Learn exactly how lead generation works, who the key players are, and how to get started in this $5-10 billion industry where consumer intent becomes a tradeable asset.

A consumer fills out a form requesting auto insurance quotes. In the next 200 milliseconds – before the thank-you page finishes loading – their information has been transmitted to an auction system, evaluated by a dozen buyers, bid on in real-time, sold to the highest bidder, and delivered to a sales agent’s screen 1,500 miles away.

The consumer thinks they requested information from a comparison website.

What actually happened is they became a product. Their intent – packaged with their permission and contact data – just traded on a marketplace they never knew existed.

This is the lead economy: a multi-billion dollar industry that connects consumer intent with businesses ready to fulfill that intent. Whether you want to start a lead generation business, buy leads for your company, or simply understand how this marketplace works, this guide covers everything you need to know.

What Exactly Is a Lead?

A lead is not contact information. Contact information is a commodity – you can buy lists of names and phone numbers for pennies per record. That’s not what moves billions of dollars annually. A lead is something more valuable: consumer intent, captured at the moment of expression, packaged with permission to make contact, and sold within a time window where that intent still has commercial value.

The Four Components of a Tradeable Lead

Every valuable lead contains four elements that must travel together, and understanding each reveals why the industry operates the way it does.

Consumer intent sits at the foundation of everything. The person is actively shopping for a product or service – they’ve moved past awareness, past consideration, into active shopping mode. This behavioral signal is what gives leads their value, separating a warm prospect from a cold name on a list.

Permission follows intent as the second critical component. The consumer must grant explicit Prior Express Written Consent (PEWC) to be contacted. Without valid consent, the contact data creates legal liability rather than value – a $6.6 million class action settlement waiting to happen rather than a sales opportunity.

Rich data gives the lead its depth and targeting precision. This means contact information plus qualifying attributes: phone number, email, and address, plus vertical-specific fields like vehicle year/make/model for auto insurance or loan amount and property value for mortgages. The more qualifying data captured, the better a buyer can assess whether the lead fits their ideal customer profile.

Fresh timing determines how much the package is worth. The timestamp of when intent was expressed matters enormously – a lead captured 30 seconds ago is worth multiples of one captured 30 hours ago. This decay dynamic drives the entire industry’s obsession with speed.

Lead vs. Prospect vs. Customer: Understanding the Difference

| Term | Definition | Status |

|---|---|---|

| Lead | Consumer who has expressed interest and granted permission to be contacted | Pre-contact, unqualified |

| Prospect | Lead that has been contacted and confirmed as a viable sales opportunity | Contacted, qualified |

| Customer | Prospect who has completed a purchase | Converted, revenue-generating |

The lead economy primarily trades in leads – pre-contact raw material. Converting leads to prospects is the buyer’s job. Some models (live transfer, appointment setting) deliver partially-qualified prospects at premium prices.

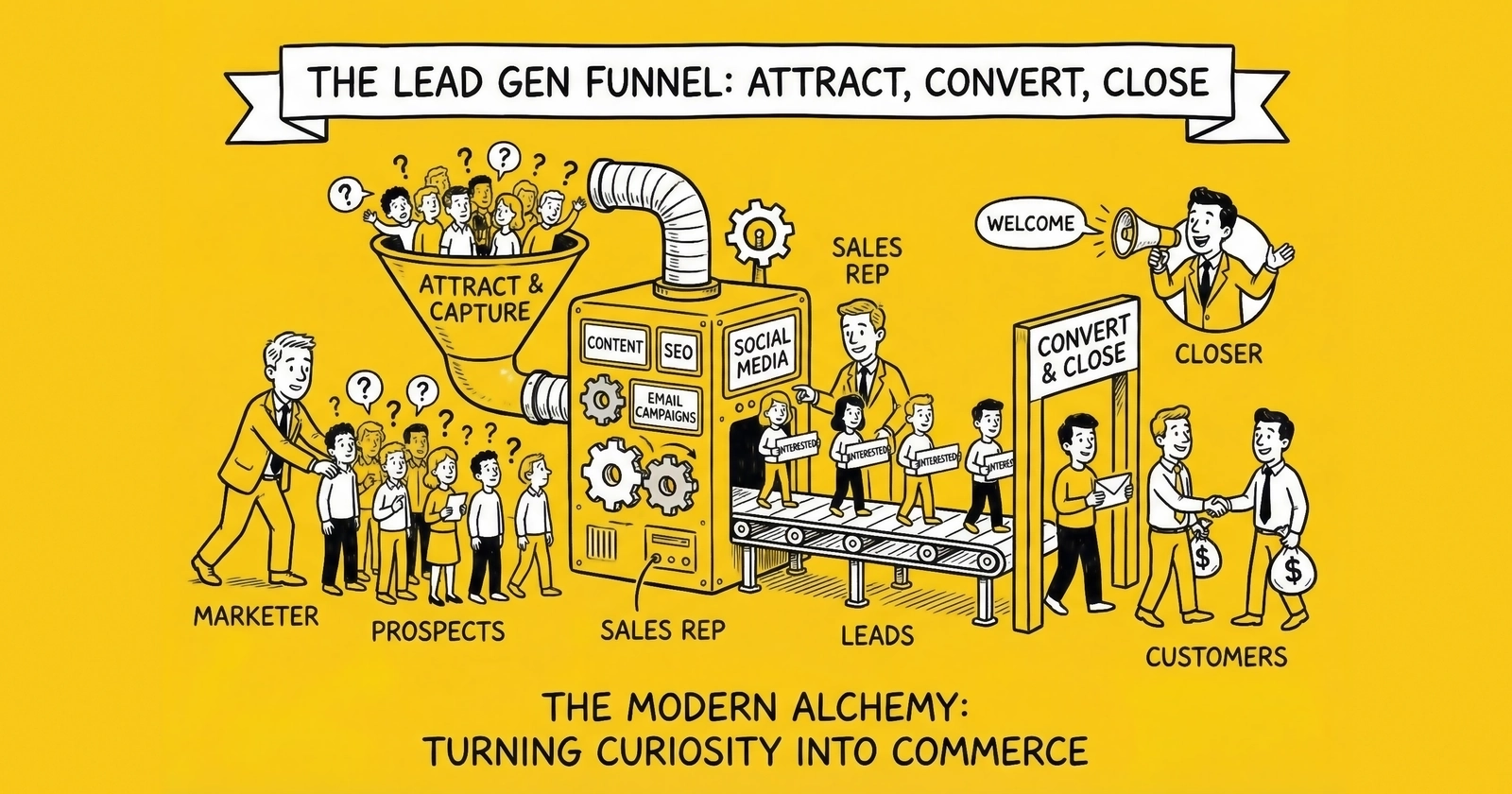

How Does Lead Generation Work?

Lead generation operates as a structured process that transforms anonymous web traffic into qualified, contactable prospects. Understanding this process reveals where value is created and where money changes hands.

The Complete Lead Journey: 8 Stages

The journey from anonymous visitor to paying customer unfolds across three distinct phases, each with its own economics and specialists.

In the generation phase, the process begins with awareness – a consumer sees advertising, content, or search results that match their intent. Capture follows when that consumer fills out a form, providing contact information and consent. Validation then kicks in as systems verify the phone number is real, the email is deliverable, and the data is accurate.

The distribution phase moves the validated lead into marketplace systems. Routing sends the lead to platforms where buyers evaluate and bid, often in real-time auctions that complete in milliseconds. Delivery transmits the complete lead data to the winning buyer via API, CRM integration, or portal access.

The conversion phase represents where leads become revenue. Contact happens when sales teams reach out via phone, SMS, or email – often within seconds of lead delivery. The conversion process qualifies need and presents solutions, and if everything aligns, a sale completes and revenue is recognized.

Why Speed Determines Everything

Lead value doesn’t decline linearly – it follows a decay curve that accelerates over time. The research is unambiguous and the numbers are stark.

Responding within one minute yields 391% higher conversion rates, according to Velocify research. The Lead Response Management Study found that leads contacted within five minutes are 21 times more likely to qualify than those contacted after 30 minutes. Perhaps most tellingly, the Lead Connect Survey revealed that 78% of customers purchase from the first responder – not the best, not the cheapest, simply the first. Yet InsideSales.com found that 63% of leads never receive any response from buyers at all.

A lead loses approximately 50% of its value within 48 hours without contact, with the steepest drop occurring in the first hour. This decay curve drives the entire industry’s obsession with speed and explains why real-time delivery commands premium pricing.

The Three-Tier Lead Marketplace

The lead economy operates as a three-tier marketplace where each tier adds value, captures margin, and shoulders specific risks. Understanding this structure reveals where money flows and where you might fit in the ecosystem.

Tier 1: Lead Generators (Publishers, Affiliates)

Generators create leads from raw traffic by running advertising campaigns, building content websites, operating comparison engines, and capturing consumer intent in forms. They’re the factories of the lead economy, transforming attention into actionable data.

Content publishers build websites that rank in Google, attracting organic traffic. Sites like NerdWallet draw millions of visitors seeking financial product information, monetizing that attention through lead generation. Comparison engines let consumers input information once and receive multiple quotes – LendingTree pioneered this model with “When banks compete, you win.” Affiliate marketers run paid advertising on Google, Facebook, and other platforms, driving traffic to landing pages they control. Call centers generate leads through outbound calling or inbound response operations, selling qualified prospects as “live transfers” at premium prices.

The key economics for generators are traffic-driven. Success depends on acquiring visitors cheaply (cost per click) and converting them efficiently (conversion rate). Master both, and you’ve built a lead generation machine.

Tier 2: Aggregators and Distributors (Brokers, Networks, Exchanges)

Distributors sit between generators and buyers, adding value through aggregation, distribution, and risk transfer. They’re the plumbing of the lead economy – not glamorous, but essential for scale.

Brokers buy leads from generators at fixed prices, assume quality risk, and resell to buyers at higher prices. Their margins come from the spread, reduced by returns and bad debt. Networks connect generators to buyers without taking title to the leads themselves, facilitating transactions, providing tracking, and taking a percentage of flow. Exchanges operate real-time auctions where leads are bid on using ping/post systems – multiple buyers bid, and the highest bidder wins, with prices discovered through genuine market dynamics.

Gross margins for distributors typically range from 15-30%, but net margins after returns, float costs, and bad debt often compress to 15-18%. The business requires significant working capital and operational excellence to succeed.

Tier 3: Lead Buyers (Carriers, Lenders, Service Providers)

Buyers purchase leads to convert them into customers, and they’re the ultimate source of all value in the system. Without buyers willing to pay for leads, the entire economy collapses.

Insurance carriers and agents represent the largest vertical – MediaAlpha alone processed over $1.5 billion in transaction value in 2024. Mortgage lenders create massive demand that fluctuates dramatically with interest rates. Solar installers face geographic economics that vary dramatically – a California lead commands multiples of one in North Dakota due to sunshine hours and utility rates. Legal practices command the highest CPLs at $200-500+ for personal injury, reflecting high lifetime case values that can exceed $50,000. Home service providers in HVAC, roofing, and plumbing find leads through platforms like Angi and HomeAdvisor.

The key economics for buyers are conversion-driven. Success depends on contact rate, qualification rate, close rate, and customer lifetime value. A buyer who can convert 2% more leads than competitors can pay significantly more per lead and still profit.

Lead Generation Channels and Methods

Lead generators use multiple channels to capture consumer intent, and each channel has different economics, intent signals, and scale potential. Understanding these differences helps you choose where to invest.

Paid Traffic Channels

Google Ads delivers the highest-intent traffic in lead generation, capturing consumers who are actively searching for solutions. Average CPC runs $4.66 across industries, up 10% year-over-year. Average CPL hit $66.69 in 2024 and is rising to $70.11 in 2026. The challenge lies in the expense and optimization expertise required – Google rewards advertisers who continuously refine their campaigns.

Facebook and Meta Ads offer roughly 68% cheaper leads at an average CPL of $21.98, with visual creative options that work well for certain verticals. The tradeoff is lower intent signals than search – these users weren’t looking for your product, they were scrolling through their feed.

TikTok Ads feature lower CPMs but highly variable conversion efficiency. The platform works well for certain verticals like beauty and education, but requires testing before scaling. What succeeds on Facebook often fails on TikTok, and vice versa.

Native advertising typically runs $0.30-2.00 CPC with content-contextual placement. The format blends with surrounding editorial content, but requires quality content to convert. Native excels at top-of-funnel awareness but requires a longer conversion path.

Organic Traffic Channels

Search engine optimization requires an investment of time and content creation rather than direct spend, but delivers traffic with no per-click costs once ranking is achieved. The challenge is patience: building organic rankings takes months and requires ongoing maintenance. But the economics can be spectacular – organic traffic converts at similar rates to paid search without the CPC.

Content marketing – educational content that attracts prospects – builds trust and authority over time. The global content marketing industry is reaching $295.1 billion by 2027, reflecting how seriously businesses take this channel. The leads generated tend to be warmer and more qualified than paid alternatives.

Referral and Direct Channels

Referral programs leverage warm introductions from existing customers, yielding higher conversion rates than cold leads. The limitation is scale – referrals grow linearly, not exponentially. But for quality, nothing beats a trusted recommendation.

Email marketing enables direct targeting of owned audiences at CPM typically running $5-50 per thousand. Building a quality list takes time, but once established, email offers the lowest-cost lead generation channel available. The key is nurturing subscribers into leads rather than burning the list with aggressive promotions.

Lead Generation Economics: Understanding the Money

The economics of lead generation split into three realms: what it costs to create leads, what it costs to distribute them, and what buyers will pay to acquire them. Understanding all three determines whether a business model is viable.

Cost Per Lead (CPL) Benchmarks by Vertical

| Vertical | CPL Range | Typical Range | Premium Tier |

|---|---|---|---|

| Auto Insurance | $5-150 | $25-75 | $100+ |

| Medicare | $30-80 | $40-60 | $80+ |

| Mortgage | $12-200+ | $50-100 | $150+ |

| Solar | $20-300 | $75-150 | $200+ |

| Legal (Personal Injury) | $100-3,000+ | $200-500 | $800+ |

| Home Services | $15-230 | $40-100 | $150+ |

The Conversion Math That Determines Profitability

Understanding the relationship between traffic cost and lead value is essential for anyone entering this industry. A simple example illustrates how narrow the margins can be.

With traffic cost (CPC) at $4.66 and a landing page conversion rate of 5%, your raw CPL calculates to $4.66 divided by 0.05, yielding $93.20. If you can sell that lead for $100, your gross margin is only $6.80. After platform fees, validation costs, and returns, you may actually lose money.

But improve that conversion rate to 7% and the math transforms. Raw CPL at 7% becomes $4.66 divided by 0.07, which equals $66.57. Sell at $100 and you pocket $33.43 in gross margin. After costs, approximately $20 remains as profit. Two percentage points of conversion improvement created a $26 profit swing per lead. This is why conversion rate optimization determines viability – small improvements in conversion compound into dramatic differences in profitability.

Exclusive vs. Shared Lead Pricing

Exclusive leads sell to exactly one buyer and command premium pricing, typically 2-3x what shared leads fetch. An auto insurance lead might sell for $60-75 exclusive, giving that buyer sole access to the consumer.

Shared leads sell to multiple buyers, typically 3-7 per lead. Per-buyer prices drop to $15-25, but cumulative revenue often exceeds exclusive pricing: 5 buyers at $20 each generates $100 total versus $70 for an exclusive sale. The tradeoff is buyer experience – consumers receiving multiple calls may become frustrated, reducing conversion rates for everyone.

The Float Reality

Lead brokerage requires significant working capital because of timing mismatches between payables and receivables. You pay publishers within 7-15 days while buyers pay you within 30-45 days. That 30-day gap multiplied by monthly volume creates substantial float requirements.

| Monthly Volume | Float Requirement |

|---|---|

| 10,000 leads | $150,000-$200,000 |

| 50,000 leads | $500,000-$750,000 |

| 100,000 leads | $1,000,000+ |

This capital requirement represents a major barrier to entry for would-be brokers and explains why established players with access to financing dominate the distribution tier.

Key Metrics Every Lead Generator Tracks

Success in lead generation requires tracking the right metrics at the right level of granularity. Without measurement, optimization is impossible.

Traffic and Acquisition Metrics

| Metric | Definition | Benchmark |

|---|---|---|

| CPC (Cost Per Click) | Price paid for each ad click | $0.50-$50+ depending on vertical |

| CTR (Click-Through Rate) | Percentage of impressions that become clicks | 2-5% for search ads |

| Conversion Rate | Percentage of visitors who become leads | 3-12% depending on vertical |

| CPL (Cost Per Lead) | Total cost to acquire one lead | $20-$200+ by vertical |

Quality and Performance Metrics

| Metric | Definition | Target |

|---|---|---|

| Contact Rate | Percentage of leads successfully reached | 40-60% for fresh leads |

| Return Rate | Percentage of leads buyers reject | Below 10-12% |

| Fill Rate | Percentage of pings resulting in successful posts | Higher = healthy demand |

| EPL (Earnings Per Lead) | Net revenue after returns and costs | 15-20% of gross sale price |

Buyer-Side Metrics

| Metric | Definition | Why It Matters |

|---|---|---|

| CPA (Cost Per Acquisition) | Total cost to acquire one customer | Must be below LTV for profitability |

| LTV (Lifetime Value) | Total revenue from one customer | Determines maximum acceptable CPA |

| ROAS (Return on Ad Spend) | Revenue generated per dollar spent | Minimum 3:1 for sustainable acquisition |

Customer Lifetime Value by Vertical

| Vertical | Typical LTV Range |

|---|---|

| Auto Insurance | $1,500-$3,000 (3-5 year policy lifetime) |

| Medicare | $800-$1,200 (annual enrollment) |

| Mortgage | $3,000-$8,000 (varies by loan size) |

| Solar | $5,000-$15,000 (varies by system size) |

| Legal (PI) | $10,000+ (contingency fee on settlement) |

Getting Started in Lead Generation: Practical First Steps

Entering the lead economy requires honest assessment of your resources, skills, and risk tolerance. There’s no single right path – but there are paths better suited to different starting points.

Step 1: Choose Your Position in the Ecosystem

Three distinct options exist, each with different requirements and rewards.

Becoming a lead generator (publisher) works best for those with marketing expertise and traffic acquisition skills. Capital requirements range from $5,000-$50,000 to start, and your focus will be creating and optimizing campaigns. This path offers the fastest route to profitability if you have advertising skills.

Becoming a lead broker or distributor suits relationship builders who are operations-oriented. Capital requirements jump to $100,000-$500,000 due to float requirements, and your focus shifts to managing supply and demand while maintaining quality control. This path takes longer to profitability but builds more defensible value.

Becoming a lead buyer makes sense for sales-focused businesses that need customers. Capital requirements vary based on your sales capacity, and the focus is converting leads efficiently. This isn’t building a lead generation business – it’s using lead generation to grow an existing business.

Step 2: Select Your Vertical

Each vertical has different economics, and your choice should reflect your knowledge, capital, and risk tolerance.

Market size matters – insurance is the largest vertical, while legal commands the highest value per lead. Complexity varies significantly: mortgage volumes fluctuate with interest rates, and solar economics vary by geography. Regulation creates barriers in some verticals: insurance and legal have strict compliance requirements that newcomers must master. Competition is a double-edged sword: established verticals have more competitors but also more demand, while emerging verticals offer less competition but smaller buyer pools.

Step 3: Build Essential Infrastructure

The infrastructure you need depends on your chosen position in the ecosystem.

Generators need landing page and form capture tools, analytics and tracking systems, ad platform accounts (Google, Meta), and consent documentation through services like TrustedForm or Jornaya. The technology investment is modest, but the optimization expertise required is substantial.

Distributors require more sophisticated infrastructure: a lead distribution platform (boberdoo, LeadsPedia, or Phonexa), validation services for phone and email verification, CRM integration capabilities, and compliance documentation systems. Budget $500-$2,500 monthly for platform costs plus $0.10-$0.50 per lead for validation and consent services.

Buyers need a CRM system for lead management, a dialer or contact system, lead tracking and attribution capabilities, and a trained sales process. The technology is less specialized than for generators or distributors, but execution requirements are higher.

Step 4: Start Small and Test

Resist the urge to scale before you understand your economics. Begin with a single vertical and traffic source, keeping things simple enough to diagnose problems. Test with $50-100 per day before committing larger budgets, and track every metric from day one – you can’t optimize what you don’t measure.

Set realistic expectations for timelines: expect 3-6 months to reach profitability as an affiliate, longer if you’re learning advertising from scratch. Expect 12-18 months to reach profitability as a broker, given the capital requirements and relationship-building timeline.

Step 5: Build Compliance Into Everything

Compliance cannot be an afterthought – it must be infrastructure built into every lead you generate or sell.

Obtain consent certificates for every lead through services like TrustedForm or Jornaya. Implement DNC (Do Not Call) scrubbing before any lead is called. Document everything for 5+ years, as litigation can emerge long after the original transaction. Consult with TCPA compliance specialists before scaling, because the mistakes you make at low volume become catastrophic at high volume.

Lead Generation Industry Statistics: Market Size and Growth

The lead generation market has reached substantial scale and continues growing as businesses recognize the value of qualified consumer intent.

Market Size

The global lead generation market runs $5-10 billion as of 2024, with projected growth reaching $15-32 billion by 2031-2035 depending on the research source. The lead generation software market alone represents $5.11 billion in 2024, projected to reach $12.37 billion by 2033 at 10.32% CAGR.

Industry Scale

More than 21,000 lead generation businesses operate in the United States, ranging from solo affiliate marketers to publicly-traded companies processing billions in transaction value. North America represents approximately 40% of global market value, while Asia-Pacific is the fastest-growing region at 12%+ CAGR.

Major Industry Players

| Company | 2024 Revenue | Primary Vertical |

|---|---|---|

| MediaAlpha (MAX) | $864.7 million | Insurance |

| LendingTree (TREE) | ~$900 million | Mortgage/Financial |

| QuinStreet (QNST) | $613.5 million | Multi-vertical |

| EverQuote (EVER) | $500.2 million | Insurance |

Fraud and Quality Challenges

The industry faces significant quality challenges that honest operators must navigate. An estimated 30% of third-party leads contain fraudulent or false information, while $84 billion is lost to digital ad fraud annually across all digital advertising. Approximately 37% of web traffic is attributed to bots, and 90% of PPC campaigns experience click fraud at some level. These realities make validation and fraud detection essential investments rather than optional enhancements.

Frequently Asked Questions

What is lead generation in simple terms?

Lead generation is the process of identifying and capturing potential customers who have expressed interest in a product or service. When someone fills out a form requesting information about auto insurance, solar panels, or mortgage rates, they become a “lead” that can be contacted by businesses offering those services. The lead generation industry creates, qualifies, and distributes these leads to businesses willing to pay for them.

How do lead generation companies make money?

Lead generation companies make money by selling leads to businesses that want customers. They acquire traffic through advertising or content, capture consumer information through forms, and sell those leads for more than the cost of acquisition. A company might pay $30 to generate a lead and sell it for $50-100 depending on quality and vertical. Margins typically run 15-40% gross, with net margins of 15-18% after returns and operational costs.

What is a good cost per lead?

A “good” cost per lead varies dramatically by industry. Auto insurance leads typically range from $25-75, mortgage leads run $50-150, solar leads cost $75-200, and legal leads for personal injury can exceed $200-500. The key metric isn’t absolute CPL but rather how CPL relates to customer lifetime value. A $200 legal lead that converts to a $50,000 case is excellent value. A $20 lead that never converts is worthless.

How do I start a lead generation business?

Starting a lead generation business follows a structured path. First, choose a vertical based on your knowledge and capital. Then build landing pages and form capture systems. Set up consent documentation through TrustedForm or Jornaya. Create advertising campaigns on Google or Facebook. Find buyers willing to purchase your leads. Start small with $50-100 daily ad spend. Optimize continuously based on conversion data. Expect to invest $5,000-$25,000 minimum and 3-6 months to reach profitability.

What is the difference between B2B and B2C lead generation?

B2C (business-to-consumer) lead generation targets individual consumers – people shopping for insurance, mortgages, or home services. It features higher volumes, lower prices per lead, and shorter sales cycles. B2B (business-to-business) lead generation targets businesses – companies shopping for software, consulting, or enterprise solutions. It features lower volumes, higher prices per lead ($100-500+), and longer sales cycles (months vs. days). The strategies and channels differ significantly.

Are purchased leads worth it?

Purchased leads are worth it when the cost per lead is lower than your cost to generate leads internally, when the lead quality (measured by contact rate and conversion rate) meets your sales team’s needs, and when your lifetime customer value exceeds your cost per acquisition. Many businesses find purchased leads essential for scale. The key is tracking ROI rigorously and working with quality vendors. Expect 63% of leads to never answer – this is industry normal, not vendor failure.

What is ping/post in lead generation?

Ping/post is a two-stage lead distribution system used for real-time bidding. In the “ping” phase, partial lead information (without personally identifiable data) goes to potential buyers who submit bids. In the “post” phase, complete information goes only to the winning bidder(s). This system protects consumer data during evaluation, ensures buyers only receive leads they want, and creates true price discovery through auction dynamics.

How do I improve lead quality?

Improving lead quality requires systematic effort across multiple dimensions. Start by using multi-step forms that require commitment and capture qualification data. Implement phone and email validation to catch invalid data before it enters your system. Add fraud detection to filter bots and fake submissions. Track conversion rates by traffic source and eliminate underperformers ruthlessly. Use consent verification (TrustedForm/Jornaya) to document legitimate leads. Test and optimize landing pages continuously. Quality leads convert at 2-3x rates of poor-quality leads, making this investment worthwhile.

What are TCPA compliance requirements for lead generation?

TCPA (Telephone Consumer Protection Act) compliance requires Prior Express Written Consent (PEWC) before calling or texting consumers. The consent must include clear disclosure that the consumer authorizes automated marketing communications, and consent must be voluntary – not a condition of purchase. Beyond consent, you must honor Do Not Call requests within 24 hours and maintain consent documentation for at least 5 years. TCPA violations carry penalties of $500-$1,500 per call, with class action settlements averaging $6.6 million.

What technology do I need for lead generation?

Essential technology for lead generation includes several categories of tools. You need a landing page builder for capturing leads and an analytics platform for tracking performance. A lead distribution platform (boberdoo, LeadsPedia) handles routing and selling leads. Consent verification (TrustedForm, Jornaya) provides compliance documentation. Validation services verify phone and email data. A CRM manages buyer relationships. Budget $500-$2,500 monthly for platform costs plus $0.10-$0.50 per lead for validation and consent services.

Key Takeaways

A lead is packaged intent, not contact data. The combination of fresh consumer intent, valid permission, and qualifying data creates value – remove any element and value collapses.

The three-tier structure creates specialized efficiency. Generators create leads from traffic, distributors provide liquidity and matching, and buyers convert leads to revenue. Each tier adds genuine value that justifies its margin.

Speed is not optional in this business. Response time research is empirically validated: 391% higher conversion at one minute, 78% of customers buy from first responder. Every minute of delay costs money.

The lead economy represents $5-10 billion today with projections reaching $15-32 billion by early 2030s. More than 21,000 lead generation businesses operate in the United States, creating opportunities at every tier of the marketplace.

Lead quality trumps lead volume in every analysis. A source with 5% returns is worth 3x a source with 15% returns at the same CPL. Track quality metrics by source and cut underperformers quickly.

Compliance is infrastructure, not overhead. TCPA violations average $6.6 million in settlements. Consent documentation costs pennies per lead; litigation costs millions.

Success requires honest self-assessment before entry. Capital requirements range from $5,000 for affiliates to $500,000+ for brokers. Expect 3-18 months to profitability depending on model.

This guide provides educational information about the lead generation industry. Statistics current as of late 2024/early 2025. Specific metrics, regulations, and market conditions change continuously – verify current data before making business decisions.