The borrowers seeking $750,000+ loans represent a fundamentally different opportunity than conforming loan prospects. Here is how to generate, price, and convert the highest-value leads in mortgage lending.

The High-Net-Worth Opportunity

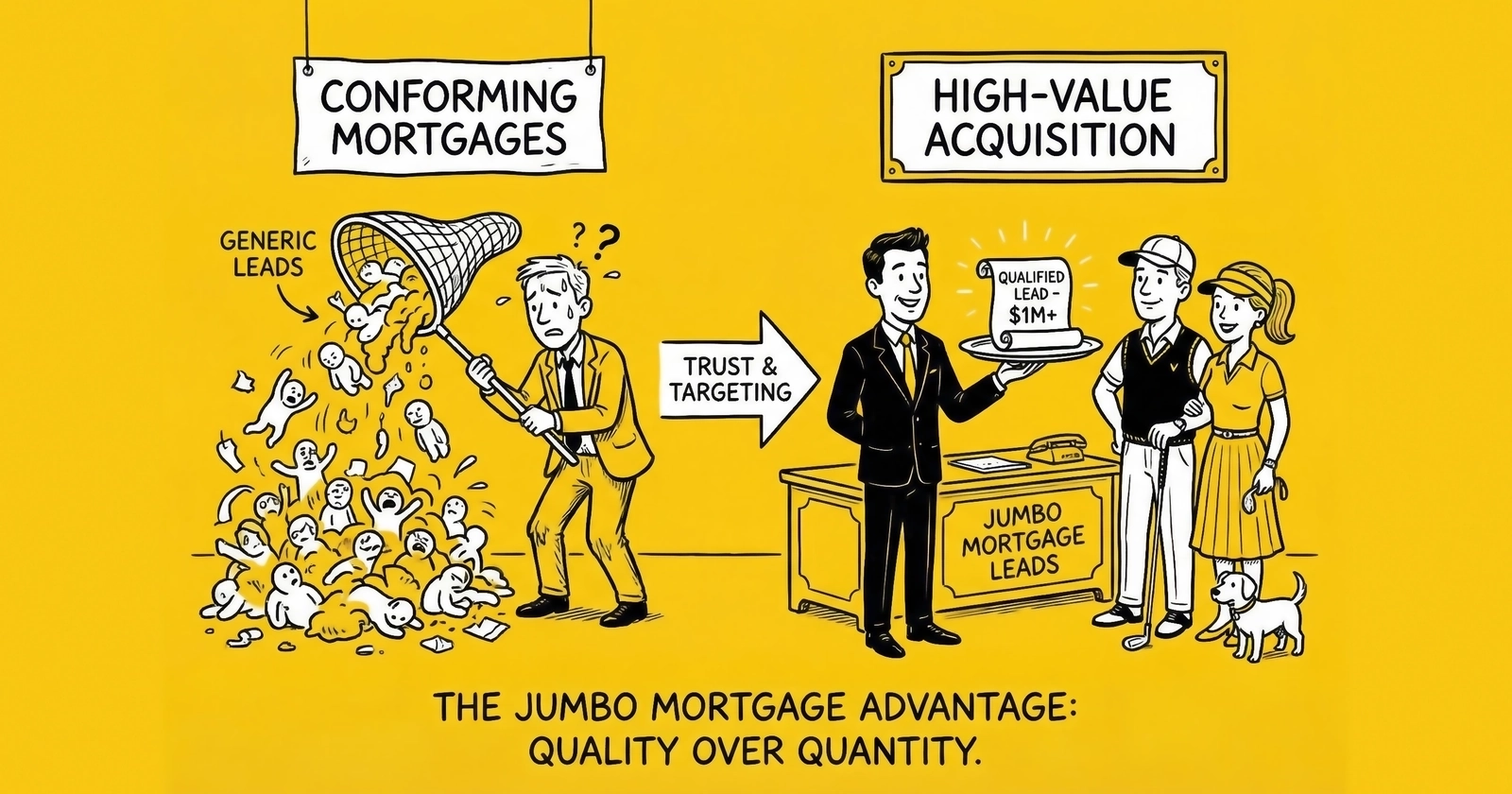

Most mortgage lead generators chase volume. They optimize for leads per dollar, conversion rates per thousand, and cost per acquisition across the broadest possible market. This approach makes sense for conforming loans where transaction values and margins cluster around predictable averages.

Jumbo mortgage leads require the opposite mindset. These borrowers seek financing above the conforming loan limits set by the Federal Housing Finance Agency (FHFA), which for 2025 stands at $806,500 for most U.S. markets and reaches $1,209,750 in designated high-cost areas like San Francisco, New York, and Los Angeles. Every jumbo lead represents a transaction that exceeds these thresholds, typically ranging from $750,000 to $3 million or higher.

The economics are striking. A jumbo mortgage at $1.2 million generates origination fees, servicing income, and cross-sell opportunities that dwarf a $300,000 conforming loan. The originator earning 0.5% on a jumbo loan makes $6,000 on that single transaction versus $1,500 on the conforming equivalent. This 4x revenue multiplier justifies substantially higher lead acquisition costs and fundamentally different marketing approaches.

But jumbo leads also come with concentrated risk. Miss on quality, and you burn expensive sales time on borrowers who cannot qualify. Target incorrectly, and you spend premium acquisition dollars reaching prospects who belong in the conforming market. Those who succeed in jumbo lead generation understand both the opportunity and the precision required to capture it.

The Threshold Framework

The Federal Housing Finance Agency adjusts conforming loan limits annually based on changes in average home prices. For 2025, the baseline conforming loan limit for one-unit properties is $806,500, up from $766,550 in 2024. This 5.2% increase reflects continued home price appreciation despite elevated mortgage rates.

High-cost area limits reach 150% of the baseline, setting the ceiling at $1,209,750 for the most expensive markets. Counties qualifying for high-cost limits include much of coastal California, the New York metropolitan area, the Washington D.C. corridor, and select markets in Hawaii and Alaska.

Any mortgage exceeding these limits enters jumbo territory, requiring financing outside the Fannie Mae and Freddie Mac guarantee structure. This distinction fundamentally changes the lending equation.

| Loan Type | 2025 Limit (Baseline) | 2025 Limit (High-Cost) |

|---|---|---|

| Conforming | Up to $806,500 | Up to $1,209,750 |

| Jumbo | Above $806,500 | Above $1,209,750 |

| Super Jumbo | Typically $2M+ | Typically $3M+ |

Super jumbo loans – typically those exceeding $2 million and reaching $5 million, $10 million, or higher – represent an even more specialized segment with distinct qualification requirements, limited lender participation, and highly customized relationship-based origination.

Geographic Arbitrage

The conforming limit varies by county, creating geographic arbitrage opportunities for lead generators who understand local thresholds. San Francisco, San Mateo, Santa Clara, Marin, Los Angeles, Orange, San Diego, New York, Kings, Queens, Nassau, Fairfax, Arlington, Alexandria, and all of Hawaii carry the high-cost limit of $1,209,750. Meanwhile, most counties outside coastal metros – the Midwest, Mountain West, South, and Southeast – remain at the baseline $806,500.

This geographic variation creates an important routing consideration. A $900,000 mortgage in Kansas City is unquestionably jumbo. The same loan amount in San Francisco remains conforming. Lead generators must understand these thresholds at the county level to properly route and price leads.

Rate Dynamics

Historically, jumbo loans carried rate premiums of 0.25% to 0.50% above conforming rates, reflecting the additional risk lenders assume without government-sponsored enterprise backing. In recent market conditions, this spread has narrowed and occasionally inverted. As of late 2025, 30-year jumbo rates typically trade within 0.125% to 0.25% of conforming rates, with some portfolio lenders offering competitive or even lower rates to attract high-net-worth borrowers.

For lead generators, the rate environment affects messaging and positioning. When jumbo rates are competitive, marketing can emphasize the financing accessibility of luxury properties. When spreads widen, messaging may need to address rate concerns more directly.

Understanding the Jumbo Borrower

Jumbo borrowers differ systematically from conforming loan prospects. Understanding these differences is essential for effective targeting, messaging, and qualification.

The income requirements tell the first part of the story. Jumbo borrowers typically earn $200,000+ annually for individual applicants and $300,000+ for households. Many earn substantially more, particularly those seeking $1.5 million+ financing. Self-employed borrowers, business owners, and professionals – physicians, attorneys, executives – represent significant segments of this market.

Beyond income, jumbo borrowers demonstrate substantial liquid assets. Lenders typically require 6-12 months of mortgage payments in reserves, meaning borrowers need $50,000-$150,000+ in accessible funds beyond closing costs. Total net worth often exceeds $1 million. Most jumbo lenders require minimum credit scores of 700-720, with many premium programs requiring 740+. The average jumbo borrower presents credit scores above 750, reflecting the financial sophistication and stability typical of this segment.

Property types skew toward primary residences, which dominate jumbo volume, but second homes and investment properties represent meaningful segments. Vacation properties in desirable markets frequently require jumbo financing.

Behavioral Patterns That Shape Strategy

High-net-worth borrowers exhibit distinct shopping behaviors that affect every aspect of lead generation strategy. They spend weeks or months researching before submitting inquiries. They consume substantial content about market conditions, rate trends, and lender reputation before engaging. This extended research phase means content marketing reaches this audience earlier in the funnel than direct response advertising.

Professional advisors significantly influence jumbo borrowers’ lender selection. Wealth managers, CPAs, and financial advisors guide their clients toward trusted mortgage providers. Referral relationships and B2B marketing to financial professionals can generate high-quality introductions that bypass traditional lead generation entirely.

While jumbo borrowers care about rates, they evaluate total value differently than conforming borrowers. Service quality, closing certainty, and relationship depth often matter as much as a 0.125% rate difference. Marketing that emphasizes only rate may miss the value proposition that resonates with this audience.

Perhaps most importantly, high-net-worth borrowers expect streamlined experiences. Complex forms, multiple calls, and repetitive documentation requests create abandonment. The lead capture and nurturing experience must reflect premium positioning – anything less signals that you do not understand who you are serving.

Many jumbo borrowers already own properties with existing mortgages, potentially creating refinance or home equity cross-sell opportunities. Understanding their portfolio provides upsell context that extends well beyond the initial transaction.

Acquisition Strategies That Work

Acquiring jumbo leads requires fundamentally different approaches than mass-market mortgage lead generation. The smaller pool of qualified prospects, higher customer lifetime value, and more sophisticated buying behavior demand precision targeting over volume optimization.

Premium Content Marketing

Content marketing is disproportionately effective for jumbo leads because the target audience actively researches before engaging. Educational content themes that perform include jumbo loan qualification requirements and documentation, comparisons of jumbo programs across lender types (banks, credit unions, private lenders), tax implications of jumbo mortgages for high earners, interest rate trends affecting luxury property financing, down payment strategies for properties above $1 million, and explanations of asset-based and bank statement loan programs.

Distribution channels must match where high-net-worth audiences consume information. SEO targeting high-intent jumbo and luxury real estate keywords builds organic reach. LinkedIn content reaches executives and high-income professionals. Premium publisher placements on financial and real estate sites provide contextual relevance. Email newsletters to opted-in high-net-worth audiences maintain ongoing engagement.

Content-generated leads typically require nurturing before conversion but arrive with higher intent and qualification than paid media leads. The investment in content pays dividends over time as articles continue generating qualified traffic months after publication.

Paid Media for Precision Targeting

Traditional paid media approaches struggle with jumbo lead acquisition because income and asset targeting options are limited on major platforms. However, several strategies enable effective paid acquisition.

Search targeting works through keyword clusters around “jumbo mortgage rates” and “jumbo loan lenders,” terms like “million dollar home financing” and luxury property variations, geographic targeting in high-cost markets with high-value property inventory, and competitor terms for banks known for jumbo lending.

Social and display approaches require more creative targeting. LinkedIn enables targeting by title, company size, and industry for high-income professionals. Facebook and Instagram offer interest-based targeting around luxury lifestyle, premium travel, and high-value purchases. Programmatic display can leverage third-party income and net worth data segments. Retargeting visitors to luxury real estate content builds on existing intent signals.

CPL expectations for jumbo leads reflect the specialized market. Exclusive jumbo leads typically run $150-$400 depending on geography and qualification depth. Shared jumbo leads trade at $75-$200, though they are less common due to lower buyer preference for sharing. Content-driven leads requiring nurture cost $80-$150 for marketing qualified leads. These CPLs exceed conforming mortgage leads by 2-3x, reflecting both the smaller target audience and higher customer value.

Referral Network Development

Given the influence of professional advisors on high-net-worth borrowers, referral marketing represents a high-ROI channel for jumbo leads. Key referral sources include wealth management firms and financial advisors, CPAs and tax professionals serving high-income clients, estate planning and trust attorneys, luxury real estate agents and brokerages, and private bankers and relationship managers.

Referral program structures take various forms. Co-marketing partnerships with content sharing and joint seminars build mutual visibility. Referral fees where permitted by regulation (verify RESPA compliance carefully) provide direct incentive. White-label programs offering financing under advisor branding deepen integration. Reciprocal referrals for clients needing wealth management services create two-way value.

Building referral relationships requires sustained relationship development rather than transactional lead purchasing. The payoff is high-quality, warm introductions to qualified borrowers who arrive with existing trust.

Real Estate Agent Partnerships

Luxury real estate agents interact with jumbo borrowers at the property search stage, often before financing conversations begin. Partnerships with agents specializing in $750,000+ properties provide early access to qualified prospects.

Effective partnership models include pre-approval programs for agent clients, joint open house events and property marketing, featured lender positioning on luxury listing websites, and rapid response commitments for offers requiring financing contingencies.

Any compensation flowing to real estate agents must comply with RESPA Section 8 requirements. Understanding mortgage lead generation compliance is essential when structuring these partnerships. Payments must reflect fair market value for actual services performed, not referral compensation. Structure partnerships carefully and document all arrangements to maintain compliance.

Qualification Requirements

Jumbo loans carry stricter qualification requirements than conforming mortgages because lenders retain the risk rather than selling to Fannie Mae or Freddie Mac. Understanding these requirements enables accurate lead qualification and appropriate buyer routing.

Credit Thresholds

Most jumbo lenders require minimum credit scores of 700, with many programs requiring 720 or higher. Premium rates and terms typically require 740+.

| Credit Tier | Jumbo Availability | Rate Impact |

|---|---|---|

| 740+ | Full programs, best rates | Baseline pricing |

| 720-739 | Most programs available | +0.125% to +0.25% |

| 700-719 | Limited programs | +0.25% to +0.50% |

| 680-699 | Specialty lenders only | +0.50% or higher |

| Below 680 | Rarely available | Exception-based only |

Lead qualification should capture credit score ranges to enable accurate routing. A lead with 650 credit seeking a $1 million loan has limited options and requires specialized buyer matching.

Down Payment and Reserve Requirements

Jumbo loans typically require larger down payments than conforming loans. Standard jumbo programs for loan amounts up to $1.5 million commonly require 10-20% down. Higher-balance jumbos in the $1.5-2.5 million range often require 15-25% down. Super jumbo loans exceeding $2.5 million frequently require 20-30% down payment. Some lenders offer jumbo loans with as little as 10% down for exceptionally qualified borrowers, but these programs require higher credit scores and additional compensating factors.

Down payment verification matters significantly. Jumbo lenders scrutinize the source of down payment funds more carefully than conforming lenders. Leads should indicate whether they have verified liquid assets versus requiring gift funds or other arrangements.

Reserve requirements represent another critical qualification factor. Jumbo lenders require post-closing reserves that significantly exceed conforming requirements. The minimum typically starts at 6 months of mortgage payments in liquid assets. Standard programs for loans above $1 million commonly require 12 months of reserves. Super jumbo loans exceeding $2-3 million often require 18-24 months of reserves. These requirements protect lenders against default risk, particularly for borrowers with complex income situations or significant property portfolios.

Debt-to-Income Considerations

Jumbo lenders typically require DTI ratios below 43%, with many preferring below 38% for optimal pricing. Some portfolio lenders accept higher DTI with compensating factors such as substantial reserves or exceptional credit. Front-end ratio (housing costs to income) preferences typically stay at 28% or below, while back-end ratio (total debt to income) maximums hold at 43% with 38% preferred.

Self-employed borrowers face additional scrutiny, with lenders typically using two-year income averaging and requiring business financials to support stated income.

Documentation Depth

Jumbo loans require comprehensive documentation that exceeds conforming standards. Income documentation includes two years of W-2s and tax returns, 30-60 days of pay stubs, two years of business returns for self-employed borrowers, K-1s, partnership returns, and corporate documentation as applicable, plus bank statements showing income deposits.

Asset documentation requires two months of bank statements for all accounts, investment account statements, retirement account statements, documentation of any gift funds, and explanation of large deposits.

Property documentation involves full appraisal with enhanced requirements for luxury properties, often a second appraisal for loan amounts above $1.5 million, plus flood certification and hazard insurance verification.

The extensive documentation requirement affects lead nurturing strategy. Prospects need preparation for documentation requirements to avoid delays and frustration during the application process. Proactive communication about what to gather helps qualified borrowers move smoothly toward closing.

Premium Pricing Dynamics

Jumbo lead pricing reflects both the higher customer lifetime value and the specialized nature of the market. Understanding pricing dynamics enables appropriate positioning whether you are generating, brokering, or buying jumbo leads.

CPL Benchmarks by Loan Amount

Lead pricing correlates directly with loan amount because larger loans generate higher origination revenue.

| Loan Amount Range | Exclusive CPL Range | Shared CPL Range |

|---|---|---|

| $750K-$1M | $150-$250 | $75-$125 |

| $1M-$1.5M | $200-$350 | $100-$175 |

| $1.5M-$2.5M | $300-$450 | $150-$225 |

| $2.5M+ | $400-$600+ | $200-$300 |

These ranges assume qualified leads with verified contact information, credit score indication, and genuine purchase or refinance intent. Raw leads with minimal qualification trade at significant discounts.

Geographic Premiums

Location significantly affects jumbo lead pricing. Premium markets command 25-50% above base pricing. These include the San Francisco Bay Area, Manhattan and surrounding boroughs, Los Angeles westside and beach communities, Miami Beach and South Florida luxury markets, and Washington D.C. with Northern Virginia.

Standard markets trade at baseline pricing, encompassing most major metro areas, secondary coastal markets, and high-cost suburbs and exurbs. Discounted markets fall 15-30% below base, including jumbo loans in low-cost markets (less common with a smaller buyer base) and investment properties (higher risk profile for lenders).

Qualification Depth Tiers

Lead value increases substantially with qualification depth. Tier 1 (Premium) leads include full qualification data – credit score, income, down payment, timeline, and verified contact. These command 100% of benchmark pricing, enjoy highest buyer demand, and experience lowest return rates.

Tier 2 (Standard) leads include basic qualification with credit score range, stated income, and verified contact. These trade at 60-75% of Tier 1 pricing with moderate buyer demand and average return rates.

Tier 3 (Basic) leads contain contact information with intent signal but limited qualification. These trade at 40-50% of Tier 1 pricing with lower buyer demand and higher return rates along with contact challenges.

Buyers pay premium prices for premium qualification because each lead represents significant sales resource investment. A wasted consultation on an unqualified $1.5 million loan prospect costs far more than a wasted call on a $200,000 conforming lead.

The Exclusive Advantage

Jumbo leads trend heavily toward exclusive distribution for several interconnected reasons. Jumbo lenders prefer exclusive leads because they invest more in each prospect. High-value prospects are worth the exclusive premium. And jumbo borrowers respond poorly to multiple simultaneous contacts.

Shared jumbo leads exist but face compressed pricing and limited buyer demand. Most successful jumbo lead operations focus on exclusive distribution with premium pricing rather than volume through shared distribution.

Conversion Excellence

High-value leads demand high-quality conversion processes. The difference between successful and unsuccessful jumbo lead operations often lies in conversion execution rather than lead generation quality.

Speed Still Wins

The first-responder advantage applies to jumbo leads as strongly as conforming leads. Research shows leads contacted within five minutes convert at dramatically higher rates than those contacted later. Response within 5 minutes delivers optimal conversion rates. Response within 1 hour incurs moderate conversion penalty. Response next business day means significant conversion loss.

The challenge for jumbo operations is maintaining speed while also providing sophisticated, consultative contact experiences. Auto-dialers that work for volume operations may feel inappropriate for high-net-worth prospects.

Best practices for jumbo response include immediate SMS acknowledgment with callback commitment, personal phone response within 15 minutes during business hours, after-hours email with morning callback promise and self-scheduling option, and initial contact from loan officer rather than call center representative.

The Consultative Approach

High-net-worth borrowers expect consultative engagement, not transactional sales processes. An effective initial call structure acknowledges the inquiry and confirms understanding of financing need, asks questions about property, timeline, and financial situation, provides preliminary rate and program information, explains next steps and documentation requirements, and schedules follow-up consultation or application appointment.

Common mistakes destroy conversion rates. Reading scripts that feel automated or impersonal signals you do not value the prospect’s time. Pushing for immediate application before building relationship creates resistance. Failing to demonstrate expertise on jumbo programs and requirements undermines credibility. Not addressing specific concerns about documentation or qualification leaves doubts unresolved.

Documentation Support

Jumbo borrowers face extensive documentation requirements, and proactive preparation support improves conversion while reducing fallout. Preparation touchpoints should include email documentation checklist immediately after initial contact, follow-up call to address questions about specific items, secure document upload portal rather than email exchanges, and reminders for commonly missed items.

Thorough pre-qualification before formal application reduces application abandonment and improves close rates. Investing 30 minutes in pre-qualification can save hours of wasted processing on leads that cannot qualify.

Multi-Channel Nurturing

Jumbo prospects often have extended decision timelines. Multi-channel nurturing maintains engagement during consideration periods. Effective nurture content includes rate update alerts when market conditions change, market analysis for their target property locations, jumbo-specific educational content, and invitations to webinars or consultations.

The channel mix should use email for content and rate updates as the primary channel, text for time-sensitive updates and scheduling, phone for milestone check-ins and relationship building, and direct mail for premium positioning and differentiation.

Building Long-Term Relationships

High-net-worth borrowers often return for future transactions and refer others in their network. Building relationship rather than just closing transaction creates long-term value that compounds over time.

Post-close relationship practices should include personal thank-you communication, annual review of portfolio and market conditions, rate monitoring with refinance opportunity alerts, and referral request after successful closing.

A jumbo borrower who closes one loan and refers three colleagues over the following years generates far more lifetime value than the initial transaction alone.

Working with Jumbo Buyers

The jumbo lead buyer universe is more specialized than the conforming market. Understanding buyer types and their requirements enables effective distribution.

Buyer Landscape

Money center banks (Chase, Bank of America, Wells Fargo, Citi) have substantial jumbo lending operations, particularly for high-net-worth clients with existing private banking relationships. They purchase jumbo leads but typically through established vendor relationships rather than spot purchases.

Regional and super-regional banks actively purchase jumbo leads to build market share. Many have competitive jumbo programs and dedicated sales teams hungry for qualified prospects.

Private banks and wealth management lenders target ultra-high-net-worth borrowers with customized solutions. They purchase highly qualified leads but typically at lower volume than retail banks.

Independent mortgage banks with jumbo programs purchase leads to supplement retail and referral channels. Program availability and appetite varies by lender and market conditions.

Credit unions increasingly offer jumbo programs, particularly for members. Some purchase leads to grow jumbo portfolios in their markets.

Portfolio lenders specialize in loans they hold rather than sell, often serving borrowers with non-standard profiles (self-employed, complex income, asset-based lending). They represent buyers for leads that standard lenders cannot serve.

Buyer Verification

Before selling jumbo leads to any buyer, verify licensing, program availability, capacity, and experience. The buyer must hold appropriate state licenses in lead origination geographies – verify through NMLS Consumer Access. They must have active jumbo programs matching lead characteristics including loan amount, property type, and borrower profile. They must have sales capacity to respond appropriately to jumbo leads; a buyer overwhelmed with volume will not convert premium leads effectively. And buyers without jumbo expertise may waste leads through poor execution, so track conversion performance and adjust routing accordingly.

Pricing Negotiations

Jumbo lead pricing negotiations differ from conforming lead discussions in several ways. Value-based pricing reflects that jumbo buyers understand the revenue potential per lead and often accept higher CPLs than their conforming programs. The volume versus quality tradeoff means many jumbo buyers prefer lower volume of higher-quality leads over higher volume with mixed qualification. Return policies for jumbo leads should be limited to specific, objective criteria given the higher CPL investment – negotiate return windows and criteria carefully. Exclusive positioning matters because many jumbo buyers require or prefer exclusivity and will pay accordingly.

Frequently Asked Questions

What defines a jumbo mortgage loan in 2025?

A jumbo mortgage is any loan exceeding the conforming loan limits set by the Federal Housing Finance Agency. For 2025, the baseline conforming limit is $806,500 for single-unit properties in most U.S. markets. In designated high-cost areas such as the San Francisco Bay Area, New York metropolitan area, and similar expensive markets, the conforming limit extends to $1,209,750. Any mortgage above these thresholds requires jumbo financing, meaning lenders hold the loan rather than selling it to Fannie Mae or Freddie Mac.

What are the typical credit score requirements for jumbo loans?

Most jumbo lenders require minimum credit scores of 700, with many programs requiring 720 or higher. Premium rates and terms typically require scores of 740 or above. Borrowers with scores in the 680-699 range may find limited options through specialty lenders at higher rates. Credit scores below 680 rarely qualify for jumbo financing except through exception-based underwriting. The higher credit requirements reflect the increased risk lenders assume when holding these larger loans on their portfolios.

How much do jumbo mortgage leads typically cost?

Jumbo lead pricing varies significantly based on loan amount, geography, and qualification depth. Exclusive jumbo leads for loan amounts between $750,000 and $1 million typically range from $150 to $250. Leads for loans exceeding $1.5 million command $300 to $450 or more for exclusive distribution. Premium markets like San Francisco and Manhattan add 25-50% to base pricing. Shared jumbo leads trade at 40-60% of exclusive pricing but face limited buyer demand due to the high-touch nature of jumbo sales.

What down payment do jumbo borrowers typically need?

Jumbo loans typically require larger down payments than conforming mortgages. Standard jumbo programs for loan amounts up to $1.5 million commonly require 10-20% down. Higher-balance jumbos in the $1.5-2.5 million range often require 15-25% down. Super jumbo loans exceeding $2.5 million frequently require 20-30% down payment. Some lenders offer lower down payment options for exceptionally qualified borrowers with compensating factors such as high credit scores and substantial reserves.

How do jumbo interest rates compare to conforming rates?

Historically, jumbo loans carried rate premiums of 0.25% to 0.50% above conforming rates because lenders cannot sell them to government-sponsored enterprises. In recent market conditions, this spread has narrowed significantly. As of late 2025, jumbo rates typically trade within 0.125% to 0.25% of conforming rates, with some portfolio lenders offering competitive or even lower rates to attract high-net-worth borrowers. The narrow spread makes jumbo financing more attractive for qualified borrowers considering luxury properties.

What reserve requirements apply to jumbo loans?

Jumbo lenders require post-closing reserves that substantially exceed conforming loan standards. Minimum requirements typically start at 6 months of mortgage payments in liquid assets. Standard programs for loans above $1 million commonly require 12 months of reserves. Super jumbo loans exceeding $2-3 million often require 18-24 months of reserves. These requirements protect lenders against default risk and ensure borrowers have financial cushion beyond the down payment and closing costs.

What targeting strategies work best for jumbo lead generation?

Jumbo lead generation requires precision targeting over volume optimization. Effective strategies include premium content marketing targeting high-intent keywords around jumbo loans and luxury property financing, LinkedIn advertising reaching high-income professionals by title and industry, partnerships with wealth managers, CPAs, and financial advisors who influence high-net-worth borrowers, and relationships with luxury real estate agents specializing in properties above $750,000. Traditional mass-market paid media approaches typically underperform due to limited income and asset targeting options.

How should jumbo leads be qualified before selling to lenders?

Effective jumbo lead qualification should verify credit score range (ideally 700+), stated income level (typically $200,000+ for individuals), down payment availability, property type and location, purchase or refinance intent, and timeline. Leads with comprehensive qualification data command premium pricing and experience lower return rates. Given the higher CPL for jumbo leads, thorough qualification protects both lead generators from returns and buyers from wasted sales resources on unqualified prospects.

What lender types purchase jumbo mortgage leads?

The jumbo lead buyer market includes money center banks with private banking operations, regional and super-regional banks building market share, independent mortgage banks with jumbo programs, credit unions offering competitive jumbo products, and portfolio lenders specializing in non-standard borrower profiles. Each buyer type has different volume appetite, pricing tolerance, and program requirements. Successful jumbo lead distribution requires matching leads to appropriate buyer types based on borrower characteristics and geographic coverage.

How do conversion rates for jumbo leads compare to conforming leads?

Jumbo leads typically show lower contact rates but higher conversion rates among contacted prospects compared to conforming leads. The high-net-worth borrowers seeking jumbo financing are often harder to reach initially but demonstrate stronger intent and qualification when engaged. Speed-to-contact remains critical, with leads contacted within five minutes converting at significantly higher rates than delayed contacts. The consultative sales approach required for jumbo borrowers means each conversation requires more time and expertise than conforming loan sales.

Key Takeaways

Jumbo mortgages exceed 2025 conforming limits of $806,500 in standard markets and $1,209,750 in high-cost areas. Understanding county-level thresholds is essential for accurate lead routing and pricing.

Jumbo borrowers typically earn $200,000+ annually, have 700+ credit scores, and maintain 6-12 months of reserves. Qualification requirements are substantially stricter than conforming loans.

Jumbo lead CPLs range from $150-$600+ depending on loan amount, geography, and qualification depth. Premium pricing reflects both smaller target audiences and higher customer lifetime value.

Content marketing and referral partnerships outperform mass-market paid media for jumbo lead acquisition. High-net-worth borrowers research extensively and trust professional advisor recommendations.

Exclusive distribution dominates the jumbo lead market because buyers invest heavily in each prospect. Shared distribution faces limited demand and compressed pricing.

Consultative sales approaches are required for jumbo borrowers who expect sophisticated engagement. Scripts and automated processes appropriate for conforming leads will fail with high-net-worth prospects.

Documentation requirements for jumbo loans are extensive. Proactive preparation support improves conversion rates and reduces application abandonment.

Speed-to-contact remains critical despite the need for consultative engagement. Immediate personal response within 15 minutes optimizes conversion while maintaining premium positioning.

Relationship-building creates long-term value beyond initial transactions. Jumbo borrowers return for future financing and refer others in their high-net-worth networks.

Conforming loan limits and regulatory information current as of December 2025. Market conditions, lead pricing, and lender requirements change continuously. Validate current thresholds and program availability before making significant investment decisions. This article provides general information and does not constitute legal or financial advice.