The pricing model you choose determines whether you capture maximum value from every lead or leave money on the table with every transaction. This guide breaks down the economics, mechanics, and optimization strategies for fixed, auction, and hybrid pricing in lead generation.

Every lead has a market value. The question is whether your pricing model captures that value or gives it away. A lead worth $80 to your highest-bidding buyer generates $80 in revenue only if your pricing mechanism enables that buyer to express their valuation. Sell that same lead at a fixed $55 and you’ve transferred $25 from your pocket to theirs.

Pricing strategy in lead generation extends far beyond setting a number. It encompasses how you discover market value, how you respond to demand fluctuations, how you differentiate by quality, and how you balance predictability against revenue optimization. Those who master pricing consistently outperform those who treat it as an afterthought.

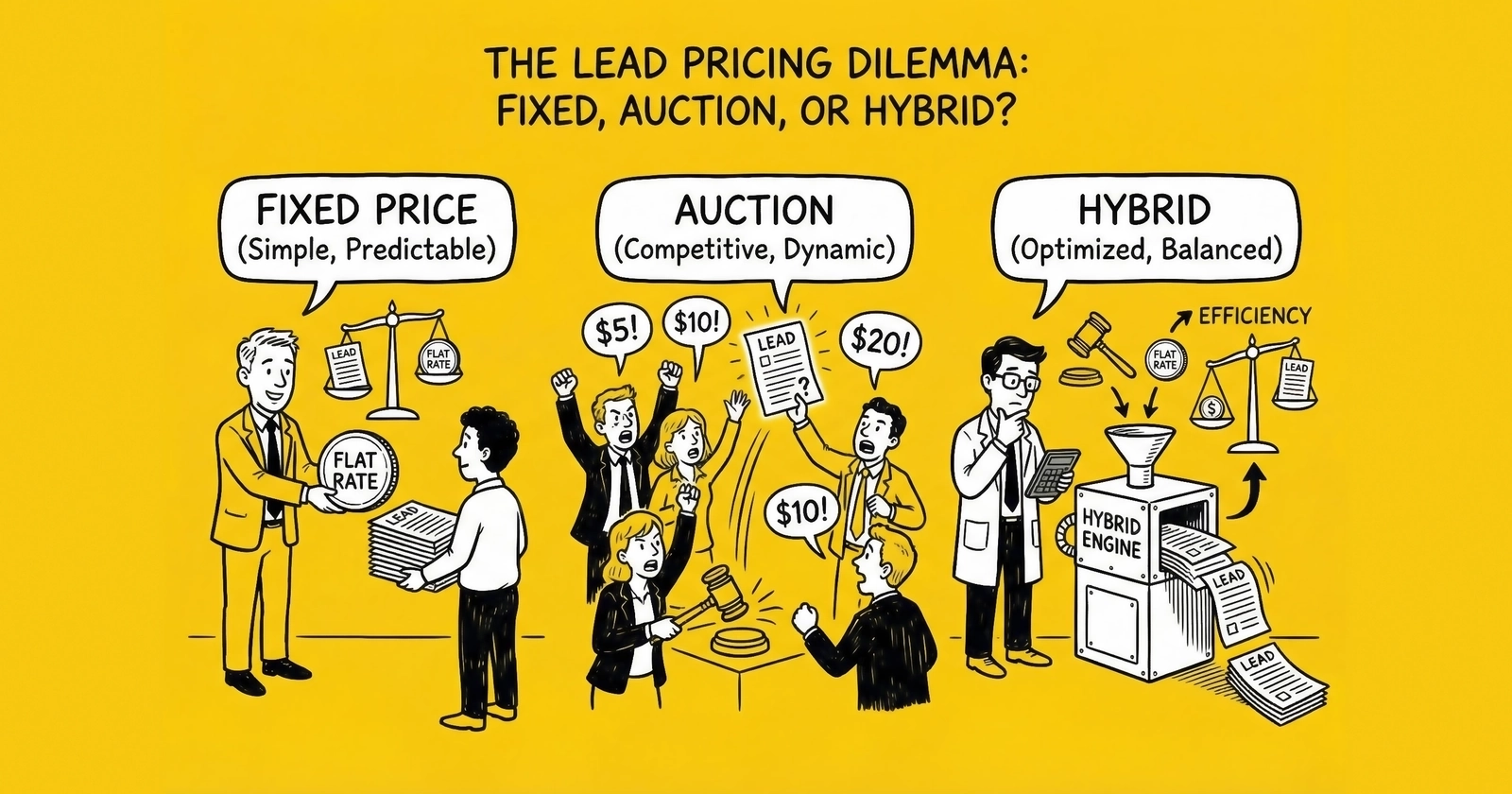

This guide examines the three fundamental pricing approaches in the lead economy: fixed pricing, auction-based pricing through ping/post systems, and hybrid models that combine elements of both. You will understand the economics, technical requirements, and strategic implications of each approach. More importantly, you will learn how to select and optimize the pricing model that fits your operation.

The Economics of Lead Pricing

Before comparing pricing models, you need to understand what drives lead value. A lead is not merely contact information. It is a packaged bundle of attributes whose market value fluctuates based on measurable characteristics.

What Determines Lead Value?

Four primary variables determine what any specific lead is worth:

Recency. Lead value decays approximately 10% per hour for most verticals. Research from the Lead Response Management Study shows that leads contacted within five minutes are 21x more likely to qualify than leads contacted after 30 minutes. A lead captured this morning is worth multiples of one captured last week. Speed-to-sale matters because speed-to-contact matters.

Exclusivity. Exclusive leads (sold to one buyer) command 2-3x the price of shared leads (sold to multiple buyers). A shared auto insurance lead might trade at $15-25. The same lead sold exclusively fetches $55-75. Buyers pay the premium because they do not compete for the same prospect’s attention.

Qualification depth. A lead with credit score, income, property value, and timeline data is worth more than a lead with just name and phone number. Additional data fields reduce buyer risk and improve routing precision. A mortgage lead with verified income and employment commands $150+, while a basic inquiry might trade at $30-50.

Vertical and geography. Customer lifetime values vary dramatically across verticals and markets. A personal injury lead supports pricing of $200-800 because case values justify it. An auto insurance lead in a competitive urban market like Los Angeles commands premiums over the same lead from rural areas with less buyer competition.

The Two Pricing Philosophies

Every pricing decision flows from one of two fundamental philosophies:

Cost-plus pricing starts with your acquisition cost and adds a margin. If leads cost $30 to acquire, you sell at $45 for a 50% markup. This approach is simple but ignores buyer willingness to pay. You are pricing based on your operations, not the lead’s value to buyers.

Value-based pricing starts with the lead’s worth to buyers and works backward. If a lead converts at 8% for an insurance agent whose average policy generates $1,200 in lifetime value, the expected revenue per lead is $96. The buyer can pay up to $96 for that lead and break even. Value-based pricing captures more of that available margin.

The evolution from cost-plus to value-based thinking represents more than a tactical adjustment. It is a fundamental change in how you approach the lead business. Cost-plus leaves money on the table. Value-based pricing requires deeper buyer knowledge but captures fair value for your inventory.

Fixed Pricing: Predictability at a Cost

Fixed pricing means agreeing on a set price per lead with each buyer, typically renegotiated monthly or quarterly based on performance. This is the traditional approach, the starting point for most lead operations, and still the dominant model for smaller operations and stable buyer relationships.

How Fixed Pricing Works

The mechanics are straightforward. You negotiate a price with each buyer based on lead type, geography, exclusivity, and volume commitment. A buyer might agree to pay $55 per exclusive auto insurance lead in California, delivered via API within 5 seconds of capture. The price remains constant regardless of individual lead characteristics or market conditions until the next negotiation cycle.

Fixed pricing creates clear expectations. Both parties know exactly what each transaction costs. Billing reconciliation is simple. Financial forecasting becomes predictable. There are no surprises when invoices arrive.

Advantages of Fixed Pricing

Predictable revenue for financial planning. When you know each lead generates $55, cash flow modeling becomes straightforward. You can project monthly revenue based on expected volume with reasonable accuracy.

Simple administration and reconciliation. No complex bid calculations, no disputes about auction mechanics, no technology dependencies beyond basic delivery confirmation. Your team can manage buyer relationships without sophisticated technical infrastructure.

Clear communication with buyers. Buyers understand what they are paying. Price negotiations happen at defined intervals. There is no confusion about why one lead cost $48 and another cost $67.

Lower technical requirements. Fixed pricing works with basic lead delivery systems. You do not need real-time bidding infrastructure, sub-second response times, or sophisticated auction logic.

Disadvantages of Fixed Pricing

Market risk stays with the seller. If demand spikes because a major competitor exits the market or a buyer desperately needs volume to hit quarterly targets, you capture none of that upside. Your price is locked while the market pays more.

No mechanism for capturing value spikes. A lead that would fetch $85 in competitive bidding sells for your fixed $55. The buyer captures the $30 surplus. Over thousands of leads, this surplus transfer becomes substantial.

Requires frequent renegotiation. Fixed prices drift from market value over time. Traffic costs change. Buyer economics evolve. Competitors adjust. Without regular renegotiation, your prices become stale. Most operations renegotiate quarterly, but market conditions can shift faster.

Leaves significant money on the table during high-demand periods. Insurance leads during open enrollment, mortgage leads during rate drops, solar leads heading into installation season. Demand surges, but your prices remain fixed.

When Fixed Pricing Works Best

Fixed pricing is appropriate in specific circumstances:

Stable buyer relationships with predictable volume. Long-term partners who value consistency over price optimization. Buyers who prefer budgeting certainty over potential savings from auction dynamics.

Verticals with low price volatility. Some markets simply do not experience dramatic demand swings. If lead prices in your vertical vary only 10-15% across the year, the complexity of auction pricing may not justify the revenue lift.

Early-stage operations. When you are building buyer relationships and establishing quality reputation, fixed pricing removes complexity. Focus on delivery reliability and quality before optimizing price capture.

Low technical capability. Operations lacking infrastructure for real-time bidding should not let technology limitations prevent them from selling leads. Fixed pricing works with basic systems.

Fixed Pricing Optimization

Even within fixed arrangements, optimization opportunities exist:

Volume tier pricing. Offer price breaks at volume thresholds. A buyer paying $55 for up to 500 leads monthly might pay $52 at 1,000 leads and $48 at 2,500 leads. You capture volume efficiency while providing buyer incentive.

Quality tier pricing. Different prices for different lead grades. Premium leads with verified data and strong intent indicators at $85. Standard leads with basic validation at $55. Aged leads or partial data at $25. This captures value variation without auction complexity.

Review triggers. Build automatic renegotiation triggers into agreements. If return rates exceed 15%, revisit pricing. If volume exceeds 150% of commitment, renegotiate. If market conditions shift significantly, open discussions. Do not wait for quarterly reviews when economics change in weeks.

Auction Pricing: Real-Time Price Discovery

Auction pricing, implemented through ping/post systems, represents true price discovery. Multiple buyers bid on each lead, and the highest bidder wins. This approach transforms lead distribution from a negotiated procurement exercise into a dynamic marketplace.

How Ping/Post Auctions Work

The ping/post protocol splits lead distribution into two phases:

The ping phase broadcasts partial, non-identifying lead data to all qualified buyers simultaneously. The ping includes geographic data (zip code, state, area code), lead attributes (credit tier, vehicle type, loan amount), and metadata (source ID, timestamp, device type). Crucially, it excludes personally identifiable information. Names, phone numbers, email addresses, and street addresses stay protected until purchase commitment.

The post phase delivers complete lead data to the winning bidder after the auction closes. Only the buyer who committed to pay receives the consumer’s contact information. Losing bidders never see the personal data.

The entire sequence from form submission to lead delivery happens in under two seconds for well-optimized systems. Industry standard ping response times run 50-100 milliseconds. Total transaction time stays under 1,500 milliseconds.

The Economics of Auction Pricing

Auction pricing maximizes revenue per lead because every lead sells at market value, not at a negotiated average. Consider this example:

Under fixed pricing, you sell California auto insurance leads at $55. Under auction pricing, the same lead might receive bids of $45, $52, $58, $62, and $71 from five different buyers. The lead sells to the $71 bidder. You captured $16 more than fixed pricing would have generated.

Industry data shows ping/post operations typically generate 15-30% higher revenue per lead compared to fixed-price arrangements with the same buyer pool. At 10,000 leads monthly, a 20% revenue lift represents $110,000 annually in additional revenue.

The reverse also applies. A lead that would sell for $55 fixed might only attract bids of $38 and $42 during low-demand periods. Auction pricing sometimes yields less than fixed pricing on individual leads. But across a large volume, the high-value leads more than compensate for the occasional below-average sale.

Advantages of Auction Pricing

Continuous price discovery. Every transaction reveals what buyers will pay for specific lead attributes. A lead from a high-value zip code with strong credit indicators might command $70 while a similar lead from a lower-value geography brings $30. The market determines prices, not quarterly contract negotiations.

Maximum revenue capture. Buyers express their true valuation through bids. You capture the highest available price on every lead rather than the average negotiated price.

Data protection. Buyers who do not win never see consumer personal information. This prevents data harvesting and maintains lead value. A buyer participating in a thousand auctions but winning only a hundred cannot build a database from the nine hundred leads they did not purchase.

Buyer matching. Different buyers value different leads differently. Auction mechanics automatically match leads to the buyers who value them most, improving both seller revenue and buyer satisfaction.

Disadvantages of Auction Pricing

Technology requirements are substantial. Your ping response times need to be sub-100 milliseconds. You need robust failover logic for when bidders timeout. You need clear rules for tie-breaking, minimum floors, and rejection handling. Most practitioners implement auction pricing through established distribution platforms rather than building custom systems.

Revenue volatility increases. Unlike fixed pricing where every lead generates $55, auction pricing might yield $71 one moment and $38 the next. Cash flow becomes less predictable even if average revenue increases.

Buyer relationship complexity. Some buyers prefer negotiated pricing certainty. They find auction mechanics confusing or frustrating. Moving to auction pricing may strain relationships with buyers who lack technical sophistication.

Infrastructure investment required. Real-time bidding requires geographic distribution of servers, in-memory caching for fast bid calculations, horizontal scaling for traffic spikes, and 99.99% uptime. These requirements have real costs.

First-Price vs Second-Price Auctions

In first-price auctions, the winning bidder pays exactly what they bid. If Buyer A bids $60 and Buyer B bids $55, Buyer A wins and pays $60. This is the dominant model in lead distribution.

First-price auctions create strategic incentives that can suppress bid prices. Sophisticated buyers learn to shade their bids. If I value a lead at $60 but suspect competition will bid $45, I might bid $48 and pocket the difference if I win.

In second-price auctions, the winner pays the second-highest bid plus a small increment. Using the same example, Buyer A would win but pay $56 instead of $60. This theoretically encourages truthful bidding because bidders never pay more than necessary to win.

Second-price auctions are rare in lead distribution. Buyers find them confusing. Sellers find them revenue-suppressing. The theoretical benefits assume rational actors with accurate value estimates, which is not always realistic in fast-moving lead markets.

Auction Pricing Optimization

Several strategies improve auction performance:

Floor pricing. Establish minimum acceptable bids. A $25 floor for exclusive auto insurance leads means any bid below that threshold gets treated as a rejection. Floor pricing protects against low-ball bids during off-peak periods but must be calibrated carefully. Too high and you reject leads that would have sold. Too low and you leave money on the table.

Bid response optimization. Track your win rates as a buyer or your fill rates as a seller. If buyers are winning 90% of auctions, they are probably overbidding. If they are winning only 10%, their bids are too conservative. Target win rates between 30-60% depending on volume needs and margin requirements.

Latency investment. Every millisecond matters. Buyers who consistently exceed response thresholds get fewer leads because auctions close before their responses arrive. Invest in infrastructure to maintain sub-100-millisecond response times.

Scenario optimization. Sophisticated platforms compare exclusive bids against combined shared revenue. If Buyer A bids $58 exclusive while Buyers B, C, D collectively bid $84 shared, the platform selects shared for higher revenue. Factor in buyer reliability and return patterns. A buyer with 90% acceptance has higher expected value than their bid suggests.

Hybrid Pricing Models

Pure fixed and pure auction models exist at extremes. Most sophisticated operations implement hybrid approaches that combine elements of both, capturing auction benefits while maintaining relationship stability and operational simplicity.

Types of Hybrid Models

Guaranteed minimum with auction upside. Negotiate a floor price with buyers, then run auctions above that floor. A buyer might guarantee $45 per lead, but participate in auctions that often yield $55-65. The seller gets downside protection. The buyer gets access to leads they might otherwise lose to higher bidders.

Tiered fixed with auction for premium. Establish fixed prices by quality tier. Standard leads at $50. Premium leads (verified data, strong intent indicators, prime geography) go to auction. This captures value variation on high-performing leads while maintaining simplicity for the bulk of inventory.

Time-based exclusivity with secondary auction. Sell leads exclusive for a defined window, typically 24-48 hours, at fixed pricing. Leads not converted during exclusivity period enter a secondary auction for shared distribution. The primary buyer gets first-mover advantage. You capture residual value from unconverted leads.

Volume commitment with spot pricing. Buyers commit to baseline volume at negotiated prices. Volume above commitment goes to spot market pricing. A buyer might commit to 1,000 leads monthly at $52, with additional leads priced dynamically based on current demand.

Quality-adjusted dynamic pricing. Fixed base prices adjusted by quality scoring. A lead with quality score 85 sells at base price. Score 95 leads sell at 120% of base. Score 70 leads sell at 80% of base. This captures quality variation without full auction complexity.

When Hybrid Models Excel

Hybrid approaches solve specific problems that pure models cannot address:

Diverse buyer capabilities. Some buyers can integrate with real-time bidding systems. Others lack technical sophistication. Hybrid models let you serve both. Sophisticated buyers participate in auctions. Others receive leads at fixed prices from inventory that did not sell at auction or from dedicated fixed-price allocation.

Market volatility with relationship needs. Verticals with seasonal swings benefit from auction pricing during peak periods but may need fixed-price stability to maintain buyer relationships during troughs. Hybrid models provide that flexibility.

Quality variation across sources. If your lead sources vary significantly in quality, hybrid models let you capture premium value on high-quality leads while maintaining reasonable pricing on standard inventory. Pure fixed pricing underprices your best leads. Pure auction might not attract bids on your lower-quality inventory.

Risk management. Hybrid models let you hedge between auction revenue optimization and fixed-price predictability. Allocate 60% to auction and 40% to fixed relationships. Adjust the mix based on market conditions and risk tolerance.

Building Effective Hybrid Systems

Successful hybrid implementations require clear rules for lead allocation:

Quality-based routing. Define objective criteria for which leads go to auction versus fixed-price buyers. Credit score above 700, verified employment, homeowner status. Subjective or arbitrary routing creates buyer frustration.

Buyer tier management. Not all fixed-price buyers deserve equal access. Top-tier buyers with low return rates, fast payment, and volume commitments get priority allocation. Lower-tier buyers receive residual inventory.

Dynamic rebalancing. Monitor performance across channels. If auction yields consistently exceed fixed prices by 25%+, consider shifting allocation toward auction. If auction fill rates drop below 80%, fixed-price relationships become more valuable.

Transparent communication. Buyers should understand how your system works. Surprises damage relationships. Explain the allocation logic, even if you do not share competitive pricing details.

Pricing Strategy Selection Framework

Choosing the right pricing model depends on your operational capabilities, buyer relationships, technical infrastructure, and strategic priorities.

Assessment Questions

Answer these questions to guide your pricing model selection:

What is your monthly lead volume?

- Under 5,000 leads: Fixed pricing likely appropriate. Auction infrastructure costs may exceed revenue lift.

- 5,000-25,000 leads: Hybrid models become viable. Test auction on subset of volume.

- Over 25,000 leads: Full auction pricing likely justified. Revenue lift at scale covers infrastructure investment.

What is your technical capability?

- Basic API delivery only: Start with fixed pricing. Build toward hybrid as capability grows.

- Real-time integration with major platforms: Hybrid or auction models accessible.

- Custom ping/post infrastructure: Full auction optimization possible.

How many active buyers do you have?

- Fewer than 5: Fixed pricing. Not enough competition for meaningful auctions.

- 5-15 buyers: Auction pricing becomes effective. Price discovery requires competitive tension.

- More than 15: Strong auction dynamics. Competitive pressure maximizes prices.

How variable is your lead quality?

- Consistent quality across sources: Fixed tiered pricing may suffice.

- Wide quality variation: Hybrid models capture value differential.

- Real-time quality scoring available: Full auction with quality-adjusted bidding.

What do your buyers prefer?

- Preference for budget certainty: Maintain fixed-price relationships, possibly with auction on surplus.

- Willing to compete for premium leads: Auction or hybrid models acceptable.

- Technical sophistication varies: Hybrid serving different buyer segments.

Implementation Recommendations by Business Stage

Early stage (under $50,000 monthly revenue): Start with fixed pricing. Focus on lead quality, buyer satisfaction, and operational reliability. Build the buyer relationships that will later support auction dynamics. Document performance metrics that will inform future pricing optimization.

Growth stage ($50,000-$250,000 monthly revenue): Introduce tiered pricing based on lead quality. Experiment with auction mechanics on 10-20% of volume. Invest in lead management platform with ping/post capability. Build buyer network to 10+ active participants.

Mature stage ($250,000+ monthly revenue): Full hybrid implementation. Primary auction for quality leads with fixed-price fallback for lower tiers. Continuous optimization of floor prices, buyer allocation, and scenario selection. Real-time analytics driving pricing decisions.

Pricing Optimization Tactics

Regardless of which model you choose, continuous optimization improves performance. These tactics apply across pricing approaches.

A/B Testing Prices

Price testing requires careful design to avoid distorting relationships or making invalid comparisons.

Test one variable at a time. If you are testing price, hold everything else constant. Same lead sources, same validation standards, same buyers.

Allow sufficient sample size. Small tests generate noisy data. You need at least 100-200 leads at each price point before drawing conclusions.

Monitor downstream metrics. Higher acceptance rates at lower prices do not mean lower prices are correct. The question is total revenue and margin, not volume alone.

Test incrementally. Do not jump from $50 to $75. Test $50 versus $55, then $55 versus $60. Large jumps make it harder to identify optimal price points.

Consider relationship impact. Dramatic price changes for established buyers require communication. Surprise price increases damage trust even when market-justified.

Elasticity Analysis

Price elasticity measures how demand changes in response to price changes. In lead generation, this translates to how buyer acceptance rate changes as price increases.

The formula: Elasticity = (% Change in Quantity) / (% Change in Price)

If a 10% price increase causes a 15% reduction in buyer acceptance, elasticity is -1.5. Demand is elastic, sensitive to price changes. If the same increase causes only a 5% reduction, elasticity is -0.5. Demand is inelastic.

Understanding elasticity tells you how aggressively to price. With inelastic demand, price increases raise revenue even though volume drops. With elastic demand, price increases reduce total revenue as volume falls faster than price rises.

Elasticity typically varies across:

Lead quality tiers. Higher-quality leads tend to have lower elasticity. Buyers need premium leads and will pay more.

Market conditions. Elasticity increases during soft markets when buyers have alternatives. It decreases during high-demand periods.

Buyer segments. Large call centers with tight unit economics are price-sensitive. Local agencies with relationship-based sales are often less so.

Return Rate Management

Returns erode pricing more than most practitioners realize. A $60 lead with 15% return rate is really a $51 lead. Managing returns protects the margins your pricing strategy creates.

Track returns by source and buyer. A source with 5% returns is worth far more than one with 15% returns at the same acquisition cost. A buyer with high returns may not be worth serving at any price.

Set clear return criteria. Invalid contact information, duplicates, filter mismatches. Not “did not convert” or “consumer changed mind.” Document criteria in buyer agreements.

Enforce return windows. Industry standards are 7-14 days depending on vertical. Enforce consistently. Selective enforcement invites gaming.

Adjust pricing for return-prone segments. If a specific lead attribute correlates with higher returns, price accordingly. If leads from a particular source generate 20% returns, your effective revenue is 20% lower than the headline price.

Frequently Asked Questions

What is the typical price difference between fixed and auction pricing?

Auction pricing typically generates 15-30% higher revenue per lead compared to fixed-price arrangements with the same buyer pool. The improvement comes from price discovery. Every lead sells at market value rather than negotiated average. High-value leads that would sell for $55 fixed might fetch $70-80 in competitive bidding. The revenue lift compounds across volume. At 10,000 leads monthly with 20% average improvement, the difference exceeds $100,000 annually.

How many buyers are needed for effective auction pricing?

Effective price discovery requires 5-15 active bidders per segment. Fewer than five limits competitive pressure. The highest bidder wins by default without much competition to drive prices up. More than fifteen rarely adds material revenue but increases system complexity. Geographic or vertical specialization may require different buyer counts for different segments. A California-only operation needs enough California-active buyers. A multi-state operation needs coverage across all territories.

What is the minimum volume for auction pricing to make sense?

Auction infrastructure costs justify themselves above 5,000-10,000 leads monthly. Below that threshold, the technology investment may exceed the revenue lift from competitive bidding. The calculation includes platform fees, integration costs, and operational complexity. Operations under 5,000 monthly leads often succeed with simpler fixed-price arrangements, transitioning to auction as volume grows.

How do you set floor prices for auction pricing?

Floor pricing establishes minimum acceptable bids. Start by analyzing your cost structure. If your fully-loaded cost per lead is $25, your floor should exceed that. Then consider market rates. If competitive fixed pricing runs $50, a $40 floor might attract bids while still improving on cost-plus. Test floor levels. Too high and you reject leads that would have sold. Too low and you accept below-market prices. Monitor fill rates. If fill rate drops below 80%, floor may be too high. Adjust based on data, not intuition.

What is the difference between first-price and second-price auctions?

First-price auctions, where winners pay their bid amount, dominate lead distribution. They are simpler for buyers to understand and generally generate higher revenue than second-price alternatives. Second-price auctions theoretically encourage truthful bidding, but the complexity confuses many buyers and the revenue often disappoints. Unless you have specific reasons to implement second-price mechanics, default to first-price.

How do hybrid pricing models work in practice?

Hybrid models combine fixed and auction elements. Common approaches include guaranteed minimums with auction upside, where buyers commit to floor prices but compete when demand is high. Quality tiering sends premium leads to auction while standard leads go to fixed-price buyers. Time-based exclusivity sells leads exclusively at fixed prices for 24-48 hours, then auctions unconverted leads for secondary distribution. The specific hybrid design depends on your buyer mix, quality variation, and technical capability.

How often should fixed prices be renegotiated?

Quarterly review is standard, but build triggers for earlier renegotiation. If return rates exceed thresholds, if volume significantly exceeds or falls below commitments, if market conditions shift materially. Traffic costs, competitive dynamics, and buyer economics change faster than quarterly cycles capture. Proactive renegotiation protects margins and maintains buyer relationships better than waiting for scheduled reviews.

What metrics matter most for lead pricing optimization?

Track effective revenue per lead, which is gross revenue minus returns, fraud, and processing costs divided by leads sold. Track price elasticity, meaning how volume responds to price changes. Monitor fill rate for auction pricing, meaning what percentage of leads receive acceptable bids. Watch buyer concentration to ensure no single buyer drives your pricing strategy. Finally, compare realized prices against market benchmarks. If your prices consistently lag competitors, you may be underpricing. If they consistently exceed benchmarks, validate that quality justifies the premium.

How do you transition from fixed pricing to auction without disrupting buyer relationships?

Transition gradually. Start with 15-20% of volume in auction while maintaining fixed arrangements. Communicate transparently with buyers about the change. Offer existing fixed-price buyers the option to participate in auctions with preferred status or guaranteed allocation. Measure performance differential over 60-90 days before expanding auction allocation. Maintain some fixed capacity for buyers who prefer predictability. The transition takes 6-12 months for most operations.

What technology is required for auction pricing?

At minimum, you need a lead distribution platform with ping/post capability. Major platforms include boberdoo, LeadsPedia, LeadHoop, and Lead Prosper. You need real-time integration with buyers, meaning API connections that can respond within 100 milliseconds. You need monitoring for response times, bid patterns, and system health. You need failover logic for when buyers timeout or reject. Most operations use established platforms rather than building custom infrastructure. Platform costs run $500-$2,500 monthly depending on volume and features.

Key Takeaways

-

Fixed pricing offers predictability at the cost of revenue optimization. Simple administration and stable relationships, but no mechanism for capturing value spikes. Best for early-stage operations, stable buyer relationships, and verticals with low price volatility.

-

Auction pricing through ping/post systems maximizes revenue per lead. Industry data shows 15-30% higher revenue compared to fixed arrangements. Every lead sells at market value through competitive bidding. Requires technical infrastructure and 5-15 active buyers for effective price discovery.

-

Hybrid models combine the benefits of both approaches. Guaranteed minimums with auction upside, quality tiering, time-based exclusivity, and volume commitments with spot pricing. Most mature operations implement hybrid strategies tailored to their buyer mix and quality variation.

-

Value-based pricing captures more margin than cost-plus. Understand buyer economics well enough to price based on what leads are worth to them, not just what they cost you. A lead that costs $30 to acquire might be worth $80 to a buyer who converts 10% to customers with $1,200 lifetime value.

-

Continuous optimization improves any pricing model. A/B test price points, analyze elasticity by segment, manage return rates aggressively, and monitor competitive benchmarks. Small improvements compound across volume.

-

Pricing model selection depends on volume, technical capability, buyer count, and strategic priorities. Under 5,000 leads monthly typically justifies fixed pricing. Over 25,000 leads monthly typically justifies full auction. The middle ground benefits from hybrid approaches that evolve as the operation matures.

-

Returns erode pricing more than most practitioners realize. A $60 lead with 15% return rate is a $51 lead. Track returns by source and buyer. Set clear criteria. Enforce windows consistently. Price to reflect return-adjusted revenue, not gross selling price.

-

Technology enables but does not guarantee pricing success. Platforms provide the infrastructure for auction mechanics. Strategy determines whether you capture maximum value. Invest in buyer network depth, quality differentiation, and optimization discipline.

Market conditions, platform pricing, and industry benchmarks current as of December 2025. Lead economics vary by vertical, geography, and operational execution. Validate current conditions before making significant pricing decisions.