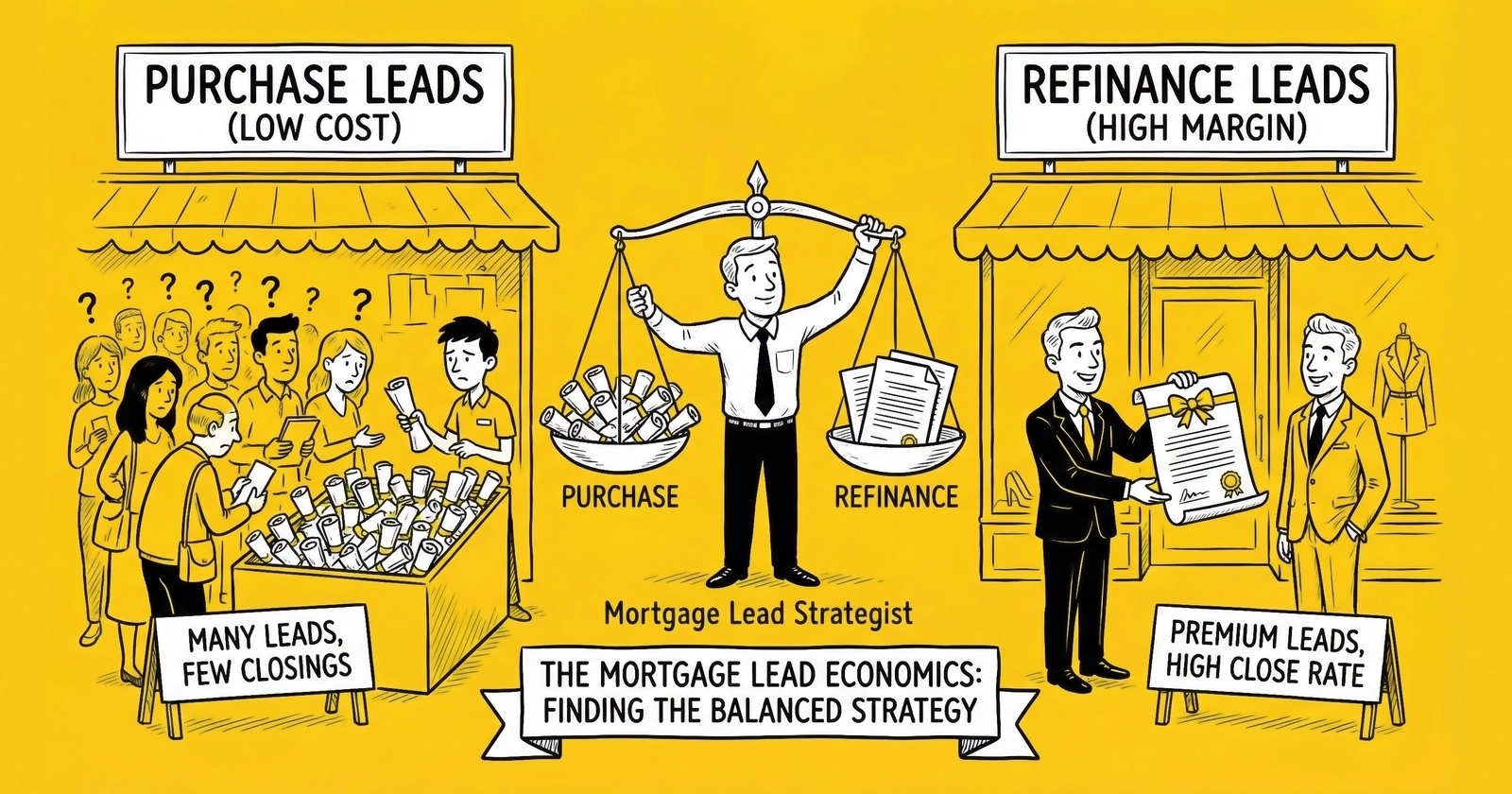

The operator who treats purchase and refinance leads as interchangeable products will learn an expensive lesson when rate cycles turn. These are fundamentally different businesses that happen to share an industry.

The Core Distinction That Defines Everything

When rates dropped from 7% to 6.5% in late 2024, refinance applications surged 300% year-over-year. Purchase applications rose 15%. Same quarter, same market, radically different responses to identical rate movement.

That disparity tells you everything you need to know about why purchase and refinance leads operate on completely different economics. One product responds to life circumstances. The other responds to a single number on the Federal Reserve’s balance sheet. Confusing the two has destroyed more mortgage lead operations than any compliance issue, technology failure, or competitive pressure.

The mortgage lead market represents approximately $5.6 billion in annual transaction value, making it one of the largest consumer lead verticals alongside auto insurance. But unlike auto insurance, where market dynamics remain relatively stable year-over-year, mortgage lead economics can invert completely within a single quarter. When 30-year fixed rates hovered near 3% in 2021, originators processed $4.51 trillion in mortgages. By 2023, with rates cresting above 7%, that figure collapsed to $1.50 trillion. Two-thirds of the volume vanished because one number changed.

For lead generators, understanding the distinct economics of purchase versus refinance isn’t academic – it’s existential. Those who build for both seasons survive. Those who optimize for one environment and assume it will persist find themselves scrambling or shutting down when conditions shift.

This guide provides the complete framework for understanding these differences, positioning your operation for current conditions, and building infrastructure that captures opportunity across the full rate cycle.

Understanding Purchase Lead Economics

What Drives Purchase Lead Demand

Purchase leads connect buyers actively seeking homes with originators who can provide financing. The fundamental driver isn’t rate levels – it’s life circumstances. People buy homes because they get married, have children, change jobs, relocate, divorce, retire, or simply decide they want to own property. These decisions happen regardless of whether mortgage rates sit at 3% or 7%.

This life-event foundation creates remarkable stability compared to refinance. High rates reduce affordability and shrink the buyer pool, but they don’t eliminate purchase demand entirely. The Mortgage Bankers Association reported purchase applications rising 15% year-over-year in Q2 2025 despite rates remaining elevated above 6.5%. This isn’t a boom, but it represents consistent, predictable demand that operators can build sustainable businesses around.

The purchase market also demonstrates geographic concentration that creates targeting opportunities. Borrowers search for homes in specific locations. A purchase lead for a buyer seeking a home in Austin holds no value for an originator licensed only in Pennsylvania. This geographic specificity enables premium pricing for leads with clear location parameters while simultaneously creating complexity for lead generators operating nationally.

Purchase decisions involve longer consideration cycles. The average homebuyer spends 4-6 months searching before making a purchase decision. Leads captured at the start of this journey require sustained nurture sequences to convert – but the payoff for patient follow-up is substantial because these borrowers will eventually transact.

Purchase Lead Pricing Dynamics

Exclusive purchase leads typically command $50 to $200 in normal market conditions, with geographic factors driving most of the variation. Premium markets like California coastal metros, New York, and South Florida often see exclusive purchase leads at $150 or higher, while Midwest markets with lower home values command proportionally lower prices.

The pricing logic follows loan value arithmetic. An exclusive lead for a $750,000 home in San Francisco generates potential origination fees, servicing income, and cross-sell opportunities that justify a $175 CPL. The same $175 price for a $180,000 home in Ohio makes no mathematical sense – the originator cannot recover that acquisition cost from the transaction economics.

Shared purchase leads trade at $20-$60 depending on the number of buyers receiving each lead, geographic targeting, and credit quality indicators. Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, industry practice has shifted toward stricter consent standards, compressing this segment as many buyers now require one-to-one consent regardless of regulatory minimums.

Current 2024-2025 purchase lead pricing benchmarks:

| Lead Type | CPL Range | Key Variables |

|---|---|---|

| Exclusive Purchase (Premium Markets) | $150-$200+ | CA, NY, FL metros; jumbo loans |

| Exclusive Purchase (Standard Markets) | $50-$100 | Most metro areas; conforming loans |

| Exclusive Purchase (Rural/Lower Value) | $30-$75 | Lower home values; reduced competition |

| Shared Purchase (2-3 buyers) | $30-$60 | Declining with consent rule changes |

| Shared Purchase (4+ buyers) | $20-$40 | Limited compliant inventory |

Purchase Lead Conversion Metrics

Purchase leads convert differently than refinance leads at every stage of the funnel. Understanding these benchmarks helps calibrate expectations and identify optimization opportunities.

Contact rates for purchase leads typically range from 25-40%, higher than refinance leads because purchase borrowers are actively engaged in a life decision and expecting calls. These consumers have begun the property search process and recognize they need financing – making them responsive to originator outreach.

Application rates from contacted purchase leads run 20-30% in strong operations, reflecting the reality that many early-stage shoppers aren’t ready to apply. The property search must progress to serious consideration before borrowers commit to the application process. Patient nurture sequences that maintain contact through the search period convert substantially more leads than aggressive early closing attempts.

Pull-through rates from application to funded loan average 65-75% for purchase transactions. This is lower than refinance pull-through because purchase transactions depend on property factors outside the borrower’s control – appraisal issues, inspection problems, title complications, or seller-side delays all create attrition that doesn’t exist in refinance.

Overall lead-to-funded conversion for purchase leads typically runs 2-4% in well-operated programs. Given CPLs of $50-$150, this translates to customer acquisition costs of $1,250-$7,500 per funded loan. Originators making $3,000-$8,000 in revenue per closed loan can make this arithmetic work – but only with strong operational execution.

Understanding Refinance Lead Economics

What Drives Refinance Lead Demand

Refinance leads connect existing homeowners with originators who can restructure current mortgages. Unlike purchase, the decision to refinance is almost entirely rate-driven. Homeowners refinance when current market rates fall meaningfully below their existing mortgage rate – typically requiring at least 50-75 basis points of improvement to justify the closing costs, time, and hassle of the transaction.

This creates feast-or-famine economics that define the refinance lead market. When rates drop quickly, millions of homeowners become refinance candidates simultaneously. Every borrower with a rate above the new market level represents a potential transaction. Lead generation becomes a volume game – capture as much demand as possible during windows that may last months or years.

When rates rise or stabilize at elevated levels, refinance demand evaporates almost completely. Homeowners with 3% mortgages from 2021 won’t refinance into 6% rates regardless of how compelling the marketing. No amount of creative messaging, attractive landing pages, or aggressive follow-up can create demand that doesn’t exist mathematically.

The refinance market in late 2025 reflects this reality. Industry projections suggest refinance volume will grow 38% in 2025 versus 2024 as rates ease from their peaks – but this growth starts from a deeply depressed base. The refinance share of total originations reached 26% by late 2024, the highest since early 2022 but far below refinance-dominant periods when that share exceeded 60%.

The current refinance opportunity is bifurcated:

Recent-vintage borrowers present the primary opportunity. Homeowners who financed at 2022-2023 peak rates (7%+) now find savings as rates decline toward 6%. This pool is smaller than historical refinance booms but represents real demand with clear rate-in-the-money qualification.

Legacy low-rate borrowers remain locked. The massive pool of sub-4% mortgages from 2020-2021 won’t refinance until rates drop to at least 3.5% – a scenario not in any mainstream forecast for 2025-2026. These borrowers are effectively out of the refinance market for the foreseeable future.

Refinance Lead Pricing Dynamics

Refinance lead pricing exhibits volatility that doesn’t exist in purchase. During refinance booms, per-lead costs can actually collapse despite surging volume because supply outstrips originator capacity. Lenders can only process so many applications, creating a ceiling on demand that holds prices down even as consumer interest explodes.

During refinance droughts like the current environment, leads become scarce and expensive – but dramatically reduced buyer appetite for refinance leads limits pricing power. Originators won’t pay premium prices for leads they can’t convert to transactions because the rate math doesn’t work.

Current 2024-2025 refinance lead pricing reflects the transition environment:

| Lead Type | CPL Range | Market Context |

|---|---|---|

| Exclusive Refinance (Rate-in-the-money) | $75-$150 | Limited supply; verified rate savings candidates |

| Exclusive Refinance (General) | $40-$80 | Includes marginal candidates; higher return risk |

| Cash-out Refinance | $60-$120 | Purpose-driven; less rate-sensitive |

| Shared Refinance | $20-$50 | Declining with consent changes |

| Aged Refinance (30-180 days) | $5-$15 | Requires aggressive nurture |

The boom-versus-bust pricing dynamic historically shows even more dramatic swings:

| Rate Environment | Refinance Lead CPL | Volume Dynamics |

|---|---|---|

| Rates falling rapidly | $15-$50 | Volume surge; capacity constraints |

| Stable low rates | $30-$75 | Sustained activity; balanced market |

| Rates rising | $75-$200+ | Demand collapse; scarcity premium |

| Stable high rates | Minimal market | Economically unviable for most borrowers |

Refinance Lead Conversion Metrics

Refinance leads convert faster than purchase leads when rate savings are clear. The transaction involves no property search – just financial optimization. A borrower with a 7.5% mortgage seeing current rates at 6.5% understands the value proposition immediately.

Contact rates for refinance leads run 20-35%, slightly lower than purchase because many refinance inquiries come from casual rate-shopping rather than committed transaction intent. Consumers check rates periodically without serious intent to proceed, creating leads that don’t respond to originator outreach.

Application rates from contacts are higher than purchase – often 25-40% when clear rate savings exist – because the decision complexity is lower. No property selection, no coordination with sellers, no inspection contingencies. The borrower simply needs to verify the savings math and proceed.

Pull-through rates from application to funded loan average 75-85% for refinance, higher than purchase because fewer external variables can derail the transaction. The property already exists, title is already clear, and the borrower has demonstrated ability to pay through their existing mortgage history.

However, overall lead-to-funded conversion varies dramatically with rate environment. During refinance booms with genuine rate savings, conversion can reach 5-8%. During rate-challenging periods, conversion drops to 1-2% as most leads lack the rate differential to justify transaction costs.

The Rate Cycle: How Markets Transform

How Rate Movements Reshape the Lead Market

Understanding rate cycle mechanics is essential for mortgage lead operators because the same business can flip from highly profitable to deeply unprofitable within months based solely on Federal Reserve policy and bond market movements.

The relationship between purchase and refinance demand during rate cycles follows predictable patterns:

Falling rates create refinance surges while maintaining stable purchase activity. Refinance volume can increase 200-400% within quarters when rates drop significantly, as millions of homeowners suddenly find themselves “in the money” for rate improvement. Purchase activity typically increases modestly as improved affordability expands the buyer pool, but the effect is less dramatic.

Rising rates devastate refinance while constraining purchase. Refinance demand can collapse 70-90% as rate savings opportunities disappear. Purchase activity contracts but persists because life events continue regardless of financing costs. The contraction in purchase is real but manageable – operators lose volume, not their entire market.

Stable low rates create steady refinance activity from new mortgage originations (borrowers can often refinance within 1-2 years if rates remain favorable) and consistent purchase demand. This is the most predictable operating environment.

Stable high rates effectively eliminate refinance as a market segment while constraining purchase to committed life-event buyers. This is the current 2025 environment.

The 30-year fixed mortgage rate averaged 6.72% in 2024, ranging from a low of 6.08% in late September to a high of 7.22% in early May. For 2025, rates have ranged from approximately 6.35% to 7.04%, with late-year declines creating improved refinance conditions for recent-vintage borrowers but leaving the massive pool of 2020-2021 borrowers locked in.

Building for Both Seasons

Those who survive long-term in mortgage lead generation build operations that function across rate environments rather than optimizing for current conditions.

Product diversification spreads risk across purchase, refinance, and home equity products. Home equity leads proved resilient during 2023-2024 when traditional refinance collapsed. Homeowners with sub-4% first mortgages who needed cash couldn’t justify refinancing their entire loan at 7%, but second mortgages or home equity lines at 8-10% still provided value. LendingTree’s home equity revenue grew 38% year-over-year in Q2 2025, demonstrating this opportunity. Understanding rate sensitivity in mortgage lead generation helps operators anticipate these market shifts.

Geographic diversification protects against regional housing market weakness. Hot markets maintain purchase activity even in challenging rate environments, while oversupplied markets see dramatic pullbacks. Lead generators with national reach can shift emphasis toward resilient markets.

Buyer type diversification recognizes different rate sensitivities. First-time buyers often have less flexibility to wait for better rates – life circumstances force purchase decisions. Repeat buyers and investors can afford patience, delaying purchases until conditions improve. Channel mix adjustments can emphasize less rate-sensitive segments during challenging periods.

Fixed cost management treats rate cycles as a fundamental operating constraint. Lead generation operations that assume current volume levels persist inevitably face painful restructuring when cycles turn. Conservative approaches maintain flexible cost structures that scale up during boom periods without locking in obligations that become unsupportable during contractions.

Cash reserves of 6-12 months operating expenses provide runway through difficult periods. Rate cycle transitions can be sudden and prolonged. Operations that reinvest all profits during good times find themselves undercapitalized precisely when preservation matters most.

Targeting Strategies: Different Approaches for Different Products

Purchase Lead Acquisition Strategies

Effective purchase lead generation aligns with homebuyer journey touchpoints rather than rate-focused messaging.

Real estate platform integration captures consumers at the property search stage. Platforms like Zillow, Redfin, and Realtor.com aggregate buyers actively looking at properties – the strongest purchase intent signal available. Zillow’s Custom Quotes program offers rate table advertising and lead generation with per-lead costs typically ranging from $75-$150 depending on loan type and metro area.

Zillow’s trajectory illustrates this approach’s value. By Q2 2025, Zillow Home Loans purchase volume exceeded $1.1 billion – up from $759 million a year earlier. Third-party lenders face increasing competition from Zillow’s own lending operation, but the platform’s massive traffic makes it essential for many practitioners.

Content marketing for first-time buyers attracts consumers making their first purchase – often less rate-sensitive because they lack the option to wait. Educational content on down payment requirements, credit score impacts, and mortgage basics captures consumers early and establishes originator relationships before competitors.

Comparison platform positioning reaches consumers actively shopping rates. Bankrate generates approximately 4 million monthly mortgage page views. NerdWallet excels with first-time buyers through educational positioning. These platforms command premium pricing because consumers arrive with clear intent.

Relocation and life-event targeting identifies buyers whose circumstances require near-term purchase regardless of rate environment. Job changes, family growth, and moving-related queries indicate purchase intent that won’t wait for better rates.

Paid media strategy for purchase emphasizes intent signals over rate messaging. Keywords like “homes for sale in [location]” and “first-time buyer programs” capture purchase intent. Rate-focused keywords attract refinance shoppers instead.

Refinance Lead Acquisition Strategies

Effective refinance lead generation centers on rate savings messaging and qualification verification.

Rate-in-the-money targeting focuses advertising on consumers whose current mortgage rate exceeds current market rates by enough to justify transaction costs. This requires understanding the existing rate distribution across the market. Currently, the opportunity concentrates on 2022-2023 originations with rates at 7%+ while 2020-2021 originations with sub-4% rates remain locked out.

Savings calculator positioning provides tools that let consumers verify their specific savings opportunity. Calculators that input current balance, rate, and remaining term to output monthly and lifetime savings create qualified leads – consumers who understand the specific dollar benefit of refinancing.

Rate alert programs capture consumer intent now and trigger outreach when conditions improve. Consumers who can’t save today may become refinance candidates when rates drop further. Rate monitoring with automated alerts positions originators to capture demand the moment it becomes viable.

Cash-out refinance targeting reaches consumers with purpose-driven equity access needs. Unlike rate-and-term refinance, cash-out transactions may proceed even without rate savings if the borrower needs funds. Home improvement, debt consolidation, and major purchase messaging reaches borrowers who’ll refinance regardless of rate differential.

Paid media strategy for refinance emphasizes rate savings explicitly. Keywords like “refinance rates,” “lower mortgage payment,” “refinance calculator,” and “current mortgage rates” capture consumers actively evaluating refinance. The difference from purchase strategy is fundamental: refinance consumers respond to rate messaging, purchase consumers respond to homebuying messaging.

Home Equity: The 2025 Opportunity

Home equity leads have emerged as the standout performer in elevated rate environments, warranting dedicated strategy attention.

The logic is straightforward: homeowners with sub-4% first mortgages who need cash won’t refinance their entire loan at 6%+. But second mortgages or home equity lines at 8-10% still provide value for specific use cases. The higher rate on the second mortgage applies only to the incremental borrowing, not the entire mortgage balance – making the arithmetic work when full refinance doesn’t.

LendingTree’s home equity revenue of $30.3 million in Q2 2025 grew 38% year-over-year, demonstrating sustained demand even in challenging rate environments.

Purpose-driven targeting works well for home equity because borrowers typically have specific use cases. Home improvement leads, debt consolidation messaging, and major expense financing (tuition, medical, vehicles) capture consumers with defined needs that justify the borrowing cost.

Equity verification matters more for home equity than other products. Properties purchased before 2020 often have substantial equity from appreciation; recent purchases may not have enough equity to qualify. Lead qualification that estimates equity position based on purchase date and location helps filter for viable candidates.

Different buyer profiles characterize the home equity market. Credit unions and community banks are particularly active home equity buyers alongside traditional mortgage lenders. Building buyer relationships in this segment may require different contacts than purchase/refinance relationships.

Response Time and Nurturing: Different Requirements

Speed-to-Contact: Universal but Different

Response time matters critically for both purchase and refinance leads, but the competitive dynamics differ.

Research consistently demonstrates extreme time sensitivity in mortgage lead response. Our guide on the five-minute rule for response time covers the full research:

- Leads contacted within one minute convert at 391% higher rates

- 78% of customers purchase from the first company that responds to their inquiry

- Leads contacted within five minutes show 100x better outcomes than those contacted after 30 minutes

- If response time drops from one minute to ten minutes, qualification odds decline by 80%

For refinance leads, speed matters because consumers are often rate-shopping across multiple sources simultaneously. A consumer submitting a rate request on LendingTree typically receives distribution to multiple lenders (within consent constraints). The first responder establishes the relationship, answers rate questions, and positions for application. Late responders face a prospect already engaged with a competitor.

For purchase leads, speed matters because borrowers in property search mode have limited windows of attention. They may be viewing houses, working with real estate agents, and juggling multiple priorities. Reaching them quickly while mortgage financing is top-of-mind dramatically improves engagement odds.

Technology requirements for speed apply equally to both product types:

Real-time lead delivery routes new submissions immediately to available sales team members through SMS alerts, phone system integration, or CRM push notifications.

Auto-dialer integration initiates outbound calls within seconds of lead receipt, eliminating the 30-60 seconds of manual dialing latency that compounds across volume.

Automated response sequences provide immediate engagement when human agents aren’t instantly available – text messages confirming receipt, emails with relevant rate or product information.

Round-robin routing ensures someone always receives the lead immediately, with backup rules escalating when primary recipients don’t respond within 2-3 minutes.

Mobile alerts keep originators connected during non-desk hours. Leads submitted at 6:30 PM shouldn’t wait until 9 AM the next morning.

Nurturing: Different Cycles, Different Content

While speed-to-contact applies universally, nurture strategy differs substantially between purchase and refinance.

Purchase lead nurturing must accommodate 4-6 month consideration cycles. The consumer who submits an inquiry today may not be ready to apply until they’ve found a property, which could take months. Effective purchase nurture sequences provide ongoing value throughout the property search:

- Market condition updates for target locations

- New listing alerts (in partnership with real estate platforms)

- Pre-approval timeline expectations

- Down payment and closing cost educational content

- Credit score improvement guidance for borderline borrowers

- Interest rate environment updates (not rate-focused, but context)

Multi-channel deployment matters for purchase nurture. Email drip campaigns maintain regular contact without overwhelming. Text messaging provides brief, high-engagement touchpoints. Direct mail achieves 5-9% response rates compared to email’s 1% – making it valuable for high-value purchase leads worth the additional cost.

Refinance lead nurturing operates on shorter cycles when rate savings are clear, but longer cycles when rate improvement requires waiting. Nurture content emphasizes:

- Rate monitoring and alerts when conditions improve

- Savings calculations specific to lead’s situation

- Refinance process education (documentation requirements, timeline)

- Cash-out opportunity messaging for leads initially seeking rate-only

- Urgency messaging when rate windows appear to be closing

The 80% of mortgage leads requiring nurturing before making a decision applies to both product types, but the nurture content and timeline differ substantially based on whether the underlying motivation is life-event (purchase) or rate-arbitrage (refinance).

Buyer Relationships: Different Originator Profiles

Who Buys Each Product Type

Purchase lead buyers include regional and community lenders who excel at relationship-based transactions, real estate-adjacent operations (builder-affiliated, brokerage mortgage arms), and portfolio lenders seeking long-term servicing relationships. When building these relationships, emphasize geographic targeting precision, life-event intent signals, and property search stage indicators.

Refinance lead buyers typically operate at larger scale with call center capacity and automated systems optimized for volume processing. Direct-to-consumer lenders like Rocket Mortgage, aggregator correspondents, and rate comparison platforms maintain standing demand. Emphasize rate-in-the-money qualification, delivery speed, and volume consistency during rate windows.

Key differences in buyer dynamics:

- Capacity: Purchase buyers absorb consistent volume year-round; refinance buyers have dramatic swings – enormous appetite during rate drops, near-zero demand during rate rises

- Returns: Purchase returns often stem from long decision cycles; refinance returns tie to rate qualification that may change between submission and processing

- Relationship focus: Don’t pitch refinance to purchase-focused community lenders; don’t expect purchase volume consistency from refinance-focused call centers

Regulatory Considerations: Product-Specific Compliance

RESPA Implications

The Real Estate Settlement Procedures Act applies to both purchase and refinance, but practical implications differ. Our dedicated guide on RESPA compliance for mortgage lead generation covers the full regulatory framework.

Marketing Services Agreements receive particular scrutiny in purchase contexts where referral relationships with real estate agents are common. RESPA Section 8’s prohibition on giving or receiving anything of value for referral of settlement service business creates compliance complexity for lead generation arrangements involving real estate professionals.

In October 2020, the CFPB rescinded its 2015 compliance bulletin that had effectively discouraged MSAs, issuing new guidance that MSAs can be lawful if properly structured. However, the Bureau emphasized that rescinding the bulletin did not mean MSAs are “per se or presumptively legal.” Each arrangement remains subject to scrutiny.

For lead generators, the safest approach generates leads through direct consumer marketing – paid advertising, content marketing, comparison platforms – rather than arrangements with entities who have pre-existing consumer relationships.

Refinance-specific RESPA concerns arise less frequently because refinance typically doesn’t involve real estate agents or title-connected referral relationships. The transaction involves existing property rather than property transfer. However, arrangements with mortgage brokers, financial advisors, or other entities who might steer refinance business still require RESPA analysis.

State Licensing Verification

The Nationwide Multistate Licensing System (NMLS) requirements affect both product types equally, but operational implications differ.

Geographic filtering is essential for purchase leads because borrowers seek homes in specific locations. A lead for a buyer seeking property in California cannot go to an originator licensed only in Texas. Purchase lead routing systems must validate buyer licensing against the property search location – which may differ from the consumer’s current residence.

Refinance geographic matching is simpler because the property location is already established. The lead routing need only match the existing property location against buyer licensing.

License verification before selling applies to both products. Before selling leads to any buyer, verify their licensing status through NMLS Consumer Access. Document verification in buyer onboarding files and periodically re-verify to catch license lapses.

Consent Documentation

Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, industry practice has shifted toward stricter consent standards for both purchase and refinance lead distribution.

Historical refinance distribution often involved selling the same consumer inquiry to multiple lenders simultaneously – the “shared lead” model. Rate-shopping consumers understood they were requesting multiple quotes. Many sophisticated buyers now require explicit one-to-one consent regardless of regulatory minimums.

Historical purchase distribution also used shared models but with somewhat more exclusive positioning because purchase transactions involve longer relationships. Buyer requirements have similarly evolved toward explicit per-lender consent.

Exclusive lead models have become the compliant default for both products, with pricing adjusting accordingly. Lead generators who built on shared distribution have pivoted to exclusive models or comparison shopping frameworks that obtain per-lender consent transparently. For practitioners weighing the trade-offs, our guide on exclusive vs shared leads provides the complete analysis.

Building Sustainable Operations Across Products

Portfolio Strategy

The most resilient mortgage lead operations maintain presence across both purchase and refinance products plus home equity, adjusting emphasis based on market conditions.

Current environment positioning (late 2025) should emphasize:

- Purchase leads: Core focus, consistent demand, stable pricing

- Home equity: Growing segment, rate-resistant, strong margins

- Refinance: Opportunistic focus on recent-vintage borrowers (2022-2023 originations)

If rates drop significantly (to 5.5% or below), be prepared to:

- Surge refinance capacity, as demand will explode

- Maintain purchase operations (don’t neglect stable business for surge opportunity)

- Adjust pricing as refinance CPLs likely compress despite volume

- Add buyer relationships to absorb increased volume

If rates rise (to 7.5% or above):

- Contract refinance operations to minimize fixed costs

- Double down on purchase and home equity

- Emphasize life-event targeting that drives demand regardless of rates

- Preserve cash for the eventual cycle turn

Technology and Team Requirements

Both product types require similar technology infrastructure with product-specific adaptations:

- Lead capture should identify product type early in form flow – rate comparison indicates refinance, property-focused indicates purchase, home improvement signals home equity

- Lead routing must accommodate different buyer sets by product

- Quality scoring differs: purchase indicators include property search stage and timeline; refinance indicators include current rate differential and LTV

- Reporting should segment by product type – blended metrics obscure performance

Staff requirements differ by focus:

- Refinance operations emphasize speed and volume with high-velocity call centers and automated systems

- Purchase operations emphasize patience with sustained nurture capability and staff comfortable with multi-month cycles

- Hybrid operations need product-specialized teams since aggressive refinance tactics may alienate first-time homebuyers needing patient education

Frequently Asked Questions

What is the fundamental difference between purchase and refinance leads?

Purchase leads connect homebuyers with mortgage originators to finance home purchases. The demand driver is life events – marriage, family growth, job changes, relocations – that occur regardless of interest rate levels. Refinance leads connect existing homeowners with originators to restructure current mortgages, typically to reduce monthly payments through lower rates. Refinance demand is almost entirely rate-driven: when market rates fall below existing mortgage rates by 50-75+ basis points, refinance becomes viable; when they don’t, demand evaporates. This fundamental difference in demand drivers creates completely different economics, pricing patterns, and operational requirements.

How do CPL benchmarks differ between purchase and refinance leads in 2024-2025?

Purchase leads maintain relatively stable pricing across rate environments. Exclusive purchase leads typically command $50-$200 depending on geography, with premium markets (California coastal, New York, South Florida) at the high end and lower-value markets proportionally lower. Refinance lead pricing exhibits dramatic volatility tied to rate cycles. In the current elevated-rate environment (late 2025), exclusive refinance leads for rate-in-the-money borrowers command $75-$150, while general refinance leads trade at $40-$80 with higher return risk. During refinance booms, CPLs can collapse to $15-$50 despite surging volume. During rate-unfavorable periods, scarcity pushes prices up but buyer demand limits pricing power.

Why do refinance leads show more volatile conversion rates than purchase leads?

Refinance conversion depends almost entirely on whether the borrower’s current rate exceeds market rates by enough to justify transaction costs. When clear savings exist, refinance leads can convert at 5-8% because the value proposition is immediately obvious and the transaction involves no property selection complexity. When rate savings are marginal or non-existent, conversion drops to 1-2% regardless of sales execution quality. Purchase conversion runs more consistently at 2-4% because the underlying decision is driven by life circumstances rather than rate arithmetic. The borrower will eventually transact – the question is whether your originator relationship survives the consideration period.

How should lead generators adjust operations when interest rates change?

When rates drop significantly, prepare for refinance volume surges by scaling delivery infrastructure, adding buyer relationships, and staffing for increased volume. Refinance leads will flood the market, but so will demand from originators seeking volume. Maintain purchase operations rather than abandoning them for surge opportunity. When rates rise, contract refinance operations to minimize fixed costs, double down on purchase and home equity products that remain viable, and preserve cash for the eventual cycle turn. Those who fail are those who build purely for current conditions and assume they’ll persist.

What targeting strategies work best for purchase leads versus refinance leads?

Purchase lead acquisition aligns with homebuyer journey touchpoints. Real estate platform integration (Zillow, Redfin, Realtor.com) captures consumers at property search stage. First-time buyer content attracts less rate-sensitive segments. Rate comparison positioning reaches consumers with clear purchase intent who are shopping financing. Relocation and life-event targeting identifies buyers whose circumstances require near-term purchase. Refinance lead acquisition centers on rate savings messaging. Rate-in-the-money targeting focuses on consumers whose current rates exceed market rates. Savings calculators create qualified leads who understand specific dollar benefits. Rate alert programs capture future demand. Cash-out messaging reaches purpose-driven borrowers less dependent on rate savings.

How does the FCC’s one-to-one consent rule affect purchase versus refinance lead distribution differently?

The rule implemented January 2025 affects both product types by constraining traditional shared lead models where multiple lenders received identical consumer inquiries. Historically, shared distribution was somewhat more common for refinance because rate-shopping consumers explicitly sought multiple quotes. Purchase leads also used shared models but with more exclusive positioning given longer relationship cycles. Both product types have seen compression in compliant shared inventory, with exclusive leads becoming the default and commanding premiums accordingly. Lead generators in both segments have pivoted to exclusive models or transparent comparison shopping frameworks that obtain per-lender consent.

What response time benchmarks apply to each product type?

Speed-to-contact is critical for both products, with research showing leads contacted within one minute convert at 391% higher rates, and leads reached within five minutes showing 100x better outcomes than 30-minute contacts. The competitive dynamics differ slightly. For refinance, consumers are often actively rate-shopping across multiple sources, making first-responder advantage acute. For purchase, consumers in property search mode have limited attention windows and may lose focus if not engaged quickly. Both products require sub-minute notification systems, auto-dialer integration, and extended coverage hours.

How should lead nurturing differ between purchase and refinance programs?

Purchase leads require longer nurturing cycles – often 4-6 months – matching the property search timeline. Effective purchase nurture provides ongoing value through market updates, listing alerts, pre-approval guidance, and educational content about homebuying. Multi-channel deployment (email, text, direct mail) maintains engagement through extended consideration periods. Refinance nurturing operates on shorter cycles when rate savings are clear but extends when waiting for rate improvement. Content emphasizes rate monitoring, savings calculations specific to the lead’s situation, and refinance process education. Urgency messaging works when rate windows appear to be closing. Both product types see approximately 80% of leads requiring nurturing before decision.

What buyer relationship strategies work for each product type?

Purchase lead buyers often include regional lenders, community banks, credit unions, and real estate-adjacent mortgage operations that prioritize relationship-based transactions. Build these relationships emphasizing geographic precision, life-event intent signals, and property search stage indicators. Refinance lead buyers typically operate at larger scale with call center capacity and automated systems optimized for volume processing. Direct-to-consumer lenders, aggregator correspondents, and rate comparison platform operators maintain standing demand for refinance leads. Emphasize rate-in-the-money qualification, speed of delivery, and volume consistency during rate windows. Managing both simultaneously requires recognizing that capacity dynamics, return patterns, and relationship maintenance differ substantially by product focus.

How do home equity leads fit into the purchase-versus-refinance framework?

Home equity leads have emerged as a distinct category performing well in elevated rate environments. The logic: homeowners with sub-4% first mortgages who need cash won’t refinance their entire loan at 6%+, but second mortgages or HELOCs at 8-10% provide value for specific use cases since the higher rate applies only to incremental borrowing. Home equity demand is purpose-driven (home improvement, debt consolidation, major expenses) rather than rate-driven like refinance or life-event-driven like purchase. This creates rate-resistant demand that persists when traditional refinance collapses. LendingTree’s home equity revenue grew 38% year-over-year in Q2 2025 demonstrating this opportunity. Smart practitioners include home equity in their product portfolio as a hedge against rate cycle volatility.

Key Takeaways

-

Purchase and refinance leads operate on fundamentally different economics. Purchase demand comes from life events (marriage, children, job changes) that occur regardless of rate environment. Refinance demand depends almost entirely on rate savings math – when market rates exceed current mortgage rates by 50-75+ basis points. Treating them as interchangeable destroys operations when cycles turn.

-

CPL benchmarks differ by product and environment. Exclusive purchase leads run $50-$200 with geographic variation but relative stability across rate cycles. Refinance leads swing from $15-$50 during booms to $75-$200 during droughts. Current 2025 conditions show purchase stable, refinance constrained to recent-vintage borrowers, and home equity outperforming.

-

Conversion metrics reveal product character. Purchase leads convert at 2-4% over 4-6 month cycles driven by property search timeline. Refinance leads convert at 1-8% depending entirely on whether rate savings math works – fast conversion when savings are clear, minimal conversion when they’re not.

-

Rate cycle management determines survival. Those who build for both seasons – maintaining purchase, refinance, and home equity capabilities even when current conditions favor one segment – survive rate transitions. Those who optimize purely for current conditions face existential risk when cycles turn.

-

Targeting strategies must differ by product. Purchase lead acquisition aligns with homebuyer journey touchpoints (real estate platforms, first-time buyer content, life-event targeting). Refinance acquisition centers on rate savings messaging (rate comparison, savings calculators, rate alerts). Using refinance tactics for purchase or vice versa underperforms significantly.

-

Speed-to-contact is universally critical. Both products see dramatic conversion improvement from sub-five-minute response – leads contacted within one minute convert at 391% higher rates. Technology infrastructure for immediate response is table stakes for both.

-

Nurturing requirements differ by product cycle. Purchase leads need 4-6 months of sustained engagement matching property search timelines. Refinance leads need rate-focused nurture with faster activation when savings become clear. The 80% of leads requiring nurturing applies to both, but content and timeline differ substantially.

-

Buyer relationships require product-specific approaches. Purchase buyers include regional lenders, community banks, and real estate-adjacent operations. Refinance buyers typically operate at larger scale with call center infrastructure. Building sustainable buyer networks requires understanding these different profiles and requirements.

-

Regulatory considerations apply to both but differ in practice. RESPA scrutiny intensifies for purchase leads involving real estate referral relationships. Consent rule compliance affects both but historically hit shared refinance distribution models harder. State licensing verification matters for both with geographic filtering essential for purchase leads seeking specific property locations.

-

Home equity fills the gap in elevated rate environments. When traditional refinance economics break down, home equity captures borrowers who need cash but won’t refinance low-rate first mortgages. Smart practitioners treat home equity as a distinct product category, not a refinance subset.

Market data and benchmarks current as of December 2025. Mortgage rates, lead pricing, and market conditions change continuously based on Federal Reserve policy, bond market movements, and housing market dynamics. Validate current conditions through industry sources before making significant investment decisions. This article provides general information for educational purposes and does not constitute legal, financial, or investment advice. Consult qualified professionals for specific compliance questions or business decisions.