Every mortgage lead represents a promise: that the consumer can actually afford the loan they’re requesting. Income and employment verification transforms that promise into evidence. Without it, you’re selling unqualified prospects to lenders who will return them, eroding your margins and relationships with every bad lead that slips through.

The numbers tell the story. Mortgage fraud risk increased 12% in 2024 compared to the previous year, with income and employment misrepresentation accounting for approximately 34% of all mortgage fraud incidents. The average cost of a fraudulent mortgage application to lenders exceeds $75,000 when factoring in investigation, remediation, and potential losses. For lead generators, the math is simpler: unverified income claims translate directly into return rates, pricing pressure, and lost buyer relationships.

This guide covers the complete income and employment verification ecosystem for mortgage lead generators. You will learn what data to verify, which services provide reliable verification, how to integrate VOE and VOI into your lead quality stack, and how to price the value you’re adding. Those who master this capability don’t just reduce returns. They command premium pricing because their leads actually close.

Understanding the Verification Landscape

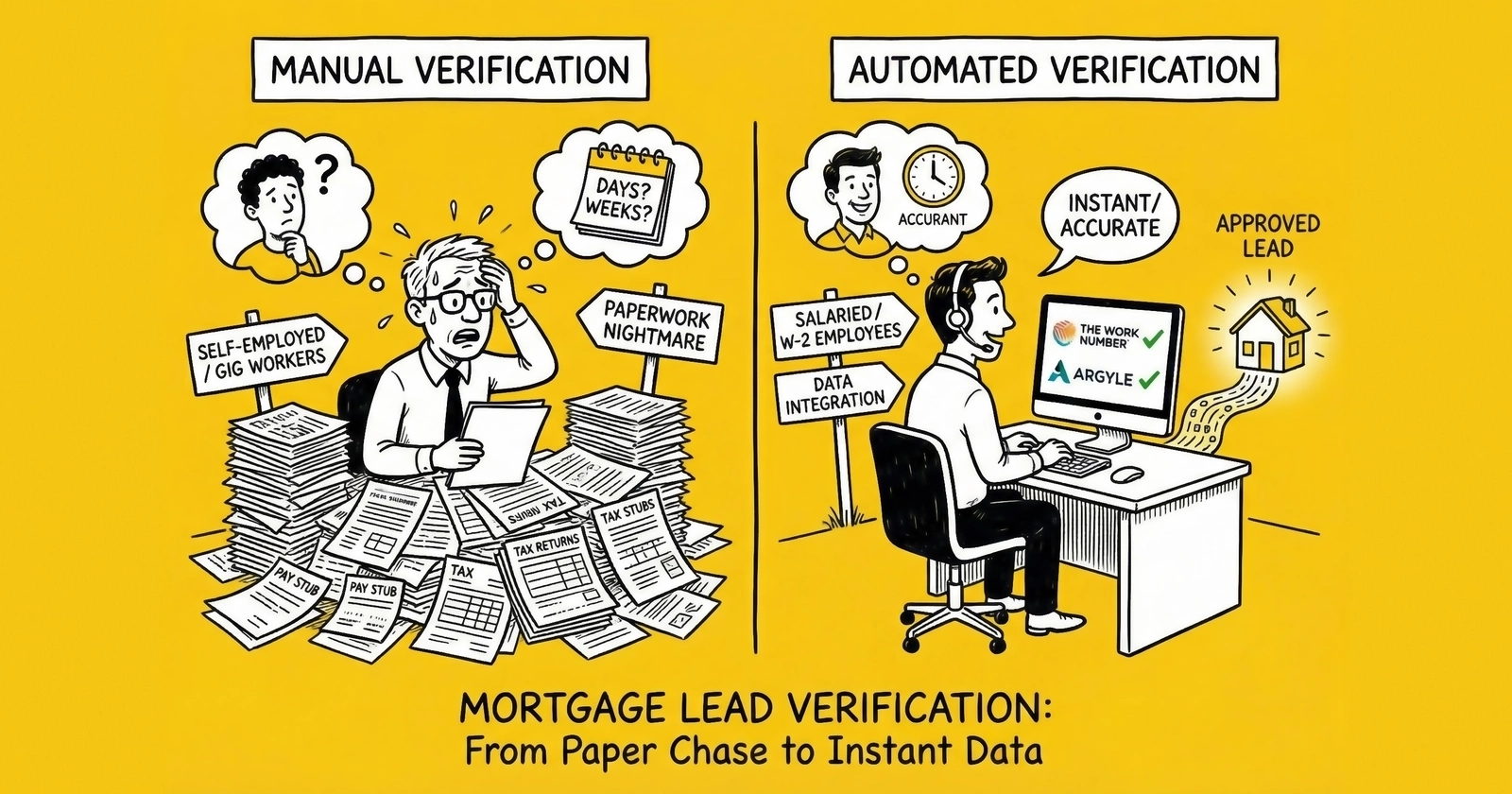

Income and employment verification exists because consumers misrepresent their financial situation. Sometimes deliberately, sometimes optimistically, sometimes through simple confusion about what counts as “income.” The lending industry has developed systematic approaches to cutting through these misrepresentations.

Why Verification Matters for Lead Quality

The fundamental challenge for mortgage lead generators is qualification uncertainty. A consumer submits a form claiming $85,000 annual income and employment at a Fortune 500 company. How much of that is true?

Without verification, you’re operating on faith. The lead might be a solid prospect for a $350,000 home purchase. Or they might be unemployed with $30,000 in annual gig income who will never qualify for the loan they think they want. The lender you sell that lead to will figure out the truth eventually. The question is whether you absorb that cost through returns or capture value through verification.

Industry data shows the scale of the problem:

- Approximately 1 in 134 mortgage applications contains fraud indicators

- Income misrepresentation appears in 34% of fraudulent applications

- Employment misrepresentation (false employer, inflated position, fabricated employment) appears in 28% of fraud cases

- The Mortgage Bankers Association estimates that fraud costs the industry $1 billion annually in direct losses

For lead generators, these statistics translate into operational reality. If even 5% of your leads contain material income or employment misrepresentations, you’re selling leads that cannot convert. At $75-150 per lead, those returns add up quickly – a dynamic that directly impacts your true cost per lead calculations.

The Verification Spectrum

Verification isn’t binary. It exists on a spectrum from basic plausibility checks to full documented confirmation:

Level 1: Self-Reported Validation The consumer’s stated income and employment are checked for internal consistency. Does the claimed salary match reasonable ranges for the claimed position? Does the employer exist? This catches obvious lies but misses sophisticated misrepresentation.

Level 2: Database Verification Consumer claims are matched against third-party databases containing employment records, income estimates, and financial indicators. Matches confirm basic claims; mismatches flag potential issues. This catches most casual misrepresentation but may have gaps in coverage.

Level 3: Direct Source Verification Employers are contacted directly, or payroll/tax records are accessed with consumer authorization. This provides definitive verification but requires consumer cooperation and takes longer to complete.

Level 4: Document Verification Pay stubs, tax returns, and bank statements are collected and analyzed. Document authenticity is verified through forensic analysis. This is the gold standard but adds significant friction and cost.

For lead generators, Levels 1-2 are typically appropriate. Levels 3-4 happen during the lender’s underwriting process. Your job is to filter out obvious problems before the lead reaches that stage.

The Cost-Quality Trade-off

Verification costs money. The question is whether that investment generates sufficient return through reduced returns, premium pricing, and buyer retention.

Consider the economics at scale:

Without income/employment verification:

- 1,000 mortgage leads at $100 average sell price = $100,000 revenue

- 15% return rate for qualification failures = $15,000 returned

- Net revenue: $85,000

With database-level verification ($3-5 per lead):

- 1,000 leads captured, 850 pass verification (15% fail at verification)

- 850 verified leads at $120 sell price (premium for verification) = $102,000 revenue

- 5% return rate (verification caught most problems) = $5,100 returned

- Verification cost: $5,000

- Net revenue: $91,900

The verified model generates 8% more net revenue while delivering dramatically better buyer experience. The buyers receiving verified leads convert at higher rates, building preference for your product.

Verification of Employment (VOE) Deep Dive

Employment verification confirms that the consumer works where they claim, in the role they claim, with the tenure they claim. This information directly affects loan qualification because employment stability and income potential are core underwriting factors.

What VOE Verifies

A complete employment verification confirms multiple data points:

Current Employment Status Is the consumer currently employed by the stated employer? This catches job changes, terminations, and fabricated employment. Approximately 4% of mortgage applicants show discrepancies between claimed and verified employment status.

Position and Title Does the consumer hold the position they claimed? A “Senior Vice President” may actually be a “Sales Representative.” Position affects income credibility and career trajectory assumptions.

Start Date and Tenure How long has the consumer worked for this employer? Lenders typically prefer 2+ years of stable employment. Recent job changes or gaps raise underwriting questions.

Employment Type Is this full-time permanent employment, part-time, contract, or temporary? Employment classification affects income stability assumptions and loan eligibility.

Income Confirmation What is the verified salary or wage rate? This may include base salary, overtime eligibility, bonus structure, and commission potential. The verified figure often differs from the consumer’s claim.

The Work Number: The Dominant Data Source

Equifax’s The Work Number database dominates employment verification in the mortgage industry. The database contains over 781 million employment records from nearly 4.74 million employers, covering roughly 65% of US non-farm employment.

How The Work Number Works

Employers contribute payroll data directly to The Work Number, typically through their payroll processor (ADP, Paychex, etc.) or HRIS system. The data is updated each pay period, providing near-real-time employment and income information.

When a verification request is made, The Work Number returns:

- Current employment status (active, terminated, on leave)

- Employer name and industry

- Job title

- Original hire date

- Most recent hire date (if rehired)

- Pay frequency

- Current rate of pay

- Year-to-date earnings

- Prior year earnings (if available)

Pricing and Access

The Work Number pricing varies by use case and volume:

- Basic employment verification: $15-25 per verification

- Employment + income verification: $35-50 per verification

- Volume discounts available for large users

- Credentialing required (must demonstrate permissible purpose)

Access requires a credentialed account with Equifax, demonstrating compliance with the Fair Credit Reporting Act (FCRA) and having a permissible purpose for the verification.

Coverage Limitations

The Work Number has strong coverage among large employers (Fortune 500 coverage exceeds 95%) but weaker coverage among small businesses. Self-employed individuals, gig workers, and those working for small employers may not appear in the database.

Coverage varies significantly by industry:

- Banking/Finance: 90%+ coverage

- Healthcare: 85%+ coverage

- Retail: 80%+ coverage

- Construction: 50-60% coverage

- Agriculture: 30-40% coverage

For lead generators, this means VOE hits will be stronger for consumers claiming employment at large companies in white-collar industries.

Alternative VOE Providers

While The Work Number dominates, alternative providers serve specific niches or offer different access models:

Experian Verify Experian’s competing employment database includes data from over 40,000 employers. Coverage is smaller than The Work Number but growing. Pricing is competitive, and integration options appeal to some users.

Argyle Argyle provides consumer-permissioned payroll data access. Rather than relying on employer-contributed databases, Argyle connects directly to payroll systems (when the consumer provides credentials) to pull real-time employment and income data. This approach achieves broader coverage but requires consumer cooperation.

Truework Truework combines automated database verification with manual verification services for cases where automation fails. If the employer isn’t in a database, Truework staff contact the employer directly. This hybrid approach provides broader coverage but with variable turnaround times.

Plaid Plaid’s payroll connections provide employment verification through consumer-permissioned access to payroll accounts. Similar to Argyle, this requires consumer credentials but provides real-time data access independent of employer database participation.

VOE Integration for Lead Generators

Integrating VOE into your lead flow requires decisions about when to verify, what to do with results, and how to price the value.

Verification Timing Options

Real-time at submission: Query employment databases as part of form submission. Pros: Fastest feedback, immediate quality signal. Cons: Adds latency, may lose leads during verification delay.

Post-submission before sale: Capture the lead, then verify before routing to buyers. Pros: No submission friction, time to handle failures gracefully. Cons: Delay before lead is saleable, costs incurred on leads that might not sell.

Asynchronous enrichment: Capture and sell basic leads while verification processes in background; update buyer when verification completes. Pros: No delay, verification adds value incrementally. Cons: Complexity in handling verification failures post-sale.

For most mortgage lead operations, post-submission verification before sale provides the best balance. You capture the lead without friction, verify quality before sale, and only route verified leads to premium buyers.

Handling Verification Failures

When verification fails (employer not found, employment not confirmed, income mismatch), you have options:

Reject the lead: Remove leads that fail verification from your inventory entirely. Clean but potentially over-filtering if verification coverage is incomplete.

Tiered routing: Route verified leads to premium buyers at premium prices; route unverified leads to standard buyers at standard prices. Captures value from both segments.

Consumer follow-up: Contact leads that fail automated verification to gather additional information (alternative employer documentation, pay stub uploads). Adds cost and friction but may recover good leads.

Flag and disclose: Sell leads with verification status disclosed to buyers, letting them make informed decisions. Transparent but may reduce prices for unverified leads.

The right approach depends on your buyer relationships and margin structure. Premium-focused operations may reject unverified leads entirely. Volume-focused operations may use tiered routing to capture value across the quality spectrum.

Verification of Income (VOI) Deep Dive

Income verification confirms the consumer’s actual earnings, independent of employment verification. A consumer may be employed where they claim but earn significantly less than they claim. Income verification closes that gap.

What VOI Verifies

Income verification goes beyond employment confirmation to establish actual earnings:

Base Income Regular salary or hourly wages, verified through payroll records or tax returns. This is the foundation of income qualification.

Variable Income Overtime, bonuses, commissions, and other variable compensation. Lenders typically average variable income over 2 years and require documentation of consistency.

Other Income Sources Self-employment income, rental property income, investment income, alimony, child support, disability payments, and Social Security. Each type requires different documentation and has different qualification rules.

Year-to-Date and Historical Current year earnings plus prior year totals. This shows income stability and trajectory. Declining income raises underwriting concerns.

Income Verification Methods

Payroll-Based Verification Services like The Work Number, Argyle, and Plaid pull income data directly from payroll systems. This provides exact figures for salary, bonuses, overtime, and deductions. Payroll verification is fast and accurate but limited to income from payroll-reported employment.

Tax Return Verification IRS Form 4506-C allows lenders (and authorized third parties) to obtain tax transcripts directly from the IRS. Tax transcripts show reported income across all sources: wages, self-employment, investments, and other income. Processing takes 3-10 business days.

Bank Statement Analysis AI-powered systems analyze bank statements to identify and categorize income deposits. This method captures all income that flows through bank accounts but requires consumer-permissioned access to statements.

Document Verification Traditional document collection (pay stubs, W-2s, tax returns) with manual or automated review. Document verification is comprehensive but slow and subject to document fraud.

Income Data Providers

The Work Number (Equifax) Provides income data alongside employment verification for employers in their database. Income figures include current pay rate, YTD earnings, and prior year earnings. Coverage matches their employment database (65%+ of non-farm employment).

Experian Verify Income verification from Experian’s employer database. Growing coverage, competitive pricing.

Argyle Consumer-permissioned payroll access provides real-time income data including base pay, deductions, bonuses, and historical earnings. Broader coverage than employer-contributed databases but requires consumer cooperation.

Plaid Income Plaid’s Income product uses consumer-permissioned bank account access to analyze deposits and identify income streams. Coverage is broad (works for any income deposited in a bank account) but requires consumer to link their bank account.

Finicity (Mastercard) Finicity provides income and asset verification through consumer-permissioned account access. Their Voie (Verification of Income and Employment) product combines payroll and bank data for comprehensive verification.

FormFree FormFree’s Passport product provides automated income and asset verification using consumer-permissioned account access. Strong integration with loan origination systems.

VOI Accuracy and Limitations

Income verification accuracy depends on the method and source:

Payroll Database Accuracy When income is verified through The Work Number or similar databases, accuracy is high (direct from payroll systems) but may miss recent changes. If a raise was granted this pay period, it may not yet appear in the database.

Tax Transcript Accuracy Tax transcripts are definitive for reported income but reflect the prior year (or prior two years for recent filings). Current income must be projected from historical data plus current employment status.

Bank Statement Accuracy Bank analysis captures actual deposits but requires categorization (is this deposit salary, a loan, a transfer from another account?). AI categorization accuracy typically ranges 90-95%, with some income misclassified.

Consumer-Permissioned Coverage Methods requiring consumer credential sharing (Plaid, Argyle) have high potential coverage but low actual participation. Many consumers are uncomfortable providing bank credentials or payroll login information to third parties. Participation rates typically range 30-60% depending on incentives and trust.

Building Your Verification Stack

Implementing income and employment verification requires technology choices, vendor relationships, and process design. The following framework guides implementation.

Architecture Decisions

Verification Timing Pre-qualification verification occurs before the lead is accepted into your system. This prevents unqualified leads from entering inventory but adds friction and may lose legitimate leads during verification delays.

Post-capture verification occurs after the lead is accepted but before sale. This eliminates capture friction while ensuring quality before buyer delivery. The trade-off is processing cost for leads that may not sell.

Asynchronous verification captures and routes leads immediately while verification processes in parallel. This maximizes speed-to-lead but complicates handling when verification fails post-sale.

For mortgage leads, post-capture verification typically provides the best balance. The high value per lead justifies verification cost, and buyer relationships depend on quality.

Verification Depth How much verification do you need? The answer depends on your buyer requirements and margin structure.

Basic verification (employment status only): Confirms the consumer is employed. Cost: $15-25. Catches unemployment and fabricated employers.

Standard verification (employment + basic income): Confirms employment and verifies income is in claimed range. Cost: $35-50. Catches employment fraud and significant income inflation.

Enhanced verification (employment + detailed income + income stability): Full employment history, detailed income breakdown, stability analysis. Cost: $50-75. Provides underwriting-ready verification.

Most lead generators find standard verification sufficient. Enhanced verification may be warranted for jumbo loans or premium buyer relationships.

Vendor Integration

API Integration Most verification providers offer REST APIs for programmatic access. Integration typically requires:

- Credentialed account with permissible purpose documentation

- API credentials and authentication setup

- Request/response handling for verification queries

- Error handling for coverage gaps and timeouts

Plan for 2-4 weeks of development time for initial integration, plus ongoing maintenance as APIs evolve.

Batch Processing For high-volume operations, batch processing may be more efficient than real-time API calls. Submit verification requests in batches (hourly, daily) and process results asynchronously.

Batch processing reduces per-verification costs (volume discounts) but adds latency. Suitable for operations where immediate verification isn’t required.

Hybrid Approaches Combine multiple verification sources for maximum coverage. For example:

- Query The Work Number for initial verification

- For non-hits, fall back to Argyle with consumer-permissioned access

- For consumers who don’t complete permissioning, route as “unverified” at lower price

Hybrid approaches maximize coverage but add integration complexity.

Handling Permissioned Verification

Consumer-permissioned verification (Plaid, Argyle, Finicity) achieves broader coverage but requires consumer action. Maximizing participation requires thoughtful UX design.

Timing the Permission Request Asking for bank credentials or payroll access at form submission creates significant friction and abandonment. Instead, request permission after initial form completion, positioning it as a way to “fast-track” their application or “get better rates.”

Trust Signals Consumers are (rightly) skeptical of credential requests. Build trust through:

- Clear explanation of what data is accessed and why

- Security certification badges (SOC 2, bank-level encryption)

- Explicit statements about what you will NOT do with their data

- Option to proceed without permissioning (at reduced priority)

Incentive Alignment Offer tangible benefits for permissioned verification:

- Priority processing/faster response from lenders

- Access to more lenders (some require verification)

- Better rate quotes (verified income supports better offers)

With strong trust signals and clear incentives, participation rates can reach 50-60%. Without them, expect 20-30%.

Quality Scoring with Verification Data

Verification results feed into broader lead quality scoring. Integrate verification outcomes with other quality signals:

Verification Match Score How closely does verified information match claimed information?

- Employment verified, exact match: +25 points

- Employment verified, minor discrepancy: +15 points

- Employment not in database, unverified: 0 points

- Employment claimed does not match verified: -50 points

Income Accuracy Score How close is verified income to claimed income?

- Within 10%: +20 points

- Within 25%: +10 points

- 25-50% discrepancy: -10 points

- More than 50% discrepancy: -40 points

Stability Indicators

- 2+ years same employer: +15 points

- Employment change within 6 months: -10 points

- Income increasing year-over-year: +10 points

- Income declining: -20 points

Combined verification scores enable tiered routing: highest scores to premium buyers at premium prices, lower scores to standard buyers or volume purchasers.

Major Verification Providers: Comparison and Selection

Choosing verification providers requires evaluating coverage, accuracy, pricing, integration complexity, and buyer acceptance.

Equifax Workforce Solutions (The Work Number)

Coverage: 169+ million individuals, 2.5+ million employers Data Source: Employer-contributed payroll data Verification Types: Employment, income Pricing: $15-50 per verification depending on depth Integration: REST API, batch processing available Turnaround: Real-time for database hits

Strengths: Dominant market position, broad coverage among large employers, high buyer acceptance (most lenders recognize The Work Number as definitive), real-time results.

Limitations: Coverage gaps for small businesses, self-employed, gig workers. Relatively expensive. Credentialing requirements can slow onboarding.

Best For: Lead generators serving traditional mortgage lenders with standard employment populations.

Experian Verify

Coverage: 40,000+ employer sources, growing Data Source: Employer-contributed and aggregated data Verification Types: Employment, income Pricing: Competitive with Equifax, volume discounts available Integration: REST API Turnaround: Real-time

Strengths: Growing coverage, competitive pricing, strong data accuracy, good alternative to Equifax for redundancy.

Limitations: Smaller coverage than The Work Number. Less universal buyer acceptance.

Best For: Lead generators seeking Equifax alternatives or backup verification sources.

Argyle

Coverage: Any employer where consumer can provide payroll credentials Data Source: Consumer-permissioned payroll system access Verification Types: Employment, income, employment history Pricing: $3-8 per successful connection Integration: JavaScript SDK, REST API Turnaround: Real-time after consumer permission

Strengths: Broad potential coverage (not limited to employer participation), real-time data, detailed income breakdown, lower cost per verification.

Limitations: Requires consumer action/permission, lower participation rates, some consumers uncomfortable providing credentials.

Best For: Lead generators seeking broader coverage, especially for small business and gig economy workers.

Plaid Income

Coverage: Any income deposited in consumer’s bank account Data Source: Consumer-permissioned bank account access Verification Types: Income (all sources), income stability Pricing: Volume-based, typically $2-5 per successful connection Integration: JavaScript SDK (Plaid Link), REST API Turnaround: Real-time after consumer permission

Strengths: Captures all income sources (not just employment), strong stability analysis, high consumer familiarity with Plaid, broad financial institution coverage.

Limitations: Requires consumer bank credential sharing, may not provide employer details, categorization accuracy varies.

Best For: Lead generators wanting comprehensive income view, including self-employed and multiple income streams.

Finicity (Mastercard)

Coverage: Consumer-permissioned across 20,000+ financial institutions Data Source: Bank and payroll account access Verification Types: Income, assets, employment Pricing: Custom pricing, generally competitive Integration: REST API, strong LOS integrations Turnaround: Real-time after consumer permission

Strengths: Comprehensive verification (income + assets), strong lender acceptance (owned by Mastercard), good GSE acceptance for Fannie/Freddie loans.

Limitations: Requires consumer permission, enterprise sales process.

Best For: Lead generators working with lenders who value GSE-accepted verification.

Truework

Coverage: Database verification + manual backup Data Source: Employer database + direct employer contact Verification Types: Employment, income Pricing: $15-40 per verification Integration: REST API Turnaround: Instant for database hits, 24-48 hours for manual

Strengths: Near-universal coverage through manual backup, good accuracy, growing database.

Limitations: Variable turnaround time (instant to days), higher cost for manual verifications.

Best For: Lead generators needing highest coverage rates willing to accept variable timing.

Selection Framework

Choose providers based on your specific requirements:

| Requirement | Primary Choice | Backup Choice |

|---|---|---|

| Maximum employer coverage | The Work Number | Truework |

| Lowest cost per verification | Argyle/Plaid | Experian |

| Fastest turnaround | The Work Number | Argyle |

| Best small business coverage | Argyle | Truework |

| Self-employed verification | Plaid Income | Finicity |

| Highest lender acceptance | The Work Number | Finicity |

Many operations use multiple providers in sequence: query The Work Number first, fall back to Argyle for non-hits, use Truework for manual verification when needed.

Improving Lead Quality Through Verification

Verification isn’t just about catching fraud. Systematic verification improves lead quality across multiple dimensions, enabling premium pricing and stronger buyer relationships.

From Validation to Qualification

Basic lead validation confirms contact information is real: phone numbers connect, emails deliver, addresses exist. Verification goes further, confirming the consumer can actually transact.

A fully validated mortgage lead might have:

- Valid phone number, mobile line type

- Verified email address

- Confirmed property address

- Clean consent documentation

A verified mortgage lead adds:

- Confirmed employment with named employer

- Verified income within stated range

- Employment tenure establishing stability

- Income trend data showing trajectory

The verified lead is qualified, not just valid. Lenders know this consumer can likely complete the transaction. That certainty commands premium pricing.

Reducing Return Rates

Return rates directly impact lead generator profitability. Every return represents wasted acquisition cost plus relationship damage.

Without verification, mortgage lead return rates typically range 15-25%, with common return reasons including:

- Cannot verify employment (25% of returns)

- Income insufficient for requested loan (20% of returns)

- Income documentation doesn’t match stated (15% of returns)

- Consumer unemployed or recently terminated (10% of returns)

Income and employment verification directly addresses 70% of these return categories. Operations implementing comprehensive verification typically see return rates drop to 5-10%.

The math at 1,000 leads monthly:

| Scenario | Return Rate | Returns | Revenue Impact |

|---|---|---|---|

| No verification | 20% | 200 | -$20,000 (at $100/lead) |

| With verification | 7% | 70 | -$7,000 |

| Improvement | -13 points | 130 fewer returns | +$13,000 |

Against verification costs of $3,000-5,000 for 1,000 leads, the ROI is clear.

Premium Pricing Strategy

Verified leads command premium prices because they perform better. Building this premium into your pricing requires positioning verification as value, not cost.

Tiered Product Structure Offer multiple lead products at different price points:

Standard leads ($75-100): Validated contact information, consent documentation, self-reported income/employment.

Verified leads ($120-150): All standard features plus database-verified employment and income within stated range.

Premium verified leads ($175-225): Full verification plus stability analysis, income trending, and permissioned income data.

Buyers self-select based on their quality requirements. High-volume buyers may want standard leads. Quality-focused buyers pay premium for verification.

Performance Guarantees Offer return rate guarantees on verified leads. “If your return rate exceeds 8% on verified leads, we’ll credit the difference.” This guarantee is possible because verification makes returns predictable. It also demonstrates confidence in your quality.

Conversion-Based Pricing For sophisticated buyers, price based on conversion outcomes rather than per-lead. Verified leads that close pay premium; leads that don’t close pay reduced rate or nothing. This requires buyer cooperation on outcome reporting but aligns incentives perfectly.

Building Buyer Preference

Beyond immediate economics, verification builds lasting buyer preference. Lenders who receive consistently verified leads develop trust in your operation. That trust manifests as:

- Priority partnership status (first look at leads, higher caps)

- Less aggressive return behavior (benefit of doubt on edge cases)

- Willingness to pay premium pricing

- Referrals to other buyers in their network

- Longer relationship tenure (lower churn)

These relationship benefits compound over time. A buyer who trusts your quality is worth 3-5x a buyer who views you as commodity supply.

Compliance Considerations

Income and employment verification touches sensitive consumer data subject to multiple regulatory frameworks. Compliance isn’t optional.

Fair Credit Reporting Act (FCRA)

Employment and income verification through consumer reporting agencies (Equifax, Experian, and services using their data) constitutes a consumer report under FCRA. This triggers several requirements:

Permissible Purpose You must have a permissible purpose for obtaining consumer reports. For mortgage lead generation, permissible purposes include:

- Written authorization from the consumer

- Legitimate business need in connection with a credit transaction initiated by the consumer

- Employment purposes (if the consumer is applying for employment)

Obtaining consumer reports without permissible purpose is a federal offense with penalties up to $1,000 per violation.

Consumer Authorization Best practice requires clear consumer authorization before verification. Include language in your form consent such as:

“By submitting this form, you authorize [Company] and its lending partners to verify your employment and income through consumer reporting agencies and other sources, and to obtain a consumer report in connection with your application.”

Adverse Action Requirements If verification results are used to deny or materially change the terms offered to a consumer, adverse action notice requirements may apply. Consult legal counsel on specific requirements for your use case.

State Privacy Laws

State privacy laws, including the California Consumer Privacy Act (CCPA), may impose additional requirements:

Disclosure Requirements Disclose what personal information you collect, how it’s used, and with whom it’s shared. Income and employment data fall within personal information definitions.

Consumer Rights Consumers may have rights to access, delete, or opt out of sale of their personal information. Build processes to honor these requests.

Security Requirements Reasonable security measures are required to protect personal information. Encryption, access controls, and security monitoring are expected.

RESPA Considerations

The Real Estate Settlement Procedures Act’s anti-kickback provisions apply to mortgage lead generation. While verification itself isn’t a RESPA concern, how verification costs are allocated matters.

If verification costs are passed through to consumers differently based on lender selection, or if verification results are used to steer consumers to particular lenders in exchange for compensation, RESPA issues may arise. Structure verification as a quality measure independent of lender selection.

Data Security Requirements

Income and employment data is sensitive. Security requirements include:

Encryption Encrypt data at rest and in transit. AES-256 for storage, TLS 1.2+ for transmission.

Access Controls Limit access to verification data to personnel with business need. Log all access for audit purposes.

Retention Limits Retain verification data only as long as needed for business purposes. Implement automated deletion after retention period expires.

Vendor Security Verify that verification vendors maintain appropriate security certifications (SOC 2, ISO 27001). Include security requirements in vendor contracts.

Future Trends in Verification

The verification landscape continues to evolve. Practitioners who anticipate these changes position themselves for continued success.

AI-Powered Verification

Artificial intelligence is transforming verification in multiple ways:

Document Fraud Detection AI systems analyze pay stubs, W-2s, and bank statements to detect manipulation. These systems identify alterations that human review would miss: pixel-level inconsistencies, font mismatches, and statistical anomalies in figures.

Document fraud detection catches sophisticated fraud that database verification misses. As document-based verification remains common in mortgage underwriting, AI fraud detection becomes essential.

Income Prediction Machine learning models predict income based on employment characteristics, industry, geography, and other factors. These predictions flag discrepancies where claimed income seems implausible given verified employment details.

Alternative Data Scoring AI models incorporate alternative data (rent payment history, utility payments, subscription patterns) to assess financial stability beyond traditional income verification. This enables qualification of consumers with non-traditional income profiles.

Open Banking and Account Aggregation

Open banking initiatives and consumer-permissioned data access are expanding verification coverage:

Financial Data Exchange (FDX) Industry standard for consumer-permissioned financial data sharing. Adoption is growing among financial institutions, enabling more reliable account aggregation.

Bank Statement Parsing AI-powered analysis of bank statements identifies income sources, calculates averages, and assesses stability. This approach works for any income deposited in a bank account, providing coverage where employer databases fall short.

Real-Time Income Monitoring Emerging services monitor income continuously (with consumer permission), flagging changes that affect loan qualification. Lenders receive alerts if a consumer’s employment status changes during the loan process.

GSE and Regulatory Evolution

Government-Sponsored Enterprise (GSE) requirements drive industry practices:

Day 1 Certainty Fannie Mae’s Day 1 Certainty program provides representation and warranty relief for loans using automated income and employment verification. Lenders increasingly require verification services that qualify for this program.

Expanding Verification Sources GSEs are approving additional verification sources beyond traditional credit bureau data. Plaid, Finicity, and other consumer-permissioned providers gaining GSE approval expands verification options.

Continuous Verification Moving from point-in-time verification to continuous monitoring through the loan process. Verification conducted at application may be refreshed at closing to catch changes.

Implications for Lead Generators

These trends create both opportunities and requirements:

Investment in Verification Infrastructure As verification becomes more sophisticated, lead generators must invest in technology to remain competitive. Point solutions give way to integrated verification platforms.

Data Partnership Strategy Multiple verification sources provide coverage and redundancy. Build relationships with multiple providers to avoid single-source dependency.

Consumer Trust Development Consumer-permissioned verification requires trust. Practitioners who build consumer confidence in their data practices capture more permissions and broader verification coverage.

Compliance Evolution Regulatory requirements continue to expand. Build compliance into operations from the start rather than retrofitting after problems emerge.

Frequently Asked Questions

What is income and employment verification in mortgage lead generation?

Income and employment verification confirms that mortgage lead consumers actually work where they claim and earn what they claim. This verification uses databases like Equifax’s The Work Number, consumer-permissioned payroll access through services like Argyle or Plaid, or direct employer contact. For lead generators, verification filters out unqualified leads before sale, reducing return rates and enabling premium pricing. Database verification typically costs $15-50 per lead for employment and income confirmation, with consumer-permissioned methods costing $3-8 per successful connection.

How does The Work Number work for employment verification?

The Work Number is Equifax’s employment verification database containing over 781 million employment records from nearly 4.74 million employers. Employers contribute payroll data directly through their payroll processors (ADP, Paychex, etc.), updated each pay period. When you query The Work Number, it returns current employment status, employer name, job title, hire dates, pay rate, and earnings history. Coverage exceeds 90% for Fortune 500 employers but may be 30-60% for small businesses and certain industries. Pricing ranges from $15-25 for basic employment verification to $35-50 for full income verification.

What percentage of mortgage leads have income or employment issues?

Industry data indicates approximately 1 in 134 mortgage applications contains fraud indicators, with income misrepresentation appearing in 34% of fraudulent applications and employment misrepresentation in 28%. Beyond intentional fraud, many consumers overstate income or misremember employer details. Without verification, expect 15-25% of mortgage leads to have qualification issues related to income or employment. This includes unemployed consumers, income significantly below claimed amounts, and employment tenure shorter than stated. Verification reduces these issues to 5-10% of leads.

How much does income verification cost per mortgage lead?

Verification costs range from $3-50 depending on method and depth. The Work Number charges $15-25 for employment verification and $35-50 for full income verification. Consumer-permissioned services like Argyle and Plaid cost $3-8 per successful connection but require consumer participation (typical rates 30-60%). Manual verification through services like Truework costs $15-40 with variable turnaround. For lead generators processing 1,000 monthly leads, expect verification costs of $3,000-5,000 monthly. This investment typically generates 3-5x return through reduced returns and premium pricing.

What is the difference between VOE and VOI?

Verification of Employment (VOE) confirms the consumer works where they claim: employer name, job title, employment status, and tenure. Verification of Income (VOI) confirms actual earnings: base salary, bonuses, commissions, overtime, and total compensation. VOE answers “does this person work there?” while VOI answers “how much do they earn?” Both are important for mortgage qualification. A consumer might be legitimately employed but earn significantly less than claimed. Comprehensive verification includes both VOE and VOI. VOE alone costs $15-25; combined VOE/VOI costs $35-50 through traditional providers.

Which verification providers are accepted by mortgage lenders?

Equifax’s The Work Number has the highest lender acceptance, recognized as definitive verification by most mortgage lenders and accepted by GSEs (Fannie Mae, Freddie Mac) for Day 1 Certainty programs. Finicity (owned by Mastercard) has strong GSE acceptance for consumer-permissioned verification. Experian Verify has growing acceptance as Experian expands their verification database. Plaid and Argyle are increasingly accepted, particularly for non-traditional income verification. When selling verified leads, confirm with buyers which verification sources they accept. Some buyers may require The Work Number specifically; others accept alternative providers.

How does consumer-permissioned verification work?

Consumer-permissioned verification (offered by Argyle, Plaid, Finicity, and others) accesses payroll or bank account data using credentials the consumer provides. The consumer connects their payroll system or bank account through a secure interface, authorizing data access. This provides real-time income and employment data regardless of employer participation in verification databases. Coverage is potentially universal but participation rates vary (30-60% depending on trust and incentives). The approach works well for gig workers, small business employees, and self-employed consumers not covered by traditional databases. Integration requires embedding the provider’s SDK in your form flow.

Can income verification catch all mortgage fraud?

No verification method catches all fraud. Database verification (The Work Number, Experian) catches employment fabrication and major income inflation but may miss recent changes and doesn’t cover all employers. Consumer-permissioned verification provides broader coverage but depends on consumer cooperation and can be gamed with synthetic accounts. Document verification catches most fraud when combined with AI-powered document analysis but adds friction and cost. A layered approach combining multiple methods catches more fraud than any single approach. Expect well-implemented verification to catch 70-85% of income/employment fraud, reducing return rates from 15-25% to 5-10%.

What compliance requirements apply to income verification?

Income and employment verification through consumer reporting agencies triggers Fair Credit Reporting Act (FCRA) requirements: you must have a permissible purpose (typically consumer authorization), and adverse action notice requirements may apply if verification results affect terms offered. State privacy laws like CCPA require disclosure of data collection and use, and may provide consumer rights to access or delete data. RESPA applies to mortgage-related activities; ensure verification practices don’t create kickback or steering concerns. Data security requirements include encryption, access controls, and secure data retention. Obtain consumer authorization before verification and work with legal counsel to ensure compliance with applicable requirements.

How do I integrate income verification into my lead generation flow?

Integration options include real-time verification at form submission (adds 1-3 second latency), post-capture verification before sale (eliminates form friction), and asynchronous verification with progressive enrichment. Most mortgage lead operations use post-capture verification: capture the lead with standard validation, then query verification services before routing to buyers. For database verification (The Work Number, Experian), implement API integration with 2-4 weeks development time. For consumer-permissioned verification, embed provider SDKs in a post-form verification flow. Handle verification failures through tiered routing (verified leads to premium buyers, unverified to standard) or consumer follow-up for additional documentation.

What ROI should I expect from income verification?

Properly implemented income and employment verification typically generates 3-5x ROI through combined benefits. Return rate reduction (from 15-25% to 5-10%) saves $10,000-15,000 per 1,000 leads at $100 average price. Premium pricing on verified leads adds $20-50 per lead, generating $20,000-50,000 per 1,000 leads. Buyer preference and retention reduces acquisition costs for new buyers and increases lifetime value of existing relationships. Against verification costs of $3,000-5,000 per 1,000 leads, expect positive ROI within the first month. Longer-term benefits from buyer relationships compound over time, making verification investment increasingly valuable.

Key Takeaways

-

Income and employment verification transforms mortgage leads from self-reported claims to qualified prospects, reducing return rates from 15-25% to 5-10%.

-

The Work Number dominates employment verification with over 781 million records from nearly 4.74 million employers, but coverage gaps exist for small businesses and gig workers.

-

Consumer-permissioned verification (Argyle, Plaid, Finicity) achieves broader coverage but requires consumer cooperation, with participation rates of 30-60% depending on trust and incentives.

-

Verification costs range from $3-50 per lead depending on method and depth, typically generating 3-5x ROI through reduced returns and premium pricing.

-

Verified leads command $20-50 premium over standard leads because they convert better. Structure tiered products (standard, verified, premium verified) to capture value across buyer segments.

-

FCRA compliance requires permissible purpose and consumer authorization before accessing employment and income data through consumer reporting agencies.

-

Combine multiple verification sources for maximum coverage: The Work Number for large employers, consumer-permissioned for gaps, manual verification as backup.

-

Future trends include AI-powered document fraud detection, continuous income monitoring, and expanding GSE acceptance of consumer-permissioned verification sources.

-

Build verification into lead quality scoring: employment match, income accuracy, and stability indicators combine with other quality signals for tiered routing and pricing.

-

Those who master verification don’t just reduce returns. They build buyer preference and relationship value that compounds over time into sustained competitive advantage.

Statistics and regulatory information current as of late 2025. Verification provider pricing and coverage subject to change; confirm current terms with providers.