carrier competition: Number of active buyers seeking leads

- Real estate activity: Transaction volume and growth trends

- Risk stability: Catastrophe exposure and carrier appetite trends

Markets scoring 20+ represent premium opportunities. Markets scoring 15-19 are solid performers. Markets scoring below 15 may not justify dedicated traffic investment.

Apply this framework to your specific operation based on which buyers you serve. An operation focused on serving independent agents has different optimal markets than one selling to carrier call centers. Align your geographic focus with your distribution capability.

Traffic Acquisition by Geography

Geographic targeting must be implemented at the traffic acquisition level, not just at lead distribution. The efficiency of your traffic acquisition directly determines margin potential in each market.

Platform Targeting Capabilities

Major advertising platforms offer geographic targeting at various levels of granularity:

Google Ads supports targeting at the state, DMA, city, and radius levels. You can exclude specific geographies and create location-based bid adjustments. For home insurance, target at the state or DMA level for efficiency, with city-level targeting in high-value metros where premium pricing justifies the complexity.

Facebook and Instagram support geographic targeting by state, city, ZIP code, and radius. Demographic overlays (homeownership, income, life events) combine with geography for precise targeting. The platform’s housing-related advertising restrictions require compliance with Fair Housing Act requirements.

Microsoft Ads provides similar geographic capabilities to Google but often at lower CPCs due to lower competition. Home insurance terms on Microsoft may offer 30-40% lower costs than Google while reaching an older, often homeowning demographic.

Programmatic display through demand-side platforms enables ZIP-code-level targeting across thousands of publishers. Premium inventory on real estate and home services sites reaches consumers with clear housing intent.

Cost Variations by Geography

Traffic acquisition costs vary significantly by geography, and these variations do not perfectly correlate with lead value.

Some markets have high traffic costs AND high lead values (California, Florida, Texas). The arbitrage opportunity depends on whether your lead value exceeds your traffic cost by sufficient margin.

Other markets have moderate traffic costs but lower lead values (Midwest, Mountain West). The math may work despite lower absolute prices if traffic efficiency is high.

The best arbitrage opportunities exist where traffic costs are proportionally lower than the reduction in lead value. A market where traffic costs 60% of California rates but lead prices are 80% of California rates offers 20 points of additional margin.

Track your cost per click, cost per form submission, and cost per valid lead separately by geography. This granularity reveals which markets deliver margin and which consume it.

Campaign Structure for Geographic Testing

Implement a systematic approach to geographic market development:

Phase 1: National baseline. Run campaigns nationally with geographic breakdown reporting to establish baseline economics. Identify which states and DMAs deliver the best performance on traffic cost, form completion rate, and lead validation metrics.

Phase 2: Geographic segmentation. Split campaigns by state or region based on Phase 1 data. Apply differential budgets that favor higher-performing geographies. Begin building geographic-specific performance baselines.

Phase 3: Market prioritization. Identify your top 10-15 performing markets for concentrated investment. Reduce or eliminate spend in markets that consistently underperform. Develop market-specific creative and landing page variations.

Phase 4: Micro-market optimization. Within proven markets, test DMA and city-level targeting. Identify specific territories within states that outperform state averages. Build buyer relationships around geographic concentration.

This phased approach prevents premature optimization based on insufficient data while systematically identifying your highest-value markets.

Geographic-Specific Landing Pages

Landing pages optimized for specific geographies convert 15-40% better than generic national pages. Local relevance signals credibility and drives form completion.

Elements that drive geographic conversion lift:

Location acknowledgment. “Compare home insurance rates in [City]” immediately signals relevance. Consumers know they have reached the right destination for their specific needs.

Local statistics. Reference local premium ranges, property values, or market conditions. “Florida homeowners pay an average of $4,231 annually for coverage” demonstrates local expertise.

State-specific compliance. Include required state disclosures appropriate to each geography. Some states mandate specific language for insurance advertising.

Local social proof. Reviews and testimonials mentioning local areas or neighborhoods build trust. Even generic testimonials with local attribution perform better than unattributed quotes.

Area-appropriate imagery. Images reflecting local architecture, climate, or landscape signal relevance. A landing page showing Mediterranean-style homes works for Florida; Tudor-style homes for the Northeast.

Build these pages using templates with dynamic content zones that populate based on geography. You can maintain hundreds of local variations while managing a single content structure.

Matching Lead Supply to Buyer Demand

Geographic targeting only works if buyer demand exists in your target markets. Understanding how buyers evaluate geographic value helps you align supply with demand.

How Buyers Price Geographic Value

Lead buyers evaluate geography based on their ability to convert and retain customers in specific territories.

Carrier buyers price based on risk appetite, competitive positioning, and growth objectives. A carrier seeking California expansion pays premium CPLs for California leads. A carrier managing coastal exposure avoids or limits Florida purchases. Understanding carrier-specific geographic appetite helps you match inventory to demand.

Independent agents value leads in their licensed and appointment territories. An agent licensed in Texas, Oklahoma, and Arkansas pays premium for leads in those states and has zero interest in leads from elsewhere. Geographic matching is binary for agent buyers.

Agency networks aggregate demand across multiple agents, creating broader geographic appetite but with specific territory allocations. Understanding which network serves which territories enables efficient routing.

Fill Rate Analysis by Geography

Fill rate, the percentage of leads that sell to at least one buyer, reveals geographic demand patterns. Track fill rates by state to identify supply-demand imbalances.

Markets with high fill rates (90%+) indicate strong buyer demand relative to supply. These markets may support price increases. Markets with low fill rates (below 70%) indicate excess supply or weak demand. These markets require either price reductions or reduced traffic investment.

Fill rate analysis should occur at least monthly, with attention to trends over time. Declining fill rates in a previously strong market may signal carrier pullback or increased competition.

Building Geographic Buyer Relationships

The strongest geographic positions come from exclusive or preferred relationships with buyers in specific territories.

Exclusive arrangements guarantee a buyer receives all your leads in a specific geography at an agreed price. These arrangements provide pricing stability and eliminate sell-through risk, but require sufficient buyer trust in your quality.

Preferred relationships give a buyer right of first refusal or priority routing in specific markets. In exchange for pricing commitments or volume guarantees, you prioritize their leads.

Territory matching pairs specific agents with the geographies where they convert best. Understanding agent close rates by territory enables routing optimization that benefits both parties.

Develop these relationships through consistent quality delivery, transparent communication, and willingness to work through inevitable lead quality issues. Geographic concentration makes relationship development more valuable because each buyer represents a larger share of your market.

Seasonal and Cyclical Patterns in Home Insurance

Home insurance lead demand follows seasonal patterns tied to real estate cycles, policy renewal timing, and catastrophe events. Understanding these patterns enables budget optimization throughout the year.

Real Estate Cycle Alignment

Home purchase activity peaks in spring and summer, with the strongest months typically being May through August. This corresponds with school year transitions, favorable weather for moving, and tax refund-driven down payments.

Home insurance leads tied to purchase transactions follow this pattern:

- January-February: Low activity, post-holiday lull

- March-April: Rising activity as spring market begins

- May-July: Peak activity, highest volume and competition

- August-September: Sustained high activity before school starts

- October-November: Declining activity as weather turns

- December: Lowest activity, holiday distractions

Lead pricing typically follows demand, with summer months commanding premiums and winter months offering discounts. However, traffic costs also rise in summer as advertisers compete for the same consumers. Monitor your margin, not just your volume.

Policy Renewal Patterns

Beyond purchase-triggered shopping, existing homeowners shop at renewal. Policy renewals tend to cluster in the quarter following home purchase, creating geographic patterns based on when housing activity peaked in each market.

Markets with strong spring home sales see renewal shopping concentrations in Q2. Markets with year-round activity (Florida, Arizona retirement areas) have more distributed renewal patterns.

Catastrophe-Driven Shopping

Major weather events trigger shopping spikes in affected regions. Following hurricanes, tornadoes, wildfires, or other catastrophes, consumers in affected areas seek coverage changes, shop for alternatives, or research their options.

These spikes are geographically concentrated and time-limited. A hurricane making landfall in Florida generates intense shopping for 2-4 weeks in affected counties. A wildfire in California triggers shopping in exposed communities.

Catastrophe response requires operational agility:

- Rapid traffic scaling in affected geographies

- Sensitivity to consumer context (avoid aggressive messaging to disaster victims)

- Understanding that carrier appetite may contract even as consumer demand spikes

- Compliance awareness (some states prohibit certain marketing practices post-disaster)

The margin opportunity in catastrophe response is real but requires ethical sensitivity. Consumers in crisis deserve information and options, not predatory marketing.

Strategic Budget Allocation

Allocate traffic budgets based on seasonal patterns and geographic demand cycles:

Q1: Emphasize year-round active markets (Florida, Texas, Arizona). Reduce spend in weather-affected markets with low transaction activity. Build inventory for spring ramp.

Q2-Q3: Maximum investment in high-activity markets. Accept higher traffic costs because lead values also peak. Focus on purchase-intent signals.

Q4: Reduce spend as transaction activity declines. Opportunistic investment in markets with specific demand drivers. Prepare for following year’s geographic strategy.

Monitor performance continuously and adjust allocations based on actual results, not just seasonal assumptions.

Premium Market Deep Dive: Coastal Florida

Florida represents the most complex and potentially valuable market for home insurance leads. Understanding Florida’s unique dynamics provides a template for analyzing other premium markets.

Market Dynamics

Florida’s home insurance market has experienced unprecedented disruption over the past five years. The state accounts for over 8% of U.S. homeowners but over 75% of the nation’s homeowners insurance litigation. Average premiums have risen from approximately $1,700 in 2018 to over $4,200 in 2024, making Florida the most expensive state for home insurance.

This cost crisis has driven intense consumer shopping. Florida homeowners actively seek coverage alternatives, creating substantial lead demand despite carrier restrictions on new writings.

Carrier Landscape

The Florida carrier landscape has shifted dramatically:

- Multiple carriers have exited the state entirely (AIG, Lexington, others)

- State-created Citizens Property Insurance has grown from 420,000 policies in 2019 to over 1.3 million in 2024

- Remaining private carriers are selective about new business, preferring newer construction, inland properties, and higher deductibles

- New entrants backed by reinsurance capital are writing in select territories

This landscape creates complicated buyer dynamics. Leads are valuable because consumers desperately need coverage, but buyer appetite is constrained because carriers are selective. Fill rates may be lower than in markets with more carrier competition.

Geographic Targeting Within Florida

Within Florida, value varies significantly by territory:

Coastal Miami-Dade, Broward, Palm Beach: Highest property values but also highest hurricane exposure. Carrier restrictions most severe. Leads may command premium pricing when buyers are active but face fill rate challenges.

Tampa Bay, Sarasota, Naples (Gulf Coast): Strong property values with significant hurricane exposure. Similar dynamics to Atlantic coast but potentially more carrier appetite for newer inland construction.

Orlando, Central Florida: Lower hurricane exposure, growing population, diverse housing stock. Often the most consistent Florida market for fill rates because carrier restrictions are less severe.

Jacksonville, North Florida: Moderate exposure, moderate property values. Steady buyer demand without the premium pricing of South Florida.

Panhandle: Lower property values, hurricane exposure from Gulf storms. More challenging economics unless traffic costs are proportionally low.

Florida-Specific Considerations

Citizens depopulation. The state actively encourages policyholders to move from Citizens to private carriers through “takeout” programs. This creates specific lead demand from carriers participating in depopulation efforts.

Assignment of benefits reform. Legislative changes in 2022-2023 reduced litigation abuse that drove carrier exits. As market stability returns, carrier appetite may recover. Monitor legislative developments.

Flood insurance requirements. Many Florida properties require separate flood coverage, affecting total cost of homeownership and consumer shopping behavior.

Wind mitigation credits. Florida requires wind mitigation discounts for properties meeting specific construction standards. Understanding mitigation qualifications helps agents convert leads effectively.

Florida exemplifies how geographic specialization creates competitive advantage. Practitioners who deeply understand Florida dynamics can capture value that generalist competitors miss.

Geographic Compliance Considerations

Insurance lead generation operates under state-specific regulatory requirements that vary significantly by geography. Compliance complexity affects both operational costs and market access.

State-Level Variations

California requires compliance with CCPA/CPRA for data handling, including “Do Not Sell” disclosures and enhanced consumer rights. California also has specific insurance advertising requirements and prohibits certain inducements.

Florida requires telemarketing registration and maintains state-specific calling restrictions. Post-hurricane marketing restrictions may apply following declared disasters.

New York requires telemarketing registration and has specific disclosure requirements for insurance solicitation.

Texas maintains extensive telemarketing regulations including registration requirements and specific time-of-day restrictions.

Each state where you generate leads may impose unique requirements. Building compliance costs into geographic profitability analysis ensures accurate margin calculations. For a detailed overview of state requirements, see our guide on insurance lead compliance and state licensing.

Insurance Marketing Regulations

Beyond general telemarketing rules, insurance marketing faces industry-specific requirements:

Agent licensing. Lead generators typically do not need insurance licenses for pure lead generation, but the line blurs when activities approach solicitation. Some states define “solicitation” broadly to include comparative information or specific coverage recommendations.

Rate quote restrictions. Displaying rate estimates may require carrier authorization in some states. Claims about “average savings” or specific rate reductions face regulatory scrutiny.

Disclosure requirements. Many states require specific disclosures on lead forms, including explanation of how information will be used and who will receive it.

Material misrepresentation. Overpromising coverage availability, understating costs, or misrepresenting carrier relationships violates insurance regulations and creates liability.

Building Compliance into Geographic Strategy

Compliance affects geographic strategy in two ways.

First, compliance costs reduce margin in states with extensive requirements. A state with high lead value but onerous compliance costs may be less attractive than a moderate-value state with simpler requirements.

Second, compliance capability creates competitive advantage. Practitioners who invest in proper licensing, disclosure management, and regulatory compliance can access markets that non-compliant competitors avoid.

Develop a compliance matrix by state covering telemarketing registration, insurance advertising requirements, data privacy obligations, and any disaster-related restrictions. Update the matrix as regulations change, and factor compliance costs into geographic profitability analysis.

Building a Geographic Lead Generation Operation

Implementing geographic targeting requires operational infrastructure that supports territory-specific traffic acquisition, lead routing, and performance tracking.

Technology Requirements

CRM with geographic capabilities. Your lead management system must support geographic segmentation, routing rules by territory, and performance reporting by state, DMA, and ZIP code.

Traffic platforms with targeting precision. Google Ads, Facebook, and programmatic platforms must be configured for geographic targeting at appropriate granularity. Campaign structures should support market-specific budgets and bid adjustments.

Landing page management. Ability to create and maintain geographic landing page variants either through dynamic content insertion or templated page generation.

Distribution routing. Lead distribution systems must support geographic routing rules, buyer territory mapping, and fill rate tracking by geography.

Performance analytics. Reporting infrastructure must provide geographic breakdowns of all key metrics: traffic cost, conversion rate, lead validation rate, fill rate, and revenue per lead.

Organizational Considerations

Geographic market ownership. Consider assigning specific team members ownership of specific markets. Deep knowledge of carrier dynamics, compliance requirements, and local conditions creates competitive advantage that generalist coverage misses.

Buyer relationship management. Geographic concentration enables deeper buyer relationships. A seller who specializes in Florida can develop carrier relationships, agent networks, and market intelligence that broad competitors lack.

Compliance specialization. State-specific compliance requirements benefit from dedicated attention. Consider compliance staff or outside counsel focused on your primary markets.

Scaling Geographic Operations

Start narrow and expand deliberately:

Phase 1: Establish 3-5 core markets. Develop deep capability in a small number of high-opportunity markets. Perfect your traffic acquisition, landing page optimization, and buyer relationships in these territories.

Phase 2: Optimize core markets. Before expanding, maximize performance in core markets. Geographic depth beats geographic breadth for smaller operations.

Phase 3: Selective expansion. Add new markets only when core markets are optimized and when you have clear buyer demand justifying the expansion. Each new market adds operational complexity.

Phase 4: Continuous optimization. Markets evolve. Carrier appetite changes. Traffic costs shift. Maintain ongoing monitoring and adjustment rather than treating geographic strategy as set-and-forget.

Measuring Geographic Performance

Effective geographic targeting requires disciplined measurement at the market level. Aggregate metrics hide geographic variation that determines profitability.

Key Metrics by Geography

Traffic metrics:

- Cost per click by state and DMA

- Click-through rate by geography (indicates ad relevance)

- Cost per form submission by territory

Conversion metrics:

- Form completion rate by geography

- Lead validation rate by territory

- Consent certification rate by state

Distribution metrics:

- Fill rate by geography

- Average price per lead by territory

- Time to sell by market

Profitability metrics:

- Gross margin by state (revenue minus traffic cost)

- Net margin after validation, consent, and overhead

- Return on ad spend by geography

Establishing Geographic Baselines

Before optimizing, establish baseline performance across all active geographies. Run consistent campaigns across markets for sufficient time to gather statistically meaningful data (typically 2-4 weeks depending on volume).

Document baseline metrics for each market. These baselines enable future optimization decisions and investment allocation.

Ongoing Monitoring Cadence

Daily: Monitor spend, volume, and any anomalies requiring immediate attention.

Weekly: Review geographic performance summaries, fill rates by market, and traffic cost trends.

Monthly: Conduct deep performance review by geography. Identify markets for increased investment, reduced investment, or strategic changes.

Quarterly: Evaluate geographic strategy against business objectives. Consider market additions, exits, or repositioning.

Decision Triggers for Geographic Changes

Define specific triggers that prompt geographic strategy adjustments:

Increase investment when:

- Fill rate exceeds 90% consistently (demand exceeds supply)

- Margin exceeds target by 20%+ for three consecutive weeks

- New buyer enters market with incremental demand

Reduce investment when:

- Fill rate drops below 70% for two consecutive weeks

- Margin falls below breakeven for three consecutive weeks

- Major buyer exits market or restricts volume

Exit market when:

- Carrier moratorium eliminates buyer demand

- Regulatory changes make operation impractical

- Sustained losses exceed patience threshold

Clear decision rules prevent emotional reactions and ensure disciplined capital allocation.

Frequently Asked Questions

What are home insurance leads and how do they differ from auto insurance leads?

Home insurance leads are consumer contact information and intent signals from individuals actively shopping for homeowners, renters, or dwelling coverage. They differ from auto insurance leads in several important ways. Home insurance purchases typically tie to real estate transactions, creating concentrated shopping around home buying rather than the annual or life-event-driven shopping common in auto. Average policy values are higher (often $1,500-$4,000+ annually versus $1,200-$2,000 for auto), and geographic variation is more pronounced due to property value differences and catastrophe risk. Lead pricing typically ranges from $30-150 depending on exclusivity, geography, and filtering, with premium coastal markets commanding the highest prices.

Why does geographic targeting matter for home insurance lead generation?

Geographic targeting matters because lead value varies 2-4x between markets based on property values, premium levels, carrier competition, and catastrophe risk. A lead from a $1.2 million San Francisco home represents 6-8x the policy value of one from a $150,000 Cleveland home, yet traffic costs may differ by only 50-100%. Capturing this spread through geographic-specific pricing creates margin that uniform-pricing competitors miss. Additionally, carrier appetite varies by geography; understanding which carriers are actively buying in which territories enables efficient routing and higher fill rates.

Which states have the highest value home insurance leads?

Premium home insurance lead markets include coastal Florida (highest premiums nationally at $4,000+ average), California (high property values despite carrier restrictions), Texas (large market, strong carrier competition), New York and New Jersey (high property values, regulatory complexity), and Colorado (growth market with moderate risk). Within these states, specific metros command premiums: Miami, Los Angeles, Houston, and New York City lead on property value; coastal areas add risk-driven premium levels. The value calculation should include both lead sale price potential and traffic acquisition cost to determine true margin opportunity.

How do catastrophe risks affect home insurance lead pricing?

Catastrophe exposure creates both opportunity and challenge. High-risk areas like coastal Florida or wildfire-prone California have consumers willing to pay higher premiums and actively shopping for coverage, creating lead demand. However, carrier appetite in these territories fluctuates with underwriting results and reinsurance costs. After major losses, carriers may restrict new writings or exit markets entirely, reducing buyer demand despite high consumer need. Lead generators must track carrier appetite dynamically, understanding that high theoretical value does not guarantee high fill rates when carriers are pulling back.

What is a good fill rate for home insurance leads by geography?

Target fill rates above 85% in primary markets and above 75% in secondary markets. Fill rates below 70% indicate supply-demand imbalance requiring either price reduction or traffic reallocation. Fill rates above 95% suggest pricing power that may support increases. Track fill rates by state and monitor trends over time. Declining fill rates often precede broader market shifts as carrier appetite changes. Fill rate analysis should occur at least monthly, with attention to which specific buyers are purchasing versus declining leads.

How should I price home insurance leads by geography?

Price based on three factors: buyer willingness to pay (determined by your fill rate and buyer feedback), traffic acquisition cost (your floor price must cover costs plus margin), and competitive positioning (what alternatives buyers have). Premium markets support $80-150+ for exclusive leads; moderate markets support $40-80; lower-value markets may only support $20-40. Test pricing changes in 5-10% increments and monitor fill rate response. If fill rates remain above 85% after a price increase, further increases may be possible. If fill rates drop below 70%, price reduction or traffic reallocation is needed.

What traffic sources work best for geographic home insurance lead targeting?

Google Ads provides highest-intent traffic with strong geographic targeting capabilities. Facebook and Instagram enable life-event targeting (recently moved, new homeowner) combined with geographic precision. Microsoft Ads often offers 30-40% lower CPCs for similar audiences. Programmatic display on real estate and home services sites reaches housing-intent consumers at lower costs than search. SEO-driven organic traffic from local content delivers highest margins but requires long-term investment. Most operations blend multiple sources, with source-by-geography analysis determining optimal allocation.

How do seasonal patterns affect home insurance lead generation strategy?

Home insurance lead demand follows real estate cycles, with peak activity from May through August corresponding to summer home buying season. Q1 is typically weakest as transaction activity drops post-holiday. Catastrophe events create geographic spikes following hurricanes, wildfires, or major storms. Budget allocation should follow seasonal patterns: maximum investment during spring and summer peak, reduced spend in Q4 and Q1, with geographic shifts to year-round active markets (Florida, Arizona, Texas) during off-seasons. Monitor margin, not just volume, as traffic costs also rise during peak periods.

What compliance requirements vary by state for home insurance leads?

Key state variations include California CCPA/CPRA requirements for data handling and “Do Not Sell” disclosures, Florida and New York telemarketing registration requirements, state-specific insurance advertising rules regarding rate claims and carrier representation, and disaster-period marketing restrictions following declared emergencies. Some states broadly define “solicitation” to include lead generation activities, potentially requiring insurance licensing. Build a compliance matrix for each state where you operate, and factor compliance costs into geographic profitability analysis.

How do I build buyer relationships for specific geographic markets?

Geographic specialization enables deeper buyer relationships than national generalist operations. Start by identifying agents and carriers actively seeking leads in your target territories. Demonstrate consistent quality through trial periods with performance tracking. Develop exclusive or preferred arrangements that guarantee volume in exchange for pricing stability. Understand each buyer’s close rate by territory to optimize routing. Regular communication about market conditions, carrier changes, and quality metrics builds trust. Geographic concentration makes each buyer relationship more valuable because they represent a larger share of your market revenue.

What technology do I need for geographic lead targeting?

Essential technology includes advertising platforms configured for geographic targeting (Google Ads, Facebook, programmatic DSPs), a CRM with geographic segmentation and reporting capabilities, landing page infrastructure supporting local page variants (either template-based generation or dynamic content), lead distribution systems with geographic routing rules, and analytics providing geographic performance breakdowns. Integration between these systems enables closed-loop optimization where distribution performance feeds back into traffic acquisition decisions. Consider additional tools for carrier appetite tracking, competitive intelligence, and compliance management.

Key Takeaways

-

Geographic targeting creates 2-4x pricing variation in home insurance leads. A lead in coastal Florida commands $100-150; the same intent in rural Midwest markets may only support $25-35. Capturing this spread through geographic-specific pricing creates margin that uniform-pricing competitors leave on the table.

-

Property values, premium levels, and carrier appetite drive geographic value. High-value markets like California and coastal Florida offer premium lead pricing potential, but carrier restrictions may limit buyer demand. Balance theoretical value against practical fill rates.

-

Traffic acquisition must align with geographic value. Generate leads where the spread between traffic cost and lead sale price is widest. Some markets have high traffic costs AND high lead values (California); others offer moderate costs with proportionally higher lead values (Tier 2 growth markets). The arbitrage is in the ratio.

-

Real estate cycles create seasonal patterns. Home insurance lead demand peaks in spring and summer with real estate transaction activity. Allocate budgets accordingly, shifting to year-round markets during off-seasons.

-

Catastrophe risk creates both opportunity and volatility. High-risk markets have consumers actively shopping and willing to pay higher premiums. But carrier appetite fluctuates with loss experience. Track carrier dynamics dynamically.

-

Local landing pages convert 15-40% better. Geographic relevance signals credibility. Invest in location-specific landing pages with local statistics, compliance language, and social proof.

-

Florida represents the highest-value and most complex market. Premiums exceed $4,000 annually, but carrier restrictions and litigation history create volatile buyer dynamics. Success requires deep market knowledge.

-

Fill rate analysis reveals supply-demand balance by geography. Target 85%+ fill rates in primary markets. Declining fill rates signal carrier pullback or pricing issues requiring response.

-

Compliance varies by state and affects profitability. California, Florida, New York, and Texas have distinct requirements. Build compliance costs into geographic margin calculations.

-

Start narrow, go deep, then expand. Develop expertise in 3-5 core markets before expanding. Geographic depth beats breadth for smaller operations. Each new market adds complexity that must be justified by margin opportunity.

Sources

- Insurance Information Institute: Homeowners Insurance Facts - Industry data on premium levels, loss ratios, and market trends by state

- NAIC Homeowners Insurance Reports - Regulatory data on carrier market share and state insurance dynamics

- FEMA National Flood Insurance Program - Flood risk data and insurance requirements affecting coastal property coverage

- NAR Research and Statistics - Real estate transaction data driving home insurance shopping seasonality

- eMarketer Digital Marketing - Digital advertising benchmarks for geographic targeting and insurance vertical performance

- BEA Consumer Spending Data - Regional economic data on housing values and insurance spending patterns

This guide provides strategic information for home insurance lead generation with geographic targeting. Insurance regulations, carrier appetites, and market conditions change continuously. Verify current requirements with appropriate legal counsel and confirm carrier demand before committing significant resources to any geographic market. Statistics reflect 2024-2025 market conditions.