How to exploit the 8.5x pricing spread between premium and emerging solar markets. A data-driven framework for identifying underserved territories, optimizing traffic acquisition costs, and building profitable solar lead operations where competitors fear to tread.

The same solar lead sells for $200 in California and $25 in North Dakota. That 8x pricing difference exists because of electricity rates, policy incentives, installer density, and customer sophistication. Most lead generators see this spread and conclude the obvious: focus on California. They are wrong.

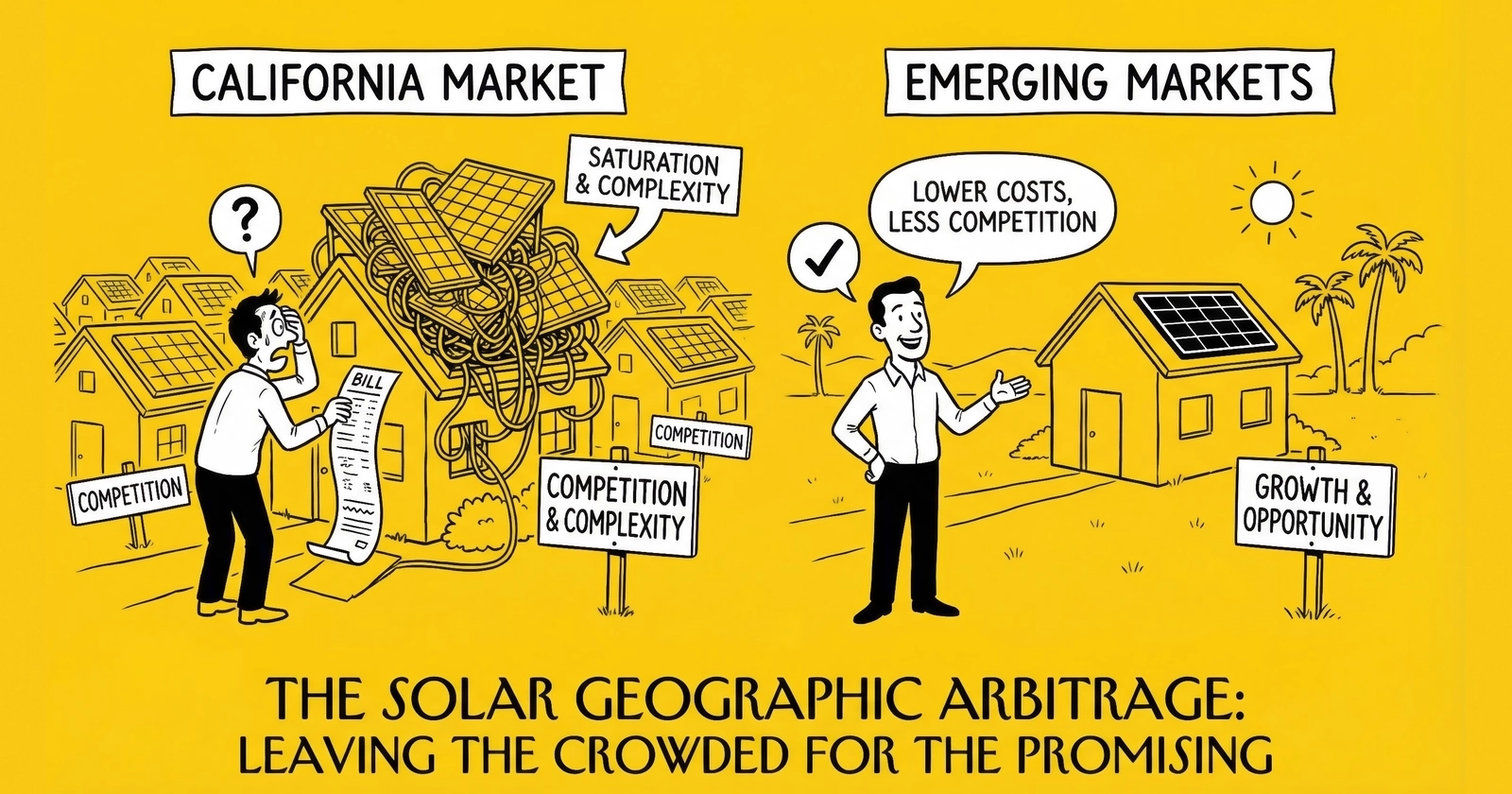

The operators making the highest margins in solar lead generation are not competing in saturated premium markets. They are identifying emerging territories where traffic costs are 80% lower, installer competition is minimal, and early-mover advantages create sustainable positioning. Geographic arbitrage in solar is not about chasing the highest CPL. It is about finding the widest spread between what leads cost to acquire and what they sell for in markets others overlook.

This guide provides the complete framework for solar geographic arbitrage: understanding why state-level value varies so dramatically, identifying low-competition opportunities before competitors arrive, executing traffic strategies that capture emerging demand, and building the buyer relationships that turn geographic positioning into durable competitive advantage. Every recommendation comes from operational experience in markets ranging from hyper-competitive California to nascent territories where the solar sales conversation is still novel.

The Geographic Pricing Reality in Solar Leads

No other lead generation vertical exhibits the geographic pricing variation of residential solar. A lead worth $1,929 in customer value in California might generate $225 in North Dakota. This 8.5x differential is not arbitrary. It reflects fundamental differences in economics, policy, infrastructure, and market maturity that create distinct arbitrage opportunities.

The Five Drivers of State-Level Value

Understanding why geographic value varies is essential for identifying opportunities. Five factors combine to determine what a solar lead is worth in any given market.

Electricity Rates set the foundation for solar economics. California homeowners pay average rates exceeding $0.25 per kilowatt-hour, among the highest in the nation. Hawaii regularly exceeds $0.30 per kWh. Massachusetts, Connecticut, and New Hampshire cluster around $0.22-$0.27 per kWh. These high-rate markets make solar payback periods shorter and sales conversations easier.

North Dakota, meanwhile, averages around $0.10 per kWh. The solar value proposition in low-rate states requires entirely different positioning, emphasizing energy independence and hedge value rather than immediate bill savings.

The math is straightforward. A California homeowner spending $300 monthly on electricity sees compelling economics from a solar installation that eliminates 80% of that bill. A North Dakota homeowner spending $90 monthly faces a much longer payback period on the same percentage reduction.

State and Utility Incentives layer additional value on top of federal credits. Massachusetts offers SMART (Solar Massachusetts Renewable Target) incentives. New York provides a 25% state tax credit up to $5,000. New Jersey maintains strong renewable portfolio standards that create SREC value. These incentive stacks can add $3,000-$10,000 to the customer value proposition.

Many emerging markets offer minimal state-level support, relying entirely on federal incentives. With the residential Investment Tax Credit eliminated after December 31, 2025, markets without state-level backstops face challenging economics in 2026 and beyond.

Net Metering Policies determine how much value solar customers receive for excess production. States with retail-rate net metering allow customers to offset consumption with production at full value. States with reduced net metering or time-of-use export rates diminish the financial case for solar unless battery storage captures self-consumption value.

California’s NEM 3.0 transition demonstrates the impact of policy changes. Export compensation was reduced by approximately 75% in April 2023. Payback periods extended from 5-6 years to 14-15 years for solar-only installations. The residential market contracted 40% in 2024 as a direct result.

Installer Density affects competition dynamics in both directions. California has hundreds of competing installers, creating downward pressure on installation costs through competition but upward pressure on lead prices through demand. High installer density means more buyers competing for limited qualified prospects.

Low-density markets have higher installation costs (less competition among contractors) but lower lead prices (fewer buyers competing). The opportunity is in markets where installer density is growing faster than lead supply.

Customer Sophistication influences close rates and sales cycle length. California homeowners have seen decades of solar marketing. They understand financing options, compare multiple quotes, and negotiate aggressively. This sophistication reduces margins but creates predictable conversion patterns.

Emerging market consumers often close faster with higher installation margins because they lack comparison benchmarks. The sales conversation feels novel rather than transactional. Lead generators who understand this dynamic can match leads to installers with appropriate expectations.

Current Market Tier Structure

For practical lead generation purposes, states cluster into five tiers based on lead value, traffic costs, and competitive intensity.

Tier 1: Premium Markets ($150-$300+ per lead)

California, Hawaii, Massachusetts, and New York command the highest lead prices. These markets combine high electricity rates, policy support, and mature installer infrastructure.

California remains Tier 1 despite NEM 3.0 challenges. Battery attachment rates reached 79% in 2024 as the value proposition shifted from grid export to self-consumption. Lead generators targeting California must qualify for storage interest, not just solar interest. A solar-only California lead has limited value. A solar-plus-storage lead with verified high electric bills remains premium.

Hawaii has the highest electricity rates in the nation, making solar economics compelling despite limited installer competition. Massachusetts combines strong state incentives with high rates and dense population. New York offers substantial state credits and serves a large market with premium installation economics.

Traffic costs in Tier 1 markets are proportionally high. Google Ads CPCs for solar terms in California regularly exceed $50-$75. Facebook CPMs run 40-60% higher than national averages. The arbitrage opportunity in these markets requires operational excellence and scale, not geographic positioning.

Tier 2: Strong Markets ($75-$150 per lead)

Texas, Florida, Arizona, New Jersey, and Colorado represent the growth frontier. These states combine strong fundamentals with lower competitive intensity than Tier 1 markets.

Texas installed the most solar capacity of any state in H1 2025 (3.8 GW), though most was utility-scale. The residential market grows but faces headwinds from utility resistance to net metering. Rising electricity prices and Texas-specific appeal for energy independence create strong demand drivers.

Florida recovered from previous policy challenges and offers compelling fundamentals: high electricity rates in summer, abundant sunshine, and a growing population of retirees with paid-off homes. Homeowners with no mortgage represent ideal solar customers since they own their roofs free and clear.

Arizona offers strong irradiance but reduced net metering since 2016 changes. The market is competitive but profitable for operators who understand utility territory nuances. New Jersey maintains high population density with good state incentives. Colorado benefits from environmental consciousness and moderate electricity rates.

Tier 2 markets offer the clearest geographic arbitrage opportunity for most practitioners. Traffic costs run 30-50% lower than California while lead prices remain strong. The competitive gap creates sustainable margin.

Tier 3: Developing Markets ($40-$75 per lead)

Nevada, Utah, New Mexico, Illinois, Virginia, Georgia, North Carolina, and South Carolina represent growth opportunities with developing infrastructure.

These states offer less installer competition, meaning lower lead costs, but also lower close rates and less sophisticated buyer operations. Lead generators serving Tier 3 markets need longer nurture sequences and more education-focused content.

Traffic acquisition costs in Tier 3 markets run 50-70% lower than Tier 1. A California-like lead in Georgia might cost $35 to acquire instead of $100+. If buyers pay $60, the margin structure is more favorable than fighting for $200 leads against entrenched competitors in saturated markets.

The opportunity in Tier 3 is timing. These markets are growing. Installer density is increasing. Lead prices are rising while traffic costs remain stable. Practitioners who establish presence now capture the appreciation as markets mature.

Tier 4: Emerging Markets ($25-$50 per lead)

Most Midwest and Mountain states fall into this tier. Low electricity rates and minimal policy support make solar economics challenging. Lead volume is limited, and buyers are price-sensitive.

Success in Tier 4 requires extremely low traffic acquisition costs. SEO-driven organic traffic, content marketing, and referral programs work better than paid advertising. The unit economics do not support high-CPL marketing spend.

However, Tier 4 markets present contrarian opportunities when policy changes create sudden demand. State-level incentive programs, utility rate increases, or federal policy shifts can move markets between tiers within months.

Tier 5: Minimal Markets (Generally Unprofitable)

North Dakota, South Dakota, Wyoming, and parts of Appalachia present minimal opportunity for lead generation. Low electricity rates, minimal sunshine, sparse population, and no policy support make these markets generally unprofitable. Even free leads have minimal buyer appetite.

The Mathematics of Geographic Arbitrage

The arbitrage opportunity is not simply selling to the highest-paying market. It is maximizing the spread between traffic acquisition cost and lead sale price across markets where that spread is widest.

Consider two scenarios:

Scenario A: California Focus

Consider a California-focused operation paying $65 per click with an 8% landing page conversion rate. The cost per lead acquired reaches $812.50, yet exclusive leads sell for only $175. The gross margin shows a loss of $637.50 per lead.

Wait, that math cannot be right. The reality is that most practitioners running California solar traffic lose money on pure direct response lead generation. They make it work through branded organic traffic with near-zero acquisition cost, call center operations where phone leads operate under different economics, battery storage upsells that increase lead value, and scale efficiencies that compress per-lead costs. For practitioners without those advantages, California is a money pit.

Scenario B: Tier 2/3 Geographic Arbitrage

Perhaps Florida offers better economics with its $18 CPC and 6% conversion rate. The cost per lead acquired drops to $300, with exclusive leads selling for $85. The gross margin still shows a loss of $215 per lead.

Still not working. The lesson is clear: direct response paid traffic for solar leads requires sophisticated optimization, scale, and often supplementary revenue streams. Pure arbitrage on traffic spreads is not sufficient.

Scenario C: Organic-Paid Hybrid in Developing Market

The real arbitrage works differently. Consider a hybrid approach in a developing market where organic traffic represents 60% of volume at an effective cost of $15 per lead, while paid traffic covers the remaining 40% at $280 per lead. The blended cost per lead reaches $121, yet leads in Georgia sell for only $65. Still negative.

The mathematical reality is sobering. Solar lead generation is a difficult business where margins require extremely efficient traffic acquisition through content, SEO, or partnerships. Operators need high sell-through rates of 85% or more to avoid unsold inventory costs, low return rates under 10% through rigorous quality verification, and optimized buyer relationships that maximize realized revenue.

Geographic arbitrage improves these margins at every step. Lower traffic costs, less sophisticated competition, installers hungry for leads in growing markets, and higher buyer loyalty because fewer alternatives exist.

California: The Saturated Premium Market

Understanding why California became saturated illuminates how to identify the next wave of opportunity markets before they reach similar competitive intensity.

Why California Dominated Solar Lead Value

For two decades, California offered the most attractive solar economics in the nation. Multiple factors converged to create a market where leads commanded premium prices:

Aggressive Policy Support: California’s California Solar Initiative, Renewable Portfolio Standards, and retail-rate net metering created a policy environment explicitly designed to drive solar adoption. The state provided additional rebates, favorable interconnection standards, and consistent political support for residential solar growth.

Highest Electricity Rates: Pacific Gas and Electric, Southern California Edison, and San Diego Gas and Electric operate some of the nation’s highest retail electricity rate structures. Tiered rates that could exceed $0.40 per kWh for high-usage customers made solar payback periods extremely attractive.

Environmental Consciousness: California’s population includes a significant segment willing to pay premiums for environmental benefits. This created demand beyond pure economics, expanding the addressable market.

Installation Infrastructure: Decades of solar development created deep installer infrastructure. Hundreds of companies competed for installations, driving down installation costs through competition while driving up lead costs through demand.

Financing Innovation: California saw the earliest development of solar leases, PPAs, and specialized loan products. This financing infrastructure made solar accessible to homeowners who could not pay cash, expanding the market dramatically.

The NEM 3.0 Shock

California’s Net Energy Metering 3.0 policy, implemented in April 2023, fundamentally altered the state’s solar economics. For a deeper analysis of how policy changes affect lead generation, see our guide on solar incentive changes for 2025. The changes demonstrate how quickly policy can shift market dynamics.

NEM 3.0 reduced export compensation by approximately 75%. A solar customer who previously received $0.25-$0.35 per kWh for excess production now receives $0.05-$0.08 per kWh during most hours. The policy shift extended payback periods from 5-6 years to 14-15 years for solar-only installations.

The market response was immediate and severe. The California Solar and Storage Association reported sales drops of 66-83% compared to 2022 baselines. Residential installations in 2024 declined 40% year-over-year. Major installers laid off workers and closed operations.

Yet California did not become worthless. The market transformed rather than disappeared:

Battery Storage Became Essential: With reduced export value, self-consumption became the primary value proposition. Battery attachment rates soared to 79%. The product shifted from “solar” to “solar-plus-storage.”

Lead Qualification Changed: A solar-only lead in California has limited value because the standalone economics no longer work for most customers. Lead generators must qualify for storage interest, high electricity usage, and battery financing capability.

Premium Positioning Intensified: The installers who survived California’s contraction are sophisticated operations with strong financing and installation capabilities. They pay premium prices for premium leads but have zero tolerance for unqualified prospects.

Lessons for Other Markets

California’s trajectory offers strategic lessons for lead generators evaluating other markets:

Policy Changes Create Compression Windows: When NEM 3.0 was announced, operators had months to pivot before implementation. Those who shifted traffic to Texas and Florida in late 2022 preserved profitability. Those who maintained California-heavy portfolios suffered margin compression and buyer churn.

Market Contraction Eliminates Marginal Players: California’s shakeout removed weak installers, leaving stronger buyers who pay premium prices but demand premium quality. The opportunity is in being the quality supplier to survivors.

Product Evolution Creates Segmentation: The shift to solar-plus-storage created a new product category. Lead generators who quickly adapted their qualification and routing captured the new market. Those who kept generating solar-only leads lost relevance.

Saturated Markets Still Offer Pockets: Even in compressed California, utility territory variation creates opportunity. SMUD territory (Sacramento) has different economics than SDG&E territory (San Diego). Lead generators who understand utility-level nuance find profitable niches within otherwise saturated markets.

Identifying Low-Competition Market Opportunities

The strategic advantage in solar lead generation comes from identifying markets before they become competitive. Early positioning in emerging territories creates sustainable advantages that late entrants cannot easily overcome.

Market Opportunity Indicators

Seven signals indicate markets poised for growth where early positioning creates advantage:

Rising Electricity Rates: Track utility rate cases and approved rate increases. A utility winning a 15% rate increase over two years signals improving solar economics. States where utilities are aggressively raising rates become more attractive for solar even without policy changes.

New State Incentive Programs: State legislatures and public utility commissions announce incentive programs months before implementation. Tracking proposed legislation and regulatory proceedings provides early warning of markets about to become attractive.

Installer Market Entry: When national installers like Sunrun, Freedom Forever, or regional players announce expansion into new territories, they are signaling market opportunity assessment. Following their expansion creates lead generation opportunities in markets with growing buyer demand.

Grid Reliability Concerns: States experiencing grid stress, rolling blackouts, or infrastructure failures see increased consumer interest in energy independence. Texas after Winter Storm Uri, California during fire seasons, and Florida during hurricane recovery all experienced demand spikes driven by reliability concerns.

Population and Housing Growth: Solar follows rooftops. States with strong population growth and new housing development create expanding addressable markets. Track Census data, building permits, and population migration patterns.

Environmental Policy Momentum: States with growing political support for renewable energy often precede incentive programs with planning documents, climate goals, and stakeholder processes. These signals indicate future policy support.

Utility-Scale Solar Development: When utilities invest in solar farms, the technology and supply chain infrastructure follows. Residential solar often grows in states where utility-scale projects have already established vendor networks and installer capabilities.

Current High-Potential Markets

Based on indicator analysis, several markets present near-term opportunity for geographic arbitrage:

South Carolina: Rising electricity rates, new state incentives under discussion, and population growth from migration create improving fundamentals. Installer density is low relative to market potential. Traffic costs run 60-70% below Tier 1 markets.

Georgia: Strong population growth, improving state policy environment, and regional installer expansion create opportunity. Georgia Power’s rate structure increasingly favors solar economics. The market is developing but not yet saturated.

Virginia: Renewable portfolio standards create utility demand for distributed generation. State incentives are strengthening. Northern Virginia’s high-income demographics and electricity rates make solar increasingly attractive.

Ohio: Surprisingly strong solar economics in parts of the state driven by high utility rates in certain territories. AEP Ohio rates create favorable payback periods. Market is nascent with minimal installer competition.

Michigan: Strong RPS, utility rate increases, and environmental consciousness create demand. The state has untapped potential in suburban Detroit, Grand Rapids, and Ann Arbor markets.

Illinois: Strong incentive programs including Solar for All and attractive net metering. Chicago suburbs and downstate markets both present opportunity. Installer density is growing but traffic competition remains low.

Market Entry Timing Framework

Entering too early wastes resources. Entering too late sacrifices positioning. The optimal entry window occurs when installer demand begins outpacing lead supply but before lead prices attract major competitors.

Phase 1: Scout (6-12 months before entry)

During the scouting phase, monitor policy developments and rate cases that signal improving economics. Track installer expansion announcements that indicate growing buyer demand. Test minimal organic content to gauge search volume and competition levels. Build relationships with regional installers through industry events like Solar Power International and state-level conferences.

Phase 2: Position (3-6 months before entry)

The positioning phase involves developing landing pages and content targeting specific markets before committing significant resources. Launch limited paid campaigns to test conversion rates and validate unit economics assumptions. Negotiate trial agreements with two or three regional installers to establish initial buyer relationships. Establish local phone numbers and regional presence signals that build credibility with consumers.

Phase 3: Capture (Market entry)

When entering the market, scale paid campaigns based on tested unit economics from the positioning phase. Build SEO presence simultaneously for long-term organic positioning that reduces future acquisition costs. Expand the installer network based on proven lead performance, using success stories from initial buyers to attract additional partnerships. Develop utility-territory-level optimization as you learn the nuances of different service areas within the state.

Phase 4: Defend (Ongoing)

Ongoing defense requires monitoring competitive entry and adjusting pricing before newcomers erode margins. Deepen installer relationships through consistent performance and exclusivity arrangements that lock in demand. Expand to adjacent territories using the established playbook developed in the initial market. Build content and SEO moats that create sustainable advantage and raise barriers for late entrants.

Traffic Acquisition for Emerging Markets

Traffic strategies for low-competition solar markets differ fundamentally from approaches that work in saturated territories. Lower search volumes, less sophisticated consumer awareness, and different competitive dynamics require adapted tactics.

Organic and Content Strategies

Emerging markets typically have lower search volume but also less content competition. This creates opportunity for SEO-first approaches that would be impossible in California.

Localized Content Clusters: Create comprehensive content addressing solar considerations for specific states, cities, and utilities. “Solar in Columbia SC: 2025 Guide” can rank on page one with modest effort. The equivalent California content requires years of authority building.

Effective content addresses state-specific incentive programs with current details, utility territory rate structures and net metering policies, and the local installer landscape including what qualities homeowners should seek. Regional weather patterns and production expectations help set realistic expectations, while coverage of available financing options and local permitting and HOA considerations rounds out the information homeowners need to make informed decisions.

Calculator and Tool Content: Interactive tools that help consumers estimate solar savings for their specific situation generate leads while building SEO authority. State-specific calculators using actual utility rates convert at high rates because they provide immediate personalized value.

Educational Sequences: Emerging market consumers need more education than California homeowners. Email nurture sequences, downloadable guides, and video content build awareness and capture leads earlier in the consideration journey.

Local Partnership Content: Content partnerships with local home improvement blogs, real estate sites, and community publications build authority and generate traffic from trusted sources.

Paid Traffic Approaches

Paid campaigns in emerging markets require different optimization than saturated territories.

Keyword Strategy: Long-tail and geographic modifiers often outperform broad terms. “Solar installers Greenville SC” may have lower volume but dramatically lower CPC and higher intent than “solar installation.”

Focus bidding on city plus solar installation variations, utility name plus solar combinations, and “how much is solar in [state]” question queries. Competitor installer names in the region often convert well, as do energy independence and grid reliability terms that resonate particularly in markets that have experienced outages or extreme weather events.

Platform Mix: Facebook and Instagram often outperform Google in emerging markets. Lower competition for impressions and the ability to target homeowner demographics based on property values and home equity creates efficient acquisition channels.

Native advertising through platforms like Taboola and Outbrain can work effectively in markets with lower digital advertising competition. CPMs run 40-60% lower than in major metros.

Audience Development: Build custom audiences from organic visitors, then create lookalikes for paid expansion. This approach works particularly well in emerging markets where the addressable audience is more concentrated.

Traffic Cost Benchmarks by Market Type

Current traffic cost benchmarks for solar-related terms vary dramatically by market type.

Tier 1 Markets

In premium markets like California, Massachusetts, and New York, Google Search CPCs range from $45 to $85, while Facebook CPMs run $25 to $40. Landing page conversion rates typically fall between 6% and 10%, resulting in effective costs per lead of $450 to $1,200. These markets demand operational excellence and scale to achieve profitability.

Tier 2 Markets

Texas, Florida, and Arizona represent the growth frontier with more accessible economics. Google Search CPCs range from $25 to $45, and Facebook CPMs run $15 to $25. Conversion rates of 5% to 8% yield effective costs per lead of $300 to $700. The combination of strong lead prices and lower traffic costs creates the clearest arbitrage opportunity.

Tier 3 Markets

Developing markets including Georgia, North Carolina, and Virginia offer Google Search CPCs of $12 to $28 and Facebook CPMs of $8 to $18. Lower conversion rates of 4% to 7% still produce effective costs per lead of $180 to $500. These markets reward early positioning before competition arrives.

Tier 4 Markets

Emerging territories like Ohio, Michigan, and Missouri present the lowest traffic costs, with Google Search CPCs of $8 to $18 and Facebook CPMs of $5 to $12. Conversion rates of 3% to 6% result in effective costs per lead of $150 to $400. Success here requires organic-first strategies since paid economics remain challenging.

These benchmarks shift constantly based on seasonal patterns, policy changes, and competitive entry. Understanding solar seasonal patterns helps optimize traffic timing. The directional relationship remains stable: lower-tier markets have proportionally lower traffic costs.

Building Buyer Networks in Emerging Markets

Geographic arbitrage requires buyers willing to purchase leads in target markets. Installer relationships in emerging territories require different approaches than established markets.

Identifying and Qualifying Buyers

Emerging markets have fewer installers, which creates both constraint (limited buyer demand) and opportunity (less competition for buyer relationships).

National Installer Expansion: Track when national players like Sunrun, Freedom Forever, Momentum Solar, and Titan Solar Power announce expansion into new states. These companies have established lead buying processes and predictable purchasing patterns.

Regional Installer Growth: Regional installers expanding from adjacent territories often seek lead sources in new markets. A company dominating North Carolina that enters South Carolina needs leads in the new territory.

Local Installer Development: Local contractors transitioning from general electrical or roofing work into solar installation need lead sources as they build sales capabilities. These buyers often accept smaller volumes and different terms than established operations.

Installer Financial Health Indicators: Before building relationships, assess buyer stability. Evaluate years in business and installation volume alongside online review patterns that reveal customer satisfaction trends. Employee count trends indicate whether the company is growing or contracting. Payment patterns with other vendors, if discoverable through industry contacts, reveal financial health. Finally, news coverage and industry reputation provide context about the installer’s market position and reliability.

Relationship Building Approaches

Emerging market buyers often lack established lead buying processes. Relationship building requires education and partnership rather than pure transaction.

Performance Demonstrations: Offer trial volumes at reduced prices or cost-sharing arrangements to prove lead quality. Installers skeptical of third-party leads become believers when they see contact rates and close rates from verified traffic.

Transparency and Reporting: Provide detailed performance reporting that helps installers understand lead economics. Share contact rates, appointment rates, and any available disposition data. Buyers who understand their numbers buy more confidently.

Exclusivity Arrangements: Emerging market installers often prefer exclusivity. They want leads that only they receive. Exclusive arrangements command premium pricing and create buyer loyalty.

Training and Optimization Support: Some emerging market installers lack sales optimization experience. Offering guidance on speed-to-contact, follow-up cadences, and objection handling improves their close rates and your relationship value.

Pricing Strategies

Pricing in emerging markets requires balancing market development with sustainable economics.

Market Development Pricing: Consider below-market introductory pricing to establish presence and prove value. Aggressive pricing that builds buyer dependency creates pricing power as the market matures.

Volume-Based Tiers: Structure pricing that rewards buyer commitment. Installers who commit to minimum monthly volumes receive better per-lead pricing, locking in demand.

Performance Pricing Experiments: Shared-revenue models where lead generators participate in installation revenue create alignment but require trust and transparency. These work better with established buyer relationships.

Geographic Premium Capture: As markets mature, lead prices rise. Practitioners who established early positioning can capture these increases while maintaining buyer relationships built during development phases.

Qualification and Quality for Geographic Arbitrage

Lead quality requirements vary by market maturity. Emerging market buyers have different tolerances and expectations than sophisticated California operations.

Market-Appropriate Qualification Levels

Mature Markets (Tier 1): Premium qualification is essential. California installers demand verified homeownership through property database matching, utility bill verification confirming usage levels, and battery storage interest confirmation. Credit pre-qualification establishes financing eligibility, while roof age and condition screening prevents wasted sales appointments. Consent documentation must meet stringent TCPA requirements. Leads failing any verification step have minimal value in these markets.

Developing Markets (Tier 2-3): Moderate qualification balances quality with volume. Self-reported homeownership with basic address verification suffices, along with electric bill amount self-reporting where only the top 20% of usage claims require upload verification. Standard TCPA consent capture meets legal requirements, while basic roof screening covers age and major issues. Credit self-attestation replaces formal pre-qualification. Quality tolerance is higher in these markets because installers have fewer lead sources.

Emerging Markets (Tier 4): Basic qualification prioritizes volume. Address verification confirms location, and phone verification via SMS ensures contact viability. Basic consent capture meets minimum legal requirements, while self-reported ownership suffices without database confirmation. Installers in emerging markets often accept less-qualified leads because alternative sources do not exist.

Quality Verification Investment Framework

Verification costs money. The question is whether incremental quality investment improves margins.

Verification Cost Stack

Individual verification costs add up but remain modest relative to lead values. Phone verification via SMS runs $0.05 to $0.15 per lead, while email verification costs $0.01 to $0.05. Address standardization adds $0.02 to $0.10. Property database lookups for homeownership verification cost $0.50 to $2.00, and utility verification ranges from $0.75 to $1.50. TrustedForm certification for consent documentation runs $0.50 to $1.00. A full verification stack totals $2.00 to $5.00 per lead.

Return on Verification Investment

The return on verification investment becomes clear when examining return rates. Unverified leads experience return rates of 25% to 35% as buyers reject poor-quality contacts. Basic verification reduces returns to 15% to 20%, while full verification brings return rates down to 5% to 10%.

Consider a $75 lead in a Tier 3 market. An unverified lead at $75 gross with a 30% return rate realizes only $52.50. A fully verified lead with $4 in verification cost starts at $71 gross, but a 7% return rate yields $66 in realized revenue. The verification pays for itself and improves buyer relationships through demonstrated quality commitment.

Fraud Prevention for Multi-Market Operations

Geographic arbitrage operations spanning multiple markets face distinct fraud challenges:

Geo-Fraud Patterns: Fraudsters may generate leads claiming locations in premium markets when actual traffic originates elsewhere. IP geolocation verification helps, but VPNs complicate detection.

Address Manipulation: Fake addresses in target territories waste buyer time. Property database verification confirms addresses exist and match claimed homeownership.

Volume Arbitrage Fraud: Some fraud operations generate high volumes in low-cost markets, hoping a percentage slip through quality controls. Velocity scoring and pattern detection help identify suspicious patterns.

Consent Fraud: Lead aggregators sometimes recycle old consent or manufacture consent documentation. TrustedForm certificates with video replay and timestamp verification prove genuine consent capture. For more on fraud prevention strategies, see our guide to solar lead fraud and homeownership verification.

Policy Monitoring and Market Dynamics

Geographic arbitrage requires constant monitoring of policy changes that shift market value overnight. Those who anticipated NEM 3.0 preserved profitability. Those who reacted after the fact took losses.

Critical Policy Monitoring Points

Federal Policy

Federal policy tracking centers on Investment Tax Credit changes, with the residential credit eliminated after 2025 while the commercial credit follows a different timeline. Proposed legislation affecting renewable energy incentives requires constant monitoring, as does Treasury guidance on incentive qualification that can shift eligibility rules.

State Policy

At the state level, net metering proceedings and proposed changes directly affect lead economics. State tax credit modifications can move markets between tiers overnight. Renewable Portfolio Standard (RPS) updates signal utility obligations that drive solar adoption, while building code requirements for solar on new construction create expanding addressable markets.

Utility Policy

Utility-level changes often fly under the radar but materially affect economics. Rate case proceedings determine electricity prices that drive the solar value proposition. Net metering tariff changes affect export compensation. Fixed charge implementations can undermine solar savings, and time-of-use rate expansions change the storage value proposition.

Regulatory Bodies

Monitor state public utility commission dockets for pending proceedings. Legislative committee hearings provide early warning of proposed changes. Governor and attorney general statements signal political direction that precedes formal policy action.

Building a Monitoring System

Effective policy monitoring requires systematic processes:

State Utility Commission Subscriptions: Most state PUCs offer email notifications for specific docket types. Subscribe to solar, net metering, and rate case dockets in priority markets.

Industry Association Intelligence: SEIA (Solar Energy Industries Association) and state-level associations monitor policy and provide member alerts. Membership costs are modest relative to intelligence value.

Legislative Tracking Services: Tools like LegiScan, BillTrack50, and state legislature RSS feeds provide early warning of proposed legislation.

Regulatory Analyst Relationships: Consulting relationships with regulatory analysts who track specific states provide interpretation and context for policy developments.

Peer Network Intelligence: Relationships with other solar lead generators (even competitors) provide early warning of market changes. Industry events, LinkedIn groups, and informal networks share intelligence.

Responding to Policy Changes

When policy changes shift market dynamics, response speed determines outcomes.

Positive Changes

When new incentives or rate increases improve market economics, scale traffic acquisition in affected markets immediately. Contact installers about increased capacity and lead appetite since they will be ramping sales teams. Develop market-specific landing pages emphasizing new benefits to capture organic positioning before competitors. Build content addressing the policy changes to establish long-term search authority.

Negative Changes

When reduced net metering or incentive eliminations damage market economics, reduce traffic spend in affected markets before losses compound. Communicate proactively with buyers about volume expectations so they can adjust. Pivot traffic to alternative markets using established playbooks developed during geographic diversification. Evaluate battery storage positioning if the market can sustain a solar-plus-storage value proposition even with degraded export economics.

Transitional Windows

The period between policy announcement and implementation creates unique opportunity. Maximize volume during deadline-driven demand surges as consumers rush to lock in expiring benefits. Capture premium pricing from installers racing to fill pipelines before transitions take effect. Simultaneously prepare for post-transition market contraction and position alternative markets for traffic migration when the window closes.

The Post-ITC Landscape and Future Opportunities

The residential Investment Tax Credit expires for new installations after December 31, 2025. This fundamental shift creates both challenges and opportunities for geographic arbitrage strategies.

Market Contraction Expectations

Without the 30% federal tax credit, residential solar economics change dramatically. Consumer costs increase $6,000 to $9,000 on typical installations, extending payback periods by approximately 30%. Industry projections suggest volume declines of 30% to 50% in 2026, and lead values will likely compress 20% to 40% as installer margins tighten.

The geographic arbitrage implications are significant. Premium markets remain viable where high electricity rates offset the lost incentive, but marginal Tier 4 and Tier 5 markets become largely unprofitable. State-level incentives become critical differentiators in market selection. The battery storage value proposition strengthens as backup power and time-of-use optimization become the primary selling points rather than grid export value.

States Positioned for Post-ITC Relevance

Markets with strong state-level support will outperform post-ITC:

New York: 25% state tax credit up to $5,000 partially offsets federal loss. Strong electricity rates maintain payback periods. Market complexity increases but opportunity persists.

Massachusetts: SMART incentives and high electricity rates create viable economics. The state has political commitment to renewable support.

California: Despite NEM 3.0 challenges, California’s combination of high rates, storage value, and potential state responses may maintain relevance for storage-focused operations.

New Jersey: Strong RPS and SREC values provide continuing incentive structure independent of federal credits.

Illinois: Solar for All and other programs may expand to fill federal gap.

Commercial Solar Pivot Opportunity

The commercial Investment Tax Credit follows a different timeline. Projects begun by July 4, 2026, can qualify for the full 30% credit if placed in service within four years. This creates potential opportunity for lead generators who develop commercial capabilities.

Commercial solar lead generation differs fundamentally from residential. Sales cycles run 6 to 18 months rather than weeks. Transaction values range from $100K to over $1M for single installations, attracting different buyer types including commercial installers, EPCs, and developers. Qualification criteria focus on property ownership, roof access rights, and energy usage patterns rather than consumer credit scores. Business credit assessment replaces consumer financing pre-qualification.

Operators who build commercial capability before residential contraction can capture this adjacent market as an offset to volume losses in the residential segment.

Frequently Asked Questions

What does geographic arbitrage mean in solar lead generation?

Geographic arbitrage in solar lead generation means exploiting the pricing differences between high-cost premium markets and lower-cost emerging markets. The same lead that sells for $200 in California might sell for $65 in Georgia. Arbitrage profit comes from the spread between what leads cost to acquire in each market versus what they sell for. Success requires finding markets where traffic acquisition costs are low relative to lead sale prices, not simply selling to the highest-paying market.

Why is there such a large price difference between states for solar leads?

The 8.5x pricing spread between top-tier and bottom-tier markets reflects fundamental economic differences. California leads command premiums because high electricity rates create 5-6 year payback periods, making solar an easy economic decision. North Dakota leads have minimal value because $0.10 per kWh electricity rates extend payback to 15+ years. Additional factors include state incentives, net metering policies, installer density, and customer sophistication. These factors compound to create dramatic state-by-state value differences.

Is California still worth targeting after NEM 3.0?

California remains a premium market but requires fundamentally different positioning. NEM 3.0 reduced export compensation by 75%, making solar-only installations economically challenging. However, battery attachment rates reached 79% because the value proposition shifted to self-consumption and backup power. Lead generators targeting California must qualify for storage interest, high electricity usage, and financing capability. Solar-only California leads have limited value. Solar-plus-storage leads remain premium.

What are the best emerging markets for solar leads in 2025?

Current high-potential markets include South Carolina (rising rates, improving policy), Georgia (population growth, regional installer expansion), Virginia (strengthening incentives, high-income Northern Virginia), Ohio (surprisingly favorable utility rates in certain territories), and Illinois (strong incentive programs, growing installer base). For a detailed breakdown of solar lead CPL by state, see our 2025 pricing guide. These markets offer traffic costs 50-70% below Tier 1 markets while lead prices are rising as installer density grows.

How do I find solar lead buyers in new markets?

Start by tracking national installer expansion announcements. When companies like Sunrun, Freedom Forever, or regional players enter new territories, they need lead sources. Regional installers expanding from adjacent states also seek new market leads. Industry events like Solar Power International and regional conferences provide buyer relationship opportunities. Performance demonstrations through trial volumes at reduced prices help convert skeptical installers who have not previously purchased third-party leads.

How does the ITC expiration affect geographic arbitrage strategy?

The residential ITC expiration after December 31, 2025, fundamentally reshapes market viability. Markets dependent solely on federal incentives (most Tier 4-5 markets) become largely unprofitable. Markets with strong state-level support (NY, MA, NJ, IL) maintain relevance. High electricity rate markets where economics work without incentives (parts of CA, HI) remain viable. Geographic arbitrage strategy must prioritize markets with state-level backstops and shift away from pure federal incentive dependency.

What verification is necessary for solar leads in emerging markets?

Emerging market buyers typically accept less verification than sophisticated California operations, but quality investment still improves margins. Essential verification includes phone confirmation via SMS, address standardization, and basic consent capture. Recommended additions include property database homeownership verification ($0.50-$2.00 per lead) and electric bill self-reporting. Full verification reduces return rates from 25-35% to 5-10%, more than paying for verification costs while building buyer relationships.

How do I monitor policy changes that affect market value?

Effective policy monitoring requires systematic approaches. Subscribe to state public utility commission dockets for solar and net metering proceedings. Join SEIA and state solar associations for industry intelligence. Use legislative tracking tools like LegiScan or BillTrack50 for proposed legislation. Build relationships with regulatory analysts who specialize in priority markets. Connect with industry peers through events and online communities for early warning signals.

What traffic sources work best for low-competition solar markets?

Emerging markets favor organic and content strategies due to lower search competition. Localized content addressing state-specific solar considerations can rank on page one with modest effort. Long-tail paid search terms with geographic modifiers often outperform broad terms at lower CPCs. Facebook and Instagram frequently outperform Google due to lower competition for homeowner demographics. Native advertising through Taboola and Outbrain works efficiently where digital ad competition is low.

How quickly can market conditions change?

Policy changes can shift market value 30% or more within 90 days. California’s NEM 3.0 announcement gave operators months to prepare, but those who waited until implementation took significant losses. Texas utility rate increases, Florida incentive changes, and state tax credit modifications can create or destroy market opportunity rapidly. Practitioners who maintain policy monitoring systems and pre-positioned traffic capabilities respond fastest to market shifts.

Should I focus on one market or diversify geographically?

Diversification protects against policy-driven market shocks. California-concentrated operations suffered severely during NEM 3.0 transition. Texas-Florida-Northeast diversified operations maintained profitability. However, spreading too thin creates mediocrity everywhere. The optimal approach focuses on 3-5 priority markets with genuine operational depth rather than thin presence across 20 states. Build excellence in chosen markets before expanding.

Key Takeaways

-

Geographic arbitrage is about spread, not absolute prices. The opportunity is in markets where the gap between traffic acquisition cost and lead sale price is widest, not necessarily where lead prices are highest. Tier 2-3 markets often offer better margin structures than hyper-competitive California.

-

Market tiers shift based on policy, not geography. States move between tiers as electricity rates change, incentives are implemented or removed, and net metering policies evolve. Today’s Tier 4 market can become Tier 2 within 18 months if policy changes favorably.

-

Early positioning creates sustainable advantage. Operators who enter emerging markets before competitors establish SEO authority, buyer relationships, and operational playbooks that late entrants cannot easily overcome. The window for early-mover advantage typically lasts 18-36 months.

-

California remains valuable but requires different positioning. NEM 3.0 transformed California from solar-only to solar-plus-storage. Lead generators who adapted to battery qualification capture premium prices. Those generating solar-only leads lost relevance.

-

The ITC expiration reshapes market viability. After December 31, 2025, markets without state-level incentive support face challenging economics. Geographic strategy must prioritize states with policy backstops and high electricity rates that maintain viability without federal credits.

-

Traffic strategy differs by market maturity. Emerging markets favor organic-first approaches due to lower competition. Mature markets require scaled paid operations with sophisticated optimization. Applying California tactics to Georgia wastes resources.

-

Buyer relationships in emerging markets require partnership. Unlike transaction-focused California relationships, emerging market installers often need education, transparency, and performance proof before becoming reliable buyers. Investment in relationship building pays long-term dividends.

-

Policy monitoring provides competitive advantage. Those who anticipated NEM 3.0 preserved profitability by pivoting early. Those who reacted after implementation took losses. Systematic policy monitoring enables proactive rather than reactive positioning.

-

Quality investment pays for itself regardless of market. Verification costs of $2-5 per lead reduce return rates from 25-35% to 5-10%, more than paying for the investment while building buyer trust and relationship durability.

-

Diversification protects against market shocks. Single-market concentration creates catastrophic risk when policy changes negatively. Geographic diversification across 3-5 priority markets maintains profitability through individual market disruptions.

Market data and policy information current as of late 2025. All regulatory claims regarding tax credits, net metering, and state incentives should be verified before acting, as policy continues to evolve rapidly. This article is excerpted from “The Lead Economy: The Complete Guide to Building a Lead Generation Business.”