A comprehensive guide to managing buyer relationships, resolving disputes, and building customer service operations that turn complaints into competitive advantage.

The email arrives at 8:47 AM on a Monday. Your largest buyer – representing 22% of monthly revenue – is threatening to terminate the relationship over what they describe as “consistent quality issues” affecting their past two weeks of purchases. They demand an immediate response. Your return rate data shows their returns at 9.3%, well within contracted terms. Your contact rate data shows no degradation. Something else is happening, but you have 24 hours to figure out what before $185,000 in monthly revenue walks out the door.

Welcome to customer service in lead generation.

This business operates at the intersection of high stakes, compressed timelines, and irreversible decisions. The leads you delivered yesterday are already being worked today. The buyer who filed a complaint at 9 AM expects resolution by 5 PM. The dispute that seems minor in isolation may represent a pattern that threatens your entire buyer portfolio.

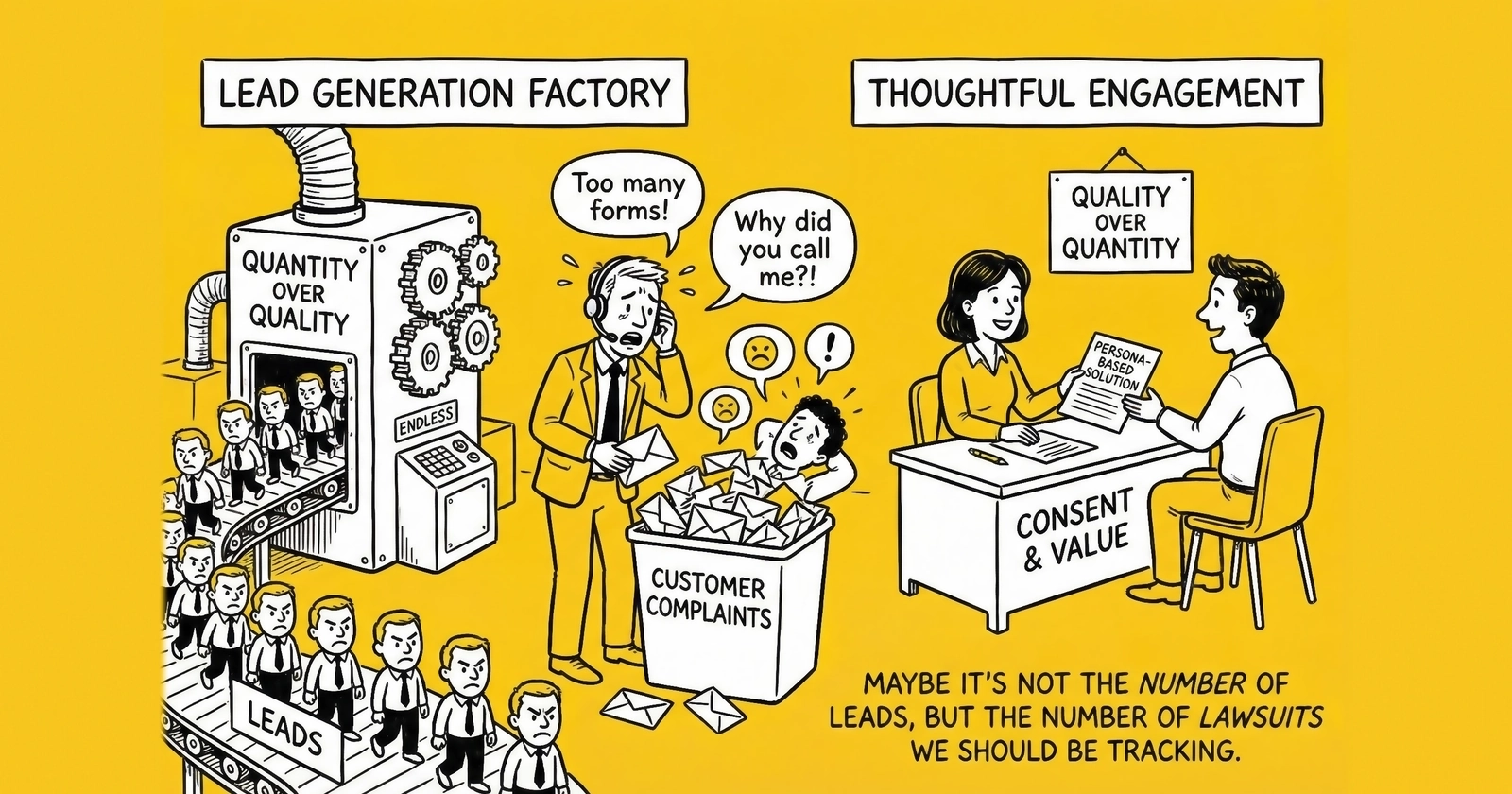

Most lead generation operations treat customer service as a cost center – something to minimize rather than optimize. That perspective costs them buyers, margins, and ultimately their businesses. Those who thrive recognize that complaint handling is the moment of truth in buyer relationships. How you respond when things go wrong determines whether buyers stay, grow, or churn. It determines whether they refer new business or warn peers away from working with you.

Industry data reveals a sobering reality: lead buyers who experience poor complaint resolution churn at 3.4x the rate of those with neutral experiences, and 6.2x the rate of those whose complaints were handled well. A single mishandled dispute can erase months of relationship building. Conversely, complaints resolved quickly and fairly often strengthen relationships beyond their pre-complaint baseline.

This guide covers everything you need to know about handling buyer complaints in lead generation: the types of complaints you will encounter, how to build systems that resolve them efficiently, the economics of complaint resolution, and the organizational capabilities that separate professional operations from amateur ones.

Understanding the Buyer Complaint Landscape

Lead buyers complain about a predictable set of issues. Understanding this landscape allows you to build systems that address the most common problems efficiently while preserving capacity for novel situations that require human judgment.

Quality-Related Complaints

Quality complaints represent 55-65% of all buyer issues in typical lead operations. They manifest in several distinct patterns.

Contact Rate Degradation: The buyer claims they cannot reach consumers. Phone numbers ring but never answer. Voicemails go unreturned. The contact rate that averaged 78% last month has dropped to 61% this month. Contact rate complaints require careful analysis because they may reflect lead quality issues, buyer operational problems, or seasonal factors affecting consumer behavior.

Data Accuracy Problems: The information captured does not match reality. The consumer’s stated income is incorrect. The property address does not exist. The phone number belongs to someone other than the named consumer. Data accuracy complaints often cluster around specific sources, making source-level analysis essential.

Intent Mismatch: The consumer does not actually want what the buyer sells. They filled out a solar form but have no interest in solar panels. They submitted an insurance inquiry but already have coverage. Intent mismatch complaints are among the most difficult to adjudicate because proving intent at the moment of form completion is inherently challenging.

Duplicate Leads: The buyer already has this consumer in their system. They purchased the same lead from you previously or from another source. Duplicate complaints require clear documentation of your deduplication processes and honest acknowledgment when duplicates slip through.

Delivery-Related Complaints

Delivery complaints account for 15-20% of buyer issues, concentrated in several categories.

Speed Issues: Leads arrive too slowly after capture. The five-minute-old lead you promised is arriving 45 minutes after the consumer submitted their information, which degrades value according to the lead decay curve. Speed complaints often indicate integration problems, queue backlogs, or infrastructure limitations that require technical investigation.

Format Problems: Lead data does not match the buyer’s required specifications. Fields are mapped incorrectly. Data types are inconsistent. Optional fields that the buyer requires are missing. Format complaints typically indicate integration configuration issues that, once identified, can be resolved systematically.

Volume Inconsistency: The buyer contracted for 500 leads per week and is receiving 280. Or they are receiving 800 when their capacity is 500, causing operational overflow. Volume complaints require examination of both your delivery systems and your volume commitment calculations.

Billing and Financial Complaints

Financial complaints represent 10-15% of buyer issues but carry disproportionate relationship risk.

Return Processing Delays: The buyer submitted returns five days ago, and their credit has not appeared. They are questioning whether you process returns at all. Return processing delays erode trust faster than almost any other issue because they involve money the buyer believes they are owed.

Pricing Discrepancies: The invoice does not match the buyer’s calculations. The per-lead price appears different from what was agreed. Tiered pricing thresholds were not applied correctly. Pricing complaints require line-item reconciliation and often reveal genuine errors in your billing systems.

Payment Term Conflicts: The buyer believed they had NET 30 terms; your invoice demands NET 15. The contract is ambiguous, or someone made verbal commitments that were not documented. Payment term complaints require contract review and, frequently, negotiation to establish clear expectations going forward.

Compliance-Related Complaints

Compliance complaints constitute 5-10% of issues but carry the highest severity.

Consent Documentation: The buyer cannot locate the consent certificate for a lead they received. The TrustedForm URL returns an error. The certificate shows a different company name than the buyer. Consent complaints require immediate investigation because they may expose the buyer to TCPA liability.

DNC Violations: The consumer claims to be on the Do Not Call registry. The buyer called them anyway using your lead. Now the consumer is threatening to file a complaint. DNC complaints require verification against registry data and honest acknowledgment when violations occurred.

Time Restrictions: The lead was delivered at a time when the buyer could not legally call. Or the lead data indicates the consumer lives in a state with calling hour restrictions that the buyer violated. Time restriction complaints often reveal gaps in your lead enrichment or the buyer’s dialing operations.

The Anatomy of Effective Complaint Resolution

Resolving complaints effectively requires more than good intentions. It requires a systematic approach that addresses both the immediate issue and the underlying relationship dynamics.

Response Time Standards

The speed of your initial response shapes the entire complaint trajectory. Industry benchmarks and buyer expectations establish clear standards.

Critical Issues (Compliance, Major Financial): Response within 2 hours during business hours. These issues carry legal or existential risk and demand immediate attention regardless of other priorities.

High Priority Issues (Quality Degradation, Delivery Failures): Response within 4 hours during business hours. These issues directly affect the buyer’s ability to operate and generate revenue from your leads.

Standard Issues (Routine Returns, Minor Discrepancies): Response within 24 hours. These issues matter but do not require immediate intervention.

Low Priority Issues (General Inquiries, Feature Requests): Response within 48 hours. These issues represent normal relationship maintenance rather than problem resolution.

Response time is measured from complaint receipt to meaningful engagement – not from receipt to acknowledgment. An auto-response does not satisfy a 2-hour standard. A human being reviewing the issue, beginning investigation, and providing substantive communication does.

The Five-Stage Resolution Framework

Effective complaint resolution follows a consistent pattern that you can systematize across your organization.

Stage 1: Acknowledge and Validate (0-2 hours)

Begin by confirming receipt and demonstrating that you understand the issue as the buyer perceives it. This is not the moment to defend or explain – it is the moment to show that you are listening.

“Thank you for bringing this to our attention. I understand you’re seeing a 40% drop in contact rates on leads delivered since December 15th, and this is affecting your team’s ability to convert at expected rates. Let me investigate and get back to you with findings.”

Validation does not mean agreement. You are not conceding that your leads are defective. You are confirming that you heard what the buyer said and take their concern seriously.

Stage 2: Investigate and Document (2-24 hours)

Conduct a thorough investigation that examines the complaint from multiple angles. Pull the relevant data: lead-level records, source attribution, delivery timestamps, validation results, prior return history, and any available buyer feedback.

Document your investigation process. If the complaint escalates to a dispute, you need records showing what you examined and what you found. If the complaint recurs, you need context for understanding patterns.

Investigation should include:

- Lead-level data review for the affected time period

- Source-level analysis to identify concentration patterns

- Comparison to baseline metrics from prior periods

- Validation system logs showing what checks passed or failed

- Any buyer-specific factors that might explain the issue

Stage 3: Determine Resolution Path (24-48 hours)

Based on your investigation, determine the appropriate resolution. Options typically include:

Full Credit: The complaint is valid, the leads were defective, and the buyer deserves refund for affected leads. This is the appropriate response when your systems failed and the buyer received something materially different from what they purchased.

Partial Credit: The complaint has merit, but the issue is shared. Perhaps some leads were problematic while others were fine. Perhaps the buyer’s operational issues contributed to the outcome. Partial credit acknowledges the problem without accepting full responsibility.

Make-Good Delivery: Instead of credit, offer replacement leads at no charge. This works when the buyer still needs volume and you can source quality leads to replace the problematic ones.

Operational Adjustment: The issue does not warrant credit but does require changes. Perhaps your filters need tightening, your validation needs enhancement, or your delivery timing needs adjustment. Acknowledge the issue and commit to specific changes.

No Action: Your investigation reveals no defect. The complaint is not valid based on contracted terms and objective evidence. Maintain your position while providing the buyer with data supporting your conclusion.

Stage 4: Communicate Resolution (48-72 hours)

Present your findings and proposed resolution clearly, with supporting data. Avoid defensive language. State what you found, what you conclude, and what you propose to do.

“After reviewing the 847 leads delivered between December 15th and December 28th, we found that leads from Source 47 showed a 31% invalid phone rate compared to our standard 6%. This source was introduced on December 12th and has been terminated. We’re issuing credit for 142 leads at $42 each, totaling $5,964. We’ve also enhanced our phone validation to prevent this pattern from recurring.”

Provide data. Buyers appreciate understanding the analysis behind your conclusion. When you share your methodology, you demonstrate professionalism and make it harder for them to dispute your findings.

Stage 5: Follow Up and Confirm (7-14 days)

After implementing the resolution, follow up to confirm the issue is resolved. Check that credits were processed correctly, that replacement leads were delivered, that operational changes took effect.

“Following up on our conversation from December 29th – I wanted to confirm that the $5,964 credit appeared on your January 1st invoice and that you’ve seen improvement in contact rates since we terminated Source 47 and enhanced our validation. Our records show your contact rate has returned to 77% over the past week. Does that align with what you’re seeing?”

Follow-up demonstrates that you care about outcomes, not just closing tickets. It also catches any execution failures before they compound into new complaints.

Building Complaint Resolution Infrastructure

Systematic complaint handling requires infrastructure that captures issues, tracks resolution, and enables analysis. The specific tools matter less than the capabilities they provide.

Complaint Capture Systems

Every buyer complaint should enter a tracking system that assigns it a unique identifier, captures the complaint details, routes it to appropriate personnel, and timestamps all activity.

Essential Fields:

- Complaint ID (unique identifier)

- Buyer ID and contact information

- Date/time received

- Issue category (quality, delivery, billing, compliance)

- Priority level (critical, high, standard, low)

- Detailed description of the issue

- Affected leads (volume, date range, source)

- Financial impact (claimed)

- Assigned owner

- Status (new, investigating, pending resolution, resolved, closed)

Capture Channels:

- Dedicated support email address

- Support ticket portal

- Phone/voicemail with transcription

- Buyer portal submission forms

- Account manager reporting

Avoid letting complaints arrive through informal channels that bypass tracking. When a buyer texts their account manager about a quality issue, that text needs to become a ticket. When a complaint comes up during a phone call, a ticket gets created before the call ends.

Escalation Protocols

Not all complaints are equal. Your system needs clear escalation paths that route critical issues to decision-makers and protect your organization from catastrophic failures.

Level 1 (Customer Service Team): Routine complaints that fall within established policies. Standard return requests, minor discrepancies, general inquiries. Resolution authority up to 3% of monthly buyer revenue.

Level 2 (Account Management): Significant issues affecting buyer satisfaction or representing unusual patterns. Quality degradation complaints, delivery system failures, pricing disputes. Resolution authority up to 10% of monthly buyer revenue.

Level 3 (Operations Leadership): Major issues with relationship or financial implications. Threats to terminate, large credit requests, compliance concerns. Resolution authority up to 25% of monthly buyer revenue.

Level 4 (Executive): Critical issues requiring senior judgment. Legal threats, major buyer churn risk, systemic failures affecting multiple buyers. Unlimited resolution authority.

Define escalation triggers clearly. Any complaint mentioning legal action escalates immediately to Level 3 minimum. Any complaint from a top-10 buyer escalates to Level 2 minimum. Any compliance-related issue escalates to Level 3 minimum.

Resolution Documentation

Every resolved complaint should generate documentation that serves three purposes: confirming the outcome to the buyer, enabling analysis of patterns, and providing evidence if disputes recur.

Resolution Record Components:

- Original complaint summary

- Investigation findings with supporting data

- Resolution decision and rationale

- Financial impact (credit issued, leads replaced, etc.)

- Preventive measures implemented

- Buyer acknowledgment/acceptance

- Follow-up confirmation

- Lessons learned (for internal review)

Store resolution records with sufficient detail that someone unfamiliar with the situation can understand what happened and why decisions were made. These records become essential when the same buyer complains about similar issues months later, or when other buyers report related problems.

The Economics of Complaint Handling

Complaint resolution has direct financial implications that extend far beyond the credits you issue. Understanding these economics allows you to make rational decisions about how much to invest in customer service and when to absorb costs that might seem avoidable.

The True Cost of Buyer Churn

Losing a buyer costs more than their monthly revenue. Calculate the full impact.

Direct Revenue Loss: Monthly revenue from the buyer multiplied by expected remaining relationship duration. If a $50,000/month buyer would have stayed another 18 months, you are losing $900,000 in lifetime value – not $50,000.

Replacement Cost: Acquiring a new buyer of equivalent size costs 5-7x what it costs to retain an existing one. If buyer acquisition costs average $15,000, replacing a churned buyer costs $75,000-$105,000 in sales effort, integration, and ramp-up.

Reputation Impact: Buyers talk to each other, especially within verticals. A buyer who churns due to poor complaint handling will tell 3-5 other potential buyers about their experience. In concentrated industries, this referral damage can close doors you did not know existed.

Opportunity Cost: While you are scrambling to replace churned volume, competitors are capturing the leads you would have sold. Growth stalls while you rebuild to your previous baseline.

For a $50,000/month buyer, the true cost of churn easily exceeds $1,000,000 when you factor in lifetime value, replacement cost, and reputation damage.

Credit Decision Framework

Given the economics above, credit decisions should be evaluated against churn risk rather than narrow win/loss calculations.

When to Issue Credits Generously:

- The issue is genuinely your fault

- The buyer is high-value and high-churn-risk

- The credit amount is small relative to relationship value

- Issuing credit maintains buyer confidence

- Your investigation is inconclusive but the buyer is acting in good faith

When to Hold the Line:

- The issue is clearly not your fault

- The buyer is testing your policies

- Issuing credit would set unsustainable precedents

- Your investigation proves the complaint invalid

- The buyer has a pattern of excessive complaints

The calculation is often counterintuitive. A $2,000 credit that seems expensive against this month’s margin is cheap insurance against a $1,000,000 churn event. Practitioners who optimize for winning individual disputes often lose at the relationship level.

Complaint Handling as Investment

Treat your customer service function as an investment that generates returns through retention, upsell, and referral.

Retention Returns: Every month a buyer stays is revenue you would have lost without effective complaint handling. If your customer service team saves two $50,000/month buyers per year from churning, they have generated $1.2 million in retained annual revenue.

Upsell Returns: Buyers whose complaints are handled well often increase volume. The $50,000/month buyer who was considering churn may become an $80,000/month buyer after experiencing your responsiveness. Complaint resolution demonstrates that you can be trusted with more volume.

Referral Returns: Satisfied buyers refer other buyers. Industry surveys indicate that lead buyers referred by existing buyers convert at 4x the rate of cold outreach and have 2x the average lifetime value. Your customer service team is also your referral generation team.

Viewed through this lens, customer service is not a cost center – it is a revenue-generating function that happens to sit in the operations organization.

Managing Specific Complaint Types

Different complaint types require different handling approaches. The following sections provide tactical guidance for the most common and most challenging situations.

Return Disputes

Return disputes occur when a buyer requests credit for leads they claim are defective, and you question whether the return is valid under your policy.

Investigation Steps:

- Pull the lead records and validation results

- Review the buyer’s stated return reason

- Check if the return falls within the contractual window

- Verify the return reason against available evidence

- Examine return patterns (is this buyer returning at unusually high rates?)

- Review source-level data for the leads in question

Common Dispute Scenarios:

Buyer claims disconnected number; your records show valid at time of delivery: Phone numbers can become disconnected between capture and buyer contact. If you validated at capture and have documentation, offer a partial credit or make-good that acknowledges the timing issue while not accepting full responsibility.

Buyer claims consumer denies submitting; you have TrustedForm certificate: Share the certificate showing the consumer’s session. This is your strongest evidence. Most buyers will accept a valid certificate as proof of legitimate submission.

Buyer claims duplicate; you show no prior sale: The consumer may have been purchased from another source. If the duplicate is cross-source rather than from you, explain this and offer to add the buyer’s suppression file to your pre-delivery deduplication.

Buyer claims intent mismatch; hard to verify: These are the most difficult disputes. Consider the buyer’s history, the source of the leads, and any available conversion data. When evidence is inconclusive, split the difference or offer make-goods.

Volume Shortfalls

Volume shortfall complaints occur when you deliver less than the buyer expected or contracted for.

Investigation Steps:

- Review the contractual volume commitment (guaranteed vs. estimated)

- Calculate actual delivery against commitment

- Identify root causes (supply issues, filter changes, technical problems)

- Assess whether the shortfall affected the buyer’s operations

Resolution Approaches:

Guaranteed volume not met: You owe the buyer the difference. Offer to catch up with additional delivery at the contracted price, or provide credit for the volume shortfall.

Estimated volume not met due to your issues: Acknowledge the shortfall, explain the cause, and offer make-goods or price adjustments to maintain the relationship.

Estimated volume not met due to market conditions: Explain the market factors affecting supply. Most buyers understand that estimated volumes are not guarantees. Offer to adjust expectations going forward.

Buyer’s filters rejected available leads: If you had leads to deliver but the buyer’s filters rejected them, the shortfall is not your responsibility. Provide data showing available volume and rejection reasons.

Quality Degradation

Quality degradation complaints indicate that lead performance has worsened over time – even if individual leads still meet basic validation requirements.

Investigation Steps:

- Pull source-level metrics for the complaint period vs. prior baseline

- Identify any source mix changes during the complaint period

- Examine validation data for patterns (phone type changes, geographic shifts, etc.)

- Review any integration or configuration changes

- Check buyer feedback data if available

Resolution Approaches:

Specific source identified as problematic: Terminate or pause the source. Issue credit for leads from that source. Communicate the corrective action to the buyer.

General degradation with no clear source: Enhance validation, tighten filters, or implement additional quality checks. Consider quality-based pricing adjustments if the buyer values quality over cost.

No objective degradation found: Share your analysis with the buyer. Explore whether their operational changes might explain the perceived decline. Offer to work together on improving outcomes.

Compliance Issues

Compliance complaints carry unique urgency and risk. Handle them with appropriate seriousness.

Immediate Actions:

- Acknowledge receipt within 1 hour

- Pull all documentation for the affected leads

- Escalate to compliance leadership immediately

- Pause delivery from any implicated sources

- Preserve all evidence for potential litigation

Investigation Steps:

- Retrieve consent certificates for affected leads

- Verify certificate validity and content

- Check consent language against regulatory requirements

- Review DNC suppression records

- Examine calling hour compliance

- Document chain of custody for all lead data

Resolution Approaches:

Consent certificate valid and shows compliance: Share the certificate with the buyer. Confirm that proper consent was captured. Help the buyer understand how to use the certificate for their own compliance records.

Consent certificate missing or invalid: Acknowledge the issue. Issue full credit for affected leads. Terminate the source that generated non-compliant leads. Implement controls to prevent recurrence.

DNC violation occurred: Accept responsibility if you delivered leads without proper DNC suppression. Credit the leads and enhance your suppression processes. If the buyer failed to scrub before calling, help them understand that final DNC responsibility rests with the caller.

Organizational Capabilities for Customer Service Excellence

Effective complaint handling requires organizational capabilities that extend beyond individual skills. Building these capabilities creates sustainable advantage.

Staffing and Training

Customer Service Representatives: The front line of complaint handling should have authority to resolve routine issues without escalation. Train them on your products, policies, and systems. Empower them to issue credits within defined limits. Hire for empathy, analytical thinking, and communication skills.

Account Managers: Relationship owners should be involved in significant complaints affecting their buyers. They provide context about buyer history, relationship dynamics, and strategic importance. Train them to balance buyer advocacy with company interests.

Technical Support: Some complaints require technical investigation – delivery failures, integration issues, data discrepancies. Ensure your technical team can support complaint resolution with appropriate priority.

Leadership: Executives should be available for escalations that require senior judgment or authority. Define clear escalation paths so critical issues reach leadership quickly.

Knowledge Management

Complaint resolution improves when institutional knowledge is captured and accessible.

Policy Documentation: Maintain clear, current documentation of return policies, credit guidelines, escalation procedures, and resolution authorities. Update these documents when policies change.

Case History: Build a searchable database of past complaints and resolutions. When a new complaint arrives, representatives should be able to find similar cases and see how they were resolved.

Buyer Profiles: Maintain profiles of key buyers that capture relationship history, complaint patterns, sensitivity points, and strategic importance. Representatives handling complaints should understand who they are dealing with.

Source Intelligence: Document source-level quality patterns, known issues, and past problems. When complaints involve specific sources, this intelligence accelerates investigation.

Performance Metrics

Measure what matters in complaint handling.

Response Time: Track time from complaint receipt to first substantive response. Measure against your standards by priority level.

Resolution Time: Track time from complaint receipt to final resolution. Long resolution times indicate process problems or resource constraints.

First-Contact Resolution: Measure the percentage of complaints resolved in a single interaction. Higher is better for efficiency and buyer satisfaction.

Credit Rate: Track credits issued as a percentage of revenue. Unusually high credit rates indicate quality problems or overly generous policies. Unusually low rates may indicate excessive rigidity damaging relationships.

Buyer Satisfaction: Survey buyers after complaint resolution. Track satisfaction scores over time and by complaint type.

Churn Correlation: Analyze whether complaint frequency or resolution quality predicts buyer churn. Use this data to prioritize improvements.

Preventing Complaints Before They Occur

The best complaint is the one that never happens. Invest in prevention alongside resolution.

Proactive Quality Monitoring

Do not wait for buyers to complain about quality issues. Monitor quality metrics continuously and address degradation before buyers notice.

Daily Monitoring:

- Source-level return rates vs. benchmarks

- Contact rate trends by source and buyer

- Validation failure patterns

- Delivery speed distribution

Weekly Analysis:

- Source portfolio quality review

- Buyer satisfaction trend analysis

- Complaint pattern identification

- Emerging issue detection

Monthly Review:

- Comprehensive quality scorecard

- Source termination/addition decisions

- Policy adjustment considerations

- Buyer relationship health assessment

When monitoring reveals problems, address them proactively. Reach out to buyers before they complain: “We noticed that leads from Source 47 showed elevated return rates last week. We’ve paused that source pending investigation. You may have received some of these leads – let us know if you’re seeing issues, and we’ll make it right.”

Clear Expectation Setting

Many complaints result from misaligned expectations rather than actual failures. Invest in setting clear expectations from the beginning of buyer relationships.

Onboarding Documentation: Provide new buyers with clear documentation of what they are purchasing: lead specifications, quality standards, return policies, delivery timelines, billing terms. Get acknowledgment that they understand and accept these terms.

Performance Benchmarks: Share expected performance metrics. If typical contact rates run 70-75%, tell buyers that upfront. If return rates average 8-10%, set that expectation. Buyers who know what normal looks like are less likely to complain about normal performance.

Policy Transparency: Make your policies accessible and understandable. Buyers should be able to find your return policy, know what constitutes a valid return reason, and understand how credits are processed. Hidden or ambiguous policies generate disputes.

Regular Relationship Maintenance

Ongoing communication prevents small issues from becoming large complaints.

Scheduled Check-Ins: Maintain regular contact with key buyers – weekly for top accounts, monthly for mid-tier, quarterly for smaller buyers. Use these conversations to surface concerns before they escalate.

Performance Reviews: Share performance data proactively. Monthly reports showing lead volume, quality metrics, and return rates demonstrate transparency and give buyers confidence in your operations.

Feedback Solicitation: Ask buyers about their experience regularly. Simple surveys or direct questions during check-ins reveal satisfaction levels and emerging issues.

Issue Acknowledgment: When you know something went wrong, acknowledge it before the buyer complains. Proactive acknowledgment demonstrates accountability and prevents the buyer from having to chase you.

Frequently Asked Questions

How quickly should I respond to buyer complaints?

Response time standards vary by issue severity. Compliance-related and major financial complaints require response within 2 hours during business hours. Quality degradation and delivery failure complaints should receive response within 4 hours. Routine issues like standard return requests can be addressed within 24 hours. These timelines measure meaningful engagement – a human reviewing the issue and providing substantive communication – not automated acknowledgment.

What is a reasonable return rate, and when should I push back on returns?

Industry return rates vary by vertical. Auto insurance typically runs 8-10%. Medicare operates at 12-15%. Solar sees 15-18% even for quality operations. Legal leads maintain the lowest rates at 5-8%. Push back on returns that exceed your documented policy terms, show patterns of abuse, or lack supporting evidence. Accept returns that fall within policy, involve genuine defects, and come from buyers acting in good faith. When in doubt, consider the relationship value versus the credit amount.

Should I issue credits to keep buyers happy even when complaints are not valid?

Sometimes. The economics of buyer churn often justify credits that seem unjustified in isolation. A $2,000 credit is cheap insurance against losing a $50,000/month buyer. However, avoid setting precedents that encourage gaming. Track credit requests by buyer, watch for patterns of excessive complaints, and hold the line when buyers are clearly testing your policies or acting in bad faith.

How do I handle a buyer who constantly complains about quality?

First, verify whether the complaints are legitimate. Pull data on their returns, compare to other buyers receiving similar leads, and determine if they are experiencing genuine issues or holding unrealistic expectations. If complaints are legitimate, fix the underlying quality problems or acknowledge that your product does not match their needs. If complaints are excessive relative to objective data, have a direct conversation about expectations and consider whether the relationship is sustainable.

What documentation should I keep for complaint resolution?

Maintain records of the original complaint, your investigation findings with supporting data, the resolution decision and rationale, any financial impact (credits, replacements), buyer acknowledgment of resolution, and follow-up confirmation. Store these records for at least two years. This documentation proves essential when disputes recur, patterns emerge, or relationships require review.

How do I handle complaints about compliance issues like missing consent certificates?

Treat compliance complaints as critical priorities requiring immediate escalation. Retrieve all relevant documentation within hours. If certificates are valid, share them with the buyer and explain their contents. If certificates are missing or invalid, acknowledge the issue immediately, credit affected leads, terminate implicated sources, and implement controls to prevent recurrence. Compliance issues carry legal risk – err on the side of caution and transparency.

When should I terminate a buyer relationship rather than continue resolving complaints?

Consider termination when a buyer consistently abuses your return policies, demands credits without legitimate basis, refuses to engage reasonably in dispute resolution, or costs more in operational overhead than they generate in margin. Before terminating, document the pattern of problematic behavior, ensure you have given fair warning, and consider whether operational changes could address the issues. Termination should be a last resort after good-faith efforts to resolve recurring problems.

How do I scale customer service as my buyer base grows?

Scale through standardization, technology, and selective hiring. Document policies and resolution procedures so new team members can handle routine issues independently. Implement ticketing systems that track complaints and route them appropriately. Automate acknowledgments, status updates, and credit processing where possible. Hire customer service staff before you are overwhelmed – being understaffed during growth creates complaint backlogs that damage relationships. Consider tiered service levels where high-value buyers receive more dedicated attention.

What is the relationship between complaint handling and buyer retention?

Strong correlation. Lead buyers who experience poor complaint resolution churn at 3.4x the rate of those with neutral experiences and 6.2x the rate of those whose complaints were handled well. Conversely, well-resolved complaints often strengthen relationships beyond their pre-complaint baseline. Buyers who see you handle problems professionally gain confidence that you will address future issues. Complaint handling is one of the highest-leverage activities for retention.

How should I handle complaints during a crisis like a major system failure or data breach?

Crisis complaints require special handling. Acknowledge the situation broadly rather than responding to individual complaints in isolation. Provide regular status updates through your communication channels. Prioritize resolution of the underlying issue over individual complaint processing. Once the crisis is resolved, proactively reach out to affected buyers with acknowledgment, explanation, and appropriate remediation. Consider credits or make-goods even without specific requests. Post-crisis, conduct a root cause analysis and share relevant findings with buyers to demonstrate that you have learned and improved.

Key Takeaways

Complaint handling is a revenue function, not a cost center. The difference between retaining and losing a $50,000/month buyer over complaint resolution is worth more than a year of customer service salaries. Treat your support operation as an investment that generates returns through retention, upsell, and referral.

Response time shapes complaint trajectories. Critical issues require response within 2 hours. High-priority issues need 4-hour response. Standard issues should receive attention within 24 hours. These windows are measured from receipt to meaningful engagement, not to auto-acknowledgment.

Follow a systematic resolution framework. Acknowledge and validate the complaint. Investigate thoroughly with documentation. Determine the appropriate resolution path. Communicate findings with supporting data. Follow up to confirm resolution took effect.

Credit decisions should consider relationship value. A $2,000 credit that seems expensive against monthly margin is cheap insurance against a churn event that costs $1,000,000 in lifetime value and replacement costs. Win the relationship, not just the individual dispute.

Build infrastructure for scale. Implement ticketing systems, escalation protocols, knowledge management, and performance metrics. Ad hoc complaint handling breaks down as buyer count grows. Systematic processes enable consistent quality at scale.

Prevent complaints through proactive monitoring. Track quality metrics daily, analyze patterns weekly, and review buyer relationships monthly. Address issues before buyers notice them. Reach out proactively when you know something went wrong.

Set clear expectations from relationship inception. Document what buyers are purchasing, share expected performance benchmarks, and make policies transparent. Misaligned expectations generate complaints that proper onboarding would prevent.

Different complaint types require different approaches. Return disputes need evidence-based analysis. Volume shortfalls require contractual review. Quality degradation demands source-level investigation. Compliance issues escalate immediately and receive maximum seriousness.

Those who build robust complaint handling capabilities gain competitive advantage that compounds over time. When buyers know you will stand behind your leads and resolve problems professionally, they buy with confidence and stay through challenges. That trust is harder to build than traffic sources, technology platforms, or buyer relationships – and more valuable than all of them.

This article reflects operational best practices and industry experience as of late 2025. Customer service approaches should be adapted to your specific business model, buyer relationships, and market conditions.