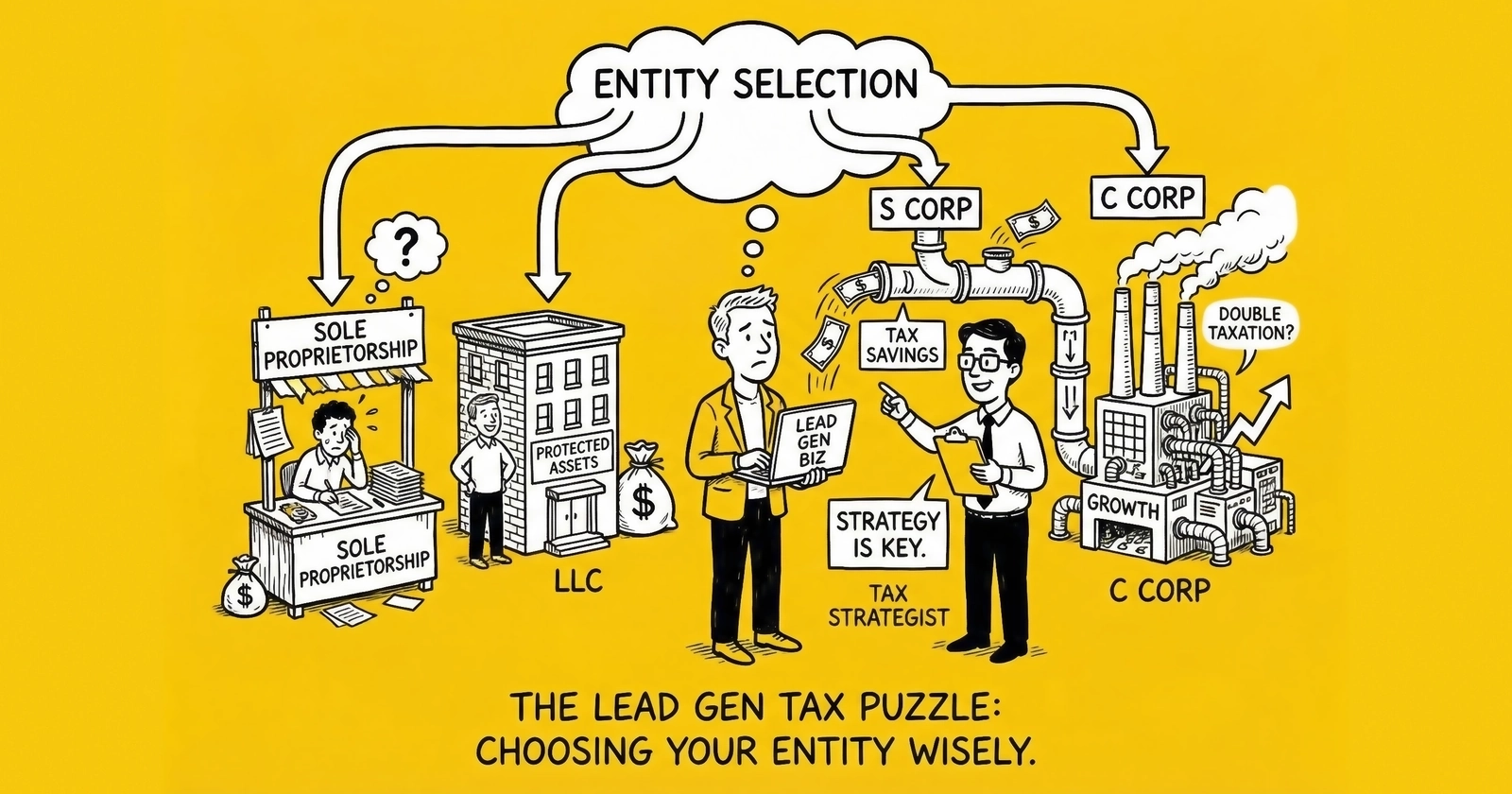

Choosing the right business entity can save lead generation operators tens of thousands of dollars annually in taxes. This guide breaks down LLC, S-Corp, and C-Corp structures with specific analysis for the unique economics of lead generation businesses.

The entity structure question sits at the foundation of every lead generation business, yet most practitioners either rush through it or avoid it entirely. They pick whatever their friend recommended, whatever their accountant defaulted to, or whatever seemed easiest when filing that first form.

That casual decision costs real money. For a lead generation business generating $500,000 in annual profit, the difference between an optimized and suboptimal entity structure can exceed $40,000 per year in unnecessary taxes. Over a decade, that compounds into a half-million dollar mistake.

The lead generation industry creates specific tax planning opportunities that general small business advice fails to address. The working capital intensity, the high transaction volume, the potential for rapid scaling, and the ability to split income between entities all create optimization possibilities that demand specialized understanding.

This guide delivers entity selection analysis built specifically for lead generation economics. The frameworks here apply whether you are launching your first lead operation or restructuring an existing business approaching seven figures in annual revenue.

Why Entity Selection Matters for Lead Generation Businesses

Entity selection determines three critical outcomes: how you pay taxes, how you protect assets, and how you can eventually exit or scale the business. For lead generation operators, these factors carry unique weight.

The Self-Employment Tax Problem

Lead generation is a labor-intensive business at the operator level. You manage campaigns, negotiate buyer relationships, optimize funnels, and handle the daily operational grind. Without proper entity structuring, every dollar of profit flows through as self-employment income subject to both income tax and the full 15.3% self-employment tax (12.4% Social Security up to the wage base limit of $168,600 in 2024 and $176,100 in 2025, plus 2.9% Medicare with no cap).

For a sole proprietor earning $300,000 in lead generation profits:

- Self-employment tax on first $168,600: approximately $25,800

- Medicare tax on remaining $131,400: approximately $3,800

- Additional Medicare tax (0.9% above $200,000): approximately $900

- Total self-employment taxes: approximately $30,500

That $30,500 comes before federal and state income taxes. The right entity structure can reduce this burden by $15,000 to $25,000 annually.

The Working Capital Reality

Lead generation businesses carry substantial receivables. You pay traffic platforms today and collect from buyers in 30-60 days. This creates a structural working capital requirement that affects entity selection in two ways.

First, the cash trapped in receivables is not available for owner distributions. An S-Corp owner cannot simply extract retained earnings without navigating distribution rules and reasonable compensation requirements.

Second, lenders evaluating your creditworthiness look at entity structure. C-Corps building retained earnings often access better credit facilities than S-Corps passing through all income to owners.

The Exit Equation

How you structure today affects how you exit tomorrow. Lead generation businesses sell. They get acquired by larger aggregators, purchased by private equity, or transitioned to key employees. Each exit path carries different tax implications based on entity structure.

A C-Corp sale typically triggers double taxation: corporate tax on the gain, then capital gains tax when distributing proceeds to shareholders. An S-Corp or LLC sale generally produces single-level taxation at capital gains rates. The difference on a $5 million exit can exceed $500,000 in additional tax liability.

The Four Entity Options Explained

Lead generation operators typically choose among four entity structures: sole proprietorship, single-member LLC, LLC taxed as S-Corp, or C-Corporation. Each carries distinct advantages and limitations for lead generation economics.

Sole Proprietorship

The default structure for anyone who starts a business without filing entity paperwork. You are the business, and the business is you.

Tax Treatment: All business income flows directly to your personal return on Schedule C. You pay ordinary income tax plus self-employment tax on 100% of net profits.

For Lead Generation: Never appropriate for any operation generating more than minimal revenue. The self-employment tax burden alone makes this structure prohibitively expensive. Add the complete lack of liability protection in an industry with TCPA litigation risk, and sole proprietorship becomes indefensible.

Use Case: Only for testing a concept before formal launch, and only with minimal capital at risk. Transition to a protected structure before generating meaningful revenue.

Single-Member LLC (Disregarded Entity)

A limited liability company with one owner that the IRS treats as a “disregarded entity” for tax purposes. You get liability protection, but all income still flows through to your personal return like a sole proprietorship.

Tax Treatment: Same as sole proprietorship: Schedule C income subject to ordinary rates plus full self-employment tax. The LLC wrapper provides legal protection without changing tax treatment.

For Lead Generation: Appropriate for very early-stage operations prioritizing simplicity and liability protection over tax optimization. Once net income exceeds $50,000-$60,000 annually, the S-Corp election typically becomes more advantageous.

Advantages:

- Simple formation and minimal compliance requirements

- Liability protection separating personal and business assets

- Flexibility to elect S-Corp taxation later without changing legal structure

- No requirements for payroll, board meetings, or corporate formalities

Disadvantages:

- Full self-employment tax on all profits

- No opportunity for income splitting between wages and distributions

- Limited credibility with some enterprise buyers who prefer contracting with corporations

LLC with S-Corp Election

The workhorse entity structure for profitable lead generation businesses. You form an LLC for liability protection, then file IRS Form 2553 to elect treatment as an S-Corporation for tax purposes.

This hybrid approach delivers the operational flexibility of an LLC with the tax benefits of S-Corp treatment.

Tax Treatment: The S-Corp is a pass-through entity. Profits flow to your personal return and you pay ordinary income tax. However, you split that income between two categories:

- Reasonable compensation (W-2 wages): Subject to both income tax and payroll taxes (employer and employee portions of Social Security and Medicare)

- Distributions (profit beyond wages): Subject to income tax only, not payroll taxes

This split creates substantial tax savings when structured properly.

The Reasonable Compensation Requirement: The IRS requires S-Corp shareholder-employees to pay themselves “reasonable compensation” for services rendered. This is not optional, and setting compensation too low invites audit risk.

Reasonable compensation analysis considers:

- Industry compensation for similar roles

- Your specific duties and time commitment

- Business profitability and ability to pay

- Geographic wage norms

- Experience and specialized expertise

For lead generation operators, reasonable compensation typically falls between $75,000 and $200,000 depending on business size, operator involvement, and geographic market. A solo operator running a $400,000 net income lead gen business might set reasonable compensation at $100,000-$125,000, with the remaining $275,000-$300,000 flowing as distributions exempt from self-employment tax.

Example Calculation:

| Structure | Sole Prop / LLC | S-Corp Election |

|---|---|---|

| Net Business Income | $400,000 | $400,000 |

| W-2 Wages | N/A | $120,000 |

| Distributions | N/A | $280,000 |

| Self-Employment Tax | ~$32,000 | N/A |

| Payroll Tax (employer + employee) | N/A | ~$18,400 |

| Payroll Tax Savings | - | ~$13,600 |

That $13,600 annual savings represents the difference between paying 15.3% self-employment tax on $400,000 versus paying payroll taxes on only $120,000. As income grows, savings scale proportionally.

For Lead Generation: The optimal structure for most lead generation businesses earning $75,000 or more in annual net income. The combination of liability protection, pass-through taxation, and payroll tax optimization makes this the default recommendation.

Advantages:

- Significant reduction in self-employment/payroll taxes

- Pass-through taxation avoiding corporate-level tax

- Liability protection through LLC structure

- Credibility with buyers and partners expecting corporate counterparties

- Flexibility to add partners or investors later

Disadvantages:

- Requires payroll processing and quarterly payroll tax filings

- Reasonable compensation documentation requirements

- Annual compliance including corporate tax return (Form 1120-S)

- Cannot have more than 100 shareholders

- Shareholders must be U.S. citizens or residents (no foreign ownership)

- Only one class of stock permitted

C-Corporation

A traditional corporation taxed separately from its owners. The corporation pays tax on its profits, and shareholders pay tax again when receiving dividends or selling shares.

Tax Treatment: The corporation pays a flat 21% federal tax rate on profits. When distributing those profits as dividends, shareholders pay qualified dividend tax rates (0%, 15%, or 20% depending on income bracket). This creates potential double taxation totaling 36.8% to 40.8% at the federal level.

When C-Corp Makes Sense for Lead Generation:

Despite double taxation concerns, C-Corps offer advantages in specific scenarios:

-

Aggressive growth with reinvestment: If you are reinvesting all profits into scaling rather than distributing to owners, the 21% flat corporate rate is lower than individual rates for high earners. A lead gen operator in the 37% bracket pays less current tax by retaining profits in a C-Corp versus flowing them through an S-Corp.

-

Outside investment: Venture capital and private equity often prefer C-Corp structures. The ability to issue multiple stock classes, accommodate foreign investors, and provide standard preferred stock terms makes fundraising cleaner.

-

Employee equity compensation: C-Corps offer more flexible options for employee stock options and equity incentive plans. If building a team and using equity as compensation, C-Corp structure provides advantages.

-

Qualified Small Business Stock (QSBS): Section 1202 allows excluding up to $10 million in capital gains (or 10x basis) from federal tax on QSBS held more than five years. This can eliminate capital gains tax entirely on a qualifying exit. To qualify, the corporation must be a C-Corp at all times, have gross assets under $50 million, and operate an active business (lead generation qualifies as an active business).

QSBS Example:

You form a C-Corp, contribute $100,000 in capital, and build a lead generation business. Five years later, you sell for $5 million. Under QSBS, you could potentially exclude the entire $4.9 million gain from federal taxation, saving approximately $980,000 in federal capital gains tax.

This benefit does not exist for S-Corps or LLCs.

For Lead Generation: C-Corp structure makes sense for lead generation businesses with credible exit timelines under five years where QSBS benefits could apply, or businesses seeking significant outside investment. For operator-owned businesses planning to distribute profits annually, the S-Corp typically remains superior.

The Qualified Business Income Deduction (Section 199A)

Pass-through business owners receive a significant additional tax benefit through the Qualified Business Income (QBI) deduction, also known as Section 199A. This deduction can reduce taxable income by up to 20% of qualified business income.

How QBI Works for Lead Generation

Lead generation is classified as a “specified service trade or business” (SSTB) under Section 199A. This matters because SSTB businesses face income-based limitations on the QBI deduction.

Income Thresholds (2024/2025):

- Single filers: Full deduction available below $191,950 (2024) / $197,300 (2025); phases out completely at $241,950 (2024) / $247,300 (2025)

- Married filing jointly: Full deduction available below $383,900 (2024) / $394,600 (2025); phases out completely at $483,900 (2024) / $494,600 (2025)

What This Means Practically:

If your taxable income (including lead generation profits) exceeds the threshold, your QBI deduction phases out. A married operator with $500,000 in taxable income receives zero QBI deduction on their lead generation income.

Planning Strategies:

-

Income timing: Deferring income or accelerating deductions to stay below thresholds in specific years can preserve the QBI deduction.

-

Retirement contributions: Maximizing qualified retirement plan contributions reduces taxable income. A solo 401(k) with profit-sharing can shelter up to $69,000 (2024) or $70,000 (2025) in contributions, with an additional $7,500 catch-up contribution for those 50 and older, potentially keeping income below QBI thresholds.

-

Charitable strategies: Bunching charitable contributions or using donor-advised funds can reduce taxable income in specific years.

-

Entity splitting: In some cases, separating high-SSTB activities from non-SSTB activities into different entities can preserve deductions. However, aggregation rules and common control provisions limit this strategy.

QBI Deduction Value:

For a lead generation operator under the income thresholds with $300,000 in qualified business income:

QBI Deduction: $300,000 x 20% = $60,000 Tax savings (at 32% marginal rate): $19,200

This additional $19,200 in annual savings stacks on top of S-Corp payroll tax savings, making comprehensive tax planning essential for lead generation operators.

State Tax Considerations

Federal entity selection only tells part of the story. State tax treatment varies dramatically and can affect optimal structure.

States Without Income Tax

Lead generation businesses based in Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, or Wyoming avoid state income tax entirely. Entity selection in these states focuses purely on federal optimization and liability protection.

However, some states impose franchise taxes, gross receipts taxes, or other business-level taxes that still create entity selection considerations.

Texas Franchise Tax Example: Texas imposes a 0.375% to 0.75% gross receipts tax on businesses above $2.47 million in annual revenue. Entity structure affects how this tax applies and whether certain deductions reduce the tax base.

California and New York Considerations

The two largest lead generation markets carry significant state tax burdens that affect entity selection.

California:

- 13.3% top individual income tax rate

- S-Corps pay a 1.5% tax on net income (minimum $800)

- LLC fee based on gross receipts ($800 minimum, scaling to $11,790 for receipts over $5 million)

- C-Corps pay 8.84% corporate tax

California’s LLC fee based on gross receipts creates a unique burden for high-revenue, low-margin lead generation operations. A lead broker with $10 million in gross receipts but only $500,000 in net income still pays the maximum $11,790 LLC fee. This can make S-Corp or C-Corp structures more attractive despite other considerations.

New York:

- 10.9% top individual income tax rate

- NYC imposes an additional tax on NYC residents and businesses

- Metropolitan commuter transportation mobility tax for NYC-area businesses

The combination of federal, state, and local taxes in New York can push effective marginal rates above 50%, making every optimization opportunity material.

Nexus and Multi-State Operations

Lead generation businesses often create tax nexus in multiple states through:

- Employees or contractors working in different states

- Lead sales to buyers in multiple states

- Physical presence (rare in modern operations)

- Economic nexus thresholds based on sales volume

Entity structure affects how multi-state taxation applies. S-Corps and LLCs pass through income to owner state of residence, but states where the business has nexus may still impose entity-level taxes or require owner-level tax filings.

Complex multi-state operations often benefit from C-Corp structures that centralize tax obligations at the corporate level, though this must be weighed against double taxation concerns.

Entity Selection by Business Stage

Optimal entity structure changes as your lead generation business evolves. What works at launch rarely remains optimal at scale.

Pre-Launch to $50,000 Net Income

Recommended: Single-Member LLC

At minimal income levels, the administrative burden of S-Corp election (payroll processing, additional returns, reasonable compensation analysis) outweighs tax savings. The self-employment tax on $50,000 of income is approximately $7,650. S-Corp payroll administration costs $1,500-$3,000 annually, and the reasonable compensation requirement limits how much you can actually save.

Focus on building the business. Elect S-Corp status once you have consistent profitability above $60,000-$75,000 annually.

$50,000 to $250,000 Net Income

Recommended: LLC with S-Corp Election

This is the sweet spot for S-Corp benefits. You are earning enough to justify administrative costs, and payroll tax savings become material.

At $150,000 net income with $80,000 reasonable compensation:

- S-Corp payroll tax savings: approximately $10,700 annually

- Administrative costs: $2,000-$4,000 annually

- Net benefit: $6,700-$8,700 annually

The math clearly favors S-Corp election in this range.

$250,000 to $1,000,000 Net Income

Recommended: LLC with S-Corp Election (with additional planning)

S-Corp remains optimal, but additional strategies become important:

-

Retirement plan maximization: Solo 401(k) contributions shelter significant income. At $400,000 net income with $150,000 salary, you can contribute up to $69,000 (2024) or $70,000 (2025) in combined employee/employer contributions, plus an additional $7,500 catch-up contribution if age 50 or older.

-

Health insurance deduction: S-Corp owners can deduct health insurance premiums as an adjustment to income, but the premiums must be included in W-2 wages. Structure this correctly to capture the full deduction.

-

Reasonable compensation documentation: As income grows, audit risk increases. Document compensation analysis annually using industry salary surveys, operator role descriptions, and time allocation studies.

-

State optimization: Consider whether business relocation provides material tax benefits. A lead generation business is inherently location-flexible, similar to geographic arbitrage strategies used in lead pricing.

Above $1,000,000 Net Income

Analysis Required: S-Corp vs. C-Corp

At this income level, multiple factors require individualized analysis:

-

Exit planning: If sale within 5 years is likely and business qualifies for QSBS, C-Corp structure may provide substantial exit tax savings that outweigh current year S-Corp benefits.

-

Reinvestment strategy: If profits are consistently reinvested rather than distributed, C-Corp’s 21% rate may be lower than pass-through rates for high-income owners.

-

Outside investment: If raising capital, C-Corp structure simplifies investor accommodation.

-

State tax planning: At seven-figure income levels, state tax savings from relocation can exceed $100,000 annually.

This level requires working with a tax advisor familiar with lead generation economics. Generic small business advice fails to capture the nuances.

Multi-Entity Structures for Lead Generation

Sophisticated lead generation operations often benefit from multi-entity structures that separate distinct business functions.

The Operating Company / Holding Company Structure

Structure:

- Operating LLC (S-Corp elected) holds lead generation business operations

- Holding LLC owns intellectual property, domains, and technology assets

- Operating company pays licensing fees to holding company

Advantages:

- Asset protection: Key assets separated from operating risk

- Potential state tax optimization if holding company resides in favorable jurisdiction

- Flexibility for future partial sales or restructuring

Considerations:

- Must have legitimate business purpose beyond tax savings

- Related party transactions require arm’s-length pricing

- Administrative complexity increases

Separating Traffic Operations from Distribution

Lead generation businesses with both traffic generation (owned and operated) and distribution (brokering third-party leads) components may benefit from separate entities.

Rationale:

- Different risk profiles warrant separate liability protection

- Buyer contracts may prefer contracting with specialized entities

- Potential to optimize entity structure for each function’s economics

Real Estate Holding Entities

Lead generation operators who own office space or other real estate should typically hold real estate in separate entities from operating businesses.

Why:

- Liability protection (real estate risk separated from business risk)

- Tax advantages through rental income treatment

- Estate planning flexibility

Implementation Checklist

Forming Your Entity

-

Select formation state: Delaware offers business-friendly laws but requires foreign qualification in your home state. Most lead generation businesses should form in their home state unless specific circumstances favor Delaware.

-

File formation documents: Articles of Organization (LLC) or Articles of Incorporation (Corp) with state filing fees ranging from $50 to $500.

-

Obtain EIN: Apply for Employer Identification Number through IRS.gov (free, immediate online).

-

Create operating agreement or bylaws: Document ownership, management, and decision-making procedures.

-

Open business bank accounts: Maintain strict separation between personal and business finances.

Electing S-Corp Status

-

File Form 2553: Must be filed within 75 days of formation or by March 15 for election effective at start of current year.

-

Establish payroll: Set up payroll processing for owner wages before first distribution.

-

Document reasonable compensation: Create file documenting compensation analysis.

-

Set up quarterly estimated taxes: Owner remains responsible for income tax on pass-through income.

Annual Compliance Requirements

S-Corp:

- Form 1120-S (corporate return) due March 15

- Schedule K-1 to each shareholder

- State corporate returns where applicable

- Quarterly payroll tax deposits and filings

- Annual W-2 and W-3 filings

- Reasonable compensation documentation updates

C-Corp:

- Form 1120 due April 15

- State corporate returns

- Quarterly estimated tax payments at corporate level

- If distributing dividends, Form 1099-DIV to shareholders

Common Entity Selection Mistakes

Mistake 1: Delaying S-Corp Election

Operators often wait too long to make the S-Corp election, paying unnecessary self-employment tax during profitable years. If your business generates consistent profits above $60,000-$75,000, the S-Corp election almost certainly makes sense.

The Cost: Each year of delay at $100,000 net income costs approximately $10,000 in excess self-employment tax.

Mistake 2: Setting Unreasonably Low Compensation

The IRS scrutinizes S-Corp owner compensation. Setting salary at $30,000 while taking $270,000 in distributions invites audit. If the IRS reclassifies distributions as wages, you pay back taxes, penalties, and interest.

Guidance: Compensation should reflect what you would pay a third party to perform your functions. Document this analysis annually.

Mistake 3: Ignoring State Tax Implications

Entity selection focused solely on federal taxes misses significant state optimization opportunities. California’s LLC fee, New York’s additional taxes, and state nexus rules all affect optimal structure.

Mistake 4: Choosing C-Corp for the Wrong Reasons

C-Corp structure is sometimes recommended for “looking more professional” or because advisors are more familiar with it. These are not valid reasons. The double taxation burden and compliance complexity of C-Corps should only be accepted when specific benefits (QSBS, investment, growth strategy) justify them.

Mistake 5: Never Reassessing Structure

Entity structure that was optimal at launch may become suboptimal as the business grows. Annual review of entity structure should be standard practice, especially when crossing income thresholds ($250,000, $500,000, $1,000,000).

Working with Tax Professionals

Entity selection and ongoing tax optimization require professional guidance. The strategies discussed here provide framework and education, but implementation demands expertise.

Finding the Right Advisor

Look for tax professionals with:

- Experience with digital marketing or technology businesses

- Understanding of lead generation economics (working capital, transaction volume, vertical dynamics)

- Multi-state tax expertise if you operate across jurisdictions

- Proactive planning orientation rather than pure compliance focus

Questions to Ask Potential Advisors

- “What experience do you have with performance marketing or lead generation businesses?”

- “How do you approach entity selection for pass-through businesses with high self-employment income?”

- “What is your planning process for clients approaching seven-figure income?”

- “How do you handle multi-state nexus issues?”

- “What are your fees for entity structure analysis and ongoing planning?”

Expected Costs

Competent tax advisory for lead generation businesses:

- Entity selection analysis: $1,000-$3,000

- Annual tax planning (six-figure business): $2,500-$5,000

- Annual tax planning (seven-figure business): $5,000-$15,000

- Annual compliance (S-Corp return plus personal return): $2,000-$5,000

These costs are investments, not expenses. Proper planning routinely saves 10x to 50x the advisory fees.

Frequently Asked Questions

When should I elect S-Corp status for my lead generation LLC?

Elect S-Corp status when your lead generation business generates consistent net income above $60,000-$75,000 annually. Below this threshold, the administrative costs of payroll processing and additional tax returns often exceed payroll tax savings. Above this threshold, S-Corp election typically saves $8,000-$15,000 or more annually in self-employment taxes. File Form 2553 within 75 days of formation or by March 15 for election effective at the start of the current year. Late elections may be possible with reasonable cause.

What is reasonable compensation for a lead generation business owner?

Reasonable compensation depends on business size, owner involvement, and geographic market. For a solo operator managing $200,000-$400,000 in annual net income, reasonable compensation typically ranges from $80,000-$130,000. Larger operations with more passive ownership may justify lower percentages. Document your analysis using industry salary data, job descriptions for your actual duties, and time allocation studies. The IRS provides no specific safe harbor, so conservative positions with thorough documentation provide the best audit protection.

Should I choose C-Corp for my lead generation business?

C-Corp makes sense in specific circumstances: if you plan to reinvest all profits into growth rather than distribute to owners, if you are raising outside investment from venture capital or private equity, or if you anticipate an exit within five years that could qualify for QSBS exclusion (up to $10 million in capital gains tax-free). For operator-owned businesses distributing profits annually, S-Corp structure typically provides lower overall tax burden by avoiding double taxation.

How does the QBI deduction work for lead generation income?

Lead generation is classified as a specified service trade or business (SSTB), which means the 20% Qualified Business Income deduction phases out at higher income levels. For 2024, single filers with taxable income above $241,950 and married filers above $483,900 receive no QBI deduction on lead generation income (thresholds increase to $247,300 and $494,600 respectively for 2025). Below these thresholds, you may deduct 20% of qualified business income, potentially saving thousands in taxes. Strategies like maximizing retirement contributions can help keep income below thresholds.

Do I need a separate entity for each lead generation brand or website?

Not necessarily. A single LLC can operate multiple brands and websites. Separate entities make sense when: distinct partners own different properties, liability separation between operations provides material protection, or specific buyer contracts require dedicated legal entities. The administrative burden and costs of multiple entities should be weighed against actual benefits. Most lead generation operators can operate multiple brands under one entity.

How do state taxes affect entity selection for lead generation?

State taxes significantly impact entity selection. California imposes an LLC fee based on gross receipts (up to $11,790 for receipts over $5 million) that can make S-Corp structure more attractive for high-revenue operations. States without income tax (Florida, Texas, Nevada, etc.) remove state-level entity optimization concerns. Multi-state operations face nexus rules that may require filings in states where you sell leads or have employees. Work with an advisor who understands your specific state situation.

What happens to my entity structure if I sell my lead generation business?

Entity structure significantly affects exit taxation. S-Corp or LLC sales generally produce single-level capital gains taxation. C-Corp asset sales trigger double taxation (corporate tax on gain, then capital gains on distribution to shareholders). C-Corp stock sales may qualify for QSBS exclusion, potentially eliminating federal capital gains tax on up to $10 million in gains if shares were held more than five years. Plan entity structure with exit in mind from day one, as changing structure later may have tax consequences.

Can I change from LLC to S-Corp or C-Corp later?

Yes, and changes are common as businesses grow. An LLC can elect S-Corp tax treatment at any time by filing Form 2553 (subject to timing rules). Converting from LLC to C-Corp for QSBS benefits is more complex and may trigger tax consequences on built-in gains. Converting from S-Corp to C-Corp is straightforward but irreversible without waiting five years to re-elect S-Corp. Plan conversions carefully with tax advisor input.

How much should I expect to save with proper entity structuring?

Savings depend on income level and current structure. Moving from sole proprietorship to S-Corp at $200,000 net income typically saves $15,000-$20,000 annually in payroll taxes. Adding QBI deduction optimization for operators under thresholds can add another $8,000-$15,000 in savings. Retirement plan maximization shelters additional income. Total optimization savings commonly reach $25,000-$50,000 annually for successful lead generation operators, making professional tax planning one of the highest-ROI investments available.

Do I need a registered agent and what does it cost?

Every LLC and corporation must maintain a registered agent in its state of formation. The registered agent receives legal documents and official state correspondence on behalf of the business. You can serve as your own registered agent if you have a physical address in the state (not a P.O. box), but most practitioners use professional registered agent services for privacy and reliability. Costs range from $50 to $300 annually. If operating in multiple states, you need a registered agent in each state where you are registered to do business.

Key Takeaways

-

Entity selection is a foundational tax decision. The difference between optimized and suboptimal structure can exceed $40,000 annually for profitable lead generation businesses. Making this decision casually costs real money every year.

-

S-Corp election is optimal for most lead generation operators. Once net income exceeds $60,000-$75,000 annually, the combination of liability protection and payroll tax savings makes LLC with S-Corp election the default choice. Payroll tax savings alone typically range from $10,000 to $25,000 annually.

-

Reasonable compensation requires documentation. Set owner compensation at defensible levels based on industry data and actual duties. Document your analysis annually. Aggressive positions invite audit risk and potential reclassification of distributions as wages.

-

C-Corp makes sense in specific scenarios. Consider C-Corp structure if raising outside investment, planning for QSBS-eligible exit within five years, or reinvesting all profits into growth without distributions.

-

State taxes affect optimal structure. California’s LLC gross receipts fee, state income tax rates, and multi-state nexus rules all influence entity selection. Do not optimize for federal taxes alone.

-

Structure should evolve with your business. The entity that worked at $100,000 in revenue may not be optimal at $1,000,000. Review entity structure annually and when crossing major income thresholds.

-

Professional guidance pays for itself. Tax advisory fees of $3,000-$15,000 annually typically generate savings of $25,000-$75,000 or more for successful lead generation operators. This is not a cost center but an investment with measurable returns.

-

Plan for exit from day one. Entity structure affects how you will eventually sell, transition, or close the business. QSBS benefits only apply to C-Corp stock held more than five years. S-Corp structure provides single-level taxation on sales. Make structure decisions with the end in mind.

Tax laws change regularly. The information in this article reflects federal tax law as of late 2024 and early 2025. State tax laws vary significantly. This article provides educational information and does not constitute tax advice. Consult a qualified tax professional before making entity selection decisions for your specific situation.