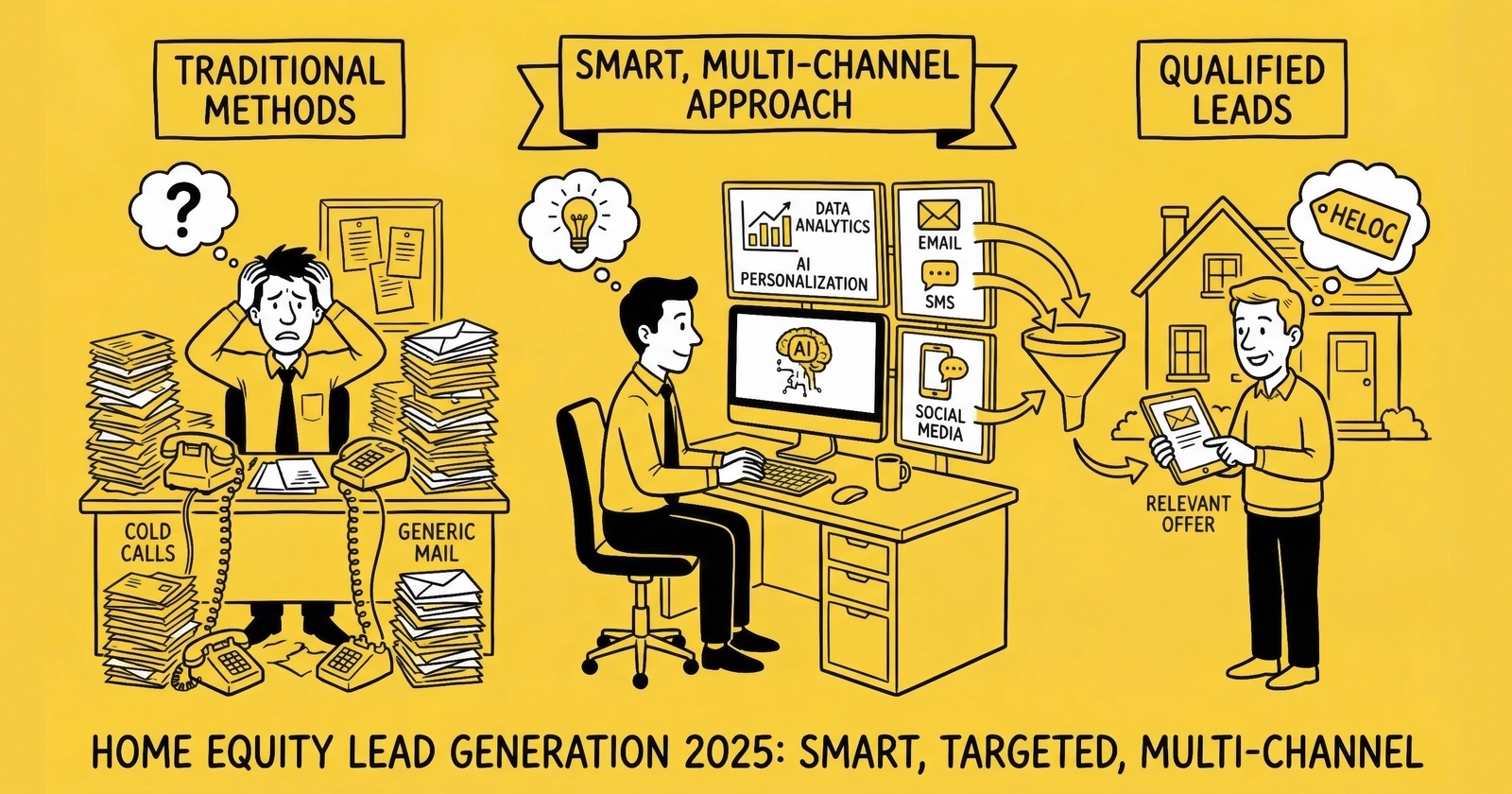

When homeowners have $17 trillion in tappable equity but refuse to refinance their 3% first mortgages, the opportunity shifts to second liens. Here is how to capture, price, and convert home equity leads in an environment that rewards operators who understand the math.

The Home Equity Opportunity: Why Second Liens Dominate in Elevated Rate Environments

The home equity lead market has emerged as the standout performer in the mortgage sector since 2022, and the economics explain why. American homeowners hold approximately $17.5 trillion in home equity as of late 2025, with tappable equity (the amount available to borrow while maintaining 20% equity) exceeding $11 trillion. This represents the largest reservoir of consumer borrowing capacity in the country.

Yet traditional cash-out refinancing has collapsed. The logic is straightforward: a homeowner who locked in a 2.875% 30-year fixed rate in 2021 will not refinance their entire mortgage at 6.5% just to access $50,000 in equity. The monthly payment difference on a $400,000 mortgage would exceed $800. No amount of marketing will overcome that math.

This creates the home equity opportunity. HELOCs (Home Equity Lines of Credit) and second mortgages allow homeowners to tap equity without disturbing their primary mortgage. Yes, HELOC rates run 8.5-10.5% in current markets. But borrowing $50,000 at 9% while preserving a $400,000 mortgage at 3% produces dramatically better economics than refinancing everything at 6.5%.

LendingTree’s home equity revenue reached $30.3 million in Q2 2025, up 38% year-over-year, demonstrating sustained demand even as traditional mortgage volumes struggle. For lead generators, this segment offers stable demand, reasonable pricing, and less competition than primary mortgage products.

This guide covers the complete home equity lead generation opportunity: market dynamics, equity calculation methods for targeting, compliance requirements, lead pricing, buyer relationships, and the operational infrastructure required to compete.

Market Overview: Home Equity Lending Landscape

Market Size and Growth Trajectory

The home equity lending market has experienced significant growth since 2022, driven by the rate environment that makes refinancing economically unviable for most homeowners. Total home equity originations reached approximately $180 billion in 2024, with projections for 2026 ranging from $200 – $220 billion as homeowners continue tapping equity for home improvements, debt consolidation, and major purchases. While this remains below the 2005 – 2006 peak of $430 billion annually, growth rates have consistently exceeded 25% year-over-year. HELOC originations specifically grew 57% in 2023 and maintained 35 – 40% growth through 2024 – 2025, bringing total outstanding HELOC balances to more than $380 billion, up from $260 billion in 2020.

Several factors sustain this demand. Home price appreciation remains the primary driver – despite rate-related affordability challenges, home values have stayed elevated, with the average homeowner gaining approximately $28,000 in tappable equity since 2020. Long-term homeowners who purchased before 2018 often have equity exceeding 50% of home value. The locked-in first mortgage rate phenomenon creates a structural floor under demand: approximately 62% of outstanding mortgages carry rates below 4%, and 89% carry rates below 6%. These homeowners will not refinance under any realistic scenario until rates drop dramatically, making second liens their only practical equity access option.

Consumer need for capital persists regardless of rate environment. Home improvement spending remains robust at approximately $450 billion annually, while debt consolidation offers compelling savings when credit card rates exceed 24% and home equity rates run 9 – 10%. Education expenses, medical costs, and business investments drive additional demand across economic conditions. Lender appetite has grown in response – banks and credit unions view home equity as attractive secured lending with lower default rates than unsecured products. Competition for qualified borrowers has increased, driving lender investment in lead acquisition and creating opportunity for well-positioned generators.

Product Types: HELOC vs. Home Equity Loan vs. Cash-Out Refinance

Understanding product distinctions helps with lead qualification and buyer matching. Each product serves different borrower needs, and matching leads to the right product type improves conversion rates.

Home Equity Line of Credit (HELOC)

A HELOC provides revolving credit secured by home equity, functioning similarly to a credit card but with your home as collateral. The interest rate is typically variable, tied to the Prime Rate, which means payments fluctuate as rates change. The structure includes a draw period (usually 10 years) during which borrowers can access funds, make interest-only payments, and reuse the credit line as they pay it down. This is followed by a repayment period (usually 20 years) during which no new draws are permitted and the balance must be repaid.

Current HELOC rates range from 8.0% to 10.5% depending on creditworthiness and loan-to-value ratio. The product works best for ongoing expenses, home improvement projects with uncertain costs, and debt consolidation where the borrower intends to pay down the balance aggressively. The flexibility to draw only what is needed when it is needed makes HELOCs attractive for borrowers who want access to capital without committing to a fixed loan amount.

Home Equity Loan (Second Mortgage)

A home equity loan provides a lump-sum disbursement at closing with a fixed interest rate for the entire loan term. Unlike the HELOC’s revolving structure, borrowers receive the full amount upfront and begin repaying immediately with consistent monthly payments. This predictability appeals to borrowers who know exactly how much they need and prefer budgeting certainty.

Current home equity loan rates run slightly higher than HELOCs, typically 8.5% to 11.0%, because the fixed-rate structure reduces lender flexibility to adjust pricing if market rates change. The product suits single large expenses with known amounts – a kitchen renovation with a firm contractor bid, for example – and borrowers who prioritize payment stability over access flexibility.

Cash-Out Refinance

Cash-out refinancing replaces the existing mortgage with a larger loan, disbursing the difference to the borrower. This creates a single first-lien mortgage at current market rates, simplifying the payment structure to one monthly obligation. However, the borrower must qualify for the entire loan amount at current rates, which is precisely why this product has collapsed in demand.

Current cash-out refinance rates run 6.5% to 7.5%, significantly below HELOC and home equity loan rates. Yet this “lower rate” is only viable when the new rate is close to or below the existing rate. A borrower with a 3.5% first mortgage considering cash-out refinance faces the math clearly: a HELOC at 8.75% on $50,000 while maintaining the low first mortgage rate, or cash-out refinance at 6.85% that requires giving up the 3.5% rate on the entire $350,000 balance. The HELOC wins decisively on total interest cost.

Major Lenders and Buyer Landscape

The home equity buyer landscape differs from traditional mortgage. Understanding who purchases leads helps with pricing and relationship development.

Traditional banks remain active in home equity, though many reduced offerings after 2008-2009 losses revealed the risks of aggressive second-lien lending. JPMorgan Chase, Bank of America, and Wells Fargo all offer home equity products but with varying appetite for third-party leads. Regional and community banks often show stronger interest in lead acquisition, viewing home equity as a relationship-building product for their geographic markets.

Credit unions represent an increasingly important buyer segment, originating approximately 28% of HELOCs in 2024, up from 22% in 2020. Their membership-focused model makes lead generation attractive – new home equity borrowers often become long-term members using multiple products. Lead pricing for credit union buyers typically runs 10-20% below bank pricing due to longer sales cycles, but conversion rates often compensate through more thorough follow-up.

Digital lenders like Figure, Spring EQ, and Better.com have disrupted traditional home equity with streamlined applications and faster closings. Figure’s blockchain-based HELOC can close in as few as 5 days, compared to 30-45 days for traditional lenders. These buyers often pay premium prices for exclusive leads with verified equity because their technology enables rapid decisioning on qualified applicants.

Fintech platforms like Unlock and Point offer alternative equity access products including home equity agreements and shared appreciation mortgages. While smaller in volume, these buyers target specific consumer segments – self-employed borrowers, those with lower credit scores, or homeowners wanting access without monthly payments – that traditional lenders avoid.

Aggregators and comparison platforms like LendingTree, NerdWallet, and Bankrate monetize home equity traffic through rate tables and lead generation. Lead generators can both compete with and sell to these platforms depending on volume and positioning.

Equity Calculation and Consumer Targeting

Home equity lead generation requires precise targeting based on estimated equity. Unlike mortgage purchase leads where any homebuyer represents a potential lead, home equity prospects must have sufficient equity to qualify. Understanding equity calculation and implementing effective targeting separates profitable operations from money-losing campaigns.

Understanding Equity Calculations

The fundamental equity calculation appears simple: Home Equity equals Current Market Value minus Outstanding Mortgage Balances. However, accurate estimation requires addressing several variables that introduce uncertainty into every calculation.

Current market value must be estimated because actual appraisal occurs only at loan application. Automated valuation models (AVMs) from CoreLogic, Black Knight, and proprietary sources provide estimates with varying accuracy. AVM accuracy typically falls within 5-10% of appraised value for standard properties in well-documented markets, but can deviate significantly for unique properties, rural areas, or rapidly changing markets where comparable sales data is limited.

Outstanding mortgage balance decreases over time through amortization but also increases if homeowners have taken second liens, HELOCs, or refinanced with cash-out. Public records show original loan amounts and recording dates but not current balances. Estimating current balance requires amortization assumptions based on original terms and identifying any subsequent encumbrances through title records.

Combined Loan-to-Value (CLTV) determines borrowing capacity. Most lenders cap CLTV at 80-90%, meaning a homeowner can only borrow if their combined first and second mortgage balances remain below this threshold. Tappable equity represents the amount available to borrow while maintaining acceptable CLTV. For a home valued at $500,000 with a $300,000 first mortgage, an 80% CLTV cap yields maximum combined debt of $400,000 and tappable equity of $100,000. A 90% CLTV cap yields $450,000 maximum combined debt and $150,000 tappable equity.

Data Sources for Equity Targeting

Effective equity targeting requires layering multiple data sources to build accurate estimates. Property data providers like CoreLogic, ATTOM, and Black Knight offer property value estimates, mortgage recording history, and owner information – CoreLogic alone processes approximately 70% of U.S. mortgage transactions, providing extensive loan-level data unavailable elsewhere. Typical costs run $0.02 – $0.15 per property record depending on volume and data fields requested, with higher pricing for enhanced valuation models and fuller property histories.

Public records from county recorder offices document mortgage recordings, liens, and property transfers. These records are public but fragmented across thousands of counties with varying digitization levels – some offer electronic access with daily updates while others require physical document requests with weeks of delay. Aggregators compile this data into searchable databases, though timeliness varies by market. Consumer data overlays from Experian, Equifax, and TransUnion provide estimated income, credit tier, and financial behavior indicators that help predict not just equity availability but propensity to borrow. A homeowner with high credit card utilization and recent balance inquiries shows different intent than one with stable low balances.

Mortgage servicer data, where available through compliant partnerships, provides actual current balances rather than estimates, though access requires careful compliance structuring to ensure proper consumer consent and data use authorization. Home value indices from Case-Shiller, FHFA, and Zillow track market-level price changes, enabling estimates of appreciation since purchase – a home purchased in 2018 in a market that appreciated 45% since then likely has substantial equity even with limited down payment.

Targeting Strategy Implementation

Practical equity targeting combines multiple approaches into a coherent strategy. Equity threshold filtering identifies homeowners likely to have sufficient equity for qualification – typical criteria include estimated CLTV below 75% (providing headroom for lender caps), minimum tappable equity of $25,000 (some lenders require $50,000 or more), property ownership duration of 3+ years (building equity through appreciation and amortization), and no recent second liens recorded (preserving borrowing capacity). These filters eliminate prospects who cannot qualify before marketing spend reaches them.

Propensity modeling predicts likelihood to take action beyond simple equity availability. Recent home improvement permit applications signal renovation intent, credit card balance trends identify potential consolidation candidates, and life stage indicators like children reaching college age or approaching retirement suggest capital needs. Prior inquiry behavior indicating previous rate shopping activity reveals active consideration.

Trigger-based targeting identifies timing signals that suggest readiness to act: recent rate decrease events make HELOCs more attractive by lowering expected interest costs, property tax assessment increases indicate value appreciation that may have created new equity, permit filings demonstrate renovation intent with near-term capital needs, and life event indicators like marriage, birth, or college enrollment create predictable financial pressure points.

Geographic optimization focuses spend on markets with strong equity positions. Long-term appreciation markets like coastal California and major metros contain homeowners with substantial equity accumulation, while stable ownership patterns in suburban areas with low turnover mean more homeowners have held properties long enough to build equity. High home improvement activity in renovation-heavy markets correlates with equity access demand.

Equity Verification in Lead Capture

Lead forms should capture data enabling equity qualification without excessive friction. The goal is gathering enough information to validate or reject leads in real time while maintaining completion rates.

Essential fields include property address (required for equity lookup), estimated home value (self-reported, provides qualification signal and engagement indicator), approximate mortgage balance (self-reported, helps qualification), borrowing purpose (home improvement, debt consolidation, other – aids buyer matching), and credit tier (self-assessed excellent/good/fair/poor for routing and pricing).

Valuable additional fields improve qualification precision and buyer matching. When the home was purchased indicates likely equity position based on appreciation since acquisition. Current mortgage rate identifies refinance versus second lien candidates – a borrower at 6.5% might consider cash-out refi while one at 3.5% definitely wants a HELOC. Desired loan amount helps match leads to buyer preferences and pricing tiers. When funds are needed indicates urgency and conversion likelihood.

Real-time verification during lead capture helps reject unqualified submissions before they consume buyer capacity. Integrate AVM lookups against provided addresses to estimate equity instantly. Run public records checks for recorded liens that reduce available equity. Consider soft credit pulls (with proper consent) for debt verification on high-value leads. A lead from a homeowner with 95% CLTV cannot convert regardless of lead quality – rejecting it at capture saves everyone resources and protects buyer relationships.

Lead Pricing and Unit Economics

Home equity lead pricing reflects the product’s position between traditional mortgage and consumer lending, with unit economics that reward operators who understand the math.

Current Market Pricing

Home equity lead prices as of late 2025:

| Lead Type | CPL Range | Notes |

|---|---|---|

| Exclusive HELOC | $30-$100 | Credit tier and loan amount drive variation |

| Exclusive Home Equity Loan | $35-$110 | Similar to HELOC with slight premium |

| Shared HELOC (2-3 buyers) | $15-$40 | Less common post-consent rule changes |

| Premium Exclusive (750+ credit, $100K+) | $80-$150 | High-value leads command premiums |

| Aged Leads (30-90 days) | $5-$15 | Requires strong nurture sequences |

Geographic variation affects pricing significantly. California and New York metros command 25-40% premium to national average due to higher home values and larger loan sizes. Texas and Florida markets carry 10-20% premiums reflecting population growth and strong housing markets. Midwest and rural areas trade at 10-20% discount where lower home values compress loan sizes.

Credit tier impacts pricing even more dramatically. Excellent credit borrowers (750+) command 30-50% premium over base pricing because they qualify with more lenders at better rates, improving conversion. Good credit (700-749) sets the base price. Fair credit (650-699) trades at 20-30% discount as fewer lenders will approve. Poor credit (below 650) is often unmarketable to traditional lenders and may require specialty buyer relationships.

Buyer Economics Driving Pricing

Understanding buyer economics helps with pricing negotiations and relationship development.

Consider a lender’s CPL tolerance calculation. With an average funded loan of $75,000, revenue per funded loan of $2,500 (from origination fees and interest margin), lead-to-funded conversion of 4%, and target marketing ROI of 3:1, the maximum sustainable CPL equals $2,500 multiplied by 4% multiplied by 33%, yielding $33.

This calculation explains why home equity lead pricing runs below primary mortgage. Smaller loan sizes mean lower per-loan revenue, compressing CPL tolerance. Operators expecting mortgage-level pricing ($75-$150) for home equity leads misunderstand the underlying economics.

However, some factors push pricing upward. Credit unions may accept lower ROI to acquire members who will use multiple products over time. Digital lenders with lower cost structures and faster closing processes can pay more per lead while maintaining margin. High-value leads with $150,000+ loan amounts justify premiums because they generate proportionally more revenue. Exclusive leads convert better than shared, supporting higher pricing through improved buyer economics.

Margin Analysis for Lead Generators

Home equity lead generation margins depend on acquisition efficiency and sell-through rates.

Sample unit economics:

| Metric | Conservative | Optimistic |

|---|---|---|

| Cost per click | $4.50 | $3.00 |

| Landing page conversion | 8% | 12% |

| Cost per raw lead | $56.25 | $25.00 |

| Qualification rate | 60% | 75% |

| Cost per qualified lead | $93.75 | $33.33 |

| Sell-through rate | 85% | 95% |

| Effective cost per sold lead | $110.29 | $35.09 |

| Average selling price | $65.00 | $75.00 |

| Gross margin | -$45.29 | $39.91 |

| Gross margin % | -69.7% | 53.2% |

This analysis illustrates why home equity lead generation rewards efficiency. The conservative scenario loses money; the optimistic scenario earns healthy margins. The difference comes from traffic acquisition efficiency driving lower CPC, conversion optimization yielding higher form completion, targeting precision producing higher qualification rates, and buyer relationships enabling higher sell-through. Operators achieving optimistic metrics can build profitable businesses. Those stuck at conservative metrics should either improve efficiency or exit the vertical.

Pricing Strategy Considerations

Volume-based pricing rewards consistent supply. Buyers at 100-500 leads per month typically pay base pricing. Those taking 500-2,000 leads monthly earn 5-10% discount. Major buyers at 2,000+ leads monthly negotiate 10-20% discounts but provide the volume stability that enables efficient operations.

Quality-based premiums justify higher pricing when supported by verification. Credit score verification commands 10-15% premium. Real-time AVM equity validation adds 10-20%. Phone verification through connected calls earns 15-25% premium. TrustedForm or Jornaya certification adds 5-10% by providing compliance documentation that reduces buyer risk.

Exclusivity arrangements affect both pricing and relationships. Exclusive leads command 40-60% premium over shared because buyers face no competition for the consumer’s attention. Buyers may require exclusivity for premium pricing, viewing shared leads as lower value regardless of qualification. However, exclusive relationships limit buyer diversification, creating risk if that buyer reduces volume or exits the market.

Compliance Framework for Home Equity Leads

Home equity lead generation operates within the same compliance frameworks as mortgage leads, with additional considerations specific to second-lien products.

TILA and Regulation Z Requirements

The Truth in Lending Act (TILA) and its implementing Regulation Z govern disclosure requirements for home equity products. While these primarily affect lenders rather than lead generators, certain provisions create compliance obligations for marketing.

Advertising triggers create disclosure cascades. Stating a specific rate (for example, “rates from 8.5%”) requires disclosure that rates may vary, payment examples, and APR information. Referencing payment amounts triggers similar disclosure requirements about rates, fees, and total cost. Claiming “no closing costs” must be accurate across all referenced lenders – if even one lender in your buyer pool charges closing costs, the claim becomes misleading.

Rate advertising accuracy matters for regulatory scrutiny. Advertised rates must be available to at least a reasonable proportion of qualified applicants. Advertising the lowest possible rate available only to borrowers with 800+ credit and 50% LTV misleads consumers if typical borrowers receive significantly higher rates. The safest approach avoids specific rate claims entirely, focusing instead on process benefits like “Check your rate in minutes” or “Compare options from multiple lenders.”

The three-day right of rescission applies to home equity transactions, during which borrowers can cancel without penalty. Lead generators should not make representations about closing timelines that ignore this requirement or pressure consumers toward rapid decisions that could be rescinded.

RESPA Considerations

The Real Estate Settlement Procedures Act (RESPA) Section 8 anti-kickback provisions apply to home equity loans and HELOCs because they involve real property as collateral.

The referral fee prohibition creates structural requirements for lead generation. As with primary mortgage, RESPA prohibits paying or receiving anything of value for referral of settlement service business. Lead generation structured as marketing services – advertising, lead capture, qualification – rather than referral fees generally complies, but specific arrangements require legal review. The key distinction is whether compensation reflects payment for marketing services performed or payment for referrals made.

Marketing Services Agreements face particular scrutiny. Partnerships with real estate agents, builders, or other settlement service providers for home equity lead generation encounter the same RESPA analysis as mortgage MSAs. Compensation must reflect actual marketing services performed at fair market value without volume or exclusivity expectations. Agreements that effectively pay for referrals – even when labeled as marketing services – violate RESPA regardless of documentation.

Documentation requirements demand records demonstrating that lead generation involves consumer marketing rather than referral relationships, that pricing reflects market rates for marketing services, that no compensation ties to loan closings or volumes, and that services are actually performed as documented. Maintain these records against potential regulatory inquiry or litigation discovery.

State Licensing Requirements

Home equity lending licensing requirements vary by state. While lead generators who simply sell leads to licensed lenders generally don’t require lending licenses, several considerations apply.

Mortgage broker licensing may be triggered in some states that define regulated activities broadly enough to encompass certain lead generation activities. Taking applications, discussing rates or terms, or appearing to act as an intermediary between borrowers and lenders may trigger licensing requirements depending on state law interpretation.

Lead generator registration requirements are emerging under state privacy laws. California, Vermont, and Texas already require data broker registration, and other states may follow. These requirements typically involve registration fees, operational disclosures, and compliance certifications.

Rate advertising restrictions exist in some states that regulate rate advertising by non-lenders, requiring disclaimers or limiting claims that can be made without licensing. Check state-specific requirements before running rate-focused campaigns.

NMLS verification is essential before selling leads to any lender or broker. Verify their licensing status through NMLS Consumer Access for every state where you generate leads. Selling leads to unlicensed entities creates potential liability and demonstrates negligent buyer vetting.

TCPA and Consent Requirements

Home equity leads involve the same TCPA consent requirements as other lead verticals, with the stakes elevated by well-funded plaintiff’s attorneys targeting mortgage-related communications.

Prior Express Written Consent (PEWC) is required for marketing calls and texts using automated dialing or prerecorded messages. Consent language must clearly identify the marketing purpose, identify the specific party or parties who will contact the consumer, be signed (electronic signature is valid), and not be conditioned on purchase of any service.

One-to-One Consent requirements have evolved. Though the FCC’s January 2025 one-to-one consent rule was vacated by the 11th Circuit, many buyers now require one-to-one consent documentation as a practical matter. Leads consented to “our lending partners” face increasing buyer rejection as compliance-conscious lenders demand cleaner consent chains.

Consent documentation through TrustedForm, Jornaya, or equivalent consent certification has become table stakes. Maintain records for a minimum of 4-5 years, matching relevant statutes of limitations. Without certification, defending against TCPA claims becomes dramatically more difficult.

State mini-TCPA compliance adds another layer. Several states impose stricter requirements than federal TCPA. Florida and Oklahoma limit call frequency; various states restrict calling hours; Georgia expanded private rights of action. Home equity campaigns must comply with state requirements for every state where leads originate, which may mean maintaining state-specific consent flows or calling restrictions.

Fair Lending Considerations

Fair lending laws including the Equal Credit Opportunity Act (ECOA) and Fair Housing Act apply to marketing as well as underwriting decisions.

Targeting discrimination risk exists even without discriminatory intent. Marketing strategies that effectively exclude protected classes create fair lending risk regardless of motivation. Excluding zip codes with high minority populations, targeting only homeowners above certain home values, or using proxy variables correlated with protected characteristics can trigger scrutiny even when the goal was simply efficiency optimization.

Disparate impact analysis should be performed periodically on marketing and lead acceptance patterns. If Black or Hispanic homeowners receive leads at significantly different rates than similarly qualified white homeowners, the pattern requires investigation and remediation. The defense of “we didn’t intend discrimination” fails when outcomes demonstrate disparate impact without adequate business justification.

Documentation of targeting criteria and business justifications provides defense against fair lending claims. “We target high-equity homeowners because lenders require minimum equity for qualification” provides legitimate justification. “We avoid certain neighborhoods” does not.

Traffic Sources and Lead Generation Strategies

Home equity lead generation draws from many of the same traffic sources as mortgage and consumer lending, with some channel-specific considerations that affect strategy and economics.

Paid Search

Google Ads remains the primary traffic source for home equity lead generation, though competition has increased substantially as the opportunity has become more widely recognized.

High-intent keywords command premium CPCs but convert well. “HELOC rates” runs $15-25 CPC with strong conversion for borrowers actively comparison shopping. “Home equity loan” costs $12-20 with good conversion across both products. “Home equity line of credit” trades at $10-18 with moderate competition, often from borrowers earlier in consideration. “Second mortgage” costs $8-15 using older terminology that some consumers still search.

Mid-funnel keywords offer lower cost with more qualification friction. “Tap home equity” runs $6-12, capturing borrowers who understand the concept but haven’t chosen a product. “Borrow against house” costs $5-10 with less sophisticated searchers who may need more education. “Cash out equity” trades at $8-15, sometimes capturing refinance intent that requires qualification.

Long-tail keywords provide targeting precision. “HELOC for home improvement” runs $8-12 with purpose-qualified traffic. “Debt consolidation home equity” costs $10-18 for borrowers with specific intent. “Home equity loan credit score 650” trades at $5-10 with credit-qualified traffic that needs appropriate buyer matching.

Ad copy must balance conversion optimization with compliance requirements. Emphasize benefits without triggering TILA disclosure requirements by avoiding specific rate claims. “Check your rate in minutes” performs well without requiring rate disclosures. “No closing costs” claims must be accurate for referenced lenders. Include qualification language to filter unqualified clicks – mentioning equity requirements or homeowner status reduces wasted spend. For a deeper dive into paid search strategies, see our Google Ads lead generation guide.

Landing page optimization determines whether expensive clicks become qualified leads. Multi-step forms reduce abandonment while gathering qualification data progressively. Capture the address field early to enable real-time equity estimation before asking detailed questions. Self-reported credit tier helps qualification and routing. Purpose questions aid buyer matching and conversion. Mobile-first design is essential given that 65% or more of home equity searches occur on mobile devices.

Display and Programmatic

Display advertising supports home equity lead generation through retargeting and prospecting, though direct response performance typically lags search because display interrupts rather than responds to intent.

Retargeting approaches recapture interested visitors. Target site visitors who abandoned forms, showing ads emphasizing ease or addressing common objections. Visitors who viewed specific rate or product pages demonstrate product interest worth pursuing. Lookalike audiences based on converters extend reach to similar users.

Prospecting targeting reaches new audiences at scale. Homeowner audiences available through Oracle, LiveRamp, and other providers identify the qualifying population. Home improvement intent audiences capture renovation-motivated borrowers. Debt consolidation interest audiences identify potential HELOC candidates. Equity propensity models from data providers score likelihood to qualify and convert.

Creative considerations for display emphasize visual connection to home ownership and improvement. “Unlock your equity” messaging resonates with homeowners who understand their home as an asset. Avoid rate-specific claims that trigger disclosure requirements. Include trust indicators like security badges and lender logos where permitted to overcome display skepticism.

Social Media Advertising

Facebook and Instagram offer home equity targeting capabilities, though recent privacy changes have reduced precision. The platform still reaches homeowners but with less granular targeting than previously available.

Targeting approaches work within platform constraints. Homeowner targeting uses platform demographic data, though accuracy varies. Life event targeting captures home purchase anniversaries and renovation intent signals. Interest-based targeting reaches home improvement and personal finance audiences. Lookalike audiences based on converters remain effective despite broader targeting restrictions.

Lead form versus landing page presents a strategic choice. Native lead forms reduce friction and keep users on-platform, but limit qualification depth. Landing pages enable AVM verification and richer qualification at the cost of another click. Hybrid approaches use native forms for initial capture with qualification follow-up by phone or email.

Compliance considerations specific to social platforms affect home equity campaigns. Housing-related ads face Facebook Special Ad Category restrictions that limit targeting precision. Campaigns cannot target by age, gender, or zip code for housing-related ads. All creative and targeting must comply with Fair Housing Act requirements, which the platforms enforce through their Special Ad Category designation.

Content and SEO

Organic traffic through content marketing offers sustainable lead volume at lower acquisition costs, though building this channel requires patience and consistent investment.

Content strategy should address questions borrowers ask throughout their consideration journey. “HELOC vs. home equity loan” comparison content captures borrowers choosing between products. “How much can I borrow against my home” calculator content engages users with interactive tools while capturing intent. “Home equity loan rates today” rate table content serves active shoppers. “Using home equity for [purpose]” educational content addresses specific use cases like renovations, debt consolidation, or education funding.

Local SEO captures geographic-specific searches. “HELOC rates [city]” content targets borrowers seeking local options. Lender comparison content for specific markets serves local intent. State-specific requirement and tax content addresses questions about home equity interest deductibility and state regulations.

Link building supports organic visibility. Financial education partnerships with credit counseling organizations or financial literacy sites provide relevant backlinks. Home improvement site relationships connect with renovation-focused content. Personal finance blog outreach expands reach within the target audience.

Content-driven lead generation typically produces lower volume than paid channels but higher quality leads with longer consideration cycles. Borrowers who found you through educational content have already engaged with your expertise and converted with informed intent.

Affiliate and Partner Channels

Home equity leads flow through various affiliate and partnership arrangements that extend reach beyond direct marketing.

Rate table affiliates like NerdWallet and Credit Karma monetize their substantial traffic through rate comparisons and lead generation. Lead generators can both compete with these platforms for traffic and sell to them for distribution, depending on relative positioning and volume.

Mortgage affiliate networks often include home equity products alongside primary mortgage, providing access to established affiliate relationships and tracking infrastructure.

Home improvement partnerships with contractors, retailers, and service providers can generate purpose-qualified leads from borrowers actively planning renovations who need financing. A kitchen remodeling company referring customers to home equity financing represents highly qualified intent.

Financial advisor referrals can produce high-quality leads from clients needing capital for investment, business, or planning purposes, though compliance structuring requires care to avoid RESPA concerns.

Compliance requires careful structuring of compensation across all affiliate and partner channels to avoid RESPA concerns and ensure proper consent documentation flows through the partnership. Every lead must arrive with clean consent regardless of origination path.

Lead Distribution and Buyer Relationships

Home equity lead distribution follows patterns similar to mortgage, with some segment-specific considerations that affect strategy and relationship development.

Distribution Models

Exclusive distribution sells each lead to a single buyer, creating a clean transaction with clear economics. Pricing runs higher at $60-$100+ for qualified leads because buyers face no competition for consumer attention. Relationships and feedback improve because buyers invest more in working each lead. Consent and compliance simplify with a single recipient. However, exclusive distribution creates risk of underselling if the buyer declines or offers below-market pricing.

Ping-post auction maximizes value through real-time competition. Lead attributes (without PII) post to multiple buyers who bid based on lead characteristics. The highest bidder receives complete lead information. This model requires sophisticated technology infrastructure for sub-second bidding and response handling. Consent language must support multiple potential buyers, and the consent documentation must clearly indicate that multiple lenders may contact the consumer.

Dedicated feeds provide consistent supply to specific buyers through fixed or floor pricing with volume commitments. Buyers specify exact qualification criteria they will accept. This model enables campaign optimization for specific buyer requirements and provides predictable revenue. However, buyer concentration creates risk if that buyer reduces volume or exits.

Buyer Qualification Criteria

Home equity buyers filter leads based on specific criteria that affect which leads they accept and at what price.

Minimum equity requirements vary by buyer risk tolerance. Most require 15-20% equity remaining post-loan, meaning borrowers cannot tap their home to 100% LTV. Maximum CLTV limits range from 80% to 95% depending on lender risk appetite and secondary market requirements. Conservative buyers reject leads with estimated CLTV above 75%, preferring borrowers with substantial equity cushion.

Credit tier restrictions segment buyers by risk tolerance. Traditional bank buyers often require 680+ credit scores, reflecting their conservative underwriting and secondary market requirements. Credit unions may accept 640+ scores while offering competitive rates to build membership. Alternative lenders and fintechs may accept scores down to 580+, though at higher rates and fees.

Geographic licensing determines which leads a buyer can accept. Verify buyer licenses cover lead states before routing. Some buyers operate nationally with licensing in all states; others are regional with limited coverage. Credit unions may have membership territory restrictions that limit which consumers they can serve.

Property type limitations affect eligibility. Most buyers want single-family primary residences, the lowest-risk collateral type. Investment properties face restrictions or higher rates. Manufactured homes may be ineligible with many buyers. Condos require HOA review and may face additional scrutiny. Rural properties may encounter appraisal issues that delay or prevent closing.

Loan amount preferences shape buyer interest. Minimum loan amounts typically run $15,000-$25,000 because smaller loans don’t generate sufficient revenue to cover origination costs. The sweet spot for most buyers falls between $50,000 and $150,000 where loan economics work well. Jumbo home equity loans exceeding $250,000 require specialized buyers with balance sheet capacity.

Lead Delivery Requirements

Technical requirements for home equity lead delivery have become increasingly standardized.

Real-time delivery via API posting to buyer systems is expected. Response time under 5 seconds is required for ping-post models where buyers bid on partial information. Complete lead data including all form fields must transfer accurately. Consent certificate URLs (TrustedForm, Jornaya) must accompany every lead. Source identifiers enable quality tracking and optimization.

Data fields typically required include property address (street, city, state, zip for AVM verification), estimated home value and mortgage balance with calculated estimated equity, desired loan amount and loan purpose for buyer matching, credit tier (self-reported or verified), full contact information (name, phone, email), best time to contact for optimal outreach scheduling, and consent timestamp with certificate reference.

Quality feedback integration closes the optimization loop. Accept buyer disposition data showing contact outcomes, application rates, and funding results. Track contact rate, application rate, and funding rate by source. Use feedback for source optimization, reducing spend on low-converting traffic. Identify problem sources early before they damage buyer relationships.

Building Buyer Relationships

Long-term buyer relationships in home equity require consistent execution across several dimensions.

Quality consistency matters more than occasional exceptional leads. Buyers value predictable lead quality over occasional home runs because they build operations around expected conversion rates. Maintain consistent qualification standards even when volume pressure encourages loosening criteria for short-term revenue.

Volume reliability builds trust and priority status. Meet volume commitments even when it requires accepting lower margin on some traffic. Buyers build operations around expected supply – staffing, marketing spend, conversion optimization. Unreliable suppliers get deprioritized when buyers allocate capacity.

Transparent communication prevents surprises that damage relationships. Proactively share quality trends, source changes, and market observations. Buyers prefer partners who communicate challenges rather than discovering problems through declining conversion rates.

Problem resolution demonstrates partnership commitment. Returns happen even with excellent qualification – consumers change their minds, circumstances change, information proves incorrect. Handle returns promptly with credits, investigation, and source-level quality improvements. Buyers who trust you to resolve problems fairly become long-term partners.

Market intelligence enables productive relationship development. Understanding buyer economics, competitive pressures, and market conditions supports pricing discussions and helps you provide value beyond simple lead delivery.

Technology and Infrastructure Requirements

Home equity lead generation requires technology infrastructure supporting real-time equity estimation, lead qualification, and buyer distribution.

Lead Capture Platform

The landing page and form technology must support several essential functions.

Multi-step forms gather qualification data without overwhelming visitors. Property address collection with autocomplete ensures accurate input for AVM lookup. Equity estimation questions about home value and mortgage balance enable real-time qualification. Purpose and credit tier questions support buyer matching and routing. Contact information with validation prevents junk submissions from consuming buyer capacity.

Real-time validation prevents unqualified leads from reaching buyers. Phone validation checks line type and connectivity to identify mobile versus landline and disconnected numbers. Email validation confirms deliverability and detects disposable address services. Address standardization and verification ensures property data matches AVM databases.

Consent capture must satisfy TCPA requirements. TCPA-compliant disclosure language must be clear, conspicuous, and complete. Electronic signature capture documents consumer agreement. TrustedForm or Jornaya script integration creates independent consent verification. Timestamp and IP documentation supports defense against potential claims.

AVM integration enables real-time equity estimation during form completion. Property data API integration with CoreLogic, ATTOM, or similar providers returns instant equity calculations based on address. The system can reject insufficient-equity submissions before they enter the buyer pipeline, protecting relationships and avoiding wasted effort.

Distribution Infrastructure

Lead routing and distribution requires sophisticated real-time capabilities.

Ping-post capability enables auction-based distribution. Anonymized attribute posting shares lead characteristics (state, credit tier, loan amount, equity estimate) with buyer APIs without revealing PII. Sub-second response handling collects and processes bids quickly enough to maintain consumer engagement. Bid aggregation and winner selection identifies the best offer. PII delivery to winning bidder completes the transaction.

Buyer API integrations must support various formats. Different buyers use different posting specifications, requiring flexible integration architecture. Real-time acceptance/rejection handling processes buyer responses immediately. Error handling and retry logic manages failed posts without losing leads. Timeout management handles non-responsive buyer systems gracefully.

Routing logic directs leads to appropriate buyers. Geographic routing ensures leads only reach buyers licensed in the consumer’s state. Credit tier routing matches leads to buyers who will accept their credit profile. Purpose-based routing connects renovation leads with home improvement specialists and consolidation leads with appropriate lenders. Exclusivity management enforces any exclusive commitments.

Waterfall distribution handles rejected leads. Sequential buyer attempts route leads to secondary buyers if the first choice declines. Price floor enforcement ensures leads aren’t sold below acceptable margin. Timeout handling moves to next buyer when current buyer doesn’t respond quickly enough.

Analytics and Reporting

Data infrastructure supporting optimization is essential for profitable operations.

Source-level tracking enables traffic optimization. Track cost per click, conversion rate, and qualification rate by source. Monitor buyer acceptance rate by source to identify quality issues. Calculate return rate by source to catch problems early. Aggregate to profitability by source for budget allocation.

Buyer performance tracking supports relationship management. Monitor acceptance rates by buyer to identify changes in appetite. Track feedback disposition rates to understand conversion. Calculate revenue per lead by buyer for relationship prioritization. Assess relationship health metrics across multiple dimensions.

Lead quality metrics connect marketing to outcomes. Contact rates indicate lead validity and consumer responsiveness. Application rates measure qualification accuracy and buyer capability. Funding rates (where feedback is available) show ultimate conversion success. Return reasons and patterns identify systematic issues requiring attention.

Financial reporting enables business management. Daily, weekly, and monthly revenue tracking supports cash flow planning. Cost analysis by source and channel guides budget allocation. Margin tracking ensures profitability across the operation. Cash flow management handles the timing differences between spend and revenue.

Frequently Asked Questions

Q1: What is the difference between a HELOC and a home equity loan?

A HELOC (Home Equity Line of Credit) provides revolving credit, similar to a credit card, secured by your home equity. You can borrow, repay, and borrow again during the draw period (typically 10 years). Interest rates are usually variable, tied to the Prime Rate. A home equity loan, sometimes called a second mortgage, provides a lump sum at closing with fixed interest rates and consistent monthly payments. HELOCs work well for ongoing expenses or projects with uncertain costs. Home equity loans suit borrowers who know exactly how much they need and prefer payment predictability. Both use your home as collateral, so defaulting risks foreclosure.

Q2: What are current HELOC and home equity loan rates in 2025?

HELOC rates in late 2025 typically range from 8.0% to 10.5%, depending on creditworthiness, combined loan-to-value ratio, and lender. Home equity loan rates run slightly higher, typically 8.5% to 11.0%, because the fixed-rate structure reduces lender flexibility. Credit score has significant impact: borrowers with 750+ scores access rates near the bottom of ranges, while those with 650-700 scores pay 1-2 percentage points more. Combined loan-to-value also matters; borrowers keeping CLTV below 70% receive better rates than those stretching to 85-90%.

Q3: How much equity do homeowners need to qualify for a HELOC or home equity loan?

Most lenders require borrowers to maintain at least 15-20% equity after the loan, meaning combined loan-to-value cannot exceed 80-85%. Some lenders extend to 90% CLTV for well-qualified borrowers. For example, a home worth $400,000 with a $250,000 first mortgage has $150,000 in equity. At 80% CLTV cap, the maximum combined debt is $320,000, meaning the maximum home equity loan or HELOC would be $70,000 ($320,000 minus $250,000 first mortgage). Minimum loan amounts typically range from $15,000 to $25,000, so properties with limited equity may not qualify.

Q4: What compliance requirements apply to home equity lead generation?

Home equity lead generation operates under multiple compliance frameworks. TCPA requires prior express written consent for marketing calls and texts using automated technology, with specific disclosure requirements about who will contact the consumer. RESPA Section 8 prohibits referral fees for settlement services, meaning lead generation must be structured as marketing services rather than referral compensation. TILA (Truth in Lending Act) regulates rate and payment advertising, triggering disclosure requirements when specific rates or payments are quoted. State privacy laws in California, Virginia, Colorado, and others require data handling disclosures and consumer opt-out rights. Verification of buyer licensing through NMLS is essential before selling leads.

Q5: What drives home equity lead pricing?

Home equity lead pricing reflects buyer economics, lead quality, and market conditions. Average exclusive HELOC leads trade at $30-$100, with credit tier, loan amount, and geography driving variation. Premium leads (750+ credit, $100K+ loan amount, verified equity) command $80-$150. Shared leads trade at $15-$40 when available. Buyer CPL tolerance derives from revenue per funded loan divided by conversion rate and target ROI. Smaller home equity loan sizes compared to primary mortgages constrain pricing below mortgage lead levels. Geographic premiums of 25-40% apply in California and New York metros. Credit tier verification, equity validation, and consent certification each add 5-20% to pricing.

Q6: Why has home equity lending grown while traditional refinancing declined?

The rate environment explains the divergence. Approximately 62% of outstanding mortgages carry rates below 4%, locked in during 2020-2021 when rates bottomed near 2.75%. These homeowners will not refinance their entire mortgage at current rates above 6.5%. However, they still need access to capital for home improvements, debt consolidation, and other purposes. HELOCs and home equity loans allow them to tap equity without disturbing their low-rate first mortgage. Paying 9% on a $50,000 HELOC while keeping a $300,000 mortgage at 3% produces far better economics than refinancing everything at 6.5%. This math drives sustained home equity demand while traditional refinance volumes remain depressed.

Q7: What equity data sources help with targeting?

Effective equity targeting requires combining multiple data sources. Property data providers like CoreLogic, ATTOM, and Black Knight offer automated valuation model (AVM) estimates and mortgage recording history. Public county records document original loan amounts and subsequent liens, though timeliness varies. Consumer data overlays from credit bureaus provide income estimates and credit tier indicators. Home value indices from Case-Shiller and FHFA track market-level appreciation for estimating current values based on purchase date. Real-time AVM APIs enable equity verification during lead capture, allowing immediate rejection of insufficient-equity submissions before they reach buyers.

Q8: How do lead generators verify buyer licensing for home equity leads?

Before selling leads to any home equity buyer, verify their licensing status through NMLS Consumer Access, the public database maintained by the Nationwide Multistate Licensing System. Check that the buyer’s company license covers the states where leads originate. For mortgage brokers, verify individual MLO (Mortgage Loan Originator) licenses are current and properly sponsored. Document verification in buyer onboarding files. Periodically re-verify to catch license lapses or state coverage changes. Selling leads to unlicensed entities creates potential liability and RESPA compliance concerns. Some credit unions operate under different licensing frameworks; verify their lending authority for your lead states.

Q9: What conversion rates should home equity lead operations expect?

Realistic benchmarks for quality home equity lead programs: 30-45% contact rate (buyers reach the consumer); 15-25% application rate (from those contacted); 65-80% pull-through rate (applications that fund). Overall lead-to-funded conversion typically runs 3-6% for quality programs. These benchmarks assume verified leads with accurate equity estimates, proper consent documentation, and capable buyer operations. Leads lacking equity verification or with consent issues convert at significantly lower rates. Response speed matters: buyers contacting leads within 5 minutes see substantially higher contact and application rates than those with 30+ minute response times.

Q10: What are the best traffic sources for home equity leads?

Paid search remains the primary traffic source, with keywords like “HELOC rates,” “home equity loan,” and “borrow against home” driving high-intent traffic at $8-25 CPC. Display advertising supports retargeting of site visitors and prospecting through homeowner audiences, though direct response performance typically lags search. Facebook and Instagram offer homeowner targeting but face Special Ad Category restrictions limiting targeting precision. Content marketing and SEO provide sustainable traffic at lower acquisition cost through rate comparison, calculator, and educational content, though with longer timelines to volume. Affiliate partnerships with rate tables and home improvement sites can generate quality traffic with proper compliance structuring.

Key Takeaways

-

The $17 trillion home equity opportunity exists because homeowners refuse to refinance low-rate first mortgages. With 62% of mortgages below 4%, HELOCs and second mortgages at 8-10% make more sense than refinancing everything at 6.5%.

-

Home equity lead pricing runs $30-$100 for exclusive leads, below primary mortgage levels. Smaller loan sizes compress lender revenue per transaction, limiting CPL tolerance. Premium pricing requires credit verification, equity validation, and enhanced consent documentation.

-

Equity calculation determines targeting precision. Combine property data providers, public records, and AVMs to estimate equity. Real-time verification during lead capture rejects unqualified submissions before they reach buyers.

-

Compliance spans TCPA, RESPA, TILA, and fair lending requirements. TCPA consent must be documented with certification. RESPA prohibits referral fees, requiring lead generation structured as marketing services. TILA regulates rate advertising. Fair lending prohibits targeting that excludes protected classes.

-

Buyer relationships require licensing verification and quality consistency. Verify all buyers through NMLS before selling leads. Credit unions, digital lenders, and traditional banks have different qualification criteria and pricing tolerance.

-

Unit economics reward efficiency. The gap between profitable and unprofitable operations comes from traffic acquisition efficiency, conversion optimization, qualification precision, and buyer relationships. Operators achieving 12% conversion and 95% sell-through earn healthy margins; those at 8% conversion and 85% sell-through lose money.

-

Technology infrastructure must support real-time equity estimation, consent certification, and ping-post distribution. Manual processes cannot compete in a market requiring sub-second qualification decisions.

-

Home equity outperformance will persist as long as first mortgage rates remain elevated above locked-in rates. Operators building expertise now position themselves for sustained demand through at least 2026-2027.

Sources

- Federal Reserve Financial Accounts of the United States - Official data on household wealth, mortgage debt, and home equity levels across the US economy

- Black Knight Mortgage Monitor - Industry research on tappable home equity, mortgage rate lock-in effect, and refinance trends

- ATTOM Data Solutions Home Equity Reports - Property-level equity analysis and homeowner wealth distribution data

- Fannie Mae Research and Insights - Secondary mortgage market data and housing finance research

- Consumer Financial Protection Bureau HMDA Data - Home Mortgage Disclosure Act lending data and market analysis

- CFPB Rules and Policy - Regulatory guidance on RESPA, TILA, and mortgage advertising compliance

Market data and regulatory information current as of December 2025. Home equity rates, lead pricing, and market conditions change continuously. This article provides general information for educational purposes and does not constitute legal, financial, or regulatory advice. Consult qualified professionals for specific compliance, lending, or business decisions.