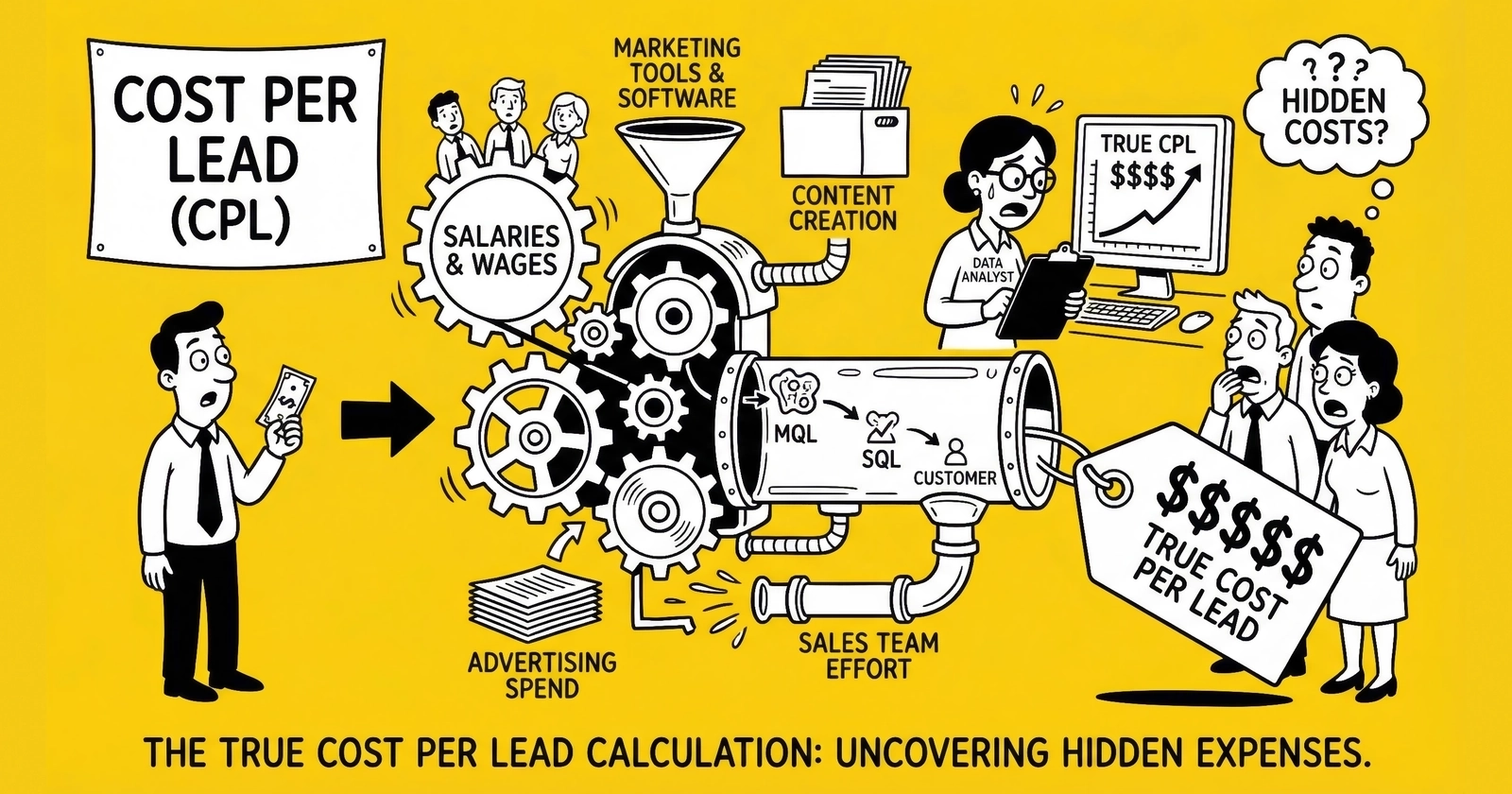

Your dashboard CPL is lying to you. The actual cost to acquire a lead is 30-60% higher than most practitioners realize. This guide shows you exactly where that money goes and how to calculate the real number.

Your Dashboard CPL Is a Fantasy

You’re running $50,000 in monthly ad spend. Your dashboard shows a $75 CPL. You’re selling leads for $100. That’s $25 margin per lead times 667 leads equals $16,675 monthly profit.

Except your P&L shows you’re barely breaking even.

The dashboard isn’t wrong. It’s just incomplete. It tracks what you spent on ads divided by leads generated. It doesn’t track the other 15 cost categories that erode margin between lead capture and cash in bank.

I’ve watched operators celebrate $50 CPL campaigns while hemorrhaging money. I’ve seen businesses collapse because they scaled campaigns where the “profitable” dashboard CPL masked $20 per lead in hidden costs.

This article gives you the complete formula. Every cost category. Real numbers. The math that survives contact with your actual bank account.

By the end, you’ll know your true CPL within $2. You’ll understand why your margins are tighter than expected. And you’ll have the framework to identify which cost categories offer the most optimization opportunity.

Why Surface CPL Is Misleading

What Dashboard CPL Actually Measures

Dashboard CPL measures one thing: media spend divided by leads generated. If you spend $10,000 and generate 150 leads, your surface CPL is $66.67. Simple. Clean. Dangerously incomplete.

Surface CPL Formula:

Surface CPL = Total Ad Spend / Total Leads GeneratedThe Costs Your Dashboard Ignores

Your dashboard CPL excludes an entire ecosystem of expenses that sit between ad click and cash collected. Creative production costs cover the designer who made your ads and the copywriter who wrote your landing page. Agency fees consume 10-20% of media spend for campaign management. Testing spend accounts for all the campaigns that failed before you found winners.

Platform fees add up through your distribution software charging per-lead or monthly subscriptions. Compare options in our lead distribution platforms guide. Technology fees accumulate from TrustedForm, Jornaya, validation services, and CRM subscriptions. Labor allocation captures the hours your team spends on campaign management, lead processing, and buyer coordination.

The compliance layer includes consent documentation, legal review, and TCPA insurance. Returns and refunds account for the 8-25% of leads buyers reject post-purchase. Float cost represents the working capital required because you pay suppliers before buyers pay you. Every one of these categories extracts money between “lead generated” and “revenue collected.” Every one gets ignored in dashboard CPL.

Q: How much higher is true CPL than dashboard CPL?

True CPL runs 30-60% higher than dashboard CPL for most lead generation operations. A campaign showing $75 dashboard CPL typically carries $98-120 true CPL when all costs are allocated.

The gap widens at smaller scale. Fixed costs like platforms, labor, and compliance spread across fewer leads. A 10,000 lead/month operation has tighter true margins than a 100,000 lead/month operation running identical campaigns.

The Complete CPL Formula

Here’s the formula your CFO wishes your marketing team used:

True Total Cost Per Lead = (Media Spend + Creative Production + Agency Fees + Testing Costs + Platform Fees + Per-Lead Technology Fees + Allocated Labor + Compliance Costs + Return Processing + Float Cost) / Net Leads Delivered

Note the denominator: net leads delivered, not leads generated. Leads that fail validation, get returned by buyers, or can’t be sold don’t count toward the denominator. They’re costs without corresponding revenue.

The Formula Breakdown

Each component carries realistic ranges that vary by operation size and vertical. Media spend is your dashboard CPL, which varies by vertical and traffic source. Creative production typically runs $0.50-3.00 per lead when amortized across your total volume. Agency fees add 10-20% of media if you’re using external management, while testing costs account for 15-25% of media spend on failed campaigns before finding winners.

Platform fees range from $0.10-0.50 per lead for distribution software, and technology fees add another $0.15-0.75 for validation, consent documentation, and CRM services. Allocated labor costs $1.00-5.00 per lead depending on team size and efficiency. Compliance costs contribute $0.25-1.00 for consent documentation, legal review, and insurance. Return processing impacts 8-25% of CPL depending on vertical, and float cost adds $0.50-1.50 for working capital carrying costs.

| Cost Category | Range (per lead) | Notes |

|---|---|---|

| Media Spend | Varies | Your dashboard CPL |

| Creative Production | $0.50-3.00 | Amortized across lead volume |

| Agency Fees | 10-20% of media | If using external management |

| Testing Costs | 15-25% of media | Failed campaigns before winners |

| Platform Fees | $0.10-0.50 | Distribution software |

| Technology Fees | $0.15-0.75 | Validation, consent, CRM |

| Allocated Labor | $1.00-5.00 | Campaign management, processing |

| Compliance Costs | $0.25-1.00 | Consent, legal, insurance |

| Return Processing | 8-25% of CPL | Vertical dependent |

| Float Cost | $0.50-1.50 | Working capital carrying cost |

Q: What’s the most commonly overlooked cost in CPL calculations?

Returns and refunds. Operators carefully track media spend, platform fees, and technology costs. They systematically underestimate the impact of leads that buyers reject post-purchase.

A 12% return rate on $100 leads means $12 per lead sold disappears. That single line item often exceeds the combined cost of platforms, technology, and labor.

Hidden Cost #1: Platform and Technology Fees

Every lead flowing through your business touches software. That software has costs that accumulate faster than most practitioners realize.

Distribution Platform Fees

Transaction-based pricing dominates the distribution platform market. Platforms like boberdoo charge $0.10-$0.50 per lead processed, depending on volume tier. At 10,000 leads/month and $0.25 per lead, that’s $2,500 monthly or $0.25 added to every lead’s true cost. Some platforms use subscription pricing instead, with monthly fees ranging from $450 to $5,000+ depending on features. boberdoo typically starts around $1,000/month, LeadsPedia ranges from $450-2,500/month, and Phonexa starts around $500/month. Many vendors offer hybrid models combining a base subscription with per-transaction fees above certain thresholds.

CRM and Sales Technology

Your CRM isn’t free. Salesforce, HubSpot, or custom solutions add $50-500+ per user monthly. If five people touch leads and you’re running 10,000 leads/month, that’s $0.25-2.50 per lead just for customer relationship management.

Dialers, email platforms, and automation tools add another layer. A predictive dialer at $150/seat/month for a 10-person team adds $1,500 monthly. Email platforms, marketing automation, and ancillary tools pile on additional costs that rarely appear in CPL calculations.

The Platform Fee Calculation

Consider a realistic example at 10,000 leads/month. Distribution platform costs include a $600 base fee plus $0.15 per lead, totaling $2,100. CRM costs for 5 users at $100 each add $500. A dialer covering 10 seats at $150 each contributes $1,500. The email platform adds another $200. The total reaches $4,300 monthly, or $0.43 per lead that never appears in your dashboard CPL.

Q: How do platform fees change at scale?

Platform fees become more efficient at scale, but the efficiency is non-linear. Volume discounts typically reduce per-lead fees 30-50% between 10,000 and 100,000 monthly leads. Fixed subscription costs become negligible.

A 100,000 lead/month operation might pay $0.15 per lead in platform costs versus $0.43 for a 10,000 lead operation. That’s $0.28 saved per lead, or $28,000 monthly margin improvement purely from scale efficiency.

Hidden Cost #2: Compliance and Consent

The regulatory landscape has transformed consent from a checkbox to a documented legal event. Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, prior express written consent documentation remains legally essential for any lead involving robocalls or autodialers – and many sophisticated buyers require one-to-one consent regardless of regulatory minimums. Documentation costs money, but the alternative costs far more.

Consent Documentation Costs

TrustedForm has become the industry standard for consent documentation, charging $0.15-$0.50 per certificate depending on volume and features. Basic certificates run $0.15, while enhanced certificates with video replay cost $0.35-0.50. If you’re generating 10,000 leads monthly and documenting every one at $0.25 each, that’s $2,500 monthly in compliance cost.

Jornaya from Verisk offers a similar pricing structure for lead intelligence and consent tracking. Many practitioners use both services for redundancy, creating belt-and-suspenders protection against TCPA litigation.

Validation Services

Real-time validation catches fraud and bad data before it enters your pipeline. Phone validation runs $0.01-0.05 per lookup, email validation costs $0.005-0.02 per lookup, and address standardization adds $0.01-0.03 per lookup. IP intelligence for fraud detection contributes another $0.02-0.10 per lookup. A comprehensive validation stack runs $0.05-0.20 per lead, but the fraud and return reduction typically delivers 3-5x ROI on that investment. Our lead validation guide covers implementation best practices.

Legal and Insurance

TCPA compliance isn’t just technology. It requires legal review of landing pages, consent language, and disclosure requirements. Budget $2,000-10,000 annually for compliance legal counsel who understands lead generation’s regulatory complexities.

TCPA insurance costs vary based on volume and risk profile, but budget $5,000-25,000 annually for meaningful coverage. At 10,000 leads monthly, that’s $0.05-0.20 per lead for legal and insurance protection.

The Compliance Cost Calculation

At 10,000 leads/month, compliance costs accumulate quickly. TrustedForm certificates at $0.25 each total $2,500. Jornaya at $0.15 per lead adds $1,500. A validation stack at $0.10 per lead contributes $1,000. Amortized legal counsel adds $500 monthly, and amortized TCPA insurance adds $1,000. The total reaches $6,500 monthly, or $0.65 per lead.

Q: Can I skip consent documentation to reduce costs?

No. Consent documentation is not a cost center to optimize. It’s risk mitigation.

TCPA litigation averages $6.6 million per settlement. A single lawsuit can eliminate years of profit. TrustedForm at $0.25 per lead is cheap insurance compared to $500-1,500 per violation statutory damages.

Hidden Cost #3: Returns and Refunds

Returns happen when buyers reject leads post-purchase. Common reasons include leads who don’t answer, consumers who provided false information, leads who don’t meet unstated criteria, and duplicates of existing contacts. Every return carries full acquisition cost with zero revenue.

Return Rates by Vertical

Return rates vary dramatically by vertical and source quality. Insurance typically sees 8-15% returns, with high-quality sources achieving 5-8% and poor sources suffering 20-30%. Mortgage runs 10-18% typically, ranging from 6-10% for quality sources to 25-35% for poor ones. Solar experiences higher friction at 15-25% typically, with quality sources at 10-15% and poor sources hitting 30-40%. Home services falls in the 12-20% range, while legal leads see the highest returns at 20-35% typically.

| Vertical | Typical Return Rate | High-Quality Sources | Poor Sources |

|---|---|---|---|

| Insurance | 8-15% | 5-8% | 20-30% |

| Mortgage | 10-18% | 6-10% | 25-35% |

| Solar | 15-25% | 10-15% | 30-40% |

| Home Services | 12-20% | 8-12% | 25-35% |

| Legal | 20-35% | 15-20% | 40-50% |

The Return Cost Calculation

Returns don’t just eliminate revenue. They create compounding costs. First, you’ve lost the lead cost you paid to acquire that lead with no refund from Google. Second, processing costs including platform fees, validation fees, and labor have already been spent. Third, high return rates damage buyer relationships, leading to lower future bids or terminated partnerships.

Consider a calculation at $100 CPL with 12% returns. You generate 100 leads, 12 get returned, and 88 leads are delivered and paid. Your $10,000 in acquisition costs spreads across only 88 leads, yielding a $113.64 effective CPL. That 12% return rate added $13.64 to your true CPL.

Source-Level Return Tracking

Not all sources return equally. A traffic source with 5% returns is worth 2-3x a source with 20% returns at the same surface CPL. Track returns by source religiously and calculate source-adjusted CPL:

Source-Adjusted CPL = (Media Spend / Leads Generated) / (1 - Return Rate)

A $50 CPL source with 5% returns has $52.63 adjusted CPL. A $50 CPL source with 20% returns has $62.50 adjusted CPL. That’s $10 per lead difference on identical dashboard metrics.

Q: How do I reduce return rates?

Three interventions deliver the highest impact. Real-time validation catches bad data before it enters your pipeline, with phone verification alone cutting returns 3-5%. Speed to buyer matters enormously since leads delivered within seconds contact at higher rates than leads aged hours, and contact failure is the leading return reason. Source accountability requires pausing sources exceeding return thresholds. A 10-day rolling return rate above 15% should trigger source review. Above 20% triggers immediate pause.

Hidden Cost #4: Float (Working Capital)

You pay suppliers before buyers pay you. This timing gap requires working capital that has real cost, and undercapitalized operators fail not from unprofitable campaigns but from timing gaps between paying suppliers and collecting from buyers.

The 60-Day Rule

The 60-day float rule states that you should maintain approximately 60 days of working capital to operate safely. The timeline works like this: on Day 0, the lead is captured and delivered to the buyer. Between Day 7 and Day 15, you pay the traffic source or publisher. Between Day 30 and Day 45, the buyer pays you. Day 60 provides a buffer for disputes and payment delays.

That 15-45 day gap between paying and receiving requires capital. Capital has cost.

Calculating Float Cost

Float cost = Average daily lead spend x Average float days x Cost of capital

Consider an example with $100,000 monthly lead spend. Daily spend averages $3,333 with a 30-day average float, creating $100,000 in outstanding capital. At a 12% annual cost of capital (1% monthly), the monthly float cost reaches $1,000. Across 10,000 leads, that’s $0.10 per lead.

At higher volumes and longer payment terms, float costs scale significantly:

| Monthly Spend | Float Days | Annual Rate | Monthly Cost | Per Lead (10K) |

|---|---|---|---|---|

| $100,000 | 30 | 12% | $1,000 | $0.10 |

| $250,000 | 45 | 12% | $3,750 | $0.38 |

| $500,000 | 60 | 15% | $7,500 | $0.75 |

Working Capital Sources and Their Costs

Different capital sources carry different costs. Credit cards offer accessibility at 18-24% APR, making them expensive but available. Business lines of credit provide 8-15% APR but require established business credit. Revenue-based financing delivers speed at 15-35% effective APR, trading convenience for expense. Factoring receivables costs 2-5% per month, trading future revenue for immediate cash. Equity or retained earnings carry opportunity cost that varies by situation, with no interest but capital that could earn returns elsewhere.

Q: How do I reduce float cost?

Three strategies work most effectively. Negotiating faster buyer payment terms makes a major difference since Net-15 versus Net-45 cuts float 30 days, and it’s worth accepting slightly lower prices for substantially reduced capital requirements. Requiring buyer prepayment eliminates float entirely for prepaid accounts, working well for smaller buyers though harder with enterprise clients. Reducing supplier payment speed through Net-30 negotiation with publishers instead of Net-15 compresses both ends and minimizes the gap.

Hidden Cost #5: Labor Allocation

Someone manages your campaigns. Whether that’s you, an employee, or an agency, time has cost. The hours spent on campaign management, lead processing, and buyer coordination represent real expenses that belong in your true CPL calculation.

Campaign Management Labor

Campaign management encompasses a substantial time investment. Bid adjustments and budget allocation consume 2-5 hours weekly. Creative refresh and testing require 3-8 hours weekly. Landing page optimization takes another 2-5 hours weekly. Reporting and analysis demand 2-4 hours weekly. Platform troubleshooting adds 2-5 hours weekly for inevitable technical issues.

A fully loaded campaign manager including salary, benefits, and overhead costs $60,000-120,000 annually, or $5,000-10,000 monthly. If that manager handles 20,000 leads/month, labor cost per lead is $0.25-0.50.

Lead Processing Labor

Leads require processing beyond automated flows. Quality review and manual validation take 1-3 hours daily. Buyer communication and dispute resolution consume 2-4 hours daily. Source management and optimization require 1-2 hours daily. Compliance monitoring adds another 1-2 hours daily.

A lead operations coordinator at $50,000-70,000 annually adds another $4,000-6,000 monthly in labor.

The Labor Allocation Calculation

At 20,000 leads/month, labor costs distribute across multiple roles. Campaign management allocated at 50% adds $3,500. A full-time operations coordinator contributes $5,000. Sales and buyer relations allocated at 25% adds $2,000. The total reaches $10,500 monthly, or $0.53 per lead.

Q: Should I outsource to reduce labor costs?

Outsourcing trades direct labor cost for agency fees and reduced control. The economics depend on volume.

Below 5,000 leads/month, outsourcing often makes sense since you can’t justify full-time specialists. Between 5,000-25,000 leads/month, a hybrid approach works best with core competencies in-house and specialized functions outsourced. Above 25,000 leads/month, in-house teams typically deliver better economics and control.

Agency fees of 10-20% of media spend often exceed in-house labor costs at scale but include expertise difficult to hire directly.

Worked Example: From $93 CPL to Reality

Let’s walk through a complete calculation for a realistic lead generation operation. This example demonstrates how a campaign that looks profitable on the dashboard can hemorrhage money when all costs are allocated.

Scenario Parameters

The vertical is auto insurance with $50,000 monthly media spend. Dashboard CPL shows $93.20 based on $4.66 CPC and 5% conversion rate, generating 536 leads monthly. The lead sale price is $100.

The dashboard view looks healthy: $50,000 spend, 536 leads, $93.20 CPL, $100 sale price equals $3,648 profit.

Adding Hidden Costs

Creative and Testing: Creative production amortized costs $800 monthly. Testing spend at 20% of media adds $10,000 monthly. Per-lead creative and testing cost: $20.15.

Agency and Management: Agency fee at 15% of media totals $7,500 monthly. Per-lead agency cost: $13.99.

Platform and Technology: Distribution platform costs $850 monthly. CRM allocation adds $300 monthly. Dialer allocation contributes $450 monthly. Per-lead platform and tech cost: $2.99.

Compliance and Validation: TrustedForm at $0.25 times 536 leads equals $134. Validation stack at $0.10 times 536 equals $54. Legal and insurance allocation adds $200. Per-lead compliance cost: $0.72.

Returns: The 12% return rate means 64 leads returned out of 536 generated, leaving 472 net delivered. Per-lead return cost: $12.71.

Labor: Campaign management allocation costs $2,000 monthly. Operations allocation adds $1,500 monthly. Per-lead labor cost: $6.53.

Float: Working capital deployed reaches $50,000. The 35-day float period creates $583 monthly float cost. Per-lead float cost: $1.09.

The True CPL Calculation

| Cost Category | Monthly Cost | Per Lead |

|---|---|---|

| Media Spend | $50,000 | $93.20 |

| Creative/Testing | $10,800 | $20.15 |

| Agency Fees | $7,500 | $13.99 |

| Platform/Tech | $1,600 | $2.99 |

| Compliance | $388 | $0.72 |

| Returns Impact | $6,819 | $12.71 |

| Labor | $3,500 | $6.53 |

| Float | $583 | $1.09 |

| Total | $81,190 | $151.38 |

True CPL: $151.38 (against a $100 sale price)

The dashboard said $6.80 margin per lead and $3,648 monthly profit. Reality shows a $51.38 loss per lead and $27,552 monthly loss. This campaign loses money on every lead despite the dashboard showing profitability.

Q: How does this example business become profitable?

Four interventions deliver the highest impact, in order of magnitude. Improving conversion rate from 5% to 7% drops media CPL from $93.20 to $66.57, saving $26.63 per lead. Reducing returns from 12% to 8% saves $4.65 per lead in return-adjusted costs. Negotiating sale price to $125 per lead instead of $100 shifts the math $25 per lead. Bringing campaign management in-house saves $14 per lead at this volume.

Combined: $26.63 + $4.65 + $25.00 + $14.00 = $70.28 savings per lead. That transforms a $51 loss into a $19 profit.

Tracking True CPL Operationally

Your finance team tracks different things than your marketing team. Connect them.

Building a True CPL Dashboard

Effective true CPL tracking requires data from multiple sources. You need ad platform spend from Google, Facebook, and other channels. Lead generation counts by source provide the volume denominators. Platform and technology invoices document fixed and variable costs. Labor time allocation captures personnel expenses. Return and refund reports show post-sale erosion. Accounts receivable aging tracks payment timing. Accounts payable timing shows when you’re paying suppliers.

Monthly true CPL calculation:

Total Monthly Costs:

Media Spend: $_____

Creative (amortized): $_____

Agency Fees: $_____

Testing Spend: $_____

Platform Fees: $_____

Technology Fees: $_____

Compliance Costs: $_____

Labor Allocation: $_____

Float Cost: $_____

Total Costs: $_____

Net Leads Delivered: _____

(Generated minus returns)

True CPL = Total Costs / Net Leads DeliveredWeekly Monitoring Metrics

You can’t recalculate true CPL daily since many costs are monthly. But you can track leading indicators weekly. Return rate by source should flag any sources exceeding 15%. Validation failure rate indicates traffic quality degradation. Contact rate by source serves as a leading indicator of future returns. Platform error rates impact lead delivery and buyer experience.

Monthly Financial Reconciliation

Every month, reconcile dashboard metrics against actual cash flow through a five-step process. Calculate dashboard CPL from ad platforms. Calculate true CPL from complete cost allocation. Calculate the gap percentage between them. Identify which cost categories drove variance. Set optimization targets for the highest-impact categories.

Q: How often should I recalculate true CPL?

Monthly for the complete calculation. Weekly for component monitoring.

True CPL shifts gradually. Media costs change weekly. Return rates fluctuate. But the structural cost categories like platforms, compliance, and labor are relatively stable. Monthly recalculation catches trend shifts. Weekly component monitoring catches emerging problems before they compound.

Frequently Asked Questions

Q1: What’s a healthy ratio between dashboard CPL and true CPL?

Dashboard CPL should be 60-75% of true CPL in a well-optimized operation. If dashboard CPL is $60 and true CPL is $80-100, your hidden cost management is reasonable.

If dashboard CPL is less than 50% of true CPL, you have structural cost problems that need immediate attention. Either hidden costs are too high or your operation lacks scale efficiency.

Q2: Which cost category offers the highest optimization opportunity?

Returns, for most practitioners. A 5-percentage-point improvement in return rate from 15% to 10% saves more per lead than eliminating most other cost categories entirely.

Returns compound: every returned lead carries its full acquisition cost with zero revenue. Cutting returns improves margin more than cutting any comparable line item.

Q3: How do true CPL economics change by vertical?

Higher-value verticals support higher true CPLs. Legal leads selling at $500+ can absorb $100+ in true CPL and remain profitable. Insurance leads selling at $50 require true CPL under $35 to maintain viable margins.

The formula is consistent. The acceptable numbers differ by what buyers pay and what LTV supports.

Q4: Should I track true CPL by source?

Absolutely. True CPL varies dramatically by source. A traffic source with $50 dashboard CPL and 8% returns has lower true CPL than a source with $45 dashboard CPL and 20% returns.

Source-level true CPL tracking reveals which sources actually make money versus which sources appear profitable while destroying margin.

Q5: How do platform fees compare across major solutions?

Distribution platform fees range from $0.10-$0.50 per lead processed, with volume discounts at scale. boberdoo starts around $1,000/month base plus per-lead transaction fees. LeadsPedia ranges from $450-2,500/month base plus transaction fees. Phonexa starts at $500+ per month with bundled features.

All-in platform costs typically run 2-5% of lead revenue for mid-scale operations.

Q6: What float period should I plan for?

60 days provides adequate working capital cushion for most operations. This assumes publishers paid Net-15, buyers paying Net-30 to Net-45, and a 15-day buffer for disputes and delays.

If your buyers pay faster at Net-15 or you can negotiate slower publisher payment at Net-30, you can reduce the float requirement proportionally.

Q7: How do I allocate labor costs to leads accurately?

Time-based allocation is most accurate. Track hours spent on campaign management, lead processing, and buyer relations. Divide monthly labor cost by monthly lead volume.

For shared resources like a campaign manager handling multiple campaigns, allocate proportionally by leads or spend managed. Avoid arbitrary allocations. A campaign manager spending 20% of time on your lead business should have 20% of their cost allocated, not 50% or 100%.

Q8: At what scale do true CPL economics improve most?

The biggest efficiency gains occur between 5,000 and 25,000 leads/month. Below 5,000, fixed costs dominate. Above 25,000, most scale efficiencies are captured.

Specific thresholds include platform volume discounts at 10,000-25,000 leads, in-house team efficiency at 15,000-30,000 leads, and negotiating power with buyers at 25,000+ leads.

Q9: How do I model true CPL before launching a new vertical?

Build a pro forma true CPL model through a five-step process. Research vertical-specific media CPL benchmarks from Google Ads and Facebook. Research vertical return rates through industry data and buyer conversations. Apply your known cost structure for platforms, compliance, and labor. Model at conservative conversion rates below industry average. Calculate true CPL and compare to achievable sale prices.

If the model shows marginal or negative unit economics at conservative assumptions, don’t launch. Wait until you can improve conversion rates or negotiate better sale prices.

Q10: What’s the relationship between true CPL and customer lifetime value for buyers?

Buyers care about cost per acquisition (CPA), not your CPL. But understanding buyer economics helps you price appropriately.

Buyer CPA = Lead Price / (Contact Rate x Conversion Rate)

If a buyer pays $100 per lead, contacts 50%, and converts 10% of contacts, their CPA is $2,000. If customer LTV is $6,000, that buyer can pay $100 per lead profitably. If customer LTV is $1,500, that buyer needs cheaper leads or better conversion to sustain the economics.

Understanding the downstream math helps you identify which buyer segments can afford your true CPL and which cannot. Cross-reference these economics with CPL benchmarks by industry for market context.

Key Takeaways

-

Dashboard CPL understates true cost by 30-60%. Every dollar your ad platform reports excludes 15+ cost categories that erode margin before cash hits your bank account.

-

Returns are the silent margin killer. A 12% return rate adds $12-15 to true CPL on a $100 lead. Track returns by source, pause underperformers within days, and treat return rate as seriously as conversion rate.

-

The complete formula includes 10 cost categories. Media spend, creative production, agency fees, testing costs, platform fees, technology fees, labor allocation, compliance costs, return processing, and float cost. Miss any category and your true CPL is fiction.

-

Float requires real capital. The 60-day working capital rule isn’t optional. Undercapitalized operators fail not from unprofitable campaigns but from timing gaps between paying suppliers and collecting from buyers.

-

Scale improves true CPL economics. Per-lead costs for platforms, compliance, and labor drop 40-60% between 10,000 and 100,000 monthly leads. If your margins are tight, scale or exit.

-

Source-level true CPL reveals hidden winners and losers. Two sources with identical dashboard CPL can have $20 per lead true CPL difference when returns and contact rates diverge. Track at the source level or optimize blindly.

Statistics based on 2024-2025 industry benchmarks from WordStream, HubSpot, and industry research. Platform pricing as of Q4 2024. Validate current costs with your specific vendors and verify return rates in your target vertical before making investment decisions.