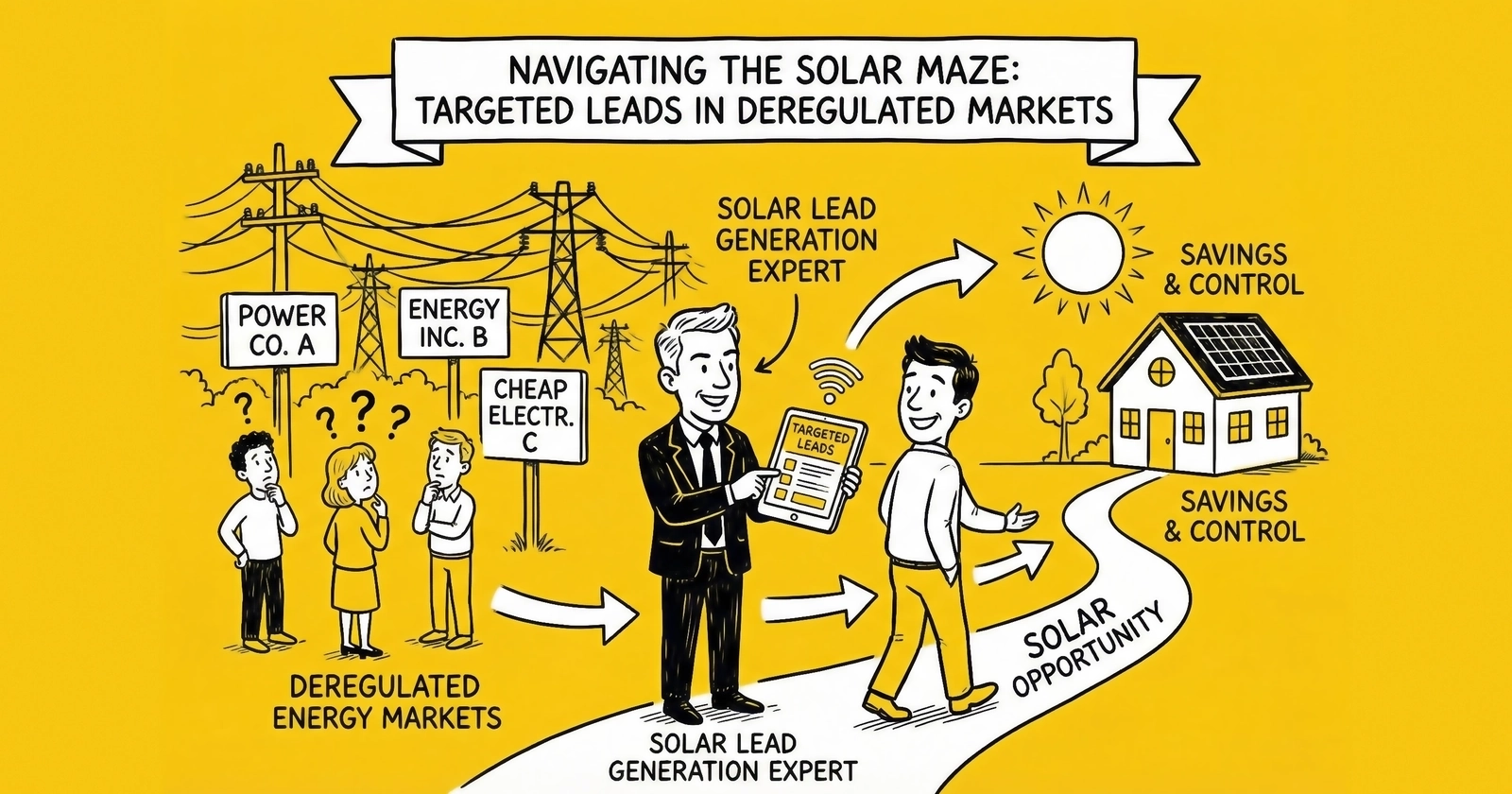

How retail choice markets, ERCOT dynamics, and competitive electricity create unique opportunities for solar lead generators who understand the regulatory landscape.

The solar lead vertical already operates with an 8.5x geographic pricing spread between California and North Dakota. Deregulated energy markets add another layer of complexity and opportunity that most lead generators fail to exploit. In states where consumers can choose their electricity provider, solar leads carry different value propositions, face distinct competitive dynamics, and require specialized qualification strategies.

Approximately 30% of U.S. electricity customers live in deregulated or partially deregulated markets. These consumers already understand shopping for electricity. They compare rates. They switch providers. This sophistication translates directly into solar conversion behavior that differs meaningfully from consumers in regulated monopoly territories.

Texas alone installed 3.8 GW of solar capacity in H1 2025, more than any other state. The ERCOT grid operates independently from the rest of the continental United States, creating a regulatory and market environment that rewards operators who understand its unique dynamics. Lead generators who treat Texas solar leads like California solar leads leave money on the table or, worse, generate leads that installers cannot convert.

This guide maps the intersection of solar lead generation and deregulated energy markets. You will learn which states offer deregulated opportunities, how retail electricity competition affects solar economics, the specific dynamics of the Texas ERCOT market, and how to qualify leads differently when selling into competitive retail environments.

Understanding Deregulated Energy Markets

Before diving into solar lead tactics, you need to understand what energy deregulation actually means and how it affects the consumers you are trying to reach.

What Deregulation Changed

In traditional regulated markets, a single utility holds a monopoly over electricity generation, transmission, distribution, and retail sales in its territory. Consumers have one option: take service from the local utility at rates set by the state public utility commission. The utility builds power plants, maintains the grid, sends the bills, and handles everything in between.

Deregulation separated these functions. The transmission and distribution infrastructure typically remains a regulated monopoly, but generation and retail electricity sales opened to competition. Consumers in deregulated markets can choose their retail electricity provider (REP) from dozens or hundreds of competing companies, each offering different rate structures, contract terms, and energy sources.

This restructuring happened primarily in the late 1990s and early 2000s, though the details vary significantly by state. Texas restructured in 2002. Pennsylvania and Ohio restructured earlier. California attempted restructuring, experienced the 2000-2001 energy crisis, and partially reversed course.

Current Deregulated States

As of 2025, the following states have significant retail electricity choice:

Fully Deregulated Residential Markets:

- Texas

- Pennsylvania

- Ohio

- Connecticut

- Illinois (partial)

- Delaware

- Maryland

- New Jersey

- New York (partial)

- Maine

Partially Deregulated Markets (commercial focus or limited residential):

- California (limited)

- Michigan (limited)

- New Hampshire

- Massachusetts

- Rhode Island

- Arizona (commercial only)

- Montana (larger customers)

- Oregon (larger customers)

- Virginia (limited)

The degree of actual retail competition varies substantially even within “deregulated” states. Some markets have robust competition with dozens of active REPs. Others have limited participation where the incumbent utility retains most customers despite theoretical choice.

Why This Matters for Solar Leads

Consumers in deregulated markets differ from consumers in regulated markets in ways that directly affect solar lead generation:

Price awareness is higher. These consumers already shop for electricity. They understand that energy costs are negotiable, not fixed. They compare options. This sophistication cuts both ways: they are more receptive to solar as another shopping option but also more demanding about understanding the economics.

Contract complexity is familiar. Consumers in competitive markets have signed electricity contracts with fixed rates, variable rates, introductory periods, and early termination fees. The complexity of solar financing options is less intimidating to consumers who already navigate contract terms for their current electricity service.

Switching costs are understood. Consumers who have switched REPs know that changing providers is possible. The psychological barrier to making a major energy decision is lower than for consumers who have never chosen their utility.

Rate volatility is experienced. Consumers in deregulated markets have lived through rate fluctuations. They understand that electricity prices can spike. This experience makes the rate-lock appeal of solar more tangible. Instead of an abstract risk, rising electricity costs are a lived reality.

Distrust of utilities exists. In some deregulated markets, particularly after rate spikes or utility failures, consumers harbor skepticism toward the traditional utility model. This creates openness to alternatives like solar that bypass the traditional system.

The Texas ERCOT Market: Largest Deregulated Opportunity

Texas represents the single largest opportunity for solar lead generation in deregulated energy markets. Understanding ERCOT dynamics is essential for any serious solar lead operator.

ERCOT Basics

The Electric Reliability Council of Texas (ERCOT) manages approximately 90% of the Texas electrical grid. Unlike the rest of the continental United States, which operates on two major interconnected grids (Eastern and Western), ERCOT operates independently. This independence exists specifically to avoid federal regulatory oversight.

ERCOT does not own generation or transmission assets. It operates the wholesale electricity market, maintains grid reliability, and manages the flow of power across transmission lines. Retail electricity providers purchase wholesale power through ERCOT and sell it to end consumers in competitive retail markets.

The Texas residential retail market is one of the most competitive in the world. The Public Utility Commission of Texas (PUCT) maintains the “Power to Choose” comparison website where consumers can compare hundreds of electricity plans from dozens of providers. Monthly switching volumes reach into the hundreds of thousands of customers.

Why Texas Solar Leads Differ

Several characteristics make Texas solar leads distinct from leads in other major solar markets:

No meaningful state incentives exist. Unlike California, New York, or Massachusetts, Texas offers no state-level solar tax credits, rebates, or SREC programs. Solar economics depend entirely on federal incentives (expiring after 2025 for residential) and the underlying utility bill savings. This means lead qualification must focus more heavily on electric bill verification and less on stacking incentive programs.

Net metering is limited. Texas has no statewide net metering mandate. Some retail electricity providers offer net metering or bill credits for solar export, but these programs vary by provider and can change with contract terms. This creates a more complex sales conversation where installer representatives must address provider-specific policies.

Retail choice enables solar buyback programs. Several REPs have developed solar-specific programs that offer competitive rates for solar customers, including buyback credits for excess generation. Companies like Chariot Energy, Green Mountain Energy, and others market specifically to solar households. This creates cross-selling opportunities and affects how consumers evaluate solar economics.

Rate volatility drives demand. Texas consumers experienced extreme rate volatility during Winter Storm Uri in February 2021 when some variable-rate customers received bills exceeding $10,000 for a single month. While regulatory changes have limited the most extreme exposure, rate volatility remains a concern that makes solar’s rate-lock appeal more compelling. Lead messaging that addresses energy independence and rate stability resonates strongly in Texas. Understanding solar lead nurturing helps convert these motivated consumers through the extended consideration cycle.

Grid reliability concerns persist. ERCOT has faced several close calls with grid failures during extreme weather events. Consumer concern about reliability creates demand for solar-plus-battery systems that can provide backup power during outages. Battery attachment rates in Texas lag California but are growing as consumers prioritize resilience.

Texas Solar Lead Qualification Specifics

When generating leads for the Texas market, several qualification factors require special attention:

Current REP identification matters. The consumer’s current retail electricity provider affects their solar economics and the complexity of the transition. Some REPs have solar-friendly policies. Others create friction. Capturing REP information during lead generation enables better routing and more accurate pricing conversations.

Fixed vs. variable rate status affects urgency. Consumers on fixed-rate electricity contracts may have less immediate urgency than those on variable rates exposed to market fluctuations. However, consumers approaching contract expiration represent high-intent prospects evaluating their next move.

Verify electric bill amounts carefully. Without meaningful state incentives, Texas solar economics depend almost entirely on electricity bill savings. Bill verification is more critical in Texas than in incentive-rich markets where generous credits can make solar work even for moderate-usage households.

Battery interest indication is valuable. Texas consumers increasingly understand the backup power value proposition. Leads indicating battery interest command premiums because solar-plus-storage systems provide significantly higher lifetime value for installers. For more on battery storage and lead qualification, see our property qualification guide.

Rural vs. urban utility territory awareness. Approximately 25% of Texas remains under traditional regulated utilities (primarily municipal utilities and electric cooperatives outside the ERCOT competitive market area). Leads from these areas have different economics and require different installer relationships. Geographic qualification must distinguish between competitive market areas (most of the state) and non-competitive territories.

Texas Market Timing

Seasonal patterns in Texas differ from coastal markets:

Summer is prime motivation season. Texas air conditioning loads create extreme summer electricity bills, often $300-$500+ monthly for larger homes. The pain point is most acute from June through September. Lead volume and conversion rates peak during summer heat when consumers experience bill shock.

Winter creates secondary demand. While heating loads are less extreme than cooling loads in Texas, winter storms and reliability concerns create demand for solar-plus-storage systems. February through March sees increased interest driven by storm preparation.

Spring installation weather is optimal. March through May offers ideal installation conditions with moderate temperatures and typically stable weather. Installers prefer contracts that can be installed during this window.

Fall represents transition opportunity. October and November see consumers evaluating their summer experience and making decisions before year-end tax deadlines. Conversion rates often improve in fall as summer bill fatigue translates to action.

Other Major Deregulated Markets

While Texas dominates deregulated solar opportunity by volume, several other competitive markets offer meaningful lead generation opportunity.

Pennsylvania

Pennsylvania operates a deregulated retail electricity market with approximately 6.2 million eligible customers. The market covers the service territories of major investor-owned utilities including PPL Electric, PECO, Duquesne Light, and others.

Solar dynamics in Pennsylvania:

Pennsylvania’s Alternative Energy Portfolio Standards require utilities to source increasing percentages of electricity from renewable sources, including solar. The state’s SREC (Solar Renewable Energy Credit) market has historically provided value to solar owners, though SREC prices have compressed significantly from early highs.

Net metering rules in Pennsylvania require utilities to provide full retail credit for excess solar generation up to 200% of annual usage. This creates favorable economics for appropriately sized systems.

Electricity rates in Pennsylvania average approximately $0.16-$0.18 per kWh for residential customers, higher than the national average but below premium markets like California or Massachusetts. The rate level supports solar economics without requiring maximum incentive stacking.

Lead qualification considerations:

- Verify utility territory (different utilities have different interconnection processes)

- Capture current electricity rate to assess payback

- SREC program complexity requires qualified installer relationships

- Roofing conditions matter more in northern climates with snow load considerations

Illinois

Illinois operates a partially deregulated market where the northern portion of the state (ComEd territory) has active retail competition while southern Illinois (Ameren territory) has more limited choice.

Solar dynamics in Illinois:

The Illinois Power Agency administers the Adjustable Block Program, which provides significant incentives for solar installations through a structured approach to renewable energy credits. The program has made Illinois one of the stronger solar markets in the Midwest despite moderate electricity rates.

Net metering requirements and the solar incentive program create favorable economics, particularly in the ComEd territory where the combination of incentives and electricity rates supports strong payback periods.

Lead qualification considerations:

- Program allocation periods affect timing (Adjustable Block Program has capacity blocks)

- Incentive eligibility requires verification of requirements

- ComEd vs. Ameren territory affects economics significantly

- Consumer sophistication varies between Chicago metro and downstate

Connecticut and New Jersey

Connecticut and New Jersey represent premium northeast deregulated markets with electricity rates among the highest in the nation (over $0.25 per kWh in Connecticut). Both states have SREC or successor incentive programs that provide ongoing compensation for solar production. High electricity rates create compelling solar economics despite northern locations, and consumer wealth levels support premium financing options.

Lead qualification considerations for both states:

- SREC/incentive program economics require verification of current levels

- High electricity rates support strong economics for moderate-usage households

- Small lot sizes in dense areas may limit system capacity

- Premium lead pricing ($150-$250 for exclusive) is appropriate given market economics

Competitive Retail Dynamics and Solar Positioning

Understanding how competitive retail electricity markets work helps lead generators craft more effective messaging and qualification strategies.

Consumer Decision Frameworks

Consumers in deregulated markets typically evaluate electricity options across several dimensions:

Price (dominant factor): Rate per kWh, fixed vs. variable structure, and total expected cost drive most decisions. Solar marketing must compete on price certainty and long-term savings.

Contract terms: Length of commitment, early termination fees, and renewal terms matter. Solar’s long-term commitment requires more justification than switching REPs.

Green energy options: Many REPs offer renewable energy plans. Consumers who already choose green electricity options are pre-qualified for environmental messaging.

Service quality: Customer service reputation, billing accuracy, and responsiveness affect provider choice. Solar installers with strong service reputations gain advantage in markets where consumers have been burned by poor REP experiences.

Risk management: After rate volatility events, some consumers prioritize stability over lowest price. Solar’s fixed cost structure appeals to risk-averse consumers.

How REPs View Solar Customers

Retail electricity providers have mixed relationships with solar:

Some REPs actively court solar customers. Companies like Green Mountain Energy, Chariot Energy, and others have developed solar buyback programs designed to attract solar households. These REPs view solar customers as high-value for several reasons: they tend to have higher incomes, they represent long-term customers unlikely to switch frequently, and they align with green branding.

Other REPs lose money on solar customers. In states with robust net metering, solar customers may export excess generation during the day and draw from the grid at night. If the REP must credit exports at retail rates while purchasing wholesale power to serve nighttime load, margins compress. Some REPs avoid marketing to solar customers or offer less favorable terms.

Utility-affiliate REPs may resist solar. REPs affiliated with traditional utilities that own generation assets sometimes have conflicted relationships with distributed solar that reduces wholesale energy demand.

Understanding this landscape helps lead generators:

- Target consumers already with solar-friendly REPs (lower friction to close)

- Educate consumers about switching to solar-compatible providers

- Avoid wasting effort on consumers locked into REP contracts with solar-hostile terms

Solar as Ultimate Electricity Shopping

For sophisticated consumers in deregulated markets, solar represents the logical endpoint of electricity shopping. Instead of comparing REP rates and hoping for savings, solar provides owned generation with locked-in economics.

This framing resonates powerfully with consumers who have spent years shopping electricity plans:

“Stop shopping for electricity forever.” The annual ritual of comparing rates and switching providers ends with solar. One decision provides decades of price certainty.

“Own your energy instead of renting it.” The ownership vs. rental framing appeals to consumers who understand they have been paying for electricity without building equity in generation assets.

“Rate-proof your home.” Market volatility concerns, regulatory changes, and fuel price uncertainty become irrelevant when your electricity comes from your roof.

“Independence from the grid.” With battery storage, consumers can reduce dependence on grid reliability. This message resonates particularly after reliability failures.

Lead forms and landing pages serving deregulated markets should incorporate this messaging framework rather than defaulting to generic solar value propositions.

Lead Qualification for Deregulated Markets

Standard solar lead qualification addresses homeownership, electric bill amount, roof condition, credit qualification, and timeline. Deregulated market leads require additional qualification dimensions.

REP and Contract Status

Current REP identification: Knowing the consumer’s current retail electricity provider helps installers understand the baseline situation. Some REPs have established solar programs with clear procedures. Others create friction. Capturing this information improves routing and speeds the sales process.

Contract expiration timing: Consumers in long-term fixed-rate contracts may face early termination fees if they reduce usage significantly before contract expiration. Understanding contract status helps set expectations and identify urgency windows.

Current rate structure: Fixed vs. variable rates affect both urgency and economic comparison. Consumers on cheap fixed rates have longer payback periods. Consumers on variable rates or expensive plans have stronger immediate economics.

Rate Verification

In deregulated markets where consumers choose their rates, self-reported electricity costs require careful interpretation.

Average vs. total annual cost: Consumers often report their “typical” monthly bill, which may be a summer peak, a winter low, or something in between. Total annual electricity cost matters more than any single monthly amount.

Promotional rates vs. ongoing rates: Some REP contracts include introductory rates that increase after a promotional period. Consumers may report the promotional rate while facing higher costs soon.

Usage vs. price decomposition: A $200 monthly bill could reflect high usage at a low rate or moderate usage at a high rate. The distinction matters for system sizing and savings projections.

Better lead forms capture:

- Average monthly bill amount (or annual total)

- Whether current plan is fixed or variable rate

- Current rate per kWh if known

- Contract expiration date

Battery and Backup Qualification

Consumers in deregulated markets, particularly Texas after Winter Storm Uri, show elevated interest in battery storage and backup power.

Backup power interest is valuable qualifying information. Leads indicating interest in battery storage or backup power command premiums because solar-plus-storage systems generate higher installer margins and create more durable customer relationships.

Power outage experience creates urgency. Consumers who have experienced significant outages, particularly in Texas, Florida, or storm-prone areas, convert at higher rates on solar-plus-storage packages.

Home characteristics affect battery value. Consumers with home offices, medical equipment, or other critical loads have stronger battery value propositions than those with flexibility during outages.

Include battery interest and backup power motivation in lead qualification. Route leads with strong battery interest to installers with storage expertise and inventory.

Pricing Dynamics in Deregulated Markets

Solar lead pricing in deregulated markets reflects the unique competitive dynamics and economics of these regions.

Texas Lead Pricing

Texas solar leads typically price in the Tier 2 range nationally ($75-$150 for exclusive qualified leads) despite the state’s massive installation volume. Several factors explain this positioning:

Lack of state incentives compresses installer margins. Without state tax credits or SREC programs, Texas installers operate on thinner margins than their California or Massachusetts counterparts. This limits CPL tolerance.

High competition among installers in major metros. The Dallas-Fort Worth, Houston, San Antonio, and Austin markets have numerous competing installers fighting for market share. This competition benefits consumers but compresses installer profits available to fund lead acquisition.

Limited net metering reduces system value. Without guaranteed retail-rate net metering, Texas solar system lifetime values are lower than in states with robust net metering. Lower lifetime values translate to lower acceptable CPLs.

Scale provides some offset. Texas volume means even moderate CPLs can support substantial lead generation businesses. Installers buying thousands of leads monthly can negotiate volume discounts that lower effective CPLs.

Recommended Texas solar lead pricing for 2024-2025:

| Lead Type | Price Range | Notes |

|---|---|---|

| Exclusive, qualified | $75-$125 | Bill verification, homeowner confirmed |

| Shared (2-3 buyers) | $30-$60 | per buyer |

| Set appointments | $100-$150 | Verified appointment with qualified homeowner |

| Aged leads (30+ days) | $10-$25 | Reduced conversion expectations |

| Battery-interested | +$15-$25 premium | Add to above based on battery interest |

Pennsylvania Lead Pricing

Pennsylvania’s combination of higher electricity rates, SREC programs, and northeast market dynamics supports higher lead pricing than Texas:

| Lead Type | Price Range | Notes |

|---|---|---|

| Exclusive, qualified | $100-$175 | Higher rates support stronger economics |

| Shared (2-3 buyers) | $45-$80 | per buyer |

| Set appointments | $125-$200 | Premium for northeast labor costs |

| Aged leads (30+ days) | $15-$35 | Longer consideration cycles |

Ohio and Midwest Markets

Ohio and similar Midwest markets price below premium coastal markets but above Texas:

| Lead Type | Price Range | Notes |

|---|---|---|

| Exclusive, qualified | $80-$130 | Moderate economics, limited incentives |

| Shared (2-3 buyers) | $35-$55 | per buyer |

| Set appointments | $100-$150 | Shorter installation season |

| Aged leads (30+ days) | $10-$25 | Seasonal timing matters |

Premium Northeast Markets (Connecticut, New Jersey)

High electricity rates support premium lead pricing:

| Lead Type | Price Range | Notes |

|---|---|---|

| Exclusive, qualified | $150-$250 | Premium market economics |

| Shared (2-3 buyers) | $60-$100 | per buyer |

| Set appointments | $175-$275 | High-value appointments |

| Aged leads (30+ days) | $25-$50 | Wealthy consumer base |

Traffic Strategies for Deregulated Markets

Generating solar leads in deregulated markets requires adapted traffic strategies that leverage the unique characteristics of these consumers.

Messaging Alignment

Standard solar messaging often emphasizes environmental benefits, energy independence, and utility bill savings. Deregulated market messaging should build on the shopping behavior these consumers already exhibit:

“You compare electricity plans every year. Here’s how to never compare again.” Speaks directly to the annual shopping ritual.

“Why rent your electricity when you could own your generation?” Ownership framing resonates with investment-minded consumers.

“Your REP will raise rates eventually. Solar won’t.” Rate volatility concern is personal for consumers who have experienced price changes.

“Texas/Pennsylvania/Ohio solar economics: What the numbers actually show.” Regional specificity builds credibility over generic national claims.

Targeting for Deregulated Markets

Several targeting strategies work well for reaching consumers in competitive electricity markets:

REP customer targeting: Some retail electricity providers allow targeted advertising to their customer bases. Consumers already engaged with their REP receive offers positioned alongside their electricity relationship.

Power to Choose visitors (Texas): Consumers actively shopping electricity on comparison websites represent high-intent prospects. Retargeting these users with solar offers captures the shopping mindset.

Home services behavioral targeting: Consumers researching home improvements, refinancing, or other major home investments in deregulated markets can be reached with solar messaging as part of the home investment consideration set.

Local news consumption: Consumers who engage with local news content about electricity prices, grid reliability, or utility issues represent qualified prospects for solution-oriented solar messaging.

Solar-friendly REP customer acquisition: Partnering with solar-friendly REPs to co-market solar installation alongside electricity plans creates aligned incentives. The REP acquires a sticky customer while the installer gains a qualified lead.

Installer Relationships in Deregulated Markets

Building effective installer relationships for deregulated market leads requires understanding how these installers operate differently.

Texas Installer Landscape

The Texas solar installer market is fragmented with a mix of national players, regional companies, and local companies:

National installers with Texas presence: Sunrun, Freedom Solar (acquired by Sunrun), and other national companies maintain significant Texas operations. They can absorb high volume but may have capacity constraints during peak seasons.

Texas-focused regional installers: Companies like Momentum Solar, Trinity Solar (northeast focus expanding), and others have built substantial Texas operations. Regional focus often means better local market knowledge and installer density in service territories.

Local installers: Numerous smaller companies serve specific metro areas. These installers often provide better service and conversion rates but have volume limitations.

When building Texas installer relationships:

- Understand each installer’s service territory at the ZIP code level

- Verify battery installation capability (not all Texas installers are battery-qualified)

- Confirm financing relationships (some Texas installers focus on cash/loan, others on PPA/lease)

- Discuss REP coordination procedures and how they handle billing transitions

Northeast Installer Relationships

Northeast deregulated markets tend to have more established installer relationships due to longer market history:

SREC knowledge is essential. Installers in Pennsylvania, New Jersey, and other SREC markets must navigate program complexities. Lead generators should verify installer program registration and SREC handling.

Winter installation limitations. Northern markets have shorter installation seasons. Leads generated in fall may not install until spring. Understand installer pipelines and timing expectations.

Higher installer labor costs. Northeast installers face higher labor costs, affecting their CPL tolerance and pricing structures.

Compliance Considerations

Solar lead generation in deregulated markets faces the same federal compliance requirements as other markets, plus some additional considerations.

Standard TCPA/Consent Requirements

All solar leads require proper Prior Express Written Consent for telemarketing calls. This requirement does not change based on market structure. Key elements:

- Clear and conspicuous disclosure of sellers who may contact the consumer

- Affirmative consent (no pre-checked boxes)

- Consent specific to the type of contact (calls, texts, emails)

- Consent documentation and retention

State-Specific Requirements

Some deregulated states have additional requirements:

Texas: The Texas Business and Commerce Code includes provisions about telemarketing and consumer protection. Verify current requirements with Texas-admitted legal counsel.

Pennsylvania: Pennsylvania’s telemarketing registration requirements apply to companies soliciting Pennsylvania consumers. The state maintains a Do Not Call list separate from the national registry.

New Jersey: New Jersey has specific consumer protection requirements for home improvement contractors, which may affect how solar leads are sold and how installers operate.

Energy-Specific Regulations

Some deregulated markets have regulations specific to energy marketing:

PUC oversight: Public utility commissions in deregulated states regulate retail electricity provider marketing. While solar installation is typically outside this jurisdiction, marketing that references electricity providers or rates may trigger scrutiny.

Switch and save claims: Marketing that compares solar to specific REP rates or promises specific savings versus electricity plans requires substantiation. Avoid making claims about competitor pricing that cannot be verified.

Green claims: Environmental marketing claims for solar (100% renewable, zero emissions, etc.) must be accurate and substantiated. The FTC’s Green Guides provide relevant guidance.

Frequently Asked Questions

What is a deregulated energy market and how does it affect solar lead generation?

A deregulated energy market is a state or region where consumers can choose their retail electricity provider from competing companies, rather than being served by a single monopoly utility. Approximately 30% of U.S. electricity customers live in deregulated or partially deregulated markets, including major states like Texas, Pennsylvania, Ohio, Connecticut, New Jersey, and Illinois. These markets affect solar lead generation because consumers already understand shopping for electricity, compare rates regularly, and are more sophisticated about energy costs. Lead messaging that positions solar as the ultimate electricity shopping decision resonates strongly with these consumers. Additionally, net metering policies, utility coordination procedures, and consumer motivations differ in deregulated markets, requiring adapted qualification and messaging strategies.

How does Texas ERCOT differ from other electricity markets for solar leads?

Texas ERCOT operates independently from the two major U.S. interconnected grids, creating a unique regulatory and market environment. For solar lead generation, Texas differs in several key ways: the state has no meaningful state-level solar incentives beyond the federal tax credit, net metering is not mandated and varies by retail electricity provider, and consumers have experienced significant rate volatility and grid reliability concerns that create urgency around energy independence. Texas installed 3.8 GW of solar capacity in H1 2025, more than any other state, but lead economics differ from incentive-rich markets like California. Lead qualification in Texas should focus heavily on electric bill verification, battery storage interest, and current retail electricity provider identification. Pricing for Texas solar leads typically falls in the $75-$125 range for exclusive qualified leads, lower than premium coastal markets but supported by massive volume.

What additional qualification questions should I ask for solar leads in deregulated markets?

Beyond standard solar qualification (homeownership, electric bill, roof condition, credit, timeline), deregulated market leads benefit from additional data collection. Ask for the consumer’s current retail electricity provider (REP) to understand their baseline situation and identify solar-friendly providers. Capture whether their current plan is fixed-rate or variable-rate, as this affects urgency and economic comparisons. Determine contract expiration timing since consumers approaching contract end represent high-intent prospects. Include questions about battery storage and backup power interest, particularly in Texas and other markets where grid reliability concerns drive solar-plus-storage adoption. Understanding whether consumers have experienced power outages or rate volatility creates opportunities for urgency-based messaging and premium product positioning.

Are solar leads more expensive in deregulated markets?

Solar lead pricing in deregulated markets varies significantly by state and does not follow a simple pattern. Texas leads typically price below premium markets ($75-$125 for exclusive qualified leads) despite high volume because the lack of state incentives compresses installer margins and limits CPL tolerance. Northeast deregulated markets like Connecticut and New Jersey support premium pricing ($150-$250 for exclusive qualified leads) due to high electricity rates, strong incentive programs, and favorable economics. Pennsylvania and Ohio fall in the middle range ($80-$175). The key insight is that electricity rate levels and state incentive programs matter more than deregulation status itself. A deregulated state with high rates and strong incentives commands premium lead pricing, while a deregulated state with moderate rates and no incentives prices lower despite consumer sophistication.

How do I target consumers who are actively shopping for electricity?

Several strategies reach consumers engaged in electricity shopping. In Texas, retargeting visitors to the Power to Choose comparison website captures consumers actively evaluating options. Partnership marketing with solar-friendly retail electricity providers creates aligned incentives where the REP acquires a sticky customer while you gain a qualified lead. Content marketing addressing “solar vs. switching REPs” or “how solar works with your electricity plan” attracts consumers researching options. Search campaigns targeting terms like “electricity comparison” or “best electricity rates” combined with solar messaging reach shopping-minded consumers. Lookalike audiences built from converted solar customers in deregulated markets help platforms find similar consumers exhibiting shopping behavior. The key is positioning solar not as an alternative to electricity but as the logical endpoint of electricity shopping, owning generation rather than forever renting it.

What role does battery storage play in deregulated market solar leads?

Battery storage plays an increasingly important role in deregulated market solar leads, particularly in Texas following Winter Storm Uri and other reliability events. Consumers in deregulated markets have experienced grid failures and rate volatility firsthand, making backup power value propositions more tangible than in stable regulated markets. Battery-interested leads command $15-$25 premiums over solar-only leads because solar-plus-storage systems generate higher installer margins and create more durable customer relationships. Texas battery attachment rates are growing as consumers prioritize resilience, though they still lag California’s 79% attachment rate. Lead qualification should include specific questions about backup power interest, home office or medical equipment that requires continuous power, and prior outage experience. Route battery-interested leads to installers with storage expertise, inventory, and installation capability since not all solar installers are battery-qualified.

How should I structure landing pages for deregulated market solar leads?

Landing pages for deregulated market solar leads should acknowledge consumer sophistication about electricity shopping and build on existing behaviors rather than introducing entirely new concepts. Lead with messaging like “Stop comparing electricity plans forever” or “Own your electricity instead of renting it” that frames solar as the natural evolution of their shopping behavior. Include state-specific content addressing local incentives, net metering policies, and REP coordination procedures. Address rate volatility and grid reliability concerns that are personal to consumers in these markets. Include form fields for REP identification and contract status alongside standard qualification questions. Consider separate landing pages for battery-interested versus solar-only traffic, as the messaging and value propositions differ. Provide transparent economics comparisons showing solar versus typical REP rates over 10, 15, and 25-year horizons to speak to consumers accustomed to comparing electricity options.

What happens to leads when a consumer’s REP has solar-hostile policies?

Some retail electricity providers in deregulated markets have policies that create friction for solar customers, such as requiring separate meters, charging additional fees, or offering unfavorable export credit rates. When leads involve consumers with solar-hostile REPs, installers must educate consumers about switching to solar-friendly providers as part of the solar purchase process. This adds steps but is not insurmountable. Solar-friendly REPs like Green Mountain Energy, Chariot Energy (Texas), and others actively court solar customers and offer competitive solar buyback programs. The lead conversion process simply includes REP switching alongside solar installation. Lead generators should understand which REPs in their markets are solar-friendly versus hostile and capture REP information during qualification. Leads from solar-hostile REP customers may require additional nurturing or may convert at slightly lower rates due to the added complexity, though they remain viable opportunities.

Should I focus on deregulated markets or regulated markets for solar leads?

The optimal approach is geographic diversification rather than exclusive focus on either market type. Deregulated markets offer consumer sophistication, shopping behavior, and specific messaging opportunities but often have compressed installer margins due to limited incentives (particularly Texas). Regulated markets like California, Florida, and Arizona offer strong incentive programs, established net metering, and premium lead pricing but consumers may be less inherently familiar with energy shopping concepts. A diversified portfolio might include Texas for volume (high lead counts at moderate pricing), California for margin (premium pricing despite market challenges), Florida for growth (recovering market with strong fundamentals), and selected northeast markets for premium economics. The post-ITC environment after 2025 will affect all markets, making geographic and market-type diversification essential risk management regardless of current focus.

How do I verify electric bills in deregulated markets where consumers choose their rates?

Electric bill verification in deregulated markets requires additional nuance because consumers select their rates and may be on promotional pricing, variable rates, or fixed contracts. Best practice is to request either bill upload (most accurate but highest friction) or multiple data points: average monthly bill, current rate per kWh if known, whether the plan is fixed or variable, and contract expiration date. Average monthly bills can be misleading if consumers report summer peaks or winter lows rather than typical months, so annual totals are preferable. Be alert to promotional rates where consumers report their introductory pricing that will increase after a promotional period. For premium lead products, consider utility bill verification services that can confirm actual usage and spending. Accurate bill verification is especially critical in Texas and other markets without strong state incentives where solar economics depend almost entirely on bill savings rather than incentive stacking.

Key Takeaways

-

Deregulated energy markets represent approximately 30% of U.S. electricity customers who already understand shopping for electricity, compare rates, and are more receptive to solar as another shopping option. Consumer sophistication in these markets enables different messaging strategies positioning solar as the ultimate electricity shopping decision.

-

Texas ERCOT is the largest deregulated solar opportunity with 3.8 GW installed in H1 2025, but leads require different qualification due to limited state incentives, no mandated net metering, and unique dynamics around retail electricity provider coordination. Texas lead pricing typically runs $75-$125 for exclusive qualified leads.

-

Battery storage interest commands premiums in deregulated markets particularly in Texas where grid reliability concerns following Winter Storm Uri have increased demand for backup power. Battery-interested leads can command $15-$25 premiums and should be routed to installers with storage expertise.

-

REP identification and contract status are valuable qualification data that help installers understand baseline economics, identify solar-friendly providers, and time sales conversations around contract expirations. Include these fields in lead forms serving deregulated markets.

-

Lead pricing varies by state economics rather than deregulation status alone. High-electricity-rate deregulated states like Connecticut and New Jersey support $150-$250 exclusive lead pricing, while Texas prices lower despite consumer sophistication due to compressed installer margins.

-

Messaging for deregulated markets should build on shopping behavior consumers already exhibit. Framing like “stop comparing electricity plans forever” and “own your generation instead of renting it” resonates with consumers accustomed to annual rate shopping.

-

Geographic diversification across deregulated and regulated markets provides resilience against policy changes, incentive expirations, and regional market fluctuations. The post-ITC environment after 2025 makes diversification essential regardless of current market focus.

-

Installer relationships in deregulated markets require understanding local dynamics including which installers handle REP coordination smoothly, battery installation capability, and service territory coverage at the ZIP code level for routing optimization.

Market data and pricing benchmarks reflect conditions as of late 2024 through early 2025. Deregulated market dynamics, REP policies, and state incentive programs change regularly. Verify current conditions with active market participants before making significant business decisions. Policy information, particularly regarding the ITC and state programs, should be confirmed with current regulatory filings.