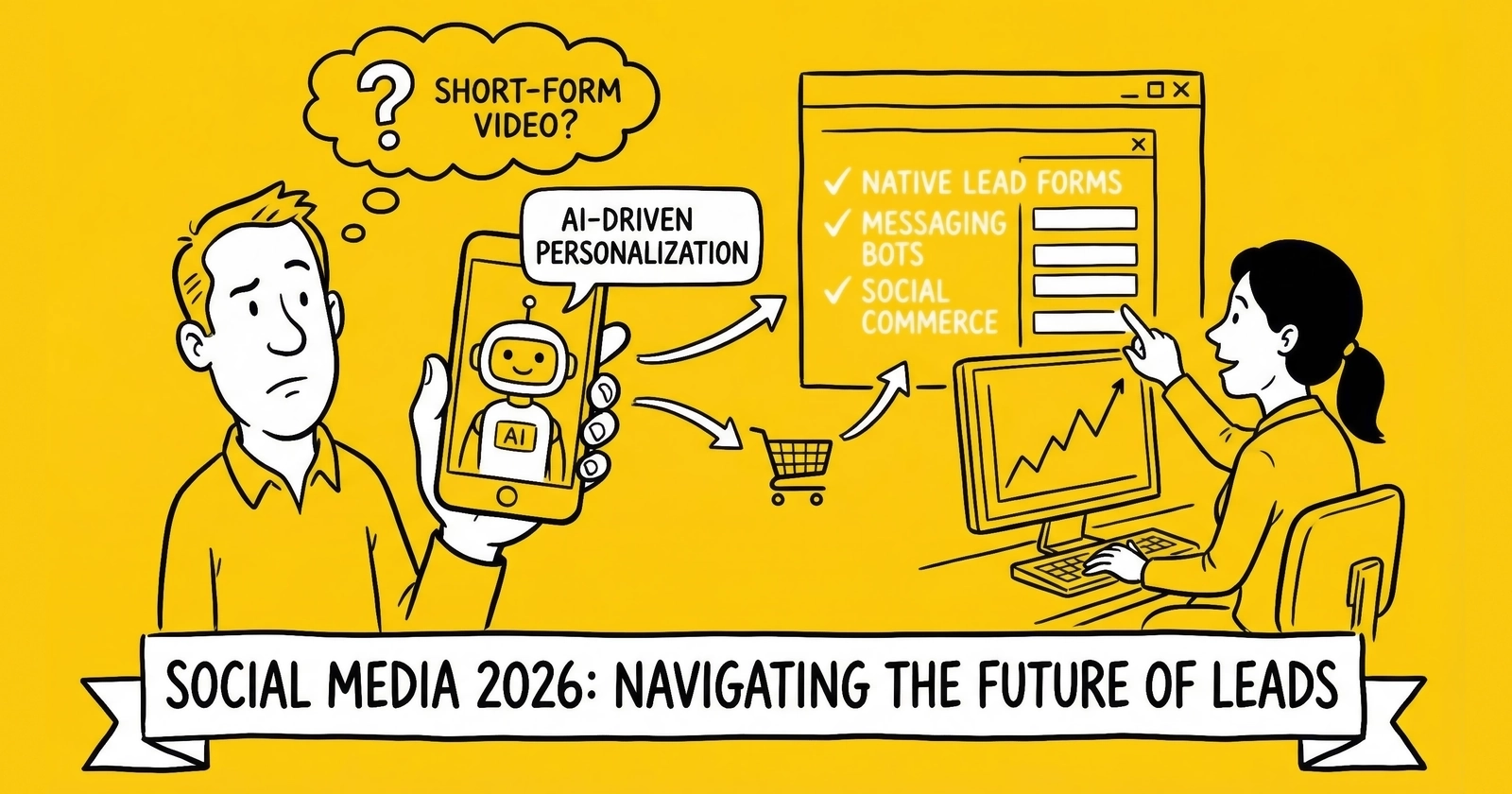

How social media lead generation evolves in 2026: platform algorithm changes, social commerce integration, AI content generation, privacy adaptations, and strategic positioning for operators.

Social media lead generation in 2026 operates in a fundamentally different environment than even two years ago. Algorithm prioritization has shifted toward AI-recommended content over social graph distribution. Privacy changes have degraded targeting precision while increasing costs. Social commerce has matured from experimental to transactional. And AI content generation has flooded platforms with volume that challenges differentiation.

For lead generation operators, these shifts demand strategic adaptation. The tactics that worked in 2023-2024 – precise targeting, lookalike audiences, retargeting sequences – have diminished in effectiveness. The operators succeeding in 2026 understand platform dynamics at a strategic level, not just tactical execution.

This analysis examines the trends reshaping social media lead generation, their implications for operators, and strategic positioning for the current environment.

The Platform Landscape Shift

The social media platform landscape has consolidated around a few dominant players while fragmenting audience attention across specialized alternatives.

Meta’s Evolution

Meta (Facebook and Instagram) remains the largest paid social channel for lead generation, but the platform operates differently than it did two years ago:

- Algorithm Prioritization: Meta’s recommendation algorithm now surfaces more AI-selected content from accounts users don’t follow, reducing organic reach for business pages to near zero. The shift toward “discovery” content – Reels, recommended posts, AI-curated feeds – means paid distribution is essentially required for business visibility.

- Targeting Degradation: Apple’s App Tracking Transparency, combined with regulatory privacy requirements, has reduced Meta’s targeting precision. Lookalike audiences perform less effectively. Detailed targeting options have been removed or restricted. The platform’s response – Advantage+ campaigns and AI-optimized targeting – works better than manual targeting in many cases but provides less control and transparency.

- Cost Inflation: CPMs on Meta have increased 15-25% year-over-year for most lead generation verticals. Competition for diminished targeting precision means more advertisers bid on broader audiences. Lead quality variance has increased correspondingly.

- Lead Generation Products: Meta’s native lead forms (Instant Forms) continue evolving with better qualification options, CRM integrations, and conditional logic. For many verticals, native forms outperform landing page redirects due to reduced friction, though lead quality concerns persist.

TikTok’s Maturation

TikTok has matured from experimental channel to established advertising platform for lead generation:

- Demographic Expansion: While still skewing younger than Meta, TikTok’s user base has aged. Users 35-54 now represent meaningful platform share. Some lead generation verticals previously excluded from TikTok – financial services, home improvement, insurance – now find viable audiences.

- Advertising Sophistication: TikTok’s advertising platform has matured with better targeting options, improved attribution, and native lead generation forms. Search advertising launched in 2024 captures high-intent traffic that traditional TikTok discovery lacked.

- Creative Requirements: TikTok’s creative demands remain distinct from other platforms. Native-feeling content outperforms polished advertising. User-generated style, trend participation, and entertainment value determine performance more than direct response messaging. This creative requirement increases production complexity for lead generation operators.

- Regulatory Uncertainty: TikTok’s regulatory status in the United States remains uncertain. Operators building TikTok-dependent lead generation face platform risk that doesn’t exist with Meta or Google.

LinkedIn’s B2B Dominance

LinkedIn has strengthened its position as the primary B2B lead generation platform:

- Premium Pricing: LinkedIn’s CPMs run 2-5x higher than Meta for comparable audiences, but B2B targeting precision – job title, company, industry, seniority – provides value that justifies premium for qualified lead generation.

- Content Quality Shift: LinkedIn’s algorithm increasingly favors thought leadership content and genuine engagement over promotional posts. Direct sales messaging performs poorly; educational content that demonstrates expertise generates better engagement and lead quality.

- Lead Gen Forms: LinkedIn’s native lead generation forms pre-fill with profile data, reducing friction and improving completion rates. The trade-off: pre-filled data may be outdated, and the frictionless experience can generate low-intent leads.

- Newsletter and Event Features: LinkedIn’s newsletter and event features provide organic distribution mechanisms that other platforms lack, creating owned audience opportunities beyond paid advertising.

Emerging and Declining Platforms

- Pinterest: Maintains relevance for visual verticals (home improvement, wedding, lifestyle) with purchase intent baked into platform behavior. Lead generation performance remains vertical-specific.

- X (Twitter): Advertising effectiveness has declined for most lead generation applications. Reduced brand safety controls, advertiser exodus, and platform instability make X a secondary consideration for most operators.

- YouTube: Short-form content (Shorts) has grown while long-form maintains value for high-consideration verticals. Lead generation typically requires integration with Google Ads for effective targeting and attribution.

- Snapchat: Maintains strong Gen Z presence but limited lead generation application beyond specific youth-focused verticals.

- Reddit: Community-based targeting provides unique access to high-intent audiences in specific niches. Advertising sophistication has improved, though scale remains limited compared to major platforms. For B2B applications, see our Reddit B2B lead generation guide.

Social Commerce Integration

Social commerce – purchasing directly within social platforms – has matured from experimental feature to meaningful revenue channel, with implications for lead generation.

The Commerce-Lead Generation Continuum

Traditional lead generation and social commerce exist on a continuum. Some products sell directly through social commerce; others require lead generation for sales process. The distinction is blurring:

- Hybrid Funnels: Some operators use social commerce for low-commitment initial purchases (educational content, assessments, consultations) that feed into larger lead-to-sale processes.

- In-Platform Qualification: Social commerce checkout flows can incorporate qualification questions that generate lead data while completing transactions.

- Commerce-to-Lead Conversion: Cart abandonment and browse behavior on social commerce create retargeting opportunities that convert to lead generation for higher-consideration products.

Platform Commerce Features

- Meta Shops: Facebook and Instagram shops enable direct purchasing with inventory management, checkout, and post-purchase communication. For lead generation operators selling information products or consultations, shops provide alternative conversion paths.

- TikTok Shop: TikTok’s commerce integration has grown rapidly, though primarily for physical products. Lead generation applications remain limited but evolving.

- Pinterest Shopping: Pinterest’s commerce integration aligns well with the platform’s purchase-intent user behavior, particularly for home, lifestyle, and aesthetic verticals.

Strategic Implications

Social commerce growth affects lead generation strategy:

- Competitive Pressure: Direct commerce competes with lead generation for consumer attention and platform inventory. Verticals where social commerce works well may see lead generation costs increase as commerce advertisers bid for similar audiences.

- Funnel Innovation: Operators can experiment with commerce-first approaches that generate leads as secondary conversion rather than primary objective.

- Data Enrichment: Commerce behavior data can enrich lead scoring and qualification when integrated with lead generation operations.

AI Content Generation Impact

AI content generation has transformed social media content production with significant implications for lead generation.

Content Volume Explosion

AI tools enable content production at volumes impossible with human-only creation:

- Scale Without Proportional Cost: Operators can produce 10x or 100x the creative variations for testing without proportional cost increases. This benefits optimization but creates differentiation challenges.

- Platform Saturation: Increased AI content across all advertisers means more competition for attention. Standing out requires quality or uniqueness that generic AI content lacks.

- Quality Variance: AI-generated content varies widely in quality. Low-quality AI content can damage brand perception and lead quality; high-quality AI content can match or exceed human-created alternatives.

Creative Testing Acceleration

AI enables creative testing at remarkable speed:

- Variation Generation: AI can produce dozens of ad variations (copy, images, video concepts) for rapid testing. Winning elements can be identified faster than traditional creative development allows.

- Personalization at Scale: AI enables content personalization by audience segment, vertical, or even individual lead characteristics – though privacy constraints limit some personalization applications.

- Iteration Speed: AI-assisted creative iteration can respond to performance data within hours rather than days or weeks, enabling real-time optimization.

Authenticity Challenges

AI content creates authenticity challenges:

- Detection and Skepticism: As consumers become more aware of AI content, skepticism toward obviously AI-generated material increases. Authenticity signals – human faces, genuine testimonials, imperfect content – may perform better.

- Platform Response: Social platforms are developing AI content labeling and potentially algorithmic deprioritization. Operators should monitor platform policies on AI-generated advertising content.

- Trust Implications: For lead generation specifically, trust matters. AI content that feels inauthentic may generate leads but reduce conversion to sales as buyers sense the disconnect between advertising and reality.

Strategic Response

Effective AI content strategy for lead generation:

- Augmentation Not Replacement: Use AI to augment human creativity – generating variations, suggesting angles, accelerating production – rather than replacing strategic creative direction entirely.

- Human Authentication: Incorporate genuine human elements – real testimonials, actual team members, authentic user experiences – alongside AI-assisted content.

- Quality Over Volume: The advantage of AI content volume is testing speed, not volume itself. Focus on identifying winning content through rapid testing rather than flooding audiences with mediocre variations.

Privacy Evolution and Targeting Adaptation

Privacy changes continue reshaping social media targeting capabilities.

Signal Loss Continues

The privacy-driven signal loss that began with iOS 14 has continued and expanded:

- Cross-App Tracking: Cross-app tracking is essentially gone for users who opt out. Retargeting based on website behavior reaches smaller audiences with less precision.

- Conversion Attribution: Attribution accuracy has degraded across platforms. Reported conversions may not match actual outcomes, complicating optimization and ROI measurement.

- Audience Matching: Custom audience matching – uploading customer lists for targeting – faces increased restrictions and reduced match rates as platforms limit data sharing.

Platform Adaptation

Platforms have adapted to privacy constraints:

- AI-Optimized Targeting: Meta’s Advantage+ and similar AI-driven targeting products optimize toward conversion objectives with less manual targeting specification. Performance often exceeds manual targeting, but transparency and control decrease.

- First-Party Data Emphasis: Platforms emphasize first-party data – signals you collect directly from users – for targeting and optimization. Lead generation operators with customer data assets gain advantage.

- Conversions API: Server-side conversion tracking (Meta’s Conversions API, etc.) captures signals that client-side pixels miss, improving attribution accuracy for operators who implement properly.

- Contextual Targeting: Interest and behavior targeting increasingly supplements deprecated tracking-based targeting. Understanding audience context matters more as precision targeting declines.

Strategic Response

Lead generation operators should adapt to privacy reality:

- First-Party Data Priority: Invest in collecting and activating first-party data. Email addresses, phone numbers, and behavioral data you collect directly become competitive advantage. The deprecation of tracking capabilities makes this investment essential – see our analysis of third-party cookie deprecation impact on lead generation for strategic context.

- Measurement Sophistication: Implement marketing mix modeling, incrementality testing, and other measurement approaches that don’t depend solely on platform-reported attribution. Our multi-touch attribution guide provides frameworks for navigating this complexity.

- Creative Differentiation: As targeting precision decreases, creative quality matters more. The right message to a broad audience can outperform the wrong message to a precise audience.

- Full-Funnel Optimization: Optimize for downstream outcomes (lead-to-sale conversion, customer lifetime value) rather than just cost per lead. Quality signals matter more when targeting is less precise.

Algorithm and Distribution Changes

Social media algorithms have shifted toward AI-recommended content with significant implications for reach and engagement.

Discovery Over Social Graph

Major platforms have shifted from social graph distribution (showing content from accounts you follow) to discovery distribution (showing AI-recommended content from anywhere):

- For You > Following: TikTok pioneered this model; Meta has followed. Users increasingly see recommended content from accounts they don’t follow, while content from followed accounts receives less priority.

- Organic Reach Decline: Business pages see near-zero organic reach on most platforms. The “build followers, then reach them organically” model has largely collapsed.

- Paid Distribution Required: Reaching audiences reliably requires paid distribution. Organic social media marketing primarily serves brand credibility and social proof rather than direct lead generation.

Engagement Algorithm Factors

Algorithms favor content that generates engagement:

- Dwell Time: How long users spend with content affects distribution. Video content that holds attention receives more reach than content users scroll past quickly.

- Engagement Velocity: Rapid initial engagement signals quality to algorithms. Content that generates quick likes, comments, and shares receives expanded distribution.

- Completion Rates: For video content, completion rate (percentage who watch to the end) strongly influences algorithmic distribution.

- Save and Share: Saves and shares carry more weight than likes in most platform algorithms, indicating content users want to return to or recommend.

Strategic Implications

Algorithm changes affect lead generation strategy:

- Content Quality Investment: Quality content that earns engagement receives more reach, reducing effective CPM. Investing in content that performs organically also improves paid performance.

- Video Priority: Video content – particularly short-form video – receives algorithmic preference on most platforms. Lead generation creative should incorporate video effectively. For comprehensive guidance on video integration, see our video-first lead generation strategy guide.

- Hook Optimization: The first 1-3 seconds of video content determine whether users engage or scroll. Hook optimization matters more than ever.

- Native Formats: Content that feels native to each platform receives algorithmic preference over content that feels promotional or cross-posted.

Influencer and Creator Integration

The creator economy has matured, creating more sophisticated integration opportunities for lead generation.

Creator-Driven Lead Generation

Creators can drive lead generation through various integration models:

- Sponsored Content: Traditional sponsored posts where creators promote lead generation offers to their audiences. Performance varies widely based on creator-audience fit and content authenticity.

- Affiliate Relationships: Performance-based creator relationships where creators earn based on leads generated. Aligns incentives but requires tracking infrastructure and may encourage aggressive promotion.

- Creator-Generated Content: Using creator-produced content for paid advertising without creator audience distribution. Provides authentic-feeling content at scale.

- Whitelisting: Running ads through creator accounts rather than brand accounts. Provides credibility of creator endorsement with scale of paid distribution.

Performance Considerations

Creator integration performance for lead generation depends on several factors:

- Audience Alignment: Creator audience demographics must match lead generation target. Large following doesn’t compensate for audience mismatch.

- Authenticity: Authentic-feeling integrations outperform obviously scripted promotions. Creators who genuinely use or believe in products generate better response.

- Disclosure Compliance: FTC requirements for sponsored content disclosure are strictly enforced. Non-compliant creator relationships create regulatory risk.

- Attribution Challenges: Attributing leads to specific creator relationships can be difficult, particularly for organic content without direct tracking links.

Strategic Approach

Effective creator strategy for lead generation:

- Performance Validation: Test creator relationships with small commitments before scaling. Many creator partnerships fail to deliver lead generation ROI despite impressive reach metrics.

- Content Rights: Negotiate content rights for creator-generated material to use in paid advertising. This often provides better ROI than organic creator posting alone.

- Micro-Creator Focus: Smaller creators (10,000-100,000 followers) often deliver better lead generation performance than mega-influencers due to higher engagement rates and audience trust.

- Vertical Specialization: Creators with vertical-specific audiences (insurance, home improvement, finance) provide more relevant reach than general lifestyle creators for lead generation applications.

Platform-Specific Optimization Trends

Each major platform has specific optimization trends for 2026.

Meta Optimization

- Advantage+ Adoption: Advantage+ campaigns (Shopping, App, and Leads) often outperform manually targeted campaigns. The shift toward AI-optimized targeting is accelerating.

- Broad Targeting: Counter-intuitively, broader targeting with strong creative often outperforms narrow targeting. Let the algorithm find converting users rather than over-constraining audiences.

- Creative Volume: Meta’s algorithm benefits from creative volume for testing. Providing 5-10+ creative variations improves optimization compared to running few ads.

- Full-Funnel Attribution: Use Meta’s attribution settings appropriately for your sales cycle. The 7-day click, 1-day view default may not suit longer consideration periods.

TikTok Optimization

- Search Integration: TikTok search advertising captures high-intent users that traditional discovery doesn’t reach. Integrate search into lead generation strategy.

- Spark Ads: Spark Ads (boosting organic content or creator content) often outperform traditional ads by maintaining native feel and engagement signals.

- Sound-On Assumption: TikTok users have sound on by default, unlike other platforms. Audio is essential, not optional.

- Trend Participation: Participating in trending formats, sounds, and challenges improves algorithmic distribution. Lead generation content must balance trend participation with conversion focus.

LinkedIn Optimization

- Thought Leadership Ads: Ads featuring thought leadership content (insights, data, perspectives) outperform direct response messaging on LinkedIn.

- Document Ads: PDF carousel ads provide extended engagement opportunity and demonstrate expertise through substantive content.

- Conversation Ads: LinkedIn’s conversation ads (multi-step Messenger ads) provide qualification capability within the ad experience.

- Retargeting Value: LinkedIn retargeting to website visitors and content engagers captures high-intent prospects worth the premium CPM.

Measurement and Attribution Evolution

Social media measurement continues evolving as platform-reported attribution becomes less reliable.

Platform Attribution Limitations

Platform-reported metrics face several challenges:

- Attribution Windows: Platform attribution windows may not match actual customer journeys. Short attribution windows under-count impact; long windows may over-attribute.

- Cross-Platform Blindness: Each platform claims credit for conversions it influenced, but cross-platform journeys aren’t captured in individual platform reporting.

- View-Through Inflation: View-through conversions (someone saw an ad and later converted) often over-attribute credit to advertising that didn’t actually influence conversion.

- iOS Limitation: iOS tracking restrictions mean a significant portion of conversions aren’t attributed to the campaigns that drove them.

Alternative Measurement Approaches

Sophisticated measurement approaches supplement platform reporting:

- Marketing Mix Modeling: Statistical analysis of marketing spend and business outcomes, independent of tracking. Provides portfolio-level measurement that platform attribution cannot.

- Incrementality Testing: Geographic or audience holdout tests that measure true incremental impact of advertising. More accurate than attribution but requires scale and patience.

- Media Mix Calibration: Using incrementality results to calibrate platform-reported attribution to actual performance.

- Survey-Based Attribution: Asking customers how they learned about you provides qualitative signal that tracking misses.

Strategic Recommendations

Measurement strategy for social media lead generation:

- Multi-Method Approach: Don’t rely solely on platform attribution. Combine platform metrics with incrementality testing, MMM, and business outcome analysis.

- Focus on Business Outcomes: Optimize for downstream outcomes (lead-to-sale conversion, revenue, profit) rather than platform metrics alone.

- Accept Uncertainty: Perfect attribution isn’t possible in the current environment. Make decisions based on directionally correct measurement rather than precise-but-wrong platform reporting.

- Test and Learn: Use controlled tests to validate what’s actually working rather than trusting attribution models that may be systematically biased.

B2B vs B2C Social Media Strategy Differences

Social media lead generation requires fundamentally different approaches for B2B and B2C audiences.

B2B Social Media Strategy

- Platform Priority: LinkedIn dominates B2B lead generation for good reason – professional targeting (job title, company, industry, seniority) enables reaching decision-makers that consumer platforms can’t identify. Meta and YouTube provide supplementary reach, but LinkedIn typically deserves the majority of B2B social budget.

- Content Approach: B2B audiences respond to thought leadership, data, and expertise demonstration rather than entertainment or emotional appeal. Content that educates – industry insights, how-to guides, research findings – generates engagement and leads. Direct promotional content underperforms.

- Lead Quality Focus: B2B sales cycles are long and deal sizes are large, making lead quality more important than lead volume. A few qualified leads often matter more than many unqualified contacts. Optimize for downstream metrics (lead-to-opportunity, opportunity-to-close) rather than cost per lead.

- Sales Integration: B2B social leads typically require sales engagement. Social lead generation strategy should integrate with sales process – lead routing, qualification handoff, and sales enablement content that supports conversion.

- Account-Based Approaches: For high-value target accounts, account-based marketing integrates social advertising with personalized outreach. Target specific companies through LinkedIn advertising, then coordinate with sales for direct engagement.

B2C Social Media Strategy

- Platform Priority: Meta (Facebook/Instagram) typically dominates B2C lead generation due to scale and audience breadth. TikTok provides opportunity for younger demographics and viral reach. Platform priority depends on specific audience – home improvement skews older (Meta-heavy), solar appeals to environmentally-conscious audiences across platforms.

- Content Approach: B2C audiences respond to emotional appeal, social proof, and offers. Entertainment value affects performance – particularly on TikTok where native-feeling content dramatically outperforms traditional ads. Testimonials, transformation stories, and urgency messaging drive conversion.

- Lead Volume Focus: B2C lead generation often emphasizes volume with qualification through the funnel. Many leads, screened through qualification questions and buyer follow-up, yield converted customers. Cost per lead optimization matters more when processing many leads.

- Speed-to-Contact: B2C leads often have short consideration windows. Speed-to-contact dramatically affects conversion – leads contacted within minutes convert at much higher rates than leads contacted hours or days later. Social lead generation should integrate with rapid response capability.

- Native Form Optimization: B2C benefits significantly from native platform forms (Meta Instant Forms, LinkedIn Lead Gen Forms) that reduce friction. The trade-off – potentially lower quality leads – is manageable when response systems can quickly qualify and engage.

Budget Allocation Strategies

Allocating social media budget across platforms and objectives requires strategic framework.

Portfolio Approach to Platform Allocation

- Core Platform (50-70% of budget): The platform that delivers most reliably for your audience and vertical. For most B2C: Meta. For B2B: LinkedIn. The core platform receives majority allocation because it’s proven.

- Growth Platform (20-35% of budget): Platforms with growth potential where you’re building capability. This might be TikTok for B2C operators building short-form video capability, or YouTube for operators developing longer-form content.

- Test Allocation (5-15% of budget): Budget for testing new platforms, formats, and approaches. Test allocation should be sufficient to reach statistical significance but limited enough that failed tests don’t damage overall performance.

Testing Budget Management

- Minimum Viable Test: Each platform and approach needs sufficient budget to determine whether it works. Insufficient test budgets produce inconclusive results. Determine minimum spend to reach 95% confidence on your primary metric; don’t test below that threshold.

- Time-Bounded Tests: Tests should have defined duration, not open-ended budget. If a test hasn’t shown clear signal within defined timeframe (typically 2-4 weeks), it’s unlikely to succeed with more time.

- Kill Criteria: Define conditions that trigger test termination before completion. Catastrophic performance – CPL 3x target, zero conversions after threshold spend – warrants early termination.

- Scale Criteria: Define conditions that warrant scaling successful tests. Performance significantly above target for sustained period triggers budget increase and expanded testing.

Seasonal and Cyclical Adjustments

- Vertical Seasonality: Different lead generation verticals have distinct seasonal patterns. Insurance peaks during Medicare AEP (October-December); solar peaks in spring/summer; home services follow weather patterns. Budget should flex with demand.

- Platform Seasonality: Platform costs vary seasonally. Q4 CPMs increase significantly due to e-commerce advertising competition. Budget more aggressively in lower-competition periods; accept lower efficiency or reduced presence during peak competition.

- Economic Sensitivity: Economic conditions affect consumer lead generation. Economic uncertainty may reduce high-consideration purchases (home improvement, solar) while increasing insurance shopping. Monitor economic indicators and adjust budget allocation accordingly.

Case Patterns: Social Media Strategy in Practice

Understanding how operators have navigated social media evolution provides practical guidance.

The Platform Diversification Pattern

An operator dependent on Meta for 90% of lead volume faced cost increases that threatened profitability. CPMs had increased 40% over two years while lead quality declined.

Strategy: Initiated structured diversification program. Allocated 20% of budget to TikTok testing with dedicated creative team for native-feeling content. Built LinkedIn capability for B2B segment that had been underserved. Maintained Meta core while reducing dependency.

Execution: TikTok testing required 6 months before achieving consistent performance. Early creative failed; native-style approaches succeeded. LinkedIn required thought leadership content investment before advertising delivered results. Meta maintained baseline performance.

Results: Within 12 months, platform mix shifted to 60% Meta, 25% TikTok, 15% LinkedIn. Blended CPL improved 15% through platform diversification. Risk reduced through reduced single-platform dependency.

Key Insight: Platform diversification requires genuine capability building, not just budget allocation. TikTok success required different creative skills; LinkedIn success required content investment.

The AI Creative Acceleration Pattern

An operator struggled with creative testing velocity. Manual creative production limited testing to 5-10 variations per month; platforms optimized best with 30+ variations.

Strategy: Implemented AI-assisted creative workflow. AI generated initial variations; humans reviewed, selected, and refined. AI handled format adaptation across platforms. Human creative direction set themes and messaging strategy.

Execution: Deployed AI image generation for variation creation. Used AI copywriting for headline and body copy variations. Maintained human review for brand alignment and compliance checking.

Results: Testing velocity increased from 10 to 50+ variations monthly. Time-to-winning-creative decreased 60%. Creative team focused on strategic direction rather than production volume. CPL improved 20% through faster optimization.

Key Insight: AI amplifies human creative capability rather than replacing it. The combination of AI volume and human quality control outperformed either alone.

The First-Party Data Advantage Pattern

An operator invested early in first-party data collection, building email list and CRM integration when competitors relied on platform targeting.

Strategy: Built first-party data asset through content marketing, email capture, and CRM integration. Implemented server-side tracking (Conversions API) before it became industry standard. Created custom audiences from customer data rather than depending on platform lookalikes.

Execution: Invested in email marketing that generated customer data. Built technology infrastructure for data integration. Trained teams on first-party data activation.

Results: When iOS 14 privacy changes degraded platform targeting, the operator maintained targeting capability through custom audiences. Competitors saw 30-40% efficiency decline; this operator saw 10-15% decline. The first-party data investment provided sustainable competitive advantage.

Key Insight: First-party data investment pays off during privacy disruptions. The operators who invested before disruption weathered changes better than those who started after. For technical implementation of server-side tracking, see our Facebook CAPI implementation guide.

Key Takeaways

-

Platform algorithm shifts toward AI-recommended discovery content have reduced organic reach to near-zero for business pages – paid distribution is now required for reliable audience reach on all major platforms.

-

Meta’s targeting precision has degraded due to privacy changes, increasing CPMs 15-25% year-over-year while Advantage+ AI-optimized campaigns often outperform manual targeting with less transparency and control.

-

TikTok has matured from experimental to established advertising platform with expanded demographics (35-54 users now viable), improved advertising tools, and search advertising for high-intent capture – though regulatory uncertainty creates platform risk.

-

AI content generation enables 10x-100x creative variation production for testing but creates differentiation challenges as platform saturation increases; the strategic response is augmentation not replacement, with human authenticity elements.

-

Social commerce integration creates hybrid funnels where commerce and lead generation coexist – operators can experiment with commerce-first approaches that generate leads as secondary conversion.

-

Privacy-driven signal loss has made first-party data a competitive advantage – operators with customer data assets who implement server-side tracking maintain capabilities that privacy-dependent competitors lose.

-

Algorithm engagement factors favor video content with strong hooks, high dwell time, and native format feel – creative quality investment improves both organic reach and paid performance.

-

Creator integration for lead generation requires performance validation through small tests before scaling – micro-creators (10K-100K followers) often outperform mega-influencers for lead generation due to higher engagement and trust.

-

LinkedIn has strengthened B2B dominance with premium pricing justified by job title, company, and seniority targeting precision that no other platform matches – thought leadership content outperforms direct sales messaging.

-

Platform-reported attribution has become unreliable, requiring multi-method measurement combining incrementality testing, marketing mix modeling, and business outcome analysis rather than trusting platform metrics alone.

Frequently Asked Questions

Which social platform should lead generation operators prioritize in 2026?

Platform priority depends on vertical, audience, and capabilities. For most B2C lead generation, Meta (Facebook/Instagram) remains the largest and most mature platform – start there unless your audience clearly lives elsewhere. For B2B lead generation, LinkedIn provides targeting precision worth the premium pricing. TikTok deserves testing budget for verticals with 18-44 audiences, particularly those where native-feeling creative is achievable. The strategic answer isn’t picking one platform but building platform-appropriate capabilities: Meta expertise is table stakes; LinkedIn capability is required for B2B; TikTok capability provides competitive advantage where audiences align.

How should operators respond to targeting precision decline?

Targeting decline requires three strategic responses. First, invest in creative quality – as targeting becomes less precise, creative does more work identifying and attracting the right audience. Strong creative with broad targeting often outperforms weak creative with narrow targeting. Second, build first-party data assets – email addresses, phone numbers, and behavioral data you collect directly enable custom audiences that don’t depend on platform tracking. Third, optimize for downstream outcomes – when lead quality variance increases due to less precise targeting, focus on lead-to-sale conversion and revenue per lead rather than just cost per lead. Quality signals in your data help platforms optimize beyond initial form submission.

Is AI-generated content effective for social media lead generation?

AI content effectiveness depends on implementation. AI excels at generating creative variations for rapid testing – producing dozens of ad copy variations, image concepts, or video scripts that humans would take weeks to create. AI struggles with authentic human connection that builds trust for lead conversion. The effective approach: use AI for production efficiency and testing velocity while maintaining human strategic direction and authentic elements (real testimonials, actual team members, genuine customer stories). Platform algorithms may also begin deprioritizing obviously AI-generated content, making human authentication increasingly important.

How do operators measure social media lead generation effectiveness given attribution challenges?

Reliable measurement requires multiple approaches beyond platform-reported attribution. Implement incrementality testing – geographic or audience holdout tests that measure true advertising impact independent of tracking. Deploy marketing mix modeling to understand portfolio-level channel contribution. Track downstream outcomes (lead-to-sale conversion, customer lifetime value, revenue) that connect to business results regardless of attribution gaps. Use platform attribution as directional signal, not precise truth – relative performance between campaigns and creative is more reliable than absolute numbers. Accept that perfect measurement isn’t achievable; make decisions based on directionally correct signals rather than false precision.

What’s the role of organic social media in lead generation strategy?

Organic social media in 2026 serves lead generation indirectly rather than directly. Near-zero organic reach means organic posting rarely generates leads directly. Instead, organic content provides: social proof when prospects research your brand; content that can be promoted with paid distribution; engagement that feeds algorithmic signals for paid campaigns; and relationship maintenance with existing leads and customers. Invest in organic content strategically – quality over quantity, engagement over posting frequency, and integration with paid strategy rather than treating organic as independent channel.

How should lead generation operators approach TikTok’s regulatory uncertainty?

TikTok regulatory risk requires balanced approach. Don’t ignore TikTok – the platform offers unique audiences, lower CPMs than Meta, and effective advertising infrastructure. But don’t build TikTok-dependent lead generation either. Diversify across platforms so TikTok disruption doesn’t devastate operations. Develop TikTok-specific capabilities (native creative, trend participation, search advertising) that capture opportunity while it exists. Maintain flexible media allocation that can shift budget to alternatives if regulatory action limits TikTok access. The worst outcomes are either missing TikTok opportunity entirely or over-concentrating on a platform facing existential regulatory risk.

What creator partnership structures work best for lead generation?

Performance-based structures align creator incentives with lead generation outcomes but require tracking infrastructure and may encourage aggressive promotion that damages trust. Fixed-fee sponsored content provides predictability but shifts performance risk to the operator. The often-overlooked structure is content licensing – paying creators to produce content you own and distribute through paid advertising, combining authentic creator content with advertising scale and targeting. This provides the authenticity benefit of creator content without depending on creator audience distribution or complex attribution. Start with small tests across multiple creators, measure performance by lead quality not just volume, and scale relationships that demonstrate actual business results.

Sources

- Meta. “Meta Business Suite: Advertising Performance Benchmarks.” https://www.facebook.com/business/insights

- TikTok. “TikTok for Business: Advertising Solutions.” https://www.tiktok.com/business/en-US

- LinkedIn. “LinkedIn Marketing Solutions: B2B Advertising.” https://business.linkedin.com/marketing-solutions

- eMarketer. “Social Media Users Research.” https://www.emarketer.com/topics/topic/social-media-users