The comparison site model generates $500M-$800M annually through two publicly traded players alone. Here is exactly how successful operators build, optimize, and monetize insurance comparison platforms that convert visitors into tradeable leads.

A consumer searches “compare auto insurance quotes” and lands on your comparison site. They enter their ZIP code, answer a few questions about their vehicle, provide contact information, and click submit. Behind the scenes, their information travels through a ping/post auction where multiple carriers bid in real-time. The winning bidders pay $35-75 each for the right to contact this consumer. Total revenue from a single form submission: $100-300.

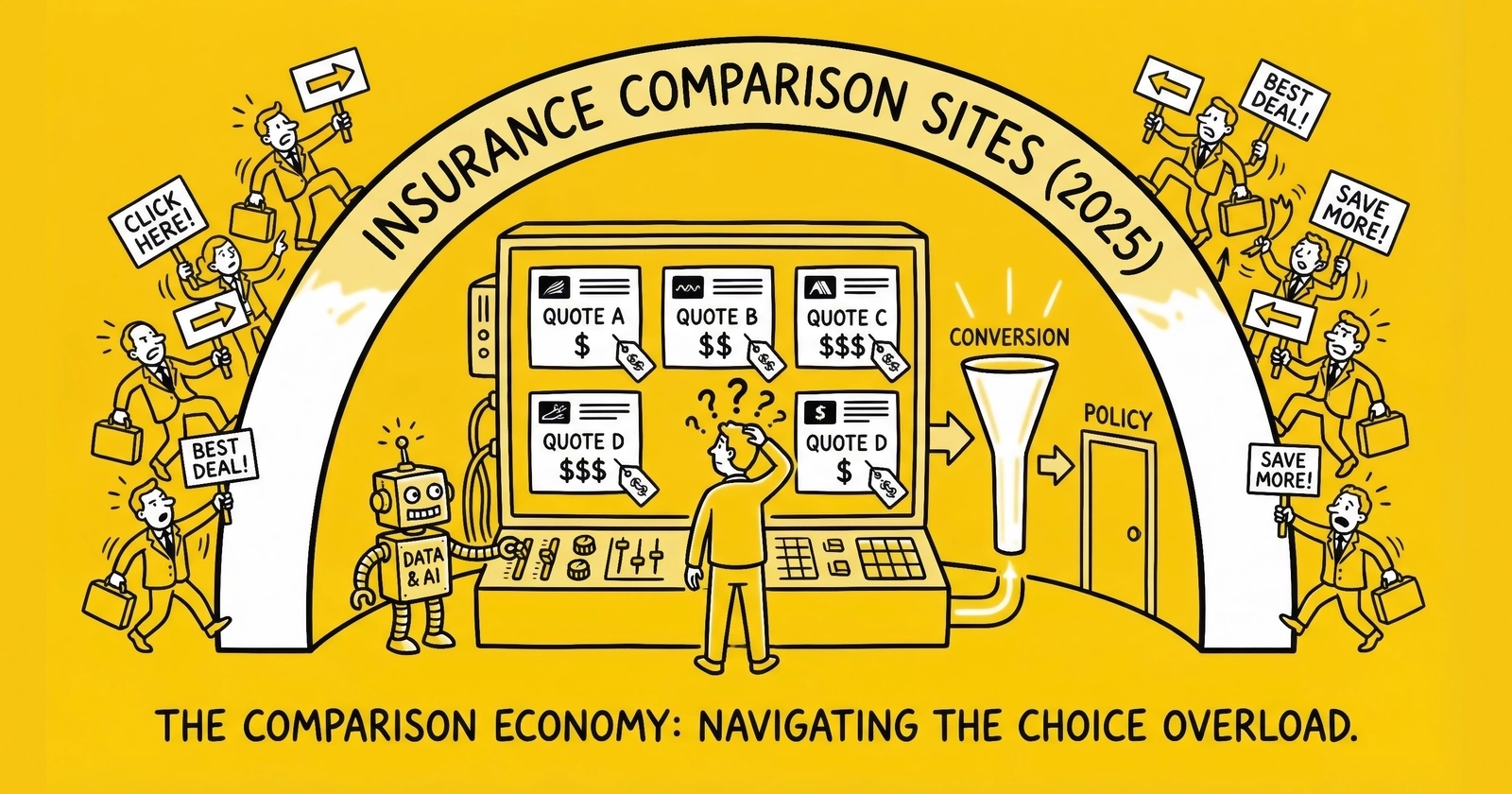

This is the insurance comparison site model. It sits at the intersection of consumer utility and lead generation economics, creating value for consumers who want competitive quotes and monetization opportunities for operators who understand how to build conversion-focused experiences.

EverQuote generated $500.2 million in revenue during 2024, with their automotive vertical alone producing $446 million – a 96% year-over-year increase. MediaAlpha facilitated $1.5 billion in transaction value across their marketplace. These numbers represent the mature end of the comparison site spectrum, but the model scales from bootstrapped operators generating 50 leads daily to enterprise platforms processing millions.

The economics are compelling when executed correctly. A comparison site with 50,000 monthly visitors, 8% conversion rate, and $80 average revenue per lead generates $320,000 monthly. The challenge lies in building the platform that achieves those metrics while maintaining compliance, quality standards, and sustainable traffic acquisition.

This guide covers every element required to build insurance comparison sites that convert: platform architecture, user experience design, carrier integrations, monetization strategies, and the operational infrastructure that separates sustainable businesses from expensive experiments.

Understanding the Comparison Site Model

Before building anything, you need to understand exactly what you are building and how it generates revenue. The comparison site model differs fundamentally from traditional lead generation because it promises consumers something specific: the ability to compare options.

The Consumer Value Proposition

Consumers visit comparison sites because shopping for insurance is tedious. Visiting five carrier websites, entering the same information five times, and comparing disconnected quotes requires substantial effort. Comparison sites promise to eliminate that friction: enter information once, receive multiple options.

This value proposition creates consumer expectations that shape every design decision. Visitors expect multiple options because they came to compare, not to receive a single quote – platforms that deliver only one option violate the implicit promise of comparison shopping. They expect relevant results that reflect their specific situation, since generic quotes that ignore their details feel like bait-and-switch. The more personalized the results appear, the higher the trust and conversion. Consumers increasingly understand they will receive calls and emails, so transparency about what happens next reduces friction and complaints. And above all, visitors expect speed and convenience – the entire point is saving time, so forms that take longer than entering information on a single carrier site fail the core value proposition.

Meeting these expectations while maximizing monetization requires careful balance. Practitioners who prioritize short-term revenue extraction over consumer experience generate complaints, chargebacks, and regulatory scrutiny. Practitioners who over-deliver on consumer experience without proper monetization build unsustainable businesses.

The Monetization Mechanics

Comparison sites monetize through several mechanisms, often in combination.

Lead Sales Through Ping/Post

The primary revenue source for most comparison sites is lead sales via ping/post auctions. When a consumer submits a form, their information enters a real-time auction where multiple buyers bid based on consumer characteristics and current demand. The site sells to multiple winners, generating $80-200+ per consumer across 2-5 buyers.

Click-Out Revenue

Some comparison models display carrier options and earn revenue when consumers click through to carrier sites. Revenue per click ranges from $5-30 depending on carrier, consumer profile, and competitive dynamics.

Affiliate Commissions

Direct relationships with carriers may include per-policy commissions when consumers purchase coverage. Commission structures vary: flat fees ($50-150 per policy) or percentage of premium (10-15% of first-year premium).

Advertising Revenue

Display advertising, sponsored placements, and content marketing partnerships provide supplemental revenue, though typically at lower rates than direct lead monetization.

The hybrid approach – combining ping/post lead sales with click-out revenue and affiliate relationships – maximizes yield across consumer types and traffic sources.

Revenue Per Visitor Economics

Understanding revenue per visitor (RPV) drives every optimization decision. Here is the math:

RPV = Conversion Rate x Revenue Per Lead

For a site converting 8% of visitors with $100 average revenue per lead:

- RPV = 0.08 x $100 = $8.00

This $8.00 RPV sets your maximum profitable traffic acquisition cost. If you pay $5 per visitor through paid search, you generate $3 profit per visitor. If you pay $10 per visitor, you lose $2 per visitor regardless of volume.

The optimization path focuses on both variables. Increasing conversion rate through form optimization, user experience improvements, trust signals, and funnel design yields dramatic returns – a 2-percentage-point improvement from 8% to 10% increases RPV by 25%. Increasing revenue per lead through better buyer relationships, quality improvements that command premium pricing, and distribution optimization that maximizes competition for each lead provides the other lever.

Small improvements in either variable compound across your entire operation. This is why successful comparison site operators obsess over conversion optimization – the leverage is extraordinary.

Platform Architecture and Technology Stack

The technical foundation of your comparison site determines what you can build on top of it. Poor architecture creates ongoing limitations; solid architecture enables continuous optimization.

Core Components

A production comparison site requires several integrated systems working together.

Form Capture and Validation

The front-end form system must handle multi-step flows, conditional logic, validation, and error handling while capturing the data required for monetization. This includes integration with consent capture services (TrustedForm, Jornaya) and phone/email validation APIs.

Lead Distribution System

The engine that receives completed leads, pings potential buyers, evaluates bids, accepts winners, and posts lead data. This system must handle real-time bidding, return processing, and multi-buyer distribution.

Carrier API Integrations

For sites that display actual quotes (not just lead capture), integrations with carrier rating APIs enable real-time quote presentation. Complexity varies by carrier; some provide simple REST APIs while others require complex integration protocols.

Analytics and Tracking

Server-side tracking infrastructure captures visitor behavior, conversion events, and revenue attribution across the entire funnel. This data drives optimization decisions.

Compliance Infrastructure

Systems that capture and store consent documentation, maintain audit trails, and support compliance verification during disputes.

Build vs. Buy Decisions

most practitioners face a fundamental choice: build custom infrastructure or leverage existing platforms.

Lead distribution platforms like boberdoo, LeadsPedia, Phonexa, and LeadByte provide pre-built distribution systems with ping/post capabilities, buyer management, and reporting. Pricing ranges from $500-$5,000 monthly depending on volume and features. These platforms eliminate months of development time and provide proven, tested infrastructure. Form builders like Unbounce, Leadpages, or specialized solutions like LeadDyno and ClickFunnels handle front-end capture without custom development. Integration with lead distribution systems varies – some offer native connections, others require custom API work.

Custom development makes sense when you need specific functionality not available in off-the-shelf solutions, when you are operating at scale where platform fees become prohibitive, or when competitive differentiation requires proprietary technology. The pragmatic path for most newcomers: start with proven platforms, validate the business model, then selectively build custom components where differentiation matters.

Integration Requirements

Successful comparison sites integrate with multiple external services. Consent capture services are foundational – TrustedForm and Jornaya are industry standards. TrustedForm creates session replays documenting exactly what consumers saw and clicked, while Jornaya provides LeadiD tokens with additional fraud and quality signals. Most sophisticated buyers require one or both for lead acceptance.

Phone validation APIs from services like Ekata, Melissa Data, and Phone Validator verify that submitted phone numbers are valid, active, and not associated with fraud patterns. Invalid phone numbers create returns and damage buyer relationships. Similar email validation services verify email syntax, domain validity, and deliverability – high invalid email rates indicate form abuse or poor traffic quality. Address standardization through USPS validation ensures submitted addresses are real and properly formatted, improving lead acceptance and enabling geographic routing.

Fraud detection rounds out the integration stack. Services like Anura, HUMAN (formerly WhiteOps), and IPQualityScore identify bot traffic, click fraud, and fraudulent submissions before they enter your lead flow. Integration complexity is real: budget 2-4 weeks of development time per integration for custom implementations, or select platforms that offer native integrations with your required services.

User Experience Design That Converts

The user experience determines whether visitors become leads. Every element – from landing page headlines to form field labels – affects conversion rates.

Landing Page Architecture

The landing page has one job: convince visitors to start the form. Everything on the page either supports that goal or distracts from it.

Above-the-Fold Requirements

The critical elements must be visible without scrolling on both desktop and mobile: a clear headline stating the value proposition, trust signals such as carrier logos and security badges, the form start or a prominent call-to-action, and a supporting credibility statement.

Effective headlines answer the visitor’s implicit question: “Why should I enter my information here?” Compare a weak headline like “Get Insurance Quotes” to a strong alternative: “Compare rates from 25+ top carriers in under 3 minutes. 87% of users find savings.” The strong version specifies quantity (25+ carriers), time commitment (under 3 minutes), and quantified benefit with social proof (87% find savings).

Trust Signals That Work

Trust signals appropriate for comparison sites include carrier logos (Progressive, GEICO, Allstate, State Farm), security badges (SSL, TRUSTe, BBB Accredited), review counts and ratings (“4.8 stars from 12,000+ reviews”), media mentions (“As featured in Forbes, NerdWallet, Bankrate”), and consumer counts (“500,000+ quotes delivered this year”).

Form Placement and Prominence

The form – or form entry point – should be immediately visible. Visitors who came to compare insurance should not hunt for where to begin. On desktop, this often means an embedded form or prominent start button above the fold. On mobile, a clear call-to-action that leads to the form.

Multi-Step Form Design

Insurance comparison sites universally use multi-step forms. The data supports this approach: multi-step forms convert approximately 86% higher than single-page alternatives.

Optimal Step Structure for Auto Insurance

The proven five-step structure for auto insurance comparison flows from low-friction to high-commitment questions.

Step 1: Basic intent qualification captures ZIP code for geographic relevance, vehicle ownership status (own, lease, finance), and current insurance status.

Step 2: Vehicle information gathers year, make, model, annual mileage, and primary use (commute, pleasure, business).

Step 3: Driver information collects date of birth, marital status, and driving history including accidents and violations.

Step 4: Current coverage asks about current carrier, existing coverage levels, and reason for shopping.

Step 5: Contact information requests name, email, phone, and street address if required.

Step Completion Benchmarks

Industry benchmarks establish expected completion rates at each step: Step 1 sees 70-80% proceed, Step 2 retains 75-85% of Step 1 completers, Step 3 holds 80-90% of Step 2 completers, Step 4 maintains 85-90% of Step 3 completers, and Step 5 converts 85-95% of Step 4 completers. Any step significantly below these benchmarks indicates specific friction that requires investigation.

Question Sequencing Principles

Start with low-friction questions. ZIP code and vehicle type feel relevant and non-invasive – they engage visitors in the process before requesting sensitive information. Save contact information for later steps. By step 5, visitors have invested 60-90 seconds answering questions. Abandoning means wasting that investment, and this psychological commitment increases completion rates even for sensitive fields.

Use conditional logic liberally. If someone indicates they do not currently have insurance, skip questions about their current carrier and coverage levels. Irrelevant questions feel wasteful and increase abandonment.

Mobile-First Requirements

Mobile traffic now exceeds 70% for most insurance comparison sites. Some verticals see 80%+ mobile traffic. Your site must be designed for mobile first, not adapted to mobile as an afterthought.

Critical Mobile Design Elements

Touch-friendly inputs require minimum tap target size of 44x44 pixels, adequate spacing between fields (16px minimum), and full-width buttons that are easy to tap. Appropriate input types matter: use type="tel" for phone numbers to trigger numeric keypads, type="email" for email fields, and type="date" for date pickers where supported.

Each step should require minimal scrolling to see all fields and the proceed button. If a step requires significant scrolling on mobile, break it into multiple steps. Mobile connections are often slower than desktop, and every second of load time reduces conversion rates – optimize images, minimize JavaScript, and leverage caching. Avoid hover states for critical information entirely, since tooltips that appear on hover do not work on mobile. Use inline explanations or tap-to-reveal patterns instead.

The Mobile Conversion Gap

Despite higher traffic volumes, mobile conversion rates typically lag desktop by 0.5-1.5 percentage points. Closing this gap represents significant revenue opportunity. A site with 100,000 monthly mobile visitors that closes a 1-percentage-point mobile conversion gap generates 1,000 additional leads monthly.

Carrier Integrations and Quote Display

The promise of comparison sites is showing consumers their options. How you fulfill that promise affects both conversion rates and monetization.

Integration Approaches

Three primary approaches exist for presenting carrier information.

Indicative quotes display estimated rate ranges based on consumer inputs without real-time carrier API integration – “Based on your profile, rates typically range from $80-$150/month.” This approach requires no carrier relationships but provides less specific value to consumers.

Real-time quoting integrates with carrier rating APIs to display actual quotes consumers could receive – “Progressive: $127/month. Allstate: $142/month. GEICO: $119/month.” This approach requires technical integration and carrier relationships but delivers genuine comparison value.

Hybrid models display some real quotes from integrated carriers alongside indicative information for non-integrated carriers, maximizing the appearance of comprehensiveness while working within integration constraints.

Building Carrier Relationships

Direct carrier relationships for API integration require business development effort and technical capability.

What Carriers Evaluate

Carriers typically evaluate traffic quality and volume projections, compliance infrastructure and consent documentation, technical capability to integrate and maintain APIs, brand safety and consumer experience quality, and geographic coverage and demographic mix. Establishing direct carrier relationships typically requires 3-6 months from initial outreach to live integration. Larger carriers with more complex integrations may take longer, while smaller regional carriers or specialty markets may move faster.

Alternative Paths

Lead aggregators and exchanges like MediaAlpha and EverQuote provide access to carrier demand without requiring direct relationships. These platforms handle buyer relationships, technical integration, and distribution – you focus on generating quality leads. The trade-off: aggregators take margin for the value they provide. Direct relationships typically yield higher revenue per lead but require more infrastructure and relationship management.

Quote Presentation Best Practices

How you present options affects both conversion and consumer perception.

Show meaningful differentiation. Displaying five carriers with identical or nearly identical prices provides little comparison value. If your quoting data shows minimal variation, emphasize other differentiators like coverage options, customer service ratings, or claims handling. Set appropriate expectations – “Compare 25+ carriers” implies consumers will see 25+ options, so if your quote display shows 3-4 options, you have created an expectations gap. Promise what you deliver.

Clarify quote accuracy, since real-time quotes are estimates based on provided information and final rates require full underwriting. Make this clear to avoid consumer frustration when actual quotes differ. For mobile quote display, remember that comparison tables that work on desktop often fail on mobile. Consider card-based layouts, horizontal scrolling, or simplified displays optimized for smaller screens.

Monetization Strategies and Buyer Relationships

Revenue optimization requires understanding how different monetization channels work and how to maximize each.

Ping/Post Distribution

The ping/post model drives primary revenue for most comparison sites. The mechanics flow through four phases.

When a consumer submits your form, your system sends a “ping” containing partial lead information – ZIP code, coverage type, driver age – to potential buyers. This ping asks, “Would you buy a lead with these characteristics, and at what price?” Each buyer’s system evaluates the ping against their current buying criteria including geographic targeting, demographic filters, volume caps, and budget availability, then returns a bid: “Yes, I’ll pay $45 for this lead.”

Your system evaluates all bids and accepts winners. You might sell to all bidders above a floor price, to the top 3 bidders, or to a single exclusive buyer depending on your distribution strategy. For accepted bids, you then send the “post” – complete lead information including contact details. The buyer pays the agreed bid amount.

Revenue Optimization Levers

Several factors drive revenue optimization. More buyers mean more competition, which typically means higher bids – build relationships with multiple buyers across carrier types including direct carriers, independent agents, and agency networks. Better targeting provides buyers with granular filtering options so they bid higher for leads matching their ideal customer profile. Quality reputation matters because buyers pay more for leads from sources with proven conversion rates and low return rates. And timing plays a role since some buyers bid higher during specific hours or days. Understanding buyer behavior patterns enables optimization.

Exclusive vs. Shared Distribution

The choice between exclusive and shared distribution significantly affects revenue and buyer relationships.

Shared Distribution

Shared distribution sells each lead to 3-7 buyers simultaneously. This approach generates lower per-buyer revenue ($15-35 per buyer) but higher total revenue per lead ($60-150 total). Buyers compete on speed-to-contact, and the consumer receives multiple calls quickly. The trade-off is higher complaint potential.

Exclusive Distribution

Exclusive distribution sells each lead to a single buyer. Per-lead revenue runs higher ($50-100) but total revenue per lead is lower since there is only one sale. This creates a better consumer experience with one contact, builds stronger buyer relationships, and produces lower complaint and return rates.

The Hybrid Approach

many practitioners segment leads by quality indicators. Higher-quality leads sell exclusive at premium prices while lower-quality leads sell shared to maximize yield. The decision depends on your positioning, buyer relationships, and risk tolerance. Exclusive distribution typically builds more sustainable businesses; shared distribution often generates higher short-term revenue.

Return Rate Management

Returns – leads that buyers reject and request refunds for – directly reduce net revenue. Understanding and managing returns is essential.

Common Return Reasons

Returns typically stem from invalid phone numbers (disconnected or wrong person), duplicate leads where the buyer already has this consumer, contact failure after multiple attempts, leads falling outside buying criteria despite filtering, and consent issues where consumers claim they did not request contact.

Return Rate Benchmarks

Return rates under 8% represent the target. Rates of 8-12% are acceptable. Rates of 12-15% indicate a problem, and anything above 15% is critical. Sustained return rates above 12% indicate quality problems requiring investigation. Buyers with high return rates will reduce bids, implement stricter filters, or terminate relationships.

Return Reduction Strategies

Better phone validation through real-time services catches invalid numbers before leads enter distribution. Duplicate checking cross-references new leads against recent submissions to catch consumers who submitted multiple times. Quality scoring flags leads with indicators of lower quality – very fast completion times, unusual data patterns – for review or different distribution. Traffic source analysis tracks return rates by source, since some sources consistently produce higher returns that you must address or cut.

Yield Optimization

Maximizing revenue per lead requires systematic optimization across multiple variables.

Buyer coverage analysis asks the critical question for every lead that fails to sell: Why? No interested buyers, buyers capped out, or below floor prices each have different solutions. Floor price optimization requires careful calibration – setting floor prices too high means leads go unsold, while setting them too low leaves money on the table. Test different floor levels by lead characteristics.

Time-based optimization recognizes that some hours produce higher bids (business hours when buyer call centers are staffed) and some days outperform others (Tuesday-Thursday often outperform weekends). Adjust traffic acquisition and distribution timing accordingly. Seasonal patterns also matter. Insurance lead demand fluctuates throughout the year. January typically sees strong demand from New Year’s resolution shopping, while summer months may see reduced demand. Plan traffic and pricing strategies around these patterns.

Traffic Acquisition Strategies

Traffic is the fuel for your comparison site. The source, quality, and cost of that traffic determines whether your operation is profitable.

Paid Search (Google Ads)

Google Ads remains the highest-intent traffic source. Consumers actively typing “compare auto insurance quotes” have immediate purchase intent.

Current Benchmarks

Average CPC for insurance keywords runs $4-8, while high-competition keywords like “auto insurance quotes” reach $10-20+. Long-tail keywords such as “cheap car insurance for new drivers” cost $2-5. Expected conversion rates range from 6-12%.

Strategic Considerations

Quality score directly affects costs, so improve landing page relevance and load speed. Match types matter: exact match and phrase match control costs, while broad match generates volume but requires careful negative keyword management. Geographic targeting enables margin optimization since some states have higher lead values – bid accordingly.

Profitability Math

The sensitivity of profitability to small changes is striking. At $8 CPC, 8% conversion rate, and $100 revenue per lead, your cost per lead equals $100 ($8 / 0.08), matching your revenue for zero margin – breakeven. But at $6 CPC and 10% conversion rate with the same $100 revenue per lead, your cost per lead drops to $60 ($6 / 0.10), leaving $40 margin per lead (40%). Small improvements in CPC or conversion rate dramatically change profitability.

SEO and Organic Traffic

Organic traffic from search rankings provides higher margins but requires sustained investment.

Content Strategy for Comparison Sites

Effective content strategies for comparison sites span multiple content types: state-specific insurance guides (“Auto Insurance in Florida: Complete 2025 Guide”), comparison content (“Progressive vs. GEICO: Which is Better?”), educational content (“How Much Auto Insurance Do I Need?”), and resource content (“Average Auto Insurance Rates by State”).

Timeline Expectations

Building organic traffic authority requires 12-24 months of consistent content development and link building. New sites should not expect significant organic traffic in the first year.

Advantages of Organic Traffic

Organic traffic offers compelling economics: no per-visitor acquisition cost, higher trust from consumers (organic results perceived as more credible), sustainable competitive advantage once established, and insulation from paid advertising cost increases.

Requirements for Success

Success requires substantial content investment (100+ quality articles), technical SEO fundamentals (site speed, mobile optimization, structured data), a link building program (guest posts, digital PR, resource link building), and ongoing content maintenance and optimization.

Social Media Advertising

Facebook, Instagram, and TikTok offer large audiences at costs often 50-70% below search.

Platform Characteristics

Facebook and Instagram provide strong demographic targeting, life event triggers (new car, moving, marriage), and retargeting capabilities. TikTok reaches younger demographics with lower CPMs but requires native creative formats. LinkedIn serves B2B insurance (commercial lines) with higher CPCs but targeted professional audiences.

Typical Benchmarks

Facebook CPL for insurance runs $20-40 compared to $60-100 for Google, while TikTok CPL ranges from $15-30 though remains variable as the platform matures. Intent level is lower than search since social advertising interrupts rather than responds to active search.

Creative Requirements

Social advertising requires constant creative refresh. Ad fatigue sets in quickly – plan for new creative variations every 2-4 weeks.

Native Advertising

Native ad networks (Taboola, Outbrain, Revcontent) place sponsored content on publisher sites. These platforms serve specific use cases: scaling beyond search capacity, powering content-driven acquisition funnels, geographic or demographic targeting, and lower-funnel retargeting.

Typical performance shows CPC of $0.50-2.00, CTR of 0.1-0.4%, and conversion rates often lower than search (1-4%). Quality varies highly by publisher. Native traffic requires extensive testing and optimization since quality varies dramatically across publishers within the same network.

Affiliate Traffic

Working with affiliate publishers who generate traffic on your behalf opens another scaling channel.

Affiliate Model Structures

Three primary compensation models structure affiliate relationships. Revenue share arrangements have affiliates earn a percentage of lead revenue (30-50%). Flat CPL models offer fixed payment per qualified lead ($20-50). Tiered performance structures provide higher rates for higher volumes or quality.

Affiliate Management Requirements

Successful affiliate programs require clear compliance guidelines and monitoring, creative approval processes, quality tracking by affiliate, and payment processing with fraud prevention.

Advantages and Risks

Affiliates provide scale without upfront traffic acquisition costs. However, quality control is challenging. Affiliate-generated traffic often has higher fraud rates and lower conversion quality. Rigorous monitoring and quick termination of underperforming affiliates is essential.

Compliance and Legal Requirements

Insurance comparison sites operate under multiple regulatory frameworks. Non-compliance creates legal liability that can destroy profitable operations.

TCPA Compliance

The Telephone Consumer Protection Act governs how consumers can be contacted.

Core Requirements

TCPA compliance demands Prior Express Written Consent (PEWC) before autodialed calls or texts, clear and conspicuous disclosure of what consumers agree to, identification of parties who may contact the consumer, acknowledgment that consent cannot be a condition of service, and honoring of consumer revocation rights.

Implementation Requirements

Your forms must capture affirmative consent through an unchecked checkbox with disclosure language meeting FCC requirements. Pre-checked boxes do not constitute valid consent.

Consent Documentation

Implement TrustedForm or Jornaya to create independent third-party documentation of consent capture. These services record session replays showing exactly what consumers saw and clicked. This documentation has been accepted by courts as evidence of consent and is required by most sophisticated lead buyers.

Penalty Exposure

The stakes are severe: $500-$1,500 per violation (per call or text), with class action multiplication across thousands of contacts. Average TCPA settlement runs $6.6 million. In 2024, TCPA filings reached 2,788 cases – a 67% increase year-over-year.

State Insurance Regulations

Insurance is primarily regulated at the state level.

Licensing Considerations

Most states do not require insurance licenses for pure lead generation (connecting consumers with licensed agents). However, the line blurs when forms provide specific quotes, when sites make coverage recommendations, or when operators discuss policy details. Some states define “solicitation” broadly. Consult with insurance regulatory counsel before operations begin.

Advertising Requirements

Many states require specific disclosures in insurance advertising. Rate claims may require carrier authorization, and comparative statements face regulatory scrutiny. Some states require disclaimers about lead selling practices.

Privacy and Data Protection

Consumer data protection requirements span multiple jurisdictions.

CCPA/CPRA (California)

California’s privacy laws grant consumers the right to know what data is collected, the right to delete personal information, the right to opt out of data sales, and require specific privacy policy disclosures.

State Privacy Laws

Multiple states have enacted comprehensive privacy laws with varying requirements. Virginia, Colorado, Connecticut, Utah, and others have laws in effect or coming into effect.

Implementation

Meeting these requirements demands a comprehensive privacy policy disclosing data practices, mechanisms for consumer rights requests, data retention and deletion policies, and vendor and buyer data processing agreements.

Carrier Compliance Standards

Beyond regulatory requirements, carriers impose additional standards.

Most carriers have strict guidelines about using their names, logos, and products in marketing materials. Many require specific consent language and documentation standards beyond regulatory minimums. Carriers specify lead quality requirements including valid contact rates, duplicate thresholds, and return limits. Some carrier agreements restrict working with competitors or require certain distribution terms.

Analytics and Performance Optimization

Data-driven optimization separates successful comparison sites from expensive experiments.

Essential Metrics

The following metrics form the foundation of comparison site optimization.

Traffic and Acquisition Metrics

| Metric | Definition | Target |

|---|---|---|

| Cost per visitor | Total traffic cost / visitors | Varies by source |

| Traffic quality score | Composite of bounce rate, time on site, pages/session | Varies by source |

| Source attribution | Traffic origin tracking | 100% attributed |

Conversion Metrics

| Metric | Definition | Target |

|---|---|---|

| Form start rate | Visitors who begin form / total visitors | 40-60% |

| Step completion rates | Users completing each step / users starting step | 70-95% |

| Overall conversion rate | Completed leads / visitors | 6-12% |

| Mobile conversion rate | Mobile leads / mobile visitors | 5-10% |

Revenue Metrics

| Metric | Definition | Target |

|---|---|---|

| Revenue per lead (RPL) | Total revenue / leads | $80-150+ |

| Revenue per visitor (RPV) | Total revenue / visitors | $6-12+ |

| Sell-through rate | Leads sold / leads generated | 85-95% |

| Return rate | Leads returned / leads sold | Under 8% |

Quality Metrics

| Metric | Definition | Target |

|---|---|---|

| Valid phone rate | Valid phones / total leads | Over 95% |

| Duplicate rate | Duplicates / total leads | Under 3% |

| Contact rate | Leads contacted / leads sold | Over 50% |

| Buyer satisfaction | Buyer ratings and feedback | Varies |

Attribution and Source Analysis

Understanding which traffic sources generate profitable leads requires proper attribution.

Source-Level Tracking

Track every metric at the source level. A traffic source with $5 CPL and 15% return rate outperforms a source with $4 CPL and 25% return rate despite the higher acquisition cost.

Attribution Models

Last-click attribution works for most comparison sites because the conversion window is short. For longer consideration cycles or multi-touch journeys, consider multi-touch attribution models.

Revenue Attribution

Connect lead revenue back to traffic source. This requires tracking leads from acquisition through distribution and payment. Most lead distribution platforms provide this tracking; ensure it integrates with your analytics.

Testing Framework

Systematic testing drives continuous improvement.

What to Test (Priority Order)

Focus testing efforts in priority order: form flow (step count, question sequence), form fields (which questions, field types), landing page headlines and value propositions, trust signals (which badges, placement), button text and design, and mobile-specific optimizations.

Testing Protocol

Rigorous protocol ensures valid results. Calculate required sample size before launching tests. Run tests to completion regardless of intermediate results. Require 95% statistical confidence before declaring winners. Document learnings from both winners and losers.

Expected Success Rate

Research suggests approximately one in eight A/B tests produces statistically significant results. Build testing into ongoing operations rather than expecting every test to win.

Scaling Your Comparison Site Operation

Moving from initial launch to scaled operation requires addressing specific challenges:

Traffic Scaling

Traffic scaling follows three paths. Horizontal expansion adds additional traffic sources beyond initial channels, opens new geographic markets within your existing vertical, and deploys seasonal campaigns during high-demand periods. Vertical expansion adds additional insurance types (home, life, health), adjacent verticals (mortgage, solar), and different consumer segments. Efficiency scaling automates bid management and optimization, builds creative production systems for continuous testing, and implements quality monitoring automation.

Operational Infrastructure

As volume increases, you need dedicated account managers for major buyer relationships, a quality assurance team for lead review and fraud detection, a technical team for integration maintenance and development, and a compliance team for regulatory monitoring and documentation.

Technology investments follow: real-time monitoring dashboards, automated alerting for anomalies, lead scoring and quality prediction, and fraud detection systems.

Team Structure

Team structure evolves with volume.

Initial Team (Under 5,000 Leads/Month)

At launch, the founder/operator handles all functions with part-time technical support and outsourced compliance review.

Growth Team (5,000-25,000 Leads/Month)

The growth phase adds a full-time traffic/marketing lead, part-time developer or technical contractor, dedicated buyer relationship management, and compliance consultation.

Scale Team (25,000+ Leads/Month)

At scale, you need a marketing team (paid acquisition, SEO, creative), development team (platform, integrations), operations team (quality, buyer relations), compliance function, and finance/analytics.

Frequently Asked Questions

What is the minimum investment needed to start an insurance comparison site?

Starting a basic insurance comparison site requires $15,000-$50,000 for initial development, compliance setup, and traffic testing. This covers landing page development, form integration, lead distribution platform subscription, consent capture services, initial traffic acquisition testing, and legal review of compliance documentation. Operators using existing platforms (Unbounce + boberdoo) can launch at the lower end; custom development approaches require more capital. Most new operations require 6-12 months and $50,000-$100,000 total investment before reaching sustainable profitability.

How long does it take to become profitable?

Most insurance comparison sites require 6-12 months to reach profitability. The first 3-4 months typically focus on form optimization and conversion rate improvement. Months 4-8 focus on traffic acquisition optimization and buyer relationship development. Profitability depends on achieving conversion rates above 6% and revenue per lead above $70 while maintaining traffic acquisition costs below $5 per visitor. Sites with experienced practitioners and existing buyer relationships may accelerate this timeline; sites entering competitive markets without existing relationships may take longer.

What conversion rate should I expect from an insurance comparison site?

Industry benchmarks show 6-12% conversion rates for well-optimized insurance comparison sites, varying by traffic source and visitor intent. Paid search traffic typically converts at 8-12%; social traffic converts at 4-8%; organic traffic converts at 10-15%. Mobile conversion rates typically run 1-2 percentage points lower than desktop. Conversion rates below 5% indicate significant optimization opportunities; rates above 15% are exceptional and may indicate issues with lead quality or data accuracy.

How do I get carriers to integrate with my site?

Building direct carrier relationships requires demonstrating traffic quality, compliance infrastructure, and technical capability. Start by working with lead aggregators (MediaAlpha, EverQuote) who provide access to carrier demand without direct relationships. As you build volume and quality reputation, approach carrier business development teams with data showing your traffic performance. The typical timeline from initial outreach to live integration is 3-6 months for carriers who agree to partner. Smaller carriers and specialty markets often move faster than major national carriers.

What is the difference between ping/post and direct carrier integration?

Ping/post distribution sends lead information to buyers through a real-time auction system where buyers bid for leads matching their criteria. This approach maximizes competition and revenue but does not provide consumers with actual quotes. Direct carrier integration connects to carrier rating APIs to display actual premium quotes consumers could receive. This approach delivers better consumer experience but requires technical integration and carrier relationships. Many successful sites combine both approaches: ping/post for monetization, direct integration for consumer-facing quote display.

How do I handle TCPA compliance on a comparison site?

TCPA compliance requires capturing valid Prior Express Written Consent through clear disclosure and affirmative consumer action. Implement unchecked checkboxes with disclosure language identifying who may contact the consumer, that calls may use automated technology, and that consent is not required for purchase. Use TrustedForm or Jornaya to document consent capture. Retain consent documentation for at least five years. Have compliance counsel review all consent language before launch. The average TCPA settlement exceeds $6.6 million – compliance is not optional overhead.

What revenue per lead should I expect for auto insurance leads?

Revenue per lead for auto insurance comparison sites ranges from $80-200+ depending on distribution model and lead quality. Shared distribution to 3-5 buyers typically generates $80-150 total revenue per lead. Exclusive distribution generates $50-100 per lead but only one sale. Live transfer leads (real-time phone connection) command $100-200+. Higher-quality leads with clean driving records, preferred demographics, and documented consent command premium pricing. Revenue varies seasonally and with carrier advertising cycles.

How do I differentiate from established comparison sites like EverQuote?

Differentiation strategies for new comparison sites include: vertical specialization (focus on specific insurance types like classic car insurance or high-risk drivers), geographic focus (dominate specific states or regions), demographic targeting (young drivers, seniors, military), superior consumer experience (faster quotes, better comparison tools), content authority (educational resources, buying guides), or technology innovation (AI-powered recommendations, chat-based interfaces). Direct competition with established players on their core markets is difficult; finding underserved niches creates opportunity.

What are the biggest mistakes new comparison site operators make?

Common mistakes include: launching without proper TCPA compliance infrastructure (creating massive liability exposure), underestimating traffic acquisition costs (profitable CPAs are harder to achieve than projections suggest), inadequate form optimization before scaling traffic (converting 4% instead of 8% doubles acquisition costs), failing to track source-level performance (averaging hides which sources are profitable), poor buyer relationship management (returns destroy margins), and underinvesting in mobile experience (where 70%+ of traffic originates). Most failures stem from scaling traffic before optimizing the conversion funnel.

How do I handle returns from lead buyers?

Return management requires proactive quality control and responsive dispute resolution. Implement phone and email validation before leads enter distribution to reduce invalid contact returns. Track return rates by traffic source and buyer to identify patterns. Establish clear return policies with buyers upfront, including eligible return reasons and documentation requirements. Investigate return patterns quickly – sustained return rates above 12% indicate quality problems requiring source-level remediation or termination. Some returns are unavoidable; excessive returns indicate operational problems.

What technology platform should I use for my comparison site?

Platform selection depends on technical capability and scale ambitions. For practitioners without development resources, combinations like Unbounce (landing pages) + boberdoo or LeadsPedia (distribution) provide turnkey solutions with monthly costs of $500-$2,000. For practitioners with development capability, custom WordPress or React front-ends with API integration to distribution platforms offer more flexibility. At scale (50,000+ leads monthly), custom-built platforms may provide cost advantages and competitive differentiation. Most successful operators start with proven platforms and selectively build custom components as specific needs emerge.

Key Takeaways

-

The comparison site model generates substantial revenue when executed correctly. EverQuote and MediaAlpha demonstrate the market opportunity with $500.2M and $864.7M in respective 2024 revenues. The model works at every scale from bootstrapped operators to enterprise platforms.

-

Revenue per visitor (RPV) is your master metric. RPV = Conversion Rate x Revenue Per Lead. At 8% conversion and $100 RPL, your RPV is $8 – which sets your maximum profitable traffic acquisition cost. Optimize both variables relentlessly.

-

Multi-step forms convert 86% higher than single-page alternatives. Strategic question sequencing – low-friction questions first, contact information last – leverages progressive commitment psychology to maximize completion rates.

-

Mobile traffic exceeds 70% but converts lower than desktop. Design mobile-first with thumb-friendly inputs, appropriate keyboard types, and minimal scrolling. Closing the mobile conversion gap represents significant revenue opportunity.

-

Ping/post distribution drives primary monetization. More buyers create more competition and higher bids. Build relationships across carrier types – direct carriers, independent agents, agency networks – to maximize buyer coverage.

-

TCPA compliance is existential, not optional. With 2,788 cases filed in 2024 (67% increase year-over-year) and average settlements exceeding $6.6 million, consent documentation through TrustedForm or Jornaya is essential infrastructure.

-

Return rate management determines profitability. Returns directly reduce net revenue. Implement validation services, track returns by source, and address quality problems quickly. Target return rates under 8%.

-

Track everything at the source level. Average metrics hide reality. A traffic source with higher CPL but lower returns may be more profitable than a cheaper source with quality problems. Source-level analysis drives optimization decisions.

-

Plan for 6-12 months to profitability. Most comparison sites require sustained investment before reaching positive unit economics. Budget for form optimization, traffic testing, and buyer relationship development before expecting returns.

Sources

- MediaAlpha Investor Relations - Publicly traded insurance lead exchange reporting $864.7M revenue and $1.5B transaction value for 2024

- Allstate Investors - Carrier financial disclosures including marketing spend trends

- TrustedForm by ActiveProspect - Consent documentation platform providing independent verification of lead capture consent for TCPA compliance

- Verisk (Jornaya) - LeadiD platform for consent verification and cross-publisher lead journey tracking

- WebRecon LLC - TCPA litigation tracking reporting 2,788 cases filed in 2024 and settlement data averaging $6.6M

- boberdoo - Lead distribution platform supporting ping/post auction protocols

- LeadExec - Scalable, automated lead capture, validation, routing, and distribution platform

- LeadsPedia - Lead management and distribution platform for comparison site operators

The comparison site model combines consumer utility with lead generation economics. Practitioners who build conversion-focused platforms, maintain compliance discipline, and develop strong buyer relationships build sustainable businesses. Those who chase shortcuts – cutting compliance corners, accepting poor traffic quality, or extracting maximum short-term revenue at the expense of consumer experience – create liability and destroy long-term value. The market rewards operators who get the details right.