Why some leads sell for $500 while others fetch $5 – and how understanding the four elements of lead value transforms your pricing, quality, and profitability.

Introduction: The $500 Lead vs. The $5 Lead

A personal injury lead sells for $400. A shared auto insurance lead sells for $15. An aged mortgage lead from 90 days ago sells for $3.

Why does the same fundamental product – consumer contact information with stated interest – command such wildly different prices?

The answer lies in understanding what makes a lead valuable in the first place. A lead is not merely contact data. You can buy lists of names and phone numbers for pennies per record. That commodity has existed for decades and holds minimal commercial value.

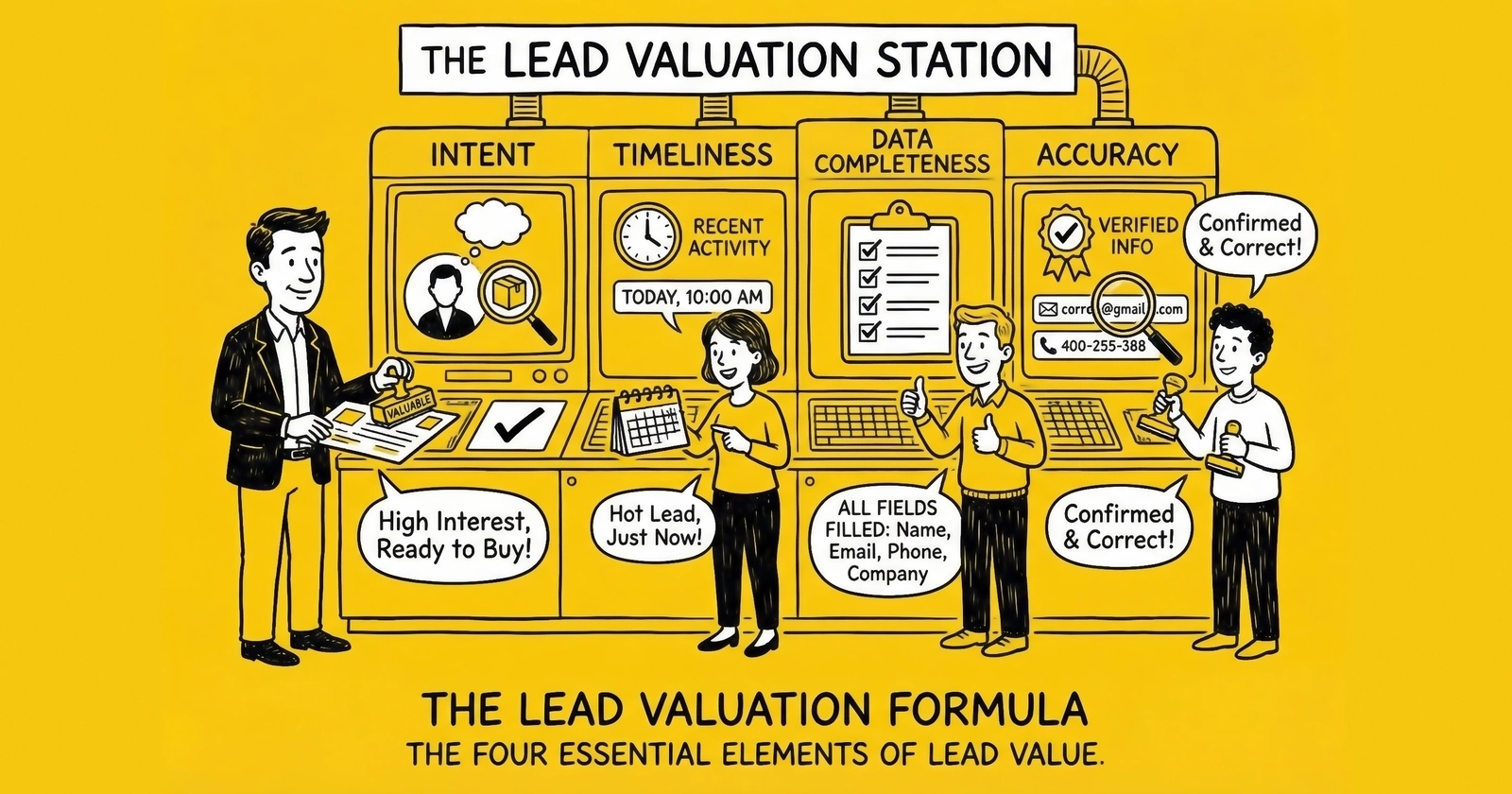

A valuable lead is something fundamentally different: consumer intent, captured at the moment of expression, packaged with verifiable permission to make contact, enriched with qualifying data, and delivered within a time window where that intent still has commercial value.

These four elements – intent, permission, data richness, and timing – combine multiplicatively to determine a lead’s market value. Remove any single element and value collapses. Optimize all four and you command premium pricing.

This article breaks down each element in detail, explains how they interact, provides CPL benchmarks across major verticals, and offers actionable strategies for maximizing lead value in your operation.

Element 1: Consumer Intent – The Raw Material of Value

What Intent Actually Means

Intent is the behavioral signal that separates a lead from a list record. When someone searches “auto insurance quotes” and fills out a comparison form, they have moved beyond awareness and consideration into active shopping. They are signaling readiness to act.

This behavioral signal is what buyers pay for. An insurance carrier will pay $50-75 for a consumer actively comparing quotes right now. They will pay $0.002 for a name on a purchased list who showed no recent intent.

The difference in value – 25,000x or more – reflects the difference in conversion probability. A consumer actively shopping converts at 10-20%. A cold list record converts at 0.01-0.1%. The economics flow directly from behavior.

How Intent is Demonstrated

Consumer intent manifests through specific actions that signal purchase readiness:

Search behavior indicates conscious need recognition. Someone searching “best solar panels for my home” has identified a problem and is seeking solutions. The search itself is evidence of intent.

Form completion represents commitment investment. The consumer took time to enter their information, answer questions, and submit a request. This friction filters casual browsers from serious shoppers.

Comparison shopping signals purchase proximity. Consumers who request multiple quotes or visit comparison sites have typically decided to buy – they are now deciding from whom.

Specific product queries indicate refined intent. A search for “Medicare Advantage plans in Florida” demonstrates more actionable intent than “what is Medicare.” The specificity correlates with purchase readiness.

Intent Strength Variations

Not all intent is equal. The strength of demonstrated intent directly affects conversion probability and lead value.

High-intent indicators:

- Specific product searches (“Geico auto insurance quote”)

- Comparison site engagement (completing multi-step forms)

- Price-focused queries (“cheapest homeowners insurance”)

- Urgency signals (“same day car insurance”)

Moderate-intent indicators:

- Category-level searches (“auto insurance”)

- Content consumption (reading “how to choose” articles)

- Tool usage (insurance calculators, savings estimators)

Low-intent indicators:

- Broad informational queries (“what is solar energy”)

- Incentivized submissions (sweepstakes entries, gift card offers)

- Co-registration checkboxes on unrelated sites

- Social media engagement without conversion action

High-intent leads command premium pricing because they convert 5-10x better than low-intent leads generated through display ads or incentivized offers.

Intent as Economic Foundation

Intent is the raw material that makes the lead economy possible. Without demonstrated consumer interest, contact data has negligible commercial value. With demonstrated intent, that same data becomes a tradeable asset worth $5-500 depending on vertical and qualification level.

Every other element of lead value builds on this foundation. Permission makes intent legally actionable. Rich data helps match intent to the right buyer. Fresh timing preserves intent before it decays. But without genuine consumer intent, the other elements have nothing to amplify.

Element 2: Permission (PEWC) – Consent Makes Leads Tradeable

Why Permission is Non-Negotiable

The Telephone Consumer Protection Act (TCPA) transformed consumer contact data from a commodity into a regulated asset. Without proper consent, contact information is not just less valuable – it is legally radioactive.

The numbers make the stakes clear. TCPA class actions reached 2,788 cases in 2024, a 67% increase over 2023. Average settlements exceed $6.6 million. Individual violations carry statutory damages of $500-1,500 per call or text. There is no cap on aggregate damages.

A company that makes 10,000 non-compliant calls faces potential exposure of $5-15 million before legal fees. This is not theoretical risk – it is weekly reality for operators who treat compliance as optional.

Permission transforms liability into opportunity. With documented Prior Express Written Consent (PEWC), the same calls that would generate seven-figure lawsuits become the foundation of profitable customer acquisition.

What Valid PEWC Requires

Prior Express Written Consent is a legal standard with specific requirements. Each element must be present for consent to be valid:

Written agreement. The consent must be documented in written form. Electronic signatures satisfying the E-SIGN Act qualify, but verbal consent does not meet this standard.

Consumer signature. The agreement must bear the signature of the person who will receive calls. Checkbox clicks, typed names, and digital signatures can qualify if properly implemented.

Clear authorization. The agreement must clearly authorize the seller to deliver marketing messages using automated technology.

Identified telephone number. The agreement must specify the phone number to which calls will be directed.

Not a condition of purchase. Consent cannot be required as a condition of buying products or services. This prevents burying consent in mandatory terms of service.

Clear and conspicuous disclosure. The consent language must be apparent to a reasonable consumer – not hidden in fine print or accessible only through hyperlinks.

Documentation Creates Defensibility

Obtaining consent is necessary but not sufficient. You must be able to prove consent existed at the time of contact. The burden of proof rests with the caller – if you cannot demonstrate valid consent, courts presume non-compliance.

Essential documentation elements for each lead include:

- Timestamp of consent (exact date and time, tamper-proof format)

- IP address of submission (establishes a real person, not a bot)

- Exact consent language displayed to the consumer

- Evidence of affirmative consumer action (checkbox selection, signature)

- Specific phone number for which consent was granted

- URL and configuration of the consent form

- Session recording or replay capability

Third-party verification services like TrustedForm and Jornaya have become industry standard for consent documentation. These platforms capture independent evidence of consent that can be presented in litigation.

However, having a verification certificate does not guarantee compliance. The certificate documents what happened – it does not ensure what happened was compliant. A certificate that captures a deficient disclosure simply documents your non-compliance.

The Value of Clean Consent

Leads with robust consent documentation command higher prices for practical reasons. Buyers face the same TCPA exposure as generators – when they purchase a lead and make calls, they inherit the consent risk.

Sophisticated buyers demand consent certificates, audit generator practices, and pay premiums for leads with bulletproof documentation. The 10-15% price premium for verified consent reflects the reduction in legal exposure buyers receive.

For generators, investing $0.15-0.50 per lead in consent verification is not a cost – it is a value-creation investment. The alternative is either selling to unsophisticated buyers at discount prices or accepting liability that can reach millions in a single lawsuit.

Element 3: Rich Data – Qualification Fields That Increase Value

Beyond Name and Phone Number

A lead containing only name and phone number has limited commercial value. The buyer knows someone expressed interest – but they know nothing about whether that person matches their ideal customer profile.

Rich data transforms leads from generic interest signals into qualified opportunities. Each additional data point helps buyers route leads more precisely, customize their sales approach, and predict conversion probability.

High-Value Data Fields by Vertical

The data fields that create value vary by vertical, but certain categories consistently increase lead pricing:

Insurance leads gain value from:

- Vehicle year, make, model (auto)

- Current coverage status and carrier

- Driving history and violations

- Home ownership and property details

- Credit tier or stated credit range

- Bundling interest (auto + home)

Mortgage leads gain value from:

- Property value and loan amount

- Loan purpose (purchase vs. refinance)

- Credit score or stated range

- Down payment amount

- Property type and occupancy

- Timeline to purchase

Solar leads gain value from:

- Roof age and condition

- Monthly electricity bill amount

- Homeownership verification

- Roof shade and orientation factors

- Financing preference (loan vs. lease vs. purchase)

- Timeline for installation

Legal leads gain value from:

- Incident date and location

- Injury severity indicators

- Medical treatment status

- Existing representation status

- Insurance coverage of opposing party

How Data Depth Affects Pricing

The correlation between data richness and lead price is direct and substantial. Consider auto insurance leads:

| Data Depth | Typical CPL | Conversion Rate |

|---|---|---|

| Name, phone, zip only | $10-20 | 3-5% |

| Basic vehicle and coverage info | $25-40 | 6-8% |

| Full vehicle, driving history, current carrier | $45-65 | 8-12% |

| Above + credit tier and bundling interest | $60-85 | 10-15% |

The pricing premium for richer data reflects genuine value to buyers. A carrier can route a lead with credit tier and bundling interest to the exact product team best positioned to close that customer. A lead with only name and phone requires expensive discovery work before any meaningful sales conversation can begin.

The Qualification Trade-off

Form length and data capture present an inherent trade-off. Each additional field reduces form completion rates while increasing the value of leads that do complete.

Multi-step forms – where consumers answer qualifying questions before providing contact information – convert 86% higher than single-page forms in many studies. The commitment escalation psychology works in your favor: once someone has invested effort answering questions, they are more likely to complete the process.

Data Verification Adds Value

Raw data captured from forms is only as valuable as its accuracy. Consumers misremember, estimate, or occasionally fabricate information. Data validation and verification create additional value.

Validation confirms data format correctness. A validated phone number has proper digit count, valid area code, and passes basic format checks.

Verification confirms data accuracy. A verified phone number has been checked against carrier databases to confirm it is active and assigned to the stated individual.

The verification stack that sophisticated practitioners deploy includes phone validation and carrier lookup, email deliverability confirmation, address standardization, identity verification, and fraud detection. Each layer adds cost ($0.02-0.25 per check) but verified leads command premiums that exceed verification costs.

Element 4: Timing (Freshness) – The Decay Curve Explained

Why Leads Are Perishable Assets

Consumer intent does not persist indefinitely. The person who filled out a solar quote form at 2 PM is highly motivated. By 6 PM, they have cooled off. By tomorrow, they have forgotten why it seemed urgent. By next week, they have either purchased from someone else or moved on entirely.

This decay is not gradual – it follows a curve that drops steeply in the first hours and continues declining over days. Research consistently shows leads lose approximately 50% of their value within 48 hours without contact, with the steepest decline occurring in the first hour.

The Speed-to-Contact Research

Multiple studies have documented the relationship between response time and conversion, with remarkably consistent findings:

391% conversion boost for one-minute response. Velocify research found that responding within one minute increases conversion rates by 391%. The consumer is still at their device, still thinking about the product, still available to engage.

21x higher qualification at five minutes. The Lead Response Management Study demonstrated that leads contacted within five minutes are 21 times more likely to qualify compared to leads contacted at 30 minutes. The gap widens dramatically with each additional minute.

78% buy from the first responder. The Lead Connect Survey found that 78% of customers purchase from the company that responds first. Not the best product. Not the lowest price. The first one to make contact.

100x better outcomes in mortgage. Industry research shows leads contacted within five minutes produce 100x better outcomes than those contacted after 30 minutes. The velocity advantage is extreme.

These statistics are not marginal improvements. They represent order-of-magnitude differences that determine whether lead investments produce returns or losses.

The Value Decay Timeline

Lead value follows a predictable decay pattern across most verticals:

| Time Since Capture | Relative Value | Characteristics |

|---|---|---|

| 0-5 minutes | 100% | Consumer engaged, topic top-of-mind |

| 5-30 minutes | 80-90% | Moderate decay, still active session |

| 1-4 hours | 60-80% | Attention has shifted, recall declining |

| 4-24 hours | 40-60% | Significant decay, competing priorities |

| 24-48 hours | 20-40% | Intent largely dissolved |

| 2-7 days | 10-20% | May have purchased elsewhere |

| 7-30 days | 5-15% | Aged lead territory |

| 30+ days | 2-10% | Bulk/recycled pricing |

Aged Leads as a Separate Product

Aged leads (typically 7+ days old) represent a distinct market segment with different economics. They price at 5-20% of fresh lead value – a $50 fresh auto lead might sell for $3-10 at 30 days old.

Despite the price discount, aged leads can deliver profitable economics for operators who have call center capacity to work high volumes at low cost per attempt, use systematic multi-touch follow-up sequences, accept lower conversion rates as part of the unit economics, and segment aged inventory by source quality and recency.

How These Elements Combine for Maximum Value

The Multiplicative Effect

Lead value is not additive – it is multiplicative. Each element amplifies or diminishes the others:

| Scenario | Intent | Permission | Data | Timing | Value |

|---|---|---|---|---|---|

| A | High | Valid PEWC | Rich | Fresh | Maximum |

| B | High | Valid PEWC | Basic | Fresh | High |

| C | High | Valid PEWC | Rich | Aged | Moderate |

| D | High | Questionable | Rich | Fresh | Risky |

| E | Low | Valid PEWC | Rich | Fresh | Low |

Scenario A – high intent, documented consent, rich data, fresh timing – commands premium pricing because every element is optimized. Remove any single element and value drops significantly.

Scenario D illustrates how questionable consent undermines everything else. Even with high intent, rich data, and fresh timing, the legal risk transforms the lead from an asset into a liability.

Scenario E shows that bulletproof consent and perfect data cannot salvage low intent. If the consumer was not genuinely shopping, no amount of documentation makes them valuable.

Optimization Priorities

When improving lead quality, prioritize elements in this order:

-

Permission first. No other improvements matter if consent is deficient. Legal exposure outweighs any revenue opportunity.

-

Intent second. Traffic quality determines baseline conversion potential. High-intent traffic with minimal data still converts better than low-intent traffic with extensive data.

-

Timing third. Speed compounds all other advantages. Fresh leads with basic data outperform aged leads with rich data in most scenarios.

-

Data fourth. Once consent, intent, and timing are optimized, data enrichment provides incremental value that improves routing and conversion.

Lead Value by Vertical: CPL Benchmarks

Insurance Lead Benchmarks

| Sub-Vertical | CPL Range | Exclusive Premium |

|---|---|---|

| Auto Insurance | $15-75 | 2-3x shared |

| Home Insurance | $20-100 | 2-3x shared |

| Medicare | $30-150 | 2-3x shared |

| Health Insurance | $30-150 | 2x shared |

| Life Insurance | $25-150 | 2x shared |

Insurance represents the largest lead generation vertical, with $5-7 billion in annual transaction value. Pricing fluctuates with carrier underwriting cycles – when carriers are profitable and growing, lead demand and prices surge. When underwriting losses force pullbacks, prices compress.

Mortgage Lead Benchmarks

| Lead Type | CPL Range | Notes |

|---|---|---|

| Purchase | $50-150 | Higher during active housing markets |

| Refinance | $30-100 | Highly rate-sensitive |

| Home Equity | $40-120 | Growing segment |

| Reverse Mortgage | $50-200 | Senior demographic targeting |

Mortgage leads are the most rate-sensitive vertical. When interest rates drop, refinance volume surges and lead prices spike. When rates rise, demand contracts dramatically.

Solar Lead Benchmarks

| Qualification Level | CPL Range | Key Factors |

|---|---|---|

| Basic Interest | $20-50 | Minimal qualification |

| Homeowner Verified | $50-100 | Property ownership confirmed |

| Utility Bill Qualified | $75-150 | Bill amount indicates savings potential |

| Roof + Credit Qualified | $100-200 | Pre-qualified for installation |

| Appointment Set | $150-300 | Scheduled consultation |

Solar leads demonstrate dramatic geographic variation. Customer acquisition cost in California averages $1,929 per closed sale versus approximately $225 in North Dakota – an 8.5x spread.

Legal Lead Benchmarks

| Practice Area | CPL Range | Case Value Basis |

|---|---|---|

| Personal Injury | $150-400 | High case values, contingency model |

| Mass Tort | $100-400 | Volume-dependent on active litigations |

| Workers Compensation | $100-300 | Employer insurance limits |

| Family Law | $50-200 | Hourly billing model |

| Criminal Defense | $50-150 | Retainer-based |

Legal leads command the highest CPLs in lead generation because case values often reach six or seven figures. A personal injury lead that converts to a signed case with a $500,000 settlement generates $150,000+ in contingency fees – making even a $400 lead economical.

Exclusive vs. Shared Leads: How Distribution Affects Value

The Economic Trade-off

The choice between exclusive and shared distribution fundamentally shapes lead economics for both generators and buyers.

Exclusive leads sell to exactly one buyer. The generator receives higher per-lead revenue but sells each lead only once. The buyer pays premium pricing but faces no competition for the prospect’s attention.

Shared leads sell to multiple buyers (typically 3-7). The generator receives lower per-buyer revenue but multiplies it across multiple sales. Each buyer pays less but competes with others for the same consumer.

Pricing and Conversion Differentials

Exclusive leads typically command 2-3x the pricing of shared leads:

| Lead Type | Shared CPL | Exclusive CPL | Multiple |

|---|---|---|---|

| Auto Insurance | $15-25 | $40-75 | 2-3x |

| Medicare | $30-50 | $80-150 | 2-3x |

| Solar | $40-75 | $100-200 | 2-3x |

| Mortgage | $35-60 | $80-150 | 2-2.5x |

Exclusive leads consistently convert at higher rates – often 50-100% higher in comparable conditions. The conversion advantage comes from:

- No race-to-call pressure that frustrates consumers

- More investment in each prospect (higher lead cost justifies deeper follow-up)

- Often higher quality sources (publishers maintaining exclusive pricing invest in quality)

- Better consumer experience (one professional call versus barrage of competing agents)

Which Approach Wins?

Neither exclusive nor shared distribution is universally superior. The optimal approach depends on buyer characteristics:

Exclusive works best for: Independent agents and smaller agencies, operations lacking call center infrastructure for speed competition, buyers seeking relationship-building, markets where conversion rate matters more than volume.

Shared works best for: Large carriers with sophisticated call center operations, operations that compete effectively on speed, buyers seeking scale with lower per-lead risk.

Measuring and Improving Lead Value

The Metrics That Matter

Tracking lead value requires metrics that capture all four elements and their interaction:

Intent indicators: Source-level conversion rates, form completion rates by traffic source, time on site before submission, search term or ad creative performance.

Permission metrics: Consent certificate capture rate, certificate claim and verification rate, return rate for consent-related issues, litigation exposure tracking.

Data quality metrics: Validation pass rates (phone, email, address), field completion rates by form step, data accuracy from buyer feedback.

Timing metrics: Lead age at delivery, time to first contact attempt, contact rate by lead age cohort, conversion rate by response time.

Improvement Strategies by Element

Improving intent: Shift traffic mix toward higher-intent channels (search vs. display), test landing page messaging for purchase-ready language, add friction that filters tire-kickers, monitor source-level conversion and cut underperformers.

Improving permission: Audit consent language against current regulatory requirements, implement third-party consent verification (TrustedForm, Jornaya), document E-SIGN compliance for electronic consent.

Improving data richness: Test multi-step forms against single-page designs, add qualifying questions that buyers value (credit tier, timeline), implement real-time validation to improve accuracy.

Improving timing: Reduce transmission latency (real-time API vs. batch), track and optimize lead delivery speed, establish buyer SLAs for speed-to-contact.

Frequently Asked Questions

What is the most important factor in determining lead value?

Consumer intent is the foundation – without genuine purchase interest, no amount of data richness or consent documentation creates value. However, permission (PEWC) is the most critical element to get right because deficient consent transforms an asset into a legal liability. Intent determines potential value; permission determines whether that value can be realized.

How much does lead value decay over time?

Lead value decays approximately 50% within 48 hours without contact, with the steepest decline in the first hour. Research shows leads contacted within one minute convert 391% better. By 30 days, leads typically retain only 5-15% of their original value.

What is the difference between exclusive and shared leads?

Exclusive leads sell to one buyer only. Shared leads sell to multiple buyers (typically 3-7). Exclusive leads command 2-3x higher pricing and convert at 50-100% higher rates. The choice depends on buyer capabilities – large call centers often prefer shared leads; independent agents typically prefer exclusive.

How do I know if my consent documentation is sufficient?

Valid Prior Express Written Consent requires: written agreement, consumer signature, clear seller authorization, identified phone number, not a condition of purchase, and clear and conspicuous disclosure. Third-party verification through TrustedForm or Jornaya provides independent documentation. Consult TCPA-specialized legal counsel to audit your specific consent flows.

What CPL should I expect by vertical?

Ranges vary significantly: Auto insurance $15-75, Medicare $30-150, mortgage $35-150, solar $50-200, legal $100-400. Premium pricing requires optimization across all four value elements.

Why do legal leads cost so much more than insurance leads?

Legal leads command $200-500 for personal injury because case values can reach hundreds of thousands of dollars. A $400 lead that converts at 3% yields $13,333 cost per signed case – still highly profitable when case fees exceed $100,000.

How does speed-to-contact affect conversion rates?

Research shows 78% of customers purchase from the first responder. Leads contacted within one minute convert 391% better. Leads contacted within five minutes are 21x more likely to qualify than those contacted at 30 minutes.

What data fields add the most value to leads?

High-value fields vary by vertical but generally include: current coverage status, stated budget or income range, credit tier, purchase timeline, and specific product interests. Fields that help buyers route leads precisely add more value than generic demographic information.

Should I invest in consent verification services?

Yes. TrustedForm or Jornaya certificates cost $0.15-0.50 per lead but provide independent documentation that can defend against TCPA litigation. Given average settlements exceed $6.6 million, the ROI on verification is substantial. Sophisticated buyers increasingly require certificates.

How can I improve lead quality without reducing volume?

Focus on improvements that filter quality rather than reducing traffic: multi-step forms that qualify intent, real-time validation that catches fraud, source-level performance tracking that identifies underperformers, and consent verification that documents compliance.

Key Takeaways

-

A lead is four elements combined: consumer intent, documented permission, rich qualifying data, and fresh timing. Missing any element degrades value; missing permission creates legal liability.

-

Intent is the foundation: Without genuine consumer interest, no optimization makes a lead valuable. High-intent traffic converts 5-10x better than low-intent.

-

Permission is non-negotiable: TCPA class actions reached 2,788 cases in 2024 with settlements averaging $6.6 million. Valid PEWC transforms liability into opportunity.

-

Data richness drives routing and conversion: Leads with full qualification data command 50-100% premiums over basic leads.

-

Timing follows a decay curve: Lead value drops 50% within 48 hours. Leads contacted within one minute convert 391% better.

-

Exclusive leads command 2-3x shared pricing and convert 50-100% higher – but shared leads work for buyers with call center infrastructure optimized for speed competition.

-

Vertical economics vary dramatically: Auto insurance leads trade at $15-75, legal leads at $150-400. The difference reflects customer lifetime value.

-

Optimization is multiplicative: Improving any single element compounds with improvements in others. A systematic approach maximizes total lead value.

Industry data and regulatory information current as of December 2025. Lead pricing, conversion rates, and compliance requirements evolve continuously. Validate current market conditions and consult qualified legal counsel before making significant business decisions.