How to distribute your marketing budget across paid search, social media, native advertising, and emerging channels using frameworks that maximize ROI instead of spreading resources thin.

The spreadsheet says you’re diversified. Budget split across Google Ads, Facebook, native networks, and a few experimental channels. Every platform gets its share. Every media buyer has something to manage.

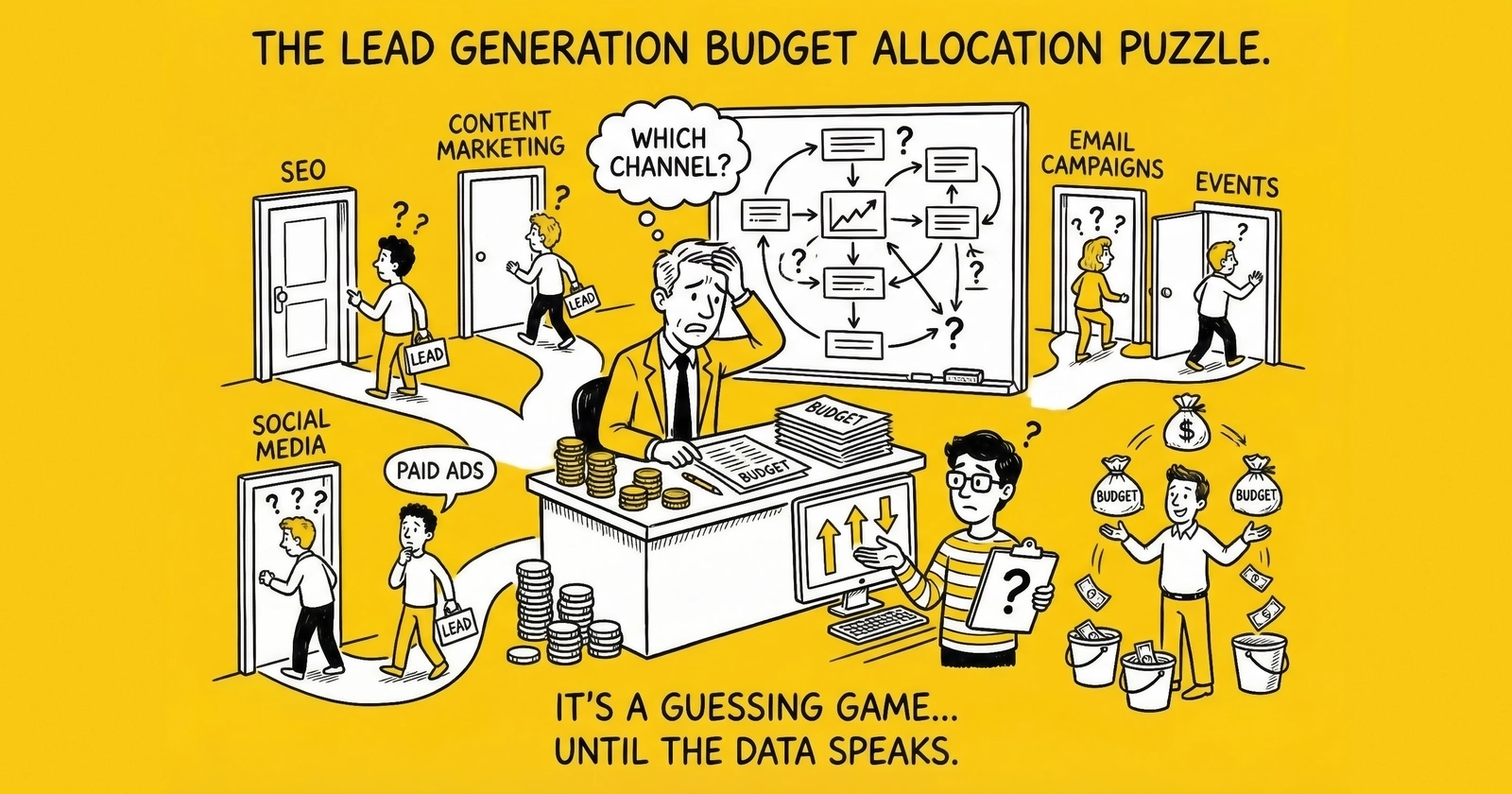

But diversification is not the same thing as optimization. You can spread budget across six channels and still waste 40% of your spend on sources that look busy while destroying margin. The difference between operators who scale profitably and those who burn cash while celebrating activity comes down to one discipline: data-driven budget allocation.

This guide provides the frameworks, benchmarks, and decision models that separate intentional channel investment from reflexive budget spreading. You will learn how to evaluate channel performance beyond surface metrics, when to consolidate versus diversify, how to calculate the true cost of channel experimentation, and what allocation models actually work at different budget levels. By the end, you will have a systematic approach to budget decisions that compounds returns instead of compounding mistakes. For the foundation of performance measurement, see our guide on blended vs channel ROI analysis.

Why Most Budget Allocation Fails

Before diving into frameworks, we need to understand why budget allocation goes wrong. The mistakes are systematic, not random. Operators repeat them because the underlying assumptions seem reasonable until you examine the math.

The Diversification Fallacy

The logic sounds prudent: spread budget across multiple channels to reduce risk. If Google Ads underperforms, Facebook picks up the slack. If social costs spike, native advertising provides alternatives. Portfolio theory applied to media buying.

The problem is that channel diversification in lead generation operates differently than financial diversification. In financial markets, uncorrelated assets genuinely reduce portfolio risk without proportionally reducing returns. In media buying, spreading budget thin across multiple channels typically reduces performance on all of them.

Why? Three reasons.

Learning algorithms need volume. Facebook’s optimization algorithms require approximately 50 conversions per week per ad set to exit the learning phase and optimize effectively. Google’s automated bidding needs 30+ monthly conversions per campaign to function well. Spread $20,000 across six channels instead of concentrating it in two, and none of them accumulate enough data to optimize. You are paying for machine learning while providing insufficient training data.

Expertise compounds. A media buyer who spends 80% of their time in Google Ads develops intuition, workflow efficiency, and pattern recognition that someone managing six platforms cannot match. The creative strategist focused on Facebook develops testing frameworks, creative templates, and audience insights that generalists miss. Diversification dilutes the human expertise that separates good campaigns from great ones.

Fixed costs per channel. Every channel carries fixed costs: platform fees, integration maintenance, creative production, and management overhead. Running six channels at $5,000 each costs more in aggregate overhead than running two channels at $15,000 each. You are paying setup and maintenance costs on channels that never reach efficient scale.

The data supports this. Operators generating fewer than 1,000 monthly leads typically see better performance concentrating 70-80% of budget in their primary channel rather than spreading evenly across alternatives.

Platform-Reported Metrics Distort Reality

Google says your cost per lead is $45. Facebook reports $32. The dashboard shows both channels performing profitably against your $75 sale price target.

But platform-reported metrics systematically overstate performance. Here is what gets missed:

Creative production costs get expensed as overhead rather than attributed to campaigns. That landing page video cost $8,000 to produce. If it runs exclusively for one campaign, the entire cost belongs to that campaign’s CPL calculation. Spread across multiple campaigns, it still needs allocation.

Agency and management fees disappear into operating expenses. Your media buying agency charges 15% of spend. Your in-house team represents salary allocation. These are direct costs of acquisition, not overhead.

Validation and compliance costs often escape attribution. TrustedForm certificates at $0.15 per lead, phone validation at $0.05-0.10, email verification, fraud detection tools. At 10,000 monthly leads, that is $2,000-3,000 in per-lead costs that platform dashboards never see.

Returns and refunds materialize 7-30 days after leads are generated. The campaign that looked profitable at $45 CPL reveals itself as $58 CPL after 12% of leads come back as returns. Platform reporting captures acquisition; it misses rejection.

The result: operators optimize based on incomplete data, shifting budget toward channels that report favorable numbers while the channels that actually generate net margin get starved.

True cost per lead requires a comprehensive formula: Total Traffic Cost = Media Spend + Creative Production (allocated) + Agency Fees + Testing/Learning Spend + Platform Fees + Per-Lead Technology Fees + Allocated Labor + Compliance Costs + Return Processing Labor + Float Cost.

A channel showing 250% ROI using platform metrics often shows 80-120% ROI when all costs are properly attributed. Still profitable, but requiring very different allocation decisions than the dashboard suggests. Our guide on calculating true cost per lead covers the complete methodology.

Chasing Volume Over Margin

Budget allocation decisions often prioritize volume metrics because they are visible and simple. Lead count is unambiguous. Cost per lead is easy to calculate. Margin requires downstream data integration that many practitioners lack.

This creates a predictable failure pattern: budget flows toward high-volume, low-margin channels while high-margin, capacity-constrained channels remain underinvested.

Consider a real example pattern:

| Channel | Monthly Volume | CPL | Sale Price | Return Rate | True Margin |

|---|---|---|---|---|---|

| Google Non-Brand | 8,400 | $42 | $65 | 14% | 18% |

| Facebook LAL | 5,200 | $38 | $68 | 8% | 31% |

| Affiliate A | 3,800 | $32 | $55 | 22% | 6% |

| Affiliate B | 1,200 | $48 | $72 | 5% | 28% |

Volume-based allocation shifts budget toward Google Non-Brand and Affiliate A because they generate the most leads at acceptable CPLs. Margin-based allocation shifts budget toward Facebook LAL and Affiliate B because they generate actual profit.

Affiliate A looks attractive at $32 CPL against a $55 sale price, until you calculate that 22% returns eliminate most of the spread. Google Non-Brand delivers scale but the 14% return rate and tight pricing create minimal margin. Meanwhile, Affiliate B’s smaller volume at higher CPL actually delivers superior returns per dollar invested.

Those who compound returns understand that a source generating 20% of volume but 40% of margin deserves budget emphasis proportional to its contribution, not its activity.

The Budget Allocation Framework

Effective budget allocation requires systematic evaluation across four dimensions: channel economics, operational fit, strategic role, and scalability. No single metric determines allocation; the framework integrates multiple factors into actionable decisions.

Dimension One: Channel Economics

Start with honest financial assessment. For each channel, calculate:

True Cost Per Lead. Include all variable costs: media spend, per-lead validation, consent certification, creative production (amortized), agency fees, and labor allocation. If you cannot attribute at least 80% of your operating costs to specific channels, your data infrastructure needs work before your allocation model does.

Net Revenue Per Lead. Sale price minus expected returns, refunds, and chargebacks. Historical return rates by channel provide the best prediction. New channels without return history should assume conservative rates (12-15% for most verticals) until proven otherwise.

Gross Margin by Channel. (Net Revenue Per Lead - True Cost Per Lead) / Net Revenue Per Lead. This is your primary financial metric. Channels below 20% gross margin typically cannot sustain profitable scaling; channels above 40% often have room for increased investment.

Margin Stability. How consistent is the margin over 90-day periods? A channel averaging 30% margin with low variance is often more valuable than one averaging 35% with wild swings. Risk-adjusted returns matter because variance destroys operations planning.

Dimension Two: Operational Fit

Financial metrics alone miss operational realities that affect performance.

Volume Capacity. Every channel has natural volume limits. Google brand search captures existing demand; you cannot scale it beyond the search volume that exists. Facebook lookalike audiences based on your customer list saturate once you have reached the available population. Know the ceiling for each channel before allocating budget you cannot spend efficiently.

Skill Requirements. Paid search requires understanding of keyword match types, bid strategies, Quality Score factors, and negative keyword management. Social media success depends heavily on creative skills. Native advertising demands content creation expertise. Assess your team’s capabilities honestly; allocating budget to channels you lack expertise to optimize is expensive education.

Speed to Scale. Some channels can absorb budget increases immediately (most paid digital). Others require time to build (SEO, influencer relationships, content marketing). Allocation should account for activation timelines, not just steady-state performance.

Competitive Dynamics. Channels favor different competitive profiles. Google Ads auctions reward deep pockets willing to lose money acquiring customers. Creative-first social platforms allow smaller companies to outperform larger competitors through better content. Assess where your competitive position enables advantage.

Dimension Three: Strategic Role

Different channels serve different purposes in your marketing architecture. Allocation should reflect strategic role, not just current performance.

Demand Capture vs. Demand Creation. Paid search captures consumers already searching for what you offer. Social media and native advertising can create demand among consumers who were not actively shopping. Both are valuable, but they serve different functions and should be measured differently.

Brand search campaigns capture existing demand efficiently. Cutting them shifts that demand to competitors or organic channels rather than eliminating it. Cutting awareness channels reduces future demand creation, with impact that may not be visible for months.

Primary vs. Supporting. Some channels drive direct conversions; others assist conversions that close elsewhere. Multi-touch attribution reveals that many awareness channels influence journeys that last-touch attribution credits to search. Understand each channel’s role in the full journey, not just its direct conversion performance.

Core vs. Experimental. Mature channels with proven performance warrant larger allocation. Emerging channels require protected testing budgets separate from core performance expectations. Mixing experimental and core channels in the same performance evaluation produces either risk aversion (cutting promising tests too early) or over-investment in unproven channels.

Dimension Four: Scalability

Allocation decisions should account for growth potential, not just current state.

Marginal Economics. Does performance hold as spend increases? Many channels show diminishing returns at higher spend levels. Facebook audiences saturate. Google keyword pools exhaust. Understanding the marginal economics curve for each channel prevents scaling past the point of profitable investment.

Expansion Pathways. Can you scale this channel through adjacencies? A successful Facebook prospecting campaign can expand to Instagram, Advantage+ audiences, and new creative tests. A successful non-brand search campaign can expand to additional keywords, match types, and geographic targeting. Channels with rich expansion pathways deserve allocation priority because they compound investment options.

Allocation Models by Budget Level

Budget size fundamentally changes optimal allocation strategy. The right approach at $10,000 monthly is wrong at $100,000, and what works at $100,000 fails at $500,000. Here are allocation frameworks for each level.

Under $10,000 Monthly: Single-Channel Focus

At limited budget levels, concentration beats diversification. You cannot afford the fixed costs and learning inefficiencies of multiple channels. Focus on one primary channel that matches your vertical and capabilities.

Recommended Allocation:

- Primary Channel: 85-90% of budget

- Testing Reserve: 10-15% of budget (for creative testing within primary channel, not new channel exploration)

Channel Selection Priority:

- Paid search if your vertical has proven search demand and you have or can acquire search expertise

- Facebook/Instagram if visual creative is a strength and your audience demographics align

- Native advertising if content creation is a core capability

At this budget level, becoming genuinely proficient in one channel will generate more profitable leads than shallow knowledge across three. The media buyer managing $8,500 monthly in Google Ads develops intuition and efficiency that someone splitting $3,000 across three platforms cannot match.

Do not test new channels until your primary channel consistently delivers target margins. Diversification is for optimizing performing systems, not escaping underperforming ones.

$10,000-$50,000 Monthly: Controlled Diversification

This range supports meaningful testing of a secondary channel while maintaining primary channel focus.

Recommended Allocation:

- Primary Channel: 65-75% of budget

- Secondary Channel: 20-25% of budget

- Testing Reserve: 5-10% of budget

Decision Framework: The secondary channel should complement, not duplicate, your primary channel. If paid search is primary (capturing existing demand), social media makes sense as secondary (creating future demand). If social is primary, consider search to capture the demand your awareness campaigns generate.

Maintain minimum investment thresholds for algorithm efficiency:

- Google Ads: At least $3,000-5,000 monthly per campaign type

- Facebook/Instagram: At least $3,000-5,000 monthly for consistent optimization

- Native advertising: At least $5,000 monthly for meaningful testing

Below these thresholds, algorithms cannot optimize effectively and you are essentially running blind.

Scaling Triggers: Increase secondary channel allocation when it achieves margin parity with primary channel for two consecutive months. Reduce allocation if secondary underperforms primary by more than 25% margin for two consecutive months.

$50,000-$150,000 Monthly: Portfolio Optimization

At this budget level, true portfolio management becomes viable. You have enough volume for multiple channels to optimize independently while maintaining strategic oversight.

Recommended Allocation:

- Primary Channel: 45-55% of budget

- Secondary Channels (2-3): 30-40% combined

- Emerging/Testing: 10-15% of budget

Portfolio Construction: Build a channel mix that balances demand capture and demand creation. A typical effective portfolio at this level:

| Channel | Role | Allocation | Purpose |

|---|---|---|---|

| Google Non-Brand Search | Primary | 35-40% | Capture active demand |

| Facebook/Instagram | Secondary | 25-30% | Create demand, retarget |

| Google Brand Search | Supporting | 10-12% | Protect branded demand |

| Native/Content | Secondary | 10-15% | Awareness, content funnel |

| Testing Pool | Experimental | 10-12% | New channel evaluation |

Reallocation Cadence: Review allocation monthly. Shift 5-10% of budget between channels based on rolling 30-day margin performance. Avoid dramatic reallocation (more than 15% in a single month) unless clear underperformance demands it.

$150,000+ Monthly: Advanced Portfolio Management

At scale, sophisticated allocation approaches become necessary to optimize across a complex channel portfolio.

Recommended Allocation:

- Core Channels (3-4): 60-70% combined

- Growth Channels (2-3): 20-25% combined

- Experimental: 10-15% of budget

Advanced Considerations:

Incrementality Testing. At this scale, invest in measuring true incrementality rather than relying on attribution models. Geographic holdout tests reveal how much conversion lift each channel actually provides versus conversions that would have occurred anyway. Research shows that 52% of brands now use incrementality testing, with companies implementing proper measurement achieving 10-20% improvement in marketing efficiency.

Cross-Channel Optimization. Understand how channels interact. Facebook awareness campaigns may drive search volume that converts through Google. Native content may build familiarity that improves social ad performance. Optimize for portfolio performance, not isolated channel metrics.

Marginal Cost Curves. Map the relationship between spend and marginal CPL for each channel. Most channels show relatively flat marginal costs up to a threshold, then rising costs as you push past efficient scale. Allocate to keep all channels operating below their inflection points.

Dynamic Budget Shifting. Implement weekly reallocation based on real-time performance within defined guardrails (no channel changes more than 15% week-over-week). Automated rules can shift budget toward outperformers while maintaining minimum investment floors that protect learning momentum.

Channel-Specific Allocation Guidance

Each major channel has distinct characteristics that affect how allocation decisions should be made. Here is channel-by-channel guidance for lead generation operations.

Paid Search: The Intent Backbone

Paid search captures consumers actively seeking what you offer. It remains the highest-intent traffic source for most lead generation verticals.

Benchmark Economics:

- Average CPL: $66-75 across industries (2024-2025 data)

- Conversion rates: 6-8% average, with top performers exceeding 10%

- Legal and financial services see CPLs of $100-150+

- Home services and automotive often achieve CPLs under $50

Allocation Considerations: Paid search is constrained by search volume. You cannot spend infinitely; available keywords set a ceiling. Allocate based on the volume available at acceptable CPLs, not based on budget percentage targets.

Segment allocation by keyword type:

- Brand terms: Protect at high impression share (90%+); these are your lowest-cost, highest-intent leads

- Non-brand high-intent: Scale to the limit of profitable CPL thresholds

- Non-brand moderate-intent: Test carefully with strict CPA caps

Geographic bid adjustments can significantly affect performance. Leads from some states may be worth 2-3x leads from others based on buyer preferences and conversion rates. Allocate within search based on geographic value differentials.

Warning Signs Demanding Reallocation:

- Quality Score declining below 6/10 on primary keywords

- Rising CPCs without corresponding conversion rate improvement

- Impression share declining despite stable or increased budget (increased competition)

Social Media Advertising: Demand Creation Engine

Facebook and Instagram remain the dominant social advertising platforms with 3.43 billion monthly active users across Meta’s family of apps. Social creates demand among consumers who were not actively searching.

Benchmark Economics:

- Average CPL: $25-35 for lead ads, rising approximately 20% year-over-year

- Conversion rates: 7-9% for native lead forms, lower for landing page redirects

- Creative performance drives massive variance: 5x performance spread between best and worst creatives

Allocation Considerations: Social media success is increasingly a creative game. Budget allocation must include creative production costs, not just media spend. Plan to test 10+ creative variations per campaign; most will underperform, but winners justify the investment.

The learning phase requires volume. Campaigns need approximately 50 conversions per week per ad set to exit learning and optimize effectively. Allocate sufficient budget to each campaign to hit this threshold; spreading thin produces perpetually suboptimal performance.

Advantage+ and broad targeting audiences often outperform detailed targeting at scale. But these algorithms need training data. New accounts or campaigns require more conservative allocation until sufficient conversion data accumulates.

Optimal Allocation Mix Within Social:

- Prospecting campaigns: 50-60% of social budget (new audience acquisition)

- Retargeting: 25-35% of social budget (highest efficiency, limited scale)

- Testing/Experimental: 10-15% of social budget (creative and audience tests)

Native Advertising: Content-Driven Acquisition

Native advertising matches the form and function of surrounding editorial content. The global native advertising market reached $104.63 billion in 2024, growing at approximately 13.9% annually.

Benchmark Economics:

- CPC ranges from $0.30-0.70 depending on platform and placement quality

- CTRs average 0.2-0.6% for Taboola/Outbrain

- Conversion rates of 2-5% on strong offers

- Higher compliance and content production overhead

Allocation Considerations: Native advertising requires content creation expertise. The ad unit is just the hook; the landing page (often advertorial-style content) does the work. Budget allocation should include content production costs, which can run $500-2,000 per advertorial piece.

Publisher performance varies dramatically. The same campaign can show 5x cost-per-acquisition differences across sites within the same network. Plan for optimization investment: initial allocation should include budget for publisher testing before you can identify the whitelist of performers.

Native works best for:

- Verticals with longer consideration cycles requiring education

- Products benefiting from story-based selling

- Audiences not actively searching but open to discovery

Native struggles for:

- Commoditized products where price comparison dominates

- Impulse purchases where content friction hurts conversion

- Audiences actively in market who want efficiency, not education

Emerging Channels: Testing With Discipline

Connected TV, podcast advertising, influencer marketing, and platform-specific channels like TikTok represent emerging opportunities with less established performance benchmarks.

Allocation Framework for Emerging Channels:

Protected Budget. Allocate 10-15% of total budget specifically for emerging channel testing. This budget has different success criteria than core channels: learning and validation, not immediate profitability.

Minimum Viable Test. Each channel requires sufficient budget for valid testing:

- Connected TV: $25,000-50,000 minimum for statistically significant lift measurement

- Podcast advertising: $10,000-20,000 for reach and response validation

- Influencer marketing: $5,000-15,000 depending on tier and vertical

- TikTok: $5,000-10,000 for initial audience and creative testing

Graduation Criteria. Emerging channels graduate to secondary or core status when they demonstrate:

- Consistent margin within 20% of established channels for 60+ days

- Scalable path (clear expansion beyond initial test)

- Operational integration (tracking, reporting, optimization processes established)

Kill Criteria. Terminate emerging channel tests when:

- Test budget exhausted without achieving minimum performance thresholds

- Fundamental mismatch between channel audience and your vertical becomes clear

- Operational complexity outweighs potential return

The discipline is maintaining emerging channel allocation as a distinct category with distinct expectations. Mixing experimental channels into core performance evaluation produces either excessive risk aversion or premature scaling.

Dynamic Reallocation: When and How to Shift Budget

Static allocation is wrong allocation. Market conditions change, channel performance shifts, and competitive dynamics evolve. Effective budget management includes systematic reallocation based on data rather than intuition.

Reallocation Triggers

Certain signals should trigger allocation review and potential adjustment:

Performance Divergence. When one channel’s margin exceeds another by more than 25% for three consecutive weeks, budget should shift toward the outperformer. The shift magnitude depends on scale potential: shift more if the outperformer has room to absorb additional budget, less if it is approaching saturation.

Cost Volatility. Sudden CPC or CPL increases (more than 20% week-over-week) without corresponding conversion improvement signal competitive pressure or platform changes. Reduce allocation to investigate before scaling back up.

Quality Degradation. Rising return rates by channel indicate sourcing problems. A channel showing return rates 1.5x baseline should see reduced allocation until quality stabilizes. Quality problems compound: continuing to scale a degrading source accelerates relationship damage with buyers.

Capacity Constraints. If a channel is hitting frequency caps, impression share limits, or audience saturation, additional budget produces diminishing returns. Plateau investment at efficient levels rather than forcing scale past economic thresholds.

Reallocation Guardrails

Discipline prevents overreaction to short-term noise while enabling response to meaningful signals.

Minimum Reallocation Threshold. Do not reallocate less than 5% of a channel’s budget. Smaller shifts create administrative overhead without meaningful impact.

Maximum Weekly Change. Do not change any channel’s allocation by more than 15% in a single week. Larger changes disrupt learning algorithms, create reporting discontinuities, and may reflect overreaction to variance rather than trend.

Protected Minimums. Establish minimum investment floors for each channel below which you do not drop regardless of short-term performance. These floors ensure you maintain presence and data flow even during optimization cycles.

Testing Isolation. Experimental channel budgets operate under different rules than core channels. Do not raid experimental budgets to fund core channel expansion; doing so systematically underfunds innovation.

Seasonal and Cyclical Adjustments

Lead generation demand varies predictably by season, and allocation should adjust accordingly.

Insurance verticals see massive demand spikes during Annual Enrollment Period (October-December for Medicare, with AEP running October 15 through December 7) and state-specific enrollment windows. Allocate 30-50% more to insurance-focused channels during peak periods.

Home services peak in spring and fall (HVAC, roofing, landscaping). Summer and winter see reduced demand. Adjust allocation to match demand curves rather than maintaining flat investment year-round.

Solar and home improvement see spring surges as homeowners emerge from winter. Allocate more aggressively January through May when conversion intent peaks.

Legal (personal injury) shows less seasonality but may see spikes correlated with specific events (mass tort developments, regulation changes).

Build historical seasonal patterns into your allocation model. Last year’s monthly performance provides a reasonable baseline for expected demand curves, adjusted for growth trends.

Measuring Allocation Effectiveness

Allocation decisions require feedback loops. You need to know whether changes improve or degrade performance to refine your model over time.

Key Metrics for Allocation Evaluation

Portfolio Gross Margin. The blended margin across all channels, weighted by volume. This is your primary performance metric. Allocation changes should aim to improve portfolio margin, not just shift activity between channels.

Marginal Return on Allocation Shift. When you move $5,000 from Channel A to Channel B, what happens to total portfolio margin? Track this explicitly. If shifts consistently produce positive returns, your allocation model is improving. If shifts are neutral or negative, you are likely reacting to noise rather than signal.

Channel Concentration Risk. Measure what percentage of leads and margin come from your top channel. Concentration above 60% from any single source represents strategic risk. Allocation should work toward sustainable diversification over time, even if short-term economics favor concentration.

Allocation Efficiency Ratio. Compare your channel allocation percentages to channel margin contribution percentages. A channel receiving 30% of budget should ideally contribute at least 30% of margin. Persistent gaps indicate misallocation.

Review Cadence

Weekly. Review channel pacing and flag significant deviations. Make minor tactical adjustments within guardrails.

Monthly. Conduct comprehensive channel performance review. Update allocation model based on trailing 30-day performance.

Quarterly. Strategic allocation review. Evaluate channel portfolio composition against business objectives. Assess emerging channel test results for graduation decisions.

Common Allocation Mistakes and How to Avoid Them

Even disciplined operators make allocation errors. Here are the most common patterns and how to prevent them.

Mistake One: Optimizing Channel Performance in Isolation

The error: Evaluating each channel against its own historical performance rather than against portfolio alternatives.

The problem: A channel improving from 15% to 20% margin looks like success until you realize your alternative channel delivers 35% margin. Budget flowing to the “improving” channel is still budget not flowing to the better performer.

The fix: Always compare channels to each other, not just to their own history. The relevant question is not “is this channel improving?” but “is this channel the best use of marginal budget?”

Mistake Two: Confusing Attribution with Value

The error: Allocating based on last-touch conversion attribution, which credits demand capture while ignoring demand creation.

The problem: Paid search captures consumers who first encountered your brand through social media or content. Cutting awareness channels to fund search may cannibalize the demand generation that feeds search volume. You optimize toward the measurable endpoint while starving the unmeasurable beginning.

The fix: Use multi-touch attribution if your infrastructure supports it. If not, at least understand the bias in your attribution model and mentally adjust for channels that play awareness roles. Maintain awareness channel investment even when direct attribution undervalues their contribution.

Mistake Three: Overreacting to Short-Term Variance

The error: Dramatically reallocating based on one or two weeks of performance data.

The problem: Lead generation data has inherent variance. A channel can outperform or underperform by 20-30% week-over-week based on random fluctuation rather than systematic change. Reallocating based on noise creates whiplash that prevents channels from optimizing.

The fix: Use rolling averages (14-day or 30-day) for allocation decisions. Require consistent outperformance or underperformance for multiple periods before significant reallocation. Distinguish between statistical noise and genuine trend.

Mistake Four: Ignoring Fixed Costs in Channel Evaluation

The error: Comparing channels based on variable costs alone while ignoring the fixed costs each channel incurs.

The problem: Adding a new channel incurs setup costs, integration work, learning curve investment, and ongoing management overhead. These fixed costs should be amortized across expected volume. A channel that looks marginally better on variable costs may actually underperform when fixed costs are included.

The fix: Calculate fully-loaded CPL including fixed cost allocation. Require new channels to deliver sufficient margin improvement to justify their incremental fixed costs within a reasonable payback period (typically 3-6 months).

Mistake Five: Equal Allocation Across Quality Tiers

The error: Spreading budget evenly across sources regardless of quality differences.

The problem: A source with 5% return rate is worth fundamentally more than one with 20% return rate, even at the same CPL. Return rates multiply through your economics: they affect margin, buyer relationships, operational efficiency, and compliance risk. Equal allocation to unequal sources destroys value.

The fix: Weight allocation by quality-adjusted margin, not just CPL or volume. A source generating fewer leads at higher margin and lower returns often deserves more budget than a high-volume, low-quality alternative.

Real Talk: The Uncomfortable Truths About Budget Allocation

Vendors want your budget. Platforms want your spend. Agencies want larger retainers. Everyone has incentives to encourage more budget, more channels, more activity. Here is what they will not tell you:

most practitioners are over-diversified, not under-diversified. The industry pushes portfolio approaches that benefit platforms and agencies more than advertisers. For the majority of lead generation businesses, concentrating budget in fewer channels with deeper expertise produces better results than spreading thin for the sake of diversification.

Channel-reported metrics systematically overstate performance. Every platform has incentives to report favorable numbers. Google wants you to spend more on Google Ads. Facebook wants you to spend more on Facebook. Their attribution models, default settings, and reporting interfaces are designed to encourage that spending. Trust but verify. Reconcile platform data against your own financial metrics.

Testing new channels is expensive, and most tests fail. That exciting emerging platform you are eager to try will probably not work for your specific business. The success stories you hear represent survivorship bias. Budget for emerging channel experiments as learning investments with uncertain returns, not as reliable growth engines.

Budget allocation cannot fix broken fundamentals. If your landing pages do not convert, your leads have quality problems, or your unit economics are unsustainable, no allocation strategy will save you. Allocation optimization is for functional operations seeking improvement, not for broken operations seeking rescue.

The best operators allocate aggressively to winners. It seems obvious, but it is surprising how few actually do it. When you find something that works, double down. Many practitioners maintain “balanced” portfolios that spread returns thinly instead of concentrating investment in proven performers. Balance is for portfolios where you cannot predict winners. In lead generation, you can see what works. Act on it.

Key Takeaways

-

Budget diversification is not the same as optimization. At lower budget levels (under $25,000 monthly), concentration in 1-2 channels typically outperforms spreading thin across 4-5.

-

Platform-reported metrics systematically overstate performance. True cost per lead must include creative production, agency fees, validation costs, labor allocation, and return rates. A channel showing $45 CPL in platform reports may actually cost $65 when all costs are attributed.

-

Allocate based on margin contribution, not volume or CPL alone. A source delivering 20% of volume but 40% of margin deserves budget emphasis proportional to its profit contribution.

-

Different budget levels require fundamentally different strategies. Under $10,000 monthly: single-channel focus. $10,000-50,000: controlled diversification. $50,000-150,000: portfolio optimization. Over $150,000: advanced portfolio management with incrementality testing.

-

Establish reallocation guardrails to prevent overreaction. Do not shift more than 15% of any channel’s budget in a single week. Use rolling averages rather than point-in-time metrics for allocation decisions.

-

Emerging channels require protected experimental budgets with different success criteria. Do not mix experimental performance expectations with core channel expectations.

-

Quality-adjusted margin is the only metric that matters for allocation decisions. Return rates, downstream conversion, and buyer relationships all factor into true channel value.

Frequently Asked Questions

How much of my budget should go to my best-performing channel?

For most lead generation operations, your best-performing channel should receive 40-60% of total budget until you approach its scalability limits. Operators often under-allocate to proven performers because they feel pressure to diversify. If your top channel delivers 50% better margin than alternatives and has room to scale, it should receive proportionally more investment. The constraint is diminishing returns as you push past efficient scale, not arbitrary diversification targets.

When should I cut a channel that is underperforming?

Cut a channel when it fails to meet minimum margin thresholds for three consecutive months and you have exhausted reasonable optimization efforts. Before cutting, ensure you are measuring accurately (including all costs and quality factors), that the channel has received sufficient budget for algorithm optimization, and that you have tested multiple creative and targeting approaches. If a channel fundamentally mismatches your vertical or audience, cut it sooner. But premature cutting often reflects inadequate testing rather than genuine channel failure.

How do I allocate budget when I am just starting out?

Start with a single channel that matches your vertical and available expertise. Allocate 85-90% of budget to building proficiency in that channel before considering diversification. For most lead generation verticals, this means either paid search (if your audience actively searches for your offer) or Facebook/Instagram (if your audience responds to visual creative and life-stage targeting). Do not spread limited budget across multiple channels; you will lack the volume for any of them to optimize properly.

What percentage should I allocate to testing new channels?

Allocate 10-15% of total budget to emerging channel testing once your core channels are performing at target margins. This testing budget operates under different expectations than core budget: success is learning and validation, not immediate profitability. Maintain this testing allocation consistently rather than raiding it when core channels need additional investment. Without systematic testing allocation, you will never identify the next growth channel.

How often should I rebalance my channel allocation?

Review allocation weekly for tactical adjustments (within guardrails of 15% maximum change per channel per week). Conduct comprehensive allocation reviews monthly based on trailing 30-day performance. Make strategic allocation changes (adding or removing channels, adjusting portfolio composition) quarterly. Avoid more frequent strategic changes; they create noise that prevents meaningful performance evaluation.

Should I allocate more to channels with lower CPL or higher volume?

Neither in isolation. Allocate based on margin contribution, which incorporates CPL, sale price, return rates, and downstream conversion. A channel with $50 CPL and 5% return rate often delivers better margin than one with $35 CPL and 18% return rate. Similarly, volume without margin is activity without profit. Calculate true margin by source and allocate to maximize margin contribution rather than optimizing for any single metric.

How do I balance brand building versus direct response in my allocation?

The right balance depends on your business model and growth stage. Lead generators focused on immediate monetization typically allocate 75-85% to direct response and 15-25% to awareness/brand building. As you scale and compete for premium buyers, brand investment becomes more valuable. Early-stage operations should focus almost entirely on direct response until profitable channels are established; brand building is a luxury for stable operations, not a priority for cash-constrained growth.

What is the minimum budget needed for proper multi-channel allocation?

Meaningful multi-channel testing requires at least $20,000-30,000 monthly. Below this level, you cannot provide sufficient budget to multiple channels for their algorithms to optimize. A secondary channel needs minimum $5,000-8,000 monthly to generate enough conversions for meaningful optimization; below that threshold, you are paying for machine learning without providing adequate training data. Smaller budgets should concentrate in a single channel until scale supports diversification.

How do I handle seasonal allocation shifts?

Build seasonal curves into your allocation model based on historical demand patterns. During peak seasons for your vertical (AEP for Medicare, spring for home services, etc.), increase allocation to high-performing channels by 20-40% while reducing experimental budgets. During off-seasons, reduce core channel spending proportionally and maintain or increase testing allocation since you have more room for learning without sacrificing prime demand. Document seasonal patterns annually to refine allocation curves over time.

When should I hire an agency versus managing allocation in-house?

Agencies add value when their expertise exceeds what you can build internally cost-effectively. For most operations under $50,000 monthly, in-house management with focused expertise builds faster than agency relationships. Between $50,000-150,000 monthly, agencies can provide specialized expertise for specific channels while you maintain overall allocation control. Above $150,000 monthly, hybrid models work well: in-house strategy and allocation decisions with agency execution on complex channels like programmatic or connected TV.

Sources

- Meta Ads Learning Phase - Official documentation on Facebook’s 50 conversions per week requirement for ad set optimization

- Hootsuite Facebook Statistics - Meta platform usage data including 3.43 billion monthly active users across Facebook, Instagram, and Messenger

- Statista Advertising Spending - Global digital advertising spend data and industry benchmarks

- Statista Native Advertising - Native advertising market size data ($104.63 billion in 2024)

- Taboola - Native advertising platform documentation on content discovery benchmarks

- Outbrain - Native advertising network with publisher performance data

- Think with Google - Google’s marketing research platform with search advertising benchmarks and best practices

- Medicare.gov Enrollment - Official Medicare Annual Enrollment Period dates (October 15 - December 7)

Statistics and benchmarks reflect 2024-2025 industry data. Channel economics, platform capabilities, and competitive dynamics evolve continuously. Validate current conditions before making significant allocation decisions.