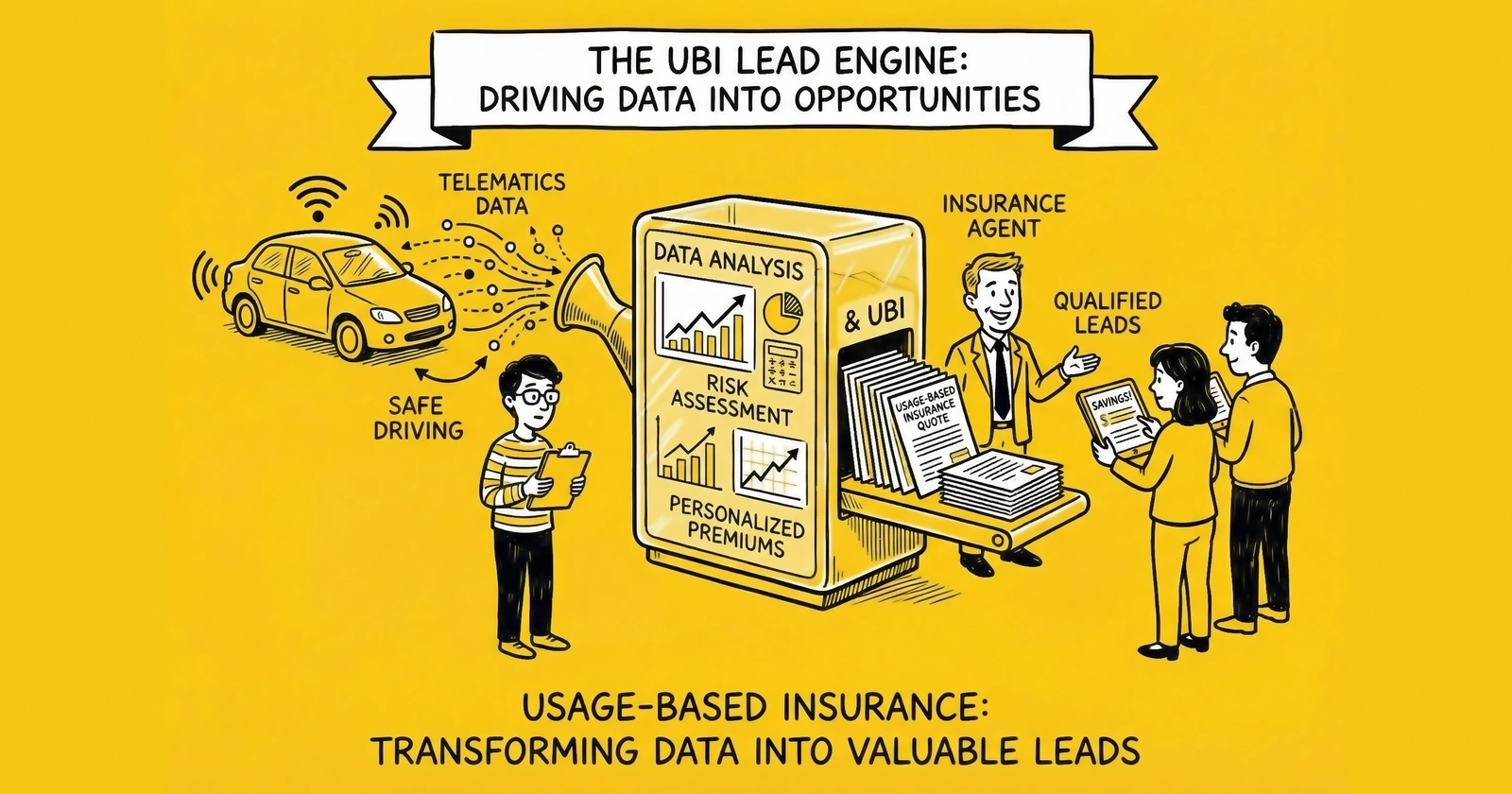

How driving behavior data is reshaping auto insurance lead generation, creating new qualification signals, premium pricing opportunities, and competitive advantages for operators who understand the technology transformation underway.

A consumer downloads their carrier’s app, agrees to share driving data, and spends three months proving they brake gently and avoid night driving. Their reward: a 15% discount and a premium that reflects actual risk. What the consumer does not see: the telematics data now attached to their profile makes them a fundamentally different lead than someone who has never been monitored.

This is the telematics revolution in auto insurance. Usage-Based Insurance (UBI) has moved from novelty to mainstream, with approximately 20% of U.S. auto insurance policies now incorporating some form of driving behavior monitoring. By 2028, industry projections suggest this figure will approach 40%. The implications for lead generation are profound. Telematics-qualified leads convert differently, price differently, and require different handling than traditional leads. Practitioners who understand these dynamics gain competitive advantage. Those who treat telematics leads as standard auto insurance inventory leave money on the table.

This comprehensive guide covers everything lead generation professionals need to understand about telematics and UBI: how the technology works, market sizing and growth trajectories, the carrier landscape and their telematics programs, lead qualification opportunities, pricing differentials, compliance considerations, and strategic positioning for the UBI-dominated future. Every insight comes from current market data and operational experience in the insurance lead vertical.

Understanding Telematics and Usage-Based Insurance

Before exploring lead generation opportunities, understanding the technology and insurance product mechanics is essential. Telematics refers to the technology that captures, transmits, and analyzes vehicle and driving data. Usage-Based Insurance refers to insurance products that use this data to price policies based on actual driving behavior rather than traditional rating factors alone.

How Telematics Technology Works

Telematics systems capture driving data through three primary mechanisms:

OBD-II Dongles plug into the vehicle’s diagnostic port (standard on all U.S. vehicles since 1996). These devices capture speed, acceleration, braking, cornering, and engine data. They transmit information via cellular connection to carrier systems. Progressive’s Snapshot device, one of the earliest UBI implementations, used this approach. Dongle programs are declining as smartphone apps offer equivalent capabilities without hardware distribution costs.

Smartphone Applications use the phone’s accelerometer, GPS, and gyroscope to capture driving behavior. The consumer installs the carrier’s app, grants location permissions, and the app automatically detects driving trips. Modern smartphone telematics can identify phone use while driving, capture route information, and distinguish between driver and passenger. State Farm’s Drive Safe & Save, Allstate’s Drivewise, and GEICO’s DriveEasy all use smartphone-based approaches.

Embedded Vehicle Systems represent the newest data source. Modern vehicles with connected car features transmit telematics data directly from manufacturer systems. General Motors’ OnStar, Ford’s SYNC, and Tesla’s connectivity all enable insurance-relevant data sharing. Toyota has partnered with multiple carriers to share driving data. This approach eliminates the need for consumer action beyond consent, dramatically increasing data availability.

What Telematics Data Captures

The specific driving behaviors that telematics systems monitor include:

Speed Patterns: Not just speeding violations, but speed relative to road conditions, speed consistency, and highway versus surface street ratios. Excessive speed is the most significant risk factor captured.

Braking Behavior: Hard braking events indicate following distance, attention, and anticipation. Frequent hard braking correlates with accident risk regardless of actual collision history.

Acceleration Patterns: Aggressive acceleration correlates with risk-taking behavior. Smooth acceleration indicates controlled, predictable driving.

Cornering: Sharp turns and g-force events indicate aggressive driving style. Consistent, smooth cornering suggests careful operation.

Time of Day: Night driving (particularly 11 PM to 4 AM) correlates with higher accident rates. Telematics captures trip timing automatically.

Mileage: Annual miles driven directly correlates with exposure. Lower-mileage drivers have fewer opportunities for accidents. Pay-per-mile programs use this as the primary rating factor.

Phone Distraction: Modern smartphone apps can detect phone use while driving, including calls, texting, and app usage. Phone distraction is increasingly weighted in UBI scoring.

Trip Duration and Frequency: Short, frequent trips may indicate different risk profiles than longer highway journeys.

Types of Usage-Based Insurance Programs

UBI products fall into four primary categories:

Pay-Per-Mile (PAYD) programs charge a base rate plus a per-mile fee. Metromile (acquired by Lemonade) pioneered this model. Mile Auto, Nationwide SmartMiles, and Allstate Milewise offer similar products. These programs appeal to low-mileage drivers (under 7,500 annual miles) who overpay under traditional rating.

Pay-How-You-Drive (PHYD) programs apply discounts or surcharges based on driving behavior quality. Progressive’s Snapshot, State Farm’s Drive Safe & Save, and Liberty Mutual’s RightTrack fall into this category. Initial discounts of 5-10% are common, with potential for 20-30% based on demonstrated safe driving.

Manage-How-You-Drive (MHYD) programs provide feedback without direct pricing impact. These serve as lead qualification and engagement tools rather than primary rating mechanisms. Insurers use them to identify safe drivers for retention and cross-sell opportunities.

Hybrid Programs combine mileage and behavior factors. GEICO’s DriveEasy, for example, considers both how much you drive and how safely you drive when calculating discounts.

Market Size and Growth Trajectory

The telematics and UBI market represents one of the fastest-growing segments of insurance technology, with direct implications for lead generation economics and strategy.

Current Market Penetration

As of 2024-2026, approximately 20% of U.S. auto insurance policies incorporate some form of telematics, up from approximately 15% in 2022 and less than 10% in 2020. This represents roughly 45-50 million active telematics policies in the United States, with growth accelerating.

The global telematics insurance market was valued at approximately $3.5 billion in 2024, with the U.S. representing roughly 40% of that total. Industry analysts project the market will reach $8-10 billion by 2030, representing a compound annual growth rate of 15-18%.

Growth Drivers

Several factors are accelerating telematics adoption:

Consumer Demand for Personalized Pricing: Drivers who know they are safe resent subsidizing high-risk drivers. Telematics offers a path to fairer pricing that appeals to the low-risk segments carriers want most.

Carrier Profitability Pressure: After devastating underwriting losses in 2022-2023 due to claims inflation, carriers are intensely focused on risk selection. Telematics provides risk signals unavailable through traditional underwriting factors like age, credit, and vehicle type.

Smartphone Ubiquity: The shift from OBD-II dongles to smartphone apps eliminated hardware costs and logistics barriers. Launching a telematics program now requires app development, not device manufacturing and distribution.

Connected Vehicle Growth: By 2030, an estimated 95% of new vehicles sold will have embedded connectivity. This data availability will make telematics-based rating the default rather than the exception.

Regulatory Pressure: Several states have considered or implemented limits on traditional rating factors like credit scores. Telematics offers an alternative risk assessment methodology based on actual behavior rather than demographic proxies.

Carrier Adoption Landscape

Virtually every major auto insurer now offers some form of UBI program:

| Carrier | Program Name | Type | Key Features |

|---|---|---|---|

| Progressive | Snapshot | PHYD | Pioneer program, 30+ years of data |

| State Farm | Drive Safe & Save | Hybrid | Largest UBI program by enrollment |

| Allstate | Drivewise | PHYD | Smartphone-based, up to 40% discount |

| GEICO | DriveEasy | Hybrid | Behavior + mileage factors |

| Liberty Mutual | RightTrack | PHYD | 90-day monitoring period |

| Nationwide | SmartRide/SmartMiles | PHYD/PAYD | Both behavior and mileage options |

| Travelers | IntelliDrive | PHYD | Targets safe drivers |

| USAA | SafePilot | PHYD | Military and family focus |

| Farmers | Signal | PHYD | Smartphone app with coaching |

| Metromile/Lemonade | Per-mile | PAYD | Pure pay-per-mile model |

State Farm’s Drive Safe & Save represents the largest UBI program by enrollment, with millions of active participants. Progressive’s Snapshot has the longest operational history, providing decades of actuarial data that inform their pricing models.

Projected Growth Scenarios

Industry projections suggest telematics penetration will reach:

- 2026: 22-25% of policies (current trajectory)

- 2027: 30-35% of policies (accelerating adoption)

- 2030: 40-50% of policies (mainstream status)

- 2035+: 60-70% of policies (default rating methodology)

For lead generators, these projections mean that telematics qualification will become increasingly important over the next decade. Leads generated today should be evaluated for telematics eligibility and interest to future-proof lead value.

Lead Generation Opportunities in the Telematics Era

The telematics revolution creates three distinct categories of lead generation opportunity: qualification enhancement for traditional leads, new telematics-specific lead products, and strategic positioning for the UBI-dominated future.

Opportunity 1: Enhanced Qualification Signals

Telematics creates new qualification data points that improve lead quality and command premium pricing.

Driving Behavior Indicators: Forms that capture self-reported driving behavior provide telematics-relevant signals without requiring actual monitoring. Questions like “How many miles do you drive annually?”, “Do you primarily drive to work or work from home?”, and “Have you used any driving apps or telematics programs before?” identify telematics-eligible prospects.

Low-mileage drivers (under 10,000 annual miles) represent prime UBI candidates. These consumers often overpay under traditional rating because standard policies assume average mileage. Capturing mileage data allows lead routing to carriers with strong pay-per-mile programs, commanding premium pricing for qualified leads.

Technology Adoption Signals: Consumers who already use driving apps (Waze, Google Maps, ride-share apps) demonstrate comfort with location sharing and technology engagement. These consumers adopt telematics programs at higher rates than technology-resistant demographics.

Questions about smartphone type (iOS vs. Android), app usage patterns, and connected car features identify technology-forward consumers who convert well in UBI programs.

Discount Motivation: Price-sensitive consumers actively seeking discounts are natural UBI candidates. Telematics programs require effort (downloading apps, maintaining good driving habits) in exchange for savings. Consumers motivated primarily by price will make that trade-off.

Leads capturing “discount seeker” intent route effectively to carriers whose UBI programs offer substantial savings for enrolled participants.

Opportunity 2: Telematics-Specific Lead Products

Beyond enhancing traditional leads, operators can create lead products specifically targeting telematics interest.

UBI Comparison Leads: Leads generated from consumers actively searching for telematics or usage-based insurance command premium pricing. Search terms like “pay per mile insurance,” “safe driver discount,” “driving app insurance,” and “low mileage insurance” indicate specific UBI interest.

These leads convert at higher rates in UBI programs because consumer intent already aligns with product offering. A consumer searching “pay per mile insurance” expects and wants mileage-based pricing.

CPL benchmarks for UBI-specific leads run 20-40% higher than standard auto insurance leads due to higher conversion rates and better risk profiles. A standard auto lead at $40 might command $50-60 when telematics intent is documented.

Low-Mileage Lead Products: Creating lead products specifically for low-mileage drivers serves the pay-per-mile carrier segment effectively. Lead forms can filter for annual mileage under 7,500 or 10,000 miles, primary use (pleasure vs. commute), and work-from-home status.

Carriers with strong PAYD programs (Metromile/Lemonade, Nationwide SmartMiles, Allstate Milewise) pay premium CPL for pre-qualified low-mileage leads because these consumers represent their ideal customer profile.

Safe Driver Lead Products: Self-reported driving history combined with telematics interest creates “safe driver” lead products. Consumers who report no accidents in five years, no violations, and interest in driving behavior monitoring are prime PHYD candidates.

These leads route effectively to carriers like Liberty Mutual (RightTrack) and Travelers (IntelliDrive) whose programs specifically target safe drivers.

Opportunity 3: Strategic Positioning for the Future

The telematics trajectory suggests that within a decade, behavior-based rating will be standard rather than optional. Lead generators positioning for this future gain competitive advantage.

Data Capture Today for Tomorrow’s Value: Forms that capture telematics-relevant data (mileage, driving patterns, technology comfort) create lead records with future value even if not immediately monetized. As carrier demand for telematics-qualified leads increases, historical data capture enables rapid product launch.

Carrier Relationship Development: Building relationships with carriers investing heavily in UBI positions lead generators as strategic partners. Progressive, State Farm, and Allstate all have sophisticated telematics operations and ongoing lead acquisition needs. Understanding their telematics priorities enables more effective partnership conversations.

Content and SEO Investment: Organic traffic strategies targeting telematics search terms build long-term competitive moats. Search volume for “usage based insurance,” “pay per mile insurance,” and “telematics discounts” grows annually. Early SEO investment captures this emerging traffic at lower competition and cost.

CPL Benchmarks and Pricing Dynamics

Telematics qualification affects lead pricing through multiple mechanisms. Understanding these dynamics enables effective pricing strategy for both lead generation and lead purchasing.

Premium Pricing for Telematics-Qualified Leads

Leads with documented telematics eligibility or interest command premium pricing because:

Better Risk Selection: Telematics-qualified leads represent lower-risk consumers on average. Low-mileage drivers and those interested in behavior monitoring tend toward conservative driving patterns. Carriers pay more for leads that convert to profitable policies.

Higher Conversion Rates: Consumers expressing telematics interest align with carrier program offerings. This intent alignment produces higher conversion rates, justifying higher CPL from buyers.

Longer Retention: Telematics program participants show higher policy retention than traditional policyholders. The engagement created by ongoing app use and driving feedback builds stickiness. Higher lifetime value justifies higher acquisition cost.

Specific Pricing Benchmarks

Based on current market conditions, telematics-qualified leads command the following premiums over standard auto insurance leads:

| Lead Type | Standard Auto CPL | Telematics Premium | Telematics CPL |

|---|---|---|---|

| Shared leads | $15-35 | +20-30% | $18-45 |

| Exclusive leads | $40-80 | +25-40% | $50-110 |

| Live transfers | $100-150 | +15-25% | $115-185 |

| Low-mileage specific | N/A | Premium product | $55-90 (exclusive) |

| UBI intent leads | N/A | Premium product | $60-100 (exclusive) |

These premiums vary by carrier relationship, geographic market, and verification depth. Leads with verified low mileage (utility bill or odometer verification) command higher premiums than self-reported mileage.

Factors Affecting Telematics Lead Pricing

Verification Level: Self-reported telematics interest commands modest premiums. Verified low mileage or documented telematics program history commands substantial premiums. The deeper the verification, the higher the pricing.

Geographic Market: Telematics adoption varies by state and metropolitan area. Urban markets with higher traffic congestion see greater telematics interest because drivers can demonstrate better behavior relative to peers. Suburban and rural markets with lower baseline risk show less telematics price sensitivity.

Carrier Demand: Different carriers weight telematics leads differently based on their strategic priorities. A carrier aggressively growing their UBI program pays premium pricing. A carrier with mature telematics enrollment may be less aggressive.

Seasonal Patterns: Like standard auto insurance, telematics leads follow seasonal demand patterns. January (New Year resolution shopping) and spring (policy renewal season) see peak demand. Telematics premiums may compress during low-demand periods.

ROI Calculation for Telematics Leads

For lead buyers, the telematics premium justifies when conversion and retention economics work:

Standard Lead Economics:

- CPL: $50

- Contact rate: 50%

- Conversion rate: 10%

- Cost per acquisition: $1,000

- First-year premium: $1,500

- Commission: $225 (15%)

- First-year ROI: Negative ($775 loss)

- Break-even: 4.4 years at 85% retention

Telematics-Qualified Lead Economics:

- CPL: $65 (30% premium)

- Contact rate: 55% (higher engagement)

- Conversion rate: 14% (intent alignment)

- Cost per acquisition: $845

- First-year premium: $1,350 (lower due to UBI discount)

- Commission: $202 (15%)

- First-year ROI: Negative ($643 loss)

- Break-even: 3.2 years at 90% retention (telematics increases retention)

Despite higher CPL, telematics leads reach profitability faster due to improved conversion and retention. The math works for buyers who understand lifetime value dynamics.

Carrier Telematics Programs: What Lead Generators Need to Know

Understanding specific carrier telematics programs enables better lead routing, pricing negotiation, and buyer relationship development.

Progressive Snapshot

Program Details: Progressive pioneered UBI in 1998 with Snapshot, originally using OBD-II dongles. The program now offers smartphone-based monitoring as the primary option. Snapshot monitors hard braking, high-speed driving, time of day, and phone use.

Discount Structure: Initial participation discount of 5-10%. Additional discounts up to 25% based on driving performance. Some drivers may see rate increases for poor driving behavior (hard braking, night driving).

Lead Implications: Progressive’s decades of telematics data make them sophisticated UBI buyers. They understand the actuarial value of behavior data and price leads accordingly. Leads routed to Progressive should emphasize telematics interest or low-mileage status.

State Farm Drive Safe & Save

Program Details: The largest UBI program by enrollment, Drive Safe & Save uses smartphone app monitoring. The program tracks acceleration, braking, cornering, phone use, and mileage. OnStar integration provides connected vehicle data for GM owners.

Discount Structure: Up to 30% discount based on driving behavior. Discounts are personalized based on individual performance. The program emphasizes coaching and improvement over time.

Lead Implications: State Farm’s massive scale means consistent lead demand. Their UBI program targets safe drivers seeking personalized pricing. Leads with clean driving history and technology comfort route well to State Farm.

Allstate Drivewise

Program Details: Smartphone-based program tracking speed, braking, time of day, and mileage. Drivewise provides real-time feedback through the app. Points and rewards gamification increases engagement.

Discount Structure: Up to 40% discount for safe driving. Initial enrollment discount plus behavior-based discounts. Transparency about scoring factors helps drivers improve.

Lead Implications: Allstate’s aggressive discount structure (up to 40%) appeals to price-sensitive consumers. Leads emphasizing discount seeking and safe driving history align with Drivewise positioning.

GEICO DriveEasy

Program Details: Hybrid program considering both mileage and driving behavior. Smartphone-based monitoring launched in 2020. Focuses on acceleration, braking, cornering, and phone use.

Discount Structure: Up to 25% discount based on driving performance. Initial participation discount applies immediately. Six-month evaluation period determines ongoing discount.

Lead Implications: GEICO’s direct model and advertising dominance create high brand recognition. Leads with GEICO preference or awareness route effectively. The hybrid mileage-behavior approach appeals to moderate-mileage safe drivers.

Liberty Mutual RightTrack

Program Details: 90-day monitoring program using smartphone app. Focuses on braking, acceleration, and overall driving style. Discount determination occurs after monitoring period concludes.

Discount Structure: Up to 30% discount after 90-day evaluation. Initial participation discount applies during monitoring. Final rate based on demonstrated behavior.

Lead Implications: The 90-day commitment frame appeals to consumers confident in their driving ability. Leads self-reporting safe driving history and willingness to participate in monitoring convert well to RightTrack.

Pay-Per-Mile Programs

Program Details: Metromile (now Lemonade), Nationwide SmartMiles, and Allstate Milewise charge base rates plus per-mile fees. These programs target drivers under 7,500-10,000 annual miles.

Discount Structure: Savings of 30-50% for low-mileage drivers. Per-mile rates typically $0.02-0.06 per mile. Monthly bills vary based on actual driving.

Lead Implications: Low-mileage leads represent the ideal customer profile for PAYD carriers. Work-from-home status, retirees, multi-car households with a low-use vehicle, and urban dwellers without daily commutes all represent prime PAYD candidates. These leads command substantial premiums when properly qualified.

Compliance Considerations for Telematics Leads

Telematics leads introduce specific compliance considerations beyond standard auto insurance lead requirements.

Data Privacy and Consent

Telematics involves location tracking, driving behavior monitoring, and potentially phone usage detection. This data sensitivity requires careful consent management.

Privacy Disclosure Requirements: Forms capturing telematics interest or qualifying data should disclose how information will be used. While the actual telematics monitoring occurs after policy purchase, lead generation activities that reference telematics programs should include appropriate privacy context.

CCPA and State Privacy Laws: California Consumer Privacy Act and similar state laws create specific obligations around data collection, disclosure, and deletion rights. Lead generation for California residents should include appropriate privacy disclosures.

Carrier-Specific Requirements: Different carriers have different consent and disclosure requirements for leads routed to their telematics programs. Understanding these requirements prevents compliance issues and lead rejections.

Telematics Claims and Representations

Marketing claims about telematics programs must be accurate:

Discount Claims: Advertising “up to 40% discount” requires that the claim be achievable. Overstatement of typical or guaranteed savings creates compliance risk.

Program Description: Describing what telematics programs monitor and how data is used must be accurate. Misrepresenting program requirements or data usage creates consumer confusion and potential regulatory issues.

Carrier Program Details: Claims about specific carrier programs should be current and accurate. Program terms change; outdated information creates problems.

TCPA Considerations

Standard TCPA requirements apply to telematics leads:

Prior Express Written Consent: Required before autodialed calls or texts to cell phones. Consent language must clearly disclose the parties authorized to contact and the nature of communications.

Consent Documentation: TrustedForm, Jornaya, or equivalent certification provides evidence of compliant consent capture. This documentation is especially important for premium lead products where buyer scrutiny is higher.

One-to-One Consent Considerations: Following FCC rulemaking and subsequent court activity, consent practices continue evolving. Telematics leads should follow current consent best practices regardless of specific regulatory status.

Building a Telematics Lead Generation Strategy

For practitioners seeking to capitalize on telematics opportunities, a structured approach maximizes results.

Phase 1: Qualification Enhancement

Start by enhancing existing auto insurance lead forms with telematics-relevant questions:

Mileage Capture: Add annual mileage questions to existing forms. Segment leads by mileage tier (under 7,500, 7,500-12,000, 12,000+). Route low-mileage leads to PAYD-focused carriers.

Driving Behavior Self-Report: Add optional questions about driving patterns, accident history, and telematics program familiarity. Use this data for routing optimization rather than pricing initially.

Technology Comfort Assessment: Gauge smartphone app usage and comfort with location sharing. Technology-forward consumers convert better in UBI programs.

Phase 2: Lead Product Development

Create telematics-specific lead products for premium pricing:

Low-Mileage Lead Product: Develop a lead product specifically qualifying low-mileage drivers. Apply additional verification (odometer photos, work-from-home verification) to command premium pricing.

UBI Interest Lead Product: Create landing pages and traffic campaigns targeting telematics search terms. These leads demonstrate specific UBI intent and command premium CPL.

Safe Driver Lead Product: Combine self-reported clean driving history with telematics interest qualification. Target consumers who are confident in their driving ability and seeking recognition through behavior-based pricing.

Phase 3: Carrier Relationship Development

Build relationships with carriers prioritizing telematics:

Identify Strategic Priorities: Research which carriers are investing most heavily in UBI growth. Progressive, State Farm, and Allstate all have substantial telematics ambitions. Smaller carriers may be even more aggressive in seeking telematics-qualified leads.

Demonstrate Value: Present data on telematics qualification rates, low-mileage lead volume, and conversion performance. Carriers seeking UBI growth value partners who understand their priorities.

Negotiate Premium Pricing: Use demonstrated quality and alignment with carrier priorities to negotiate premium CPL. Telematics-qualified leads are worth more; capture that value through pricing.

Phase 4: Long-Term Positioning

Prepare for a telematics-dominated future:

SEO and Content Investment: Build organic traffic for telematics and UBI search terms. This traffic will become increasingly valuable as market penetration grows.

Data Infrastructure: Ensure your systems capture and store telematics-relevant data points for future use. Historical data enables rapid product launch as market demand increases.

Technology Partnerships: Explore relationships with connected vehicle data providers, OEM data platforms, and telematics technology vendors. These partnerships may enable lead products impossible to create independently.

The Future of Telematics and Lead Generation

The telematics revolution is not a temporary trend but a fundamental transformation of auto insurance rating. Understanding the trajectory helps lead generators position for long-term success.

Near-Term Developments (2026-2027)

Accelerating Adoption: Current 20% penetration will reach 30-35% as carrier investment intensifies and consumer awareness grows. This mainstream adoption increases demand for telematics-qualified leads.

Premium Pricing Pressure: As telematics becomes standard, the premium for telematics-qualified leads may compress. First-mover advantages favor operators who build capability now.

Connected Vehicle Integration: Partnerships between carriers and automakers will increase. Direct data feeds from vehicles reduce consumer action required for telematics enrollment.

Medium-Term Developments (2027-2030)

Default Rating Methodology: Telematics may become the default rating approach for new policies in many states. Traditional rating factors (age, credit) may become supplemental rather than primary.

Real-Time Rating: Continuous telematics data may enable dynamic pricing that adjusts based on recent driving behavior. Monthly or even trip-by-trip pricing may emerge.

Lead Qualification Transformation: As telematics becomes ubiquitous, lead qualification will shift from “are they interested in telematics” to “what does their telematics history show.” Historical behavior data becomes the key qualification signal.

Long-Term Developments (2030+)

Autonomous Vehicle Transition: As autonomous driving features advance, the concept of “driver behavior” evolves. The transition period creates uncertainty, but telematics data from vehicles (rather than drivers) may become primary.

Embedded Insurance: Insurance purchased through vehicle manufacturers or ride-share platforms may bypass traditional lead generation entirely. The lead economy adapts by focusing on segments where traditional shopping behavior persists.

Behavior-Based Pricing Across Verticals: The telematics model may expand beyond auto to home (smart home sensors), health (wearables), and commercial lines. Lead generators who understand behavior-based qualification in auto are positioned for cross-vertical expansion.

Frequently Asked Questions

What is telematics in insurance?

Telematics refers to technology that captures, transmits, and analyzes vehicle and driving data for insurance purposes. Systems use OBD-II dongles, smartphone apps, or embedded vehicle connectivity to monitor speed, braking, acceleration, mileage, and time of day. Insurance carriers use this data to price policies based on actual driving behavior rather than traditional factors alone. Approximately 20% of U.S. auto policies currently use some form of telematics, with projections suggesting 40-50% penetration by 2030.

How does usage-based insurance differ from traditional auto insurance?

Traditional auto insurance prices policies using demographic and historical factors: age, gender, credit score, vehicle type, and claims history. Usage-Based Insurance (UBI) adds actual driving behavior data to rating decisions. Pay-per-mile programs charge based on actual miles driven. Pay-how-you-drive programs apply discounts or surcharges based on driving behavior quality. UBI rewards safe, low-mileage drivers who would otherwise subsidize higher-risk drivers under traditional rating.

What CPL premium should I expect for telematics-qualified leads?

Telematics-qualified leads command 20-40% premiums over standard auto insurance leads. A standard exclusive auto lead at $60 might command $75-85 with documented telematics interest or low-mileage qualification. Low-mileage specific leads (under 7,500 annual miles) and UBI intent leads (consumers searching for telematics programs) command the highest premiums. Verification depth affects pricing: self-reported data commands lower premiums than verified low mileage or telematics program history.

Which carriers have the most active telematics programs?

Progressive’s Snapshot pioneered UBI with 25+ years of history. State Farm’s Drive Safe & Save represents the largest program by enrollment. Allstate’s Drivewise offers up to 40% discounts. GEICO’s DriveEasy combines mileage and behavior factors. Liberty Mutual’s RightTrack uses 90-day monitoring periods. For pay-per-mile specifically, Metromile (now Lemonade), Nationwide SmartMiles, and Allstate Milewise target low-mileage drivers. Understanding carrier program specifics enables effective lead routing.

How do I qualify leads for telematics programs?

Effective telematics qualification captures: annual mileage (under 10,000 miles is prime for PAYD), driving patterns (commute vs. pleasure, night driving frequency), self-reported driving history (accidents and violations in past five years), technology comfort (smartphone usage, app familiarity, connected car features), and direct telematics interest (prior program participation or stated interest in behavior-based pricing). Forms with 4-6 telematics-relevant questions provide sufficient qualification without excessive friction.

What is the difference between pay-per-mile and pay-how-you-drive insurance?

Pay-per-mile (PAYD) programs charge a base rate plus a per-mile fee (typically $0.02-0.06 per mile). Mileage is the primary rating factor. These programs target drivers under 7,500-10,000 annual miles. Pay-how-you-drive (PHYD) programs apply discounts based on driving behavior quality (braking, speed, time of day) rather than mileage. These programs reward safe driving regardless of mileage. Some programs combine both factors in hybrid models. Different consumer profiles align with each program type.

How does telematics affect lead conversion rates?

Telematics-qualified leads typically convert 20-40% higher than standard auto insurance leads because consumer intent aligns with carrier program offerings. A consumer actively seeking pay-per-mile insurance expects and wants mileage-based pricing. This intent alignment reduces sales friction. Additionally, telematics-interested consumers tend toward lower-risk profiles that carriers actively seek, improving quote competitiveness and close rates.

What privacy concerns exist with telematics leads?

Telematics involves location tracking, driving behavior monitoring, and potentially phone usage detection. Lead generation activities that reference telematics programs should include appropriate privacy disclosures. California Consumer Privacy Act and similar state laws create obligations around data collection and disclosure. Forms should clarify that actual telematics monitoring occurs after policy purchase and enrollment in carrier programs. Accurate representation of what data is collected and how it is used prevents compliance issues.

How will telematics affect the auto insurance lead market long-term?

Telematics penetration is projected to reach 40-50% by 2030 and 60-70% by 2035. As behavior-based rating becomes standard, lead qualification will shift from “telematics interest” to “telematics history.” Historical driving data may become the primary qualification signal. Connected vehicle data will reduce consumer action required for monitoring. First-mover advantages favor lead generators who build telematics capability now before the market fully transforms.

Should I create separate telematics lead products or enhance existing products?

Both approaches work. Enhancement adds telematics qualification to existing auto insurance forms with minimal disruption. This captures the easy value from routing optimization. Separate products create premium offerings targeting specific segments: low-mileage drivers, UBI searchers, and safe driver self-identifiers. Start with enhancement to learn what data matters, then develop dedicated products for highest-value segments where premium pricing justifies focused traffic acquisition.

Key Takeaways

-

Telematics represents a fundamental transformation in auto insurance rating. Current 20% penetration will reach 40-50% by 2030. Lead generators who build telematics qualification capability now gain first-mover advantage before the market fully transforms.

-

Telematics-qualified leads command 20-40% price premiums. Low-mileage qualification, UBI search intent, and safe driver self-identification all create premium lead products. The premium reflects better risk selection, higher conversion rates, and longer policy retention.

-

Different telematics programs target different consumer segments. Pay-per-mile programs target drivers under 7,500-10,000 annual miles. Pay-how-you-drive programs reward safe driving behavior regardless of mileage. Understanding program differences enables effective lead routing.

-

Major carriers are investing heavily in telematics. Progressive, State Farm, Allstate, GEICO, and Liberty Mutual all have mature programs. Building relationships with carriers prioritizing UBI growth positions lead generators as strategic partners.

-

Lead qualification should capture mileage, driving patterns, technology comfort, and telematics interest. These data points enable routing optimization and premium pricing today while building infrastructure for the telematics-dominated future.

-

Compliance considerations include privacy disclosure, accurate program representation, and standard TCPA requirements. Telematics data sensitivity requires careful consent management and accurate marketing claims about program benefits.

-

The long-term trajectory suggests behavior-based rating will become default. Connected vehicle data, real-time rating, and eventual autonomous vehicle transition will further transform the market. Strategic positioning today enables long-term competitive advantage.

Market data and carrier program information current as of December 2025. Telematics program terms, discount structures, and carrier priorities evolve; verify current details before making significant strategic decisions.