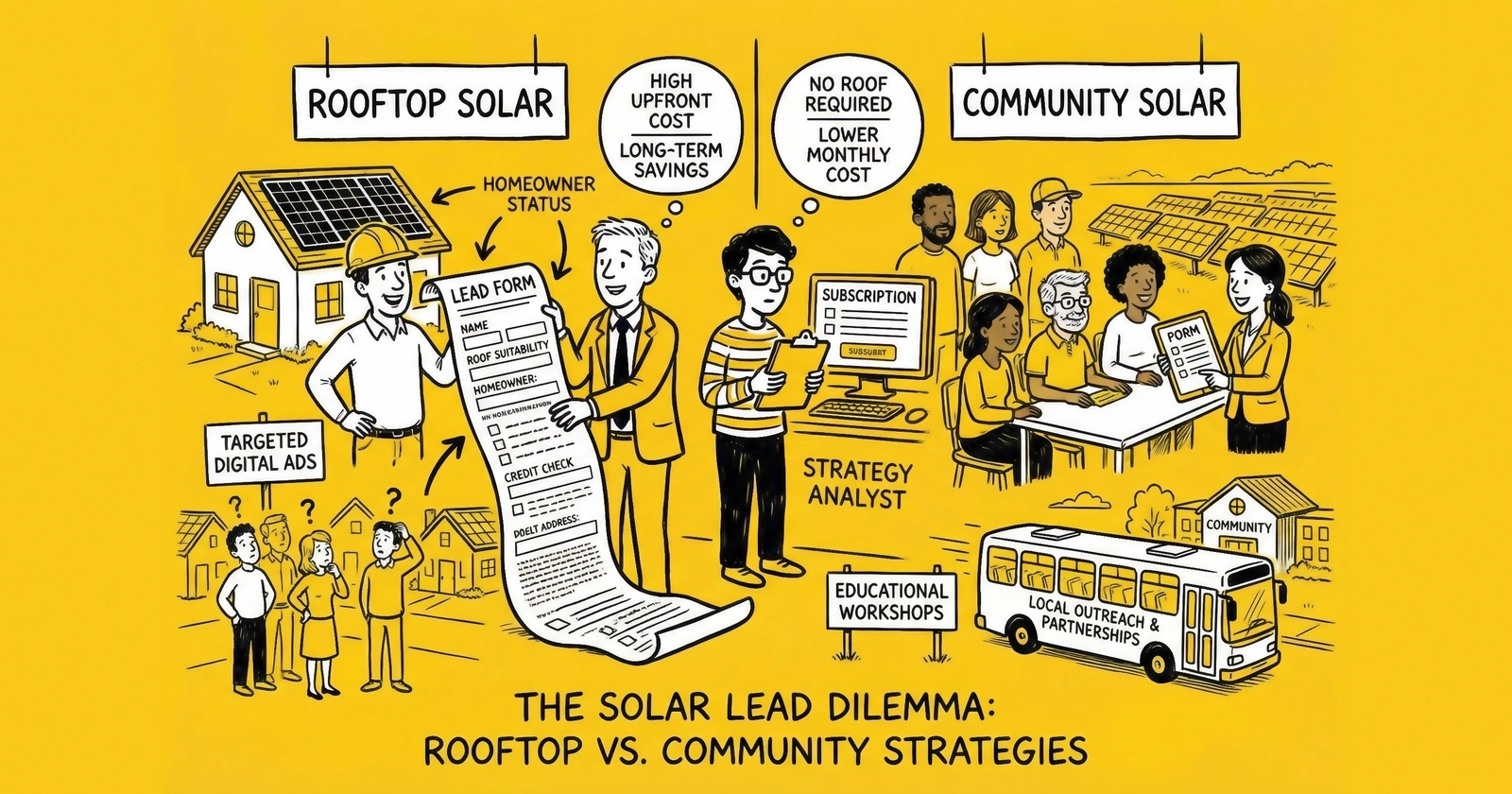

Two solar models, two entirely different customer profiles, two distinct lead generation approaches. Master the targeting, qualification, and conversion strategies that separate profitable solar lead operations from expensive experiments.

The solar lead generation market is not one market. It is two markets wearing the same name, attracting fundamentally different customers, requiring fundamentally different strategies, and rewarding fundamentally different operational approaches.

Rooftop solar leads target homeowners who will own their energy production system, make a $20,000-$35,000 investment decision, and navigate permitting, installation, and interconnection processes that span 60-120 days. Community solar leads target renters, condo dwellers, and homeowners who cannot or will not install panels, offering bill savings through subscription to a shared solar project with no upfront cost and cancellation flexibility that resembles a utility program more than a home improvement project.

These distinctions matter because lead generators who conflate these markets burn money. The qualification requirements differ. The customer objections differ. The economics differ. The geographic arbitrage opportunities differ.

This guide provides the complete strategic framework for both rooftop and community solar lead generation: qualification requirements, targeting strategies, conversion optimization, pricing benchmarks, and the operational approaches that determine success in each market. Every recommendation comes from market data and operational experience in a vertical that punishes generalists.

Understanding the Two Solar Markets

Before diving into lead generation tactics, operators must understand what they are selling and to whom. These fundamentals determine everything that follows.

Rooftop Solar: The Ownership Model

Rooftop solar involves installing photovoltaic panels on the customer’s property – typically their home’s roof, but sometimes ground-mounted systems, carports, or pergolas. The customer either purchases the system outright, finances it through a solar loan, or enters a lease or power purchase agreement (PPA) where a third party owns the equipment but the customer uses the power.

The Typical Rooftop Customer

The rooftop solar customer profile has non-negotiable requirements. They must own their home – renters simply cannot authorize installation. Their roof needs to cooperate: south-facing orientation in the northern hemisphere, minimal shading from trees or neighboring structures, age under 15-20 years to avoid requiring replacement before installation, and sufficient square footage for meaningful energy production.

Economics drive the decision timeline. Homeowners paying $150 or more monthly in electricity reach the threshold where solar typically makes financial sense. Credit scores above 650 open access to most financing products, though some lease arrangements work with scores as low as 600. Perhaps most importantly, these customers expect to remain in their home for seven years or longer – aligning with typical payback periods. And they live in states where favorable net metering, strong incentives, or high electricity rates make the numbers work.

2024-2026 Market Dynamics

The rooftop solar market contracted 12% nationally in 2024, with California volumes dropping 41% following NEM 3.0 implementation. Q2 2025 marked the lowest residential installation quarter since Q2 2021. The Investment Tax Credit (ITC) expiration at the end of 2026 creates deadline-driven demand followed by likely contraction of 30-50% in 2026.

Despite these headwinds, the market remains substantial. Solar still accounted for 58% of all new electricity-generating capacity added to the U.S. grid in the first half of 2025. Installers continue purchasing leads aggressively, with exclusive qualified leads commanding $100-$200+ in premium markets.

Community Solar: The Subscription Model

Community solar allows consumers to receive credits on their electric bills from a shared solar project located elsewhere – typically a solar farm or commercial installation within their utility territory. No panels go on the customer’s property. No installation occurs. The customer subscribes to receive a portion of the project’s production, paying a discounted rate for those credits.

The Typical Community Solar Subscriber

The community solar subscriber profile opens doors that rooftop solar cannot. Renters qualify. Condo owners qualify. Homeowners whose roofs face the wrong direction, sit under tree canopy, or would need replacement before supporting panels – they all qualify. The only geographic requirement is living within the utility service territory of an operating community solar project.

These subscribers pay their own electric bills and hold accounts in their names. They value bill savings without investment, installation hassles, or long-term commitment. Many have declined rooftop solar due to roof issues, credit limitations, or simply preferring not to make a $25,000 decision about their home. Community solar gives them a path to participate in solar energy without those barriers.

2024-2026 Market Dynamics

Community solar capacity exceeded 7 gigawatts nationally by mid-2025, with projects operating in 43 states plus the District of Columbia. New York, Massachusetts, Minnesota, and Illinois represent the largest markets. The subscriber base continues expanding as utilities, developers, and third-party administrators compete for customers.

The community solar market benefits from lower barriers to entry for consumers. No credit requirements typically apply. No roof assessment needed. No permitting delays to navigate. Cancellation provisions resemble utility programs rather than binding contracts. This accessibility expands the addressable market beyond traditional rooftop solar candidates.

Why the Distinction Matters for Lead Generation

A lead generator treating these markets identically makes three costly mistakes.

Qualification waste. Rooftop solar qualification requires ownership verification, roof assessment, credit evaluation, and property type confirmation. Community solar qualification primarily requires utility service territory verification and account confirmation. Applying rooftop-level qualification to community solar leads adds friction without value. Applying community solar-level qualification to rooftop leads delivers unqualified prospects that installers cannot close.

Targeting inefficiency. Rooftop solar targeting should focus on single-family homeowners in owner-occupied properties with high electricity costs. Community solar targeting should focus on renters, multi-family residents, and homeowners in unsuitable-roof situations. Broad solar targeting captures both audiences but optimizes for neither.

Pricing mismatch. Rooftop solar leads command $100-$200+ for exclusive qualified leads because the underlying transaction is $20,000-$35,000 with installer margins that justify aggressive acquisition costs. Community solar leads command $20-$60 because the underlying transaction is a subscription with modest margins and higher churn. Pricing community solar leads like rooftop leads makes you uncompetitive. Pricing rooftop leads like community solar leads leaves money on the table.

Rooftop Solar Lead Generation Strategies

Rooftop solar represents the established, higher-margin opportunity in solar lead generation. It also presents the highest barriers to success: complex qualification, policy-driven volatility, and buyer sophistication that quickly identifies quality issues.

Geographic Targeting: The 8.5x Spread

No other lead vertical exhibits the geographic pricing variation of rooftop solar. Lead value ranges from $1,929 per closed sale in California to $225 in North Dakota – an 8.5x differential driven by five interconnected factors.

Electricity rates directly determine payback periods. California average residential rates exceed $0.25 per kWh. Hawaii, Massachusetts, and Connecticut have similarly high rates. North Dakota hovers around $0.10 per kWh. Higher rates mean faster payback and easier sales conversations.

State and utility incentives layer on top of federal credits. Massachusetts has SMART incentives. New York offers a 25% state tax credit up to $5,000. California had robust support before NEM 3.0 changes. North Dakota offers nothing meaningful beyond the federal ITC.

Net metering policies determine compensation for exported electricity. States with retail-rate net metering – paying the full electricity rate for power sent to the grid – provide stronger economics than states with reduced compensation or avoided-cost rates.

Installer density affects both pricing and buyer availability. California’s mature market has hundreds of competing installers creating robust lead demand. Less competitive markets have fewer buyers and lower lead prices.

Customer sophistication influences close rates. California homeowners have seen decades of solar marketing and negotiate aggressively. Emerging market consumers often close faster with higher margins.

State Tier Targeting Framework

| Tier | States | Exclusive Lead Price | Strategic Approach |

|---|---|---|---|

| Tier 1 | CA, HI, MA, NY | $150-$300+ | Storage qualification required, utility-level targeting |

| Tier 2 | TX, FL, AZ, NJ, CO | $75-$150 | High volume potential, carrier diversification |

| Tier 3 | NV, UT, NM, IL, VA, GA, NC, SC | $40-$75 | Education-focused content, longer nurture |

| Tier 4 | Midwest, Mountain states | $25-$50 | Low-cost traffic only, organic/SEO emphasis |

| Tier 5 | ND, SD, WY, Appalachia | Generally unprofitable | Avoid or minimal investment |

Selling leads at state-level pricing still leaves money on the table. Within California alone, three major investor-owned utilities – PG&E, SCE, and SDG&E – have distinct tariff structures, export adder schedules, and customer economics. A lead in San Diego under SDG&E territory has different value than one in Sacramento under SMUD. Lead generators who route at utility or ZIP code level capture premium pricing that state-level sellers miss.

Qualification Requirements for Rooftop Solar

Rooftop solar leads face fraud rates of 25-35% for third-party leads. Comprehensive qualification is essential for buyer relationships and sustainable operations.

Ownership Verification

Ownership verification is non-negotiable – renters cannot authorize installation. Property database matching through ATTOM or CoreLogic runs $0.50-$2.00 per lead and catches most misrepresentations. Utility bill upload verification creates the highest friction but also the highest accuracy. Identity verification services checking name-to-address matches provide a middle ground. Self-reported ownership serves only as a first filter; it is insufficient alone.

Roof Qualification

Roof qualification determines whether installation is even viable. Age matters most – roofs over 20 years old typically require replacement first, adding $10,000-$25,000 to the project cost and killing most deals. Orientation affects production: south-facing is preferred in the northern hemisphere, while east-west produces 10-15% less and north-facing often disqualifies entirely. Shading from trees or adjacent structures can reduce production by 25-50%. The roof needs sufficient area for a meaningful system size, structural capacity to support 3-4 pounds per square foot of panel weight, and compatible materials – asphalt shingles are standard while tile requires specialized mounting.

Electric Bill and Credit Qualification

Electric bill size indicates economic opportunity. The sweet spot starts at $150 monthly, providing meaningful savings potential. The ideal range runs $200-$400 monthly – high motivation combined with an affordable system size. Bills under $100 monthly offer limited savings and extended payback periods that make closing difficult.

Credit qualification determines financing eligibility. Standard loan products require 650+ FICO scores. Some lease and PPA products work with scores as low as 600. Self-attestation screening helps reduce obvious mismatches before spending on verification.

Timeline Assessment

Timeline assessment affects conversion probability and lead value. Prospects ready to move within 30 days are hot – these command premium prices. Near-term buyers in the 1-3 month window represent strong prospects at standard value. Research-phase consumers looking 3-6 months out are nurture candidates worth discounted pricing. Anyone talking about “eventually” or 6+ months has low conversion probability.

Traffic Sources for Rooftop Solar

Different traffic sources produce leads with different qualification levels and conversion patterns.

Google Search represents the highest-intent traffic. Consumers actively typing “solar installation near me” or “cost of solar panels” have immediate purchase intent. Expect CPCs of $8-$20 for competitive solar keywords, with premium markets commanding higher costs.

Facebook and Instagram enable targeting based on homeownership, life events, and interests. Intent runs lower than search but costs are 50-70% lower. Creative requirements are higher – visual content showing installations, savings testimonials, and process simplicity perform best.

Native advertising through Taboola, Outbrain, and similar networks drives discovery traffic. Lower intent requires education-focused landing pages that build the case for solar before asking for contact information.

SEO and content marketing generates organic traffic through educational content about solar economics, installation processes, and incentives. Lower cost-per-lead but slower to scale. Works well in competitive markets where paid CPCs are prohibitive.

YouTube pre-roll captures attention during related content consumption. Works for awareness and consideration, but requires strong landing page conversion optimization.

Lead aggregators like SolarReviews and EnergySage provide volume at established pricing. Quality varies by source; monitor source-level performance and negotiate for transparency.

California-Specific Strategy: The Storage Imperative

California requires special attention because NEM 3.0 fundamentally changed the value proposition. Export compensation dropped by approximately 75%. Payback periods extended from 5-6 years to 14-15 years for solar-only systems. Installations dropped 38-50%.

The strategic response: qualify for storage interest, not just solar interest.

Battery attachment rates reached 79% in California by late 2024. The value proposition shifted from grid export – selling excess production to the utility – to self-consumption, storing production for evening use when electricity costs are highest. A California solar lead without storage interest has limited value. A solar-plus-storage lead with verified high electric bills remains premium.

For California leads, add qualification questions about interest in battery storage and backup power, awareness of time-of-use rate plans, understanding of evening rate premiums, and backup power motivation driven by fire season or grid reliability concerns.

Messaging shifts accordingly. Emphasize energy independence over bill elimination. Focus on TOU rate optimization – generating power during cheap hours, using stored power during expensive hours. Highlight backup power benefits during outages. Position storage as essential, not optional.

Post-ITC Strategy: Preparing for 2026

The residential Investment Tax Credit – the 30% federal tax credit – expires for new installations after December 31, 2025. This creates a compressed demand window through year-end 2025 followed by fundamental market restructuring.

The impact without the ITC is severe. Direct consumer costs increase $6,000-$9,000 on typical installations. Payback periods extend approximately 30% longer. Expected 2026 volume will decline 30-50%. Lead values will compress 20-40% as buyer margins tighten.

Strategic preparations should start now. Diversify geographically to reduce concentration risk. Build commercial solar capability where different ITC timelines apply. Focus on high-electricity-rate markets where economics work without federal incentives. Develop battery storage expertise as the value proposition shifts. Build relationships with financially stable installers who will survive the contraction.

Community Solar Lead Generation Strategies

Community solar represents a distinct opportunity with different economics, different customer profiles, and different operational requirements. The market is growing, barriers to entry are lower, and customer acquisition costs are more modest – but so are margins.

Understanding the Community Solar Value Proposition

Community solar works through subscription. The customer signs up to receive credits from a shared solar project, paying a discounted rate – typically 10-20% less than their normal electric rate – for those credits. They receive credit on their electric bill for their portion of project production while maintaining their existing utility relationship with a single bill.

No installation. No upfront cost. No credit requirement in most cases. Cancellation typically allowed with 30-90 days notice.

The customer value proposition is simple: save 10-20% on electric bills with no investment, no roof work, and minimal commitment.

The developer and administrator value proposition: acquire subscribers to monetize project capacity, typically paying $20-$60 per qualified subscriber lead.

Geographic Targeting: Utility Territory Is Everything

Unlike rooftop solar where state-level factors dominate, community solar lead generation lives or dies at the utility territory level.

Community solar projects only benefit customers within specific utility service territories. A project in upstate New York only serves National Grid customers in that territory. A project in Illinois only serves ComEd or Ameren customers depending on location. A lead from outside the target utility territory has zero value – not reduced value, zero value.

Market assessment requires identifying operating community solar projects by utility territory, understanding subscriber capacity availability since some projects are fully subscribed, knowing the developer and administrator landscape and who is actively buying leads, and tracking new project development pipelines.

Primary Community Solar Markets

| State | Key Utilities | Market Maturity | Lead Demand |

|---|---|---|---|

| New York | National Grid, Con Edison, Central Hudson, NYSEG | Mature, competitive | High, price-sensitive |

| Massachusetts | National Grid, Eversource | Mature | Moderate to high |

| Minnesota | Xcel Energy, Minnesota Power | Established | Steady |

| Illinois | ComEd, Ameren | Growing rapidly | High, expanding |

| New Jersey | PSE&G, JCP&L, Atlantic City Electric | Growing | Increasing |

| Colorado | Xcel Energy | Established | Moderate |

| Maryland | Various | Developing | Growing |

Emerging markets in Maine, Connecticut, Virginia, New Mexico, and California offer expansion opportunities as projects come online, though California operates under a distinct program structure.

Qualification Requirements for Community Solar

Community solar qualification is simpler than rooftop but still requires verification to avoid waste.

Utility Account Verification

Utility account verification is the primary requirement. The customer must have an active electric account within the project’s utility service territory, and that account must be in their name – though some programs allow authorized users. Requesting account number verification adds friction but confirms legitimacy.

Address and Territory Verification

Address verification confirms utility territory through ZIP code lookup against utility territory maps, address standardization and validation, and multi-family or apartment verification since these housing types are typically eligible.

Bill Amount and Credit Considerations

Bill amount awareness affects subscriber value. Higher bills mean larger allocation and more developer margin. Some developers segment by bill size, paying premiums for larger accounts. Minimum bill thresholds – typically $50-$75 monthly – may apply.

Credit qualification is typically not required. Most community solar programs skip credit checks entirely, which opens the market to consumers declined for rooftop financing. Some programs in certain states may have soft credit requirements, but this is the exception.

Timeline and Intent

Timeline and intent verification matters differently than in rooftop. Immediate enrollment readiness matters more than extended timelines. Some programs have enrollment windows tied to project capacity. Leads willing to wait for spots have lower value than immediately enrollable subscribers.

Traffic Sources for Community Solar

Community solar traffic strategy differs from rooftop because the product is simpler but the targeting is more restrictive.

Geographic targeting precision matters most. Unlike rooftop where state-level campaigns work, community solar requires utility-territory-level targeting. Facebook’s geographic targeting enables this precision. Google’s location targeting works but may capture out-of-territory traffic at the edges.

Facebook and Instagram represent the primary acquisition channel for most community solar lead generators. Geographic targeting by ZIP code clusters within utility territories enables precision. Renter targeting options unavailable to rooftop marketers expand reach. Lower CPCs than rooftop solar keywords improve economics. Visual creative should show bill savings, not installation – there is no installation to show.

Google Search works but with different keywords. Terms like “community solar near me,” “solar savings without installation,” “apartment solar program,” and “renter solar options” indicate high intent, though volume is lower than general solar terms.

Email marketing to renter databases and multi-family resident lists can work in high-density markets. Partnership with apartment complexes, property management companies, and utility programs provides warm audiences.

Utility program partnerships in states with utility-administered community solar create lead opportunities. Some utilities run enrollment programs and purchase leads from qualified vendors.

Door-to-door and field marketing remain viable in dense urban markets where utility territory alignment is clear and population density supports cost-effective canvassing.

Creative Strategy: The Simplicity Advantage

Community solar creative should emphasize what rooftop solar cannot offer: simplicity and accessibility.

The primary messaging pillars center on no installation and no roof work required, immediate 10-20% savings on electric bills, no upfront cost and no long-term lock-in, availability to renters and condo owners and anyone with an electric bill, and supporting local solar without owning panels.

Creative elements that convert include bill comparison visualizations showing before and after, “no credit check” messaging where applicable, enrollment process simplicity emphasizing 5-minute signup, cancel-anytime flexibility, and local project imagery rather than generic solar panels.

Objection handling should address the “too good to be true” concern by explaining the economics simply. Answer “what’s the catch” by emphasizing program legitimacy and utility participation. Explain “why haven’t I heard of this” by noting that community solar is newer than rooftop.

Qualification Workflow for Community Solar

An efficient community solar qualification workflow prevents waste while minimizing friction.

The workflow begins with utility territory pre-qualification. Before any form interaction, verify the user’s location falls within an active utility territory where you have buyer relationships. Geo-fencing landing pages by ZIP code prevents out-of-territory submissions.

Next come basic eligibility questions: whether they pay their own electric bill, whether the account is in their name, which electric utility serves them through a dropdown of valid options, and approximate monthly electric bill in ranges.

Contact information capture follows with name, email, phone, service address that must be within territory, and best time to contact.

A verification layer adds phone verification via SMS, address standardization and utility territory confirmation, and optionally utility account number for premium qualification.

Lead delivery happens through real-time API delivery to developers and administrators, immediate acknowledgment to the consumer setting enrollment expectations, and documentation of consent per developer requirements.

Pricing and Economics for Community Solar Leads

Community solar lead economics differ substantially from rooftop.

Current Pricing Benchmarks (2026)

| Lead Type | Price Range | Typical Enrollment Rate |

|---|---|---|

| Exclusive, verified | $40-$60 | 25-40% |

| Exclusive, basic | $25-$40 | 15-25% |

| Shared (2-3 buyers) | $15-$25 | 8-15% |

| Aged leads (30+ days) | $5-$15 | 5-10% |

Why are prices lower than rooftop? The underlying economics differ fundamentally. Rooftop installers earn $4,000-$8,000 gross profit per installation, justifying $1,500-$3,000 customer acquisition costs. Community solar developers earn $50-$200 annually per subscriber depending on program structure and allocation size, with subscriber churn of 10-20% annually. The lifetime value per subscriber simply cannot support rooftop-level acquisition costs.

The volume opportunity offsets lower per-lead pricing. The addressable market is larger, including renters, condo owners, and unsuitable-roof homeowners. Enrollment rates run higher since it is a simpler decision with lower commitment. A lead generator might earn $150 from a single rooftop exclusive or $35 from a community solar lead, but generate 5x the community solar volume at lower cost-per-lead acquisition.

Targeting Strategies: Rooftop vs Community Solar

The distinct customer profiles require distinct targeting approaches across paid media, organic content, and lead qualification.

Demographic Targeting Differences

Rooftop solar demographic targets focus on homeowners exclusively – that is required, not preferred. Age ranges from 35-65 covering prime home-buying years with established credit. Household income runs $75,000 and above to ensure financing qualification and investment capacity. Single-family home residents in suburban and rural locations provide roof access and space. Homeownership tenure of 3 or more years indicates settled residents planning to stay. Credit scores of 650 and above enable financing qualification.

Community solar demographic targets are more inclusive. Both renters and homeowners qualify. Age ranges from 25-65, a broader span reflecting the simpler decision. Household income starts at $40,000 since they just need to be electric bill payers. Apartment, condo, townhouse, and single-family residents all work. Urban and suburban locations are fine since utility territory matters more than housing density. Any tenure works because flexibility is a selling point. No credit requirement targeting is possible.

Behavioral Targeting Differences

Rooftop solar behavioral signals include home improvement interest, energy efficiency research, Tesla or EV ownership and interest, environmental consciousness, financial planning and investment behavior, recent moves indicating new homeowners shopping for improvements, and high electricity usage indicators.

Community solar behavioral signals include renter lifestyle indicators, budget-conscious shopping behavior, bill management app usage, sustainability interest at lower intensity than rooftop, apartment and condo living indicators, and utility complaint or price sensitivity signals.

Geographic Targeting Differences

Rooftop solar geographic approach involves state-level tier optimization focusing spend on Tier 1-2, utility territory refinement within states, ZIP code-level pricing for maximum arbitrage, complete avoidance of Tier 5 markets, and seasonal geographic rotation to southern markets in winter.

Community solar geographic approach treats utility territory as the primary filter. Target only areas with active, unsold project capacity. Urban density often correlates with opportunity. State policy matters but utility matters more. New project launches create geographic burst opportunities.

Keyword Strategy Differences

Rooftop solar keyword categories break into three groups. High-intent transactional keywords include “solar installation” plus city or state, “solar panel cost” plus location, “best solar companies near me,” and “solar quotes” plus ZIP code. Research and comparison keywords include “is solar worth it in” plus state, “solar panel pros and cons,” “how much do solar panels save,” and “solar payback period” plus state. Financing-focused keywords include “solar loan rates,” “solar lease vs buy,” and “zero down solar.”

Community solar keyword categories also break into groups. Program awareness keywords include “community solar near me,” “community solar” plus state, “shared solar program,” and “solar for renters.” Problem-solution keywords include “save on electric bill without solar panels,” “solar for apartments,” “condo solar options,” and “no roof solar program.” Utility-specific keywords include “community solar” plus utility name, utility name plus “solar program,” and “solar savings” plus utility territory.

Conversion Optimization: Different Funnels for Different Products

The landing page structure, form design, and conversion process should differ substantially between rooftop and community solar.

Rooftop Solar Landing Page Best Practices

Above-the-fold requirements include a clear value proposition covering savings amount, payback period, and environmental impact. Social proof should show installation count, customer ratings, and industry recognition. A qualifier statement like “For homeowners with suitable roofs” sets expectations. The CTA should read “Get Your Free Solar Quote” or “Check Your Roof’s Solar Potential.”

Multi-step form structure works best for rooftop. Step 1 captures address entry, which enables satellite roof analysis and filters renters through property type lookup. Step 2 gathers electricity information: utility provider through a dropdown, monthly bill amount in ranges, and rate plan if known. Step 3 handles property qualification with homeowner confirmation, roof age estimate, shading assessment, and planned home tenure. Step 4 collects contact information including name, email, phone, preferred contact method, and best time to reach. Step 5 provides confirmation with expectation setting about what happens next, timeline for contact, and no obligation free quote messaging.

Post-form experience should include a thank you page with process explanation, confirmation email with timeline, optional satellite roof imagery showing solar potential, and resource links for self-education.

Community Solar Landing Page Best Practices

Above-the-fold requirements emphasize simplicity with messaging like “Save on electricity, no installation required.” Accessibility messaging should state “For renters and homeowners.” No-cost and no-risk emphasis should read “No upfront investment, cancel anytime.” The CTA should be “Check Your Eligibility” or “Start Saving Today.”

Form structure should be shorter than rooftop. Step 1 handles utility territory verification with ZIP code entry and utility provider confirmation if multiple serve the area. Step 2 confirms eligibility through questions about active electric account, account in their name, and approximate monthly bill for allocation sizing. Step 3 captures contact information: name, email, phone, and service address. Step 4 provides confirmation with enrollment expectation including what happens next, timeline for enrollment, and savings estimate based on bill size.

Post-form experience should include a thank you page explaining the enrollment process, confirmation email with program details, FAQ addressing common questions, and developer or administrator contact information.

Form Length Trade-offs

Rooftop solar benefits from longer forms with 5-7 fields that reduce volume but improve qualification. Installers prefer fewer, better-qualified leads over high-volume low-qualification. Return rates drive this preference – a 25% return rate destroys margins.

Community solar benefits from shorter forms with 3-5 fields that maximize volume while maintaining minimum qualification. Enrollment rates are higher, churn handles some qualification failure, and developer economics support higher volume at lower per-lead prices.

Mobile Optimization Priorities

Mobile traffic dominates both markets. Both markets need single-column form layouts, large tap targets for buttons, minimal scrolling required, auto-advance between form steps, phone number formatting assistance, and address autocomplete.

Rooftop-specific mobile needs include roof imagery and satellite view integration, bill upload capability, and complex form navigation that works on mobile.

Community solar-specific mobile needs include ZIP code lookup with instant eligibility confirmation, utility territory verification without page reload, and enrollment process preview.

Lead Quality and Fraud Prevention

Both solar markets face fraud challenges, though the specific patterns differ.

Rooftop Solar Fraud Patterns

Incentive fraud involves fraudsters filling forms to collect affiliate commissions without generating legitimate prospects. Indicators include high-velocity submissions from single IP addresses, impossible geographic patterns, and phone or email mismatches.

Ownership fraud involves consumers misrepresenting homeownership status to obtain quotes or satisfy curiosity. Property database verification catches most cases.

Recycled leads are the same consumer sold to multiple buyers as “exclusive.” TrustedForm certificates with timestamps detect this pattern.

Credit fraud involves leads generated from populations unlikely to qualify for financing. Pre-qualification screening reduces this waste.

Community Solar Fraud Patterns

Territory fraud involves leads from outside utility service territories, whether through VPN usage, incorrect address entry, or deliberate misrepresentation. Utility territory verification is essential.

Account fraud involves consumers without electric accounts in their name attempting to enroll. Account verification catches most cases, though some slip through to enrollment rejection.

Volume fraud involves affiliate-driven form submissions with fake or recycled contact information. Phone verification and behavioral analysis address this pattern.

Churn arbitrage involves consumers who enroll, receive credit for the first month, then immediately cancel. This is less a lead quality issue and more a developer program design issue, but high early-churn rates from specific sources indicate quality problems.

Verification Stack by Market

Rooftop solar verification should be comprehensive. The stack includes phone verification via SMS at form submission, email confirmation with unique link, address standardization and property type lookup, ownership verification through property databases, utility territory confirmation, TrustedForm or similar session recording, behavioral velocity scoring, and post-delivery buyer feedback loop. This costs $3-$8 per lead with a return rate target under 10%.

Community solar verification should be streamlined. The stack includes phone verification via SMS, address-to-utility territory matching, ZIP code geo-verification comparing IP to stated location, duplicate detection across submissions, basic velocity scoring, and post-delivery enrollment rate tracking. This costs $1-$3 per lead with an enrollment rate target of 20% or higher for qualified leads.

Working with Buyers: Installers vs Developers

The buyer landscape differs between markets, affecting relationship management, pricing negotiations, and operational requirements.

Rooftop Solar Buyer Relationships

National installers like Sunrun, Freedom Forever, and Momentum Solar want volume across broad geographic areas. They accept higher CPLs for verified quality and have sophisticated lead intake systems. Working with nationals requires meeting their technical integration requirements and understanding capacity constraints that affect buying patterns.

Regional installers dominate specific territories and often want exclusivity in their service areas. They convert at higher rates in their core markets and may pay premium prices for geographic exclusivity. Building exclusive arrangements with strong regional installers creates stable demand.

Local installers prefer fewer, higher-quality leads over volume. Response time is critical – their conversion depends on being first to contact prospects. Real-time delivery during business hours maximizes their success.

Rooftop buyers want contact rates above 70%, accurate utility and property information, verified ownership status, realistic timeline expectations from consumers, honest exclusivity representation, and real-time delivery during business hours.

Community Solar Buyer Relationships

Project developers build and own solar projects, then need subscribers to monetize capacity. They may have internal enrollment teams or work with third-party administrators. Lead volume requirements scale with project capacity coming online.

Subscription administrators manage enrollment, billing, and subscriber relationships on behalf of developers. Companies like Arcadia, Perch Energy, and Nautilus Solar manage subscriber acquisition and may purchase leads directly.

Program aggregators consolidate subscriber acquisition across multiple projects and developers. They function similarly to lead aggregators in other verticals, adding a layer between generators and end buyers.

Community solar buyers want utility territory accuracy since leads from outside territory are worthless, valid contact information, active utility account confirmation, reasonable bill size indication, quick enrollment capability since leads lose value rapidly, and low early-cancellation rates from their leads.

Pricing Negotiation Differences

Rooftop solar pricing factors include geographic tier with Tier 1 commanding 2-3x Tier 4, qualification depth comparing ownership verified versus self-reported, exclusivity model comparing exclusive versus shared, return policy terms comparing liberal versus strict, delivery timing comparing real-time versus batch, and volume commitments with minimums for premium pricing.

Community solar pricing factors include utility territory based on active capacity availability, enrollment rate history demonstrating proven conversion, verification level comparing account confirmed versus basic, volume capacity matching project needs, churn performance tracking early cancellation rates, and seasonal timing aligned with project launch windows.

Seasonal Patterns and Timing

Both solar markets exhibit seasonal patterns, though the drivers differ.

Rooftop Solar Seasonality

Spring peak from March through May brings increasing daylight that triggers consumer awareness. Tax refund season provides down payment capital. Installation weather windows open. Summer bill previews motivate action. Lead prices peak in April and May.

Summer plateau from June through August brings peak electricity bills that reinforce the value proposition, but vacation season reduces decision-making availability. Installer capacity constraints emerge. Heat in southern markets slows installation.

Fall urgency from September through November brings year-end tax credit deadlines driving urgency, especially in 2026. Q4 installation capacity fills quickly. Premium pricing for guaranteed year-end installation becomes available. Lead quality requirements tighten.

Winter trough from December through February brings holiday season reducing consumer attention. Cold weather prevents northern installations. Lower electricity bills reduce motivation. Southern market opportunity emerges as competition decreases.

Community Solar Seasonality

Community solar seasonality follows project development timelines more than consumer behavior. New projects coming online create burst subscriber acquisition needs.

Q1 through Q2 sees new year projects often launching in spring, creating enrollment capacity and lead demand. Summer brings steady demand, though some developers pause acquisition when projects are fully subscribed. Q4 sees year-end project completions that may create late-year demand spikes.

Utility program cycles also matter. Some utility-administered community solar programs have annual enrollment periods, creating predictable demand windows.

Subscriber churn patterns create ongoing opportunity. Existing subscribers cancel throughout the year, creating replacement capacity needs. Churn-driven acquisition tends to be steadier than project-launch-driven acquisition.

Frequently Asked Questions

What is the difference between rooftop solar and community solar leads?

Rooftop solar leads target homeowners who will install panels on their property, making a $20,000-$35,000 investment decision. Community solar leads target renters and homeowners who subscribe to receive bill credits from a shared solar project elsewhere, with no installation and no upfront cost. The qualification requirements, customer profiles, and economics differ substantially. Rooftop leads command $100-$200+ for exclusive qualified leads while community solar leads typically price at $25-$60.

Can the same lead be sold to both rooftop and community solar buyers?

In theory, a homeowner declined for rooftop solar (due to roof issues, shading, or credit) could be redirected to community solar. In practice, this requires consent for the secondary use and buyer willingness to accept redirected leads. Some operations run dual-qualification funnels where leads that fail rooftop qualification automatically route to community solar if they remain within valid utility territories. This maximizes lead value but requires transparent disclosure to all buyers.

Which market has higher profit potential: rooftop or community solar leads?

Rooftop solar leads have higher per-lead margins ($100-$200+ vs $25-$60) but face more complex qualification, higher traffic costs, and greater policy volatility. Community solar has lower per-lead margins but larger addressable market (including renters), simpler qualification, and steadier demand tied to project development cycles. The answer depends on your traffic acquisition capabilities, geographic focus, and operational sophistication. Many successful operators participate in both markets.

How do I verify utility territory for community solar leads?

Utility territory verification requires mapping ZIP codes to utility service territories, which is publicly available information but requires ongoing maintenance as boundaries occasionally change. Several data services provide utility territory lookup APIs. Alternatively, asking consumers to identify their utility provider during form completion enables verification against known territory boundaries. The key is preventing leads from outside valid territories, which have zero value to buyers.

What qualification rate should I expect for rooftop solar leads?

Industry benchmarks suggest 40-60% of raw form submissions will pass comprehensive rooftop qualification (ownership verified, suitable roof, adequate electric bill, reasonable credit, and valid timeline). This means 40-60% of your traffic acquisition cost produces saleable leads. Higher qualification rates suggest insufficient filtering; lower rates suggest traffic quality issues or overly aggressive form completion claims. Premium exclusive lead products targeting 10-15% conversion to sale require rigorous upstream qualification.

What enrollment rate should I expect for community solar leads?

Community solar leads with proper utility territory verification and basic account confirmation typically enroll at 20-40% rates. Enrollment is simpler than rooftop installation (no site visit, no permitting, no credit approval), so rates are higher than rooftop close rates. Lower enrollment rates indicate territory mismatch, invalid accounts, or contact quality issues. Higher rates indicate well-qualified leads with motivated subscribers.

How does the federal tax credit expiration affect community solar?

The residential Investment Tax Credit expiration at the end of 2026 primarily affects rooftop solar economics. Community solar projects qualify for commercial tax credits (Section 48E) with different timelines – projects begun by July 4, 2026 can qualify if placed in service within four years. The residential ITC expiration may actually benefit community solar by expanding the addressable market: homeowners who would have installed rooftop panels may turn to community solar as a lower-commitment alternative when economics become less favorable.

What are the biggest mistakes in solar lead generation?

The three most common mistakes are: (1) treating rooftop and community solar as the same market with the same qualification and targeting, wasting resources on mismatched leads; (2) ignoring geographic arbitrage and selling leads at uniform national pricing when state and utility-level pricing captures dramatically more value; (3) skipping verification steps that add $3-$8 per lead but reduce return rates from 25% to under 10%, improving net economics substantially. Each mistake represents money left on the table or actively lost to waste.

How should I price leads in emerging community solar markets?

Emerging community solar markets (new state programs, recently launched projects) present pricing uncertainty. Start by understanding developer economics: what subscriber lifetime value supports what acquisition cost? New programs may have developer incentives that support premium pricing temporarily. Projects nearing full subscription may pay premiums for remaining capacity. Markets with multiple competing projects create buyer competition. Price discovery through direct developer relationships beats applying benchmarks from mature markets where dynamics differ.

What technology stack do I need for solar lead generation?

Core requirements include: landing page infrastructure with form builders supporting multi-step flows, geographic targeting and utility territory verification capabilities, phone verification integration (Twilio or similar), property data API access for ownership verification (rooftop), lead delivery system with real-time API capability, TrustedForm or equivalent consent documentation, and analytics tracking source-level performance. Community solar operations need utility territory mapping data. Rooftop operations benefit from satellite imagery integration for roof assessment visualization. CRM integration for nurture sequences adds value for longer sales cycles.

Key Takeaways

Rooftop and community solar are fundamentally different markets. Rooftop targets homeowners making $20,000-$35,000 investment decisions with complex qualification. Community solar targets renters and homeowners subscribing to receive bill credits with minimal commitment. Treating these as the same market wastes resources on mismatched leads.

Geographic arbitrage remains the core rooftop strategy. The 8.5x pricing spread from California to North Dakota reflects electricity rates, state incentives, and net metering policies. State-level pricing captures value. Utility-level targeting captures even more. Never sell rooftop leads at uniform national pricing.

Utility territory is everything for community solar. A community solar lead from outside the project’s utility territory has zero value. Geographic targeting must operate at utility territory level, not state level. ZIP code verification and utility provider confirmation are essential qualification steps.

Qualification investment pays for itself. Adding $3-$8 per rooftop lead for ownership verification, roof assessment, and property qualification reduces return rates from 25% to under 10%. The net economics improve substantially despite higher per-lead costs. Community solar benefits from lighter verification focused on territory and account validity.

California rooftop leads require storage qualification. NEM 3.0 changed the value proposition from grid export to self-consumption. Battery attachment rates reached 79%. A California solar-only lead has limited value. A solar-plus-storage lead with verified high electric bills remains premium.

Community solar expands the addressable market. Renters, condo owners, and unsuitable-roof homeowners represent a large population excluded from rooftop solar. Community solar’s no-installation, no-upfront-cost model captures this demand. The simpler decision enables higher enrollment rates and lower qualification requirements.

Buyer relationships differ by market. Rooftop installers want qualified leads with ownership verification, accurate property data, and honest exclusivity. Community solar developers want territory-accurate leads with valid accounts and quick enrollment capability. Understanding what each buyer type values enables better service and premium pricing.

The ITC expiration reshapes rooftop economics. After December 31, 2025, the 30% federal residential tax credit disappears. Payback periods extend approximately 30%. Lead volume will decline 30-50% in 2026. Community solar may benefit as the lower-commitment alternative becomes relatively more attractive.

Both markets reward operators who understand the nuances. Generic “solar leads” thinking produces generic results. Practitioners who master geographic arbitrage, build market-appropriate verification stacks, and develop buyer relationships suited to each market’s economics consistently outperform those treating solar as a monolithic opportunity.

Market data current as of December 2025. Policy information reflects the post-ITC expiration environment for residential solar. Community solar program availability varies by state and utility territory. Verify current program status and utility territory boundaries before acting on geographic targeting decisions.