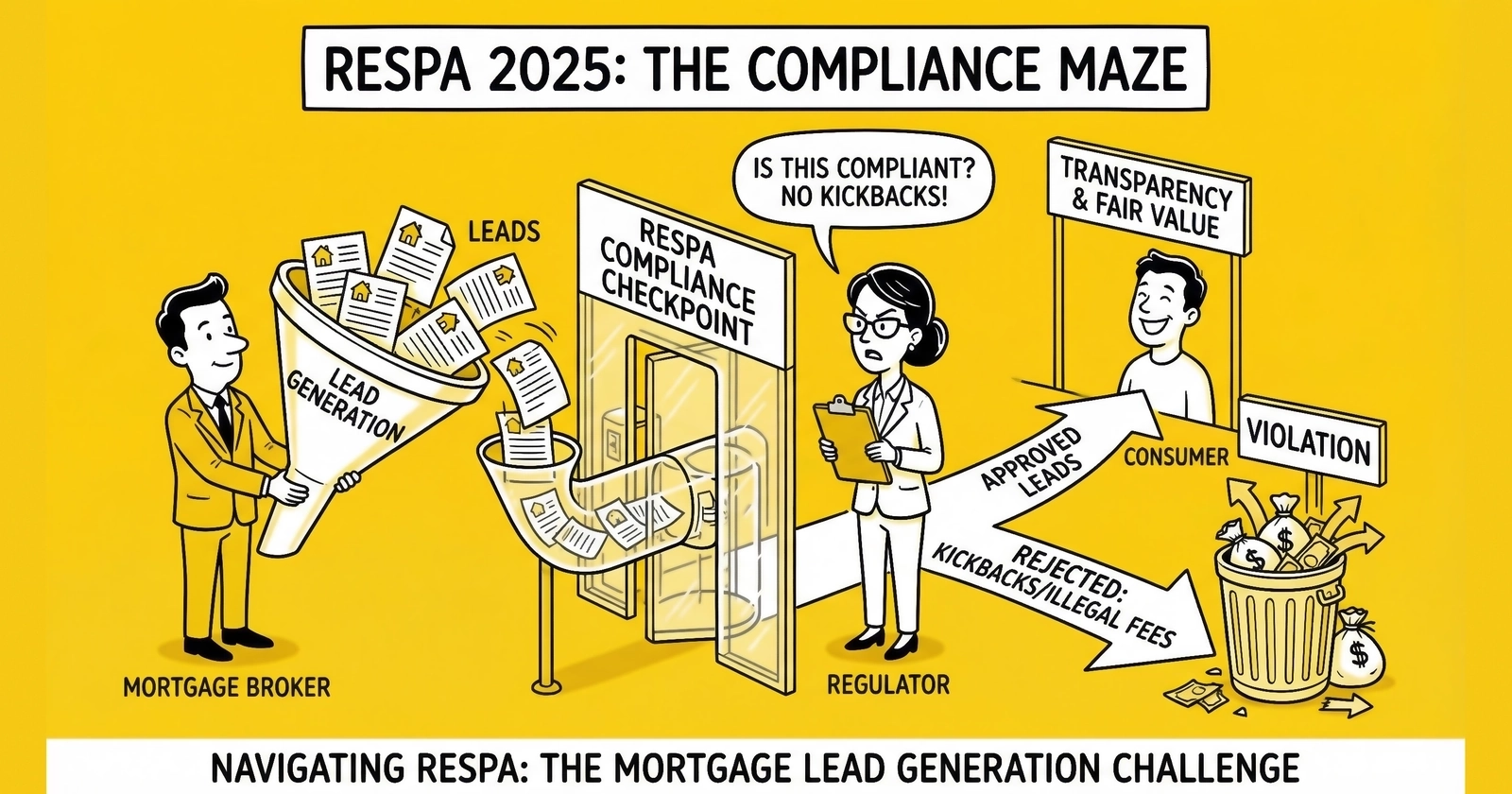

The Real Estate Settlement Procedures Act shapes every aspect of mortgage lead generation. Understanding RESPA Section 8 prohibitions, marketing services agreement requirements, and affiliated business arrangement rules separates compliant operators from those facing seven-figure penalties. This comprehensive guide covers everything mortgage lead generators need to know about RESPA compliance in 2026.

Understanding RESPA and Its Impact on Lead Generation

The Real Estate Settlement Procedures Act, enacted in 1974 and now enforced by the Consumer Financial Protection Bureau, regulates referral relationships in real estate transactions. For mortgage lead generators, Section 8 creates the primary compliance framework governing how leads can be sold, purchased, and referred.

RESPA Section 8 prohibits giving or accepting “any fee, kickback, or thing of value” for referrals of settlement service business. This seemingly straightforward prohibition creates complex compliance requirements for mortgage lead generation operations.

Why RESPA Matters for Lead Generators

The mortgage lead industry operates in a gray zone that RESPA never anticipated. When Congress passed RESPA in 1974, digital lead generation did not exist. The law targeted traditional referral fee arrangements between real estate agents, mortgage brokers, and title companies.

Modern lead generation creates new questions that regulators continue to wrestle with. Is selling a lead a referral? Does paying for advertising constitute a kickback? When does a marketing services agreement cross into prohibited territory? These questions become particularly acute in mortgage lead distribution where significant money changes hands.

The CFPB has provided guidance through enforcement actions, consent orders, and compliance bulletins. These actions establish the boundaries that compliant operators must respect, though significant ambiguity remains in how digital lead generation fits within a regulatory framework designed for a pre-internet world.

The Stakes of Non-Compliance

RESPA violations carry severe penalties that can devastate a lead generation business. Civil penalties reach up to $11,176 per violation, adjusted annually for inflation. Criminal penalties include fines up to $10,000 and potential imprisonment for up to one year. Private litigation exposes violators to treble damages, meaning courts can award plaintiffs three times their actual damages. When violations occur systematically across thousands of transactions, class action exposure can quickly reach catastrophic levels.

Recent enforcement demonstrates the CFPB’s aggressive stance. The Bureau has pursued actions against mortgage companies, real estate brokerages, and lead generation companies for various RESPA violations. No corner of the industry enjoys immunity from regulatory scrutiny.

Section 8 Prohibitions Explained

Section 8 contains two primary prohibitions that affect mortgage lead generation, each creating distinct compliance obligations.

Section 8(a): Kickbacks and Referral Fees

Section 8(a) prohibits giving or receiving “any fee, kickback, or thing of value pursuant to any agreement or understanding” that business will be referred. This prohibition sweeps broadly, covering direct referral fees for mortgage applications, payments disguised as marketing fees without corresponding services, gifts and entertainment given to influence referrals, and split fees where services are not actually rendered.

The key question for lead generators is whether selling a lead constitutes a referral. The answer depends on the relationship between parties and what the payment actually covers. When a lead generator sells consumer information to a lender without any understanding about where specific business should go, the transaction looks more like selling a service than making a referral. When payments correlate with closed loans or vary based on which lender receives the lead, the arrangement starts resembling a prohibited kickback.

Section 8(b): Unearned Fees

Section 8(b) prohibits accepting “any portion, split, or percentage of any charge made or received” for settlement services unless services are actually performed. This prohibition targets fee splits without corresponding work, payments for services never rendered, and arrangements where one party receives compensation without providing value.

For lead generators, this means any fees charged must correspond to actual services provided. Simply marking up leads without adding value could trigger Section 8(b) concerns. If you acquire a lead for $20 and sell it for $50, you need to document what services justified that $30 markup. Data validation, verification calls, real-time delivery technology, and quality scoring all represent legitimate value-added services that support higher pricing.

Safe Harbors and Exemptions

RESPA provides several safe harbors that protect legitimate business arrangements when properly structured.

Payments for goods or facilities actually furnished enjoy protection. Lead generators can receive compensation for actual services provided, including lead generation and marketing services, technology platforms and software, data validation and verification services, and customer service and support functions. The key is documenting that real services justify the compensation.

Employer-employee relationships receive different treatment. Payments to employees for referrals do not violate Section 8, provided the employee is a bona fide employee rather than an independent contractor. This distinction matters when structuring sales compensation in lead generation companies.

Affiliated business arrangements with required disclosures enjoy safe harbor protection when structured correctly. The arrangement must include written disclosure to consumers, a clear statement that consumers are not required to use the affiliated provider, and compensation limited to return on ownership interest rather than referral fees.

Cooperative brokerage and referral arrangements between licensed real estate agents are exempt under certain conditions, though this safe harbor rarely applies to lead generation companies directly.

Marketing Services Agreements Under Scrutiny

Marketing Services Agreements have become a focal point for CFPB enforcement. These arrangements, where one party pays another for marketing services, can mask prohibited referral fees when not properly structured and documented.

The 2015 CFPB Compliance Bulletin

The CFPB’s 2015 Compliance Bulletin on Marketing Services Agreements established that the Bureau would scrutinize these arrangements closely. The bulletin identified common characteristics of problematic MSAs that signal regulatory concern.

Payments that vary based on referral volume rather than actual marketing services rendered suggest the arrangement compensates for referrals, not marketing. Agreements that provide little or no actual marketing value while moving significant money between parties raise immediate red flags. Arrangements where the primary purpose appears to be lead generation rather than marketing stretch the concept of “marketing services” beyond defensible bounds. Payments that exceed fair market value for services provided suggest the excess compensates for something else, likely referrals.

Structuring Compliant Marketing Agreements

Legitimate marketing services agreements require careful attention to structure and documentation.

The agreement must specify actual marketing services to be performed, and these services must be distinguishable from mere referrals. Brand advertising and promotional materials represent legitimate marketing. Event sponsorships with documented attendance qualify when the sponsoring party receives real marketing value. Content creation and distribution, market research and analysis, and similar activities all constitute services that can justify compensation.

Compensation must reflect fair market value for services rendered, not referral value. This requires third-party valuations or market comparisons demonstrating that similar services command similar prices in arms-length transactions. Document how rates were determined and conduct periodic reviews to ensure pricing remains aligned with market rates. Compare what you pay marketing partners to what you pay non-referring parties for similar services. If you pay $5,000 monthly to a real estate agent for marketing services but only $1,500 to a non-affiliated marketing firm for comparable work, that disparity suggests you are paying for referrals disguised as marketing.

Compliant arrangements track actual performance of marketing services independently from referral activity. Monitor advertising impressions and reach, event attendance and engagement, content distribution metrics, and other indicators of marketing value delivered. Track lead sources separately from MSA activities to demonstrate that marketing payments do not correlate with referral volume.

The most critical element of compliant marketing agreements is independence from referrals. Payments cannot correlate with referral volume. If marketing payments increase when referrals increase, the arrangement likely violates RESPA regardless of what the contract says. The Bureau looks at economic reality, not paperwork.

Affiliated Business Arrangements

Affiliated Business Arrangements represent another area where mortgage lead generators must exercise caution. These arrangements involve ownership relationships between settlement service providers and create both opportunities and compliance risks.

AfBA Requirements

To qualify for the AfBA safe harbor, arrangements must meet three requirements without exception.

Consumers must receive written disclosure of the affiliated relationship at or before the time of referral. The disclosure must describe the nature of the relationship in terms consumers can understand, provide estimated charges for the affiliated provider’s services, and include a statement that the consumer is not required to use the affiliated provider. Timing matters critically. A disclosure delivered after the consumer has already committed accomplishes nothing.

Consumers cannot be required to use the affiliated provider as a condition of the transaction. This prohibition extends beyond direct requirements to include conditioning favorable treatment on use of affiliates and tying arrangements that pressure consumers toward affiliated services. Even subtle pressure can destroy safe harbor protection.

Payments for referrals must be limited to return on ownership interest. Shareholders can receive dividends based on their ownership percentage, and those dividends can reflect actual business performance. But no additional payments tied to referral volume are permissible. If a 10% owner receives $100,000 in dividends while another 10% owner who made more referrals receives $150,000, the extra $50,000 represents a prohibited referral fee.

Common AfBA Mistakes

Lead generators involved in affiliated business arrangements frequently make errors that eliminate safe harbor protection.

Inadequate disclosures leave arrangements unprotected even when the underlying business structure complies. Common deficiencies include missing or incomplete information, disclosures provided too late in the process, and failure to update disclosures when relationships change. An outdated disclosure describing last year’s ownership structure does not protect current transactions.

Disguised referral fees destroy AfBA protection regardless of nomenclature. Payments labeled as management fees, consulting fees, or technology fees that actually compensate for referrals violate RESPA. The Bureau examines economic substance, not creative labeling.

Coercive practices eliminate safe harbor protection even when disclosures are perfect. Training must ensure employees understand that consumers have genuine choices, and monitoring must verify that subtle pressure does not emerge in practice. Recording and reviewing consumer interactions can reveal coercive patterns that policy alone cannot prevent.

CFPB Enforcement Trends 2024-2026

The CFPB continues aggressive RESPA enforcement with particular attention to digital business models. Recent actions provide guidance on current priorities and risk areas that prudent practitioners should monitor closely.

Recent Enforcement Actions

The Bureau has pursued actions against various industry participants, establishing precedents that inform compliance requirements.

Mortgage lenders have faced enforcement for kickback arrangements with real estate agents, title companies, and lead generators. Penalties have ranged from hundreds of thousands to millions of dollars, with consent orders requiring extensive remediation and ongoing monitoring.

Real estate brokerages have faced actions for receiving prohibited payments from lenders and title companies in exchange for referrals. These cases often involve marketing services agreements that the Bureau determined provided little actual marketing value.

Title companies have faced enforcement for paying kickbacks to real estate agents and mortgage brokers, demonstrating that enforcement extends throughout the settlement services ecosystem.

Enforcement Priorities

Current CFPB priorities signal where operators face elevated risk.

Digital lead generation has attracted increased scrutiny as the Bureau works to apply RESPA to business models that did not exist when the law was written. Arrangements where payments may correlate with referral volume receive particular attention, and the Bureau has signaled that it will not treat digital transactions differently than traditional referral arrangements simply because they occur online.

Marketing services agreements remain a focal point as the Bureau continues finding arrangements that provide little actual marketing value while compensating for referrals. Operators should assume that any MSA will face skeptical examination.

Affiliated business arrangements receive ongoing examination for compliance with disclosure and anti-tying requirements. The Bureau has found violations in arrangements that appeared facially compliant but failed in implementation.

Data and technology arrangements represent an emerging priority as the Bureau reviews structures that may facilitate or disguise prohibited payments. Platform fees, data licensing arrangements, and technology sharing agreements all warrant careful compliance analysis.

Building a Compliant Mortgage Lead Program

Creating a RESPA-compliant mortgage lead generation program requires systematic attention to legal requirements and operational controls from initial design through ongoing operations.

Lead Generation Structure

The structure of your lead generation program determines RESPA exposure and available compliance strategies.

Direct consumer acquisition presents minimal RESPA risk when executed properly. Lead generators who acquire leads directly from consumers through advertising and then sell those leads face limited RESPA concerns, provided they are not receiving payments from settlement service providers for referrals. The transaction looks like what it is: selling consumer information that the generator acquired through legitimate marketing.

Selling leads to mortgage lenders requires careful structuring to maintain this straightforward characterization. Price leads based on objective criteria unrelated to conversion, such as geographic location, credit indicators, or loan type. Document the value provided through lead generation services including marketing costs, verification procedures, and technology infrastructure. Real-time lead validation systems provide tangible value that justifies compensation. Avoid arrangements where prices adjust based on loan closings, and maintain arm’s length relationships with buyers that do not suggest referral arrangements.

Network arrangements where leads are referred to specific lenders require heightened compliance attention because they start resembling traditional referral relationships. Ensure consumers understand they are being referred and document fair market value for any payments. Avoid exclusive arrangements that pressure consumers toward particular providers, and monitor for signs of steering or coercion that could eliminate safe harbor protection.

Pricing and Payment Structures

How you price and receive payment for leads affects RESPA compliance in ways that warrant careful attention during business model design.

Per-lead pricing based on fixed prices for leads meeting specified criteria generally presents lower RESPA risk than performance-based pricing. When you charge $25 for a lead meeting certain criteria regardless of whether the loan closes, the payment looks like compensation for lead generation services rather than a referral fee.

Performance-based pricing that varies based on loan closings or funded amounts raises significant RESPA concerns. Such arrangements may be characterized as referral fees because compensation correlates with referral success. A $50 lead that becomes $100 if the loan closes looks like a $50 service fee plus a $50 referral bonus.

Revenue sharing arrangements where lead generators share in revenue from closed loans likely violate RESPA unless structured as legitimate ownership returns in properly constituted affiliated business arrangements. Even then, the safe harbor requirements must be met precisely.

Hybrid models combining fixed and variable pricing require careful analysis to ensure variable components do not create prohibited referral fee arrangements. When in doubt, obtain a legal opinion before implementing hybrid pricing structures.

Documentation Requirements

Comprehensive documentation supports RESPA compliance by demonstrating the legitimate business rationale for arrangements if regulators ask questions.

Written service agreements should specify exact services to be provided, compensation methodology and how rates were determined, independence from referral volume, and compliance obligations for both parties. Vague agreements invite regulatory skepticism.

Fair market value analysis documents how compensation was determined to be fair market value through market research and comparisons, third-party valuations where available, rationale for pricing decisions, and periodic reviews with updates. This documentation proves particularly important for marketing services agreements.

Performance records demonstrate actual services provided through lead generation activity logs, marketing campaign metrics, technology utilization records, and support service documentation. These records prove you delivered the services that justify your fees.

Compliance monitoring documentation shows ongoing attention to regulatory requirements through training records, audit results, issue identification and remediation actions, and policy updates. This documentation demonstrates a compliance culture rather than mere compliance paperwork.

Common RESPA Violations to Avoid

Understanding common violations helps operators steer clear of enforcement actions by recognizing problematic patterns before they create regulatory exposure.

Paying for Referrals Disguised as Marketing

The most common violation involves payments labeled as marketing fees that actually compensate for referrals. Warning signs include payments that increase with referral volume, marketing agreements with no meaningful services, fees that exceed fair market value for actual services, and arrangements with parties who control referral flow. If the math only works because you are paying for referrals, the marketing label provides no protection.

Accepting Payments for Unearned Fees

Lead generators who mark up leads without adding value risk Section 8(b) violations. Legitimate markups require actual services that add value, documentation of services provided, reasonable relationship between markup and services, and clear disclosure of the generator’s role in the transaction. The question is not whether you can make money, but whether you earn that money through legitimate services.

Steering and Tying Arrangements

Conditioning services on use of particular providers violates RESPA even when no money changes hands. Requiring consumers to use specified lenders, offering better terms for using affiliated providers, limiting choices to partners who pay referral fees, and creating artificial preferences through compensation all violate Section 8 regardless of how the arrangement is documented.

Inadequate Affiliated Business Disclosures

Affiliated arrangements without proper disclosures lose safe harbor protection completely. Missing disclosures, late disclosures, incomplete information, and failure to update for changes all eliminate the protection that proper AfBA structure would otherwise provide. The disclosure requirement is not a technicality; it is essential to the safe harbor.

Compliance Program Implementation

Effective compliance requires systematic program implementation that embeds RESPA requirements into operational processes.

Written Policies and Procedures

Comprehensive written policies should cover RESPA requirements and prohibitions in terms employees can understand, permitted and prohibited activities with specific examples, approval processes for new arrangements including required legal review, documentation requirements for ongoing operations, monitoring and testing procedures, and issue escalation and remediation protocols. Policies sitting in a drawer provide no protection. They must be implemented and enforced.

Training Programs

Regular training ensures understanding throughout the organization. Initial training for new employees should cover RESPA basics before they handle any mortgage lead activity. Annual refresher training maintains awareness over time. Updates when regulations or guidance change keep everyone current. Role-specific training for high-risk positions ensures those with greatest compliance exposure understand their obligations. Documentation of training completion demonstrates the compliance culture that regulators value.

Monitoring and Testing

Ongoing monitoring identifies issues before they become violations or enforcement actions. Regular review of marketing agreements catches arrangements that drift out of compliance over time. Audit of payments and compensation identifies correlations with referral volume that suggest prohibited arrangements. Testing of disclosure processes verifies that required information reaches consumers when required. Analysis of referral patterns reveals steering or concentration that warrants investigation. Prompt investigation of anomalies demonstrates the proactive compliance culture that mitigates enforcement risk.

Third-Party Due Diligence

Vendors and partners create RESPA exposure that extends beyond your direct operations. Review partner compliance programs before engagement to understand their approach to RESPA. Assess proposed arrangement structures for RESPA risk before signing agreements. Monitor partner activities for compliance indicators and red flags. Address issues promptly when they emerge, and document due diligence efforts to demonstrate reasonable compliance practices if questions arise later.

Working with Legal Counsel

RESPA compliance requires qualified legal guidance given the stakes involved and the complexity of applying a 1974 statute to modern digital business models.

When to Engage Counsel

Seek legal advice for new marketing or referral arrangements before implementation, not after problems emerge. Changes to existing programs that may affect RESPA analysis warrant fresh review. Regulatory inquiries or investigations require immediate legal engagement. Complex ownership structures involving affiliated businesses need careful legal structuring. Unusual compensation arrangements that depart from established patterns deserve legal evaluation before implementation.

Selecting RESPA Counsel

Choose attorneys with specific RESPA experience rather than generalist business lawyers. Look for background in mortgage industry regulation, CFPB enforcement experience defending similar companies, both transactional and compliance capabilities, and industry relationships that provide insight into regulatory trends. RESPA compliance is specialized work that generalists struggle to provide effectively.

Attorney-Client Privilege

Protect compliance communications to preserve the candid advice that effective compliance requires. Clearly label privileged communications and limit distribution to necessary parties. Avoid waiving privilege inadvertently through careless distribution or unnecessary disclosure. Understand the limits of privilege, particularly for documents that mix legal advice with business communications.

Future Regulatory Developments

The regulatory landscape continues to evolve as the CFPB works to apply RESPA to digital business models and Congress considers potential legislative updates.

Potential Rule Changes

The CFPB has authority to update RESPA regulations through rulemaking, and several areas may see clarification. Treatment of digital lead generation remains ambiguous, and the Bureau could provide clearer guidance on when lead sales constitute referrals. Marketing services agreement guidance could be updated based on enforcement experience. New safe harbors or prohibitions could address arrangements that current rules address poorly. Coordination with state regulators could produce more consistent enforcement approaches.

Industry Advocacy

Industry groups advocate for clearer guidance that allows legitimate business models to operate with greater certainty. Trade association engagement with the CFPB provides industry perspective on proposed rules. Comment letters on proposed rules shape final regulatory outcomes. Industry best practices development creates compliance standards that benefit compliant operators. Educational initiatives help smaller companies understand their obligations.

Technology Impacts

Emerging technology creates new compliance questions that existing guidance does not clearly address. Artificial intelligence in lead generation raises questions about how automated systems make referral decisions. Blockchain-based referral tracking could provide transparent audit trails but also create new compliance challenges. Automated compliance monitoring may help operators maintain compliance at scale. Digital disclosure delivery presents opportunities for more effective consumer information.

Technology Solutions for RESPA Compliance

Modern lead generation operations require robust technology infrastructure to maintain RESPA compliance at scale while operating efficiently.

Automated Compliance Monitoring Systems

Technology platforms can help identify potential violations before they become enforcement actions by continuously analyzing operations against compliance rules.

Payment correlation analysis through automated systems can detect when marketing payments correlate with referral volume, flagging arrangements for legal review before patterns become established. These systems track payment timing relative to referral activity, variance analysis between marketing activity and compensation, trend detection that might indicate problematic patterns, and anomaly alerts when relationships deviate from documented terms.

Documentation management through electronic systems maintains the documentation trail essential for defending arrangements. Service delivery tracking with timestamps, marketing activity logs with engagement metrics, fair market value analysis archives, and training completion records all become readily accessible for audits or investigations.

Real-time disclosure tracking through digital systems ensures affiliated business arrangement disclosures are delivered properly through automated disclosure delivery at the right point in the consumer journey, consumer acknowledgment tracking, version control for disclosure updates, and audit trail generation for regulatory examinations.

Lead Management Platform Considerations

When selecting or configuring lead management platforms, evaluate RESPA compliance features carefully.

Pricing structure flexibility matters because the platform should support pricing models that do not correlate with loan closings. Look for fixed per-lead pricing capabilities, quality-based pricing independent of conversion, clear separation between lead fees and any other arrangements, and audit trails for pricing decisions.

Data segregation capabilities help maintain the separation between lead activities and referral relationships that compliance requires. Separate reporting for marketing activities versus lead sources, clear attribution that does not link marketing payments to referral success, and independent tracking of services performed versus business referred all support compliance documentation.

Compliance reporting built into the platform should support documentation needs through marketing service performance reports, lead source analysis independent of downstream conversion, payment reconciliation with service delivery, and exception reporting for unusual patterns.

Integration with Consent Platforms

RESPA compliance intersects with other regulatory requirements including TCPA consent. Integrated platforms should maintain separate but coordinated compliance records, enable complete audit trail reconstruction, support both RESPA and TCPA documentation requirements, and facilitate comprehensive compliance reviews that address multiple regulatory frameworks simultaneously.

Practical Implementation Checklist

Implementing RESPA compliance requires systematic attention across multiple operational areas, from initial program design through ongoing operations.

Pre-Launch Compliance Review

Before launching any new lead generation arrangement, complete thorough compliance review.

Legal structure analysis should include review of the proposed arrangement with qualified RESPA counsel, documentation of the business rationale separate from referral value, fair market value establishment through objective analysis, and creation of comprehensive service agreements that specify compliance obligations.

Operational setup should configure systems to track service delivery, establish payment processes independent of referral volume, create disclosure delivery mechanisms for affiliated arrangements, and build monitoring and exception reporting capabilities.

Training and documentation should train all personnel on RESPA requirements, document training completion, establish escalation procedures for compliance questions, and create policy acknowledgment records that demonstrate organizational commitment.

Ongoing Compliance Monitoring

After launch, continuous monitoring ensures ongoing compliance through structured review cycles.

Monthly reviews should analyze payment patterns for correlation with referrals, review marketing service delivery against agreements, verify disclosure delivery for affiliated arrangements, and document any anomalies and remediation steps taken.

Quarterly assessments should conduct comprehensive arrangement reviews, update fair market value analyses, review partner compliance programs, and assess regulatory developments for potential impact on existing arrangements.

Annual audits should complete independent compliance review, examine all active arrangements against current guidance, update policies and procedures as needed, and refresh training programs with current content reflecting any regulatory changes.

Vendor and Partner Management

Third-party relationships create RESPA exposure requiring active management throughout the relationship lifecycle.

Due diligence before engaging partners should review their compliance programs and history, assess arrangement structures for RESPA risk, document due diligence efforts, and establish compliance expectations in written agreements.

Ongoing monitoring after engagement should track partner activities for compliance indicators, conduct periodic compliance reviews, address issues promptly when identified, and document monitoring activities.

Issue resolution when problems arise should investigate promptly and thoroughly, document findings and remediation actions, consider relationship termination for serious issues, and report issues to leadership and counsel as appropriate.

State-Level Considerations

While RESPA is federal law, state regulations may impose additional requirements on mortgage lead generation that operators must address.

State Licensing Requirements

Many states require licensing for various activities in the mortgage industry. Mortgage broker licensing may be required for certain referral activities that cross into brokering. Some states have implemented lead generator registration requirements. These requirements parallel the state-level mini-TCPA laws that add complexity to multi-state operations. Marketing company licensing exists in specific jurisdictions. Lead generators should review state requirements with qualified counsel before operating in any jurisdiction rather than assuming federal compliance suffices.

State Consumer Protection Laws

State unfair and deceptive practices laws may create additional exposure beyond RESPA. State attorneys general can pursue enforcement under state law for practices that may not violate RESPA but harm consumers. Private rights of action under state law can expose operators to litigation beyond federal remedies. Some states impose requirements that exceed federal RESPA provisions, and compliance with federal law does not immunize operators from state enforcement.

Multi-State Operations

Operating across multiple states requires state-by-state compliance assessment to understand varying requirements, licensing in required jurisdictions before operating there, policies that address the strictest applicable requirements across your footprint, and monitoring of state regulatory developments that may change compliance obligations.

Frequently Asked Questions

Is selling mortgage leads legal under RESPA?

Selling mortgage leads is legal when structured properly. The key is ensuring payments compensate for actual lead generation services rather than referrals. Fixed per-lead pricing based on objective criteria generally presents lower risk than conversion-based pricing. Document the services provided and ensure compensation reflects fair market value for those services, not the value of referrals to specific lenders.

What is the difference between a referral fee and paying for leads?

A referral fee compensates someone for directing business to a particular provider. Paying for leads compensates for the marketing and lead generation services that produced the consumer inquiry. The distinction matters because RESPA prohibits referral fees but permits payment for actual services. The structure of the arrangement, correlation with closed loans, and documentation of services provided determine which characterization applies.

How do I structure a marketing services agreement to comply with RESPA?

RESPA-compliant marketing services agreements require actual marketing services, fair market value compensation, no correlation between payments and referrals, and comprehensive documentation. Specify the services to be performed, document how pricing was determined, track actual performance of marketing activities, and ensure payments do not vary based on referral volume or loan closings.

What disclosures are required for affiliated business arrangements?

Affiliated business arrangements require written disclosure provided at or before the time of referral. The disclosure must describe the nature of the affiliation, provide estimated charges for the affiliated provider’s services, and clearly state that the consumer is not required to use the affiliated provider. Keep records of disclosure delivery and update disclosures when relationships change.

Can I pay real estate agents for mortgage leads?

Paying real estate agents for mortgage leads raises significant RESPA concerns. Such payments may be characterized as prohibited referral fees unless structured as legitimate marketing services with fair market value compensation unrelated to referral volume. The arrangement requires careful legal analysis, comprehensive documentation, and ongoing monitoring to ensure compliance.

What penalties apply to RESPA violations?

RESPA violations can result in civil penalties up to $11,176 per violation, criminal penalties including fines up to $10,000 and imprisonment up to one year, and treble damages in private litigation. Class action exposure can multiply damages across many transactions. The CFPB has authority to pursue enforcement actions including consent orders, restitution requirements, and injunctive relief.

How does the CFPB investigate RESPA violations?

The CFPB investigates through various means including consumer complaints, examinations of supervised entities, referrals from other agencies, and industry monitoring. Investigations typically involve document requests, interviews, and analysis of business practices. Cooperation and prompt remediation can influence enforcement outcomes, but violations found during investigation may result in formal enforcement actions.

What records should I maintain for RESPA compliance?

Maintain comprehensive records including service agreements, fair market value analyses, performance documentation, training records, and compliance monitoring results. Records should demonstrate the services provided, how compensation was determined, independence from referral volume, and ongoing compliance efforts. Retain records for at least three years after the transaction or arrangement ends.

Can I share revenue with mortgage partners based on closed loans?

Revenue sharing based on closed loans creates significant RESPA risk. Such arrangements may be characterized as prohibited referral fees because compensation correlates with referral success. Limited exceptions exist for legitimate ownership returns in affiliated business arrangements meeting all requirements. Consult legal counsel before implementing any revenue-sharing arrangement.

How do I evaluate whether a lead generation arrangement complies with RESPA?

Evaluate arrangements by examining the services actually provided, whether compensation reflects fair market value for those services, any correlation between payments and referrals or closings, disclosure practices, and documentation. Consider whether the arrangement would be characterized as paying for services or paying for referrals. When in doubt, obtain a legal opinion before proceeding.

Building a Compliance Culture

Sustainable RESPA compliance extends beyond policies and procedures to organizational culture that values compliance as integral to business success.

Leadership Commitment

Effective compliance starts at the top with executive sponsorship of compliance initiatives that signals organizational priority. Adequate resources for compliance functions enable effective programs. Clear accountability for compliance failures demonstrates that violations carry consequences. Recognition for compliance excellence reinforces desired behaviors throughout the organization.

Employee Engagement

Front-line employees must understand and embrace compliance for programs to succeed in practice. Regular communication about compliance importance keeps the topic visible. Clear channels for raising compliance concerns enable early identification of potential issues. Protection for good-faith compliance reporting encourages employees to surface problems rather than hiding them. Integration of compliance into performance evaluation ensures that compliance behavior affects career outcomes.

Continuous Improvement

Compliance programs should evolve with regulatory developments and operational experience. Regular assessment of program effectiveness identifies gaps before they create problems. Incorporation of lessons from enforcement actions in the industry applies others’ expensive lessons to your benefit. Proactive adaptation to regulatory guidance keeps programs current. Benchmarking against industry best practices ensures your program reflects current standards.

Key Takeaways

-

RESPA Section 8 prohibits referral fees and kickbacks in mortgage transactions, creating compliance requirements for lead generators selling to or partnering with mortgage lenders.

-

Marketing services agreements require actual marketing services, fair market value compensation unrelated to referral volume, and comprehensive documentation to avoid characterization as prohibited referral fees.

-

Affiliated business arrangements must include proper disclosures, no required use provisions, and compensation limited to returns on ownership interest to qualify for safe harbor protection.

-

The CFPB continues aggressive enforcement, with penalties including civil fines up to $11,176 per violation, criminal penalties, and treble damages in private litigation.

-

Compliant programs require written policies, regular training, ongoing monitoring, third-party due diligence, and qualified legal counsel for complex arrangements.

-

Lead pricing based on objective criteria unrelated to loan closings presents lower RESPA risk than conversion-based or revenue-sharing models.

-

Documentation of services provided, fair market value analysis, and independence from referral volume provides the foundation for defending arrangements if questioned.

-

Future regulatory developments may clarify treatment of digital lead generation, but operators should build compliance programs based on current guidance and enforcement trends.