Master workers comp insurance leads with industry-specific CPL benchmarks, B2B targeting strategies, vertical segmentation, and compliance frameworks. The definitive guide for agencies building sustainable commercial insurance lead programs.

A warehouse manager in Ohio receives a call about workers compensation coverage. She has 47 employees, premiums renewing in 60 days, and an Experience Modification Rate that just increased after two claims last year. The agent who reaches her first with a competitive quote and risk management insight will likely win her business – and the $45,000 annual premium that comes with it.

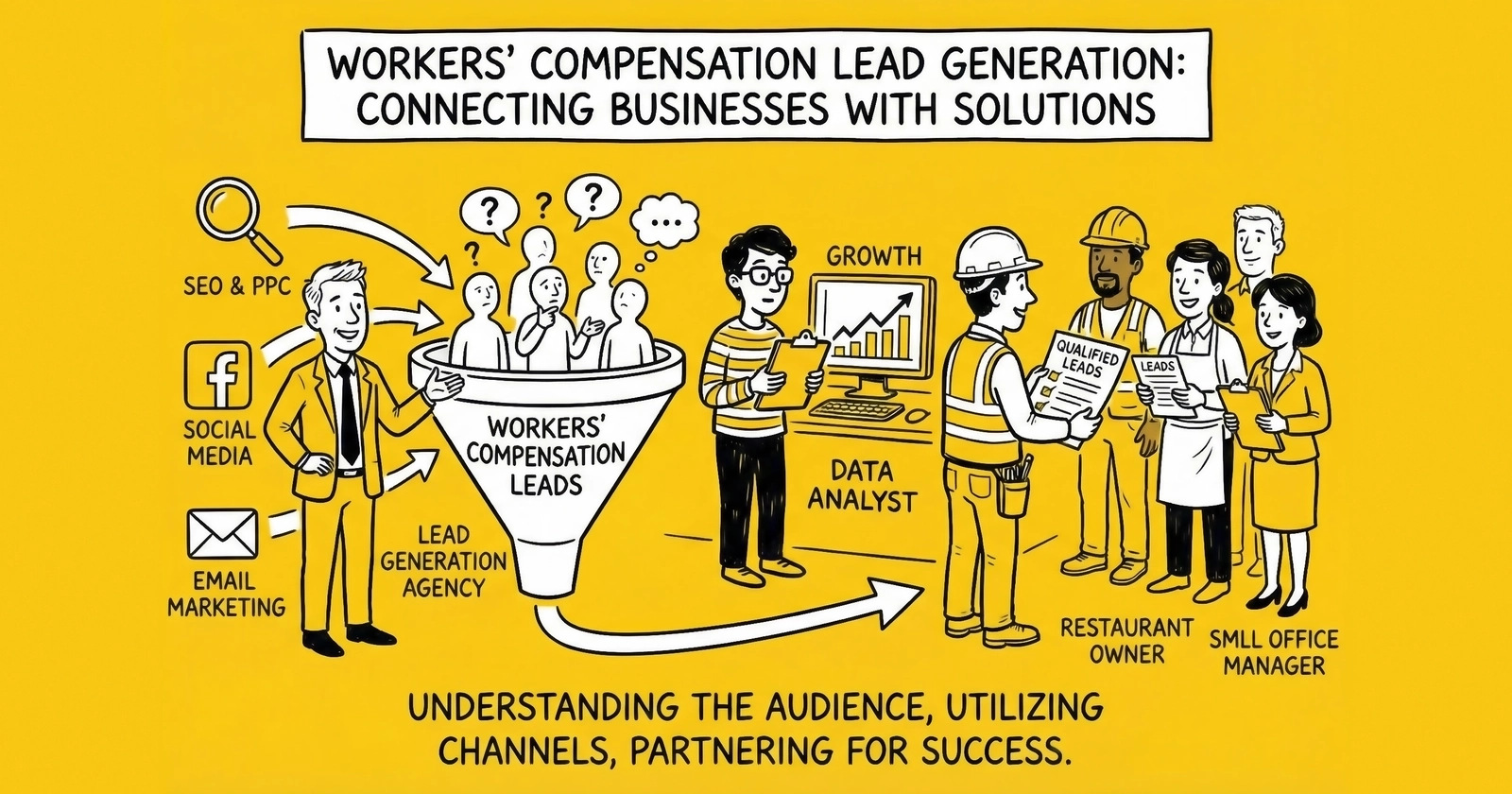

This scenario plays out thousands of times daily across America. Workers compensation insurance represents approximately $46 billion in written premiums annually in the United States, making it one of the largest commercial insurance lines. Unlike personal lines where consumers shop once or twice per year, workers comp operates on a B2B sales cycle where timing, industry expertise, and relationship building determine who captures the account.

Workers compensation lead generation differs fundamentally from consumer insurance verticals like auto or Medicare. You are not targeting individuals scrolling through comparison sites. You are reaching business owners and risk managers making decisions that affect their operating costs, employee welfare, and regulatory compliance. The leads cost more. The sales cycles run longer. The lifetime value per account dwarfs most consumer policies.

This guide provides agencies with the strategic framework, tactical execution playbook, and compliance guardrails needed to build a sustainable workers comp lead generation program. Whether you are an established commercial insurance agency diversifying into workers comp or a specialized agency scaling your existing book, the economics and methods detailed here will inform your decisions.

Understanding the Workers Compensation Market

The workers compensation market operates with dynamics that differ substantially from personal lines insurance. Understanding these fundamentals shapes every lead generation decision you will make.

Market Size and Regulatory Structure

Workers compensation insurance generated approximately $46.4 billion in net written premiums in 2023, according to the National Association of Insurance Commissioners. The market has experienced moderate growth of 2-4% annually in recent years, driven by wage inflation and economic expansion that increases payroll exposure.

The competitive landscape varies significantly by state due to the state-specific nature of workers comp regulation. Four states – Ohio, North Dakota, Washington, and Wyoming – operate exclusive state funds where employers must purchase coverage from the state, meaning private insurance is simply not available in these markets. Approximately 20 states operate competitive state funds that compete with private insurers, including California, Colorado, New York, and Texas. These funds often serve as insurers of last resort while also competing for standard risk business. The remaining states operate fully private markets where commercial insurers compete for business.

This fragmented regulatory environment creates both complexity and opportunity. Agencies with expertise in specific state requirements and industry classifications develop competitive advantages that generalist agencies cannot easily replicate. An agency that understands California’s workers comp intricacies – the largest and most complex market – can command premium positioning that a generalist simply cannot match.

Buyer Profiles and Decision Dynamics

Workers compensation purchasing decisions typically involve multiple stakeholders with different priorities, and understanding which stakeholder you are targeting determines your messaging, content strategy, and qualification criteria.

Business owners focus primarily on premium cost, cash flow implications, and how coverage affects their bottom line. Small business owners with fewer than 50 employees often make decisions personally and value simplicity and trust above sophisticated analysis. CFOs and controllers evaluate total cost of risk including premiums, deductibles, experience modification factors, and administrative burden. They respond to data-driven presentations demonstrating cost reduction strategies. HR directors concern themselves with claims management, return-to-work programs, and compliance with state requirements. They value carriers with strong claims handling and safety resources. Risk managers, found in larger organizations, evaluate coverage structure, loss control services, and carrier financial stability. They conduct thorough due diligence and often work with multiple brokers.

A lead generation campaign targeting small business owners differs fundamentally from one targeting risk managers at mid-market companies. The messaging that resonates with an owner worried about cash flow will fall flat with a risk manager evaluating coverage structure.

How Premium Calculations Create Targeting Criteria

Workers compensation premiums follow a formula that creates natural targeting criteria for lead generation: Premium equals Payroll divided by 100, multiplied by the Class Code Rate, multiplied by the Experience Modification Rate.

Every job classification carries a rate reflecting its risk level. Office clerical work under Code 8810 might carry a rate of $0.30 per $100 of payroll, while roofing under Code 5551 might carry a rate of $15.00 or higher. High-rate class codes create more premium dollars per employee, making them more valuable lead targets. The Experience Modification Rate, or EMR, adjusts the standard rate based on the employer’s claims history compared to similar employers. An EMR above 1.00 indicates worse-than-average experience and premium surcharges; below 1.00 indicates better-than-average. Employers with high EMRs face premium pain and often shop aggressively for solutions. Payroll exposure scales premium directly – an employer with $5 million in annual payroll represents 50x the premium opportunity of one with $100,000 in payroll, assuming similar class codes.

This formula creates clear targeting parameters: you want employers in high-rate class codes, with meaningful payroll exposure, and ideally an EMR situation that creates shopping motivation. A roofing contractor with 20 employees and an EMR of 1.25 presents a far more attractive lead opportunity than an accounting firm with the same headcount.

CPL Benchmarks and Lead Economics

Workers compensation lead generation operates at premium pricing compared to personal lines. Understanding the benchmarks helps you budget appropriately and evaluate vendor pricing.

Current CPL Ranges

| Lead Type | CPL Range | Typical CPL | Notes |

|---|---|---|---|

| Exclusive | $150-400 | $200-300 | Single buyer, higher conversion |

| Shared | $75-200 | $100-150 | 3-5 buyers, speed competition |

| Live Transfer | $200-500 | $300-400 | Pre-qualified, immediate conversation |

| Aged (30-60 days) | $25-75 | $40-60 | Requires systematic nurture |

These benchmarks reflect mid-market leads for businesses with 10-100 employees without extensive filtering. Premium filters – specific industries, employee count thresholds, or geographic targeting – increase costs 25-50% above baseline.

Factors That Drive Pricing Variation

Employee count significantly impacts pricing. Leads for larger employers command premium pricing. A lead for a 200-employee manufacturer might cost $350-500 exclusive, while a lead for a 15-employee retail store might cost $125-175. Industry vertical matters as well – high-hazard industries like construction, manufacturing, and healthcare generate higher premiums and therefore support higher lead costs. The same lead source charging $150 for a general contractor might charge $250 for a roofing contractor.

Geographic market plays a role too. Competitive markets like California, New York, and Texas see higher lead costs due to both increased demand and higher underlying premium rates. Purchase timing affects pricing seasonally, with leads generated during Q4 and Q1 – when many annual policies renew – commanding premium pricing. Off-cycle leads may be available at 15-25% discounts. Finally, data completeness drives pricing variation. Leads with verified contact information, employee counts, current carrier, and renewal dates cost more than basic contact-only leads.

Unit Economics and Lifetime Value

Understanding the complete unit economics helps you determine maximum acceptable CPL for your operation. Average premium for businesses with 10-100 employees typically ranges from $8,000-75,000 annually, depending on industry and state. A reasonable average for modeling purposes is $25,000-35,000. Standard commission on workers comp ranges from 7-15% depending on carrier, premium size, and agency relationship – assume 10% for baseline calculations. Industry benchmarks show 4-8% conversion from lead to bound policy for agencies with mature follow-up processes; assume 5% for conservative planning.

Consider this sample calculation: With a lead CPL of $200 and a 5% conversion rate, your cost per acquisition reaches $4,000. Against an average premium of $30,000 and first-year commission of 10%, you earn $3,000 in year one – a negative $1,000 ROI. This calculation explains why customer lifetime value matters enormously in workers comp. A single year’s commission rarely covers acquisition cost for premium leads.

The multi-year value calculation transforms the economics entirely. With year one commission at $3,000, year two retention at 85% yielding $2,550, year three retention at 80% yielding $2,040, and year four retention at 75% yielding $1,530, the four-year value reaches $9,120. That produces 128% ROI on the $4,000 acquisition cost. Agencies that retain accounts for 4+ years can justify lead costs that would destroy single-transaction businesses.

B2B Targeting Strategies

Workers compensation lead generation requires B2B marketing approaches that differ fundamentally from consumer insurance tactics. You are reaching business decision-makers through professional channels with business-focused messaging.

The Power of Industry Vertical Targeting

The most effective workers comp lead generation programs focus on specific industry verticals rather than pursuing all employers generically. Vertical specialization provides multiple compounding advantages.

Credibility builds faster when you speak an industry’s language. An agency that specializes in restaurant workers comp understands slip-and-fall risks, kitchen burns, delivery driver exposures, and seasonal staffing patterns. This expertise builds trust faster than generic pitches ever can. Content relevance follows from vertical focus, enabling industry-specific materials that address actual concerns. A white paper on “Managing Workers Comp Costs for Home Healthcare Agencies” speaks directly to a home health operator in ways generic content cannot.

Referral networks develop within verticals. Satisfied restaurant clients refer other restaurant owners. Accountants who specialize in construction refer their contractor clients. The network effect compounds over time. Carrier relationships deepen with specialization as well. Many carriers specialize in specific industries. An agency focusing on transportation can develop deep relationships with carriers that prioritize trucking risks, accessing better coverage and pricing than a generalist agency would ever see.

High-Value Industry Verticals

Certain industries present particularly attractive workers comp lead opportunities based on premium size, shopping frequency, and accessibility.

Construction and contracting stands out for its high class code rates that create substantial premiums even for smaller employers. A 15-employee roofing contractor might generate $50,000+ in annual premium. Construction employers shop frequently due to EMR fluctuations and project-based coverage needs. Healthcare and social services employers face significant workers comp exposure from patient handling, needlesticks, and workplace violence. The sector employs millions of workers and generates substantial premium volume. Home healthcare agencies are particularly active shoppers due to dispersed workforce challenges.

Manufacturing carries elevated risk profiles and corresponding premium rates. Mid-size manufacturers with 50-200 employees represent sweet-spot prospects with meaningful premium and professional purchasing processes. Staffing agencies and PEOs carry workers comp for placed employees, creating concentrated premium opportunities – a staffing firm placing 500 workers might represent $200,000+ in annual workers comp premium. Transportation and logistics operations face significant workers comp exposure, and the growth of e-commerce has expanded this sector substantially. Hospitality generates consistent workers comp needs with relatively accessible decision-makers, though high employee turnover creates ongoing claims management challenges that specialized agencies can address.

Company Size Segmentation

Different company sizes require different lead generation and sales approaches. Understanding where to focus determines resource allocation.

Micro businesses with 1-9 employees represent the lowest premium per account but highest volume of potential prospects. The decision-maker is typically the owner, sales cycles are short, but lifetime value is limited. These prospects are best reached through digital channels and scalable outreach. Small businesses with 10-49 employees represent the sweet spot for many agencies. They offer meaningful premium of $10,000-50,000, accessible decision-makers, and businesses large enough to value professional insurance guidance. They respond well to inbound content marketing and targeted outreach.

Mid-market companies with 50-249 employees present substantial premium opportunity of $50,000-250,000 with more sophisticated purchasing processes. They may involve HR directors or CFOs alongside owners. Sales cycles run longer but retention is stronger once acquired. These accounts are worth higher CPL investment for quality leads. Large accounts with 250+ employees offer premium opportunities that can reach $500,000 or more, but purchasing involves formal RFP processes, incumbent broker relationships, and multi-month evaluation cycles. Lead generation matters less than relationship development and technical capabilities.

Geographic Targeting Considerations

Workers compensation is regulated at the state level, creating geographic targeting opportunities that reward local expertise.

High-premium states like California, New York, and Florida have elevated workers comp costs due to regulatory environments and claims patterns. Employers in these states pay more premium dollars, supporting higher acquisition costs. States with competitive state funds – California, New York, Colorado – have employers accustomed to shopping and comparing options. They may be more responsive to outreach than employers in markets with less competition.

Multi-state employers face complex compliance requirements and often seek sophisticated agency partners. These prospects respond well to expertise-based marketing. Regional industry concentration creates natural targeting efficiencies – tech in California, manufacturing in the Midwest, agriculture in California and Florida. Aligning vertical focus with geographic presence multiplies your competitive advantage.

Lead Generation Channels and Tactics

Workers compensation leads flow through multiple channels, each with distinct characteristics, costs, and quality profiles. Effective programs typically blend several channels to balance volume, quality, and cost.

Search Engine Marketing

Google Ads remains the highest-intent channel for workers comp lead generation. Business owners searching “workers compensation insurance quotes” or “workers comp insurance for contractors” have immediate purchase interest. Current benchmarks show average CPC of $8-25 for workers comp keywords, conversion rates of 3-6% from landing page to lead, effective CPL of $150-500 depending on keyword competitiveness, and the highest intent level in the market.

High-intent, high-competition keywords like “workers compensation insurance” face extreme competition and CPCs exceeding $30. More specific keywords offer better economics. Industry-specific terms like “restaurant workers comp insurance” deliver lower CPC with higher relevance. State-specific searches like “California workers compensation quotes” enable geographic targeting. Problem-focused queries like “reduce workers comp costs” target cost-conscious shoppers. EMR-related searches like “high experience modification rate help” capture motivated shoppers actively seeking solutions. Long-tail keywords convert at higher rates because they capture more specific intent. An employer searching “workers comp insurance for staffing agencies in Texas” knows exactly what they need.

LinkedIn Advertising

LinkedIn provides unmatched B2B targeting capabilities for workers comp lead generation. You can target by job title, company size, industry, and geography with precision impossible on other platforms. Targeting options include job titles like Business Owner, HR Director, CFO, Risk Manager, and Operations Manager. Company size filters allow targeting 10-50 employees, 51-200 employees, or 201-500 employees. Industry filters cover construction, manufacturing, healthcare, transportation, and more. Geography can be narrowed to state, metro area, or radius targeting.

Current benchmarks show average CPC of $6-12, average CPL on lead gen forms of $100-250, conversion rates of 8-15% on native forms, and high quality due to decision-maker targeting. LinkedIn’s native Lead Gen Forms reduce friction by pre-populating user information, improving conversion rates. However, lower friction can reduce lead quality, so you must balance ease of submission against qualification requirements.

LinkedIn users respond to educational content rather than direct sales pitches. Effective approaches include industry-specific guides like “5 Ways Construction Companies Can Reduce Workers Comp Costs,” compliance updates like “2026 Workers Compensation Changes Affecting Healthcare Employers,” benchmarking content like “How Your Workers Comp Costs Compare to Industry Averages,” and risk management insights like “Return-to-Work Programs That Actually Work.” Gate valuable content behind lead capture forms to generate qualified prospects interested in specific topics.

Content Marketing and SEO

Organic content marketing provides the most cost-effective long-term lead generation, but requires sustained investment before producing results.

Industry guides demonstrate expertise and attract qualified traffic. “The Complete Guide to Workers Compensation for Home Healthcare Agencies” might rank for dozens of relevant keywords and generate leads for years. State-specific content capitalizes on varying workers comp rules across states. “California Workers Compensation Requirements 2026” targets employers in your key markets with compliance-focused content. Educational articles answer common employer questions: “How is my Experience Modification Rate calculated?” or “What happens if an employee gets injured at work?” These informational queries build awareness and trust. Interactive tools like “Workers Comp Premium Estimator” or “EMR Impact Calculator” generate engagement and capture contact information from high-intent visitors.

Expect 6-12 months before meaningful organic traffic develops. Content marketing is a long-term investment, not a quick lead generation tactic. But once established, organic content generates leads at CPL 60-80% below paid channels.

Direct Outbound

Direct outreach to target employers remains viable for workers comp lead generation, though regulatory compliance requires careful execution.

Business databases like ZoomInfo, D&B Hoovers, and Apollo provide employer contact information with filtering by industry, employee count, and geography. Quality varies – expect 15-25% bounce rates on email addresses and higher rates of outdated phone numbers. Cold email prospecting for commercial insurance operates in a gray area. B2B email is not subject to CAN-SPAM’s consumer protections in the same way, but aggressive tactics damage reputation and deliverability. Effective approaches include highly targeted lists by specific industry, geography, and company size; personalized messaging referencing specific business characteristics; educational value propositions rather than hard sales pitches; and clear opt-out mechanisms with compliance to preferences.

Cold calling businesses about workers comp requires TCPA compliance consideration, particularly regarding autodialing and time-of-day restrictions. Manual dialing to business phone numbers during business hours generally presents lower regulatory risk than automated consumer outreach, but consult legal counsel for your specific operation. Effective phone outreach focuses on value-add conversations: “We specialize in helping manufacturing companies reduce workers comp costs. Would you be interested in a no-obligation rate comparison?” The goal is appointment setting rather than phone sales.

Referral and Partner Networks

The highest-quality workers comp leads often come from professional referral relationships. Accountants and CFOs who advise business clients on operational costs often refer insurance needs. CPAs specializing in construction or healthcare develop deep client relationships and trust. Payroll companies have direct visibility into employer payroll data – the exact information needed to quote workers comp. Some payroll companies offer workers comp integration through PEO arrangements or carrier partnerships. HR consultants working with small and mid-size employers advise on benefits and compliance, including workers compensation, and can become valuable referral sources. Industry associations for specific industries provide access to members through sponsorships, speaking opportunities, and partnership programs.

Building referral networks requires relationship investment but produces leads that convert at 2-3x the rate of cold leads due to warm introduction and implied endorsement. The best agencies build these networks systematically over years.

Lead Qualification and Scoring

Not all workers comp leads deserve equal attention. Effective qualification focuses resources on prospects most likely to convert and retain.

Essential Qualification Criteria

Business type and industry determine whether you can competitively quote and service the employer. An agency without healthcare expertise should not pursue nursing home leads expecting to win against specialized competitors. Employee count determines premium potential and appropriate sales resource allocation. A 10-employee prospect might receive automated nurture while a 150-employee prospect warrants immediate personal outreach.

Current coverage status matters – is the employer currently insured? Uninsured employers face compliance urgency but may also present non-standard risk profiles. Currently insured employers shopping for alternatives represent standard market opportunities. Renewal timing is critical because employers rarely switch mid-term. Knowing renewal timing enables appropriate follow-up scheduling. Decision-maker confirmation prevents wasted resources. Reaching the office manager when you need the owner accomplishes nothing. Geographic operation affects carrier availability – multi-state operations require carriers licensed in all operating states.

Building a Scoring Model

Lead scoring prioritizes follow-up and resource allocation. A simple scoring model for workers comp might weight employee count at 25%, giving 1 point for under 10 employees, 3 points for 10-49, 5 points for 50-199, and 4 points for 200+ where complexity increases. Industry match at 20% awards 5 points for target verticals, 3 for adjacent industries, and 1 for outside focus. Decision authority at 20% gives 5 points for owners and CFOs, 3 for HR and ops managers, and 1 for unknown contacts. Renewal timing at 15% awards 5 points for under 60 days, 3 points for 60-120 days, and 1 point for over 120 days. Engagement level at 10% gives 5 points for quote requests, 3 for content downloads, and 1 for basic inquiries. Data completeness at 10% awards 5 points for all fields, 3 for partial, and 1 for minimal information.

Score thresholds determine routing: 20-25 points warrant immediate sales contact, 15-19 enter priority nurture sequences, 10-14 go to standard nurture tracks, and below 10 requires re-evaluation of qualification.

When to Disqualify

Some leads should be rejected or returned rather than pursued. Employers in monopolistic state fund states – Ohio, North Dakota, Washington, and Wyoming – cannot purchase private workers comp coverage. These leads have no market opportunity. Leads that don’t respond after 6-8 contact attempts across multiple channels likely won’t convert and should be removed from active pursuit. Some employers present risk profiles most carriers won’t quote – extensive claims history, hazardous operations, compliance issues. Unless you specialize in hard-to-place risks, these leads waste sales resources. Employers expecting rates 40% below market or demanding coverage structures no carrier offers won’t become clients. Qualify expectations early to avoid wasted effort.

Sales Process and Conversion

Converting workers comp leads requires a structured sales process adapted to B2B insurance purchasing dynamics.

Speed-to-Contact Impact

While workers comp leads don’t decay as rapidly as consumer insurance leads, response time still matters significantly. Research findings show leads contacted within 5 minutes are 100x more likely to be reached than those contacted at 30 minutes. Seventy-eight percent of buyers purchase from the first vendor to respond with useful information. B2B prospects expect professional response within one business day; same-day response creates competitive advantage.

For workers comp, the “first responder advantage” translates to being the first agency to provide substantive value – not just the first to make contact. An immediate response with relevant industry expertise and specific questions demonstrates capability more effectively than a generic follow-up. Response standards should target under 1 hour for inbound inquiries during business hours, under 4 hours for downloaded content and gated assets, and under 30 minutes for exclusive third-party leads or under 5 minutes for shared leads.

Multi-Touch Follow-Up Sequences

Workers comp sales cycles typically span 30-90 days. Systematic follow-up prevents leads from falling through cracks during extended evaluation periods.

For an exclusive lead, day one should include immediate acknowledgment email with relevant content, a phone call within 30 minutes, and if no answer, a voicemail plus follow-up email. Day two brings a phone call at a different time and a LinkedIn connection request if the decision-maker is identified. Day four includes email with an industry-specific content piece and a phone call. Day seven brings a check-in email referencing previous content and a phone call. Day fourteen offers a value-add email with industry news or a compliance update plus a phone call. Day twenty-one delivers a re-engagement email with a new offer like an audit or consultation. Day thirty provides final outreach with a clear next step.

This 8-10 touch sequence over 30 days maintains presence without harassment. Adjust cadence based on engagement signals – responsive prospects warrant more frequent contact; non-responsive prospects need longer spacing.

Consultative Sales Approach

Workers comp sales succeed through consultative approaches rather than transactional price quoting. Discovery questions should probe beyond surface needs: What is your current Experience Modification Rate, and how has it trended? What claims have you experienced in the past 3 years? What safety programs do you currently have in place? How are claims managed when they occur? What would an ideal workers comp program look like for your business?

These questions accomplish two goals: gathering information needed for competitive quoting, and demonstrating expertise that differentiates from agencies offering only price comparisons.

Sophisticated buyers want more than low quotes. Demonstrate value through EMR analysis and improvement strategies, loss control and safety program recommendations, claims management and return-to-work guidance, premium audit preparation assistance, and experience with their specific industry. The agency that helps an employer reduce their EMR from 1.20 to 1.00 delivers more value than one that simply finds a slightly lower rate – even if the immediate premium is similar.

Proposal and Closing

Workers comp proposals should quantify value beyond premium comparison. Include premium summary with coverage details, EMR analysis and projected trajectory, loss control services included, claims management process, safety resources available, carrier financial stability information, and agency team and service commitment.

Common objections require prepared responses. When prospects say “My current agent is fine,” respond: “I’m not suggesting anything is wrong with your current arrangement. But many employers haven’t compared options in several years and may be paying more than necessary. A no-obligation comparison only takes 15 minutes of your time to gather information.” When they say “I don’t have time for this right now,” respond: “I completely understand. When is your renewal date? I can follow up 60-90 days before to ensure you have time to evaluate options without pressure.” When they say “Just send me a quote,” respond: “I can certainly provide a quote. To make sure it’s accurate and competitive, I need about 10 minutes to ask a few questions. When would be a good time for a quick call?”

Compliance Considerations

Workers compensation lead generation operates within multiple regulatory frameworks. Understanding compliance requirements protects your agency from liability while enabling effective marketing.

TCPA and Telemarketing Regulations

The Telephone Consumer Protection Act governs telemarketing practices including calls, texts, and faxes. While B2B communications face fewer restrictions than consumer outreach, compliance still matters. Key requirements include maintaining internal Do Not Call lists and honoring opt-out requests, complying with time-of-day calling restrictions of generally 8 AM to 9 PM in the recipient’s time zone, identifying yourself and your agency at the beginning of calls, and providing opt-out mechanisms for ongoing communications.

The FCC has provided guidance that calls to business numbers are generally subject to fewer restrictions than calls to personal phones. However, many business decision-makers use mobile phones that may be registered to them personally, creating potential TCPA exposure. Best practice is to obtain consent before automated calling or texting to any phone number. Manual dialing to business lines during business hours presents lower risk but is not zero-risk.

State Insurance Marketing Regulations

Insurance marketing is regulated at the state level, with requirements varying by jurisdiction. Common requirements include that only licensed agents may solicit insurance business, advertising must be truthful and not misleading, specific disclosures may be required in marketing materials, and some states require advertising approval or filing.

If your lead generation involves making specific coverage recommendations or discussing policy terms, that activity may constitute solicitation requiring licensure. General educational content and information gathering typically do not trigger licensing requirements, but the line can be unclear. Consult with compliance counsel to ensure your lead generation activities align with state insurance regulations in your operating jurisdictions.

Data Privacy and Security

Business contact information is subject to various privacy regulations depending on source and usage. CAN-SPAM requires commercial emails include physical address, clear identification as advertising, and opt-out mechanisms. While B2B email has more flexibility than consumer email, professional practice includes honoring unsubscribe requests promptly.

Lead data contains business contact information that should be protected from unauthorized access. Implement reasonable security measures including access controls, encryption for sensitive data, and secure disposal of data no longer needed. When purchasing leads from third-party providers, verify that the provider has appropriate consent and data handling practices. Liability for improperly sourced leads can extend to purchasers.

Technology and Tools

Effective workers comp lead generation requires technology infrastructure for lead capture, management, and nurture.

CRM and Marketing Automation

A commercial insurance-focused CRM is essential for managing workers comp lead programs. Key capabilities include pipeline management to track leads through stages from initial inquiry through bound policy with visibility into conversion metrics at each stage, activity tracking to log calls, emails, meetings, and follow-up tasks to maintain complete prospect interaction history, automation to trigger follow-up sequences, task assignments, and notifications based on lead status and timing, and reporting to generate reports on lead source performance, conversion rates, and sales activity metrics.

Popular options include Salesforce with insurance-specific configurations, HubSpot with strong marketing automation integration, AgencyBloom which is insurance-specific, HawkSoft with agency management and CRM features, and Applied Epic for comprehensive agency management.

Marketing automation platforms manage lead nurture sequences, content delivery, and engagement tracking. Key functions include email sequence automation, lead scoring and qualification, content personalization, landing page management, and analytics and attribution. Your marketing automation platform should integrate with your CRM to maintain unified lead records and enable sales-marketing alignment.

Lead Management and Compliance Technology

For agencies purchasing leads from multiple sources, lead management platforms consolidate intake, distribution, and tracking. Capabilities include multi-source lead intake via API, email, or file upload; duplicate detection and merging; lead routing based on criteria like geography, industry, and value; source performance tracking; and return management for rejected leads.

Consent documentation and compliance verification protect against regulatory exposure. TrustedForm creates independent certificates documenting form submissions and consent capture, providing evidence for TCPA compliance if leads are contacted by phone. Jornaya tracks consumer journey across publishers and provides lead quality signals. While less common in B2B, it is available for workers comp leads. Call recording for all sales calls supports compliance verification and training purposes. Inform prospects of recording as required by state law.

Measuring Success

Effective measurement enables optimization of workers comp lead generation programs over time.

Key Performance Indicators

Volume metrics track leads generated per period, leads by source and channel, and lead velocity trends over time. Quality metrics measure lead-to-opportunity conversion rate, lead scoring distribution, and disqualification rate with reasons. Conversion metrics track opportunity-to-quote rate, quote-to-bind rate, overall lead-to-bind conversion, and average sales cycle length. Financial metrics calculate cost per lead by source, cost per opportunity, cost per acquisition for bound policies, premium per lead, and ROI by source and overall.

Benchmarking Performance

Industry benchmarks help contextualize your performance.

| Metric | Target Range | Notes |

|---|---|---|

| Lead-to-Quote Rate | 25-40% | Percentage of leads receiving formal quotes |

| Quote-to-Bind Rate | 15-25% | Percentage of quotes converting to bound policies |

| Lead-to-Bind Rate | 4-8% | Overall conversion from lead to customer |

| Average Sales Cycle | 45-90 days | Time from lead to bound policy |

| Contact Rate | 50-70% | Percentage of leads reached by phone |

| CPL (Exclusive) | $150-300 | Cost per qualified exclusive lead |

| CAC | $2,000-5,000 | Cost to acquire a bound account |

Performance outside these ranges signals either optimization opportunity or exceptional performance worth understanding and replicating.

Attribution and Source Analysis

Multi-touch attribution for workers comp leads can be complex given extended sales cycles. At minimum, track first touch to understand where the lead originated – this informs top-of-funnel investment. Track last touch to understand what interaction preceded conversion – this informs bottom-of-funnel optimization. Measure source quality by lead source including conversion rates, premium value, and retention. A source delivering $200 leads that convert at 8% outperforms a source delivering $100 leads that convert at 3%. Track lifetime value by source to identify channels that attract the most valuable long-term clients, not just one-year shoppers.

Frequently Asked Questions

What is the average cost per lead for workers compensation insurance leads?

Workers compensation lead pricing varies significantly based on lead type, quality, and targeting. Exclusive leads typically range from $150-400, with $200-300 being most common for mid-market prospects with 10-100 employees. Shared leads range from $75-200, with 3-5 agencies competing for each lead. Live transfer leads command premium pricing of $200-500 due to pre-qualification and immediate connection. These prices assume general market leads; specific industry targeting, larger employee counts, or geographic restrictions can increase costs 25-50% above baseline.

How do workers comp leads differ from personal lines insurance leads?

Workers compensation leads differ from personal lines in several fundamental ways. First, they target businesses rather than individual consumers, requiring B2B marketing approaches and longer sales cycles of 45-90 days versus same-day decisions for auto insurance. Second, the decision-making process often involves multiple stakeholders – business owners, CFOs, HR directors – rather than a single consumer. Third, lead costs are substantially higher at $150-300 versus $25-75 for auto insurance because premium values and lifetime customer value justify greater acquisition investment. Fourth, industry expertise matters more; workers comp buyers evaluate agency knowledge of their specific industry risks alongside pricing.

What industries are best to target for workers comp lead generation?

The most attractive industries for workers comp lead generation combine high premium rates, meaningful employer concentrations, and accessible decision-makers. Construction and contracting consistently ranks among the best verticals due to high class code rates – a 15-employee roofing contractor might generate $50,000+ in annual premium. Healthcare and social services offers strong opportunities with large employer concentrations and significant workplace risks. Manufacturing provides substantial premium opportunities with professional purchasing processes. Staffing agencies present concentrated premium where a firm placing 500 workers might represent $200,000+ annually. Transportation and logistics has expanded significantly with e-commerce growth. Hospitality offers accessible decision-makers though lower premium per account.

How long does it take to convert a workers comp lead to a sale?

Workers compensation sales cycles typically range from 45-90 days for standard accounts, though this varies based on several factors. Accounts shopping due to renewal timing may move faster at 30-45 days if you engage when they are actively evaluating options. Larger accounts with formal RFP processes may take 90-120 days or longer. Mid-term inquiries from employers not facing renewal may extend to 6-12 months as the prospect waits for their renewal window. Building pipeline requires consistent lead generation over multiple months to account for these extended conversion timelines.

Should I buy exclusive or shared workers comp leads?

The choice between exclusive and shared leads depends on your sales infrastructure and economics. Exclusive leads cost 50-100% more but convert at significantly higher rates – typically 6-10% versus 3-5% for shared leads – because you face no competition for the prospect’s attention. For agencies with limited sales capacity or premium service models, exclusive leads often deliver better ROI despite higher per-lead costs. Shared leads make sense for agencies with rapid response infrastructure and strong sales processes that can compete effectively on speed. Many agencies blend both, using exclusive leads for priority verticals and shared leads for supplemental volume.

What conversion rate should I expect from workers comp leads?

Conversion rates from lead to bound policy typically range from 4-8% for quality workers comp leads with proper follow-up processes. Breaking this down: expect 50-70% contact rate when reaching decision-makers by phone, 25-40% of contacts progressing to formal quotes, and 15-25% of quotes binding to policies. Overall lead-to-bind conversion of 4-8% is realistic with systematic follow-up over 60-90 days. Rates below 4% signal either lead quality issues, inadequate follow-up processes, or competitive positioning problems. Rates above 8% indicate strong execution that may support increased volume investment.

How do I comply with TCPA when calling workers comp leads?

TCPA compliance for workers comp leads involves several considerations. For calls to business phone numbers, restrictions are generally less stringent than consumer calls, but many business contacts use personal mobile phones creating potential exposure. Best practices include obtaining consent before any automated calling or texting, maintaining internal Do Not Call lists and honoring opt-out requests promptly, complying with time-of-day restrictions of 8 AM to 9 PM in the recipient’s time zone, using manual dialing for cold outreach to reduce TCPA risk, clearly identifying yourself and your agency at call beginning, and documenting consent for any leads that will receive ongoing contact. For purchased leads, verify the source has appropriate consent documentation. Consider consulting TCPA counsel for your specific operations.

What technology do I need for workers comp lead generation?

Essential technology includes a CRM system capable of tracking multi-touch, multi-month sales cycles with activity logging and pipeline management – commercial insurance-focused options like AgencyBloom or HawkSoft work well, or general platforms like Salesforce or HubSpot with appropriate configuration. Marketing automation enables lead nurture sequences and content delivery during extended sales cycles. For agencies purchasing from multiple sources, a lead management platform consolidates intake, applies scoring, and routes leads to appropriate follow-up tracks. Consent documentation tools like TrustedForm provide compliance protection for leads receiving phone contact. Call recording with appropriate disclosure supports both compliance and sales training.

How do I measure ROI on workers comp lead generation?

Measuring workers comp lead generation ROI requires tracking costs and outcomes over extended timeframes. Calculate cost per acquisition by dividing total lead generation spend including media, platform fees, and labor by bound policies. Compare this CPA against average first-year commission to determine initial ROI – which is often negative for premium leads. Then factor lifetime value: with typical 4-5 year retention and 7-15% annual commission, a $30,000 average account generates $9,000-15,000 in lifetime commission. Track retention rate by acquisition source to identify channels that attract long-term clients versus one-year shoppers. Sophisticated measurement includes opportunity cost analysis and marginal cost calculations for scaling decisions.

Can I generate workers comp leads through content marketing?

Content marketing is highly effective for workers comp lead generation, though it requires sustained investment before producing results. The strategy works because business decision-makers actively research workers comp topics – class code questions, EMR calculations, safety requirements, cost reduction strategies – and agencies providing valuable answers build credibility and capture contact information. Effective content types include industry-specific guides like “Complete Workers Comp Guide for Construction Companies,” state compliance resources like “California Workers Comp Requirements 2026,” educational articles answering common questions, and interactive tools like EMR calculators and premium estimators. Expect 6-12 months before meaningful organic traffic develops, but established content programs generate leads at 50-70% lower CPL than paid channels with higher quality due to demonstrated expertise.

Key Takeaways

Workers compensation lead generation operates at premium pricing of $150-400 CPL for exclusive leads, reflecting the B2B complexity and substantial lifetime account value of $9,000-15,000 in commission over typical retention periods.

Industry vertical specialization dramatically improves conversion rates and competitive positioning. Agencies focusing on specific sectors like construction, healthcare, or manufacturing develop expertise that generalist competitors cannot match.

Lead economics require multi-year lifetime value calculations. First-year commission rarely covers acquisition cost for quality leads, but 4-5 year retention transforms the ROI equation entirely.

Sales cycles of 45-90 days demand systematic multi-touch follow-up processes. Leads contacted within minutes still convert at higher rates, but the relationship development requires sustained engagement over weeks or months.

Geographic and regulatory complexity creates both challenges and opportunities. Understanding state-specific requirements and carrier appetites enables competitive positioning in target markets.

Content marketing and organic search provide the most cost-effective long-term lead generation at 50-70% lower CPL than paid channels, but require 6-12 months of investment before producing meaningful results.

Conversion benchmarks of 4-8% lead-to-bind provide realistic planning targets. Performance below this range signals lead quality, follow-up process, or competitive positioning problems requiring diagnosis.

Compliance considerations spanning TCPA, state insurance regulations, and data privacy require careful attention. The B2B context provides more flexibility than consumer marketing but does not eliminate regulatory requirements.

Benchmark data reflects 2024-2026 market conditions for the U.S. workers compensation insurance market. Individual results vary based on agency capabilities, market positioning, and geographic focus. Consult with legal counsel regarding compliance requirements for your specific operations.