Kitchen and bathroom remodeling leads combine high project values with intense competition, creating a vertical where lead quality and speed-to-contact determine success more than volume alone.

The home remodeling industry represents one of the most valuable lead generation verticals in home services, with kitchen and bathroom projects commanding the highest average ticket values and the most competitive lead marketplace dynamics. Understanding how to generate, qualify, and convert these leads separates profitable contractors and lead generators from those bleeding money on unqualified prospects.

Kitchen and bathroom remodeling leads operate differently from emergency home services like HVAC or plumbing repair. These are considered purchase decisions with longer sales cycles, multiple stakeholders, and higher price sensitivity. A homeowner calling for emergency furnace repair will pay whatever it takes. A homeowner planning a kitchen remodel will get three to five quotes, research contractors extensively, and take weeks or months to decide.

This guide covers everything operators need to know about kitchen and bathroom remodeling leads: market sizing and economics, lead types and pricing benchmarks, acquisition channels, qualification criteria, conversion optimization, and the platform dynamics that shape competition in this vertical.

Market Overview: Understanding the Remodeling Economy

The U.S. home remodeling market represents a significant economic sector, with the Joint Center for Housing Studies at Harvard University estimating total remodeling expenditures exceeding $450 billion annually. Kitchen and bathroom projects account for a substantial portion of this spending, driven by their impact on home value, functionality, and daily living quality. For context on how remodeling CPLs compare to other verticals, see our cost per lead benchmarks by industry.

Kitchen Remodeling Market

Kitchen remodeling remains the most popular major home improvement project. According to the National Kitchen and Bath Association (NKBA) and industry surveys, project costs vary dramatically based on scope and finish quality.

A minor kitchen remodel typically runs $15,000 to $35,000 and includes cabinet refacing or painting, new countertops, updated fixtures and hardware, mid-range appliances, and flooring replacement. These projects appeal to homeowners seeking a refresh without structural changes.

Mid-range kitchen remodels fall in the $35,000 to $75,000 range. At this level, homeowners expect new semi-custom cabinets, stone or quartz countertops, premium appliances, lighting updates, and minor layout modifications. The investment reflects meaningful quality improvements while staying below the threshold of major reconstruction.

Major kitchen remodels start at $75,000 and can exceed $150,000. These projects involve custom cabinetry, high-end appliances, structural changes like wall removal or island additions, premium finishes throughout, and complete reconfiguration of the space. Projects at this level require longer timelines and more sophisticated contractor capabilities.

The average kitchen remodel in the United States costs approximately $25,000 to $50,000, though this varies significantly by region. Coastal markets and major metropolitan areas typically run 30-50% higher than national averages, reflecting both higher labor costs and elevated material specifications common in affluent markets.

Bathroom Remodeling Market

Bathroom remodeling ranks second only to kitchens in popularity and value, following similar tier structures based on project scope.

Minor bathroom remodels range from $5,000 to $15,000 and typically include vanity replacement, fixture updates, paint and minor tile work, and lighting improvements. These projects offer meaningful refreshes that homeowners can complete relatively quickly.

Mid-range bathroom remodels cost between $15,000 and $35,000. This tier encompasses full tile replacement, new tub or shower installations, updated vanity and countertops, improved lighting and ventilation, and fixture upgrades throughout. Projects at this level address both aesthetics and functionality.

Major bathroom remodels range from $35,000 to $75,000 or more. Complete gut renovations at this level include expansion or layout changes, high-end fixtures like walk-in showers and freestanding tubs, custom tile work, heated floors, and smart features. Master bathroom renovations increasingly reach this tier as homeowners invest in spa-like personal retreats.

The average bathroom remodel costs approximately $12,000 to $25,000, with master bathroom renovations trending toward the higher end and secondary bathrooms at the lower end.

Return on Investment Considerations

Remodeling Magazine’s annual Cost vs. Value Report provides critical context for lead generation economics. Kitchen and bathroom projects consistently rank among the highest ROI home improvements. Minor kitchen remodels typically recoup 75-85% of their cost at sale, while major mid-range kitchen remodels return 50-60%. Mid-range bathroom remodels recover 60-70% of costs, with bathroom additions returning 50-60%.

These ROI figures matter for lead generation because they influence homeowner motivation and sales messaging. Leads motivated by future home sale typically move faster than those planning for personal enjoyment, creating qualification opportunities for lead generators who understand how to identify and segment these different buyer personas.

Lead Types and Pricing Benchmarks

Kitchen and bathroom remodeling leads come in several formats, each with distinct pricing, quality characteristics, and optimal use cases.

Exclusive Leads

Exclusive leads are sold to a single contractor, eliminating direct competition for that specific prospect. The premium for exclusive leads reflects their higher conversion potential, as detailed in our exclusive vs shared leads comparison. Without competing contractors calling simultaneously, the first responder advantage becomes absolute rather than relative.

| Lead Type | Price Range | Expected Contact Rate | Expected Booking Rate |

|---|---|---|---|

| Kitchen Exclusive | $75-$200 | 50-70% | 15-25% |

| Bathroom Exclusive | $50-$150 | 55-75% | 18-28% |

| Combined K&B Exclusive | $100-$250 | 50-65% | 12-22% |

Shared Leads

Shared leads are distributed to multiple contractors, typically 2-4 for remodeling projects. The economics require understanding that booking rates decline as share count increases. A lead shared with two competitors behaves differently than one shared with four.

| Lead Type | Price Range | Expected Contact Rate | Expected Booking Rate |

|---|---|---|---|

| Kitchen Shared (3-4 buyers) | $25-$60 | 40-55% | 8-15% |

| Bathroom Shared (3-4 buyers) | $20-$50 | 45-60% | 10-18% |

| Combined K&B Shared | $35-$75 | 35-50% | 6-12% |

Scheduled Appointments

Some lead sources qualify leads further by scheduling actual appointments. Kitchen appointments typically cost $150 to $350, while bathroom appointments run $100 to $250, with show rates of 50-70% for scheduled appointments. The higher price reflects the qualification and scheduling work already completed. For contractors with limited sales capacity, appointments can be more cost-effective despite higher unit costs.

Live Transfers

Live transfers connect homeowners directly with contractors while still on the phone with the lead generator. Kitchen live transfers cost $100 to $300, bathroom transfers run $75 to $200, with connection rates of 65-80% and appointment booking rates of 30-50% from connected calls. Live transfers combine immediacy with qualification, making them valuable for contractors with available sales staff.

Geographic Price Variation

Lead pricing varies significantly by geography, reflecting both competition density and project values.

Premium markets carry the highest lead costs. San Francisco Bay Area runs 40-60% above national average, New York Metro adds 35-50%, Los Angeles 30-45%, Boston 25-40%, and Washington D.C. 25-35%. Standard markets like Chicago, Dallas, Houston, Phoenix, and Atlanta trade near national averages, with most major metropolitan areas falling within 10% either direction.

Value markets offer lower lead costs, with secondary cities and suburbs running 15-25% below average and rural or exurban areas 25-40% below. Geographic arbitrage opportunities exist for lead generators who can efficiently serve lower-cost markets while maintaining quality. A lead generator operating in both San Francisco and Sacramento can often achieve better aggregate economics than one focused solely on the premium market.

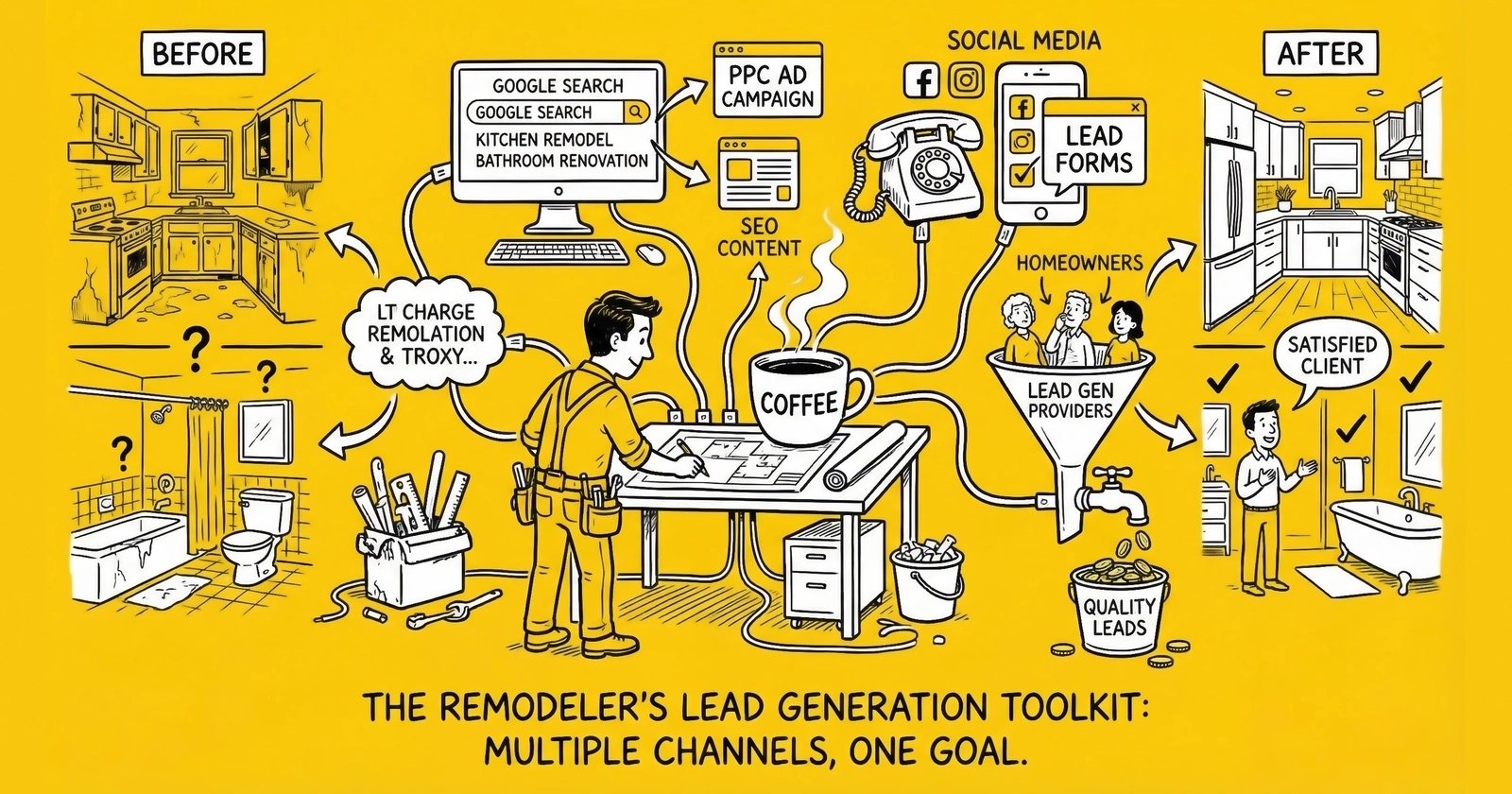

Lead Acquisition Channels

Kitchen and bathroom remodeling leads originate from multiple channels, each with distinct economics and quality characteristics.

Paid Search (Google Ads, Bing)

Paid search remains the primary channel for high-intent remodeling leads. Homeowners actively searching for “kitchen remodeling contractors” or “bathroom renovation near me” demonstrate clear purchase intent.

| Metric | Kitchen Keywords | Bathroom Keywords |

|---|---|---|

| Average CPC | $6-$12 | $5-$10 |

| Conversion Rate | 4-7% | 5-8% |

| Cost Per Lead | $90-$200 | $70-$150 |

| Mobile Share | 55-65% | 55-65% |

High-intent kitchen searches include variations like “kitchen remodel contractors [city],” “kitchen renovation cost estimate,” “kitchen remodeling quotes,” “cabinet installation near me,” and “kitchen design services [city].” Bathroom searches with strong intent follow similar patterns: “bathroom remodel contractors [city],” “bathroom renovation cost,” “shower replacement contractors,” “bathroom tile installation [city],” and “tub to shower conversion [city].”

Quality Score optimization matters significantly in this vertical. Remodeling keywords typically achieve Quality Scores of 5-7 out of 10. Improving to 8-10 requires dedicated landing pages per service type, location-specific content for local service areas, mobile-optimized pages with fast loading speeds, and trust signals including licenses, insurance, and reviews.

Social Media (Meta, TikTok, Pinterest)

Social platforms generate remodeling leads through visual inspiration and targeted advertising, though with different dynamics than search.

Meta (Facebook/Instagram) delivers leads at $35 to $75 CPL for remodeling, though lead quality tends toward lower intent as these prospects are often in the inspiration stage rather than active shopping. The platform works best for brand awareness and retargeting warm prospects, requiring before/after galleries and project videos to drive engagement.

Pinterest offers a unique advantage for remodeling because users actively save inspiration. CPL runs $40 to $80, with lead quality showing high consideration but longer timelines. Design-focused contractors and those with premium positioning find particular success here.

TikTok represents a growing channel for remodeling content at $25 to $50 CPL, reaching younger demographics and first-time homeowners. Time-lapse transformations and personality-driven brands perform well, though the audience skews less affluent than other platforms.

Social leads typically require longer nurturing sequences than search leads. A homeowner saving kitchen ideas on Pinterest may be 6-12 months from project initiation, while a Google searcher for “kitchen contractors near me” may be ready to get quotes this week.

Marketplace Platforms

Lead marketplaces aggregate demand and distribute to contractors, each with distinct positioning and economics.

Angi (HomeAdvisor) operates as the largest home services marketplace with remodeling CPL of $40 to $100 for shared leads. Lead quality varies significantly, with price-shoppers common. The platform works best for volume-focused contractors with strong sales processes who can convert despite lower lead quality.

Thumbtack uses a quote-based model with costs of $15 to $40 per quote sent. Leads are active shoppers expecting multiple quotes, making the platform suitable for contractors comfortable competing on price and response speed.

Houzz Pro takes a design-focused approach with premium positioning options. Lead quality trends toward higher-end projects and design-conscious homeowners, making it ideal for design-build firms and premium contractors.

Porch leverages its partnership with Lowe’s to provide retail lead flow at $30 to $70 CPL. The retail-triggered interest suits value-oriented contractors seeking volume.

BuildZoom differentiates through permit data integration that provides project intelligence. Premium lead pricing of $100 to $300 reflects verified project intent through permit activity, attracting contractors seeking qualified, high-value projects.

Content Marketing and SEO

Organic search traffic provides sustainable lead flow with superior economics but requires significant upfront investment. Target keywords include “[city] kitchen remodeling,” “bathroom renovation cost [year],” “best kitchen contractors [city],” “how much does a bathroom remodel cost,” and “[style] kitchen design ideas.”

Effective content categories for lead generation include cost guides with local pricing data, before/after project galleries, material and finish comparisons, design trend content, and contractor selection guides.

The typical SEO timeline requires patience. Months 1-6 focus on content development and technical optimization. Months 6-12 bring early rankings with limited organic leads. Months 12-24 deliver meaningful organic lead flow. Beyond 24 months, the investment yields sustainable competitive advantage.

The long timeline makes SEO challenging for newcomers but highly valuable for established players. A contractor ranking first for “kitchen remodeling [major city]” may generate 50-100 qualified leads monthly at near-zero marginal cost.

Referral Programs

Existing customer referrals represent the highest-quality remodeling leads, with conversion rates of 30-50% from referral to sale. Cost per referral ranges from zero to $500 depending on incentive payments, often producing the lowest customer acquisition cost of all channels. The limitation is volume, constrained by the existing customer base.

Successful referral programs require systematic outreach including post-project follow-up with referral requests, clear incentive structures (discounts, gift cards, or cash), easy referral submission processes, and thank-you communications to referrers.

Lead Qualification Criteria

Remodeling leads require qualification to separate serious prospects from browsers, DIYers, and those with unrealistic expectations.

Essential Qualification Fields

Basic information validates serious interest: full name confirms commitment, phone number requires verification via SMS or voice, email address needs format validation and deliverability confirmation, and property address confirms ownership and service area eligibility.

Project scope questions determine fit: room type (kitchen, bathroom, or both), project size (minor refresh, major remodel, or complete gut), and desired timeline (immediate, 1-3 months, 3-6 months, or 6+ months).

Budget indicators predict conversion potential. Using ranges rather than specific numbers reduces form abandonment. Financing interest indicates serious buyers with potential for higher spend. Decision-maker confirmation ensures both spouses or partners are involved in the process.

Property details filter out non-buyers. Homeowner versus renter status serves as an essential filter since renters cannot contract for improvements. Property type (single-family, condo, or multi-family) affects project complexity. Home age impacts scope and permit requirements.

Qualification Scoring

Effective lead scoring separates high-value prospects from those unlikely to convert.

High-value indicators that add points include immediate timeline with readiness to start within 30 days, budget above $30K for kitchen or $15K for bathroom projects, previous remodeling experience indicating process familiarity, specific feature requests for cabinets, countertops, or tile, pre-approved financing, and single decision-maker or both decision-makers engaged.

Low-value indicators that subtract points include “just getting ideas” timeline extending 12+ months out, budget below market minimum for quality work, renter status or unclear property ownership, requests for email-only response (often indicating tire-kickers), vague project vision without specific scope, and history of requesting quotes without hiring.

Disqualification Criteria

Some leads should be filtered before delivery to contractors:

- Renters who cannot contract for property improvements

- Properties outside the service area

- Budget below contractor minimums

- Commercial properties requiring different licensing and insurance

- Properties in foreclosure or tax default

- Repeat submissions within 90 days already in pipeline

Lead Generation Platforms and Technology

The technology infrastructure for remodeling lead generation requires several integrated components.

Landing Page Requirements

Remodeling landing pages must balance conversion optimization with lead quality. Essential elements include clear service identification (kitchen remodeling or bathroom renovation), geographic targeting with city or metro name prominent, trust signals including license numbers, insurance, and years in business, social proof through reviews, star ratings, and project photos, and multi-step forms that reduce abandonment while qualifying.

Form design best practices spread qualification across steps. Step 1 captures basic qualification including room type and timeline. Step 2 gathers property details like homeowner status and address. Step 3 requests contact information: name, phone, and email. Step 4 offers optional detail capture for budget and specific interests.

Multi-step forms typically achieve 15-25% higher completion rates than single-page forms for remodeling leads, as we explore in our guide to multi-step forms and conversion optimization. Each step creates commitment, and the initial questions seem less invasive than immediately asking for contact details.

Lead Validation Technology

Real-time validation prevents invalid leads from entering the pipeline.

Phone validation encompasses format verification for valid structure, line type identification for landline, mobile, or VoIP, carrier lookup for spam and fraud indicators, and disconnected number checks where real-time data is available. For a complete overview of validation techniques, see our guide on lead validation for phone, email, and address.

Email validation includes syntax verification, domain validation through MX record checks, deliverability prediction, and disposable email filtering.

Address validation covers USPS address standardization, service area confirmation, property type verification for residential confirmation, and ownership data append where available.

Lead Distribution Infrastructure

For lead generators selling to multiple contractors, distribution technology determines efficiency.

Ping-post distribution works in three steps. First, lead data without contact information is sent to potential buyers. Second, buyers respond with bid prices. Third, leads are delivered to winning bidders. The advantage is maximum yield through real-time auction mechanics.

Direct distribution routes leads immediately to assigned buyers based on filters including geographic, project type, and capacity-based routing. This approach is simpler but potentially delivers lower monetization.

Key platform capabilities include real-time delivery via API, webhook, or CRM integration, acceptance tracking for buyer confirmation of receipt, return management for invalid lead credits, and reporting and analytics covering volume, quality, and revenue by source.

Conversion Optimization for Remodeling Leads

Converting remodeling leads into customers requires understanding the considered purchase decision process.

Speed-to-Contact

Despite remodeling being a considered purchase, speed-to-contact significantly impacts conversion. Understanding the lead decay curve is essential: response under 5 minutes delivers 3-4x higher contact rates. The 5-30 minute window provides baseline performance. Waiting 30-60 minutes drops contact rates 25-40%, and response times over 1 hour see 50%+ lower contact rates.

The first contractor to make meaningful contact often sets the frame for the homeowner’s decision. Even if the homeowner intends to get multiple quotes, the first impression influences all subsequent evaluations.

Multi-Touch Follow-Up

Remodeling leads require systematic follow-up due to longer decision timelines. The cadence should unfold strategically across time.

On Day 1, make a call attempt within 5 minutes of lead receipt. If no answer, send an SMS: “Hi [Name], this is [Contractor] about your [kitchen/bathroom] project. When’s a good time to discuss?” Make a second call attempt 2-4 hours later and send an email with company introduction and portfolio link.

During Days 2-3, schedule morning and evening call attempts. Send text messages with value propositions and emails with relevant project examples.

In Week 2, make call attempts and send emails with design inspiration content along with texts offering scheduling options.

Throughout Month 1, maintain biweekly touchpoints via email with value-added content including design tips and material guides. Include seasonal promotions or incentives where appropriate.

For Months 2-6 nurture, shift to monthly email newsletters with seasonal content aligned to remodeling trends and re-engagement offers for stalled leads.

Many remodeling sales close 60-120 days after initial lead submission. Contractors who stop following up after two weeks lose significant conversion opportunity.

In-Home Consultation Optimization

For remodeling, the in-home consultation is where sales happen. Optimizing the appointment-to-sale conversion matters as much as lead-to-appointment conversion.

Pre-appointment preparation includes a confirmation call or text 24 hours before, sending digital portfolios relevant to the project type, confirming all decision-makers will be present, and gathering preliminary scope information.

During the appointment, present credentials and trust signals including license, insurance, and reviews. Practice active listening before presenting solutions. Show relevant past project photos and references. Provide written estimates before leaving when possible.

Post-appointment follow-up begins with same-day thank you emails including estimate documentation. Follow-up calls within 48 hours address questions. Send comparison guides if competing with other quotes, and maintain contact until the decision is made.

Closing Rate Optimization

Industry benchmarks for in-home remodeling consultations reveal significant variance by lead source:

| Lead Source | Appointment Show Rate | Close Rate (Kept Appointments) | Overall Conversion |

|---|---|---|---|

| Exclusive leads | 70-85% | 25-35% | 18-30% |

| Shared leads | 50-65% | 15-25% | 8-16% |

| Referrals | 85-95% | 40-55% | 34-52% |

| Marketplace platforms | 45-60% | 12-22% | 5-13% |

Improving close rates requires identifying and addressing common objection patterns. Price objections call for value selling, financing options, and material value education. Timing objections require project scheduling flexibility and seasonal incentives. Trust objections need references, reviews, and warranty documentation. Scope objections benefit from design visualization, material samples, and 3D renderings.

Competitive Landscape

The remodeling lead generation market includes multiple player types, each with distinct strengths and vulnerabilities.

National Marketplace Platforms

Angi/HomeAdvisor holds the dominant position in home services lead aggregation with strong brand recognition, massive traffic, and homeowner trust. However, lead quality variance and contractor complaints about pricing create vulnerabilities. Contractors should use it as a supplemental source rather than primary reliance.

Houzz occupies the premium design-focused segment with high-income demographics and project inspiration integration. The trade-offs are smaller lead volume and higher service expectations. Contractors should position for design-build and premium work when using this platform.

Thumbtack operates as a multi-service marketplace with a quote model offering consumer choice and transparent pricing. The weakness is race-to-bottom pricing pressure. Contractors should compete on speed and personality, not price alone.

Independent Lead Generators

Independent lead generation companies operate across the remodeling vertical, generating leads through paid advertising and selling to contractors through various models. Exclusive lead generation delivers to single contractors at premium pricing. Shared lead distribution sends to multiple contractors at lower unit costs. Appointment setting provides qualified and scheduled consultations. Local market specialists offer regional expertise in specific geographies.

When evaluating lead generators, look for quality indicators including consent documentation through TrustedForm or Jornaya certificates, clear return policies with credit for invalid leads, volume transparency without overselling market capacity, and geographic accuracy with actual service area matching.

Local SEO Dominance

Local SEO creates a durable competitive advantage for contractors who invest. Ranking factors for local remodeling searches include Google Business Profile optimization (complete, accurate, and actively managed), review velocity and rating through ongoing review generation, website content with location-specific and service-specific pages, local citations with consistent NAP across directories, and backlink profiles with local links from relevant sources.

Investment requirements include $2,000 to $5,000 for initial optimization and $500 to $1,500 monthly for ongoing content and link building. The timeline to meaningful results runs 6-18 months, but the long-term advantage is substantial because competitors cannot easily replicate years of accumulated authority.

Building a Remodeling Lead Operation

For lead generators entering or scaling in the remodeling vertical, the operational requirements differ from emergency home services.

Market Entry Considerations

Vertical complexity sets remodeling apart. Remodeling leads require more qualification than simple service calls. A plumbing lead is straightforward: someone needs a plumber. A remodeling lead involves project scope, budget, timeline, design preferences, and decision-maker dynamics. This complexity demands more sophisticated capture and qualification processes.

Contractor relationships require ongoing management. Remodeling contractors are more sophisticated lead buyers than many home service categories. They understand lead economics, demand quality accountability, and switch sources readily. Relationship management requires ongoing communication and quality maintenance.

Seasonality creates predictable fluctuations, though less extreme than HVAC. Spring brings high demand as homeowners emerge from winter planning. Summer maintains steady demand but competes with vacation scheduling. Fall provides a secondary peak before holidays for weather-independent work. Winter sees lower demand in cold climates but steady activity in warm regions.

Technology Requirements

Lead capture infrastructure needs a landing page platform with form builder, phone and email validation API integration, address verification services, and consent capture with documentation through TrustedForm or equivalent.

Lead distribution requires a CRM or lead management platform, real-time API delivery capability, return and credit management, and revenue tracking with analytics.

Traffic acquisition demands Google Ads and Bing Ads accounts, Meta advertising accounts, analytics and tracking through GA4 and conversion tracking, and call tracking for phone leads.

Economics and Unit Metrics

Lead generator economics when selling to contractors follow predictable patterns:

| Metric | Kitchen Leads | Bathroom Leads |

|---|---|---|

| Traffic cost (CPC) | $6-$12 | $5-$10 |

| Landing page conversion | 5-8% | 6-9% |

| Traffic cost per lead | $75-$240 | $55-$165 |

| Validation pass rate | 85-92% | 85-92% |

| Effective cost per valid lead | $82-$280 | $60-$195 |

| Sale price (exclusive) | $100-$200 | $75-$150 |

| Gross margin | 15-45% | 20-50% |

Margins tighten in competitive markets and expand in underserved geographies. Lead generators achieve profitability through volume efficiency, quality maintenance that reduces returns, and buyer relationship management.

Contractor economics when buying leads follow these benchmarks:

| Metric | Exclusive Leads | Shared Leads |

|---|---|---|

| Lead cost | $100-$175 | $35-$65 |

| Contact rate | 60-75% | 45-55% |

| Appointment rate (from contacts) | 35-45% | 25-35% |

| Show rate | 75-85% | 55-70% |

| Close rate (from kept appointments) | 28-38% | 18-28% |

| Overall lead-to-sale | 5-12% | 2-6% |

| Effective cost per sale | $850-$3,500 | $600-$3,250 |

With average remodeling project values of $25,000 to $50,000, effective customer acquisition costs of $1,500 to $3,000 typically represent 3-6% of project revenue, an acceptable range for most contractors.

Frequently Asked Questions

Q: What is a good cost per lead for kitchen and bathroom remodeling?

Kitchen remodeling leads typically cost $75-$200 for exclusive delivery and $25-$60 for shared leads with 3-4 contractors. Bathroom leads run slightly lower at $50-$150 exclusive and $20-$50 shared. However, cost per lead is less important than cost per acquired customer. An exclusive lead at $150 that converts at 8% yields an effective customer acquisition cost of $1,875. A shared lead at $40 that converts at 3% yields an effective cost of $1,333. Calculate your target CPL by working backward from acceptable customer acquisition cost and historical conversion rates.

Q: How do kitchen and bathroom remodeling leads differ from other home service leads?

Remodeling leads involve considered purchase decisions rather than emergency service needs. This creates longer sales cycles measured in weeks to months versus days, more price comparison behavior, multiple stakeholder involvement where both partners need to agree, and higher expectations for consultation and design input. Lead generation requires more qualification, and conversion requires more touchpoints than emergency service leads. The upside is higher project values of $15,000-$75,000+ versus $300-$1,500 for typical service calls.

Q: Which lead sources work best for kitchen and bathroom remodeling contractors?

The optimal mix depends on contractor capacity and positioning. High-volume contractors often rely on marketplace platforms like Angi and Thumbtack for consistent flow despite lower conversion rates. Premium contractors may focus on Houzz, referral programs, and organic search for higher-quality leads. Most successful contractors diversify across 3-5 sources to reduce single-platform dependency. Paid search through Google Ads consistently delivers the highest intent leads but at higher costs. Test multiple channels and track lead-to-revenue attribution to identify your best sources.

Q: What qualification criteria matter most for remodeling leads?

Four criteria dramatically affect lead value: homeowner status since renters cannot contract for improvements, project timeline distinguishing ready-now from researching for someday, budget alignment with realistic expectations for quality work, and decision-maker availability confirming all decision-makers are engaged. Leads missing any of these criteria convert at significantly lower rates. Effective lead forms qualify on these dimensions before capturing contact information, reducing wasted spend for both lead generators and contractors.

Q: How long does the sales cycle take for kitchen and bathroom remodeling leads?

From initial lead submission to project start, typical timelines range from 30-120 days for bathrooms and 60-180 days for kitchens. The cycle includes initial contact over 1-3 days, consultation scheduling over 1-2 weeks, in-home consultation, decision period of 2-6 weeks, contract signing, and project scheduling which may include permit and material lead times. Contractors who expect immediate conversion will be disappointed. Building nurture sequences for leads not ready to decide today captures significant additional revenue from initially non-converting leads.

Q: What return rates should contractors expect for remodeling leads?

Return rates for remodeling leads typically run 10-18% depending on lead source and validation quality. Common return reasons include wrong phone numbers at 8-12% of returns, out-of-service-area addresses at 15-20%, renters misidentified as homeowners at 10-15%, and duplicate submissions at 5-10%. Work with lead sources that offer clear return policies and credit for legitimately invalid leads. Sources with return rates consistently above 20% indicate quality problems requiring source adjustment or termination.

Q: How can contractors improve close rates on remodeling leads?

Close rate improvement focuses on three areas. First, speed-to-contact: reaching leads within 15 minutes significantly improves engagement. Second, pre-consultation preparation including sending project-relevant portfolios, confirming all decision-makers will attend, and gathering preliminary scope information. Third, consultation excellence through presenting value rather than just price, showing relevant past work, providing financing options, and following up systematically after the appointment. Contractors who focus only on lead cost while ignoring close rate optimization often achieve worse economics than those paying more for leads but converting them effectively.

Q: Should contractors buy exclusive or shared remodeling leads?

The answer depends on sales capacity and close rate. Exclusive leads eliminate direct competition and typically convert at 1.5-2x the rate of shared leads, justifying their premium pricing. However, if contractor sales bandwidth is limited, the higher close rate of exclusive leads may not offset their higher cost compared to processing more shared leads through an efficient sales process. Model the economics: if you can contact, consult, and close at your historical rates, which approach produces more profitable revenue? Many contractors use exclusive leads for high-value kitchen projects and shared leads for smaller bathroom work.

Q: What role does seasonality play in remodeling lead generation?

Remodeling shows moderate seasonality with spring from March through May as the peak demand period as homeowners emerge from winter planning phases. Summer maintains steady demand but competes with vacation schedules. Fall from September through November provides a secondary peak before holidays. Winter slows in cold climates but remains active in warm regions. Lead costs typically run 10-20% higher in spring peak than in winter trough. Savvy contractors maintain marketing presence during slower periods when competition is lower and lead costs are more favorable, building pipeline for the busy season.

Q: How do I evaluate a remodeling lead generation company?

Key evaluation criteria include consent documentation through TrustedForm or equivalent for TCPA protection, return policy terms specifying credit for invalid leads within a defined timeframe, delivery method comparing real-time API versus batch email, geographic accuracy ensuring leads actually fall within your service area, and client references from other contractors using the service. Request test leads before committing to volume agreements. Track lead quality metrics rigorously: contact rate, appointment rate, close rate, and revenue per lead. Terminate sources that fail to meet acceptable quality thresholds regardless of cost per lead.

Key Takeaways

-

Kitchen remodeling leads typically cost $75-$200 for exclusive delivery, with bathroom leads at $50-$150. Cost per acquired customer matters more than cost per lead. Calculate backward from acceptable customer acquisition cost and historical conversion rates to determine sustainable CPL targets.

-

Remodeling leads involve considered purchase decisions with 30-180 day sales cycles. Unlike emergency service leads, these prospects will get multiple quotes and take weeks to decide. Lead generation and sales processes must accommodate this longer timeline.

-

Qualification criteria that predict conversion include homeowner status, project timeline, budget alignment, and decision-maker availability. Leads missing these criteria convert at dramatically lower rates. Build qualification into lead capture forms to improve downstream economics.

-

Speed-to-contact still matters despite longer sales cycles. Contractors who reach leads within 15 minutes achieve 2-3x higher engagement than those waiting hours. The first contractor to make meaningful contact often sets the frame for the homeowner’s decision process.

-

Multi-touch follow-up sequences are essential. Many remodeling sales close 60-120 days after initial lead submission. Contractors who stop following up after two weeks abandon significant conversion opportunity to more persistent competitors.

-

Geographic arbitrage exists between premium markets (coastal metros, major cities) with lead costs 30-50% above national average and secondary markets with lower competition and costs. Lead generators can achieve better aggregate economics by serving multiple market tiers.

-

Platform diversification reduces risk. Relying on a single lead source (whether Angi, Google Ads, or any other channel) creates vulnerability to platform changes, cost increases, or quality degradation. Maintain 3-5 active lead sources with regular performance tracking.

-

Close rate optimization at the consultation stage often provides better return than lead cost reduction. A 5-point improvement in close rate (25% to 30%) reduces effective customer acquisition cost by 17%, equivalent to substantial lead cost reduction that may be harder to achieve.

Kitchen and bathroom remodeling leads represent one of the most valuable verticals in home services lead generation. The combination of high project values, considered purchase behavior, and sophisticated buyers creates both opportunities and challenges for lead generators and contractors who understand the dynamics. Success comes from matching lead quality to contractor expectations, maintaining rigorous qualification, and building sales processes that accommodate the longer decision timelines these projects require.