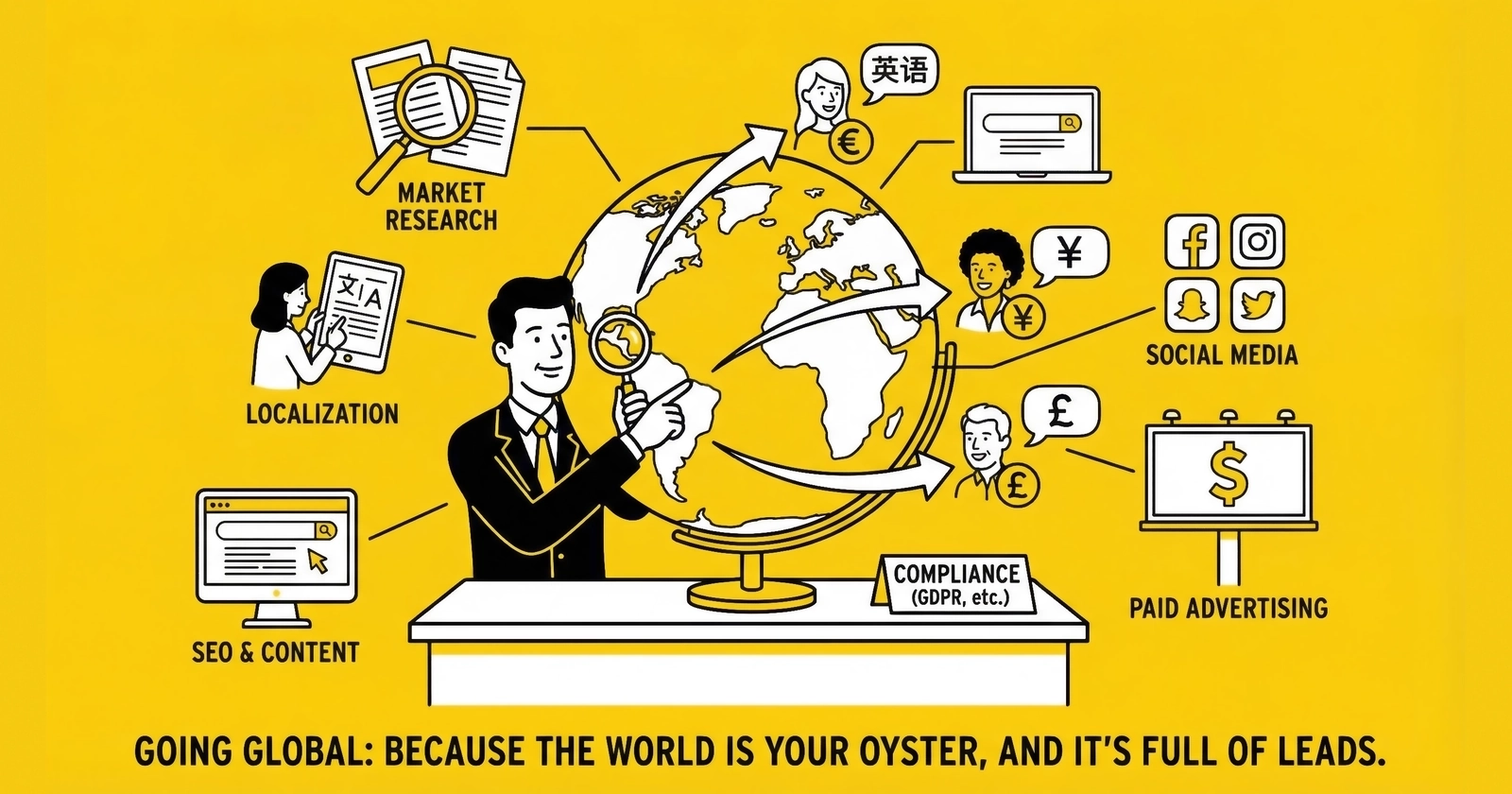

A comprehensive guide to building lead generation operations in global markets, navigating regulatory frameworks from GDPR to LGPD, and capturing opportunity in underserved international verticals.

The US lead generation market represents approximately 40% of global transaction value. That means 60% of the opportunity exists elsewhere.

Yet most American lead generation operators never look beyond their borders. They assume international expansion is too complex, too risky, or too different from what they know. That assumption creates arbitrage opportunity for those willing to learn the mechanics.

International lead generation is not simply exporting US playbooks to new geographies. It requires understanding different regulatory frameworks, cultural expectations around consent and communication, varied technology infrastructure, and market-specific economics that can differ dramatically from American benchmarks.

This guide walks you through everything you need to know about expanding lead generation operations internationally: market analysis by region, regulatory deep dives, operational considerations, and the specific tactics that work in markets from the United Kingdom to Brazil to Australia.

The Case for International Expansion

Before diving into mechanics, you need to understand why international expansion deserves consideration in the first place.

Market Size and Growth Dynamics

The global lead generation market is valued at approximately $5-10 billion as of 2024, with projections reaching $15-32 billion by the early 2030s. While North America dominates at roughly 40% market share, two dynamics make international markets increasingly attractive.

First, growth rates outside North America are accelerating. The Asia-Pacific region shows compound annual growth rates exceeding 12%, driven by digital transformation across India, Southeast Asia, and established Asian markets. Latin America, despite economic volatility, demonstrates strong growth in specific verticals like financial services and insurance.

Second, competition density varies dramatically. In the US, more than 21,000 lead generation businesses compete for market share. In most international markets, the competitive landscape is far less crowded. The same level of operational excellence that yields modest margins in saturated US verticals can generate premium returns in less mature markets.

Diversification Benefits

Geographic diversification provides operational resilience. When regulatory changes disrupt US operations, international revenue streams continue. When seasonal patterns depress US demand, counter-seasonal markets pick up slack. When platform changes affect US traffic sources, international campaigns on different platforms remain unaffected.

Consider the regulatory volatility around the FCC one-to-one consent rule, which was ultimately vacated by the Eleventh Circuit in January 2025 before taking effect. Operators with international revenue streams were better positioned to weather such regulatory uncertainty because their entire business model did not depend on US telemarketing regulations.

Arbitrage Opportunities

International markets offer arbitrage opportunities that have largely been competed away in the US. Cost per click for competitive keywords can be 30-70% lower in equivalent non-English markets. Conversion rates on similar offers can be higher due to less consumer fatigue from aggressive marketing. And CPL benchmarks often trail US equivalents by 20-40%, creating room for margin.

Those who recognized these dynamics five years ago built sustainable international businesses. The window remains open, though it narrows each year as more sophisticated players enter.

Regional Market Analysis

Understanding regional dynamics is essential before committing resources. Each major region presents distinct opportunities, challenges, and market structures.

Europe: Mature Markets with Regulatory Complexity

The European market represents the most significant opportunity outside North America, with established financial services sectors, high internet penetration, and sophisticated consumer expectations.

United Kingdom. Post-Brexit, the UK operates under its own data protection framework (UK GDPR), which largely mirrors EU GDPR with some variations. The UK lead generation market is mature, particularly in financial services, insurance, and home improvement verticals. London-based buyers are sophisticated and expect US-level quality standards. CPLs run 20-30% lower than equivalent US verticals, but margins are also compressed by competition from established UK operators.

Germany. The largest European economy presents significant opportunity in insurance, automotive, and B2B verticals. German consumers are privacy-conscious, and marketing practices considered normal in the US can trigger compliance issues or consumer backlash. Telemarketing is heavily restricted. Email marketing requires explicit opt-in consent with clear documentation. The market rewards operators who understand German expectations around data protection and communication frequency.

France. Strong potential in insurance, home improvement, and financial services. French data protection authority (CNIL) actively enforces GDPR with significant penalties. The market prefers local-language operations with native French-speaking sales representatives.

Nordics (Sweden, Norway, Denmark, Finland). High-value markets with sophisticated digital infrastructure but small populations limiting volume potential. B2B verticals show strong performance. Consumer verticals are competitive due to established local players.

Southern Europe (Spain, Italy, Portugal). Developing lead generation markets with strong growth in financial services and solar. Lower CPLs but also lower conversion rates and longer payment cycles. Economic volatility affects buyer reliability.

Canada: Familiar Market with Key Differences

Canada offers the most accessible international market for US operators due to language overlap, cultural similarity, and integrated economies. However, assuming Canada operates identically to the US is a common and costly mistake.

Regulatory Framework. Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) governs federal data protection, while provincial laws (PIPA in Alberta and British Columbia, Quebec’s privacy law) add complexity. Canada’s Anti-Spam Legislation (CASL) imposes strict requirements on commercial electronic messages, including email and SMS, with penalties up to $10 million CAD for organizations.

Market Dynamics. The Canadian insurance market differs significantly from the US, with provincial rather than federal regulation. Mortgage and real estate lead generation follows similar patterns to the US but with distinct market cycles. The solar market is smaller and concentrated in specific provinces. Home services verticals perform well in major metropolitan areas.

Operational Considerations. Many US platforms and technology providers support Canadian operations with minimal adjustment. However, payment processing, phone number provisioning, and compliance documentation all require Canada-specific solutions. Bilingual operations (English/French) are essential for Quebec-based campaigns.

Australia and New Zealand: High-Value English-Speaking Markets

Australia and New Zealand present attractive opportunities for English-speaking operators due to language compatibility, sophisticated financial services sectors, and high per-capita consumer spending.

Australian Market. Australia’s Privacy Act 1988, governed by the Australian Privacy Principles (APPs), applies to organizations with annual turnover exceeding $3 million AUD. Insurance, mortgage, and solar verticals are well-developed with established buyer networks. The market is dominated by a few major platforms and networks, making buyer access critical. CPLs for insurance leads range from $40-120 AUD depending on vertical and quality.

Time Zone Challenges. The 14-18 hour time difference from US East Coast creates operational complexity. Real-time lead delivery to US-based buyers is impractical for live transfer models. Data lead models with 24-48 hour contact windows perform better.

Do Not Call Registry. Australia operates a federal Do Not Call Register with significant penalties for violations. Unlike the US, registration is free for consumers and compliance verification is mandatory before any telemarketing contact.

Latin America: High Growth with High Volatility

Latin American markets show strong growth but present significant operational complexity including currency volatility, payment challenges, and varying regulatory frameworks.

Brazil. The largest Latin American market operates under Lei Geral de Protecao de Dados (LGPD), which closely mirrors GDPR. Consent must be “free, informed, and unequivocal.” Brazil’s National Data Protection Authority (ANPD) has already taken enforcement action against telemarketing firms for improper data practices. Fines can reach 2% of annual revenue, capped at R$50 million per violation (approximately $10 million USD). The Brazilian insurance and financial services markets are substantial, but payment collection from Brazilian buyers requires local infrastructure or partners.

Mexico. Strong potential in insurance, solar, and home services. Mexico’s Federal Law on Protection of Personal Data governs lead generation activities. The market is less mature than Brazil, creating opportunity but also infrastructure challenges. US-Mexico cross-border operations benefit from geographic proximity and USMCA trade framework.

Argentina, Chile, Colombia. Developing markets with specific vertical opportunities. Currency volatility makes pricing and margin management complex. Local partners are typically essential for buyer access and payment collection.

Asia-Pacific: Fastest Growth, Highest Complexity

Asia-Pacific represents the fastest-growing lead generation region globally, but also presents the most complexity for Western operators.

India. The world’s largest English-speaking digital market with over 800 million internet users. India’s Personal Data Protection Bill (PDPB) establishes a comprehensive framework modeled on GDPR. B2B lead generation performs well, particularly for software and professional services. Consumer verticals face challenges from income levels and buyer sophistication.

Southeast Asia (Singapore, Malaysia, Thailand, Philippines, Vietnam, Indonesia). Rapidly developing markets with varying regulatory frameworks. Singapore operates sophisticated data protection under the Personal Data Protection Act (PDPA). Other markets range from developing to minimal regulation. The Philippines’ English proficiency makes it attractive for lead generation operations, though buyer networks are less developed.

Japan and South Korea. Sophisticated markets with strong local competition. Entering requires significant localization investment and typically local partnerships. The opportunity exists but entry barriers are high.

China. Effectively inaccessible for foreign lead generation operations due to regulatory restrictions, internet control, and market structure. Ignore for practical purposes.

Regulatory Deep Dive: What You Need to Know

International lead generation lives or dies on compliance. Unlike the US, where TCPA violations primarily create civil liability, international regulatory violations can trigger criminal penalties, market exclusion, and company-ending fines. Understanding the major frameworks is essential.

GDPR: The Global Standard

The European Union’s General Data Protection Regulation (GDPR) has become the de facto global standard for data protection legislation. Even if you never operate in Europe, understanding GDPR matters because most modern privacy laws worldwide are modeled on its principles.

Lawful Basis for Processing. GDPR requires a lawful basis for processing personal data. For lead generation, two bases are relevant: consent and legitimate interest.

Consent under GDPR must be “freely given, specific, informed, and unambiguous.” Pre-checked boxes are prohibited. Silent consent is prohibited. Consent must be as easy to withdraw as to give. The burden of proving valid consent falls entirely on the data controller.

Legitimate interest can theoretically justify some lead generation activities, but requires documented balancing tests demonstrating that your interest does not override the individual’s rights. Most regulators view lead generation with skepticism under legitimate interest claims.

Consent Requirements. GDPR consent for marketing purposes must be:

- Separate from other terms and conditions

- Clear about what the individual is consenting to

- Specific about which organizations will contact them

- Documented with evidence of when, how, and what was consented to

- Withdrawable at any time with immediate effect

The practical implication: vague disclosure language that works under TCPA does not work under GDPR. You cannot obtain consent to “share with partners” without identifying those partners. You cannot obtain blanket consent for multiple purposes without separate opt-ins for each purpose.

Data Subject Rights. GDPR grants individuals extensive rights including access, rectification, erasure (“right to be forgotten”), data portability, and objection to processing. Lead generation operations must have systems to honor these requests within one month.

Penalties. Maximum fines reach 20 million euros or 4% of global annual revenue, whichever is higher. Individual compensation claims are also available. Major penalties have been issued, including a 746 million euro fine against Amazon (2021) and numerous penalties in the tens of millions against other organizations.

LGPD: Brazil’s Comprehensive Framework

Brazil’s Lei Geral de Protecao de Dados (LGPD), effective September 2020, establishes a GDPR-like framework with some distinctions.

Consent Standard. LGPD requires “free, informed, and unequivocal” consent. Unlike GDPR, LGPD explicitly allows sensitive data processing for specific purposes including protection of life and regulatory compliance.

Enforcement Reality. Brazil’s National Data Protection Authority (ANPD) has moved from guidance to enforcement. The ANPD’s first enforcement action targeted a telemarketing firm distributing voter data without proper legal basis. This signals regulatory focus on lead generation specifically.

Penalties. Fines can reach 2% of annual revenue in Brazil, capped at R$50 million (approximately $10 million USD) per violation. Daily penalties, data blocking, and processing suspension are also available remedies.

Data Breach Notification. Controllers must notify the ANPD and affected data subjects within 3 business days of confirming a security incident (per Resolution CD/ANPD No. 15/2024).

Practical Implications. Operating in Brazil requires:

- Documented lawful basis for all processing

- Clear disclosure of data sources and purposes

- Easy opt-out mechanisms for marketing

- Verification of third-party data supplier compliance

- Awareness of state-level “do-not-spam” registries

PIPEDA and CASL: Canadian Requirements

Canada’s regulatory framework combines general data protection (PIPEDA) with specific anti-spam legislation (CASL).

PIPEDA Principles. Canada’s framework emphasizes ten fair information principles:

- Accountability

- Identifying purposes

- Consent

- Limiting collection

- Limiting use, disclosure, and retention

- Accuracy

- Safeguards

- Openness

- Individual access

- Challenging compliance

For lead generation, the consent and purpose limitation principles are most critical. Organizations must identify purposes before or at the time of collection and cannot use information for new purposes without additional consent.

CASL Requirements. Canada’s Anti-Spam Legislation applies to commercial electronic messages (email, SMS, social media messages). Key requirements:

- Express consent required before sending commercial messages

- Clear identification of sender in every message

- Unsubscribe mechanism required in every message

- Consent must include specific identification of the organization

- Implied consent is limited and time-bound

CASL penalties reach $10 million CAD for organizations and $1 million CAD for individuals. Unlike US CAN-SPAM, CASL allows private right of action, meaning recipients can sue for violations.

Australian Privacy Principles

Australia’s Privacy Act establishes 13 Australian Privacy Principles (APPs) governing personal information handling.

Collection Limits. Organizations may only collect personal information reasonably necessary for their functions. This limits the scope of data fields in lead forms.

Use and Disclosure. Information can generally only be used for the primary purpose for which it was collected. Secondary purposes require consent or fall within specific exceptions.

Direct Marketing. APP 7 specifically addresses direct marketing. Organizations must provide a simple opt-out mechanism. If information was collected from a third party (lead purchased from another source), the first direct communication must include the source of the information.

Do Not Call Register. Australia’s Do Not Call Register prohibits telemarketing calls to registered numbers. Unlike the US, registration is free for consumers and compliance checking is mandatory. Violations can result in penalties up to $2.2 million AUD per day.

UK PECR and Post-Brexit Framework

The UK operates under a modified GDPR (UK GDPR) plus the Privacy and Electronic Communications Regulations (PECR) for marketing communications.

PECR Electronic Marketing Rules. PECR requires consent for:

- Marketing calls using automated dialing systems

- Marketing calls to individuals registered with the Telephone Preference Service (TPS)

- Marketing text messages

- Marketing emails (with limited B2B exception)

Telephone Preference Service. The TPS is the UK’s do-not-call registry. Unlike the US DNC, there is no cost to consumers for registration. Organizations must screen against TPS before any live marketing calls to individuals. Corporate subscribers can register with the Corporate TPS (CTPS).

Enforcement. The Information Commissioner’s Office (ICO) enforces both UK GDPR and PECR. Fines for PECR violations can reach 500,000 GBP under the older framework, while UK GDPR violations can trigger the higher GDPR-level penalties.

Operational Considerations for International Expansion

Beyond regulatory compliance, successful international lead generation requires addressing operational challenges that don’t exist in purely domestic operations.

Technology Infrastructure

Lead Distribution Platforms. Most US-based lead distribution platforms (boberdoo, LeadsPedia, Phonexa) support international operations with varying levels of capability. Key considerations include:

- Multi-currency support for pricing and billing

- International phone number validation

- Multi-language interface for international team members

- Compliance documentation appropriate to local requirements

- Time zone handling for caps, routing, and reporting

Phone Number Provisioning. International phone operations require local phone numbers for each market. Providers like Twilio, Vonage, and local alternatives offer number provisioning, but costs and capabilities vary. Some countries restrict who can provision numbers or require local business registration.

Payment Processing. Collecting payments from international buyers and paying international suppliers requires multi-currency capability. Payment terms may differ from US norms. Wire transfers remain common for larger transactions. Currency conversion timing can significantly impact margins.

Data Storage and Processing. GDPR and similar frameworks often require data to be processed or stored within specific geographic boundaries. Cloud infrastructure selection matters. Using US-based servers to process EU data may violate data transfer requirements.

Team Structure and Capabilities

International operations require capabilities that purely domestic operations do not:

Language. Operating in non-English markets requires native language capability for customer service, quality assurance, and buyer relations. Translation is not sufficient; cultural nuance matters.

Time Zones. Real-time operations (live transfers, immediate follow-up) become complex across time zones. A 12-hour time difference means your prime selling hours are someone else’s middle of the night.

Local Knowledge. Understanding local market dynamics, buyer expectations, vertical-specific regulations, and cultural norms requires people with direct market experience. Hiring local talent or partnering with local experts is typically essential.

Legal Support. International compliance requires legal counsel with jurisdiction-specific expertise. US attorneys generally cannot advise on GDPR compliance. Build relationships with qualified counsel in each market before beginning operations.

Buyer Development

Finding and developing buyers in international markets presents challenges:

Network Access. US lead generation operators benefit from established buyer networks built over decades. International markets may lack equivalent network infrastructure, requiring more direct buyer development effort.

Buyer Sophistication. Buyer expectations vary by market. Some international buyers have sophisticated lead buying operations comparable to major US buyers. Others are new to purchased leads and require education on quality standards, pricing, and operational requirements.

Payment Reliability. Payment risk varies significantly by market and buyer type. Established public companies pay reliably. Smaller private buyers may present collection challenges, especially in markets with weaker commercial legal frameworks.

Relationship Building. Many international markets place higher emphasis on relationship-based business than transactional US models. Building buyer relationships may require more time investment, in-person meetings, and ongoing relationship maintenance.

Currency and Financial Considerations

Exchange Rate Exposure. Revenue in foreign currencies creates exchange rate risk. A 10% currency movement can eliminate margins on international campaigns. Hedging strategies exist but add complexity and cost.

Transfer Pricing. Multi-entity international structures create transfer pricing considerations. Tax authorities in multiple jurisdictions may scrutinize intercompany transactions. Proper structure and documentation are essential.

Banking Infrastructure. Opening bank accounts in foreign jurisdictions can be difficult for foreign entities. Multi-currency business accounts from providers like Wise, Mercury, or traditional banks with international capability help manage international financial operations.

VAT and GST. Most countries outside the US impose value-added tax (VAT) or goods and services tax (GST) on commercial transactions. Understanding when and how these taxes apply to lead generation transactions, and managing related compliance obligations, adds complexity.

Vertical Opportunities by Region

Lead generation vertical economics vary significantly by region. Understanding which verticals work where helps prioritize market entry decisions.

Insurance

Insurance lead generation exists in every developed market, but market structure varies:

UK and Europe. Price comparison sites (compare-the-market.com, comparethemarket.com, check24.de) dominate insurance lead generation. Entering as a lead generator typically means supplying these platforms or building direct-to-consumer operations that compete with established players.

Australia. The insurance market is concentrated among a few major carriers and comparison sites. iSelect and comparethemarket.com.au are dominant. CPLs range from $40-120 AUD depending on product line.

Canada. Provincial regulation creates complexity. Auto insurance lead generation works differently in each province. Life and health insurance markets show opportunity.

Latin America. Growing insurance penetration creates lead generation opportunity, particularly in Brazil and Mexico. Market immaturity means less competition but also less buyer sophistication.

Financial Services

Mortgage and Lending. Mortgage lead generation works wherever developed mortgage markets exist. UK, Australia, and Canada all have active mortgage lead buyers. Market cycles differ from US cycles, creating diversification value.

Personal Loans. Strong performance in UK and Australian markets. Regulatory scrutiny varies; some markets heavily restrict lead generation for high-cost credit products.

Credit Cards. Opportunity exists but affiliate models (CPA on approved applications) typically outperform lead generation models.

Home Services

Solar. Solar lead generation works wherever residential solar markets exist. Australia and Germany show strong potential. UK solar incentives have fluctuated, affecting market economics.

Home Improvement. Remodeling, HVAC, and similar services show potential in developed markets with aging housing stock. UK home improvement lead generation is active.

Moving Services. Cross-border opportunity for international moving leads connecting consumers with service providers.

B2B Lead Generation

B2B lead generation often works better internationally than consumer verticals due to:

- Language barriers are lower in business contexts (English as business lingua franca)

- Transaction values are higher, justifying higher acquisition costs

- Buyer sophistication tends to be higher

- Regulatory burden is sometimes lighter (e.g., GDPR consent requirements have B2B carve-outs in some cases)

Software, professional services, and industrial supply verticals show strong international B2B lead generation performance.

Building Your International Expansion Strategy

International expansion should be systematic rather than opportunistic. A structured approach reduces risk and increases probability of success.

Phase 1: Market Selection (Months 1-2)

Evaluate potential markets against criteria including:

- Market size and growth trajectory

- Regulatory complexity and compliance cost

- Language requirements and team capability

- Existing relationships or entry points

- Competitive landscape

- Buyer accessibility

Prioritize 2-3 markets for initial focus. Trying to enter too many markets simultaneously diffuses resources and reduces success probability.

Phase 2: Regulatory and Structural Preparation (Months 2-4)

Before generating leads, establish:

- Legal entity structure (local entity vs. cross-border operation)

- Regulatory compliance framework for each market

- Banking and payment infrastructure

- Technology platform configuration

- Compliance documentation templates

- Legal counsel relationships

This phase requires investment before revenue. Rushing past it creates liability exposure.

Phase 3: Pilot Operations (Months 4-8)

Launch limited operations to test:

- Traffic source performance in new markets

- Conversion rates and quality metrics

- Buyer response and relationship development

- Operational processes and team capability

- Financial performance and margin reality

Pilots should be small enough to limit exposure but large enough to generate meaningful data. Target 100-500 leads per market to validate assumptions.

Phase 4: Scale and Optimization (Months 8-18)

Based on pilot learnings, scale successful markets:

- Increase traffic investment in performing sources

- Expand buyer relationships

- Optimize operational efficiency

- Build local team capability

- Develop market-specific competitive advantages

Expect 12-18 months to reach meaningful scale in new international markets. Faster timelines typically indicate insufficient compliance preparation or unsustainable practices.

Common Mistakes in International Lead Generation

Learning from others’ mistakes accelerates your path to success.

Mistake 1: Assuming US Playbooks Transfer Directly

US lead generation practices do not work everywhere. Consent standards, communication norms, and buyer expectations vary. What converts in the US may fail or create liability internationally.

The Fix. Research each market specifically. Consult local experts. Test assumptions rather than extrapolating from US experience.

Mistake 2: Underestimating Compliance Complexity

Operators routinely underestimate the time, cost, and ongoing effort required for international compliance. “We’ll figure it out as we go” leads to violations, penalties, and forced market exit.

The Fix. Invest in compliance infrastructure before generating revenue. Budget 15-25% of expected international revenue for compliance-related costs in early phases.

Mistake 3: Ignoring Language and Cultural Differences

Machine translation of landing pages, forms, and communications creates poor user experience and can generate invalid consent under strict regulatory frameworks. Cultural misalignment damages conversion rates and brand perception.

The Fix. Invest in native language capability. Localize rather than translate. Understand cultural norms around privacy, communication, and commercial relationships.

Mistake 4: Inadequate Buyer Development

Some operators assume that generating quality leads will automatically attract buyers. International buyer networks are less developed than US networks. Buyers may be harder to find, less sophisticated, or slower to onboard.

The Fix. Begin buyer development before or concurrent with traffic testing. Build relationships proactively. Accept that buyer development may take longer than anticipated.

Mistake 5: Underpricing Currency and Financial Risk

Currency fluctuations, payment delays, and collection challenges can eliminate margins on otherwise profitable operations. Practitioners who price without buffer for these risks often discover profitability was illusory.

The Fix. Build margin buffer into international pricing (5-10% above break-even). Consider currency hedging for significant exposure. Require shorter payment terms or prepayment from new international buyers.

Frequently Asked Questions

What is the best country to start international lead generation?

Canada is typically the easiest entry point for US-based operators due to language overlap, cultural similarity, and integrated economies. The UK is the second choice for English-language operations. Both markets have mature buyer networks and familiar operational patterns. However, “best” depends on your existing capabilities, vertical focus, and strategic objectives.

How does GDPR affect lead generation differently than TCPA?

GDPR focuses on data protection and processing rights, while TCPA focuses specifically on telemarketing contact. GDPR requires a lawful basis (typically explicit consent) for collecting and processing personal data, with strict requirements around what consent means. TCPA regulates how and when you can contact people by phone or text. Operating in Europe requires GDPR compliance for data handling plus additional rules (like PECR in the UK) for marketing communications. GDPR penalties can reach 4% of global revenue, significantly higher than typical TCPA exposure.

Can I sell US-generated leads to international buyers?

Yes, but with caveats. The lead must have been generated with consent that covers the intended use, including contact by the international buyer. Cross-border data transfer rules may apply (GDPR restricts transfers outside the EU without appropriate safeguards). The buyer must comply with their local regulations regarding how they contact the lead. Practically, this works best for B2B leads or high-value consumer transactions where the complexity is justified.

What are typical CPL benchmarks in international markets?

International CPLs typically run 20-40% lower than equivalent US verticals, though this varies significantly by market and vertical. UK insurance leads range from $25-80 USD equivalent. Australian mortgage leads run $50-150 AUD. Brazilian insurance leads may be $15-40 USD equivalent. These benchmarks are approximate and shift with market conditions, competition, and currency movements.

Do I need a local entity to operate lead generation in another country?

It depends on the jurisdiction and scale of operations. Some countries require local presence for certain activities. GDPR requires a representative in the EU if you process EU data without EU establishment. Practical considerations often favor local entities: local banking, contract enforceability, tax efficiency, and regulatory relationships all benefit from local presence. For pilot operations, cross-border operation may be acceptable; for scaled operations, local entities are typically advisable.

How do I find lead buyers in international markets?

Start with US buyers who have international operations. Many insurance carriers, mortgage lenders, and service providers operate internationally and may buy leads in multiple markets. Industry conferences with international attendance (LeadsCon, Affiliate Summit, Performance Marketing Insights) provide networking opportunities. LinkedIn and targeted outreach can identify potential buyers. Local industry associations and publications often list active market participants.

What technology changes are needed for international lead generation?

Key technology requirements include: multi-currency pricing and billing, international phone number validation (different formats per country), data storage compliant with local requirements (EU data in EU facilities), consent documentation meeting local standards, time zone handling for routing and caps, and multi-language support for team operations. Most major lead distribution platforms support international operations, but configuration is required.

Is international lead generation more profitable than domestic?

It can be, but not automatically. Lower CPLs often come with lower conversion rates, longer payment cycles, and additional operational costs. Currency exposure adds risk. Compliance costs are higher. Those who achieve superior international margins typically have: lower customer acquisition costs due to less competition, strong buyer relationships providing pricing power, efficient operational infrastructure, and disciplined risk management. Simply expanding internationally does not guarantee improved profitability.

How long does it take to become profitable in a new international market?

Expect 12-18 months to reach profitability in a new international market, assuming adequate preparation and investment. This timeline includes: regulatory preparation (2-4 months), pilot operations (4-6 months), optimization and scaling (6-12 months). Faster timelines typically indicate either exceptional market fit and execution, or insufficient compliance preparation that creates future liability.

What are the biggest regulatory risks in international lead generation?

GDPR enforcement presents the largest financial risk, with penalties up to 4% of global revenue or 20 million euros. Brazil’s LGPD can impose processing suspensions that effectively shut down operations. CASL violations in Canada can reach $10 million CAD. Beyond financial penalties, regulatory action can trigger market exclusion, reputational damage, and buyer loss. The risk is not theoretical: major penalties have been issued, enforcement is increasing, and lead generation specifically has drawn regulatory attention in multiple jurisdictions.

Key Takeaways

-

International markets represent approximately 60% of global lead generation opportunity, with growth rates exceeding US markets in regions like Asia-Pacific (12%+ CAGR) and less competitive density in most verticals.

-

GDPR, LGPD, PIPEDA, and other international frameworks impose stricter requirements than US TCPA, with explicit consent standards, broader data subject rights, and penalties reaching 4% of global revenue. Compliance is not optional.

-

Canada and the UK offer the most accessible entry points for US operators due to language overlap and mature buyer networks, while Latin America and Asia-Pacific present higher growth potential with greater operational complexity.

-

Successful international expansion requires 12-18 months of systematic market selection, regulatory preparation, pilot operations, and scaling. Rushing creates compliance liability and operational failures.

-

Technology infrastructure, local team capability, buyer development, and currency management present operational challenges beyond pure regulatory compliance. Each requires investment before revenue.

-

Common mistakes include assuming US playbooks transfer, underestimating compliance costs, ignoring language and cultural differences, and underpricing currency and financial risk. Learn from others’ failures rather than repeating them.

-

Vertical performance varies by region. Insurance and financial services work in most developed markets. Solar follows incentive structures. B2B lead generation often transfers more easily than consumer verticals due to English as business language and higher transaction values.

Regulatory information current as of December 2025. Consult qualified legal counsel in each jurisdiction before beginning operations. This article does not constitute legal advice.