How agencies, consultants, and entrepreneurs build profitable lead businesses without generating a single lead themselves.

Introduction: The White Label Opportunity

A marketing agency closes a new client who needs 500 mortgage leads monthly. The agency has never generated a mortgage lead in its existence. They have no landing pages, no compliance infrastructure, no buyer relationships in the mortgage vertical, and no time to build these capabilities before the client expects delivery.

Three weeks later, the client receives their first batch of leads – delivered through a portal branded with the agency’s logo, accompanied by the agency’s reports, and invoiced at the agency’s rates. The client has no idea the leads originated from a specialized white label partner halfway across the country.

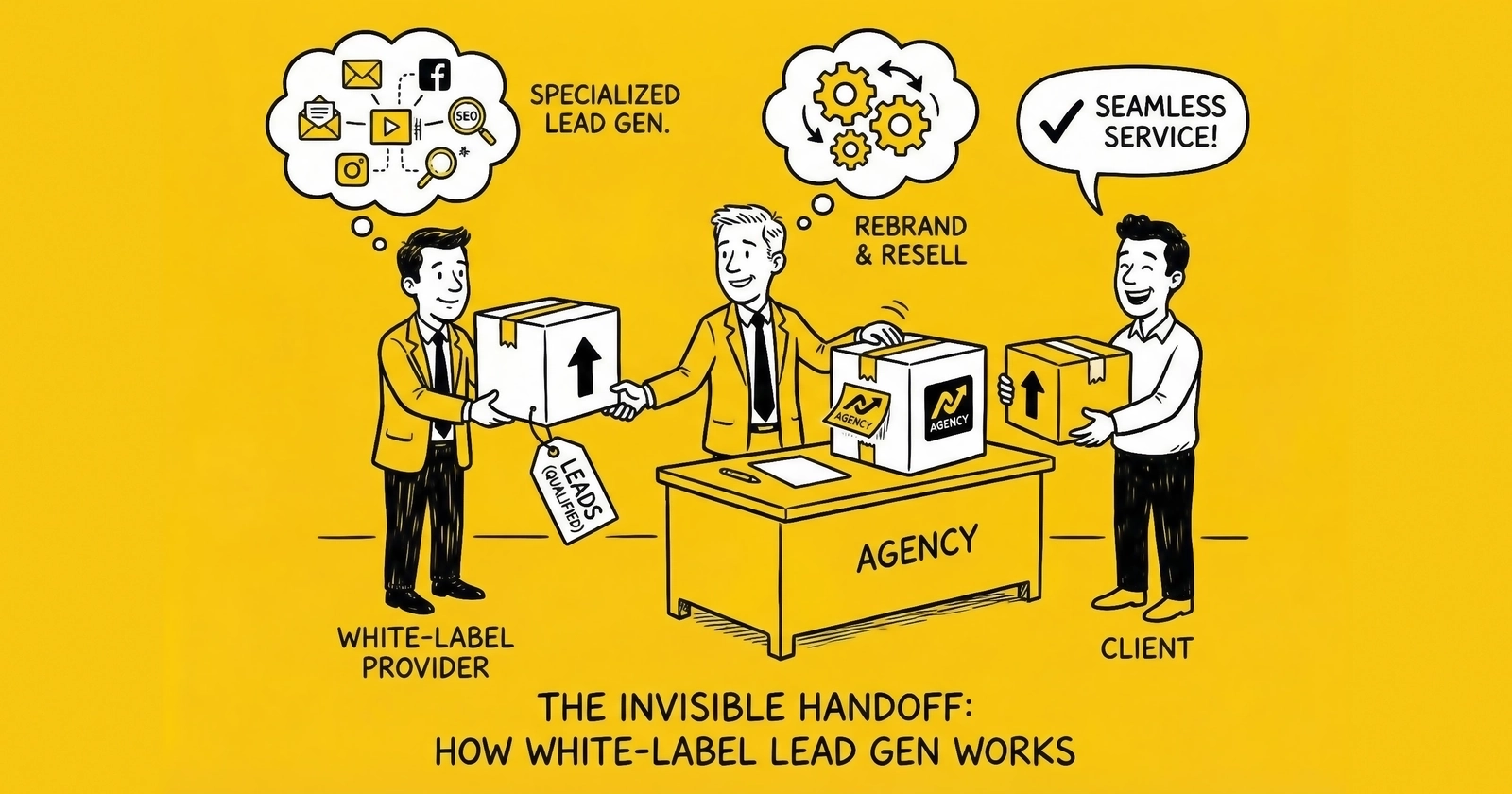

This is white label lead generation: the business model where one company generates leads and another company sells them as their own. The arrangement benefits everyone involved. The white label provider gains distribution without sales overhead. The reseller gains product without production overhead. The end client gains leads from a trusted advisor who coordinates rather than creates.

The white label lead generation market has grown substantially as agencies recognize they cannot be experts in every vertical and specialized generators recognize they cannot efficiently serve every small buyer. Industry data suggests the reseller model now accounts for 15-25% of total lead volume in verticals like insurance, solar, and home services – anywhere that end buyers are fragmented and relationship selling matters.

This guide covers everything you need to know about white label lead generation: how to evaluate the opportunity, how to select partners, how to structure profitable arrangements, and how to avoid the pitfalls that sink underprepared resellers.

What Is White Label Lead Generation?

White label lead generation occurs when one company produces leads that another company rebrands and sells as their own product. The term “white label” comes from the practice of shipping products with blank labels, allowing the retailer to add their own branding before sale.

How the White Label Model Works

The typical white label arrangement involves three parties:

The White Label Provider generates leads through their own traffic sources, landing pages, and conversion infrastructure. They handle the technical and operational complexity: managing ad platforms, optimizing landing pages, processing consent documentation, validating contact information, and routing leads to their reseller partners.

The Reseller (often a marketing agency, consultant, or vertical specialist) sells leads to end clients under their own brand. They manage the client relationship, set pricing, handle customer service, and often provide additional value through strategy, reporting, or integration services.

The End Buyer purchases leads believing they come from the reseller. They receive leads branded with the reseller’s identity, delivered through the reseller’s systems, and supported by the reseller’s team. The white label provider remains invisible.

White Label vs. Affiliate vs. Broker: Understanding the Differences

These three models are often confused but operate quite differently:

| Model | Who Owns the Client | Who Brands the Product | Who Sets Pricing | Risk Profile |

|---|---|---|---|---|

| White Label | Reseller | Reseller | Reseller | Reseller bears client risk |

| Affiliate | Advertiser/Network | Advertiser | Advertiser | Publisher bears traffic risk |

| Broker | Broker | Broker (usually) | Broker | Broker bears inventory risk |

Affiliate publishers drive traffic to someone else’s offers and earn commission per lead or action. They don’t own the client relationship – the advertiser or network does. Affiliates are paid based on the advertiser’s rates, not their own pricing decisions.

Brokers purchase leads from generators and resell them, taking title to the inventory. They bear the risk of returns and price fluctuations. Brokers typically work with many suppliers and many buyers, operating as market makers.

White label resellers don’t generate leads or take inventory risk. They represent a lead generation capability to their clients while a partner produces the actual leads. The reseller owns the client relationship and sets their own pricing, but doesn’t own inventory between purchase and sale.

The key distinction: white label is a fulfillment arrangement where the reseller controls the client relationship and margin, while the provider handles production. It’s closer to private-label manufacturing than to financial trading.

Why Companies Choose White Label Lead Generation

For Resellers: Expanding Service Offerings Without Building Infrastructure

Marketing agencies constantly face the “build vs. partner” decision. A client needs Medicare leads, but the agency specializes in home services. Building Medicare lead generation capability from scratch would require:

- Learning a completely new vertical with unique compliance requirements

- Developing landing pages and conversion flows specific to Medicare

- Establishing relationships with Medicare Advantage buyers

- Implementing CMS-compliant consent capture and documentation

- Training staff on Medicare enrollment periods and regulations

The investment might total $100,000-$200,000 and take 12-18 months before generating meaningful revenue. If the client churns in month six, that investment becomes a loss.

White label partnerships solve this problem. The agency can say “yes” to the Medicare opportunity immediately, fulfill through a specialized partner, capture margin on the relationship, and avoid the infrastructure investment entirely. If the client churns, the agency loses revenue but not sunk capital.

Common reseller types include:

- Full-service marketing agencies adding lead generation to their service mix

- Vertical consultants who advise industries but lack fulfillment capabilities

- Sales organizations seeking warm leads for their teams

- Technology providers bundling leads with their software platforms

- Regional specialists serving local markets without national infrastructure

For White Label Providers: Distribution Without Sales Overhead

Lead generation companies excel at production: traffic acquisition, conversion optimization, compliance infrastructure, and quality control. Many of them struggle with sales – particularly sales to small and medium buyers who require relationship management but purchase modest volumes.

Consider a lead generator producing 50,000 solar leads monthly. They might efficiently serve 10 buyers purchasing 3,000+ leads each. But reaching the thousands of local installers who need 50-200 leads monthly would require a sales team, support infrastructure, and billing systems that don’t scale efficiently at low volumes.

White label partnerships provide distribution through partners who already have client relationships. The generator focuses on production efficiency; resellers handle client acquisition and retention. Each party contributes their core competency.

For providers, white label relationships offer:

- Stable volume commitments from partners with client portfolios

- Reduced customer service burden as resellers handle end-client support

- Predictable revenue through contractual minimums

- Access to markets the provider couldn’t efficiently reach directly

For End Clients: Access to Quality Without Complexity

End buyers often prefer working with trusted advisors over anonymous vendors. An insurance agency might trust their marketing consultant’s lead recommendation more than a cold pitch from an unknown lead company. The consultant’s endorsement transfers credibility.

Clients also benefit from consolidated vendor relationships. Rather than managing separate vendors for SEO, paid advertising, email marketing, and lead generation, they work with a single agency that coordinates everything. The agency’s white label partnerships remain invisible, but the client receives integrated service.

The Economics of White Label Lead Generation

Understanding the economics requires examining both sides of the arrangement: what providers charge and what resellers can earn.

Typical Pricing Models

White label providers generally offer three pricing structures:

Flat Rate Per Lead: The provider charges a fixed price per delivered lead regardless of what the reseller charges their client. Example: Provider charges $25 per auto insurance lead; reseller sells at $40-50.

Percentage Markup: The provider sets a base price and the reseller adds their margin. Example: Base cost of $30 plus 30-40% reseller margin yields client price of $39-42.

Volume Tiers: Pricing improves as volume increases, rewarding resellers who aggregate demand. Example: $45 per lead for 100-499 monthly, $38 for 500-999 monthly, $32 for 1,000+ monthly.

Margin Realities for Resellers

Reseller margins typically range from 20-40% of the end client price. This sounds attractive, but several factors compress realized margins:

Client returns and disputes: When clients reject leads as invalid or low-quality, resellers often credit them while still owing the provider. A 10% return rate on the client side without corresponding credits from the provider can eliminate half your margin.

Payment timing gaps: Clients typically pay Net-30 or Net-45 while providers may require prepayment or Net-15 terms. This float costs money, particularly at scale.

Account management overhead: Client relationships require time – answering questions, generating reports, handling complaints, renegotiating terms. This labor cost often isn’t fully accounted in margin calculations.

Platform and technology costs: White label portals, CRM integrations, and reporting tools add $200-500 monthly in overhead that spreads across client volumes.

Here’s how the math often plays out:

| Line Item | Example |

|---|---|

| Client payment per lead | $50.00 |

| Provider cost per lead | $35.00 |

| Gross margin | $15.00 (30%) |

| Client returns (8%) | -$4.00 |

| Float cost (2%) | -$1.00 |

| Technology/overhead | -$1.50 |

| Account management (allocated) | -$2.00 |

| Net margin per lead | $6.50 (13%) |

At 1,000 leads monthly, that’s $6,500 in profit – viable but requiring efficiency. At 100 leads monthly, the $650 barely covers the time invested. White label reselling rewards scale.

Minimum Volume Requirements

Most white label providers require volume minimums to justify the relationship overhead:

| Vertical | Typical Monthly Minimum |

|---|---|

| Auto Insurance | 200-500 leads |

| Mortgage | 100-300 leads |

| Solar | 100-250 leads |

| Home Services | 150-400 leads |

| Legal | 50-100 leads |

These minimums matter. If you can only guarantee 50 leads monthly, many providers won’t engage – or will charge premium rates that destroy your margins. Aggregate client demand before approaching providers.

Provider Economics

From the provider’s perspective, white label arrangements trade margin for distribution efficiency and payment reliability:

Lower margins per lead: Providers typically discount 15-25% from their direct-sale prices to attract white label partners.

Lower customer acquisition cost: The reseller handles client acquisition, eliminating provider sales expense.

More predictable volume: Committed minimums from reseller partners enable better capacity planning.

Faster payment: Many providers require prepayment or weekly billing from white label partners, reducing float exposure.

A provider might accept $35 per lead from a white label partner who purchases 2,000 leads monthly with prepayment, versus $45 per lead selling directly to end clients who require Net-45 terms and average 100 leads monthly. The math often favors the white label arrangement.

Evaluating the White Label Opportunity

Before pursuing white label partnerships, assess whether the model fits your situation.

Who Should Consider White Label Reselling

White label lead generation works best for:

Marketing agencies with existing client relationships who want to expand services without building new competencies. If clients already trust you for other services, adding lead generation creates cross-sell revenue on established relationships.

Vertical consultants with industry expertise who advise businesses in specific industries. Insurance consultants, solar advisors, mortgage coaches – these specialists have credibility and client access but lack fulfillment infrastructure.

Sales organizations needing lead supply for their teams. Rather than building lead generation capability, they partner with providers and focus on conversion.

Technology companies bundling leads with software. A CRM vendor might partner with lead providers to offer “leads included” packages that increase platform stickiness.

Regional players serving local markets where national lead generators lack presence or interest. Local relationships plus remote fulfillment can work well.

Who Should Avoid White Label Reselling

White label arrangements work poorly for:

Companies without existing client relationships. Building a client base from scratch while simultaneously managing white label relationships means struggling on two fronts. You’re better off choosing one path.

Operators who want to build equity in traffic sources. White label reselling builds relationship equity, not traffic equity. If you want to own traffic sources that appreciate over time, direct generation is a better path.

Highly price-sensitive buyers who comparison shop aggressively. Your margin comes from relationship value, not price competitiveness. If clients can easily find the same leads cheaper elsewhere, the model breaks down.

Those uncomfortable with dependency. Your product comes from a partner you don’t control. If they raise prices, reduce quality, or exit the market, your business is immediately affected.

Self-Assessment Framework

Before pursuing white label partnerships, answer these questions honestly:

-

Do you have clients who need leads you cannot currently provide? If yes, quantify the demand – verticals, volumes, geographies, and price sensitivity.

-

Can you add meaningful value beyond lead fulfillment? If you’re purely reselling with no additional service, clients can eventually disintermediate you.

-

Do you have the capital for float and minimum commitments? White label arrangements require upfront payments and ongoing commitments even when client demand fluctuates.

-

Can you handle client service for leads you didn’t generate? When clients complain about quality, you’re on the front line. Can you effectively resolve issues you didn’t create?

-

Are your clients relationship-oriented or transaction-oriented? Relationship buyers value your curation and support. Transaction buyers will eventually shop for better prices.

If you answered “no” to more than one of these questions, white label reselling may not be your best path.

Finding and Vetting White Label Partners

Partner selection determines white label success more than any other factor. A poor partner delivers poor leads, damages your client relationships, and creates liability exposure. A strong partner becomes a competitive advantage.

Where to Find White Label Providers

Industry events and conferences: LeadsCon, Affiliate Summit, and vertical-specific conferences bring providers and resellers together. Many white label relationships begin as conference conversations.

Lead distribution platform networks: Platforms like boberdoo, LeadsPedia, and Phonexa maintain ecosystems of publishers, some of whom offer white label arrangements.

Referrals from non-competing agencies: Agencies in different geographies or verticals often share supplier information. Ask peers who they work with.

Industry publications and directories: Lead generation trade publications feature providers seeking distribution partners.

Direct outreach to lead generators: Many established generators don’t actively market white label programs but will consider arrangements when approached. Research companies generating leads in your target verticals and inquire directly.

Essential Due Diligence Questions

Before committing to any white label partnership, verify the following:

Quality and Compliance

How do you capture consent? Demand specifics: What disclosure language do consumers see? What consent documentation services do they use (TrustedForm, Jornaya, other)? Request sample certificates.

What is your current return rate across your reseller partners? Honest providers will share ranges. Anything above 15% warrants scrutiny. Below 8% suggests strong quality control.

How do you validate leads before delivery? Phone validation, email verification, fraud detection – understand their quality stack.

What happens when a lead is returned? Understand the return policy, documentation requirements, and credit process.

Can you provide references from current reseller partners? Speak with existing partners about their experience. Ask specifically about quality consistency, support responsiveness, and issue resolution.

Operations and Capacity

What volume can you reliably support in my target verticals and geographies? Ensure they have production capacity matching your client needs.

What is your typical lead delivery latency? Fresh leads should deliver within seconds of capture. Delays indicate infrastructure limitations or inventory warehousing.

What reporting will I receive? Understand what visibility you’ll have into volume, quality metrics, and delivery status.

How do you handle volume fluctuations? If your client needs spike during a busy season, can the provider scale? If demand drops, what are your obligations?

What is your technology stack for lead delivery? API integration, portal access, CRM connectors – understand how leads will actually reach your clients.

Business Terms

What are the minimum volume commitments? Understand both initial commitments and ongoing requirements.

What are the payment terms? Prepayment, weekly billing, Net-15, Net-30 – understand cash flow implications.

What exclusivity requirements exist? Can you work with multiple providers in the same vertical, or does this partnership require exclusivity?

What termination provisions apply? How much notice is required? What happens to prepaid balances?

Is there liability indemnification? If a lead creates TCPA liability, who bears responsibility? Strong providers indemnify resellers for leads they produce.

Red Flags That Indicate Problems

Avoid providers who:

-

Cannot or will not provide consent documentation samples. This suggests compliance gaps that could become your liability.

-

Resist providing reseller references. Good providers have satisfied partners willing to speak on their behalf.

-

Promise unrealistically low prices. If they’re 30% below market, they’re likely cutting corners somewhere – quality, compliance, or both.

-

Can’t explain their traffic sources clearly. “We have proprietary sources” without any specifics is a warning sign. Legitimate providers describe their acquisition channels.

-

Require unusually long commitments upfront. Asking for 12-month commitments before you’ve tested the product suggests they don’t trust their own quality to retain you.

-

Have inconsistent or conflicting stories. If their sales team and operations team describe different processes, internal chaos will become your problem.

Running a Pilot Program

Never commit to significant volume without testing. Structure a pilot program:

Duration: 30-60 days is sufficient to assess quality patterns.

Volume: 100-500 leads depending on your vertical, enough to reach statistical significance on quality metrics.

Metrics to track: Return rate, contact rate (if available), client feedback, delivery latency, reporting accuracy, and issue resolution speed.

Decision criteria: Define acceptable thresholds before the pilot begins. “If return rate exceeds 12%, we will not proceed” is clearer than “we’ll evaluate quality.”

Exit terms: Ensure the pilot agreement allows termination if thresholds aren’t met.

A $5,000 pilot that prevents a $50,000 mistake is excellent insurance.

Structuring White Label Partnerships

Once you’ve selected a partner, structure the relationship to protect your interests and enable profitable operations.

Essential Contract Elements

Volume commitments and flexibility: Define minimum monthly volumes, but negotiate flexibility for demand fluctuations. Many resellers fail because they commit to volumes their clients don’t materialize, then pay for unused capacity.

Pricing and adjustment provisions: Lock pricing for meaningful periods (6-12 months minimum), with clear provisions for adjustments. Understand what triggers price changes and how much notice you’ll receive.

Quality standards and return policies: Define what constitutes a valid lead, what returns are accepted, and what documentation is required for returns. Ambiguous return policies create disputes.

Delivery specifications: Lead fields, format, delivery method (API, portal, email), delivery timing, and technical requirements.

Branding and white labeling scope: What branding appears where? Can you fully customize the client portal? What about consent certificates and documentation?

Compliance responsibilities: Who is responsible for TCPA compliance? What indemnification exists? Who maintains consent records and for how long?

Termination provisions: Notice periods, refund of prepaid balances, transition assistance, and non-compete provisions.

Exclusivity Considerations

Providers often request exclusivity – you work with them alone in a specific vertical. Consider carefully:

Risks of exclusivity: If your sole provider raises prices, reduces quality, or exits the market, you have no backup. You’re entirely dependent on one partner.

Potential benefits of exclusivity: Exclusive partners often receive better pricing, priority during capacity constraints, and more responsive support.

Middle ground approaches: Geographic or volume-based exclusivity can provide benefits while limiting risk. “Exclusive for California solar” is less risky than “exclusive for all solar everywhere.”

Many experienced resellers maintain two to three providers per vertical, even if one receives the majority of volume. Backup relationships provide insurance and negotiating leverage.

Scaling the Relationship

Start with conservative commitments and scale based on proven performance:

Phase 1 (Months 1-3): Minimum viable commitment, close monitoring of quality metrics, frequent communication with provider.

Phase 2 (Months 4-6): Increase volume if Phase 1 metrics are acceptable. Negotiate improved pricing based on track record.

Phase 3 (Months 7-12): Stabilize at target volume. Begin discussions about additional verticals, expanded geographies, or new product types.

Ongoing: Annual reviews of pricing, performance, and relationship terms. Markets change; partnerships should evolve.

Operating a White Label Lead Business

Successful white label operations require disciplined execution across several dimensions.

Managing Client Relationships

Your clients pay you for leads. They don’t know or care about your provider relationship. You own the experience.

Set appropriate expectations: Don’t promise what your provider can’t deliver. If you commit to 95% contact rates when your provider delivers 75%, you create dissatisfaction regardless of absolute quality.

Communicate proactively: When issues arise – and they will – inform clients before they discover problems themselves. “We’re seeing higher-than-normal invalid rates this week and are working with our team to resolve it” beats clients calling to complain.

Add value beyond leads: Reporting, strategy, integration support, conversion coaching – services that justify your margin and make clients reluctant to disintermediate you.

Track client-level performance: Understand which clients are profitable and which aren’t. Some clients consume disproportionate support resources, dispute excessively, or pay slowly. Manage these relationships or exit them.

Quality Monitoring and Issue Resolution

Implement systems to catch quality problems before clients do:

Track quality metrics by source and time period: If your provider uses multiple traffic sources, understand which sources deliver your leads. Quality varies by source, and patterns emerge over time.

Establish feedback loops: When clients report issues, document them and communicate to your provider. Aggregate patterns: “Three clients this month reported low contact rates on morning leads” is more actionable than individual complaints.

Request root cause analysis: When quality problems occur, push providers to explain why and what they’re changing. “We’ll look into it” isn’t acceptable.

Maintain your own validation layer if practical: Real-time phone validation costs $0.02-0.05 per lead. If your provider’s validation is weak, adding your own layer might be worthwhile.

Compliance Responsibilities

Even as a reseller, you have compliance obligations:

Verify consent documentation exists: Request sample certificates and spot-check that documentation exists for leads you deliver to clients.

Understand your liability exposure: If a lead you delivered results in TCPA litigation against your client, you may be brought into the lawsuit. Ensure your provider agreements include indemnification and that your provider has adequate insurance.

Maintain records: Keep your own records of what leads were delivered to which clients and when. You may need this documentation years later.

Educate clients on their responsibilities: Your clients bear responsibility for how they contact leads. Ensure they understand TCPA requirements, calling hour restrictions, and DNC obligations.

Financial Management

White label reselling is a margin business that rewards financial discipline:

Manage cash flow carefully: If you prepay providers and clients pay Net-45, you need working capital. A 60-day float on $50,000 monthly lead purchases requires approximately $100,000 in accessible capital.

Track profitability by client: Not all clients are equally profitable. High-maintenance clients, slow payers, and heavy returners may generate revenue but destroy margins.

Monitor return rates vigilantly: Returns are margin killers. If a client’s return rate spikes, investigate immediately. Are they cherry-picking? Has quality actually declined? Address problems before they compound.

Build reserves: Seasonal demand fluctuations, client churns, and provider issues happen. Maintain reserves equivalent to 2-3 months of operating expenses.

Common Pitfalls and How to Avoid Them

White label reselling has predictable failure modes. Understanding them in advance helps you avoid them.

Pitfall 1: Insufficient Due Diligence on Partners

The mistake: Signing with a provider based on a sales pitch without verifying claims.

The consequence: Quality is poor, returns spike, clients churn, and you’ve committed to volumes you can’t profitably fulfill.

The prevention: Run pilots. Speak to references. Verify consent documentation. Never commit to significant volume without proof of quality.

Pitfall 2: Over-Promising to Clients

The mistake: Committing to lead specifications, volumes, or quality levels your provider can’t reliably deliver.

The consequence: Client expectations exceed reality. Constant dissatisfaction leads to churn, refund demands, and damaged reputation.

The prevention: Understand your provider’s real capabilities – not their sales claims – and set client expectations conservatively. Under-promise, over-deliver.

Pitfall 3: Ignoring the Economics

The mistake: Pricing based on gross margin without accounting for returns, float, overhead, and account management costs.

The consequence: Volume grows while profits shrink. You’re busy but not making money.

The prevention: Calculate true net margin including all costs. If net margin per lead is below $5 at your current scale, question whether the arrangement is viable.

Pitfall 4: Single-Provider Dependency

The mistake: Putting all volume with one provider because it’s simpler and they offer better pricing.

The consequence: When that provider raises prices, reduces quality, or exits the market, your business is immediately disrupted.

The prevention: Maintain backup relationships even if one provider handles most volume. The premium paid for optionality is insurance worth having.

Pitfall 5: Neglecting Compliance

The mistake: Assuming the provider handles all compliance, so you don’t need to verify or maintain records.

The consequence: When a TCPA lawsuit names you (and it can), you lack documentation to demonstrate good-faith compliance efforts.

The prevention: Verify consent documentation exists for leads you deliver. Maintain your own records. Include indemnification in provider agreements. Carry appropriate insurance.

Pitfall 6: Treating It as Passive Income

The mistake: Viewing white label as a “set and forget” revenue stream requiring minimal attention.

The consequence: Quality degrades unnoticed, client relationships weaken, and the business erodes before you realize it’s failing.

The prevention: Allocate real time to managing white label operations. Monitor quality metrics weekly. Engage with clients regularly. Stay close to your providers.

Building Competitive Advantage as a White Label Reseller

If anyone can become a white label reseller, how do you compete? The answer lies in adding value that pure resellers cannot replicate.

Service and Relationship Differentiation

Deep industry knowledge: Clients value advisors who understand their business. An agency that knows mortgage lending inside and out provides more value than one selling generic leads.

Responsive support: When issues arise, fast and effective resolution matters. Being the advocate who solves problems for clients builds loyalty.

Strategic guidance: Helping clients optimize their lead conversion process, integrate leads with their systems, and improve their overall acquisition strategy makes you a partner rather than a vendor.

Technical Integration Value

CRM and workflow integration: Delivering leads directly into client systems, formatted for their specific workflows, adds convenience that justifies margin.

Customized reporting: Dashboards tailored to client needs, scheduled reports in preferred formats, and analytics that inform decisions create stickiness.

Multi-source coordination: If clients need leads across multiple verticals, coordinating delivery from multiple providers into a unified experience is valuable.

Aggregation and Curation

Quality filtering: If you invest in your own validation layer, you can improve upon provider quality, delivering demonstrably better leads than clients could get directly.

Best-of-breed sourcing: Access to multiple providers allows you to route leads from the best source for each situation. Clients benefit from curation they couldn’t accomplish alone.

Volume consolidation: Aggregating demand from multiple clients gives you negotiating leverage with providers, potentially accessing pricing unavailable to smaller direct buyers.

Building Long-Term Defensibility

The most defensible white label businesses combine:

- Relationship depth: Clients view you as a trusted advisor, not an interchangeable vendor

- Integration complexity: Technical integration creates switching costs

- Proprietary value-add: Services, analytics, or quality improvements that others cannot easily replicate

- Portfolio diversification: Multiple clients across multiple verticals reduce concentration risk

Pure reselling without value-add is vulnerable to disintermediation. Clients eventually realize they could work directly with the provider – or find cheaper alternatives. Sustainable white label businesses provide value beyond connection.

White Label Lead Generation Across Verticals

Economics and operational considerations vary by vertical. Here’s what to expect in major markets:

Insurance

The largest lead generation vertical with the most mature white label ecosystem.

Typical provider pricing: $15-40 for auto, $25-60 for home, $40-80 for Medicare Typical reseller margins: 25-35% Key considerations: Compliance complexity varies by line. Medicare leads require CMS-compliant consent. Health insurance leads face ACA regulations. State-specific licensing requirements affect who can receive which leads. Provider landscape: MediaAlpha, EverQuote, and numerous specialized generators offer various white label arrangements.

Mortgage

Highly rate-sensitive with volume that fluctuates dramatically based on interest rate environment.

Typical provider pricing: $20-80 for refinance, $30-100 for purchase Typical reseller margins: 20-30% Key considerations: Demand evaporates when rates rise. RESPA implications for certain referral arrangements. Credit score and loan amount significantly affect lead value and pricing. Provider landscape: LendingTree, Bankrate ecosystem, and numerous vertical specialists.

Solar

Strong geographic variation creates arbitrage opportunities.

Typical provider pricing: $25-100 depending on geography Typical reseller margins: 30-40% Key considerations: California and established markets are expensive and competitive. Emerging markets offer better economics but less volume. State incentive policies affect demand significantly. Provider landscape: EnergySage, SolarReviews, and regional specialists.

Home Services

Fragmented market with strong local dynamics.

Typical provider pricing: $15-75 depending on service type Typical reseller margins: 25-35% Key considerations: Lead value varies dramatically by service – a roof replacement lead is worth 10x a gutter cleaning lead. Geographic targeting is critical for local providers. Provider landscape: Angi ecosystem, Thumbtack, and numerous vertical-specific generators.

Legal

Highest value per lead but most complex compliance environment.

Typical provider pricing: $50-250 for personal injury, $100-400+ for mass tort Typical reseller margins: 30-45% Key considerations: State bar advertising rules vary and are strictly enforced. Attorney advertising must meet ethical requirements. Intake qualification requirements are demanding. Provider landscape: Specialized legal marketing agencies and mass tort case buyers.

Frequently Asked Questions

What is white label lead generation?

White label lead generation is a business arrangement where one company produces leads and another company rebrands and sells them as their own product. The white label provider handles lead generation – traffic acquisition, landing pages, consent capture, validation – while the reseller manages client relationships and sales. End clients receive leads branded with the reseller’s identity, typically unaware of the underlying provider. This model enables agencies, consultants, and entrepreneurs to offer lead generation services without building production infrastructure.

How much can you make reselling leads through white label partnerships?

Reseller margins typically range from 20-40% of the end client price, but net margins after returns, float costs, and overhead often compress to 10-18%. At 1,000 leads monthly with $10 net margin per lead, that’s $10,000 monthly profit. At 100 leads monthly, the same margin yields $1,000 – often insufficient to justify the time invested. White label reselling rewards scale. Most successful resellers aggregate demand from multiple clients to reach 500+ leads monthly per vertical, achieving margins that justify the operational overhead.

What are the typical costs involved in starting a white label lead reselling business?

Startup costs for white label lead reselling include: provider minimum commitments (typically 100-500 leads monthly at $25-75 per lead = $2,500-$37,500 monthly); working capital for float (60+ days of lead costs if providers require prepayment); technology costs for portals and CRM integration ($200-$500 monthly); and client acquisition costs. Realistic first-year investment ranges from $25,000-$100,000 depending on vertical and scale. Many resellers start white label as an add-on to existing service businesses rather than standalone ventures, reducing incremental capital requirements.

How do I find reliable white label lead generation partners?

Find white label partners through industry conferences (LeadsCon, Affiliate Summit), lead distribution platform networks (boberdoo, LeadsPedia ecosystems), referrals from non-competing agencies, and direct outreach to established lead generators. Vet partners thoroughly before committing: verify consent documentation practices, request references from existing reseller partners, understand their traffic sources, review return policies, and run pilot programs of 100-500 leads before committing to significant volume. Quality partners willingly provide references and documentation; reluctance suggests problems.

What are the risks of white label lead generation for resellers?

Primary risks include: partner dependency (if your sole provider fails, your business fails), quality variability (you deliver leads you don’t control), compliance exposure (TCPA liability can extend to resellers), margin compression (providers can raise prices, clients can demand lower prices), and client disintermediation (clients may eventually go direct to providers). Mitigate these risks by maintaining multiple provider relationships, monitoring quality metrics closely, requiring indemnification in provider contracts, building value-add services beyond pure lead delivery, and creating integration stickiness that increases switching costs.

How is white label lead generation different from buying and reselling leads as a broker?

Brokers purchase leads and take title to inventory, bearing the risk of price fluctuations and unsold inventory. White label resellers don’t take inventory risk – leads flow directly from provider to end client, with the reseller earning margin on facilitation. Brokers often work with many suppliers and buyers, operating as market makers. White label resellers typically have dedicated provider relationships and represent those leads as their own product. The key distinction is risk profile: brokers bear inventory risk, resellers bear relationship and margin risk but not inventory exposure.

What compliance considerations apply to white label lead resellers?

Even as a reseller, you have compliance responsibilities. Verify that your provider captures valid TCPA consent and maintains documentation. Understand that you may be named in litigation if leads you delivered result in complaints. Ensure provider agreements include indemnification for leads they produce. Maintain your own records of lead delivery. Educate your clients on their responsibilities for contacting leads. Carry appropriate insurance (E&O, cyber liability). The FTC and FCC don’t distinguish between lead generators and resellers when pursuing enforcement – everyone in the chain bears responsibility.

Can I white label leads in any industry, or are some verticals better than others?

Some verticals have more developed white label ecosystems than others. Insurance, mortgage, solar, and home services have numerous providers offering white label arrangements. Legal lead generation has providers but more complex compliance requirements. B2B lead generation is less commonly white labeled because the lower volume, higher value nature favors direct relationships. Healthcare lead generation faces significant HIPAA and consent challenges. Financial services beyond mortgage has regulatory complexity. Start in verticals with established provider ecosystems and clear compliance frameworks before expanding to more complex areas.

How do I price leads to my clients when reselling white label?

Price based on market rates and your value-add, not just cost-plus margin. Research what competitors charge and what clients typically pay. Start at market rates, then adjust based on your services (do you provide integration support? conversion coaching? quality guarantees?). Ensure your margin is sufficient after accounting for returns, float, technology costs, and account management time. Many resellers fail by pricing too aggressively to win clients, then discovering margins don’t cover true costs. A sustainable price that delivers value beats an unsustainable price that wins business but loses money.

What technology do I need to operate a white label lead business?

Essential technology includes: lead delivery infrastructure (API integration or portal access from your provider, delivery mechanism to your clients), CRM for managing client relationships and lead tracking, reporting tools for client dashboards and internal metrics, validation services if you add your own quality layer, and billing systems for invoicing clients and reconciling with providers. Many providers offer white-labeled portals you can customize with your branding. Budget $500-$1,500 monthly for technology costs at moderate scale, more if you build custom integration infrastructure.

How long does it take to build a profitable white label lead business?

Timeline depends on whether you have existing client relationships. Agencies adding white label to existing service offerings can become profitable within 3-6 months if clients are ready to purchase. Building from scratch – acquiring clients while simultaneously establishing provider relationships – typically takes 12-18 months to reach meaningful profitability. The fastest path: identify 3-5 clients with concrete lead needs, then find providers to fulfill that specific demand. Avoid building provider relationships hoping clients will materialize – start with demand, not supply.

Key Takeaways

-

White label lead generation enables service expansion without infrastructure investment. Agencies and consultants can say “yes” to client needs across verticals without building lead generation capability from scratch.

-

Reseller margins typically run 20-40% gross but compress to 10-18% net after accounting for returns, float costs, technology overhead, and account management time. Profitability requires scale – plan for 500+ leads monthly per vertical.

-

Partner selection determines success more than any other factor. Due diligence on consent practices, quality metrics, references, and operational capabilities is non-negotiable. Run pilots before committing to significant volume.

-

Maintain multiple provider relationships even if one handles most volume. Single-provider dependency creates existential risk when that provider changes terms, reduces quality, or exits the market.

-

Compliance responsibility doesn’t disappear in white label arrangements. Verify consent documentation exists, include indemnification in contracts, maintain your own records, and ensure clients understand their contact responsibilities.

-

Sustainable competitive advantage comes from value-add, not pure reselling. Deep industry knowledge, technical integration, responsive support, and strategic guidance justify margins and prevent disintermediation.

-

The economics vary significantly by vertical. Insurance has the most mature ecosystem; legal offers highest margins but most complexity; solar features strong geographic arbitrage; home services is fragmented with local dynamics.

-

Start with client demand, not provider supply. Identify clients with concrete lead needs, quantify that demand, then find providers to fulfill it. Building supply before demand is backward.

This guide is adapted from The Lead Economy, a comprehensive resource for lead generation professionals. For deeper exploration of business models, compliance requirements, and operational frameworks, explore the complete book. Statistics and market data current as of late 2025.