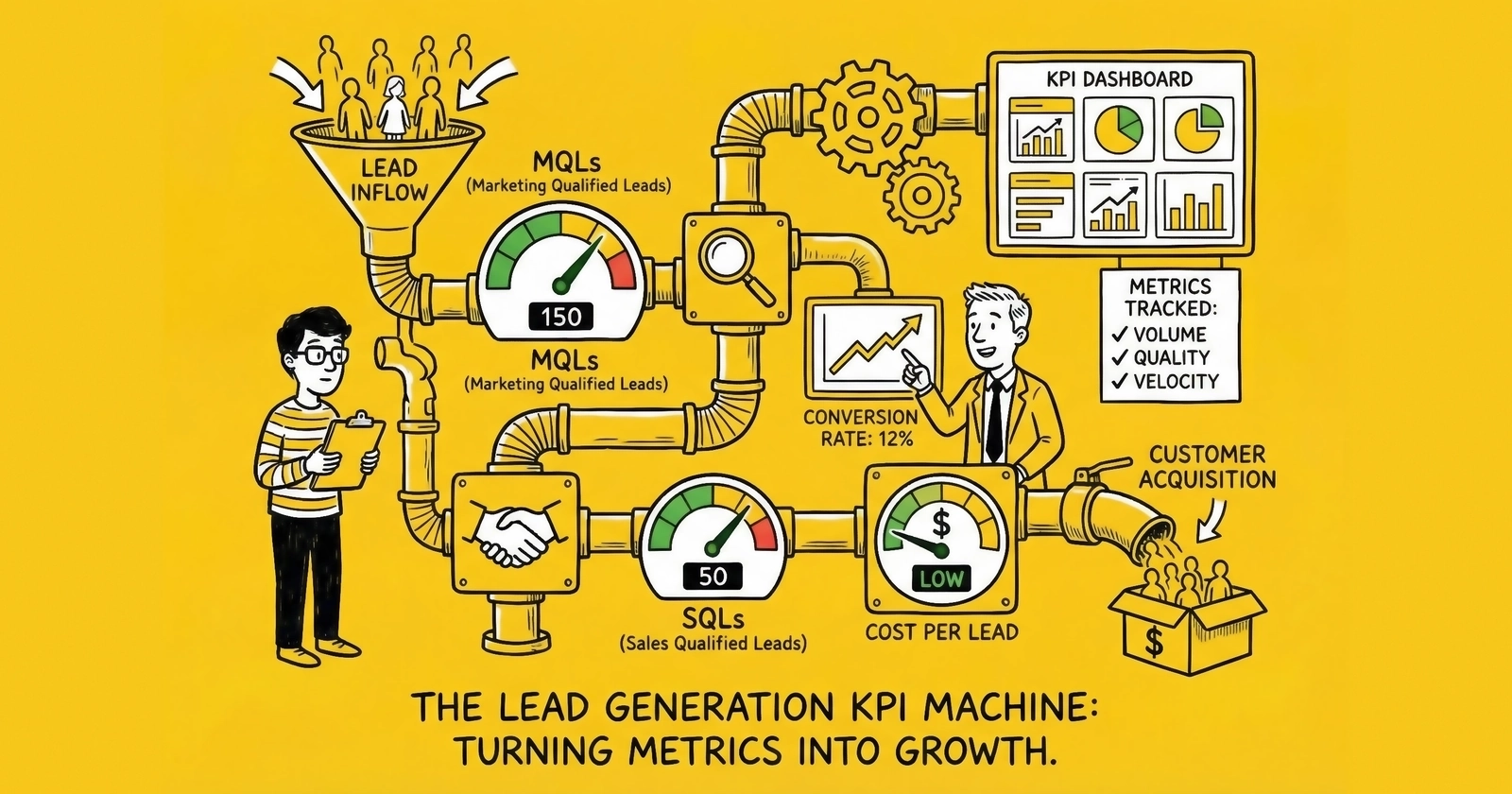

Stop tracking vanity metrics that make dashboards look impressive but tell you nothing about profitability. These 15 KPIs separate operators who scale from those who optimize their way into bankruptcy.

Most lead generation businesses track everything and measure nothing. They build dashboards filled with impressive numbers, generate weekly reports packed with colorful charts, and present metrics that make campaigns look spectacular. Then they wonder why the bank account tells a different story.

The problem is not insufficient data. The problem is tracking metrics that feel good rather than metrics that predict survival. Vanity metrics measure activity – they tell you something happened. Cost per click shows you bought traffic. Conversion rate confirms forms got filled. Revenue proves leads got sold. All useful confirmation, none sufficient for decisions.

The metrics that matter answer harder questions: Are we making money after all costs? Which sources produce leads buyers actually want? What predicts next month’s profitability, not yesterday’s activity? This guide covers the 15 KPIs that determine whether your lead generation operation thrives or dies, organized across five categories – traffic, conversion, quality, revenue, and profitability. Skip the vanity metrics. Focus here.

Traffic Metrics: Measuring What You Buy

Traffic metrics answer the first question every lead generator must answer: Are we acquiring visitors efficiently? Before a lead exists, you buy attention. These metrics tell you what that attention costs and whether it converts.

1. Cost Per Click (CPC)

CPC measures the average cost to bring one visitor to your landing page or offer. Calculate it by dividing total ad spend by total clicks. This is your raw material cost – every lead starts with a click, and the price you pay for clicks sets the floor for everything downstream. A $15 CPC into a 10% conversion rate means your minimum CPL starts at $150 before you add any other costs.

Benchmark ranges vary significantly by channel. Google Search Ads typically run $2.50 to $8.00, though highly competitive verticals like insurance and legal push $15 or higher. Facebook and Meta Ads range from $0.50 to $3.00, while native advertising comes in cheaper at $0.30 to $2.00. LinkedIn Ads command premium pricing at $5.00 to $12.00 given the B2B audience quality, and TikTok Ads fall in the $0.50 to $2.50 range.

CPC alone tells you nothing about profitability. Track CPC in context with conversion rate and lead quality. Rising CPC with stable conversion rates demands either higher lead prices or new traffic sources – the math will eventually force your hand if you ignore the trend.

2. Click-Through Rate (CTR)

CTR measures the percentage of people who see your ad and click on it, calculated by dividing total clicks by total impressions and multiplying by 100. This is the first indication of message-market fit. Low CTR means your creative fails to resonate, your targeting misses the audience, or your offer lacks appeal. You can buy impressions all day, but impressions without clicks just burn money.

Benchmarks differ dramatically across channels. Google Search Ads average 3-5%, with well-optimized campaigns hitting 7% or higher. Display advertising typically sees just 0.4-0.6%, while Facebook Feed Ads range from 0.9-1.5%. Email campaigns perform at 2-5%, and native ads run 0.2-0.5%.

Here is what most practitioners miss: CTR directly influences CPC. Platforms reward high-CTR ads with lower costs. A 2% improvement in CTR often reduces CPC by 10-15%. Monitor CTR weekly by creative and audience – this small metric has outsized impact on your economics.

3. Traffic Quality Score

Traffic Quality Score measures the composite health of incoming traffic relative to its ability to convert and generate value. Platforms calculate this differently – Google’s Quality Score (1-10) incorporates expected CTR, landing page experience, and ad relevance, while Meta uses relevance diagnostics. You can also build your own composite using form start rate, time on page, and bounce rate weighted by importance.

Not all clicks are equal. A click from someone actively shopping for auto insurance is worth multiples of a click from someone who misunderstood your ad. Traffic quality predicts conversion quality, which predicts revenue, which determines profitability. The causation chain is direct and unforgiving.

What good looks like: Google Quality Score of 7+ indicates healthy traffic, bounce rate below 50% on landing pages, form start rate above 40% of visitors, and average time on page above 45 seconds. Traffic quality degrades over time, so monitor quality weekly by source. When Quality Score drops from 8 to 6, your effective CPC just increased 30% – the platform is taxing you for underperformance.

Conversion Metrics: Measuring What You Capture

Traffic means nothing without conversion. These metrics track how efficiently you transform visitors into leads and what that transformation costs.

4. Conversion Rate (CVR)

Conversion rate measures the percentage of visitors who complete your desired action, typically form submission. Calculate it by dividing total leads by total visitors and multiplying by 100. This is the multiplier between traffic cost and lead cost – a 5% conversion rate means 1 in 20 visitors becomes a lead, while a 10% conversion rate means 1 in 10. Same traffic, half the cost per lead. This is the highest-leverage optimization point in your funnel.

Benchmark ranges by vertical reveal significant variation. Auto insurance typically converts at 8-15%, Medicare at 6-12%, solar at 4-10%, mortgage at 5-12%, legal at 3-8%, and home services at 7-15%. These ranges reflect the natural friction inherent to each buying decision.

The conversion-quality tradeoff deserves special attention. High conversion rates are not automatically good. Aggressive tactics generate high CVR and terrible lead quality – when CVR suddenly jumps 40%, investigate whether you removed friction that should stay. Track CVR by traffic source, device, and landing page. Mobile typically converts 30-40% lower than desktop, and weekly variance above 15% indicates something changed that requires investigation.

5. Cost Per Lead (CPL)

CPL measures the total cost to generate one lead, typically calculated by dividing total marketing spend by total leads generated. But that simple formula misses the real picture. True CPL equals media spend plus creative costs plus agency fees plus platform fees plus validation costs plus allocated labor, all divided by total leads. A lead that appears to cost $45 actually costs $62-75 when you include validation fees, technology costs, and labor allocation.

Benchmark ranges by vertical provide useful context. Auto insurance runs $25-75 standard and $100+ for premium leads. Medicare sits at $40-60 standard, $80+ exclusive. Solar commands $75-150 standard, $200+ qualified. Mortgage ranges from $50-100 standard to $150+ with tight filters. Legal personal injury leads cost $200-500+, and home services fall at $40-100.

Track CPL by source, not just in aggregate. Your blended CPL of $55 might hide a $32 organic source subsidizing a $95 paid source that should be paused. The aggregate obscures the actionable insight.

6. Form Abandonment Rate

Form abandonment rate measures the percentage of visitors who start your form but fail to complete it. Calculate it by subtracting form completions from form starts, dividing by form starts, and multiplying by 100. Every abandoned form represents a qualified prospect who raised their hand and then walked away – these are not casual browsers. They engaged with your offer, started providing information, and stopped. Understanding why they stopped reveals optimization opportunities.

Benchmark ranges scale with form complexity. Simple forms of 3-5 fields see 15-25% abandonment. Medium forms of 6-10 fields reach 25-40%. Complex forms of 11+ fields push 40-65% abandonment. The correlation between field count and abandonment is nearly linear.

Where abandonment happens tells you what to fix. Sensitive fields like SSN and income cause 30-50% of visitors to drop. Unclear questions drive 15-25% abandonment. Mobile friction from small fields and difficult typing accounts for 20-35% drops. Slow page load adds 7% more abandonment per second of delay. Identify your highest-abandonment fields and test alternatives. Split long forms into multi-step progressions. Track abandonment by field and device weekly.

Quality Metrics: Measuring What Buyers Accept

Volume means nothing if buyers reject your leads. Quality metrics track whether the leads you generate meet buyer standards and convert into revenue.

7. Validation Pass Rate

Validation pass rate measures the percentage of submitted leads that pass your validation stack – phone verification, email validation, duplicate checking, and fraud detection. Calculate it by dividing leads passing validation by total submitted leads and multiplying by 100. Leads that fail validation cannot be sold, representing wasted traffic acquisition cost with zero revenue potential. Low validation rates signal problems with traffic quality, form design, or fraud exposure.

Benchmark ranges define healthy operations. Phone validation should pass at 85-95%, email validation at 90-98%. Duplicate rates typically run 2-8% of volume, while fraud and bot rates should stay at 1-5% – higher signals serious problems. Composite validation pass rate across all checks should land between 75-90%.

Monitor validation failure reasons by source. Sudden spikes in duplicate rates indicate bot activity or affiliate fraud. Validation failure trends predict return rate problems before buyer complaints arrive – this is a leading indicator worth watching closely.

8. Buyer Acceptance Rate

Buyer acceptance rate measures the percentage of leads submitted to buyers that are accepted into their systems. Calculate it by dividing leads accepted by buyers by leads submitted to buyers and multiplying by 100. This is the market’s verdict on your lead quality. Buyers who reject leads at 30% rate are telling you something is wrong – either data quality, consumer intent, or targeting mismatch. Low acceptance rates compress margins and damage buyer relationships.

Benchmark ranges establish clear expectations. High-quality sources achieve 90-98% acceptance. Average sources land at 80-90%. Performance below 75% is concerning, and below 60% threatens the buyer relationship entirely.

Track acceptance by buyer and source combination. Low acceptance from a single buyer may not indicate quality problems – that buyer might have unusual filters or capacity constraints. But low acceptance across multiple buyers demands investigation. The pattern reveals whether the problem is your leads or a specific buyer’s preferences.

9. Return Rate

Return rate measures the percentage of accepted leads that buyers subsequently return for quality issues. Calculate it by dividing leads returned by leads accepted and multiplying by 100. Returns erode margins directly and relationships indirectly. A lead you sold for $50 that gets returned is not neutral – you processed it, delivered it, collected payment, and then refunded it. That is negative margin after processing costs. Persistent high returns lead to buyer termination.

Benchmark ranges vary by vertical based on inherent qualification complexity. Auto insurance returns run 8-15%, Medicare 12-20%, solar 15-25%, mortgage 10-18%, legal 5-12%, and home services 8-15%.

Common return reasons follow predictable patterns. Invalid phone numbers (wrong number, disconnected) account for 25-35% of returns. Cannot contact (rings but no answer after attempts) drives 20-30%. Not shopping (changed mind, already purchased) causes 15-25%. Duplicate (already received from another source) represents 10-15%. Incorrect information (mismatched data fields) adds another 10-15%.

Return rate is a lagging indicator – problems surface 7-14 days after lead generation. Industry benchmarks for return rates vary by vertical and help calibrate expectations. Track returns by source and return reason. Rising returns from a single source require immediate investigation; rising returns across all sources indicate systematic quality degradation demanding urgent attention.

Revenue Metrics: Measuring What You Earn

Quality leads generate revenue. Revenue metrics track what you actually earn from your lead generation activity.

10. Earnings Per Lead (EPL)

EPL measures the average revenue generated per lead across all sales and outcomes. The simple calculation divides total lead revenue by total leads generated. But the more accurate calculation matters more: Net EPL equals gross lead sales minus returns minus chargebacks, divided by total leads. EPL is the revenue side of your unit economics equation – it must exceed CPL for your business to function. The gap between gross EPL and net EPL reveals true revenue reality.

Target EPL benchmark runs 15-20% above gross sale price expectations. If you sell leads at $50 average, target $57-60 gross EPL to provide buffer for returns.

A concrete example illustrates the math. Gross lead sales of $50,000 minus returns of $4,500 (9%) minus chargebacks of $500 across 1,000 leads generated yields gross EPL of $50 but net EPL of just $45. That $5 difference per lead equals $5,000 monthly at volume – money many practitioners think they have but do not. Track EPL by source and buyer. Sources with high EPL deserve investment; sources with EPL below CPL deserve elimination.

11. Revenue Per Click (RPC)

RPC measures average revenue generated per click on your advertising, calculated by dividing total lead revenue by total clicks. This provides a complete view of traffic efficiency – combining conversion rate and lead price into a single metric. A source with high CPC and high RPC can outperform a source with low CPC and low RPC. This metric enables true source comparison.

The power of RPC for optimization becomes clear through comparison. Source A with $3 CPC, 8% CVR, and $45 lead price yields $3.60 RPC and $0.60 profit per click. Source B with $5 CPC, 12% CVR, and $55 lead price yields $6.60 RPC and $1.60 profit per click. Source B costs more per click but generates 167% more profit per click. CPC alone would wrongly favor Source A – a decision that leaves money on the table.

Optimize budgets toward highest RPC sources, not lowest CPC sources. When RPC drops below CPC, that source is losing money – pause or optimize immediately.

12. Sell-Through Rate

Sell-through rate measures the percentage of generated leads that are successfully sold to buyers. Calculate it by dividing leads sold by total leads generated and multiplying by 100. Not every lead sells – validation failures, no buyer bid, capacity limits, and routing errors all prevent sales. Leads that do not sell represent pure cost with zero revenue. Sell-through rate reveals how much of your inventory actually monetizes.

Benchmark ranges establish performance tiers. High-performing operations achieve 85-95% sell-through. Average operations land at 70-85%. Struggling operations fall below 70%.

Understanding what kills sell-through helps you fix it. Validation failures consume 5-15% of leads. No buyer bid in auction loses 2-10%. Buyer capacity limits block 1-5%. Technical and routing failures waste 1-3%. Compliance rejections remove 1-5%.

Track sell-through by source. Some sources generate leads that consistently fail to find buyers – this is a targeting problem, not a distribution problem. The source is attracting the wrong consumers, and no amount of distribution optimization will fix targeting mismatch.

Profitability Metrics: Measuring What You Keep

Revenue is not profit. Profitability metrics track what remains after all costs – the money that actually accrues to your business.

13. True ROI (After All Costs)

True ROI measures actual return on investment after accounting for every cost of lead generation. Calculate it as true net revenue minus true total cost, divided by true total cost, multiplied by 100. True net revenue equals gross revenue minus returns minus refunds minus chargebacks. True total cost includes media, creative, agency, testing, platform fees, per-lead tech fees, labor, compliance, and float cost.

most practitioners calculate ROI using only media spend, dramatically overstating returns. A campaign showing 250% ROI on media spend typically shows 80-120% true ROI when all costs are attributed. The difference determines strategic decisions about scaling, pricing, and margin management.

The hidden costs most practitioners miss add up quickly. Technology and platform fees run 5-15% of media spend. Labor allocation consumes 15-25% of operating costs. Compliance costs including consent certificates, legal review, and audits exceed $25,000 monthly at scale. Float cost eats 3-6% annually on outstanding receivables. Return processing labor adds $3-10 per returned lead.

Calculate true ROI quarterly using full cost allocation. True ROI below 50% on a campaign indicates fundamental unit economics problems that scale cannot solve – in fact, scale will amplify the losses.

14. Net Margin Per Lead

Net margin per lead measures the actual profit remaining after all costs for each lead generated. Calculate it by dividing total net revenue minus total allocated costs by total leads. This is your true unit economics metric – it tells you exactly how much profit each lead contributes to your business. A $5 net margin on 10,000 monthly leads is $50,000 profit. A $2 net margin on 20,000 leads is only $40,000 profit. Volume without margin is a slow path to bankruptcy.

Industry net margins after all costs typically range from 15-18%. Healthy net margin per lead sits at $8-15 depending on vertical. Minimum sustainable is $5 net margin per lead at scale – below that, you are running in place.

A concrete example walks through the math. A lead selling for $50 carries media cost of $22, validation and tech fees of $3, allocated labor of $4, compliance costs of $2, returns at 12% rate costing $6, and float cost of $1. Net margin per lead: $12, representing 24% margin.

Track net margin by source monthly. Sources with margin below $5 per lead need optimization or elimination – scale amplifies losses, not profits.

15. Lifetime Value of Buyer Relationships

Buyer LTV measures the total net value generated from a buyer relationship over its complete duration. Calculate it as average monthly revenue from buyer multiplied by average relationship length in months multiplied by net margin percentage. Acquiring new buyers is expensive. Maintaining existing buyers is profitable. A buyer generating $15,000 monthly at 17% net margin for 24 months contributes $61,200 in lifetime value. Understanding buyer LTV informs decisions about relationship investment, conflict resolution, and strategic prioritization.

What drives buyer LTV deserves careful attention. Relationship longevity matters most – the difference between 12 and 36 months triples LTV. Revenue per month compounds over relationship lifetime, making volume growth with existing buyers highly valuable. Margin maintenance during negotiations protects LTV from erosion. Churn prevention adds incremental value with each extended month.

Calculate LTV by buyer annually. Track early warning signals of churn – declining volume, increasing complaints, payment delays – and intervene before relationships end. A buyer saved is worth far more than a buyer acquired.

Predictive Metrics: Leading Indicators That Signal Future Performance

Lagging indicators tell you what happened. Predictive metrics tell you what will happen. The operators who consistently outperform competitors track leading indicators that provide early warning signals before problems compound into crises.

The FORECAST Framework for Predictive KPIs

Predictive metrics follow the FORECAST Framework, measuring signals that precede outcomes:

F - Funnel Velocity Metrics. Track speed of movement through your conversion funnel, not just conversion rates.

O - Opportunity Pipeline Health. Monitor buyer capacity, contract renewals, and relationship signals before they impact revenue.

R - Revenue Trajectory Signals. Identify leading indicators that correlate with future revenue outcomes.

E - Early Warning Indicators. Detect degradation patterns before they become visible in revenue metrics.

C - Capacity Utilization Forecasts. Project future processing capacity needs based on current pipeline.

A - Acquisition Cost Trajectories. Monitor CPC and CPL trends that predict margin compression.

S - Source Quality Drift. Detect changes in traffic source quality before they impact conversion rates.

T - Timing Pattern Analysis. Identify cyclical patterns that inform resource allocation.

Predictive Metric #1: Lead Velocity Rate (LVR)

Lead Velocity Rate measures the month-over-month growth rate of qualified leads entering your pipeline. Calculate it as (This Month Qualified Leads - Last Month Qualified Leads) / Last Month Qualified Leads multiplied by 100.

LVR predicts future revenue more accurately than current revenue itself. A company with flat revenue but 20% LVR will outperform one with growing revenue but negative LVR within two to three months. LVR provides 60-90 day forward visibility into revenue trajectory.

Benchmark targets:

- Healthy growth: 10-15% monthly LVR

- Aggressive growth: 20%+ monthly LVR

- Warning zone: Below 5% or negative LVR

Track LVR by source to identify which channels are accelerating versus decelerating. A blended 12% LVR might hide a 25% decline from your best source subsidized by growth from lower-quality sources.

Predictive Metric #2: Time-to-First-Contact Degradation

Monitor not just average speed-to-lead, but the trend line. If median time-to-first-contact increases from 4 minutes to 7 minutes over three weeks, you have a capacity problem developing before it shows up in conversion rates.

Calculate weekly moving averages and set alerts when degradation exceeds 15% from baseline. By the time conversion rates decline measurably, you have already lost thousands of dollars in leads that could have converted with faster response.

Predictive Metric #3: Buyer Capacity Utilization

Track what percentage of each buyer’s contracted capacity you are filling. A buyer at 95% capacity will reject leads or slow acceptance, impacting your sell-through rate. A buyer at 40% capacity may be shopping for alternative suppliers.

Calculate daily: Leads Delivered to Buyer / Buyer Daily Capacity Cap. Maintain 70-85% utilization as the healthy range. Above 85% requires capacity negotiation. Below 60% signals relationship risk.

Predictive Metric #4: Source Quality Drift Score

Sources do not degrade suddenly; they drift gradually. Create a composite score tracking week-over-week changes in validation pass rate, conversion rate, and return rate by source.

Quality Drift Score = (This Week Composite Quality - Four Week Average Composite Quality) / Four Week Average multiplied by 100.

A source showing -8% Quality Drift for three consecutive weeks will become a problem within 30 days even if absolute metrics still look acceptable. Early intervention prevents the gradual degradation from reaching crisis levels.

Predictive Metric #5: Contract Renewal Pipeline

For buyer relationships, track contract renewal dates and relationship health scores. A buyer whose contract renews in 60 days but shows declining volume, increasing complaints, or payment delays represents revenue risk that will not appear in current metrics until the contract lapses.

Create a renewal risk dashboard showing: days until renewal, trailing 90-day volume trend, complaint frequency, and payment timeliness. Address relationships scoring poorly before renewal negotiations begin.

Predictive Metric #6: Margin Compression Indicator

Calculate trailing 30-day margin trend by source. When CPL increases faster than EPL for a source, margin compression is occurring regardless of absolute margin levels.

Margin Compression Rate = (CPL Growth Rate - EPL Growth Rate) over 30 days.

Positive values indicate compression; act when compression exceeds 2% monthly for three consecutive periods. This metric provides 60-90 day warning before margin problems become acute.

Real-Time Dashboard Architecture: From Data to Decisions

Effective dashboards do more than display metrics; they drive action. The architecture of your dashboard system determines whether operators can respond to issues in minutes or discover them in post-mortems.

The Three-Screen Command Center

High-performing lead generation operations use a three-screen architecture that separates monitoring functions.

Screen 1: Real-Time Operational Status

This screen answers: “What is happening right now?” Configure for 10-second refresh rates.

Elements:

- Current hour lead volume versus same hour yesterday (percentage delta with color coding)

- Real-time acceptance rate by active buyer (last 100 leads)

- Live validation failure rate with reason codes

- Speed-to-contact timer showing current median and distribution

- Active call center agent status with queue depth

- System health indicators for all integrated platforms

Alert Configuration:

- Volume drops 25%+ from baseline: immediate alert

- Acceptance rate drops 10%+ from 24-hour average: immediate alert

- Validation failures exceed 15%: warning alert

- Speed-to-contact exceeds 10 minutes: escalation alert

Screen 2: Daily Performance Tracking

This screen answers: “How is today performing versus plan?” Configure for 5-minute refresh rates.

Elements:

- Today’s lead volume versus daily target (gauge chart with pace indicator)

- Day-over-day CPL and EPL comparison by source

- Sell-through rate trending hourly

- Return rate (leads returned in last 24 hours versus 7-day average)

- Buyer-level delivery and acceptance summary

- Quality composite score versus threshold

Visual Design:

- Use sparklines showing 24-hour trend for each metric

- Color code thresholds: green (exceeds target by 10%+), yellow (within 10% of target), red (misses target by 10%+)

- Include “time remaining today” calculations projecting end-of-day performance

Screen 3: Strategic Performance Trends

This screen answers: “Where is the business heading?” Configure for hourly refresh during business hours.

Elements:

- Trailing 30-day revenue and margin trend lines

- Month-to-date performance versus forecast

- Source performance matrix (quadrant chart: volume vs. margin)

- Buyer concentration risk indicator

- Predictive metric dashboard (LVR, Quality Drift, Margin Compression)

- Week-over-week cohort comparison

Dashboard Implementation Stack

Data Layer: Consolidate data from CRM, ad platforms, validation services, and distribution systems into a central warehouse. Modern stacks use Snowflake, BigQuery, or Redshift with ELT tools like Fivetran or Airbyte for data ingestion.

Transformation Layer: Transform raw data into dashboard-ready metrics using dbt or similar tools. Pre-compute aggregations, rolling averages, and derived metrics rather than calculating in the visualization layer.

Visualization Layer: Choose tools based on refresh requirements and team capabilities:

- Tableau or Looker for complex analysis with sub-minute refresh

- Metabase or Mode for cost-effective self-service analytics

- Custom dashboards with Grafana for operational monitoring

- Real-time streaming dashboards with Apache Superset for command center displays

Alerting Layer: Implement multi-channel alerting through PagerDuty, Opsgenie, or native platform alerting. Configure escalation paths so critical alerts reach the right person within two minutes.

Dashboard Anti-Patterns to Avoid

The Metric Graveyard: Dashboards with 50+ metrics where nothing is actionable. Limit each view to 5-7 metrics maximum.

The Vanity Gallery: Dashboards designed to impress rather than inform. If a metric does not drive decisions, remove it.

The Stale Display: Dashboards that refresh daily for metrics requiring hourly attention. Match refresh frequency to decision cadence.

The Context Void: Metrics without benchmarks, targets, or historical comparison. Every metric needs reference points.

The Action Gap: Dashboards that show problems without clear next steps. Link metrics to documented response procedures.

Building Your KPI Dashboard

Metrics without visualization remain abstractions. Effective dashboards transform data into decisions by presenting the right information at the right time.

The Three-Dashboard Architecture

Different audiences need different views. The executive dashboard, reviewed weekly, builds around 5-7 metrics maximum – executives need strategic context, not operational detail. Include revenue versus target as a gauge chart, net margin trend as a line chart covering 90 days, lead volume and velocity showing growth trajectory, a quality composite as a single metric with traffic light indicator, and buyer concentration as a pie chart showing revenue distribution. Traffic-light indicators using green, yellow, and red surface issues immediately without requiring interpretation.

The operations dashboard, reviewed daily, provides real-time data for people making hourly decisions. For guidance on executive dashboard design, see the dedicated guide. Include current hour volume versus baseline, source performance matrix, quality alert feed, and buyer acceptance rates. Speed matters here – stale data leads to delayed responses.

The financial dashboard, reviewed weekly, connects operational activity to business outcomes. Include true ROI by source, net margin trends, return rate impact, and month-to-date profitability versus plan. This dashboard answers the question that matters most: are we making money?

The 15/30/90 Review Cadence

Daily reviews take 15 minutes. Check volume against baseline. Take action on anomalies exceeding 15% deviation. Weekly reviews take 30 minutes. Analyze week-over-week trends. Compare source performance. Document action items with owners. Monthly deep dives take 90 minutes. Reconcile operational metrics with financial actuals. Calculate true ROI with full cost allocation. Update forecasts based on actual performance.

The cadence matches decision speed to data freshness. Daily reviews catch anomalies before they compound. Weekly reviews identify trends while there is still time to adjust. Monthly reviews ensure operational metrics translate into actual profitability.

KPI Benchmarks by Vertical

Different verticals have different economics. Apply these benchmarks to calibrate expectations for your specific market.

Auto Insurance

| Metric | Target | Warning Zone |

|---|---|---|

| CPL | $25-75 | Above $100 |

| CVR | 8-15% | Below 6% |

| Return Rate | 8-15% | Above 20% |

| Net Margin | 15-20% | Below 12% |

| Sell-Through | 85-95% | Below 75% |

Medicare/Health Insurance

| Metric | Target | Warning Zone |

|---|---|---|

| CPL | $40-60 | Above $80 |

| CVR | 6-12% | Below 5% |

| Return Rate | 12-20% | Above 25% |

| Net Margin | 15-18% | Below 10% |

| Sell-Through | 80-90% | Below 70% |

Solar

| Metric | Target | Warning Zone |

|---|---|---|

| CPL | $75-150 | Above $200 |

| CVR | 4-10% | Below 3% |

| Return Rate | 15-25% | Above 30% |

| Net Margin | 12-18% | Below 10% |

| Sell-Through | 75-85% | Below 65% |

Mortgage

| Metric | Target | Warning Zone |

|---|---|---|

| CPL | $50-100 | Above $150 |

| CVR | 5-12% | Below 4% |

| Return Rate | 10-18% | Above 25% |

| Net Margin | 15-20% | Below 12% |

| Sell-Through | 80-90% | Below 70% |

Legal (Personal Injury)

| Metric | Target | Warning Zone |

|---|---|---|

| CPL | $200-500 | Above $800 |

| CVR | 3-8% | Below 2% |

| Return Rate | 5-12% | Above 15% |

| Net Margin | 18-25% | Below 15% |

| Sell-Through | 85-95% | Below 75% |

Frequently Asked Questions

What is the most important KPI for lead generation?

Net margin per lead is the most important KPI because it reveals true profitability after all costs. Revenue metrics like EPL or CPL tell only half the story. A business optimizing for volume with thin margins will always lose to a business optimizing for net margin at sustainable volume.

How do you calculate true cost per lead?

True CPL requires allocating all costs: media spend, creative production, agency fees, platform fees, validation costs, allocated labor, and compliance costs. The formula: True CPL = (Media + Creative + Agency + Testing + Platform + Validation + Labor + Compliance) / Total Leads. Most practitioners understate CPL by 25-40%.

What is a good conversion rate for lead generation?

Conversion rates of 5-12% are typical depending on vertical. Auto insurance and home services achieve 8-15%. Legal and solar typically see 3-10%. Extremely high rates above 20% often indicate insufficient filtering, leading to quality problems downstream.

How do you measure lead quality accurately?

Lead quality requires multiple metrics: validation pass rate (technical quality), buyer acceptance rate (market acceptance), return rate (outcome quality), and buyer conversion rate (comprehensive quality). No single metric captures quality completely. Build a composite weighting these factors by importance.

What causes high return rates in lead generation?

High return rates stem from data quality issues (invalid phone numbers), intent problems (consumers not shopping), targeting mismatches (wrong geography, ineligible consumers), and timing delays (lead aged before delivery). Analyze returns by reason code to identify specific causes.

How often should you review lead generation KPIs?

Daily reviews (15 minutes) catch immediate anomalies. Weekly analysis (30 minutes) identifies trends. Monthly deep dives (90 minutes) reconcile operations with financials. The cadence matches decision speed to data freshness.

What is a good net margin for lead generation businesses?

Industry net margins after all costs typically range from 15-18%. Margins below 12% signal structural problems that scale cannot solve. Target 15-18% net margin for sustainable operations.

How do you calculate ROI for lead generation campaigns?

True ROI = ((Net Revenue - Total Cost) / Total Cost) x 100. Net revenue means gross revenue minus returns and chargebacks. Total cost includes media, creative, technology, labor, compliance, and float cost. Simple ROI using only media spend overstates returns by 40-60%.

What is the difference between CPL and EPL?

CPL (Cost Per Lead) measures what you spend to generate a lead. EPL (Earnings Per Lead) measures what you earn from selling a lead. EPL must exceed true CPL for the business to work. Target EPL 15-20% above gross sale expectations to buffer returns.

How do you improve lead generation metrics?

Improve traffic metrics by optimizing creative and targeting. Improve conversion metrics by reducing form friction. Improve quality metrics by tightening validation. Improve revenue metrics by diversifying buyers. Improve profitability by cutting underperforming sources. Always optimize for net margin, not any single upstream metric.

Key Takeaways

Track 15 metrics across five categories – traffic, conversion, quality, revenue, and profitability – because each category answers different questions about your operation’s health. Calculate true costs, not platform costs, by including technology fees, labor allocation, compliance costs, and float. Simple CPL understates true acquisition cost by 25-40%.

Net margin per lead is your north star. Revenue without margin is activity without profit. Target 15-18% net margin after all costs for sustainable operations. Return rate predicts relationship health – monitor returns by source and reason, and treat rates above 20% as systematic quality problems demanding immediate intervention.

Match measurement cadence to decision speed. Daily checks catch anomalies. Weekly reviews enable tactical adjustments. Monthly analysis informs strategic decisions. Optimize for profit per click, not cost per click – high CPC sources with high conversion rates and margins outperform cheap traffic that fails to convert.

Build vertical-specific benchmarks because context determines whether metrics indicate success or failure. A 12% CVR is excellent for legal but merely average for auto insurance. Quality compounds through the funnel – poor validation rates predict poor acceptance rates, which predict high returns. Catch quality problems early before they cascade into revenue destruction.

Those who scale are not those with the most data. They are those who know which data matters – and act on it before problems compound into catastrophes.