How to navigate mass tort lead campaigns where raw leads trade at $50-400 and signed retainers command $500-5,000+, with campaign lifecycles that can make or break a lead generation business in 18 months.

A single television commercial airs in February 2023, asking veterans and their families if they lived or worked at Camp Lejeune between 1953 and 1987. Within weeks, law firms are paying $400 per qualified lead. Within months, over 150,000 administrative claims have been filed with the Navy JAG. By the end of 2024, the litigation has generated approximately 540,000-550,000 total claims filed, with legal advertising spend estimated at hundreds of millions of dollars.

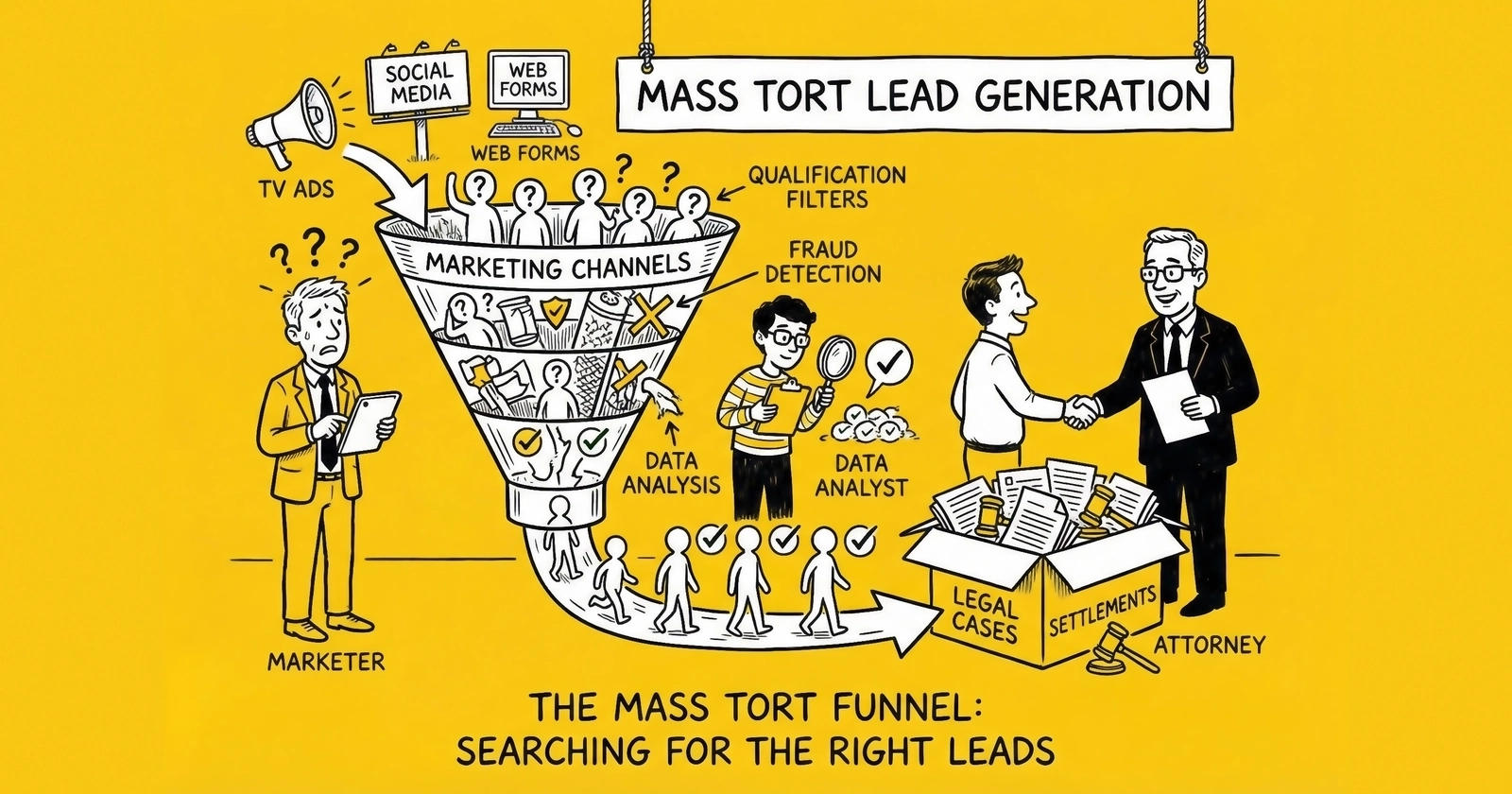

This is mass tort lead generation: the highest-volume, highest-volatility segment of legal lead acquisition. Single campaigns can generate tens of thousands of leads monthly during peak periods. Pricing can swing 300% between campaign emergence and maturity. And operators who time their entry correctly capture margins that dwarf standard personal injury economics.

But mass tort also destroys lead generation businesses that misread the market. Enter a campaign too early, and you accumulate inventory with no buyers. Enter too late, and competition has compressed margins below profitability. Miss the exit signals, and you are generating leads for litigation that has closed to new claimants.

This guide covers the complete mass tort lead generation landscape: the economics that drive premium pricing, the campaign lifecycle that determines optimal entry and exit timing, the qualification requirements that separate profitable leads from worthless inventory, and the compliance framework that keeps operators on the right side of attorney advertising rules and criminal statutes.

Understanding Mass Tort Litigation

Mass tort refers to civil actions where numerous plaintiffs sue one or more defendants for injuries arising from a common cause. Unlike class actions, where a single representative plaintiff pursues claims on behalf of an entire class, mass tort cases are individually filed but share common defendants, products, or exposure circumstances.

Mass Tort vs. Class Action: The Critical Distinction

The distinction matters for lead generation economics. In class actions, a single representative plaintiff files one lawsuit on behalf of all affected individuals. Class members share in any settlement or verdict, typically receiving modest payments of $50-500, and they are automatically included unless they actively opt out. Lead generation serves no purpose in class actions because there are no individual clients to sign.

Mass torts operate differently. Each plaintiff files a separate lawsuit, and each case is evaluated on its specific circumstances – individual exposure levels, documented injuries, and unique damages. This individualized approach means settlements can range from $10,000 to over $1,000,000 depending on case strength. Every claim requires its own documentation of exposure and injury, which explains why law firms invest heavily in finding and signing individual claimants.

This distinction explains why mass tort lead generation exists as a substantial industry. Law firms need to identify, qualify, and sign individual claimants. Each signed retainer represents a potentially lucrative case. The economics support aggressive acquisition spending.

Why Mass Tort Commands Premium CPLs

The economics of mass tort lead generation trace directly to settlement values and the contingency fee structure.

| Campaign Type | Typical Settlement Range | Attorney Fee (33-40%) | Justifiable Lead Cost |

|---|---|---|---|

| Talc/Ovarian Cancer | $100,000-$1,000,000+ | $33,000-$400,000+ | $2,000-$15,000 |

| Camp Lejeune | $21,000-$550,000+ (projected) | $7,000-$220,000 | $500-$5,000 |

| Roundup/NHL | $50,000-$200,000+ | $16,500-$80,000+ | $1,000-$8,000 |

| Hernia Mesh | $50,000-$500,000+ | $16,500-$200,000 | $500-$5,000 |

| Paragard IUD | $25,000-$200,000+ | $8,250-$80,000+ | $500-$3,000 |

When a single case can generate $50,000+ in legal fees, attorneys can justify paying $1,000-$5,000 per signed retainer. Even at 15-25% lead-to-sign conversion rates, the math works.

Current Major Mass Tort Campaigns (2024-2025)

The mass tort landscape shifts continuously as new litigation emerges and existing campaigns mature or close. As of late 2025, major active campaigns include:

Camp Lejeune Water Contamination (Maturation Phase)

The Camp Lejeune litigation is active, with DOJ settlement negotiations underway for the “cleanest” cancer cases. Eligible claimants include those who served or resided at the base between 1953 and 1987 for a minimum of 30 days. Qualifying conditions include cancer, Parkinson’s, kidney disease, and other conditions linked to contaminated water. Over 117,000 administrative claims were filed with Navy JAG before the August 10, 2024 statute of limitations, with the Congressional Budget Office estimating $21 billion in potential payouts. Lead pricing has settled at $200-$450 for qualified leads and $1,000-$4,000+ for signed retainers, with prices declining as maturation continues.

Settlement Projections (Industry Estimates):

| Injury Severity | Projected Settlement Range |

|---|---|

| Minor injuries | ~$10,000 |

| Moderate cases | $50,000-$250,000 |

| Severe cases (cancer) | $500,000-$1,000,000+ |

DOJ Strategy: The Department of Justice is prioritizing settlements for the “cleanest” cases – cancer claims with strongest causation evidence and clearest documentation. This creates a tiered settlement timeline where severe cases resolve first.

Technology Evolution: AI platforms like Supio and SimplyConvert have become essential for law firms managing Camp Lejeune claim documentation at scale. These tools automate medical record review, causation analysis, and case valuation – capabilities that barely existed when the Camp Lejeune Justice Act was signed in August 2022.

Compliance Alert: In July 2025, a TCPA lawsuit emerged against Prime Marketing over Camp Lejeune robocalls, demonstrating that mass tort volume does not exempt operators from telemarketing compliance requirements.

Lead Pricing Dynamics: Some lead providers now offer signed retainers at 25% legal fee arrangements (versus the typical 33-40%), reflecting market maturation and increased competition for qualified claimants

Johnson and Johnson Talc Litigation

Multiple settlement programs are active with ongoing litigation. Eligible conditions include ovarian cancer and mesothelioma linked to talcum powder use. Lead pricing runs $300-$600 for qualified leads with diagnosis and $2,000-$8,000+ for signed retainers with medical records.

Roundup/Glyphosate (Bayer/Monsanto)

The litigation is ongoing with $10 billion+ in settlements announced. Eligible conditions are non-Hodgkin’s lymphoma with documented Roundup exposure. Qualified leads price at $250-$500, with signed retainers at $1,500-$5,000+.

3M Military Earplugs

The MDL has concluded with a settlement program now active. Eligible claimants served in the military between 2003 and 2015 and used the affected earplugs. Conditions include hearing loss and tinnitus. Lead pricing is declining as the settlement program matures.

PFAS/Forever Chemicals

This campaign is emerging with multiple MDLs forming. Exposure sources include contaminated water and AFFF firefighting foam. Early-stage lead pricing runs $75-$200 for qualified leads.

NEC Baby Formula

An active MDL covers premature infants who developed necrotizing enterocolitis after using certain baby formulas. Qualified leads price at $400-$800, with signed retainers commanding $3,000-$10,000+.

Hair Relaxer

The MDL is active and growing. Eligible conditions include uterine cancer, ovarian cancer, and endometriosis linked to chemical hair relaxer use. Qualified leads price at $150-$350, with signed retainers at $1,000-$4,000+.

The Mass Tort Campaign Lifecycle

With an understanding of current campaigns and their economics, operators must master campaign timing. Mass tort campaigns follow predictable phases, each with distinct implications for lead generation. Understanding this lifecycle enables informed decisions about campaign entry, resource allocation, and exit timing.

Phase 1: Emergence (3-12 months)

A mass tort begins when scientific evidence, regulatory action, or initial lawsuits establish a potential link between a product or exposure and documented harms.

Market Characteristics

During emergence, few firms actively seek leads while eligibility criteria are still being defined. Settlement values remain purely speculative, and buyer demand is limited to early-mover firms willing to bet on litigation development.

Lead Economics

CPLs reach their lowest levels during emergence, typically $50-$150 for raw leads. Buyers stay selective, often requiring specific qualification criteria before purchasing. Volume potential remains uncertain, and many early leads may not ultimately qualify as litigation criteria clarify over time.

Strategic Considerations

Generators who build inventory during emergence bet on litigation developing successfully. Those who guess wrong accumulate leads with no market. The Camp Lejeune litigation exemplified successful early positioning – operators who began generating leads when the PACT Act was moving through Congress in early 2022 captured significant volume at low CPLs before competition intensified.

Entry Signals

Watch for MDL consolidation (multidistrict litigation designation), FDA warnings or regulatory agency action, peer-reviewed studies establishing causation, major law firms beginning television campaigns, and initial bellwether trial scheduling. These indicators suggest a campaign is transitioning from speculation to actionable opportunity.

Phase 2: Growth (6-24 months)

As litigation advances through judicial consolidation, scientific validation, and early trial activity, buyer demand increases dramatically.

Market Characteristics

During growth, multiple law firms compete actively for leads while television advertising increases substantially. Qualification criteria become well-defined, enabling lead generation companies to scale operations rapidly with clear eligibility standards.

Lead Economics

CPLs increase 100-300% from emergence levels as buyer demand typically exceeds supply. Quality requirements tighten as firms become more sophisticated in their case selection, and signed retainer pricing reaches its peak.

Strategic Considerations

Growth phase offers the optimal balance of volume opportunity and pricing. Demand exceeds supply, but the market has not yet peaked. This is the window for aggressive scaling. Most mass tort lead generation revenue is captured during growth phase.

Peak Market Indicators

Several signals indicate a campaign has reached peak growth: major law firms launching national television campaigns, multiple lead generation companies entering the market, signed retainer prices increasing 50%+ from early levels, industry conferences featuring sessions on the specific litigation, and lead buyers proactively seeking generator relationships rather than waiting for outreach.

Phase 3: Maturity (12-36 months)

Mature campaigns reach equilibrium between supply and demand.

Market Characteristics

Pricing stabilizes at levels reflecting actual case values as settlement frameworks often emerge, providing clarity on what cases are worth. Lead quality becomes the primary competitive differentiator, and buyers have accumulated enough data to distinguish quality sources from underperformers.

Lead Economics

CPLs stabilize or begin slight decline while quality metrics dominate buyer decisions. Source-level performance data drives volume allocation, meaning generators with strong conversion rates capture more business. Margin compression begins for commodity leads that lack differentiation.

Strategic Considerations

Generators with strong quality metrics maintain buyer relationships and volume. Those with poor conversion rates find themselves excluded from distribution networks. During maturity, differentiation through qualification depth, documentation, and conversion rates becomes essential.

Phase 4: Decline (6-18 months)

As filing deadlines approach, statutes of limitations expire, or settlement programs absorb available claimants, lead volume and buyer demand decline.

Market Characteristics

Decline phase brings filing deadline announcements and settlement fund establishment. Buyer interest wanes despite available inventory as attention shifts to new competing campaigns with fresher economics.

Lead Economics

CPLs compress significantly while volume becomes harder to generate as fewer eligible individuals remain. Buyers focus on case quality over new acquisition, and some generators exit to pursue emerging campaigns where margins are more attractive.

Strategic Considerations

The decline phase rewards operators who built diversified portfolios rather than concentrating on single campaigns. Successful mass tort specialists maintain awareness of emerging litigation to redirect traffic and creative assets as current campaigns wind down.

Exit Signals

Recognize when to exit: filing deadline announcements, settlement program establishment with enrollment cutoffs, major buyers reducing budgets or pausing acquisition, CPLs declining 30%+ from peak levels, and emerging campaigns attracting buyer attention and capital. Practitioners who miss these signals find themselves generating leads for a market that has moved on.

CPL Benchmarks and Pricing Models

Lifecycle phase determines general pricing trends, but the specific economics depend on qualification depth and delivery model. Mass tort lead pricing operates on two distinct models that reflect different levels of qualification and conversion risk.

Raw Lead Pricing: $50-$400

Raw leads represent individuals who express interest in mass tort litigation but have not been fully qualified or signed. Pricing varies by campaign maturity and qualification depth.

| Qualification Level | CPL Range | Typical Criteria |

|---|---|---|

| Basic Inquiry | $50-$100 | Name, contact info, basic interest |

| Preliminary Qualified | $100-$200 | Exposure dates, condition present |

| Verified Qualified | $200-$350 | Documentation reviewed, criteria met |

| Premium Qualified | $300-$400+ | Medical records, specific diagnosis |

Several factors determine raw lead pricing. Campaign stage matters most: emergence yields $50-$150 leads, growth pushes prices to $150-$300, and maturity commands $200-$400. Leads with documented diagnoses command 50-100% premiums over self-reported claims. Evidence of product use or location presence increases value significantly. Exclusive leads price 40-60% higher than shared leads sold to multiple buyers.

Signed Retainer Pricing: $500-$5,000+

Signed retainers represent fully qualified claimants who have executed representation agreements with law firms. The lead generator has completed intake, verified eligibility, and obtained signatures.

| Case Quality Tier | Price Range | Documentation Level |

|---|---|---|

| Basic Signed | $500-$1,500 | Self-reported qualifying criteria |

| Documented Signed | $1,500-$3,000 | Exposure verification, treatment records |

| Premium Signed | $3,000-$5,000+ | Full medical records, diagnosis confirmed |

Signed retainer pricing depends on documentation depth and case strength. Cases with complete medical records command the highest prices, while specific diagnoses linked to the litigation (ovarian cancer for talc, non-Hodgkin’s lymphoma for Roundup) price at multiples of general health claims. Documentary evidence of product use, employment at a facility, or residence in an affected area increases value substantially. Timeline alignment also matters – exposure must fall within relevant litigation periods to support viable claims.

The Lead-to-Signed Conversion Spread

Understanding the spread between raw lead costs and signed retainer value determines profitability for operators working both models.

Example Calculation:

| Metric | Value |

|---|---|

| Raw lead cost | $200 |

| Qualification rate | 30% |

| Sign rate (of qualified) | 60% |

| Effective lead-to-signed rate | 18% |

| Signed retainer value | $2,500 |

| Revenue per raw lead | $450 (18% x $2,500) |

| Gross margin per lead | $250 (125%) |

The economics work when qualification and sign rates are accurately estimated, operational costs (intake staff, systems, compliance) are controlled, lead costs remain stable during the conversion cycle, and buyers honor pricing commitments. Practitioners who overestimate conversion rates or underestimate intake costs discover their margins were illusory after the first month’s financials.

Qualification Requirements by Campaign Type

Pricing reflects qualification depth, making the qualification process central to profitability. Mass tort lead quality requirements vary by litigation but share common elements. Buyers have accumulated conversion data and reject leads that do not meet increasingly specific criteria.

Universal Qualification Elements

Every mass tort lead requires verification across four dimensions.

Exposure Documentation

Proof of exposure takes different forms depending on the litigation. Product use can be documented through photographs, purchase records, or prescriptions. Employment at an affected facility requires pay stubs, tax records, or ID badges. Residence in a contaminated area needs utility bills, lease agreements, or military records. Duration and dates of exposure must align with the litigation timeframe.

Medical Diagnosis

Buyers require evidence of specific conditions linked to the litigation – not just general health complaints. Diagnosis dates often must post-date exposure to establish causation. Treatment history, provider information, and medical records availability all factor into lead quality and pricing.

Timeline Alignment

Exposure must fall within relevant litigation periods as defined by the case. Diagnosis must occur within statute of limitations to preserve the claim. For some campaigns, latency periods between exposure and diagnosis are evaluated as part of case strength.

Prior Representation

Leads already represented on the same matter are universally rejected – you cannot solicit someone else’s client. Some campaigns reject leads with prior mass tort representation on any matter. Always ask explicitly: “Have you contacted or been contacted by another law firm about this matter?”

Campaign-Specific Qualification Criteria

Each major campaign has its own qualification requirements that determine lead acceptance and pricing.

Camp Lejeune

Qualified claimants must have lived or worked at Camp Lejeune between August 1953 and December 1987, with a minimum 30-day cumulative exposure that can span multiple periods. Qualifying medical conditions include various cancers, Parkinson’s disease, kidney disease, liver disease, and others scientifically linked to contaminated water. Family members who lived on base as dependents also qualify. Veterans must provide DD-214 or military service records for verification.

Talc/Ovarian Cancer

Claimants must demonstrate regular use of talcum powder products (Johnson’s Baby Powder, Shower to Shower) and have a diagnosis of ovarian cancer or mesothelioma. Use must predate diagnosis by typically 10+ years to establish causation. Documentation of product use through receipts, photographs, or sworn testimony strengthens case value.

Roundup/Non-Hodgkin’s Lymphoma

Qualification requires documented exposure to Roundup or glyphosate herbicides and a diagnosis of non-Hodgkin’s lymphoma. Professional users – landscapers, agricultural workers, groundskeepers – often have stronger cases due to prolonged exposure. Duration and frequency of exposure directly affects case value.

Hair Relaxer

Claimants need evidence of regular use of chemical hair relaxer products (Dark and Lovely, Just For Me, and similar brands) and a diagnosis of uterine cancer, ovarian cancer, or endometriosis. Most buyers require minimum use duration of 5+ years. This litigation disproportionately affects Black women, which is reflected in targeting strategies.

Disqualifying Factors Across Campaigns

Screen for universal disqualifiers before investing in full qualification. Leads with existing counsel on the same matter cannot be solicited – that is fundamental. Expired statutes of limitations (which vary by state and campaign) eliminate otherwise valid claims. Most campaigns require specific diagnosed conditions, not just symptoms, so general health complaints without diagnosis are rejected. Exposure dates must align with litigation parameters; dates outside the qualifying period invalidate the lead. Many campaigns require minimum exposure durations that casual users cannot meet. Finally, individuals who have already resolved claims through prior settlements cannot bring new claims on the same matter.

Documentation Requirements for Premium Pricing

Leads with documentation command significant premiums over self-reported data:

| Documentation Level | Pricing Impact |

|---|---|

| Self-reported only | Base pricing |

| Employer/residence verification | +25-40% |

| Medical diagnosis confirmation | +50-100% |

| Complete medical records | +100-200% |

The investment in documentation verification often pays for itself through higher sale prices and lower rejection rates.

Lead Generation Strategies for Mass Tort

With qualification requirements defined, the question becomes how to reach affected populations efficiently. Mass tort lead generation requires distinct strategies from personal injury or other legal verticals. Campaign lifecycles, volume requirements, and qualification complexity demand specialized approaches.

Television Advertising: The Market Driver

Television remains the dominant acquisition channel for major mass tort campaigns. Legal advertising tracking data consistently shows mass tort campaigns among the highest spenders in local television advertising.

Television serves multiple roles in mass tort ecosystems. It generates awareness among affected populations who may not realize they have claims. Repeated exposure establishes campaign legitimacy, making consumers more likely to respond. Television creates search and social demand that digital operators can capture. And it reaches demographics with lower digital engagement – seniors and veterans in particular – who represent significant portions of affected populations.

Television Economics

Television CPAs range from $150-$400 for qualified leads, but the channel requires significant capital: $500K+ monthly for national campaigns. Lead quality depends heavily on qualification screening at intake, and television works best for high-volume campaigns with broad qualifying criteria that can absorb the investment.

Strategic Consideration

Most independent lead generators cannot compete in television due to capital requirements. However, television creates demand that digital channels can capture at lower CPLs. Awareness-driven search campaigns (“Camp Lejeune lawsuit,” “talc cancer lawsuit”) become viable when television spending is high.

Paid Search: Capturing Existing Demand

Search advertising captures demand generated by television and news coverage. When mass tort campaigns receive significant media attention, search volume spikes for related terms.

High-Intent Keywords

The most valuable search terms follow predictable patterns: “[Product/location] lawsuit” (Camp Lejeune lawsuit), “[Condition] lawsuit” (ovarian cancer lawsuit), “[Product] lawyer” (Roundup cancer lawyer), and qualification queries like “Do I qualify for [litigation].” These patterns repeat across every major campaign.

Search Economics

CPCs range from $15-$75 for competitive mass tort terms. With strong landing pages, conversion rates of 10-20% to qualified lead are achievable, yielding effective CPLs of $100-$400. The channel requires significantly less capital than television while capturing demand that television creates.

Search Strategy

Monitor television spending to predict search demand – when major firms increase TV spend, search volume follows within weeks. Build campaigns during emergence to establish Quality Score before competition intensifies. Use exact match and phrase match to control relevance, and exclude informational queries that do not indicate litigation intent.

Social Media: Targeting Affected Populations

Social platforms enable targeting of specific demographics and interest groups aligned with mass tort eligibility.

Platform-Specific Approaches

Facebook and Instagram offer age and location targeting for demographic alignment – useful for reaching veterans or residents of specific geographic areas. Interest targeting works well for product users: gardening interests for Roundup, beauty and hair care for hair relaxer. Lookalike audiences built from converting leads improve efficiency over time, and video content enables storytelling about affected populations that builds emotional connection.

TikTok has emerged as a channel for reaching younger demographics, with user-generated content styles performing better than polished advertising. The platform works particularly well for campaigns affecting younger populations such as NEC baby formula and hair relaxer.

YouTube serves mass tort through pre-roll on relevant content, educational videos about litigation, and remarketing to viewers who have engaged with related content.

Social Economics

CPMs range from $8-$25 across platforms. Conversion rates typically run 5-15% to form completion, yielding effective CPLs of $75-$250. Targeting precision improves efficiency substantially compared to broad television, though volume may be more limited.

Native and Display: Awareness Building

Native advertising and programmatic display build awareness and capture attention among target demographics.

Native Advertising Approach

Native ads use “You may be entitled to compensation” style headlines with editorial-style content explaining the litigation. Placement on news sites, health content, and relevant verticals reaches affected populations where they consume information. This channel works particularly well during emergence phase when direct search demand is still low.

Programmatic Display

Display advertising serves mass tort through remarketing to site visitors who did not convert, contextual targeting on relevant content, and geographic targeting for location-based campaigns. Display generally produces lower CPLs but also lower quality without strong qualification processes to screen incoming leads.

Content Marketing and SEO: Long-Term Asset Building

Organic search traffic provides leads at effectively zero marginal cost but requires significant upfront investment.

SEO Approach

Build authoritative content about specific litigation, targeting informational queries that indicate potential eligibility. Qualification tools and calculators engage visitors and capture contact information. Condition-specific landing pages serve both organic traffic and paid campaign destinations.

Timeline Considerations

Ranking for competitive terms takes 6-12 months, which means operators who start SEO too late may miss the campaign peak entirely. However, organic visibility provides ongoing value for multi-year campaigns and reduces dependence on paid channels as costs rise in mature phases.

Content Strategy

Effective content includes FAQ pages addressing common qualification questions, educational material about exposure circumstances and medical conditions, settlement value projections and case updates, and symptom checkers or qualification assessments that help visitors self-identify as potential claimants.

Mass Tort Compliance Framework

Channel strategy is only part of the equation. Legal lead generation operates within an ethical framework more restrictive than any other vertical. Mass tort adds complexity due to the volume of claims, the emotional nature of health-related litigation, and aggressive enforcement of advertising rules.

Attorney Advertising Rules Apply

All state bar rules governing attorney advertising and solicitation apply to mass tort campaigns. The volume and visibility of mass tort advertising attracts regulatory attention.

Truthful Communications (Rule 7.1)

Advertising cannot contain false or misleading claims about settlement values. Outcome claims like “millions recovered” require substantiation and appropriate disclaimers. No guaranteed results or timelines – ever. The temptation to overstate potential recovery is strong in mass tort; resist it.

Advertising Labeling (Rule 7.2)

Many jurisdictions require “Advertisement” or “Attorney Advertising” labeling on all marketing materials. The responsible attorney must be identified, and state-specific disclosure requirements must be followed. No bait-and-switch claims that promise one thing and deliver another.

Solicitation Prohibition (Rule 7.3)

This is where mass tort compliance becomes critical. No direct contact with identified individuals known to have claims. No use of medical records, hospital lists, or diagnosis databases for outreach. No in-person solicitation under any circumstances. Digital targeting must reach audiences, not identified individuals – this distinction matters.

The Mass Tort Solicitation Challenge

Mass tort creates specific solicitation risks due to the nature of the claims.

Prohibited Practices

Never obtain hospital or medical facility lists and contact patients directly. Never use prescription data to identify and contact individuals taking specific medications. Never contact individuals identified in news reports as victims. Never purchase lists of diagnosed individuals for outreach. These practices constitute prohibited solicitation and can result in bar complaints, civil liability, and in some states, criminal charges.

Permitted Practices

Advertising to demographics likely to be affected (age groups, occupational categories) is permitted. Geographic targeting of areas near affected facilities is acceptable. Interest-based targeting works – gardening interests for herbicide litigation, for example. Content marketing that attracts individuals to self-identify falls squarely within permitted activity.

The Gray Area

Targeting based on interests or demographics is permitted. Targeting based on identified medical conditions or known exposure may constitute prohibited solicitation depending on specificity and data source. When uncertain, err toward broader targeting.

TCPA Requirements

Mass tort lead generation involves the same TCPA requirements as other lead categories – with particular attention due to the vulnerable populations often involved.

Consent Requirements

Prior express written consent is required for marketing calls using automated technology. Consent must be clear and conspicuous – buried disclosures invite litigation. Identify the specific law firm or firms who will receive the lead as part of the consent language. Document every consent with TrustedForm or Jornaya certificates that can be retrieved for litigation defense.

Revocation Handling

Honor opt-out requests within 10 business days as required by regulation. Recognize standard opt-out keywords (stop, quit, cancel, unsubscribe) and process them automatically. Sync opt-out status across all channels to prevent inadvertent contact after revocation.

TCPA Litigation Risk

Mass tort lead generation companies are frequent TCPA defendants. The combination of high volume, vulnerable populations, and aggressive outreach creates substantial risk. TCPA class actions exceeded 2,700 filings in 2024, with legal lead generators among common defendants.

State-Specific Compliance Considerations

Several states warrant particular attention due to aggressive enforcement or unique requirements.

Texas

Texas updated its barratry statutes in 2025 to specifically address digital solicitation. Criminal penalties for prohibited solicitation include $10,000-$50,000 in civil penalties and potential felony charges. The state maintains strict attorney advertising requirements that extend to lead generators.

Florida

The 30-day rule restricts contact with accident victims and applies to mass tort where “incident” dates are identifiable. The Florida Bar actively enforces these restrictions against both attorneys and their lead generation partners.

California

Runner and capper prohibitions under Business and Professions Code Section 6151 carry criminal penalties including fines and potential jail time. Contracts procured through prohibited solicitation are void, meaning attorneys cannot enforce retainer agreements if the lead source violated solicitation rules.

New York

New York aggressively enforces against unlicensed activity in legal marketing. The state imposes restrictions on non-attorney ownership of legal marketing entities and applies increased scrutiny to mass tort advertising claims.

Documentation and Retention

Maintain comprehensive records for defense against regulatory and litigation challenges. Archive all advertising creative, landing pages, television spots, and social ads for at least 5 years. Retain consent records including TrustedForm certificates, form submissions, and recorded consent for the same period. Keep qualification documentation – notes, call recordings, verification records – organized and retrievable. Preserve buyer communications including contracts, lead delivery confirmations, and quality discussions. Maintain written compliance policies for advertising, consent capture, and qualification that demonstrate your operational standards.

Working with Law Firm Buyers

Compliance protects the operation; buyer relationships determine its success. Mass tort lead buyers include national litigation firms, regional practices, and case acquisition companies. Understanding buyer types enables effective relationship building and distribution diversification.

Buyer Categories

Understanding the different buyer types enables effective relationship building and distribution diversification.

National Mass Tort Firms

These firms handle thousands of cases per litigation with significant advertising budgets – often the same firms driving television awareness. Their sophisticated intake and case management systems can absorb volume requirements of 500-5,000+ signed cases per campaign. They prefer signed retainers over raw leads because their infrastructure is optimized for case processing rather than intake.

Regional Litigation Firms

Regional firms focus on specific geographic markets and may participate in MDL or partner with national firms for case processing. Volume requirements are more modest at 50-500 cases per campaign. These buyers may accept raw leads with strong qualification when they lack intake capacity.

Case Acquisition Companies

These entities aggregate cases for placement with law firms. They operate intake centers and qualification processes, buying both raw leads and signed retainers. Volume capacity reaches thousands of leads monthly, making them often the largest buyers in the market. They function as intermediaries between generators and the law firms that ultimately handle the cases.

Lead Aggregators

Aggregators collect leads from multiple sources and resell to law firms or acquisition companies. They offer lower pricing but reliable volume absorption – useful for overflow and backup distribution when primary buyers are saturated.

Buyer Qualification and Selection

Not all buyers are equal. Evaluate potential buyers across four dimensions before committing volume.

Financial Stability

Assess payment terms and payment history carefully. Determine whether the buyer has adequate capitalization for the campaign duration – mass tort can span years. Request references from other generators who have worked with them.

Quality Feedback

Quality buyers provide conversion data that helps you optimize. They communicate rejection reasons so you can improve qualification. They track source-level performance and share that intelligence. Buyers who take leads without feedback leave you flying blind.

Compliance Posture

Determine whether buyers have compliance requirements they will share. Ask whether they will sign compliance representations. Understand how they handle bar complaints – will they support you or throw you under the bus?

Volume Capacity

Confirm monthly lead capacity by campaign to avoid overselling. Understand geographic coverage limitations. Assess case type flexibility in case you need to pivot.

Distribution Diversification

Successful mass tort lead generators distribute across multiple buyers rather than depending on a single relationship.

Primary Buyers (50-60% of volume)

Build relationships with 2-3 primary buyers who offer premium pricing and direct feedback on quality. These relationships should include committed volume agreements that provide predictability on both sides.

Secondary Buyers (25-35% of volume)

Case acquisition companies often serve as secondary buyers, providing scale and backup for primary buyer saturation. They fill geographic gaps and may accept leads that primary buyers reject based on their different qualification standards.

Overflow (10-15% of volume)

Aggregators and backup buyers absorb overflow at lower pricing but with reliable purchase. This tier ensures monetization of all qualified leads and reduces the risk of inventory aging while primary buyers process their allocation.

Buyer Relationship Management

Mass tort campaigns are finite. Relationship management determines whether you access the next campaign’s demand.

During Active Campaigns

Provide consistent volume against commitments – nothing erodes trust faster than underdelivery. Communicate proactively about quality issues before buyers discover them. Accept feedback and implement improvements visibly. Honor pricing agreements even when market shifts might let you extract more elsewhere.

Between Campaigns

Maintain relationships with regular communication even when no leads are flowing. Share intelligence about emerging litigation to demonstrate value. Discuss next campaign opportunities before they become competitive. Build the trust that translates to preferred access when the next wave emerges.

Scaling Mass Tort Operations

Buyer relationships established, the path forward is growth. Mass tort lead generation rewards scale. Volume efficiency, buyer relationships, and operational infrastructure create advantages that compound over time.

Operational Infrastructure Requirements

Scaling requires infrastructure across four operational areas.

Lead Capture and Qualification

Build multi-step forms with progressive qualification that screens out unqualified leads before you pay for them. Implement real-time phone verification to ensure contactability. Deploy fraud detection and duplicate screening to protect lead quality. Capture consent with third-party verification (TrustedForm or Jornaya) for every lead.

Intake Operations (for Signed Retainer Model)

Signed retainer operations require trained intake specialists, preferably with legal backgrounds who understand qualification nuances. Call recording and quality assurance ensure consistency. Electronic signature capability enables remote retainer execution. Case management system integration keeps data synchronized. Compliance documentation processes protect against regulatory exposure.

Distribution and Fulfillment

Real-time lead routing to buyers ensures speed-to-lead that impacts conversion. API integrations with buyer systems reduce friction. Return handling and dispute resolution processes address quality disagreements. Revenue tracking by source and buyer enables optimization.

Financial Systems

Buyer payment tracking and reconciliation prevent revenue leakage. Cash flow management becomes critical with 15-45 day payment cycles typical of the industry. Media cost accounting by campaign enables profitability analysis by lead source – the data that drives optimization.

Staffing Considerations

Mass tort operations require specialized skills across several functional areas.

Media Buyers

Effective mass tort media buyers need experience with legal advertising and knowledge of compliance requirements. Campaign lifecycle awareness helps them adjust strategy as campaigns mature. Multi-platform capabilities ensure efficient spend allocation across channels.

Intake Specialists

Intake staff need legal terminology knowledge and genuine empathy for health-affected individuals who are often distressed. Qualification criteria mastery ensures accurate screening, and compliance training prevents inadvertent violations during calls.

Quality Assurance

QA personnel handle call review and scoring to maintain intake standards. They conduct form audits and verification, analyze conversion rates to identify problems, and integrate buyer feedback into process improvements.

Compliance

Compliance staff require state bar rule knowledge and TCPA expertise. Documentation management and regulatory monitoring ensure the operation stays ahead of enforcement trends.

Volume Scaling Challenges

Mass tort scaling faces distinct challenges that differ from other lead generation verticals.

Campaign Finite Life

Volume opportunity exists for 12-36 months typically, requiring continuous identification of emerging campaigns. Infrastructure built for one campaign may not transfer easily to the next – different qualification criteria, buyer relationships, and traffic sources may be required.

Quality at Scale

Qualification rates often decline as volume increases because reaching beyond the core affected population brings in more marginal leads. Traffic sources that work at low volume may degrade at scale. Buyer tolerance for rejection rates limits how far you can push volume.

Capital Requirements

Media spend precedes revenue by 30-60 days, creating cash flow pressure during growth. The signed retainer model requires additional intake investment. Multi-campaign diversification demands working capital to operate across multiple litigation simultaneously.

Competition Intensity

Growth phase attracts new entrants who bid up media costs. CPAs increase as campaigns mature. Margin compression requires continuous efficiency improvements just to maintain profitability.

Risk Management in Mass Tort

Scale creates exposure. Mass tort lead generation carries specific risks that require active management.

Litigation Risk

Mass tort lead generators face litigation on multiple fronts.

TCPA Class Actions

High-volume calling creates substantial class action exposure. Serial litigators target mass tort campaigns specifically because the volume creates large potential damages. A single lawsuit can allege thousands of violations, with statutory damages of $500-$1,500 per violation creating existential risk.

State Consumer Protection

State attorneys general pursue deceptive advertising claims against aggressive mass tort marketers. Unauthorized practice of law allegations can arise from qualification processes that go too far. Enforcement varies by state but can be swift and severe.

Bar Complaints

Attorney buyers may face discipline for lead sources that violate solicitation rules, and those complaints often name lead generators. Even if no formal sanction results, reputational damage affects buyer relationships and future access.

Campaign Risk

Campaign risk takes several forms. Not all mass tort litigation develops as expected – scientific evidence may weaken, defendants may win early rulings, or settlements may fall short of projections. Early investment may yield no returns if the litigation fails to attract buyer demand. Qualification criteria changes during litigation development can invalidate inventory you already accumulated.

Timeline risk compounds the challenge. Filing deadlines may accelerate unexpectedly when courts or settlement administrators impose cutoffs. Settlement announcements can end campaigns overnight with no warning. Buyers may exit before your inventory is sold, leaving you with leads and no revenue.

Quality disputes strain relationships and cash flow. Buyers may reject leads at higher rates than projected based on different qualification interpretations. Return policies may change mid-campaign as buyers accumulate data. Collection disputes can tie up capital for months.

Compliance Risk

Regulatory enforcement comes from multiple directions: FCC TCPA enforcement for telemarketing violations, state bar advertising enforcement for attorney rule violations, and state attorney general consumer protection divisions for deceptive practices.

Criminal exposure is real. Barratry statutes in Texas, California, and other states carry criminal penalties. Solicitation violations can result in criminal charges against individuals, not just the business entity. Business operators face personal liability that cannot be discharged through corporate structure.

Risk Mitigation Strategies

Effective risk management requires action across multiple dimensions.

Diversification

Operate across multiple campaigns simultaneously to reduce dependence on any single litigation. Work with multiple buyers per campaign to protect against buyer-specific issues. Use multiple traffic sources to avoid single-point-of-failure vulnerability. Maintain backup distribution relationships that can absorb volume if primary buyers pause.

Documentation

Maintain complete advertising archives that demonstrate compliance. Verify consent for every lead with third-party certificates. Document quality processes in written form. Preserve buyer communications for dispute resolution.

Insurance

TCPA-specific coverage is available from some carriers and worth investigating. E&O insurance for professional liability provides baseline protection. Consider enhanced coverage during high-volume campaigns when exposure is greatest.

Legal Counsel

Establish a relationship with TCPA defense counsel before you need them – mid-lawsuit is too late to find good representation. Work with attorney advertising specialists for compliance review of new campaigns. Ensure quick access during regulatory inquiries when response time matters.

Emerging Mass Tort Opportunities

Risk managed, the operator’s attention turns to the next opportunity. Successful mass tort operators continuously monitor the litigation landscape for emerging campaigns. Early positioning in developing litigation creates competitive advantage.

Indicators of Emerging Campaigns

Monitoring several indicator categories helps identify campaigns before they become competitive.

Regulatory Signals

Watch for FDA warnings or black box additions on medications, product recalls, EPA contamination findings, and OSHA enforcement actions. Regulatory activity often precedes litigation by 6-18 months.

Scientific Evidence

Peer-reviewed studies establishing causation signal potential litigation. Meta-analyses confirming health effects strengthen the scientific foundation. Medical journal publications and expert consensus development indicate the science is maturing.

Legal Activity

Initial lawsuits filed mark the beginning of organized litigation. MDL petition filings or grants indicate consolidation is coming. Bellwether trial scheduling suggests cases are advancing. Major law firms announcing case investigations signals they see viable claims.

Media Coverage

Investigative journalism often surfaces issues before litigation develops. Documentary releases drive public awareness. News coverage of affected populations creates search demand. Social media awareness spreading indicates a potential audience for lead generation.

Evaluation Framework for New Campaigns

Before committing resources to emerging litigation, evaluate the opportunity across five dimensions.

Affected Population Size

Determine how many potential claimants exist based on product usage, geographic exposure, or employment records. Assess whether the population is identifiable and reachable through available targeting. Understand the geographic distribution to plan traffic acquisition.

Scientific Foundation

Evaluate whether causation is established through peer-reviewed research. Assess the strength of epidemiological evidence linking exposure to injury. Identify alternative causation arguments defendants might raise.

Settlement Potential

Research the defendant’s financial capacity to pay judgments or settlements. Look for precedent settlements in similar litigation to reference. Project case values based on injury severity and documented damages.

Timeline

Determine the statute of limitations timeline by state. Identify whether filing deadlines are approaching that might compress the opportunity window. Estimate how long until bellwether trials that will establish case value benchmarks.

Competition

Assess who else is entering this campaign and their capabilities. Estimate the capital required to compete effectively. Identify any barriers to entry that might protect early movers.

Current Emerging Campaigns (2025)

Several campaigns warrant monitoring as of late 2025.

PFAS/Forever Chemicals

Widespread water contamination affects millions of Americans through municipal and industrial exposure routes. Multiple MDLs are forming as litigation consolidates. The campaign is in early stage with significant growth potential for operators who position early.

Social Media Mental Health

Litigation against Meta, TikTok, and other platforms involves claims around adolescent mental health effects. Regulatory attention is increasing, which may accelerate litigation development. The campaign presents unique targeting challenges because the affected population is minors.

Ozempic/GLP-1 Side Effects

Emerging claims around GLP-1 weight loss medications allege stomach paralysis, pancreatitis, and other serious side effects. High-profile defendants (Novo Nordisk, Eli Lilly) have deep pockets for settlements. The significant user population creates volume potential.

Acetaminophen/Autism

Claims link prenatal acetaminophen exposure to neurodevelopmental effects including autism spectrum disorders. Scientific evidence is still developing, but an MDL is active. Targeting challenges exist because the affected population involves prenatal exposure that occurred years ago.

Frequently Asked Questions

1. What is mass tort lead generation and how does it differ from personal injury leads?

Mass tort lead generation focuses on litigation where numerous plaintiffs sue common defendants for injuries from the same product, exposure, or incident. Unlike standard personal injury leads (car accidents, slip and falls) where each case involves unique circumstances, mass tort cases share common liability theories. This creates distinct economics: campaigns have finite lifecycles (1-3 years typically), volume potential is much higher (tens of thousands of leads per campaign), and pricing varies dramatically by campaign stage. Mass tort lead pricing ranges from $50-$400 for raw leads to $500-$5,000+ for signed retainers, compared to personal injury leads at $200-$800 for similar quality tiers.

2. How much can I expect to pay for Camp Lejeune leads in 2025?

Camp Lejeune lead pricing as of late 2025 has stabilized in the mature phase of the campaign lifecycle. Qualified raw leads (verified exposure dates, qualifying condition identified) trade at $200-$450. Signed retainers with complete documentation command $1,000-$4,000+, with premium pricing for cases with extensive medical records and strong diagnoses. Leads with just basic exposure verification but no confirmed qualifying condition price at $100-$200. Shared leads price 40-60% lower than exclusive leads. Pricing has declined from peak levels in 2023-2024 as the campaign matured and initial filing rushes subsided.

3. What qualification criteria determine whether a mass tort lead is valuable?

Three elements determine mass tort lead value: exposure documentation, medical diagnosis, and timeline alignment. These factors align with broader principles of understanding lead quality scores. Exposure documentation proves the individual was exposed to the product, worked at the facility, or resided in the affected area during the relevant period. Medical diagnosis confirms they have a condition specifically linked to the litigation (not just general health complaints). Timeline alignment verifies exposure occurred during the legally relevant window and diagnosis falls within statute of limitations. Leads with all three elements documented command premium pricing. Leads with only self-reported claims and no documentation price at 50-70% discounts and experience higher rejection rates.

4. How do I know when to enter or exit a mass tort campaign?

Entry timing signals include: MDL consolidation announcement, major law firms launching television campaigns, peer-reviewed studies establishing causation, and emerging buyer demand. The optimal entry window is typically 3-6 months after these signals when demand is rising but competition has not peaked. Exit signals include: filing deadline announcements, settlement program establishment, declining buyer budgets, CPL compression exceeding 30% from peak, and emerging campaigns attracting buyer attention. Exit too late and you hold inventory with declining value. Most mass tort operators maintain ongoing campaign monitoring to identify both entry and exit signals.

5. What is the difference between selling raw leads and signed retainers?

Raw leads are individuals expressing interest who have not been fully qualified or signed to representation. You capture their information, perform basic qualification, and sell to law firms or case acquisition companies. Revenue per lead: $50-$400 depending on qualification depth. Signed retainers involve complete intake: qualification verification, document collection, and execution of representation agreements. Revenue per signed retainer: $500-$5,000+. The signed retainer model requires intake operations (staff, training, systems, compliance) but captures 3-10x the revenue per qualified individual. Most generators start with raw leads and add signed retainer capability as they scale.

6. How do I ensure mass tort lead generation complies with attorney advertising rules?

Compliance requires maintaining the distinction between advertising (permitted) and solicitation (prohibited). Advertising targets general audiences based on demographics, interests, or geography. Solicitation targets specific individuals known to have claims. Never purchase or use medical records, hospital lists, or diagnosis databases for outreach. Target audiences likely to be affected (veterans, geographic areas, age groups, occupational categories) rather than identified individuals. Maintain advertising archives for 5+ years. Use clear labeling as required by state bar rules. Capture documented consent with third-party verification (TrustedForm or Jornaya). Work with attorneys who understand mass tort advertising compliance.

7. What are the major active mass tort campaigns as of 2025?

Major active campaigns as of late 2025 include: Camp Lejeune water contamination (mature phase, approximately 600,000+ claims filed), Johnson and Johnson talc litigation (ongoing settlement programs, multiple paths), Roundup/glyphosate with non-Hodgkin’s lymphoma claims (ongoing, $10 billion+ in settlements announced), hair relaxer and uterine/ovarian cancer (growing MDL), NEC baby formula (active MDL, premium-priced leads), Paragard IUD (active claims), and emerging PFAS/forever chemicals litigation. Campaign activity levels and lead pricing vary. Operators should monitor litigation developments and buyer demand to assess current opportunity levels.

8. How long do mass tort campaigns typically last?

Mass tort campaign lifecycles typically span 2-5 years from emergence to decline, though some extend longer. The emergence phase (limited buyer demand, low pricing) lasts 3-12 months. Growth phase (rising demand, increasing prices) spans 6-24 months. Maturity (stable demand, price equilibrium) continues 12-36 months. Decline (falling demand, compressed margins) concludes in 6-18 months. Some campaigns, like asbestos litigation, continue for decades. Others, like 3M earplugs, move through the full cycle in 3-4 years. Campaign duration depends on defendant resources, plaintiff population size, scientific evidence development, and settlement negotiations.

9. What compliance documentation should I maintain for mass tort leads?

Maintain comprehensive documentation including: advertising archives (all creative, landing pages, television spots, social ads) for 5+ years, consent records with third-party verification certificates for every lead, qualification notes including call recordings and verification documentation, buyer communications and contracts, written compliance policies, and training records. This documentation defends against TCPA litigation (proving consent), bar complaints (proving advertising rather than solicitation), and buyer disputes (proving qualification claims). The investment in documentation pays for itself with the first regulatory inquiry or lawsuit defense.

10. What conversion rates should I expect in mass tort lead generation?

Conversion rates vary by campaign and qualification depth. Lead-to-qualified rates (raw leads meeting campaign criteria) typically range 20-40% for well-targeted traffic. Qualified-to-signed rates (qualified leads executing retainers) range 40-70% depending on intake effectiveness. End-to-end raw-lead-to-signed-retainer rates typically fall between 10-25% for quality exclusive leads. Case acceptance rates (signed retainers accepted by law firms after attorney review) range 85-95% when qualification is thorough. Lower conversion rates indicate targeting problems (wrong audience), qualification gaps (missing criteria), or intake issues (process failures). Track conversion by source to identify underperformers.

Key Takeaways

-

Mass tort lead generation offers the highest volume potential in legal lead generation, with single campaigns generating tens of thousands of leads monthly, but campaigns have finite lifecycles requiring continuous portfolio management across emerging, mature, and declining litigation.

-

Pricing varies dramatically by campaign stage and qualification depth: raw leads trade at $50-$400 while signed retainers command $500-$5,000+, with 3-10x pricing variance between emergence and maturity phases within the same campaign.

-

Campaign lifecycle timing determines profitability: enter during emergence for lowest CPLs but uncertain buyer demand, enter during growth for optimal volume/pricing balance, and exit before decline phase compresses margins below profitability.

-

Qualification requirements are strict and campaign-specific: exposure documentation, medical diagnosis, and timeline alignment determine lead value. Leads with all three elements command premium pricing; self-reported claims without documentation price at 50-70% discounts.

-

Compliance requires maintaining the advertising/solicitation distinction with particular care in mass tort due to vulnerable populations and regulatory attention. TCPA consent, attorney advertising rules, and state-specific barratry statutes all apply.

-

Distribution diversification across multiple buyers protects against buyer saturation, payment risk, and campaign-specific volatility. Build relationships with national firms, case acquisition companies, and aggregators.

-

The signed retainer model captures 3-10x the revenue of raw lead sales but requires intake operations including trained staff, call recording, electronic signature capability, and compliance documentation processes.

-

Emerging campaign identification creates competitive advantage. Monitor regulatory signals, scientific publications, initial litigation filings, and major law firm activity to position for developing litigation before competition intensifies.

Conclusion

Mass tort lead generation represents the highest-stakes segment of legal lead acquisition. The economics are compelling: campaigns can generate hundreds of thousands of leads, individual signed retainers command $1,000-$5,000+, and well-timed entry into developing litigation produces margins that dwarf standard personal injury economics.

But the risks match the rewards. Campaign lifecycles are finite. Timing entry and exit incorrectly destroys margins that looked attractive on paper. Compliance failures create criminal exposure in states like Texas and California. And the volume that makes mass tort attractive also makes TCPA litigation risk substantial.

Those who succeed in mass tort share common characteristics. They monitor the litigation landscape continuously, positioning for emerging campaigns before competition intensifies. They build qualification processes that produce leads buyers actually accept and convert. They maintain buyer relationships across campaigns, ensuring access to demand when the next opportunity emerges. And they treat compliance as core infrastructure rather than a box to check.

Mass tort lead generation is not for casual operators. The capital requirements, operational complexity, and compliance burden create barriers that protect margins for those who clear them. The question is whether you are prepared to build the infrastructure, manage the risks, and commit to the continuous campaign monitoring that success requires.

For practitioners who are, mass tort offers volume and margins that no other lead generation vertical can match.

Pricing and campaign information current as of late 2025. Mass tort litigation status changes rapidly. This article provides general information and does not constitute legal advice. Consult with an attorney specializing in mass tort litigation and attorney advertising for current campaign status and compliance guidance.