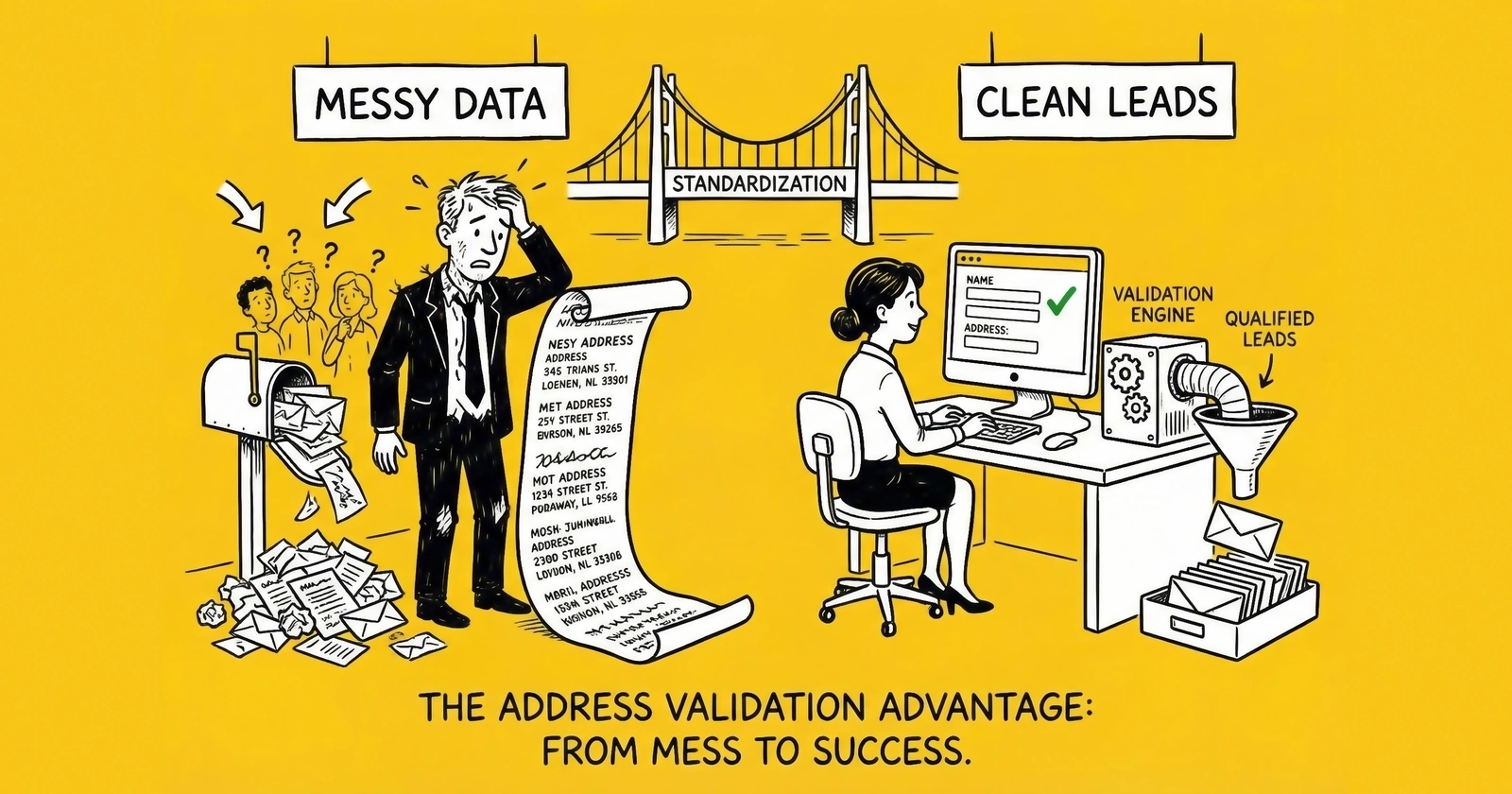

Every lead contains an address. And every address that fails to validate represents money lost, mail returned, and opportunities wasted. In lead generation, address quality determines whether your direct mail reaches mailboxes, whether your geographic targeting works, whether your fraud detection catches bad actors, and whether your leads sell to buyers who need accurate location data.

The problem is deceptively complex. Addresses arrive in dozens of formats, riddled with typos, incomplete elements, and outright fabrications. A consumer types “123 Main St” but means “123 N Main Street, Apt 4B.” A bot submits “1600 Pennsylvania Avenue NW” because it sounds legitimate. An incentivized form-filler invents an address that passes basic format checks but represents a vacant lot.

Address validation and standardization solve these problems systematically. Validation confirms an address exists and is deliverable. Standardization converts addresses to official postal formats that maximize delivery rates and enable geographic analysis. Together, they form a critical layer in the lead quality stack that separates professional operators from amateurs losing money on bad data. This is one component of comprehensive lead validation covering phone, email, and address.

This guide covers the complete landscape of address validation for lead generation: the technology behind it, the vendors who provide it, the integration patterns that work, and the ROI calculations that justify the investment. You will learn exactly what to validate, when to validate it, and how to build address quality into your operations from day one.

Why Address Validation Matters in Lead Generation

Address validation might seem like a minor detail compared to phone and email verification. After all, most lead buyers contact prospects by phone or email, not postal mail. But address data serves purposes far beyond mail delivery, touching nearly every aspect of lead quality and monetization.

Geographic Qualification and Routing

In verticals like solar, home services, roofing, and HVAC, address determines everything. A solar lead from Arizona has different value than one from Michigan. A roofing lead from a dense urban zip code routes to different buyers than one from a rural area. A home services lead from a 3,000 square foot house commands different pricing than one from a 600 square foot apartment. Without validated addresses, geographic routing fails. Leads route to wrong markets, wrong service areas, and wrong buyers. The cascade effect wastes buyer capacity, damages relationships, and creates operational chaos that compounds with every misdirected lead.

Fraud Detection and Quality Assurance

Address validation provides powerful fraud signals that complement your other verification layers. When a claimed address does not exist, does not match the IP geolocation, or appears on multiple leads with different names, you have detected fraud that phone and email validation missed entirely.

Sophisticated fraudsters create fake leads with valid phone numbers and deliverable emails. They purchase prepaid phones and create throwaway email addresses specifically for this purpose. But creating fake physical addresses is harder. The USPS maintains comprehensive databases of every deliverable address in the country, and matching against these databases catches fabrications that technical contact validation cannot detect. For a complete view of fraud prevention strategies, see our lead fraud detection and prevention guide.

Regulatory Compliance and Documentation

Several verticals require physical address documentation for compliance purposes that extend beyond simple verification. Mortgage leads under RESPA need accurate property addresses tied to the transaction. Insurance leads require valid policyholder locations for underwriting and regulatory purposes. Legal leads must confirm jurisdiction-relevant addresses to establish venue and standing.

When regulatory audits occur, validated address documentation demonstrates due diligence. Unstandardized, unvalidated addresses suggest sloppy operations and invite deeper scrutiny. The documentation you maintain today becomes your defense tomorrow when regulators or litigation counsel come asking questions.

Direct Mail Integration

Direct mail remains surprisingly relevant in lead generation, particularly for insurance, mortgage, and high-ticket home services. Physical mail pieces supporting phone and email outreach improve contact rates 15-25% in many campaigns, creating a multi-touch approach that cuts through digital noise.

But direct mail requires deliverable addresses. The USPS returns undeliverable mail at rates of 10-15% for unstandardized consumer data. That represents wasted print costs, postage, and campaign effectiveness. Validated, standardized addresses reduce undeliverable rates to 2-4%, transforming direct mail from a cost center into a contact rate multiplier.

Property Data Enrichment

Validated addresses unlock property-level data that transforms lead value in ways that nothing else can replicate. Once an address validates and geocodes, you can append property type, ownership status, building age, square footage, estimated value, and dozens of other attributes that qualify leads and justify premium pricing.

A solar lead from a validated address that enriches to “single-family, owner-occupied, 2,500 sq ft, south-facing roof, built 1995” is worth 3-5x a lead with an unvalidated address and no property context. The address becomes a key that unlocks an entire profile of property intelligence.

Understanding Address Standardization

Before validation comes standardization. Raw addresses arrive in infinite variations that must be normalized before meaningful validation can occur. This preprocessing step transforms chaos into consistency.

The Problem of Address Chaos

Consumers enter addresses in whatever format feels natural to them. They abbreviate inconsistently. They omit elements. They transpose numbers. They use colloquial names for streets. They forget apartment numbers. They misspell everything from street names to city names to state abbreviations.

Consider these variations, all representing the same physical location: “123 North Main Street, Apartment 4B, Springfield, IL 62701” might arrive as “123 N. Main St. #4B, Springfield IL” or “123 N Main, Apt 4-B, Springfield, Illinois 62701-4532” or simply “123 North Main Street, 4B, Springfield” or even “123 N. Main Street, Suite 4B, Springfield, IL.” Without standardization, these appear as five different addresses in your database. Matching fails. Deduplication fails. Geographic analysis fails. The same prospect submitting multiple leads counts as multiple unique leads rather than duplicates, inflating your costs and damaging buyer relationships.

USPS Standardization: The Official Format

The United States Postal Service defines official address formatting through the Coding Accuracy Support System (CASS). CASS-certified address standardization converts any valid US address into the official postal format that maximizes deliverability and enables reliable data operations.

Address line standardization handles the street-level details: street numbers formatted consistently, directional prefixes (North, South, East, West) abbreviated to their standard forms (N, S, E, W), street suffixes standardized (Street becomes ST, Avenue becomes AVE, Boulevard becomes BLVD), secondary unit designators normalized (Apartment becomes APT, Suite becomes STE), and unit numbers formatted according to postal conventions.

City, state, and ZIP standardization ensures location data matches official records: city names spelled according to USPS standards without colloquial alternatives, state names converted to two-letter abbreviations, ZIP codes completed to ZIP+4 format when available, and ZIP+4 codes validated against current USPS assignment to confirm they represent real delivery areas.

The Delivery Point Barcode (DPBC) addition provides the highest level of address precision. This 11-digit code uniquely identifies the delivery point, enables maximum mail processing efficiency, and confirms the address reaches a real, specific mailbox rather than a general delivery area.

The CASS Certification Requirement

CASS certification means a software provider has passed USPS testing and maintains current postal data. This certification provides several benefits that matter for professional lead operations.

Postal discounts become available when mailers use CASS-certified addresses, with savings reaching 10-15% for high-volume direct mail operations. The accuracy guarantee requires CASS-certified providers to maintain 98.5% or higher accuracy on test files, with regular recertification and mandatory database updates on USPS release schedules. Deliverability codes returned by CASS processing include Delivery Point Validation (DPV) indicators showing whether addresses are deliverable, vacant, or commercial versus residential.

For lead generation, CASS certification matters because it represents the highest standard of address accuracy available. Non-CASS-certified tools may provide address formatting, but they cannot provide the delivery confidence that CASS certification enables. When buyers ask about your data quality standards, CASS certification is the credential that demonstrates professional-grade operations.

The Address Validation Process

Address validation moves beyond standardization to confirm whether an address actually exists and is deliverable. The process involves multiple verification layers, each providing different confidence levels and catching different types of problems.

Layer 1: Format Validation

Format validation checks whether submitted data contains the structural elements of a valid address. This layer catches obvious garbage before more expensive checks run against the data.

Format validation catches missing street numbers, missing street names, invalid state codes, ZIP codes with wrong digit counts, obviously fake entries like “123 Fake Street,” and PO Box format errors. This validation is essentially free, requiring only pattern matching against known address structures without any database lookups or API calls. It should reject 3-5% of submissions as obviously malformed, preventing these from consuming your validation budget.

Layer 2: USPS Data Matching

The core of address validation involves matching submitted addresses against USPS address databases. This confirms that the address exists as a recognized delivery point and catches well-formatted fabrications that passed the first layer.

The USPS database consists of several components that work together. The ZIP+4 File contains all valid ZIP+4 ranges with associated address information, updated monthly with approximately 42 million records covering every deliverable address in the United States. The DPV File (Delivery Point Validation) confirms whether specific addresses are actually deliverable; a valid ZIP+4 does not guarantee deliverability, but DPV confirmation does. The LACSLink File tracks address conversions from rural routes to street addresses, critical for areas that have undergone postal conversion where old-format addresses need translation. The SuiteLink File matches business names to secondary addresses like suite numbers, important for B2B address validation where company names must resolve to specific delivery points.

When an address matches against these files and returns positive DPV confirmation, you have high confidence it represents a real, deliverable location where mail will arrive.

Layer 3: Geocoding

Geocoding converts validated addresses into latitude/longitude coordinates. This enables geographic analysis, distance calculations, and spatial fraud detection that would be impossible with text-only address data.

Geocoding accuracy varies significantly across providers and address types. Rooftop or point-level geocoding places coordinates at the actual building location with accuracy within 10-50 meters, providing the highest confidence for fraud detection and geographic routing. Parcel centroid geocoding places coordinates at the center of the property parcel with accuracy within 50-100 meters, acceptable for most geographic routing purposes. Street segment interpolation estimates coordinates based on address number position within the street segment, with accuracy within 100-500 meters that works only for city-level analysis. ZIP centroid geocoding places coordinates at the center of the ZIP code with accuracy measured in kilometers, insufficient for any lead-level analysis.

For lead validation, rooftop-level geocoding provides maximum value. If an address returns only ZIP centroid coordinates, it likely does not exist as a deliverable address or the geocoding provider lacks the data precision needed for your use case.

Layer 4: Deliverability Indicators

Beyond confirming existence, validation should return deliverability indicators that assess whether mail will actually reach the address. These codes transform binary “valid/invalid” decisions into nuanced quality assessments.

DPV Match indicates a confirmed deliverable address with active mail delivery. DPV No Match means the address format is recognized but not confirmed deliverable, possibly indicating new construction, a gated community, or a non-existent address. Vacant flags addresses confirmed to exist but flagged as vacant by USPS based on no mail pickup for 90+ days. CMRA (Commercial Mail Receiving Agency) identifies addresses that are mail-forwarding locations like UPS Store or Mailboxes Etc., which may indicate a privacy-conscious consumer or a fraud attempt. RDI (Residential Delivery Indicator) confirms whether the address is residential or commercial, important for B2C versus B2B routing decisions.

A DPV-confirmed residential address has fundamentally different value than a CMRA at a commercial strip mall, and your validation pipeline should capture and act on these distinctions.

Address Validation Vendors and Pricing

The address validation market includes comprehensive platforms, specialized point solutions, and embedded options within larger lead management systems. Pricing typically follows per-lookup models with volume discounts that can significantly reduce costs at scale.

Comprehensive Validation Platforms

Smarty (formerly SmartyStreets) provides CASS-certified US address validation with rooftop geocoding and property data enrichment. Their developer-friendly API handles real-time and batch processing with modern documentation and integration patterns. Pricing as of 2024-2025 starts with a free tier of 250 lookups per month, core plans starting at $0.00425 per lookup at 10,000 monthly volume, and volume discounts reaching $0.001-0.002 per lookup at 1M+ monthly volume. Key features include autocomplete for form integration, ZIP+4 and DPV confirmation, latitude/longitude geocoding, vacant address flagging, and CMRA detection.

Melissa Data provides enterprise-grade data quality solutions including address validation, standardization, geocoding, and enrichment. Their platform handles US and international addresses with extensive customization options. Enterprise contracts are required for most services, with typical per-lookup costs of $0.01-0.05 depending on validation depth and volume. Annual subscription options are available for predictable budgeting. Key features include CASS and SERP certification, global address validation across 240+ countries, property data enrichment, identity verification integration, and move update tracking through NCOALink.

Loqate, a GBG Company, processes over 3 billion address verifications monthly across 250 countries. Their strength is global coverage and form autocomplete integration that reduces data entry errors at the source. US address validation runs $0.041-0.047 per lookup at standard volume, with volume discounts and custom enterprise pricing available. Key features include 80% faster address entry with autocomplete, premise and sub-premise level validation, AI-powered error correction, GDPR compliance features for international operations, and real-time and batch APIs.

Experian Data Quality offers address validation as part of their broader data quality suite. Enterprise-focused with strong integration into credit and identity verification workflows, they serve organizations that need address validation as part of a comprehensive data quality program. Enterprise sales are required, with bundled pricing alongside other data quality services and typical costs of $0.02-0.10 per lookup depending on the service package. Key features include CASS certification, consumer and business address distinction, integration with Experian identity data, and move tracking and forwarding services.

Specialized Solutions

PostGrid focuses on address verification for direct mail applications, with strong automation and print integration that connects validation directly to fulfillment. They offer pay-as-you-go and subscription options with verification costs varying by volume and a free trial available. Key features include CASS and SERP certification, bulk processing up to 200,000 addresses, direct mail automation integration, and CRM integrations with Salesforce and HubSpot.

Lob combines address verification with direct mail API capabilities, enabling validated addresses to flow directly into print and mail workflows without manual handoffs. Address verification starts at $0.02-0.05 per lookup, with bundled pricing available for volume users who also use mail services. Key features include address autocomplete, CASS-certified validation, mail piece design and delivery, and tracking and analytics for campaign performance.

Lead Platform Integrations

Many lead distribution platforms include address validation as embedded features or partner integrations. LeadConduit from ActiveProspect integrates with multiple address validation providers through their enhancement marketplace, allowing operators to add validation as a workflow step. Boberdoo offers address validation as part of their lead processing workflow with partner integrations baked into the platform. Lead Prosper includes address standardization in their form processing pipeline.

For practitioners already using these platforms, integrated validation often provides the most efficient implementation path, though pricing may be higher than direct API integration with specialized vendors. The convenience of built-in validation sometimes justifies the premium over building custom integrations.

Implementation Patterns for Lead Generation

Address validation can occur at multiple points in the lead lifecycle. The optimal pattern depends on your role in the ecosystem, lead volume, and quality requirements. Each approach offers distinct tradeoffs between data quality, user experience, and operational cost.

Real-Time Form Validation

Real-time validation checks addresses as consumers complete forms. Invalid or undeliverable addresses trigger immediate feedback, allowing correction before submission completes.

Implementation follows a straightforward pattern: integrate autocomplete that suggests validated addresses as users type, validate the complete address on form blur or submission, display correction suggestions for standardization errors, and block submission for genuinely invalid addresses. This approach provides the highest data quality at capture because users can correct errors immediately, invalid leads never enter your system, and downstream validation costs decrease since you are not paying to re-validate already-clean data.

The disadvantages require consideration. Real-time validation adds 100-300ms latency to form submission. It may reject legitimate addresses with validation database gaps, particularly for new construction. It can increase form abandonment if validation is too aggressive about rejecting borderline addresses. And it carries higher per-lookup costs since batch discounts do not apply.

This pattern works best for publishers generating their own leads who prioritize quality over volume and can absorb some abandonment in exchange for cleaner data.

Post-Capture Batch Validation

Batch validation processes leads in bulk after capture, typically in scheduled jobs running hourly or daily. This approach separates lead capture from lead qualification.

Implementation captures leads with minimal client-side validation, queues them for batch processing, validates and standardizes in bulk with thousands of addresses per request, flags or rejects invalid leads before distribution, and enriches valid leads with geocodes and property data. The advantages include lower per-lookup costs at volume, no form latency impact on conversion rates, ability to retry temporary validation failures, and capacity to test different validation thresholds before committing to acceptance or rejection.

The disadvantages are significant. Invalid leads enter your system before filtering. Users cannot correct errors since they have long since left your form. Time-to-distribution delays for valid leads while they wait in the batch queue. And initial follow-up attempts may be wasted on leads that will ultimately fail validation.

This pattern works best for high-volume aggregators purchasing leads from multiple sources where controlling the capture experience is not possible.

Ping-Post Validation

In ping-post distribution, address validation occurs during the ping phase before lead commitment. This puts validation at the decision point where it directly affects pricing and acceptance.

Implementation receives the ping with address data, validates and standardizes during bid evaluation, factors the validation result into bid price, and completes the post only if the address validates acceptably. The advantages include validation cost incurred only for actionable leads, invalid addresses reducing bids or blocking purchase entirely, standardization enabling accurate geographic routing, and property enrichment enabling premium pricing for qualified leads. For more on this distribution model, see our guide to ping-post systems and real-time lead auctions.

The disadvantages center on latency. Validation adds time to ping response that may cause you to miss deals. Validation timeouts can block otherwise good transactions. The entire validation sequence must complete in a millisecond timeframe to remain competitive.

This pattern works best for buyers and aggregators in ping-post marketplaces who need to make quality-based pricing decisions in real time.

Hybrid Validation

Most sophisticated operations combine patterns: lightweight validation at capture with comprehensive validation in batch or at distribution. This approach optimizes for both user experience and data quality.

Implementation layers validation appropriately. At capture, format validation plus autocomplete runs for free or near-free with fast response times. Post-capture queue processing handles USPS standardization plus DPV check at $0.01-0.02 per lead. At distribution, geocoding plus property enrichment runs at $0.02-0.05 per lead, but only for leads that have already passed earlier validation gates.

This approach catches obvious errors at the lowest cost, distributes validation investment appropriately across the lead lifecycle, enables staged rejection based on validation depth, and optimizes the cost-versus-quality tradeoff. The disadvantages include more complex implementation, pipeline coordination requirements, and potential delays at multiple processing points.

This pattern works best for operators at scale who have optimized their validation economics and can invest in the infrastructure to support multi-stage processing.

Property Data Enrichment: Beyond Basic Validation

Validated addresses unlock property-level data that transforms lead value in specific verticals. Understanding available enrichment and its applications helps maximize the return on your address validation investment.

Available Property Data

Once an address validates to a specific parcel, property databases provide extensive enrichment that goes far beyond confirming deliverability.

Physical characteristics include property type (single-family, condo, multi-family, commercial), square footage for both building and lot, year built, number of rooms and bedrooms and bathrooms, roof type and approximate age, pool or garage or basement indicators, and construction materials. Ownership and occupancy data covers owner names and mailing address, owner-occupied versus rental status, length of ownership, purchase date and price, and current estimated value. Financial indicators include mortgage presence and approximate balance, lien information, assessed value and tax status, and recent sale history. Geographic context adds school district, flood zone designation, HOA presence, and distance to various amenities.

This data transforms a simple address into a comprehensive property profile that enables qualification, segmentation, and premium pricing.

Vertical-Specific Applications

Different verticals extract different value from property enrichment. Understanding these applications helps you prioritize enrichment investment.

For solar leads, property data determines viability. Roof type, home orientation, square footage, and ownership status separate qualified prospects from non-starters. A validated address enriching to “single-family, owner-occupied, 2,200 sq ft, asphalt shingle roof, south-facing, built 2005” represents a qualified solar opportunity. See our complete guide to solar lead generation for more on property-based qualification. The same validation returning “condo, renter-occupied, HOA present” indicates likely rejection and should price accordingly or be suppressed entirely.

For home services leads, property size correlates with service value. A pest control lead from a 4,000 sq ft home has different value than one from an 800 sq ft apartment because service scope and pricing scale with property size. HVAC leads benefit from knowing construction year, square footage, and HVAC system age to estimate equipment replacement likelihood.

For mortgage leads, property value and existing mortgage data inform refinance potential directly. A validated address showing $400,000 home value with $300,000 mortgage balance indicates refinance opportunity. Property purchase date suggests original rate environment and refinance likelihood based on when the borrower locked in their current terms. Our mortgage lead generation guide covers qualification strategies in depth.

For insurance leads, property characteristics affect policy pricing and risk assessment across multiple dimensions. Age, construction type, square footage, pool presence, and geographic hazard zones all factor into underwriting. Validated addresses enable pre-qualification against these factors before routing leads to carriers.

Enrichment Vendor Pricing

Property enrichment adds cost beyond basic validation, but the ROI calculation typically favors the investment.

CoreLogic offers enterprise pricing typically ranging from $0.10-0.30 per property record depending on data depth and volume commitments. ATTOM provides volume-based pricing at approximately $0.05-0.15 per record. Melissa bundles property data with address validation at an incremental $0.02-0.05 per record. DataTree from First American offers enterprise contracts competitive with CoreLogic.

The ROI calculation is straightforward: if property enrichment costs $0.10 per lead and enables $5 higher pricing for qualified leads, enrichment pays for itself at just 2% improvement in lead value. For verticals where property data drives qualification, enrichment ROI typically exceeds 10:1, making it one of the highest-return investments in the lead quality stack.

Address Validation and Fraud Detection

Address validation provides unique fraud signals that complement phone and email verification. Understanding these signals strengthens your overall fraud detection capability and catches sophisticated fraud that other validation layers miss.

Fraud Signals from Address Validation

Non-existent addresses provide the most obvious signal. If the claimed address does not match any deliverable address in USPS databases, the submission is either erroneous or fraudulent. Error rates for legitimate consumers run 2-5%; non-existent address rates above 10% indicate systematic fraud rather than occasional typos.

Vacant addresses warrant additional verification. USPS flags addresses as vacant when mail goes uncollected for 90+ days. A lead claiming to live at a vacant address is either lying about their residence or the property has changed status since their form submission. Legitimate vacant rates should remain under 3% of residential leads.

CMRA addresses, those Commercial Mail Receiving Agencies like UPS Store and Mailboxes Etc., indicate the consumer is using a forwarding address rather than their residence. This may indicate privacy consciousness or fraud. CMRA addresses in residential lead flows warrant scrutiny and additional verification before acceptance.

Geographic inconsistency triggers investigation. When IP geolocation differs significantly from claimed address, such as an IP in California with an address in Florida, the submission warrants additional verification. Some geographic variance is normal due to VPNs, mobile networks, and travel, but systematic inconsistency indicates fraud operations submitting leads from centralized locations.

Property mismatch reveals fabrication. When claimed property characteristics conflict with enriched data, fraud is likely. A lead claiming to be a homeowner at an address that enriches to “renter-occupied multi-family” is providing false information that should trigger rejection.

Velocity patterns expose recycling. Multiple leads from the same address with different names, or the same name and phone with different addresses, indicate either household-level interest (legitimate but rare) or fraud (much more common). Address deduplication windows of 30-90 days catch recycling attempts.

Implementing Address-Based Fraud Rules

Combine address signals with other fraud indicators for comprehensive scoring. A scoring system might assign non-existent addresses 30-40 points, vacant addresses 15-25 points, CMRA addresses 10-15 points depending on context, IP/address mismatch over 500 miles 15-20 points while allowing for VPNs and travel, property mismatch 20-30 points for owner versus renter conflicts, and duplicate addresses within 30 days 25-35 points for likely recycled leads.

Scoring thresholds vary by vertical and risk tolerance. Most operations block leads scoring above 70-80 points, manually review leads scoring 50-70, and accept leads below 50 with standard processing. Your thresholds should reflect your specific fraud exposure and false positive tolerance.

Cost-Benefit Analysis: The ROI of Address Validation

Address validation costs money. The question is whether it saves more than it costs. For most lead generation operations, the math strongly favors validation investment, often by margins that make validation one of your highest-ROI operational improvements.

Direct Cost Savings

Reduced returns for geographic mismatch represent the first savings category. Buyers reject leads outside their service areas, and without validated addresses, 5-10% of leads route incorrectly based on ZIP code errors, city misspellings, or state confusion. At $40 CPL, a 5% return rate on 10,000 leads costs $20,000 monthly. Validation reducing returns to 1% saves $16,000 every month.

Reduced fraud losses add to the savings. Address-based fraud detection catches 10-20% of fraud that phone and email validation misses entirely. If 15% of leads are fraudulent and address validation catches an additional 2% (the incremental portion of fraud that other validation missed), savings at $40 CPL on 10,000 leads reach $8,000 monthly.

Direct mail efficiency provides savings for operations including physical mail. Reducing undeliverable rates from 12% to 3% saves 9% of mail costs. At $0.50 per piece for 10,000 pieces monthly, direct savings reach $450 plus improved campaign effectiveness from higher delivery rates.

Revenue Enhancement

Premium pricing for enriched leads generates new revenue. Property-enriched leads command 15-40% premiums in solar, home services, and mortgage verticals where property characteristics drive qualification. If enrichment enables $5 higher pricing on 30% of leads (those with valuable property profiles), revenue increase on 10,000 leads reaches $15,000 monthly.

Improved buyer relationships compound over time. Buyers receiving consistently validated, standardized addresses with accurate geographic data purchase more volume at better terms. The relationship value accumulates as buyers learn to trust your data quality and prioritize your leads over competitors with less reliable operations.

ROI Calculation Example

Consider an operation processing 10,000 leads monthly. Without validation, average CPL is $40 with a 5% return rate for geographic mismatch and 0% incremental fraud detection from addresses. With validation at $0.04 per lead, average CPL increases to $42 due to premium pricing, return rate drops to 1%, and 2% additional fraud is detected. The monthly impact shows $20,000 revenue increase from premium pricing, $16,000 saved from reduced returns, $8,000 saved from fraud detection, offset by $4,000 in validation costs. Net monthly benefit: $40,000.

At $0.04 per lead for comprehensive validation, the $4,000 monthly cost returns $40,000 in savings and revenue enhancement. ROI: 900%. Even conservative estimates assuming half the benefit yield 400%+ ROI. Address validation pays for itself many times over in professional lead generation operations.

Common Address Validation Mistakes

Fifteen years in lead generation reveals patterns of address validation failures that cost operators money. Avoiding these mistakes ensures your validation investment delivers full value.

Format-Only Validation

Checking that an address has the right structure (number, street, city, state, ZIP) catches perhaps 5% of bad addresses. The remaining 95% have correct format but wrong content. “123 Fake Street, Springfield, IL 62701” passes format validation but does not exist. The solution is requiring DPV confirmation from CASS-certified validation, not just format matching.

Ignoring Standardization

Accepting unstandardized addresses creates downstream problems: failed deduplication, incorrect geographic routing, and database inconsistency. “123 North Main St” and “123 N. Main Street” appear as different addresses without standardization. The solution is standardizing every address to USPS format before storage, regardless of validation outcome. Preserve the original input in a separate field for debugging, but operate against standardized data.

Over-Aggressive Rejection

Some legitimate addresses fail validation due to new construction, recent street name changes, or database gaps. Rejecting every non-DPV-matched address loses real leads and frustrates legitimate prospects. The solution is implementing tiered handling. Block clearly invalid addresses, flag uncertain ones for review, and track validation failure patterns to identify systematic issues versus random errors.

Validating Too Late

Validating addresses after buyer delivery means invalid leads have already damaged buyer relationships and triggered returns. The damage is done before you even know there was a problem. The solution is validating before distribution. Catch problems while you can still suppress delivery and preserve buyer trust.

Ignoring Secondary Units

Apartment and suite numbers significantly affect deliverability. “123 Main Street” might be valid while “123 Main Street, Apt 4B” is not (if the building has only 3 units). Conversely, “123 Main Street” might be incomplete for a multi-unit building. The solution is validating complete addresses including secondary unit designators and flagging addresses that might need unit information.

Static Validation Data

USPS updates address databases monthly. Streets get renamed, ZIP codes split, new construction gets added. Validation against stale data produces incorrect results that accumulate over time. The solution is confirming your vendor maintains current CASS certification and updates databases on USPS release schedule. Ask about their update frequency and recertification status.

Neglecting Property Enrichment

For verticals where property data drives qualification, stopping at address validation leaves money on the table. Enrichment costs pennies and enables premium pricing. The solution is evaluating property enrichment ROI for your vertical. If property characteristics affect lead value, enrichment usually pays for itself within the first month.

Integration Best Practices

Effective address validation requires thoughtful integration with your lead management infrastructure. These practices ensure validation adds value without creating bottlenecks or operational fragility.

API Design Considerations

Timeout handling prevents validation latency from blocking your entire operation. Address validation APIs occasionally experience latency spikes, and your design should include configurable timeouts (typically 2-5 seconds) and fallback behavior. Do not let validation latency block lead capture entirely; queue leads for later validation if necessary.

Retry logic handles transient failures gracefully. Implement exponential backoff retry for failed validations, with leads queuing for later processing rather than immediate rejection. Most validation failures are temporary, and a retry 30 seconds later often succeeds.

Response caching reduces costs and latency for repeated addresses. The same addresses appear repeatedly through duplicates, household members, and lead recycling. Cache validation results for 24-72 hours to reduce API costs and latency on repeated lookups. Be careful about cache invalidation for addresses that may have status changes.

Batch optimization improves economics for high-volume operations. When processing leads in batch, group addresses for bulk API calls. Most vendors offer batch endpoints that process hundreds of addresses per request at lower per-lookup costs than individual calls.

Data Architecture

Standardized storage enables reliable downstream operations. Store addresses in standardized format, not raw input format. This enables reliable matching, deduplication, and analysis across your entire lead database. Preserve the original input in a separate field for debugging and audit purposes.

Validation metadata supports quality analysis and routing decisions. Store validation results alongside addresses: DPV status, geocoordinates, vacancy indicator, validation timestamp, and confidence scores. This data enables quality analysis and informed routing decisions without re-running validation.

Update tracking maintains data freshness over time. Addresses change through moves, construction, and street renaming. For long-term lead databases, periodic revalidation catches addresses that have become invalid or updated. The USPS NCOALink service tracks consumer moves for 48 months and can flag addresses that need attention.

Form Integration

Autocomplete implementation improves user experience and data quality simultaneously. As users type, suggest validated addresses that match their input. Most users select from suggestions, eliminating typos entirely and reducing validation failures from user error.

Progressive validation provides feedback throughout the form experience. Validate incrementally as users complete fields. Check ZIP code validity before they enter the street. This provides immediate feedback without waiting for full form completion, letting users correct problems in context.

Error messaging guides users toward success. When validation fails, provide actionable guidance. “We could not verify this address. Please check the street number and spelling.” works better than generic “Invalid address” errors. Help users succeed rather than simply blocking them.

Frequently Asked Questions

What is address validation in lead generation?

Address validation confirms that a submitted physical address exists, is deliverable, and follows official postal formatting. For lead generation, it ensures geographic routing works correctly, enables property-based qualification, supports fraud detection, and maintains data quality for buyers requiring accurate location information.

How much does address validation cost per lead?

Basic USPS standardization and DPV confirmation typically costs $0.01-0.04 per lookup depending on volume. Comprehensive validation including geocoding runs $0.03-0.08 per lookup. Property enrichment adds $0.05-0.15 per record. Volume discounts of 30-60% apply at scale, with enterprise operations achieving sub-penny basic validation costs.

What is CASS certification and why does it matter?

CASS (Coding Accuracy Support System) certification from USPS confirms that address validation software meets postal accuracy standards of 98.5%+ on test files. CASS-certified processing provides official standardization, DPV confirmation, and qualifies mailers for postal discounts. For lead generation, CASS certification represents the highest confidence in address accuracy.

How does address validation help detect fraud?

Address validation reveals fraud through several signals: non-existent addresses (fabricated data), vacant addresses (no one lives there), CMRA addresses (mail forwarding services), geographic inconsistency with IP location, and property characteristic mismatches (claiming ownership of a rental). These signals complement phone and email validation to catch sophisticated fraud.

Should I validate addresses in real-time or batch?

Real-time validation provides best data quality by catching errors before leads enter your system, but adds form latency and costs more per lookup. Batch validation costs less but allows invalid leads to enter your system before filtering. Most operations use hybrid approaches: lightweight real-time checks plus comprehensive batch validation before distribution.

What is the difference between address validation and standardization?

Standardization converts addresses to official USPS format (abbreviations, directionals, ZIP+4) without confirming existence. Validation confirms the address exists and is deliverable through DPV matching. A standardized address might still be non-existent; a validated address has been confirmed against USPS delivery point databases.

How accurate are address validation services?

CASS-certified services maintain 98.5%+ accuracy on USPS test files. Real-world accuracy for consumer-submitted addresses typically runs 95-98% for legitimate submissions. The gap represents new construction, rural addresses, and database timing issues. False positive rates (valid addresses incorrectly rejected) should remain below 1-2%.

What property data can I get from validated addresses?

Once an address validates to a specific parcel, property databases provide: property type, square footage, year built, number of rooms, roof type, ownership status, owner name, purchase date and price, estimated value, mortgage information, and geographic context (school district, flood zone, HOA). Property enrichment costs $0.05-0.15 per record and enables premium lead pricing in relevant verticals.

How often should I revalidate addresses in my database?

For active lead databases, revalidate addresses at key lifecycle points: before distribution, before direct mail campaigns, and before any contact attempting to reach the physical location. For long-term databases, quarterly revalidation catches moves and address changes. The USPS NCOALink (National Change of Address) service tracks consumer moves for 48 months.

Which address validation vendor should I choose?

Vendor selection depends on volume, integration requirements, and budget. Smarty offers developer-friendly APIs with competitive pricing for mid-volume operations. Melissa provides enterprise-grade solutions with extensive enrichment options. Loqate excels at global coverage and autocomplete integration. For practitioners already using lead distribution platforms, embedded validation integrations often provide the simplest implementation path.

Key Takeaways

Address validation serves multiple purposes beyond mail delivery: geographic routing, fraud detection, property-based qualification, and compliance documentation. In verticals like solar, home services, and mortgage, validated addresses directly affect lead value and buyer acceptance.

CASS-certified validation provides the highest accuracy standard, including USPS standardization, DPV confirmation, and geocoding. Non-certified tools may format addresses but cannot confirm deliverability with the same confidence.

Address validation costs $0.01-0.08 per lead depending on depth and volume. ROI typically exceeds 500% through reduced returns, fraud detection, and revenue enhancement from enriched leads.

Hybrid validation patterns optimize cost and quality: lightweight checks at capture, comprehensive validation before distribution, and property enrichment for relevant verticals.

Address-based fraud signals complement phone and email validation. Non-existent addresses, vacant properties, CMRA locations, and geographic inconsistencies catch fraud that technical contact validation misses.

Property enrichment transforms lead value in home-related verticals. Understanding property type, size, ownership, and characteristics enables premium pricing and improved buyer matching.

Common mistakes include format-only validation, ignoring standardization, rejecting too aggressively, validating too late, and using stale validation data. Avoid these to maximize validation value.

Store addresses in standardized format with validation metadata. This enables reliable deduplication, geographic analysis, and quality tracking across your lead operation.

Sources

-

USPS PostalPro - Official USPS resource for postal addressing standards, CASS certification requirements, and address quality programs that define industry-standard validation thresholds.

-

USPS PostalPro: CASS - USPS Coding Accuracy Support System (CASS) certification documentation explaining the 98.5% accuracy threshold and DPV (Delivery Point Validation) requirements.

-

USPS PostalPro: Address Quality - USPS guidance on address standardization, explaining why 10-15% of unstandardized addresses are undeliverable and how validation reduces returns.

-

Google Developers: Structured Data - Technical reference for structured address data markup, relevant for integrating address validation into lead capture systems.

-

Schema.org: PostalAddress - Structured data vocabulary for address components, providing the data model underlying address standardization and enrichment systems.