Master auto insurance leads with real CPL benchmarks, conversion rates, and quality metrics used by the industry’s top performers. Includes 2026 pricing, seasonal patterns, compliance requirements, and strategic guidance for both lead buyers and generators.

A consumer types “cheap car insurance” into Google. Within 200 milliseconds, their information travels through an auction system, gets evaluated by a dozen buyers, sells to the highest bidder, and lands on an agent’s screen 1,500 miles away. The consumer thinks they requested quotes from a comparison site. What actually happened: their intent became a product that traded on a marketplace they never knew existed.

This is auto insurance lead generation. It represents the largest and most sophisticated vertical in the lead economy, with an estimated $5.2-6.8 billion in annual transaction value across all insurance sub-verticals and $3-4 billion specifically in auto. When Progressive spent $3.5 billion on advertising in 2024 – nearly tripling from $1.22 billion the year before – they were fueling an ecosystem that touches every corner of insurance distribution.

Auto insurance is the bellwether vertical. The technology, the compliance frameworks, the unit economics – what develops here spreads to mortgage, solar, legal, and home services. If you want to understand where lead generation is heading, you watch auto insurance first.

This guide provides everything agents, carriers, and lead generators need to operate successfully in this market: real pricing benchmarks, conversion metrics, qualification standards, and compliance requirements that determine who wins and who loses money.

Market Overview: The Auto Insurance Lead Landscape

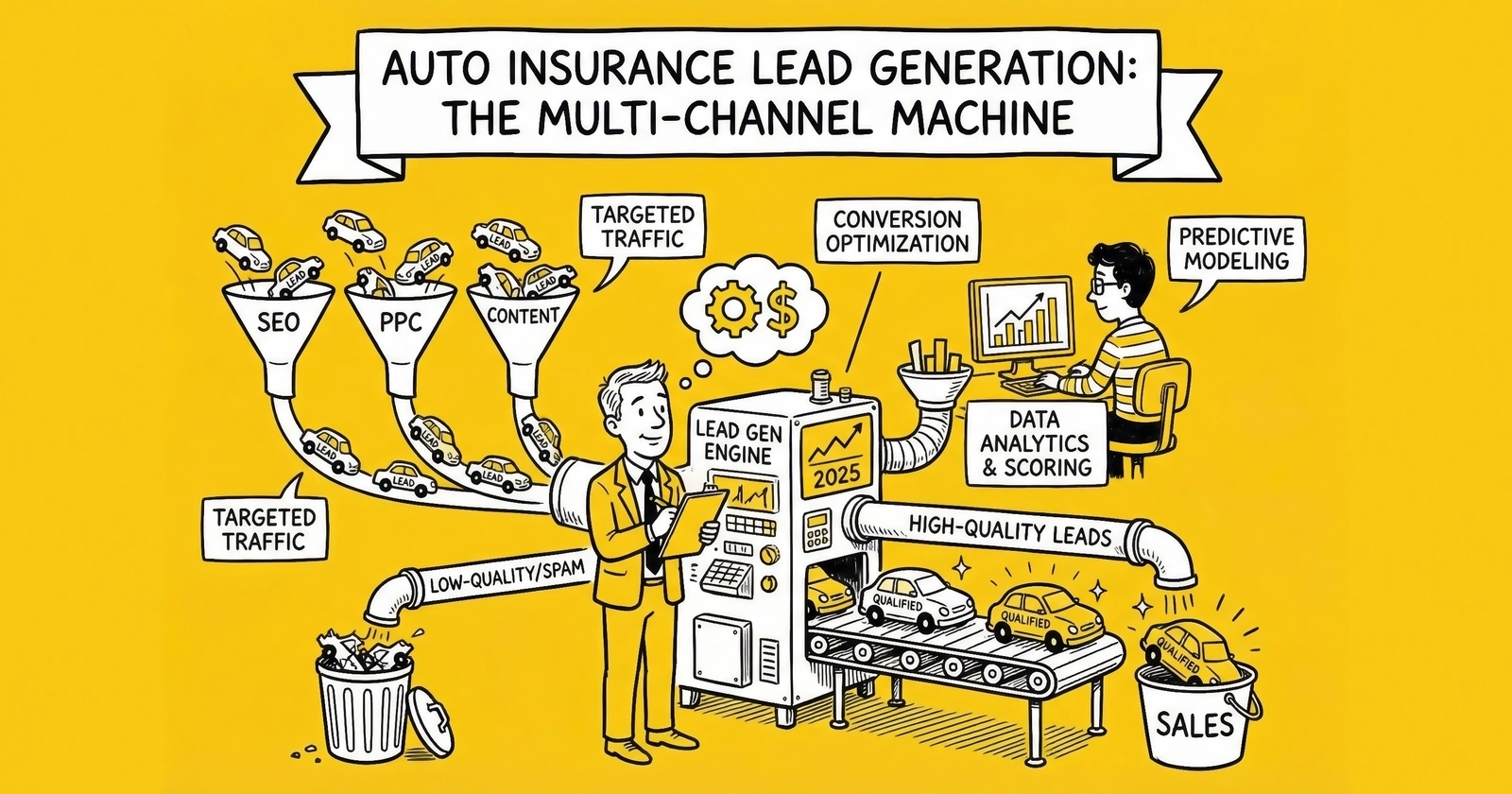

The auto insurance lead generation market operates as a multi-billion dollar ecosystem connecting consumer shopping intent with carriers and agents competing for that attention. Understanding the market structure helps you position effectively whether you are buying leads, selling them, or building a business around this vertical.

Market Size and Transaction Volume

The total addressable market for auto insurance lead generation in the United States ranges from $3-4 billion annually for the auto sub-vertical specifically, within the broader $5.2-6.8 billion insurance lead ecosystem. This estimate encompasses direct carrier spending on performance marketing channels, third-party intermediary transaction values, and the substantial affiliate traffic flowing through comparison and aggregation sites.

Two publicly traded companies provide exceptional visibility into market dynamics. MediaAlpha reported $864.7 million in revenue for 2024, representing 123% year-over-year growth. Their transaction value reached $1.5 billion across the marketplace, with Property and Casualty insurance driving the majority of performance. Q4 2024 transaction value increased 202% year-over-year – reflecting the dramatic recovery in carrier advertising spend. MediaAlpha operates the industry’s largest programmatic insurance marketplace, connecting more than 1,200 active partners and generating nearly 119 million consumer referrals annually.

EverQuote crossed $500.2 million in revenue for 2024, growing 74% from the prior year. Their automotive vertical alone generated $446.1 million – a 96% increase from the prior year. This single sub-vertical now represents nearly 90% of their total revenue, making EverQuote effectively a pure-play auto insurance lead company despite operating in other verticals.

These two companies represent approximately 50-65% of the intermediated market, suggesting total intermediary transaction value in the $2.5-3.5 billion range. Adding direct traffic purchases, smaller intermediaries, and affiliate volume brings the total auto insurance lead market to an estimated $3-4 billion annually.

Carrier Advertising Spend: The Market Driver

Carrier advertising budgets directly determine market demand and pricing. When carriers invest aggressively, lead prices rise and inventory sells quickly. When they pull back, prices compress and generators scramble for buyers. Understanding carrier behavior is essential for anyone in the lead generation business because carrier spending responds to their own underwriting results, competitive positioning, and capital deployment strategies – not to lead generator economics.

The 2024 numbers tell the story. Progressive led with $3.5 billion in ad spend, representing a staggering 187% increase from 2023 and capitalizing on their return to profitability. Allstate maintained stable positioning at $1.87 billion, while GEICO pulled back from peak spending to approximately $1.6 billion as Berkshire focused on underwriting discipline. State Farm continued its direct investment approach at $1.11 billion.

Progressive’s near-tripling of ad spend occurred within a single year as underwriting profitability returned. Their Q4 2024 combined ratio of 87.4% explained the aggressive investment – they were generating exceptional returns with capacity for growth. CEO Tricia Griffith noted they were capitalizing on “very high levels of ambient shopping” in personal auto, with strong conversion rates indicating competitive pricing. The carrier spending surge of 2024 reflects the industry’s recovery from two difficult years. Auto insurers experienced unprecedented underwriting losses in 2022 and 2023 due to claims inflation, forcing them to restrict new business and cut advertising. As rate increases earned through and profitability returned, carriers quickly ramped their growth investments.

The Underwriting-to-Advertising Connection

Insurance carriers expand advertising when they are profitable and need growth; they contract when underwriting losses require rate increases. This creates a predictable but asymmetric cycle that shapes the entire lead generation market.

The expansion phase – like 2024’s surge – can happen quickly when carriers determine they have rate adequacy and competitive positioning. Progressive’s near-tripling of ad spend from $1.22 billion to $3.5 billion occurred within a single year. The contraction phase tends to be slower but more sustained. Carriers pull back gradually as losses accumulate, often hoping that competitors will reduce advertising first. By the time industry-wide pullback occurs, lead demand has already begun declining, creating inventory pressure for generators.

Sophisticated lead generators track carrier combined ratios (the ratio of losses plus expenses to premiums), quarterly earnings commentary, and advertising activity to anticipate shifts. Combined ratios below 100% indicate underwriting profitability and potential for advertising expansion. Combined ratios above 100% signal losses that eventually force pullbacks. Lead generators dependent on a single carrier face substantial risk when that carrier’s strategy shifts. Building relationships across multiple carriers and distribution channels – direct carriers, independent agents, captive agency networks – provides stability. When one buyer segment contracts, others may expand or maintain volume.

Why Auto Insurance Leads Command Premium Pricing

Auto insurance leads represent the highest-volume sub-vertical for several structural reasons that create consistent demand and support premium pricing.

Shopping frequency drives consistent demand throughout the year. Consumers typically compare quotes annually, whenever rates increase, or when life changes like a new car, moving, or adding a teen driver trigger shopping behavior. Unlike home insurance, which is tied to real estate transactions, or life insurance, which is triggered by major life events, auto insurance generates year-round shopping activity that keeps the market liquid.

Quoting simplicity enables rapid conversion and keeps the sales cycle short. Standardized data fields – vehicle information, driver details, current coverage – allow consumers to complete forms in 2-3 minutes while carriers can return quotes within seconds. This friction-free process supports high form completion rates and creates a velocity that other verticals cannot match.

High customer lifetime value justifies aggressive acquisition investment. A retained auto insurance customer generates $1,500-$3,000 in lifetime value across 3-5 policy years. This LTV supports aggressive cost-per-acquisition spending, creating robust demand for quality leads even at premium price points.

Regulatory standardization simplifies operations compared to more complex verticals. Unlike health insurance, which is subject to ACA rules, or Medicare, which is subject to CMS oversight, auto insurance operates under relatively consistent state-level regulation without federal enrollment periods or benefit standardization. This makes lead generation operations more straightforward to scale.

CPL Benchmarks: What Auto Insurance Leads Actually Cost

Lead pricing varies dramatically based on distribution model, quality filtering, and market conditions. These benchmarks reflect 2026 pricing across established intermediaries and direct publisher relationships. For a deeper breakdown across all insurance sub-verticals, see our comprehensive CPL benchmarks guide.

Exclusive Leads: $40-100

Exclusive leads sell to exactly one buyer, eliminating competition for the prospect’s attention. The premium pricing reflects real value: no race-to-call dynamics where you compete with four other agents calling within minutes of form submission, higher conversion rates that industry data shows at 50-100% above equivalent shared leads, better consumer experience from a single professional call rather than a barrage of competing outreach, and more time for relationship building since investing effort in personalized follow-up makes sense when you have paid $75 for a lead without worrying that a competitor already closed the sale.

Pricing within the $40-100 range depends on several factors. Geographic targeting matters, with coastal urban areas commanding premiums over rural markets. Credit tier filtering separates preferred risks from non-standard applicants. Vehicle value and driver demographics influence price points. Real-time delivery commands higher prices than batch processing. Consent documentation quality, particularly TrustedForm certification versus basic documentation, affects what buyers will pay.

Premium exclusive leads in the $80-100 range typically include verified contact information, real-time API delivery, and documented TCPA-compliant consent. Budget exclusive leads in the $40-60 range may have less stringent verification and slightly delayed delivery. The difference comes down to how much certainty you need and how much you are willing to pay for it.

Shared Leads: $15-35

Shared leads sell to 3-7 buyers simultaneously, with each buyer competing on speed-to-contact and sales execution. The lower per-lead cost reflects the competitive dynamics inherent in the model.

Speed determines success in the shared lead environment. Research shows 78% of customers purchase from the first responder. If you cannot call within the first minute, you are essentially competing for the 22% who did not buy from someone faster. Volume economics apply – lower per-lead costs enable higher volume purchasing, but only if your sales infrastructure can compete on speed. Conversion rates compress under competition, with contact rates of 45-55% and conversion rates of 8-12% dropping when multiple agents pursue the same consumer.

Pricing within the $15-35 range depends on the number of buyers in the share pool, since 3 buyers versus 7 buyers significantly affects conversion probability. Lead freshness matters – real-time delivery versus 5-minute delay creates meaningful differences. Basic versus enhanced filtering changes the lead quality you receive. Return policy terms affect the total cost calculation.

The math works for operations with call center infrastructure optimized for rapid response. The math fails for agents who check leads once or twice daily.

Live Transfers: $100-200+

Live transfer leads connect consumers directly to agents while still in shopping mode. The consumer submits a form, a call center screens them for intent and basic qualification, then transfers the warm call to the purchasing agent.

Premium pricing reflects substantial advantages over form-based leads. Near-certain contact means the consumer is on the phone, engaged, and ready to discuss coverage. Pre-qualification by call centers screens for shopping intent, eliminating tire-kickers and non-buyers before you invest time. Immediate engagement eliminates chase-the-lead dynamics – the conversation starts the moment the transfer connects. Higher conversion rates follow logically: live transfers convert at 15-25%, compared to 8-12% for form leads.

Live transfer pricing ranges from $100-150+ depending on qualification depth, geographic targeting, and time-of-day delivery. Some carriers pay $200+ for transfers meeting specific demographic and coverage criteria. The economics justify the pricing when you factor in the eliminated waste from no-contact leads and the higher conversion probability.

Aged Leads: $3-15

Aged leads – 30, 60, or 90+ days old – price at 5-20% of fresh lead costs. Fresh real-time leads at $40-100 convert at 15-20% and serve as primary acquisition channels. 30-day aged leads at $8-15 convert at 8-12% and work for supplemental volume. 60-day aged leads at $4-8 convert at 5-8% and serve well for training and testing. 90+ day aged leads at $3-5 convert at 3-5% and require systematic nurture programs to extract value.

Aged leads work for operators with systematic nurture capabilities. The math can be compelling: if fresh leads cost $50 and convert at 15%, that yields $333 cost per sale. If aged leads cost $5 and convert at 5%, that yields $100 cost per sale – better unit economics, if you have the operational capacity to work them properly. For strategies on converting aged and cold leads, systematic follow-up sequences matter more than speed.

Contact information degrades over time. Expect higher invalid contact rates with aged leads and build that into your cost models. Industry estimates suggest 3-5% monthly contact degradation – meaning a 90-day lead might have 10-15% invalid contact information. Factor this into your purchasing decisions and margin calculations.

Lead Sources and Acquisition Channels

Understanding where auto insurance leads originate helps you evaluate quality, set expectations, and optimize your purchasing strategy. Different channels produce leads with different intent levels, contact rates, and conversion patterns.

Search Engine Marketing

Google search represents the highest-intent traffic source in the market. Consumers actively typing “auto insurance quotes” or “car insurance near me” have immediate purchase intent and are ready to act. Current benchmarks show average CPC of $4-7 for insurance keywords, extreme competition levels since insurance ranks among the most expensive ad categories, the highest intent signals in the market, massive scale potential that requires sophisticated optimization, and premium quality grades since consumers are actively shopping.

The insurance industry collectively spends over $11 billion annually on digital customer acquisition, with Google capturing the largest share. This spending intensity creates opportunity through substantial demand while simultaneously creating challenge through intense competition for consumer attention. Success requires expertise in campaign management, landing page optimization, and bid strategy – or working with publishers who have developed that expertise.

Comparison Engines and Aggregators

Comparison sites like EverQuote, The Zebra, Insurify, and Policygenius capture consumers who want multiple quotes from a single form submission. These platforms generate substantial volume by offering convenience: consumers enter information once, the platform sells leads to multiple carriers and agents, and consumers receive competing quotes.

Lead quality from comparison engines tends to be high because consumers are actively shopping and understand they will receive multiple contacts. Contact rates often exceed 50% because consumers expect the outreach – they signed up knowing quotes would arrive. The comparison model aligns consumer interests in convenience and competitive quotes with platform monetization through lead sales. This alignment creates sustainable volume at predictable quality, making comparison engines reliable sources for serious lead buyers.

Affiliate Marketing Networks

Affiliate publishers run paid advertising on Google, Facebook, native ad networks, and other platforms, driving traffic to landing pages they control. They monetize by selling leads to aggregators or directly to buyers.

Quality varies significantly by affiliate. Smart buyers monitor source-level performance metrics to identify which affiliates deliver value. They cut underperforming affiliates quickly rather than hoping performance improves. They reward quality sources with preferential pricing or volume commitments to strengthen relationships. They request source transparency from aggregators to maintain visibility into what they are buying.

The programmatic insurance marketplace has matured substantially, with platforms like MediaAlpha providing real-time bidding, fraud detection, and quality scoring that improve efficiency for both publishers and buyers. This infrastructure enables sophisticated quality management at scale.

Social Media Advertising

Facebook, Instagram, and TikTok enable targeting based on life events, demographics, and behavioral signals. While intent is lower than search, costs are often 50-70% lower: Facebook average CPL runs $20-35 compared to $60-80 for Google. Intent levels are lower since consumers are not actively searching, but creative requirements for visual, engaging content can overcome some of that gap. Targeting advantages through life events like new car purchases, moving, or marriage enable relevant timing that catches consumers when insurance shopping makes sense.

Social media works for awareness and consideration stages. Expect longer sales cycles and more follow-up required compared to search-generated leads. The lower acquisition cost can make the economics work if you have the nurture infrastructure to convert prospects who are not ready to buy immediately.

Organic Content and SEO

Publishers like NerdWallet and Bankrate build content authority that ranks in Google for insurance queries. Their leads command premium pricing because organic traffic has no per-click cost and builds trust before form submission – consumers arrive having already engaged with helpful content.

Building comparable presence requires significant investment: 12-24 months of content development, substantial link building and authority development, ongoing content maintenance and optimization, and editorial quality that earns consumer trust. The payoff is higher-margin traffic once established – but the path requires commitment and patience that not every operator has.

Speed-to-Contact: The Single Most Important Factor

If there is one operational factor that determines success in auto insurance lead buying, it is speed-to-contact. The data is unambiguous: faster response correlates directly with higher conversion. This is not marketing theory – it is documented performance reality that separates successful operations from struggling ones.

The Research Foundation

Multiple studies have documented the speed-to-contact effect, with consistent findings across methodologies. Velocify’s research found that calling a lead within the first minute boosts conversion rates by 391% compared to delayed outreach. This finding has been replicated across industries and lead types. The explanation is intuitive: a consumer who just submitted a form is sitting at their computer or phone, actively thinking about insurance, and available to engage.

The Lead Response Management Study demonstrated that teams calling leads within five minutes are 100 times more likely to connect compared to waiting an hour. The same research found them 21 times more likely to qualify the lead into their sales pipeline. These are not marginal improvements – they are order-of-magnitude differences in performance.

The Lead Connect Survey found that 78% of customers purchase from the first responder who reaches them. When multiple agents compete for the same shared lead, the winner is not determined by price or product superiority – it is determined by who calls first.

Why Speed Matters Psychologically

The speed-to-contact effect is not merely about being available when the consumer is near their phone. Several psychological dynamics amplify the advantage of rapid response.

Recency and attention matter significantly. A consumer who just completed an insurance form has insurance actively in their working memory. They are thinking about coverage, considering options, and mentally prepared for a conversation. An hour later, they have moved on to other tasks. Breaking through that mental barrier requires more effort and reduces conversion probability.

Commitment and consistency play a role as well. Taking the action of submitting a form creates a small commitment. Following through on that commitment by engaging with the responding agent feels psychologically consistent. The consumer has already taken a step toward buying – a quick response keeps them moving in that direction.

Trust forms through responsiveness. A rapid, professional response signals competence and customer orientation. If this agent responds quickly to a quote request, the consumer reasons, they will probably respond quickly to claims or service needs. Speed becomes a proxy for service quality.

Shopping momentum accumulates during active research. A consumer actively comparing insurance options has momentum. A call that arrives while they are still comparing catches them in that mode. A call that arrives later interrupts whatever they have moved on to – and interruptions are easier to dismiss.

Technology Requirements for Sub-Minute Response

Achieving sub-minute response times requires purpose-built infrastructure, not wishful thinking about motivated agents.

Real-time lead delivery is the foundation. Your CRM or dialer must receive leads the moment they are generated – delays of even 30 seconds in transmission compound with any delay in agent response. Work with lead sources that support real-time API delivery, not batch file transfers.

Predictive dialing systems allow call centers to begin outreach instantly as leads arrive. Modern dialers can prioritize new leads above aged inventory, adjusting dial rates dynamically to ensure fresh leads get immediate attention. Without this automation, even dedicated agents cannot consistently hit sub-minute response.

Click-to-call functionality embeds calling into the lead workflow. When an agent can initiate a call with a single click directly from their lead queue, you eliminate the seconds lost to number dialing and system switching. Those seconds add up across hundreds of daily calls.

Automated first-touch supplements human outreach by establishing contact immediately. Configure your systems to send immediate SMS or email acknowledgment while agents prepare to call. This establishes contact, reduces the chance of the prospect submitting additional forms elsewhere, and buys time for human follow-up without leaving the consumer wondering if anyone received their request.

Economic Impact of Speed

The speed-to-contact advantage compounds across your entire operation. Consider two agencies buying identical leads at $50 each. Agency A responds in 45 seconds and achieves 55% contact rates and 12% conversion. Agency B responds in 5 minutes and achieves 45% contact rates and 9% conversion.

Agency A’s results: 100 leads at 55% contact rate yields 55 conversations, and 12% conversion yields 6.6 sales. Cost per sale: $758. Agency B’s results: 100 leads at 45% contact rate yields 45 conversations, and 9% conversion yields 4.1 sales. Cost per sale: $1,220.

Agency A’s speed advantage delivers 61% more sales at 38% lower cost per acquisition – from identical leads at identical pricing. Over a year of lead buying, this differential represents substantial competitive advantage and profitability improvement. Speed is not a nice-to-have operational metric. It is the difference between a sustainable business and one that bleeds money on every lead purchase.

Qualification Fields and Lead Quality Indicators

The data captured on a lead form directly impacts conversion probability and lead value. Understanding which fields matter helps you evaluate lead quality and set appropriate pricing expectations.

Vehicle and Driver Information

Vehicle data enables accurate quoting and indicates risk profile. Year, make, and model determine replacement cost, safety ratings, and theft risk. VIN, while optional, enables exact vehicle identification and eliminates guessing. Annual mileage matters because high mileage means higher exposure and higher premiums. Vehicle use – commute, pleasure, or business – affects risk classification. Ownership status – owned, financed, or leased – influences coverage requirements. Leads with complete vehicle information convert at higher rates because agents can quote accurately. Missing or inaccurate vehicle data leads to price surprises that kill sales.

Understanding current insurance status enables effective sales positioning. Currently insured status matters because uninsured prospects may have rate issues. Current carrier provides competitive intelligence and indicates switching likelihood. Coverage levels allow matching or improving current coverage. Policy expiration enables timing for follow-up and switching. Reason for shopping – whether price, service, or life change – adjusts the pitch approach. Consumers switching from a competitor represent different opportunities than first-time buyers or those with coverage gaps. Each requires different sales approaches, and the data captured on the form enables that customization.

Driver profile directly impacts insurability and pricing. Age is a primary rating factor. Gender serves as a rating factor in most states. Marital status is a statistical risk indicator. Accidents over the past 3-5 years, particularly at-fault incidents, affect eligibility. Violations over 3-5 years, including tickets and DUIs, dramatically impact rates. License status matters because suspended or revoked licenses mean limited carrier options. Years licensed affects premium based on experience. Leads with clean driving records convert at higher rates and generate higher LTV – carriers compete more aggressively for preferred risks. High-risk leads with accidents, DUIs, or young drivers have value but require specialized carrier relationships.

Credit and Demographic Indicators

Credit-based insurance scoring impacts rates in most states, making demographic indicators valuable even without pulling credit directly. Credit tier, though self-reported, affects rate competitiveness. Homeownership correlates with stability and creates bundling opportunity. Education level serves as a rating factor for some carriers. Occupation enables professional discounts from certain carriers. While you cannot pull credit on a lead, self-reported proxies like homeownership and education correlate with credit tier and help predict conversion likelihood.

Conversion Rate Benchmarks and Unit Economics

Understanding realistic conversion expectations prevents overspending on leads and enables accurate ROI projections.

Contact and Conversion Rates

Contact rate measures the percentage of leads where you successfully reach the consumer by phone. Industry benchmarks for fresh auto insurance leads show exclusive real-time leads at 50-60% contact rates, shared real-time leads at 45-55%, shared delayed leads at 40-50%, and aged leads of 30+ days at 30-40%.

Contact rates have declined industry-wide over the past decade due to caller ID spoofing awareness, robocall fatigue, carrier-level call blocking, and consumer screening behavior. Improving contact rates requires sub-minute response times, multi-channel outreach combining phone, SMS, and email, proper caller ID management, and optimal time-of-day calling.

Conversion rate measures the percentage of contacted leads who purchase a policy. Industry benchmarks show exclusive leads converting at 12-15% of contacts, shared leads at 8-12%, live transfers at 15-25%, and aged leads at 5-10%. These rates vary significantly based on agent and carrier competitiveness, sales process quality, speed-to-contact, and CRM and follow-up systems.

The Unit Economics Calculation

Combining these metrics reveals true cost per acquisition. For shared leads, consider 100 leads at $25 each for $2,500 spend. At 50% contact rate, that yields 50 conversations. At 10% conversion, that produces 5 sales for a cost per sale of $500. For exclusive leads, consider 100 leads at $70 each for $7,000 spend. At 55% contact rate, that yields 55 conversations. At 14% conversion, that produces 7.7 sales for a cost per sale of $909.

Exclusive leads produce 54% more sales but cost 82% more per acquisition. The right choice depends on sales capacity, capital, and growth objectives. Neither answer is universally correct – the correct answer depends on your operation.

Cost per acquisition only matters relative to customer lifetime value. Average first-year premium runs $1,200-$1,800. Agent commission in the first year is 10-15%, or $120-$270. Policy retention rate averages 80-85% annually. Average policy lifetime runs 3-5 years. Customer LTV reaches $1,500-$3,000.

A $500 cost per acquisition looks expensive against first-year commission of $180. But against $2,000 lifetime value, it represents a 4:1 return – sustainable and scalable. The key is understanding that lead economics work over the policy lifecycle, not on day one.

Working with MediaAlpha and EverQuote

The two dominant platforms in auto insurance lead generation operate differently, with distinct value propositions for both publishers and buyers.

MediaAlpha operates a real-time bidding marketplace where publishers offer leads and buyers bid for them. Their platform facilitates real-time auctions where each lead sells to the highest bidder based on characteristics and current demand, ping/post technology where publishers ping with partial data and receive bids before posting to winners, quality scoring through fraud detection and lead quality assessment before distribution, and direct carrier integrations with major insurance carriers. For publishers, MediaAlpha provides access to premium demand and transparent pricing. For buyers, it offers scale, predictable supply, and quality assurance.

EverQuote combines a consumer-facing comparison platform with B2B lead distribution. Their consumer brand positions around “Compare auto insurance quotes” to drive organic traffic. Multi-carrier delivery sells leads to multiple buyers in the shared model. They maintain direct relationships with both carrier and agent buyer segments. Their vertical focus is primarily auto, with expansion to home and life insurance. Their consumer-facing brand creates organic traffic that supplements paid acquisition, reducing overall cost structure.

When choosing platforms, consider volume requirements since MediaAlpha can deliver higher volumes for large buyers. Both support various pricing structures. Both offer filtering and validation for quality requirements. API requirements vary by platform for integration complexity. Direct account management becomes available at volume for those who need relationship depth. Most serious operations work with multiple platforms to diversify supply and optimize pricing.

Working with Carriers vs. Agents

Lead distribution strategies differ substantially between selling to carriers directly versus independent agents. Understanding both models helps you position appropriately.

Carrier Direct Relationships

Major carriers like Progressive, GEICO, and Allstate direct purchase leads at scale through sophisticated in-house acquisition teams. Volume requirements start at 1,000+ leads daily minimum for direct relationships. Technology requirements include real-time API integration and ping/post capability. Quality standards are strict with low return thresholds. Pricing is often lower per-lead, but massive scale compensates.

Carriers want consistent volume they can staff against, predictable quality they can model, compliant consent documentation, and geographic and demographic diversity. The challenges include long sales cycles of 6-12 months to establish relationships, demanding SLAs with financial penalties, single point of failure if the relationship ends, and price pressure from procurement teams.

Carrier-Specific Requirements and Preferences

Each major carrier maintains distinct requirements that lead generators must understand to maximize acceptance rates and pricing.

Progressive operates the most sophisticated lead buying operation in the market. Their requirements include TrustedForm certification mandatory for all leads, real-time ping-post integration with sub-500ms response expectations, and strict geographic caps that adjust dynamically based on their capacity. Progressive’s algorithm evaluates leads across dozens of variables – driver age, vehicle type, current insurance status, credit proxy indicators – and prices accordingly. High-quality leads matching their preferred risk profiles can command 30-50% premiums over baseline pricing. Progressive’s scale means they can absorb significant volume, but their technology demands require investment to meet their specifications.

GEICO emphasizes call-based lead generation more heavily than competitors. Their direct-response model – built on Warren Buffett’s acquisition strategy – prioritizes inbound calls and live transfers over form-based leads. Lead generators working with GEICO typically see higher prices for call-based products but stricter requirements on call quality and transfer procedures. GEICO’s technology integration is somewhat less sophisticated than Progressive’s, with more manual processes in their lead evaluation workflow.

Allstate purchases through both direct carrier relationships and their network of captive agents. The dual-channel approach creates complexity – leads may route to corporate or to specific agents depending on territory and capacity. Allstate’s requirements emphasize consent documentation and brand compliance, with specific restrictions on how their brand can be referenced in lead generation creative. Their captive agent network creates opportunities for territory-specific relationships that bypass corporate procurement.

State Farm maintains the most conservative approach to third-party lead purchasing among major carriers. Their captive agent model means most lead buying happens at the agent level rather than corporate. State Farm corporate does purchase leads for specific programs, but volume is modest compared to Progressive or GEICO. Lead generators typically access State Farm demand through independent aggregators or agent-direct relationships rather than carrier contracts.

| Carrier | Primary Channel | Key Requirements | Volume Potential | Pricing Tier |

|---|---|---|---|---|

| Progressive | Ping-Post | TrustedForm, sub-500ms response | Very High | Premium |

| GEICO | Calls/Transfers | Call quality, transfer protocols | High | Premium |

| Allstate | Hybrid | Brand compliance, dual routing | Medium-High | Standard+ |

| State Farm | Agent-Level | Varies by agent | Medium | Variable |

Independent Agent Relationships

Independent agents and agency networks purchase leads to grow their books of business with different characteristics. Volume requirements run 10-500 leads monthly per agent. Technology requirements are basic CRM integration or portal access. Quality expectations are higher per-lead, with willingness to pay premium for exclusivity. Pricing is often higher per-lead than carrier direct.

Agents want exclusive distribution with no competition for the same lead, local geographic targeting, verified contact information, and responsive support when issues arise. The advantages include shorter sales cycles of weeks rather than months, higher per-lead pricing, relationship-based loyalty, and diversification across many buyers.

Hybrid Distribution Models

Successful lead generators serve both segments, routing premium exclusive leads to agents at $60-80, shared leads to carrier call centers at $18-25, and aged inventory to specialized remarketers at $3-8. This diversification protects against single-buyer dependency while maximizing yield across lead quality tiers.

Newer Market Entrants and Insurtech Carriers

The auto insurance market has seen significant new entrants over the past five years, creating additional demand channels for lead generators.

Root Insurance pioneered usage-based insurance using smartphone telematics, targeting drivers who believe their actual driving behavior deserves better rates than traditional actuarial factors suggest. Root purchases leads actively, particularly those indicating interest in telematics or usage-based pricing. Their technology-first approach means strong API integration requirements but fast decision-making on lead acceptance. Root’s target demographic skews younger and more tech-comfortable than traditional carriers.

Lemonade expanded from renters and homeowners insurance into auto, bringing their AI-powered claims processing and digital-native experience. Lemonade targets a similar demographic to Root – younger, urban, digitally comfortable consumers who prefer app-based interactions over phone calls. Their lead buying focuses on digital channels and emphasizes quick quote delivery.

Metromile pioneered pay-per-mile insurance before being acquired by Lemonade in 2022. The pay-per-mile model continues under the Lemonade umbrella, targeting low-mileage drivers who feel overcharged by traditional pricing. Leads indicating low annual mileage or work-from-home status can command premium pricing from pay-per-mile programs.

Hippo operates primarily in homeowners but has expanded into auto through bundling strategies. Their value proposition centers on modern coverage for modern risks. Lead generators working with Hippo typically access them through bundled home-and-auto lead products rather than auto-only inventory.

Jerry and Policygenius represent a different category – consumer-facing comparison platforms that both buy leads and compete with traditional lead generators for consumer attention. Understanding their positioning helps calibrate competitive strategy.

| Entrant | Business Model | Target Demographic | Lead Focus |

|---|---|---|---|

| Root | Usage-based telematics | Young, tech-forward | Mobile, digital channels |

| Lemonade | Digital-native, AI claims | Urban, millennial | App-first consumers |

| Metromile | Pay-per-mile | Low-mileage, WFH | Mileage qualifiers |

| Hippo | Modern coverage bundles | Homeowners | Bundle opportunities |

These newer carriers typically offer less volume than traditional majors but may accept risk profiles that established carriers decline. Non-standard risks, young drivers, or thin-credit-file consumers rejected by Progressive or GEICO may find homes with insurtech carriers willing to price for that risk rather than decline it.

Seasonality and Strategic Timing

Auto insurance lead pricing and volume follow predictable seasonal patterns that inform campaign planning and budget allocation.

Annual and Intraweek Patterns

January sees high demand with CPL impact of +15-25% as New Year’s resolution shopping combines with policy renewals concentrated in Q1. Carriers increase budgets and competition intensifies. February through March brings moderate-to-high demand with +5-15% impact. April and May see moderate demand at baseline pricing. June and July show moderate-to-low demand with -5-10% impact as vacation season reduces active shopping – some carriers pull back spend and lead supply exceeds demand. August and September return to moderate demand at baseline. October and November see moderate-to-high demand with +5-15% impact as back-to-school life changes, teen driver additions, and pre-holiday planning increase activity. December brings low demand with -10-20% impact as holiday distractions reduce consumer shopping and many carriers cut Q4 budgets if annual targets are met.

Within each week, Tuesday and Wednesday deliver highest volume and best quality. Weekends see lower volume with variable quality. Morning leads from 9 AM to 12 PM show highest contact rates since consumers at computers during work hours complete more forms. Evening leads from mobile devices show lower completion intent.

Quality Metrics to Track

Successful lead buying requires systematic tracking of metrics that reveal true performance beyond surface-level CPL.

Lead Quality and Performance Metrics

For lead quality, track valid phone rate as the percentage with working phone numbers, targeting above 95%. Monitor email deliverability as the percentage with valid email addresses, targeting above 90%. Implementing proper phone, email, and address validation catches bad data before it enters your pipeline. Track duplicate rate as the percentage matching existing leads, targeting below 3%. Monitor return rate as the percentage rejected by buyers, targeting below 10%. Require TrustedForm rate as the percentage with consent certificates at 100%.

For performance metrics, track speed-to-contact as time from receipt to first dial, targeting under 60 seconds. Monitor contact rate as the percentage reached by phone, targeting above 50%. Track conversation rate as the percentage with meaningful dialogue, targeting above 40%. Monitor quote rate as the percentage receiving price quotes, targeting above 30%. Track bind rate as the percentage purchasing policies, targeting above 8%.

Track cost per contact by dividing CPL by contact rate. Track cost per sale by dividing total spend by policies bound. Track ROAS by dividing premium by lead spend. Most critically, track all of these by source. A $30 lead with 8% conversion costs more per sale than a $45 lead with 12% conversion. Without source-level tracking, you optimize for the wrong variable.

Compliance Requirements

Auto insurance lead generation operates under multiple regulatory frameworks. Non-compliance creates legal liability that can destroy profitable operations.

TCPA Requirements

The Telephone Consumer Protection Act governs how leads can be contacted. For autodialed calls or texts, Prior Express Written Consent is required. Consent must be “clear and conspicuous” and must identify specific sellers authorized to call. Though the FCC’s one-to-one consent rule was vacated by the Eleventh Circuit in January 2025, many sophisticated buyers still require seller-specific consent.

Consent documentation best practices include implementing TrustedForm or Jornaya certificates, capturing IP address, timestamp, and user agent, recording exact consent language displayed, and retaining documentation for 5+ years.

Penalty exposure is severe. Violations carry $500-$1,500 per violation with class action multiplier across thousands of calls. Average TCPA settlement runs $6.6 million. 2024 saw 2,788 TCPA filings, up 67% year-over-year. This is not theoretical risk – it is active litigation exposure that requires constant attention.

State and Carrier Requirements

Insurance marketing faces state-specific requirements. Lead generators typically do not need insurance licenses for pure lead generation, but the line blurs when forms provide quotes or coverage recommendations. Some states define “solicitation” broadly to include lead generation activities. Many states require specific disclosures, rate claims may require carrier authorization, and comparative statements face regulatory scrutiny.

Federal and state Do Not Call requirements apply: scrub against National DNC Registry before calling, honor internal DNC requests immediately, comply with state supplemental DNC lists, and maintain entity-specific company DNC lists.

Beyond regulatory requirements, carriers impose additional standards including brand usage guidelines, consent language requirements, data security standards, and lead quality thresholds with clawback provisions. Meeting carrier standards is table stakes for maintaining distribution relationships.

Frequently Asked Questions

What is the average cost of an auto insurance lead in 2026?

Auto insurance lead pricing ranges from $15-100+ depending on distribution model and quality filters. Shared leads average $15-35, exclusive leads $40-100, and live transfers $100-150+. Pricing varies by geography, driver demographics, and market conditions. Aged leads of 30+ days drop to $3-15. These benchmarks reflect 2026 pricing through established intermediaries like MediaAlpha and EverQuote.

How do I calculate ROI on auto insurance leads?

Calculate cost per sale by dividing total lead spend by policies bound. Compare to customer lifetime value of $1,500-$3,000 for auto insurance. If cost per sale is $500 and LTV is $2,000, your ROI is 4:1. Track by source to identify which lead providers deliver best returns. The critical metric is cost per sale at the source level, not average CPL across all sources.

What conversion rate should I expect from auto insurance leads?

Industry benchmarks show 45-55% contact rates and 8-12% conversion rates of contacts for fresh leads. Exclusive leads convert 50-100% higher than shared leads. Live transfers convert at 15-25%. Speed-to-contact dramatically impacts results – leads contacted within one minute convert 391% better.

Should I buy exclusive or shared auto insurance leads?

Exclusive leads cost 2-3x more but convert 50-100% higher with no competition for the prospect. Choose exclusive if you cannot compete on speed or want higher conversion rates. Choose shared if you have call center infrastructure for rapid response and want lower per-lead costs with higher volume. Many operations blend both types based on capacity and objectives.

How quickly should I contact auto insurance leads?

Contact leads within 60 seconds of receipt. Research shows 391% higher conversion for one-minute response. 78% of customers buy from the first responder. If you cannot respond quickly, reconsider your lead buying strategy – you are competing for what’s left after faster competitors.

What information should auto insurance lead forms collect?

Essential fields include contact information, vehicle year/make/model, current insurance status, driver date of birth, and driving history including accidents and violations. Optional enhancements include VIN, current carrier, coverage levels, and credit tier proxies. More fields improve lead quality but reduce form completion rates – balance depth against volume.

How do I verify auto insurance lead quality?

Implement phone validation through carrier lookup and line type verification, email validation through syntax, domain, and deliverability checks, and address verification. Require TrustedForm or Jornaya certificates for consent documentation. Monitor return rates by source – sustained rates above 10-12% indicate quality issues requiring investigation or source termination.

What are the TCPA requirements for auto insurance leads?

TCPA requires Prior Express Written Consent before autodialed calls or texts. Consent must be clear, conspicuous, and identify specific parties authorized to contact. Document consent with certificates, timestamps, and exact language displayed. Violations carry $500-$1,500 penalties per call, with class actions averaging $6.6 million in settlements.

When is the best time to buy auto insurance leads?

January sees highest demand and pricing at +15-25%. Summer months offer lower competition and pricing at -5-10%. Tuesday and Wednesday deliver highest volume. Morning leads from 9 AM to 12 PM show highest contact rates. Avoid December when consumer shopping drops significantly unless you can negotiate favorable pricing during the lull.

What is the difference between real-time and aged auto insurance leads?

Real-time leads deliver within seconds of form submission, with consumers still in shopping mode. Contact rates run 50-55%. Aged leads are 30-90+ days old, priced at 5-20% of fresh leads. Contact rates run 30-40%. Aged leads require different sales approaches – persistence over speed, value positioning over urgency, and systematic nurture sequences.

Key Takeaways

Auto insurance represents the largest lead generation vertical at $3-4 billion in annual transaction value for auto specifically, with MediaAlpha at $864.7M in 2024 and EverQuote at $446M in auto alone providing market transparency through public reporting.

Lead pricing follows clear tiers: exclusive leads at $40-100, shared leads at $15-35, live transfers at $100+, and aged leads at $3-15. Pricing varies by geography, quality filtering, and market conditions.

Speed-to-contact determines success more than any other factor. Leads contacted within 60 seconds convert 391% higher. 78% of customers buy from the first responder.

Realistic conversion benchmarks show 45-55% contact rates and 8-12% conversion rates, yielding cost-per-sale of $500-900 for most operations. Customer LTV of $1,500-$3,000 makes this math work over the policy lifecycle.

TCPA compliance is non-negotiable. With 2,788 cases filed in 2024, up 67% year-over-year, and average settlements exceeding $6.6 million, consent documentation through TrustedForm or Jornaya is essential infrastructure, not optional overhead.

Carrier advertising spend drives the market. Progressive’s $3.5 billion in 2024 spending, up 187%, created exceptional demand – but the market is cyclical and will eventually contract when underwriting conditions change.

Track metrics at the source level. Surface-level CPL comparisons miss the point. Source-level cost-per-sale analysis reveals which leads actually deliver returns and which destroy margin.

Sources

- Insurance Information Institute - Auto Insurance Facts - Industry statistics on premiums, claims, and market sizing

- MediaAlpha Investor Relations - Public company financial reports documenting $864.7M 2024 revenue and transaction volume data

- EverQuote Investor Relations - Public company filings showing $446.1M auto insurance vertical revenue for 2024

- GEICO About Page - Carrier information for market positioning and direct-response model context

- 47 U.S.C. 227 - TCPA Statute - Federal statutory requirements for consent and telemarketing compliance

- ActiveProspect TrustedForm - Consent certification platform documentation for TCPA compliance

Statistics and pricing benchmarks current as of 2025. Market conditions, carrier advertising behavior, and regulatory requirements change – verify current data before making significant purchasing decisions.