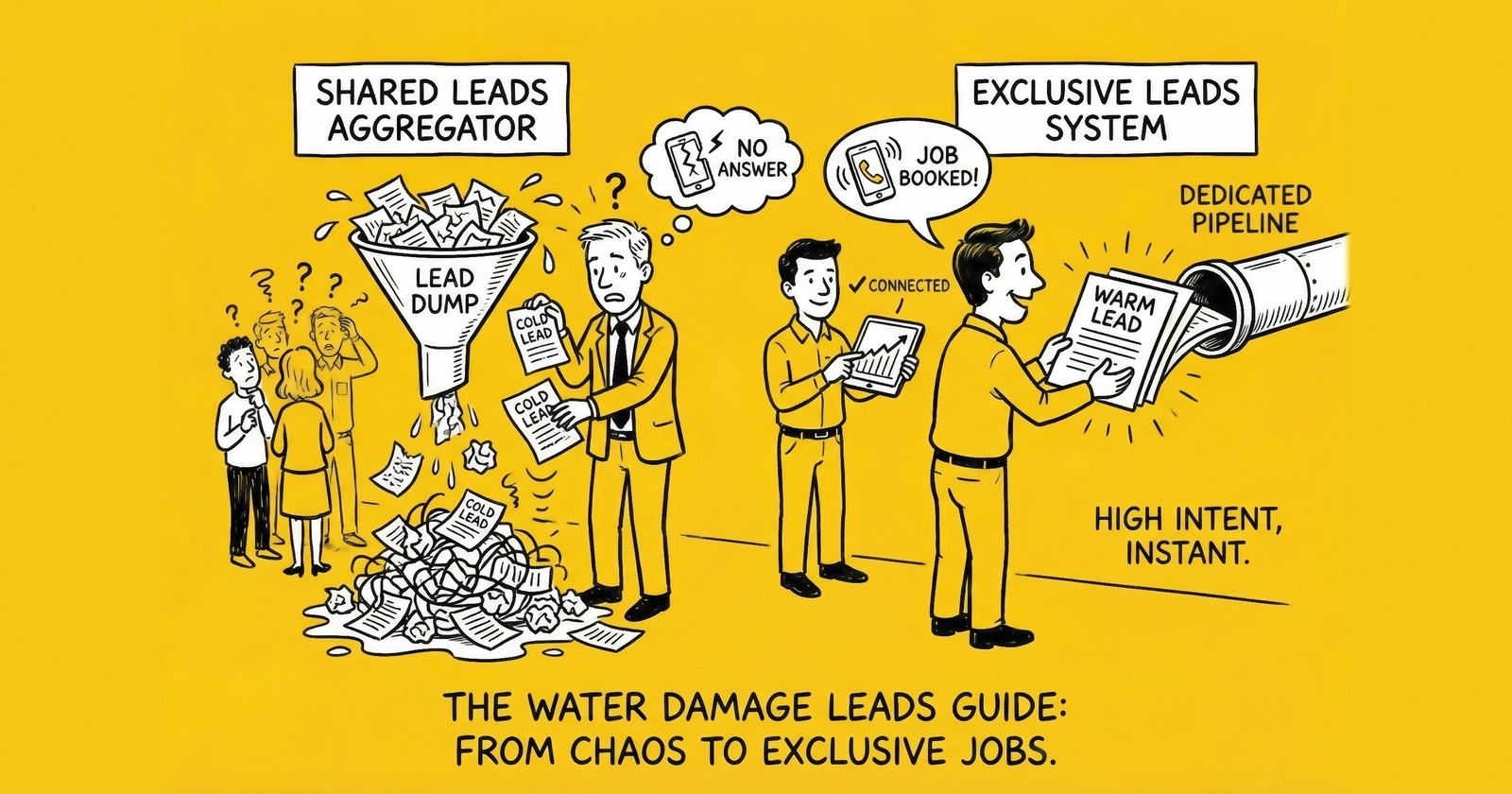

Why water damage leads command premium pricing, how the 24/7 emergency cycle creates unique operational requirements, and what separates profitable restoration lead operations from those drowning in returns.

A burst pipe at 2 AM. A basement flooding during a thunderstorm. A sewage backup on Christmas morning. Water damage does not wait for business hours, and neither does the demand for restoration services.

The water damage restoration industry generates approximately $14 billion in annual revenue in the United States, with emergency service calls representing the highest-margin segment. A single residential water mitigation job averages $3,000-$7,000, while large-scale commercial restoration can exceed $100,000. Understanding what makes a lead valuable helps contextualize these economics. Insurance covers most claims, creating motivated homeowners who need immediate service and have funding to pay for it.

For lead generators, water damage represents one of the most lucrative home services verticals. Emergency leads command $100-$400+ depending on damage severity, geographic market, and delivery speed. The 24/7 nature of demand creates operational complexity but also barriers to entry that protect margins for operators who build the infrastructure to serve it.

This guide covers the complete landscape of water damage lead generation: the market dynamics that drive premium pricing, the emergency response requirements that determine conversion rates, the insurance claim process that affects buyer economics, and the operational frameworks for building sustainable lead flow in this high-stakes vertical.

Water Damage Market Dynamics 2024-2025

The water damage restoration market operates on fundamentals that differ significantly from other home services verticals. Understanding these dynamics explains why the economics support premium lead pricing and what factors affect lead value.

Market Size and Growth Drivers

The water damage restoration and remediation market in the United States exceeds $14 billion annually, with projections indicating continued growth of 6-8% through 2030. Several structural factors drive this expansion.

Climate-related events are increasing in both frequency and intensity. NOAA data shows a 40% increase in billion-dollar weather events over the past decade, and each major weather event generates surge demand for restoration services. Hurricanes, flooding, and intense rainstorms have become more common, creating predictable spikes in emergency lead volume.

Aging infrastructure creates consistent baseline demand independent of weather patterns. The average age of residential plumbing systems continues to increase, with many homes containing pipes 40-60 years old. Pipe failures, water heater ruptures, and appliance malfunctions generate steady demand year-round, providing lead generators with reliable volume even during mild weather periods.

Insurance penetration supports the entire market structure. Approximately 90% of homeowners have insurance policies that cover water damage from sudden events, though flood-specific events require separate policies. This insurance backing means homeowners can afford restoration services immediately, removing the financing barrier that constrains other home services verticals.

Mold awareness has accelerated response timelines significantly. Homeowners now understand that delaying restoration by even 24-48 hours can lead to mold growth, additional structural damage, and health concerns. This urgency compresses decision timelines and benefits lead generators by creating motivated buyers who act quickly.

Lead Pricing Benchmarks

Water damage leads command premium pricing due to job values and urgency factors. Current market benchmarks reflect the economic reality of restoration services:

| Lead Type | Price Range | Typical Conversion Rate |

|---|---|---|

| Exclusive emergency (real-time) | $150-$400+ | 25-45% |

| Exclusive standard | $75-$150 | 15-30% |

| Shared emergency (2-3 buyers) | $50-$125 | 10-20% |

| Live transfer (warm) | $200-$500+ | 35-55% |

| Aged leads (24+ hours) | $15-$40 | 5-12% |

Job value justifies premium CPL. A typical residential water damage mitigation job generates $3,000-$7,000 in revenue, with larger jobs reaching $15,000-$25,000. At a 30% conversion rate, a $200 exclusive lead yields effective cost per acquisition of $667 against multi-thousand-dollar job values. The math supports aggressive lead acquisition.

Emergency premiums are substantial. Leads captured during active water emergencies command 50-100% premiums over standard inquiries. A homeowner with water actively flooding their basement will pay almost any price for immediate response, and restoration companies recognize this by paying accordingly for real-time emergency leads.

Geographic variation is pronounced across markets. Markets with high property values such as California coastal areas, Northeast metro regions, and Florida command 25-40% premiums over national averages. Markets prone to specific water events like hurricane zones, flood plains, and regions with severe winter weather experience seasonal pricing spikes that can double or triple baseline rates.

Major Market Players

The water damage restoration market includes national franchises, regional companies, and local independents, each with different lead acquisition behaviors and operational characteristics.

National franchise networks dominate the visible landscape with brands like ServiceMaster (including ServiceMaster Restore), SERVPRO (operating over 2,000 franchise locations), Paul Davis Restoration, Rainbow International, and PuroClean. These franchise networks typically have corporate-level marketing programs but also allow franchisees to purchase leads independently. Franchise operators often represent stable, high-volume lead buyers with strong operational capacity and 24/7 infrastructure already in place.

Insurance carrier preferred vendor networks represent a parallel lead flow that competes with but does not replace third-party lead generation. Major insurance carriers maintain preferred vendor networks for restoration services, and companies on these networks receive direct referrals from insurance adjusters. Understanding which buyers already receive carrier referrals helps lead generators identify operators seeking supplemental volume.

Local and regional companies represent the majority of potential lead buyers by count. These independent restoration companies and regional chains offer market-specific expertise but vary widely in lead purchasing sophistication. They may lack 24/7 capacity and often prove more price-sensitive than national franchises, yet they can become excellent partners with proper support and relationship development.

The lead aggregator and marketplace landscape includes several platforms distributing water damage leads. Angi (formerly HomeAdvisor) includes water damage in home services categories. Thumbtack services restoration requests through its marketplace model. Google Local Services Ads has expanded to include water damage restoration in many markets. Specialized restoration lead aggregators serve the industry with vertical-specific offerings.

Understanding Emergency Lead Dynamics

Water damage leads divide into distinct categories with different economics, conversion patterns, and operational requirements. Understanding these categories enables appropriate pricing and buyer matching that maximizes value for both lead generators and restoration companies.

True Emergency Leads

True emergencies involve active water intrusion requiring immediate response. These represent the highest-value lead category in water damage, commanding premium pricing and converting at rates that justify aggressive acquisition costs.

Defining characteristics separate true emergencies from other lead types. Water is actively present, whether through flooding or a leak in progress. Immediate response is required rather than scheduling for tomorrow. The homeowner is typically distressed and highly motivated to solve the problem immediately. Time sensitivity is measured in minutes rather than hours. These calls often occur outside normal business hours, during the night or on weekends when other contractors are unavailable.

Common emergency triggers include burst pipes (especially during winter freeze events), water heater failures, appliance malfunctions from washing machines or dishwashers, sewage backups, roof leaks during storms, foundation flooding during heavy rain, and flash flooding affecting basements. Each trigger type carries different job value implications and may require different buyer capabilities.

True emergency leads convert at 25-45% rates when delivered in real-time to restoration companies with 24/7 response capacity. The conversion premium justifies CPLs of $150-$400+ depending on geographic market and damage severity indicators captured during qualification.

Serving emergency leads requires specific operational infrastructure. You need 24/7 lead capture and delivery capability that operates without delays. The five-minute rule applies even more strongly to emergency leads. Real-time notification to buyers must achieve sub-minute delivery. Buyers must have 24/7 dispatch capacity verified before onboarding. You should verify that the buyer can respond to the property within 1-2 hours before routing leads to them.

Non-Emergency Restoration Leads

Not all water damage leads involve active emergencies. A significant portion of the market involves lower-urgency situations that still represent genuine restoration needs.

Assessment requests come from homeowners who discovered past water damage such as staining, warping, or mold growth and want professional evaluation. These leads carry less urgency but represent genuine restoration opportunities. The homeowner has already moved past the panic phase and is making more deliberate decisions.

Post-emergency follow-up leads involve homeowners who addressed the immediate crisis, perhaps by having a plumber stop the leak, but need restoration work including drying, demolition, and reconstruction. Lower urgency characterizes these leads, but solid job potential remains.

Insurance claim support requests come from homeowners navigating insurance claims who need documentation, estimates, or advocacy. These leads can convert to full restoration jobs or remain limited to inspection services. The insurance angle affects both lead value and buyer fit.

Non-emergency leads price 40-60% below true emergency rates but maintain respectable conversion rates of 15-30%. They suit restoration companies seeking consistent volume rather than premium-priced emergency calls, and they provide baseline revenue stability for lead generation operations.

Seasonal Patterns and Weather Events

Water damage lead volume follows predictable seasonal patterns with unpredictable event-driven spikes layered on top.

The winter peak from December through February in cold climates creates concentrated demand from frozen and burst pipes. Lead volume can increase 200-400% during severe cold snaps. This demand is geographically concentrated in northern markets but extremely urgent when it occurs, with homeowners facing immediate property damage and habitability concerns.

Spring and fall transitions bring temperature fluctuations that stress plumbing systems. Moderate but consistent demand for pipe-related emergencies characterizes these periods, providing reliable lead volume without the dramatic spikes of winter or hurricane season.

Hurricane season from June through November in coastal markets generates the most dramatic volume swings. Major hurricanes create massive surge demand that overwhelms local capacity. A single Category 3+ hurricane can produce months of restoration demand in affected areas. Pre-positioning buyer relationships before hurricane season creates significant opportunity for lead generators willing to invest in preparation.

Storm season through spring and summer across regions brings severe thunderstorms, flash flooding, and roof leaks from hail damage. This creates consistent demand with less concentration than hurricane impact but broader geographic distribution.

Baseline demand from appliance failures, water heater malfunctions, and plumbing issues generates year-round volume independent of weather. This baseline supports consistent lead generation operations outside seasonal peaks and provides the foundation for sustainable business models.

The Insurance Factor: Understanding Claim Economics

Insurance coverage fundamentally shapes water damage lead economics. Most residential water damage is covered by homeowners insurance, creating unique dynamics that affect lead value and buyer behavior throughout the transaction.

How Insurance Affects Lead Value

Standard homeowners insurance typically covers sudden and accidental water damage from burst pipes and appliance failures, water damage from firefighting efforts, storm-related water intrusion with some limitations, and vandalism-related water damage. However, certain categories are typically excluded: flood damage requires separate flood insurance, gradual damage from maintenance neglect is not covered, sewer backup often requires a separate endorsement, and damage from intentional acts falls outside coverage.

The economic implication is significant. When insurance covers damage, the homeowner is not paying out of pocket, which removes price sensitivity from the transaction entirely. Restoration companies can charge market rates of $3,000-$10,000 or more for residential mitigation because the insurance company pays.

Insurance coverage affects lead value significantly:

| Insurance Status | Lead Value Impact |

|---|---|

| Active claim, adjuster assigned | Premium value (+25-50%) |

| Covered damage, claim not yet filed | Standard value |

| Coverage uncertain | Moderate value |

| Clearly not covered (flood, gradual) | Reduced value (-30-50%) |

| No insurance | Significantly reduced |

The Insurance Claim Process

Understanding the claim process helps lead generators capture valuable information and communicate appropriately with homeowners throughout their journey.

The emergency response phase during hours 0-4 represents the optimal lead capture window. The homeowner discovers damage and seeks immediate mitigation. They have not yet called insurance but need immediate help stopping the damage. Leads captured during this window have no preferred vendor bias.

Insurance notification typically occurs during hours 4-24. The homeowner contacts their insurance company to report the claim. Insurance may suggest preferred vendors but typically does not mandate them. The homeowner retains the right to choose their own restoration company.

Adjuster assignment happens during days 1-5 under normal circumstances. Insurance assigns an adjuster to evaluate the claim. For catastrophic events like hurricanes or major floods, adjuster availability may be delayed by weeks due to volume.

Mitigation documentation spans days 1-14 as the restoration company performs emergency mitigation including water extraction, drying, and demolition of damaged materials. Thorough documentation is essential for insurance payment. Companies that excel at documentation achieve higher claim approval rates.

Claim settlement occurs during weeks 2-8 as insurance approves or negotiates the claim amount. The restoration company receives payment directly from insurance or through the homeowner depending on arrangement.

The lead generation implications are clear. The early emergency phase represents the highest-value capture window. Leads captured before insurance notification have no preferred vendor bias. Understanding coverage helps qualify lead value accurately. Restoration companies that handle insurance paperwork provide added value that homeowners appreciate.

Working with Insurance-Focused Buyers

Many restoration companies specialize in insurance work and have specific lead requirements that differ from cash-pay focused operators.

Preferred buyer characteristics include IICRC certification (Institute of Inspection, Cleaning and Restoration Certification), experience with insurance documentation requirements, established relationships with insurance adjusters, ability to bill insurance directly, and Xactimate estimating software proficiency. Xactimate serves as the industry standard for insurance claims, and companies lacking this capability struggle with insurance work.

Insurance-focused buyers want specific information from leads: damage documentation including photos if available, insurance status covering whether the claim is already filed or pending, damage type to help determine coverage likelihood, property type since residential and commercial claims differ, and contact timing indicating when they can reach the homeowner.

When building your buyer network, screen restoration companies for insurance capability. Ask whether they handle insurance claims directly, what certifications their technicians hold, whether they use Xactimate for estimating, what percentage of their jobs involve insurance claims, and what their average claim approval rate is. These questions reveal which buyers can effectively convert insurance-covered leads.

Lead Qualification for Water Damage

Effective qualification separates premium leads from low-value inquiries. Water damage leads require specific information that enables both accurate pricing and successful buyer matching.

Essential Data Points

Damage information forms the foundation of qualification. Capture the type of water damage whether burst pipe, flood, sewage, appliance, or roof leak. Determine the water source to classify contamination level. Estimate the area affected in square footage if known or number of rooms. Establish duration of exposure and whether this just happened, was discovered today, or has been ongoing for days. Confirm current status including whether water is still flowing, stopped but wet, or already drying.

Water category classification significantly affects job scope and cost. Water damage professionals classify water by contamination level, and capturing this information enables accurate lead pricing.

Category 1 represents clean water from broken pipes, rainwater, or melted ice. This carries the lowest health risk and requires standard mitigation procedures.

Category 2 represents gray water from washing machines, dishwashers, or toilet overflow containing urine only. This involves moderate contamination and requires additional precautions during remediation.

Category 3 represents black water from sewage, flooding from rivers or streams, or standing water with microbial growth. This carries the highest contamination and requires specialized remediation protocols.

Category 3 jobs command 30-50% higher fees than Category 1. Capturing water source information enables accurate lead pricing and appropriate buyer matching.

Property information provides context for job size and complexity. Capture property type including single family, multi-family, or commercial. Determine property ownership status as owner, renter, or property manager. Note property age and construction type when available. Confirm basement or crawl space presence since these areas frequently suffer water damage. Record square footage if known to help estimate job scope.

Insurance information affects lead value and buyer fit. Ask whether the homeowner has homeowners insurance. Determine whether they have contacted their insurance company. Find out if an adjuster has been assigned. Explore whether they know if this type of damage is covered.

Contact information must be verified for emergency leads. Capture verified phone number with mobile preferred for emergency situations. Note best time to reach for non-emergencies. Record property address as the service location. Confirm current location if different from property since the homeowner may have evacuated.

Disqualifying Factors

Screen for situations that reduce lead value or indicate non-genuine inquiries before routing to buyers.

Leads where the homeowner already has a restoration company on-site or scheduled are not actionable. Some indicate this situation to get multiple quotes for comparison, which is legitimate but converts at lower rates.

Damage that occurred weeks or months ago shifts from emergency mitigation to remediation and reconstruction. Value remains but the urgency premium disappears entirely. Mold remediation may be required rather than water mitigation, changing the buyer fit.

Flood damage in flood zones requires flood insurance separate from homeowners insurance. Uninsured flood damage leads have significantly reduced value as homeowners face full out-of-pocket costs for restoration.

Commercial property leads from employees without authority to hire contractors often convert poorly. Seek property managers or owners who can make purchasing decisions without lengthy approval processes.

Price shopping leads from callers wanting quotes for insurance comparison purposes rather than immediate service can still have value but should be priced accordingly and matched with appropriate buyers.

Lead Scoring Framework

Implement scoring to enable tiered pricing and buyer matching:

| Factor | High Value | Medium Value | Low Value |

|---|---|---|---|

| Timing | Active emergency | Same-day need | Future appointment |

| Water Category | Category 3 (sewage) | Category 2 | Category 1 |

| Area Affected | Multiple rooms | Single room | Localized |

| Insurance | Claim filed | Coverage likely | Unknown/no coverage |

| Property Type | Commercial | Large residential | Small residential |

| Decision Authority | Property owner | Renter with landlord OK | Renter, needs approval |

High-value leads scoring in the top tier on multiple factors justify premium pricing of $200-$400+. Medium-value leads fit standard pricing of $100-$200. Low-value leads should be priced at $50-$100 or distributed through shared or aged channels.

24/7 Operations: Building Emergency Response Infrastructure

Water damage lead generation requires operational infrastructure that other home services verticals do not. The 24/7 nature of emergencies creates both barriers to entry and competitive advantages for operators who build appropriate systems.

Real-Time Lead Capture

Emergency leads lose value by the minute. A homeowner with an active basement flood needs help immediately, and if your lead capture or delivery introduces delays, competitors with faster systems will capture the conversion.

Landing page design must prioritize speed and mobile accessibility. Use mobile-optimized design since the majority of emergency searches occur on mobile devices. Position click-to-call prominently above the fold where distressed homeowners see it immediately. Design forms for completion under 60 seconds. Include clear emergency messaging like “24/7 Response” and “Immediate Help” that signals immediate availability. Implement location detection for geographic routing to match leads with appropriate buyers.

Form field strategy requires balancing information capture against form abandonment. Essential fields that you should always capture include phone, address, and damage type. Important fields to capture when possible include water source, affected area, and insurance status. Optional fields that should not gate form submission include property details, photos, and detailed description. The goal is capturing enough information for accurate pricing and routing without losing leads to form fatigue.

Phone versus form considerations affect conversion significantly. Emergency leads convert substantially better through phone contact. A homeowner describing their flooded basement to a live person converts at 40-50% rates. The same homeowner filling out a form and waiting for callback may have already called competitors by the time you respond.

The recommended approach features click-to-call prominently for emergency traffic. Use forms for information capture after hours or for non-emergency inquiries. Implement callback systems with sub-5-minute response targets for form submissions. Consider live transfer operations for highest-value emergency leads where you connect the homeowner directly to restoration company dispatch.

Lead Delivery Systems

Real-time delivery is essential for emergency water damage leads. Delays measured in minutes cost conversions.

API and webhook integration provides the fastest delivery. Configure direct system integrations with buyer CRMs for sub-second delivery. When a lead submits, the buyer’s system should receive notification immediately rather than through batched hourly or end-of-day processes.

Multi-channel notification ensures delivery even when primary channels fail. For buyers without API capability, implement parallel notifications including SMS to dispatch phone as the primary channel, email to intake address as secondary, portal notification as backup, and optional voice calls for high-value leads.

Acknowledgment requirements protect lead value. For premium-priced emergency leads, require buyer acknowledgment confirming that the lead was received, commitment to response timeline, and escalation if no acknowledgment arrives within 10-15 minutes.

Fallback routing prevents lead waste. If the primary buyer does not acknowledge within your defined window, route to the secondary buyer. Do not let premium emergency leads expire while waiting for unresponsive buyers.

Buyer Capacity Management

Emergency lead operations require careful buyer capacity monitoring to maintain conversion rates and buyer relationships.

Verify 24/7 coverage before onboarding buyers for emergency leads. Confirm 24/7 dispatch capability exists. Verify after-hours response protocols. Test actual response times with sample scenarios. Establish escalation contacts if primary dispatch fails to respond.

Monitor capacity signals continuously. Watch for response time increasing from 5 minutes to 30 minutes. Note acknowledgment delays that suggest overwhelmed operations. Track increasing return rates that indicate capacity strain. Listen when buyers request volume reduction.

Practice proactive capacity management rather than reactive problem-solving. Contact buyers before problems arise. Send pre-storm communications in weather-affected markets. Conduct seasonal capacity planning for winter freeze season and hurricane season. Discuss volume adjustments proactively rather than delivering surprise overloads.

Geographic coverage mapping ensures complete market coverage. Build buyer coverage that matches your lead generation geography. Identify a primary buyer per service area. Establish a secondary or backup buyer per service area. Create overflow relationships for surge events. Avoid dead zones where no buyer has capacity.

Traffic Acquisition Strategies

Water damage lead generation requires traffic strategies optimized for emergency intent and local service delivery. The right mix of channels depends on your operational capabilities and target markets.

Search Engine Marketing

Paid search represents the primary traffic source for water damage leads due to high intent and local targeting capability. Users actively searching for restoration services convert at rates that justify premium CPCs.

Keyword strategy should segment by intent level. Emergency intent keywords carry the highest value and include terms like “water damage emergency,” “burst pipe [city],” “flooded basement help,” “water damage restoration near me,” and “24 hour water damage service.” Service intent keywords carry high value and include “water damage restoration [city],” “water damage repair company,” “water damage cleanup service,” and “water extraction [city].” Assessment intent keywords carry moderate value and include “water damage estimate,” “water damage cost,” “water damage inspection,” and informational queries like “how to dry out flooded basement.”

CPC benchmarks reflect the economic reality of restoration services. Emergency keywords command $40-$100+ per click. Service keywords range from $25-$60 per click. Assessment and informational keywords cost $10-$30 per click.

Geographic targeting must align with buyer coverage since water damage is inherently local. Configure campaigns for radius targeting around major metro areas. Build city-level campaigns for high-value markets. Implement zip code exclusions for areas outside buyer coverage. Apply location bid adjustments based on buyer capacity and pricing. Geographic arbitrage strategies can help maximize returns across different markets.

Ad copy elements should emphasize emergency response. Emergency-focused ad copy converts higher for water damage. Include messaging like “24/7 Emergency Response,” “Fast Response Time,” and “Insurance Claims Accepted.” Use strong “Call Now” calls to action. Feature local phone numbers when possible to increase trust.

Google Local Services Ads

Google Local Services Ads has expanded to include restoration services in many markets, changing the competitive landscape for lead generation.

For restoration companies directly, LSA provides pay-per-lead pricing rather than per-click, the “Google Guaranteed” badge that builds consumer trust, prime placement above traditional search ads, and lead filtering based on service area and job type.

For lead generators, LSA creates both competition and opportunity. You cannot run LSA for restoration services on behalf of clients since LSA requires direct business verification. However, understanding LSA helps you position your leads against LSA competition, recognize which buyers are maximizing LSA versus seeking supplemental sources, and target keywords and ad positions that complement LSA results rather than competing directly.

Local SEO and Content Marketing

Organic search provides sustainable lead flow independent of paid advertising costs, reducing dependence on increasingly expensive paid channels.

Local SEO requirements include Google Business Profile optimization for restoration-focused keywords, local landing pages for each service area, citation building across relevant directories, and review generation and management.

Content marketing captures early-stage intent. Informational content like “How to handle a burst pipe,” “What to do when your basement floods,” “Water damage insurance claim guide,” and “Signs of hidden water damage” serves dual purposes: SEO ranking and email or SMS capture for nurture sequences. Not all traffic converts immediately, but education-seekers become leads when emergencies occur.

Service area pages targeting specific locations provide geographic relevance. Create pages for [City] water damage restoration, [City] emergency flood cleanup, and [City] burst pipe repair. These pages should include local-specific content about weather patterns and common issues, local testimonials if available, clear calls to action, and contact information with local phone numbers.

Social Media Advertising

Social platforms offer targeting options that complement search advertising, though with different intent characteristics.

Facebook and Instagram provide homeowner demographic targeting, geographic targeting by zip code, interest-based targeting around home improvement and home insurance, and weather-triggered campaigns during storms.

Nextdoor offers hyperlocal targeting with community recommendation dynamics, neighborhood-level campaigns, and event-triggered advertising that reaches affected areas quickly.

Social traffic typically has lower intent than search traffic because users are not actively searching for restoration services. Social campaigns work best for brand awareness in target geographies, retargeting previous website visitors, seasonal awareness before hurricane season or with winter freeze warnings, and post-event follow-up after storms hit a region.

Weather-Triggered Advertising

Water damage demand correlates directly with weather events, creating opportunities for operators who implement weather-based advertising automation.

Storm tracking should monitor weather forecasts for severe thunderstorm warnings, flash flood watches and warnings, winter storm warnings indicating freeze events, and hurricane tracking with landfall predictions.

Automated response protocols activate when weather triggers occur. Increase bids on emergency keywords. Activate storm-specific ad copy that addresses the current situation. Expand geographic targeting to affected areas. Notify buyers of anticipated demand surge so they prepare for volume.

Post-event windows represent peak opportunity. The 24-72 hours following significant weather events create concentrated demand. Homeowners discover damage as storms pass. Search volume spikes dramatically. Competition for visibility intensifies. Conversion rates increase due to genuine urgency and motivated buyers.

Building Your Buyer Network

Water damage lead generation success depends on reliable buyers who can convert leads to jobs. Building and managing this network requires understanding buyer types, screening for capability, and maintaining relationships through performance cycles.

Buyer Types and Characteristics

National franchise operators offer consistent demand across markets, established 24/7 infrastructure, and standardized processes and quality. They may have corporate purchasing rules that constrain flexibility. Individual franchisees vary in lead aggressiveness depending on their local market position and growth goals.

Regional multi-location companies maintain strong presence in specific markets and are often aggressive lead buyers with good capacity for volume. They may have geographic gaps in coverage. They typically prove responsive as relationship partners since decisions happen closer to operations.

Local independent operators bring market-specific expertise but show variable lead purchasing sophistication. They may lack 24/7 capacity that emergency leads require. They tend to be price-sensitive but can become excellent partners with proper support and relationship investment.

Insurance preferred vendors receive regular insurance referral flow and are therefore less dependent on purchased leads. They maintain high claim processing capability. They may cherry-pick leads based on insurance status. Their purchasing behavior tends toward quality focus over volume.

Buyer Screening Criteria

Before onboarding restoration company buyers, verify capability across multiple dimensions.

Operational capacity includes 24/7 dispatch capability for emergency leads, response time commitments, geographic coverage area, crew availability and backup capacity, and equipment inventory including extractors, dehumidifiers, and air movers.

Insurance capability includes IICRC certification, Xactimate proficiency, insurance direct billing experience, and claims documentation capabilities.

Financial stability includes time in business with 2+ years preferred, payment history references, credit availability for lead purchasing, and collection process reliability.

Quality indicators include Google review rating with 4.0+ preferred, Better Business Bureau status, state licensing verification, and insurance coverage confirmation.

Pricing and Terms

Structure pricing and terms to align incentives between lead generators and buyers.

Pricing models include per-lead pricing as the standard and most common model, performance tiers with volume discounts for high-volume buyers, exclusive premiums of 30-50% above shared rates, and emergency premiums based on time-of-day and weather conditions.

Payment terms should favor prepaid accounts for new buyers. Established relationships can move to Net 15-30 terms. Credit limits should reflect payment history. Automatic billing works well for high-volume accounts.

Return policies must define what qualifies for credit: invalid contact information, already working with another company, wrong geographic area, non-homeowner or renter without authority, and duplicate leads previously submitted.

Return windows should provide 24-72 hours for standard validation claims. Emergency leads may have shorter same-day windows given the speed-to-contact importance.

Relationship Management

Long-term buyer relationships require ongoing attention and proactive communication.

Performance monitoring should track by buyer the lead volume delivered, return rates, conversion rates if the buyer shares this data, payment timing, and response time patterns.

Regular communication cadence includes weekly check-ins during onboarding, monthly reviews for established accounts, quarterly business discussions, and pre-season capacity planning.

Quality feedback loops leverage the conversion data that restoration companies accumulate. Seek feedback on which lead types convert best, optimal delivery timing, data quality issues, and market conditions affecting conversion.

Capacity adjustment should happen proactively based on signals. Reduce volume before buyers complain about capacity. Increase volume when buyers have expansion capacity. Adjust during seasonal transitions. Coordinate around weather events rather than reacting to them.

Measuring Success: Key Performance Metrics

Water damage lead generation performance requires tracking metrics that reflect the unique dynamics of emergency services.

Lead Quality Metrics

| Metric | Target Benchmark | Indicates |

|---|---|---|

| Contact Rate | 70-85% | Phone number validity |

| Qualification Rate | 60-80% | Targeting accuracy |

| Return Rate | Under 15% | Lead quality consistency |

| Duplicate Rate | Under 5% | Capture system integrity |

Contact rate targets are especially important for emergency leads. Homeowners with active water emergencies answer their phones. Contact rates below 70% indicate phone validation issues or non-emergency traffic that should be investigated.

Qualification rate measures what percentage of leads contacted meets buyer criteria including homeowner status, genuine damage, and appropriate geography. Qualification rates below 60% suggest targeting or screening issues that need correction.

Return rate above 15% indicates quality problems requiring investigation. Common causes include phone issues, geographic mismatches, and non-decision-maker contacts.

Conversion Metrics

If buyers share conversion data, track performance by lead type:

| Metric | Emergency Leads | Standard Leads |

|---|---|---|

| Lead-to-Appointment | 35-50% | 20-35% |

| Appointment-to-Job | 70-85% | 60-75% |

| Lead-to-Job | 25-40% | 12-25% |

Conversion data enables source-level quality assessment, traffic channel optimization, buyer-match improvement, and pricing justification. Not all buyers share this data, but those who do provide invaluable feedback for optimizing lead generation operations.

Financial Metrics

| Metric | Target | Calculation |

|---|---|---|

| Revenue per Lead | $150-$300+ | Total revenue / leads delivered |

| Gross Margin | 35-50% | (Revenue - traffic cost) / revenue |

| Cost per Lead | $50-$150 | Total acquisition cost / leads generated |

| Return on Ad Spend | 2.5-4x | Revenue / advertising spend |

Seasonal adjustments affect all metrics. Expect metric fluctuation based on seasonality. Winter freeze events bring temporarily higher CPL but also higher revenue per lead. Hurricane aftermath creates dramatically higher volume with potential margin compression. Mild weather periods reduce volume but should maintain efficiency focus.

Frequently Asked Questions

Q: What is a typical cost per lead for water damage restoration?

A: Water damage lead costs vary significantly by lead type and market conditions. Exclusive emergency leads typically range from $150-$400+, with true 24/7 emergency leads commanding premiums during active water events. Shared leads cost $50-$125 but convert at lower rates due to competition among multiple restoration companies. Live transfer leads (warm phone connections) range from $200-$500+ but convert at 35-55% rates. Aged leads (24+ hours) price at $15-$40 and convert at 5-12%. The relevant metric is cost per acquired job, not cost per lead alone. A $300 emergency lead converting at 35% yields effective CPA of $857 against average job values of $3,000-$7,000.

Q: How does insurance coverage affect water damage lead value?

A: Insurance coverage significantly impacts lead value because it determines payment source. Approximately 90% of homeowners have policies covering water damage from sudden events (burst pipes, appliance failures). Insurance-covered leads are more valuable because homeowners are not paying out-of-pocket, removing price sensitivity. Restoration companies can bill insurance directly for $3,000-$10,000+ jobs. Leads with active insurance claims or confirmed coverage command 25-50% premiums. Flood damage requires separate flood insurance – leads for uninsured flood damage have significantly reduced value as homeowners face full costs. Capturing insurance status during lead qualification enables accurate pricing and buyer matching.

Q: What makes a high-quality water damage lead?

A: High-quality water damage leads include: active emergency status (water currently present or very recent), verified contact information (mobile phone tested), confirmed property ownership or renter with landlord approval, specific damage details (water source, affected area, contamination level), and insurance status when known. Water source categorization matters significantly – Category 3 (sewage) leads command 30-50% premiums over Category 1 (clean water) due to higher job values and specialized remediation requirements. Geographic accuracy (lead location matches buyer service area) and timing (captured during emergency phase rather than days later) also determine quality. Screen for disqualifiers: already working with a company, damage occurred weeks ago, seeking quotes only for insurance purposes.

Q: How important is response time for water damage leads?

A: Response time is critical – arguably more important in water damage than any other home services vertical except perhaps HVAC emergencies. Homeowners with active flooding call multiple companies simultaneously and hire whomever can arrive first. Studies show the first responder captures the job 60-80% of the time for true emergencies. Leads contacted within 5 minutes convert at 2-4x the rate of those contacted after 30 minutes. For lead generators, this means real-time delivery is essential. Sub-minute delivery via API or SMS with buyer acknowledgment requirements outperforms email or batched delivery. Live transfer operations (connecting the homeowner directly to restoration company dispatch) achieve 35-55% conversion rates by eliminating all callback delay.

Q: Should I focus on emergency leads or non-emergency restoration leads?

A: The optimal strategy includes both, with emphasis depending on your operational capabilities. Emergency leads convert at higher rates (25-45% vs. 15-30%) and command premium pricing (50-100% above standard) but require 24/7 operational infrastructure and buyers with round-the-clock dispatch capability. Non-emergency leads (assessment requests, post-emergency restoration, mold concerns) offer steadier volume, lower operational complexity, and broader buyer options but at lower CPL and conversion rates. Most successful water damage lead generators build emergency capability as their competitive advantage – the 24/7 infrastructure creates barriers to entry that protect margins – while also capturing non-emergency volume for baseline revenue stability. A typical portfolio might be 60% emergency leads during high-demand periods, 40% during normal conditions.

Q: How do weather events affect water damage lead generation?

A: Weather events are the primary volume driver for water damage leads. Severe thunderstorms, flash flooding, winter freeze events, and hurricanes can increase lead volume by 200-500% within hours. Sophisticated practitioners implement weather-triggered advertising that automatically increases bids, activates event-specific ad copy, and expands geographic targeting when weather alerts activate. Post-storm windows (24-72 hours after events pass) represent peak demand as homeowners discover damage. Pre-storm preparation includes confirming buyer capacity, staging creative assets, and establishing surge pricing agreements. Hurricane markets (Gulf Coast, Atlantic seaboard) and freeze-prone markets (Midwest, Northeast) require seasonal capacity planning. Those who capture weather-driven demand build buyer relationships before events occur, not during the chaos of response.

Q: What certifications should water damage lead buyers have?

A: The primary industry certification for water damage restoration is IICRC (Institute of Inspection, Cleaning and Restoration Certification). IICRC-certified technicians have completed training in water damage restoration, mold remediation, and related disciplines. When screening buyers, verify IICRC certification at the company or technician level. Additional credentials that indicate quality buyers include: Xactimate proficiency (the industry-standard estimating software for insurance claims), state licensing (required in some jurisdictions), liability insurance coverage, and workers compensation insurance. Companies with insurance carrier preferred vendor status typically meet higher operational standards. For lead generators, verified certifications serve as quality signals when marketing leads to restoration companies – buyers trust sources that screen for genuine, qualified leads.

Q: How do I handle lead quality disputes with restoration company buyers?

A: Establish clear return policies upfront that define what constitutes an invalid lead: wrong phone number, outside service area, already working with another company, duplicate of previously submitted lead, non-homeowner without decision authority. Typical return windows are 24-72 hours for standard leads, same-day for emergency leads. Require documentation for disputed leads (call recordings, notes on why lead was invalid). Track return rates by buyer – rates above 15% indicate either lead quality issues or buyer misuse of return policies. For persistent disputes, review call recordings together, adjust lead criteria, or consider ending relationships with problematic buyers. Some buyers abuse return policies to get free leads; protect against this by implementing return rate caps (e.g., returns above 20% require investigation before further credits).

Q: What is the best traffic source for water damage leads?

A: Google Ads search campaigns represent the primary traffic source for water damage leads due to high intent and local targeting capability. Users searching for “water damage restoration near me” or “flooded basement help” have immediate need and convert at rates that justify CPCs of $40-$100+ for emergency keywords. Google Local Services Ads (LSA) has expanded to include restoration services, providing pay-per-lead pricing with the “Google Guaranteed” badge. Local SEO through Google Business Profile optimization provides sustainable organic lead flow. Social media advertising (Facebook, Instagram, Nextdoor) offers geographic targeting but lower intent – users are not actively searching for restoration services. Social works best for retargeting, seasonal awareness campaigns, and post-storm follow-up in affected areas. The optimal strategy combines search advertising for immediate capture with SEO for long-term sustainability.

Q: How do I build 24/7 operational capability for water damage leads?

A: Building 24/7 capability requires infrastructure across capture, delivery, and buyer management. For capture: implement mobile-optimized landing pages with click-to-call, forms that submit instantly via API, and tracking that operates around the clock. For delivery: configure real-time lead posting to buyer systems, SMS notifications to dispatch phones as backup, and escalation protocols when primary buyers do not acknowledge within 10-15 minutes. For buyer management: verify 24/7 dispatch capability before onboarding, test actual response times, establish escalation contacts, and implement fallback routing to secondary buyers. Consider live transfer operations for highest-value emergency leads – an answering service or call center that verifies emergency status, captures qualification data, and connects homeowners directly to restoration company dispatch. The infrastructure investment creates competitive barriers that protect margins.

Q: What is the difference between water damage mitigation and restoration leads?

A: Mitigation leads involve active emergencies requiring immediate intervention – water extraction, structural drying, damaged material demolition to prevent further damage. These are the highest-value leads, typically captured within 24-48 hours of water events. Restoration leads involve rebuilding after mitigation – drywall replacement, flooring installation, painting, and returning the property to pre-loss condition. Restoration work often occurs weeks after the initial emergency and may be handled by general contractors rather than specialized restoration companies. Some restoration companies handle both mitigation and restoration; others specialize in one phase. For lead generators, mitigation leads command premium pricing (emergency services) while restoration leads price closer to standard home improvement leads. Capturing lead stage during qualification enables appropriate pricing and buyer matching.

Key Takeaways

-

Water damage leads command premium pricing ($150-$400+ for exclusive emergency leads) because job values support aggressive acquisition costs. A typical residential mitigation job generates $3,000-$7,000 revenue, with larger jobs reaching $15,000-$25,000. Insurance coverage removes price sensitivity for most residential claims.

-

True emergency leads (active water intrusion) convert at 25-45% rates and justify the highest CPLs. Non-emergency leads (assessment requests, post-emergency restoration) price 40-60% lower but maintain respectable 15-30% conversion rates. Capture damage timing and severity to enable tiered pricing.

-

Response time determines conversion more than any other factor in water damage. The first restoration company to arrive typically captures the job. Real-time lead delivery (sub-minute via API/SMS) is essential for emergency leads. Live transfer operations achieve 35-55% conversion by eliminating callback delays entirely.

-

24/7 operational capability creates competitive advantage. The infrastructure required for round-the-clock lead capture, real-time delivery, and buyer management creates barriers to entry that protect margins. Practitioners who build this capability capture premium emergency demand that competitors cannot serve.

-

Weather events drive volume spikes of 200-500% above baseline. Winter freeze events, hurricanes, and severe storms generate surge demand within hours. Pre-position buyer relationships and advertising automation before events occur. Post-storm windows (24-72 hours) represent peak capture opportunity.

-

Insurance status significantly affects lead value. Covered leads command premiums because homeowners are not paying out-of-pocket. Capture insurance status during qualification. Screen buyers for insurance claim capability (IICRC certification, Xactimate proficiency, direct billing experience).

-

Build diversified buyer networks with primary, secondary, and overflow relationships. No single buyer can absorb surge demand during major weather events. Verify 24/7 dispatch capability before onboarding for emergency leads. Monitor capacity signals and adjust volume proactively.

-

Track quality metrics rigorously: contact rates above 70%, qualification rates above 60%, return rates below 15%. Conversion data from buyers enables source-level optimization. Cost per acquired job matters more than cost per lead.

Conclusion

Water damage lead generation occupies a unique position in the lead economy: high stakes, premium pricing, and operational requirements that separate serious operators from those who cannot serve the market effectively.

The economics are favorable. Job values of $3,000-$15,000+ support lead acquisition costs that would be unsustainable in most verticals. Insurance coverage removes the financing barrier that limits other home services markets. Homeowners facing active water emergencies are highly motivated buyers who convert at rates exceeding 40% when reached immediately.

But the operational requirements are real. True emergency leads lose value by the minute. A homeowner with water flooding their basement will hire whomever can arrive first – and they are calling multiple companies simultaneously. Serving this market requires 24/7 capture infrastructure, real-time delivery systems, and buyer networks with genuine round-the-clock response capability.

Those who build this infrastructure earn their margins. The 24/7 operational requirement creates barriers to entry that casual competitors cannot overcome. Weather-driven demand spikes reward those who have pre-positioned buyer relationships and advertising automation. The combination of high lead values, insurance backing, and operational complexity creates a market where prepared operators thrive.

The fundamentals point in one direction: water damage will remain a premium lead generation vertical. Climate trends suggest increasing weather intensity. Aging infrastructure ensures steady baseline demand. Insurance coverage maintains payment certainty. For practitioners willing to invest in the infrastructure that emergency response requires, water damage lead generation offers sustainable opportunity in a market where urgency creates value.

Pricing benchmarks and market data current as of late 2025. Water damage restoration requirements vary by jurisdiction. This article provides general information about lead generation practices and does not constitute professional advice regarding restoration services, insurance claims, or construction practices. Consult appropriate professionals for jurisdiction-specific guidance.