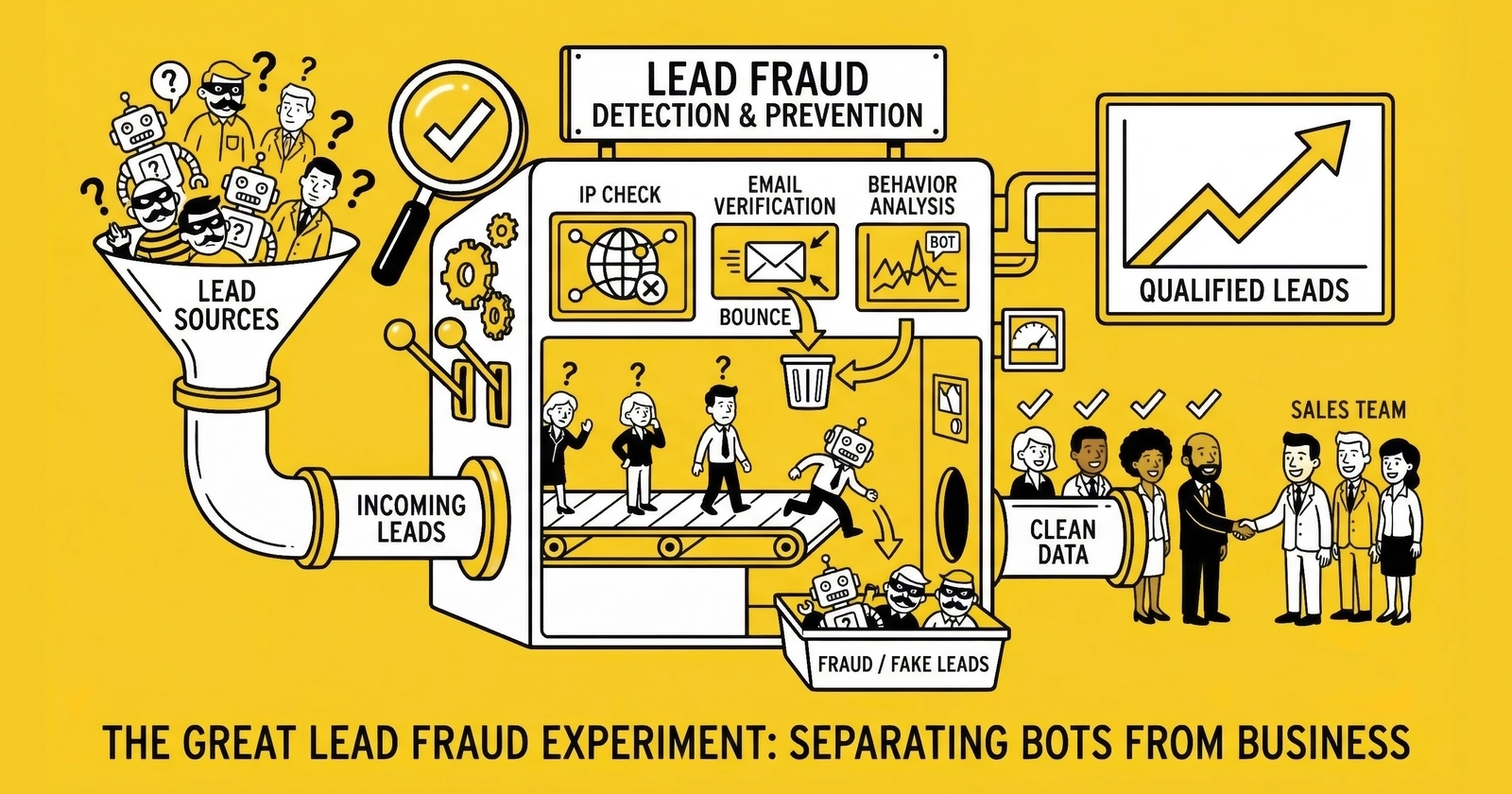

Learn how to identify, prevent, and respond to lead fraud using proven detection signals, technology stacks, and workflows that protect your margins and buyer relationships.

Every lead generation operator faces a sobering reality: a significant percentage of the leads flowing through your system are worthless. Not low-quality. Not hard-to-convert. Worthless. Generated by bots, fabricated with synthetic identities, or recycled from databases years old.

Lead fraud is not an exception in this industry. It is a structural feature of the lead economy. Where money follows intent, fraudsters follow money. The same systems that enable millisecond auctions and instant delivery also create attack surfaces for bad actors who profit from volume regardless of conversion.

Those who thrive understand this reality and build detection systems accordingly. They invest pennies per lead to save dollars in chargebacks, buyer complaints, and reputation damage. They treat fraud prevention not as a cost center but as margin protection.

This guide walks you through the complete landscape of lead fraud: how it works, how to detect it, what technology to deploy, and how to build workflows that protect your business without strangling legitimate lead flow.

The Scale of Lead Fraud: An $84 Billion Problem

The numbers are staggering. According to Juniper Research and Statista, global ad fraud losses reached $84 billion annually by 2023, with projections exceeding $100 billion by 2025. This represents roughly 22% of total digital advertising spend – money that pays for clicks, impressions, and leads that never had a real human behind them.

For lead generation specifically, the problem concentrates in third-party lead flows. Industry analyses consistently show that 25-30% of third-party leads contain some form of fraud or quality issue. When you buy leads from affiliates, networks, or aggregators, roughly one in three has problems ranging from complete fabrication to technically-valid-but-commercially-worthless submissions.

Why Lead Fraud Persists

Three structural factors make lead fraud persistent and profitable.

The first is asymmetric information. The generator knows exactly how a lead was produced. The buyer knows only what data appears on their screen. This information gap creates opportunity for fraud that goes undetected until conversion data reveals the problem – days, weeks, or months later.

The second is volume-based incentives. Most lead generation compensation structures reward volume. Affiliates earn on leads delivered, not leads converted. This creates rational incentive to maximize volume even at quality’s expense. Fraudulent leads are cheaper to produce than legitimate ones.

The third is detection costs. Comprehensive fraud detection requires investment in technology, staff, and process. Many practitioners calculate that some fraud is cheaper to absorb than to prevent. This calculation often proves wrong when buyer relationships deteriorate, but the initial logic persists.

What Does Lead Fraud Actually Cost?

Beyond the obvious loss of paying for worthless leads, fraud carries hidden costs that compound the damage. Direct loss accounts for payment on leads that never had conversion potential. Buyer chargebacks follow when buyers identify fraud and demand returns and credits. Reputation damage accumulates as buyers reduce spend or terminate relationships entirely.

The compliance exposure is particularly dangerous – TCPA liability for calls to fabricated consent can devastate a business. Operational waste consumes sales team time as agents contact fake leads. Perhaps most insidiously, data pollution corrupts your analytics and optimization, leading to decisions based on fraudulent signals.

A single fraudulent lead at $50 CPL represents more than $50 in loss. The sales agent who spends 8 minutes attempting contact, the marketing optimization that incorrectly attributes a campaign success, the buyer relationship strained by quality complaints – these compound the direct financial hit into something far more damaging.

Types of Lead Fraud: Know Your Enemy

Fraud in lead generation takes multiple forms, each requiring different detection approaches. Understanding these categories helps you build targeted defenses rather than generic filters.

Bot Traffic

Imperva’s Bad Bot Report shows that malicious bot traffic accounts for approximately 37% of all web traffic, with total bot traffic (including benign bots like search crawlers) exceeding 50%. This malicious traffic is designed to scrape content, test stolen credentials, or in our case, submit fake leads at scale.

Sophisticated bots now mimic human behavior convincingly. They pause before clicking, scroll pages naturally, and complete forms at human-like speeds. Simple CAPTCHA systems catch perhaps 60% of bot traffic; the remaining 40% requires behavioral analysis to identify.

Bot characteristics reveal themselves through patterns: identical or near-identical data across submissions, completion timing that’s too fast or suspiciously consistent, missing or inconsistent browser fingerprint signals, traffic from known datacenter IP ranges, and identical user agents across multiple submissions. Any single signal might have innocent explanation. Multiple signals together paint a clear picture.

Click Fraud

Studies from ClickCease and similar platforms indicate that 90% of PPC campaigns experience some level of click fraud. Competitors, bots, and click farms consume advertising budget without any intent to convert.

For lead generators running paid traffic, click fraud represents double damage: you pay for the click and receive no lead in return. For lead buyers, click fraud manifests as traffic quality issues – campaigns that showed strong click metrics but produced few valid leads. The numbers tell the story: fraudulent clicks convert at 1.29% compared to 2.54% for legitimate clicks – roughly half the rate. The average advertiser loses 14% of PPC budget to click fraud, and Google Ads refunds cover only a fraction of actual fraudulent clicks.

Incentivized Leads

A lead is incentivized when the consumer’s primary motivation was receiving something of value – a gift card, contest entry, or cash payment – rather than genuine interest in your product.

Incentivized leads are not necessarily fake. Real humans with real contact information submit them. But their intent is fundamentally misaligned with buyer expectations. Conversion rates on incentivized leads typically run 70-90% below standard leads because the consumer never wanted the product – they wanted the incentive.

Warning signs emerge in the data: sudden volume spikes from specific sources, unusually high conversion rate to lead (everyone fills out the form) paired with unusually low conversion rate to sale (no one actually wants the product), geographic clustering suggesting click farms, and email addresses showing patterns like throwaway domains or sequential naming.

Synthetic Identities

Synthetic identity fraud combines real and fabricated information to create fictitious personas. A fraudster might pair a legitimate phone number with a fabricated name and address, or use a real SSN belonging to someone else entirely.

This fraud type is particularly dangerous because individual data elements validate successfully. The phone number is real and answers. The email exists. But the person described by combining these elements does not exist, or the contact information belongs to someone who never consented to contact.

Detection requires cross-validation: name/address combinations that don’t appear in identity databases, phone numbers with owner mismatches, email addresses created recently or with suspicious naming patterns, and IP addresses geographically distant from stated address. No single check catches synthetic identity fraud – only the combination of validations reveals the fabrication.

Recycled and Aged Leads Sold as Fresh

Perhaps the most common fraud in lead distribution involves old leads repackaged and sold as new. A lead captured six months ago gets a fresh timestamp and enters the market at premium pricing.

This fraud devastates conversion rates because lead value decays predictably. A lead loses approximately 10% of its value every hour without contact. By day two, conversion probability has dropped 50%. A six-month-old lead sold as fresh has near-zero conversion potential while commanding fresh-lead pricing.

Detection methods include IP address and device fingerprint matching against historical records, phone number de-duplication across time windows, email engagement analysis to determine when an address last interacted with your content, and consumer complaint data suggesting they filled out forms months ago.

Fraud Detection Signals: Building Your Early Warning System

Effective fraud detection combines multiple signals, each providing partial information that together reveals patterns humans cannot see in real-time.

IP Analysis

IP addresses provide the first layer of fraud detection. Every lead submission originates from an IP address that carries rich contextual information.

Legitimate traffic patterns show residential ISP origins located near the consumer’s stated address, with single submissions and clean blacklist status from consumer ISPs. Fraud patterns reveal datacenter, VPN, or proxy origins from different states or countries, with multiple submissions per minute from known fraud sources on hosting provider networks.

Datacenter IPs are not always fraudulent – legitimate users on corporate networks or VPNs show datacenter origins. But datacenter traffic warrants additional scrutiny. When datacenter IP combines with other risk signals, fraud probability increases substantially.

Device Fingerprinting

Beyond IP addresses, device fingerprinting captures hardware and software characteristics that identify unique devices across sessions. Core fingerprinting elements include browser type, version, and installed plugins; screen resolution and color depth; installed fonts and language settings; canvas and WebGL rendering signatures; and audio context fingerprints.

Fraudsters can spoof individual fingerprint elements, but spoofing everything consistently is difficult. A browser claiming to be Chrome on Windows that renders canvas like Safari on macOS creates a fingerprint mismatch that flags the submission.

Modern device fingerprinting correctly identifies unique devices 95-99% of the time across sessions. The technology has matured substantially, though iOS privacy features and fingerprint randomization in some browsers reduce accuracy. Cross-browser fingerprinting – identifying the same device across Chrome and Firefox – remains challenging.

Form Completion Timing

Humans fill out forms at predictable speeds. Reading a question, considering the answer, and typing takes time. Bots complete forms either instantly (no reading required) or with suspiciously consistent timing (programmed delays that lack natural variation).

For short forms with 5 fields, minimum human time runs 15-20 seconds, with anything under 8 seconds indicating fraud. Medium forms with 10 fields take humans 30-45 seconds, with under 15 seconds suggesting fraud. Long forms with 20 or more fields require 60-90 seconds from humans, with under 30 seconds being a fraud indicator.

Timing analysis should capture not just total completion time but keystroke dynamics. Humans type with irregular rhythm – faster on familiar sequences, slower when thinking. Bots type with machine precision unless specifically programmed to introduce variability.

Behavioral Patterns

The most sophisticated fraud detection analyzes entire user sessions, not just form submissions. How did the user arrive? What did they do before completing the form? How did their mouse move?

Mouse movement tells a story: humans move cursors in curved paths with micro-corrections, while bots move in straight lines or teleport. Scroll behavior differs too – humans scroll in varied increments, pausing on content, while bots scroll uniformly or not at all. Click patterns show humans clicking with slight positional variation, while bots click exact pixel coordinates. Navigation paths reveal humans who browse, compare, and return to pages, contrasted with bots that proceed directly to forms. Session duration separates humans who spend time reading from bots that complete journeys in seconds.

Modern behavioral analysis platforms build risk scores from dozens of these signals, creating confidence intervals around submissions rather than binary accept/reject decisions.

Fraud Prevention Technology Stack: What You Need

Building a fraud prevention capability requires technology investment across three layers: prevention (stopping fraud before it enters), detection (identifying fraud that gets through), and remediation (handling discovered fraud).

Prevention Technologies

CAPTCHA and challenge systems provide the first defense line. reCAPTCHA v3, hCaptcha, and similar services score visitor behavior invisibly, flagging suspicious users for additional challenges while passing legitimate traffic through frictionlessly. Cost runs free for basic tiers, rising to $1-3 per 1,000 assessments for advanced features. Effectiveness stops 60-80% of basic bot traffic, though sophisticated bots increasingly defeat CAPTCHA systems.

Bot management platforms offer enterprise-grade protection. Solutions like Cloudflare Bot Management, Akamai Bot Manager, and DataDome analyze traffic patterns at the edge, blocking known bots and challenging suspicious traffic before it reaches your forms. Cost ranges from $2,500-$50,000+ annually depending on traffic volume, with leading platforms achieving 90-95% bot detection rates.

Detection Technologies

Lead verification services like Jornaya, TrustedForm, and LeadConduit verify leads in real-time as they’re captured or received. They check phone validity, email deliverability, address accuracy, and provide risk scores. Cost runs $0.05-$0.50 per lead depending on verification depth, catching 70-85% of fraudulent leads when properly configured.

Device intelligence platforms including Fingerprint.js, HUMAN (formerly White Ops), and similar services provide device-level intelligence – identifying unique devices, detecting emulators, and flagging known fraud devices. Cost ranges from $0.001-$0.01 per identification, with 95%+ device identification accuracy.

Identity verification services become essential for high-value leads. Plaid, Alloy, and Ekata validate that submitted information represents a real, reachable person by checking public records, phone ownership, and email/address associations. Cost runs $0.15-$2.00 per verification, catching 90%+ synthetic identity fraud.

Remediation Technologies

Lead scoring and routing platforms like Boberdoo, LeadConduit, and custom-built systems (see our lead distribution platforms comparison) score leads based on fraud signals, routing high-risk leads to manual review queues rather than immediate rejection.

Chargeback management systems track patterns when buyers dispute lead quality, aggregate claims, and provide evidence for discussions with traffic sources.

Verification Levels: Finding the Right Investment

Fraud prevention technology pricing varies significantly based on verification depth and volume. Understanding what each level provides helps you match investment to risk.

Basic verification at $0.03-$0.08 per lead covers phone number validity (is this a real, dialable number?), email deliverability (will email reach this address?), and basic IP analysis (residential vs. datacenter). What you miss at this level includes phone number ownership verification, behavioral analysis, device fingerprinting, and identity graph matching. This level suits high-volume, low-CPL verticals where some fraud is acceptable.

Standard verification at $0.08-$0.20 per lead includes all basic verification plus phone number line type (mobile vs. landline vs. VoIP), address validation and standardization, consent verification through TrustedForm certificates, and basic device fingerprinting. You still miss full identity verification, advanced behavioral analysis, and cross-publisher de-duplication. This level works for most lead generation operations, catching 70-80% of fraud at reasonable cost.

Advanced verification at $0.20-$0.50 per lead adds identity graph matching (does this name/phone/email belong together?), advanced behavioral scoring, cross-publisher de-duplication, real-time device risk scoring, and historical lead de-aging detection. Missing at this level are SSN/identity verification and credit bureau matching. This investment makes sense for high-value verticals like mortgage and auto finance where individual lead values exceed $50.

Enterprise verification at $0.50+ per lead adds SSN verification where permitted, credit bureau pre-qualification, custom fraud rules and scoring, and dedicated support and tuning. This level suits financial services with leads valued $100+ where compliance requirements mandate exhaustive verification.

The ROI of Fraud Prevention: Pennies Save Dollars

Fraud prevention costs must be evaluated against fraud losses. The math is straightforward but often miscalculated because operators consider only direct lead costs, not downstream impacts.

The ROI formula is simple: (Fraud Loss Prevented - Detection Cost) / Detection Cost.

Consider this scenario: monthly lead volume of 10,000 leads, average CPL of $40, pre-detection fraud rate of 25%, detection rate of 80% (of fraud caught), and detection cost of $0.15 per lead.

The calculation reveals the power of prevention. With 25% fraud, you have 2,500 fraudulent leads. At 80% detection, you catch 2,000 of them. Fraud loss prevented totals 2,000 multiplied by $40, equaling $80,000. Detection cost runs 10,000 multiplied by $0.15, equaling $1,500. Net savings: $78,500. ROI: 5,233%.

The math shows why fraud prevention is non-negotiable at scale. A $0.15 investment per lead returns $7.85 in fraud prevention for every dollar spent.

Beyond direct fraud losses, prevention preserves buyer relationships. A buyer receiving 25% fraudulent leads stops buying. A buyer receiving 5% fraudulent leads adjusts pricing. The first scenario ends revenue streams; the second maintains them at slight margin compression.

What fraud rate do buyers typically accept? Buyers generally tolerate 3-5% fraud/invalid rates as normal market friction. Rates above 8-10% trigger complaints and return requests (see our lead return rates benchmarks). Rates above 15% result in relationship termination. Your fraud prevention target should aim for sub-5% delivered fraud rates regardless of what you receive from sources.

Building a Fraud Detection Workflow

Effective fraud prevention requires systematic process, not ad-hoc investigation. Here is a workflow structure that scales from startup to enterprise.

Real-Time Scoring

Every lead receives a fraud score at capture or receipt. This score combines IP risk signals (datacenter, VPN, velocity), device fingerprint analysis (emulator, known fraud device), form completion behavior (timing, mouse movement), data validation (phone valid, email deliverable), and historical matching (seen this lead before?).

Score interpretation guides action. Leads scoring 0-30 are high risk and should be rejected or routed to manual review. Scores from 31-60 indicate medium risk requiring enhanced verification. The 61-80 range represents low risk suitable for standard processing. Scores of 81-100 signal minimal risk deserving priority delivery.

Tiered Verification

Based on initial scores, leads route to appropriate verification depth.

High risk leads (0-30) hold for manual review. An analyst examines full session data, checks identity graphs, and makes accept/reject decisions. Expected rejection rate exceeds 70%.

Medium risk leads (31-60) proceed through automated enhanced verification with additional identity checks, phone ownership validation, and address verification. Expected rejection rate runs 20-40%.

Low risk leads (61-100) receive standard processing with basic validation confirming data accuracy. Expected rejection rate stays at 5-15%.

Post-Delivery Monitoring

Fraud detection continues after delivery. Conversion data reveals fraud patterns invisible at submission time. You might notice leads from Source X converting at 0.5% versus 3% average, specific geographic regions showing zero conversions, or time-of-day patterns suggesting non-US traffic.

Weekly conversion analysis by source, geography, and demographic reveals quality patterns. Sources showing persistent underperformance require investigation and potential termination.

Feedback Loop Integration

Buyer feedback completes the detection cycle. When buyers flag leads as fraudulent, disconnected, or wrong-person, the response follows a clear path: flag the lead in your system, match against source for chargeback, add signals to detection model training, update source quality scores, and adjust bidding and routing accordingly.

This feedback loop improves detection over time. The frauds you catch today train the models that catch new fraud tomorrow.

Responding to Fraud Discoveries: Protocols and Partners

Discovering fraud triggers structured response. How you handle discoveries determines whether fraud is an occasional loss or an existential threat.

Immediate Response Protocol

When systematic fraud is identified, quarantine comes first. Pause lead routing from suspected source, hold pending deliveries for review, and preserve all session data and logs.

Next, quantify the scope. Determine how many leads are affected, what time period is involved, which buyers received fraudulent leads, and what total financial exposure looks like.

Evidence collection follows. Gather documentation for partner discussions including IP logs and geographic analysis, device fingerprint data, form completion timing records, conversion data showing patterns, and specific lead examples with full context.

Partner Communication

With traffic sources, present evidence factually. Avoid accusations; focus on data. “We observed [specific pattern] in leads from your source between [dates]. Here is the evidence. We need to understand what happened and how to prevent recurrence.”

Good partners investigate and remediate. Bad partners deflect and disappear. Their response tells you everything about whether the relationship continues.

With buyers, proactive disclosure builds trust. “We identified a quality issue affecting [X] leads delivered between [dates]. We are crediting your account and have terminated the responsible source.”

Buyers appreciate honesty. They despise discovering fraud themselves and then learning you knew but didn’t disclose.

Financial Resolution

Chargeback policies should be established before fraud occurs. Define what documentation triggers chargeback rights, what time window applies, what percentage is refundable, and how disputes are resolved.

Standard terms allow 24-72 hour review windows with 100% refund for demonstrable fraud – disconnected numbers, wrong-person confirmations, and duplicate leads.

Frequently Asked Questions

What percentage of leads should I expect to be fraudulent? First-party leads generated on your own properties typically show 5-10% fraud rates. Third-party leads from affiliates and networks run 15-30% fraud rates. Premium networks with strict quality controls achieve 10-15%. The rate you experience depends heavily on traffic sources, verticals, and your detection capabilities.

How much should I spend on fraud prevention? Invest $0.10-$0.25 per lead for standard verification in most verticals. High-value verticals like mortgage and auto finance warrant $0.25-$0.50 per lead. If your fraud prevention cost exceeds 2-3% of CPL, you are likely over-investing or operating in an unusually fraud-prone segment.

Can I prevent all fraud? No. Zero fraud is impossible without rejecting legitimate leads. The goal is economically optimal fraud reduction – catching enough fraud that remaining losses cost less than additional detection investment. Most operations target 90-95% fraud detection rates.

What is the best CAPTCHA solution? reCAPTCHA v3 offers the best balance of effectiveness and user experience for most applications. hCaptcha provides similar protection with better privacy characteristics. Enterprise operations with significant bot pressure should consider dedicated bot management platforms rather than CAPTCHA alone.

How do I detect recycled leads? Phone number and email de-duplication across time windows catches obvious recycling. Device fingerprinting identifies the same device submitting across multiple properties. Consent certificate timestamps from TrustedForm and Jornaya document original capture time regardless of current submission claims.

Should I reject or quarantine suspicious leads? Quarantine medium-risk leads for secondary review rather than immediate rejection. False positives cost you legitimate leads. A 24-48 hour review queue with manual analysis recovers valid leads while confirming fraudulent ones. Reject only high-confidence fraud.

How do I handle buyer fraud complaints? Treat every complaint as valid until investigated. Document the specific leads, pull session data, and analyze for fraud indicators. If fraud is confirmed, credit immediately and investigate the source. If legitimate, provide evidence supporting validity. Never dismiss complaints without investigation.

What legal exposure do I face from fraudulent leads? Delivering leads with fabricated consent creates TCPA liability for the buyer who calls them. If the “consumer” never consented, calls constitute violations. Your contracts should include representations about consent validity and indemnification for consent-related claims. Fraud prevention reduces this exposure.

How quickly does fraud detection improve? With proper feedback loops, detection accuracy improves measurably within 30-60 days of implementation. Initial deployment catches obvious fraud. Buyer feedback and conversion analysis train models to catch subtle patterns. Continuous improvement is expected and necessary – fraudsters adapt, and detection must keep pace.

What metrics should I track for fraud prevention? Track fraud detection rate (fraud caught divided by total fraud), false positive rate (valid leads rejected as fraud), buyer complaint rate, source-level quality scores, and fraud prevention ROI. Monthly trending shows whether your defenses are improving or degrading against evolving threats.

Key Takeaways

Lead fraud is structural, not exceptional. With $84 billion in annual ad fraud losses and 25-30% of third-party leads containing quality issues, fraud prevention is not optional – it is core infrastructure.

Detection requires multiple signals. IP analysis, device fingerprinting, timing analysis, and behavioral patterns each catch different fraud types. Layered detection catches what single-signal approaches miss.

Spend pennies to save dollars. Standard verification at $0.10-$0.20 per lead delivers 50:1 or better ROI against fraud losses. The math overwhelmingly favors investment.

Build systematic workflows. Real-time scoring, tiered verification, post-delivery monitoring, and feedback loops create sustainable fraud prevention that improves over time.

Respond to discoveries with protocol. Quarantine, quantify, collect evidence, and communicate with partners. How you handle fraud determines whether it remains occasional or becomes existential.

Target 90-95% detection, not 100%. Perfect fraud prevention rejects legitimate leads. Optimize for economic value, not theoretical purity.

Integrate buyer feedback. The leads that fraudsters beat your detection to catch eventually reveal themselves in conversion data. Buyer complaints are intelligence, not complaints.