Master the two fundamental approaches to ROI measurement, understand when to use each, and learn how to optimize your marketing portfolio for maximum profitability.

Your marketing dashboard shows impressive numbers. Google Ads delivers a 4:1 return. Facebook shows 3.5:1. Native advertising claims 2.8:1. The sum of all your channels suggests you should be wildly profitable.

But the bank account tells a different story. Cash flow is tight. Actual profit margins are thinner than the dashboards predict. Something in your measurement is broken, and you cannot figure out what.

The problem is not your data. The problem is how you are analyzing it.

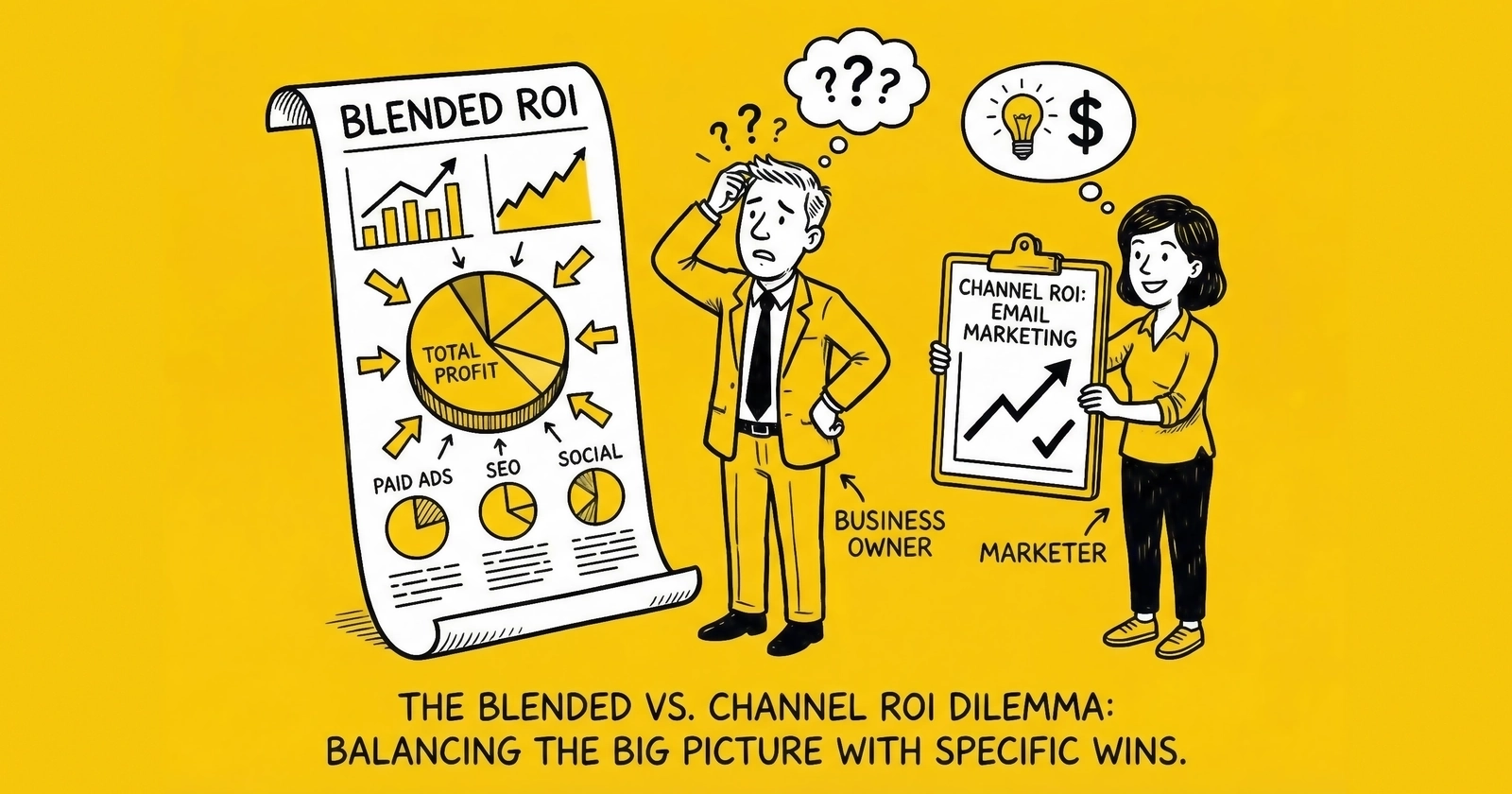

Marketing ROI measurement splits into two fundamental approaches: blended ROI, which measures overall marketing performance as a unified investment, and channel-specific ROI, which isolates each traffic source to evaluate individual contribution. Most practitioners default to one approach exclusively and miss critical insights the other provides.

This matters because measurement methodology determines capital allocation. The operator who measures wrong allocates wrong, scales the wrong campaigns, cuts the wrong sources, and watches margin evaporate while dashboards remain green. The operator who understands both measurement frameworks makes decisions based on reality rather than reporting artifacts.

This article breaks down both approaches in complete detail. You will learn when blended analysis reveals truth that channel-specific analysis obscures. You will understand when isolating channel performance is essential and when it creates false precision. You will develop frameworks for portfolio optimization that combine both perspectives. And you will master the attribution challenges that make accurate measurement genuinely difficult. For the foundation of these calculations, see our guide on calculating true cost per lead.

The math determines your margin. Let us get it right.

What Is Blended ROI Analysis?

Blended ROI analysis treats your entire marketing spend as a single investment and measures return against that total. Rather than asking “how did Facebook perform?” blended analysis asks “how did marketing perform?”

The calculation is straightforward:

Blended ROI = (Total Revenue from Marketing - Total Marketing Spend) / Total Marketing Spend x 100

An operation spending $100,000 monthly across all channels that generates $350,000 in attributable revenue shows 250% blended ROI. The formula does not distinguish between the Google contribution, the Facebook contribution, or the native contribution. It measures the marketing function as a single entity.

Why Blended Analysis Matters

Blended ROI captures synergies that channel-specific analysis misses entirely.

Consider how modern customer journeys actually work. A consumer sees your Facebook ad, does not click, but remembers your brand. Three days later they search on Google, see your brand name, and click your organic result. They browse, leave without converting, then see a retargeting ad on a news site. Finally, they search your brand directly and convert through a branded paid search ad.

Which channel deserves credit? Channel-specific analysis would credit the branded search campaign with 100% of the value under last-touch attribution, or credit Facebook with 100% under first-touch. Either assignment misses the reality that multiple channels worked together.

Blended analysis sidesteps this attribution problem entirely. It acknowledges that marketing works as a system and measures whether the system as a whole generates acceptable returns.

This perspective proves especially valuable when:

Marketing mix is complex. Operations running 5-10 or more traffic sources face diminishing returns from channel isolation. The interaction effects between awareness campaigns, retargeting, and conversion campaigns become more important than any individual channel’s isolated performance.

Customer journeys span extended periods. Verticals like mortgage, solar, and insurance involve consideration windows of weeks or months. Tracking every touchpoint becomes technically difficult and analytically messy. Blended analysis provides clear signal despite attribution fog.

Budget decisions involve portfolio tradeoffs. When evaluating whether to increase total marketing investment, blended ROI provides the relevant answer. The question is not “should we spend more on Facebook?” but “should we spend more on marketing?” Blended ROI addresses the latter directly.

Management requires simplified reporting. Executive dashboards need clear metrics that drive decisions without requiring deep marketing expertise to interpret. Blended ROI provides a single number that answers the fundamental question: is marketing investment working?

Calculating True Blended ROI

Surface-level blended calculation divides revenue by spend. True blended ROI requires comprehensive cost inclusion that most practitioners miss.

Revenue components must be complete:

Include all revenue attributable to marketing activity. For lead generation, this means net revenue after returns, refunds, and chargebacks, not gross lead sales. A lead sold for $50 that gets returned generates zero revenue regardless of which channel produced it.

For operations with multiple revenue streams (lead sales, affiliate commissions, service fees), aggregate all marketing-attributable revenue.

Be rigorous about the definition of “marketing-attributable.” Revenue from direct navigation, organic search for non-branded terms, and referral traffic might or might not count depending on your business model. Define the scope clearly and apply it consistently.

Cost components must be comprehensive:

Include all marketing spend across all channels. Most practitioners get this right.

Include agency fees and media management costs. A 15% agency fee on $100,000 monthly spend adds $15,000 in costs that belong in the blended calculation.

Include creative production costs. Video production, landing page development, photography, and copywriting all represent marketing investment.

Include technology costs attributable to marketing. Your analytics platform, tag management system, conversion tracking infrastructure, and A/B testing tools serve marketing. They belong in the blended cost calculation.

Include marketing labor costs. Salaries for media buyers, marketing managers, and campaign analysts represent direct marketing investment. Fully-loaded compensation (including benefits, taxes, and overhead allocation) provides the accurate figure.

Include a share of compliance costs proportional to marketing’s role. Consent documentation, TCPA compliance infrastructure, and legal review serve the lead generation function that marketing feeds.

A realistic blended ROI calculation might look like this:

| Component | Amount |

|---|---|

| Media Spend (all channels) | $100,000 |

| Agency Fees (15%) | $15,000 |

| Creative Production (amortized) | $8,000 |

| Technology Platforms | $6,000 |

| Marketing Team Labor | $25,000 |

| Compliance (marketing portion) | $4,000 |

| Total True Marketing Cost | $158,000 |

| Revenue Component | Amount |

|---|---|

| Gross Lead Revenue | $400,000 |

| Less: Returns (12%) | ($48,000) |

| Less: Bad Debt (2%) | ($8,000) |

| Net Revenue | $344,000 |

True Blended ROI = ($344,000 - $158,000) / $158,000 = 118%

Compare this to the naive calculation using only media spend against gross revenue: ($400,000 - $100,000) / $100,000 = 300%. The reporting gap is 182 percentage points. One calculation suggests extraordinary performance; the other suggests healthy but unremarkable returns.

Most operations live closer to the 118% reality than the 300% fantasy.

Blended ROI Benchmarks by Business Model

What constitutes “good” blended ROI varies by business model and vertical:

Lead generation operations (selling leads):

- Sustainable: 50-100% blended ROI

- Good: 100-150% blended ROI

- Excellent: 150%+ blended ROI

These ranges assume comprehensive cost inclusion. Operations reporting 300%+ blended ROI are typically missing significant cost categories.

Lead buyers (purchasing leads for internal conversion):

- Sustainable: 20-50% blended marketing ROI

- Good: 50-80% blended ROI

- Excellent: 80%+ blended ROI

Lead buyers measure against customer lifetime value, not immediate conversion value, so sustainable ranges differ. See our guide on lead ROI calculation for detailed methodology.

Affiliate and performance marketers:

- Sustainable: 30-60% blended ROI after all costs

- Good: 60-100% blended ROI

- Excellent: 100%+ blended ROI

Higher gross margins in affiliate models allow for lower percentage returns while maintaining absolute profit.

What Is Channel-Specific ROI Analysis?

Channel-specific ROI analysis isolates individual traffic sources to evaluate each channel’s independent contribution. Rather than asking “how did marketing perform?” it asks “how did this particular channel perform relative to its specific investment?”

The calculation focuses on single channels:

Channel-Specific ROI = (Revenue from Channel - Spend on Channel) / Spend on Channel x 100

An operation spending $30,000 monthly on Facebook that generates $90,000 in Facebook-attributed revenue shows 200% channel-specific ROI for that source.

Why Channel-Specific Analysis Matters

Channel-specific ROI enables optimization decisions that blended analysis cannot support.

Consider an operation with $100,000 monthly budget across five channels:

| Channel | Spend | Revenue | Channel ROI |

|---|---|---|---|

| Google Non-Brand | $35,000 | $98,000 | 180% |

| Facebook Prospecting | $25,000 | $55,000 | 120% |

| Google Brand | $15,000 | $75,000 | 400% |

| Retargeting | $10,000 | $45,000 | 350% |

| Native Ads | $15,000 | $27,000 | 80% |

Blended ROI across all channels: ($300,000 - $100,000) / $100,000 = 200%

That 200% blended number is healthy, but it obscures critical insight. Native advertising underperforms dramatically. Google Brand and Retargeting show exceptional efficiency. Should budget shift from Native to Brand and Retargeting?

Channel-specific analysis enables that question. Blended analysis alone cannot answer it.

This perspective proves especially valuable when:

Optimizing within fixed budgets. When total marketing investment is capped, channel-specific analysis identifies reallocation opportunities. Moving $10,000 from a 80% ROI channel to a 350% ROI channel significantly improves blended results without increasing total spend.

Evaluating channel marginal contribution. Some channels create demand; others capture it. Channel-specific analysis (when combined with incrementality testing) reveals which sources drive truly incremental conversions versus which harvest existing intent.

Diagnosing performance degradation. When blended ROI declines, channel-specific analysis pinpoints the problem source. A 10% blended decline could reflect a 50% decline in one channel masked by stability elsewhere. Our guide on auditing lead generation funnel leaks provides systematic approaches to identifying problems.

Negotiating with platforms and agencies. Performance conversations require channel-level specificity. Telling your agency “improve Facebook performance” requires knowing Facebook’s isolated contribution.

Testing new channels. Evaluating channel viability demands isolated measurement. A new TikTok test should be evaluated against its own investment, not diluted into blended results.

Calculating True Channel-Specific ROI

Channel-specific ROI sounds straightforward but contains significant complexity.

Revenue attribution challenges:

How do you determine which revenue belongs to which channel? The options are:

Last-touch attribution credits the final interaction before conversion. Simple but systematically overvalues closing channels (brand search, retargeting) while undervaluing awareness channels (prospecting, display).

First-touch attribution credits the initial brand interaction. This overvalues introduction channels while ignoring conversion contribution.

Multi-touch attribution distributes credit across touchpoints. More accurate but requires sophisticated tracking infrastructure and creates complexity in interpretation.

Platform-reported attribution uses each platform’s native reporting. Convenient but biased, as platforms have incentive to claim credit for conversions.

The attribution model you choose significantly affects channel-specific ROI calculations. The same underlying data produces dramatically different channel ROI figures depending on methodology.

A realistic example:

| Channel | Last-Touch Revenue | First-Touch Revenue | Linear Attribution Revenue |

|---|---|---|---|

| Facebook Prospecting | $40,000 | $85,000 | $62,000 |

| Google Non-Brand | $75,000 | $65,000 | $70,000 |

| Google Brand | $95,000 | $20,000 | $48,000 |

| Retargeting | $90,000 | $10,000 | $40,000 |

Google Brand and Retargeting look exceptional under last-touch but mediocre under first-touch because they capture existing demand rather than create it. Facebook looks mediocre under last-touch but excellent under first-touch because it creates the demand other channels capture.

There is no “correct” attribution. Each model reveals different truth.

Cost allocation challenges:

Which costs belong to which channel? Direct media spend is obvious. But consider:

Your media buyer manages all channels. How much of their salary belongs to Facebook versus Google? Time-tracking provides one answer. Spend-proportional allocation provides another. Neither is definitively correct.

Your landing page serves all traffic sources. How should development and hosting costs allocate? By visitor volume? By conversion contribution? By strategic priority?

Your analytics platform enables all measurement. Does its cost belong to all channels equally, or weighted by the data volume each generates?

Creative production might serve one channel or many. A video produced for Facebook but repurposed for YouTube belongs partially to each.

Channel-specific ROI requires cost allocation decisions. Document your methodology and apply it consistently. Reasonable people can disagree on approach; the key is internal consistency that enables period-over-period comparison.

The Interaction Effect Problem

Channel-specific analysis assumes channels operate independently. They do not.

Facebook prospecting creates audience awareness. Retargeting converts that aware audience. If you cut Facebook prospecting, retargeting’s apparent efficiency will decline because you have stopped feeding its audience pool.

Google Brand captures consumers searching your name. But they only search your name because other channels created brand awareness. Attribute 100% of brand search value to the brand search campaign and you miss that prospecting funded the awareness.

Native advertising might show weak direct response but create significant branded search volume. Cut native and branded volume might decline, but you would never see the connection in channel-specific analysis.

These interaction effects mean channel-specific ROI for any individual source is not purely independent. The 400% ROI on brand search is partially borrowed from the prospecting that built brand awareness. The 80% ROI on native advertising might be subsidizing brand search performance that appears elsewhere.

sophisticated practitioners recognize this limitation. They use channel-specific analysis for directional optimization while acknowledging that isolated channel ROI overstates efficiency for closing channels and understates efficiency for awareness channels.

When to Use Blended Analysis

Blended ROI analysis serves specific strategic purposes. Deploy it when:

Strategic Resource Allocation

Blended analysis answers the question: “Should we invest more in marketing overall?”

If your blended ROI is 150% and cost of capital is 12%, marketing investment generates superior returns to alternative uses of capital. This justifies increased marketing budget regardless of how that budget distributes across channels.

Conversely, if blended ROI is 30% and cost of capital is 15%, marketing investment barely exceeds your hurdle rate. Total marketing budget might need reduction or efficiency improvements before expansion.

Channel-specific analysis cannot answer this question. Knowing that Facebook delivers 200% ROI and Native delivers 80% does not tell you whether total marketing investment should grow or shrink.

Long Consideration Window Verticals

Industries with extended purchase cycles (mortgage, solar, commercial insurance, B2B SaaS) make channel-specific attribution increasingly unreliable.

A mortgage borrower might research for 2-3 months before applying. They touch a dozen marketing interactions across multiple devices. Tracking every touchpoint becomes technically difficult. Assigning credit becomes analytically arbitrary.

Blended analysis acknowledges this reality. It measures whether your marketing system as a whole produces acceptable returns, without pretending you can precisely attribute multi-month journeys to specific channels.

For these verticals, blended ROI provides more reliable signal than channel-specific analysis despite lower precision.

Complex Multi-Channel Ecosystems

Operations running 10+ traffic sources, multiple creative formats, complex retargeting sequences, and email nurture create interaction effects that channel-specific analysis cannot capture.

The consumer sees a YouTube pre-roll, visits via organic search, receives email nurture, clicks a display retargeting ad, and converts through branded search. Five channels contributed. Channel-specific analysis can assign credit using some model, but no model accurately captures the true contribution of each.

Blended analysis accepts that the system produced the outcome. It measures system performance without requiring impossible precision about component contribution.

When your marketing ecosystem grows sufficiently complex, blended ROI becomes the primary health metric while channel-specific analysis serves as a diagnostic tool.

Benchmarking and Investor Communication

External parties (investors, lenders, acquirers) need simple metrics that capture marketing efficiency without requiring deep channel expertise.

“Our marketing delivers 120% blended ROI after all costs” is a statement investors can evaluate. “Our Facebook delivers 180% under linear attribution but 240% under time-decay while Google Brand shows 400% last-touch but 180% first-touch” is not.

For capital raising, due diligence, and M&A conversations, blended ROI provides the clarity that channel-specific complexity obscures.

Early-Stage Operations

Operations still finding product-market fit and channel-market fit lack the volume for reliable channel-specific analysis.

With 200 monthly conversions distributed across 5 channels, you are measuring 40 conversions per channel. Statistical variance at that scale makes month-over-month channel comparison unreliable. A channel showing 150% ROI in January and 80% in February might not have changed at all; you might just be seeing noise.

Blended analysis aggregates volume, reducing variance and providing more reliable signal despite lower granularity.

As volume grows and individual channels generate 200+ monthly conversions, channel-specific analysis becomes statistically meaningful.

When to Use Channel-Specific Analysis

Channel-specific ROI analysis serves different strategic purposes. Deploy it when:

Optimizing Within Fixed Budgets

Most operations face budget constraints. The question is not “should we spend more?” but “should we spend differently?”

Channel-specific analysis identifies reallocation opportunities. If Channel A delivers 200% ROI and Channel B delivers 60% ROI, shifting budget from B to A improves overall returns without increasing total investment.

This optimization requires channel-level granularity that blended analysis cannot provide.

Best practice: calculate channel-specific ROI monthly, rank channels by marginal efficiency, and reallocate 10-15% of budget from bottom performers to top performers each quarter.

Diagnosing Performance Changes

When blended ROI declines, channel-specific analysis identifies the problem.

A 20% decline in blended performance could reflect:

- A 50% decline in one major channel

- A 15% decline across all channels

- Dramatic decline in one channel masked by improvement elsewhere

- New channel investment with poor initial performance

Each diagnosis leads to different action. Channel-specific analysis enables accurate diagnosis.

Similarly, when blended performance improves, channel-specific analysis reveals whether improvement comes from efficiency gains (doing the same thing better) or mix shifts (doing more of what already works). These have different implications for future optimization.

Evaluating New Channels

New channel testing requires isolation. If you add TikTok at $10,000 monthly to an existing $100,000 portfolio, blended analysis measures whether the $110,000 total delivers acceptable returns. It cannot tell you whether the $10,000 TikTok increment specifically performs.

Channel-specific analysis isolates the test. Did TikTok specifically generate returns justifying continued investment, expansion, or termination?

New channel evaluation demands:

- Minimum test duration (typically 60-90 days for lead generation)

- Minimum test budget (sufficient volume for statistical significance)

- Clear success criteria defined before launch

- Isolated measurement separate from portfolio effects

Without channel-specific analysis, you cannot make informed continue/expand/kill decisions on new channels.

Negotiating Performance Improvements

Agency and platform conversations require channel-level specificity.

“Improve Facebook performance by 25% or we reallocate budget” is a specific, actionable directive. “Improve blended performance” leaves the agency unclear on where to focus.

Channel-specific analysis enables performance-based conversations with specific targets, timelines, and consequences.

Similarly, vendor negotiations for affiliate partnerships, lead source contracts, and platform-specific pricing require channel-level economics. You cannot negotiate Google CPCs based on blended performance.

Attribution Model Validation

Running channel-specific analysis under multiple attribution models reveals important patterns.

If a channel shows consistent strong performance across first-touch, last-touch, and linear attribution, you have high confidence in its value.

If a channel shows radically different performance under different models, investigate further. The channel might play an awareness role (strong first-touch, weak last-touch), a closing role (weak first-touch, strong last-touch), or might be over-credited by platform self-reporting.

This diagnostic use of channel-specific analysis under multiple attribution models builds understanding that single-model analysis misses.

Portfolio Optimization: Combining Both Approaches

sophisticated practitioners do not choose between blended and channel-specific analysis. They use both approaches in combination for comprehensive portfolio optimization.

The Two-Level Framework

Level 1: Blended Analysis for Strategic Decisions

Blended ROI answers strategic questions:

- Should total marketing investment grow or shrink?

- Is marketing meeting return thresholds for continued investment?

- How does marketing ROI compare to other capital deployment options?

- What is the trend in overall marketing efficiency?

Review blended metrics monthly at minimum. Major strategic decisions (significant budget changes, headcount adjustments, platform investments) should reference blended ROI as the primary metric.

Target: blended ROI should exceed your cost of capital by at least 50% to justify continued investment. A 15% cost of capital means targeting 75%+ blended ROI. Below that threshold, marketing investment competes unfavorably with alternatives.

Level 2: Channel-Specific Analysis for Tactical Decisions

Channel-specific ROI answers tactical questions:

- Which channels should receive more/less budget?

- Which channels require performance improvement?

- Which new channels justify expansion?

- Which underperformers should be terminated?

Review channel-specific metrics weekly for active optimization. Monthly for strategic reallocation. Quarterly for incrementality validation.

The tactical insights from Level 2 improve the blended metrics measured at Level 1. They are complementary, not competing.

Marginal Efficiency Analysis

The most powerful application combines both perspectives: marginal efficiency analysis.

Rather than measuring average channel ROI, marginal analysis asks: “What happens to returns as I spend the next dollar on this channel?”

Channels exhibit diminishing marginal returns. The first $10,000 on Facebook might deliver 300% ROI by reaching the most receptive audiences. The next $10,000 delivers 200% as you expand to less receptive audiences. The next delivers 150%. Eventually, marginal returns fall below your threshold.

Marginal efficiency analysis identifies the optimal spend level for each channel, not the maximum spend level.

The framework:

- For each channel, plot ROI at different spend levels (requires historical data or controlled tests)

- Identify the marginal ROI at current spend levels

- Rank channels by marginal ROI (not average ROI)

- Allocate incremental budget to highest marginal ROI channels

- Reduce budget from channels where marginal ROI has fallen below threshold

This approach optimizes the portfolio, not individual channels. It accepts that channels interact and that optimal allocation depends on the entire mix.

The Incrementality Overlay

Both blended and channel-specific analysis measure correlation. Incrementality testing measures causation.

Platform-reported conversions include consumers who would have converted anyway. A consumer who planned to refinance their mortgage and saw your retargeting ad along the way gets attributed to retargeting despite intending to convert regardless.

Incrementality testing isolates true lift by comparing outcomes between exposed and unexposed groups.

Methods include:

Geo experiments: Run campaigns in test markets only, compare to matched control markets. The difference represents true incremental lift.

Holdout tests: Randomly exclude a portion of your audience from campaigns. Compare conversion rates between exposed and holdout groups.

Platform lift studies: Meta Conversion Lift, Google Conversion Lift, and similar tools measure incrementality within their ecosystems.

Incrementality testing has shown that retargeting campaigns often show 400-800% ROI in platform reporting but only 20-80% true incremental ROI. Brand search campaigns showing 500%+ reported ROI might deliver 100-200% incremental ROI because most branded searchers would have converted organically.

Best practice: conduct incrementality testing on your top 3-5 channels annually. Use results to adjust channel-specific ROI expectations and inform reallocation decisions.

Portfolio Balancing for Risk Management

ROI optimization is not the only consideration. Risk management requires diversification even when concentration would maximize returns.

Consider an operation where Facebook delivers 200% ROI and all other channels deliver 100% ROI. Pure ROI optimization suggests putting everything on Facebook.

But platform risk is real. Account bans, algorithm changes, policy shifts, and rising competition can devastate single-platform operations overnight. The 2021 Apple ATT changes reduced Facebook advertising effectiveness by 30-50% for many advertisers.

Portfolio balancing trades some ROI efficiency for risk reduction:

- No single channel should exceed 40-50% of total budget

- Maintain at least 3-4 meaningful traffic sources

- Ensure at least one owned/organic channel (SEO, email) that does not depend on paid platforms

- Test new channels continuously to develop backup options

The optimal portfolio is not the one with highest ROI. It is the one with highest risk-adjusted returns that survives platform changes.

Channel Mix Decisions: A Practical Framework

When you need to decide how to allocate budget across channels, use this structured framework:

Step 1: Establish Blended Baseline

Calculate current blended ROI using comprehensive costs. This is your performance baseline.

Target: identify whether blended ROI exceeds your threshold for continued marketing investment. If not, efficiency improvements take priority over growth.

Step 2: Calculate Channel-Specific Metrics

For each significant channel (5%+ of budget), calculate:

- Channel-specific ROI under your primary attribution model

- Volume contribution (leads or conversions)

- Cost per acquisition

- Return rate (for lead generation)

- Trend (improving, stable, declining)

Create a channel scorecard that enables side-by-side comparison.

Step 3: Apply Marginal Analysis

For channels with sufficient data (typically 90+ days of history at meaningful spend), estimate marginal efficiency:

- How has ROI changed as spend changed?

- At current spend, what is marginal (not average) ROI?

- Is the channel in growth phase (improving marginal returns), maturity (stable), or saturation (declining marginal returns)?

Channels in saturation with declining marginal returns may be overfunded even if average ROI remains acceptable.

Step 4: Validate with Incrementality

For your highest-spend channels, incorporate incrementality data if available:

- What is the gap between reported ROI and incremental ROI?

- Which channels show the largest discrepancy?

- How should incrementality data adjust your ROI expectations?

Channels with large gaps between reported and incremental performance deserve scrutiny. They may be capturing demand rather than creating it.

Step 5: Consider Strategic Factors

Pure ROI optimization misses strategic considerations:

Volume requirements: Some channels cannot scale. A 300% ROI channel that caps at $10,000 monthly matters less than a 150% ROI channel that scales to $100,000.

Time to impact: SEO investments might show negative ROI for 6-12 months before positive returns emerge. Channel mix must balance short-term performance with long-term positioning.

Competitive dynamics: Channels where you have competitive advantage (proprietary creative, unique audiences, operational excellence) deserve priority even at similar ROI to channels where you compete head-to-head.

Platform risk: Over-concentration in any platform creates existential risk regardless of ROI performance.

Step 6: Make Allocation Decisions

With comprehensive data, make specific allocation decisions:

Expand: Channels with high marginal ROI, growth potential, and strategic importance. Increase budget 15-25% per quarter until marginal returns decline to threshold levels.

Maintain: Channels with acceptable ROI operating near optimal efficiency. Maintain current budget with continuous optimization.

Optimize: Channels with below-threshold ROI but strategic value. Apply intensive optimization before reducing budget. Set specific improvement targets and timelines.

Reduce: Channels with persistently below-threshold ROI despite optimization attempts. Reduce budget 20-30% and reallocate to higher performers.

Terminate: Channels with unacceptable ROI and no strategic value. Exit completely and redeploy resources.

Document decisions and rationale. Review outcomes quarterly against expectations.

Attribution Challenges in ROI Measurement

Accurate ROI measurement depends on accurate attribution. Attribution faces structural challenges that limit precision regardless of methodology.

Cross-Device Journeys

Consumers use 3-4 devices during purchase consideration. A mortgage shopper researches on mobile during their commute, compares rates on their work laptop, discusses with their spouse on a tablet, and applies on their home desktop.

Without robust identity resolution, tracking systems see four different people. The Facebook ad viewed on mobile, the organic visit on laptop, and the conversion on desktop appear as unrelated events.

Solutions exist but require investment:

- Email-based identity matching requires authentication

- Probabilistic matching uses signals like IP address and device fingerprinting (limited by privacy restrictions)

- Platform-provided identity graphs work within single ecosystems only

- Customer data platforms attempt cross-platform identity stitching

Even with sophisticated identity resolution, coverage typically reaches 60-80% of journeys. The remaining 20-40% contain unmatchable fragments that create attribution blind spots.

Privacy Restrictions

Privacy regulation and browser restrictions increasingly limit tracking:

Safari Intelligent Tracking Prevention: Blocks third-party cookies entirely and limits first-party cookie duration to 7 days.

Chrome third-party cookie deprecation: Originally planned for 2024, delayed but inevitable. Will eliminate cross-site tracking that multi-touch attribution depends on.

iOS App Tracking Transparency: Requires explicit opt-in for cross-app tracking. Opt-in rates average 25-30%, meaning 70-75% of iOS users are untrackable across apps.

GDPR and state privacy laws: Require consent for data collection and limit data retention. Non-consenting users create tracking gaps.

Current estimates suggest 30-40% of web traffic uses privacy-protective browsing that limits standard tracking. That percentage grows annually.

The implication: ROI measurement increasingly operates on incomplete data. Attribution models trained on visible journeys may not represent invisible ones. Directional accuracy remains possible; precise attribution becomes impossible.

Strategic response:

Implement server-side tracking to recover 20-40% of signal lost to client-side blocking. Server-side event tracking through tools like Google Tag Manager Server-Side and Facebook Conversions API provides more durable measurement.

Invest in first-party data collection. Every email captured, every phone number collected, every authenticated session extends identity resolution capability.

Accept measurement uncertainty. Design decision processes that function with directional rather than precise data.

Walled Garden Fragmentation

Major advertising platforms operate as walled gardens with limited data sharing:

- Facebook knows what happens on Facebook properties but not what happens elsewhere

- Google knows what happens on Google properties but not what happens on Facebook

- TikTok, LinkedIn, Twitter, and other platforms each maintain separate data silos

Each platform reports conversions using its own attribution window and methodology. When multiple platforms claim credit for the same conversion, your total “attributed conversions” exceeds actual conversions.

De-duplication requires independent measurement that platforms do not naturally provide. Building unified views across walled gardens requires:

- Consistent UTM parameters on all traffic

- Landing pages that capture UTM data into lead records

- Lead-level P&L connecting marketing source to revenue outcome

- Acceptance that cross-platform attribution is directional, not precise

View-Through Attribution Debates

Did the impression that someone saw but did not click contribute to their conversion?

Platforms say yes. Facebook’s default 7-day view-through window credits conversions to ad views even without clicks. Google similarly claims view-through conversions.

Independent measurement often disagrees. Studies suggest view-through conversions are heavily overcounted. An impression that preceded a conversion may have contributed nothing if the consumer would have converted anyway.

The truth lies somewhere between. Display impressions have some influence, but platforms exaggerate their contribution because their revenue depends on advertisers believing impressions drive value.

Strategic response:

Do not accept platform view-through attribution at face value. Compare view-through claims to incrementality test results. Many advertisers find that reducing or eliminating view-through attribution from their measurement produces more accurate ROI figures.

Consider shortening view-through windows from platform defaults (often 7-28 days) to 1-3 days, where causal connection is more plausible.

Common Measurement Mistakes

Operators make predictable errors in ROI measurement. Avoiding these mistakes immediately improves decision quality.

Mistake 1: Conflating Channel ROI with Marginal ROI

Average channel ROI obscures marginal efficiency. A channel showing 200% average ROI might show 50% marginal ROI at current spend levels because the easy conversions are captured and expansion reaches diminishing audiences.

Optimizing for average ROI rather than marginal ROI leads to over-investment in saturated channels and under-investment in growth-phase channels.

Solution: Track ROI at different spend levels. Plot the relationship between spend and returns. Optimize for marginal, not average, efficiency.

Mistake 2: Ignoring Return Rates in Channel Comparison

Channel comparison using gross conversion counts or gross revenue ignores that quality varies by source.

A channel producing 1,000 leads at $30 CPL with 25% return rate nets 750 usable leads at $40 effective CPL.

A channel producing 800 leads at $35 CPL with 8% return rate nets 736 usable leads at $38 effective CPL.

The second channel is more efficient despite lower volume and higher nominal CPL. Return rates must factor into channel comparison.

Solution: Calculate effective CPL after returns for all channel comparison. Compare net economics, not gross.

Mistake 3: Trusting Platform Self-Reporting

Every platform has incentive to show strong performance. Facebook wants you to spend on Facebook. Google wants you to spend on Google. Platform-reported ROI systematically overstates true contribution.

Operators who budget based on platform-reported figures without independent validation allocate toward channels that claim credit rather than channels that create value.

Solution: Use platform data for within-platform optimization. Validate with independent measurement (incrementality tests, blended analysis, lead-level P&L) for cross-platform allocation decisions.

Mistake 4: Optimizing for Short Measurement Windows

Campaigns need sufficient time to reach statistical significance. Judging channel performance on 7-14 days of data creates false conclusions that get reversed with additional time.

Lead generation compounds this problem because the conversion event (form submission) precedes the value event (lead sale) by days or weeks. A 14-day measurement window might capture conversions but miss returns and revenue.

Solution: Use 30-day minimum measurement windows for tactical optimization. Use 60-90 day windows for strategic decisions. Never make major reallocation decisions based on less than 30 days of data.

Mistake 5: Ignoring Float and Cash Flow Timing

ROI calculations using accrual accounting ignore cash flow timing. A campaign might show positive ROI but destroy cash flow if you pay for media in 15 days and collect revenue in 60 days.

The 60-day float problem is especially acute for lead generation. You fund acquisition immediately. Buyers pay net-30 or net-45. Return windows extend 30+ days beyond sale. Actual cash collection might lag conversion by 90+ days.

Solution: Calculate cash-adjusted ROI that accounts for float cost. Add cost of capital for the float period to your expense base.

Mistake 6: Failing to Allocate Overhead to Channels

Channel ROI that includes only media spend ignores agency fees, technology costs, labor, and compliance overhead.

An operation showing 250% channel ROI on media spend might show 100% ROI when overhead allocates properly. The strategic implications of 250% versus 100% are completely different.

Solution: Develop consistent overhead allocation methodology. Apply it uniformly across channels. Measure true channel ROI, not media-only ROI.

Frequently Asked Questions

Q: What is the difference between blended ROI and channel-specific ROI?

Blended ROI treats all marketing spend as a single investment and measures total return against total cost. It answers: “Is marketing working overall?” Channel-specific ROI isolates individual traffic sources to measure each channel’s contribution. It answers: “Which channels perform best?” Most sophisticated operations use both: blended for strategic decisions about total marketing investment, channel-specific for tactical decisions about budget allocation.

Q: Which approach is more accurate for measuring marketing performance?

Neither is inherently more accurate; they answer different questions. Blended ROI provides more reliable signal in complex multi-channel environments where interaction effects matter. Channel-specific ROI provides more actionable insight when optimizing budget allocation across sources. Accuracy depends on comprehensive cost inclusion and appropriate attribution methodology, not the choice between blended and channel-specific measurement.

Q: How do I choose the right attribution model for channel-specific analysis?

The choice depends on your business model and decision needs. Last-touch attribution suits operations focused on conversion optimization where closing channels matter most. First-touch attribution suits operations measuring demand generation effectiveness. Multi-touch models (linear, time-decay, position-based) provide balanced views for complex journeys. Data-driven attribution works for high-volume operations with sophisticated tracking. Most operations should use multiple models to understand channel contribution from different perspectives.

Q: What is a good blended ROI benchmark for lead generation?

For lead generation operations with comprehensive cost inclusion, sustainable blended ROI ranges from 50-100%. Good performance is 100-150%. Exceptional performance exceeds 150%. These ranges assume you include all marketing-related costs, not just media spend. Operations reporting 300%+ blended ROI are typically missing significant cost categories in their calculation.

Q: How do I handle channels that create demand versus channels that capture demand?

Awareness channels (prospecting, display, content) create demand that closing channels (brand search, retargeting) capture. This creates attribution challenges. Awareness channels often look weak in last-touch attribution but strong in first-touch. Use multiple attribution models to understand the full picture. Validate with incrementality testing to understand true causal contribution. Accept that closing channels are partially dependent on awareness channels feeding them audience.

Q: How often should I review and reallocate budget based on ROI analysis?

Daily for anomaly detection and pacing issues. Weekly for source-level optimization within channels. Monthly for cross-channel budget reallocation. Quarterly for strategic portfolio review and incrementality validation. Annual for comprehensive channel mix evaluation. Avoid making major reallocation decisions more frequently than monthly, as shorter windows create noise-driven decisions.

Q: What is incrementality testing and why does it matter for ROI measurement?

Incrementality testing measures true causal impact by comparing outcomes between groups exposed to marketing versus control groups that were not. While attribution shows correlation (this conversion touched this channel), incrementality shows causation (this conversion would not have happened without this channel). Studies show that retargeting and brand search often have significantly lower incremental value than platform-reported attribution suggests. Sophisticated practitioners conduct incrementality testing on major channels annually.

Q: How do privacy restrictions affect ROI measurement accuracy?

Privacy restrictions (Safari ITP, Chrome cookie deprecation, iOS ATT) reduce tracking coverage. Current estimates suggest 30-40% of traffic uses privacy-protective browsing that limits attribution. This creates gaps in multi-touch attribution data. Strategies to address include implementing server-side tracking to recover lost signal, investing in first-party data collection, accepting that measurement precision has structural limits, and using incrementality testing to validate attribution-based conclusions.

Q: Should I use platform-reported ROI or calculate my own?

Use platform-reported data for within-platform optimization (which audiences, creatives, placements perform best on that platform). Calculate independent ROI for cross-platform budget decisions. Platforms have incentive to show strong performance and use attribution methods that favor their contribution. Independent measurement using lead-level P&L and incrementality testing provides more objective cross-channel comparison.

Q: How do I balance ROI optimization with risk management in channel allocation?

Pure ROI optimization might suggest concentrating budget in your highest-performing channel. This creates platform risk. Account bans, algorithm changes, or policy shifts can devastate single-platform operations. Balance ROI optimization with diversification: no single channel should exceed 40-50% of total budget, maintain 3-4 meaningful traffic sources, and test new channels continuously to develop backup options. The optimal portfolio is not highest ROI but highest risk-adjusted returns.

Key Takeaways

-

Blended ROI measures marketing as a unified investment and answers strategic questions about total marketing efficiency. Use it to decide whether total marketing investment should grow or shrink.

-

Channel-specific ROI isolates individual traffic sources and enables tactical optimization. Use it to allocate budget across channels and identify underperformers requiring intervention.

-

True blended ROI requires comprehensive cost inclusion: media spend, agency fees, creative production, technology platforms, marketing labor, and allocated compliance costs. Operations reporting 300%+ ROI are typically missing major cost categories.

-

Channel-specific analysis depends on attribution model choice. Last-touch favors closing channels; first-touch favors awareness channels. Most operations should use multiple models to understand full channel contribution.

-

Marginal ROI matters more than average ROI for allocation decisions. A channel showing 200% average ROI but 50% marginal ROI at current spend levels is saturated and overfunded despite strong headline performance.

-

Incrementality testing validates attribution by measuring true causal impact. Studies show retargeting and brand search often deliver significantly lower incremental value than platform reporting suggests. Test your major channels annually.

-

Privacy restrictions limit tracking coverage to 60-70% of journeys. Server-side tracking and first-party data strategies help recover lost signal. Accept that precision has structural limits.

-

Platform-reported ROI systematically overstates contribution. Use platform data for within-platform optimization, but validate with independent measurement for cross-platform decisions.

-

The optimal portfolio balances ROI optimization with risk diversification. No single channel should exceed 40-50% of budget. Maintain multiple traffic sources to survive platform changes.

-

sophisticated practitioners combine blended and channel-specific analysis: blended for strategic investment decisions, channel-specific for tactical allocation, and incrementality for ground-truth validation.

Sources

- WebKit Intelligent Tracking Prevention - Safari’s tracking prevention methodology that blocks third-party cookies and limits first-party cookie duration

- WebKit Tracking Prevention Policy - Official WebKit documentation on tracking restrictions affecting attribution measurement

- Apple App Tracking Transparency - iOS framework requiring explicit opt-in for cross-app tracking, affecting mobile attribution

- Google Privacy Sandbox - Chrome’s initiative to deprecate third-party cookies and implement privacy-preserving measurement

- Meta Conversions API - Server-side event tracking documentation for recovering signal lost to browser restrictions

- Meta Attribution Settings - Facebook’s attribution window configuration and methodology for conversion measurement

- GDPR Official Guide - EU General Data Protection Regulation requirements affecting data collection and marketing measurement

Statistics and methodologies current as of late 2025. Attribution models, privacy regulations, and platform capabilities evolve continuously; validate current best practices before implementation.