The home security market generates billions in recurring revenue annually. Those who capture this demand understand that these leads differ fundamentally from one-time purchases – security leads sell subscriptions worth thousands over the customer lifetime, and the competition for them is fierce.

The home security lead generation market operates at the intersection of fear, technology, and recurring revenue economics. Unlike leads for one-time purchases, home security leads represent consumers committing to multi-year monitoring contracts worth $1,000-$3,000 or more over the subscription lifetime. This fundamental difference shapes every aspect of the market: how leads are priced, how they convert, who buys them, and what separates profitable operations from those bleeding money.

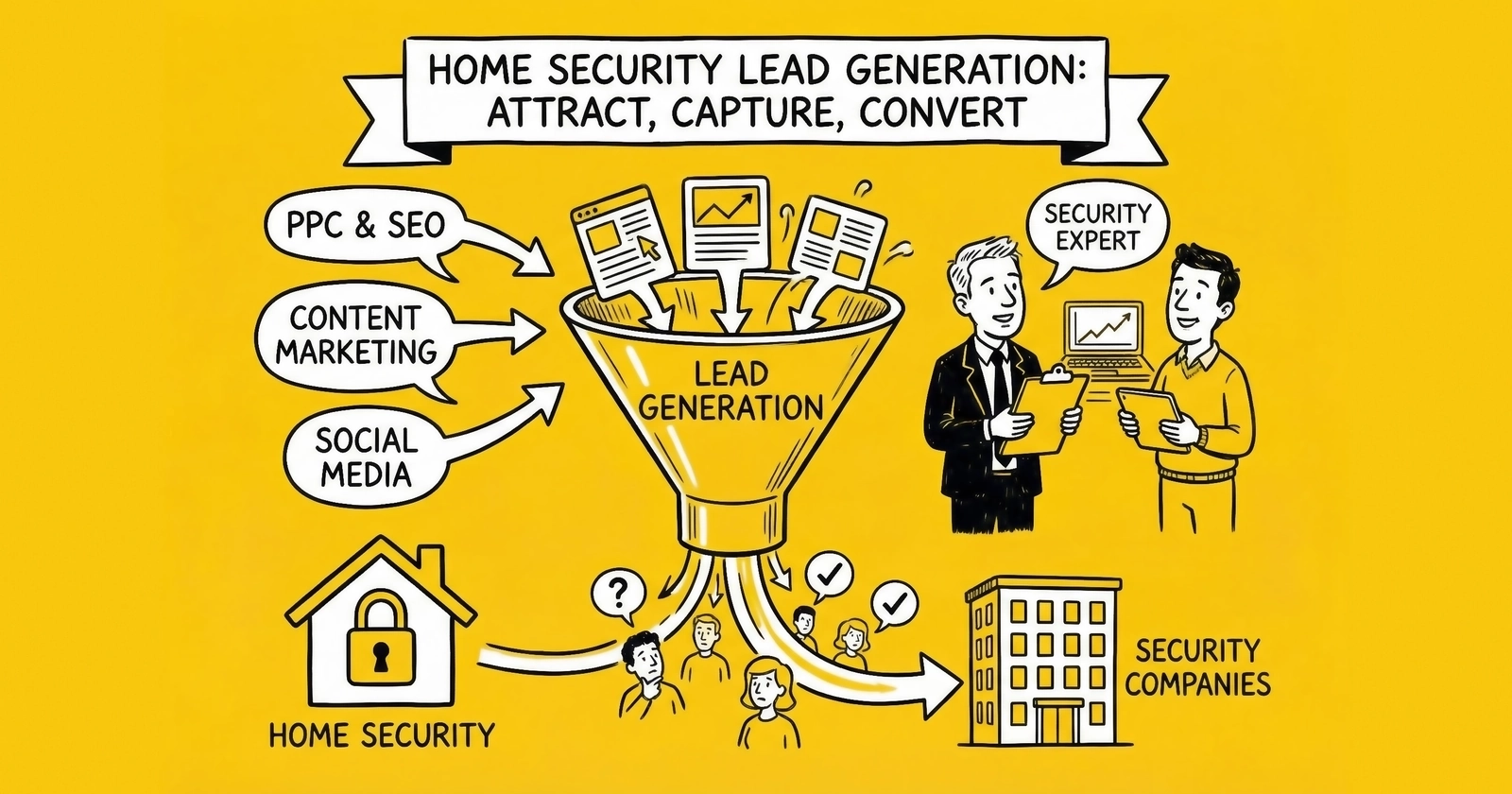

This guide provides the comprehensive framework for home security lead generation: market dynamics, pricing benchmarks, the competitive landscape dominated by major players like ADT and Vivint, traffic acquisition strategies, compliance requirements specific to alarm industry licensing, and the operational considerations that determine success.

The numbers tell the story. Home security leads command $40-$150 for exclusive leads depending on system type and buyer, with monitored alarm leads at the premium end. Conversion rates to closed sales typically run 8-15% for qualified leads. But the economics only work when you understand the subscription value buyers are calculating – a 36-month monitoring contract at $45 per month generates $1,620 in recurring revenue, justifying customer acquisition costs that would be absurd for a one-time product sale.

The Home Security Market Landscape 2026

The home security industry has transformed dramatically over the past decade. What was once a market dominated by traditional monitored alarm systems has evolved into a complex ecosystem spanning DIY smart home devices, professional monitoring services, video surveillance, and integrated home automation. Understanding this landscape is essential for effective lead generation.

Market Size and Structure

The U.S. residential security market exceeds $70 billion annually when including equipment sales, installation services, and monitoring subscriptions. The lead generation segment serving this market represents an estimated $800 million to $1.2 billion in annual transaction value across all intermediaries, affiliate networks, and direct generation channels.

This market breaks into distinct segments with different lead economics. Professional monitored security represents the premium segment, where companies like ADT, Vivint, Brinks Home, and SimpliSafe provide equipment, installation, and 24/7 monitoring services. Monthly monitoring fees range from $30-$60, with typical contract lengths of 24-36 months. These companies are the primary buyers of security leads, paying premium CPLs because customer lifetime values justify aggressive acquisition costs.

The DIY smart security segment has grown substantially with products from Ring, Nest, Wyze, SimpliSafe (self-install options), and Eufy. These systems offer optional professional monitoring or self-monitoring through smartphone apps. Lead generation for this segment focuses on product sales rather than subscription acquisition, commanding lower CPLs but higher volume.

Commercial security serves businesses with more sophisticated systems. Lead values are significantly higher at $200-$500 or more, but volume is lower and sales cycles are longer. This segment requires different marketing approaches than residential. Video surveillance only addresses consumers wanting cameras without full security systems, and this growing segment is often an entry point for eventual full system purchases.

Major Players and Buyer Dynamics

The home security lead market is dominated by a small number of large buyers who purchase the majority of available leads. Understanding their competitive dynamics helps explain pricing and demand patterns.

ADT remains the largest player in the U.S. market with over 6 million customers and approximately 40% market share in professional monitoring. ADT acquires leads through multiple channels: direct advertising, affiliate networks, lead aggregators, and their authorized dealer network. The company reported customer acquisition costs averaging $800-$1,200 per subscriber in recent financial disclosures, indicating their willingness to pay substantial CPLs for qualified leads.

Vivint Smart Home operates as the second-largest professional installation company, with a focus on smart home integration. Vivint’s direct sales model historically relied heavily on door-to-door sales, but the company has increased its lead-based acquisition spending significantly. Their customer acquisition costs run higher than ADT’s due to full-service installation and premium equipment positioning.

Brinks Home Security, formerly Monitronics/MONI, operates largely through dealer networks, making them indirect but significant lead buyers. Local dealers affiliated with Brinks actively purchase leads for their territories. SimpliSafe has disrupted the market with no-contract monitoring options and DIY installation. Their customer acquisition model blends direct response advertising with lead purchasing, though they maintain lower CPL thresholds due to their lower average customer lifetime value from month-to-month contracts.

ADT Authorized Dealers represent a critical buyer segment. ADT’s authorized dealer program includes thousands of local security companies that sell ADT-monitored systems. These dealers actively purchase leads and often pay premium CPLs for exclusive leads in their territories. Regional security companies number in the thousands across the United States. Many lack the marketing sophistication to generate their own leads cost-effectively, making them consistent lead buyers through aggregators and local lead generation services.

Why Home Security Leads Are Different

Several characteristics distinguish home security leads from other home services categories, and understanding these differences is essential for building a profitable operation.

Subscription economics fundamentally change the math. The buyer is not purchasing a one-time service; they are acquiring a customer who will pay $35-$60 monthly for 2-5 years. A single acquired customer generates $840-$3,600 in monitoring revenue over the subscription lifetime, plus additional revenue from equipment sales, smart home add-ons, and upgrades. This subscription economics model allows buyers to pay CPLs that would seem irrational for one-time purchases.

Fear and safety motivation drive consumer behavior in this market. Security purchases are emotionally driven. Consumers shopping for security systems have often experienced a triggering event: a neighborhood break-in, moving to a new home, news about crime trends, or a personal safety concern. This emotional urgency creates higher conversion rates when leads are contacted quickly.

Complex qualification requirements set home security apart from simpler categories. Buyers want to know whether the consumer owns their home, since renters may need landlord permission. They need to understand if there is an existing security system, distinguishing between takeover opportunities and new installs. Home type matters because single-family homes are preferred over apartments. Approximate home value correlates with ability to pay and equipment needs.

Geographic density economics make territory management essential. Security companies have geographic service areas. A lead in an area where a company has no installation capacity has zero value to them. Geographic targeting is not just preferred – it is mandatory for most buyers.

Licensing requirements add another layer of complexity. Unlike many home services, alarm system sales and installation require state-specific licensing. Lead generation companies must understand these requirements because they affect which buyers can legally purchase leads in each state and what disclosures may be required.

Lead Pricing and Economics

Home security lead pricing varies dramatically based on lead type, exclusivity, geographic market, and qualification level. Understanding these pricing dynamics is essential for both generators and buyers.

Current Pricing Benchmarks

| Lead Type | Price Range | Typical Booking Rate |

|---|---|---|

| Exclusive monitored security | $75-$150 | 12-20% |

| Semi-exclusive (2-3 buyers) | $40-$75 | 8-14% |

| Shared (4+ buyers) | $20-$40 | 5-10% |

| DIY/self-install interest | $15-$35 | 8-15% |

| Live transfer (warm transfer) | $80-$175 | 20-35% |

| Scheduled appointment | $100-$200 | 25-45% |

| Aged leads (30+ days) | $5-$15 | 2-6% |

These prices reflect national averages. Specific markets and buyer relationships can push prices significantly higher or lower.

Factors Affecting Lead Value

Homeownership status serves as the primary value differentiator. Verified homeowners command premium pricing because renters represent lower-value leads. Many security companies decline to install in rental properties, and those that do face higher churn rates. Expect a 20-40% premium for verified homeowner leads.

Credit qualification data significantly increases lead value. Many security companies offer equipment financing or require credit checks for monitoring contracts. Leads with credit qualification data – even soft credit tier indicators – command premiums because they reduce waste from credit declines.

Existing system status affects buyer interest differently depending on circumstances. Leads from consumers with no current security system are most valuable. “Takeover” leads from consumers with existing systems who want to switch providers have moderate value. Leads from consumers recently under contract with competitors have limited near-term value.

Home type determines installation complexity and buyer preference. Single-family homes represent the ideal installation scenario. Townhomes and condos may have HOA restrictions. Apartments present installation challenges and landlord permission requirements. Lead qualification by home type affects pricing accordingly.

Geographic market variations create significant price differences. Premium markets with high population density, higher crime rates, and higher income areas command higher CPLs. Rural markets with limited installer coverage command lower prices or no demand at all.

Intent signals from the traffic source correlate with conversion rates. Leads captured from high-intent sources like search ads for “home security installation near me” convert better than leads from passive sources like content sites or sweepstakes. Expect a 30-50% price differential based on intent quality.

The Economics Behind the Numbers

Why do buyers pay $100+ for a single lead? The math explains everything.

Consider a typical monitored security customer with monthly monitoring at $45 and a contract term of 36 months. Gross monitoring revenue reaches $1,620, and average equipment revenue adds another $400, bringing total gross revenue per customer to $2,020.

If leads convert at 15% and average $100, the cost per acquired customer comes to $667. Against gross revenue of $2,020 per customer, that leaves gross margin of $1,353 per customer before installation costs. Even accounting for installation labor, equipment costs, and customer support, the unit economics support aggressive lead purchasing. The key variable is conversion rate. A buyer who converts at 20% can pay significantly more per lead than one converting at 10%.

This is why lead quality matters more than lead cost in home security. A “cheap” $40 lead that converts at 5% results in an $800 cost per acquisition. A “premium” $120 lead that converts at 20% results in only $600 cost per acquisition. The more expensive lead is actually far cheaper when you measure what matters.

Seasonal Patterns

Home security lead demand exhibits moderate seasonality with identifiable peak and valley periods. October through November sees increased demand driven by pre-holiday security concerns. January and February bring New Year resolutions and respond to post-holiday break-in news coverage. Summer months generate demand from moving season and new homeowner activity.

Lower demand periods include December, when holiday distractions reduce shopping activity, and late summer, when back-to-school focus diverts attention.

The seasonality is less pronounced than weather-dependent categories like HVAC. Security concerns are year-round, and new home purchases – a major trigger – occur throughout the year. Budget allocation should be relatively steady, with perhaps 15-20% premium allocation during peak periods.

Traffic Acquisition Strategies

Generating home security leads requires understanding which traffic sources deliver qualified, motivated consumers at sustainable costs. The competitive landscape includes well-funded national advertisers, making traffic acquisition challenging but achievable for operators who master specific channels.

Paid Search

Google Ads and Microsoft Ads remain primary channels for home security lead generation, though competition from major players has driven costs up significantly.

High-intent keywords command premium CPCs but deliver highest-converting traffic. Terms like “home security system installation,” “home alarm monitoring service,” “ADT authorized dealer near me,” “best home security system 2026,” and “professional security monitoring” attract consumers ready to buy. Moderate-intent keywords balance volume and cost with terms like “home security camera systems,” “wireless security system,” “smart home security,” and “doorbell camera installation.” Lower-intent keywords offer volume at lower costs but require strong landing page qualification, including comparison searches like “ring vs simplisafe comparison,” general searches for “home security tips,” and broader “smart home automation” queries.

National average CPCs for home security terms range from $8-$25 for high-intent keywords, with branded terms often exceeding $30. Geographic targeting to specific metros can reduce competition but limits scale.

Home security landing pages must accomplish aggressive qualification while maintaining conversion rates. Essential elements include a clear value proposition covering monitoring price, equipment included, and installation timing. Trust signals such as licensing, industry certifications, and reviews build credibility. Qualification questions in the form should capture homeowner status, current system status, and home type. A prominently displayed phone number serves consumers who prefer to call. Mobile optimization is critical since 50% or more of traffic arrives on mobile devices. Page load speed should stay under 3 seconds to prevent abandonment.

Well-optimized home security landing pages convert 8-15% of clicks to lead submissions. Below 6% indicates landing page problems that need diagnosis. Above 15% may indicate over-qualification where forms are too long, losing valid leads who abandon the process.

Social Media Advertising

Facebook and Instagram provide effective channels for home security lead generation, particularly for reaching homeowners through demographic and life-event targeting.

Targeting capabilities on these platforms enable precise audience selection. Homeowner targeting is available through demographic selections. Recent movers represent highly valuable life event targeting for security. New homebuyers can be reached based on mortgage activity signals. Income targeting at $75,000 or more household income correlates with security purchasing behavior. Interest targeting captures home improvement and smart home technology enthusiasts. Lookalike audiences built on converted leads extend reach to similar prospects.

Home security social advertising benefits from emotional messaging balanced with rational value propositions. Safety-focused messaging around themes like “Protect what matters most” resonates with consumers. Local crime statistics create urgency and relevance. Smart home benefits address technology and convenience angles. Special offers featuring free equipment or discounted monitoring provide concrete incentives. Video content demonstrating systems and the installation process builds understanding and trust.

Facebook Lead Ads provide high volume at lower cost but typically lower quality than website landing pages. The tradeoff requires strategic thinking: Lead Ads deliver higher volume at lower CPL with lower conversion rates of 5-10%, while landing page traffic produces lower volume at higher CPL with higher conversion rates of 10-15%. Many practitioners run both, using Lead Ads for volume and landing pages for quality leads.

Facebook CPMs for homeowner targeting run $15-$35 in competitive markets. Cost per lead through Lead Ads typically ranges $30-$60 for basic qualification. Website conversion campaigns run $50-$100 per lead for qualified submissions.

Display and Programmatic

Programmatic display advertising reaches home security prospects across thousands of websites. The key to success lies in targeting precision and brand safety controls.

Effective targeting approaches include contextual targeting on home improvement, real estate, and news sites where security-interested consumers browse. Retargeting website visitors who did not convert captures interested prospects for another attempt. Intent-based audiences from data providers identify consumers actively researching security systems. CRM retargeting nurtures unconverted leads from your database back toward conversion.

Home security advertising must avoid placement near negative content. Crime stories, though contextually relevant, can create brand concerns that work against conversion. Work with DSPs that provide robust brand safety controls to protect campaign performance.

Display typically serves as a lower-funnel supplement rather than a primary lead source. CPLs run $60-$120 for qualified leads, but display excels at frequency building and retargeting to support other channels.

SEO and Content Marketing

Organic search provides the highest-margin leads for operators willing to invest in long-term content development. The delayed payoff rewards patience with superior economics.

Product comparison content performs exceptionally well with articles like “ADT vs. Vivint vs. SimpliSafe” addressing consumers deep in their research process. Local content targeting “Best home security companies in [City]” captures geographic intent. Educational content explaining “How home security monitoring works” serves informational queries that build authority. Buyer guides providing a “Complete guide to choosing a security system” position your site as a trusted resource. Cost content addressing “Home security system costs in 2026” captures price-sensitive shoppers.

Focus keyword targeting on informational and commercial-intent terms where major advertisers compete less aggressively. Reviews, specific need-based camera recommendations, monthly cost queries, and installation process questions all represent opportunities for content that ranks without competing directly against massive ad budgets.

SEO investment requires 6-12 months before generating meaningful lead volume. However, leads generated through organic search typically cost $10-$30 effective CPL once content matures, representing the best long-term economics available in this market.

Affiliate Marketing

Home security affiliate programs provide lead generation opportunities without direct media buying, offering an alternative path into the market.

Most major security companies operate affiliate programs with attractive compensation. ADT’s affiliate program pays $125-$200 per qualified lead or sale. SimpliSafe offers commission-based compensation on equipment sales. Various aggregators provide per-lead compensation arrangements for affiliates who can deliver volume.

Successful affiliates typically focus their efforts on specific content formats. Review and comparison websites rank for commercial queries. Local directories and home services sites capture geographic searches. YouTube content reviewing security products reaches video-first consumers. Blog content targeting long-tail keywords captures specific queries with less competition.

FTC guidelines require clear disclosure of affiliate relationships in all content. Security-specific requirements may include state licensing disclosures depending on how closely affiliate content approaches “solicitation” of alarm services. Consult with legal counsel to ensure compliance.

Lead Qualification and Validation

Home security lead quality depends heavily on proper qualification. Leads that fail basic criteria waste buyer resources and damage generator relationships over time.

Essential Qualification Fields

The minimum viable lead requires full name, validated phone number, address or ZIP code for service area matching, email address, and homeownership status. Without these basics, you cannot deliver a lead worth buying.

Enhanced qualification fields significantly increase lead value and include home type distinguishing single family from townhome, condo, or apartment. Current security system status captures whether prospects have no system, have a system and want to switch, or recently cancelled service. Timeframe indicates whether the prospect wants immediate service, plans to act within 30 days, or is just researching. Reason for interest reveals whether a recent incident, moving, or general interest triggered the inquiry. Property ownership confirmation adds another verification layer.

Premium qualification fields command top pricing and include credit tier from self-reported data or soft-pull indicators, home value estimates, number of entry points covering doors and windows, and smart home interest in cameras, automation, or video doorbells.

Validation Requirements

Phone validation must cover format verification for 10-digit U.S. numbers, line type identification distinguishing landline from mobile from VoIP, carrier lookup for deliverability assessment, DNC registry checking critical for compliance, and litigator scrubbing to reduce TCPA risk.

Address validation requires USPS standardization, deliverability verification, geographic service area matching, and property type confirmation where available through data services.

Email validation encompasses syntax validation, domain verification, mailbox existence checks, and spam trap detection to protect deliverability for future communication.

Duplicate detection must check against recent submissions within a 30-90 day window, check against buyer CRM systems where integration exists, and provide cross-source duplicate identification to prevent paying for the same lead twice.

Consent Documentation

Home security leads require robust consent documentation due to the TCPA requirements that govern outbound calling. Getting this wrong exposes everyone in the chain to substantial legal risk.

TCPA consent language must be “clear and conspicuous” and specifically authorize contact from the parties who will call. Standard language should include express acknowledgment of consent to receive calls and texts, identification of who will contact whether specific companies or categories, acknowledgment that calls may use automated systems, and disclosure that consent is not required for purchase.

Services like TrustedForm and Jornaya provide third-party certification of consent capture that documents the timestamp of form submission, page URL and content at time of submission, user interaction with the page, consent language presented, and IP address and device information.

For home security leads, consent certification is not optional – it is essential for buyer acceptance and legal protection.

Compliance Considerations

Home security lead generation operates under multiple regulatory frameworks. Understanding these requirements protects your business and ensures buyer acceptance.

TCPA Requirements

The Telephone Consumer Protection Act applies to all calls and texts made to leads. Prior express written consent is required for autodialed or prerecorded calls to cell phones. The FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, but many sophisticated buyers still require consent specific to individual sellers rather than broad lists of partners.

Called party consent means only the person who provided consent can be called. Calling other numbers for the same household requires separate consent. Do Not Call compliance requires checking all leads against the National DNC Registry before calling and maintaining internal DNC lists for consumers who request no further contact. Time restrictions prohibit calls before 8 AM or after 9 PM in the called party’s time zone under federal rules, and many states have more restrictive windows.

State Licensing Requirements

Unlike many home services, alarm system installation and monitoring requires state licensing. While lead generation itself typically does not require an alarm license, the regulatory environment affects lead generation in several ways.

Buyer licensing requirements mean lead buyers must be properly licensed in each state where they operate. Selling leads to unlicensed companies creates legal and reputation risk for generators.

Advertising requirements in some states mandate alarm license numbers in advertising. If your landing pages make claims about installation or monitoring services rather than simply collecting information for referral, license disclosure may be required.

Solicitation definitions vary by state, with some defining “solicitation” of alarm services broadly. Content that goes beyond information collection to provide specific pricing or service recommendations may trigger licensing requirements.

Major state considerations include California requiring an Alarm Company Operator License for installation and monitoring, Texas regulating under the Private Security Act, Florida potentially applying electrical contractor licensing, and New York licensing alarm installers by county and municipality. Consult with legal counsel familiar with alarm industry regulations in your target states.

FTC and Advertising Compliance

FTC guidelines govern advertising claims and disclosures across all marketing channels. Truthful claims are required, meaning all claims about security system capabilities, pricing, and service must be truthful and substantiated.

Clear pricing disclosure requires that if you promote pricing, all material terms must be disclosed including contract length, equipment costs, and installation fees. Endorsements and reviews must reflect genuine experiences if using testimonials, and connections between endorsers and companies must be disclosed. Comparison claims must be substantiated and not misleading when comparing to competitors.

Building Buyer Relationships

For lead generators, developing and maintaining relationships with security company buyers determines long-term success. The buyer landscape includes both national companies and thousands of local dealers, each requiring different relationship approaches.

Buyer Segmentation

Tier 1 national companies include ADT, Vivint, Brinks, and SimpliSafe. These buyers have high volume capacity measured in thousands of leads monthly. They employ sophisticated lead scoring and routing systems. They maintain established compliance requirements and typically work through authorized aggregators or direct relationships with proven generators.

Tier 2 regional security companies operate across multiple states with 10-100 or more employees. They have moderate volume capacity measured in hundreds of leads monthly. They may purchase directly or through aggregators and are often willing to pay premium prices for exclusive territorial leads.

Tier 3 local dealers and installers operate within a single state or local area. They have lower volume capacity measured in dozens of leads monthly and require higher touch relationship management. Many affiliate with national monitoring brands like ADT as Authorized Dealers.

Relationship Development

Working with national buyers requires patience and process. Expect rigorous onboarding including compliance audits before you deliver your first lead. Lead quality metrics will be tracked and reported throughout the relationship. Pricing is typically formulaic based on quality scores. Plan for long sales cycles of 3-6 months to establish an initial relationship.

Regional buyers offer more flexibility in pricing and terms. You can often develop direct relationships with decision makers rather than working through procurement departments. Onboarding is faster but may require geographic exclusivity commitments. Quality feedback tends to be more personal and actionable.

Local dealers present a relationship-driven dynamic more than process-driven. Volume is lower but potentially higher per-lead prices compensate. These buyers may require more support including lead delivery assistance and CRM integration. Loyalty potential is high if quality remains consistent over time.

Pricing Negotiations

Value-based pricing arguments strengthen your position in negotiations. Qualification level with verified homeownership or credit qualification commands premium pricing. Consent documentation certified through TrustedForm or similar services reduces buyer risk. Contact rate metrics demonstrate lead quality if you track post-sale performance. Exclusive versus shared delivery creates clear value differentiation. Geographic specificity adds value for territory-focused buyers.

Volume commitments benefit both parties. Buyers may offer price premiums for guaranteed volume. Minimum volume commitments reduce buyer risk and demonstrate generator capacity. Ramp-up periods for new relationships let you start small, prove quality, and scale.

Performance adjustments require clear agreement on return policies covering what qualifies for credit, quality score thresholds establishing minimum standards for acceptance, and price adjustments based on conversion data sharing when buyers provide feedback.

Lead Distribution and Delivery

How leads are delivered to buyers affects conversion rates and buyer satisfaction. Home security leads require rapid delivery to capture the emotional urgency driving consumer shopping.

Delivery Methods

Real-time API integration represents the gold standard for lead delivery. Leads arrive within seconds of submission. Buyer systems can apply immediate filtering logic. This method is required for speed-to-contact optimization. Technical complexity is higher but buyer satisfaction is highest.

Ping-post distribution maximizes revenue through competitive bidding. Lead information is “pinged” to multiple buyers who bid on leads meeting their criteria. The highest price wins exclusive or priority delivery. This approach maximizes revenue per lead but adds operational complexity.

Email and CRM push works for smaller buyers without API capability. This approach introduces delay that reduces conversion rates but may work for appointment-based leads where immediacy is less critical.

Scheduled batches represent a legacy approach declining in prevalence. The significant conversion rate penalty limits utility to aged lead distribution where immediacy no longer matters.

Speed-to-Contact Optimization

Home security leads decay rapidly. Research consistently shows that leads contacted within 5 minutes convert at 3-5 times the rate of leads contacted after 30 minutes. Delivery infrastructure must support rapid buyer response with lead transmission under 5 seconds from submission, buyer notification systems including SMS, push, and real-time dashboards, click-to-call integration for immediate outbound dialing, and routing logic that prioritizes available sales capacity.

Routing Logic

Geographic routing ensures leads match buyers with installation coverage. Consider travel radius for technician dispatch. Exclude leads from territories with no buyer coverage rather than waste them on buyers who cannot service them.

Quality-based routing sends highest-quality leads to best-converting buyers. Apply tiered pricing based on lead attributes. Consider buyer conversion rate when pricing leads to reward performance.

Capacity-based routing respects buyer volume caps to avoid overwhelming sales teams. Distribute evenly when multiple buyers have equal priority. Pause routing when buyer capacity is exhausted to maintain quality.

Performance Tracking and Optimization

Sustainable home security lead generation requires rigorous performance tracking and continuous optimization across all operational dimensions.

Key Metrics to Track

Traffic metrics form the foundation of performance analysis. Track cost per click by source and campaign to understand acquisition efficiency. Monitor click-through rates by creative and placement to optimize ad performance. Measure landing page conversion rates to identify optimization opportunities. Calculate cost per lead by source to compare channel economics.

Quality metrics reveal whether you are generating leads buyers want. Track lead validation pass rates to catch problems early. Monitor qualification field completion rates to ensure forms are working. Review contact rates reported by buyers to understand post-delivery performance. Watch duplicate rates across sources to prevent paying twice for the same prospect.

Revenue metrics determine profitability. Track revenue per lead by source to identify your most valuable channels. Monitor sell-through rate as the percentage of leads accepted by buyers. Track return and rejection rates by buyer to identify problematic relationships. Calculate net revenue after returns for accurate profit measurement.

Buyer relationship metrics ensure partnership health. Capture buyer-reported conversion rates when shared to benchmark quality. Monitor time from lead delivery to first contact to ensure speed-to-contact. Track buyer satisfaction scores to predict relationship longevity. Watch payment timeliness as an indicator of relationship strength.

Optimization Priorities

Traffic source optimization drives sustainable profitability. Reallocate budget toward highest-quality sources measured by buyer feedback and conversion. Eliminate sources with consistently high return rates. Test new traffic sources with limited initial investment. Monitor for traffic quality degradation over time as sources mature or change.

Landing page optimization balances volume and quality. A/B test headlines, offers, and form structures continuously. Optimize for qualified leads rather than just lead volume. Balance conversion rate with lead quality since very high conversion often means insufficient qualification. Test different qualification question sequences to find the optimal flow.

Buyer mix optimization protects against concentration risk. Diversify across multiple buyers to reduce dependency on any single relationship. Prioritize buyers who provide conversion feedback since data enables optimization. Negotiate better terms with data showing quality performance. Exit relationships with buyers who consistently underperform on payment or feedback.

Frequently Asked Questions

What is a home security lead and how is it generated?

A home security lead is contact information from a consumer actively interested in purchasing or learning about home security systems, monitoring services, or related products. These leads are typically generated through online advertising (search, social, display), content marketing, affiliate websites, or direct response campaigns. The consumer submits their information through a web form or phone call, expressing interest in receiving information about security systems. Quality leads include qualification data such as homeownership status, current security system status, and installation timeframe, enabling buyers to prioritize contacts most likely to convert.

What is a good cost per lead for home security systems?

Home security lead costs vary significantly based on lead type and quality. Exclusive leads for monitored security systems typically range $75-$150, while semi-exclusive leads (shared with 2-3 buyers) run $40-$75. Shared leads available to multiple buyers cost $20-$40. Live transfer leads, where the consumer is transferred directly to a sales representative, command $80-$175 due to higher conversion rates. The relevant metric is cost per acquisition, not cost per lead. A $120 lead that converts at 18% produces a $667 customer acquisition cost. A $50 lead that converts at 6% produces an $833 customer acquisition cost. Quality typically justifies premium pricing.

Who are the main buyers of home security leads?

The home security lead market is dominated by large monitoring companies (ADT, Vivint, Brinks Home, SimpliSafe), their authorized dealer networks, and regional security installation companies. ADT alone has over 6 million customers and purchases significant lead volume both directly and through their dealer network. Authorized dealers of major brands often purchase leads for their specific territories. Regional security companies without sophisticated marketing capabilities rely on lead purchasing for customer acquisition. Lead aggregators and brokers serve as intermediaries, purchasing leads from generators and distributing to these end buyers.

How do subscription economics affect home security lead pricing?

Home security is fundamentally different from one-time purchase categories because buyers are acquiring subscribers, not single-transaction customers. A typical monitored security customer pays $35-$55 monthly for 24-36 months, generating $840-$1,980 in monitoring revenue alone. Including equipment sales and potential upsells, customer lifetime value often exceeds $2,000. This subscription economics model allows buyers to pay customer acquisition costs of $600-$1,000 while maintaining profitability. Lead pricing reflects this – buyers can pay $100+ per lead because converting even 15% of leads produces acceptable acquisition costs relative to lifetime value.

What qualification information makes home security leads more valuable?

The most valuable qualification data for home security leads includes: homeownership verification (renters convert at lower rates and may face installation restrictions), current security system status (new installs are most valuable, followed by system replacements), property type (single-family homes are ideal), installation timeframe (immediate intent is most valuable), and credit qualification indicators (since many buyers require credit checks for monitoring contracts). Leads with complete qualification data command 20-40% premium pricing over basic contact information. Enhanced fields like home value, number of entry points, and specific feature interests further increase lead value for sophisticated buyers.

What are the TCPA compliance requirements for home security leads?

TCPA compliance is critical for home security leads because buyers typically contact leads via phone. Key requirements include: obtaining prior express written consent before making autodialed or prerecorded calls to cell phones, with consent specific to the companies that will call (though the FCC’s one-to-one consent rule was vacated in January 2025, many sophisticated buyers still require this); checking all numbers against the National Do Not Call Registry; respecting state and federal calling time restrictions (no calls before 8 AM or after 9 PM in the called party’s time zone); maintaining internal DNC lists for consumers requesting no contact. Lead generators should use consent certification services like TrustedForm or Jornaya and ensure consent language clearly identifies who will contact the consumer.

Do I need an alarm license to generate home security leads?

Lead generation itself typically does not require an alarm license, but the regulatory environment varies by state and depends on the nature of your activities. If your marketing goes beyond collecting consumer information to providing specific pricing, coverage recommendations, or service comparisons, some states may classify this as solicitation requiring licensing. Lead buyers (installation companies, monitoring services) must be properly licensed in states where they operate. Selling leads to unlicensed companies creates legal and reputation risk. Consult with legal counsel familiar with alarm industry regulations in your target states to ensure compliance.

What is the best traffic source for home security leads?

The “best” traffic source depends on your resources, timeline, and quality requirements. Paid search (Google Ads, Microsoft Ads) provides highest-intent traffic but faces intense competition from major advertisers, with CPCs of $8-$25 for valuable keywords. Social media advertising (Facebook, Instagram) enables precise homeowner and life-event targeting at moderate costs. SEO and content marketing delivers highest-margin leads long-term but requires 6-12 months investment before significant volume. Most successful operations use multiple channels: paid search for consistent high-intent volume, social for targeting specific demographics, and SEO for long-term cost reduction. Track cost per acquisition (not just CPL) by source to optimize allocation.

How do seasonal patterns affect home security lead generation?

Home security lead demand exhibits moderate seasonality, less pronounced than weather-dependent categories. Peak periods include October-November (pre-holiday security concerns), January-February (New Year resolutions and post-holiday break-in news), and summer months (moving season creates new homeowner demand). December typically sees lower demand due to holiday distractions. However, security concerns are year-round, and major demand drivers (new home purchases, neighborhood incidents, life changes) occur throughout the year. Budget allocation should remain relatively steady with 15-20% premium allocation during peak periods rather than dramatic seasonal swings.

What conversion rates should I expect from home security leads?

Conversion rates vary significantly by lead type and buyer execution. Shared leads typically convert at 5-10% to closed sales. Exclusive leads convert at 12-20%. Live transfer leads achieve 20-35% conversion because the consumer is immediately connected to a sales representative. Scheduled appointment leads (where an installation visit is already booked) convert at 25-45%. Speed-to-contact dramatically affects conversion – leads contacted within 5 minutes convert at 3-5 times the rate of those contacted after 30 minutes. Buyer sales process quality also matters significantly; the same leads may convert at 10% with one buyer and 20% with another based on follow-up systems and sales skills.

How can I differentiate my home security leads in a competitive market?

Differentiation in home security lead generation comes from quality, qualification, and service. Quality differentiation includes rigorous validation (phone verification, address standardization, fraud detection), consent certification (TrustedForm or equivalent), and DNC scrubbing. Qualification differentiation means capturing additional data points (credit indicators, home type, urgency) that help buyers prioritize leads. Service differentiation includes real-time delivery, integration with buyer CRM systems, transparent performance reporting, and responsive relationship management. Geographic specialization (deep expertise in specific regions) can create competitive advantage against national generalists. Building reputation through consistent quality and buyer satisfaction creates long-term defensibility that pricing competition cannot easily erode.

Key Takeaways

-

Subscription economics drive premium lead pricing. Home security leads command $75-$150 exclusive CPL because buyers acquire subscribers worth $1,500-$3,000+ in lifetime monitoring revenue. Calculate your target cost per acquisition based on customer lifetime value, then work backward to acceptable CPL.

-

Lead quality matters more than lead cost. A $120 lead converting at 18% produces a $667 CPA. A $50 lead converting at 6% produces an $833 CPA. Focus on conversion rate optimization, not just CPL reduction. Invest in qualification and validation that improves buyer conversion.

-

Speed-to-contact is decisive. Leads contacted within 5 minutes convert at 3-5 times the rate of those contacted after 30 minutes. Delivery infrastructure must support real-time lead transmission and immediate buyer notification.

-

Qualification data creates value. Basic contact information is commoditized. Leads with verified homeownership, current system status, installation timeframe, and credit indicators command 20-40% premium pricing and convert at higher rates.

-

TCPA compliance is non-negotiable. Though the FCC’s one-to-one consent rule was vacated in January 2025, many sophisticated buyers still require specific consent for each company that will contact consumers. Implement TrustedForm or equivalent consent certification. Check all leads against DNC registries. Non-compliance creates existential legal risk.

-

Geographic targeting is mandatory, not optional. Security companies have defined service territories. Leads outside a buyer’s installation coverage have zero value. Build routing logic that matches leads to buyer geographic capabilities.

-

Buyer relationships determine long-term success. The market has a small number of major buyers (ADT, Vivint, Brinks, regional companies) and thousands of local dealers. Develop relationships across buyer tiers to ensure consistent demand for your lead supply.

-

Subscription economics justify higher CPA. Unlike one-time purchases, security leads convert to multi-year subscribers. This fundamental difference allows buyers to pay CPLs that seem high relative to initial transaction value but make sense when measured against customer lifetime value.

-

Diversify traffic sources for sustainability. Paid search provides high-intent traffic but faces intense competition. Social enables demographic targeting. SEO delivers highest margins long-term. Successful operations combine multiple channels and track performance by source.

-

Alarm industry licensing affects the ecosystem. While lead generation typically does not require licensing, understanding state requirements for installation and monitoring companies helps you sell to qualified buyers and avoid regulatory complications.

Sources

- Statista: Security Alarm Monitoring Industry - Market size and subscriber data for the US residential security industry

- Security.org: Home Security Research - Consumer research on home security purchasing behavior and system preferences

- Security Industry Association - Industry association data on security market structure and dealer network

- SBA Business Guide - Licensing requirements for home service businesses across states

- HubSpot Sales Blog - Sales process benchmarks and speed-to-contact conversion research

- InsideSales.com Research - Lead response time studies documenting the impact of contact speed on conversion rates

The home security lead generation market rewards operators who understand subscription economics, prioritize lead quality over volume, and build lasting buyer relationships. The consumers submitting these leads are often responding to fear and urgency – they deserve to be connected with legitimate security providers quickly. Those who respect this dynamic, comply with regulations, and deliver consistent quality will capture sustainable profits in this substantial market.