Why personal injury leads command $200-800+ per lead, how to navigate attorney advertising rules, and what separates profitable PI lead operations from those that face regulatory consequences.

A consumer types “car accident lawyer near me” into Google. Within seconds, their search intent triggers advertising bids exceeding $250 per click. If that consumer fills out a lead form, their information becomes worth $200-800 to personal injury attorneys competing for the case.

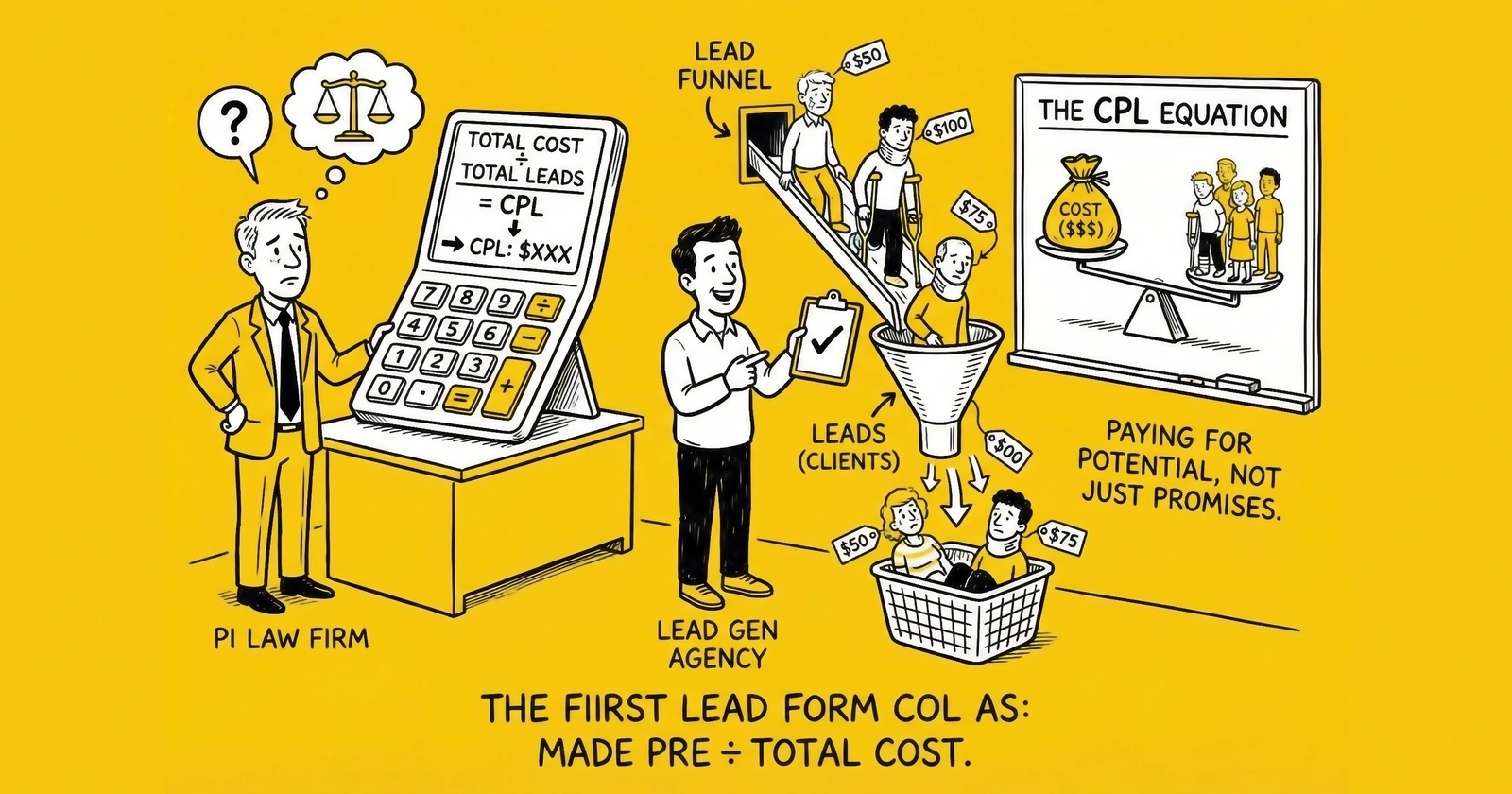

This is the personal injury lead market: the highest CPLs in the entire lead generation industry, driven by case values that can reach into the hundreds of thousands of dollars. A single successful personal injury case generates $33,000-$100,000+ in attorney fees on contingency arrangements. That economic reality supports lead acquisition costs that would bankrupt operators in other verticals.

Personal injury lead generation attracts operators for obvious reasons. The CPLs are high, the buyer demand is consistent, and the contingency fee structure means attorneys have strong economic incentive to acquire cases. But the vertical also carries unique challenges: state bar advertising rules that vary by jurisdiction, ethical constraints that can result in criminal liability for violations, and quality requirements that have intensified as law firms accumulate conversion data.

Understanding these dynamics is essential for anyone considering this market. The line between legitimate lead generation and prohibited solicitation blurs easily in personal injury. Practitioners who dismiss compliance as administrative overhead discover – often too late – that the consequences extend beyond fines to criminal charges and complete business destruction.

The rewards justify careful navigation. Operators who master the compliance framework, build relationships with quality-focused law firm buyers, and deliver leads that convert to signed cases find personal injury among the most profitable verticals in lead generation. The investment in understanding the market pays dividends that exceed any other vertical.

This guide covers the complete landscape of personal injury lead generation – the economics that drive premium pricing, the qualification requirements that determine lead value, the ethical framework that governs operations, and the operational frameworks for building a sustainable business in this space.

Why Personal Injury Leads Are So Expensive

The economics of personal injury lead generation trace directly to case values and the contingency fee structure that defines how personal injury attorneys get paid. Understanding this relationship explains why CPLs that would be absurd in insurance or solar – or even other legal verticals like family law or bankruptcy – are routine in personal injury.

The Contingency Fee Model

Personal injury attorneys work on contingency, typically taking 33-40% of the settlement or verdict amount. The client pays nothing upfront. If the attorney wins, they take a percentage. If they lose, they absorb all costs – including the thousands spent on lead acquisition.

This model creates predictable economics for lead acquisition. Consider a routine auto accident case with an average settlement between $25,000 and $50,000. At a standard 33% contingency fee, that generates $8,250-$16,500 in attorney revenue. Most firms allocate 15-20% of their fee revenue to marketing costs, which translates to an acceptable marketing budget of $1,237-$3,300 per signed case. Even at a 10% lead-to-signed-case conversion rate, an attorney can justify paying $124-$330 per lead. At 20% conversion rates – achievable with quality leads and fast intake – acceptable CPLs rise to $247-$660 per lead.

The math works because the lifetime value of a successful case far exceeds lead acquisition costs. A $500 lead that converts to a $100,000 settlement generates $33,000+ in legal fees. Even at a 5% conversion rate, that is a $1,650 return on every $500 lead investment. The ROI justifies premium pricing that no other vertical can match.

Case Value Variation Creates CPL Tiers

Personal injury encompasses multiple case types with dramatically different economics, and these differences explain the wide CPL ranges you observe in the market. Auto accident leads, representing the largest volume category, typically price between $200 and $500. The severity of the accident and resulting injuries drives significant price variation within this range. Slip and fall leads price lower at $150-$350 because proving liability – demonstrating that a property owner knew about or should have known about a hazard – presents greater legal challenges than establishing fault in a car accident.

Medical malpractice commands the highest CPLs in personal injury, ranging from $400 to $800 or more. These premium prices reflect settlements that regularly exceed $500,000 and can reach into the millions. Attorneys can justify $800 per lead when a single case might generate $200,000+ in fees. The trade-off is that med mal cases require extensive expert review – often costing $5,000-$15,000 – before case acceptance, and only 15-25% of inquiries become signed cases after merit screening.

Mass tort presents unique economics with pricing that depends entirely on campaign lifecycle. Raw leads range from $50-$400 depending on whether the litigation is in its emergence, growth, maturity, or decline phase. Signed retainers command $500-$5,000+ based on case strength and documentation quality. Workers’ compensation leads price more moderately at $100-$250 because higher conversion rates and clearer causation reduce acquisition risk. Product liability fills the middle ground at $300-$600, reflecting complex cases with high settlement potential.

Competition Intensity Amplifies Pricing

Personal injury advertising spending exceeded $2.5 billion in 2024, with approximately 26.9 million legal service ads airing locally. Law firms compete aggressively for cases in a market where 1.32 million active attorneys in the United States chase finite inventory.

Google Ads competition creates the highest CPCs in lead generation. Personal injury keywords regularly exceed $250 per click in competitive metropolitan markets. Los Angeles, Houston, and Miami see auction prices that would be unsustainable in any other vertical. Keywords like “accident lawyer” or “injury attorney” routinely bid at $150-$350 per click.

The result: cost-per-click for competitive terms ranges from $70 to $250, with conversion rates of 10-15% producing effective CPLs of $700-$1,500 before any optimization. Sophisticated lead generators outperform these benchmarks through better landing pages, geographic targeting, and quality traffic sources – but the baseline economics explain why personal injury leads command premium pricing.

Geographic Variation in Economics

Personal injury lead economics vary dramatically by metropolitan area. Markets with high case values and aggressive attorney competition drive premium CPLs, while smaller markets with fewer firms may offer lower competition but smaller case values.

Los Angeles represents the most competitive personal injury market in the country. CPCs for auto accident terms routinely exceed $300, and effective CPLs can reach $800-$1,200 for quality exclusive leads. The competition reflects the market size – millions of potential claimants, thousands of attorneys, and marketing budgets that can exceed $10 million annually for large firms.

Houston and Dallas follow similar patterns, with aggressive attorney advertising driving CPCs above $200 and creating intense competition for quality leads. These Texas markets add complexity through strict barratry laws that impose criminal penalties for prohibited solicitation – a consideration that affects both lead generators and their attorney clients.

Miami and South Florida present unique dynamics. The market is notorious for fraud, with staged accidents and ring operations that have attracted federal law enforcement attention. Lead generators working in South Florida must implement enhanced fraud screening, and law firm buyers apply stricter qualification requirements than in markets with lower fraud prevalence.

Smaller markets offer different trade-offs. A city like Charlotte or Nashville might see CPCs of $80-$150 with correspondingly lower CPLs. The reduced competition can improve margins, but the smaller volume of potential cases limits scale. Lead generators must decide whether to concentrate in a few large markets or distribute across many smaller ones.

CPL Benchmarks by Case Type

Understanding current market pricing enables realistic budget planning and performance evaluation. These benchmarks reflect 2024-2026 market conditions, though pricing shifts based on competition, seasonality, and market dynamics.

Auto Accident Leads: $200-$500

Auto accident leads represent the highest volume category in personal injury lead generation. The consistent demand stems from the unfortunate regularity of motor vehicle accidents – approximately 6 million police-reported crashes occur annually in the United States. This massive volume creates a substantial addressable market for lead generators who can deliver qualified prospects to hungry law firm buyers.

Quality tiers drive significant price variation within this category. Shared leads, sold to 2-4 law firms simultaneously, price between $50 and $125. Exclusive leads command $200-$350 because a single firm receives sole access to the consumer. Premium exclusive leads with strong intent signals and injury documentation push into the $350-$500 range. Live transfers – real-time phone connections to an intake team – represent the highest tier at $400-$600 or more, reflecting both the immediacy and the verified engagement of the consumer.

Geographic variation is significant within each tier. Los Angeles, Houston, Miami, and New York City command 25-50% premiums over national averages due to intense local competition and higher case values. Rural markets and states with tort reform price 30-50% below major metro areas. A lead worth $350 in Miami might fetch only $200 in rural Montana.

Injury severity creates additional pricing stratification. Leads indicating hospitalization, surgery, or broken bones command 50-100% premiums over leads with soft tissue injuries only. A lead noting “surgery required” might price at $450 while a “minor back pain” lead from the same accident prices at $200. The difference reflects case value economics: surgery cases settle for multiples of soft tissue cases.

Slip and Fall Leads: $150-$350

Premises liability leads price lower than auto accidents due to liability complexity. Proving that a property owner knew about or should have known about a hazard is more challenging than proving fault in a car accident, where police reports and eyewitness accounts often establish clear responsibility.

Standard exclusive leads capturing basic incident information price between $150 and $225. Qualified exclusive leads with property type identified and injuries documented command $225-$300. Commercial property incidents reach the top of the range at $275-$350 because higher case values and clearer liability – commercial properties have documented safety protocols and often maintain security footage – improve case economics.

Lead quality depends heavily on incident location. Cases at major retail chains like Walmart, Target, and grocery stores or other commercial properties often have security footage and incident reports that strengthen liability arguments. These properties have insurance, documented maintenance schedules, and professional management – all factors that support successful litigation. Cases at private residences face greater liability challenges and homeowner insurance limits that cap potential recovery, resulting in correspondingly lower case values and lead prices.

Medical Malpractice Leads: $400-$800+

Medical malpractice commands the highest CPLs in personal injury because case values regularly exceed $500,000 and can reach into the millions. A successful birth injury case might settle for $2-5 million, generating attorney fees exceeding $600,000 at standard contingency rates. These economics justify premium lead acquisition costs.

However, these leads require extensive screening before case acceptance. Standard inquiries with basic healthcare provider and outcome information price between $400 and $550. Qualified leads with clinical details and treatment timelines documented push into the $550-$700 range. Expert-screened leads with preliminary merit assessments completed command $700-$800 or more.

Medical malpractice conversion rates are low by design. Attorneys must invest in expert review – often costing $5,000-$15,000 – before accepting cases. Only 15-25% of med mal inquiries become signed cases after merit screening. CPLs reflect this anticipated attrition. An attorney paying $600 per lead who signs 20% of inquiries has an effective cost of $3,000 per signed case – still acceptable when case fees average $100,000+.

Specialty matters significantly within this category. Birth injury and surgical error leads command premiums over medication error or diagnostic delay cases due to higher average case values. The calculation is straightforward: a birth injury case might settle for $2-5 million while a medication error case might settle for $200,000-$500,000. The lead that can produce a million-dollar case is worth more than the lead that can produce a $200,000 case.

Mass Tort Leads: $50-$400 (Raw) / $500-$5,000+ (Signed)

Mass tort pricing depends entirely on campaign lifecycle and case strength. These campaigns involve multiple plaintiffs alleging harm from the same product, drug, or medical device. Unlike standard personal injury where lead value remains relatively stable, mass tort pricing fluctuates dramatically based on litigation stage and inventory scarcity.

Raw lead pricing varies by campaign stage. During the emergence phase when litigation is early and buyer demand is still developing, leads price between $50 and $150. As campaigns move into active growth with established signing activity, prices rise to $100-$300. At maturity when claims are established and deadline pressure intensifies, leads command $200-$400. In decline as deadlines approach and qualifying plaintiffs become scarce, prices drop back to $75-$200 as conversion rates fall.

Signed retainer pricing reflects case quality more than campaign timing. Basic qualification with minimal documentation commands $500-$1,500. Cases with verified documentation push into the $1,500-$3,000 range. Medical diagnosis confirmation – proof that the plaintiff has the specific condition alleged in the litigation – commands premium pricing of $3,000-$5,000 or more.

Mass tort pricing volatility exceeds other personal injury categories. Camp Lejeune leads during the peak of that litigation commanded premiums that would have been unimaginable in the early months of the campaign. Practitioners who entered early at $75 per lead saw market prices rise to $400+ as litigation matured. Those who understood campaign timing and positioned inventory appropriately captured significant margins.

The Signed Case Model: Higher Returns, Greater Complexity

Personal injury lead monetization operates on two distinct models with different economics, risk profiles, and operational requirements. Understanding both helps you choose the right approach for your capabilities and growth objectives.

The Lead Model (Lower Barrier, Lower Revenue)

The lead model involves generating leads through advertising, qualifying inquiries based on case criteria, and selling qualified leads to law firms or case acquisition companies. Your involvement ends at lead delivery. Revenue per lead typically ranges from $200 to $500 with gross margins of 30-50%. Volume can scale to hundreds or thousands of monthly leads, and collection cycles run Net 15-30 days.

This model offers significant operational advantages. Complexity stays manageable without the need for intake staff and case management systems. Revenue recognition happens quickly upon lead delivery rather than case signing. There is no dependency on case outcomes – you get paid whether the lead becomes a successful case or not. The model scales directly with your traffic acquisition capabilities. Capital requirements remain modest compared to building intake operations.

The challenges are equally real. Revenue per case value generated is lower because you are capturing only a portion of the value chain. Commodity pricing pressure intensifies as more generators enter the market. Quality requirements keep increasing as law firm buyers accumulate conversion data and demand better performance. Integrated players who handle both generation and intake capture the full margin and can outbid pure-play generators on traffic.

This model works best for lead generators with strong traffic acquisition expertise who want to monetize without building legal operations infrastructure. If your competitive advantage lies in media buying, landing page optimization, or audience targeting rather than sales and operations, the lead model lets you leverage your strengths.

The Signed Case Model (Higher Revenue, Higher Complexity)

The signed case model extends beyond lead generation to include intake qualification, signing process management, and delivery of executed retainer agreements to law firms. You own the client relationship through signing. Revenue per signed case ranges from $500 to $5,000+ with gross margins of 40-60%. Lead-to-sign conversion typically falls between 10% and 25%, with payment upon signing.

The advantages of this model are substantial. Higher revenue per case means more value captured from your traffic investment. Greater pricing power comes from delivering signed cases rather than raw leads – law firms pay premium prices for cases ready to work. Deeper quality control enables you to optimize the entire funnel. Stronger law firm relationships develop when you demonstrate ability to deliver signed retainers consistently.

These advantages come with corresponding challenges. Intake operations require staff, training, systems, and compliance infrastructure. Capital intensity increases with payroll and technology investments. Case rejection risk means some signed cases may be returned after attorney review. The revenue cycle lengthens because you must move leads through qualification and signing before monetizing.

This model suits operators willing to invest in intake infrastructure and compliance systems to capture greater share of case value. If you have operational management capabilities and appetite for building a services organization alongside your traffic business, signed cases offer superior unit economics.

Case Acquisition Companies: A Middle Path

Case acquisition companies aggregate leads from multiple sources, qualify them internally, and either sell qualified leads to law firms or operate as lead-to-signed-case operations. These organizations range from national case acquisition networks to mass tort consolidators specializing in specific litigation to regional acquisition operations to large PI firms with internal acquisition teams.

Working with case acquisition companies offers advantages for lead generators who want higher volume capacity without building their own intake operations. These buyers can absorb thousands of leads monthly with standardized buying processes and less negotiation required for each transaction. Payment cycles tend to be faster than direct law firm relationships because acquisition companies have established treasury operations.

The trade-offs mirror what you would expect. Per-lead pricing runs lower because the acquisition company needs margin to cover their intake operations and law firm distribution. Quality feedback is less direct because you are not working directly with the attorneys evaluating case merit. These companies may compete with your other distribution channels if they sell to the same law firms you work with directly. Qualification requirements can be strict because their business depends on delivering quality to law firm buyers.

Attorney Advertising Rules: The Compliance Framework

Personal injury lead generation operates within an ethical framework more restrictive than any other vertical. State bar rules govern attorney advertising and solicitation, with violations potentially resulting in attorney discipline including disbarment – and criminal charges for lead generators who cross certain lines.

The Advertising vs. Solicitation Distinction

This distinction is the central compliance challenge in legal lead generation. Getting it wrong can destroy a lead generation business and expose attorney clients to discipline or worse.

Advertising reaches the general public without targeting specific individuals known to need legal services. Lead generation fits this category when ads target keywords, interests, or demographics rather than identified individuals; when consumers initiate contact by visiting websites or completing forms; and when communications respond to consumer-initiated inquiries. This is the permitted model for legal lead generation.

Solicitation involves targeting specific individuals known to need legal services. This includes cold-calling accident victims identified from police reports, contacting individuals who posted about accidents on social media, in-person visits to accident victims in hospitals or at accident scenes, and real-time electronic messaging to identified potential clients. This is prohibited conduct that can result in criminal prosecution, not just business inconvenience.

The line matters because crossing it creates exposure that extends far beyond lost revenue. Prohibited solicitation can result in felony charges in some states, disgorgement of all fees collected, civil penalties reaching into the tens of thousands per violation, and permanent exclusion from the industry.

Key State Bar Rules

Rule 7.1 governs truthful communications, requiring that all communications about lawyer services be accurate and not misleading. Lead generation advertising cannot make false claims about outcomes, exaggerate likely results, or misrepresent attorney qualifications. Claims about “millions recovered” require documentation. Violations expose both the advertising attorney and the lead generator to bar discipline and potential fraud claims.

Rule 7.2 addresses advertising more broadly, permitting attorneys to advertise through public media, written communication, and electronic communication. Lead generators operate within this rule when creating advertising on behalf of attorney clients. The rule permits broad advertising but requires certain disclosures that vary by state. Understanding disclosure requirements for each target market is essential for compliant campaign design.

Rule 7.3 prohibits solicitation, barring attorneys from soliciting employment through live person-to-person contact when pecuniary motivation is primary. This prohibition extends to those acting on behalf of attorneys – including lead generators. The rule creates the bright line that separates legitimate lead generation from prohibited runner and capper activity.

State-Specific Variations Create Compliance Complexity

California maintains relatively permissive advertising rules but requires extensive disclosures. “ADVERTISEMENT” labeling is required on materials that promote attorneys. Client testimonials are permitted with appropriate disclaimers about past results not guaranteeing future outcomes. California operators enjoy more creative flexibility than those in stricter states but must maintain rigorous disclosure compliance.

Texas stands among the strictest jurisdictions. Written attorney advertisements must include disclaimers in specific formats. Texas requires that certain communications include “ATTORNEY ADVERTISEMENT” prominently displayed. Real-time contact restrictions affect pay-per-call models where live transfers connect consumers with attorneys. The compliance burden in Texas exceeds most other states, but the market size makes it essential for national operators to master.

Florida occupies middle ground with active enforcement. Florida Rule 4-7.13 addresses direct mail solicitation with strict requirements. Attorneys cannot send targeted solicitation to accident victims or their families within 30 days of the accident. This “30-day rule” affects how lead generators can use accident data sources and creates a waiting period before certain outbound contact methods become permissible.

New York takes an aggressive enforcement stance on unlicensed activity. The New York Department of Financial Services, in conjunction with bar regulators, has pursued enforcement actions against lead generators whose marketing materials were deemed too specific about case outcomes. New York scrutiny extends beyond traditional bar enforcement to include financial services regulation, creating multiple enforcement vectors for non-compliant operations.

The Runner and Capper Problem

State laws prohibit “runners” and “cappers” – individuals who solicit clients on behalf of attorneys for compensation. Lead generators must understand where legitimate lead generation ends and prohibited conduct begins. This is not an academic distinction; it determines whether your business model is legal or criminal.

California Business and Professions Code Section 6151 defines a runner or capper as any person acting for consideration as an agent for an attorney in the solicitation or procurement of business. The consequences are severe: contracts procured through runners are void, clients can recover all fees paid, criminal penalties include fines up to $15,000, and potential jail time applies for repeat offenders. A lead generation business built on prohibited solicitation can have its entire revenue disgorgement with principals facing criminal prosecution.

Texas Penal Code Section 38.12 makes barratry – solicitation prohibited by professional conduct rules – a criminal offense. Third-degree felony penalties apply for repeat violations. Civil penalties range from $10,000 to $50,000 per violation. Criminal prosecution for persistent violations can result in prison time. Attorneys knowingly accepting improperly solicited cases face disbarment, making them unlikely to work with generators who cannot demonstrate compliant practices.

The 2026 Texas digital solicitation update deserves particular attention. Texas updated its barratry statutes specifically to address digital solicitation, making clear that electronic communications targeting identified individuals known to need legal services constitute prohibited solicitation. The traditional runner showing up at emergency rooms and the digital operator sending targeted messages to identified accident victims now face similar legal exposure. The mode of contact does not change the legal analysis.

Practical Compliance Guidance

Building compliant operations requires embedding these practices into your standard procedures rather than treating compliance as an afterthought.

Target audiences, not individuals. Advertising to “people interested in personal injury attorneys” is permitted. Contacting “John Smith who was in the I-95 accident on Tuesday” is solicitation. The distinction lies in whether you are reaching consumers based on demographic or interest characteristics versus reaching specific people you have identified as needing legal services. Any data source that tells you who specifically was in an accident – police reports, hospital lists, social media monitoring – creates solicitation risk when used for outbound contact.

Let consumers initiate contact. Your advertising should drive consumers to call or fill out forms. You should not be reaching out to identified accident victims. The consumer must choose to engage with your advertising and provide their information voluntarily. Inbound models where consumers respond to broadcast advertising are generally safe. Outbound models where you contact identified individuals create solicitation risk.

Maintain advertising archives. Keep copies of all creative, landing pages, and marketing materials for at least 3-5 years. Many states require 2-3 year retention, but litigation statutes of limitations may extend longer. When a bar inquiry arrives years after a campaign ran, your ability to produce the actual materials used can determine whether you survive the investigation.

Document your compliance process. Written policies explaining how you avoid prohibited solicitation protect you if regulatory inquiries occur. Your documentation should explain how you source data, what outbound contact methods you use, how you train staff on prohibited practices, and how you monitor for compliance violations. When regulators investigate, they want to see evidence of proactive compliance – not just assertions that you followed the rules.

Work with attorneys who understand the rules. Sophisticated law firm buyers will require compliance attestations and may audit your practices before buying. If a buyer does not ask about your advertising practices, they may not understand the risks they are taking – and that ignorance provides no protection when regulators investigate.

Qualification Requirements: What Makes a Valuable Lead

Personal injury lead quality depends on information that enables case evaluation. Generic contact information is worthless. Qualified leads include incident details, injury documentation, and timing indicators that allow attorneys to assess case merit quickly.

Essential Qualification Data Points

Incident information forms the foundation of lead qualification. You need the date of incident for statute of limitations screening – most personal injury claims must be filed within 2-4 years, varying by state and case type. The type of incident (auto, slip and fall, workplace, medical) determines which attorneys will be interested and what qualification criteria apply. Location establishes jurisdiction, which determines applicable law and court venue. A description of what happened enables preliminary liability assessment. Information about other parties involved identifies potential defendants. Details about witnesses or documentation indicate evidence availability that affects case strength.

Injury information determines case value more than any other factor. Capture the type of injuries sustained, medical treatment received including hospitalization, surgery, or ongoing care, the treatment timeline indicating when care began relative to the incident, current treatment status, impact on daily activities or work, and injury severity indicators like surgery, broken bones, or permanent effects. A lead indicating surgery and hospitalization is worth multiples of a lead indicating “my back hurts a little.”

Legal status screening prevents wasted effort and ethical violations. Determine whether the consumer is already represented by an attorney – this is disqualifying because bar rules prohibit contact with represented parties. Ask whether insurance companies have made contact, whether any claims or lawsuits have been filed, and whether the consumer has spoken with other law firms. These factors affect both case value and competitive dynamics.

Contact information must be verified and actionable. Capture a valid phone number verified at point of capture, email address, preferred contact method and time, and best time to reach the consumer. Leads with disconnected phones or invalid contact information waste buyer resources and generate returns.

Disqualifying Factors

Screen for common disqualifiers before delivery to reduce returns and maintain buyer relationships. Already represented consumers cannot be solicited – bar rules prohibit contact with represented parties, and violating this rule creates serious ethical exposure. Statute of limitations expiration, typically 2-4 years for personal injury and 1-2 years for medical malpractice but varying by state and case type, makes cases non-viable. No injury or no treatment disqualifies most leads because attorneys require documented medical care – “I feel fine but wanted to check my options” is not a case. No clear liability means no case because someone must be at fault – “I tripped on my own shoelace” is not actionable. Pre-existing conditions only, unless the incident aggravated the condition, are not compensable.

These disqualifiers seem obvious, but failing to screen for them is one of the most common quality failures in personal injury lead generation. Every returned lead damages your relationship with buyers and erodes your reputation in a market where reputation determines who gets premium pricing and consistent volume.

The Speed Imperative

Lead timing matters more in personal injury than most verticals, and the reasons go beyond simple contact rates.

Evidence preservation decreases over time. Security footage gets erased – often after 30-90 days at commercial properties, sometimes sooner at smaller businesses. Witnesses forget details or become difficult to locate. Accident scenes change as property is repaired or modified. Leads contacted quickly can be advised to preserve evidence that disappears weeks later. An attorney who receives a lead 48 hours after an accident can immediately send a spoliation letter to preserve video evidence; an attorney who receives the same lead two weeks later may find the footage already overwritten.

Medical documentation requires continuity for case success. Gaps in treatment undermine case value because insurance companies argue that if the injury was serious, the person would have sought immediate treatment. Leads contacted early can be advised to maintain treatment continuity and document their injuries properly. Those contacted weeks later may have already created gaps that defense attorneys will exploit.

Speed-to-intake correlates directly with signing. The first attorney to make contact often signs the case. Leads receiving callbacks 24 hours later have often already retained counsel or lost interest. Personal injury is a competitive market where multiple firms pursue the same cases; the firm with fastest intake wins disproportionately.

Personal injury buyers will pay premiums for verified fresh leads with sub-5-minute delivery. The 391% conversion advantage for one-minute response time documented in general lead generation applies with particular force in personal injury where multiple firms compete for each case. Some sophisticated buyers will not accept leads older than 4-6 hours because conversion rates drop so dramatically with age.

Working with Law Firms: Building Sustainable Buyer Relationships

Personal injury lead buyers fall into categories with different requirements, pricing tolerance, and working styles. Understanding these differences enables effective buyer diversification and sustainable revenue.

Direct Law Firm Relationships

Law firms want exclusive leads in their practice areas and geographic markets with fast delivery – ideally real-time or within minutes. They expect complete contact and incident information, compliance documentation including consent records and advertising copies, consistent quality because they track conversion by source, and responsiveness when quality issues arise. Firms that buy leads have conversion data going back years; they know exactly which sources produce cases and which waste their intake team’s time.

Typical terms include Net 15-30 payment terms with some firms paying faster, 24-72 hour return windows for invalid leads, volume commitments with pricing tiers, geographic and case type specifications, and quality minimums for contact rate and qualification rate. These terms are negotiable, but the negotiation leverage depends on your proven performance and the alternatives available to both parties.

Direct relationships offer significant advantages. Higher per-lead pricing results from eliminating the middleman margin that case acquisition companies capture. Direct feedback on lead quality and conversion helps you optimize your operations. Relationship-based buying with predictable volume enables business planning. Exclusive arrangements with top-performing firms can lock in premium pricing.

The challenges require honest assessment. Limited capacity characterizes most firms – they can handle 50-200 leads monthly before intake teams become overwhelmed. Collection risk exists because some smaller firms have cash flow issues, particularly contingency-fee practices waiting for case settlements. Relationship management overhead accumulates as your buyer network grows. Geographic limitations constrain most firms to specific markets, requiring you to build relationships in each market you serve.

Building Your Buyer Network

Successful personal injury lead generators typically work with a diversified buyer mix that balances pricing, volume capacity, and risk management.

Primary distribution should represent 60-70% of your volume, flowing to direct relationships with 5-10 law firms that provide consistent demand, relationship stability, and detailed quality feedback. These are your core partners who receive your best leads – the freshest, most qualified prospects with the highest conversion potential. You invest in these relationships because they provide premium pricing and valuable feedback that helps you improve overall quality.

Secondary distribution handles 20-30% of volume through case acquisition company relationships that absorb excess volume, provide backup demand when law firm buyers reach capacity, and cover geographic gaps where you lack direct relationships. Pricing may run lower than direct relationships – typically 15-25% less – but reliability is higher and management overhead is lower.

Overflow and backup channels handle the remaining 10-20% of volume through aged lead buyers, shared lead networks, and backup relationships for leads that do not fit primary distribution. This ensures no lead goes unmonetized. A lead that would be rejected by primary buyers at $400 might still sell to aged lead buyers at $75 – recovering your acquisition cost even when the lead does not meet premium criteria.

Building a Sustainable Personal Injury Lead Business

Long-term success in personal injury lead generation requires building infrastructure that supports quality, compliance, and relationship depth rather than simply maximizing lead volume.

Establishing Market Position

New entrants to personal injury lead generation face a strategic choice: compete broadly across case types and geographies, or specialize deeply in specific segments. Each approach carries different risk-reward profiles.

Broad competition requires significant capital for traffic acquisition across multiple markets, technology to handle diverse qualification requirements, and relationships with enough law firm buyers to absorb varied lead types. The advantage is diversification – when one case type or market softens, others may compensate.

Deep specialization focuses resources on becoming the dominant source for specific case types or geographies. An operator might focus exclusively on trucking accident leads, building expertise in Federal Motor Carrier Safety Administration regulations, specialized qualification criteria, and relationships with firms that handle commercial vehicle litigation. The narrower focus enables premium positioning and deeper buyer relationships, but creates concentration risk if that segment experiences disruption.

Most successful operators start narrow and expand thoughtfully. Mastering one case type or geographic market builds the operational foundation – compliance processes, buyer relationships, quality systems – that enables expansion into adjacent segments.

Building Buyer Relationships at Scale

The transition from working with a few law firms to operating a scaled lead business requires systematic relationship management that preserves the personal attention law firms expect while serving a growing buyer network.

Effective scaling patterns include dedicating account managers to buyer segments, establishing regular performance review cadences (typically monthly for active buyers), creating self-service portals for lead access and reporting, and implementing systematic quality feedback collection that informs source optimization.

The relationship intensity that characterizes direct law firm sales must persist even as operations scale. Law firms expect responsiveness when issues arise, transparency about lead sourcing and quality, and genuine partnership rather than transactional vendor relationships.

Quality and Intake Optimization

Quality determines long-term success in personal injury lead generation. Buyers accumulate conversion data and shift volume to sources that produce cases. One bad quarter can end a relationship that took years to build. Reputation in this market spreads quickly; law firms talk to each other about which lead sources perform.

Lead Quality Metrics

Track these metrics to understand your quality position relative to market standards. Contact rate – the percentage of leads that answer calls – should reach 60-75%. Falling below this threshold indicates data quality issues: bad phone numbers, disconnected lines, or consumers who provided false information. Qualification rate – the percentage of contacted leads meeting case criteria – should hit 40-60%. Falling short suggests targeting issues: your traffic is attracting people who do not actually have viable cases. Sign rate – the percentage of qualified leads that sign retainers – should reach 50-70%. Lower rates indicate intake process issues: slow follow-up, poor sales technique, or friction in the signing process. Case acceptance rate – the percentage of signed cases accepted by law firms after attorney review – should hit 85-95%. Gaps here reveal qualification issues: your intake team is signing cases that attorneys reject upon review.

Improving Lead Quality

Form optimization prevents quality problems at the source. Ask disqualifying questions early in the form flow – already represented status and incident date should appear before you collect detailed contact information. Capture injury severity indicators including hospitalization, surgery, and ongoing treatment because these drive premium pricing. Require detailed incident descriptions that enable liability assessment. Use multi-step forms to filter casual inquiries; consumers who complete multiple steps demonstrate higher intent. Verify phone numbers at point of capture through real-time validation APIs.

Traffic targeting determines who sees your advertising and ultimately who fills out your forms. Focus on high-intent keywords including specific injury types and “lawyer near me” queries. Exclude informational queries like “how long do I have to sue” that indicate research rather than hiring intent. Target geographic markets with strong case economics where settlements are higher and attorney competition supports premium pricing. Layer demographic targeting on social platforms to reach audiences most likely to have viable cases.

Lead verification catches problems before they reach buyers. Real-time phone validation confirms numbers are valid and reachable. Duplicate detection against existing inventory prevents selling the same lead multiple times. Fraud screening identifies synthetic leads generated by bots or click farms. Address verification confirms geographic qualification for market-specific buyers.

Intake Best Practices

For practitioners handling intake, execution discipline separates profitable operations from money-losing ones.

Speed matters above almost everything else. Target sub-5-minute first contact for all new leads. Staff intake teams for peak hours including evenings and weekends when consumers have time to talk. Use automated scheduling for missed calls so consumers can book callback times. Implement callback sequences for no-answers with at least 5-7 contact attempts across multiple days and times.

Qualification rigor ensures you sign cases attorneys will accept. Train intake specialists on specific case criteria for each case type and buyer. Use standardized qualification scripts that capture all required data points consistently. Document all qualification elements in your CRM for later reference. Record calls for quality assurance so supervisors can identify training needs.

The signing process converts qualified prospects into delivered cases. Offer electronic signature options that allow immediate signing while intent is high. Follow up persistently with unsigned qualified leads – 5-7 attempts minimum before abandoning. Address common objections systematically with prepared responses. Confirm consumer understanding of contingency terms to prevent later disputes.

Compliance documentation protects your business when questions arise. Record consent at every touchpoint with timestamps and IP addresses. Maintain an advertising archive of all creative materials used. Document intake processes in written procedures. Prepare for bar inquiry by maintaining organized records that demonstrate compliant practices.

Frequently Asked Questions

1. What is the average cost per lead for personal injury cases?

Personal injury leads range from $200 to $800+ depending on case type and quality tier. Auto accident leads typically cost $200-$500 for exclusive leads. Medical malpractice leads range from $400-$800+ due to higher case values and settlement potential. Mass tort leads vary from $50-$400 for raw leads to $500-$5,000+ for signed retainers. Shared leads price 50-70% lower than exclusive leads but convert at lower rates due to competition among multiple law firms receiving the same consumer’s information.

2. Why are personal injury leads more expensive than other verticals like insurance or solar?

Personal injury CPLs reflect the contingency fee economics of the legal industry. A single successful case generates $33,000-$100,000+ in attorney fees on 33-40% contingency arrangements. This allows attorneys to pay $300-$500 per lead while still achieving 10-20x return on investment for cases that sign and settle. The high advertising costs (Google Ads CPCs exceeding $250 for competitive PI keywords) and intense competition among 1.32 million attorneys further improve pricing. By comparison, an insurance policy might generate $1,500-$3,000 in lifetime value – far less than a single PI settlement.

3. How do I ensure my leads are compliant with attorney advertising rules?

Compliance requires understanding the distinction between advertising (permitted) and solicitation (prohibited). Advertising targets the general public through search, social, and display advertising – reaching people based on interests or demographics, not identified individual circumstances. Solicitation targets specific individuals known to need legal services. Never cold-call accident victims identified from police reports, hospital records, or social media posts. Document your advertising processes, maintain creative archives for 3-5 years, and use clear labeling as required by state bar rules. Work with attorneys who can advise on jurisdiction-specific requirements before launching campaigns.

4. What information should I collect on a personal injury lead form?

Essential data includes: incident date and type (to screen for statute of limitations), injury description and treatment status (to assess case value), other parties involved (to identify potential defendants), attorney representation status (to screen already-represented leads), and verified contact information. Capture injury severity indicators (hospitalization, surgery, ongoing treatment) to enable premium pricing. Ask about liability factors (who caused the incident, witness availability) to support case evaluation. Always capture consent documentation with timestamps and record the advertising source for compliance tracking.

5. Should I work with law firms directly or through case acquisition companies?

Most successful operators work with both. Direct law firm relationships offer higher per-lead pricing (no middleman margin taking 20-30%), direct quality feedback that helps you improve, and relationship stability with predictable volume. Case acquisition companies offer higher volume capacity (they can take thousands of leads monthly), standardized processes with less negotiation, and backup demand when law firm buyers reach capacity. A typical distribution mix: 60-70% to direct law firm relationships for premium pricing, 20-30% to case acquisition companies for volume absorption, 10-20% to overflow and backup channels for leads that do not fit primary distribution.

6. What is the difference between selling leads and selling signed cases?

Lead sales generate $200-$500 per qualified lead with your involvement ending at delivery. Signed case sales generate $500-$5,000+ per signed retainer but require intake operations (staff, training, systems, compliance infrastructure) to qualify leads and manage the signing process. Lead model advantages: lower complexity, faster revenue recognition, scalable with traffic, lower capital requirements. Signed case model advantages: higher revenue capture per case, greater pricing power, deeper quality control, stronger law firm relationships. Choose based on your operational capabilities and willingness to invest in intake infrastructure.

7. How quickly do I need to deliver personal injury leads?

Speed is critical – arguably more critical than in any other lead generation vertical. The first attorney to make contact often signs the case. Target real-time or sub-5-minute delivery. Studies show 391% higher conversion for one-minute response. Personal injury attorneys will pay 20-40% premiums for verified fresh leads with guaranteed fast delivery. Aged personal injury leads (24+ hours old) lose significant value as consumers have often already retained counsel, spoken with insurance adjusters, or lost urgency. Some operators will not accept leads older than 4-6 hours.

8. What are the biggest mistakes in personal injury lead generation?

Common mistakes include: generating leads that violate solicitation rules (targeting identified accident victims from police reports or hospital data), insufficient qualification leading to high rejection rates from attorney buyers, slow delivery that allows competitors to sign cases first, inadequate compliance documentation that exposes attorney clients to bar discipline, and working with too few buyers without backup distribution. Quality failures are particularly damaging in this vertical – attorneys track conversion by source and eliminate underperforming generators permanently. One bad month can end a relationship that took years to build.

9. How do mass tort lead campaigns differ from standard personal injury?

Mass tort campaigns have finite lifecycles (emergence, growth, maturity, decline) typically spanning 1-3 years per litigation. Pricing varies dramatically by campaign stage and case strength – $75 leads during emergence can become $400 leads at maturity. Volume opportunities can reach tens of thousands of leads monthly during peak periods, far exceeding typical personal injury volumes. Quality requirements are stricter – buyers require exposure documentation, diagnosis verification, and timeline confirmation that proves the plaintiff was exposed during the relevant period. Campaign timing determines profitability: enter too early and buyer demand does not exist; enter too late and competition has compressed margins to unprofitable levels.

10. What conversion rate should I expect from personal injury leads?

Conversion rates vary by quality tier and buyer capability. Industry benchmarks by stage: 60-75% contact rate (leads that answer calls), 40-60% qualification rate (contacted leads meeting case criteria), 50-70% sign rate (qualified leads signing retainers), 85-95% case acceptance rate (signed cases accepted by law firms after attorney review). End-to-end lead-to-case conversion typically ranges from 10-25% for quality exclusive leads. Mass tort leads may convert lower (5-15%) due to stricter eligibility requirements including medical diagnosis confirmation and exposure verification. Track conversion by source to identify your best performers.

Key Takeaways

Personal injury leads command $200-$800+ CPLs because case values justify the cost. A $400 lead on a $100,000 settlement generates $33,000+ in attorney fees at standard contingency rates. The ROI math works even at modest conversion rates.

Case type determines pricing tiers. Auto accidents ($200-$500), slip and fall ($150-$350), medical malpractice ($400-$800+), and mass tort ($50-$400 raw, $500-$5,000+ signed) each have distinct economics tied to settlement values and liability complexity.

Qualification requirements are strict. Capture incident details, injury severity, treatment status, and liability factors. Screen for disqualifiers (already represented, statute expired, no treatment) before delivery to maintain buyer relationships.

State bar compliance is non-negotiable. The line between advertising (permitted) and solicitation (prohibited) determines legality. Crossing it creates criminal liability in states like Texas and California, not just business risk. Document your compliance processes.

Work with both law firms and case acquisition companies. Direct relationships offer higher pricing and quality feedback. Acquisition companies provide volume capacity and backup demand. Diversify your buyer base.

Speed drives conversions in personal injury more than any other vertical. Sub-5-minute delivery and real-time transfers command premium pricing. The first attorney to contact often signs the case.

Quality metrics determine long-term success. Buyers track source-level performance ruthlessly. Generators with strong conversion data maintain preferred relationships and premium pricing while underperformers get cut.

Conclusion

Personal injury lead generation offers the highest CPLs in the lead economy for a reason. The complexity, the compliance burden, and the ethical constraints create barriers that limit competition and protect margins for operators who navigate them successfully.

The economics are straightforward: attorneys pay premium prices because case values support premium acquisition costs. A $500 lead that produces a $200,000 settlement generates $66,000+ in fees. The math works at conversion rates that would devastate other verticals.

But the barriers are real. State bar rules vary by jurisdiction and carry discipline consequences for attorneys and criminal liability for generators who cross ethical lines. Quality requirements have intensified as law firms accumulate conversion data. Those who dismissed compliance as optional have faced consequences that destroyed their businesses.

Success requires understanding both the opportunity and the constraints. Build compliant advertising processes that reach consumers without targeting identified individuals. Capture qualification data that enables premium pricing and accurate case evaluation. Deliver leads fast enough to capture cases before competitors. Document everything. And work with buyers who value quality over volume.

The personal injury lead market rewards operators who respect its complexity. The CPLs justify the investment in doing it right.

Pricing and regulatory information current as of late 2025. State bar rules vary by jurisdiction. This article provides general information and does not constitute legal advice. Consult with an attorney specializing in advertising ethics for jurisdiction-specific guidance.