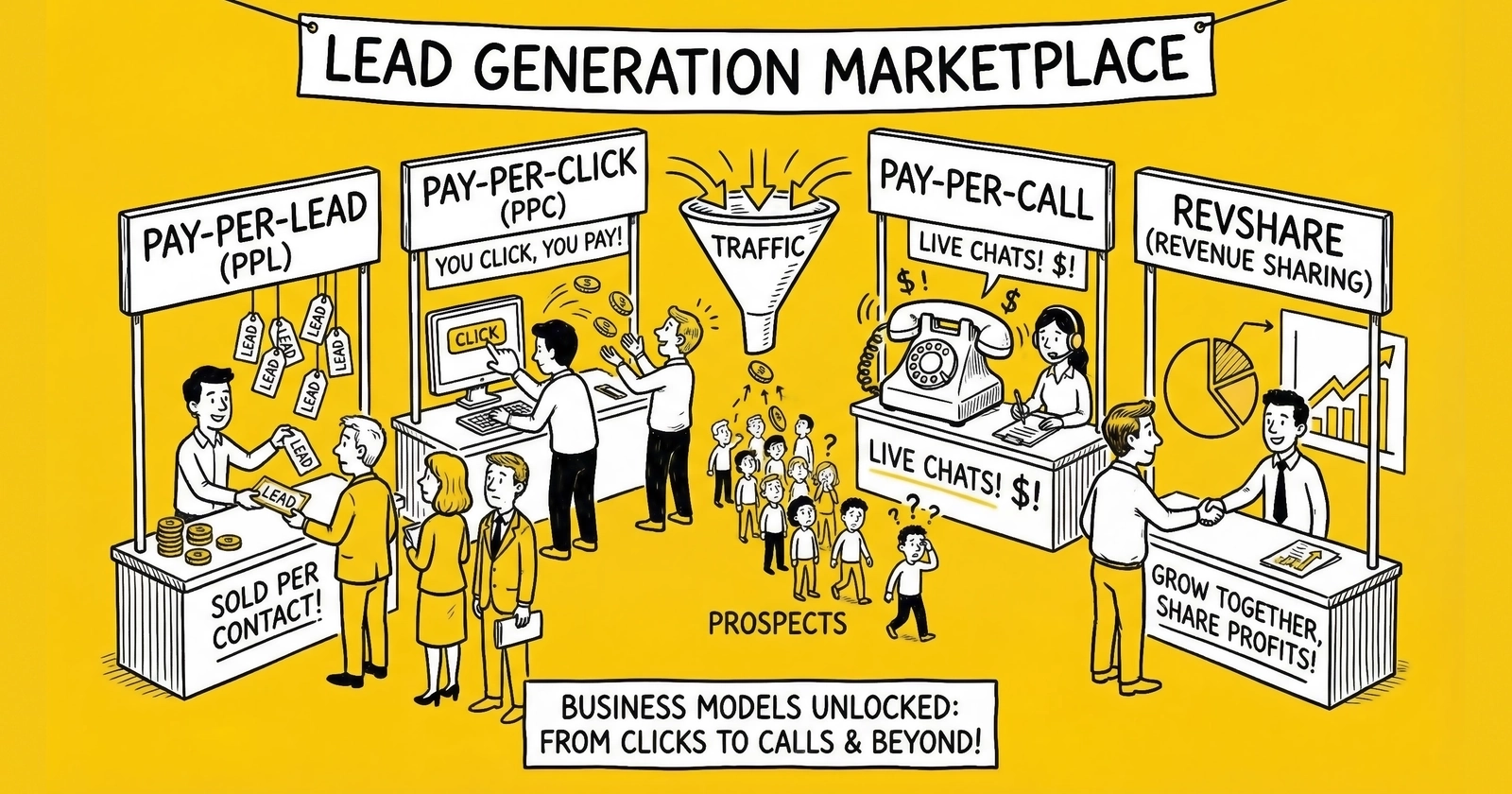

A comprehensive guide to choosing the right business model for your lead generation company, with capital requirements, profit margins, and strategic fit for each approach.

The lead generation industry processes billions of dollars in annual transaction value across dozens of verticals. But not every operator participates the same way. Some buy and resell leads, capturing spreads of 15-18%. Others build content properties generating 60% net margins. Still others provide the technology infrastructure that powers the entire ecosystem.

Understanding these twelve distinct business models separates operators who build sustainable wealth from those who burn capital chasing the wrong opportunity. This guide breaks down each model with the specificity you need: actual capital requirements, realistic margin expectations, operational realities, and the strategic fit for different operator profiles.

Here is the reality most conference presentations skip: every model works for the right operator with the right resources. Every model fails for operators who mismatch their capital, skills, or timeline expectations.

The Twelve Models at a Glance

Before diving deep, here is the complete landscape of lead generation business models:

| Model | Capital Required | Net Margin | Time to Profit |

|---|---|---|---|

| 1. Lead Broker | $200K-$550K | 15-18% | 6-12 months |

| 2. Direct Generator (O&O) | $50K-$125K | 25-40% | 6-12 months |

| 3. Ping/Post Exchange | $500K-$2M | 20-35% | 18-30 months |

| 4. Affiliate Network | $75K-$225K | 25-40% | 9-15 months |

| 5. Call Center/Live Transfer | $200K-$500K | 15-25% | 9-15 months |

| 6. Owned Media Publisher | $500K-$1M | 40-60% | 12-24 months |

| 7. Platform/SaaS Provider | $2M-$5M | 20-30% | 24-36 months |

| 8. Vertical Aggregator | $200K-$450K | 18-25% | 6-12 months |

| 9. Data Enhancement Provider | $400K-$800K | 20-35% | 12-18 months |

| 10. Aged Lead Specialist | $125K-$350K | 15-30% | 3-6 months |

| 11. Exclusive Lead Provider | $300K-$700K | 30-45% | 6-12 months |

| 12. Co-Registration Network | $300K-$700K | 15-25% | 9-15 months |

These numbers represent realistic operational requirements, not theoretical minimums. Many practitioners have launched with less capital. Most did not survive their first significant challenge.

Model 1: Lead Broker

A lead broker purchases leads from generators and resells them to buyers, taking pricing and quality risk on every transaction. You do not generate traffic or convert consumers. You aggregate supply, match it to demand, and capture the spread. Think of yourself as a market maker. Lead generators want reliable demand and fast payment. Lead buyers want consistent quality and single-vendor simplicity. You sit in the middle, providing both and earning the margin for absorbing risk that neither party wants to manage.

The pitch deck version of brokering shows 25-40% gross margins. The reality is considerably less forgiving. Sell prices vary by vertical: $8-15 for shared auto insurance leads, $25-75 for exclusive insurance leads, $50-200 for mortgage leads, and $150-500 for legal leads. On the cost side, lead acquisition consumes 60-75% of sell price, compliance verification through services like TrustedForm and Jornaya runs $0.15-0.50 per lead, technology platform fees take 1-5% of transaction value, and validation services add another $0.10-0.50 per lead.

What actually lands in your account tells a different story than gross margin suggests. That 25-40% gross margin shrinks rapidly once you factor in return rates of 8-15% when buyers reject leads for quality issues, bad debt of 1-3% from buyers who do not pay, and float cost of 2-4% representing the cost of capital while waiting for payment. The result is a net margin of 15-18%.

Lead brokering is fundamentally a working capital business because you pay suppliers before buyers pay you. Consider what happens at 500 leads per day with $30 average cost and Net 45 buyer terms. Your float requirement alone reaches $675,000. Add a return reserve of $135,000 plus variable operating expenses for 45 days, and you arrive at a total minimum capital of $800,000-$1,000,000. Most failed brokers did not fail because they could not find leads or buyers. They failed because they ran out of cash waiting for buyers to pay.

Choose brokering if you have substantial capital (minimum $200,000 to start small), strong relationship management skills, and comfort with negotiation. Former account managers, business development professionals, and enterprise sales veterans often excel here. The critical challenges you will face include cash flow timing mismatch where suppliers expect Net 7-15 payment while buyers pay Net 30-60, the “almost sold” problem where leads matching 90% of criteria but failing one filter erode margin, and margin compression as new brokers undercut pricing while technology lets generators bypass you entirely.

Model 2: Direct Lead Generator (Owned and Operated)

A direct lead generator creates leads from traffic sources you control and sells directly to buyers. Unlike brokers who aggregate third-party supply, you own the entire funnel: the ads, the landing pages, the forms, the consumer relationships. This model offers higher margins than brokering because you eliminate the middleman. But it introduces traffic risk: the daily uncertainty of whether your campaigns will produce leads at profitable cost.

The revenue structure mirrors broker sell prices: $20-75 for insurance, $40-150 for mortgage, $100-400 for solar, and $200-800 for legal. The cost structure differs substantially. Traffic acquisition consumes 30-50% of revenue, landing page hosting and technology takes 1-3%, compliance tools run 2-5%, and validation services add 2-4%.

Consider the economics in the insurance vertical. With monthly ad spend of $150,000 generating 7,500 leads, your cost per lead is $20. At an average sell price of $45, you achieve a gross margin of 56% and net margin of 35-45%. The catch: traffic cost is volatile. A $20 CPL can become $35 after a platform algorithm change. Your 56% gross margin becomes 22% overnight.

Capital requirements for direct generation include 30-60 days of ad spend as reserve ($75,000-$150,000), technology and tools ($5,000-$10,000), and float capital for buyer payments ($100,000-$200,000), bringing the total minimum to $180,000-$360,000. Choose direct generation if you have deep traffic acquisition expertise. You need to understand platform dynamics, creative testing discipline, and analytical rigor to identify winners quickly and kill losers faster. If you have never run profitable paid media campaigns, this model has a steep learning curve.

The critical challenges in direct generation revolve around dependencies and decay. Traffic source dependency means that if 60% of leads come from one platform, you are one policy change from crisis. Algorithm and policy changes mean what worked last month may violate policy this month. Creative fatigue gives every ad a lifespan – your best-performing creative in January is exhausted by March. Conversion rate decay affects even great landing pages as competitors copy successful elements.

Model 3: Ping/Post Exchange

A ping/post exchange operates a real-time marketplace where leads are auctioned to the highest qualified bidder. Unlike brokers who negotiate fixed prices, exchanges facilitate dynamic price discovery. Buyers bid what a lead is worth based on their specific criteria and current capacity. The exchange does not take pricing risk on individual leads. Instead, you earn a transaction fee (typically 5-15% of the winning bid) for operating marketplace infrastructure.

The revenue structure centers on platform transaction fees of 5-15% of lead value, making the business volume-dependent where more transactions equal more revenue. Some exchanges also charge listing fees, premium placement, or analytics subscriptions. At scale, the economics become compelling. Consider an exchange processing 500,000 leads monthly at $40 average lead value. Gross transaction value reaches $20,000,000. With an 8% take rate, platform revenue hits $1,600,000 with an operating margin around 50%.

The capital requirements for exchanges are front-loaded on technology. Platform development runs $200,000-$1,000,000 or more. Infrastructure costs $10,000-$50,000 monthly. Network building requires $100,000-$500,000 in the first two years. The minimum to launch ranges from $500,000-$2,000,000. This is not a weekend project. Building a functioning exchange takes 12-24 months and significant capital.

Choose the exchange model if you have substantial technology capability, patient capital, and understanding of marketplace dynamics. The barrier to entry is high. The barrier to exit is also high: once buyers and sellers depend on your platform, switching costs keep them loyal. The critical challenges include network building (buyers will not join without seller inventory while sellers will not join without buyer demand, breaking this cycle requires subsidizing one side until critical mass), technology investment (real-time bidding must be fast at sub-second, reliable at 99.9% or higher, and secure), and quality standardization where one bad actor damages trust in your entire marketplace.

Model 4: Affiliate Network

An affiliate network connects publishers (traffic sources) to buyers (advertisers) without taking inventory risk. Unlike brokers who purchase and resell leads, networks facilitate transactions and take a percentage of deal flow. Your role is matchmaker, quality enforcer, and payment processor. Publishers access multiple offers through single integration. Buyers access distributed traffic sources without managing hundreds of relationships.

The revenue structure centers on a 10-20% revenue share of lead value, with additional fees possible for premium placement, advanced analytics, and compliance tools. The economics at scale demonstrate the model’s potential. With 200,000 leads monthly at $50 average buyer price and 85% payout to publishers ($42.50), the network retains 15% ($7.50). Gross network revenue reaches $1,500,000 with net margin of $600,000 (40%).

Capital requirements include $50,000-$200,000 to build the technology platform, $425,000 for publisher float covering 15 days of payouts, and $75,000 for fraud reserve, bringing minimum capital to $500,000-$700,000. Choose the network model if you excel at relationship management on both sides of the marketplace. You need publisher recruitment skills, buyer development capability, and fraud prevention expertise. Technical competence matters, but relationship management determines success.

The critical challenges unique to networks relate to trust and concentration. Fraud management presents a constant threat because affiliate networks are fraud magnets, with sophisticated fraudsters targeting networks for volume and anonymity. Quality control at scale becomes difficult when 150 or more publishers produce enormously variable quality while buyers expect consistency. Concentration risk means that if 40% of volume comes from three publishers, those publishers have leverage over your entire operation.

Model 5: Call Center / Live Transfer

A call center generates and qualifies leads via phone, then transfers live connections directly to buyers. Unlike form-based leads where buyers must initiate contact, live transfers deliver consumers who are already on the phone, pre-qualified, and ready to talk. This model commands premium pricing ($50-$500 or more per transfer) because it eliminates the buyer’s biggest cost: speed-to-contact and qualification labor.

Transfer values vary significantly by vertical. Medicare supplement transfers command $20-75, auto insurance runs $30-100, final expense life insurance brings $50-150, solar transfers fetch $75-200, and legal (mass tort) commands $150-500 or more. The cost structure is labor-intensive: labor consumes 40-50% of revenue, lead acquisition takes 10-20%, telephony infrastructure runs 5-10%, and technology and compliance add another 5-10%. Net margin lands at 15-25%.

Labor-intensive businesses have different capital profiles than technology or arbitrage plays. Telephony setup runs $10,000-$50,000, initial hiring and training costs $20,000-$100,000, lead acquisition float requires $50,000-$200,000, and you need 60-day operating reserves on top of everything. The minimum capital totals $400,000-$600,000.

Choose call center operations if you have operational excellence in your DNA. You are managing people, processes, quality control, and regulatory compliance across dozens of agents. Manufacturing executives, operations managers, and service center veterans find this model familiar. The critical challenges center on people and compliance. Labor management is relentless as agent turnover runs 30-50% annually, requiring constant hiring, training, and performance management. TCPA compliance makes every call a potential lawsuit, with violations carrying $500-$1,500 per call in statutory damages. Buyer capacity volatility means that when buyer capacity drops, agents sit idle or you scramble for backup buyers at lower rates.

Model 6: Owned Media Publisher

An owned media publisher builds content properties that generate leads organically through SEO, direct traffic, and brand recognition. Unlike paid traffic models, owned media creates assets that attract visitors without ongoing media spend. Think NerdWallet for financial products, Bankrate for mortgages, or Healthline for healthcare. These properties rank for high-intent keywords, attract millions of visitors, and convert traffic into leads. This is the highest-margin model in lead generation. It is also the slowest to build.

The cost structure favors operators who can wait. Content creation takes 20-35% of revenue, technology runs 10-15%, and SEO and marketing consume another 10-15%. At maturity, the economics are exceptional. Consider an established insurance comparison site generating 500,000 monthly organic visitors. With a 3% conversion rate, you produce 15,000 monthly leads. At $45 average lead value, monthly revenue reaches $750,000 with net profit of $375,000 (50%). These economics represent a mature property after years of investment.

Capital requirements are front-loaded with returns delayed. Content investment during the first 18 months runs $200,000-$500,000. Technology platform costs $50,000-$150,000. Operating costs during the build phase add $200,000-$400,000. The minimum to reach profitability totals $500,000-$1,000,000 over 18-24 months.

Choose owned media if you have patient capital, SEO expertise, content strategy skills, and the tolerance for 12-24 months of investment before meaningful revenue. This model is not for operators who need revenue immediately. The critical challenges all relate to patience and platform dependency. Time to profitability spans 12-24 months of investment before meaningful revenue, and many practitioners give up first. Algorithm dependency means Google algorithm changes can eliminate 30-50% of organic traffic overnight. Content commoditization accelerates as AI makes content easier to produce, making differentiation harder each year.

Model 7: Platform / SaaS Provider

A platform provider builds and licenses technology infrastructure to other lead generation companies. Instead of generating or brokering leads yourself, you enable others to do so through subscriptions, transaction fees, or usage-based pricing. Think boberdoo, LeadsPedia, Phonexa. Your customers are the brokers, publishers, and buyers. Your product is the software that makes their businesses run.

The revenue structure combines recurring and transactional elements. Platform subscriptions range from $500-$10,000 or more monthly per customer. Transaction fees run $0.01-$0.50 per lead processed. Setup and integration fees bring $5,000-$50,000 per implementation. At maturity, SaaS economics become highly attractive. With 200 active customers at $2,500 average monthly revenue per customer, monthly recurring revenue reaches $500,000. Add transaction revenue of $100,000, and annual recurring revenue hits $6,000,000. Early-stage companies often operate at a loss while building customer base.

Capital requirements are the highest of any model. Initial product development runs $500,000-$2,000,000. Sales and marketing during the first two years costs $500,000-$1,500,000. Customer success infrastructure adds $200,000-$500,000. The total to break-even reaches $2,000,000-$5,000,000.

Choose the platform model if you have genuine technical capability, venture capital or substantial angel investment, and tolerance for 2-3 year development cycles. This requires either building technology yourself or managing technical teams effectively. The critical challenges relate to capital intensity and customer dynamics. Development investment never stops – continuous engineering investment is required or technical debt accumulates if you under-invest. Customer concentration means a few large customers often represent disproportionate revenue. Sales cycle length extends enterprise deals to 6-12 months from initial contact to closed contract.

Model 8: Vertical Aggregator

A vertical aggregator specializes deeply in one industry, aggregating leads from multiple sources and developing expertise that generalist brokers cannot match. Your differentiation is vertical knowledge: understanding buyer needs, regulatory requirements, and pricing dynamics better than anyone. Where a general broker handles a dozen verticals superficially, you handle one completely.

The economics reflect your expertise premium. You can command pricing 10-30% above generalist brokers. Deeper buyer relationships yield larger volume commitments. Vertical-specific consulting provides additional revenue streams. Net margin reaches 18-25%, reflecting the expertise premium over general brokering.

Capital requirements mirror general brokering plus expertise investment. Working capital for float matches broker requirements. Vertical expertise development adds $50,000-$200,000. Compliance infrastructure specific to your vertical costs $25,000-$100,000. The minimum capital totals $200,000-$450,000.

Choose vertical aggregation if you have deep domain expertise. Industry veterans from insurance, mortgage, solar, or legal backgrounds bring knowledge that takes outsiders years to develop. This specialization commands premium pricing and builds defensible expertise. The critical challenges all stem from concentration. Vertical concentration risk means when your vertical struggles, you struggle – there is no diversification cushion. Market cycle sensitivity exposes you to every cycle without escape hatches. Expertise maintenance requires continuous investment as regulations change and market dynamics shift, or your advantage erodes.

Model 9: Data Enhancement Provider

A data enhancement provider enriches lead data with additional attributes: phone validation, email verification, fraud detection, demographic append, credit indicators. You do not generate or broker leads. You make other people’s leads more valuable. Think TrustedForm, Jornaya (consent verification and lead intelligence), BriteVerify (email validation), or Anura (fraud detection).

The revenue structure is transaction-based. Per-lookup pricing ranges from $0.05-$0.50 depending on complexity. Subscription tiers with volume commitments provide revenue predictability. Enterprise custom pricing captures large accounts. At scale, the economics benefit from operating leverage. With 10,000,000 monthly transactions at $0.15 average revenue per transaction, monthly revenue reaches $1,500,000 with net profit of $375,000 (25%). The marginal cost of each additional transaction is minimal once infrastructure is built.

Capital requirements include $200,000-$500,000 for the technology platform, $50,000-$200,000 for data partnerships, and $50,000-$150,000 for infrastructure. The minimum to launch totals $400,000-$800,000.

Choose data enhancement if you have data science expertise, API architecture skills, and ability to manage complex data provider relationships. Customer retention is high once customers integrate your API. The critical challenges relate to data quality and differentiation. Data provider dependency means your service is only as good as your data sources. Accuracy verification matters because customers trust your data to make decisions – inaccuracy costs them money and trust. Commoditization threatens basic validation services as they become increasingly commodity, requiring superior accuracy or additional data layers to differentiate.

Model 10: Aged Lead Specialist

An aged lead specialist acquires leads that did not sell when fresh and resells them at significant discounts to buyers with lower quality requirements. Where fresh leads sell for $40, aged leads might sell for $5-15. This is the clearance rack of lead generation. Not glamorous, but profitable.

Pricing tiers reflect age directly. Leads aged 7-14 days command $6-10. Those at 15-30 days fetch $4-7. Leads aged 31-60 days sell for $2-4. Beyond 60 days, pricing drops to $0.50-2. The economics depend on acquisition efficiency. With 100,000 monthly leads acquired at $3.00 average cost and sold at $8.00 average price with a 20% return rate, net profit reaches $416,000 (26%). The best operators build relationships with generators who would otherwise discard unsold inventory.

Capital requirements are lower than fresh lead brokering. Inventory acquisition runs $50,000-$200,000. Technology platform costs $25,000-$75,000. The minimum capital totals $125,000-$350,000.

Choose aged leads if you want the fastest path to revenue in lead generation. With proper buyer relationships, you can reach profitability in 3-6 months. Your buyers are typically large call centers with excess capacity, agents in training who need practice leads, or nurture campaign operators. The critical challenges relate to quality and compliance. Inventory quality variability means some batches are leads that barely missed real-time sale while others are junk that did not sell for good reason. Consent expiration creates compliance risk when leads age beyond consent validity windows. Buyer education requires managing expectations as many buyers expect fresh lead performance at discount prices.

Model 11: Exclusive Lead Provider

An exclusive lead provider generates and sells leads to single buyers only. No multi-selling, no shared access. Each consumer’s information goes to exactly one buyer, justifying premium pricing (typically 2-3x shared lead pricing). Exclusivity is both a pricing strategy and a quality signal. Exclusive leads reach consumers before competitors, enabling better contact rates.

The premium pricing transforms economics substantially. Exclusive insurance leads command $80-150 compared to $30-50 for shared leads, while generation cost remains similar. With 5,000 monthly leads at $110 average exclusive price, monthly revenue reaches $550,000. After quality rejections of 12% ($66,000), net profit hits $181,500 (33%). Exclusive models trade volume for margin – lower total revenue but higher profitability per lead.

Capital requirements include $100,000-$300,000 for traffic and generation investment, $50,000-$100,000 for quality infrastructure, and $200,000-$400,000 for working capital. The minimum totals $300,000-$700,000.

Choose exclusive leads if you can maintain premium quality standards and prefer deeper relationships with fewer buyers. This model requires tight quality control and operational discipline. Accidentally multi-selling destroys the business. The critical challenges center on quality and capacity. Quality maintenance is non-negotiable – premium pricing requires premium quality, and quality degradation leads to buyer complaints and churn. Capacity matching matters because exclusive leads have one buyer, and if you generate more than buyer capacity, excess has no home. Buyer concentration means fewer, larger buyers, with each representing significant revenue concentration risk.

Model 12: Co-Registration Network

A co-registration network captures leads during other conversion events by presenting related offers consumers can opt into. When you buy plane tickets and see “Would you like travel insurance quotes?”, that is co-registration. The model generates high volume at low cost per lead because traffic already exists for other purposes.

The revenue structure reflects the lower-intent nature of co-registration leads. Lead values run 30-60% of direct leads ($15-35 versus $40-80 for insurance). Revenue share with host sites takes 20-40% of lead value. At scale, the volume compensates for lower per-lead value. With 5,000,000 monthly reach and an 8% opt-in rate, you generate 400,000 monthly leads. At $22 average lead value, net profit reaches $3,520,000 (20%). Co-registration achieves scale that direct generation cannot match.

Capital requirements include $100,000-$300,000 for the technology platform, $50,000-$200,000 for publisher development, and $50,000-$100,000 for compliance infrastructure. The minimum totals $300,000-$700,000.

Choose co-registration if you can build relationships with high-traffic sites and manage complex consent compliance. Your success depends on publisher relationships and the ability to maintain compliant implementations across dozens of sites. The critical challenges revolve around consent and perception. Consent complexity requires explicit, separate consent for every offer – pre-checked boxes were common five years ago but today they are lawsuit invitations. Quality perception works against you because co-registration leads convert at lower rates, and some buyers view them as low-quality regardless of actual performance. Publisher dependency means that if major publishers reduce placements, volume drops quickly.

Choosing Your Model: A Decision Framework

Capital constraints determine which models are even accessible. With under $100,000, consider affiliate participation or content-based owned media if you have patience, but avoid broker or exchange models due to insufficient capital for float. Between $100,000-$300,000, direct lead generation becomes viable, aged lead specialist offers the fastest path to profitability, and network operator is possible at smaller scale. With $300,000-$700,000, most models become accessible including exclusive lead provider, co-registration network, and vertical aggregator, while call center operations become possible at modest scale. Above $700,000, full broker operations become viable, platform/SaaS consideration makes sense with additional investment, and ping/post exchange becomes feasible with significant technical investment.

Your existing skills should guide model selection as much as your capital. Digital marketing and paid media experience points toward direct generator or aged leads models. Sales and business development backgrounds fit broker or vertical aggregator roles. Call center and operations experience translates to live transfer or broker operations. Software and technology capability enables platform or exchange models. Content and SEO expertise powers owned media and direct generation. Industry veterans should consider vertical aggregator or exclusive provider models where their domain knowledge commands premium pricing.

Risk tolerance varies across models in predictable patterns. Lower risk models include platform/SaaS with its recurring revenue, owned media once established, and data enhancement with utility-like stability. Medium risk models include direct generator, network operator, and vertical aggregator. Higher risk models include broker with its cash flow exposure, call center with TCPA liability, and co-registration with consent complexity.

Frequently Asked Questions

Which lead generation business model is most profitable?

Owned media publishing achieves the highest net margins (40-60%) once established because organic traffic eliminates ongoing acquisition costs. However, this model requires 12-24 months and $500,000-$1,000,000 in investment before reaching profitability. For practitioners seeking faster returns, direct lead generation (25-40% net margin) and exclusive lead provision (30-45% net margin) offer strong profitability with shorter timelines.

How much capital do I need to start a lead generation business?

Capital requirements vary dramatically by model. The aged lead specialist model can launch with $125,000-$350,000 and reach profitability in 3-6 months. Direct lead generation requires $50,000-$125,000. Lead brokering demands $200,000-$550,000 to manage cash flow timing. Platform/SaaS businesses require $2,000,000-$5,000,000 to reach break-even. Choose your model based on available capital, not aspirations.

What is the difference between a lead broker and a lead network?

A lead broker purchases leads from generators and resells them to buyers, taking pricing and quality risk on every transaction with typical net margins of 15-18%. A lead network facilitates transactions between publishers and buyers without taking inventory risk, earning 10-20% of lead value as a transaction fee. Brokers require more capital for float but capture higher per-lead margins. Networks require less capital but must manage larger volumes to achieve similar revenue.

How long does it take to become profitable in lead generation?

Time to profitability ranges from 3-6 months (aged lead specialist) to 24-36 months (platform/SaaS provider). Direct lead generation typically reaches profitability in 6-12 months. Lead brokering takes 6-12 months. Owned media publishing requires 12-24 months. The key factor is matching your capital runway to your chosen model’s profitability timeline. Undercapitalization during the build period is the most common failure mode.

What skills do I need to succeed in lead generation?

Required skills depend on your chosen model. Traffic acquisition and conversion optimization matter most for direct generators. Relationship management and negotiation drive broker success. Technical architecture and product development are essential for platform providers. Operations management determines call center outcomes. Content strategy and SEO expertise power owned media. Start with models that leverage your existing strengths rather than requiring skills you must develop from scratch.

What is the ping/post model in lead generation?

The ping/post model is a real-time auction system where leads are sold to the highest qualified bidder. When a consumer submits a lead form, a “ping” containing non-PII data is sent to multiple buyers who bid based on their criteria. The winning buyer receives the complete lead via “post.” This model provides optimal pricing through competition, with exchanges earning 5-15% transaction fees. Building a ping/post exchange requires $500,000-$2,000,000 and 18-30 months to reach profitability.

Is lead generation still profitable in 2025?

Yes, lead generation remains highly profitable across all twelve business models when operated correctly. Major players like MediaAlpha process over $1.5 billion in annual transaction value. EverQuote exceeded $500.2 million in 2024 revenue. The industry continues growing as businesses rely on third-party leads for customer acquisition. However, regulatory complexity (TCPA, state privacy laws) and platform changes require more sophisticated operations than in previous years. Practitioners who invest in compliance infrastructure and quality control outperform those who cut corners.

Which lead generation model has the lowest risk?

The platform/SaaS model carries the lowest operational risk once established due to recurring revenue and low regulatory exposure (you are not touching leads directly). Owned media publishing also offers lower risk at maturity due to diversified organic traffic. However, both models require substantial upfront investment. For practitioners with less capital, the affiliate model offers low regulatory exposure and minimal capital requirements, though platform dependency creates its own risk. No model is risk-free; the key is matching your risk tolerance to your chosen model’s exposure profile.

How do I transition between lead generation business models?

Model evolution follows predictable paths. Many publishers began as affiliates, learning traffic acquisition before building direct buyer relationships. Publishers who achieve reliable generation often expand into brokerage to capture more value chain. Brokers evolve toward network models to reduce capital intensity. Operators with sophisticated technology can transition to platform/SaaS models. The progression typically requires 12-24 months per transition and additional capital for each evolution. Start with a model that builds capabilities for your target end state.

What are the biggest mistakes new lead generation businesses make?

The most common mistakes are undercapitalization (particularly failing to account for the 60-day float in brokering), choosing models based on aspiration rather than current resources and skills, over-concentration in single buyers, sources, or platforms, underestimating TCPA compliance requirements, and expecting owned media or platform models to generate revenue quickly. Successful operators match their capital, skills, and timeline expectations to model requirements rather than hoping resources will materialize during operations.

Key Takeaways

Match resources to model, not ambition to model. Every model works for operators with appropriate capital, skills, and timeline expectations. Every model fails for those who mismatch.

Capital requirements vary by orders of magnitude. Aged lead specialists can launch with $125,000. Platform providers need $2,000,000-$5,000,000. Choose based on what you have, not what you hope to raise.

Time to profitability determines capital planning. Aged leads reach profitability in 3-6 months. Owned media takes 12-24 months. Platform/SaaS requires 24-36 months. Your runway must exceed your model’s timeline.

Highest margins require longest timelines. Owned media (40-60% net margin) and exclusive leads (30-45%) outperform brokering (15-18%) but require more capital, expertise, or patience.

Working capital kills more brokers than competition. The 60-day float between supplier payment and buyer collection is the silent killer. If you cannot cover that gap, choose a different model.

Skill fit matters as much as capital fit. Traffic acquisition expertise powers direct generation. Relationship management drives brokering. Technical capability enables platforms. Start with models that leverage existing strengths.

Evolution paths are predictable. Affiliate to publisher. Publisher to broker. Broker to network. Operator to platform. Choose a starting point that builds capabilities for your ultimate destination.

Risk profiles differ dramatically. Call centers face TCPA exposure on every call. Brokers carry cash flow risk. Owned media faces algorithm dependency. Platforms enjoy recurring revenue stability. Know your risk tolerance.

This article is adapted from “The Lead Economy” by industry professionals with 15+ years of operational experience across all twelve business models. Statistics and market data current as of late 2025.