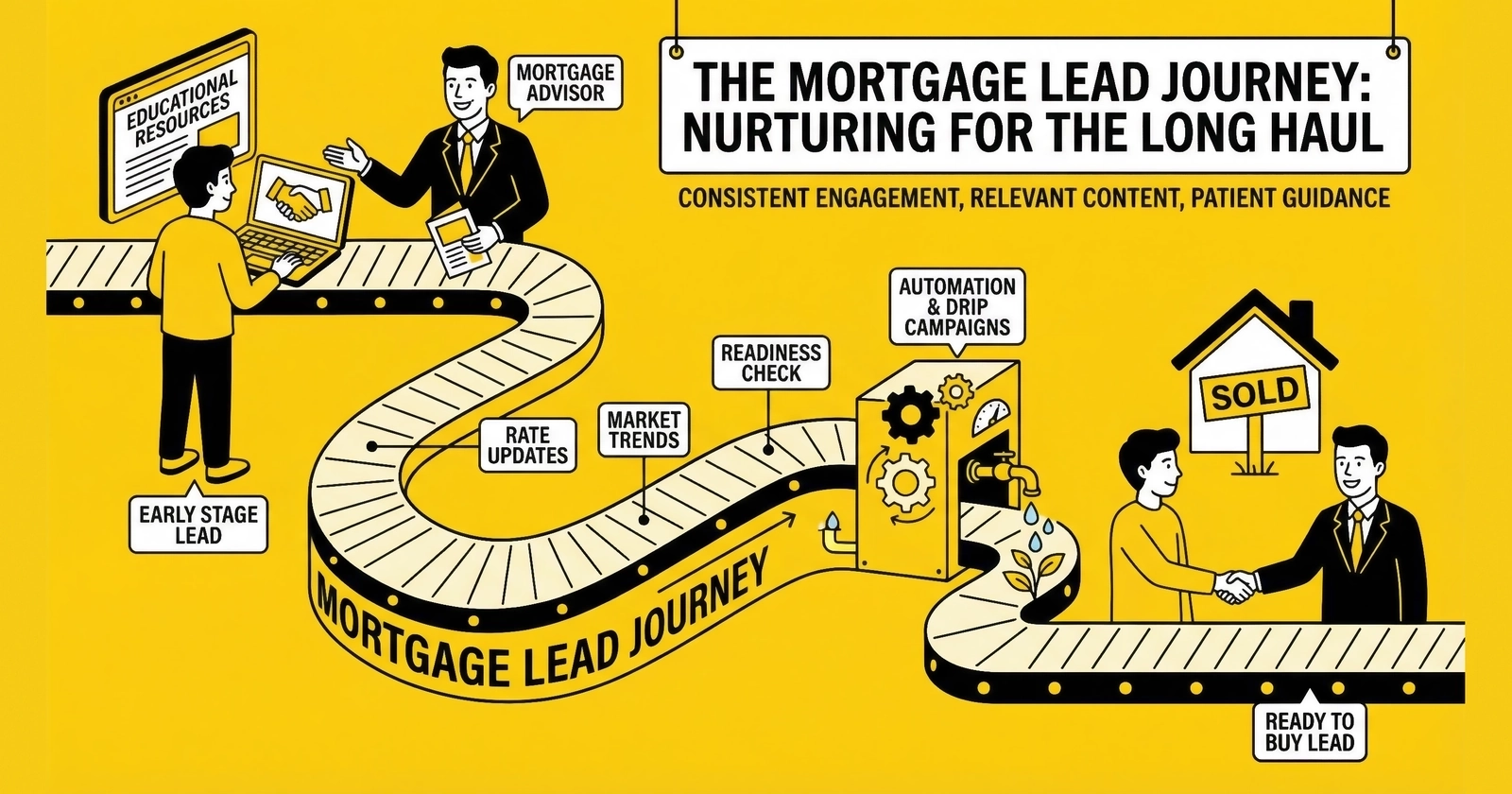

Mortgage purchase decisions take 30-90 days from first inquiry to funded loan. Those who build systematic nurturing infrastructure capture the 80% of leads that require sustained engagement before converting.

The Reality of Mortgage Sales Cycles

The mortgage industry operates on fundamentally different timelines than most lead generation verticals. A consumer requesting auto insurance quotes might purchase within 24 hours. A homeowner evaluating solar panels often decides within two weeks. But a mortgage lead represents the beginning of a journey that typically spans 30 to 90 days from initial inquiry to funded loan.

This extended cycle creates both challenge and opportunity.

The challenge: leads captured today may not convert for months. First-contact speed matters enormously – leads contacted within one minute convert at 391% higher rates, as detailed in our guide to speed-to-lead optimization – but that initial speed represents only the opening move. What follows determines whether the opportunity materializes or dissipates to competitors who maintained better presence during the consideration phase.

The opportunity: the operators who build systematic nurturing infrastructure extract value that competitors abandon. Industry research indicates that approximately 80% of mortgage leads require sustained engagement before making purchase decisions. Only 20-25% of consumers who request mortgage quotes purchase within the first week. The remaining 75-80% either purchase later from whoever stayed in touch, purchase from a competitor who happened to reach them at the right moment, or delay indefinitely.

For mortgage lead buyers paying $50 to $200+ per exclusive lead, abandoning 80% of that investment after initial contact represents catastrophic economics. A systematic nurturing approach that converts an additional 3-5% of the lead pool can double the effective return on lead spend.

This guide provides the complete framework for building mortgage lead nurturing systems that work. We will cover the psychological dynamics of mortgage decisions, multi-channel nurture sequence design, rate watch programs that maintain relevance during extended consideration periods, email automation architecture, and conversion timeline optimization. Those who master these disciplines build sustainable competitive advantage in a vertical where most participants still treat lead nurturing as an afterthought.

Understanding the Mortgage Buyer Psychology

Before designing nurturing systems, you must understand why consumers who requested mortgage information do not purchase immediately. The reasons are not random, and effective nurturing addresses each barrier systematically.

The Extended Consideration Cycle

Mortgage decisions involve the largest financial commitment most consumers ever make. A 30-year mortgage represents decades of payment obligations. This gravity creates natural deliberation that does not exist in lower-stakes purchases.

Purchase transactions follow timelines dictated by real estate markets, not consumer preference. A buyer who falls in love with a home in March may not close until May or June. The mortgage inquiry initiates a process involving property searches, offer negotiations, inspections, appraisals, and underwriting – each stage introducing potential delays. Lead nurturing must span this entire journey, not just the initial shopping phase.

Refinance decisions operate differently but still involve extended consideration. Homeowners contemplating refinance must evaluate whether rate savings justify closing costs, assess their timeline in the property, and often coordinate with household decision-makers. Even motivated refinancers typically require 2-4 weeks to move from inquiry to application.

Home equity transactions fall between purchase and refinance timelines. Borrowers tapping equity for renovations, debt consolidation, or major purchases often research options while simultaneously planning the underlying project. This parallel consideration extends timelines beyond what purely financial decisions would require.

Barriers to Immediate Conversion

Understanding why consumers pause helps you design nurturing content that addresses specific concerns rather than simply repeating sales messages.

Information Gathering Phase

Many consumers request mortgage quotes as part of research, not as immediate purchase precursors. They are comparing rates, understanding options, or getting educated. These consumers need information, not sales pressure. Nurturing that provides genuine value builds trust; aggressive selling creates resistance.

Rate Uncertainty

In volatile rate environments, consumers often hesitate awaiting more favorable conditions. A borrower who requested quotes when rates spiked to 7.2% may pause hoping for improvement. Rate watch programs address this by keeping borrowers informed as conditions change, enabling timely action when their threshold arrives.

Competing Priorities

Mortgage applications require documentation assembly, credit review, and sustained attention that competes with work, family, and daily responsibilities. A consumer ready to move forward on Tuesday may become unreachable by Thursday as life intervenes. Nurturing maintains the thread until they resurface.

Decision Complexity

Mortgage products involve tradeoffs between rates, points, closing costs, and terms that many consumers find confusing. Rather than make uncertain decisions, they delay. Educational nurturing that builds understanding enables confident action.

Household Coordination

Major financial decisions often require spouse or partner alignment. One party may have initiated the inquiry; completing the transaction requires consensus. Nurturing content that explains options clearly can be shared within households, advancing the decision process even without direct engagement.

Credit Timing

Consumers aware their credit scores are improving may delay mortgage applications until their profile strengthens. Rate monitoring and periodic check-ins keep your option visible until their timing aligns.

The Trust Development Process

Mortgage lending is fundamentally a trust business. Borrowers are making decades-long commitments to institutions they often know primarily through marketing materials and initial conversations. This trust does not develop instantaneously.

Nurturing sequences build trust through consistent, valuable communication over time. Each touchpoint that provides useful information without aggressive sales pressure deposits into a trust account. When the consumer is ready to transact, they engage the entity they trust most – often whoever maintained professional presence without becoming annoying.

Research on mortgage consumer behavior indicates that brand familiarity significantly impacts lender selection. When comparing similar rates, familiarity often becomes the deciding factor. Systematic nurturing creates this familiarity in a controlled, professional manner.

Rate Watch Programs: The Mortgage Nurturing Differentiator

Rate watch programs represent the most powerful nurturing tool specific to mortgage lead generation. Unlike generic drip campaigns, rate watches provide genuine, time-sensitive value that borrowers cannot easily replicate themselves.

The Rate Watch Concept

A rate watch program monitors interest rate movements and notifies enrolled borrowers when rates hit their specified thresholds. For a borrower who expressed interest but paused hoping for lower rates, a message announcing “Rates dropped to 6.5% – below your target” provides compelling reason to re-engage.

Rate watch programs work because they solve a real problem. Consumers lack efficient mechanisms to monitor rate movements continuously. Major financial websites report rates, but borrowers must actively check. Rate watch notifications bring the information to them, positioning your operation as a helpful service rather than pure sales channel.

Implementation Architecture

Threshold Capture

Threshold capture begins at lead acquisition or first contact. Ask borrowers what rate would trigger their decision: “At what rate would refinancing make sense for you?” or “What rate would fit your budget for the home purchase you’re considering?” This threshold becomes the trigger for future notifications.

Rate Data Integration

Rate data integration connects your nurturing system to reliable rate sources. You can establish API connections to rate aggregators like Bankrate, Zillow, or the Freddie Mac Primary Mortgage Market Survey. Alternatively, implement manual daily updates from your lock desk or secondary marketing team. Third-party mortgage marketing platforms with built-in rate monitoring offer another path. For most operations, daily rate updates suffice. Intraday movements rarely cross thresholds, and over-notification creates fatigue.

Trigger Automation

Trigger automation compares current rates against stored thresholds and fires notifications when conditions match. Configure triggers to notify when rates drop to or below the borrower’s target threshold, when rates drop a specified number of basis points from when they first inquired, on significant market movements regardless of individual thresholds (50+ basis point drops), and on rate spikes that create urgency for fence-sitters.

Message Personalization

Message personalization references the borrower’s specific situation. “Rates hit 6.5% this morning – the level you said would make your refinance worth pursuing” outperforms generic “Rates are down” announcements.

Rate Watch Message Examples

Threshold hit notification:

Subject: Rates just hit your target

[First Name], you mentioned that 6.5% would make refinancing worthwhile. This morning, 30-year fixed rates dropped to 6.48%.

Based on your current $350,000 balance at 7.25%, moving to 6.5% would reduce your monthly payment by approximately $175.

Want me to run final numbers and lock this rate? Reply to this email or call [Phone] before rates move again.

Significant movement alert:

Subject: Rates down 0.5% since your inquiry

[First Name], since you requested mortgage quotes three weeks ago, 30-year fixed rates have dropped from 7.1% to 6.6%.

For a $400,000 purchase loan, this drop reduces your estimated monthly payment by $145.

Are you still in the market? I would be happy to run updated numbers based on current pricing.

Urgency creation for rising rates:

Subject: Rate lock reminder - rates trending up

[First Name], the 30-year fixed has increased 25 basis points over the past week and forecasts suggest continued upward pressure.

If you were planning to move forward, locking now protects against further increases. We can hold your rate for 45 days while you complete your home search.

Should I send over lock options?

Rate Watch Frequency Management

Rate volatility varies substantially across market cycles. During stable periods, weeks may pass without meaningful movement. During volatile periods, rates may swing 50+ basis points within days.

Configure your rate watch system with minimum notification intervals preventing over-messaging during volatile periods – even with significant daily movements, limit notifications to 2-3 per week maximum per borrower. Threshold significance filters should require meaningful rate changes before triggering notifications; a 5 basis point movement rarely justifies contact, while 25+ basis points typically does. Personalized cadence preferences allow borrowers to specify their desired update frequency, as some want daily market updates while others prefer notification only when their specific threshold hits. Finally, sunset provisions should retire rate watch enrollments after extended periods (6-12 months) without engagement, since borrowers who never respond to rate notifications have likely purchased elsewhere or changed their plans.

Multi-Channel Nurture Sequence Design

Effective mortgage lead nurturing operates across multiple channels, each serving specific purposes in the borrower journey. Single-channel approaches consistently underperform integrated strategies.

Email: The Nurturing Backbone

Email remains the primary nurturing channel due to its low cost, high deliverability to opted-in recipients, and capacity to convey detailed information. However, email effectiveness varies significantly based on execution quality.

Deliverability Fundamentals

Before designing sequences, ensure your sending infrastructure supports inbox placement. Authenticate your domain with SPF, DKIM, and DMARC. Maintain list hygiene by removing bounces and long-term non-engagers. Warm new sending domains gradually. Mortgage email open rates average 15-25%; poorly configured senders see under 10% while optimized senders exceed 30%.

Sequence Design for Mortgage

Mortgage nurturing emails should follow a progression from educational content to soft engagement to direct calls to action. A typical purchase lead sequence progresses through these touchpoints: Day 1 delivers a welcome email with rate summary and next steps outline. Day 3 provides educational content on the mortgage process and timeline expectations. Day 7 covers pre-approval benefits and documentation preparation. Day 14 offers a market update with current rate environment analysis. Day 21 includes a soft check-in asking about home search progress. Day 30 presents comparison content on loan products and features. Day 45 triggers a rate alert or market conditions update. Day 60 delivers the final active nurturing message before moving to maintenance cadence. Ongoing monthly touches include market updates and seasonal content maintaining connection.

Subject Line Optimization

Mortgage emails face aggressive spam filtering and consumer resistance to obvious sales messaging. Testing consistently shows informational subject lines outperforming promotional ones. “Understanding your mortgage rate lock options” outperforms “Get the lowest rates today” in both opens and downstream conversion.

Content Personalization

Reference the specific product the borrower quoted (purchase vs. refinance vs. HELOC), their location (for state-specific considerations), loan amount range, and any information captured during initial contact. Generic emails perform significantly worse than personalized communications.

SMS: Speed and Visibility

Text messaging delivers immediate visibility with 98% open rates and 90% read within three minutes. For mortgage nurturing, SMS handles time-sensitive communications that email delays would undermine. Appropriate use cases include immediate post-inquiry acknowledgment, rate alert notifications for significant movements, appointment reminders and confirmations, application status updates, document request follow-ups, and time-sensitive lock deadline reminders.

Compliance Requirements

SMS marketing to mortgage leads requires Prior Express Written Consent (PEWC) under TCPA regulations. Capture forms must include clear disclosure that the borrower agrees to receive text messages. Document consent with timestamps, form URLs, and ideally TrustedForm or Jornaya certificates. Non-compliant texting creates liability of $500-$1,500 per message.

SMS Timing Restrictions

Federal TCPA restricts texts to 8 AM - 9 PM in the recipient’s time zone. Several states impose stricter windows (8 AM - 8 PM in Florida and Maryland). Configure your automation to respect the most restrictive applicable requirement.

Frequency Management

Consumer tolerance for marketing texts is lower than email. Limit mortgage nurturing SMS to 2-4 messages per week at maximum intensity, with most sequences using 4-6 total texts across the entire nurturing period.

SMS Template Examples

Immediate acknowledgment:

Thanks [First Name]. Got your mortgage request. A loan officer will reach out within 15 min with rate options. Reply YES to confirm this is the best number.

Rate alert:

[First Name], rates dropped to 6.5% this morning - your target level. Want me to lock this rate? Reply YES or call [Phone].

Appointment reminder:

Reminder: Your mortgage consultation is tomorrow at 2pm with [LO Name]. We will call you at [Phone]. Reply C to confirm.

Phone Outreach in Nurturing Sequences

While initial speed-to-contact determines first-call success, strategic phone outreach throughout the nurturing cycle significantly impacts overall conversion.

Structured Call Sequences

Rather than random follow-up calls, implement structured patterns. Research suggests optimal contact attempt patterns for aged mortgage leads include 6-8 total contact attempts across the nurturing period with varied timing across morning, afternoon, and early evening. Mix days of the week and leave voicemail on every attempt with varied, value-added messages.

Voicemail Strategy

Voicemails keep your name present in borrower awareness even when calls go unanswered. Effective mortgage voicemails are brief (under 30 seconds), reference a specific reason for calling (rate movement, timeline check-in, document question), provide value rather than pure sales pressure, and include callback information.

Call Timing by Borrower Segment

Research indicates mortgage lead response rates peak at different times. Working professionals respond best at 8-9 AM before work and 5-7 PM after work. Self-employed borrowers are most reachable from 10 AM-12 PM and 2-4 PM during business hours. Weekend calls on Saturday 9-11 AM show strong response for refinance leads.

Call Disposition Tracking

Document every call attempt outcome: no answer, voicemail left, wrong number, contact but not interested, contact but not ready, contact and interested, contact and converted. This data enables optimization of call timing, message effectiveness, and sequence length.

Direct Mail for High-Value Segments

Physical mail has experienced a renaissance as digital channels become increasingly crowded. For high-value mortgage leads, direct mail provides meaningful lift.

Direct mail makes sense for jumbo loan leads ($750,000+) where per-lead value justifies cost, leads who engaged with emails but have not converted, rate watch enrollees who hit their threshold but have not responded to digital outreach, and borrowers in extended consideration windows (60+ days) – a segment that may also benefit from aged lead strategies.

Content Approach

Mortgage direct mail performs best with tangible value: rate comparison worksheets, closing cost breakdowns, or mortgage timeline checklists that recipients keep rather than immediately discard. Include clear response mechanisms (phone number, personalized URL, QR code) and track response rates by piece variation.

Cost-Benefit Calculation

Direct mail costs $1-3 per piece for production and postage. At $2 per piece, mailing 100 high-value leads costs $200. If direct mail increases conversion by 2% on those 100 leads, generating 2 additional funded loans worth $3,000 each in origination revenue, the ROI is substantial.

Email Automation Architecture

Building effective mortgage email automation requires thoughtful architecture that handles multiple borrower scenarios, responds to behavioral signals, and maintains compliance throughout.

Sequence Structure Framework

Entry Triggers

Entry triggers determine how leads enter nurturing sequences. These include new lead submission (the primary entry point), lead status changes (contacted but not converted), behavioral triggers (returned to website, opened rate alert), time-based triggers (30 days since last contact), and external triggers (rate movement, market events).

Conditional Branching

Conditional branching routes leads through appropriate paths based on their characteristics. Route differently for purchase vs. refinance vs. home equity (different content focus), timeline urgency (active home shopper vs. early research), credit profile (qualified vs. needs improvement), loan amount tier (different product considerations), and geographic location (state-specific compliance, local market content).

Exit Conditions

Exit conditions remove leads from sequences when appropriate. Triggers include conversion to application (transfer to application nurturing sequence), explicit opt-out (mandatory CAN-SPAM compliance), unqualified status (verified not a real opportunity), extended non-engagement (12+ months without any interaction), and known competitor close (purchased elsewhere).

Purchase Lead Nurturing Sequence

Purchase leads require nurturing that spans the home search and purchase process, which may extend 3-6 months or longer.

Phase 1: Immediate Engagement (Days 1-7)

The goal is establishing relationship and demonstrating value while intent remains fresh.

Day 1 (immediate): Send a confirmation email with rate summary, an SMS acknowledgment with call expectation, and attempt phone contact within 5 minutes.

Day 2 (if no phone contact): Send a follow-up email: “Still want to discuss your mortgage options?” Accompany with SMS: “Tried reaching you yesterday. When is a good time for a quick call?”

Day 3: Deliver an educational email: “What to expect during the mortgage process.” Make a second phone attempt at different time of day.

Day 5: Send a value-add email: “5 documents to gather before applying for a mortgage.” Make a third phone attempt.

Day 7: Send a check-in email: “How is your home search going?”

Phase 2: Active Nurturing (Days 8-30)

The goal is maintaining presence while providing ongoing value.

Day 10: Send a market update email with current rate analysis and soft call to action: “Ready to get pre-approved?”

Day 14: Deliver educational email: “Understanding mortgage points: when to pay, when to pass.”

Day 18: Send rate watch enrollment invitation if not already enrolled. Make phone attempt with specific reason (checking on pre-approval interest).

Day 21: Send home search tips email with local market insights and subtle mention of pre-approval strengthening offers.

Day 28: Deliver monthly market summary with rate trends and clear next-step call to action.

Phase 3: Long-Term Nurturing (Days 31-90+)

The goal is maintaining connection through extended consideration without over-messaging.

Bi-weekly: Rate updates when significant movement occurs and market condition emails when relevant.

Monthly: Newsletter-style content with market insights, tips, and process information. Periodic phone touches (once per 30 days) checking on progress.

Event-triggered: Rate watch alerts when thresholds hit and re-engagement sequence if behavioral signals indicate renewed interest.

Phase 4: Maintenance (90+ days)

The goal is light-touch presence for extended timelines.

Monthly: Market update email. Annual rate anniversary contact for previous year’s inquirers.

Triggered only: Rate watch notifications and response to website revisits or email engagement.

Refinance Lead Nurturing Sequence

Refinance leads require shorter, more rate-focused sequences since the decision is primarily financial rather than tied to external timelines like home purchases.

Phase 1: Immediate Engagement (Days 1-7)

Day 1 (immediate): Send rate comparison email showing savings potential, SMS acknowledgment, and phone contact attempt within 5 minutes.

Day 2 (if no phone contact): Send email: “Your refinance savings estimate” with personalized numbers. Accompany with SMS featuring savings summary.

Day 3: Deliver educational email: “Is refinancing right for you? The break-even calculation.” Make phone attempt.

Day 5: Send email: “The refinance process: what to expect and timeline.”

Day 7: Offer rate watch enrollment for borrowers who cited rates as the barrier.

Phase 2: Active Nurturing (Days 8-30)

Day 10: Send email: “Today’s rates vs. your current rate” with updated comparison. Make phone attempt.

Day 14: Deliver educational email: “Cash-out vs. rate-and-term refinance options.”

Day 21: Send rate update email if significant movement. Make check-in phone call.

Day 28: Deliver monthly summary with rate trends and savings recalculation.

Phase 3: Rate Watch Mode (Days 31+)

Refinance leads who do not convert within 30 days often wait for rate improvement. Transition to rate-watch-driven nurturing with active rate watch monitoring and threshold-based notifications, monthly market update emails, quarterly phone touches checking on plans, and immediate outreach when rates hit enrolled thresholds.

Home Equity Lead Nurturing Sequence

Home equity leads often involve project planning alongside financial considerations, requiring content that addresses both elements.

Phase 1: Immediate Engagement (Days 1-7)

Day 1: Send email with equity estimate and rate options (HELOC vs. loan), SMS acknowledgment, and phone contact attempt.

Day 3: Deliver educational email: “HELOC vs. home equity loan: which fits your plans?”

Day 5: Send email: “How much equity can you access?” with general guidelines.

Day 7: Deliver project planning content relevant to common uses (renovation, debt consolidation).

Phase 2: Active Nurturing (Days 8-30)

Day 10: Send rate comparison email showing current HELOC and home equity loan rates.

Day 14: Deliver email: “Using home equity responsibly: best practices.” Make phone check-in.

Day 21: Send project-focused email based on stated purpose (renovation tips, consolidation calculators).

Day 28: Deliver monthly rate update with equity access summary.

Phase 3: Extended Nurturing (Days 31+)

Continue with bi-weekly rate updates (home equity rates are often more volatile than first mortgages), monthly market emails, triggered outreach when rates drop significantly, and seasonal content tied to common equity uses (spring renovation season, back-to-school consolidation).

Behavioral Triggers and Dynamic Nurturing

Beyond time-based sequences, behavioral triggers enable responsive nurturing that adapts to borrower actions in real time.

Website Behavior Triggers

Return Visit Triggers

When a nurtured lead returns to your website, trigger immediate outreach. This return indicates renewed interest that may not persist. Install tracking pixels that connect anonymous browsing to known contacts and configure triggers to fire on return visits after 7+ days of inactivity. Deliver immediate email: “Saw you were back on our site. Still have questions about [their product interest]?” Consider SMS or phone follow-up for high-value leads.

Page-Specific Triggers

Different pages indicate different intent levels. Calculator usage suggests readiness to run numbers and proximity to decision point. Rate page visits indicate active comparison and price sensitivity. Application page visits signal high intent and potential readiness to apply. FAQ and process page browsing suggests research phase and need for education.

Configure automation to deliver relevant content based on page visits. A borrower who viewed your application page three times warrants more aggressive follow-up than one browsing general content.

Email Engagement Triggers

Open-Based Triggers

Open-based triggers identify leads showing renewed interest. A lead who opens their first email in 30 days should trigger a re-engagement sequence. A lead who opens a rate alert should trigger phone follow-up within hours. A lead who opens multiple emails in the same day should trigger an immediate call attempt.

Click-Based Triggers

Click-based triggers indicate specific interests. A click on a rate calculator should trigger a follow-up with personalized rate scenario. A click on an application link without completion should trigger an assistance offer. A click on educational content should continue the educational sequence and delay sales pressure.

Response-Based Triggers

Configure automation to respond appropriately to direct replies. Questions about rates should route to a loan officer with notification for immediate response. Requests for documentation should trigger a documentation checklist email. “Not interested” responses should move to suppression with a polite close-out. “Bought elsewhere” responses should update status with an optional win-back sequence in 6-12 months for future transactions.

Rate Movement Triggers

Beyond individual rate watch thresholds, configure system-wide triggers for significant market movements. A rate drop exceeding 25 basis points in a week should generate mass notification to the rate-watch pool. A rate spike exceeding 25 basis points should send urgency messages to fence-sitters. Rate volatility alerts should deliver market uncertainty content positioning your expertise.

Conversion Timeline Optimization

Understanding and optimizing conversion timelines enables realistic expectations and appropriate resource allocation across the nurturing cycle.

Benchmarking Mortgage Conversion Timelines

Industry research provides baseline expectations for mortgage lead conversion timelines:

| Lead Type | Median Days to Application | Median Days to Funding | Conversion Rate by Day 30 | Conversion Rate by Day 90 |

|---|---|---|---|---|

| Purchase (active buyer) | 14-21 | 45-60 | 35-45% | 60-70% |

| Purchase (early research) | 60-90 | 90-120 | 10-15% | 25-35% |

| Refinance (rate-motivated) | 7-14 | 30-45 | 50-60% | 70-80% |

| Refinance (cash-out) | 21-30 | 45-60 | 30-40% | 55-65% |

| Home equity | 14-21 | 30-45 | 35-45% | 55-65% |

These benchmarks assume competent nurturing. Operations without systematic follow-up see significantly lower conversion rates, particularly beyond the initial contact window.

Optimizing for Timeline Compression

Several factors can accelerate conversion timelines.

Speed-to-contact improvement matters enormously. Every minute of response delay costs conversion probability. Operations achieving sub-minute response times see 20-30% higher same-day conversion than those responding within 5-10 minutes.

Pre-qualification streamlining removes friction from the process. Enable online applications, simplify initial documentation, and provide instant feedback where possible.

Proactive timeline management aligns nurturing with buyer circumstances. For purchase loans, understand the buyer’s timeline and align nurturing intensity accordingly. A buyer under contract needs aggressive support; a buyer beginning to look needs educational nurturing.

Rate lock strategies can enable earlier commitment. Offering extended rate locks (60-90 days) removes rate risk for borrowers in extended home search periods.

Resource Allocation by Timeline Stage

Not all leads warrant equal nurturing investment. Allocate resources based on timeline stage and conversion probability.

Days 1-7 (High intensity): Multiple phone attempts, daily email touches acceptable, SMS engagement, and loan officer direct involvement.

Days 8-30 (Moderate intensity): Bi-weekly phone touches, weekly email communication, rate watch enrollment. Automation handles most touches with escalation for engaged leads.

Days 31-60 (Lower intensity): Monthly phone touches, bi-weekly email, rate watch notifications as triggered. Primarily automated with exception handling.

Days 61+ (Maintenance mode): Monthly email newsletter, quarterly phone check-ins for high-value leads, rate watch remains active. Minimal human resources; automation handles nearly all activity.

Technology Infrastructure for Mortgage Nurturing

Effective mortgage lead nurturing requires technology infrastructure that automates sequences, manages compliance, integrates across channels, and enables measurement.

CRM Requirements for Mortgage Operations

Your CRM must handle mortgage-specific requirements beyond generic lead management.

Lead lifecycle tracking spans from acquisition through funded loan, including all touchpoints, disposition changes, and conversion events. Rate watch data management stores individual rate thresholds, notification history, and response tracking. Compliance documentation encompasses consent records, communication timestamps, and suppression list management. Pipeline visibility tracks leads through application, processing, underwriting, and closing stages for those who convert. Integration capabilities connect to loan origination systems, rate engines, and marketing automation platforms.

Popular mortgage CRM options include Salesforce (with mortgage configuration), Velocify/Ellie Mae, Jungo, and Total Expert. Selection depends on existing technology stack and specific operational requirements.

Marketing Automation Platform Selection

Marketing automation platforms must support the multi-channel, trigger-based nurturing that mortgage operations require.

ActiveCampaign offers strong automation capabilities with integrated CRM functionality at mid-market pricing ($50-300/month). The platform handles complex conditional logic and integrates with major mortgage CRMs.

HubSpot provides comprehensive marketing automation with pricing that scales by contact count. The Professional tier ($800/month) unlocks advanced automation features with a strong ecosystem of mortgage-specific integrations.

Total Expert is built specifically for mortgage and financial services, combining CRM and marketing automation in a single platform. Mortgage-specific templates, compliance features, and LOS integration are built-in.

Marketo serves enterprise mortgage operations requiring sophisticated segmentation, attribution, and scale. Implementation investment is substantial ($1,000-3,000/month plus implementation costs).

Integration Architecture

Mortgage nurturing requires integration between multiple systems.

Lead distribution platform to CRM integration ensures lead data, source information, and consent documentation flow to CRM immediately upon capture or purchase.

CRM to marketing automation integration synchronizes contact records, segment membership, and trigger events bidirectionally. Status changes in CRM should update automation sequences; engagement in automation should update CRM records.

Rate data to automation integration flows current rate information to the automation system for rate watch notifications and dynamic content.

LOS to CRM/automation integration ensures that for leads who convert to applications, loan status updates trigger appropriate automation (application nurturing, status updates, closing sequence).

Build integrations with clear data ownership rules. Define which system is the “source of truth” for each data element to prevent synchronization conflicts.

Compliance Framework for Mortgage Lead Nurturing

Mortgage lead nurturing operates under overlapping regulatory frameworks. Non-compliant nurturing creates liability that can exceed the lifetime value of your entire lead database.

TCPA Requirements

The Telephone Consumer Protection Act governs calls and texts to consumers.

Prior Express Written Consent (PEWC) is required for marketing calls and texts to cell phones using automated technology. Your consent language must clearly identify the seller(s) authorized to contact the borrower and describe communication types.

Calling hours are restricted to 8 AM - 9 PM in the borrower’s time zone federally, with stricter windows in some states (8 AM - 8 PM in Florida and Maryland). Configure all automated outreach to respect these boundaries.

Do Not Call compliance requires scrubbing against the National DNC Registry, state DNC lists, and your internal DNC list before each contact attempt.

Revocation handling requires honoring opt-out requests within 10 business days (the outer limit; immediate suppression is best practice). The FCC identified specific opt-out keywords requiring immediate cessation: “stop,” “quit,” “revoke,” “opt out,” “cancel,” “unsubscribe,” and “end.”

CAN-SPAM Requirements

Commercial email must comply with CAN-SPAM Act requirements: clear sender identification with valid physical postal address, honest and non-deceptive subject lines, functional unsubscribe mechanism in every message, and honoring unsubscribe requests within 10 business days. All reputable email platforms handle these requirements automatically, but verify configuration.

RESPA Considerations

The Real Estate Settlement Procedures Act creates unique compliance considerations for mortgage marketing. RESPA Section 8 prohibits giving or receiving “any thing of value” in exchange for referral of settlement service business.

For lead nurturing specifically, RESPA relevance means nurturing content must not reference referral fees or kickback arrangements. Co-marketing with real estate agents or other settlement providers requires careful structuring. Any value provided to partners in exchange for referrals violates RESPA regardless of how it is characterized.

Fair Lending Considerations

Nurturing practices must not discriminate on prohibited bases. Segmentation criteria cannot use protected characteristics as proxies. Geographic targeting must not effectively redline. Content and service levels must be consistent across demographic groups. Nurturing exit criteria cannot differentially impact protected classes.

Documentation and Retention

Maintain documentation proving compliant operations: consent records for at least 5 years (beyond TCPA’s 4-year statute of limitations), communication logs with timestamps, content delivered, and delivery confirmation, suppression list additions with timestamps and reasons, and training records documenting staff compliance education.

Measuring Nurturing Performance

Effective measurement enables continuous optimization and justifies ongoing investment in nurturing infrastructure.

Key Performance Indicators

Sequence conversion rate measures the percentage of leads entering nurturing who ultimately convert to applications. This is your primary outcome metric with a benchmark of 15-25% for engaged leads across the full nurturing lifecycle.

Stage conversion rates track conversion at each stage – lead to contact, contact to application, application to approval, approval to funding – to identify where leads fall out of the funnel.

Time to conversion measures how long leads spend in nurturing before converting, informing sequence length and resource allocation.

Engagement rates by channel include email metrics (open rates targeting 20-30%, click rates targeting 3-5%, reply rates), SMS response rates (targeting 15-25%), and phone contact rates (targeting 20-35%) with conversation rates.

Rate watch effectiveness measures conversion rate for rate watch enrollees when their threshold is hit, indicating whether rate watches actually drive action.

Cost per nurture-converted lead divides total nurturing program costs (technology, labor, communication costs) by conversions for comparison to fresh lead acquisition costs.

Incremental conversion value identifies conversions attributable specifically to nurturing versus what would have converted without nurturing, requiring measurement of control groups or historical baselines.

Attribution Methodology

Attributing conversions to nurturing touches requires clear methodology.

Last-touch attribution credits the final nurturing touch before conversion. Simple to implement but undervalues early-funnel nurturing.

First-touch attribution credits the initial nurturing engagement. Useful for understanding what brings leads into active engagement but ignores conversion-driving later touches.

Multi-touch attribution distributes credit across all touches in the journey. More accurate but requires more sophisticated tracking and analysis.

For mortgage nurturing, multi-touch attribution that weights rate watch notifications and final engagement touches more heavily often provides the most actionable insights.

A/B Testing Framework

Systematic testing improves performance over time.

Test one variable at a time. Changing multiple elements makes it impossible to identify what caused differences.

Run tests to statistical significance. Small sample sizes produce unreliable results. Use significance calculators to determine required sample sizes.

Test high-impact elements first. Subject lines, send timing, and rate watch thresholds typically have larger impact than secondary elements.

Document and implement winners. When tests identify winners, update standard sequences. Many organizations test but fail to implement learnings.

Frequently Asked Questions

What is mortgage lead nurturing and why does it matter?

Mortgage lead nurturing is the systematic process of maintaining contact with leads who do not purchase immediately, providing value through educational content, rate updates, and timely check-ins until they are ready to convert. It matters because approximately 80% of mortgage leads require sustained engagement before making decisions. Only 20-25% of consumers who request mortgage information purchase within the first week. Without nurturing, you abandon the majority of your lead investment.

How long should mortgage lead nurturing sequences run?

Sequence length should match the consideration cycle for each product type. Purchase leads for active home shoppers need 45-90 day sequences, while early-research purchase leads may require 6-12 months of light-touch nurturing. Refinance leads typically need 30-60 day sequences, with transition to rate-watch-driven nurturing for those who do not convert. Home equity leads usually require 30-45 day sequences. All sequences should include maintenance-phase communication for leads who remain in extended consideration.

What is a rate watch program and how do I implement one?

A rate watch program monitors interest rate movements and notifies enrolled borrowers when rates hit their specified thresholds. Implementation requires: capturing rate thresholds from borrowers (“What rate would make refinancing worthwhile?”), integrating rate data sources (APIs, manual updates, or third-party platforms), configuring trigger automation that compares current rates to stored thresholds, and personalizing notification messages with borrower-specific savings calculations. Rate watches provide genuine value by solving the problem of continuous rate monitoring that borrowers cannot easily do themselves.

What channels should I use for mortgage lead nurturing?

Effective mortgage nurturing uses multiple channels: email serves as the primary channel for educational content and regular updates; SMS handles time-sensitive communications like rate alerts and appointment reminders; phone outreach maintains personal connection, especially for high-value opportunities; and direct mail reaches high-value leads who may not engage digitally. Each channel serves specific purposes, and integrated multi-channel sequences outperform single-channel approaches consistently.

How do I maintain TCPA compliance in mortgage lead nurturing?

TCPA compliance requires documented Prior Express Written Consent before any automated calls or texts to cell phones. Capture consent at lead acquisition with clear disclosure of communication types and authorized senders. Restrict calls and texts to 8 AM - 9 PM in the borrower’s time zone (8 AM - 8 PM in some states). Scrub against DNC registries and internal suppression lists before each contact. Honor opt-out requests immediately. Store consent documentation for at least 5 years. Consider integration with TrustedForm or Jornaya for consent certificate retention.

What conversion rates should I expect from mortgage lead nurturing?

Conversion rates vary significantly by lead quality, lead type, and operational execution. Fresh leads in active nurturing sequences typically achieve 15-25% conversion to application. Aged leads (30-60 days) convert at 6-12%. Leads beyond 90 days may convert at 2-5% but still provide positive ROI given minimal marginal nurturing costs. Rate watch programs that hit borrower thresholds often see 25-40% conversion rates when the alert fires, demonstrating the power of threshold-based engagement.

How do I segment mortgage leads for nurturing?

Primary segmentation dimensions include: product type (purchase, refinance, home equity); timeline urgency (active buyer under contract, actively searching, early research, waiting for rates); credit profile (qualified, needs improvement, not provided); loan amount tier (conforming, jumbo, small balance); and engagement level (highly engaged, moderately engaged, dormant). Dynamic segmentation based on behavioral signals (email opens, website visits, rate watch engagement) should continuously re-segment leads based on current behavior rather than just initial capture data.

What technology do I need for mortgage lead nurturing?

At minimum, you need a CRM capable of mortgage-specific tracking and automation triggers, an email marketing platform with conditional automation, and systems for SMS delivery and compliance management. For sophisticated operations, add marketing automation platforms like ActiveCampaign or HubSpot, rate data integration for automated rate watch notifications, website tracking for behavioral triggers, and integration with loan origination systems for closed-loop tracking. The technology investment should scale with lead volume and operational complexity.

How often should I contact mortgage leads during nurturing?

Frequency should decrease over time as leads age. Days 1-7: daily contact acceptable across channels (phone attempts, email, SMS as appropriate). Days 8-30: 2-3 touches per week combining automated email and periodic phone/SMS. Days 31-60: weekly email, bi-weekly phone touch. Days 61+: bi-weekly to monthly email, quarterly phone for high-value leads. Rate watch notifications fire based on rate movements regardless of cadence, but limit to 2-3 per week even during volatile periods.

How do I measure the ROI of mortgage lead nurturing programs?

Calculate incremental conversion value by comparing conversion rates for nurtured leads against a control group or historical baseline. If nurtured leads convert at 18% versus 10% for non-nurtured leads, and average revenue per funded loan is $3,000, nurturing adds $240 per lead ($3,000 x 8% incremental conversion). Subtract nurturing program costs (technology, labor, communication costs per lead) to determine net ROI. Most operations see 200-400% ROI on well-implemented nurturing programs.

What content should I include in mortgage nurturing emails?

Content should progress from educational to engagement-focused: early sequence emails explain the mortgage process, documentation requirements, and what to expect; mid-sequence content provides rate updates, market analysis, and comparison information; later sequence content offers check-ins, timeline reminders, and softer calls to action. Include personalized elements like estimated payment calculations, local market insights, and product-specific information. Avoid aggressive sales messaging throughout; nurturing builds trust through value rather than pressure.

Key Takeaways

-

Mortgage sales cycles span 30-90+ days from inquiry to funded loan. Speed-to-contact matters for initial engagement, but systematic nurturing over weeks and months determines whether the 80% of leads requiring extended consideration ever convert.

-

Rate watch programs provide the most powerful mortgage-specific nurturing tool. By monitoring rate thresholds and notifying borrowers when their target rates hit, rate watches provide genuine value while creating natural re-engagement triggers.

-

Multi-channel nurturing significantly outperforms single-channel approaches. Email handles educational content and regular updates; SMS delivers time-sensitive rate alerts; phone maintains personal connection; direct mail reaches high-value leads who may not engage digitally.

-

Sequence design should match borrower psychology and timeline. Purchase leads need extended sequences spanning home search timelines. Refinance leads need shorter, rate-focused sequences with transition to rate watch mode. Home equity leads require project-aware content alongside financial information.

-

Behavioral triggers enable responsive nurturing that adapts in real time. Website return visits, email engagement signals, and rate watch threshold hits should trigger immediate, relevant outreach rather than waiting for scheduled touches.

-

Compliance infrastructure is non-negotiable. TCPA, CAN-SPAM, RESPA, and fair lending requirements constrain nurturing activities. Build compliance into automation design from the beginning rather than retrofitting.

-

Measure nurturing performance rigorously. Track sequence conversion rates, stage conversion rates, channel engagement metrics, and cost per nurture-converted lead. Use A/B testing to optimize continuously.

-

Resource allocation should scale with timeline stage. High-intensity engagement in days 1-7 transitions to moderate touch in weeks 2-4, then to automated maintenance with exception handling beyond 30 days.

-

Technology investment enables scale. CRM, marketing automation, and integration infrastructure allow nurturing hundreds or thousands of leads simultaneously with consistent quality.

-

Those who master mortgage nurturing extract value that competitors abandon. While competitors fight over fresh lead inventory with compressed margins, nurturing-capable operations build sustainable competitive advantage through superior lead economics.

Statistics and industry benchmarks current as of late 2025. Mortgage rates, market conditions, and regulatory requirements change continuously. Validate current information through industry sources before making significant operational decisions. This article provides general information and does not constitute legal, financial, or compliance advice. Consult qualified professionals for specific guidance.