The infrastructure for collaborative data analysis without privacy violation. Understanding how clean rooms enable partner matching, attribution, and audience building in a post-cookie landscape.

The privacy walls around customer data grow higher each quarter. Third-party cookies are disappearing. State privacy laws multiply. Consumers demand control over their information. Yet lead generation depends on matching, enrichment, and collaborative insights that historically required sharing raw data between parties.

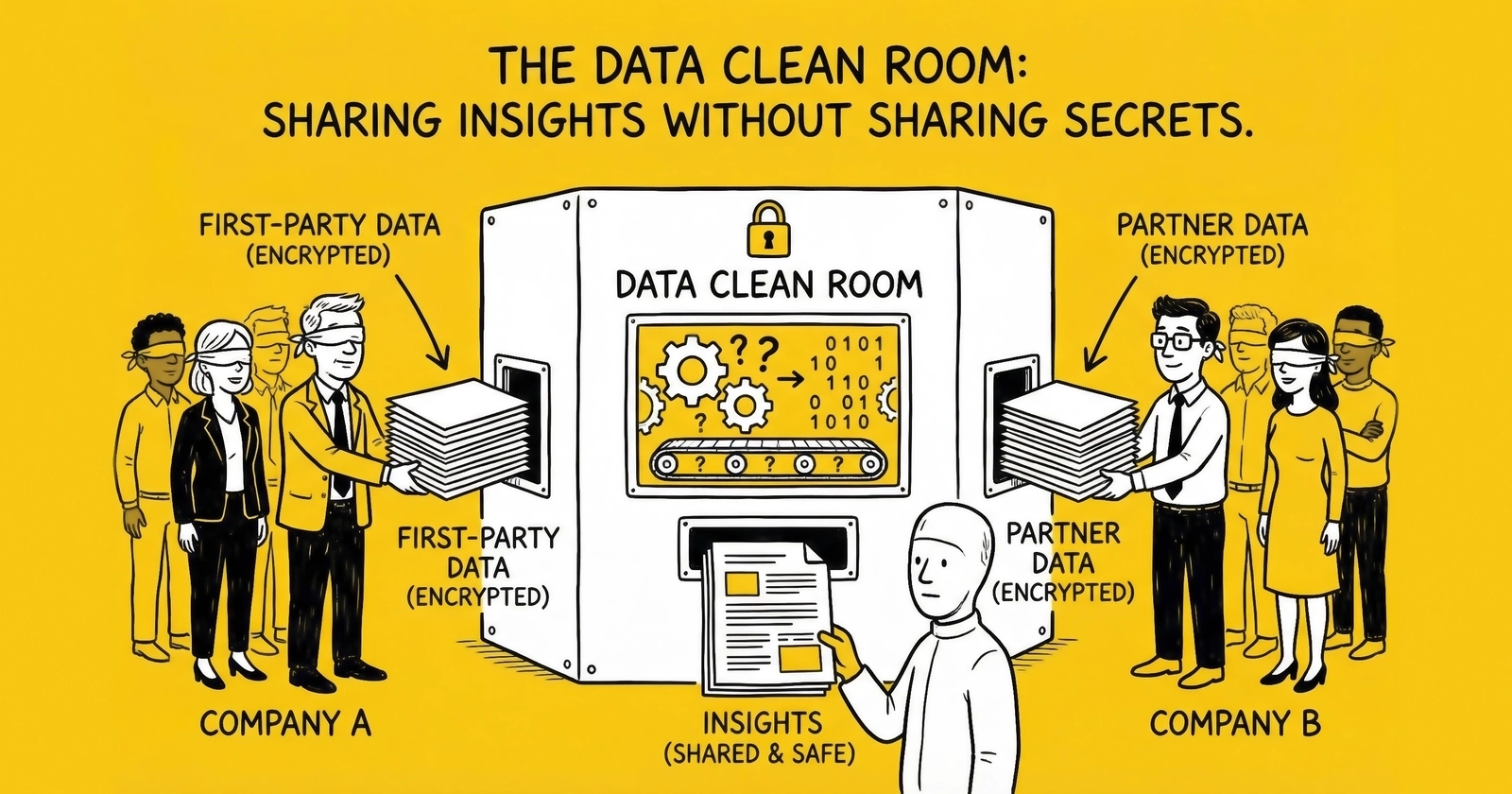

Data clean rooms resolve this apparent contradiction. They enable collaborative analysis between partners without either party seeing the other’s raw data. Your customer list never leaves your control. Your partner’s customer list never leaves theirs. But insights emerge: overlap counts, conversion paths, lookalike characteristics, attribution signals.

For lead generation operators, clean rooms represent both infrastructure evolution and competitive opportunity. The early movers are already using clean room technology for partner matching, suppression, measurement, and audience building. Those waiting will find their partners expecting capabilities they cannot provide.

Forrester’s Q4 2024 B2C Marketing CMO Pulse Survey found 90% of B2C marketers now use clean rooms for marketing use cases. The 2025 State of Retail Media Report shows 66% adoption in retail media networks specifically. IDC projects 60% of enterprises will collaborate through clean rooms by 2028. This is not emerging technology anymore. This is mainstream infrastructure that lead generation operations must understand and implement.

This guide covers what data clean rooms actually are, how they work technically, the specific use cases for lead generation, platform options and selection criteria, implementation requirements, and the governance frameworks necessary for compliant operation.

What Data Clean Rooms Actually Are

A data clean room is a secure computational environment where multiple parties can analyze combined data without exposing raw information to each other. Each party contributes their data, encrypted and protected. Analysis happens inside the clean room. Only aggregated, privacy-protected outputs emerge.

The concept originated in advertising and media, where publishers and advertisers needed to match audiences without sharing customer databases. The same principle applies throughout lead generation: publishers, brokers, buyers, and partners all have valuable data that becomes more valuable when combined, but raw data sharing creates privacy liability, competitive risk, and regulatory exposure.

The “Non-Movement of Data” Principle

The key differentiator of clean rooms is that your data never leaves your control. Partner data never leaves their control. The data does not physically transfer between parties. Instead, encrypted versions of the data exist within the clean room environment, where secure computation produces insights without decryption.

Consider the traditional approach to partner matching. You want to know which of your prospects are already customers of Partner A. Without clean rooms, this requires either sharing your prospect list with Partner A (exposing your data) or Partner A sharing their customer list with you (exposing their data). Someone has to take the risk. Someone has to trust.

Clean rooms eliminate this trust requirement through technology. Both lists enter encrypted. Matching happens through privacy-preserving techniques like secure multi-party computation, differential privacy, or trusted execution environments. Results emerge: “47 of your prospects are existing customers of Partner A.” Neither party ever sees the other’s raw data. Neither party knows which 47 unless permissions specifically allow that granularity.

This non-movement principle enables collaboration that would otherwise be impossible. Legal teams that rejected raw data sharing approve clean room analysis. Partners who competed for customers collaborate on insights. Data that sat unused in silos becomes analytically valuable.

How Clean Rooms Work Technically

Clean room implementations vary by provider, but the core architecture follows consistent patterns:

Data Ingestion. Each party uploads their data to the clean room environment. During ingestion, records are hashed, tokenized, or encrypted depending on the privacy model. Personal identifiers become opaque tokens that can be matched but not reverse-engineered.

Identity Resolution. The clean room matches records across parties using common identifiers, typically hashed email addresses or phone numbers. Advanced implementations use probabilistic matching when deterministic matches are not available, inferring likely matches from combinations of partial signals.

Query Execution. Users write queries against the combined dataset. Crucially, queries execute within the clean room environment, not on exported data. The clean room enforces rules about what queries are permitted: minimum aggregation thresholds, differential privacy guarantees, output restrictions.

Output Delivery. Query results are reviewed against privacy policies before delivery. Outputs that might identify individuals are blocked or modified. Only privacy-safe aggregated results reach the requesting party.

Audit Logging. Every action within the clean room is logged: what queries ran, who requested them, what outputs were produced. This audit trail supports compliance verification and dispute resolution.

Privacy Models in Clean Rooms

Different clean room providers implement different privacy guarantees:

Aggregation Minimums. The simplest privacy control: outputs must represent at least N records, typically 25-100. A query returning “3 records matched” is blocked because 3 individuals might be identifiable.

Differential Privacy. Mathematical guarantees that individual records cannot be identified from outputs. Noise is added to results such that any individual’s presence or absence cannot be determined from the output. This enables privacy-safe analytics even for sensitive queries.

Secure Multi-Party Computation. Cryptographic protocols enabling computation on encrypted data. Multiple parties can jointly compute results without any party seeing the other’s inputs. Computationally intensive but provides strong cryptographic guarantees.

Trusted Execution Environments. Hardware-based isolation ensuring that computation occurs in protected memory that even the cloud provider cannot access. Data is only decrypted inside the secure enclave during computation.

For lead generation applications, most implementations use aggregation minimums plus differential privacy. The cryptographic approaches provide stronger guarantees but add complexity and computational overhead.

Use Cases for Lead Generation

Clean rooms enable several high-value use cases specific to lead generation operations. Understanding these use cases helps prioritize implementation and identify the right technology approach.

Audience Overlap Analysis

The foundational clean room use case: identifying overlaps between your audience and partner audiences without sharing raw data.

Publisher-Buyer Matching. Publishers want to know which of their leads are likely to convert with specific buyers. Buyers want to understand publisher audience composition before purchasing. Clean room overlap analysis enables both parties to evaluate fit without the publisher revealing their entire lead database or the buyer exposing their customer profile.

The mechanics: the publisher uploads lead data (hashed emails, demographics, behavioral signals). The buyer uploads customer data (hashed emails, purchase history, LTV). The clean room matches and returns aggregate statistics: “34% of the publisher’s leads match your high-LTV customer profile.” Both parties learn valuable information without privacy exposure.

Partner Ecosystem Mapping. For organizations practicing ecosystem-led growth, clean rooms enable systematic mapping of partner relationships against target accounts. Which of your prospects are already customers of Partner A? Partner B? Partner C? Without clean rooms, this mapping requires either manual introduction requests or data sharing agreements that most partners will not sign.

Account mapping platforms like Crossbeam and Reveal provide this functionality specifically for B2B account overlap analysis. They encrypt account data from each party, compute overlaps, and return matched accounts along with relationship strength indicators. The platforms essentially run specialized clean rooms focused on account matching use cases.

Geographic and Demographic Distribution. Beyond simple matching, clean rooms enable analysis of how partner audiences distribute across geographies, demographics, and other segmentation dimensions. A solar lead generator might discover that Partner A’s customer base concentrates in high-solar-potential ZIP codes, making partnership more valuable than raw overlap counts suggest.

Suppression Without Exposure

Clean rooms solve the suppression paradox: you want to avoid marketing to people you should not target, but identifying those people requires knowing who they are.

Partner Customer Suppression. If Partner A’s customers should not receive your acquisition marketing, clean room matching enables suppression without Partner A sharing their customer list. Upload your target audience. Match against their customer database. Receive back a suppression signal for matched records, not the identities themselves.

The operational impact is significant. Rather than accidentally marketing to existing partner customers (damaging the relationship) or requiring partners to share customer lists (privacy violation), you achieve suppression through privacy-preserving computation. The clean room confirms “these 47 accounts on your target list are our existing customers” without revealing which 47.

Existing Customer Suppression. Similarly, you can identify leads you are about to purchase who are already your customers, preventing wasted spend on people who have already converted. Upload your customer database. Match against incoming lead pools before purchase. Suppress matches.

Compliance Suppression. For regulated verticals, clean rooms enable matching against suppression lists (TCPA litigators, Do Not Call registries, state-specific restrictions) without the list owner revealing the complete database.

Attribution Across Partners

Traditional attribution tracks the customer journey within your owned properties. Clean room attribution tracks journeys that cross partner boundaries.

Partner Influence Measurement. Did exposure to Partner A’s content contribute to conversion on your site? Traditional attribution cannot answer this question because Partner A’s touchpoints are invisible to your measurement. Clean room analysis reveals these cross-partner journeys: “Leads who engaged with Partner A’s content converted at 2.3x the rate of leads without partner exposure.”

This use case is particularly valuable for understanding ecosystem influence. When a prospect engages with partner content, visits your site, and converts, your attribution gives full credit to your touchpoints. Clean room attribution reveals the partner exposure that primed the conversion. This data supports accurate partner compensation and strategic planning.

Lead Source Quality Verification. Buyers can verify lead source quality by matching purchased leads against conversion outcomes. Rather than relying on publisher-reported metrics, the buyer brings purchase data while the publisher brings source data. The clean room computes actual conversion rates by source, traffic type, and other dimensions.

This closed-loop verification changes the relationship between publishers and buyers. Publishers with genuinely high-quality leads can prove performance. Buyers can validate claims before committing to volume agreements. The clean room provides neutral ground for measurement.

Multi-Touch Journey Analysis. For complex B2B sales, leads often touch multiple vendors before converting. Clean room analysis assembles the complete journey from multiple parties’ touchpoint data, revealing which combination of exposures drives conversion.

Lookalike Modeling and Audience Building

Clean rooms enable collaborative audience building based on combined success signals.

Joint Customer Profile Development. Both parties contribute customer data. The clean room identifies characteristics that successful customers share. Those characteristics inform targeting criteria applied to external audiences without either party seeing the other’s raw customer data.

For lead generators, this enables powerful audience expansion. If your highest-converting leads share characteristics with Partner A’s customers, targeting audiences similar to the combined profile outperforms targeting based on either party’s data alone.

Enrichment Without Data Transfer. Rather than purchasing third-party data and integrating it with your lead records, clean rooms enable enrichment queries: “What do you know about these 10,000 hashed emails?” The enrichment provider returns aggregate characteristics without you receiving individual-level data you would then need to protect.

This pattern addresses the growing concern about data minimization. Privacy regulations favor approaches where you do not accumulate unnecessary personal data. Clean room enrichment provides the analytical benefit without the data accumulation liability.

Measurement and Reporting

Clean rooms provide neutral ground for performance measurement that both parties can trust.

Buyer-Publisher Performance Verification. Publishers and buyers often dispute performance metrics. Publishers report high conversion rates; buyers report lower numbers. Clean rooms resolve this by providing a neutral computational environment where both parties contribute their data and receive verified results.

Network Aggregate Reporting. Lead networks can provide aggregate performance reporting to publishers and buyers without revealing individual partner details. Publishers see how their leads perform relative to network averages. Buyers see source quality distributions without identifying specific publishers.

Regulatory Compliance Reporting. For regulated verticals, clean rooms enable compliance reporting that verifies process adherence without revealing protected consumer data. Regulators or auditors can verify that consent was captured, that data handling followed proper procedures, and that suppression was applied correctly, all through aggregated analysis rather than raw data access.

Platform Options and Selection Criteria

The clean room market has matured significantly. Several major platforms serve the lead generation industry, each with different architectural approaches, integration patterns, and pricing models.

LiveRamp

LiveRamp dominates enterprise clean room implementations, particularly for organizations that need identity resolution across fragmented customer data.

Strengths. LiveRamp’s RampID provides persistent identity resolution across devices and touchpoints. Their Safe Haven product offers a mature clean room implementation with strong enterprise features. Native integrations with major ad platforms enable activation of clean room audiences for targeting.

Considerations. Enterprise pricing puts LiveRamp out of reach for many lead generation operations. Implementation complexity requires dedicated data engineering resources. Best suited for organizations already using LiveRamp for identity resolution.

Best For. Enterprise lead buyers, large publishers with sophisticated data operations, organizations needing cross-device identity resolution.

Snowflake Clean Rooms

Snowflake has emerged as a leading clean room platform, leveraging their data cloud infrastructure to enable secure collaboration.

Strengths. SQL-based interface familiar to data teams. Native integration with existing Snowflake data infrastructure. Flexible privacy controls. Strong performance on large datasets. Cloud-native architecture eliminates data movement.

Considerations. Requires Snowflake as underlying data platform. More technical implementation than turnkey solutions. Privacy controls require configuration rather than coming pre-built.

Best For. Organizations already using Snowflake for data warehousing. Data teams comfortable with SQL. Companies wanting maximum flexibility in clean room configuration.

AWS Clean Rooms

Amazon’s clean room offering integrates with the broader AWS ecosystem, enabling secure collaboration without data movement between AWS accounts.

Strengths. Native AWS integration for organizations on that cloud. Cryptographic computing options for stronger privacy guarantees. Flexible collaboration patterns. Pay-as-you-go pricing aligned with cloud economics.

Considerations. Requires AWS infrastructure. Less mature than specialized clean room providers. Limited built-in identity resolution requiring partner solutions.

Best For. AWS-native organizations. Technical teams comfortable building custom clean room workflows. Organizations prioritizing cryptographic privacy guarantees.

Google Ads Data Hub

Google’s clean room provides access to Google advertising data for measurement and analysis.

Strengths. Direct access to YouTube, Search, and Display campaign data. Strong measurement capabilities. Integration with Google Cloud Platform. No minimum aggregation smaller than 50 users.

Considerations. Limited to Google advertising ecosystem. No cross-platform matching outside Google properties. Restricted query capabilities compared to general-purpose clean rooms.

Best For. Organizations with significant Google advertising spend. Agencies managing large Google campaigns. Publishers wanting to match audiences against Google properties.

InfoSum

InfoSum pioneered the “data non-movement” approach, maintaining a decentralized architecture where data never leaves each party’s infrastructure.

Strengths. Strongest privacy guarantees through decentralized architecture. No data ever leaves your control, even encrypted. Fast time-to-insight for media and advertising use cases. Publisher-friendly features.

Considerations. Smaller market presence than cloud giants. More specialized for advertising measurement than general analytics. Premium pricing.

Best For. Privacy-conscious organizations. Publishers requiring strongest possible data protection guarantees. Organizations unable to move data to third-party infrastructure.

Habu

Habu positions as the interoperability layer across clean room platforms, enabling collaboration across different cloud environments.

Strengths. Multi-cloud support connecting different clean room platforms. Marketing-focused interface accessible to non-technical users. Pre-built activation integrations. Strong for retail media and shopper marketing use cases.

Considerations. Adds another layer to the technology stack. Best value for organizations needing cross-platform collaboration. Relatively newer entrant compared to established platforms.

Best For. Organizations collaborating with partners on different cloud platforms. Marketing teams wanting accessible clean room interface. Retail and CPG companies in shopper marketing use cases.

Selection Criteria for Lead Generation

When evaluating clean room platforms for lead generation specifically, prioritize:

Existing Infrastructure Alignment. If you are on Snowflake, Snowflake Clean Rooms integrates naturally. AWS shop? AWS Clean Rooms reduces friction. The wrong platform choice creates integration overhead that delays time-to-value.

Partner Ecosystem Compatibility. Your clean room is only useful if partners can connect to it. Evaluate which platforms your key partners already use or are willing to adopt. The best technical solution fails if partners cannot participate.

Identity Resolution Capability. Lead generation depends on matching. Platforms with strong identity resolution (LiveRamp, Snowflake with LiveRamp integration, InfoSum) provide better match rates than platforms requiring you to bring your own identity solution.

Activation Paths. Can you activate clean room audiences for targeting? Some platforms excel at analytics but require manual export for campaign activation. Others provide native integrations with advertising platforms.

Pricing Model Alignment. Enterprise licensing requires volume commitments that may not match lead generation economics. Compute-based pricing aligns costs with actual usage. Per-match pricing makes sense for high-volume matching use cases.

Implementation Complexity. Enterprise clean room implementations often require months of data engineering work. Turnkey solutions sacrifice flexibility for faster deployment. Match implementation complexity to your technical capacity and timeline requirements.

Implementation Requirements

Clean room implementation is as much organizational preparation as technology deployment. The organizations achieving value from clean rooms share common characteristics that struggling implementations lack.

Data Infrastructure Prerequisites

Clean rooms analyze data you provide. The quality and completeness of that data determine the value of insights you receive.

Unified Customer Identity. Before contributing data to a clean room, you need consistent customer identity within your own systems. If the same customer appears as three records in your database with different identifiers, your clean room matches will be fragmented. Identity resolution within your own data should precede cross-party matching.

Consistent Data Schemas. Clean room queries work against defined schemas. Inconsistent field values (“California,” “CA,” “Calif.”), missing required fields, and data quality issues degrade match rates and analytical accuracy. Data normalization should precede clean room ingestion.

Complete Outcome Data. Attribution and measurement use cases require complete outcome tracking. If you cannot reliably connect leads to conversions within your own systems, clean room analysis of the same data will not produce reliable results. Garbage in, garbage out applies regardless of how sophisticated the analytical environment.

Privacy Classification. Which data elements can be contributed to clean rooms? Which require additional consent? Which must remain internal only? Data classification should be established before implementation, not discovered during partner negotiations.

Governance Framework Requirements

Clean room technology enables collaboration. Governance frameworks determine what collaboration is permitted.

Purpose Limitation. For what purposes may clean room analysis be conducted? Legitimate uses include audience matching, attribution measurement, and suppression. Questionable uses might include competitive intelligence or pricing manipulation. Document permitted purposes before partner negotiations.

Data Element Scope. Which data elements may be contributed? Typically limited to identifiers (hashed email, phone) plus non-sensitive attributes (demographics, behavioral signals). Sensitive categories (health information, financial details, precise location history) may require additional controls or exclusion.

Output Restrictions. What outputs may be extracted from the clean room? Common restrictions include minimum aggregation thresholds, prohibition on individual-level exports, and differential privacy requirements on sensitive queries. Define output policies before granting access.

Retention Limits. How long may data remain in the clean room environment? Shorter retention reduces exposure from potential breaches but requires more frequent data refresh. Balance privacy protection against operational convenience.

Access Controls. Who within each organization may access the clean room? Which partners may participate? Role-based access control should mirror your internal data governance.

Audit Requirements. What logging is required? How long must audit records be retained? Who may review audit logs? Strong audit requirements support compliance verification and dispute resolution.

Partner Agreement Structures

Clean room collaboration requires contracts that address unique considerations beyond standard data sharing agreements.

Data Contribution Terms. What data will each party contribute? In what format? With what refresh frequency? Document expectations clearly because misaligned assumptions create implementation friction.

Permitted Queries. What types of analysis may each party conduct? Typically symmetrical: if you can query against their data, they can query against yours. But asymmetric permissions are possible when contribution is asymmetric.

Output Ownership. Who owns the insights generated? Typically both parties own outputs from their own queries, but joint analyses may produce outputs that both parties want.

Cost Allocation. Clean room platforms charge for compute, storage, and sometimes per-query fees. How are these costs shared? Common approaches include 50/50 split, proportional to data volume contributed, or the requesting party pays for their queries.

Termination Procedures. When the partnership ends, what happens to data in the clean room? Typically all party data is deleted, but audit records may persist. Define exit procedures in advance.

Technical Implementation Steps

The technical implementation follows a relatively standard pattern across platforms:

Phase 1: Infrastructure Setup (Week 1-2). Provision clean room environment. Configure access controls. Establish data ingestion pipelines. Test connectivity with partner systems.

Phase 2: Data Preparation (Week 2-4). Normalize and validate source data. Implement required hashing or encryption. Create data schemas aligned with clean room requirements. Conduct quality assurance on prepared data.

Phase 3: Initial Matching (Week 4-5). Contribute data to clean room. Execute test matches. Validate match rates and output quality. Tune identity resolution parameters if needed.

Phase 4: Use Case Implementation (Week 5-8). Build queries for specific use cases. Test output against known results. Validate privacy controls are functioning. Document query templates for ongoing use.

Phase 5: Operationalization (Week 8-12). Establish refresh schedules. Implement monitoring and alerting. Train users on query patterns. Create runbooks for common operations.

Timeline estimates assume organizational readiness. Organizations with poor data quality, unclear governance, or unresolved partner agreements may require significantly longer implementation periods.

Privacy and Compliance Considerations

Clean rooms are designed for privacy compliance, but they do not automatically ensure it. Understanding the compliance landscape helps avoid common pitfalls.

GDPR and Data Protection Regulations

Under GDPR and similar data protection regulations, clean room analysis raises several considerations:

Legal Basis. Even privacy-preserving analysis requires a legal basis for processing. Legitimate interest typically supports B2B matching and measurement use cases. Explicit consent may be required for consumer-facing analyses or sensitive categories.

Data Controller Responsibilities. Each party remains a data controller for their contributed data. Clean room participation does not transfer controller responsibilities. You remain accountable for the lawfulness of your data collection and the appropriateness of your analytical purposes.

Data Minimization. Only contribute data elements necessary for the intended analysis. Clean rooms enable analysis without unnecessary data accumulation, which supports the data minimization principle, but you must still limit your contribution to necessary elements.

Purpose Limitation. Analysis should align with purposes disclosed to data subjects when data was collected. If your privacy policy does not contemplate partner matching, clean room participation may require policy updates.

Cross-Border Transfers. If clean room infrastructure spans jurisdictions, standard contractual clauses or other transfer mechanisms may be required. Most enterprise clean room providers address this through their terms of service, but verify compliance with your legal team.

CCPA and State Privacy Laws

California Consumer Privacy Act and similar state laws impose additional requirements:

Sale of Personal Information. Some clean room activities might constitute “sale” of personal information under CCPA’s broad definition, even though no data actually transfers. Consult legal counsel on whether your intended use cases trigger sale obligations and how to structure activities to remain compliant.

Consumer Rights. Data subjects retain access and deletion rights. Your clean room processes should accommodate these rights when exercised. Can you identify and remove a specific consumer’s data from your clean room contribution on request?

Service Provider Classification. If you engage clean room providers as service providers under CCPA, ensure contracts include required service provider terms. The clean room provider’s standard contract may or may not satisfy CCPA requirements.

TCPA and Lead Generation Compliance

For lead generation specifically, clean room activities should support rather than undermine TCPA compliance:

Consent Documentation. Clean rooms can verify consent capture across distributed lead generation networks. Publishers can demonstrate consent without sharing raw lead data. Buyers can verify consent before purchase.

Suppression Implementation. TCPA litigator suppression through clean room matching reduces litigation exposure. Match your target audiences against suppression lists without the list owner revealing their complete database.

Audit Trail Maintenance. Clean room audit logs provide independent verification of data handling processes. In litigation, documented clean room procedures support compliance narratives.

Privacy by Design Principles

Effective clean room implementations embody privacy by design:

Purpose Limitation. Define specific, limited purposes for clean room analysis. Avoid open-ended access that enables purpose creep.

Data Minimization. Contribute only necessary data elements. Exclude unnecessary identifiers and attributes.

Storage Limitation. Implement data retention limits. Delete contributed data when no longer necessary.

Security. Leverage clean room platform security capabilities. Verify encryption, access controls, and audit logging meet your security requirements.

Accountability. Document your clean room governance. Maintain records demonstrating compliance with privacy requirements.

Practical Considerations for Lead Generation Operations

Beyond the technical and compliance dimensions, practical operational considerations determine clean room success.

Realistic Expectations for Match Rates

Clean room match rates depend on the quality and coverage of identity data on both sides. Set realistic expectations:

Email-Based Matching. When both parties have email addresses, expect 50-70% match rates for overlapping populations. Match rates decline when email addresses are incomplete, outdated, or captured inconsistently.

Phone-Based Matching. Phone number matching can achieve higher rates (60-80%) when numbers are standardized, but phone numbers change more frequently than email addresses.

Probabilistic Matching. When deterministic identifiers are not available, probabilistic matching using name, address, and other signals typically achieves 30-50% of deterministic match rates.

Match Rate Degradation. Match rates decline over time as people change email addresses, phone numbers, and other identifiers. Regular data refresh maintains match quality.

Lower-than-expected match rates often indicate data quality issues rather than platform problems. Investigate match failures to identify opportunities for data improvement.

Cost-Benefit Analysis

Clean room implementations involve multiple cost categories:

Platform Fees. Annual licensing for enterprise platforms ranges from $50,000 to $500,000+ depending on features and volume. Compute-based pricing models may be more economical for lower-volume use cases.

Implementation Costs. Internal or external data engineering resources for implementation. Expect 200-500 hours for initial implementation, depending on complexity and organizational readiness.

Ongoing Operations. Data preparation, refresh management, query development, and user support require ongoing resources. Budget 0.25-0.5 FTE for ongoing clean room operations in most implementations.

Partner Coordination. Relationship management, agreement negotiation, and joint planning consume resources beyond pure technology costs.

Benefits should justify these investments:

Partner Relationship Value. What is the revenue impact of improved partner relationships enabled by clean room collaboration?

Attribution Improvement. What budget efficiency gains result from more accurate cross-partner attribution?

Suppression Savings. What wasted marketing spend is avoided through clean room suppression matching?

Premium Positioning. What pricing premium can you command by demonstrating performance through clean room measurement?

Conservative estimates suggest clean room investments pay back within 12-18 months for organizations with active partnership programs. Organizations without strong partnership needs may not realize sufficient value to justify investment.

Organizational Readiness Assessment

Before committing to clean room implementation, assess organizational readiness:

Data Infrastructure. Is your customer data unified and quality-controlled? Can you produce clean exports for clean room ingestion? Is your identity resolution mature?

Partnership Maturity. Do you have active partnerships that would benefit from clean room collaboration? Have partners expressed interest in secure data collaboration? Are partnership relationships stable enough to justify joint technology investment?

Technical Capability. Do you have data engineering resources for implementation? Are technical teams comfortable with SQL-based analytics? Can you support ongoing operations without dedicated vendor support?

Governance Clarity. Are data governance policies documented? Is there clear authority to approve clean room participation? Are legal and compliance teams aligned on acceptable use cases?

Executive Sponsorship. Is there leadership support for the initiative? Clean room implementations often require cross-functional coordination that stalls without executive backing.

Organizations strong across these dimensions implement successfully. Organizations with significant gaps should address readiness issues before committing to platform investments.

The Strategic Context: Why Clean Rooms Matter Now

Clean room adoption is accelerating because multiple industry trends converge to make collaborative data analysis both more necessary and more feasible.

Third-Party Data Degradation

The data ecosystem that powered lead generation for two decades is fragmenting. Third-party cookies are disappearing. Device identifiers are restricted. Data brokers face regulatory scrutiny. The shared identity layer that enabled cross-site tracking and audience building is eroding.

Clean rooms provide an alternative path to collaborative insights. Instead of relying on third-party data aggregators, you collaborate directly with partners who have first-party relationships with the audiences you want to reach. The insights are more accurate because they are based on first-party data. The relationships are more durable because they do not depend on infrastructure controlled by browser vendors or platform operators.

Partnership as Distribution Strategy

As direct channels saturate and costs increase, partnerships become more strategically important. Ecosystem-led growth, nearbound marketing, and channel partnerships all depend on effective data collaboration between parties.

Clean rooms enable partnerships that raw data sharing precludes. Partners who refused to share customer lists for competitive reasons willingly participate in clean room matching. Legal teams that blocked data sharing agreements approve clean room collaboration. The technology unlocks partnerships that organizational dynamics previously prevented.

Regulatory Trajectory

Privacy regulation is tightening globally. GDPR enforcement is maturing. State privacy laws are proliferating. Federal privacy legislation remains possible. The regulatory trajectory favors data minimization, purpose limitation, and privacy-preserving technologies.

Clean rooms align with this trajectory. They enable analytical value from data collaboration while respecting privacy principles that regulations require. Organizations building clean room capabilities now position themselves for a regulatory environment that is likely to grow more restrictive, not less.

Competitive Differentiation

As clean room adoption crosses into mainstream, lack of capability becomes competitive disadvantage. Publishers who cannot provide clean room-based measurement lose to publishers who can. Buyers who cannot participate in partner clean rooms lose access to partnership opportunities. Networks that cannot facilitate secure data collaboration lose to networks that can.

The window for building clean room capability as competitive advantage is closing. Early movers gained significant advantage. Fast followers can still differentiate. Laggards will find themselves competing against industry standard capability.

Frequently Asked Questions

What exactly is a data clean room?

A data clean room is a secure computational environment where multiple parties can analyze combined data without exposing raw information to each other. Each party contributes their data in encrypted or anonymized form. Analysis happens within the clean room environment. Only aggregated, privacy-protected outputs emerge. Neither party sees the other’s raw data, but both gain insights from the combined analysis.

How do data clean rooms protect privacy?

Clean rooms protect privacy through multiple mechanisms: data encryption during contribution and analysis, identity resolution using hashed or tokenized identifiers, minimum aggregation thresholds preventing individual identification, differential privacy adding mathematical guarantees against re-identification, and strict output controls preventing raw data export. The specific privacy mechanisms vary by platform, but all reputable clean rooms prevent raw data exposure.

What is the difference between a data clean room and a data warehouse?

A data warehouse centralizes your own data for internal analysis. A data clean room enables secure analysis of multiple parties’ data without any party seeing the other’s raw data. The key distinction is multi-party collaboration with privacy protection. You could run a data warehouse with just your data. A clean room only makes sense when collaborating with partners whose data you cannot access directly.

How much does a data clean room cost?

Enterprise clean room platforms range from $50,000 to $500,000+ annually for licensing, depending on features and scale. Implementation typically requires 200-500 hours of data engineering work. Ongoing operations require 0.25-0.5 FTE. For organizations not ready for enterprise platforms, cloud-native options like AWS Clean Rooms offer pay-as-you-go pricing that scales with actual usage, potentially starting at a few thousand dollars annually for modest use cases.

What match rates can I expect from clean room matching?

Email-based matching typically achieves 50-70% match rates when both parties have complete, quality email data for overlapping populations. Phone-based matching can reach 60-80% with standardized phone data. Probabilistic matching using multiple signals achieves 30-50% of deterministic rates. Actual match rates depend heavily on data quality, age of records, and consistency of data capture across parties.

Do I need consent to participate in data clean room analysis?

Clean room participation typically requires a legal basis for processing, which may include legitimate interest for B2B contexts or consent for consumer data. The “non-movement of data” principle and privacy-preserving outputs may reduce consent requirements compared to raw data sharing, but this varies by jurisdiction and use case. Consult with legal counsel on consent requirements for your specific situation.

How long does clean room implementation take?

Implementation timelines range from 4-12 weeks for organizations with mature data infrastructure and clear governance. Organizations requiring significant data preparation, governance development, or partner alignment may require 3-6 months. The primary drivers of timeline are data readiness and organizational alignment rather than pure technology deployment.

Can small lead generation businesses benefit from clean rooms?

Clean rooms provide the most value for organizations with active partnership programs and sufficient data scale to make matching meaningful. Small businesses may find the implementation overhead exceeds the benefit. However, participation in partner clean rooms does not require running your own infrastructure. If major partners offer clean room collaboration, even smaller organizations can participate as data contributors without significant technology investment.

What is the relationship between clean rooms and CDPs?

Customer Data Platforms (CDPs) unify your own customer data from multiple sources. Clean rooms enable collaboration with external parties. They are complementary: a CDP provides the unified, quality data you contribute to clean rooms. Organizations often implement CDPs first to establish data foundation, then leverage that foundation for clean room collaboration.

Which industries use data clean rooms most?

Clean rooms originated in advertising and media but have expanded across industries. Retail media networks use clean rooms for shopper marketing collaboration. Financial services use them for compliant data sharing. Healthcare and pharma use them for privacy-preserving research. Lead generation across insurance, mortgage, solar, and other verticals increasingly adopts clean rooms for publisher-buyer collaboration and partner matching.

Key Takeaways

-

Data clean rooms enable collaborative analysis without privacy exposure. The “non-movement of data” principle means your data never leaves your control. Partner data never leaves theirs. Only aggregated, privacy-protected insights emerge from analysis performed within the secure environment.

-

Lead generation use cases span the value chain. Audience overlap analysis identifies partnership opportunities. Suppression prevents wasteful outreach without exposing customer lists. Attribution tracks conversion paths across partner boundaries. Lookalike modeling builds audiences from combined success signals.

-

Adoption has crossed from early adopter to mainstream. Forrester reports 90% of B2C marketers now use clean rooms. IDC projects 60% enterprise adoption by 2028. Organizations without clean room capability increasingly find themselves unable to participate in partner collaboration that competitors take for granted.

-

Platform selection should align with existing infrastructure. Snowflake users benefit from native Snowflake Clean Rooms. AWS organizations find AWS Clean Rooms integrates naturally. LiveRamp dominates enterprise identity resolution. Match platform choice to your technology stack and partner ecosystem.

-

Implementation requires data readiness and governance clarity. Clean rooms analyze data you provide. Poor internal data quality produces poor clean room insights. Governance frameworks defining permitted uses, data elements, output restrictions, and partner agreements should precede technology implementation.

-

Privacy compliance requires attention despite privacy-preserving technology. Clean rooms support privacy by design principles but do not automatically ensure compliance. Legal basis for processing, purpose limitation, data minimization, and consumer rights still require attention in clean room contexts.

-

The strategic value extends beyond specific use cases. Clean rooms unlock partnerships that raw data sharing precludes. They align with regulatory trajectory favoring privacy-preserving technologies. They enable first-party data collaboration as third-party data degrades. Building capability now positions organizations for an industry where secure collaboration becomes expected.

-

Start with clear use cases and realistic expectations. Organizations achieving value from clean rooms identify specific use cases with quantifiable benefits before implementation. Match rate expectations should reflect data quality reality. Cost-benefit analysis should account for full implementation and operational costs.

Sources

- Forrester Research - Verifies Q4 2024 B2C Marketing CMO Pulse Survey finding 90% of B2C marketers use clean rooms for marketing use cases

- AWS Clean Rooms - Amazon’s clean room offering enabling secure collaboration without data movement between AWS accounts

- InfoSum - Decentralized data collaboration platform pioneering the “data non-movement” approach

- Habu - Multi-cloud interoperability layer enabling cross-platform clean room collaboration

- LiveRamp - Enterprise identity resolution and Safe Haven clean room platform

- Snowflake - Cloud data platform with native clean room capabilities for secure data collaboration

Data clean rooms represent infrastructure evolution for lead generation operations navigating privacy constraints while maintaining analytical capability. The organizations building these capabilities now will collaborate effectively with partners who increasingly expect privacy-preserving data practices. Those waiting will find themselves unable to participate in partnerships that define the next era of lead generation. For comprehensive frameworks on ecosystem-led growth, server-side tracking, and privacy-first lead generation, see The Lead Economy covering the complete transformation roadmap.