The invisible infrastructure that routes billions in lead value every year. Learn exactly how lead distribution systems work, the 7 types of routing, and how to set up distribution that maximizes revenue.

A consumer clicks “submit” on an insurance quote form. In the next 200 milliseconds, that lead travels to a distribution platform, gets broadcast to a dozen potential buyers, receives competitive bids, and routes to the highest bidder. The consumer sees a confirmation page. Behind the scenes, a real-time auction just determined which agent’s phone will ring.

This is lead distribution: the decision engine that determines which buyer receives which lead, at what price, and in what sequence. Those who master distribution build sustainable competitive advantages. They extract more value from each lead, maintain buyer loyalty through quality matching, and scale their operations efficiently.

This guide covers everything you need to understand lead distribution systems: the routing types, the platforms, the technical requirements, and the operational considerations that separate professional operations from amateur ones.

What Is Lead Distribution?

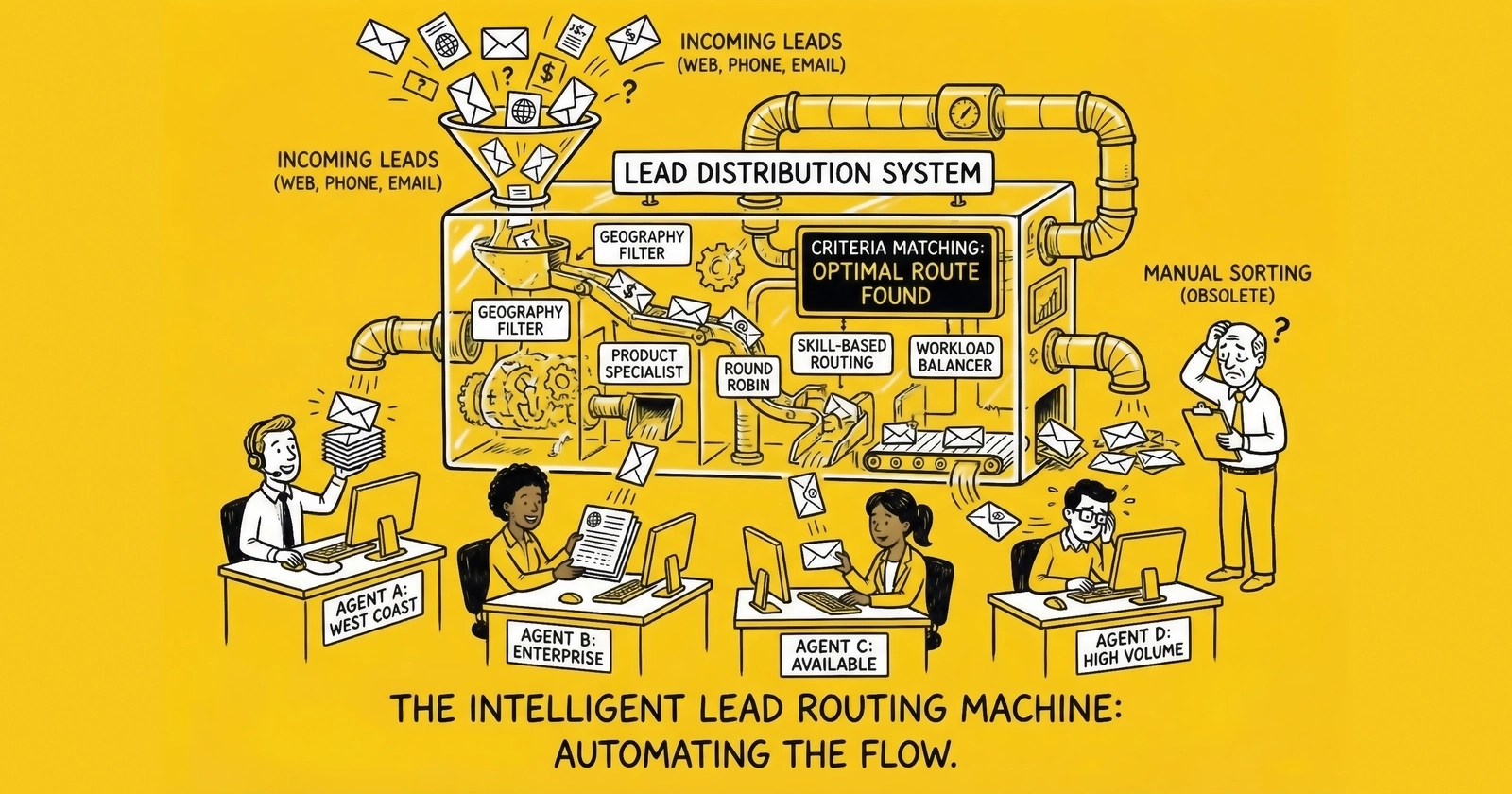

Lead distribution is the automated process of routing qualified leads from generators – publishers, affiliates, and comparison sites – to buyers such as agents, lenders, service providers, and sales teams. The distribution system sits between lead creation and lead consumption, making real-time decisions about where each lead should go.

The fundamental problem that lead distribution solves is matching. A single lead might qualify for twelve different buyers, each with unique filter criteria, geographic requirements, volume caps, and bid levels. Some buyers want exclusive leads while others accept shared leads at lower prices. Some pay premium for instant delivery while others accept delayed batches for discounts.

Manual lead distribution becomes impossible at scale. A human cannot evaluate a dozen buyer qualifications, check capacity limits, compare prices, and route the lead within milliseconds. Distribution systems automate these decisions, executing complex routing logic faster than a confirmation page loads.

Three primary groups rely on lead distribution systems. Lead generators – the publishers – create leads through advertising, content, and comparison sites. They need distribution systems to sell leads to multiple buyers efficiently, maximize revenue through competitive bidding, and manage buyer relationships at scale. Lead aggregators, often called brokers, buy leads from multiple generators and resell them to end buyers. They need distribution systems to manage supply from various sources, normalize data formats, and route to the appropriate buyers based on complex criteria. Lead buyers – the end clients – purchase leads to convert into customers. Larger buyers with internal lead acquisition teams use distribution systems to manage their own routing across sales teams, branch locations, or dealer networks.

The 7 Types of Lead Routing

Every distribution platform implements one or more routing frameworks. Each makes different tradeoffs between revenue optimization, buyer fairness, and operational complexity. Understanding these seven types helps you select the right approach for your operation.

1. Round-Robin Distribution

Round-robin routing distributes leads in strict rotation among qualified buyers. Lead 1 goes to Buyer A, Lead 2 to Buyer B, Lead 3 to Buyer C, then back to Buyer A for Lead 4. This approach works best for franchise networks, dealer distribution, insurance agent networks, and any context where perceived fairness matters more than revenue optimization.

The system maintains a rotation queue where each qualifying buyer receives leads in sequence, ensuring mathematically equal distribution. When a buyer hits their cap or filters out of a lead, the rotation advances without penalizing their position.

The primary advantage of round-robin lies in its absolute fairness, which eliminates disputes about preferential treatment. The system is simple to explain to buyers and requires minimal configuration. However, this simplicity comes with limitations – round-robin does not optimize for revenue, so a $30 buyer receives the same leads as a $60 buyer. The system also requires skip logic for capped or filtered buyers, adding some operational complexity.

2. Weighted Distribution

Weighted distribution allocates leads proportionally across buyers based on assigned weights. If Buyer A has weight 50, Buyer B has weight 30, and Buyer C has weight 20, they receive roughly 50%, 30%, and 20% of qualifying leads respectively. This approach suits operations with volume commitments, performance-based allocation, or buyers with varying capacity requirements.

Weights typically reflect contracted volumes or performance targets. A buyer committed to 500 leads monthly receives higher weight than one committed to 100. The system continuously rebalances to maintain proportions throughout the period.

Setting weights correctly starts with contracted volume commitments. If Buyer A wants 500 leads per month and Buyer B wants 250, assign weights of 66 and 34 (or a 2:1 ratio). Then adjust based on performance – buyers with strong conversion and low returns might earn weight bonuses, while buyers with deteriorating metrics might see automatic reductions. This honors volume commitments while enabling automatic performance-based adjustment, making weighted distribution more flexible than strict round-robin. The trade-off is that it requires careful weight management, does not optimize for price, and adds complexity through rebalancing logic.

3. Geographic Routing

Geographic routing directs leads to buyers based on location matching: state licensing, territory assignments, or proximity calculations. This approach is essential for regulated industries like insurance, mortgage, and legal where licensing determines who can receive which leads. It also serves local service businesses where proximity affects customer experience.

The system maintains buyer geographic profiles including licensed states, target zip codes, and service radiuses. Each incoming lead matches against these profiles, and only geographically qualified buyers receive the lead.

For regulated industries, route at the state level minimum to ensure licensing compliance. For local services like home improvement, HVAC, and solar, route at the zip code or radius level. A contractor 40 miles away provides worse customer experience than one 5 miles away, even if both are technically “in territory.”

Geographic routing ensures compliance with licensing requirements and improves conversion by matching local buyers. The limitations include reducing the buyer pool for each lead, requiring accurate license and territory data, and creating coverage gaps in low-demand areas.

4. Waterfall (Priority-Based) Distribution

Waterfall distribution routes leads through a sequential cascade of buyers until one accepts. The lead flows from top-tier buyers – highest priority, typically highest price – to lower tiers if the top tier rejects. This approach works well for operations with tiered buyer relationships, exclusive partner arrangements, or when maximizing fill rate matters more than speed.

Configuration involves setting buyers in priority order. When a lead arrives, the system offers it to the Priority 1 buyer first. If they reject or timeout, it offers to Priority 2, continuing until someone accepts or the waterfall exhausts all options.

Premium buyers get first access, which maximizes revenue from high-value leads. Fallback tiers recover leads that premium buyers reject. The downside is that sequential processing adds latency, lower-tier buyers receive what amounts to “leftovers,” and position negotiations become part of buyer relationships.

Performance benchmarks for waterfall recovery tell an important story. Recovery rates below 10% indicate poor performance with leads dying in the waterfall. Rates between 10-20% are acceptable, 20-30% represent strong performance, and rates above 30% indicate elite operations with excellent fallback strategies.

5. Ping/Post Auction

Ping/post is a two-phase auction system that enables real-time competitive bidding. In the ping phase, partial non-identifying lead data broadcasts to all qualified buyers who return bids. In the post phase, full lead data delivers to the winning bidder. This approach works best for high-volume operations with competitive buyer ecosystems, price discovery, and maximum revenue extraction.

The process unfolds in seven steps. First, a lead arrives at the distribution platform. The system extracts non-identifying attributes like zip code, state, and lead type, then broadcasts the ping to all qualified buyers simultaneously. Buyers return bids within a timeout window of typically 100 – 200 milliseconds. The platform selects the winner – usually the highest bidder or best scenario – and full lead data posts only to that winner. Finally, the winner accepts or rejects final delivery.

Ping/post enables true market pricing through competitive bidding, with parallel processing ensuring all buyers bid simultaneously and price discovery occurring on every transaction. The limitations are significant, however – the approach requires sophisticated infrastructure, sub-second latency requirements, and buyers need systems capable of real-time bid calculation.

The industry standard for ping response is sub-100 milliseconds. Buyers who consistently exceed this threshold miss auctions. Total transaction time from form submission to lead delivery should be under 2 seconds for well-optimized systems, with some platforms achieving sub-second total times.

6. Capacity-Based Routing

Capacity-based routing distributes leads based on real-time buyer availability: current volume against caps, queue depth, and agent availability. This approach serves operations where buyer capacity fluctuates throughout the day, buyers have strict volume limits, or lead quality depends on timely follow-up.

The system tracks each buyer’s current status including leads delivered today, remaining capacity, current queue depth, and agent availability. It routes preferentially to buyers with available capacity and skips or deprioritizes buyers approaching limits.

This approach prevents overwhelming buyers and maintains lead quality by ensuring timely follow-up while respecting volume commitments. The challenges include requiring real-time capacity visibility, integration complexity with buyer systems, and varying queue visibility across buyers.

When all buyers hit capacity, effective fallback strategies become critical. Secondary waterfalls route to backup buyers at lower prices, aged lead queues hold leads for batch processing to buyers accepting older leads, cross-vertical routing attempts placement in adjacent verticals, and unsold disposition logs leads for analysis while potentially returning them to the source for refund. Effective fallback recovers 20 – 40% of leads that would otherwise go unsold.

7. Time-Based Routing

Time-based routing adjusts distribution logic based on when leads arrive: business hours, day of week, and seasonal patterns. This approach suits operations with buyers who have varying availability, different pricing by time period, or leads with time-sensitive conversion requirements.

Configuration involves setting routing rules that activate at specific times. Route to Buyer A during business hours from 8am to 6pm, Buyer B during evenings. Skip Buyer C entirely on weekends. Apply different price floors for different time periods.

This matching of leads to available buyers enables time-based pricing strategies and accounts for contact rate variations. The complexity lies in time zone management, requiring buyer availability data, and potentially reducing buyer pools during off-hours.

Professional operations combine multiple routing types. Geographic filtering comes first, followed by ping/post for competitive segments, weighted distribution during off-hours, and waterfall fallback for unsold leads. The platform executes this logic in milliseconds.

How Ping/Post Systems Work

Ping/post represents the most sophisticated lead distribution technology. Understanding its mechanics is essential for anyone operating at scale.

The Two-Phase Transaction

The first phase – the ping – carries non-identifying information for bid solicitation. Typical ping data includes geographic information like zip code, state, and area code. It includes lead attributes such as credit tier, loan amount, and vehicle type. Metadata covers source ID, timestamp, and device type. An exclusivity flag indicates whether the offering is exclusive or shared.

Critically, the ping does NOT include consumer name, phone number, email address, full street address, or any personally identifiable information. This separation is fundamental. Buyers who do not win the auction never see consumer contact information. They cannot build databases from pings they never paid for.

The second phase – the post – delivers complete lead data when the auction closes and a winner emerges. The winning bidder receives name, phone, email, address, and all qualifying information. Only the winning bidder receives this data. The transmission is encrypted and logged for compliance purposes.

Auction Mechanics

Most ping/post systems use first-price auctions: the winning bidder pays exactly what they bid. If Buyer A bids $50 and Buyer B bids $45, Buyer A wins and pays $50. Sophisticated buyers “shade” bids below their true valuation, betting they only need to beat the second-highest bid.

Advanced platforms calculate optimal scenarios automatically when deciding between exclusive and shared sales. If Buyer A bids $60 exclusive but Buyers B, C, and D collectively offer $80 for shared access, the platform compares exclusive revenue of $60 against shared revenue of $80. The $80 shared scenario wins mathematically.

But the calculation grows more complex when factoring in buyer reliability through acceptance and return rates, exclusivity contractual obligations, and long-term relationship value. Sophisticated platforms like boberdoo recalculate optimal scenarios after each rejection, recovering 20-40% additional revenue from leads that initial buyers declined.

Latency Requirements

Speed matters critically. Target timing breaks down as follows: ping transmission under 50 milliseconds, bid response under 100 milliseconds, post delivery under 500 milliseconds, total transaction under 1 second. Platforms processing millions of pings invest heavily in geographic distribution, response optimization, and horizontal scaling.

Lead Distribution Platforms

The lead distribution platform market has matured into a specialized ecosystem. Platforms generally fall into three categories: Lead Distribution Automation, Affiliate Management, and Call Tracking. Understanding the major players helps you select the right infrastructure for your operation.

Lead Distribution Platforms

Among the major platforms, boberdoo serves enterprise and high-volume operations best. For a detailed breakdown, see our lead distribution platforms comparison. It has become the industry standard for ping/post with approximately 85 reports, financial instrumentation, and scenario optimization. Pricing typically starts around $1,000 per month plus setup and transaction fees.

LeadExec excels at multi-channel distribution with 9 delivery methods, 5 distribution types, and integrated TCPA certification. It offers a free tier with paid options starting around $660 per month.

LeadsPedia serves hybrid networks well with unified lead distribution and affiliate management in a single dashboard. Pricing ranges from $450 to $2,500 per month.

LeadHoop targets aggregators managing multiple sources with full funnel visibility and integrated Jornaya/TrustedForm. Custom pricing applies.

Lead Prosper works for SMB and agile sellers with API-first lightweight routing and bid penalties for high-return buyers. Pricing is transaction and volume based.

ActiveProspect (LeadConduit) takes a compliance-first approach as the home of TrustedForm with compliance middleware and data enhancement. Volume-based pricing applies.

For newcomers processing fewer than 10,000 leads monthly, LeadExec offers a free tier for testing and learning. Lead Prosper provides accessible entry with transaction-based pricing. LeadsPedia works well if you are also managing affiliate relationships.

For operations at scale processing 50,000+ leads monthly, boberdoo provides the financial instrumentation and reporting depth that complex operations require. LeadHoop excels for aggregators managing multiple sources and buyers.

For compliance-critical operations, ActiveProspect (LeadConduit) works as middleware in front of other platforms, adding compliance filtering.

Call Tracking Platforms

For operations where phone calls drive revenue, specialized call tracking infrastructure becomes essential.

Phonexa serves enterprise multi-channel operations with Ping Post Calls 2.0, predictive routing, and a full marketing suite. Usage-based pricing plus platform fee applies.

Ringba targets pay-per-call specialists with Ring Tree real-time bidding and native marketplace. Usage-based pricing applies.

TrackDrive handles outbound and inbound hybrid operations with lead-to-call automation and Voice Marketing Cloud. Subscription plus usage pricing applies.

Retreaver serves complex campaigns with tag-based dynamic routing. Usage-based pricing applies.

Platform Pricing Reality

Total cost of ownership includes monthly platform fees of $450-$5,000+, transaction fees of $0.01-$0.10 per lead, integration costs, and validation service fees. A mid-market operation processing 50,000 leads monthly should expect $2,500-$3,000 per month in total platform costs. Evaluate on total cost, not headline pricing.

Setting Up Buyer Filters and Criteria

Buyer filters define exactly which leads each buyer wants. Properly configured filters prevent rejections, reduce returns, and maintain buyer satisfaction.

Filters fall into several core categories. Geographic filters include state and province requirements that prove essential for licensed industries, zip code lists or ranges, metro and DMA targeting, and radius from location for local services. Attribute filters cover credit score ranges like 620-699 or 700+, loan amount ranges, property values, vehicle year, make, and model, homeowner status, and coverage types requested. Source filters encompass approved publisher lists, blocked publisher lists, sub-source allowlists and blocklists, and device type distinctions between mobile and desktop. Timing filters address business hours only restrictions, day of week limitations, and seasonal availability.

The art lies in balancing specificity against fill rate. Overly restrictive filters reject convertible leads while overly loose filters cause returns. Start with buyer requirements, then adjust based on return patterns. Monitor monthly – a 15% return rate signals filter problems while sub-50% fill rate suggests overly restrictive criteria.

Managing Caps and Volume Control

Caps limit how many leads each buyer receives. Proper cap management prevents overwhelming buyers while ensuring you meet volume commitments.

Several cap types serve different purposes. Daily caps set maximum leads per day and are most common for buyers with fixed daily call center capacity. Weekly caps set maximum leads per week and prove useful for buyers who prefer even distribution rather than front-loading. Monthly caps set maximum leads per month and often reflect contracted volume commitments. Budget caps set maximum spend per period and stop routing when buyers have spent their budget allocation. Concurrent caps set maximum active or unworked leads and prevent queue buildup when leads are not being worked.

When a buyer hits their cap mid-day, options depend on your routing configuration. The system can skip and continue, allowing the buyer to exit rotation while leads route to other buyers. It can queue for later, holding leads until the cap resets though this risks aging. It can cascade to lower tier, routing to backup buyers at different terms. Or it can pause the source, stopping lead acquisition if the primary buyer is capped.

For ping/post systems, capped buyers simply do not receive pings, ensuring they do not see leads they cannot purchase.

Distribution Speed and Delivery Methods

How leads reach buyers affects conversion. Faster delivery methods command premium pricing. Different buyers require different delivery formats.

API and webhook delivery achieves sub-second transmission and suits real-time sales teams. CRM integration takes 1-5 seconds and serves Salesforce and HubSpot users. Portal access provides on-demand retrieval for self-service buyers. Email notification takes minutes and works for low-volume buyers. SMS alerts arrive in seconds and serve mobile sales teams. FTP and SFTP batch delivery operates on schedules for enterprise and legacy systems. CSV export requires manual retrieval and suits the smallest buyers.

The speed benchmarks tell the story. API and webhook delivery achieves under 500 milliseconds. CRM integration takes 1-5 seconds. Email requires 30 seconds to 2 minutes. SMS takes 5-30 seconds. Portal access depends on how frequently the buyer checks. Batch FTP takes hours based on schedule.

For high-intent leads where speed-to-contact drives conversion, API delivery is the only professional choice. As documented in our lead decay curve analysis, a lead contacted in 1 minute converts at 391% higher rates.

Troubleshooting Distribution Issues

When distribution problems occur, systematic diagnosis identifies root causes quickly.

Low Fill Rate

When a high percentage of leads go unsold, start by asking diagnostic questions. Are buyer filters too restrictive? Are buyers capped? Is geographic coverage adequate? Are bids below floor prices?

Solutions include expanding buyer criteria, adding backup buyers for underserved segments, lowering floor prices during slow periods, and reviewing unsold lead patterns for common attributes.

High Return Rate

When returns exceed 10-15% (see our lead return rates benchmarks), the diagnostic questions shift. Are returns clustered by source? Are returns clustered by lead attribute? Is data quality declining? Did buyer filters change without a system update?

Solutions involve tightening validation on problem sources, adjusting filters to match buyer acceptance patterns, improving data capture quality, and auditing source compliance.

Slow Distribution

For latency issues, check validation services, buyer endpoint response times, platform load, and timeout configurations. Solutions include reviewing validation response times, setting appropriate timeouts, and contacting slow buyers about endpoint performance.

Monitoring Dashboard Essentials

Track real-time metrics including leads received, fill rate, revenue per lead, and error rate. Track trend metrics including hour-over-hour comparisons and acceptance trends. Set alert triggers for fill rate drops 10%+ below baseline and acceptance drops 15%+. Configure alerts for meaningful deviation from baseline, not arbitrary fixed values.

FAQ: Lead Distribution Questions

How much does a lead distribution platform cost?

Platform costs range from $450 per month for entry-level solutions to $5,000+ per month for enterprise platforms. Transaction fees typically add $0.01-$0.10 per lead. Total cost including validation services and integrations runs $1,500-$4,000 per month for mid-market operations processing 25,000-75,000 leads monthly.

How fast should leads be distributed?

For real-time distribution via API, target sub-second delivery from platform receipt to buyer system. Total time from consumer form submission to buyer receipt should be under 2 seconds. For high-intent verticals like insurance and mortgage, speed-to-contact directly impacts conversion: leads contacted within five minutes are 21x more likely to qualify than those contacted after 30 minutes.

What is the difference between exclusive and shared leads?

Exclusive leads sell to one buyer only. The buyer receives the lead knowing no competitors are contacting the same consumer. Exclusive leads typically command 2-3x the price of shared leads.

Shared leads sell to multiple buyers, typically 3-5, who compete for the consumer’s business. Combined revenue from shared sales often exceeds single exclusive sales: three buyers at $15 each totaling $45 beats one exclusive buyer at $35.

Should I use ping/post or direct post distribution?

Use ping/post when multiple buyers compete for similar leads, price discovery matters, lead volume exceeds 5,000 per month, or the buyer ecosystem is competitive. Use direct post when single buyer relationships dominate, prices are contracted and fixed, volume is low, or buyer infrastructure cannot support real-time bidding.

Many operations use hybrid approaches: ping/post for competitive segments, direct post for exclusive partners.

How do I handle leads that do not sell?

Implement tiered fallback with secondary waterfalls routing to lower-tier buyers at reduced prices, aged lead queues for buyers accepting older leads at discounts, cross-vertical routing, and source credits. Effective fallback recovers 20-40% of leads that primary routing does not place.

What return rate is acceptable?

Target under 5% for elite performance, 5-10% for strong performance, and 10-15% as acceptable. Returns above 15% indicate filter misalignment or source quality issues. Investigate patterns by source, attribute, and time period.

How many buyers should I have for each lead type?

Minimum coverage varies by routing type. For round-robin, maintain 3-5 buyers. For ping/post, target 5-15 active bidders. For waterfall, build 3-4 tiers with 2-3 buyers per tier. More buyers improve fill rates but increase relationship management costs.

What compliance features do I need?

Essential compliance capabilities include TrustedForm and Jornaya integration for consent certificate capture and verification, DNC scrubbing to check against Do Not Call registries, consent storage to retain certificates for 5+ years, and litigator screening to flag known TCPA plaintiffs.

Every major platform integrates with TrustedForm and/or Jornaya. If yours does not, you are taking unnecessary legal risk.

How do I measure distribution performance?

Track these core metrics with their targets: fill rate (percentage of leads sold) should exceed 85%, revenue per lead (net revenue after returns) depends on vertical, time-to-route (capture to delivery) should be under 2 seconds, buyer acceptance (percentage of routed leads accepted) should exceed 80%, return rate (percentage of accepted leads returned) should stay under 10%, and waterfall recovery (percentage of rejected leads resold) should exceed 20%.

Review metrics daily for quick scans, weekly for trend analysis, and monthly for strategic assessment.

Frequently Asked Questions

What is the most important factor when choosing a lead distribution system?

The most important factor is matching the platform’s capabilities to your operational scale and routing complexity. A new operator processing 5,000 leads monthly does not need enterprise ping/post infrastructure. Conversely, an operation processing 100,000+ leads monthly will outgrow entry-level platforms quickly. Evaluate your current volume, anticipated growth, buyer ecosystem complexity, and compliance requirements. Platform migrations are expensive and disruptive, so choose infrastructure that accommodates 2-3 years of projected growth.

What is the difference between ping/post and direct post distribution?

Direct post delivers complete lead data immediately to the designated buyer without a bidding phase. The lead routes based on pre-configured rules like round-robin, weighted, or geographic at fixed prices. Ping/post adds a competitive bidding layer: partial lead data broadcasts to multiple buyers who return real-time bids, with full data posting only to the winner. Ping/post optimizes for revenue through price discovery but requires more sophisticated infrastructure from both platform and buyers. Direct post is simpler and faster but forfeits competitive pricing benefits.

What is lead velocity and why does it matter for distribution?

Lead velocity measures how quickly leads flow through your distribution system from capture to buyer delivery. High velocity operations process leads in under 2 seconds while slow operations take 5-10 seconds or more. Velocity matters because lead value decays rapidly. A lead contacted within 1 minute converts at dramatically higher rates than one contacted in 5 minutes. Distribution bottlenecks like slow validation services, buyer endpoint timeouts, and platform processing delays directly reduce conversion rates and buyer satisfaction. Monitor velocity metrics continuously and investigate any degradation immediately.

What is buyer acceptance rate and what is considered healthy?

Buyer acceptance rate measures the percentage of routed leads that buyers accept rather than reject. A healthy acceptance rate exceeds 80%. Rates between 70-80% indicate filter misalignment or data quality concerns. Rates below 70% signal serious problems requiring immediate investigation. Low acceptance often indicates that buyer filter configurations in your system do not match their actual criteria, lead data quality has degraded, or source quality has declined. Track acceptance by buyer, source, and lead attribute to identify patterns.

What is the role of lead validation in distribution?

Lead validation occurs between lead capture and distribution, verifying data accuracy and compliance before routing. Validation services check phone number validity to confirm the number can receive calls, email deliverability, address verification, duplicate detection to identify recent submissions, and consent certification through TrustedForm and Jornaya. Validation adds 100-500 milliseconds to processing time but prevents routing bad leads that would result in returns, compliance violations, or wasted buyer spend. The cost of validation at $0.02-$0.15 per lead is far less than the cost of returns and compliance failures.

What is the ideal number of buyers in a ping/post auction?

For healthy ping/post auctions, target 5-15 active bidders per lead segment. Fewer than 5 bidders reduces competitive pressure and price discovery benefits. More than 15 bidders rarely improves pricing since the top 5-7 bidders typically determine the winning price, but it increases infrastructure load. The goal is sufficient competition that buyers must bid their true valuations. Monitor average bids per auction and winning bid margins. If the winning bid consistently exceeds second place by large margins, you may have insufficient buyer competition.

What is waterfall recovery rate and how can it be improved?

Waterfall recovery rate measures the percentage of leads rejected by primary buyers that successfully sell to lower-tier buyers in your waterfall cascade. Strong operations recover 20-30% of initially rejected leads through fallback routing. Improve recovery by adding more fallback tiers with progressively lower price requirements, recruiting specialty buyers who accept leads with specific rejection reasons like geographic gaps or credit tier mismatches, implementing aged lead programs for buyers accepting older leads at discounts, and analyzing rejection patterns to identify underserved segments needing dedicated buyers.

What is the impact of time zones on lead distribution?

Time zone management significantly impacts distribution performance for national operations. A lead generated at 3pm Pacific reaches an East Coast buyer at 6pm local time, potentially outside business hours. Configure buyer availability schedules in their local time zones, not your operational time zone. Route leads preferentially to buyers in the consumer’s time zone when possible, as local buyers often achieve better contact rates. Implement time-based routing rules that activate different buyer sets based on the lead’s originating time zone, not just the current time.

What is duplicate lead handling and what strategies exist?

Duplicate leads occur when the same consumer submits information multiple times across different sources or within your own network. Duplicate handling strategies include rejection to block duplicates entirely, suppression windows to accept if the last submission was more than 30-90 days ago, cross-buyer deduplication to allow duplicates if routing to different buyers, and revenue share to claim attribution if the same consumer converts for a buyer you sent previously. Most platforms offer configurable deduplication based on phone number, email, or name and address combinations. Set suppression windows based on your vertical’s typical sales cycle length.

What is the relationship between distribution speed and lead conversion rates?

Distribution speed directly correlates with conversion rates, particularly for high-intent verticals like insurance, mortgage, and home services. Research consistently shows that leads contacted within 1 minute convert at 391% higher rates. The relationship is exponential, not linear: the difference between 30-second and 60-second contact is more significant than the difference between 5-minute and 6-minute contact. Every component of your distribution pipeline – validation, routing logic, buyer delivery – should be optimized for speed. Buyers who receive leads faster should achieve better conversion metrics, justifying premium pricing for low-latency delivery.

Key Takeaways

Lead distribution is the decision engine that determines which buyer receives which lead, at what price, in what sequence. Master it and you maximize revenue. Ignore it and you leave money on the table.

Seven routing types serve different needs. Round-robin delivers fairness. Weighted allocation maintains proportional distribution. Geographic routing ensures compliance. Waterfall handles tiered relationships. Ping/post enables price discovery. Capacity-based routing manages availability. Time-based routing addresses scheduling. Most operations combine multiple types.

Ping/post systems run real-time auctions in under 2 seconds. The ping broadcasts non-identifying data to all buyers. Buyers return bids within 100-200 milliseconds. The post delivers full data to the winner only. This infrastructure separates professional operations from amateur ones.

Platform selection shapes your capabilities for years. Evaluate total cost of ownership at $1,500-$4,000 per month typical for mid-market, integration requirements, routing sophistication, and compliance features. Major players include boberdoo, LeadExec, LeadsPedia, and Phonexa.

Configure buyer filters based on actual acceptance patterns, not just stated requirements. Monitor return rates by source and attribute. Tighten filters where returns cluster. Review quarterly as buyer needs evolve.

Speed matters critically for distribution. API delivery achieves sub-second transmission. Every second of delay reduces conversion probability. For high-intent leads, five-minute response yields 21x higher qualification rates than 30-minute response.

Build fallback strategies that recover unsold leads. Secondary waterfalls, aged lead queues, and cross-vertical routing recover 20-40% of leads that primary routing does not place. This incremental revenue often determines profitability.

This guide provides educational information about lead distribution systems. Platform pricing and capabilities change; verify current specifications before making selection decisions.