A comprehensive analysis of the FCC’s vacated one-to-one consent rule, the 11th Circuit’s decision, and strategic guidance for lead generation operators navigating the current regulatory environment.

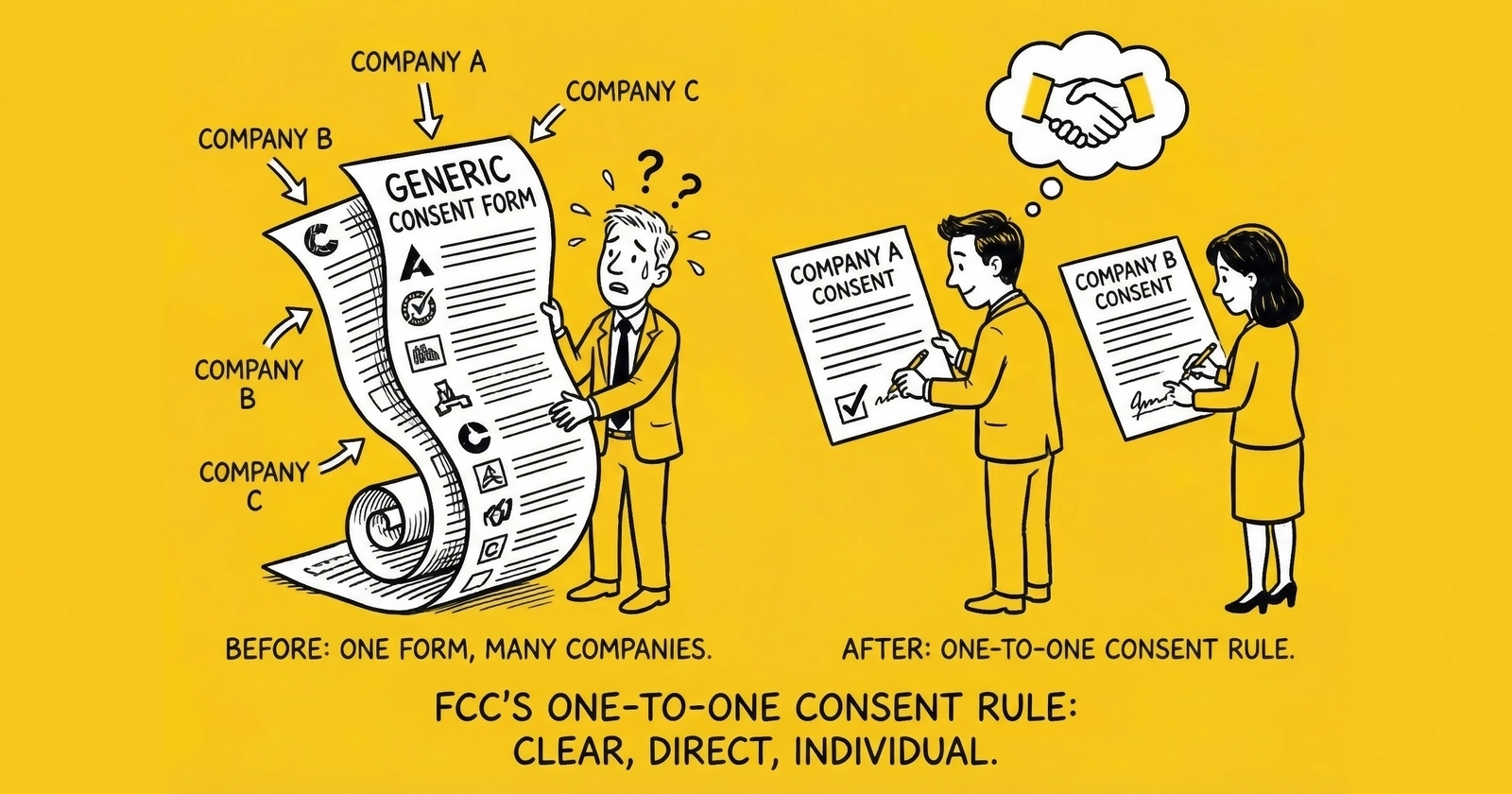

The one-to-one consent rule represented the most significant regulatory threat to the lead generation industry in decades. In December 2023, the FCC voted 4-1 to require that consumers provide separate consent to each company before receiving marketing calls or texts. The rule would have eliminated multi-seller consent lists overnight – the foundation of comparison shopping sites and lead aggregators across insurance, mortgage, solar, and every major vertical.

Then, on January 24, 2025, within hours of the FCC postponing the rule’s effective date, the 11th Circuit Court of Appeals vacated it entirely. The rule has been formally deleted from the Code of Federal Regulations.

The legal battle is over. The strategic questions remain.

This article provides lead generation professionals with a complete understanding of what happened, why it happened, what the current regulatory landscape looks like, and how to make informed decisions about consent practices going forward. Whether you continue with multi-seller consent or adopt one-to-one practices voluntarily, you need to understand the full picture.

What Was the One-to-One Consent Rule?

The FCC’s one-to-one consent rule would have fundamentally restructured how lead generators obtain and document consumer consent for telemarketing.

The Core Requirement

Under the proposed rule, prior express written consent (PEWC) would have been valid only for a single, specifically identified seller. The consent disclosure would need to name the exact company authorized to contact the consumer. Multi-seller consent lists – where consumers agree to receive calls from dozens or hundreds of potential buyers through a single disclosure – would have become legally invalid for TCPA purposes.

What Changed in the Definition

The FCC amended the definition of prior express written consent in 47 CFR 64.1200(f)(9) to require:

Seller-Specific Consent. The agreement must authorize contact from one specifically identified seller at a time. No more blanket consent covering “our marketing partners,” “affiliated companies,” or lists of dozens of potential callers.

Logical and Topical Association. Any communications must be “logically and topically associated” with the interaction that prompted the consent. A consumer seeking insurance quotes could receive insurance-related calls, but not calls about unrelated products or services.

Robocall Restriction. The rule applied specifically to calls and texts made using automated dialing systems or prerecorded/artificial voice technology – the categories most relevant to high-volume lead generation operations.

The Stated Purpose

FCC Chairwoman Jessica Rosenworcel described the rule as closing the “lead generator loophole.” The Commission’s concern centered on comparison shopping websites and lead forms that obtained consumer consent for contact from hundreds of companies through a single, often obscure disclosure. Consumers who filled out a quote request form expecting one or two calls might receive dozens, each from a company the consumer had never heard of and could not recall authorizing.

The FCC estimated the rule would significantly reduce unwanted robocalls by eliminating the mass-consent practices that fueled them.

Industry Impact Assessment

Had the rule taken effect, the operational changes would have been substantial:

Lead Aggregators and Comparison Sites. The multi-buyer model would have required complete restructuring. Each potential buyer would need separate consent capture, either through dynamic disclosure showing the matched buyer before consent, or through sequential consent flows for each party.

Ping/Post Systems. The traditional ping/post workflow – where leads are offered to multiple buyers after capture as discussed in our multi-buyer distribution guide – would face complications. Consent obtained before buyer matching could not authorize contact from a buyer identified later, unless the buyer was named in the original disclosure.

Lead Pricing. Exclusive leads with verified one-to-one consent would command significant premiums. Shared leads would lose value or become unmarketable without restructured consent flows.

Form Design and User Experience. Adding dynamic buyer identification or multiple consent steps would reduce conversion rates. Early industry estimates suggested 20-40% conversion decline for forms requiring sequential consent for multiple parties.

Timeline of Events

The one-to-one consent rule moved from proposal to vacatur in just over a year. Understanding this timeline helps explain where we are now and what might come next.

December 13, 2023: FCC Adoption

The FCC voted 4-1 to adopt the one-to-one consent rule. Commissioner Brendan Carr cast the lone dissenting vote, arguing the rule exceeded the Commission’s statutory authority and would harm legitimate marketing while doing little to stop bad actors who ignore rules entirely.

The rule was scheduled to take effect one year later, giving the industry time to implement changes.

Throughout 2024: Industry Preparation

The lead generation industry spent 2024 preparing for compliance. Lead distribution platforms developed new consent capture tools. Publishers redesigned forms. Buyers updated their lead acceptance criteria. Consent verification services like TrustedForm and Jornaya added features to document seller-specific consent.

Meanwhile, industry groups filed legal challenges. The Insurance Marketing Coalition, along with other trade associations, petitioned the 11th Circuit Court of Appeals to vacate the rule.

January 24, 2025: The Dual Events

On January 24, 2025, two things happened within hours of each other:

Morning: FCC Postponement. The FCC issued an order postponing the rule’s January 27, 2025 effective date by one year, until January 26, 2026. The Commission cited the pending judicial review and the need to provide regulatory certainty while litigation proceeded.

Afternoon: 11th Circuit Vacatur. Hours after the FCC’s postponement order, the 11th Circuit Court of Appeals issued its decision in Insurance Marketing Coalition Limited v. FCC (Case No. 24-10277), vacating the rule entirely.

The postponement became moot within hours of being issued.

Post-Vacatur: Rule Deletion

Following the 11th Circuit’s decision, the FCC formally repealed the vacated language as part of its broader “Delete, Delete, Delete” proceeding to eliminate outdated and unnecessary regulations. The one-to-one consent requirement has been removed from the Code of Federal Regulations. The prior definition of prior express written consent – which permits multi-seller consent – remains in effect.

Why It Was Vacated

The 11th Circuit’s reasoning in Insurance Marketing Coalition v. FCC centered on one question: Did Congress give the FCC authority to impose a one-to-one consent requirement? The court concluded it did not.

The Statutory Text

The TCPA uses the term “prior express consent” without defining it. Congress did not specify what form consent must take, how it must be documented, or whether it must be seller-specific. The statute simply requires that consent exist before certain types of calls are made.

The Court’s Analysis

The 11th Circuit applied the principle that undefined statutory terms receive their “plain and ordinary meaning” under common law. The court looked to how consent has been traditionally defined in legal contexts.

Under common law, consent requires only that a person “clearly and unmistakably” state willingness to receive the communication in question. There is no common law requirement that consent be given to each individual party separately. A consumer can consent to receive calls from multiple parties through a single authorization, provided the authorization is clear.

The Core Holding

The court’s conclusion was direct: “At bottom, the FCC has decreed a duty that the statute does not require and that the statute does not empower the FCC to impose.”

The one-to-one consent requirement was an FCC policy preference, not a statutory mandate. The Commission had exceeded its implementation authority by adding requirements Congress never enacted.

Current Status

The regulatory status is now clear: multi-seller consent is legal under federal law.

What the Law Requires

The current PEWC requirements under 47 CFR 64.1200(f)(9) are:

- Written agreement (electronic signatures satisfying E-SIGN are valid)

- Consumer signature

- Clear authorization for telemarketing calls using automated technology

- Identification of the telephone number to which calls may be made

- Consent cannot be a condition of purchase

- Clear and conspicuous disclosure

The disclosure must identify the parties authorized to call, but there is no requirement that consent be limited to a single party. A disclosure authorizing contact from “ABC Insurance Agency and [list of named partners]” satisfies federal requirements, provided the disclosure is clear and conspicuous.

What Changed on April 11, 2025

While the one-to-one consent rule was vacated, the FCC’s separate revocation rules took effect on April 11, 2025. These rules require:

10-Business-Day Revocation Window. Companies must honor opt-out requests within 10 business days of receipt – significantly tighter than prior 30-day practices.

Standard Opt-Out Keywords. Text messages containing “STOP,” “quit,” “revoke,” “opt out,” “cancel,” “unsubscribe,” or “end” must be treated as definitive revocation.

Any Reasonable Method. Companies cannot require consumers to use a specific opt-out mechanism. Any reasonable method that clearly expresses intent to stop receiving calls must be honored. (Note: The “reasonable methods” provision allowing any revocation channel was delayed until April 2025 via partial waiver.)

Where Enforcement Stands

The vacatur does not mean open season on aggressive practices. The TCPA’s core requirements remain in effect:

- Prior express written consent is still required for telemarketing calls using automated technology

- Do Not Call requirements remain

- Calling hour restrictions (8 AM - 9 PM recipient’s local time) remain

- Statutory damages of $500-$1,500 per violation remain

- The four-year statute of limitations remains

TCPA litigation continues at record levels, as detailed in our TCPA litigation statistics guide. In 2024, 2,788 TCPA cases were filed – a 67% increase over 2023. Through October 2025, filings were running 97% ahead of 2024’s pace. Approximately 80% of all TCPA lawsuits are filed as class actions, with average settlements exceeding $6.6 million.

The litigation environment, not the regulatory environment, now drives most compliance decisions.

Why Many Operators Still Use One-to-One Consent

The rule was vacated. Multi-seller consent is legal. Yet many sophisticated practitioners continue implementing one-to-one consent practices. This apparent contradiction makes strategic sense for several reasons.

Stronger Litigation Defense

When a lead buyer faces a TCPA lawsuit, the strength of their consent defense depends on documentation quality. Multi-seller consent creates inherent ambiguity: Did the consumer really understand they were authorizing calls from this specific company? Did they even see the list of authorized callers?

One-to-one consent eliminates this ambiguity. A TrustedForm certificate showing the consumer saw “By clicking Submit, I authorize [Specific Company Name] to contact me…” creates a clean, defensible consent record. The consumer cannot credibly claim they did not know who would call – the company name was displayed at the moment of consent.

In TCPA litigation, ambiguity favors plaintiffs. One-to-one consent removes ambiguity. For companies facing aggressive litigation environments, the defensive value justifies the operational complexity.

Buyer Preferences and Requirements

Sophisticated lead buyers increasingly require one-to-one consent or its functional equivalent as a condition of purchase. These buyers have analyzed their litigation exposure and concluded that leads with seller-specific consent are worth more – and worth paying more for.

The market is pricing in litigation risk. Leads with one-to-one consent documentation command 10-30% premiums in some verticals because buyers know these leads are defensible. Leads with generic multi-seller consent face increasing buyer skepticism and price pressure.

If your buyers require one-to-one consent, regulatory status is irrelevant. The market requirement drives your practice.

State-Level Activity

Federal law is not the only law. Several states have enacted or proposed telemarketing regulations that exceed federal standards:

Florida’s Telephone Solicitation Act (FTSA). Florida’s statute includes broader autodialer definitions and stricter requirements than federal TCPA. While the FTSA was amended in May 2023 to narrow some provisions, Florida remains a high-risk jurisdiction with active plaintiff’s bar.

Oklahoma’s Telephone Solicitation Act (OTSA). Oklahoma requires prior express written consent with stricter requirements and creates a private right of action with significant penalties.

Maryland’s “Stop the Spam Calls Act.” Maryland imposes 8 AM - 8 PM calling hours and retains broader autodialer definitions than post-Duguid federal standards.

State attorneys general are also increasingly active in telemarketing enforcement. A practice that is federally compliant may still violate state law. Operators with national reach must consider the most restrictive applicable jurisdiction.

CMS Medicare Requirements

For practitioners in Medicare-related verticals, the regulatory picture is different. The Centers for Medicare and Medicaid Services (CMS) implemented one-to-one consent requirements for Medicare Advantage and Part D marketing in 2024. These requirements are not affected by the 11th Circuit’s decision – CMS has independent statutory authority under Medicare regulations.

Under CMS rules:

- Prior express written consent must authorize contact from a specific plan or Third-Party Marketing Organization (TPMO)

- Consent cannot be shared across multiple plans

- A 48-hour waiting period applies between education and enrollment events

- Scope of Appointment documents cannot include products beyond initial request

Medicare lead generators must implement one-to-one consent regardless of TCPA status because CMS mandates it. This regulatory overlay means a significant segment of the industry operates under one-to-one requirements whether the FCC rule exists or not.

Regulatory Intent Signal

The FCC attempted this rule once. A future FCC could attempt similar goals through different regulatory mechanisms. Congress could amend the TCPA to explicitly require one-to-one consent.

The vacatur reflects the 11th Circuit’s reading of current statutory authority, not a policy determination that one-to-one consent is bad policy. An FCC that believes in one-to-one consent – and this FCC clearly does – will look for alternative pathways.

Companies that build for these possibilities now avoid disruptive transitions later. If you implement one-to-one consent voluntarily today, you will not need emergency restructuring if requirements change tomorrow.

Implementation Strategies

For operations choosing to implement one-to-one consent – whether voluntarily or due to buyer requirements – several approaches are available.

Dynamic Consent Disclosure

The most sophisticated approach uses real-time matching to display specific seller information at the moment of consent.

How It Works:

- Consumer begins completing lead form

- System identifies likely buyer(s) through ping/post or pre-matching algorithms

- Matched buyer name(s) are dynamically inserted into consent disclosure

- Consumer sees “By submitting, I consent to receive calls from [Matched Buyer Name]…”

- Consent certificate captures the specific disclosure displayed

Technical Requirements:

- Real-time buyer matching before form submission

- Dynamic form rendering capability

- Consent verification integration (TrustedForm/Jornaya) configured to capture dynamically rendered content

- Sub-second matching response times to avoid form latency

Advantages:

- Clean one-to-one consent documentation

- Minimal additional user friction

- Compatible with existing lead flow architecture

Challenges:

- Requires buyer matching before consent (some ping/post flows match after)

- Matching failures leave no buyer to display

- Technical complexity and potential points of failure

Pre-Defined Limited Seller Lists

A simpler approach pre-defines a small list of potential buyers and displays all of them in the disclosure.

Example Disclosure:

By clicking “Get My Quotes,” I provide prior express written consent to be contacted by Alpha Insurance, Beta Insurance, and Gamma Insurance at the number provided. I consent to receive marketing calls and texts using automated technology…

When It Works:

- Small number of exclusive buyer relationships (3-5 companies)

- Stable buyer roster without frequent changes

- Vertical where consumers expect comparison across named companies

When It Fails:

- Large buyer networks (displaying 50 company names is not clear or conspicuous)

- Frequently changing buyer relationships

- Situations where not all listed buyers will receive the lead

Separate Consent Flows

Another approach separates initial lead capture from seller-specific consent.

Structure:

- Initial form captures consumer interest and contact information

- Consumer receives immediate response showing matched sellers

- Consumer provides separate consent for each seller they select

- Only consented sellers receive the lead

Impact on Conversion:

This approach typically reduces conversion rates 20-40% because it adds steps to the consumer journey. Each additional click or decision point causes drop-off.

When Justified:

- High-value verticals where lead prices support reduced volume

- Premium positioning where consumer choice is a selling point

- Regulatory environments requiring explicit separation

Hybrid Approaches

many practitioners implement hybrid strategies:

Primary + Fallback. Dynamic matching with a defined fallback list if matching fails.

Tiered Consent. One-to-one consent for primary matched buyer, additional consent step for secondary buyers.

Vertical-Specific. One-to-one for Medicare (required by CMS), multi-seller for other verticals.

The right approach depends on your vertical, buyer relationships, litigation risk tolerance, and technical capabilities.

What to Watch For

The regulatory environment continues to evolve. Operators should monitor several developments that could reshape consent requirements.

FCC Action Through Other Mechanisms

The FCC could pursue similar goals through different regulatory pathways:

Disclosure Requirements. Rather than mandate one-to-one consent, the FCC could require specific disclosure formats that make multi-seller consent impractical – such as requiring each authorized caller to be listed in a specific font size.

Definition of “Clear and Conspicuous.” The FCC could tighten standards for what constitutes clear and conspicuous disclosure, making lengthy multi-seller lists presumptively non-compliant.

Robocall Mitigation. Broader robocall mitigation rules could impose requirements that indirectly limit multi-seller consent practices.

Congressional Action

Congress could amend the TCPA to explicitly require one-to-one consent, eliminating the statutory authority question that drove the 11th Circuit’s decision.

While TCPA amendment has proven difficult historically – the statute has remained largely unchanged since 1991 – bipartisan concern about robocalls creates potential for legislation. Any amendments could include consent requirements the FCC lacks authority to impose unilaterally.

State Law Developments

State legislatures continue proposing and enacting telemarketing regulations:

Virginia’s 2026 Changes. Virginia’s updated telemarketing law, effective January 2026, includes provisions affecting text message consent and a 10-year opt-out honor period.

California Privacy Expansion. California continues expanding CCPA/CPRA with implications for lead data handling.

Additional Mini-TCPA Laws. Other states may follow Florida, Oklahoma, and Maryland in enacting state-level telemarketing restrictions.

Litigation Trends

Plaintiff strategies evolve continuously:

Consent Challenge Theories. Even where consent exists, plaintiffs challenge whether disclosure was truly “clear and conspicuous,” whether consumers understood authorization scope, and whether consent was properly documented.

E-SIGN Compliance. Following Bradley v. Dentalplans.com (2024), plaintiffs increasingly challenge electronic consent on E-SIGN grounds, arguing that failing to provide E-SIGN disclosures invalidates electronic PEWC.

State Law Claims. Plaintiffs are pairing federal TCPA claims with state mini-TCPA claims to increase exposure and complicate settlement negotiations.

Supreme Court Watch

The Supreme Court’s consideration of McLaughlin Chiropractic Associates v. McKesson Corp. could affect future TCPA litigation. The case addresses whether federal district courts are bound by FCC interpretations of the TCPA under the Hobbs Act.

A ruling limiting judicial deference to FCC guidance would create more litigation uncertainty – different courts could reach different conclusions about the same requirements. For practitioners, this means potentially inconsistent treatment across jurisdictions and increased need for conservative compliance approaches.

Frequently Asked Questions

1. Is one-to-one consent now required?

No. The FCC’s one-to-one consent rule was vacated by the 11th Circuit on January 24, 2025. Multi-seller consent remains valid under federal TCPA law. However, CMS still requires one-to-one consent for Medicare Advantage and Part D marketing, and some state laws may impose stricter requirements.

2. What exactly did the 11th Circuit decide?

The court held that the FCC exceeded its statutory authority by requiring one-to-one consent. The TCPA requires “prior express consent” but does not define the term. The court ruled that consent has a plain and ordinary meaning under common law that does not require seller-by-seller authorization. The FCC cannot add requirements Congress did not enact.

3. Can the FCC try again?

The FCC could pursue similar goals through different regulatory mechanisms, though any approach would face legal challenges if it exceeds the Commission’s statutory authority. Congress could also amend the TCPA to explicitly require one-to-one consent, which would give the FCC clear authority to implement such rules.

4. Why do some lead buyers still require one-to-one consent?

Buyers requiring one-to-one consent are managing litigation risk. Leads with seller-specific consent create cleaner, more defensible documentation if a lawsuit arises. The buyer’s name appears in the consent disclosure, eliminating arguments that the consumer did not know who would call. Many buyers view the premium pricing as worthwhile insurance against class action exposure.

5. Does the vacatur affect state laws?

No. The 11th Circuit decision interprets federal TCPA authority only. State mini-TCPA laws operate independently under state authority. Florida’s FTSA, Oklahoma’s OTSA, and other state telemarketing statutes remain in effect with their own requirements. Operators must comply with the most restrictive law applicable to each call.

6. What about Medicare leads?

Medicare lead generation is governed by CMS regulations under Medicare program authority, not TCPA authority. CMS requires one-to-one consent for Medicare Advantage and Part D marketing regardless of the FCC rule’s status. Medicare lead generators must implement seller-specific consent as a condition of operating in that space.

7. How should I document consent now?

Best practices remain unchanged, as covered in our TCPA compliance guide:

- Use TrustedForm, Jornaya, or equivalent to create independent documentation

- Capture timestamp, IP address, disclosure language displayed, and consumer action

- Claim and retain certificates for at least five years

- Associate certificates with lead records permanently

- Verify certificates before calling to confirm disclosure adequacy

The difference is whether your disclosure must name a single seller (one-to-one) or may name multiple sellers (multi-seller). Documentation requirements apply equally to both approaches.

8. What if I already implemented one-to-one consent?

You can continue using one-to-one consent – it is a stricter standard that exceeds federal requirements. Many practitioners choose to maintain these practices for the litigation defense benefits and buyer relationships described above. Alternatively, you can revert to multi-seller consent if that better serves your business model.

9. Should I be concerned about future rule changes?

Regulatory environments change. The FCC demonstrated clear interest in one-to-one consent through the 2023 rulemaking. Future administrations could pursue similar goals through different mechanisms, and Congress could amend the TCPA directly. Operators building for potential future requirements face less disruption if changes occur.

10. How does this affect my existing lead buyers?

Check your buyer contracts. If buyers contractually require one-to-one consent or specific consent documentation standards, those requirements survive the rule’s vacatur. The regulatory change does not affect private contractual obligations. If you want to change consent practices, you may need to renegotiate buyer agreements.

Key Takeaways

-

The one-to-one consent rule was vacated on January 24, 2025. The 11th Circuit held in Insurance Marketing Coalition v. FCC that the FCC exceeded its statutory authority. Multi-seller consent is legal under federal TCPA law.

-

The rule has been formally deleted from the CFR. The prior definition of prior express written consent remains in effect, permitting consent for multiple sellers in a single disclosure.

-

many practitioners continue using one-to-one consent anyway. Reasons include stronger litigation defense, buyer requirements, state law concerns, CMS Medicare mandates, and preparation for potential future requirements.

-

TCPA litigation remains at record levels. With 2,788 cases filed in 2024 (67% increase), 80% filed as class actions, and average settlements exceeding $6.6 million, litigation risk – not regulatory requirements – drives most compliance decisions.

-

April 2025 revocation rules took effect. The 10-business-day revocation window and standard opt-out keywords are now mandatory, separate from the vacated one-to-one consent rule.

-

CMS Medicare consent requirements are unaffected. Medicare Advantage and Part D marketing still requires one-to-one consent under CMS authority, regardless of TCPA status.

-

State laws create a patchwork. Florida, Oklahoma, Maryland, and other states have mini-TCPA laws with requirements exceeding federal standards. National operators must consider state-level exposure.

-

Regulatory uncertainty continues. The FCC could pursue alternative approaches, Congress could amend the TCPA, and state legislatures remain active. The 11th Circuit decision answers the immediate question but does not close the long-term debate.

Sources

- Insurance Marketing Coalition v. FCC (11th Cir. 2025) - Court opinion vacating one-to-one consent rule

- FCC December 2023 TCPA Order - Original one-to-one consent rulemaking and April 2025 revocation rules

- 47 CFR 64.1200 - TCPA Regulations - Current PEWC definition and requirements

- WebRecon LLC - TCPA litigation statistics and filing data

- TCPAWorld - Eric Troutman’s analysis of one-to-one consent developments

- CMS Medicare Marketing Guidelines - Medicare Advantage consent requirements

- Cornell Law - Facebook v. Duguid - ATDS definition case summary

- TrustedForm - Consent verification platform for documenting one-to-one consent

- Jornaya TCPA Guardian - Independent consent verification and compliance documentation service

- NCSL State Telemarketing Laws - National Conference of State Legislatures database of state telemarketing regulations

This article reflects regulatory status and industry practices as of late 2025. TCPA requirements evolve through FCC rulemaking, court decisions, and state legislative action. Consult qualified legal counsel for current compliance requirements specific to your operations.