The three property qualification factors that separate sellable solar leads from expensive waste. Master these evaluation criteria and watch your return rates drop while buyer satisfaction climbs.

Solar lead generation attracts operators with its premium CPLs. Exclusive leads command $100-$200+ in top markets. The unit economics look compelling on paper. But the industry’s dirty secret is that 25-35% of solar leads fail basic property qualification, never converting because the home itself cannot support an installation.

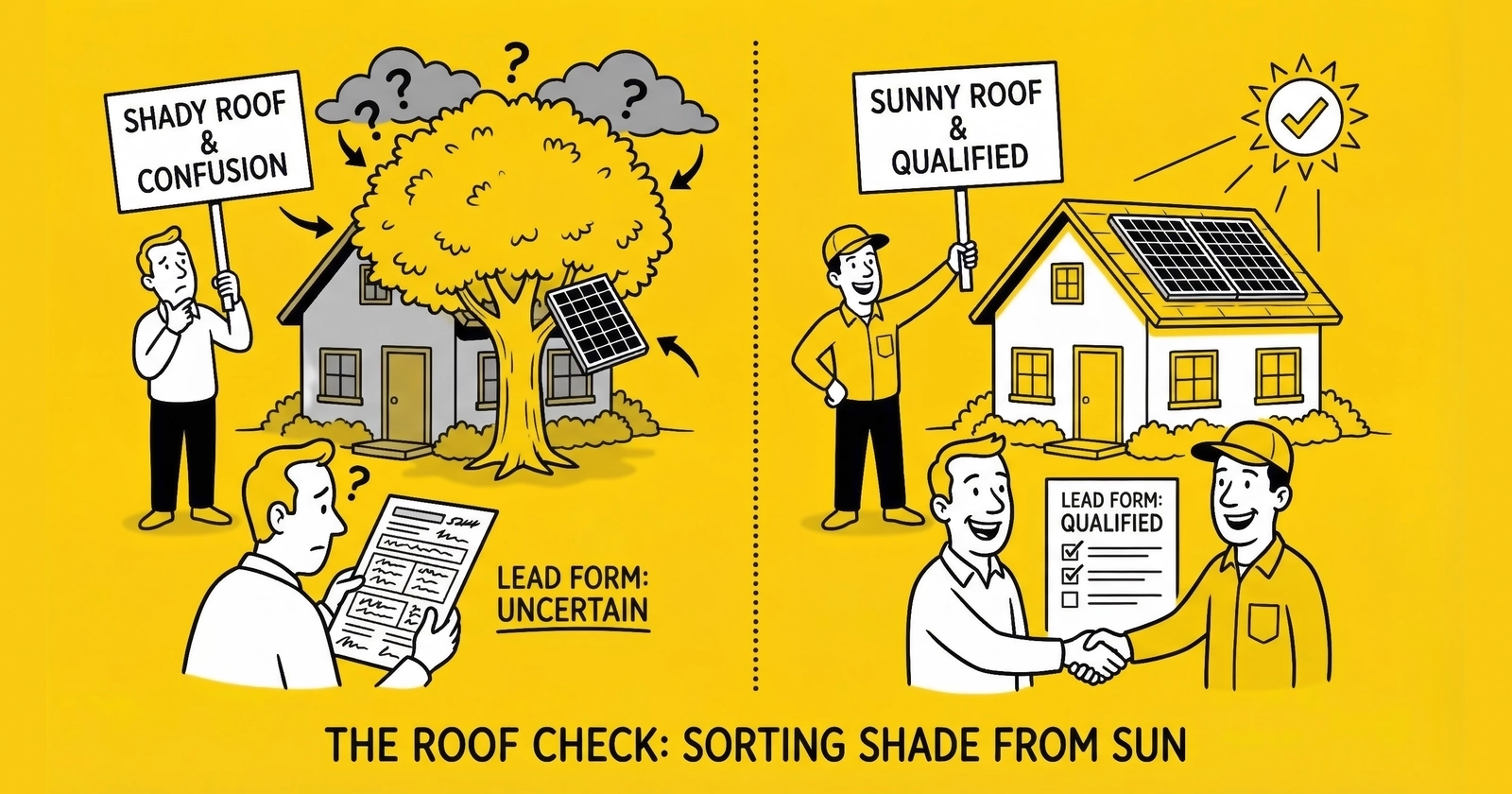

This qualification gap represents the difference between profitable solar operations and expensive lessons. When a lead reaches an installer only to discover the roof needs replacement, the property faces heavy shading, or the “homeowner” is actually a renter, everyone loses. The installer wastes a sales appointment. The lead generator absorbs a return. The consumer gets frustrated by a process that should have filtered them earlier.

The three pillars of solar lead qualification are roof assessment, ownership verification, and shading analysis. Together, these property factors account for more disqualifications than credit issues, electric bill size, or consumer intent combined. An operation that masters these three criteria will outperform competitors who focus solely on consumer-level qualification.

This guide provides the comprehensive framework for solar property qualification. We cover roof age assessment methodologies, ownership verification techniques, shading evaluation approaches, and the technology stack that makes pre-delivery qualification economically viable. Every benchmark reflects current 2024-2025 market conditions. Every recommendation comes from operational experience in the solar lead vertical.

Why Property Qualification Matters More Than Consumer Qualification

The solar lead industry spends enormous energy qualifying consumers: credit scores, electric bill amounts, purchase intent, timeline urgency. These factors matter. But property qualification determines whether a sale is even possible.

Consider the math. A consumer with a 720 credit score, $300 monthly electric bill, and strong purchase intent represents an ideal prospect on paper. But if that consumer’s roof is 25 years old, the home faces significant tree shading, or the property is actually a rental, no amount of consumer qualification produces a sale. The property itself kills the deal.

The Property Disqualification Cascade

Property issues disqualify leads at three stages, each with different cost implications.

Pre-capture disqualification occurs when property screening happens during form completion. Consumers self-report roof age, shading issues, or ownership status, and the form either exits them gracefully or routes them to appropriate alternatives. Cost impact: minimal. The lead never enters your pipeline.

Pre-delivery disqualification occurs when verification happens between capture and sale to buyers. Property database lookups, satellite imagery review, or utility bill verification catches issues before the lead sells. Cost impact: traffic acquisition cost only. No buyer relationship damage.

Post-delivery disqualification occurs when buyers discover property issues during sales process. The lead returns. The buyer questions your quality. Your return rate climbs. Cost impact: full lead cost plus buyer relationship damage plus processing overhead.

The financial difference between these stages is substantial. A lead that self-disqualifies during form completion costs you perhaps $5-15 in traffic acquisition. A lead that returns after delivery costs $100-200+ in lead price, plus buyer relationship erosion, plus the administrative overhead of processing returns. Practitioners who invest in earlier-stage qualification consistently outperform those who let property issues surface downstream.

Return Rate Economics

Solar lead return rates range from 15-25% industry-wide, with property-related returns comprising roughly 40-50% of total returns. The breakdown typically follows this pattern:

| Return Reason | Percentage of Returns | Property-Related |

|---|---|---|

| Wrong contact info | 20-25% | No |

| Not actually interested | 15-20% | No |

| Roof issues | 15-20% | Yes |

| Ownership issues | 10-15% | Yes |

| Shading/orientation | 8-12% | Yes |

| Credit qualification | 8-12% | No |

| Electric bill too low | 5-10% | Partially |

| Other | 5-10% | Mixed |

Operations that implement comprehensive property qualification typically reduce return rates by 8-12 percentage points. On $150 exclusive leads with 1,000 monthly volume, reducing returns from 20% to 10% represents $15,000 monthly in avoided return costs alone. The quality improvement also enables premium pricing and preferred buyer relationships.

Roof Age Assessment: The First Qualification Gate

Roof age is the single most predictive property factor for solar installation viability. A roof nearing end-of-life requires replacement before panels can be installed. Adding $10,000-25,000 to the project cost changes the economics fundamentally. Most consumers expecting a $25,000 solar investment will not proceed when facing a combined $35,000-50,000 project.

Roof Lifespan by Material

Different roofing materials have different expected lifespans, which determines when solar installation becomes problematic.

| Roof Material | Expected Lifespan | Solar Installation Threshold |

|---|---|---|

| Asphalt shingles (3-tab) | 15-20 years | 12-15 years remaining |

| Architectural shingles | 25-30 years | 15-20 years remaining |

| Metal roofing | 40-70 years | Rarely an issue |

| Tile (clay/concrete) | 50+ years | Rarely an issue |

| Wood shake | 20-30 years | 15-20 years remaining |

| Slate | 75-100 years | Rarely an issue |

| Flat (built-up/EPDM) | 15-25 years | 10-15 years remaining |

Solar installations typically carry 25-year warranties. Installers require sufficient remaining roof life to avoid removing panels for roof replacement during the warranty period. The general rule: if the roof has fewer than 15 years of expected remaining life, the lead becomes problematic.

Roof Age Verification Methods

Self-reported age captures the consumer’s own knowledge of their roof. This is the lowest-cost approach but suffers from accuracy issues. Consumers often do not know when their roof was last replaced, especially if they purchased the home post-replacement. Accuracy rate: approximately 60-70% for “within 5 years” estimates.

Pre-qualification question format: “When was your roof last replaced?”

- Within the last 5 years

- 5-10 years ago

- 10-15 years ago

- More than 15 years ago

- I’m not sure

Leads selecting “More than 15 years ago” warrant additional verification or lower buyer expectations. Leads selecting “I’m not sure” should receive follow-up verification before premium pricing.

Property record lookup uses county assessor data and permit records to identify roof replacement history. Many jurisdictions require permits for roof replacement, creating searchable records. Cost: $1-3 per lookup through aggregated services like ATTOM or CoreLogic. Accuracy: high for permitted work, misses unpermitted replacements.

The limitation: permit data has significant geographic coverage gaps. Some counties maintain excellent digital records accessible via API. Others have paper-only archives. Rural areas often have minimal permit requirements. Property data services aggregate available records but cannot manufacture data that does not exist.

Satellite imagery analysis uses aerial photography to assess roof condition visually. Services like Nearmap, EagleView, and Google Earth provide imagery that trained analysts or AI systems can evaluate for visible deterioration: missing shingles, color fading, structural sagging, debris accumulation.

Cost: $2-5 per property for automated analysis, $5-15 for human review. Accuracy: varies by image quality and recency. Urban areas with frequent flyovers have better data than rural properties.

Aurora Solar and similar design platforms provide roof assessment as part of solar design tools. These platforms use satellite imagery plus 3D modeling to evaluate roof suitability. While primarily used by installers for system design, lead generators can access these tools for pre-qualification.

Cost: typically subscription-based ($200-500/month for limited usage). Returns assessment of roof viability including age-related concerns. Provides additional value by generating preliminary system designs that enhance lead value.

Implementing Roof Age Qualification

The practical implementation combines self-reported data with verification for high-value leads.

Tier 1: All leads receive a roof age question during form completion. Responses of “More than 15 years ago” trigger either graceful exit messaging or routing to buyers who specifically handle roof-contingent sales.

Tier 2: Premium leads ($100+ CPL) receive property data verification post-capture. Permit history and property characteristics cross-reference the self-reported data. Discrepancies flag leads for additional review.

Tier 3: Exclusive leads ($150+ CPL) receive satellite imagery review. Visible roof condition assessment supplements age data. Leads with visible deterioration receive notes in the delivery indicating roof concerns, setting appropriate buyer expectations.

The verification stack adds $3-8 per lead in direct costs. On exclusive leads, this investment reduces return rates by 3-5 percentage points, generating positive ROI at volumes above 200 monthly leads.

Ownership Verification: Confirming Authority to Install

Solar installations require property owner authorization. Renters cannot authorize roof-mounted equipment installation. This obvious qualification criterion nonetheless accounts for 10-15% of solar lead returns.

Why Ownership Verification Is Harder Than It Seems

Self-reported ownership has approximately 85-90% accuracy. This sounds high until you calculate the cost of 10-15% false positives. On 1,000 leads monthly at $150 CPL, 10% non-owner leakage represents $15,000 in leads that cannot convert.

The accuracy gap stems from several sources:

Living arrangements complexity: Adult children living in parent-owned homes often consider themselves the “decision maker” even without ownership. Domestic partners or spouses may not be on the title. Multigenerational households create ambiguity about who can authorize installation.

Intentional misrepresentation: Some consumers claim ownership to receive information or quotes they would otherwise be denied. Others participate in referral programs that incentivize submissions regardless of qualification.

Genuine confusion: Rent-to-own arrangements, land contracts, and life estates create ownership ambiguity. Some consumers genuinely believe they own property they do not.

Investment properties: Landlords researching solar for rental properties may complete residential lead forms. While technically owners, they are not the occupants and face different economics.

Ownership Verification Methods

Property database matching cross-references the consumer name against property ownership records. Services like ATTOM, CoreLogic, and LexisNexis Property provide ownership data by address. Cost: $0.50-2.00 per lookup.

The match confirms that the name provided appears on the property title. It does not confirm the person completing the form is actually that person, which requires identity verification.

Identity verification services add a layer confirming the consumer is who they claim. Services like Plaid (for bank account verification), Persona, and traditional KYC providers confirm identity through document verification, knowledge-based authentication, or financial account connection.

For solar leads, full identity verification is typically overkill. The combination of property database matching with phone verification (confirming the phone number matches identity records) provides sufficient confidence at lower cost.

Utility account verification confirms the consumer has an electric account at the property address. This serves multiple purposes: it verifies residency, captures electric bill amount, and provides soft ownership signal (utility accounts typically require owner authorization for service changes).

Methods include:

- Bill upload: Consumer uploads a recent utility bill. Highest friction, highest accuracy. Simultaneously captures usage data for qualification.

- Account linking: Integration with utility data services (UtilityAPI, Arcadia) that connect to utility accounts with consumer authorization.

- Bill verification: Consumer provides account number, and system verifies with utility (limited availability).

Bill upload is the most common approach for premium solar leads. The friction filters unqualified prospects, and the captured data enhances lead value through verified usage information.

Credit header matching uses soft credit inquiry data to confirm name, address, and phone alignment. Credit headers contain identity information (name, addresses, phone numbers) without full credit data. Matching the provided information against credit headers confirms the consumer exists at the claimed address.

Cost: $0.50-1.50 per lookup through services like SentiLink or Ekata. Does not confirm ownership directly but verifies the identity-address connection.

Implementing Ownership Verification

The tiered approach balances cost against quality requirements.

Minimum standard (all leads):

- Self-reported ownership question during form capture

- Address validation and standardization

- Phone verification via SMS

Standard verification (shared leads):

- Property database ownership lookup

- Flag non-matches for review or routing to specialty buyers

- Utility bill amount capture (self-reported acceptable)

Premium verification (exclusive leads):

- Full property database verification

- Utility bill upload or account linking

- Credit header matching for identity confirmation

- Return guarantee based on verified ownership

The verification depth should match the lead value. A $50 shared lead does not justify $8 in verification costs. A $200 exclusive lead absolutely justifies comprehensive verification that reduces returns and commands premium pricing.

Shading Analysis: The Hidden Conversion Killer

Shading reduces solar production dramatically. Even partial shade on a portion of a solar array can cut output 25-50% due to how panels are wired in series. Heavy shading makes solar economics unworkable, yet shading is one of the least-captured qualification criteria in solar lead generation.

Understanding Shading Impact

Solar panels produce electricity based on sunlight received. Shading sources include:

Vegetation: Trees are the most common shading source. Deciduous trees shade heavily in summer when solar production should peak. Evergreens provide year-round obstruction. Neighbor trees may be outside the property owner’s control to remove.

Adjacent structures: Neighboring buildings, particularly in dense urban environments, can shade portions of rooftops during parts of the day. Chimney shadows, satellite dishes, and HVAC equipment create localized shading.

Topography: Hills to the south (in northern hemisphere) reduce available sun hours. Valley locations may have compressed solar windows.

The production impact follows a nonlinear pattern. A single shaded panel in a string of panels can reduce the entire string’s output to the shaded panel’s level. Modern microinverters and power optimizers mitigate this string effect but add equipment cost.

Shading Categories and Lead Value Impact

| Shading Level | Production Impact | Lead Value Impact |

|---|---|---|

| Minimal (0-5% annual shading) | Negligible | Full value |

| Light (5-15% annual shading) | 5-15% reduction | Full value with equipment notes |

| Moderate (15-30% annual shading) | 15-35% reduction | Reduced value, requires design mitigation |

| Heavy (30%+ annual shading) | 35%+ reduction | Significantly reduced or disqualified |

Leads with heavy shading typically do not convert. The economics of solar depend on offsetting electricity costs. When production drops 35%+ due to shading, payback periods extend beyond acceptable ranges for most consumers.

Shading Assessment Methods

Self-reported assessment asks consumers about shade on their roof. This is the lowest-cost approach but suffers from accuracy limitations. Consumers often underestimate shading because they observe their yard, not their roof. A home with a shaded backyard may have an unshaded south-facing roof – or vice versa.

Pre-qualification question format: “How much shade does your roof receive during the day?”

- Full sun most of the day

- Some morning or evening shade

- Shaded for several hours during midday

- Heavy shade throughout the day

Leads selecting “Shaded for several hours during midday” or “Heavy shade throughout the day” warrant verification or specialty routing.

Google Project Sunroof provides free shade analysis for millions of U.S. addresses. The tool estimates solar potential including shading factors. While limited in accuracy compared to professional tools, it provides a quick, free assessment.

Integration approach: Use Google Sunroof API (where available) to pull solar potential estimates. Flag addresses with below-average potential for the market.

Limitation: Coverage is incomplete. Many addresses return “insufficient data.” Rural areas have lower coverage than urban/suburban.

Professional shade analysis tools like Aurora Solar, Helioscope, and HelioScope provide detailed 3D modeling with shade simulations throughout the year. These tools are primarily designed for installer use but can be accessed by lead generators for pre-qualification.

Cost: Subscription-based ($200-1,000+/month depending on volume). Returns detailed production estimates accounting for shading, orientation, and roof characteristics.

Satellite imagery AI analysis uses machine learning to identify shade-producing vegetation and structures from aerial imagery. Services are emerging that analyze satellite photos to estimate shading automatically.

Cost: $1-5 per property. Accuracy improving rapidly as training data accumulates.

Consumer-submitted photos request that consumers upload photos of their roof or property. Human analysts or AI systems evaluate shading from the submitted imagery.

Cost: Highly variable depending on analysis method. Photo collection is free; analysis ranges from $1-10 per property.

Implementing Shading Assessment

Shading assessment typically supplements rather than replaces other qualification. The implementation layers onto existing processes.

Layer 1: Self-reported (all leads) Include shading question in form. Route heavy-shade responses to specialty buyers or educational nurture sequences.

Layer 2: Automated screening (standard leads) For properties not self-reporting shading issues, run addresses through Google Sunroof or equivalent where available. Flag low-potential addresses for review.

Layer 3: Design verification (premium leads) For exclusive leads in premium markets, generate preliminary designs using Aurora Solar or similar. Include shading analysis in the design output. Deliver the design with the lead, increasing lead value while verifying suitability.

The investment in shading verification pays returns through reduced post-delivery disqualification. A lead that receives a preliminary design showing 85% solar access commands higher prices and generates fewer returns than an unverified lead.

The Integrated Qualification Stack

Property qualification is most effective as an integrated system rather than isolated checks. The comprehensive stack combines multiple data sources and verification methods into a cohesive qualification process.

The Three-Stage Model

Stage 1: Form-Level Qualification

During form completion, capture self-reported data on all three property factors:

- Roof age (last replacement or “built with house”)

- Ownership status (own vs. rent vs. other)

- Shading assessment (sun exposure question)

Also capture:

- Property address (for subsequent verification)

- Electric bill amount (system sizing and motivation)

- Utility provider (territory and rate structure)

- Contact information (for verification and delivery)

This stage filters the most obvious disqualifications at minimal cost. Consumers who self-report rental status, 25+ year old roofs, or heavy shading either exit or route to appropriate paths.

Stage 2: Pre-Delivery Verification

Between capture and sale, run verification checks appropriate to lead value:

For shared leads ($50-100):

- Address standardization and validation

- Basic property database lookup (ownership confirmation)

- Phone verification

For exclusive leads ($100-200+):

- Full property database matching (ownership, property characteristics)

- Satellite imagery assessment (roof condition, shading indicators)

- Utility bill verification (upload or account linking)

- Preliminary solar potential assessment (Google Sunroof minimum, Aurora Solar for premium)

This stage catches misrepresentations and accuracy issues before leads reach buyers. The verification cost ($3-8 per lead) is justified by reduced returns and premium pricing.

Stage 3: Enhanced Delivery Package

For premium leads, the delivery package includes verification documentation:

- Confirmed ownership status

- Property characteristics summary

- Verified electric usage

- Preliminary solar potential estimate (where generated)

- Any identified concerns or notes

This transparency builds buyer confidence and justifies premium pricing. Buyers paying $150-200 per exclusive lead expect comprehensive information. Leads delivered with full documentation command price premiums and generate higher close rates.

Technology Stack Components

Building this qualification capability requires specific technology infrastructure:

Lead capture platform must support:

- Conditional form logic (routing based on responses)

- Address validation integration

- Phone verification (SMS or call)

- Field mapping for verification data append

Platforms like Unbounce, Leadpages, and custom implementations support these requirements. More sophisticated needs may require dedicated lead management platforms.

Property data provider supplies:

- Ownership verification

- Property characteristics (age, size, type)

- Permit history (where available)

- Valuation data (for segmentation)

ATTOM, CoreLogic, and LexisNexis Property are primary providers. Many lead platforms offer pre-integrated access.

Satellite imagery/design tool provides:

- Roof assessment

- Shading analysis

- Production estimates

- System design capability

Aurora Solar is the most common choice for solar-specific analysis. EagleView and Nearmap provide imagery without solar-specific analysis.

Utility data service enables:

- Bill amount verification

- Usage history

- Rate plan identification

UtilityAPI and Arcadia are primary providers with consumer-authorized account access. Bill upload workflows provide an alternative without account integration.

Verification orchestration connects components into a unified workflow:

- API integration between capture and verification

- Conditional logic for verification depth

- Data aggregation for delivery packages

- Reporting on verification outcomes

Most operations build this orchestration in their CRM or lead distribution platform. High-volume operations may require dedicated middleware.

Cost Structure Analysis

The comprehensive qualification stack adds $3-15 per lead depending on depth:

| Component | Cost per Lead | When Applied |

|---|---|---|

| Address validation | $0.05-0.15 | All leads |

| Phone verification (SMS) | $0.03-0.10 | All leads |

| Property database (basic) | $0.50-1.50 | All verified leads |

| Property database (full) | $1.50-3.00 | Premium leads |

| Utility data verification | $0.50-2.00 | Premium leads |

| Satellite/design analysis | $2.00-5.00 | Exclusive leads |

| Credit header matching | $0.50-1.50 | Premium leads |

Total: $0.58-$1.75 for basic verification Total: $4.50-$10.00 for comprehensive verification

The ROI calculation is straightforward. If comprehensive verification ($8 average) reduces returns by 8 percentage points on $150 leads, the return prevention value is $12 per lead (8% x $150). The net benefit is $4 per lead plus improved buyer relationships and premium pricing opportunity.

Buyer Communication and Return Management

Property qualification affects buyer relationships beyond simple return rates. How you communicate qualification data and manage property-related returns influences long-term partnership value.

Pre-Delivery Communication

Premium lead buyers expect qualification transparency. The delivery should include:

Verified data fields clearly distinguished from self-reported data. Buyers interpret “verified ownership” differently than “claims to own.” Use clear labeling:

- “VERIFIED: Property ownership confirmed via [source]”

- “SELF-REPORTED: Consumer states roof replaced in 2019”

- “ASSESSED: Moderate shading observed via satellite imagery”

Qualification notes for any concerns identified. Rather than withholding leads with minor issues, communicate the issues transparently:

- “Note: Roof age 18 years per permit records. Consumer aware, states roof in good condition.”

- “Note: Partial shading from adjacent structure observed. May impact production estimate 10-15%.”

This transparency builds trust. Buyers prefer receiving qualified leads with known issues rather than discovering issues post-contact.

Preliminary assessments where available. Leads delivered with solar potential estimates, preliminary system designs, or production calculations command premium pricing. The assessment work helps buyers prioritize leads and reduces their front-end assessment costs.

Return Policy Design

Property-related returns require clear policies that balance buyer protection with generator economics.

Standard return grounds for property issues typically include:

- Confirmed non-owner (renter, authorized user, etc.)

- Roof requires replacement before installation (confirmed, not just old)

- Property unsuitable for solar (HOA prohibition, structural limitations, extreme shading)

Non-returnable conditions protect generators from excessive returns:

- Self-reported conditions (consumer knew and disclosed)

- Marginal shading (buyer responsibility to assess)

- Roof age alone (without confirmed replacement requirement)

- Consumer decision to address roof first

Documentation requirements for property returns:

- Written assessment from sales representative

- Photos or reports documenting issue

- Timeline (returns within 5-10 business days of contact)

Clear policies set expectations. Both parties understand the boundaries before issues arise.

Return Analysis for Quality Improvement

Track property-related returns by category and source. This analysis drives qualification improvement.

Return categorization:

- Ownership: non-owner, unclear ownership, landlord situation

- Roof: age-related, condition-related, material-related, structural

- Shading: vegetation, structures, topography

- Other property: HOA restrictions, unsuitable type, etc.

Source correlation: Identify which traffic sources generate higher property-related returns. Some sources attract more renters. Some geographic areas have older housing stock. Use return data to adjust source quality assessments and targeting.

Verification gap analysis: When property returns occur, investigate whether the issue was detectable pre-delivery. Each return represents an opportunity to improve the verification stack. A roof condition return that satellite imagery would have caught indicates a gap in the verification process.

Monthly or quarterly analysis of property returns should inform ongoing qualification improvements. Operations that systematically reduce property-related returns over time demonstrate quality commitment to buyers.

Advanced Qualification Strategies

Beyond the core verification stack, advanced strategies enhance property qualification for sophisticated operations.

Predictive Property Scoring

Machine learning models can score properties for solar suitability based on multiple factors:

Input features:

- Property age and characteristics

- Roof age (where known)

- Geographic and topographic data

- Satellite imagery analysis

- Neighborhood solar adoption rates

- Utility rate structure

- Electric usage patterns

Output: Property suitability score (0-100) predicting installation viability.

The model trains on historical data correlating property characteristics with conversion outcomes. Properties receiving installations provide positive training examples. Returns and disqualifications provide negative examples.

Over time, the scoring model identifies subtle patterns humans miss. Perhaps certain construction years correlate with roof issues. Perhaps specific neighborhoods have hidden shading problems. The model captures these patterns and applies them to new leads.

Implementation requires significant data volume (thousands of conversion outcomes) and data science capability. For operations at scale (10,000+ monthly leads), the investment in predictive scoring can differentiate qualification quality.

Geographic Specialization

Property qualification requirements vary by market. Understanding geographic patterns enables targeted strategies.

Housing stock age patterns: Florida and Arizona have younger average housing stock than the Northeast. Roof age concerns are less prevalent in markets with 1990s+ construction booms. Adjust roof age thresholds by market.

Vegetation patterns: Pacific Northwest and Southeast face more vegetation-related shading than desert Southwest. Shading assessment deserves more weight in high-vegetation markets.

HOA prevalence: Sunbelt states with newer planned communities have higher HOA prevalence. HOA restrictions on solar are declining but still represent a qualification factor in HOA-heavy markets.

Building type mix: Urban markets have more condos and multi-family properties (unsuitable for residential solar). Suburban markets have more single-family detached homes. Adjust property type qualification by market.

Geographic expertise enables market-specific qualification strategies rather than one-size-fits-all approaches.

Installer Feedback Integration

The most valuable qualification data comes from installer feedback on what actually converts.

Structured feedback collection:

- Reason for non-conversion (specific categories)

- Property issues encountered

- Consumer knowledge accuracy

- Quality score for the lead

Feedback loop to qualification:

- Aggregate feedback by issue type

- Identify patterns in disqualification reasons

- Adjust qualification criteria based on actual conversion blockers

Installers encounter qualification issues that pre-delivery verification misses. A systematic feedback loop captures this intelligence and improves qualification over time.

The challenge is getting installers to provide feedback. Incentive structures that tie pricing or priority to feedback completion increase participation. Simplified feedback forms (30 seconds maximum) improve completion rates.

Frequently Asked Questions

What is the ideal roof age for solar lead qualification?

Roofs with 15+ years of expected remaining life qualify without concern. For asphalt shingle roofs (the most common type), this means roofs replaced within the last 10-12 years. Roofs between 12-18 years old warrant additional assessment of condition. Roofs over 20 years old on asphalt shingles should receive either condition verification or clear communication to buyers about the roof age. Metal, tile, and slate roofs have longer lifespans and rarely present age-related qualification issues. The key threshold is whether the roof will outlast the 25-year solar system warranty without requiring replacement.

How do I verify homeownership for solar leads?

The most reliable ownership verification combines property database matching with identity confirmation. Services like ATTOM and CoreLogic provide property ownership records by address. Cross-reference the consumer-provided name against ownership records. When names match, ownership is confirmed. For additional confidence, verify the consumer’s identity through phone number matching against identity databases or utility bill verification. Utility bills in the consumer’s name at the property address provide strong ownership evidence. The combination of property database lookup ($0.50-2.00) and utility bill verification ($0.50-2.00) provides high-confidence ownership verification for $1.00-4.00 per lead.

What percentage of solar leads typically fail property qualification?

Industry data suggests 25-35% of unqualified solar leads have property issues that ultimately prevent installation. The breakdown varies by market but typically includes: 10-15% ownership issues (renters, non-decision-makers), 8-12% roof issues (age, condition, material problems), 5-10% shading issues (trees, structures, orientation), and 5-8% other property issues (HOA restrictions, structural limitations, unsuitable property types). Comprehensive pre-delivery qualification can identify and address 60-70% of these issues before leads reach buyers, significantly reducing return rates.

Should I disqualify leads with partial shading?

Partial shading reduces solar production but does not necessarily disqualify a property. Modern equipment (microinverters, power optimizers) mitigates shading impact for partially shaded roofs. The qualification decision depends on shading severity. Properties with less than 15% annual shading typically remain viable with appropriate equipment. Properties with 15-30% shading may still convert but require accurate production estimates that set consumer expectations appropriately. Properties with more than 30% shading face challenging economics and frequently fail to convert. Rather than disqualifying partially shaded leads entirely, communicate shading assessments transparently and route to buyers who specialize in shade-mitigation designs.

How much should I spend on property qualification per lead?

Property qualification investment should scale with lead value. For shared leads selling at $50-75, spend $1-3 on basic verification (address validation, ownership lookup, phone verification). For exclusive leads selling at $100-150, spend $4-8 on comprehensive verification (full property database, utility verification, basic shading assessment). For premium exclusive leads selling at $150-200+, consider spending $8-15 on full verification including satellite imagery analysis or preliminary design generation. The ROI calculation is straightforward: if verification spending reduces returns by X percentage points on leads valued at Y dollars, the return prevention value must exceed the verification cost. At typical return prevention rates (8-12 percentage points), comprehensive verification pays for itself on leads priced above $75.

What property data services work best for solar lead qualification?

The primary property data providers are ATTOM, CoreLogic, and LexisNexis Property. Each offers ownership verification, property characteristics, and permit history (where available). For solar-specific assessment, Aurora Solar provides the most comprehensive capability, combining property data with 3D roof modeling, shading analysis, and system design. Google Project Sunroof offers free solar potential estimates for covered addresses but has limited accuracy and incomplete coverage. EagleView and Nearmap provide high-resolution aerial imagery for roof assessment. For utility data, UtilityAPI and Arcadia enable consumer-authorized account access. Most operations use a combination: a property data provider for ownership and characteristics, a solar design tool for installation assessment, and a utility data service for bill verification.

How do I handle leads where the roof needs replacement?

Leads with roofs requiring replacement represent potential value if handled appropriately. Some solar installers partner with roofing companies and offer combined roof-plus-solar packages. Route roof-contingent leads to these specialty installers rather than standard buyers. Alternatively, price these leads at a discount (30-50% below standard pricing) with clear communication about the roof situation. Some operations maintain separate “roof-first” nurture sequences, following up with these prospects after roof replacement. The key is transparent communication: buyers who receive leads clearly labeled as roof-contingent can price and process appropriately. Leads presented as standard but discovered to need roof replacement generate returns and damage buyer relationships.

Can AI effectively assess shading from satellite imagery?

AI-based shading analysis has improved significantly in recent years. Current systems can identify shade-producing vegetation and structures from satellite imagery with reasonable accuracy. However, limitations remain. Imagery recency affects accuracy; trees grow and buildings change. Seasonal variation matters; deciduous trees shade differently in summer versus winter. Three-dimensional modeling is imperfect; flat imagery cannot fully capture height relationships. AI shading analysis works best as a screening tool that flags potential issues for human review or detailed modeling. Properties flagged by AI as potentially shaded warrant deeper assessment through tools like Aurora Solar that perform true 3D shade simulations. For lead qualification purposes, AI analysis provides value as a first-pass filter identifying properties that need additional assessment before premium pricing.

What ownership situations are most commonly misrepresented?

The most common ownership misrepresentations fall into predictable categories. Adult children living with parents often consider themselves decision-makers but lack ownership authority. Renters occasionally misrepresent to gather information or because they genuinely believe they can authorize installation (particularly long-term renters). Domestic partners or spouses not on the title may complete forms believing they can authorize decisions. Land contract or lease-purchase residents have ownership-like rights but may not have full authority. Property managers or family members of elderly owners sometimes complete forms on behalf of owners. Each situation requires nuanced handling. The verification goal is identifying who can actually authorize installation, not necessarily confirming the form-filler is on the title. Clear form questions (“Can you authorize permanent modifications to this property’s roof?”) help filter genuine misunderstandings.

How do property qualification requirements differ by market tier?

Market tier affects property qualification emphasis. In Tier 1 markets (California, Hawaii, Massachusetts, New York), property qualification is table stakes. Understanding geographic pricing differences helps calibrate verification investment. Buyers expect comprehensive verification and will not accept leads with property issues. Premium pricing in these markets justifies higher verification investment. In Tier 2-3 markets (Texas, Florida, Arizona, developing states), qualification requirements are meaningful but more flexible. Some buyers accept leads with disclosed minor issues. Verification investment should match regional pricing. In Tier 4-5 markets (Midwest, Plains, low-volume states), verification economics are challenged. Lower lead values support only basic verification. Focus verification resources on ownership confirmation rather than comprehensive property assessment. Geographic expertise enables appropriate verification investment by market rather than universal standards.

Key Takeaways

Property qualification determines solar lead viability more than consumer qualification. A consumer with perfect credit and strong intent cannot convert if the roof needs replacement, the property is shaded, or they do not own the home. Invest verification resources accordingly.

Roof age is the single most predictive property factor. Roofs with fewer than 15 years of remaining life frequently require replacement before installation. Capture roof age during form completion and verify through property records and satellite imagery for premium leads.

Ownership verification requires multiple signals. Self-reported ownership has 85-90% accuracy. Property database matching plus utility bill verification provides high-confidence ownership confirmation. The combination costs $1-4 per lead and eliminates 60-70% of ownership-related returns.

Shading assessment is underutilized in solar lead qualification. Heavy shading kills solar economics, yet most lead forms either ignore shading or capture only self-reported assessments of limited accuracy. Satellite imagery analysis and design tools provide objective shading assessment.

Verification investment should scale with lead value. Basic verification ($1-3) for shared leads. Comprehensive verification ($4-8) for exclusive leads. Premium verification with design generation ($8-15) for high-value exclusive leads. The ROI is positive when verification cost is exceeded by return prevention value.

Property qualification enables premium pricing. Leads delivered with verified ownership, roof assessment, shading analysis, and preliminary designs command 20-40% price premiums over unverified leads. The verification investment creates differentiated product quality.

Buyer communication transparency builds relationships. Deliver verification results clearly, noting what is verified versus self-reported. Communicate identified concerns with context. Buyers who trust your qualification are more forgiving when occasional issues arise.

Systematic return analysis drives continuous improvement. Track property-related returns by category and source. Each return represents a gap in the verification stack. Monthly analysis should identify patterns and inform qualification refinements.

Geographic specialization enables market-appropriate strategies. Housing stock age, vegetation patterns, HOA prevalence, and building type mix vary by market. Adjust qualification emphasis based on regional property characteristics rather than applying universal standards.

The qualification investment compounds over time. Return rate improvements, buyer relationship strength, and premium pricing capability build together. Operations that systematically improve property qualification create sustainable competitive advantages in the solar lead market.

Property data and qualification methods current as of December 2024. Verification service pricing and capabilities should be confirmed with current providers. Market conditions and regulatory requirements continue evolving.