Two routing architectures, fundamentally different philosophies. Waterfall optimizes for revenue extraction. Round robin optimizes for relationship equity. Understanding when to use each method separates profitable operations from ones bleeding money through mismatched infrastructure.

A lead arrives in your distribution system. Within milliseconds, your routing logic must decide: which buyer receives this lead? The decision seems simple. The implications are not.

The routing method you choose determines your revenue per lead, your buyer relationships, your operational complexity, and ultimately whether your lead business scales profitably or collapses under the weight of misaligned incentives.

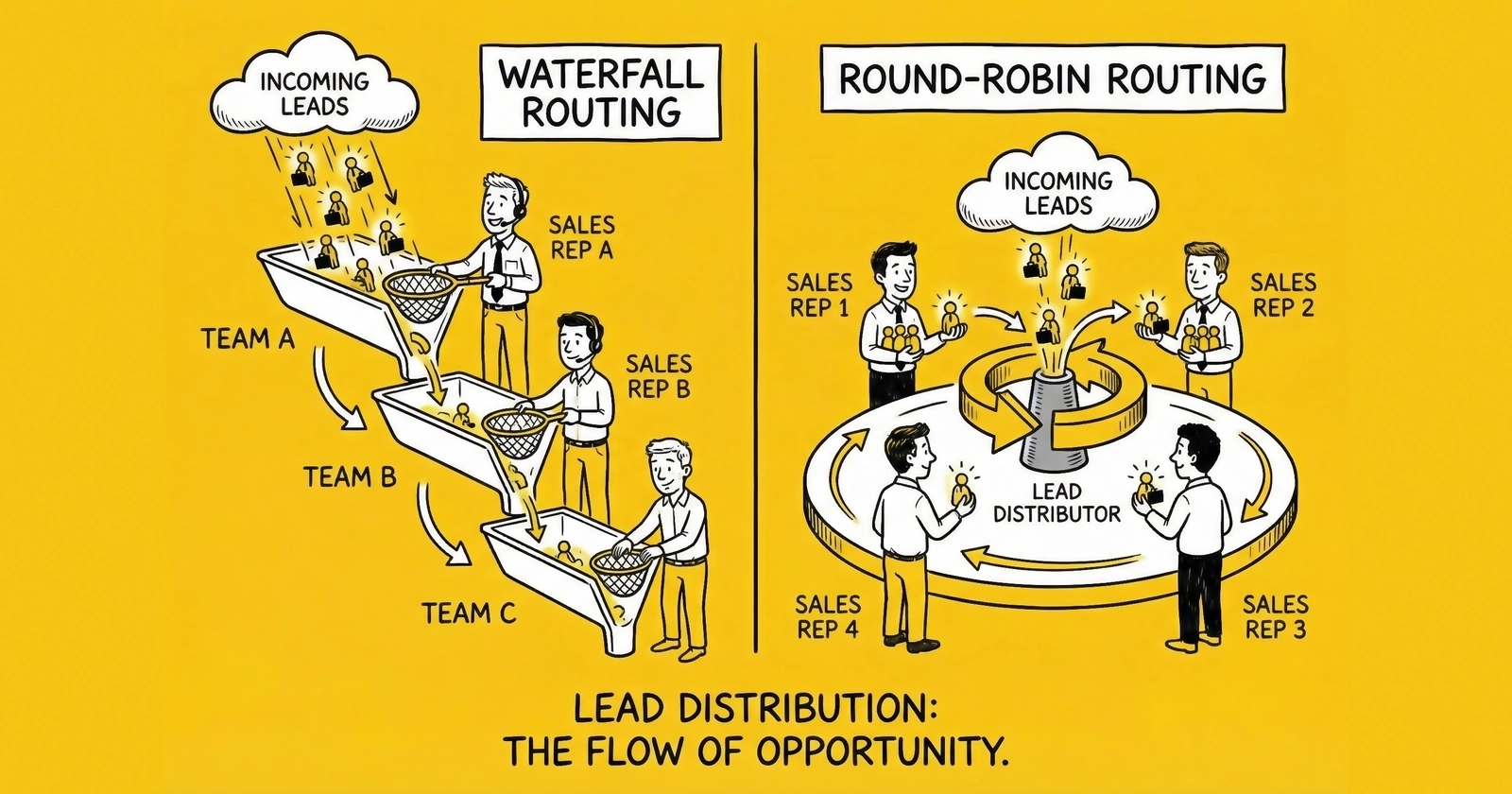

Two routing architectures dominate lead distribution: waterfall and round robin. Each represents a fundamentally different philosophy about how leads should flow from generators to buyers. Waterfall treats leads as economic assets to be optimized. Round robin treats leads as fair-share allocations to be equitably distributed.

most practitioners choose their routing method by accident or by copying competitors. This approach leaves substantial money on the table. Those who build sustainable businesses choose routing methods deliberately, matching infrastructure to business model, buyer relationships, and commercial objectives.

This guide provides the framework for that decision: how each method works, when each excels, the implementation considerations that determine success, and the hybrid approaches that sophisticated practitioners deploy to capture advantages from both.

What Is Lead Routing?

Lead routing is the decision engine at the heart of every lead distribution operation. When a consumer submits a form, routing logic determines which buyer receives that lead, in what sequence, at what price, and under what conditions.

The routing decision happens in milliseconds. The implications compound over months and years. A routing architecture that extracts 15% more value per lead translates to hundreds of thousands of dollars annually for operations processing 50,000 leads monthly.

Professional lead distribution platforms support multiple routing algorithms. The two most fundamental are waterfall distribution (sequential priority-based routing) and round robin distribution (rotational equal-share routing). Understanding both is essential whether you are building your own system, configuring a third-party platform, or evaluating vendor capabilities.

Q: What problem does lead routing solve?

A single lead might qualify for twelve different buyers, each with unique filter criteria, geographic requirements, volume caps, and bid levels. Some buyers want exclusive leads. Others accept shared leads at lower prices. Some pay premium for instant delivery. Others accept delayed batches for discounts.

Manual lead distribution is impossible at scale. A human cannot evaluate a dozen buyer qualifications, check capacity limits, compare prices, and route the lead within milliseconds. Distribution systems automate these decisions, executing complex routing logic faster than a confirmation page loads.

Waterfall Distribution Explained

Waterfall distribution routes leads through a sequential cascade of buyers based on priority hierarchy. When a lead arrives, the system offers it to the highest-priority buyer first. If that buyer accepts, the waterfall ends. If they reject (via explicit rejection or timeout), the lead cascades to the next buyer in priority sequence. This continues until a buyer accepts or the waterfall exhausts all options.

The name reflects the mechanics: leads “fall” from tier to tier like water cascading over rocks, settling at whatever level will accept them.

How Waterfall Routing Works

The waterfall begins with buyer tier assignment. Most practitioners establish three to five tiers based on buyer value:

Tier 1 buyers represent your highest-value accounts: highest prices, strongest payment history, lowest return rates. These buyers earned premium position through relationship strength and commercial commitment. They receive first access to every qualifying lead.

Tier 2 buyers show promise but have not achieved Tier 1 status. Perhaps they are newer accounts still building track record, or established accounts with slightly higher return rates. They receive leads only after Tier 1 buyers have declined.

Tier 3 and below often represent smaller buyers, newer accounts without payment history, or buyers with performance issues you are actively managing. These tiers serve as catch-all capacity, ensuring leads find homes even when premium buyers are capped out.

When a lead enters the waterfall:

- System evaluates lead against Tier 1 buyer filters

- If any Tier 1 buyer qualifies, system attempts delivery to highest-priority match

- Buyer has defined timeout window (typically 5-30 seconds) to accept or reject

- If accepted, lead delivers and waterfall ends

- If rejected or timeout expires, lead cascades to next qualified buyer

- Process repeats until acceptance or exhaustion

Waterfall Mechanics: Position Matters

Waterfall position determines opportunity. First-position buyers see the freshest leads and have maximum acceptance opportunity. Lower-position buyers receive leads already rejected by others, potentially for quality reasons that affect their performance too.

This creates powerful incentives. Premium buyers demand first position for their qualifying criteria. They will pay more for that privilege because first position means higher lead quality and more selection. Budget buyers accept lower positions in exchange for lower prices or guaranteed volume. They understand they are getting “second look” inventory.

Position negotiations become part of buyer relationships. Managing these relationships while optimizing overall yield requires careful balancing of commercial interests, relationship equity, and long-term strategic value.

Timeout Configuration

Timeouts determine how long to wait for buyer response before cascading. The timeout decision involves trade-offs:

Too short: You miss slow-but-willing buyers. A buyer whose system processes in 8 seconds cannot participate if your timeout is 5 seconds.

Too long: Leads age during the cascade, reducing value for subsequent buyers. A lead that waits 30 seconds at each of four tiers arrives 2 minutes old to the fifth tier buyer.

Typical timeouts range from 5-30 seconds depending on vertical and buyer infrastructure. High-intent verticals like insurance and mortgage tolerate shorter timeouts because lead freshness matters critically. Lower-intent verticals might allow longer timeouts to maximize fill rate.

sophisticated practitioners configure differentiated timeouts per buyer. A buyer with modern API integration might get 5-second timeout. A buyer whose system processes batch-style might get 30 seconds. The cascade advances once any buyer responds, regardless of timeout configuration.

When Waterfall Excels

Waterfall distribution delivers maximum value in specific scenarios:

Revenue optimization priority. When your primary objective is extracting maximum revenue from each lead, waterfall ensures your highest-paying buyers see inventory first. A $75 Tier 1 buyer receives leads before a $45 Tier 2 buyer sees them.

Quality-differentiated buyers. When you have buyers with meaningfully different price points and conversion capabilities, waterfall matches lead quality to buyer capacity. Premium leads route to premium buyers. Leads that premium buyers reject route to buyers who specialize in working harder inventory.

Exclusive buyer arrangements. When certain buyers have contracted for exclusive first-look access to specific lead types, waterfall enforces those agreements programmatically. The exclusive buyer receives their contracted priority regardless of other buyer bids.

Variable capacity scenarios. When buyer capacity fluctuates significantly, waterfall handles overflow naturally. When Tier 1 buyers are capped, leads flow to Tier 2 without manual intervention.

Waterfall Limitations

The sequential nature of waterfall creates limitations:

Latency accumulation. Each rejection adds time. A lead that cascades through five tiers at 10 seconds each arrives to the sixth tier 50 seconds old. In high-intent verticals, this latency costs conversion.

No price discovery. Waterfall routing does not reveal what lower-tier buyers would pay. Your Tier 2 buyer might pay $60 for leads you are sending to Tier 1 at $50, but you never discover this because Tier 1 accepts first.

Position rigidity. Static tier assignments do not adapt to changing buyer performance. A Tier 1 buyer whose conversion rates decline continues receiving premium inventory until you manually adjust their position.

Lower-tier perception. Buyers in lower tiers know they receive pre-rejected inventory. This can create relationship friction, particularly with buyers who believe they deserve higher position.

Waterfall Performance Benchmarks

Understanding industry benchmarks helps assess whether your waterfall is performing at acceptable levels:

| Metric | Poor | Acceptable | Strong | Elite |

|---|---|---|---|---|

| Fill Rate | <70% | 70-80% | 80-90% | >90% |

| Waterfall Recovery | <10% | 10-20% | 20-30% | >30% |

| Time-to-Route | >3 sec | 2-3 sec | 1-2 sec | <1 sec |

| Tier 1 Acceptance | <50% | 50-65% | 65-80% | >80% |

| Return Rate | >15% | 10-15% | 5-10% | <5% |

These benchmarks vary by vertical and lead type. Insurance leads typically achieve higher fill rates due to buyer density. Niche verticals with fewer buyers may see lower fill rates as acceptable.

Round Robin Distribution Explained

Round robin distribution routes leads in strict rotation among qualified buyers. Lead 1 goes to Buyer A, Lead 2 to Buyer B, Lead 3 to Buyer C, then back to Buyer A for Lead 4. This rotation continues indefinitely, ensuring mathematically equal distribution among participants.

The philosophy is fairness: every qualified buyer receives identical opportunity, regardless of price point, relationship tenure, or conversion performance.

How Round Robin Routing Works

Round robin maintains a rotation queue for qualified buyers. When a lead arrives:

- System identifies all buyers whose filters match the lead

- System checks which qualified buyer is next in rotation

- Lead routes to that buyer

- Rotation advances to next position

- Next lead repeats with updated rotation position

The rotation is deterministic. Given the same buyer pool and starting position, the same sequence occurs every time. This predictability matters for buyers who want to understand when they will receive leads.

Skip Logic and Position Preservation

True fairness requires handling exceptions without penalizing affected buyers. What happens when Buyer A is capped for the day but their rotation comes up? What if Buyer B’s call center is closed for a holiday?

Most implementations include skip logic: if a buyer cannot accept a lead (capped, closed, or filtered out), the rotation advances to the next buyer without advancing the skipped buyer’s position. When Buyer A returns to availability, they resume their normal rotation slot.

This position preservation is essential. Without it, a buyer who hits cap early in the day would lose their proportional share for the rest of the day. With it, they simply pause receiving leads until capacity returns.

Weighted Round Robin

Pure round robin allocates leads equally regardless of buyer size. A national chain wanting 1,000 leads monthly receives the same rotation share as a local operator wanting 50 leads. This creates mismatches between allocation and capacity.

Weighted round robin addresses this by assigning different rotation frequencies based on capacity or commitment. If Buyer A has weight 3 and Buyer B has weight 1, Buyer A appears three times in the rotation for every one appearance of Buyer B. Over time, Buyer A receives 75% of leads while Buyer B receives 25%.

The weighting can reflect:

- Volume commitments: Buyer contracted for 500 leads gets higher weight than one contracted for 100

- Payment reliability: Buyers with perfect payment history earn weight bonuses

- Performance metrics: Buyers with strong conversion and low returns see weights increase

- Capacity: Buyers with larger sales teams receive proportionally more leads

When Round Robin Excels

Round robin distribution delivers maximum value in specific scenarios:

Fairness-critical relationships. When perceived fairness matters more than revenue optimization, round robin eliminates disputes about preferential treatment. No buyer can claim the system favors competitors.

Franchise and dealer networks. Franchise operators distributing leads to franchisees need demonstrable equity. An agent in Des Moines receives the same lead opportunity as an agent in Dallas. Neither can claim the system favors competitors.

Insurance agent networks. Insurance carrier and agency networks often mandate round robin to prevent allegations of favoritism. Regulatory and relationship considerations override pure revenue optimization.

Similar buyer pricing. When buyers pay roughly equivalent prices, there is little revenue advantage to waterfall priority. Round robin simplifies operations without meaningful revenue sacrifice.

Relationship-driven operations. When long-term buyer relationships matter more than transaction-by-transaction optimization, round robin signals commitment to fairness that strengthens partnerships.

Round Robin Limitations

The equal-distribution philosophy creates limitations:

No revenue optimization. Round robin does not distinguish between a $40 buyer and a $60 buyer. Both receive equal share regardless of price point. This leaves money on the table when buyer pricing varies significantly.

Quality-blind allocation. Round robin does not match lead quality to buyer capability. A premium lead might route to a budget buyer while a marginal lead routes to a premium buyer. Mismatches reduce ecosystem efficiency.

Capacity misalignment. Pure round robin ignores capacity differences. A buyer with 5 agents receives the same lead count as a buyer with 50 agents, potentially overwhelming the smaller operation while underserving the larger one.

No competitive pressure. Buyers face no incentive to increase their prices or improve their service. Their allocation is fixed regardless of performance. This removes the market feedback that drives improvement.

Waterfall vs Round Robin: Direct Comparison

The choice between waterfall and round robin reflects a fundamental question: what are you optimizing for? The answer determines which method serves your operation.

Revenue Optimization

Waterfall advantage: Waterfall maximizes revenue by routing leads to highest-paying buyers first. A Tier 1 buyer at $65 always receives opportunity before a Tier 2 buyer at $45. This creates 15-30% higher average revenue compared to round robin with the same buyer pool.

Round robin limitation: Round robin ignores price differentiation. High-paying and low-paying buyers receive equal allocation. Average revenue settles at the mean buyer price rather than skewing toward the high end.

Relationship Equity

Round robin advantage: Round robin provides demonstrable fairness. Every buyer receives identical opportunity. No buyer can claim discrimination. This matters significantly in regulated industries, franchise networks, and relationship-driven operations.

Waterfall limitation: Lower-tier buyers know they receive pre-rejected inventory. This creates resentment, particularly when buyers believe their performance warrants higher position. Managing tier disputes consumes relationship capital.

Lead Freshness

Round robin advantage: Leads route immediately to the next rotation buyer without cascade delays. A lead submitted at 10:00:00 AM reaches its destination by 10:00:01 AM. See our guide on speed-to-lead strategies for why this matters.

Waterfall limitation: Each cascade tier adds latency. A lead that passes through four tiers at 10 seconds each arrives 40 seconds old. In high-intent verticals where 1-minute response produces 391% higher conversion than 2-minute response, this latency matters.

Operational Complexity

Round robin advantage: Configuration is straightforward. Define qualified buyers, set weights if desired, and let the rotation run. Minimal ongoing management required.

Waterfall limitation: Tier assignments require careful calibration and ongoing management. Performance changes require tier adjustments. Buyer negotiations around position consume operational attention. Timeout configurations need tuning.

Comparison Summary

| Factor | Waterfall | Round Robin |

|---|---|---|

| Revenue optimization | Strong | Weak |

| Relationship equity | Weak | Strong |

| Lead freshness | Degrades with tiers | Preserved |

| Operational complexity | Higher | Lower |

| Price discovery | None | None |

| Buyer incentives | Pay more for position | None |

| Best for | Revenue-focused operations | Fairness-critical networks |

Implementation Considerations

Choosing between waterfall and round robin is only the first decision. Implementation details determine whether your routing logic delivers expected results or creates unexpected problems.

Platform Selection

Your routing implementation is constrained by your platform’s capabilities. Major lead distribution platforms support both waterfall and round robin with varying sophistication:

boberdoo offers sophisticated waterfall logic with scenario optimization, calculating optimal exclusive versus shared distribution. For a comprehensive comparison, see our lead distribution platform selection guide. Parallel pinging evaluates all buyer options simultaneously before selecting the best route. The platform processes millions of pings daily for enterprise operations.

LeadsPedia provides both routing types with accessible configuration interfaces. The hybrid lead distribution and affiliate management architecture serves operations running multiple distribution models.

LeadExec supports five distribution methods including price-based, priority (waterfall), round robin, weighted, and percentage-based routing. Configuration through browser-based wizards enables rapid adjustments without development resources.

Phonexa handles all five lead flows with predictive routing capabilities. The Call Logic module adds sophisticated routing for pay-per-call operations.

Match your routing needs to platform capabilities before purchasing or building.

Filter Configuration

Both routing methods depend on accurate filter configuration. Filters determine which buyers qualify for each lead before routing logic applies.

Geographic filters: State, zip code, DMA, radius from location. Essential for licensed industries (insurance, mortgage) where buyers can only receive leads in territories where they hold licenses. Geographic arbitrage strategies leverage these filters effectively.

Attribute filters: Credit tier, loan amount, property value, vehicle year, coverage type. Match leads to buyers based on their product focus and qualification requirements.

Source filters: Approved publisher lists, blocked sources, sub-source restrictions. Allow buyers to accept leads only from traffic sources with proven performance.

Timing filters: Business hours, day of week, seasonal availability. Prevent routing leads to buyers who cannot work them immediately.

Configure filters before worrying about routing priority. A buyer with misconfigured filters receiving wrong leads will return them regardless of their rotation position or tier assignment.

Capacity Management

Both methods require capacity management to prevent overwhelming buyers or missing volume commitments.

Daily caps: Maximum leads per day, typically reflecting call center staffing.

Weekly and monthly caps: Maximum leads per period, often reflecting contracted commitments.

Budget caps: Maximum spend per period, stopping routing when buyer has exhausted their allocation.

Concurrent caps: Maximum unworked leads in queue, preventing pile-up when leads are not being processed.

In round robin, when a buyer hits cap, skip logic advances the rotation without disrupting their position. In waterfall, capped buyers are excluded from consideration until cap resets.

Real-Time Monitoring

You cannot optimize what you do not measure. Both routing methods require monitoring to ensure expected performance.

Fill rate: Percentage of leads successfully delivered to at least one buyer. Low fill rate signals capacity gaps, filter misalignment, or quality issues.

Time-to-route: Elapsed time from lead receipt to routing decision. Increasing latency signals system problems or excessive cascade delays.

Buyer acceptance rate: Percentage of routed leads accepted by each buyer. Declining acceptance signals filter changes, capacity problems, or relationship issues.

Return rate: Percentage of accepted leads subsequently returned. Rising returns indicate quality problems, compliance issues, or buyer dissatisfaction.

Build dashboards providing real-time and historical views. Configure alerts for meaningful deviations from baseline.

Hybrid Approaches

sophisticated practitioners rarely use pure waterfall or pure round robin. They combine methods to capture advantages of both while mitigating limitations of each.

Waterfall with Round Robin Fallback

The most common hybrid routes leads through a priority waterfall first. If Tier 1 and Tier 2 buyers decline, remaining inventory enters round robin distribution among Tier 3 buyers rather than continuing cascade.

How it works:

- Lead enters waterfall, offered to Tier 1 buyers

- If Tier 1 accepts, routing complete

- If Tier 1 declines, cascade to Tier 2

- If Tier 2 accepts, routing complete

- If Tier 2 declines, lead enters round robin among Tier 3 buyers

- Round robin ensures fair distribution among fallback buyers

This approach captures premium revenue through waterfall priority while providing equitable treatment for lower-tier buyers. It also reduces cascade latency by eliminating sequential evaluation among similar-quality buyers.

Round Robin with Quality Tiers

This hybrid stratifies leads by quality before distribution, running separate round robin rotations for premium and standard inventory.

How it works:

- Lead receives quality score based on validation results, data completeness, and source reputation

- Premium leads (score above threshold) enter Premium Round Robin

- Standard leads (score below threshold) enter Standard Round Robin

- Each pool rotates independently among qualified buyers

This prevents scenarios where Buyer A coincidentally receives three premium leads while Buyer B receives three marginal ones. Quality-adjusted round robin provides fairness within comparable inventory tiers.

Geographic Partitioning

Operations covering multiple geographies often partition routing by region, using different methods for different markets.

How it works:

- Lead arrives with geographic data (state, zip code)

- System identifies applicable regional routing rules

- Competitive markets (California, Texas, Florida) may use waterfall for revenue optimization

- Low-density markets may use round robin to ensure buyer engagement

- Different timeout and capacity rules apply per region

Geographic partitioning acknowledges that buyer density and competitive dynamics vary by location. The routing method that optimizes California results may not work for Montana.

Time-Based Method Switching

Some operations switch routing methods based on time, using different approaches for different periods.

How it works:

- During business hours (8 AM to 6 PM), waterfall routing prioritizes immediate conversion

- During evening hours, round robin distributes leads for next-day follow-up

- Weekend leads may route differently than weekday leads

- Seasonal periods may trigger different routing configurations

Time-based switching acknowledges that lead value and buyer capacity vary by period. A 10 AM lead has different characteristics than a 10 PM lead and may warrant different routing treatment.

Making the Decision: Framework for Choosing

The choice between waterfall and round robin depends on your specific operation. Use this framework to evaluate which method matches your requirements.

Step 1: Assess Your Buyer Ecosystem

How much price variance exists among your buyers?

- High variance (some buyers pay 50%+ more than others): Waterfall captures price premium

- Low variance (buyers within 10-15% of each other): Round robin simplifies without material revenue loss

How important is perceived fairness?

- Critical (franchise networks, agent distribution, regulated contexts): Round robin eliminates disputes

- Secondary (commercial lead marketplaces): Waterfall optimizes revenue

How much capacity variance exists?

- High variance (some buyers want 10x the volume of others): Weighted round robin or waterfall

- Low variance (buyers have similar capacity): Pure round robin works

Step 2: Evaluate Your Commercial Model

What is your primary optimization objective?

- Maximum revenue per lead: Waterfall with price-based tiering

- Maximum buyer satisfaction: Round robin with quality stratification

- Balance of both: Hybrid approach with waterfall for premium, round robin for standard

Do you have exclusive partnership agreements?

- Yes, with guaranteed first-look provisions: Waterfall required to honor contractual priority

- No exclusive arrangements: Either method works

How do you price leads?

- Variable pricing based on buyer tier: Waterfall aligns routing with pricing

- Flat pricing across buyers: Round robin works without complexity

Step 3: Consider Your Operational Capacity

What is your technical sophistication?

- High (dedicated engineering team, custom integrations): Either method with hybrid optimization

- Medium (competent ops team, third-party platform): Platform-native routing capabilities

- Low (minimal technical resources): Simple round robin with platform defaults

How much ongoing routing management can you sustain?

- Significant (dedicated resources for tier management and optimization): Waterfall rewards investment

- Minimal (set-and-forget preference): Round robin requires less maintenance

Decision Matrix

| If You Are… | Consider |

|---|---|

| Lead aggregator optimizing revenue | Waterfall with EPL optimization |

| Insurance agency network | Round robin with quality tiers |

| Franchise lead distribution | Round robin with weighted allocation |

| Marketplace with diverse buyer pricing | Waterfall with fallback round robin |

| New operation learning the business | Round robin for simplicity |

| High-volume operation at scale | Waterfall with hybrid fallback |

Advanced Optimization Strategies

Once you have selected and implemented your routing method, optimization opportunities emerge. These advanced strategies extract incremental value from your routing infrastructure.

EPL (Earnings Per Lead) Optimization

Rather than routing purely on bid price, EPL optimization considers expected actual revenue after accounting for acceptance rates and return patterns.

Consider two buyers:

- Buyer A bids $60 but accepts only 70% of posts and returns 15% of accepted leads

- Buyer B bids $50 but accepts 95% of posts and returns 3% of accepted leads

Buyer A expected value: $60 x 0.70 x 0.85 = $35.70 Buyer B expected value: $50 x 0.95 x 0.97 = $46.08

EPL optimization routes to Buyer B despite the lower bid because actual expected revenue is higher. This approach requires tracking acceptance and return patterns by buyer and incorporating that data into routing decisions.

Dynamic Position Adjustment

Rather than static tier assignments, dynamic adjustment changes buyer positions based on real-time performance.

A buyer whose acceptance rate drops from 85% to 65% might automatically move from Tier 1 to Tier 2. A buyer whose conversion rates consistently exceed peers might earn automatic promotion. Understanding lead quality scores helps calibrate these thresholds.

Dynamic adjustment keeps routing aligned with current buyer value rather than historical negotiation. It also removes awkward conversations about manual tier changes by making position earned through performance.

Fallback Revenue Recovery

When primary routing exhausts without acceptance, fallback strategies recover value that would otherwise be lost.

Secondary waterfall: Route to backup buyers at reduced prices.

Aged lead queue: Hold leads for batch processing to buyers accepting older inventory at discounts.

Cross-vertical routing: Attempt placement in adjacent verticals where the lead might have value.

Auction fallback: Send unsold leads to real-time auction for price discovery.

Effective fallback strategies recover 20-40% of leads that would otherwise go unsold. This incremental revenue often represents the difference between profitable and marginal operations.

A/B Testing Routing Logic

Routing changes should be tested before full deployment. A/B testing routes identical traffic through different configurations to measure performance differences.

Run tests long enough to achieve statistical significance. A test showing 5% improvement over two hours might reverse over two days. Balance desire for quick results against need for reliable data.

Start with small test populations and expand as confidence grows. Testing major routing changes on 50% of traffic risks significant revenue impact if the change underperforms.

Real-World Scenarios

Abstract principles become concrete through practical examples. These scenarios illustrate how routing decisions play out in actual operations.

Scenario 1: Insurance Lead Aggregator

Situation: You are an insurance lead aggregator processing 75,000 leads monthly across auto, home, and Medicare verticals. You have 35 active buyers ranging from large carriers to independent agents. Buyer prices range from $28 to $85 per lead depending on vertical and buyer.

Challenge: Maximize revenue while maintaining buyer relationships and ensuring adequate lead distribution to smaller accounts.

Solution: Implement waterfall with fallback round robin.

- Tier 1 (8 buyers): Premium carriers and large agencies paying $60+ per lead. First look at all inventory.

- Tier 2 (12 buyers): Mid-market buyers paying $40-60. Receive leads Tier 1 declines.

- Tier 3 (15 buyers): Smaller agents paying $28-40. Round robin distribution of leads remaining after Tier 2.

Results: Average revenue per lead increased 18% compared to previous round robin approach. Tier 3 buyers reported satisfaction with equitable treatment among their cohort. Fill rate maintained at 87%.

Scenario 2: Franchise Dealer Network

Situation: You are a home services franchisor distributing leads to 120 franchisees across 38 states. Franchisees pay fixed monthly fees that include lead allocation. Perceived fairness is critical because franchisees compare notes and complain loudly about inequities.

Challenge: Ensure demonstrably fair distribution while accounting for franchisee capacity differences and geographic coverage.

Solution: Implement weighted round robin with geographic partitioning.

- Each franchisee receives weight based on their territory size and contracted lead volume

- Geographic partitioning ensures leads route only to franchisees serving each territory

- Dashboard provides real-time visibility showing each franchisee their allocation versus target

- Monthly reconciliation ensures cumulative fairness despite daily variance

Results: Franchisee complaints about lead distribution dropped 85%. Transparency via dashboard eliminated “black box” suspicions. Weighted allocation aligned volume with franchisee capacity.

Scenario 3: Mortgage Lead Generator

Situation: You are a mortgage lead generator selling directly to loan officers. Your 45 buyers have dramatically different preferences: some want exclusive leads at premium prices, others prefer shared leads at volume discounts. Rate sensitivity creates significant day-to-day price volatility.

Challenge: Accommodate diverse buyer preferences while optimizing for volatile market conditions.

Solution: Implement hybrid routing with exclusive/shared optimization.

- Exclusive buyers enter waterfall competition, bidding for first access

- Shared buyers receive leads in round robin rotation after exclusive window closes

- Platform calculates whether exclusive sale or combined shared sales generates more revenue

- Dynamic floor pricing adjusts based on daily rate environment

Results: Revenue per lead increased 22% compared to static pricing. Exclusive buyers accepted premium positioning. Shared buyers received predictable volume through round robin. Market volatility handled through dynamic pricing rather than routing changes.

Frequently Asked Questions

What is the main difference between waterfall and round robin lead distribution?

Waterfall distribution routes leads sequentially through a priority hierarchy, offering each lead to the highest-tier buyer first and cascading down only if rejected. Round robin distribution rotates leads equally among all qualified buyers regardless of price or performance. The fundamental distinction is philosophical: waterfall optimizes for revenue extraction by prioritizing highest-paying buyers, while round robin optimizes for relationship equity by ensuring every buyer receives identical opportunity.

What is the typical revenue difference between waterfall and round robin routing?

Operations with significant buyer price variance typically see 15-30% higher average revenue per lead with waterfall compared to round robin. This advantage comes from ensuring highest-paying buyers receive first access to inventory. However, if your buyers pay within 10-15% of each other, the revenue difference becomes negligible, and round robin may perform equally well with lower operational complexity.

What is the ideal fill rate for a lead distribution operation?

Target fill rates above 85% for mature operations with established buyer networks. Fill rates between 70-85% are acceptable for newer operations still building buyer relationships. Fill rates below 70% indicate capacity gaps, filter misalignment, or lead quality issues requiring investigation. Elite operations achieve 90%+ fill rates through robust buyer networks and effective fallback strategies that recover leads primary routing cannot place.

What is skip logic in round robin distribution?

Skip logic is a mechanism that handles exceptions in round robin rotation without penalizing affected buyers. When a buyer cannot accept a lead due to hitting their daily cap, being closed, or not matching filters, skip logic advances the rotation to the next qualified buyer while preserving the skipped buyer’s position. When the skipped buyer returns to availability, they resume their normal rotation slot without losing their proportional share.

What is EPL optimization in lead routing?

EPL (Earnings Per Lead) optimization is an advanced routing strategy that considers expected actual revenue rather than bid price alone. It calculates expected value by factoring in acceptance rates and return patterns. For example, a buyer bidding $50 with 95% acceptance and 3% returns generates higher expected value ($46.08) than a buyer bidding $60 with 70% acceptance and 15% returns ($35.70). EPL optimization routes to the higher expected value regardless of nominal bid.

What is weighted round robin and when should you use it?

Weighted round robin assigns different rotation frequencies to buyers based on capacity or commitment level. If Buyer A has weight 3 and Buyer B has weight 1, Buyer A appears three times in rotation for every one appearance of Buyer B, receiving 75% of leads over time. Use weighted round robin when buyers have significantly different volume needs or commitments but you still want equitable treatment within their contracted allocation.

What is the cascade timeout and how does it affect lead freshness?

Cascade timeout is the waiting period at each waterfall tier before a lead cascades to the next tier if no buyer responds. Typical timeouts range from 5-30 seconds depending on vertical and buyer infrastructure. Each tier adds latency: a lead passing through five tiers at 10 seconds each arrives nearly a minute old to the sixth tier. In high-intent verticals where 1-minute response produces 391% higher conversion than 2-minute response, this accumulated latency can significantly impact buyer performance.

What is a hybrid routing approach and what are common configurations?

Hybrid routing combines waterfall and round robin methods to capture advantages of both. Common configurations include: waterfall for premium Tier 1 and Tier 2 buyers with round robin fallback for Tier 3; separate round robin pools stratified by lead quality score; geographic partitioning using waterfall in competitive markets and round robin in low-density markets; and time-based switching using waterfall during business hours and round robin for after-hours distribution.

What is the best routing method for franchise or dealer networks?

Round robin distribution is typically the best choice for franchise and dealer networks where perceived fairness is critical. Franchisees and dealers frequently compare notes about lead allocation, and any perception of favoritism creates significant relationship friction. Weighted round robin with geographic partitioning provides demonstrable equity while accounting for territory size and capacity differences. Transparency dashboards showing real-time allocation versus targets further eliminate “black box” suspicions.

What are the key metrics for measuring lead routing performance?

Track five core metrics to evaluate routing performance: fill rate (percentage of leads successfully delivered to buyers), time-to-route (latency from lead receipt to delivery), buyer acceptance rate (percentage of routed leads accepted by each buyer), return rate (percentage of accepted leads subsequently returned), and revenue per lead (average revenue after accounting for returns). Build dashboards providing real-time and historical views, and configure alerts for meaningful deviations from established baselines.

Key Takeaways

-

Waterfall optimizes for revenue extraction. By routing leads to highest-paying buyers first, waterfall captures premium value before offering inventory to lower-priced buyers. Operations with significant buyer price variance typically generate 15-30% higher revenue with waterfall compared to round robin.

-

Round robin optimizes for relationship equity. Every qualified buyer receives identical opportunity regardless of price point or relationship tenure. This demonstrable fairness eliminates disputes about preferential treatment and suits franchise networks, agent distribution, and regulated contexts.

-

Lead freshness degrades with waterfall depth. Each cascade tier adds timeout delay. A lead passing through five tiers at 10 seconds each arrives nearly a minute old. In high-intent verticals, this latency costs conversion. Round robin preserves freshness through immediate routing.

-

Hybrid approaches capture advantages of both. Sophisticated operations use waterfall for premium tiers with round robin fallback, quality-stratified round robin, geographic partitioning, or time-based switching. Pure single-method implementations rarely optimize across all objectives.

-

EPL optimization outperforms price-only routing. Routing to highest bidder ignores acceptance and return patterns. A $50 bid with 95% acceptance and 3% returns beats a $60 bid with 70% acceptance and 15% returns. Factor actual expected value into routing decisions.

-

Fill rate is the fundamental health metric. Operations below 70% fill rate are leaving money on the table through insufficient buyer coverage, filter misalignment, or quality issues. Target 85%+ for mature operations. Build fallback strategies to recover 20-40% of leads that primary routing does not place.

-

Platform capabilities constrain routing options. Evaluate platforms based on your specific routing requirements. Major platforms (boberdoo, LeadsPedia, LeadExec, Phonexa) support both methods with varying sophistication. Match platform to operational needs.

-

Routing is a strategic decision, not a technical detail. The method you choose determines revenue extraction, buyer relationships, operational complexity, and scaling capacity. Make the choice deliberately based on your business model, buyer ecosystem, and commercial objectives.

Routing methods and platform capabilities current as of December 2025. Platform features and pricing subject to change; verify directly with vendors.