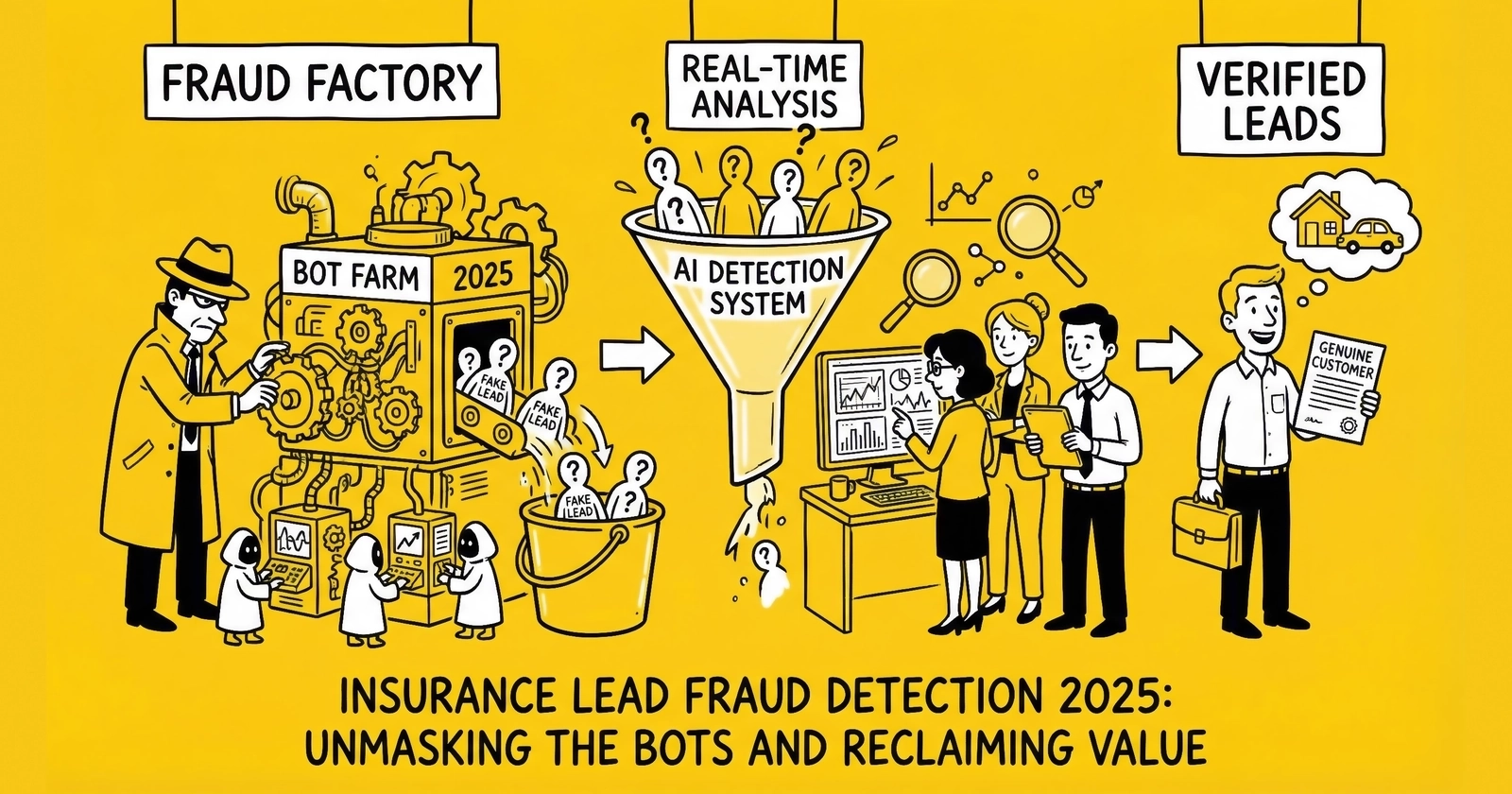

Master the detection, prevention, and response strategies for insurance lead fraud. Learn the fraud patterns targeting your operation, the technology stack that stops them, and the ROI calculations that justify prevention investment.

Insurance leads represent the highest-value segment of the lead generation industry. When a single auto insurance lead sells for $40-100 and Medicare leads reach $80-150 during enrollment periods, fraudsters follow the money. The same characteristics that make insurance the bellwether vertical for lead generation – high transaction values, sophisticated distribution technology, and intense buyer demand – also make it the most attractive target for fraud.

The scale of the problem is staggering. Industry research consistently shows that 25-30% of third-party insurance leads contain fraudulent or materially problematic data. At an estimated $5.2-6.8 billion in annual insurance lead transaction value, fraud represents a $1.3-2.0 billion annual drain on the ecosystem. This is not a marginal issue affecting the unlucky few. It is a structural feature of the market that every operator must address.

Those who thrive in insurance lead generation are those who invest in fraud prevention as margin protection rather than viewing it as a cost center. They understand that every fraudulent lead caught before purchase saves not just the lead cost, but the downstream costs of sales team time, buyer chargebacks, relationship damage, and potential compliance exposure.

This guide provides the complete framework for insurance lead fraud: the patterns targeting your operation, the detection signals that reveal them, the technology stack that prevents them, and the response protocols that minimize damage when fraud gets through.

The Insurance Lead Fraud Landscape

Understanding the fraud landscape requires examining both the macro-level statistics and the specific patterns that target insurance leads. The same market dynamics that create opportunity for legitimate operators create opportunity for fraudsters.

The $84 Billion Fraud Problem

According to Juniper Research and Statista, global digital advertising fraud losses reached $84 billion annually by 2023, with projections exceeding $100 billion by 2026. This represents roughly 22% of total digital advertising spend flowing to clicks, impressions, and leads that never had a real human behind them.

For insurance lead generation specifically, the problem concentrates in third-party lead flows. When you buy leads from affiliates, networks, or aggregators, industry data suggests roughly one in three has problems ranging from complete fabrication to technically-valid-but-commercially-worthless submissions. Understanding ping/post systems helps you recognize where in the distribution chain fraud can enter.

The insurance vertical faces elevated fraud exposure for structural reasons:

High lead values create concentrated incentives. A fraudster generating 1,000 fake auto insurance leads at $50 each extracts $50,000. The same operation targeting $5 retail leads yields only $5,000. Fraud naturally gravitates toward the highest-value verticals, and insurance sits at the top.

Complex distribution chains obscure attribution. Insurance leads often flow through multiple intermediaries – from publisher to aggregator to network to buyer. Each handoff creates opportunity for fraud injection and reduces visibility into lead origins. By the time a fraudulent lead reaches the final buyer, attribution to the original source may be impossible.

Delayed conversion feedback enables undetected fraud. Insurance sales cycles run days to weeks, not minutes. A fraudster can inject thousands of leads before conversion data reveals the pattern. Compare this to e-commerce, where bots do not complete purchases and fraud becomes immediately visible.

Seasonal demand spikes create cover. During Medicare Annual Enrollment Period (October 15-December 7), lead volume surges 300-500%. Fraudsters exploit this volume to hide fraudulent leads within the noise. Quality monitoring that works during steady-state periods may miss fraud patterns obscured by legitimate volume spikes.

Why Insurance Lead Fraud Persists

Three structural factors make insurance lead fraud persistent and profitable despite industry awareness:

Asymmetric information. The generator knows exactly how a lead was produced. The buyer knows only what data appears on their screen. This information gap creates opportunity for fraud that goes undetected until conversion data reveals the problem – days, weeks, or months later.

Volume-based incentives. Most lead generation compensation structures reward volume. Affiliates earn on leads delivered, not leads converted. This creates rational incentive to maximize volume even at quality’s expense. Fraudulent leads cost less to produce than legitimate ones, and the commission structure rewards quantity over quality.

Detection costs. Comprehensive fraud detection requires investment in technology, staff, and process. Many practitioners calculate that some fraud is cheaper to absorb than to prevent. This calculation often proves wrong when buyer relationships deteriorate, but the initial logic persists in operations focused on short-term metrics.

The True Cost of Insurance Lead Fraud

Beyond direct losses, insurance lead fraud carries hidden costs that multiply the financial impact:

| Cost Category | Description | Typical Impact |

|---|---|---|

| Direct Lead Cost | Payment for leads that never had conversion potential | $40-150 per fraudulent lead |

| Sales Team Time | Agents spending 8-15 minutes attempting contact with fake leads | $25-50 per lead in labor |

| Buyer Chargebacks | Returns and credits when buyers identify fraud | 100% of lead cost plus relationship damage |

| Reputation Damage | Buyers reduce spend or terminate relationships | Revenue loss of 20-50% from affected buyers |

| Compliance Exposure | TCPA liability for calls to fabricated consent | $500-1,500 per violation in settlements |

| Data Pollution | Analytics and optimization based on fraudulent signals | Misallocated marketing spend, degraded targeting |

| Return Rate Inflation | Increased returns erode margins across all leads | 2-5% margin compression |

A single fraudulent Medicare lead at $100 CPL represents far more than $100 in loss. The agent who spends 12 minutes attempting contact, the marketing optimization that incorrectly attributes campaign success, the buyer relationship strained by quality complaints – these compound the direct financial hit into losses of $200-300 or more per fraudulent lead.

Insurance Lead Fraud Patterns: Know Your Enemy

Fraud targeting insurance leads takes multiple forms, each requiring different detection approaches. Understanding these categories helps you build targeted defenses rather than generic filters that miss sophisticated attacks.

Bot-Generated Leads

Automated software programs generate fake insurance leads at scale, representing the most common form of fraud. Modern bots have evolved far beyond simple scripts that complete forms instantly with random data.

Sophisticated Bot Characteristics

Today’s bots exhibit human-like timing, pausing between keystrokes, scrolling pages naturally, and completing forms at realistic speeds that defeat simple timing analysis. They generate realistic mouse movements with curved paths and micro-corrections that mimic human behavior, neutralizing basic behavioral detection. These bots cycle through rotating identities using stolen or synthetic personal information, submitting forms with different names, addresses, and phone numbers that individually pass validation. Rather than using datacenter IPs, sophisticated operations route traffic through residential proxy networks – IP addresses purchased from compromised consumer devices that defeat IP-based detection. Browser fingerprint spoofing randomizes configurations to make each submission appear as a unique device, circumventing fingerprinting defenses.

Insurance-Specific Bot Patterns

Insurance-focused bots employ specialized tools: VIN generators that create plausible vehicle identification numbers, address databases that pair real streets with realistic but non-existent addresses, phone number pools using recently ported or recycled numbers, and pre-filled data fields using information harvested from data breaches.

Bot-generated leads typically account for 30-40% of detected fraud in insurance lead flows. Detection requires multiple overlapping signals because bots that defeat one detection method may fail another.

Human Fraud Farms

Human fraud farms employ real people to fill out insurance lead forms manually, bypassing nearly all automated bot detection. Workers, often located in regions with low labor costs, receive small payments for each form completed.

These operations produce leads with real typing patterns and natural interaction behavior, valid phone numbers (often prepaid or VoIP), functional email addresses, realistic form completion timing, and no bot signatures or automation indicators. The leads look authentic on paper and pass most validation checks. The phone numbers ring. The emails exist. But the consumers have no genuine interest in insurance and were paid pennies to submit their information.

Fraud farms represent approximately 15-25% of insurance lead fraud. Detection requires velocity analysis across the source or IP range, geographic clustering detection, cross-referencing against known fraud farm phone number pools, and post-delivery conversion analysis revealing systematic non-conversion patterns.

Synthetic Identity Fraud

Synthetic identity fraud combines real and fabricated information to create fictitious personas that pass individual validation checks. A fraudster might pair a legitimate phone number with a fabricated name and address, or use real consumer data obtained from data breaches without that consumer’s knowledge.

Common patterns include real phone numbers paired with fabricated names, legitimate addresses with incorrect resident names, valid SSN ranges paired with mismatched demographic data, and email addresses that deliver but were created specifically for fraud.

The Liability Danger

Synthetic identity fraud carries the highest compliance risk because individual data elements validate successfully. The phone number is real and may answer. The email exists. But the person described by combining these elements either does not exist or never consented to contact.

When agents call these leads, they may reach real people who never requested insurance information – creating TCPA exposure with every dial. Synthetic identity fraud represents 10-15% of insurance lead fraud but creates disproportionate compliance risk.

Recycled and Aged Leads Sold as Fresh

Perhaps the most common fraud in insurance lead distribution: old leads repackaged with fresh timestamps and sold at premium pricing. A lead captured six months ago gets a new date and enters the market as if just generated.

Why Recycled Leads Fail

Lead value decays predictably. Industry data shows leads lose approximately 10% of their value every hour without contact. By day two, conversion probability has dropped 50%. By week two, conversion probability approaches zero. A six-month-old lead sold as fresh has near-zero conversion potential while commanding fresh-lead pricing.

Recycling patterns in insurance include aged Medicare leads resold during enrollment periods, auto insurance leads recycled when carrier advertising surges, duplicate detection database rotations that reset “uniqueness” status, and cross-vertical recycling where home insurance leads get resold as auto leads to different buyers.

Recycled leads represent 20-30% of insurance lead fraud. Detection requires historical matching against phone numbers, emails, and device fingerprints; consent certificate timestamp validation through TrustedForm or Jornaya; attention to consumer complaint patterns (“I filled this out months ago”); and cross-network deduplication services.

Incentivized Leads

Incentivized leads occur when consumers’ primary motivation was receiving something of value – gift cards, contest entries, cash payments – rather than genuine interest in insurance. These leads are not necessarily fake: real humans with real contact information submit them. But their intent is fundamentally misaligned with buyer expectations.

Telltale characteristics include unusually high form completion rates (everyone fills out the form) paired with unusually low conversion rates (no one actually wants insurance). You will often see volume spikes from specific sources, geographic clustering suggesting coordinated campaigns, and email patterns indicating throwaway addresses.

The Quality Trap

Incentivized leads may pass all technical validation and appear legitimate until sales teams attempt conversion. Contact rates may be acceptable, but conversion rates plummet because the consumer never wanted insurance – they wanted the incentive.

Incentivized traffic accounts for 10-20% of insurance lead quality issues and can be particularly damaging because high volumes of technically-valid-but-commercially-worthless leads erode buyer trust over time.

Detection Signals: Building Your Early Warning System

Effective insurance lead fraud detection combines multiple signals, each providing partial information that together reveals patterns humans cannot identify in real-time.

IP Intelligence Analysis

Every insurance lead submission originates from an IP address carrying rich contextual information. IP analysis provides the first layer of fraud detection.

Critical IP Signals

| Signal | Legitimate Pattern | Fraud Indicator |

|---|---|---|

| IP Type | Residential ISP | Datacenter, VPN, proxy |

| Geographic Match | IP near stated address | Different state/country |

| Request Velocity | Single submission | Multiple submissions per minute |

| Blacklist Status | Clean reputation | Known fraud source |

| ASN Reputation | Consumer ISP | Hosting provider, anonymization service |

| Carrier Match | ISP matches phone area code | Geographic inconsistency |

Insurance-Specific Considerations

Medicare leads with IPs outside the service area of quoted plans warrant immediate scrutiny. Auto insurance leads with VPN indicators may be legitimate – consumers sometimes hide location for rate shopping reasons – but they still merit additional verification. Health insurance leads with datacenter IPs during enrollment periods signal elevated fraud attempts, as fraudsters exploit seasonal volume to hide within legitimate traffic.

Datacenter IPs are not always fraudulent – legitimate users on corporate networks or VPNs may show datacenter origins. But datacenter traffic warrants additional scrutiny, especially when combined with other risk signals.

Device Fingerprinting

Beyond IP addresses, device fingerprinting captures hardware and software characteristics that identify unique devices across sessions. Core fingerprinting elements include browser type, version, and installed plugins; screen resolution and color depth; installed fonts and language settings; Canvas and WebGL rendering signatures; audio context fingerprints; and timezone and system clock characteristics.

What Fingerprinting Reveals

A legitimate consumer typically uses one or two devices to submit insurance forms. A fraudster submitting hundreds of fake leads needs to mask this – and device fingerprinting catches the attempt.

Fraudsters can spoof individual fingerprint elements, but spoofing everything consistently is difficult. A browser claiming to be Chrome on Windows that renders canvas like Safari on macOS creates a fingerprint mismatch that flags the submission.

Modern device fingerprinting correctly identifies unique devices 95-99% of the time across sessions. Cross-browser fingerprinting (identifying the same device across Chrome and Firefox) remains challenging, and iOS privacy features reduce accuracy on Apple devices.

Form Completion Timing

Humans fill out insurance forms at predictable speeds. Reading a question about vehicle information, recalling the VIN, and typing it takes time. Bots complete forms either instantly (no reading required) or with suspiciously consistent timing (programmed delays that lack natural variation).

Insurance Form Timing Benchmarks

| Form Type | Minimum Human Time | Fraud Indicator |

|---|---|---|

| Basic auto quote (5-7 fields) | 20-30 seconds | Under 12 seconds |

| Full auto application (15-20 fields) | 60-90 seconds | Under 30 seconds |

| Medicare qualification (10-12 fields) | 45-60 seconds | Under 20 seconds |

| Home insurance quote (12-15 fields) | 50-75 seconds | Under 25 seconds |

Timing analysis should capture not just total completion time but keystroke dynamics. Humans type with irregular rhythm – faster on familiar sequences like zip codes, slower when looking up VIN information. Bots type with machine precision unless specifically programmed to introduce variability.

Behavioral Pattern Analysis

The most sophisticated fraud detection analyzes entire user sessions, not just form submissions. How did the user arrive at the insurance form? What did they do before completing it? How did their mouse move?

Behavioral Signals for Insurance Lead Fraud

Legitimate insurance shoppers often compare multiple pages, read about coverage options, and return to forms – their navigation paths show genuine exploration. Bots proceed directly to forms with no browsing. When moving through pages, humans move cursors in curved paths with micro-corrections while bots move in straight lines or teleport between form fields. Humans scroll in varied increments, pausing on content; bots scroll uniformly or not at all. Click patterns reveal similar distinctions: humans click with slight positional variation while bots click exact pixel coordinates.

Session duration provides another signal. Legitimate shoppers spend time reading coverage explanations while bots complete journeys in seconds. Multi-tab behavior also differentiates real users from automated systems – legitimate shoppers often open multiple tabs to compare insurers while bots typically operate in single-tab mode.

Modern behavioral analysis platforms build risk scores from dozens of these signals, creating confidence intervals around submissions rather than binary accept/reject decisions.

Cross-Reference Validation

Insurance lead fraud detection benefits from cross-referencing lead data against multiple external sources.

Phone ownership verification asks whether the submitted name matches the phone number’s registered owner – services like Ekata, Plaid, and Melissa provide identity graph matching for this purpose. Address validation confirms whether the address exists, whether it is residential, and whether the claimed resident matches public records. For auto insurance, vehicle verification determines if the VIN corresponds to a real vehicle matching the stated make, model, and year. Some states offer DMV record access for license verification as an additional identity confirmation layer. Credit header matching checks whether the combination of name, address, and phone appears in credit bureau headers without pulling actual credit reports.

Cross-reference validation catches synthetic identity fraud that creates valid individual data elements in invalid combinations. The phone number is real, but it belongs to someone else. The address exists, but the stated resident moved two years ago.

Fraud Detection Technology Stack

Building fraud prevention capability for insurance leads requires technology investment across three layers: prevention (stopping fraud before it enters), detection (identifying fraud that gets through), and remediation (handling discovered fraud appropriately).

Layer 1: Prevention Technologies

Bot Management Platforms

Enterprise solutions like Cloudflare Bot Management, Akamai Bot Manager, and DataDome analyze traffic patterns at the edge, blocking known bots and challenging suspicious traffic before it reaches your insurance forms. These platforms cost $2,500-$50,000+ annually depending on traffic volume and achieve 90-95% bot detection rates. They work best for publishers and generators with significant direct traffic.

CAPTCHA and Challenge Systems

reCAPTCHA v3, hCaptcha, and similar services provide first-line defense. Modern CAPTCHAs score visitor behavior invisibly, flagging suspicious users for additional challenges while passing legitimate traffic through frictionlessly. Basic tiers are free, with advanced features running $1-3 per 1,000 assessments. Effectiveness varies: these systems stop 60-80% of basic bot traffic, though sophisticated bots increasingly defeat CAPTCHA systems. Deploy them as basic protection on all insurance lead forms.

Honeypot Fields

Hidden form fields that legitimate users never see but bots automatically complete provide a simple but effective defense. Any submission containing data in the honeypot field is automatically fraudulent. Implementation costs nothing and catches 10-20% of unsophisticated bots – baseline protection that belongs on every form.

Layer 2: Detection Technologies

Lead Verification Services

Services like TrustedForm, Jornaya (now Verisk), and dedicated verification platforms validate insurance leads in real-time as they are captured or received.

TrustedForm creates independent verification of consumer consent by recording form interactions, capturing consent language display, and generating certificates that document compliant generation. TrustedForm Insights provides 22 proprietary data points per lead for behavioral analytics and fraud detection, identifying bot activity, form manipulation, and suspicious patterns. ActiveProspect reports identifying over 200,000 bots weekly across the TrustedForm network. Costs range from $0.10-$0.50 per lead depending on verification depth, with effectiveness catching 70-85% of fraudulent leads when properly configured.

Jornaya (Verisk) tracks consumer shopping behavior across 40,000+ publisher websites, providing visibility into whether a consumer has been shopping across multiple insurance sites. This cross-network visibility enables fraud pattern detection unavailable from single-publisher analysis – including identification of “over-shopped” leads (consumers who have submitted dozens of forms) and coordinated fraud attempts visible only at network scale. At $0.10-$0.30 per lead, Jornaya delivers unique cross-publisher intelligence for fraud detection.

Device Intelligence Platforms

Fingerprint.js, HUMAN (formerly White Ops), and similar platforms provide device-level intelligence – identifying unique devices, detecting emulators, and flagging known fraud devices. Costs run just $0.001-$0.01 per identification with 95%+ device identification accuracy.

Identity Verification Services

For high-value insurance leads, identity verification services validate that submitted information represents a real, reachable person. Ekata (Mastercard subsidiary), Plaid, and Alloy check public records, phone ownership, and email/address associations. At $0.15-$2.00 per verification, these services catch 90%+ of synthetic identity fraud. They make economic sense for Medicare and high-value life insurance leads where individual lead values exceed $75-100.

Phone Validation Services

Phone validation goes beyond checking whether a number is technically valid to provide fraud-relevant intelligence. Line type detection distinguishes mobile, landline, or VoIP – and non-fixed VoIP numbers (Google Voice, TextNow) correlate with 3-5x higher fraud rates than mobile numbers. Carrier identification flags prepaid carriers and certain VoIP providers that correlate with elevated fraud risk. Number age analysis identifies very new numbers that may indicate recently activated devices for fraud purposes. Porting history reveals numbers ported multiple times, which may indicate fraud or number recycling.

Services like Twilio Lookup, Telnyx, and Melissa provide this intelligence at $0.01-$0.05 per lookup.

Layer 3: Remediation Technologies

Lead Scoring and Routing

Platforms like Boberdoo, LeadsPedia, and LeadConduit score leads based on fraud signals, routing high-risk leads to manual review queues rather than immediate rejection or distribution. Multi-tier routing based on fraud scores enables differentiated handling.

| Score Range | Classification | Recommended Action |

|---|---|---|

| 0-30 | High Risk | Reject or manual review queue |

| 31-60 | Medium Risk | Enhanced verification before distribution |

| 61-80 | Low Risk | Standard processing with monitoring |

| 81-100 | Minimal Risk | Priority delivery to premium buyers |

Return Management Systems

When buyers dispute insurance lead quality, systems must track patterns, aggregate claims by source, and provide evidence for discussions with traffic suppliers. Return reason analysis distinguishes legitimate quality issues from buyer cherry-picking.

Fraud Alert Integration

Real-time fraud alerts should route to appropriate response workflows: automatic rejection at high confidence levels, escalation to fraud review at moderate levels, and evidence preservation for all flagged submissions.

Recommended Stack by Operation Size

Startup Operations (Under 5,000 leads/month)

Start with a basic stack combining reCAPTCHA v3, honeypot fields, and phone validation. This runs $0.05-$0.10 per lead and catches 60-70% of fraud – adequate protection while you build volume and learn your traffic patterns.

Mid-Market Operations (5,000-50,000 leads/month)

Deploy a standard stack adding bot management, TrustedForm or Jornaya, and device fingerprinting to your phone validation. At $0.15-$0.30 per lead, this investment catches 75-85% of fraud and provides the documentation needed for buyer quality discussions.

Enterprise Operations (50,000+ leads/month)

Build an enterprise stack incorporating all standard components plus identity verification, custom fraud rules, and dedicated fraud analysis resources. At $0.30-$0.50 per lead, this investment catches 85-95% of fraud – the level of protection required when monthly lead volume represents seven-figure revenue exposure.

The ROI of Insurance Lead Fraud Prevention

Fraud prevention costs must be evaluated against fraud losses. The math is straightforward but often miscalculated because operators consider only direct lead costs, not downstream impacts.

Calculating Fraud Prevention ROI

Formula:

Prevention ROI = (Fraud Loss Prevented - Detection Cost) / Detection CostExample: Auto Insurance Lead Operation

- Monthly lead volume: 10,000 leads

- Average CPL: $50

- Pre-detection fraud rate: 25%

- Detection rate: 80% (of fraud caught)

- Detection cost: $0.20 per lead

Calculation:

- Fraudulent leads (25%): 2,500

- Fraud detected (80%): 2,000 leads

- Fraud loss prevented: 2,000 x $50 = $100,000

- Detection cost: 10,000 x $0.20 = $2,000

- Net savings: $100,000 - $2,000 = $98,000

- ROI: 4,900%

The math shows why fraud prevention is non-negotiable at scale. A $0.20 investment per lead returns $49 in fraud prevention for every dollar spent.

Medicare Lead Fraud Prevention ROI

Medicare leads during enrollment periods command $80-150 pricing, making fraud prevention even more critical:

- Monthly volume during AEP: 8,000 leads

- Average CPL: $120

- Pre-detection fraud rate: 30%

- Detection rate: 80%

- Detection cost: $0.35 per lead

Calculation:

- Fraudulent leads (30%): 2,400

- Fraud detected (80%): 1,920 leads

- Fraud loss prevented: 1,920 x $120 = $230,400

- Detection cost: 8,000 x $0.35 = $2,800

- Net savings: $227,600

- ROI: 8,129%

Hidden ROI: Relationship Preservation

Beyond direct fraud losses, prevention preserves buyer relationships. Buyer behavior shifts predictably as fraud rates climb. At 5% fraud rates, buyers continue purchasing with normal pricing – this represents acceptable market friction. At 10% fraud rates, buyers request credits and begin questioning quality. At 15% fraud rates, buyers demand price reductions or threaten termination. Above 20% fraud rates, buyers terminate relationships entirely.

A buyer who discovers consistent fraud problems may not just adjust pricing – they may share intelligence with other buyers, damaging your market reputation. The relationship preservation value of fraud prevention can exceed direct cost savings.

Acceptable Fraud Rate Benchmarks

Insurance lead buyers generally accept 3-5% fraud/invalid rates as normal market friction. Rates above 8-10% trigger complaints and return requests. Rates above 15% result in relationship termination. Your fraud prevention target should aim for sub-5% delivered fraud rates regardless of what you receive from sources.

Building a Fraud Detection Workflow for Insurance Leads

Effective fraud prevention requires systematic process, not ad-hoc investigation. This workflow structure scales from startup to enterprise operations.

Stage 1: Real-Time Scoring

Every insurance lead receives a fraud score at capture or receipt. This score combines IP risk signals (datacenter, VPN, proxy, velocity), device fingerprint analysis (emulator, known fraud device, fingerprint anomalies), form completion behavior (timing, mouse movement, keystroke dynamics), data validation (phone valid and matches line type expectations, email deliverable), historical matching (seen this phone/email/device before?), and cross-reference validation (name/phone/address combination matches identity graphs?).

Score Interpretation for Insurance Leads

| Score Range | Risk Level | Action |

|---|---|---|

| 0-30 | High Risk | Hold for manual review; do not distribute |

| 31-50 | Elevated Risk | Enhanced verification before distribution |

| 51-70 | Moderate Risk | Standard processing with source monitoring |

| 71-85 | Low Risk | Normal distribution |

| 86-100 | Minimal Risk | Priority delivery to premium buyers |

Stage 2: Tiered Verification

Based on initial scores, leads route to appropriate verification depth.

High-risk leads scoring 0-30 are held for manual review. An analyst examines full session data, checks identity graphs, and makes an accept/reject decision. Expected rejection rate runs 70-80%.

Elevated-risk leads scoring 31-50 receive automated enhanced verification including additional identity checks, phone ownership validation, and address verification against property records. Expected rejection rate: 30-50%.

Moderate-risk leads scoring 51-70 undergo standard verification with source-level monitoring. Track this source’s fraud rates; if patterns emerge, escalate to enhanced verification for all leads from this source. Expected rejection rate: 10-20%.

Low and minimal-risk leads scoring 71-100 receive standard processing with basic validation confirming data accuracy. Expected rejection rate: 3-8%.

Stage 3: Post-Delivery Monitoring

Fraud detection continues after delivery. Conversion data reveals fraud patterns invisible at submission time: sources with 0.5% conversion rates versus 5% average, geographic regions showing zero conversions despite volume, time-of-day patterns suggesting non-US traffic, and demographic patterns indicating systematic targeting of non-buyers.

Weekly conversion analysis by source, geography, and lead characteristics reveals quality patterns. Sources showing persistent underperformance require investigation and potential termination.

Key Metrics to Monitor

| Metric | Warning Threshold | Action Threshold |

|---|---|---|

| Conversion rate by source | 50% below average | 75% below average |

| Contact rate by source | 20% below average | 40% below average |

| Return rate by source | 15% | 25% |

| Fraud flag rate by source | 10% | 20% |

Stage 4: Feedback Loop Integration

Buyer feedback completes the detection cycle. When buyers flag insurance leads as fraudulent, disconnected, or wrong-person, your system should flag the lead with the specific return reason, match against the source for chargeback/credit, add signals to detection model training data, update source quality scores, and adjust bidding, routing, and acceptance criteria accordingly. If a pattern emerges, escalate to source termination review.

This feedback loop improves detection over time. The frauds that beat your detection today train the models that catch new fraud tomorrow.

Responding to Fraud Discoveries

Discovering fraud triggers structured response. How you handle discoveries determines whether fraud is an occasional loss or an existential threat to your insurance lead operation.

Immediate Response Protocol

Step 1: Quarantine

When systematic fraud is identified, pause lead routing from the suspected source immediately. Hold pending deliveries for review before distribution. Preserve all session data, logs, and evidence. Notify affected internal teams.

Step 2: Quantify

Determine fraud scope by answering critical questions: How many leads are affected? What time period does the fraud span? Which buyers received fraudulent leads? What is total financial exposure (your cost plus potential buyer credits)?

Step 3: Evidence Collection

Gather documentation for partner discussions and potential legal needs. This includes IP logs and geographic analysis, device fingerprint data and matching patterns, form completion timing records, consent certificates with timestamps, conversion data showing non-performance patterns, and specific lead examples with full session context.

Partner Communication

With Traffic Sources

Present evidence factually. Avoid accusations; focus on data. “We observed [specific pattern] in leads from your source between [dates]. Here is the evidence. We need to understand what happened and how to prevent recurrence.”

Good partners investigate and remediate. Bad partners deflect and disappear. Their response tells you everything about whether the relationship continues.

Document all communications. If the relationship ends in dispute, documentation matters.

With Buyers

Proactive disclosure builds trust. “We identified a quality issue affecting [X] leads delivered between [dates]. We are crediting your account and have terminated the responsible source.”

Buyers appreciate honesty. They despise discovering fraud themselves and then learning you knew but did not disclose. Proactive communication preserves relationships that reactive disclosure destroys.

Financial Resolution

Chargeback policies should be established before fraud occurs. Define what documentation triggers chargeback rights, what time window applies (typically 24-72 hours for insurance leads), what percentage is refundable, and how disputes are resolved.

Standard terms allow 24-72 hour review windows with 100% refund for demonstrable fraud (disconnected numbers, wrong-person confirmations, duplicate leads within defined windows, failed consent validation).

Source Recovery

Your contracts with traffic sources should include representations about lead quality and consent validity, indemnification for compliance claims arising from fraudulent leads, chargeback rights mirroring your buyer obligations, and termination rights for fraud pattern discovery.

Case Studies: Insurance Lead Fraud in Practice

Understanding how fraud actually manifests in insurance lead operations provides context for prevention efforts.

Case Study 1: Medicare AEP Bot Attack

Situation: A Medicare lead generator experienced a sudden 400% volume increase from an affiliate source during the first week of Annual Enrollment Period. Initial quality metrics looked acceptable – form completion timing was normal, contact information validated, and early contact rates matched expectations.

Discovery: By week two, buyer complaints emerged. Agents reported consumers who answered but had no recollection of requesting Medicare information. Conversion rates from the source fell to 0.3% versus 6% average.

Investigation Findings

The operation ran a sophisticated bot using a residential proxy network. Real phone numbers sourced from data breach databases gave the leads a veneer of authenticity. Form completion was timed to match human patterns, and device fingerprints rotated to appear as unique devices.

Detection Gaps

IP analysis passed because residential proxies were used. Phone validation passed because numbers were real – just not belonging to people who requested contact. Timing analysis passed because bots were programmed for human-like delays. Device fingerprinting passed because fingerprints were spoofed.

What Would Have Caught It

Identity verification matching phone ownership to submitted names would have revealed the mismatch. Cross-network shopping behavior analysis through Jornaya would have shown no shopping activity. TrustedForm Insights behavioral scoring could have flagged anomalies. A faster feedback loop with buyers would have enabled earlier pattern detection.

Outcome: $340,000 in fraudulent leads distributed before detection. Approximately $280,000 recovered through source clawback. Buyer relationship damaged but maintained with proactive credits.

Case Study 2: Human Fraud Farm Infiltration

Situation: An auto insurance lead aggregator onboarded a new affiliate promising high-volume, low-cost traffic. Initial test batches performed adequately – contact rates of 48% and conversion rates of 7%, slightly below average but acceptable for the pricing.

Discovery: Over three months, performance gradually declined. Contact rates remained stable (real humans answered), but conversion rates dropped to 2%. Buyer complaints mentioned consumers who were “hostile” or “clearly not interested.”

Investigation Findings

The operation was a fraud farm in Southeast Asia. Workers were paid $0.05-0.10 per completed form and used real phone numbers from prepaid carrier pools along with legitimate-looking email addresses created in bulk. There were no bot indicators whatsoever – all human behavior patterns.

Detection Challenges

All technical validation passed. Behavioral analysis showed human patterns. IP addresses were VPN-routed through US residential proxies. No velocity anomalies appeared at the individual device level.

What Would Have Caught It

Carrier lookup would have identified prepaid/disposable phone patterns. Geographic clustering analysis would have revealed many leads originating from the same prepaid carrier pools. Cross-reference validation would have shown phone/name mismatches. Earlier buyer feedback integration would have revealed the hostility pattern.

Outcome: $180,000 in degraded leads over three months. Source terminated. Buyer pricing adjusted by 15% for six months to rebuild trust.

Case Study 3: Internal Recycling Fraud

Situation: A health insurance lead buyer noticed familiar names in their lead deliveries – consumers they remembered working months earlier. Investigation revealed leads being sold as “fresh” that were 4-6 months old.

Discovery: Consent certificate analysis showed TrustedForm timestamps from previous enrollment periods. The leads had originally been purchased by other buyers, aged out of their systems, and reentered the market with new submission timestamps.

Investigation Findings

The lead seller was purchasing aged lead databases. Systems added fresh timestamps at data import. Original consent certificates were stripped or replaced. Leads sold at fresh pricing ($45-60) had originally sold for $8-15 as aged inventory.

Detection Gaps

The seller’s timestamp was accepted at face value. No independent consent verification occurred at point of purchase. Deduplication only checked against the buyer’s own historical leads.

What Would Have Caught It

TrustedForm certificate validation would have revealed the original capture date. Cross-network deduplication via Jornaya would have flagged the recycled leads. Historical phone number matching across 180-day windows would have identified repeats. Consumer complaint tracking – “I filled this out months ago” – would have provided a clear signal.

Outcome: $95,000 in recycled leads purchased over two months. Full recovery from seller through contract enforcement. Seller relationship terminated with industry warning disseminated.

Frequently Asked Questions

What percentage of insurance leads should I expect to be fraudulent?

First-party insurance leads (generated on your own properties) typically show 5-10% fraud rates with proper validation. Third-party leads from affiliates and networks run 15-30% fraud rates. Premium networks with strict quality controls achieve 10-15%. The rate you experience depends on traffic sources, sub-vertical (Medicare experiences higher fraud than auto), and your detection capabilities.

How much should I spend on fraud prevention for insurance leads?

Invest $0.15-$0.30 per lead for standard verification in auto and home insurance. Medicare and high-value life insurance leads warrant $0.25-$0.50 per lead given higher individual lead values. If your fraud prevention cost exceeds 1% of CPL, you may be over-investing – but most operations underinvest. A $50 auto lead should carry $0.15-$0.50 in fraud prevention cost.

Can I eliminate all insurance lead fraud?

No. Zero fraud is impossible without rejecting legitimate leads that show false-positive fraud signals. The goal is economically optimal fraud reduction – catching enough fraud that remaining losses cost less than additional detection investment would. Most mature operations target 85-95% fraud detection rates while accepting 5-15% residual fraud.

How do I detect recycled insurance leads being sold as fresh?

Consent certificate validation provides the strongest protection. TrustedForm certificates include original capture timestamps that cannot be falsified. Jornaya LeadiD tokens similarly document original lead generation timing. Cross-network deduplication services identify leads that have circulated through the ecosystem. Historical matching against your own lead databases catches leads you have previously purchased.

What fraud patterns are specific to Medicare leads?

Medicare lead fraud intensifies during enrollment periods when volume surges provide cover for fraudulent activity. Common patterns include synthetic identities targeting the 65+ demographic, recycled leads from previous enrollment periods resold with fresh timestamps, incentivized leads from sweepstakes targeting seniors, and sophisticated bots exploiting the seasonal volume spikes. CMS one-to-one consent requirements add compliance complexity that some fraudsters exploit through fabricated consent records.

Should I reject or quarantine suspicious insurance leads?

Quarantine medium-risk leads for secondary review rather than immediate rejection. False positives cost you legitimate leads and may damage source relationships. A 24-48 hour review queue with manual analysis recovers valid leads while confirming fraudulent ones. Reject only high-confidence fraud (scores below 30 on 100-point scale). For leads scoring 30-60, enhanced verification should determine disposition.

How do I handle buyer fraud complaints about insurance leads?

Treat every complaint as valid until investigated. Document the specific leads, pull session data, and analyze for fraud indicators. If fraud is confirmed, credit immediately and investigate the source. If the lead appears legitimate, provide evidence supporting validity and work with the buyer to understand why their conversion failed. Never dismiss complaints without investigation – even unfounded complaints provide intelligence about buyer expectations and potential process improvements.

What legal exposure do I face from fraudulent insurance leads?

Delivering leads with fabricated consent creates TCPA liability for buyers who call them. If the consumer never consented, calls constitute violations potentially worth $500-$1,500 per call in litigation. Understanding TCPA compliance requirements is essential for protecting your operation. Your contracts should include representations about consent validity and indemnification for consent-related claims. Fraud prevention directly reduces this compliance exposure. Beyond TCPA, fraudulent Medicare leads may trigger CMS enforcement against TPMOs, and systematic fraud could attract FTC scrutiny for deceptive practices.

How quickly does fraud detection effectiveness improve?

With proper feedback loops, detection accuracy improves measurably within 30-60 days of implementation. Initial deployment catches obvious fraud. Buyer feedback and conversion analysis train models to catch subtle patterns. Continuous improvement is expected and necessary – fraudsters adapt to detection methods, and your systems must evolve in response. Plan for quarterly reviews of fraud detection effectiveness with model retraining as needed.

What fraud prevention is required for CMS Medicare compliance?

CMS requires TPMOs to implement systems that prevent unauthorized data sharing and ensure valid consent. While CMS does not mandate specific fraud prevention technologies, the one-to-one consent requirement effectively requires robust consent documentation and verification. TPMOs that distribute leads generated through fraud face potential CMS enforcement, contract termination by carriers, and exclusion from Medicare marketing. Fraud prevention is effectively required for compliant Medicare lead operations even if not explicitly mandated.

Key Takeaways

-

Insurance lead fraud represents a $1.3-2.0 billion annual problem within the $5.2-6.8 billion insurance lead market. With 25-30% of third-party leads containing fraudulent or problematic data, fraud prevention is core infrastructure, not optional expense.

-

Five fraud types require different detection approaches. Bot-generated leads need behavioral and device analysis. Human fraud farms require velocity and pattern detection. Synthetic identities demand identity graph cross-referencing. Recycled leads need consent certificate validation. Incentivized leads require conversion-based quality monitoring.

-

Multi-layered detection catches what single-signal approaches miss. IP analysis, device fingerprinting, behavioral scoring, identity verification, and consent validation each catch different fraud types. Effective prevention combines multiple layers with tiered response based on confidence levels.

-

Prevention ROI typically exceeds 2,000% for insurance lead operations. A $0.20 per lead investment preventing 80% of 25% fraud on $50 CPL leads saves $10 per lead – a 50:1 return. The math overwhelmingly favors investment.

-

Medicare leads face elevated fraud risk during enrollment periods. Higher CPLs ($80-150), seasonal volume spikes, and sophisticated targeting of the senior demographic create concentrated fraud exposure. Enhanced detection during AEP and OEP is essential.

-

Feedback loops improve detection over time. Buyer complaints, conversion analysis, and return pattern data train detection models to catch evolving fraud patterns. Systems that learn from outcomes outperform static rule sets.

-

Response protocols matter as much as detection. Quarantine, quantify, collect evidence, and communicate with partners. How you handle fraud discoveries determines whether incidents remain isolated or damage buyer relationships and market reputation.

-

Fraud prevention protects compliance, not just margins. Leads with fabricated consent create TCPA liability. Medicare lead fraud risks CMS enforcement. Fraud prevention reduces compliance exposure alongside direct financial protection.

Sources

- Statista: Digital Ad Fraud Cost Worldwide - Global digital advertising fraud statistics showing $84B annual losses

- Juniper Research - Research projecting digital ad fraud to exceed $100B by 2026

- CHEQ - Ad fraud and bot detection research and technology platform

- TrustedForm by ActiveProspect - Consent verification platform identifying 200,000+ bots weekly; TrustedForm Insights behavioral analytics

- Verisk (Jornaya) - Cross-publisher lead journey tracking for fraud detection and consent verification

- Fingerprint - Device intelligence and fingerprinting platform for fraud detection

- Cloudflare Bot Management - Enterprise bot detection and prevention platform

- Twilio Lookup - Phone validation and carrier lookup services for fraud prevention

Statistics and regulatory information current as of late 2024 and early 2025. Fraud patterns and detection technology capabilities continue to evolve as the detection and evasion arms race progresses. Review vendor capabilities and threat intelligence regularly to maintain effective protection.