Temperature extremes drive demand, but the operators who dominate HVAC lead generation understand the twelve-month calendar, not just the peak weeks.

HVAC lead generation operates on a simple truth that most practitioners misunderstand: the money is not made during heat waves or cold snaps. Those weeks determine whether you survive. The money is made during the shoulder seasons when competition retreats and homeowners make planned decisions rather than desperate ones.

This guide provides the complete framework for HVAC lead generation: seasonal demand patterns, emergency versus scheduled lead dynamics, local service marketing strategies, marketplace platforms like Angi and HomeAdvisor, booking rate optimization, and the pricing intelligence that separates profitable operations from those bleeding money during the wrong months.

The numbers are clear. HVAC leads range from $30-$80 for exclusive leads depending on season and urgency, with emergency leads commanding 40-60% premiums during extreme weather events. Understanding when to scale spend, when to focus on nurturing, and when to build relationships with contractors determines annual profitability more than any single campaign optimization.

HVAC Market Dynamics 2024-2026

The HVAC industry generates approximately $130 billion in annual revenue in the United States, with residential service representing roughly 40% of that total. The lead generation market serving HVAC contractors has matured significantly, with established players, predictable pricing, and well-understood seasonality patterns.

Current Lead Pricing Benchmarks

Lead pricing in HVAC varies more dramatically by circumstance than most verticals. The same lead type can command 2-3x different prices depending on timing, urgency, and geographic market.

| Lead Type | Price Range | Typical Booking Rate |

|---|---|---|

| Exclusive (standard) | $30-$80 | 15-25% |

| Exclusive (emergency) | $60-$120 | 25-40% |

| Shared (2-3 buyers) | $15-$35 | 8-15% |

| Scheduled appointment | $75-$150 | 30-50% |

| Live transfer | $50-$100 | 35-55% |

| Aged leads (30+ days) | $3-$10 | 3-8% |

The math reveals why contractors pay these premiums. A typical HVAC service call generates $300-$600 in revenue. A system replacement averages $7,000-$15,000 for residential installations. Even at the high end of lead costs, a $120 emergency lead converting at 30% yields an effective cost per acquisition of $400 against multi-thousand-dollar ticket sizes.

Major Market Players

Angi (formerly Angie’s List and HomeAdvisor) dominates the HVAC lead marketplace. Following the 2021 merger, Angi reaches over 35 million monthly unique visitors and has over 250,000 home service professionals on the platform. The company charges contractors per lead, with HVAC leads typically ranging from $15-$50 depending on job type, geography, and competition density.

Yelp for Business provides both organic visibility and paid lead generation for HVAC contractors. Yelp’s advertising products allow contractors to pay for enhanced visibility and direct lead inquiries. The platform skews toward urban and suburban markets with higher review density.

Thumbtack operates on a quote-request model where homeowners describe their project and contractors pay to submit quotes. HVAC contractors report lead costs of $10-$40 depending on project complexity and geographic competition.

Google Local Services Ads (LSA) has become the fastest-growing HVAC lead source. Contractors pay per lead rather than per click, with HVAC leads typically costing $25-$75. The “Google Guaranteed” badge provides trust signals that drive higher conversion rates than standard search ads. For practitioners also running traditional paid search, our Google Ads lead generation guide covers complementary strategies.

Direct generators include affiliate networks and independent lead generation companies that generate leads through paid search, content marketing, and local SEO, then sell to contractors at wholesale rates for distribution or direct prices for exclusive delivery.

Service Type Segmentation

HVAC encompasses distinct service categories with different lead economics.

Cooling Services

Cooling services dominate summer demand. AC repair represents the highest volume with moderate urgency, while AC replacement commands the highest ticket size but involves the longest consideration period. AC installation for new construction follows predictable timing based on building schedules. AC maintenance generates the lowest CPL but serves as a relationship-building opportunity that leads to larger jobs.

Heating Services

Heating services drive winter demand. Furnace repair creates high-urgency situations during cold snaps that mirror summer AC emergencies. Furnace replacement follows similar dynamics to AC replacement with extended decision cycles. Heat pump service represents a growing segment, particularly in mild climates where these systems handle both heating and cooling. Boiler service maintains regional concentration in the Northeast and Midwest where these systems remain common in older homes.

Heat Pump Market Dynamics

The heat pump segment deserves dedicated attention due to its explosive growth trajectory and distinct lead economics. Heat pump installations grew 15% annually between 2022 and 2025, driven by federal incentives through the Inflation Reduction Act, state-level electrification mandates, and increasing consumer awareness of energy efficiency benefits. The Department of Energy projects heat pump shipments will triple by 2030 compared to 2020 levels.

Heat pump leads differ from traditional HVAC leads in several important ways. The consideration cycle is longer – averaging 45-60 days versus 14-21 days for furnace replacement – because consumers research efficiency ratings, rebate eligibility, and contractor qualifications more thoroughly. Lead quality varies dramatically based on homeowner knowledge; educated buyers who understand heat pump technology convert at 25-35% while those confused about heat pumps versus AC convert at only 8-12%.

Geographic patterns reveal market opportunity. Cold-climate heat pump technology has matured to perform effectively in temperatures as low as -15 degrees Fahrenheit, opening northern markets previously considered unsuitable. Maine, Vermont, and Massachusetts have become heat pump leaders with 40%+ market share for new heating installations. Traditional heat pump strongholds in the Southeast continue growing but face competition from multiple HVAC contractors entering the space.

Contractor capability segmentation matters more for heat pumps than traditional HVAC. Proper heat pump installation requires specific training – undersized units, incorrect refrigerant charges, and inadequate ductwork modifications account for most performance complaints. Lead generators should qualify contractors for heat pump certification (NATE heat pump specialty) before routing high-value heat pump leads. Contractors with heat pump certification convert these leads at 30-40% versus 15-20% for general HVAC contractors attempting heat pump installations.

Pricing for heat pump leads reflects the higher consideration and ticket value. Exclusive heat pump leads command $60-$100 versus $40-$70 for general heating leads. The premium is justified by average ticket sizes of $12,000-$25,000 for full heat pump system installation – substantially higher than furnace replacement at $4,000-$8,000. Rebate and incentive awareness adds conversion value; leads that include rebate qualification information convert 40% better because contractors can immediately discuss net costs rather than sticker shock.

Seasonal patterns for heat pumps differ from traditional HVAC. Peak demand occurs in spring and fall shoulder seasons when homeowners plan major home improvements and can wait 2-4 weeks for installation. Emergency heat pump service remains rare because most heat pump homes retain backup heating systems. Marketing emphasis should shift toward efficiency benefits and rebate windows rather than urgency messaging that drives furnace and AC leads.

Crossover Services

Several service categories provide year-round opportunity regardless of season. Ductwork repair and cleaning maintains steady demand as homeowners address indoor air quality. Indoor air quality services have grown substantially post-pandemic as consumers became more aware of filtration and ventilation. This recurring-service opportunity parallels what pest control operators have long understood about converting one-time service calls into ongoing contracts. Smart thermostat installation appeals to energy-conscious homeowners seeking efficiency gains. Maintenance contracts provide recurring revenue and lead generation opportunities for contractors building long-term customer relationships.

Understanding which service types your leads represent directly affects pricing strategy and contractor relationships. A lead for AC maintenance has different value than a lead for emergency furnace repair on the coldest night of the year.

Seasonal Demand Patterns

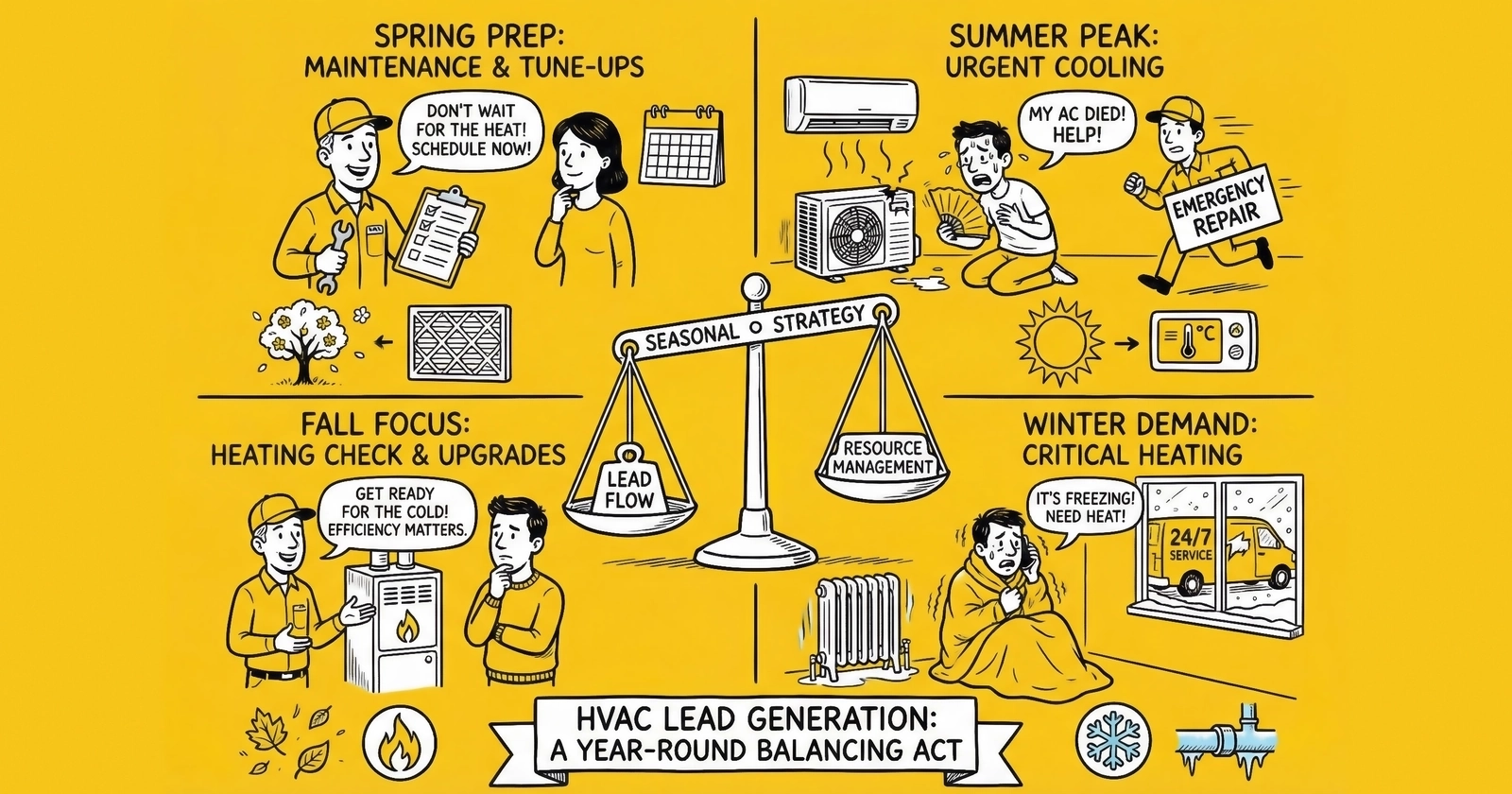

HVAC seasonality is more nuanced than “hot equals cooling leads, cold equals heating leads.” Understanding the full annual cycle reveals optimization opportunities that most practitioners miss.

Summer Peak Season (June-August)

Summer represents the highest-volume period for HVAC leads in most markets. Air conditioning failures during heat waves create urgent demand that converts at premium rates.

Volume peaks during sustained temperatures above 90 degrees Fahrenheit, with emergency leads increasing 200-400% during heat waves versus normal summer days. Booking rates climb to 25-40% as homeowners desperately seek relief from dangerous heat. Replacement leads spike as aging systems fail under stress, pushing homeowners who were planning to “wait another year” into immediate purchasing decisions.

Standard exclusive CPL runs $50-$80 during normal summer operation. Emergency CPL during heat waves escalates to $80-$120 as competition intensifies. Shared CPL holds at $25-$40, though conversion rates suffer when contractors are overwhelmed.

The operational challenges during summer peak require careful attention. Contractor capacity constraints become binding as the best contractors stop buying leads by late June. Lead response time expectations compress to minutes rather than hours. Return rates increase as contractors cannot service all purchased leads within acceptable timeframes. Quality differentiation matters more as supply floods the market and homeowners become more selective.

The summer peak creates a trap for inexperienced practitioners. Volume looks attractive, but competition for contractor attention intensifies. Contractors who bought leads enthusiastically in May become selective by July when their schedules are booked three weeks out. Those who win summer are those who built contractor relationships during slower months.

Winter Secondary Peak (December-February)

Winter heating demand creates a secondary peak with different characteristics than summer cooling demand.

Geographic variation is pronounced in ways that reshape regional strategy. Northern states like Minnesota, Wisconsin, and Michigan experience heating demand rivaling or exceeding summer cooling demand. Southern states including Florida, Texas, and Arizona see minimal winter heating activity. Coastal California and the Pacific Northwest have mild heating seasons but still generate meaningful volume worth pursuing.

Furnace failures during cold snaps create emergency demand comparable to summer AC failures. Heat pump service requests have grown substantially as installations increase across moderate climates. Homeowners in cold climates treat heating failures as life-safety issues, increasing urgency and willingness to pay premium rates for immediate service.

Exclusive heating CPL typically runs $40-$70 during normal winter operation. Emergency heating CPL during cold snaps escalates to $60-$100. Northern markets command 15-25% premiums above national averages, while southern markets price 20-30% below national averages reflecting lower demand intensity.

Heating season is shorter but more intense than cooling season in most markets. Contractor availability is generally better than summer because AC technicians have lighter schedules. Energy costs during winter drive more aggressive shopping behavior for system replacement as homeowners experience the financial pain of inefficient heating systems.

Shoulder Seasons (March-May, September-November)

The shoulder seasons represent the hidden opportunity in HVAC lead generation. Most practitioners scale back during these periods, creating lower competition and better contractor relationships.

Spring Opportunity

Spring brings homeowners emerging from winter who begin considering AC maintenance before summer arrives. System replacement decisions accelerate as people anticipate summer stress and want new equipment installed before they need it. Contractors have capacity and are hungry for work after slower winter months. CPLs typically run 20-30% below summer peaks, creating attractive economics for operators who maintain volume.

Fall Opportunity

Fall triggers post-summer evaluation of AC performance that often surfaces replacement discussions. Pre-winter furnace maintenance and inspection demand increases as temperatures drop. Contractors transition from cooling to heating with available capacity during the handoff period. CPLs again run 20-30% below summer peaks, matching spring economics.

Why Shoulder Seasons Matter

The economics of shoulder seasons favor lead generators who understand contractor psychology. During peak seasons, contractors are overwhelmed. They cannot follow up effectively, their crews are stretched thin, and they become selective about which leads to pursue. During shoulder seasons, the same contractor has time to make multiple calls, send detailed proposals, and close sales that would have been lost during chaos.

A spring lead that costs $40 and converts at 20% yields an effective CPA of $200. A summer lead that costs $70 and converts at 15% (due to overwhelmed contractor follow-up) yields an effective CPA of $467. The “cheaper” shoulder season lead is actually 57% more profitable when measured through to conversion.

Annual Calendar Strategy

Month-by-month guidance for HVAC lead generation budget allocation reveals the rhythm of successful operations.

January-February focuses on heating emergency demand in cold markets. Volume remains moderate but contractor availability is strong. Allocate 60-80% of average monthly budget.

March-April marks the transition to cooling. Maintenance campaigns work well as homeowners prepare for summer. Contractors are hungry for work, making this an excellent relationship-building period. Allocate 80-100% of average monthly budget.

May brings the pre-summer surge. Increase spend to capture planning-stage leads before contractors fill their schedules for June. Allocate 100-120% of average monthly budget.

June-August represents peak season. Maximum volume arrives alongside highest competition and contractor capacity constraints. Allocate 130-150% of average monthly budget, but monitor contractor purchasing patterns closely for signs of saturation.

September-October offers the post-summer transition. This is an excellent period for replacement leads as homeowners evaluate summer performance and make decisions before winter. Allocate 90-110% of average monthly budget.

November-December shifts to heating focus in cold markets. Holiday distractions reduce volume, but pre-winter maintenance captures last-minute demand from organized homeowners. Allocate 70-90% of average monthly budget.

Emergency Leads Versus Scheduled Leads

The distinction between emergency and scheduled leads fundamentally shapes HVAC lead generation strategy. Each requires different acquisition tactics, contractor relationships, and pricing models.

Emergency Lead Dynamics

Emergency leads occur when HVAC systems fail during extreme weather – no air conditioning during a heat wave, no heat during a cold snap. These leads convert at dramatically higher rates but command premium prices and create operational challenges. The same emergency-versus-scheduled dynamic applies to other home services verticals – garage door repair follows nearly identical patterns with after-hours failures driving premium pricing.

The urgency is extreme. Homeowners will pay premium prices for immediate service when their family’s comfort or safety is at risk. Response time expectations compress to minutes rather than hours. Competition for these leads intensifies during weather events as every operator tries to capture the spike. The seasonal concentration creates capacity planning challenges that require advance preparation.

Effective acquisition tactics for emergency leads center on urgency signals. Search keywords with urgency modifiers like “AC repair now” or “emergency furnace repair” indicate immediate need. Call-based campaigns that connect homeowners immediately to contractors capture the urgency moment. Targeting during and immediately after weather events maximizes volume. Mobile-first landing pages optimized for click-to-call remove friction when speed matters most.

Emergency leads typically command 40-60% premiums over standard leads. A standard AC repair lead might cost $40-$60, while an emergency AC repair during a heat wave runs $70-$100. Standard furnace repair leads price at $35-$55, while emergency furnace repair during a cold snap escalates to $60-$90.

Emergency leads require contractors with specific capabilities. These contractors need 24/7 dispatch capability to respond when calls come at 2 AM. They need adequate technician capacity during peak events rather than skeleton crews. Parts inventory for common emergency repairs prevents delays that frustrate homeowners. And they need willingness to pay premium CPLs for high-conversion leads rather than balking at the cost.

Building an emergency lead program requires identifying contractors who can actually deliver on the implicit promise. A homeowner who submitted an emergency lead and waits 24 hours for a callback has a terrible experience. The lead generator’s reputation suffers even though the contractor failed to perform.

Scheduled Lead Dynamics

Scheduled leads represent planned HVAC work: maintenance contracts, system evaluations, replacements, and non-urgent repairs. These leads convert at lower rates but offer more predictable volume and better contractor relationships.

The lower urgency allows longer sales cycles without the pressure of extreme temperatures. Price comparison is more common as homeowners collect multiple quotes and make considered decisions. Seasonal distribution concentrates in shoulder seasons when planning occurs. Higher consideration level for major purchases like system replacement means longer nurture periods.

Acquisition tactics for scheduled leads differ from emergency approaches. Content marketing addressing maintenance, efficiency, and cost savings attracts planners. SEO targeting informational queries like “HVAC maintenance checklist” or “when to replace AC” captures research-stage homeowners. Email nurturing maintains relationships with leads not ready to purchase immediately. Social media campaigns targeting homeowner demographics build awareness before urgent need arises.

Scheduled leads price below emergency leads across categories. Maintenance and tune-up leads run $20-$40. System evaluation leads cost $35-$55. Replacement inquiry leads command $50-$80 based on the higher ticket value.

Scheduled leads favor contractors with different strengths than emergency work requires. These contractors excel at consultative selling where they educate homeowners and build trust. They maintain strong closing processes for considered purchases that unfold over days or weeks. They have follow-up systems for longer sales cycles that keep their company top-of-mind. They offer financing options for major replacements that make large purchases accessible.

Balancing Your Portfolio

The optimal HVAC lead generation operation maintains both emergency and scheduled lead capabilities, shifting emphasis based on conditions.

During peak seasons, scale emergency lead acquisition during extreme weather. Ensure contractor partners have capacity commitments before the weather hits. Price leads to reflect the conversion premium buyers receive. Accept higher CPLs for higher conversion rates because the math works.

During shoulder seasons, emphasize maintenance and planned replacement. Build contractor relationships during lower-competition periods when you have their attention. Generate leads for nurturing into peak season when demand materializes. Capture planning-stage homeowners before they become emergencies.

The ratio between emergency and scheduled leads depends on geographic market and contractor relationships. A northern market operator might generate 70% scheduled leads and 30% emergency leads annually, with emergency leads concentrated in winter heating crises. A southern market operator might reverse that ratio, with summer cooling emergencies dominating volume.

Local SEO and Google Business Profile Optimization

HVAC is an inherently local business. Homeowners want contractors who can arrive quickly, understand local building codes, and have established reputations in their community. Local SEO strategies are essential for HVAC lead generation.

Google Business Profile Fundamentals

Google Business Profile (GBP) has become the primary discovery mechanism for local HVAC contractors. Appearing in the “Local Pack” (the map results for local searches) drives significant lead volume.

Complete Every Field

Google rewards complete profiles with better visibility. The business name should be your legal business name without keyword stuffing, which violates guidelines. A verified address is required for Local Pack inclusion. Use a trackable phone number for attribution. Link to a landing page optimized for local search. Hours of operation are critical for service businesses. Service area settings enable geographic targeting for leads. Categories should include a primary designation of HVAC Contractor with secondary categories like AC Repair and Heating Contractor. Attributes highlighting emergency service, 24-hour service, and free estimates signal capabilities. List all offerings in products and services with detailed descriptions.

Photos and Visual Content

Businesses with photos receive 42% more requests for directions and 35% more clicks to websites according to Google’s data. For HVAC contractors, exterior photos of the office and vehicle fleet establish legitimacy. Interior photos of the showroom demonstrate professionalism. Team photos showing technicians build trust by putting faces to the service. Before and after project photos demonstrate quality work. Equipment and installation photos showcase capabilities.

Posts and Updates

Regular posts signal an active business that Google rewards with visibility. Weekly posts about seasonal tips, promotions, or company news keep the profile fresh. Offer posts with specific calls to action drive conversions. Event posts for community involvement build local relevance. Product posts highlighting specific services educate potential customers.

Review Generation and Management

Reviews are the primary trust signal for local HVAC services. A contractor with 200 reviews averaging 4.8 stars will capture more leads than a competitor with 20 reviews averaging 5.0 stars – volume and recency matter alongside rating.

Systematic Request Process

Every completed job should trigger a review request. Send an email request within 24 hours of service completion while the experience is fresh. SMS requests drive faster response with higher open rates than email. Provide a direct link to the Google review page to remove friction. Follow up with a second request if no review appears within 48 hours.

Timing Optimization

Request reviews when customer satisfaction is highest. The moment after resolving an emergency repair when relief is palpable is ideal. After system installation when new equipment is working perfectly creates positive associations. After positive follow-up on maintenance service reinforces the relationship.

Response Requirements

Respond to all reviews without exception. Thank positive reviewers specifically, referencing details of their job to show genuine attention. Address negative reviews professionally and offer resolution paths. Response time itself signals engagement to potential customers evaluating options.

Review Velocity Targets

For competitive HVAC markets, target a minimum of 5-10 new reviews monthly. Maintain a rolling average above 4.5 stars. Recent reviews from the last 90 days carry more weight than older reviews in both algorithms and consumer perception.

Local Search Ranking Factors

The Local Pack algorithm considers three primary factors: relevance, distance, and prominence.

Relevance optimization requires complete GBP categories matching search queries. Service descriptions should use common search terminology that homeowners actually type. Website content should mirror GBP information for consistency signals.

Distance considerations include service area settings in GBP. Website content should address specific neighborhoods and cities. Local content creation for each service area demonstrates geographic relevance.

Prominence building depends on review quantity and quality. Local citations across directories with consistent NAP (name, address, phone) reinforce legitimacy. Website authority and local content contribute to overall prominence. Google Ads activity shows correlation with Local Pack performance, though Google has not confirmed it as a ranking factor.

Local Landing Page Strategy

Each major service area should have dedicated landing pages optimized for local search.

Page structure should include the city or neighborhood name in the title tag and H1. The service type should be clearly identified early. Local content mentioning specific neighborhoods, landmarks, and conditions demonstrates genuine local knowledge. Local trust signals including reviews and case studies from the area build credibility. A clear call to action with phone number and form drives conversions.

Content differentiation requires unique content for each location page without duplication. Discuss local weather patterns and how they affect HVAC systems in that specific area. Cover local utility programs and rebates that homeowners can access. Address local building code considerations that affect installations. Mention community involvement that demonstrates local commitment.

Technical requirements include schema markup for local business structured data. Consistent NAP with GBP ensures no conflicts that confuse algorithms. Mobile-optimized design serves the majority of local searchers. Fast page loading with Core Web Vitals compliance satisfies user experience signals. For detailed conversion optimization guidance, see our landing page optimization guide.

Marketplace Platforms: Angi, HomeAdvisor, and Alternatives

Lead marketplace platforms provide access to homeowner demand without requiring contractors to build their own marketing infrastructure. Understanding how these platforms work – and their limitations – is essential for HVAC lead generation.

Angi/HomeAdvisor Platform Economics

Following the 2021 merger of Angie’s List and HomeAdvisor, Angi operates the largest home services lead marketplace. Understanding the platform’s economics helps optimize participation.

Contractors pay per lead rather than per job or sale. Lead prices vary by job type, location, and competition, with HVAC leads typically ranging $15-$50. Emergency leads and major installations command higher prices. Geographic competition affects pricing, with dense urban markets costing more.

Leads are typically shared with 3-4 contractors, so homeowners expect multiple quotes. Response time is critical because the first-to-call advantage is significant. Lead quality varies as some homeowners are price-shopping only rather than ready to buy.

Shared lead booking rates typically run 8-15%. Booking rate varies based on response time, follow-up quality, and pricing competitiveness. Top-performing contractors achieve 20% or higher through superior processes that differentiate them from competition.

Cost management strategies include setting daily and weekly spending caps to control budget. Adjust target preferences to focus on high-conversion job types. Use the pause feature during capacity constraints when technicians are booked out. Monitor lead quality and dispute invalid leads promptly to protect ROI.

Maximizing Marketplace ROI

Success on marketplace platforms requires treating lead acquisition as a competitive process, not a passive channel.

Speed-to-Contact

Marketplace leads are shared, so the first contractor to reach the homeowner captures a significant advantage. Data consistently shows that contractors who call within 5 minutes of lead receipt book jobs at rates 3-5x higher than those who wait an hour.

Implementation requires real-time lead notifications rather than batched delivery. Dedicated staff for immediate follow-up during business hours ensures someone is always ready. After-hours voicemail with a callback commitment maintains engagement. Automated text message acknowledgment provides immediate touchpoint even when calls cannot happen instantly.

Quote Presentation

Homeowners receiving 3-4 quotes become price-focused. Differentiation beyond price becomes essential to win jobs without racing to the bottom.

Emphasize technician qualifications and certifications that competitors may lack. Highlight warranty and guarantee offerings that reduce buyer risk. Show proof of insurance and licensing that legitimizes your operation. Provide references or case studies demonstrating successful similar work. Offer financing options for major work that makes purchasing accessible.

Review Leverage

Marketplace profiles display reviews prominently, and contractors with more and better reviews convert leads at higher rates.

Request reviews on the platform specifically, not just on Google. Respond to all reviews, both positive and negative. Feature reviews mentioning specific job types you want more of. Address negative reviews with resolution offers that show commitment to customer satisfaction.

Alternative Platforms

Beyond Angi/HomeAdvisor, other platforms serve the HVAC lead market.

Yelp for Business is strong in urban markets with review-conscious consumers. Advertising products range from enhanced listings to direct lead generation. Review quality and quantity drive visibility on the platform. Cost per lead typically runs $20-$50 for HVAC services.

Thumbtack uses a quote-based model where homeowners describe their needs and contractors pay to send quotes. This works well for planned work but less effectively for emergency service where speed matters. Cost per quote typically runs $10-$40 depending on project scope.

Google Local Services Ads is growing rapidly as Google prioritizes LSA in local results. The “Google Guaranteed” badge builds consumer trust effectively. The pay-per-lead model costs typically $25-$75 per lead. Background check and licensing verification are required for participation.

Direct lead generation companies sell leads from affiliate networks or independent generators. Exclusive or semi-exclusive delivery options provide different economics. Pricing typically runs $30-$80 for exclusive HVAC leads. Quality varies significantly by source, requiring careful vetting.

Platform Strategy

The optimal approach uses multiple platforms while tracking performance rigorously.

Diversification reduces dependence on any single lead source. Multiple platforms capture different customer segments with varying preferences. Fallback options protect against platform policy changes. A/B testing of pricing and positioning becomes possible across platforms.

Tracking requirements include unique tracking numbers for each platform. CRM integration enables lead-to-booking attribution. Revenue tracking for ROI calculation goes beyond booking rate alone. Lifetime value analysis reveals the true worth of acquired customers.

Budget allocation should direct more resources to higher-performing platforms. Maintain minimum presence on secondary platforms for diversification even when they underperform. Adjust allocation seasonally based on platform-specific patterns. Test new platforms with limited budgets before scaling commitment.

Booking Rate Optimization

The booking rate – the percentage of leads that convert to scheduled service appointments – determines HVAC lead generation profitability more than lead cost alone. A $50 lead with a 20% booking rate is more valuable than a $30 lead with a 10% booking rate.

Speed-to-Contact Requirements

Research consistently demonstrates that response time is the single most important factor in lead conversion. A study by Lead Connect found that 78% of customers buy from the first responder. In HVAC, where customers often contact multiple contractors simultaneously, first-mover advantage is decisive.

Response under 5 minutes is optimal and achieves booking rate gains of 3-5x over slower response. Response in 5-30 minutes is acceptable and still captures most first-mover advantage. Response in 30-60 minutes shows declining returns as competition has likely engaged the homeowner. Response over 1 hour creates significant disadvantage with booking rates halved or worse.

Real-Time Notification Infrastructure

Leads should arrive via API or real-time webhook rather than periodic batch delivery. Push notifications to dispatcher phones and tablets ensure immediate awareness. SMS alerts for after-hours leads catch urgent situations. Email serves as backup notification but should not be the primary channel.

Staffing for Response

Dedicated intake staff during peak hours ensures someone is always ready to call. An on-call dispatcher for after-hours emergency leads maintains 24/7 coverage. Staff need scripts and authority to schedule appointments immediately without escalation. Handoff procedures when the primary responder is unavailable prevent leads from falling through cracks.

Automated Touchpoints

Immediate SMS acknowledgment provides instant connection: “Thank you for contacting [Company]. A specialist will call you within 5 minutes.” Automated calendar links for self-scheduling give eager customers a path to book immediately. Immediate email with company information and reviews educates the homeowner while they wait for the call.

Follow-Up Sequences

Not all leads answer the first call. Systematic follow-up captures homeowners who were busy, distracted, or need multiple touches before committing.

Day One Protocol

Call within 5 minutes of lead receipt. Send SMS immediately after a failed call attempt. Make a second call 2-4 hours after the initial attempt. Send an end-of-day email with company overview and trust signals.

Day Two Protocol

Make a morning call at a different time than Day 1 attempt. Send a mid-day SMS check-in referencing the previous attempts.

Day Three Protocol

Make an evening call attempt that catches people home from work when they have time to talk.

Week Two Protocol

Make a final call attempt. Send a “last chance” email with limited-time offer to create urgency.

Nurture Sequence for Non-Responsive Leads

Weekly email with helpful content including maintenance tips and efficiency advice maintains presence. Seasonal reminders about pre-summer AC checks and pre-winter furnace tune-ups trigger action. Special offers during shoulder seasons provide compelling reasons to re-engage.

Scripting and Training

What contractors say during lead calls directly affects booking rates. Scripting ensures consistent quality and captures best practices.

Opening Script Elements

Identify yourself and company immediately to establish legitimacy. Reference how they found you to establish the connection. Acknowledge their HVAC issue to show you understand their situation. Express understanding of urgency for emergency leads to build rapport.

Discovery Questions

Ask what the specific issue is to diagnose before quoting. Ask how old the system is to assess repair versus replace dynamics. Ask when the problem started to gauge urgency. Ask whether they have had previous service on this system to identify relationship opportunities. Ask about their schedule for the next few days to move toward booking.

Booking Conversation

Provide an estimated service window rather than an exact time to manage expectations. Explain what the technician will do to set clear expectations. Discuss service call fee structure transparently. Confirm contact information for dispatch. Send confirmation immediately after the call to lock in the commitment.

Objection Handling

For price objections, emphasize value, warranties, and technician expertise that justify the investment. For timing objections, offer flexible scheduling and explain the risks of delay. For comparison shopping objections, offer to match competitors while emphasizing differentiators that justify your pricing.

Conversion Analytics

Tracking booking rates requires robust analytics infrastructure.

Key metrics include lead-to-contact rate to determine whether you reached the homeowner. Contact-to-appointment rate measures whether contacted leads booked service. Appointment-to-completion rate tracks whether booked appointments actually happened. Completion-to-sale rate reveals whether service calls converted to revenue.

Segmentation analysis should examine booking rate by lead source to identify which platforms perform best. Analyze booking rate by job type comparing emergency versus scheduled. Track booking rate by time of day and day of week to optimize scheduling. Compare booking rate by assigned salesperson or dispatcher to identify coaching opportunities.

Attribution requirements include unique tracking numbers per lead source. CRM integration enables lead-to-revenue tracking. Regular reporting with weekly minimum cadence maintains visibility. A feedback loop to lead acquisition provides quality insights that improve sourcing.

Building Contractor Relationships

For lead generators working with HVAC contractors rather than operating as contractors themselves, relationship quality determines long-term success. Contractors who trust their lead sources pay better prices, provide better feedback, and remain loyal during competitive periods.

Contractor Selection Criteria

Not all HVAC contractors make good lead buyers. Selecting contractors who can convert leads effectively protects your reputation and ensures sustainable relationships.

Operational requirements include adequate staffing for timely response with a minimum of 2-3 technicians. Dispatch capability must match your lead hours. A CRM or lead management system should be in place. Follow-up processes that maximize conversion are essential.

Financial stability indicators include an established business of 2 or more years. Look for consistent payment history and adequate credit line for lead purchasing. Avoid contractors with history of payment disputes.

Reputation indicators include positive Google reviews with 4.0 or higher average and 50 or more reviews. Licensing and insurance should be verified. Check BBB rating if applicable. Investigate any significant complaint patterns.

Relationship Management

Once contractors are onboarded, ongoing relationship management sustains performance.

Regular communication should include weekly or biweekly check-ins during the first 90 days. Monthly reviews once the relationship is established maintain connection. Quarterly business reviews with data analysis provide strategic insights. Annual strategy sessions for capacity planning align expectations.

Performance transparency means sharing lead quality metrics including contact rates and booking rates. Discuss return patterns and reasons openly. Provide competitive benchmarking with anonymized data. Collaborate on optimization rather than dictating terms.

Capacity monitoring requires tracking response time trends, as slowing suggests capacity stress. Monitor return rate changes because increases suggest oversupply. Adjust lead volume before the contractor requests changes. Build trust through proactive management that anticipates needs.

Pricing and Terms

Lead pricing structures should align contractor and generator incentives.

Per-lead pricing is simple and most common. Performance-based pricing offers lower base cost with bonus for booked leads. Revenue share is complex but aligns incentives fully. Subscription or retainer models provide predictable costs and guaranteed volume.

Term considerations include minimum volume commitments, exclusivity radius for geographic territory protection, return policies defining what qualifies for credit, and payment terms such as net 15, net 30, or prepaid.

Seasonal adjustments should include higher prices during peak season reflecting supply and demand dynamics. Volume incentives during shoulder seasons encourage off-peak purchasing. Capacity-based pricing offers discounts for guaranteed volume commitments.

Frequently Asked Questions

Q: What is a good cost per lead for HVAC?

A: HVAC lead costs vary significantly by lead type and season. Standard exclusive leads typically range $30-$80, with emergency leads during extreme weather commanding $60-$120. Shared leads cost $15-$35 but convert at lower rates. The relevant metric is cost per acquisition, not cost per lead. A $70 lead with a 20% booking rate ($350 CPA) outperforms a $40 lead with a 10% booking rate ($400 CPA). Calculate your CPA targets based on average ticket size and acceptable customer acquisition costs, then work backward to acceptable CPL.

Q: How does seasonality affect HVAC lead generation?

A: HVAC exhibits pronounced dual-peak seasonality. Summer cooling demand peaks during June-August, with volume increasing 200-400% during heat waves compared to shoulder season baselines. Winter heating demand creates a secondary peak in December-February, particularly in northern markets. Shoulder seasons (March-May and September-November) offer lower lead costs (20-30% below peak) with better contractor availability and often higher conversion rates. Successful operators allocate 130-150% of average monthly budget to peak seasons and 60-80% to shoulder seasons.

Q: Which platforms work best for HVAC leads – Angi, Google LSA, or direct generation?

A: Each platform has distinct strengths. Angi/HomeAdvisor provides high volume but shared leads, making speed-to-contact critical. Google Local Services Ads are growing rapidly and the “Google Guaranteed” badge builds trust, though costs run $25-$75 per lead. Direct lead generation through your own campaigns offers the most control but requires marketing expertise. The optimal strategy uses multiple platforms, tracking performance rigorously and allocating budget toward the highest-performing sources. Most successful contractors maintain presence on 3-4 platforms while building direct marketing capabilities for long-term competitive advantage.

Q: What booking rate should HVAC contractors expect from purchased leads?

A: Booking rates vary by lead type and contractor execution. Shared leads typically book at 8-15%. Exclusive leads book at 15-25%. Emergency leads during peak demand can reach 25-40%. Live transfer leads (homeowner already on the phone) book at 35-55%. However, execution matters more than averages. Contractors who respond within 5 minutes book at 3-5x the rate of those who wait an hour. Systematic follow-up sequences capture an additional 30-50% of leads that do not answer the first call. Focus on improving your booking rate rather than accepting industry averages.

Q: How important is Google Business Profile for HVAC lead generation?

A: Google Business Profile is essential for HVAC lead generation. Appearing in the Local Pack (map results for local searches) drives significant lead volume, and GBP is the primary factor determining Local Pack visibility. Complete every profile field, add photos regularly, post weekly updates, and systematically generate reviews (target 5-10 new reviews monthly with 4.5+ star average). Contractors with strong GBP profiles report that organic leads from Google Maps and local search represent 30-50% of their total lead volume – essentially free leads that reduce overall customer acquisition costs.

Q: Should I focus on emergency leads or scheduled leads for HVAC?

A: The optimal strategy includes both, with emphasis varying by season and capacity. Emergency leads convert at higher rates (25-40% vs. 15-25% for scheduled) but cost more (40-60% premium) and concentrate during unpredictable extreme weather events. Scheduled leads (maintenance, planned replacement) offer steadier volume, lower costs, and often better long-term customer value through maintenance contracts. During peak seasons, emphasize emergency leads when contractor capacity allows. During shoulder seasons, focus on scheduled leads that build relationships and capture planning-stage homeowners. Most successful operations generate 60-70% scheduled leads annually with emergency leads concentrated during peak weather events.

Q: How do I handle lead quality issues with HVAC leads?

A: Lead quality issues require systematic tracking and resolution. First, define quality criteria clearly: valid contact information, genuine service need, correct geographic area, no duplicate submissions. Track quality metrics by source to identify problem suppliers. Implement validation at point of capture: phone verification, address validation, and consent capture. Establish clear return policies with lead sources – most marketplaces allow disputed leads for invalid contacts or service area mismatches. When working with direct generators, require TrustedForm or similar consent documentation. Quality issues that exceed 15-20% of volume indicate source problems requiring renegotiation or termination.

Q: What is the best follow-up sequence for HVAC leads?

A: Effective follow-up sequences include multiple touchpoints across channels. Day 1: Call within 5 minutes, immediate SMS if no answer, second call 2-4 hours later, end-of-day email. Day 2: Morning call, mid-day SMS. Day 3: Evening call (catches people home from work). Week 2: Final call attempt, “last chance” email with limited-time offer. For non-responsive leads, add to a nurture sequence with weekly educational emails and seasonal maintenance reminders. Leads that do not respond within 2 weeks should move to long-term nurture rather than active outreach, but do not discard them – seasonal maintenance offers can reactivate leads 3-6 months later.

Q: How do I optimize for local SEO in competitive HVAC markets?

A: Local SEO for competitive HVAC markets requires a multi-pronged approach. First, optimize your Google Business Profile completely and maintain it actively. Second, build dedicated landing pages for each service area with unique, locally-relevant content. Third, develop local citations across directories (Yelp, BBB, industry directories) with consistent NAP (Name, Address, Phone). Fourth, generate reviews systematically – aim for higher review velocity than competitors. Fifth, create locally-focused content addressing regional conditions (climate-specific HVAC advice, local utility programs, building code considerations). Sixth, build local links through community involvement, sponsorships, and partnerships. Monitor Local Pack rankings for target keywords and adjust strategy based on competitive movements.

Q: What is the lifetime value of an HVAC customer and how should it affect lead pricing decisions?

A: HVAC customer lifetime value extends well beyond the initial service call. A typical residential HVAC customer might generate: initial service call ($300-$600), potential system replacement over time ($7,000-$15,000), annual maintenance contracts ($150-$300/year for 5-15 years), and emergency repairs (2-3 over system lifetime at $200-$800 each). Total lifetime value can reach $15,000-$25,000 for a customer who stays with a contractor through a full equipment lifecycle. This LTV justifies customer acquisition costs of $150-$500, which in turn supports lead costs of $50-$150 assuming reasonable booking rates. Contractors who only consider the initial service call when evaluating lead economics underinvest in lead generation and lose market share to competitors who understand lifetime value.

Q: How does weather forecasting affect HVAC lead generation strategy?

A: Weather is the primary demand driver for HVAC leads. Practitioners who monitor forecasts gain 48-72 hours of lead time before demand spikes. When forecasts predict temperatures above 95 degrees or below 20 degrees Fahrenheit, expect emergency lead demand to increase 100-300% within 24-48 hours. Strategic responses include: increasing paid search bids 24-48 hours before extreme weather, pre-negotiating contractor capacity commitments, preparing landing pages with urgency messaging, and scheduling additional intake staff. Conversely, mild weather forecasts suggest reducing acquisition spend to avoid overpaying for leads that will not convert urgently. Sophisticated practitioners build weather triggers directly into their bidding automation.

Seasonal Demand Modeling for HVAC Lead Generation

Beyond calendar-based planning, sophisticated HVAC lead generation operations build predictive models that anticipate demand fluctuations with greater precision. Seasonal demand modeling combines historical patterns, weather data, economic indicators, and market-specific variables to forecast lead volume and optimize acquisition timing.

Building a Demand Forecasting Model

Effective demand modeling starts with historical data aggregation. At minimum, compile two years of lead volume data broken down by week, service type, and geographic market. Overlay this with weather data including daily high and low temperatures, degree days (heating and cooling), and extreme weather events. Include conversion metrics – not just lead volume but booking rates and revenue per lead – to model quality variation alongside quantity.

The base seasonal pattern emerges from year-over-year comparison. Most markets show predictable curves: spring ramp (weeks 12-20), summer peak (weeks 22-35), fall transition (weeks 36-44), and winter secondary peak (weeks 48-8). Quantify each phase by indexing weekly volume against annual average. A summer peak index of 1.4 means that week typically generates 40% more leads than annual weekly average.

Weather adjustment factors modify the base forecast based on actual conditions versus historical norms. Extreme heat (temperatures exceeding the 90th percentile for that calendar week) typically increases cooling lead volume by 50-100% above the seasonal baseline. Extreme cold (temperatures below the 10th percentile) increases heating lead volume by similar margins. Build these multipliers from historical analysis of weather deviation versus lead volume deviation.

Geographic segmentation improves model accuracy. National averages mask substantial regional variation. A Phoenix market model differs dramatically from a Minneapolis model – summer peaks are more extreme in Phoenix while winter peaks are more extreme in Minneapolis. Build separate models for each major geographic market or market cluster, then aggregate for portfolio-level forecasting.

Predictive Variables Beyond Weather

Weather dominates short-term demand, but other variables affect medium-term patterns worth modeling.

Economic indicators correlate with replacement lead volume. Home sales activity, consumer confidence indices, and local employment data predict homeowner willingness to invest in major HVAC replacements. When home sales increase, so do HVAC replacement leads as new homeowners address deferred maintenance. Rising consumer confidence precedes higher conversion rates on high-ticket installations.

Utility rate changes affect demand timing. Announced rate increases drive efficiency-related leads as homeowners seek to reduce consumption. Smart lead generators monitor utility commission proceedings to anticipate rate-driven demand 3-6 months before implementation.

Rebate and incentive windows create demand spikes. Federal tax credit deadlines, state efficiency program enrollment periods, and utility rebate fund availability all affect when homeowners act. Model these predictable demand drivers and adjust acquisition spend to capture resulting volume.

New construction activity predicts installation lead volume with 6-12 month lead time. Building permit data, available from local government sources, signals future demand for new HVAC installations as developments move from permitting to completion.

Operationalizing Demand Forecasts

Demand models only create value when connected to operational decisions.

Budget allocation should follow demand forecasts. Allocate acquisition spend proportionally to expected volume, with adjustments for CPL variation. If summer CPLs run 30% above shoulder season, the summer spend increase should be proportionally lower than the volume increase – the goal is maintaining acceptable unit economics, not just chasing volume.

Staffing decisions benefit from demand visibility. Intake staff, lead validation teams, and contractor support resources should scale with anticipated volume. A 100% increase in summer lead volume requires corresponding increases in processing capacity to maintain response time standards.

Contractor capacity commitments should align with forecasts. Share demand projections with key contractors before peak seasons, securing capacity commitments while they have scheduling flexibility. Contractors who know volume is coming can staff appropriately; those surprised by demand spikes become unreliable partners.

Traffic source allocation optimizes within demand context. High-CPL channels like Google Ads become more attractive during high-demand periods when conversion rates increase and contractor urgency supports premium pricing. Lower-CPL channels like organic content and nurture campaigns become relatively more attractive during shoulder seasons when the same lead is harder to convert.

Model Validation and Refinement

Demand models require ongoing validation against actual results. Track forecast accuracy weekly, measuring the gap between predicted and actual volume. Acceptable variance is plus or minus 15% for weekly forecasts, plus or minus 10% for monthly forecasts.

When forecasts miss significantly, investigate root causes. Weather models may need recalibration if climate patterns are shifting. Economic correlations may weaken during unusual market conditions. New competitors may be capturing demand that historically converted through your funnel.

Machine learning approaches can improve forecast accuracy when sufficient historical data exists. Regression models that weight multiple input variables outperform simple calendar-based forecasts. Time series models like ARIMA or Prophet capture cyclical patterns and trend changes automatically. However, model complexity should match data availability – sophisticated ML models require 3-5 years of clean historical data to train reliably.

Scenario Planning for Demand Uncertainty

Even the best models face uncertainty. Build scenario plans for demand deviations.

High-demand scenarios (20%+ above forecast) require rapid scaling responses. Pre-negotiate standby contractor capacity that activates when thresholds trigger. Maintain reserve advertising budget for opportunistic spending during demand spikes. Queue additional staff from temporary agencies familiar with your processes.

Low-demand scenarios (20%+ below forecast) require cost containment responses. Identify which acquisition channels to reduce first while preserving high-ROI sources. Plan for contractor retention activities that maintain relationships during volume dips. Shift resources to pipeline-building activities that generate future value when current volume disappoints.

Extreme weather scenarios deserve specific planning. What happens if a heat wave coincides with your team’s capacity constraints? What if a mild winter eliminates the secondary heating peak? Run through these scenarios annually, developing playbooks that enable rapid response when unusual conditions emerge.

Key Takeaways

-

HVAC lead pricing ranges from $30-$80 for standard exclusive leads, with emergency leads during extreme weather commanding $60-$120. Shared leads cost $15-$35 but book at lower rates. Calculate cost per acquisition, not just cost per lead, to evaluate true economics.

-

Seasonality creates dual peaks: summer cooling (June-August) and winter heating (December-February). Shoulder seasons (March-May, September-November) offer lower CPLs, better contractor availability, and often higher conversion rates due to reduced contractor overwhelm.

-

Speed-to-contact is the primary conversion driver. Leads contacted within 5 minutes book at 3-5x the rate of those contacted after an hour. Implement real-time notifications, dedicated intake staff, and automated acknowledgment systems.

-

Google Business Profile is essential for local HVAC lead generation. Complete profile optimization, systematic review generation (5-10 monthly), and regular posting signal active engagement and improve Local Pack visibility.

-

Marketplace platforms (Angi, Google LSA, Thumbtack) provide volume but require platform-specific optimization. First-to-call advantage is critical on shared lead platforms. Diversify across multiple platforms while tracking performance rigorously.

-

Emergency leads convert at 25-40% but concentrate during unpredictable weather events. Scheduled leads (maintenance, planned replacement) offer steadier volume at lower costs. The optimal portfolio includes both, with emphasis varying by season and contractor capacity.

-

Booking rate optimization through systematic follow-up, scripted conversations, and conversion analytics improves profitability more than lead cost reduction. A 5-point improvement in booking rate (15% to 20%) reduces effective CPA by 25%.

-

Contractor relationships are the foundation of sustainable HVAC lead generation. Select contractors with operational capacity, track performance transparently, and adjust volume proactively based on capacity signals.

Sources

- Department of Energy: Heat Pump Systems - Federal guidance on heat pump technology, efficiency ratings, and market adoption trends

- ASHRAE Standards and Guidelines - American Society of Heating, Refrigerating and Air-Conditioning Engineers technical standards and market research

- NAHB Housing Economics - National Association of Home Builders data on residential construction and HVAC installation demand

- Harvard Business Review: Lead Response Time - Research documenting speed-to-contact conversion impact (78% first-responder advantage)

- ServiceTitan Industry Blog - HVAC contractor operational benchmarks for booking rates, technician utilization, and seasonal demand patterns

- InsideSales.com Research - Lead response studies validating 3-5x conversion improvement for sub-5-minute contact

Understanding HVAC lead generation seasonality and optimization strategies positions operators to capture demand throughout the annual cycle – not just during the peak weeks that everyone chases. The money is made in the margins: shoulder season efficiency, booking rate optimization, and contractor relationships that sustain through competitive periods.