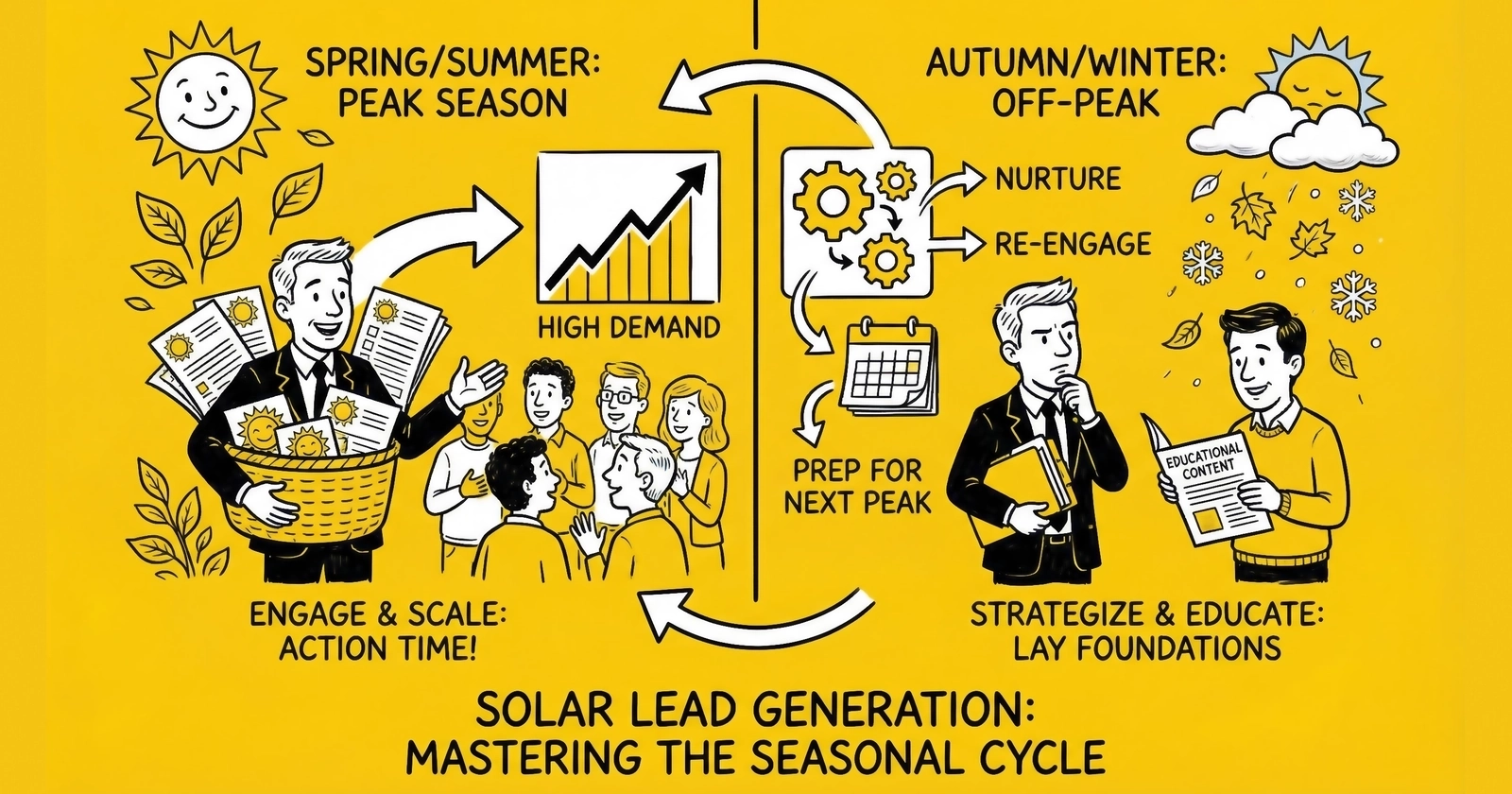

Understanding solar’s annual rhythms transforms reactive scrambling into strategic advantage. This guide maps monthly demand cycles, budget allocation frameworks, and staffing models that capture peak opportunity while protecting margins during troughs.

Solar lead generation operates on predictable seasonal cycles that most practitioners learn through expensive trial and error. The lead worth $180 in April might fetch $120 in January. The installer desperate for volume in March becomes capacity-constrained by July. The year-end tax credit rush creates artificial demand spikes that disappear overnight once deadlines pass.

Understanding these patterns is not optional for solar lead generators. Those who align traffic acquisition, pricing strategies, and staffing models with natural demand cycles consistently outperform those who spread resources evenly across the calendar year. An identical annual budget produces dramatically different results depending on when and how it deploys.

This comprehensive guide maps the seasonal rhythms of solar lead generation: month-by-month demand patterns, geographic variations that override national averages, budget allocation frameworks that maximize ROI, staffing models that scale efficiently, and the planning calendars that prepare operations for peak performance. Every recommendation comes from operational experience in a vertical where timing determines profitability.

The solar market in 2026 presents unique seasonal dynamics. The residential Investment Tax Credit (ITC) expired for new installations after December 31, 2025, creating compressed year-end demand in late 2025 followed by uncertain 2026 patterns. California’s NEM 3.0 disrupted traditional California seasonality by shifting the value proposition toward battery storage. For more on the solar incentive changes affecting lead generation, see our detailed guide. Geographic variations mean spring peaks in Massachusetts while installations continue year-round in Florida. Understanding these nuances separates sophisticated practitioners from commodity volume players.

The Annual Solar Lead Cycle: Month-by-Month Analysis

Solar demand follows a predictable annual rhythm driven by weather patterns, consumer psychology, installer capacity, and policy deadlines. While geographic variations exist, the fundamental cycle remains consistent across most U.S. markets.

January: The Winter Trough Begins

January represents one of the lowest-demand months for solar leads in most markets. Holiday season aftermath leaves consumers financially stretched and mentally distracted. Northern markets face weather that prevents installation and reduces solar’s psychological relevance when daylight hours are shortest.

Demand Indicators

Lead volume typically runs 65-75% of annual average, with CPL pricing 20-30% below peak levels. Installer buyer demand remains low to moderate, while conversion rates lag 8-12% below average due to longer decision cycles.

Operational Reality

Installers carry holiday inventory and face weather delays. Many reduce or pause lead buying through mid-January. Southern market demand remains stable, creating geographic arbitrage opportunities for generators with Florida, Texas, and Arizona traffic.

Strategic Actions

This month calls for reduced traffic acquisition spend, typically 30-40% below peak months, with budget concentration on southern markets where demand holds steady. Use the reduced competition for SEO and content development. Build relationships with new buyers who have bandwidth for evaluation, and prepare creative and landing page tests for spring campaign launch.

February: Transition Month

February shows early signs of demand recovery as consumers move past holiday distractions and begin spring planning. Tax refund season approaches, creating future down payment availability. Days noticeably lengthen, making solar more psychologically relevant.

Demand Indicators

Lead volume climbs to 70-80% of annual average as CPL pricing settles 15-25% below peak. Installer buyer demand recovers, and conversion rates approach average levels.

Operational Reality

Installers begin ramping for spring. Those who reduced staff face hiring pressure. Lead buying increases but remains below spring levels. Competition for traffic begins intensifying as smart practitioners position for the coming surge.

Strategic Actions

Begin scaling traffic acquisition toward spring levels and finalize buyer agreements for spring volume. Complete hiring and training for expanded operations. Launch A/B tests on creative and landing pages to optimize before peak, and review geographic targeting for new policy environments.

March: Spring Surge Begins

March marks the beginning of peak solar season. Tax refund deposits provide down payment capital. Installation weather improves in northern markets. Daylight savings time increases awareness of solar potential. Consumer confidence rises with improving weather and longer days.

Demand Indicators

Lead volume reaches 95-110% of annual average as CPL pricing approaches peak levels. Installer buyer demand strengthens and increases throughout the month, with conversion rates running above average.

Operational Reality

Installer capacity expands to meet demand. Competition for quality leads intensifies. CPLs begin rising across platforms. Buyers who reduced winter purchasing return aggressively. Volume expectations should increase weekly through the month.

Strategic Actions

Scale traffic acquisition to 110-120% of average monthly budget and activate spring campaign creative with seasonal messaging. Increase staffing for lead processing and quality assurance. Monitor capacity constraints with key buyers and begin premium pricing conversations with volume-constrained buyers.

April: Peak Season Intensifies

April represents peak solar lead season in most markets. Tax refunds are in hand. Summer electricity bill previews from prior year utility statements create urgency. Installation weather is optimal. The combination of capital availability and motivation creates the year’s highest demand period.

Demand Indicators

Lead volume surges to 115-130% of annual average with CPL pricing at or near annual peak. Installer buyer demand reaches maximum levels, and conversion rates hit peak performance.

Operational Reality

Installers compete aggressively for leads. Premium pricing becomes achievable for quality inventory. Capacity constraints emerge for top installers. Sales cycles shorten as consumers are motivated and installers are hungry. The spring window feels compressed because it is.

Strategic Actions

Scale traffic acquisition to 130-150% of average monthly budget. Implement premium pricing for exclusive leads in high-demand territories. Monitor quality metrics carefully since fraud increases with volume. Document performance data for buyer relationship development, and build inventory for May delivery if generation exceeds immediate demand.

May: Peak Season Continuation

May maintains peak season intensity with slightly different dynamics. Tax refund capital has been spent or committed. Consumers shift focus toward summer planning but solar remains relevant as summer cooling bills approach. School year end distracts family decision-makers.

Demand Indicators

Lead volume sustains 110-125% of annual average with CPL pricing at or near peak. Installer buyer demand remains very strong, though conversion rates begin slightly softening.

Operational Reality

Installers begin experiencing backlog from spring sales. Installation capacity becomes the limiting factor. Some buyers reduce lead purchasing because they cannot service additional prospects before summer. Lead inventory becomes valuable for buyers who can deliver.

Strategic Actions

Maintain elevated traffic acquisition at 120-140% of average. Identify capacity-constrained buyers and route elsewhere. Consider aged lead strategies for inventory exceeding immediate demand. Document spring performance for summer buyer negotiations, and begin planning for summer shoulder season.

June: Transition to Summer Plateau

June marks the transition from spring peak to summer plateau. Consumer attention shifts to vacation planning and end-of-school activities. Installation weather remains optimal but installer capacity constraints become apparent. The urgency of spring gives way to summer’s more relaxed decision timeline.

Demand Indicators

Lead volume moderates to 100-115% of annual average with CPL pricing 5-10% below peak. Installer buyer demand remains strong but moderates, and conversion rates return to average or slightly above.

Operational Reality

Installer backlogs from spring sales create capacity constraints. Many cannot promise installation before late summer. Sales cycles extend as urgency decreases. Competition for traffic remains elevated but CPCs begin softening.

Strategic Actions

Scale back traffic acquisition to 100-115% of average. Focus on buyers with available installation capacity and emphasize lead quality over quantity as conversion rates soften. Use CPC softening to test new traffic sources cost-effectively, and prepare messaging for summer bill shock relevance.

July: Summer Plateau

July represents stable summer demand with distinct characteristics. Peak electricity bills create motivation through bill shock. Vacation season reduces consumer availability for sales appointments. Extreme heat in southern markets slows installation pace and reduces outdoor sales activity.

Demand Indicators

Lead volume settles to 90-105% of annual average with CPL pricing 10-15% below peak. Installer buyer demand ranges from moderate to strong, while conversion rates drop below average due to vacation interference.

Operational Reality

The summer plateau settles in. Installers have installation backlog but slowing sales. Many become selective about lead quality, preferring fewer high-quality leads to volume. Southern market heat affects both installation productivity and consumer willingness to schedule home consultations.

Strategic Actions

Maintain traffic acquisition at 90-100% of average. Emphasize utility bill messaging highlighting summer electricity costs. Target early morning and evening for consumer engagement. Focus on quality improvements as buyers become more selective, and plan for fall acceleration and year-end push.

August: Late Summer Slowdown

August represents continued summer dynamics with early fall anticipation. Back-to-school activities dominate consumer attention. Vacation season winds down but school preparation takes priority. Installers begin planning for fall acceleration and year-end capacity.

Demand Indicators

Lead volume dips to 85-100% of annual average with CPL pricing 10-20% below peak. Installer buyer demand remains moderate, and conversion rates stay below average.

Operational Reality

The summer slowdown continues. Consumer focus shifts to school and family logistics. Installers use this period for crew training, equipment preparation, and sales team development. Lead buying remains active but at moderate levels.

Strategic Actions

Reduce traffic acquisition to 85-95% of average. Use lower competition to test new audiences and creative. Build content and SEO presence for fall traffic capture. Negotiate fall volume commitments with key buyers, and prepare year-end tax credit messaging for September launch.

September: Fall Acceleration

September brings renewed demand as summer ends and year-end planning begins. Back-to-school routines settle. Consumers emerge from vacation mode with fresh focus on household decisions. The specter of year-end tax credit deadlines begins influencing buyer psychology.

Demand Indicators

Lead volume rebounds to 95-110% of annual average with CPL pricing rising toward peak. Installer buyer demand strengthens and increases, and conversion rates improve.

Operational Reality

Installers shift to year-end mode. Those with tax credit deadline experience understand the compressed timeline. Lead demand increases as installers stock pipelines for Q4 closing. Competition for quality traffic intensifies.

Strategic Actions

Scale traffic acquisition to 110-120% of average. Launch year-end tax credit messaging where applicable. Reconnect with buyers who reduced summer purchasing. Plan staffing for Q4 volume increases, and secure capacity commitments from key buyers.

October: Year-End Push Begins

October marks the beginning of year-end urgency for solar leads, particularly in years with tax credit deadlines. Installers calculate backward from year-end installation requirements. Leads generated in October must close, permit, and install by December 31 in deadline years. The sales cycle compression creates both opportunity and pressure.

Demand Indicators

Lead volume climbs to 105-120% of annual average with CPL pricing at or approaching peak. Installer buyer demand becomes very strong, and conversion rates rise above average driven by urgency.

Operational Reality

Installers shift to deadline mode. Those who can guarantee year-end installation command premium pricing. Lead quality requirements tighten because there is no time for marginal prospects. Verification becomes critical as buyers cannot afford wasted follow-up time.

Strategic Actions

Scale traffic acquisition to 120-140% of average. Implement premium pricing for verified, high-intent leads. Emphasize timeline qualification in lead forms and increase verification investments to reduce returns. Monitor installer capacity for routing optimization.

November: Deadline Intensity

November represents peak year-end intensity in tax credit deadline years. Installation capacity becomes the limiting factor. Installers turn away leads they cannot serve before year-end. Premium pricing for guaranteed installation leads reaches annual highs.

Demand Indicators

Lead volume in early month reaches 110-130% of annual average, dropping to 60-80% in late month during deadline years. CPL pricing peaks for early leads then declines for late leads. Installer buyer demand runs intense early and declining late, with conversion rates varying dramatically by timing.

Operational Reality

The calendar becomes the enemy. Leads generated after mid-November in deadline years have minimal value because installation cannot complete before year-end. Installers who reach capacity stop buying entirely. The market bifurcates between deadline-viable leads commanding premium pricing and post-deadline leads at commodity pricing.

Strategic Actions

Maximize early November traffic when deadline leads are still viable. Monitor installer capacity signals daily. Pivot to post-deadline messaging after mid-month. Reduce traffic acquisition sharply as deadline viability ends, and prepare for January market conditions.

December: Holiday Transition

December brings the unique combination of year-end deadline intensity in early month and holiday shutdown in late month. The first two weeks may see continued strong demand for leads that can still install before year-end. The last two weeks see dramatic demand decline as holidays dominate consumer attention.

Demand Indicators

Lead volume runs 80-100% of annual average in early month, dropping to 50-70% in late month. CPL pricing declines through the month. Installer buyer demand starts moderate early and becomes minimal late, with conversion rates below average.

Operational Reality

The industry enters holiday mode. Even in non-deadline years, consumer focus shifts to holiday activities. Installers reduce or pause operations for the holidays. Lead buying declines through the month regardless of pricing.

Strategic Actions

Reduce traffic acquisition to 70-80% of average in early month and 50-60% in late month. Focus on southern markets where holiday impact is less pronounced. Use the quiet period for system optimization and planning, and prepare January campaigns and annual planning for the coming year.

Geographic Variations in Seasonal Patterns

National averages obscure significant geographic variation in solar seasonality. Understanding regional differences enables sophisticated traffic allocation that captures premiums where demand peaks while maintaining volume in stable markets.

California: The Unique Market

California historically represented 35-40% of the U.S. residential solar market, making its seasonal patterns disproportionately important. NEM 3.0 implementation in April 2023 disrupted traditional patterns by fundamentally changing the value proposition.

Before NEM 3.0, California exhibited strong year-round demand with Q1-Q2 peak, minimal winter trough due to mild weather, and less seasonal variation than national average (15-20% versus 30-40%). For context on how net metering policies affect solar lead value, see our detailed analysis.

After NEM 3.0, California shows contracted overall volume with a 40% decline in 2024, battery storage attachment rates of 79%, and qualification requirements that now include storage interest. The year-round pattern persists but at lower volumes.

For lead generators, the implications are clear: California leads without storage qualification have limited value post-NEM 3.0. The seasonal pattern matters less than the product shift. Operators must qualify for battery interest to capture California demand regardless of timing.

Northeast Markets: Compressed Season

Massachusetts, New York, Connecticut, and New Jersey exhibit pronounced seasonality with compressed installation windows. Winter creates a deep trough from December through February at 40-50% below peak. The spring surge runs March through June at 110-130% of average. Summer plateau from July through August holds at 90-100% of average, followed by a fall secondary peak from September through November at 100-120% of average.

Winter weather prevents installation in many locations. Snow cover makes solar feel irrelevant to consumers. Spring emergence creates concentrated demand that strains installer capacity.

For lead generators, concentrate Northeast budget in the March-June window. Reduce winter spend to minimal brand maintenance. Prepare for rapid scaling in early spring. Build relationships with installers who can handle spring volume surges.

Florida and Texas: Year-Round Markets

Sunbelt markets with year-round installation weather show flattened seasonal curves. There is no significant winter trough. Spring peak is less pronounced at 105-115% of average. Summer challenges from extreme heat moderate demand somewhat. Fall stability holds at 100-110% of average.

Year-round installation weather eliminates weather-driven seasonality. Summer heat creates both installation challenges and strong utility bill motivation. Population of retirees with paid-off homes provides stable demand.

Florida and Texas provide volume stability that complements seasonal Northeast markets. Use these markets to maintain revenue during northern winter troughs. Budget allocation can remain relatively stable throughout the year. Summer represents opportunity as northern markets soften.

Arizona and Nevada: Extreme Heat Impact

Desert markets present unique summer challenges despite abundant sunshine. Fall demand runs strong from September through November. Spring from March through May shows moderate levels. Summer creates a trough from June through August at 75-85% of average. Winter stability holds at 90-100% of average.

Extreme summer heat reaching 110-115F prevents outdoor work and consumer home visits. Fall bill shock from summer cooling costs creates motivation. Reduced net metering following Arizona’s 2016 changes altered economics.

Arizona and Nevada provide counter-cyclical opportunity when other markets peak. Strong fall demand coincides with broader fall acceleration. Summer volume reduction frees resources for other markets.

Mountain West: Short Season, High Intensity

Colorado, Utah, and Montana present compressed but intense seasonal windows. The very short peak runs June through September at 120-140% of average. Extended winter trough spans October through April at 60-80% of average. Transition periods in May and October run 90-110% of average.

Winter weather severely limits the installation window. High elevation increases snow and cold impacts. Summer intensity reflects compressed opportunity.

Mountain West requires dramatic budget reallocation. Summer months warrant 150-200% of average budget. Winter months may warrant minimal maintenance spend. Staffing must flex dramatically or rely on shared resources with counter-seasonal markets.

Budget Planning and Allocation Strategies

Effective seasonal budget allocation requires moving beyond equal monthly distribution toward demand-aligned spending. Those who capture seasonal premiums while protecting winter margins consistently outperform those who spread budget evenly.

The Equal-Spend Trap

many practitioners default to dividing annual budgets by twelve. This approach wastes money during low-demand periods and underinvests during high-demand windows.

Consider this example of equal-spend inefficiency with an annual budget of $600,000. Dividing equally yields $50,000 monthly. At April’s peak demand CPL of $45 due to competitive bidding, that budget generates 1,111 leads. At January’s low demand CPL of $28 with available inventory, the same budget generates 1,786 leads.

The equal-spend approach generates more leads in January when demand and conversion rates are lower, and fewer leads in April when installer buying peaks. The resulting revenue yield significantly underperforms demand-aligned allocation.

Seasonal Allocation Framework

Align budget allocation with demand patterns, not calendar months.

Peak Season Months (April-May, October)

Allocate 130-150% of average monthly budget. These months warrant aggressive investment because installer demand peaks and supports premium pricing. Conversion rates are highest during these windows. Competition justifies higher CPLs for quality positioning, and revenue per lead exceeds cost increases.

Strong Season Months (March, June, September, Early November)

Allocate 110-130% of average monthly budget. These transition and secondary peak months justify above-average investment because demand remains strong. Competition is less intense than peak months. Conversion rates exceed annual average, and inventory building opportunities exist.

Shoulder Season Months (July-August, Late November)

Allocate 85-100% of average monthly budget. These stable periods warrant modest investment because demand is reliable but not exceptional. CPLs moderate, creating testing opportunities. Quality improvements deliver better ROI than volume increases, and installer relationships can strengthen during moderate periods.

Trough Months (December-February)

Allocate 50-75% of average monthly budget. These low-demand periods require reduced investment because consumer attention is elsewhere. Installer buying decreases regardless of pricing. CPLs are lower but conversion rates decline faster. Working capital preservation matters for spring scaling.

Sample Annual Budget Allocation

For a $600,000 annual solar lead generation budget:

| Month | Allocation % | Budget | Rationale |

|---|---|---|---|

| January | 65% | $32,500 | Winter trough, southern focus |

| February | 75% | $37,500 | Transition, building momentum |

| March | 115% | $57,500 | Spring surge begins |

| April | 145% | $72,500 | Peak season |

| May | 135% | $67,500 | Peak continuation |

| June | 110% | $55,000 | Summer transition |

| July | 95% | $47,500 | Summer plateau |

| August | 90% | $45,000 | Late summer slowdown |

| September | 110% | $55,000 | Fall acceleration |

| October | 130% | $65,000 | Year-end push |

| November | 85% | $42,500 | Mixed (early strong, late weak) |

| December | 55% | $27,500 | Holiday trough |

| Total | 100% | $605,000 | Slight over-allocation for flexibility |

The 5% over-allocation provides flexibility for opportunistic spending during unexpectedly strong periods or emergency capacity needs.

Geographic Budget Diversification

Multi-market operators can smooth revenue through geographic diversification by pairing complementary markets: Northeast with its spring peak alongside Florida and Texas with stable year-round demand, California post-NEM 3.0 alongside Arizona with its fall peak, and Mountain West with its summer peak alongside southern markets for winter stability.

The geographic allocation strategy shifts budget toward in-season markets while maintaining baseline presence in off-season markets. This approach captures seasonal premiums while maintaining buyer relationships and market presence year-round.

Quarterly geographic shifts might look like this: Q1 allocates 60% to southern markets and 40% national. Q2 shifts to 70% northern markets and 30% southern. Q3 balances 50% national with 50% targeted toward Arizona fall and summer stability elsewhere. Q4 emphasizes 60% to deadline-sensitive markets and 40% to year-round markets.

Staffing and Operational Adjustments

Seasonal volume variation requires operational flexibility. Lead generation businesses that cannot scale capacity up and down with demand either leave opportunity on the table during peaks or bleed money during troughs.

Staffing Model Framework

Build staffing models around three tiers that provide both stability and flexibility.

Tier 1: Core Team (Year-Round)

Size the core team at 60-70% of peak capacity. These employees work year-round, maintain institutional knowledge, handle off-season operations, and provide the foundation for peak season scaling. Core team roles typically include operations management, key account relationships, quality assurance leadership, technical and platform management, and compliance oversight. Core team members should cross-train on multiple functions to maintain productivity during slower periods and provide backup during peak seasons.

Tier 2: Seasonal Expansion (Peak Periods)

Add 30-40% capacity during peak seasons through seasonal employees, contractors, or temporary staff. These resources handle volume surges that exceed core team capacity. Seasonal roles typically include additional quality assurance reviewers, expanded lead verification teams, sales support for buyer relationship management, customer service for consumer inquiries, and traffic management support.

The seasonal hiring timeline begins 8 weeks before peak with posting positions and recruiting. By 6 weeks before peak, complete hiring decisions. At 4 weeks, begin training and onboarding. At 2 weeks, conduct supervised production. During the peak period itself, maintain full productivity with ongoing coaching.

For solar lead generation, this means spring seasonal hires should complete hiring by late January with training throughout February for March readiness.

Tier 3: Overflow Partners (Surge Capacity)

Maintain relationships with call centers, BPO providers, or contract teams who can absorb unexpected volume surges. These partners sacrifice some margin but prevent capacity constraints during exceptional demand periods. Selection criteria include solar industry experience or quick training capability, flexible volume commitments, quality standards alignment, technology integration capability, and reasonable pricing for variable volume.

Activate overflow partners when volume exceeds 120% of planned peak capacity. The margin sacrifice is justified by capturing demand that would otherwise be lost.

Technology Capacity Planning

System infrastructure must scale with seasonal demand or become the bottleneck that limits revenue capture.

Lead distribution systems face 3-5x normal lead volume routing during peak periods. Test systems under simulated peak load 4-6 weeks before anticipated volume. Identify and resolve bottlenecks before they cost revenue.

Database and CRM capacity must accommodate more leads meaning more data storage, more queries, and more integration calls. Ensure database capacity and response times remain acceptable under peak load. Clean historical data before peak seasons to improve performance.

Telephony infrastructure requires adequate trunk capacity, queue management capability, and recording storage for increased call volume. Verify with providers that capacity can scale on short notice if demand exceeds projections.

Verification and compliance systems including TrustedForm, Jornaya, phone verification, and identity services all face proportionally higher load during peak periods. Confirm API rate limits and capacity with vendors. Pre-purchase capacity allocations for critical compliance tools.

Integration reliability becomes critical as buyer integrations, CRM connections, and analytics pipelines all experience increased load during peak periods. Test end-to-end integration performance under peak conditions. Identify slow links before they cause lead delivery delays.

Training and Preparation Calendar

Seasonal success requires advance preparation. Those who train before peaks outperform those who scramble during them.

Six to eight weeks before peak season: post seasonal positions, review and update training materials, audit system capacity and plan upgrades, and finalize buyer agreements for peak volume.

Four to six weeks before peak season: complete seasonal hiring, begin training programs, test systems under simulated load, and finalize budget allocation by channel and geography.

Two to four weeks before peak season: complete training with supervised production, launch campaign creative and landing page updates, confirm buyer readiness and capacity, and establish daily monitoring protocols.

During peak season: maintain daily performance monitoring and optimization, conduct weekly buyer relationship check-ins, ensure continuous quality assurance, and manage capacity in real-time.

Post-peak transition: complete performance analysis and documentation, execute seasonal staff transition planning, perform system maintenance and cleanup, and initiate planning for next peak cycle.

Counter-Cyclical Strategies and Opportunities

While most practitioners chase peak season volume, sophisticated players find opportunity in off-seasons through counter-cyclical strategies that others overlook.

Lower CPL Acquisition for Nurture Programs

Off-season lead costs decline 20-40% in most markets while competition decreases. Operators with strong nurture capabilities can acquire leads cheaply during troughs and convert them during peaks.

The winter nurture acquisition strategy involves acquiring leads during December-February when costs are lowest. Implement structured nurture sequences using email, SMS, and educational content that maintain engagement over 60-90 days. Convert nurtured leads during spring when installer demand and consumer motivation align.

The economics work: winter lead acquisition at $90 CPL compares to spring lead acquisition at $140 CPL. Adding nurture program cost of $8-12 per lead yields an effective spring CPL via nurture of $100-102.

The nurture approach requires sophisticated email and SMS sequences, patient capital since leads acquired in December may not convert until April, strong initial lead quality because low-quality aged leads never convert, and consent management for extended contact periods.

SEO and Content Development

Reduced competition during off-seasons creates opportunity for organic traffic development that pays dividends during peak periods.

Use December-February for content creation, technical SEO improvements, and link building. Target keywords that will drive traffic during spring peaks. The reduced competition means faster indexing and better positioning when demand returns.

Content focus areas include geographic-specific content such as state solar guides and utility territory information. Educational content covers how solar works, financing options, and installation process. Comparison content addresses solar versus other energy improvements and installer comparisons. Seasonal content targets tax credit guides and spring planning resources.

Content created during slow seasons compounds value throughout the year while requiring minimal ongoing investment once published.

Buyer Relationship Development

Off-seasons provide bandwidth for relationship development that peak periods do not permit.

Schedule quarterly business reviews during January-February when both parties have time for strategic discussion. Implement new integrations and optimize routing rules during low-volume periods when errors have minimal impact. Negotiate favorable terms for the coming year when installers are planning budgets rather than scrambling for capacity.

Stronger buyer relationships translate to premium pricing during peak seasons at 5-15% above market, priority routing during capacity constraints, faster payment terms, lower return rates through better quality alignment, and advance notice of buyer expansion or contraction.

Southern Market Focus

While northern markets experience pronounced winter troughs, southern markets maintain relative stability.

The winter geographic pivot shifts traffic acquisition budget toward Florida, Texas, Arizona in winter, and California during December-February. These markets continue generating leads while northern competition decreases.

The economic benefits include maintaining revenue during overall market trough, retaining traffic team expertise through active campaigns, keeping buyer relationships active year-round, and capturing installation capacity available from weather-challenged northern installers expanding south.

Policy Deadline Impact on Seasonal Patterns

Tax credit deadlines create artificial seasonality that overlays natural market rhythms. Understanding deadline dynamics is essential for year-end planning.

The 2025 ITC Expiration Impact

The residential Investment Tax Credit expires for new installations after December 31, 2025. This creates unique 2025 seasonal dynamics and uncertain 2026 patterns.

The residential ITC expiration concentrates demand into Q4 2025 beyond typical year-end patterns. Leads generated after mid-November 2025 have minimal value because installation cannot complete before the deadline.

Installer capacity constraints evolve through the quarter. September and October bring strong demand with capacity available. Early November sees very strong demand with capacity tightening. Mid-November accepts deadline-viable leads only. Late November through December shifts to post-deadline market only.

Pricing implications follow a similar arc. Early Q4 2025 brings premium pricing for deadline-viable leads. Mid-November 2025 sees peak premium for last installation slots. Late November 2025 experiences rapid price decline as deadline passes. December 2025 returns to commodity pricing for 2026 installation leads.

Post-ITC Seasonal Pattern Projections

Without the residential tax credit, 2026 seasonal patterns will likely shift toward natural demand rhythms.

Expected 2026 changes include elimination of year-end urgency without a tax deadline, Q4 demand normalizing to typical fall patterns, overall volume decline of 30-50%, and geographic concentration in high-electricity-rate markets.

Planning implications include reducing year-end budget allocations for 2026, strengthening focus on premium markets where economics still work, developing commercial solar capability which operates on a different ITC timeline, and building battery storage qualification into lead products.

State Policy Deadline Awareness

State-level policy changes can create local deadline dynamics that override national patterns. Examples include net metering changes with implementation deadlines, state incentive program expiration dates, rate structure changes with effective dates, and interconnection rule modifications.

Monitoring requirements include subscribing to utility commission docket alerts, following state solar association communications, tracking proposed legislation affecting solar economics, and monitoring utility rate case proceedings.

Policy-driven demand spikes can occur at any time of year depending on state-specific deadlines. Practitioners who monitor policy developments capture opportunities that others miss.

Building Your Seasonal Planning Calendar

Effective seasonal management requires formal planning processes that prepare operations before demand shifts occur.

Annual Planning Cycle

September-October: Annual Planning

Develop comprehensive annual plans during fall when current year performance is visible and coming year patterns are predictable. Planning elements include annual budget development with seasonal allocation, geographic targeting strategy for coming year, staffing model and hiring timeline, technology capacity requirements, and buyer relationship targets.

January: Q1 Launch and Spring Preparation

Execute winter operations while preparing for spring surge. Activities include finalizing spring creative and landing pages, completing seasonal hiring and training, confirming buyer capacity and agreements, and testing system capacity under simulated load.

April-May: Peak Season Execution

Focus entirely on execution and optimization during peak periods. Activities include daily performance monitoring, real-time capacity management, quality assurance emphasis, and buyer relationship management.

July-August: Mid-Year Review and Fall Planning

Assess first-half performance and prepare for fall acceleration. Activities include mid-year performance analysis, budget reallocation based on actuals, fall campaign development, and year-end deadline preparation when applicable.

Monthly Rhythms

Within seasonal patterns, monthly rhythms keep operations aligned with demand.

Week 1 month-start activities include prior month performance review, budget pacing assessment, buyer payment and relationship review, and staffing level confirmation.

Weeks 2-3 maintain execution focus with daily optimization activities, quality monitoring and improvement, testing and iteration, and buyer communication.

Week 4 month-end and forward planning covers performance documentation, coming month preparation, budget and staffing adjustments, and seasonal transition activities when applicable.

Frequently Asked Questions

Q: When is the best time to generate solar leads?

A: April and May represent peak solar lead season in most U.S. markets. Spring combines tax refund availability, improving installation weather, and strong consumer motivation from prior summer electricity bills. Lead pricing reaches annual highs during these months because installer demand peaks. Secondary peaks occur in September-October as year-end approaches. Geographic variations matter: Florida and Texas maintain stable year-round demand, while Northeast markets show pronounced spring peaks and winter troughs.

Q: How much should seasonal variation affect my marketing budget?

A: Seasonal budget allocation should range from 50-75% of average during winter trough months to 130-150% of average during peak spring months. This represents approximately 3x variation between lowest and highest months. Equal monthly distribution wastes money during low-demand periods and underinvests during high-opportunity windows. The specific allocation depends on your geographic mix, with multi-market operators using geographic diversification to smooth seasonal swings.

Q: How do I staff for seasonal volume variation?

A: Build a core team sized at 60-70% of peak capacity who work year-round. Add seasonal employees or contractors (30-40% additional capacity) during peak periods. Maintain overflow relationships with call centers or BPO providers for unexpected volume surges. Seasonal hiring should begin 8 weeks before peak periods to allow adequate training time. Cross-training core team members enables productivity during slow periods and backup during peaks.

Q: Does the ITC expiration change solar seasonality?

A: Yes, significantly. The December 31, 2025 residential ITC expiration creates intense Q4 2025 demand followed by uncertain 2026 patterns. For 2025, expect compressed year-end urgency with leads generated after mid-November having minimal value (installation cannot complete before deadline). For 2026 and beyond, expect elimination of year-end deadline dynamics, normalized Q4 patterns, and overall volume decline of 30-50% as the fundamental economics shift without the 30% tax credit.

Q: How do geographic markets differ in seasonality?

A: Pronounced variation exists across regions. The Northeast shows 40-50% swings between spring peak and winter trough due to weather constraints. Florida and Texas maintain stable year-round demand with no significant winter decline. California post-NEM 3.0 shows flattened seasonality but requires battery storage qualification. Arizona and Nevada peak in fall (September-November) after summer cooling bill shock. Mountain West markets have extremely compressed seasons (June-September only). Smart practitioners diversify geographically to smooth revenue.

Q: Should I buy leads during the off-season for later conversion?

A: This strategy works for operators with sophisticated nurture programs. Winter leads cost 20-40% less than spring leads but require 60-90 day nurture sequences to convert during spring demand windows. The economics work when nurture costs ($8-12 per lead) plus winter acquisition cost are less than spring acquisition cost. Requirements include strong email and SMS sequences, patient capital, high initial lead quality, and proper consent management for extended contact periods. Not recommended for operators without proven nurture capability.

Q: What technology capacity do I need for seasonal scaling?

A: Plan for 3-5x normal volume during peak periods. Lead distribution systems need load testing 4-6 weeks before peaks. Database capacity should accommodate increased storage and query volume. Telephony requires adequate trunk capacity for call volume increases. Verification services (TrustedForm, phone validation) need confirmed API rate limits. Integration reliability becomes critical as buyer systems also face increased load. Identify bottlenecks during slow periods when fixes have minimal impact.

Q: How do policy deadlines affect seasonal planning?

A: Tax credit deadlines create artificial seasonality overlaying natural patterns. The 2026 ITC expiration concentrates demand into Q4 with leads after mid-November having minimal value. State policy changes (net metering modifications, incentive expirations) can create local deadline dynamics at any time of year. Monitoring requirements include utility commission dockets, state solar associations, and proposed legislation. Practitioners who anticipate policy changes position traffic acquisition before competitors.

Q: What metrics should I track by season?

A: Track all standard metrics with seasonal benchmarking. Compare current period to same period prior year rather than prior month. Key seasonal metrics include: volume versus seasonal expectation, CPL versus seasonal benchmark, conversion rate versus seasonal average, return rate by season, buyer capacity utilization, and ROI by season. Document seasonal performance patterns to improve future planning. Metrics that look weak compared to peak periods may be strong for off-season benchmarks.

Q: How do I build installer relationships during slow seasons?

A: Off-seasons provide relationship-building opportunities that peak periods do not permit. Schedule quarterly business reviews during January-February when both parties have bandwidth. Implement new integrations during low-volume periods when errors have minimal impact. Negotiate coming-year terms when installers are planning rather than scrambling. Share performance data and optimization recommendations. Installers who see genuine partnership effort during slow periods become loyal buyers during competitive peak periods.

Q: What happens if I cannot scale for seasonal demand?

A: Operators who cannot scale miss peak season premiums that fund annual profitability. Alternatives include: geographic diversification toward stable markets, buyer relationships with capacity-constrained installers who pay premiums for reliable volume, aged lead strategies that generate during peaks for later sale, and partnership models that share capacity with complementary operators. Long-term, building seasonal flexibility is essential for solar lead generation profitability.

Key Takeaways

-

Solar leads follow predictable annual rhythms. Spring (March-May) represents peak season with highest lead values and installer demand. Winter (December-February) is the trough. Understanding these patterns enables strategic budget and staffing allocation that captures opportunity while protecting margins.

-

Geographic variation overrides national averages. Northeast markets show 40-50% swings between peak and trough while Florida and Texas maintain year-round stability. Arizona peaks in fall. Mountain West has extremely compressed summer-only seasons. Diversify geographically to smooth revenue and capture premiums in seasonally strong markets.

-

Budget allocation should range from 50% to 150% of monthly average. Equal monthly distribution wastes money during low-demand periods and underinvests during peaks. Allocate 130-150% of average budget to April-May peak, 50-75% to December-February trough, and scale proportionally between.

-

Staff in three tiers: core (60-70% of peak capacity), seasonal expansion (30-40% additional), and overflow partners (surge capacity). Core team maintains year-round operations and institutional knowledge. Seasonal hires handle peak volume. Overflow prevents capacity constraints during unexpected surges.

-

The 2026 ITC expiration creates unique dynamics. Q4 2026 demand will concentrate intensely around tax credit deadline with leads after mid-November having minimal value. 2026 patterns will normalize without year-end deadline dynamics but at 30-50% lower overall volume.

-

Off-seasons create strategic opportunities. Lower CPLs enable nurture acquisition strategies. Reduced competition benefits SEO and content development. Buyer relationships strengthen when both parties have bandwidth. Geographic pivots to southern markets maintain revenue during northern troughs.

-

Policy monitoring provides competitive advantage. Tax credit deadlines, net metering changes, and state incentive expirations create demand spikes and value shifts. Practitioners who anticipate policy changes through regulatory monitoring position traffic acquisition before competitors react.

-

Technology capacity must scale 3-5x for peak periods. Test systems under simulated peak load 4-6 weeks before anticipated demand. Identify bottlenecks during slow periods when fixes have minimal business impact. Verify vendor capacity limits for critical integration partners.

Seasonal patterns determine solar lead generation profitability. Those who align budget, staffing, and strategy with natural demand rhythms capture premiums during peaks while protecting margins during troughs. Plan the calendar, allocate resources accordingly, and let demand patterns work for you rather than against you.