Apply the Jobs-to-be-Done framework to lead generation – understand what buyers really need, identify unmet needs, and build products that help buyers accomplish their actual jobs.

The lead generation industry operates on a fundamental misunderstanding. Operators build products around leads – lead volume, lead quality, lead types, lead pricing. Buyers purchase these leads and feed them into their sales processes. But this product-centric view obscures what’s actually happening: buyers aren’t purchasing leads at all. They’re hiring leads to get a job done.

Theodore Levitt, the legendary Harvard marketing professor, made this distinction famous: “People don’t want a quarter-inch drill; they want a quarter-inch hole.” Tony Ulwick, who developed the Jobs-to-be-Done (JTBD) framework, pushed further: people don’t even want the hole. They want a picture hanging on their wall. They want the feeling of a beautiful living room.

For lead generation, the parallel is precise: insurance agents don’t want leads. They want clients. They want revenue. They want a sustainable book of business that generates renewals and referrals. Mortgage brokers don’t want aged leads at $3 each – they want funded loans that earn commissions. Solar installers don’t want Facebook leads – they want rooftops with contracts signed.

When operators understand the jobs their buyers are actually trying to accomplish, everything changes. Product decisions align with buyer success. Marketing messaging resonates because it speaks to real problems. Pricing reflects value delivered rather than costs incurred. Competition becomes less about lead quality comparisons and more about which operation helps buyers get their jobs done better.

What Is the Jobs-to-be-Done Framework?

Jobs-to-be-Done originated with Tony Ulwick, founder of the innovation consulting firm Strategyn, in the early 1990s. His insight came from applying Six Sigma thinking to innovation: if you could define exactly what customers were trying to accomplish (independent of any product), you could systematically create solutions that helped them accomplish it better.

Ulwick’s first major success using this methodology came in 1992 with Cordis Corporation, a maker of angioplasty balloons. By focusing on the jobs surgeons were trying to get done rather than the features of existing products, Cordis increased its market share from 1% to over 20%. Stock price quadrupled.

Clayton Christensen of Harvard Business School later popularized the framework, famously declaring: “Your customers are not buying your products. They are hiring them to get a job done.”

The core principle is deceptively simple: products come and go, but underlying jobs persist. Consider the job of “listening to music on the go.” Over decades, customers have hired vinyl records, cassette tapes, CDs, MP3 players, and streaming services. Each product was “fired” when something better came along. But the job never changed.

This stability is what makes JTBD powerful for strategy. If you define your market as “MP3 players,” you build a roadmap for a dying product. If you define your market as “helping people listen to music on the go,” you see streaming coming and position accordingly. Microsoft defined their market as “competing with iPods” and lost $300 million on the Zune. Pandora defined their market as “helping people create a mood with music” and signed up 90,000 new users per day.

For lead generation, the equivalent trap is defining the market as “leads” rather than understanding the jobs buyers actually need to accomplish.

The Three Types of Customers in Every Lead Transaction

JTBD distinguishes between three customer types, and getting this wrong is fatal for lead gen operators:

The Job Beneficiary

This is the person who ultimately benefits from the job getting done. In lead generation, the job beneficiary is typically the salesperson who closes deals and earns commissions. Their job is something like “acquire customers to build a sustainable book of business” or “close enough deals to exceed quota.”

The job beneficiary cares deeply about whether leads convert into revenue. They experience the emotional frustration of bad leads and the satisfaction of good ones directly.

The Job Executor

The job executor helps get the job done on behalf of the beneficiary. In many lead gen contexts, this is an inside sales rep, appointment setter, or call center that works leads before passing qualified opportunities to the closer. In smaller operations, the beneficiary and executor are the same person.

Executors care about different things than beneficiaries. They want leads that answer phones, pick up calls, and engage in conversation. Whether those conversations ultimately convert is often someone else’s problem.

The Purchase Decision Maker

The purchase decision maker controls the budget and approves lead purchases. In small agencies, this is the same person as the beneficiary. In larger operations, it’s a manager, marketing director, or owner who evaluates lead ROI at the aggregate level rather than the individual lead level.

Purchase decision makers care about metrics: cost per acquisition, return on ad spend, lead-to-close ratios. They’re evaluating your leads against every other customer acquisition method.

Why this distinction matters:

Operators who build products for job executors (call center agents) may miss features critical for job beneficiaries (the closers). Operators who optimize for purchase decision maker metrics (cost per lead) may inadvertently harm job beneficiaries (lead quality drops).

The risk is concrete: if you target the wrong customer type, competitors who target the right one will take market share. Before SaaS products existed, CRM software required IT departments (job executors) to install and maintain it for salespeople (job beneficiaries). Once cloud-based CRMs emerged, IT became unnecessary. Companies that built for IT found themselves disrupted.

In lead gen, consider aged lead products. The purchase decision maker sees $2/lead as superior to $40/lead for fresh exclusive. But the job beneficiary knows aged leads at $2 convert at rates that make the effective cost per acquisition higher than fresh leads at $40. When operators align with beneficiaries rather than just decision makers, they build more defensible businesses.

Mapping the Lead Buyer’s Job: Eight Steps

Every job, regardless of industry, moves through eight sequential steps. Understanding where lead buyers struggle at each step reveals opportunities for operators to add value.

Step 1: Define

The buyer determines what they need to accomplish and why it matters.

For lead buyers, this might be: “I need 50 new auto policies this month to hit bonus,” or “I need to fill my appointment calendar with refinance prospects to close $2M in loans this quarter.”

Where buyers struggle at this step:

- Unclear on what lead volume they need for their conversion rates

- Uncertain how many opportunities they can realistically work

- Fuzzy on whether leads or other acquisition methods will best accomplish their goal

Operator opportunities:

- Calculators that help buyers determine appropriate lead volume based on their metrics

- Educational content on typical conversion rates by vertical and lead type

- Consultation during onboarding to right-size initial lead orders

Step 2: Locate

The buyer researches and gathers resources needed to get the job done.

For lead buyers, this involves identifying lead sources, comparing vendors, reading reviews, and requesting sample leads or trial campaigns.

Where buyers struggle at this step:

- Overwhelming number of lead vendors with similar claims

- Difficulty evaluating quality before purchasing

- Limited transparency on where leads actually originate

- Past negative experiences creating skepticism about all vendors

Operator opportunities:

- Clear, verifiable transparency about lead sources and generation methods

- Risk-free trials or performance guarantees that reduce evaluation burden

- Case studies with specific metrics from similar buyers that demonstrate customer experience excellence

- Industry presence (reviews, testimonials, forum participation) that builds credibility

Step 3: Prepare

The buyer sets up the environment to work leads effectively.

For lead buyers, preparation includes CRM configuration, lead routing rules, dialer setup, scripts development, and staff training.

Where buyers struggle at this step:

- Complex integration requirements with existing systems

- Time investment required before seeing any results

- Training needs for new lead types or verticals

- Establishing follow-up sequences and automation

Operator opportunities:

- Pre-built integrations with common CRMs and dialers

- Templates and playbooks for working specific lead types

- Done-for-you setup services

- Onboarding support that accelerates time to first conversion

Step 4: Confirm

Before starting the job, the buyer ensures everything is ready.

For lead buyers, confirmation means verifying that lead delivery works, that CRM captures data correctly, that staff knows the process, and that tracking is in place to measure results.

Where buyers struggle at this step:

- Anxiety about whether large purchases will perform

- Difficulty testing systems end-to-end before going live

- Concerns about lead authenticity and data accuracy

- Need for validation that spend will generate return

Operator opportunities:

- Test lead delivery to verify integration before live campaigns

- Verification features that confirm lead authenticity (TrustedForm, phone validation)

- Staging periods where buyers can evaluate quality before scaling

- Performance benchmarks that set realistic expectations

Step 5: Execute

The buyer performs the job – working leads to generate opportunities and closed deals.

For lead buyers, execution is calling, texting, emailing, presenting, following up, and closing. This is where the lead either works or doesn’t.

Where buyers struggle at this step:

- Leads that don’t answer, aren’t interested, or misrepresented intent

- Timing issues – leads received when buyer can’t immediately work them

- Data quality problems – wrong numbers, incomplete information

- Competition from other buyers working the same leads simultaneously

Operator opportunities:

- Lead verification and validation before delivery

- Delivery timing aligned with buyer availability

- Data enrichment that provides complete, accurate contact information

- Exclusive distribution that eliminates competition anxiety

- Real-time delivery that enables immediate contact

Step 6: Monitor

The buyer checks progress to ensure things are going as planned.

For lead buyers, monitoring means tracking contact rates, appointment rates, conversion rates, and calculating true ROI by lead source, type, and time period.

Where buyers struggle at this step:

- Limited visibility into what happens after leads are delivered

- Difficulty attributing conversions back to specific leads or campaigns

- Manual tracking that’s time-consuming and error-prone

- Delayed feedback loops that prevent timely optimization

Operator opportunities:

- Dashboard reporting showing lead performance metrics

- Disposition tracking integrated with lead delivery

- Conversion attribution features

- Alerts when lead performance deviates from expectations

- Comparative benchmarking against similar buyers

Step 7: Modify

If monitoring indicates problems, the buyer adjusts their approach.

For lead buyers, modification might mean changing lead filters, adjusting volume, switching verticals, revising scripts, or training staff differently.

Where buyers struggle at this step:

- Uncertainty about what’s causing poor performance

- Difficulty distinguishing lead quality issues from sales process issues

- Time lag between making changes and seeing results

- Lack of data to inform adjustment decisions

Operator opportunities:

- Diagnostic tools that help identify performance root causes

- A/B testing capabilities for different lead types or filters

- Responsive account management that helps troubleshoot problems

- Flexible campaign adjustments without penalties

- Transparent data that enables informed optimization

Step 8: Conclude

The buyer completes the job and assesses outcomes.

For lead buyers, conclusion means closing out campaigns, calculating final ROI, deciding whether to continue purchasing, and determining next steps.

Where buyers struggle at this step:

- Extended sales cycles that delay final attribution

- Difficulty isolating lead contribution from other marketing efforts

- Decision fatigue from evaluating multiple lead sources

- Pressure to justify lead spend to management

Operator opportunities:

- Long-tail conversion tracking for extended sales cycles

- Clear reporting that enables lead performance justification

- Win-back programs for lapsed buyers who may reconsider

- Success documentation for internal stakeholder communication

Identifying Unmet Needs: Where Buyers Struggle Most

Unmet needs emerge when buyers struggle to accomplish a step quickly and accurately. Quantifying these unmet needs reveals the highest-value opportunities for product innovation.

The process works like this:

- Define the job and job steps for your target buyer segment

- For each step, identify the customer needs (actions + variables)

- Survey buyers to measure how difficult each need is to satisfy

- Prioritize needs with high difficulty scores as innovation opportunities

For example, within the “Execute” step of working leads, a buyer need might be: “Determine whether the prospect is genuinely interested in the product” (action = determine, variable = genuine interest level).

If 75% of buyers say this is difficult to accomplish quickly and accurately, you’ve found an unmet need. Solutions might include:

- Intent verification before lead delivery

- Recorded verbal consent demonstrating interest

- Pre-qualification questions that filter low-intent inquiries

- Intent scoring based on behavioral signals

This is fundamentally different from asking buyers what features they want. Buyers don’t always know what features would help – Henry Ford’s “faster horse” problem. But they absolutely know where they struggle. JTBD systematically uncovers those struggles and translates them into product opportunities.

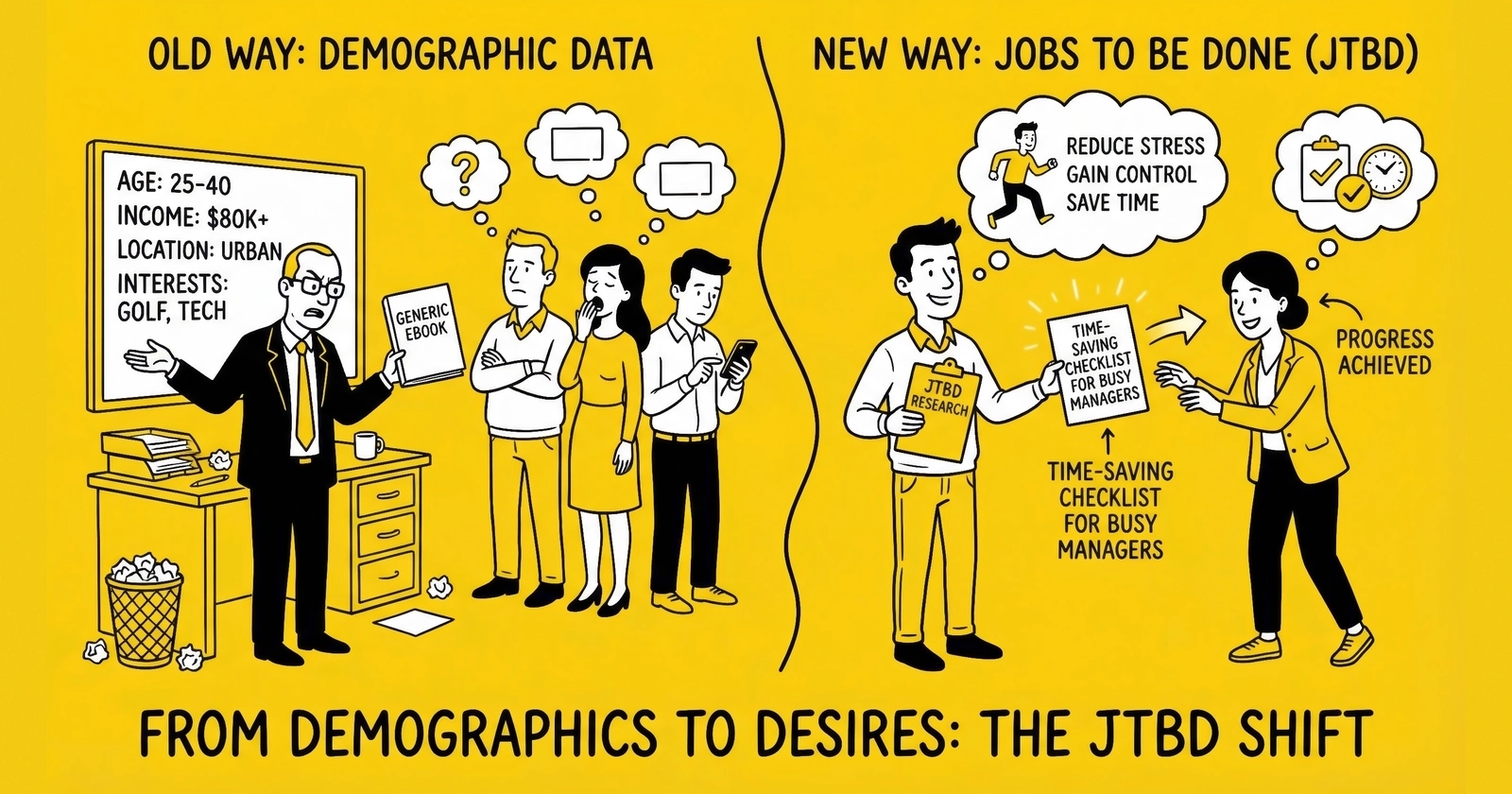

Segmenting by Struggle, Not Demographics

Traditional segmentation in lead gen relies on demographics: solo agents vs. agency owners, Medicare vs. P&C, urban vs. rural. But demographic buyer personas alone don’t predict which buyers will pay for your solution or how much they’ll value it.

JTBD segments by unmet needs – which customers struggle the most with specific job steps, regardless of their demographic characteristics.

Consider two very different lead buyers:

Buyer A: 25-year-old inside sales rep at a national solar company in Phoenix, works 100+ leads per day, paid on appointment setting metrics.

Buyer B: 55-year-old independent insurance agent in rural Ohio, works 20 leads per week, evaluates every lead personally before calling.

Demographically, these buyers look nothing alike. Traditional segmentation would place them in entirely different categories.

But what if both struggle with the same unmet need: “Determine the optimal time to contact each prospect”?

Both buyers waste effort calling at suboptimal times. Both would value a solution that tells them when specific prospects are most likely to answer. Both would pay for this capability because it directly addresses their struggle.

This is the power of needs-based segmentation. The underserved segment cuts across demographics. An operator who builds optimal contact time intelligence serves both buyers – and every buyer in between who shares that struggle.

To implement needs-based segmentation:

- Survey a broad sample of buyers across demographics

- Measure difficulty scores for all needs across job steps

- Use statistical clustering to identify groups with similar unmet need profiles

- Profile these groups to understand what characteristics correlate (if any)

- Target the segment with highest unmet need scores and willingness to pay

The resulting segments often surprise operators. The “struggling” segment might include both novice buyers (who lack experience) and high-volume operations (where scale amplifies small inefficiencies). Building for this segment – rather than arbitrarily chosen demographics – generates more growth.

Job Statements: Defining What Buyers Actually Want

A job statement crystallizes the job in precise language that the entire organization can align around. The format is:

[Verb] + [Object] + [Context]

Examples for lead buyers:

- “Acquire customers profitably in the Medicare supplement market”

- “Convert internet-generated leads into scheduled in-home appointments”

- “Build a book of business that generates renewal income within three years”

- “Close enough deals monthly to support my family without cold calling”

Notice what’s absent from these statements: products. There’s no mention of leads, lead types, or lead vendors. The job statement focuses purely on what the buyer is trying to accomplish.

This matters because job statements enable operators to identify all the ways buyers currently get the job done – including methods that don’t involve purchased leads:

- Referral networks from existing clients

- Community involvement and local marketing

- Cold calling purchased lists

- Door knocking

- Digital advertising run by the buyer

- Social media lead generation

- Direct mail campaigns

All of these compete with your lead product. They’re all “hired” to accomplish the same job. Understanding this competitive landscape – which extends far beyond other lead vendors – enables more effective positioning and product development.

If a buyer can accomplish their job through referrals better than through purchased leads, they won’t purchase leads regardless of quality or price. The operator’s task isn’t convincing them that leads are better – it’s understanding why referrals work better for their specific job context and either improving leads to compete or targeting buyers for whom leads are actually the superior solution.

Emotional Jobs: What Buyers Want to Feel

JTBD recognizes that every functional job has emotional and social components. Buyers don’t just want to accomplish tasks – they want to feel certain ways while accomplishing them.

Common emotional jobs for lead buyers:

- Feel confident that lead spend will generate return

- Feel competent working leads effectively

- Feel in control of customer acquisition rather than dependent on unpredictable sources

- Avoid anxiety about wasted money on bad leads

- Avoid embarrassment of explaining poor ROI to managers or business partners

- Feel successful through visible growth and closed deals

- Feel secure knowing there’s a predictable pipeline of opportunities

Operators who address only functional jobs miss half the value equation. A lead product might deliver acceptable contact rates and conversion metrics while still leaving buyers feeling anxious, out of control, or incompetent. These emotional failures create churn even when functional performance is adequate.

Solutions that address emotional jobs:

Transparency and control features: Detailed source information, adjustable filters, and pause/resume capabilities reduce anxiety and increase feelings of control.

Success validation: Dashboards that highlight wins, comparisons to benchmarks, and milestone celebrations reinforce competence and success.

Risk mitigation: Guarantees, credit policies, and trial periods reduce the emotional stakes of purchasing decisions.

Support responsiveness: Fast, knowledgeable support that treats buyers as partners rather than transactions addresses feelings of being valued and understood.

Social proof: Case studies and testimonials from peers validate that success is achievable and that the buyer isn’t alone in their efforts.

Premium pricing often reflects emotional value more than functional value. Two lead products with identical contact rates and conversion metrics will command different prices if one makes buyers feel confident and in control while the other leaves them anxious and uncertain.

Competitive Analysis Through the JTBD Lens

Traditional competitive analysis compares product features: lead types, delivery methods, pricing, and geographic coverage. Feature-to-feature comparison leads to commodity thinking – if both products have the same features, they’re interchangeable except for price.

JTBD competitive analysis asks different questions:

- What job are buyers hiring competitors to do?

- Which job steps do competitors help buyers accomplish?

- Where do competitors leave needs unmet?

- How quickly and accurately do competitors help buyers complete each step?

This analysis often reveals non-obvious competitive dynamics:

A lead vendor might compete more directly with a CRM’s lead generation features than with another lead vendor. If buyers can generate leads themselves through Facebook integration with their CRM, that CRM is competing for the same job – even though it looks nothing like a lead product.

Competitor weaknesses become visible at the job step level. Maybe a competitor delivers great leads (Execute step) but provides no performance tracking (Monitor step). Buyers who need monitoring capabilities are underserved – a segment vulnerable to an operator who addresses that need.

Speed and accuracy are the metrics that matter for competitive comparison. At each job step:

- How quickly does the competitor’s solution help buyers accomplish the step?

- How accurately does the solution accomplish what buyers need?

A competitor might satisfy a need but do so slowly (leads arrive 24 hours after submission) or inaccurately (half of lead data has errors). Each gap represents opportunity.

Microsoft’s Zune failed not because it lacked features – it had more features than iPods. It failed because it didn’t accomplish the job (creating a mood with music) any faster or more accurately than existing solutions. Streaming services won by accomplishing the job dramatically faster (no purchasing or downloading) and more accurately (algorithmic recommendations matched mood with minimal effort).

Positioning to the Job, Not the Product

Traditional lead gen positioning emphasizes product attributes:

- “Fresh, exclusive leads delivered in real-time”

- “30-day aged leads at $2 per record”

- “Medicare Advantage leads from television campaigns”

This positioning invites direct comparison on attributes – freshness, exclusivity, source, price. It commoditizes the offering.

JTBD positioning emphasizes the job and outcomes:

- “Help agents get in front of qualified prospects faster than any other method”

- “Enable mortgage professionals to hit funding targets without cold calling”

- “Give solar installers a predictable pipeline of rooftop opportunities”

This positioning speaks to what buyers actually want to accomplish. It differentiates based on job outcomes rather than product features. Competitors who continue positioning on features suddenly seem to be talking about something different entirely.

The most powerful positioning targets specific job steps where your solution excels. If your strength is the Confirm step – helping buyers verify lead quality before working leads – position around that:

“Know exactly which leads will convert before you make your first call.”

This doesn’t mention lead type, source, or price. It speaks directly to an unmet need (determining genuine interest level) at a specific job step (Confirm). Buyers who struggle with that need recognize themselves immediately.

Implementing JTBD in Lead Generation Operations

Putting JTBD into practice requires structured research and organizational commitment.

Step 1: Define Your Market as a Job

Stop thinking of your market as “leads” or even “lead buyers.” Define it as the job buyers are trying to accomplish:

“We help sales professionals acquire customers predictably and profitably.”

This definition immediately expands your competitive frame (all customer acquisition methods compete) while focusing your innovation efforts (anything that helps accomplish this job better is potentially valuable).

Step 2: Identify Your Customer Types

Map the job beneficiaries, job executors, and purchase decision makers in your target segments. Understand what each type cares about and how their incentives align or conflict.

For enterprise accounts, the structure might be:

- Job beneficiary: Field sales reps who close deals

- Job executor: Inside sales team that qualifies leads

- Purchase decision maker: VP of Sales or CMO who approves budget

For SMB accounts:

- All three roles might be the same person: an independent agent who buys, works, and closes their own leads

Build different communication strategies for each customer type.

Step 3: Map Job Steps and Identify Needs

Through buyer interviews and observation, map the eight steps for your target buyers’ jobs. Within each step, identify the specific needs – the actions and variables that determine success.

Use structured interviews asking:

- “Walk me through how you work leads from the moment they arrive.”

- “Where in this process do you get stuck or frustrated?”

- “What takes longer than it should?”

- “What information do you wish you had that you don’t?”

Document needs in the format: [Action verb] + [Variable]

- “Determine the prospect’s level of genuine interest”

- “Minimize time wasted on leads that won’t answer”

- “Ensure follow-up happens at optimal intervals”

Step 4: Quantify Unmet Needs

Survey a broad sample of buyers with questions about each need:

“How difficult is it for you to [accomplish this need]?”

Scale responses from 1-10. Aggregate results to identify which needs have highest difficulty scores across your buyer population. These high-difficulty needs are your innovation priorities.

Step 5: Segment by Struggle

Use clustering analysis to identify groups of buyers with similar unmet need profiles. Profile these segments to understand who they are and how to reach them.

Target the segments where:

- Unmet needs are highest (they’re struggling)

- Willingness to pay is demonstrated (they buy solutions)

- Your capabilities align (you can actually solve their problems)

Step 6: Build and Position Around Jobs

Develop product features that directly address high-priority unmet needs. Position those features in terms of job outcomes, not product attributes.

Instead of: “We added lead verification.” Say: “Now you’ll know which leads are worth calling before you dial.”

Instead of: “We integrated with Salesforce.” Say: “Your leads flow directly into your workflow without manual entry.”

Key Takeaways

-

Lead buyers “hire” leads to accomplish specific jobs, not to own lead data. The job is typically a form of customer acquisition – closing deals, booking appointments, or building a book of business. Understanding this reframes every product and pricing decision operators make.

-

Jobs remain stable even as products change. Agents have been trying to acquire customers for decades through classified ads, cold calling, purchased lists, and now digital leads. The underlying job doesn’t change. The products that help accomplish the job continuously evolve.

-

Three distinct customer types exist in every lead transaction: the job beneficiary (the salesperson who closes), the job executor (often an assistant or inside sales rep who works leads), and the purchase decision maker (the business owner or manager who approves budgets). Operators who confuse these roles build products that miss the mark.

-

Every job follows eight steps: Define, Locate, Prepare, Confirm, Execute, Monitor, Modify, and Conclude. Lead buyers navigate these steps whether they articulate them or not. Operators who understand which steps cause friction can build solutions that eliminate that friction.

-

Unmet needs at each job step represent product opportunities. When buyers struggle to accomplish a step – say, confirming lead authenticity before calling – operators who solve that struggle create defensible value. These unmet needs are the real roadmap for product innovation.

-

Traditional demographic segmentation fails in lead gen. A rural Medicare agent and an urban final expense producer may have identical unmet needs around working leads efficiently. Segmenting by struggle rather than demographics reveals the true target segments willing to pay for solutions.

-

Job statements follow a specific structure: [Verb] + [Object] + [Context]. For lead buyers, examples include “acquire customers profitably in my territory” or “convert internet leads into scheduled appointments.” Clear job statements focus product development on outcomes rather than features.

-

Emotional and social jobs matter alongside functional jobs. Buyers want to feel confident, competent, and in control. They want to avoid the anxiety of wasted spend and the embarrassment of explaining poor ROI to their managers. Solutions that address these emotional jobs command premium pricing.

-

Competitive analysis through JTBD reveals non-obvious competitors. A lead seller’s competition isn’t just other lead sellers – it’s every alternative method buyers use to acquire customers: referral networks, community involvement, direct mail, digital advertising they run themselves. All compete to get the same job done.

-

Positioning to the job step rather than product features creates differentiation. Instead of “We sell high-intent insurance leads,” position as “We help agents get in front of qualified prospects faster than any other method.” This speaks to the job, not the product.

Frequently Asked Questions

What makes JTBD different from other frameworks for understanding customers?

Most frameworks focus on customer characteristics (demographics, psychographics) or product preferences (feature requests, satisfaction scores). JTBD focuses on the underlying goal customers are trying to accomplish, independent of any specific product. This creates stability – jobs don’t change even as products evolve – and reveals competition across all methods customers use to accomplish the job, not just similar products.

How do I know if my buyer’s job is “acquire customers” or something more specific?

Job statements should be specific enough to guide decisions but general enough to remain stable. “Acquire customers” is too broad – it doesn’t distinguish between acquiring customers through leads versus other methods. “Buy internet leads” is too narrow – it’s about the product, not the job. “Acquire qualified prospects through purchased leads efficiently enough to maintain positive ROI” hits the right level of specificity for a lead gen context.

What if different buyers have different jobs?

They absolutely do. An agency owner trying to “build enterprise value for eventual sale” has a different job than an agent trying to “earn enough to support my family without cold calling.” Both might buy leads, but their success criteria differ. The key is identifying which jobs represent large enough segments to build products around, then targeting those segments intentionally rather than trying to serve all jobs simultaneously.

How do I differentiate between job beneficiary and job executor in lead gen?

Ask: Who ultimately benefits when leads convert into revenue? That’s the job beneficiary. Who performs the work of calling, qualifying, and presenting? That’s the job executor. In many SMB contexts, they’re the same person. In larger operations, inside sales reps (executors) qualify leads and pass appointments to closers (beneficiaries). Understanding this helps you build appropriate features for each role.

Can JTBD help with pricing decisions?

Yes. Traditional pricing is cost-plus or competitive-matching. JTBD pricing is value-based: how much is it worth to buyers to get their job done better? If your solution helps buyers close 20% more deals, the value is a function of their average commission, not your cost to generate leads. Survey buyers on willingness to pay to accomplish specific outcomes to calibrate pricing to value rather than costs.

How do I conduct JTBD research with lead buyers?

Start with qualitative interviews – 15-20 deep conversations with buyers across segments. Ask about their jobs (what they’re trying to accomplish), steps (how they go about it), and struggles (where things break down). Then quantify with surveys – measure difficulty scores for needs you identified across a larger sample. The combination of qualitative insight and quantitative validation reveals concrete opportunities.

How does JTBD relate to lead quality?

“Lead quality” is a product-centric concept. JTBD reframes it: does the lead help buyers accomplish their job quickly and accurately? A lead that answers the phone but has no intent doesn’t accomplish the job. A lead with intent who answers but provides wrong information introduces inaccuracy. Thinking about quality in terms of job accomplishment reveals which quality dimensions actually matter and which are vanity metrics.

What if buyers don’t know what they struggle with?

Buyers always know their struggles – they experience them daily. What they may not know is how to articulate struggles in product feature terms, or what solutions are possible. JTBD interviews focus on the struggle (“What takes longer than it should?”) rather than the solution (“What features do you want?”). Henry Ford’s customers knew they struggled with slow transportation; they just didn’t know cars were the answer.

How do I prioritize among many unmet needs?

Prioritize based on three factors: (1) How many buyers share this unmet need? (2) How much are they struggling? (3) Can we address this need better than alternatives? High-opportunity needs score high on all three. A need shared by 90% of buyers with severe struggle that you can uniquely address is higher priority than a need shared by 10% with moderate struggle that competitors already address well.

Does JTBD apply to aged leads or just fresh leads?

JTBD applies to any product that helps buyers accomplish a job. Aged leads accomplish a different job than fresh leads: “generate opportunities at lower cost with acceptance of lower conversion rates.” The job steps and needs differ – aged lead buyers care more about filtering and volume than speed-to-contact. Operators should understand the distinct jobs each product type addresses rather than assuming all lead products serve the same job.

How often should I update my understanding of buyer jobs?

Jobs themselves are stable – agents have been trying to acquire customers for a century. But unmet needs evolve as competitive solutions address previously unsatisfied needs and create new expectations. Review unmet need quantification annually or when significant competitive moves occur. What was differentiated yesterday becomes table stakes tomorrow.

Conclusion

The lead generation industry’s product-centric thinking – leads are the product, buyers are the customers, quality and price are the competitive dimensions – blinds operators to what’s actually happening in their markets.

Buyers don’t want leads. They want to acquire customers. They want sustainable businesses. They want the confidence that comes from predictable pipelines and the security of sufficient income. Leads are just one of many things they “hire” to accomplish these jobs.

Operators who internalize Jobs-to-be-Done see their businesses differently. Competition expands to include everything buyers might use to acquire customers – referrals, digital advertising, community involvement, cold calling. Opportunity becomes visible at each job step where buyers struggle. Segmentation shifts from demographics to struggles. Positioning moves from product features to job outcomes.

This isn’t just theory. Cordis Corporation transformed market share using these principles. Countless product companies have used JTBD to identify opportunities that competitors missed. The framework works because it aligns product development with what customers actually care about – accomplishing their jobs quickly and accurately.

For lead generation, the framework offers a path beyond commodity competition. Instead of fighting over lead quality claims and price comparisons, operators can focus on helping buyers accomplish their jobs better than any alternative method. That’s a competition worth winning.

Sources

- Ulwick, Anthony W. “Jobs to be Done: Theory to Practice.” IDEA BITE PRESS, 2016.

- Christensen, Clayton M. “The Innovator’s Solution.” Harvard Business Review Press, 2003.

- Strategyn - Jobs-to-be-Done Framework

- Harvard Business Review - Know Your Customers’ Jobs to Be Done

- JTBD.info - Jobs-to-be-Done Resources

- Levitt, Theodore. “Marketing Myopia.” Harvard Business Review, 1960.