Revenue recognition in lead generation is deceptively complex. When you sell a lead for $50 with a 72-hour return window and a 12% historical return rate, that sale is not $50 of revenue. Understanding the accounting treatment that keeps your books accurate, your auditors satisfied, and your decisions grounded in financial reality.

Why Lead Business Accounting Is Different

Most business accounting follows a straightforward pattern: deliver a product or service, recognize revenue, match costs. Lead generation breaks this pattern in ways that confuse accountants unfamiliar with the industry and create material risks for operators who get it wrong.

The lead generation business model introduces three complications that standard accounting training does not address. First, revenue is contingent. A lead sold today might be returned tomorrow under contractual return provisions. Second, the performance obligation is ambiguous. When exactly have you delivered “a lead”? At capture? At delivery? At buyer acceptance? At successful contact? Third, timing mismatches between cash flows and economic reality create divergence between what your bank account shows and what your P&L should reflect.

These complications have real consequences. Practitioners who recognize revenue at the point of sale without reserving for returns overstate income and find themselves short on cash when returns come in. Businesses that cannot articulate their revenue recognition policy to auditors face qualified opinions or worse. And companies seeking acquisition or investment watch deals collapse when buyers discover the books do not reflect economic reality.

This article provides the accounting framework you need. Whether you are running a $50,000-per-month operation or preparing for institutional due diligence, these principles apply. The goal is not to make you a CPA but to ensure you speak the same language as your accountants and make decisions grounded in accurate financial data.

Understanding Revenue Recognition Fundamentals

Revenue recognition determines when and how much revenue appears on your income statement. Get this wrong, and every downstream financial metric becomes unreliable. Your margins are fiction. Your profitability is unknown. Your tax liability may be miscalculated.

The Core Principle: Earned Revenue

Revenue is recognized when it is earned and realizable. “Earned” means you have substantially completed your performance obligation to the customer. “Realizable” means you have reasonable assurance of collection.

For lead generation, this creates an immediate question: what exactly is the performance obligation? Consider the variations:

Scenario A: Basic lead delivery. You capture a consumer’s information and deliver it to a buyer within milliseconds. Is your obligation complete at delivery?

Scenario B: Lead with return provisions. The same lead includes a 72-hour return window during which the buyer can reject for duplicate status, invalid contact information, or failure to meet criteria. Is your obligation complete before that window closes?

Scenario C: Performance-based pricing. You sell leads at a base price plus a bonus if the consumer converts to a customer. Your obligation extends until conversion outcome is known.

Each scenario requires different accounting treatment. The mistake most practitioners make is treating all leads like Scenario A when their contracts more closely resemble Scenario B or C.

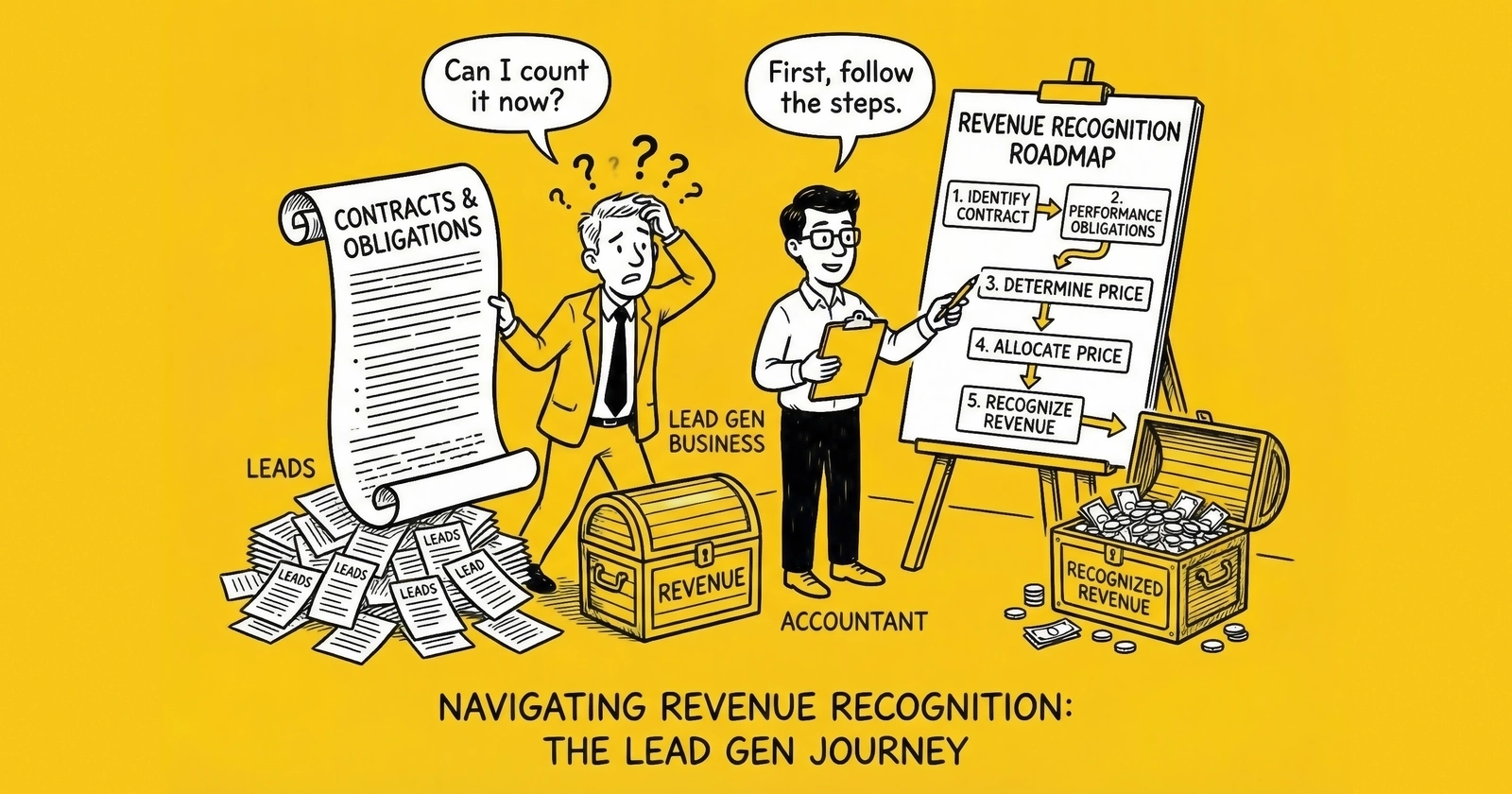

ASC 606: The Governing Standard

ASC 606, the Financial Accounting Standards Board’s revenue recognition standard (Revenue from Contracts with Customers), provides the authoritative framework. While primarily designed for larger enterprises, the principles apply to lead generation businesses of any size and inform how your accountant should approach your books.

ASC 606 establishes a five-step model for revenue recognition:

Step 1: Identify the contract. A contract exists when you have an agreement with a buyer that creates enforceable rights and obligations. Your lead purchase agreement, terms of service, or ping-post integration documentation typically constitutes the contract.

Step 2: Identify performance obligations. A performance obligation is a promise to deliver a distinct good or service. In lead generation, this is typically the delivery of qualified consumer contact information that meets agreed-upon criteria.

Step 3: Determine the transaction price. The transaction price is what you expect to receive for fulfilling the contract. This is not necessarily the list price if returns, chargebacks, or volume discounts apply.

Step 4: Allocate the transaction price. If a contract includes multiple performance obligations, the price must be allocated to each. This matters if you bundle leads with ancillary services.

Step 5: Recognize revenue when obligations are satisfied. Revenue is recognized when control transfers to the customer, which typically occurs upon delivery for lead generation.

The nuance for lead businesses comes in Steps 3 and 5. The transaction price must account for variable consideration (returns and refunds), and the timing of recognition must reflect actual transfer of control given your specific contract terms.

Revenue Recognition for Lead Sales

The standard lead sale involves capturing consumer information and delivering it to a buyer for a stated price. The accounting treatment depends on your contract terms, specifically around acceptance, returns, and payment timing.

Point-of-Sale Recognition with Return Reserves

Most lead businesses recognize gross revenue at the point of sale, typically when the lead is accepted by the buyer and delivery confirmation is received. This seems reasonable until you factor in return provisions.

If your buyer agreement includes a return window and your historical return rate runs 12%, that $50 sale is not $50 in expected revenue. It is approximately $44 in expected value at the moment of initial acceptance.

The proper approach involves recognizing gross revenue at point of sale and simultaneously establishing a contra-revenue reserve based on historical return rates. This reserve reduces net revenue to reflect expected returns that have not yet occurred.

Example journal entry for a $50 lead sale with 12% expected returns:

Debit: Accounts Receivable $50.00

Credit: Gross Revenue $50.00

Debit: Revenue Contra (Returns) $6.00

Credit: Returns Reserve Liability $6.00Net recognized revenue: $44.00

When returns actually occur, the liability is reduced rather than revenue being adjusted:

Debit: Returns Reserve Liability $50.00

Credit: Accounts Receivable $50.00This approach provides accurate period-by-period revenue reporting without the distortion of recognizing full revenue in month one and recording return adjustments in month two.

Calculating Return Reserve Rates

Return reserves should be calculated at the source-buyer level, not the aggregate business level. Your return rate from Affiliate Network A selling to Buyer B might be 8%, while the same leads from Network A selling to Buyer C run 18%. Blending these into a single reserve obscures the true economics of each relationship and creates inaccurate P&L by source.

Calculate trailing return rates using a 90-day lookback window. This provides enough data for statistical reliability while remaining responsive to trend changes. For new source-buyer combinations, use vertical-specific industry averages until you accumulate sufficient data.

| Vertical | Typical Return Rate | Conservative Reserve |

|---|---|---|

| Auto Insurance | 8-15% | 12% |

| Home Insurance | 10-18% | 15% |

| Mortgage | 10-18% | 15% |

| Solar | 15-25% | 20% |

| Legal | 20-35% | 28% |

Review and adjust reserves monthly. If actual returns consistently exceed or fall short of reserves, adjust the rate accordingly. Material over-reserving understates income; under-reserving overstates it. Neither helps you make good decisions.

Exclusive vs. Shared Lead Accounting

Revenue recognition differs between exclusive and shared lead models, and the distinction matters for accurate margin analysis.

An exclusive lead sold for $45 represents one revenue event with one set of direct costs. Accounting is straightforward: $45 revenue minus applicable costs equals margin.

A shared lead sold three times at $18 each represents three revenue events totaling $54. But these are not equivalent business activities. Each sale carries:

- Separate delivery obligations

- Separate return windows and potential returns

- Separate collection risk

- Separate compliance documentation requirements

For financial reporting, track shared leads as multiple transactions, not a single lead with $54 revenue. This maintains comparability with exclusive lead economics and enables accurate margin analysis by lead type.

When evaluating whether to shift a vertical from exclusive to shared distribution (or vice versa), calculate revenue per lead rather than revenue per sale:

Exclusive model:

- Sale price: $42

- Return rate: 10%

- Effective revenue per lead: $37.80

Shared model (3 buyers):

- Sale price: $18 x 3 = $54

- Return rate: 15% per sale

- Effective revenue per lead: $45.90

The shared model wins on revenue per lead despite lower per-sale pricing, but the analysis must account for the operational complexity of three delivery integrations, three billing relationships, and three potential return disputes per lead.

Deferred Revenue Situations

Certain lead business arrangements require deferred revenue treatment, where cash received is not immediately recognized as income.

Prepaid buyer accounts. When buyers prepay for leads, the cash received is a liability (Deferred Revenue or Customer Deposits), not revenue. Revenue is recognized as leads are delivered and accepted:

Cash receipt:

Debit: Cash $10,000

Credit: Deferred Revenue $10,000

Lead delivery (200 leads at $50):

Debit: Deferred Revenue $10,000

Credit: Lead Revenue $10,000Monthly minimums with shortfall credits. If your contract guarantees delivery of 1,000 leads monthly with credits for shortfall, any portion of payment corresponding to undelivered leads is deferred until delivery occurs or the obligation expires.

Performance bonuses. If you receive a bonus contingent on buyer outcomes (consumer conversion, policy binding, loan closing), recognize the bonus only when the outcome is determined. Until then, the potential bonus is variable consideration that should not be included in recognized revenue.

Cost Recognition and Matching

The matching principle requires that costs be recognized in the same period as the revenue they generate. For lead generation, this creates specific challenges around traffic acquisition timing, platform fees, and compliance costs.

Traffic Acquisition Costs

Traffic acquisition is the largest direct cost for lead generators. Proper cost recognition requires matching media spend to the leads it generates.

For leads generated and sold in the same accounting period, matching is straightforward: the media spend that generated this month’s leads is recognized this month. But complications arise when leads cross period boundaries.

Leads generated in Month 1, sold in Month 2. The cost should be recognized when the lead sells, not when the traffic was purchased. This requires inventory accounting for unsold leads:

Month 1 (lead generated, not sold):

Debit: Lead Inventory $25.00

Credit: Cash (or AP) $25.00

Month 2 (lead sold):

Debit: Cost of Goods Sold $25.00

Credit: Lead Inventory $25.00For real-time lead operations where leads are sold within minutes of generation, the distinction is immaterial. For operations with significant aged lead inventory, proper inventory accounting is essential.

Failed campaigns and testing costs. Not all traffic spend generates sellable leads. Failed campaigns, testing spend before optimization, and invalid leads represent costs without corresponding revenue.

Two approaches are defensible. The direct expense approach treats all traffic spend as period expense, accepting that some spend does not generate revenue. The allocation approach spreads testing and failure costs across successful leads as overhead.

The direct expense approach is simpler and more conservative. The allocation approach provides more accurate lead-level unit economics. Choose based on your operational sophistication and what decisions the data needs to support.

Platform and Technology Costs

Lead distribution platforms, CRM systems, validation services, and compliance documentation create recurring costs that must be allocated appropriately.

Transaction-based fees (per-lead charges from platforms like boberdoo, LeadsPedia, or validation services) are direct costs matched to specific leads. Recognize them when the lead transaction occurs.

Subscription fees (monthly platform fees, CRM subscriptions, fixed technology costs) are period expenses recognized monthly regardless of lead volume. Do not capitalize or defer these unless the subscription provides a material benefit extending beyond the current period.

Implementation and setup costs for new technology platforms may be capitalized and amortized if they create a long-term asset. A $25,000 platform implementation project with a 36-month expected benefit can be amortized at approximately $695 per month rather than expensed entirely in Month 1.

Compliance Cost Allocation

Compliance costs include consent documentation systems, legal review, TCPA insurance, and potential litigation reserves. The accounting treatment depends on whether costs are incurred for specific leads or as general infrastructure.

Per-lead compliance costs (TrustedForm certificates at $0.25 per lead, Jornaya tokens, real-time validation) are direct costs matched to specific leads. These are straightforward: the cost attaches to the lead that incurred it.

General compliance infrastructure (annual legal retainers, platform subscriptions for compliance monitoring, staff time for compliance management) are period expenses allocated across all leads. Calculate a per-lead compliance allocation rate by dividing monthly compliance infrastructure costs by monthly lead volume.

Litigation reserves deserve special attention. Your compliance costs should include a reserve for potential TCPA or state regulatory exposure based on historical dispute rates and average resolution costs.

If you face one TCPA demand letter per 50,000 leads, with average resolution cost of $15,000 (including legal fees and any settlement), your litigation reserve should be approximately $0.30 per lead. This seems small, but at 100,000 leads monthly, you are reserving $30,000 for compliance contingencies.

Operators who skip litigation reserves report inflated margins until a lawsuit arrives. The reserve creates a more accurate picture of true profitability even if most periods show no actual litigation expense.

Accounting for Returns and Refunds

Returns are the most commonly mishandled accounting item in lead generation. Proper treatment requires understanding both the revenue impact and the operational cash flow implications.

Return Provision Accounting

When a buyer returns a lead under your contractual provisions, the accounting treatment depends on whether you previously reserved for returns.

With return reserve in place:

Debit: Returns Reserve Liability $50.00

Credit: Accounts Receivable $50.00The return reduces both the liability (your obligation to accept returns) and the receivable (what the buyer owes you). Net revenue for the period is unaffected because the reserve already reduced recognized revenue.

Without return reserve (not recommended):

Debit: Returns and Refunds Expense $50.00

Credit: Accounts Receivable $50.00The return creates an expense that reduces current-period income, even though the original sale occurred in a prior period. This creates period-to-period volatility that obscures underlying business performance.

Chargebacks and Payment Disputes

Chargebacks differ from contractual returns. A chargeback occurs when a buyer disputes a charge with their payment processor, reversing the transaction outside your normal return process.

For chargebacks where you lose the dispute:

Debit: Chargeback Loss $50.00

Debit: Chargeback Fee $25.00

Credit: Cash (or Accounts Receivable) $75.00Chargeback losses should be tracked separately from returns because they represent a different type of risk (buyer relationship or fraud issues versus lead quality issues) and carry additional fees.

If chargeback rates become material, establish a chargeback reserve similar to the return reserve approach.

Bad Debt and Uncollectible Accounts

Not all buyers pay. Accounts receivable that become uncollectible require write-off.

Establishing bad debt reserve:

Calculate your historical bad debt rate (uncollected accounts / total sales). Apply this rate to current accounts receivable to establish an allowance for doubtful accounts:

Debit: Bad Debt Expense $3,000

Credit: Allowance for Doubtful Accounts $3,000Writing off specific accounts:

When a specific receivable is determined to be uncollectible:

Debit: Allowance for Doubtful Accounts $1,500

Credit: Accounts Receivable $1,500For small operations, the direct write-off method (expensing bad debt when specific accounts become uncollectible) is acceptable. For larger operations or those seeking external financing, the allowance method provides more accurate period-by-period expense matching.

Cash vs. Accrual Accounting Considerations

The choice between cash and accrual accounting significantly impacts how your financials present business performance. Most lead generation businesses of any scale should use accrual accounting, but understanding the differences helps you interpret your numbers correctly.

Cash Basis Limitations

Cash basis accounting recognizes revenue when cash is received and expenses when cash is paid. This creates significant distortions for lead businesses.

Consider this scenario: In December, you generate and deliver 10,000 leads at $50 each ($500,000 in sales). You pay $200,000 for traffic in December. Buyers pay on Net-45 terms.

Cash basis December P&L:

- Revenue: $0 (no cash received yet)

- Expense: $200,000 (traffic paid)

- Net: -$200,000 (appears to be a massive loss)

Cash basis January P&L:

- Revenue: $500,000 (December’s sales collected)

- Expense: $0 (no new traffic paid this month)

- Net: $500,000 (appears to be a huge profit)

Neither month reflects economic reality. December was profitable; January may not be. Cash basis accounting hides this.

Accrual Basis Advantages

Accrual accounting recognizes revenue when earned (leads delivered) and expenses when incurred (traffic consumed), regardless of cash timing.

Accrual December P&L:

- Revenue: $500,000 (leads delivered and accepted)

- Expense: $200,000 (traffic that generated those leads)

- Net: $300,000 (reflects actual economic performance)

Accrual accounting provides decision-useful information. You can see which months are truly profitable, which traffic sources generate positive unit economics, and whether your business is actually growing.

Cash Flow Statement Importance

Accrual accounting does not eliminate the need to manage cash. The cash flow statement reconciles accrual-basis income to actual cash movement, revealing the timing gaps that can sink even profitable businesses.

The sixty-day float requirement in lead generation means your cash flow statement will show different timing than your P&L. A profitable month on an accrual basis might still consume cash if you are growing, because you pay for December’s leads in December but collect December’s revenue in February.

Monitor both statements. The P&L tells you if the business is economically viable. The cash flow statement tells you if you can survive long enough to prove it.

Financial Reporting for Lead Businesses

Accurate financial reporting requires presenting lead business economics in formats that enable good decision-making. Standard financial statement formats work, but the chart of accounts and supporting schedules need adaptation.

Chart of Accounts Structure

A lead generation chart of accounts should separate revenue and costs by the dimensions that drive your business decisions.

Revenue accounts:

- Gross Lead Revenue (by vertical, by lead type)

- Less: Returns and Refunds (by vertical, by buyer)

- Less: Chargebacks

- Net Lead Revenue

Cost of Goods Sold accounts:

- Traffic Acquisition (by source, by platform)

- Lead Purchases (if brokering)

- Per-Lead Validation Costs

- Per-Lead Compliance Costs (TrustedForm, etc.)

Operating Expense accounts:

- Platform and Technology (subscription-based)

- Labor (by function: traffic, operations, sales)

- Marketing and Business Development

- Professional Services (legal, accounting)

- General and Administrative

This structure enables analysis by vertical, source, and buyer while maintaining clean rollup to standard financial statements.

Contribution Margin Analysis

The most useful management report for a lead business is contribution margin by source and buyer. This shows which relationships actually make money after all direct costs.

Contribution margin formula:

Revenue from Source/Buyer

- Returns and Refunds

- Traffic Acquisition Cost

- Per-Lead Direct Costs

= Contribution MarginRun this analysis weekly. Sources that were profitable last month may have deteriorated. Traffic quality shifts, buyer preferences change, and competition alters auction dynamics.

A typical contribution margin report reveals that 20% of sources generate 80% of profit. The middle 60% often breaks even, subsidized by top performers. The bottom 20% loses money on every transaction. Ruthless source management based on contribution margin drives profit improvement faster than any other operational lever.

Financial Metrics Dashboard

Track these metrics monthly (at minimum) to maintain visibility into business health:

| Metric | Formula | Target Range |

|---|---|---|

| Net Revenue per Lead | Net Revenue / Leads Delivered | Vertical-specific |

| Return Rate | Returns / Gross Leads Sold | Under 12% |

| Gross Margin | (Net Revenue - Direct Costs) / Net Revenue | 25-45% for brokers, 60-80% for generators |

| Operating Margin | (Gross Profit - Operating Expenses) / Net Revenue | 15-30% |

| Days Sales Outstanding | (AR / Revenue) x 365 | Under 45 days |

| Bad Debt Rate | Write-offs / Revenue | Under 2% |

Trend these metrics over time. A single month’s numbers are less important than directional movement. Margins declining 2 percentage points per month for three consecutive months signal a problem requiring investigation.

Audit and Due Diligence Preparation

Whether preparing for an annual audit or positioning for acquisition, lead businesses face specific scrutiny areas where inadequate documentation creates problems.

Revenue Recognition Documentation

Auditors and acquirers want to see a documented revenue recognition policy that addresses:

Timing of recognition. When exactly do you recognize revenue? At lead delivery? At buyer acceptance? After return window closes? Your policy must be consistent with your contracts and applied uniformly.

Treatment of variable consideration. How do you account for returns, chargebacks, and performance bonuses? What data supports your reserve calculations?

Consistency. Have you applied the same policy across reporting periods? Changes in recognition policy require disclosure and potentially restatement.

Prepare a written revenue recognition memo that references your standard buyer agreements and explains your accounting treatment. This document should exist before anyone asks for it.

Contract Documentation

Maintain complete documentation of all buyer relationships, including:

- Master service agreements

- Rate cards and pricing schedules

- Return policy provisions

- Payment terms

- Any modifications or amendments

Auditors will sample buyer contracts and trace revenue recognition to contract terms. Missing or inconsistent documentation creates audit findings.

Supporting Schedules

Prepare supporting schedules that tie detailed operational data to financial statement line items:

Revenue bridge: Gross leads generated to net revenue recognized, showing validation failures, unsold leads, returns, and pricing adjustments.

Returns analysis: Returns by buyer, by source, by month, with comparison to reserves.

Accounts receivable aging: Current, 30-day, 60-day, 90-day, and over-90-day buckets by buyer.

Cost allocation methodology: Documentation of how overhead costs are allocated to leads or business segments.

These schedules should be producible within 48 hours of request. If generating them requires weeks of work, your ongoing record-keeping needs improvement.

Common Due Diligence Issues

Acquirers and investors consistently flag these issues in lead business due diligence:

Inadequate return reserves. Historical returns significantly exceed reserves, indicating revenue was overstated.

Buyer concentration. Single buyers representing over 25% of revenue create risk that affects valuation.

Compliance exposure. Insufficient documentation of consent, missing TrustedForm certificates, or unclear TCPA procedures create contingent liability concerns.

Founder-dependent operations. Critical relationships or operational knowledge concentrated in the founder rather than documented in processes.

Address these issues proactively. The time to fix them is before you are in a transaction, not during due diligence when every problem discovered affects price.

Tax Considerations for Lead Businesses

Tax treatment follows accounting treatment in most cases, but several lead-business-specific considerations warrant attention.

Revenue Timing

The IRS generally follows GAAP (Generally Accepted Accounting Principles) for revenue recognition. If you recognize revenue at delivery with return reserves under accrual accounting, the same treatment applies for tax purposes.

Cash-basis taxpayers may have different timing of revenue recognition for tax purposes. Consult a tax advisor about whether your business qualifies for cash-basis tax treatment and the implications of that election.

Deductible Expenses

Most lead generation operating costs are currently deductible business expenses. Areas requiring attention:

Software and platform costs. Generally deductible as incurred if treating as operating expenses. If capitalized for book purposes, may need similar treatment for tax.

Compliance and litigation costs. Legal fees for routine compliance matters are deductible. Settlement payments may be deductible unless related to certain penalties. Document the nature of all legal expenses clearly.

Bad debt write-offs. Specific write-offs are deductible when accounts become worthless. Reserve additions are not deductible for most taxpayers; only actual write-offs create deductions.

State Tax Nexus

Lead generation creates complex state tax nexus questions. If you generate leads from consumers in California and sell to buyers in Texas, which state can tax the transaction?

The answer depends on state-specific sourcing rules and your physical or economic presence in each state. Lead businesses operating across multiple states should engage tax advisors familiar with these issues. State tax audits targeting digital businesses have increased substantially since 2020.

Sales Tax on Lead Sales

Most states do not impose sales tax on B2B lead sales, treating them as services rather than tangible personal property. However:

- Some states are expanding digital service taxation

- Bundled offerings (leads plus software access) may have different treatment

- State rules vary and change frequently

Confirm sales tax treatment in states where you have significant activity. Do not assume leads are non-taxable without verification.

Frequently Asked Questions

When should I recognize revenue for a lead sale: at delivery or after the return window closes?

Revenue should be recognized at the point of delivery when control transfers to the buyer, provided you establish an appropriate reserve for expected returns. Waiting until the return window closes is overly conservative and creates delayed revenue recognition that does not reflect the economic substance of the transaction. The combination of point-of-sale recognition with a return reserve based on historical rates is the standard approach under ASC 606 and provides the most accurate period-by-period reporting.

How do I calculate the appropriate return reserve rate for my business?

Calculate your trailing return rate using a 90-day lookback window at the source-buyer level, not the aggregate business level. For new relationships without sufficient history, use vertical-specific industry averages (typically 8-15% for insurance, 10-18% for mortgage, 15-25% for solar, 20-35% for legal). Review and adjust monthly based on actual experience. If your reserves consistently over- or under-predict actual returns by more than 2 percentage points, adjust the rate.

Is lead generation revenue considered product revenue or service revenue?

The classification depends on the nature of what you are delivering. Most lead generation is properly classified as service revenue because you are providing access to consumer information rather than transferring a physical product. However, for tax and regulatory purposes in certain jurisdictions, the specific classification may matter. Consult with your accountant on the appropriate classification for your financial statement presentation and tax filings.

How should I account for shared leads sold to multiple buyers?

Track shared leads as multiple transactions, not a single lead with combined revenue. Each sale to a different buyer is a separate revenue event with its own delivery obligation, return window, and collection risk. This treatment maintains comparability with exclusive lead economics and enables accurate margin analysis by lead type. For internal management reporting, also track revenue per lead (total revenue from all sales divided by leads generated) to compare economic performance between exclusive and shared models.

What is the correct treatment for prepaid buyer deposits?

Prepaid deposits should be recorded as a liability (Deferred Revenue or Customer Deposits) when received, not as revenue. Revenue is recognized as leads are delivered and accepted under the terms of your agreement. This treatment reflects that you have an obligation to deliver leads in exchange for the cash received. If the buyer’s deposit exceeds lead deliveries by the end of the contract period, the treatment of unused deposits depends on your contract terms (refundable, non-refundable, or rollover to future periods).

How do I handle bad debt from buyers who do not pay?

For most small to mid-size lead businesses, the direct write-off method is acceptable: record bad debt expense when specific accounts become uncollectible. For larger operations or those seeking external financing, the allowance method is preferred: establish an allowance for doubtful accounts based on historical collection rates, charge estimated bad debt expense monthly, and write off specific accounts against the allowance when deemed uncollectible. Track bad debt rates by buyer to identify credit risk concentration.

Should my lead business use cash or accrual accounting?

Accrual accounting is strongly recommended for any lead business generating more than $100,000 in annual revenue or seeking financing or acquisition. Cash accounting creates significant distortions due to the timing mismatch between paying for traffic and collecting from buyers. A month that is highly profitable on an accrual basis may show a loss on cash basis if traffic payments occur before buyer collections. Accrual accounting provides the decision-useful information you need to manage the business effectively.

What documentation do auditors require for revenue recognition?

Auditors want to see a written revenue recognition policy, sample buyer contracts demonstrating how the policy applies to actual agreements, supporting schedules showing the calculation of return reserves and bad debt allowances, and reconciliation between gross leads and recognized revenue. They will sample transactions to verify that actual accounting treatment matches stated policy. Prepare this documentation proactively rather than scrambling when auditors arrive.

How do I account for TCPA litigation reserves?

Establish a litigation reserve based on historical dispute frequency and average resolution cost. If you receive one demand letter per 50,000 leads with average resolution cost of $15,000, your reserve should be approximately $0.30 per lead. Recognize this as a compliance expense that increases a litigation reserve liability. When actual claims are resolved, reduce the liability accordingly. This approach smooths the P&L impact of episodic litigation and provides more accurate ongoing profitability measurement.

What financial metrics should I track monthly for my lead business?

Track net revenue per lead, return rate, gross margin, operating margin, days sales outstanding (DSO), and bad debt rate monthly at minimum. Compare each metric to prior periods and budget to identify trends requiring attention. For operational management, also track contribution margin by source and by buyer weekly to identify which relationships are actually profitable after all direct costs.

Key Takeaways

-

Revenue recognition at point of sale requires return reserves. Recognize gross revenue when leads are delivered and accepted, but simultaneously establish a contra-revenue reserve based on historical return rates. This provides accurate period-by-period reporting without waiting for return windows to close.

-

Calculate reserves at the source-buyer level. Aggregate return rates obscure the true economics of individual relationships. Your return rate from Source A to Buyer B may differ substantially from Source A to Buyer C. Track and reserve accordingly.

-

ASC 606’s five-step model applies to lead businesses. Identify the contract, identify performance obligations (lead delivery meeting specifications), determine transaction price (including variable consideration for returns), allocate price to obligations, and recognize revenue when obligations are satisfied.

-

Accrual accounting is essential for decision-useful reporting. Cash accounting creates severe distortions due to the 45-60 day gap between paying for traffic and collecting from buyers. Profitable months can appear as losses and vice versa under cash accounting.

-

Contribution margin by source and buyer is the most important management report. This analysis reveals which 20% of relationships generate 80% of profit and which bottom tier loses money on every transaction.

-

Prepare for audit and due diligence proactively. Document your revenue recognition policy, maintain complete contract files, and build supporting schedules before anyone asks. The time to fix problems is before you enter a transaction, not during due diligence.

This article provides general information about accounting principles for lead generation businesses. It is not a substitute for professional accounting advice. Consult with a qualified CPA familiar with your specific circumstances for guidance on your accounting policies and financial reporting.